UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________ to __________

Commission File Number:

(Exact name of Registrant as specified in its charter) |

| ||

(State or other jurisdiction of incorporation or organization) |

| (I.R.S. Employer Identification No.) |

| ||

(Address of principal executive offices) |

| (Zip Code) |

Registrant’s telephone number, including area code: (

Securities registered pursuant to Section 12(b) of the Act:

Title of each class |

| Trading Symbol(s) |

| Name of each exchange on which registered |

|

| The |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ☐ | Accelerated filer | ☐ |

☒ | Smaller reporting company | ||

|

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes

As of August 11, 2023, there were

|

| Page Number | ||

PART I – FINANCIAL INFORMATION |

|

| ||

|

|

|

| |

Item 1. | Financial Statements |

|

| |

|

|

|

|

|

|

| 3 |

| |

|

|

|

|

|

|

| 4 |

| |

|

|

|

|

|

|

| 5 |

| |

|

|

|

|

|

| Unaudited Condensed Consolidated Statements of Stockholder’ Equity (Deficit) |

| 6 |

|

|

|

|

|

|

| Notes to Unaudited Condensed Consolidated Financial Statements |

| 7 |

|

|

|

|

|

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

| 16 |

| |

|

|

|

|

|

| 19 |

| ||

|

|

|

|

|

| 19 |

| ||

|

|

|

| |

|

| |||

|

|

|

| |

| 20 |

| ||

|

|

|

|

|

| 20 |

| ||

| 2 |

| Table of Contents |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | ||||||||

UNAUDITED CONDENSED CONSOLIDATED BALANCE SHEETS | ||||||||

|

| June 30, 2023 |

|

| December 31, 2022 |

| ||

ASSETS |

|

|

|

|

|

| ||

CURRENT ASSETS |

|

|

|

|

|

| ||

Cash |

| $ |

|

| $ |

| ||

Certificates of deposit |

|

|

|

|

|

| ||

Inventory |

|

|

|

|

|

| ||

Prepaids and other current assets |

|

|

|

|

|

| ||

Total Current Assets |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

OTHER ASSETS |

|

|

|

|

|

|

|

|

Other assets |

|

|

|

|

|

| ||

Licenses, net of amortization |

|

|

|

|

|

| ||

TOTAL ASSETS |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CURRENT LIABILITIES |

|

|

|

|

|

|

|

|

Accounts payable |

| $ |

|

| $ |

| ||

Accrued expenses |

|

|

|

|

|

| ||

Advances from related party |

|

|

|

|

|

| ||

Total Current Liabilities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

TOTAL LIABILITIES |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

Common stock, $ |

|

|

|

|

|

| ||

Additional paid-in capital |

|

|

|

|

|

| ||

Accumulated deficit |

|

| ( | ) |

|

| ( | ) |

TOTAL STOCKHOLDERS' EQUITY |

|

|

|

|

|

| ||

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

|

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

The Accompanying notes are an integral part of these condensed consolidated financial statements | ||||||||

| 3 |

| Table of Contents |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | ||||||||||||||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS | ||||||||||||||||

| ||||||||||||||||

|

| For the Three Months Ended June 30, 2023 |

|

| For the Three Months Ended June 30, 2022 |

|

| For the Six Months Ended June 30, 2023 |

|

| For the Six Months Ended June 30, 2022 |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||

Revenues |

| $ |

|

| $ |

|

| $ |

|

| $ |

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenues |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OPERATING EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Selling, general and administrative |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Amortization of patent costs |

|

|

|

|

|

|

|

|

|

|

|

| ||||

TOTAL EXPENSES |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating loss |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

OTHER INCOME/(EXPENSE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

| ||||

Total other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOSS BEFORE PROVISION FOR INCOME TAXES |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for income taxes |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS PER SHARE - BASIC AND DILUTED |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

| $ | ( | ) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WEIGHTED AVERAGE NUMBER OF SHARES OUTSTANDING - BASIC AND DILUTED |

|

|

|

|

|

|

|

|

|

|

|

| ||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Accompanying notes are an integral part of these condensed consolidated financial statements | ||||||||||||||||

| 4 |

| Table of Contents |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | ||||||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | ||||||||

|

|

|

|

| ||||

|

| For the Six Months Ended June 30, 2023 |

|

| For the Six Months Ended June 30, 2022 |

| ||

|

|

|

|

|

|

| ||

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

| ||

Net loss |

| $ | ( | ) |

| $ | ( | ) |

Adjustments to reconcile net loss to |

|

|

|

|

|

|

|

|

net cash used in operating activities: |

|

|

|

|

|

|

|

|

Stock-based compensation |

|

|

|

|

|

| ||

Amortization |

|

|

|

|

|

| ||

Changes in assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

|

|

|

| ||

Inventory |

|

|

|

|

| ( | ) | |

Prepaids and other current assets |

|

|

|

|

| ( | ) | |

Accounts payable |

|

| ( | ) |

|

| ( | ) |

Accrued expenses |

|

|

|

|

|

| ||

Net cash used in operating activities |

|

| ( | ) |

|

| ( | ) |

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

|

|

|

|

|

Investments in certificates of deposit |

|

| ( | ) |

|

|

| |

Redemptions of certificates of deposit |

|

|

|

|

|

| ||

Net cash provided by investing activities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Proceeds from sale of common stock and warrants, net of issuance costs |

|

|

|

|

|

| ||

Proceeds from exercise of warrants |

|

|

|

|

|

| ||

Net cash provided by financing activities |

|

|

|

|

|

| ||

|

|

|

|

|

|

|

|

|

NET INCREASE (DECREASE) IN CASH |

|

| ( | ) |

|

|

| |

BEGINNING CASH BALANCE |

|

|

|

|

|

| ||

ENDING CASH BALANCE |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION: |

|

|

|

|

|

|

|

|

Cash payments for interest |

| $ |

|

| $ |

| ||

Cash payments for income taxes |

| $ |

|

| $ |

| ||

|

|

|

|

|

|

|

|

|

NON-CASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

Conversion of management fees and patent liability into common stock |

| $ |

|

| $ |

| ||

The Accompanying notes are an integral part of these condensed consolidated financial statements

| 5 |

| Table of Contents |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC. | ||||||||||||||||||||||||||||||||||||||||||||

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY (DEFICIT) | ||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders' |

| |||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||||||||

December 31, 2022 |

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round-up shares issued in reverse stock split |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

| |||||||

Stock-based compensation |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Net loss |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||||

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders' |

| |||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||||||||

March 31, 2023 |

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Round-up shares issued in reverse stock split |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

| ( | ) |

|

|

|

|

|

| |||||||

Stock-based compensation |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Net loss |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2023 |

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||||

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders' |

| |||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||||||||

December 31, 2021 |

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock and accompanying warrants, net of issuance costs |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Common stock issued for related party patent liabilities |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Common stock issued for warrant exercise |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Stock-based compensation |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Net loss |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022 |

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||||

|

| Series A Preferred Stock |

|

| Series B Preferred Stock |

|

| Series C Preferred Stock |

|

| Common Stock |

|

| Additional Paid-in |

|

| Accumulated |

|

| Total Stockholders' |

| |||||||||||||||||||||||

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Shares |

|

| Amount |

|

| Capital |

|

| Deficit |

|

| Equity |

| |||||||||||

March 31, 2022 |

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Issuance of common stock and accompanying warrants, net of issuance costs |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Common stock issued for warrant exercise |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

Stock-based compensation |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

|

|

|

|

| |||||||

Net loss |

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

| - |

|

|

|

|

|

|

|

|

| ( | ) |

|

| ( | ) | |||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2022 |

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

| - |

|

| $ |

|

|

|

|

| $ |

|

| $ |

|

| $ | ( | ) |

| $ |

| |||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Accompanying notes are an integral part of these condensed consolidated financial statements | ||||||||||||||||||||||||||||||||||||||||||||

| 6 |

| Table of Contents |

CREATIVE MEDICAL TECHNOLOGY HOLDINGS, INC.

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2023

NOTE 1 – ORGANIZATION AND SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Organization - Creative Medical Technologies Holdings, Inc. (the “Company”) is a commercial stage biotechnology company dedicated to the advancement of identifying and translating novel biological therapeutics in the fields of immunotherapy, endocrinology, urology, neurology and orthopedics. The Company was incorporated on December 3, 1998, in the State of Nevada under the name Jolley Marketing, Inc. On May 18, 2016, the Company closed a transaction which was accounted for as a recapitalization, reverse merger, under which Creative Medical Technologies, Inc., a Nevada corporation (“CMT”) became the Company’s wholly owned subsidiary, and Creative Medical Health, Inc. (“CMH”), which was CMT’s sole stockholder prior to the merger, became the Company’s principal stockholder. In connection with this merger, the Company changed its name to Creative Medical Technologies Holdings, Inc. to reflect its current business.

CMT was originally created on December 30, 2015 (“Inception”), as the urological arm of CMH to monetize a patent and related intellectual property related to the treatment of erectile dysfunction (“ED”), which it acquired from CMH in February 2016. Subsequently, the Company has expanded its development and acquisition of intellectual property beyond urology to include therapeutic treatments utilizing “re-programmed” stem cells, and the treatment of neurologic disorders, lower back pain, type I diabetes, and heart, liver, kidney, and other diseases using various types of stem cells through our ImmCelz, Inc., StemSpine, Inc. and AlloCelz LLC subsidiaries. However, neither ImmCelz Inc., StemSpine Inc. nor AlloCelz LLC have commenced commercial activities.

The Company currently conducts substantially all of its commercial operations through CMT, which markets and sells the Company’s CaverStem® and FemCelz® disposable kits utilized by physicians to perform autologous procedures that treat erectile dysfunction and female sexual dysfunction, respectively.

In 2020, through the Company’s ImmCelz Inc. subsidiary, the Company began developing treatments that utilize a patient’s own extracted immune cells that are then “reprogrammed” by culturing them outside the patient’s body with optimized stem cells. The immune cells are then re-injected into the patient from whom they were extracted. The Company believes this process endows the immune cells with regenerative properties that may be suitable for the treatment of multiple indications. In contrast to other stem cell-based approaches, the immune cells are significantly smaller in size than stem cells and are believed to more effectively penetrate areas of the damaged tissues and induce regeneration.

Use of Estimates –The preparation of the consolidated financial statements in conformity with accounting principles generally accepted in the U.S. requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the balance sheet and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Basis of Presentation – The consolidated financial statements and accompanying notes have been prepared in accordance with U.S. generally accepted accounting principles (“U.S. GAAP”). The consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany balances and transactions have been eliminated in consolidation. In the opinion of the Company’s management, the consolidated financial statements include all adjustments, which include only normal recurring adjustments, necessary for the fair presentation of the Company’s financial position for the periods presented.

Risks and Uncertainties - The Company has a limited operating history and has generated minimal revenues from its operations.

| 7 |

| Table of Contents |

The Company’s business and operations are sensitive to general business and economic conditions in the U.S. and worldwide. These conditions include short-term and long-term interest rates, inflation, fluctuations in debt and equity capital markets and the general condition of the U.S. and world economy. A host of factors beyond the Company’s control could cause fluctuations in these conditions, including the political environment and acts or threats of war or terrorism. Adverse developments in these general business and economic conditions, including through recession, downturn or otherwise, could have a material adverse effect on the Company’s financial condition and the results of its operations.

The Company has only recently started to generate sales and we have limited marketing and/or distribution capabilities. The Company has limited experience in developing, training, or managing a sales force and will incur substantial additional expenses if it decides to market any of its current and future products and services with an internal sales organization. Developing a marketing and sales force is also time-consuming and could delay the launch of its future products and services. In addition, the Company will compete with many companies that currently have extensive and well-funded marketing and sales operations. The Company’s marketing and sales efforts may be unable to compete successfully against these companies. In addition, the Company has limited capital to devote to sales and marketing.

The Company’s industry is characterized by rapid changes in technology and customer demands. As a result, the Company’s products and services may quickly become obsolete and unmarketable. The Company’s future success will depend on its ability to adapt to technological advances, anticipate customer demands, develop new products and services, and enhance the Company’s current products and services on a timely and cost-effective basis. Further, the Company’s products and services must remain competitive with those of other companies with substantially greater resources. The Company may experience technical or other difficulties that could delay or prevent the development, introduction or marketing of new products and services or enhanced versions of existing products and services. Also, the Company may not be able to adapt new or enhanced products and services to emerging industry standards, and the Company’s new products and services may not be favorably received. In addition, the Company may not have the capital resources to further the development of existing and/or new ones.

On July 8, 2022, the Company received a letter from The Nasdaq Stock Market LLC advising us that we were not in compliance with Nasdaq Listing Rule 5550(a)(2) because the closing bid price of our common stock was below $1.00 per share for 30 consecutive business days. Pursuant to Nasdaq’s Listing Rules, the Company had a 180-day grace period, until January 4, 2023, during which the Company could have regained compliance if the bid price of our common stock closed at $1.00 per share or more for a minimum of ten consecutive business days. Subsequent to January 4, 2023, the Company has been granted an additional 180-day grace period. On June 12, 2023, the company effected a 10-to-1 reverse common stock split. Following the reverse stock split, the closing bid price of our common stock was above $1.00 per share for ten consecutive business days from June 12, 2020 to June 26, 2023. Pursuant to Nasdaq’s Listing Rules, the company was in compliance with Nasdaq Listing Rule 5550(a)(2). On June 27, 2023 the Company received written notice from the Nasdaq Stock Market notifying the Company that is had regained compliance with the minimum bid price requirement.

Regarding the war between Russia and Ukraine, we have no direct exposure to those geographies. We cannot predict how global supply chain activities, or the economy at large may be impacted by a prolonged war in Ukraine or sanctions imposed in response to the war, or whether future conflicts, if any, may adversely affect our results of operations.

Revenue - The Company recognizes revenues in accordance with Accounting Standards Codification (“ASC”) 606, “Revenue from contracts with customers”. Revenues are recognized when control of the promised goods or services is transferred to our customers, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services. Deferred revenue represents amounts which still have yet to be earned.

The Company generates revenue from the sale of disposable stem cell concentration kits. Revenues are recognized when control of the promised goods or services are transferred to the customer, in an amount that reflects the consideration we expect to be entitled to in exchange for those goods or services, which is generally on delivery to the customer.

| 8 |

| Table of Contents |

Payments received for which the earnings process is not yet complete are deferred. As of June 30, 2023, the Company had $

Concentration Risks – The Federal Deposit Insurance Corporation insures cash deposits in most general bank accounts for up to $

Fair Value of Financial Instrument – The Company’s financial instruments consist of cash and cash equivalents, and payables. The carrying amount of cash and cash equivalents and payables approximates fair value because of the short-term nature of these items.

Fair value is an exit price, representing the amount that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants. As such, fair value is a market-based measurement that should be determined based on assumptions that market participants would use in pricing an asset or liability. Fair value measurements are required to be disclosed by level within the following fair value hierarchy:

Level 1 – Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

Level 2 – Inputs (other than quoted prices included in Level 1) are either directly or indirectly observable for the asset or liability through correlation with market data at the measurement date and for the duration of the instrument’s anticipated life.

Level 3 – Inputs lack observable market data to corroborate management’s estimate of what market participants would use in pricing the asset or liability at the measurement date. Consideration is given to the risk inherent in the valuation technique and the risk inherent in the inputs to the model.

When determining fair value, whenever possible the Company uses observable market data, and relies on unobservable inputs only when observable market data is not available. As of June 30, 2023, and 2022, the Company had no outstanding derivative liabilities.

Basic and Diluted Income (Loss) Per Share – The Company follows Financial Accounting Standards Board (“FASB”) ASC 260 Earnings per Share to account for earnings per share. Basic earnings per share (“EPS”) calculations are determined by dividing net loss by the weighted average number of shares of common stock outstanding during the year. Diluted earnings per share calculations are determined by dividing net income by the weighted average number of common shares and dilutive common share equivalents outstanding. During loss periods when common stock equivalents, if any, are anti-dilutive they are not considered in the computation. During the six-months ended June 30, 2023 and 2022, the Company had options to purchase

Following the approval of the Company’s Board of Directors, on June 12, 2023, the Company effected a

Cash Equivalents – The Company classifies its highly liquid investments with maturities of three-months or less at the date of purchase as cash equivalents. Management determines the appropriate classification of its investments at the time of purchase and reevaluates the designations of each investment as of the balance sheet date for each reporting period. The Company classifies its investments as either short-term or long-term based on each instrument’s underlying contractual maturity date. Investments with maturities of less than 12 months are classified as short-term and those with maturities greater than 12 months are classified as long-term. The cost of investments sold is based upon the specific identification method.

Inventories – Inventories are valued on a cost basis. The cost of inventories is determined on a first-in, first-out basis.

| 9 |

| Table of Contents |

Recent Accounting Pronouncements – The Company has reviewed all recently issued, but not yet adopted, accounting standards in order to determine their effects, if any, on its results of operation, financial position or cash flows. Based on that review, the Company believes that none of these pronouncements will have a significant effect on its financial statements.

NOTE 2 – LICENSING AGREEMENTS

ED Patent – The Company acquired a patent from CMH, a related company on February 2, 2016, in exchange for

Multipotent Amniotic Fetal Stem Cells License Agreement - On August 25, 2016, CMT entered into a License Agreement dated August 25, 2016, with a university. This license agreement grants to CMT the exclusive right to all products derived from a patent for use of multipotent amniotic fetal stem cells composition of matter throughout the world during the period ending on the expiration date of the longest-lived patent rights under the patent. The license agreement also permits CMT to grant sublicenses. Under the terms of the license agreement, CMT is required to diligently develop, manufacture, and sell any products licensed under the agreement. CMT paid the University an initial license fee within 30 days of entering into the agreement. CMT is also required to pay annual license maintenance fees on each anniversary date of the agreement, which maintenance fees would be credited toward any earned royalties for any given period. The License Agreement provides for payment of various milestone payments and earned royalties on the net sales of licensed products by CMT or any sub licensee. CMT is also required to reimburse the University for any future costs associated with maintaining the patent. CMT may terminate the license agreement for any reason upon 90 days’ written notice and the University may terminate the agreement in the event CMT fails to meet its obligations set forth therein, unless the breach is cured within 30 days of the notice from the University specifying the breach. CMT is also obligated to indemnify the University against claims arising due to the exercise of the license by CMT or any sub licensee. As of June 30, 2023, no amounts are currently due to the University.

The Company estimates that the patent expires in February

Lower Back Patent– The Company, through its subsidiary StemSpine, LLC, acquired a patent from CMH, a related company, on May 17, 2017, covering the use of various stem cells for the treatment of lower back pain from pursuant to a Patent Purchase Agreement, which was amended in November 2017. As amended, the agreement provides the following:

| · | The Company is required to pay CMH $ |

| · | In the event the Company determines to pursue the technology via use of autologous cells, the Company will pay CMH: |

| o | $ |

| o | $ |

| o | $ |

| · | In the event the Company determines to pursue the technology via use of allogenic cells, the Company will pay CMH: |

| 10 |

| Table of Contents |

| o | $ |

| o | $ |

| o | $ |

| · | Payment may be made in cash or shares of our common at a discount of |

| · | In the event the Company’s shares of common stock trade below $ |

| · | For a period of five years from the date of the first sale of any product derived from the patent, the Company is required to make royalty payments of |

The Company paid CMH the $

The patent expires on

The Company has elected to amortize the additional $300,000 associated with the patent over a ten-year period on a straight-line basis. Amortization expense of $

ImmCelz™ - On December 28, 2020, ImmCelz, Inc. (“ImmCelz”), a newly formed Nevada corporation and wholly owned subsidiary of the Company, entered into a Patent License Agreement dated December 28, 2020 (the “Agreement”), with Jadi Cell, LLC. (“Jadi”), a company controlled by Dr. Amit Patel, a former director of the Company. The Agreement grants to ImmCelz™ the patent rights under U.S. Patent# 9,803,176 B2, “Methods and compositions for the clinical derivation of an allogenic cell and therapeutic uses”. The contract grants ImmCelz™ access to proprietary process of expanding the master cell bank of Jadi Cell LLC, as currently practiced by Licensor, and as documented in standard operating procedures (SOPs) and other written documentation to augment autologous cells. The terms of the agreement are as follows:

| · | Licensee shall pay Licensor a license fee of $ |

| · | Within thirty (30) days of the end of each calendar quarter during the term of this Agreement, Licensee will pay Licensor five percent (5%) of the Net Income of ImmCelz™. during such calendar quarter (the “Continuing Royalty”) |

| · | in one or a series of related transactions, of all or substantially all of the business or assets of Licensee ImmCelz, Inc. (“Sale of Assets”) will result in a one-time ten-percent allocation to the licensor, the Continuing Royalty will be calculated at five percent (5%) of the Net Income of Licensee in any calendar quarter in which the Net Income in such calendar quarter reflects the receipt of any consideration from such Sale of Assets. |

To date, the Company has not made any payments to Jadi Cell under this agreement, other than the $

| 11 |

| Table of Contents |

The Company has elected to amortize the patent over a ten-year period on a straight-line basis. Amortization expenses of $

The following is a rollforward of the Company’s licensing agreements for the six months-ended June 30, 2023.

|

| Assets |

|

| Accumulated Amortization |

| ||

|

|

|

|

|

|

| ||

Balances at December 31, 2022 |

| $ |

|

| $ | ( | ) | |

Addition of new assets |

|

|

|

|

|

|

| |

Amortization |

|

|

|

|

| ( | ) | |

Balances at June 30, 2023 |

| $ |

|

| $ | ( | ) | |

NOTE 3 – RELATED PARTY TRANSACTIONS

Jadi Cell License Agreement

On December 28, 2020,

StemSpine Patent Purchase

The Company acquired U.S. Patent No. 9,598,673 covering the use of various stem cells for the treatment of lower back pain from its affiliate CMH pursuant to a Patent Purchase Agreement dated May 17, 2017, which was amended in November 2017. The inventors of the patent were Thomas Ichim, PhD and Amit Patel, MD, former directors of the Company, and Annette Marleau, PhD. The Patent Purchase Agreement is described in detail in Note 2 above. Pursuant to the Patent Purchase Agreement, the Company paid CMH the $

NOTE 4 – DEBT

During the six-months ended June 30, 2023 and 2022 there were no debt issuances.

As of June 30, 2023, and 2022, the Company had no outstanding loans.

NOTE 5 – DERIVATIVE LIABILITIES

As-of June 30, 2023 and 2022, the Company had no outstanding derivative liabilities and there was no derivative activity during the six-months ended June 30, 2023 and 2022.

| 12 |

| Table of Contents |

NOTE 6 – STOCK-BASED COMPENSATION

On September 6, 2021, the Company’s Board of Directors, and holders of a majority of the voting power of the Company’s stockholders approved the Company’s 2021 Equity Incentive Plan (the “2021 Plan”) and reserved

During the six-months ended June 30, 2022, Messrs. Warbington and Dickerson received

|

| Inputs Used |

| |

|

|

|

| |

Annual dividend yield |

| $ | - |

|

Expected life (years) |

|

|

| |

Risk-free interest rate |

|

| % | |

Expected volatility |

|

| % | |

Common stock price |

| $ |

| |

During the six-months ended June 30, 2023 and 2022, the fair market value of the options was insignificant to the financial statements.

Since the expected life of the options was greater than the Company’s historical stock information available, the Company determined the expected volatility based on price fluctuations of comparable public companies.

There were no options issued during the six-months ended June 30, 2023, and 11,183 options issued during the six-months ended June 30, 2022.

Option activity for the six-months ended June 30, 2023, consists of the following:

|

| Stock Options |

|

| Weighted Average Exercise Price |

|

| Weighted Average Life Remaining |

| |||

Outstanding, December 31, 2022 |

|

|

|

| $ |

|

|

|

| |||

Issued |

|

| - |

|

|

| - |

|

|

| - |

|

Exercised |

|

| - |

|

|

| - |

|

|

| - |

|

Expired |

|

| - |

|

|

| - |

|

|

| - |

|

Outstanding, June 30, 2023 |

|

|

|

| $ |

|

|

|

| |||

Vested, June 30, 2023 |

|

|

|

| $ |

|

|

|

| |||

See Note 2 for discussion related to the issuance of common stock in connection with licensing agreements.

See Note 7 for warrant rollforward.

| 13 |

| Table of Contents |

NOTE 7 – STOCKHOLDERS’ EQUITY

May 2022 Private Offering

On May 3, 2022, the Company completed the sale of (i)

The Common Warrants have a five-year term, and an exercise price of $

The Pre-Funded Warrants were classified as a component of permanent equity because they are freestanding financial instruments that are legally detachable and separately exercisable from the shares of common stock with which they were issued, are immediately exercisable, did not embody an obligation for the Company to repurchase its shares, and permitted the holders to receive a fixed number of shares of common stock upon exercise. In addition, the Pre-Funded Warrants did not provide any guarantee of value or return.

Roth Capital Partners (“Roth”) acted as sole placement agent for the offering. The Company paid Roth a placement agent fee in the amount of $

On June 12, 2023 the Company announced that its Board of Directors has approved a share repurchase program. The program authorizes the Company to repurchase up to $

Warrants

In connection with our May 2022 private offering, we issued pre-funded warrants to purchase

Assumptions used in calculating the fair value of the warrants issued in 2022 were as follows:

|

| Range of Inputs Used |

| |

Annual dividend yield |

| $ | - |

|

Expected life (years) |

|

|

| |

Risk-free interest rate |

|

| % | |

Expected volatility |

|

| % | |

Common stock price |

| $ |

| |

As of June 30, 2023, and 2022, warrants to purchase

Warrant activity for the six-months ended June 30, 2023 consists of the following:

|

| Warrants |

|

| Weighted Average Exercise Price |

|

| Weighted Average Life Remaining |

| |||

Outstanding, December 31, 2022 |

|

|

|

| $ |

|

|

|

| |||

Issuances |

|

| - |

|

|

| - |

|

|

| - |

|

Exercises |

|

| - |

|

|

| - |

|

|

| - |

|

Outstanding, June 30, 2023 |

|

|

|

| $ |

|

|

|

| |||

| 14 |

| Table of Contents |

NOTE 8 – SIGNIFICANT RESEARCH AND DEVELOPMENT PURCHASE

On December 15, 2022, the Company purchased a set of components referred to as “research tools” for $5,000,000 from Narkeshyo LLC, an entity a former director and current consultant of the Company is affiliated with, pursuant to the terms of an Asset Purchase Agreement between the Company and Narkeshyo. Some of the acquired research tools were originally developed by the former director and current consultant. Under the terms of the agreement, the Company made an initial payment to Narkeshyo in the amount of $

The vision and pipeline of the Company is based on robust and thorough development of its biological platforms, therapies and products. This acquisition of the research tools aligned with the Company’s priority of advancing and augmenting its suite of cGMP (Current Good Manufacturing Practices) cellular therapy products. The Company believes that the acquired research tools will allow it to protect its intellectual property while complying with regulatory requirements, and accelerate product development. The information contained in the research tools will not only be used to support and fast-track the Company’s regulatory filings (such as IND, NDA, ANDA and export applications), but also, provide clinical and regulatory support to potential partners and collaborators without having to divulge trade secrets and know-how.

A third-party analysis of this acquisition concluded it would accelerate development time by 3-5 years and result in a substantial reduction in the Company’s research and development expenses over the long term.

The purchased tools included (but were not limited to):

| · | Toxicology |

| · | Screening |

| · | Preclinical Testing |

| · | Assays |

| · | Authorization |

| · | Tools of Biological Transaction |

| · | Tools of Intellectual Property |

NOTE 9 – SUBSEQUENT EVENTS

There were no material subsequent events during this period.

| 15 |

| Table of Contents |

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Management’s Discussion and Analysis of Financial Condition and Results of Operations analyzes the major elements of our balance sheets and statements of operations. This section should be read in conjunction with our Annual Report on Form 10-K for the year ended December 31, 2022, and accompanying notes to these financial statements included in this report. All amounts are in U.S. dollars.

Forward-Looking Statement Notice

This quarterly report on Form 10-Q contains forward-looking statements about our expectations, beliefs or intentions regarding, among other things, our product development efforts, business, financial condition, results of operations, strategies or prospects. In addition, from time to time, we or our representatives have made or may make forward-looking statements, orally or in writing. Forward-looking statements can be identified by the use of forward-looking words such as “believe,” “expect,” “intend,” “plan,” “may,” “should” or “anticipate” or their negatives or other variations of these words or other comparable words or by the fact that these statements do not relate strictly to historical or current matters. These forward-looking statements may be included in, but are not limited to, various filings made by us with the SEC, press releases or oral statements made by or with the approval of one of our authorized executive officers. Forward-looking statements relate to anticipated or expected events, activities, trends or results as of the date they are made. Because forward-looking statements relate to matters that have not yet occurred, these statements are inherently subject to risks and uncertainties that could cause our actual results to differ materially from any future results expressed or implied by the forward-looking statements. Many factors could cause our actual activities or results to differ materially from the activities and results anticipated in forward-looking statements, including, but not limited to, those set forth in our most recent annual report referenced below.

This report identifies important factors which could cause our actual results to differ materially from those indicated by the forward-looking statements.

All forward-looking statements attributable to us or persons acting on our behalf speak only as of the date of this report and are expressly qualified in their entirety by the cautionary statements included in this report. We undertake no obligations to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events. In evaluating forward-looking statements, you should consider these risks and uncertainties.

Overview

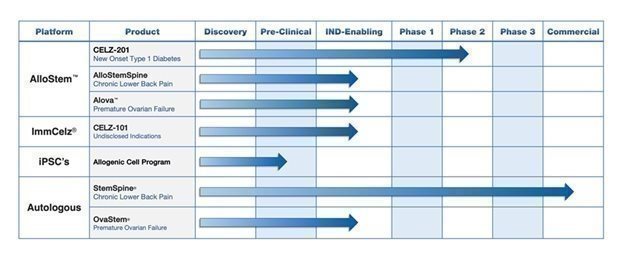

We are a commercial stage biotechnology company dedicated to the advancement of identifying and translating novel biological therapeutics in the fields of immunotherapy, endocrinology, urology, neurology and orthopedics. Our platforms, therapies and products include the following:

Our subsidiary, Creative Medical Technologies, Inc. (“CMT”), was originally created to monetize U.S. Patent No. 8,372,797 and related intellectual property related to the treatment of erectile dysfunction (“ED”), which it acquired in May 2016. Subsequently, we have expanded our development and acquisition of intellectual property beyond urology to include therapeutic treatments utilizing “re-programmed” stem cells, and the treatment of neurologic disorders, lower back pain, Type-1 diabetes, and heart, liver, kidney, and other diseases using various types of stem cells through our ImmCelz, Inc., StemSpine, Inc. and AlloCelz LLC subsidiaries. However, neither ImmCelz Inc. nor AlloCelz LLC have commenced commercial activities.

We currently conduct substantially all of our commercial operations through CMT, which markets and sells our CaverStem® and FemCelz® disposable kits utilized by physicians to perform autologous procedures that treat erectile dysfunction and female sexual dysfunction, respectively. Our CaverStem® and FemCelz® kits are currently available through physicians at eight locations in the United States.

| 16 |

| Table of Contents |

In 2020, through our ImmCelz Inc. subsidiary, we began developing treatments that utilize a patient’s own extracted immune cells that are then “reprogrammed/supercharged” by culturing them outside the patient’s body with optimized cell-free factors. The immune cells are then re-injected into the patient from whom they were extracted. We believe this process endows the immune cells with regenerative properties that may be suitable for the treatment of multiple indications. In contrast to other stem cell-based approaches, the immune cells are significantly smaller in size than stem cells and are believed to more effectively penetrate areas of the damaged tissues and induce regeneration.

In June 2022, we signed an agreement with Greenstone Biosciences Inc. for the development of a human induced pluripotent stem cell (iPSC) pipeline for our ImmCelz® platform. This project was identified as iPScelz™. The efforts by Greenstone Biosciences Inc. are expected to complement and expand our current work on novel therapeutic cell lines.

In October 2022, we announced the development of our AlloStem™ Clinical Cell Line, a proprietary allogenic cell line which includes a Master Cell Bank and a Drug Master File. We believe we will able to use this cell line for many of our programs, including our ImmCelz® immunotherapy platform for multiple diseases, OvaStem® for Premature Ovarian Failure, CELZ-201 for Type 1 diabetes, StemSpine® for lower back pain, and IPScelz ™ inducible pluripotent stem cell program in ongoing development with Greenstone Biosciences.

In November 2022, we announced that the FDA had cleared the Company’s CELZ-201 Investigational New Drug (IND) application for the treatment of Type 1 Diabetes, which will allow us to begin a Phase I/II clinical trial. The primary objective of the study will be to evaluate CELZ-201 in patients with newly diagnosed Type 1 Diabetes. Patient recruitment is expected to begin in 2023.

In February 2023, the Company reported positive three-year follow-up data for its StemSpine® pilot study. The three-year data demonstrates continued efficacy of the StemSpine® procedure for treating chronic lower back pain without any serious adverse effects reported.

In March 2023, the Company announced that it filed an application with the FDA to receive Orphan Drug Designation for the treatment of Brittle Type 1 Diabetes using its ImmCelz®(CELZ-100) platform, and in April 2023, the Company reported positive one-year follow-up data and significant efficacy using CELZ-001 to treat patients with Type 2 Diabetes without any serious adverse effects reported

In addition to our clinical research efforts, we are currently seeking to expand the commercial sale and use of our CaverStem® and FemCelz® products by physicians in the United States.

Results of Operations – For the Three-month Periods Ended June 30, 2023, and 2022

Gross Revenue. We generated no revenue for the three-months ended June 30, 2023 and 2022.

Cost of Goods Sold. We generated no cost of goods sold for the three-months ended June 30, 2023 and 2022.

Gross Profit/(Loss). We generated no gross profit for the three-months ended June 30, 2023 and 2022.

Selling, General and Administrative Expenses. General and administrative expenses for the three-months ended June 30, 2023, totaled $859,537, in comparison with $1,108,428 for the comparable period a year ago. The decrease of $248,891, or 23% is primarily due to a decrease of $90,194 in marketing, $38,152 in travel, $76,000 in timing-related Board of Director expenses and $37,887 in D&O.

Amortization Expenses. Amortization expenses for the three-month periods ended June 30, 2023 and 2022, totaled $23,021.

Research and Development Expenses. Research and development expenses for the three-months ended June 30, 2023, totaled $309,480 in comparison to $659,695 for the comparable period a year ago. The decrease of $350,215, or 53% was primarily due to trial-related start-up expenses of $410,000 incurred in 2022 associated with our CELZ-201 Phase I/II diabetes trial.

Operating Loss. For the reasons stated above, our operating loss for the three-months ended June 30, 2023, was $1,192,038 in comparison with $1,791,144 for the comparable period a year ago.

| 17 |

| Table of Contents |

Other Income. Other income for the three-months ended June 30, 2023, totaled $89,913 in comparison with $0 for the comparable period a year ago. The increased income of $89,913 is due to increased interest income associated with $9,581,207 in short-term certificates of deposit.

Net Income/Loss. For the reasons stated above, our net loss for the three-months ended June 30, 2023, was $1,102,125 in comparison with a net loss of $1,791,144 for the comparable period a year ago.

Results of Operations – For the Six-month Periods Ended June 30, 2023, and 2022

Gross Revenue. We generated no revenue for the six-months ended June 30, 2023, in comparison with $15,000 for the comparable period a year ago. The pause in sales reflects the Company’s re-evaluation of marketing and distribution options to generate improved sales of the Caverstem and FemCelz procedures.

Cost of Goods Sold. We generated no cost of goods sold for the six-months ended June 30, 2023, in comparison with $6,791 for the comparable period a year ago. The decrease is due to the reduction in sales.

Gross Profit/(Loss). We generated $0 in gross profit for the six-months ended June 30, 2023, in comparison with $8,209 in gross profit for the comparable period a year ago.

Selling, General and Administrative Expenses. General and administrative expenses for the six-months ended June 30, 2023, totaled $1,630,557, in comparison with $2,238,845 for the comparable period a year ago. The decrease of $607,928, or 27% is primarily due to decreases of $194,000 in consulting expenses, $131,136 in marketing expenses, $121,309 in D&O insurance, $76,000 in Board of Directors payment timing, $49,490 in accounting fees, $44,672 in travel, and $32,098 in stock-based compensation.

Amortization Expenses. Amortization expenses for the six-month periods ended June 30, 2023 and 2022, totaled $46,042.

Research and Development Expenses. Research and development expenses for the six-months ended June 30, 2023, totaled $628,500 in comparison to $669,695 for the comparable period a year ago. The decrease of $41,186, or 6% was primarily due to of trial-related start-up expenses in 2022 associated with our CELZ-201 Phase I/II diabetes trial.

Operating Loss. For the reasons stated above, our operating loss for the six-months ended June 30, 2023, was $2,305,108 in comparison with $2,946,013 for the comparable period a year ago.

Other Income. Other income for the six-months ended June 30, 2023, totaled $151,060 in comparison with $0 for the comparable period a year ago. The increased income of $151,060 is due to interest income associated with $9,581,207 in short-term certificates of deposit.

Net Income/Loss. For the reasons stated above, our net loss for the six-months ended June 30, 2023, was $2,154,048 in comparison with a net loss of $2,946,013 for the comparable period a year ago.

Liquidity and Capital Resources

As of June 30, 2023, we had $13,570,757 of available cash and certificates of deposit and positive working capital of approximately $13,336,116. In comparison, as of December 31, 2022, we had $18,399,136 of available cash and positive working capital of $15,425,798.

On May 3, 2022 we received gross proceeds of $17,000,000, before deducting placement agent fees and expenses, upon the closing of an unregistered sale of equity securities of (i) 299,167 shares of our common stock and pre-funded warrants to purchase 456,389 shares of common stock (the “Pre-Funded Warrants”), and (ii) accompanying warrants to purchase 1,511,112 shares of common stock at an exercise price of $20.00 per share (“Warrants”), at a combined offering price of $22.50 per share of common stock/Pre-Funded Warrant and related Warrant to a group of institutional investors (the “Purchasers”). The Warrants have a five-year term, and an exercise price of $20.00 per share. The Pre-Funded Warrants do not expire and had an exercise price of $0.001 per share. Roth Capital Partners acted as sole placement agent for the offering. We paid Roth a placement agent fee in the amount of $1,360,000 and issued Roth a warrant to purchase 113,334 shares of common stock with the same terms as the common warrants issued to the purchasers. Pursuant to the Purchase Agreement, the Company and the Purchasers entered into a Registration Rights Agreement, pursuant to which the Company agreed to file a registration statement with the Securities and Exchange Commission to register the resale of the shares of Common Stock issued in the offering and the shares of Common Stock underlying the Warrants and Pre-Funded Warrants. On May 10, 2022, we filed a Form S-3 registration statement to register the shares, Warrants and Pre-Funded Warrants for resale. The registration went effective on May 19, 2022, fulfilling our contractual obligation. From June through July 2022, all of the Pre-Funded Warrants were exercised for shares of common stock.

| 18 |

| Table of Contents |

Cash Flows

Net Cash used in Operating Activities. We used cash in our operating activities due to our losses from operations. Net cash used in operating activities was $4,828,379 for the six months-ended June 30, 2023, in comparison to $3,332,429 for the comparable period a year ago, an increase of $1,495,950 or 45%. The increase in cash used in operations was primarily related to $3,000,000 in cash payments related to the purchase of research tools referenced in Note 8 offset by reductions in general and administrative expenses.

Net Cash Received in Investing Activities. Cash received in investing activities was $497,410 for the six-months ended June 30, 2023, related to net redemptions of $497,410 in certificates of deposit in comparison to $0 for the six-months ended June 30, 2022.

Net Cash from Financing Activities.

There were no cash proceeds or expenditures from financing activities during the six-months ended June 30, 2023 compared to $15,472,220 for the six-months ended June 30, 2022. The $15,472,220 is related to the May, 2022 financing referenced in Note 7.

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with generally accepted accounting principles accepted in the United States. In connection with the preparation of our financial statements, we are required to make assumptions and estimates about future events and apply judgments that affect the reported amounts of assets, liabilities, revenue, expenses, and the related disclosures. We base our assumptions, estimates and judgments on historical experience, current trends, and other factors that management believes to be relevant at the time our consolidated financial statements are prepared. On a regular basis, we review the accounting policies, assumptions, estimates and judgments to ensure that our financial statements are presented fairly and in accordance with GAAP. However, because future events and their effects cannot be determined with certainty, actual results could differ from our assumptions and estimates, and such differences could be material.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

As a smaller reporting company, we have elected not to provide the disclosure required by this item.

Item 4. Controls and Procedures

Evaluation of disclosure controls and procedures

Our management, with the participation of our Chief Executive Officer and Chief Financial Officer, evaluated the effectiveness of our disclosure controls and procedures (as defined in Rule 15(d)-15(e) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) as of the end of the period covered by this report. Based on that evaluation, our Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures as of the end of the period covered by this report were not effective in ensuring that information required to be disclosed by us in reports that we file or submit under the Exchange Act (i) is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms, and (ii) is accumulated and communicated to our management, including our principal executive and principal financial officers, or persons performing similar functions, as appropriate to allow timely decisions regarding required disclosure.

Description of Material Weaknesses

A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting, such that there is a reasonable possibility that a material misstatement of a company’s annual or interim financial statements will not be prevented or detected on a timely basis. A significant deficiency is a deficiency, or a combination of deficiencies, in internal control over financial reporting that is less severe than a material weakness, yet important enough to merit attention by those responsible for oversight of a company’s financial reporting. In connection with the preparation and audit of the Company’s financial statements for the year ended the December 31, 2022, management identified the following deficiencies that alone or in combination, represent material weaknesses in internal control over financial reporting, the material weaknesses are still present for the six months ended June 30, 2023 and are as follows:

· | Previously, we failed to adequately disclose the transaction in which we purchased research tools for $5,000,000 from Narkeshyo LLC, an entity a former director and current consultant of the Company is affiliated with. |

|

|

· | During the year ended December 31, 2022, we did not sufficiently segregate the duties of our officers. |

We intend to remediate the deficiencies described above, and take such other action as we deem appropriate to further strengthen our internal control over financial reporting. We are currently in the process of establishing additional review and procedure controls. For instance, subsequent to quarter end we have implemented a policy whereby disbursements over a certain dollar threshold require dual authorization for processing and payment. The Company expects to remediate the deficiencies and obtain operating effectiveness over the next few quarters. However, because of its inherent limitations, internal control over financial reporting may not prevent or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Changes in internal control over financial reporting

There were no changes in our internal control over financial reporting that occurred during the period covered by this Quarterly Report on Form 10-Q that have materially affected, or are reasonably likely to materially affect, our internal control over financial reporting.

| 19 |

| Table of Contents |

PART II – OTHER INFORMATION

Item 1. Legal Proceedings

From time to time, we may become involved in various lawsuits and legal proceedings, which arise in the ordinary course of business. However, litigation is subject to inherent uncertainties, and an adverse result in these or other matters may arise from time to time that may harm our business.

In October 2022, we terminated an employee for cause. Subsequent to the termination, in December 2022, the employee brought claims against us for breach of contract, wrongful termination and related claims in the Superior Court of the State California (Orange County). The parties have submitted the action for arbitration before JAMS, where it is now pending.

Item 6. Exhibits

Exhibits |

|

|

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| ||

| Rule 13a-14(a)/15d-14a(a) Certification of Principal Executive Officer* | |

| Rule 13a-14(a)/15d-14a(a) Certification of Principal Financial Officer* | |

| ||

| ||

101.INS |

| Inline XBRL Instance Document |

101.SCH |

| Inline XBRL Taxonomy Extension Schema Document |

101.CAL |

| Inline XBRL Taxonomy Extension Calculation Linkbase Document |

101.DEF |

| Inline XBRL Taxonomy Extension Definition Linkbase Document |

101.LAB |

| Inline XBRL Taxonomy Extension Label Linkbase Document |

101.PRE |

| Inline XBRL Taxonomy Extension Presentation Linkbase Document |

________

† Management contract or compensatory plan or arrangement.

| 20 |

| Table of Contents |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Creative Medical Technology Holdings, Inc. |

| |

|

|

|

|

Date: August 11, 2023 | By | /s/ Timothy Warbington |

|

|

| Timothy Warbington, Chief Executive Officer |

|

|

| (Principal Executive Officer) |

|

|

|

|

|

Date: August 11, 2023 | By | /s/ Donald Dickerson |

|

|

| Donald Dickerson, Chief Financial Officer |

|

|

| (Principal Financial Officer) |

|

| 21 |