| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials. | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

About PRA Group, Inc.

Headquartered in Norfolk, Virginia and incorporated in Delaware, we are a global financial and business services company with operations based primarily in the Americas, Europe and Australia. Our primary business is the purchase, collection and management of portfolios of nonperforming loans. The accounts we purchase are primarily the unpaid obligations of individuals owed to credit originators, which include banks and other types of consumer, retail and auto finance companies. We purchase portfolios of nonperforming loans at a discount in two broad categories: Core and Insolvency. Our Core operation specializes in purchasing and collecting nonperforming loans, which we purchase since the credit originators have chosen not to pursue, or have been unsuccessful in, collecting the full balance owed. Our Insolvency operation consists primarily of purchasing and collecting on nonperforming loans where the customer is involved in a bankruptcy proceeding, or the equivalent thereof, in certain European countries. We also provide fee-based services on class action claims recoveries in the United States (“U.S.”). For more information about our business, please refer to our Annual Report on Form 10-K for the year ended December 31, 2023 (“2023 Form 10-K”) as filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 29, 2024. The information contained on, or that can be accessed through, our website, including any document referenced in this Proxy Statement, is not, and shall not be deemed to be, a part of this Proxy Statement.

Notice of Annual Meeting of Stockholders

| DATE: | Thursday, June 13, 2024 | |

| TIME: | 9:30 a.m. Eastern Time | |

| LOCATION: | Virtual Meeting | |

| RECORD DATE: | April 23, 2024 |

The PRA Group, Inc. (the “Company”) 2024 Annual Meeting of Stockholders (the “Annual Meeting”) will be held virtually on Thursday, June 13, 2024, beginning at 9:30 a.m. Eastern Time. Instructions on how to access and participate in the Annual Meeting are provided under “Instructions for Attending and Participating in the Virtual Annual Meeting” on page 2 of the enclosed Proxy Statement. Only stockholders of record as of the close of business on April 23, 2024 are entitled to receive notice of, and to vote during, the Annual Meeting.

At the Annual Meeting, stockholders will be asked to vote on the following items:

| • | Election of the 11 director nominees named in the accompanying Proxy Statement for a one-year term; |

| • | Ratification of the appointment of Ernst & Young LLP as the Company’s independent registered public accounting firm for 2024; |

| • | Approval, on a non-binding advisory basis, of the compensation of the Company’s named executive officers (“Say-on-Pay”); and |

| • | Any other business that may properly come before the Annual Meeting and any adjournments or postponements thereof. |

We are providing access to our proxy materials by internet in accordance with the SEC’s “notice and access” rules. These rules permit us to provide access to our proxy materials, including the Notice of Annual Meeting, Proxy Statement and our 2023 Annual Report to Stockholders, by notifying you of their availability on the internet instead of mailing printed copies. Accordingly, on or about April 29, 2024, we will mail to our stockholders a Notice of Internet Availability of Proxy Materials. The Notice of Internet Availability of Proxy Materials will provide instructions on how to access and review our proxy materials on the internet and request printed copies. Stockholders will not receive printed copies of our proxy materials unless they request such copies. If requested, printed copies will be available free of charge. We believe that providing our proxy materials through the internet increases the ability of our stockholders to access the information they need while simultaneously reducing the environmental impact and cost to the Company of the Annual Meeting.

Every vote is important and valued by the Company. Therefore, we encourage you to vote your shares through the internet, by phone or, if you requested and received a printed copy of the proxy card, by mail, using the instructions provided below even if you plan to attend the Annual Meeting.

By Order of the Board of Directors,

| LaTisha Owens Tarrant |

| Corporate Secretary

April 29, 2024 |

|

YOU CAN VOTE IN ONE OF FOUR WAYS | ||||||

|

Visit www.AALvote.com/PRAA to vote VIA THE INTERNET |

|

If you received printed proxy materials, sign, date and return your proxy card in the envelope provided to vote BY MAIL | |||

|

Call (866) 804-9616 to vote BY TELEPHONE |

|

Attend the Annual Meeting virtually and vote via the link provided. | |||

|

Important notice regarding the availability of proxy materials for the Annual Meeting of Stockholders to be held on June 13, 2024: The Company’s Proxy Statement and 2023 Annual Report to stockholders are available at

| ||||||

PRA Group, Inc.

2024 Proxy Statement

Table of Contents

| i | ||||

|

|

i |

| ||

|

|

i |

| ||

|

|

i |

| ||

|

|

ii |

| ||

|

|

ii |

| ||

|

|

iv |

| ||

| 1 | ||||

|

|

1 |

| ||

|

|

1 |

| ||

|

|

1 |

| ||

|

|

1 |

| ||

| Instructions for Attending and Participating in the Virtual Annual Meeting |

|

2 |

| |

| 3 | ||||

|

|

3 |

| ||

|

|

3 |

| ||

|

|

4 |

| ||

|

|

4 |

| ||

|

|

6 |

| ||

|

|

6 |

| ||

|

|

7 |

| ||

|

|

7 |

| ||

|

|

7 |

| ||

|

|

8 |

| ||

|

|

8 |

| ||

|

|

9 |

| ||

|

|

9 |

| ||

|

|

9 |

| ||

|

|

10 |

| ||

|

|

10 |

| ||

| 11 | ||||

| 12 | ||||

| PROPOSAL 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

18 | |||

|

|

19 |

| ||

|

|

19 |

| ||

|

|

19 |

| ||

|

|

19 |

| ||

| 21 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 36 | ||||

| 36 | ||||

| 37 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

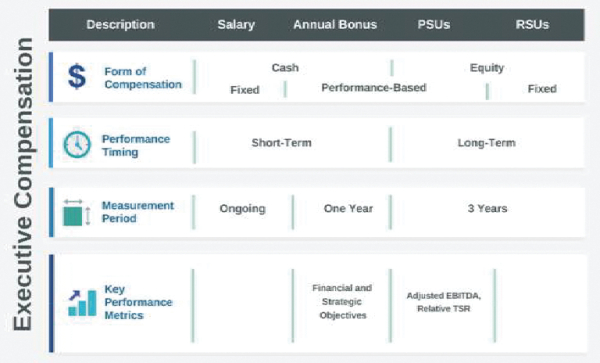

| Performance Measures Used to Link Company Performance and Compensation Actually Paid to the NEOs |

45 | |||

| Securities Authorized for Issuance Under Equity Compensation Plan |

46 | |||

| 47 | ||||

| Security Ownership of Certain Beneficial Owners and Management |

47 | |||

| 48 | ||||

| 49 | ||||

|

|

49 |

| ||

|

|

49 |

| ||

|

|

49 |

| ||

|

|

50 |

| ||

|

|

50 |

| ||

|

|

50 |

| ||

|

|

50 |

| ||

|

|

51 |

| ||

|

|

51 |

| ||

| 2024 Proxy Statement | PRA Group |

Proxy Summary

This summary highlights certain information contained elsewhere in the Proxy Statement but does not contain all information that you should consider prior to casting your vote. Therefore, you should read the entire Proxy Statement carefully before voting.

Annual Meeting

| Date and Time: | Thursday, June 13, 2024, at 9:30 a.m. Eastern Time | |

| Location: | Virtual Meeting | |

| Record Date: | April 23, 2024 | |

Voting Matters and Board Vote Recommendations

| Agenda Item

|

Board Vote

|

Page

| ||||

| Proposal 1: |

Elect the 11 director nominees named in this Proxy Statement for a one-year term | FOR | 11 | |||

| Proposal 2: |

Ratify the appointment of Ernst & Young LLP (“EY”) as our independent registered public accounting firm for 2024 | FOR | 18 | |||

| Proposal 3: |

Advisory vote to approve our named executive officer (“NEO”) compensation (“Say-on-Pay”) | FOR | 22 | |||

Corporate Governance Highlights

| Independent Oversight | • Our Board of Directors (“Board”) is comprised primarily of independent (11 of 12) directors.

• Our Board Committees are comprised solely of independent directors.

• We have a Lead Independent Director who, among other responsibilities, presides over executive sessions of our independent directors, which occur at each in-person or virtual Board meeting.

• The roles of Chairman of the Board and Chief Executive Officer (“CEO”) are separate.

• Our Compensation Committee engages an independent compensation consultant to advise and support the Compensation Committee’s work. | |

| Board Refreshment |

• Our Board and all Board Committees conduct annual performance evaluations.

• Our directors cannot stand for re-election after they reach the age of 75. | |

| Stockholder Rights and Alignment |

• Our stockholders have the right to call special meetings.

• Our directors are elected annually.

• Our directors must be elected by a majority of the votes cast in uncontested elections.

• We have stock ownership guidelines that apply to our directors and executive officers in order to align their interests with the interests of our stockholders.

• All incentive compensation for our executive officers is subject to recoupment (or clawback) by the Company in the event of an accounting restatement, to comply with applicable law or if the executive officer violates restrictive covenants included in the officer’s equity award or employment agreement. | |

| Environmental, Social and Governance (“ESG”) | • Our Nominating and Corporate Governance Committee oversees significant ESG matters with the support of management’s ESG Steering Committee, which is comprised of senior members of management and operates pursuant to a written charter.

• We have adopted a Statement on Human Rights.

• We have adopted a Political Contributions Statement.

• We have adopted an Environmental and Sustainability Statement. | |

| Hedging/Pledging | • Our directors, executive officers and employees are prohibited from engaging in short sales and hedging transactions involving the Company’s equity securities and may not pledge our common stock. | |

| 2024 Proxy Statement | PRA Group i |

Director Dashboard

We are led by directors whose qualifications, experience and backgrounds support the effective oversight of our business and affairs, further our strategic goals and provide valued guidance to management. The charts below reflect key data about our Board as of April 29, 2024.

| Board Diversity Matrix (As of April 29, 2024) | ||||||||

| Total Number of Directors |

12 | |||||||||||||||

|

|

Female | Male | Non-Binary | Did Not Disclose Gender |

||||||||||||

| Part I: Gender Identity |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| Directors |

3 | 9 | 0 | 0 | ||||||||||||

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

|

|

|

| ||||

| African American or Black |

1 | 0 | 0 | 0 | ||||||||||||

| Alaskan Native or Native American |

0 | 0 | 0 | 0 | ||||||||||||

| Asian |

0 | 1 | 0 | 0 | ||||||||||||

| Hispanic or Latinx |

1 | 0 | 0 | 0 | ||||||||||||

| Native Hawaiian or Pacific Islander |

0 | 0 | 0 | 0 | ||||||||||||

| White |

1 | 8 | 0 | 0 | ||||||||||||

| Two or More Races or Ethnicities |

0 | 0 | 0 | 0 | ||||||||||||

| LGBTQ+ |

|

|

|

1 |

|

|

| |||||||||

| Did Not Disclose Demographic Background |

|

|

|

0 |

|

|

| |||||||||

2023 Company Performance Highlights

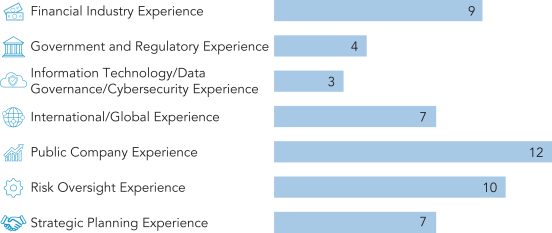

| • | Total portfolio purchases were $1.2 billion in 2023 compared to $850.0 million in 2022. The increase was primarily driven by improving portfolio supply in the U.S. |

| • | Total cash collections (collections on our owned finance receivables portfolios) remained stable at $1.7 billion for both 2023, and 2022. |

| • | Total revenues were $802.6 million in 2023 compared to $966.5 million in 2022. The decrease was driven by: |

| • | a $140 million decrease in changes in expected recoveries, primarily due to lower overperformance and a net increase to the estimated remaining collections of certain pools compared to a net decrease during 2023; and |

| • | a $15 million decrease in portfolio income, largely the result of higher levels of consumer liquidity driving a lower supply of nonperforming loan portfolios in the years leading up to 2023. |

| • | Total operating expenses were $702.1 million in 2023 compared to $680.7 million in 2022. The increase was driven by: |

| • | a $12 million increase in legal collection costs, primarily reflecting higher volumes of lawsuits filed in the U.S. during 2023; |

| ii PRA Group | 2024 Proxy Statement |

| • | an $11 million increase in agency fees, due to higher collections in Brazil; and |

| • | $20 million of non-recurring expenses, including severance, case-specific litigation, and the impairment of real estate associated with the closing of an owned U.S. call center. |

| • | Net income/(loss) attributable to the Company was ($83.5) million in 2023, compared to $117.1 million in 2022. |

| • | Our cash efficiency ratio (cash receipts, which are cash collections plus fee income, less operating expenses, divided by cash receipts) was 58.0% in 2023 compared to 61.0% in 2022. |

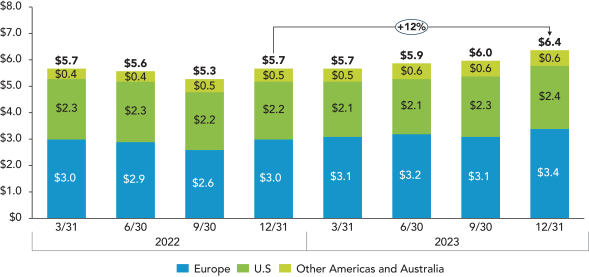

| • | Estimated remaining collections (the sum of all future projected cash collections on our owned finance receivables portfolios) was $6.4 billion at the end of 2023, compared to $5.7 billion at the end of 2022. |

| 2023 TOTAL PORTFOLIO PURCHASES $1.2B |

2023 TOTAL CASH COLLECTIONS $1.7B |

2023 TOTAL REVENUES $802.6M | ||

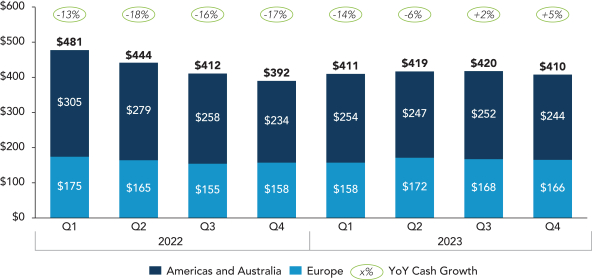

Portfolio Purchases ($ in millions)

Cash Collections ($ in millions)

| 2024 Proxy Statement | PRA Group iii |

Estimated Remaining Collections ($ in billions)

Investor Outreach and Engagement

We interact with our investors in a variety of ways. Our Investor Relations team meets regularly with stockholders, prospective stockholders, and investment analysts. These meetings often include participation by our CEO, Chief Financial Officer (“CFO”), and other business leaders, and focus on topics such as how we deliver growth and profitability as well as drive our strategy. In addition to these meetings, our management also engages routinely with our stockholders and other stakeholders. We value input from our stockholders and communicate regularly with them to better understand their perspectives, address any questions or concerns, and help increase their understanding of our business. Throughout 2023, we contacted many of our stockholders, including our top 50 stockholders, conducted more than 70 unique meetings and engaged with holders of more than 35% of our shares outstanding. These discussions generally focused on the Company’s business strategy, market positioning, financial performance and other relevant governance and non-governance matters. We also communicate with our stockholders through other avenues, including our SEC filings, news releases, investor conferences, non-deal roadshows, annual report, annual meeting, annual proxy statement, ESG report, and investor relations website. In addition, we hold quarterly conference calls, which are open to the public, to discuss our financial results.

| 2023 STOCKHOLDER MEETINGS 70+ |

2023 % OF SHARES ENGAGED >35% |

2023 INVESTOR CONFERENCES AND NON-DEAL ROADSHOWS 7 | ||

| iv PRA Group | 2024 Proxy Statement |

120 CORPORATE BOULEVARD

NORFOLK, VIRGINIA 23502

Proxy Statement

Annual Meeting of Stockholders

June 13, 2024

Purpose

This Proxy Statement is being made available to stockholders on or about April 29, 2024 in connection with a solicitation by the Board of PRA Group, Inc. (the “Company,” “we,” “us” or “our”) of proxies to be voted at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) and any adjournments or postponements. The Annual Meeting will be held virtually on Thursday, June 13, 2024 at 9:30 a.m. Eastern Time for the purposes set forth in the accompanying Notice of Annual Meeting of Stockholders.

Record Date

At the close of business on April 23, 2024, which is the record date for the Annual Meeting (the “Record Date”), there were 39,352,006 shares of our common stock outstanding and entitled to vote at the Annual Meeting.

Quorum

In order for business to be conducted at the Annual Meeting, a majority of the issued and outstanding shares of our common stock entitled to vote, represented in person or by proxy, must be present. Abstentions and broker shares that include “broker non-votes” that are present and entitled to vote are counted as present for purposes of determining a quorum. See “Broker Non-Votes” on page 51 of this Proxy Statement for an explanation of what constitutes a broker non-vote.

Vote Required

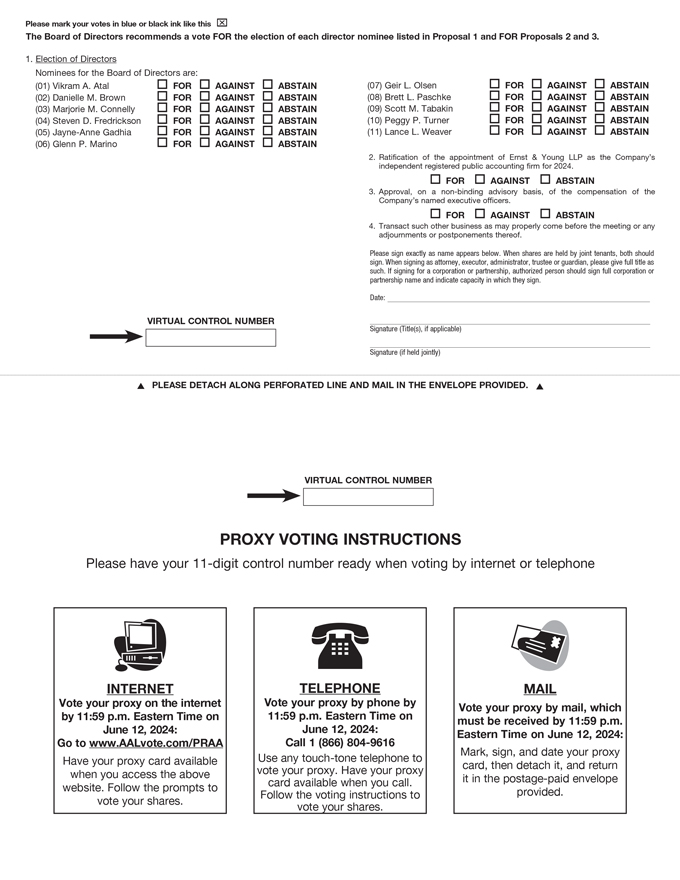

Each stockholder will have one vote for each share of our common stock held as of the Record Date. Shares of our common stock represented by properly executed proxies will be voted at the Annual Meeting in accordance with the choices indicated on the proxy.

If you provide specific voting instructions, your shares will be voted as you instruct. If you vote through the internet or by phone and vote as recommended by our Board or if you sign and return your proxy card, but do not provide instructions, your shares will be voted as follows:

| • | FOR the election of the 11 nominees for directors named in this Proxy Statement for a one-year term (“Proposal 1”); |

| • | FOR the ratification of the appointment of EY as our independent registered public accounting firm for 2024 (“Proposal 2”); and |

| • | FOR the approval, on a non-binding advisory basis, of the compensation of our NEOs (“Proposal 3”). |

With respect to Proposal 1, each director nominee will be elected if the director nominee receives a majority of the votes cast. Abstentions and broker non-votes will not be counted as votes cast and will therefore have no effect on Proposal 1. Proposal 2 and Proposal 3 will be approved if a majority of the shares present in person or represented by proxy and entitled to vote on the matter, vote in favor of the applicable proposal. Abstentions will have the effect of a vote “AGAINST” Proposal 2 and Proposal 3. However, broker non-votes will have no effect on these proposals.

| 2024 Proxy Statement | PRA Group 1 |

Instructions for Attending and Participating in the Virtual Annual Meeting

The Annual Meeting will be a completely virtual meeting. There will be no physical meeting location. However, stockholders will have the same rights and opportunities to participate in the virtual Annual Meeting as they would at an in-person meeting.

The Annual Meeting will begin at 9:30 a.m. Eastern Time on Thursday, June 13, 2024. In order to attend and participate in the Annual Meeting, including voting your shares and submitting questions, you must register at www.viewproxy.com/PRAGroup/2024 by 11:59 p.m. Eastern Time on June 12, 2024. If you are a record holder, you must register using the virtual control number included on your Notice of Internet Availability of Proxy Materials or on your proxy card (if you requested and received a printed copy of the proxy materials). If you hold your shares beneficially through a bank, broker or other nominee, and your voting instruction form or Notice of Internet Availability of Proxy Materials indicates that you may vote those shares, then you may access, participate in and vote at the Annual Meeting with the control number indicated on that voting instruction form or Notice of Internet Availability of Proxy Materials. Otherwise, you must provide a legal proxy from your bank, broker or other nominee during registration and you will be assigned a virtual control number in order to vote your shares and submit questions during and before the Annual Meeting. If you are unable to obtain a legal proxy to vote your shares, you will still be able to attend the Annual Meeting (but will not be able to vote your shares or submit questions) so long as you demonstrate proof of stock ownership. Instructions on how to connect and participate via the internet, including how to demonstrate proof of stock ownership, are posted at www.viewproxy.com/PRAGroup/2024.

On the day of the Annual Meeting, if you have properly registered, you may enter the Annual Meeting by logging in using the password you received via email in your registration confirmation. We encourage you to check in by 9:15 a.m. Eastern Time on June 13, 2024, the day of the Annual Meeting, so that any technical difficulties may be addressed before the Annual Meeting. If you encounter any difficulties accessing the Annual Meeting live webcast during the meeting, please email VirtualMeeting@viewproxy.com or call (866) 612-8937.

Even if you plan to attend the live webcast of the Annual Meeting, we encourage you to vote in advance via the internet, by telephone or by mail so that your vote will be counted in the event you later decide not to attend the Annual Meeting.

| 2 PRA Group | 2024 Proxy Statement |

Corporate Governance

The primary responsibility of our Board is to exercise its business judgment while acting in the best interests of the Company and our stockholders. Our Board is responsible for establishing broad corporate policies, setting strategic direction and overseeing management, which is responsible for the daily operations of the Company. Our Board must fulfill its responsibilities consistent with its fiduciary duties to the Company and our stockholders and in compliance with applicable laws and regulations. To assist our Board with fulfilling its duties, our Board has implemented a leadership structure that supports its oversight responsibilities, created standing and ad hoc committees to formally handle duties that our Board deems significant, and adopted policies and procedures that reflect our Board’s commitment to good corporate governance, including Corporate Governance Guidelines, a Code of Conduct and a policy to approve transactions with related parties.

Board Leadership

Our Board believes that the decision of whether to have the same individual occupy the offices of Chairman of the Board (“Chairman”) and CEO should be made by our Board, from time to time, in its business judgment after considering relevant factors, including the specific needs of the Company and what is in the best interests of the Company and our stockholders.

Currently, the roles of Chairman and CEO are separated, which our Board believes is appropriate. Separation of the roles allows Mr. Atal to focus on managing the daily operations of the Company in his role as President and CEO, while Mr. Fredrickson, in his role as Chairman, oversees our Board’s significant functions. Mr. Fredrickson has leveraged his extensive experience in the financial sector and past daily operational management experience to effectively and efficiently guide our Board by focusing its attention on issues of greatest importance to the Company and our stockholders.

Our Corporate Governance Guidelines provide that a Lead Independent Director will be selected by the independent directors whenever the individual selected to serve as Chairman is also the CEO or otherwise not independent. Although Mr. Fredrickson is independent, the Board has retained the Lead Independent Director role given expanded Board leadership responsibilities with respect to board refreshment, new director onboarding, investor engagement and strategic planning. Lance L. Weaver currently serves as the Lead Independent Director and has the following duties and responsibilities:

| • | preside at all meetings of the independent directors; |

| • | consult with the Chairman and CEO concerning the agenda for Board meetings and approve the agenda for Board meetings; |

| • | be available to advise Committee chairs in fulfilling their designated roles and responsibilities with our Board; |

| • | be available for consultation and direct communication with stockholders where appropriate, upon reasonable request; and |

| • | lead the annual evaluation of the Chairman and CEO. |

Building Our Board

Our Board recognizes that the duties and responsibilities of a director require highly skilled individuals with diverse qualities, backgrounds, attributes and professional experience. Our Board and the Nominating and Corporate Governance Committee consider the qualifications of directors and director candidates individually and in the broader context of our Board’s overall composition and the Company’s current and future needs. The Nominating and Corporate Governance Committee reviews potential candidates for director vacancies and recommends nominees to our Board for approval. In identifying potential candidates for Board membership, the Nominating and Corporate Governance Committee relies on suggestions and recommendations from directors, stockholders, management and others, including executive search and board advisory firms when deemed appropriate. During 2023, the Board engaged a third-party search firm to conduct a director search. The search firm identified candidates and also considered candidates recommended by directors and a stockholder. Mr. Marino and Ms. Gadhia were recommended to the Nominating and Corporate Governance Committee as part of this director search process launched in 2023 and conducted by the third-party search firm. The Nominating and Corporate Governance Committee does not distinguish between nominees recommended by stockholders and other nominees.

Stockholders wishing to suggest candidates to the Nominating and Corporate Governance Committee for consideration as directors may submit a written notice to our Corporate Secretary following the procedures set forth in our Amended and Restated By-Laws (“By-Laws”), as described under “Stockholder Proposals” on page 51 of this Proxy Statement.

Our Board and Nominating and Corporate Governance Committee have determined that there are general requirements for service on our Board that all directors must possess, including the following:

| • | high integrity and ethical standards; |

| • | commitment to representing the long-term interests of stockholders; |

| 2024 Proxy Statement | PRA Group 3 |

Corporate Governance

| • | a proven record of success in the individual’s field; |

| • | an understanding of, and respect for, good corporate governance practices; |

| • | a high degree of financial literacy; |

| • | experience leading complex organizations; |

| • | the ability to devote the time necessary to properly discharge the duties associated with serving as a director, including attending and participating in Board and Committee meetings; |

| • | intangible qualities such as willingness to ask difficult questions while continuing to work collegially with other directors and management; and |

| • | an appreciation for diversity and inclusion. |

While our Board does not have a specific diversity and inclusion policy, it does consider self-identified diversity characteristics, including race, ethnicity, gender, age, cultural background and professional experiences in evaluating candidates for Board membership.

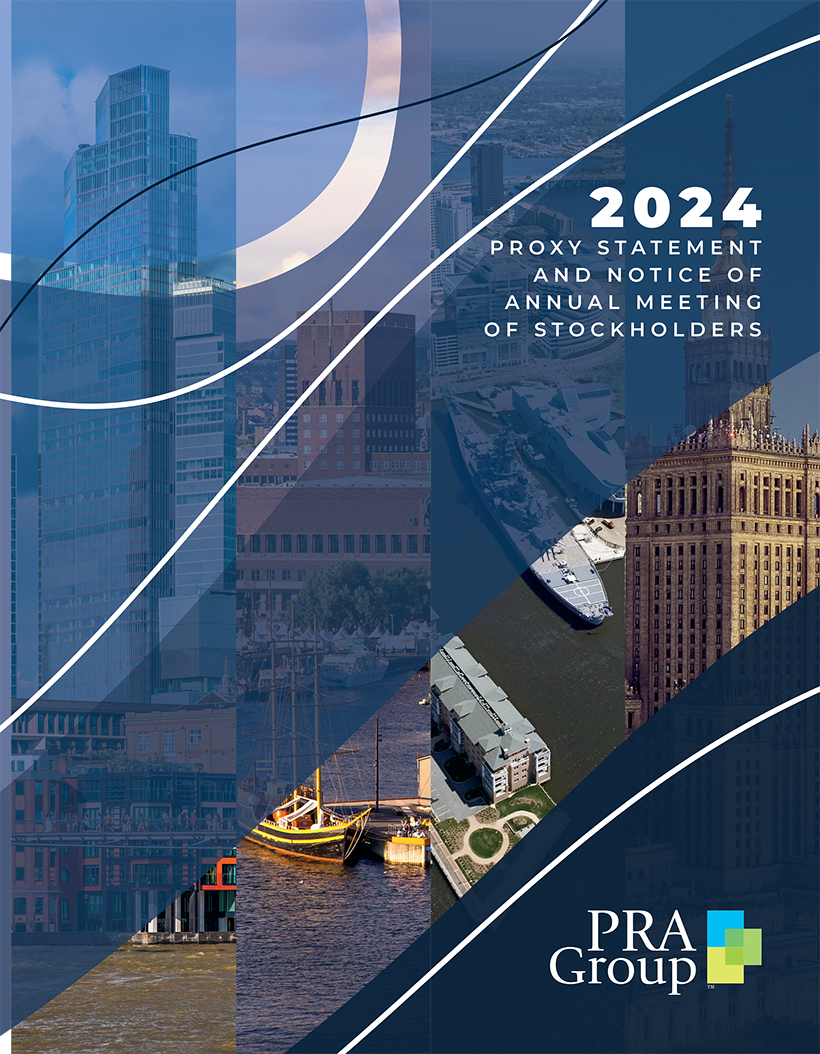

Director Qualifications

In addition to the characteristics each director must possess, our Board and the Nominating and Corporate Governance Committee have identified the following qualifications, experience, knowledge, skills and abilities that are important to be represented on our Board as a whole, in light of the Company’s current needs and business priorities:

| Desired Skills and

|

Our Board as a whole should:

| |

| Financial Industry |

understand the complex financial and highly regulated environment in which our business operates in order to evaluate our operating and strategic performance. | |

| Government and Regulatory |

have experience in compliance with international, federal and state laws, regulations and agencies because our business is heavily regulated and directly affected by governmental and regulatory actions. | |

| Information Technology, Data Governance and Cybersecurity |

have experience with information technology because our business relies on data and information technology and we face threats of business or technology disruptions and/or cyber incidents. | |

| International/Global |

have a global perspective and international experience useful in evaluating our operating and strategic performance and growth because our business and strategy are global. | |

| Public Company |

have a comprehensive understanding of the complex financial and legal issues facing U.S. public companies because we are a publicly-traded company regulated by the SEC and listed on the Nasdaq Stock Market (“Nasdaq”). | |

| Risk Oversight |

have a comprehensive understanding of the risks facing our business and industry and the policies and procedures that are appropriate for effective risk oversight and mitigation. | |

| Strategic Planning |

have experience setting a long-term corporate vision, assessing geographies in which to operate, and evaluating competitive positioning and a comprehensive understanding of transformation planning processes to support the development of, and modifications to, our strategic plan. | |

Board Committees

The standing Committees of our Board are the Audit Committee, Compensation Committee, Nominating and Corporate Governance Committee and Risk Committee. Each standing Committee operates pursuant to a written charter, which is available on the Investor Relations page of our website at www.pragroup.com. All members of the standing Committees are independent as defined by Nasdaq listing standards and SEC rules. In addition, each member of the Compensation Committee is a “non-employee director” within the meaning of Rule 16b-3 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and each member of the Audit Committee is an “audit committee financial expert” as defined by the Exchange Act. Each standing Committee has the ability to retain, at the Company’s expense, special legal, accounting or other consultants or advisors it deems necessary in the performance of its duties. Additional information concerning the standing Committees as of April 1, 2024 is included in the following chart.

| 4 PRA Group | 2024 Proxy Statement |

Corporate Governance

| Audit | ||||

|

Members:

Marjorie M. Connelly, Chair John H. Fain Brett L. Paschke Scott M. Tabakin |

Primary Roles and Responsibilities:

● monitors and reviews the integrity of the Company’s financial reports and monitors and provides oversight of the Company’s systems of internal controls regarding accounting and financial reporting;

● engages and monitors the independence and performance of the Company’s independent registered public accounting firm;

● monitors the independence and performance of the Company’s internal auditors; and

● provides an avenue of communication between the Company’s independent registered public accounting firm, management, the internal audit department and our Board. |

Number of meetings held in 2023: 11 | ||

|

Compensation | ||||

|

Members:

Brett L. Paschke, Chair Danielle M. Brown John H. Fain James A. Nussle |

Primary Roles and Responsibilities:

● develops and oversees the implementation of the Company’s compensation philosophy with respect to its directors, CEO, other NEOs and other executive officers;

● determines compensation for the Company’s executive officers;

● oversees the design of the Company’s compensation program, consistent with the Company’s compensation philosophy, internal equity considerations and market practice;

● considers compliance with applicable laws and regulations that have an impact on the Company’s business when making compensation decisions to encourage the highest standards of integrity and ethical conduct; and

● reviews compensation programs and policies for features that may encourage excessive risk taking and determine the extent to which there may be a connection between compensation and risk. |

Number of meetings held in 2023: 9 | ||

| Nominating and Corporate Governance | ||||

|

Members:

Lance L. Weaver, Chair James A. Nussle Peggy P. Turner Geir L. Olsen |

Primary Roles and Responsibilities:

● develops and recommends to our Board a set of effective corporate governance policies and procedures applicable to the Company;

● identifies individuals qualified to become Board members and recommends that our Board select a group of director nominees for each annual meeting of our stockholders;

● oversees annual evaluation of our Board;

● reviews periodically the Company’s Related Party Transaction Policy, makes recommendations to our Board concerning changes and approves transactions;

● considers candidates recommended by stockholders in accordance with our By-Laws and Certificate of Incorporation using the same criteria in evaluating candidates nominated by a stockholder as it does for candidates recommended by our Board or management; and

● oversees significant ESG matters. |

Number of meetings held in 2023: 6 | ||

| Risk | ||||

|

Members:

Scott M. Tabakin, Chair Danielle M. Brown Marjorie M. Connelly Peggy P. Turner Glenn P. Marino |

Primary Roles and Responsibilities:

● oversees the Company’s enterprise risk management program, including its governance structure, risk management framework and policies and procedures;

● reviews and approves our business continuity management program;

● receives reports and presentations from management on significant risks facing the Company and the results of any risk management reviews and assessments, including the following risks: operations, compliance, underwriting, strategy, legal, reputation, information security, technology and data management, and vendor management; and

● reviews material reports or inquiries from government or regulatory agencies related to any significant enterprise risks. |

Number of meetings held in 2023: 5 | ||

| 2024 Proxy Statement | PRA Group 5 |

Corporate Governance

Board’s Role in Risk Oversight

Our Board recognizes that the Company faces a broad range of risks, including financial, regulatory, operational, political, reputational, governance, legal and cyber, that may affect the Company’s ability to execute corporate strategies and fulfill business objectives. Our Board has delegated to its Risk Committee responsibility for overseeing the Company’s risk profile and management’s processes for assessing and managing risk, while management is responsible for daily risk management. Our Chief Risk and Compliance Officer attends all meetings of the Risk Committee and meets in executive session with the Risk Committee at each of its meetings.

Our Board has also assigned to its remaining Committees responsibility for reviewing, evaluating and making recommendations concerning important risk categories that fall within their scope of responsibility, including the following:

| • | The Audit Committee receives quarterly updates from our CFO and the independent registered public accounting firm on financial risks, compliance with reporting requirements and internal controls regarding accounting and financial reporting; quarterly reports from the Senior Vice President, Chief Audit Executive - Corporate Audit Services, who oversees the Company’s internal audit department, on the results of internal audit activities; and any reports related to complaints and allegations of fraud or illegal acts regarding accounting, internal accounting controls, or auditing matters and any submissions by employees, including those submitted confidentially and/or anonymously, regarding questionable accounting or auditing matters. |

| • | The Compensation Committee designs the Company’s compensation programs and incentives in a manner that does not encourage employees, including our NEOs, to take unnecessary or excessive risks. The Compensation Committee, with assistance from Pearl Meyer & Partners, LLP (“Pearl Meyer”), the Compensation Committee’s current independent compensation consultant, has reviewed the Company’s compensation policies and practices for all employees, including our NEOs, as they relate to risk management practices and risk-taking incentives, and has determined that there are no risks arising from these policies and practices that are reasonably likely to have a material adverse effect on the Company. |

Management’s role in assisting our Board with its risk oversight responsibility is critical. In order to support our Board’s risk oversight role, the Company has a Risk Assessment and Action Committee (“RAAC”), which reviews, evaluates and reports on the processes used to identify, assess and manage risk throughout the Company. The RAAC is comprised of the Company’s executive officers and is chaired by our Chief Risk and Compliance Officer, who reports to the Risk Committee at each of its meetings.

Members of senior management routinely attend Board meetings and report on their activities, including significant risks. These reports include risk considerations and discussions concerning actions and strategies for monitoring, managing and mitigating any risks identified. In addition, the Company’s Compliance Department, which reports to our Chief Risk and Compliance Officer, documents known compliance risks, assesses the sufficiency of risk identification, and recommends risk management and mitigation strategies.

Board’s Role in ESG

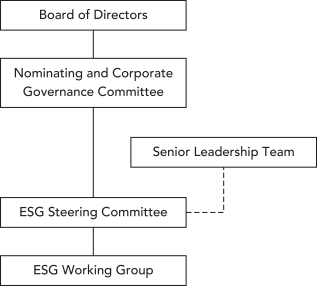

Our Board recognizes the importance of ESG to our overall strategic plan. As a result, our Board has delegated to the Nominating and Corporate Governance Committee oversight of our significant ESG and sustainability practices, policies and activities. To support the Nominating and Corporate Governance Committee, we have formed an ESG Steering Committee, which is comprised of senior members of management. The ESG Steering Committee supports our Board’s ESG oversight role by developing and making recommendations regarding our overall strategy with respect to ESG matters, recommending reporting standards and advising on communications with stakeholders, including our employees and investors. The ESG Steering Committee also oversees the ESG Working Group, which consists of employees across the Company whose daily responsibilities involve ESG matters and who support our ESG disclosures by collecting and providing relevant data to the ESG Steering Committee.

| 6 PRA Group | 2024 Proxy Statement |

Corporate Governance

Under our ESG governance structure, which is illustrated below, we have adopted a Human Rights Statement, Political Contribution Statement and Environmental and Sustainability Statement, publish an annual ESG Review and have incorporated ESG in our enterprise risk management program.

Board’s Role in Management Succession Planning

Our Board oversees management succession with a critical focus on succession for the CEO given the importance of the role an its direct reporting to the Board. As outlined in our Corporate Governance Guidelines the Board maintains and approves a succession plan for the CEO that includes a plan for emergencies and the death, disability, termination, retirement or resignation of the CEO. Our CEO succession plan is triggered whenever the CEO is unable to perform the CEO’s duties, in which case an emergency meeting of the Board is called. During the emergency meeting, the Board determines whether the individual identified as an emergency successor should be appointed as CEO based on the nature of the event that prompted the meeting. If the Board determines that the event is not temporary or that it is not necessary or in the Company’s best interest to appoint an interim CEO, the Board will appoint a permanent replacement CEO. Our CEO succession plan also outlines an internal and external communication plan and provides for periodic review of the plan by our Board.

The Nominating and Corporate Governance Committee oversees succession planning for our executive officers. At least annually, our CEO meets with the Nominating and Corporate Governance Committee to discuss succession planning for all executive officers and, in the CEO’s discretion, any of the CEO’s direct reports (collectively, “senior management”). The CEO meets at least annually with the Compensation Committee to discuss the performance of senior management and communicates any performance-related issues to the full Board to the extent such issues impact the management succession plan.

Director Independence

Our Board has established guidelines, which conform to the independence requirements included in the Nasdaq listing standards and SEC rules and regulations, to assist it in determining director independence. Based on these guidelines, our Board has determined that Messrs. Fain, Fredrickson, Marino, Nussle, Paschke, Tabakin and Weaver and Mses. Brown, Connelly and Turner are independent according to Nasdaq listing standards and SEC rules. In addition, our Board has determined that Ms. Gadhia, if elected to our Board, will be independent according to Nasdaq listing standards and SEC rules.

Director Attendance

During 2023, our Board held 13 meetings. Each director attended at least 75% of the aggregate number of meetings of our Board and the Committees on which the director served during 2023. Directors are encouraged to attend our Annual Meeting of Stockholders and all then serving directors attended our 2023 Annual Meeting of Stockholders (“2023 Annual Meeting”).

| 2024 Proxy Statement | PRA Group 7 |

Corporate Governance

Communications with Our Board

Stockholders may communicate with members of our Board by transmitting their correspondence by mail or email. All such communications should be sent to the attention of our Corporate Secretary as specified below:

Corporate Secretary

PRA Group, Inc.

120 Corporate Boulevard

Norfolk, Virginia 23502

corporatesecretary@pragroup.com

Communications that are addressed to one or more directors will be collected and organized by our Corporate Secretary and forwarded to our Chairman, or if addressed to a specific independent director, to that director, as soon as practicable. Communications that are abusive, derogatory or that present safety or security concerns may be handled differently. If multiple communications are received on a similar topic, our Corporate Secretary may forward only representative correspondence or summaries. Our Corporate Secretary will determine whether any communication addressed to our entire Board as a whole should be properly addressed by our entire Board or by a Committee. If a response to the communication is warranted, the content and method of the response will be coordinated with our Corporate Secretary. Stockholders may use the Company’s toll-free ethics hotline to communicate concerns to our Board in a confidential or anonymous manner by dialing 1-855-874-2659. All stockholder communications to the Company’s confidential ethics hotline are referred to our Lead Independent Director.

Director Compensation

Our Board, upon the recommendation of the Compensation Committee, establishes the compensation for our non-employee directors. Non-employee director compensation for 2023 included annual cash retainers for our Board members, Board Chair, Committee members, Committee Chairs, and our Lead Independent Director. On the date of our 2023 Annual Meeting, each non-employee director also received an equity award valued at approximately $155,000 that consisted of restricted stock units (“RSUs”) that vest on the anniversary of the grant date or the date of the next annual meeting of the Company’s stockholders that follows the grant date, if earlier. The vesting schedule for the RSUs and the director stock ownership guidelines described below are intended to align our non-employee directors’ economic interests with those of our stockholders.

Cash retainers for our Board for 2023 were as follows:

| Annual Cash Retainers |

2023 | |

| Chairman |

$ 125,000 | |

| Lead Director |

$ 30,000 | |

| Audit Committee Chair |

$ 30,000 | |

| Compensation Committee Chair |

$ 30,000 | |

| Nominating and Corporate Governance Committee and Compliance Committee Chair |

$ 30,000 | |

| Risk Committee Chair |

$ 30,000 | |

| Board Member |

$ 70,000 | |

| Audit Committee Member |

$ 15,000 | |

| Compensation Committee Member |

$ 15,000 | |

| Nominating and Corporate Governance Committee and Compliance Committee Members |

$ 15,000 | |

| Risk Committee Member |

$ 15,000 | |

Note that Committee Chairs only receive a retainer for their service as Committee Chairs and not also for serving as Committee Members.

| 8 PRA Group | 2024 Proxy Statement |

Corporate Governance

Our non-employee directors received the following compensation for service during 2023:

| Name(1) |

Fees Earned or Paid in Cash |

Stock Awards(2) |

Total | |||

| Vikram A. Atal(3) |

$ 28,750 | $ 0 | $ 28,750 | |||

| Danielle M. Brown |

$ 100,000 | $ 154,991 | $ 254,991 | |||

| Marjorie M. Connelly |

$ 115,000 | $ 154,991 | $ 269,991 | |||

| John H. Fain |

$ 107,500 | $ 154,991 | $ 262,491 | |||

| Steven D. Fredrickson |

$ 195,000 | $ 154,991 | $ 349,991 | |||

| James A. Nussle |

$ 115,000 | $ 154,991 | $ 269,991 | |||

| Geir L. Olsen |

$ 28,800 | $ 154,978 | $ 183,778 | |||

| Brett L. Paschke |

$ 107,500 | $ 154,991 | $ 262,491 | |||

| Scott M. Tabakin |

$ 107,500 | $ 154,991 | $ 262,491 | |||

| Peggy P. Turner |

$ 100,000 | $ 154,991 | $ 254,991 | |||

| Lance L. Weaver |

$ 115,000 | $ 154,991 | $ 269,991 | |||

|

(1) Mr. Marino was elected to our Board effective March 15, 2024. (2) Amounts represent the aggregate grant date fair value of the stock awards calculated by multiplying the number of RSUs granted by the closing price of our common stock on the grant dates, which was $23.67 on June 13, 2023 and $23.10 on June 15, 2023, respectively. The actual amount of compensation realized by a director will depend upon the market price of our common stock on the vesting date. (3) Mr. Atal was appointed as the Company’s President and CEO effective March 27, 2023. Amounts reflect his compensation for service as a non-employee director prior to his appointment as the Company’s President and CEO. | ||||||

In addition to the compensation described above, each non-employee director is reimbursed for travel expenses incurred for attending Board meetings and reasonable expenses associated with participating in continuing education programs. We offer no retirement benefits or perquisites to directors. We maintain policies of directors’ and officers’ liability insurance covering all directors.

Director Stock Ownership Guidelines

Recognizing that each director should have a substantial personal investment in the Company, our Board has adopted stock ownership guidelines that require beneficial ownership by each non-employee director of shares of our common stock valued at not less than five times the director’s annual cash retainer for serving on our Board. Directors are expected to acquire and maintain this share ownership threshold within five years after joining our Board. As of March 31, 2024, all non-employee directors who have served on our Board for at least five years have met the stock ownership requirement.

Code of Conduct

Our Board has adopted a Code of Conduct, which applies to our directors and all employees of the Company, including our CEO and our CFO, who is also our principal accounting officer. Our Code of Conduct, which can be found on the Investor Relations page of our website at www.pragroup.com, governs the work behavior and business relationships of the Company’s directors, officers, employees and independent third parties acting on behalf of the Company and sets forth the Company’s policies regarding ethics and standards of business conduct, including conflicts of interest and insider trading. We will disclose amendments to our Code of Conduct, as well as any waivers of the Code, on our website as permitted by SEC rules. During 2023, there were no waivers of our Code of Conduct for any director or executive officer.

Policy for Approval of Related Party Transactions

Our Board has adopted a written policy (“Related Party Transaction Policy”) for review, approval and disclosure of transactions between the Company and directors, director nominees, executive officers, beneficial owners of more than 5% of our common stock and immediate family members of any of the foregoing (each, a “related party”). Under our Related Party Transaction Policy, the Nominating and Corporate Governance Committee must approve or ratify any related party transaction that involves greater than $120,000 in a calendar year and in which a related party has a direct or indirect material interest. Under our Related Party Transaction Policy, certain transactions with related parties are deemed pre-approved, such as transactions in which the related party’s interest arises solely from the person’s service as a director of another entity that is a party to the transaction, certain charitable contributions and transactions determined by competitive bids. In assessing a related party transaction, the Nominating and Corporate Governance Committee considers several factors including the commercial reasonableness of the terms of the transaction, the materiality of the transaction to the Company and the impact of the transaction on the related party’s independence.

| 2024 Proxy Statement | PRA Group 9 |

Corporate Governance

Pledging

Our Anti-Pledging Policy prohibits our directors, officers and employees from pledging, alienating, attaching or otherwise encumbering our common stock and any purported pledge, alienation, attachment or encumbrance thereof is void and unenforceable against the Company or any affiliate of the Company.

Hedging

Our Anti-Hedging Policy prohibits our directors, officers and employees from speculating or hedging their interests in equity securities of the Company. Accordingly, directors, officers and employees may not “play the market” in equity securities of the Company by engaging in speculative transactions such as any direct or indirect hedging transaction that could reduce or limit the individual’s economic risk with respect to his or her holdings, ownership or interest in the common stock or other securities of the Company, including outstanding RSU and performance stock unit (“PSU”) awards, the value of which are derived from, make reference to or are based on the value or market price of common stock or other securities of the Company. Prohibited transactions include same day purchase and sales, prepaid variable forward contracts, equity swaps, short sales, collars, puts, calls or other derivative securities that are designed to hedge or offset a decrease in market value of the equity securities of the Company.

| 10 PRA Group | 2024 Proxy Statement |

Proposal 1: Election of Directors

Directors are elected at each annual meeting to serve until the next annual meeting and until their successors are duly elected and qualified. Each director nominee was nominated by our Board for election upon the recommendation of the Nominating and Corporate Governance Committee. Moreover, each nominee was elected previously by our stockholders except Mr. Marino and Ms. Gadhia.

Our Board currently consists of 12 directors. Mr. Fain will retire from our Board effective June 13, 2024, which is consistent with our Corporate Governance Guidelines that restrict the nomination for re-election of a person who will be 75 years of age on the date of the annual meeting of stockholders at which the person’s election would be considered. In addition, the Nominating and Corporate Governance Committee did not nominate Mr. Nussle for re-election at his request due to his expanded professional responsibilities. As a result, our Board will be reduced to 11 directors as of the date of the Annual Meeting.

Nominees for director who receive the affirmative votes of a majority of the votes cast in person or by proxy at the Annual Meeting will be elected. Any nominee for director who does not receive the affirmative vote of a majority of the votes cast must offer promptly in writing to submit the director’s resignation to our Board. The Nominating and Corporate Governance Committee will then consider the offer and will recommend to our full Board what action should be taken. Our Board will consider all factors it deems relevant to the best interests of the Company and our stockholders and determine whether to accept the director’s resignation within a reasonable period of time after certification of the election results.

Each nominee has consented to serve as a director if elected. We have no reason to believe that any of the nominees will be unable or unwilling for good cause to serve. However, if any nominee should become unable or unwilling to serve, proxies may be voted for another person nominated as a substitute by our Board or our Board may reduce the number of directors. If our Board nominates a substitute, the shares represented by all valid proxies will be voted for that nominee.

We did not receive any nominations or recommendations for director from stockholders for consideration at the Annual Meeting.

|

|

| OUR BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH DIRECTOR NOMINEE.

|

| 2024 Proxy Statement | PRA Group 11 |

Director Nominees

Age: 68

Mr. Atal has served as the Company’s President and CEO since March 27, 2023. From 2013 until March 27, 2023, Mr. Atal served as President of Atal Advisers, LLC, a business and strategy consulting firm. Since 2016, he has also served as Senior Advisor to McKinsey and Company, Inc., covering the banking, payments, consumer lending and analytics domains. Prior to forming Atal Advisers, Mr. Atal served in executive roles with increasing responsibility with Citigroup, Inc. (“Citigroup”) (NYSE) for 27 years, including as Executive Vice President for Citigroup’s global consumer bank from 2008 to 2013, where he had responsibility for shaping the consumer bank as an information-centric enterprise, leveraging analytics and data to drive growth, and overseeing loss mitigation efforts related to Citigroup’s high-risk consumer portfolio through the financial crisis; Chairman and CEO for Citi Cards’ branded and retail partner cards franchise in North America; leadership of partnership programs for Citi Cards, serving as CFO of the U.S. cards franchise and overseeing SEC, regulatory and business financial reporting. Since 2017, Mr. Atal has served on the board of directors, including on the audit committee, of Goldman Sachs Bank USA.

Director Skills and Qualifications:

Mr. Atal’s experience as a senior executive in the financial services industry along with his significant international experience working for complex, publicly traded organizations qualify him to serve on our

Board.

|

|

Financial Industry |

|

Government & Regulatory | |||

|

|

International/Global |

|

Public Company | |||

|

|

Risk Oversight |

|

Strategic Planning | |||

Public Company Directorships:

| • | Goldman Sachs Bank USA |

Education:

| • | Fellow of U.K. Charter Accountants Institute |

| • | B.S., Economics London School of Economics |

| • | B.A. Mathematics, St. Stephens College, Delhi |

Age: 53

Independent

Committees: Compensation, Risk

Ms. Brown has served as Chief Information Officer (“CIO”) for Whirlpool Corporation (“Whirlpool”) (NYSE), a global kitchen and laundry company, since November 2020. Ms. Brown, who is a certified Lean Six Sigma Black Belt, has over 20 years of experience in global technology services. Before joining Whirlpool, she served for four years as the CIO for Brunswick Corporation (“Brunswick”) (NYSE), a global manufacturer and marketer of recreation products. Prior to her role at Brunswick, Ms. Brown served for 16 years in roles of increasing responsibility with DuPont Corporation (“DuPont”) (NYSE), including CIO for a global business unit and head of global transformation and productivity. During her time at DuPont, Ms. Brown was also head of global data, business insight and analytics and global information technology strategy, planning, organization development and compliance.

Director Skills and Qualifications:

Ms. Brown’s experiences, including her tenure as CIO of large, publicly traded and global companies, provide her with a comprehensive understanding of the complex issues facing public companies and qualify her to serve on our Board.

|

|

Information Technology/Data Governance/ Cybersecurity Experience | |||||

|

|

International/Global |

|

Public Company | |||

|

|

Risk Oversight |

|

Strategic Planning | |||

Education:

| • | MBA, Drexel University |

| • | M.S., Management Information Systems, Penn State University |

| • | B.S., Computer Science, Indiana University |

| 12 PRA Group | 2024 Proxy Statement |

Director Nominees

Age: 62

Independent

Committees: Audit, Risk

Ms. Connelly has approximately 30 years of experience as an executive in financial services and operations. From 2014 until her retirement in 2017, Ms. Connelly was the Chief Operating Officer of Convergys Corporation, a publicly traded, global leader in customer management. From 2012 to 2013, she was the Interim President of Longwood University. From 2009 to 2011, Ms. Connelly was the Global Chief Operating Officer at Barclaycard where she was responsible for the operations and technology support of the consumer and commercial credit card, merchant acquiring and point of sale finance businesses. From 2006 to 2008, Ms. Connelly was the Chief Operating Officer of Wachovia Securities, and prior to that, she spent 12 years at Capital One Financial Corporation (NYSE) in roles of increasing responsibility, including Executive Vice President, Head of Infrastructure for U.S. credit card operations and interim Chief Information Officer. Since 2021, Ms. Connelly has served on the board of directors, including on the audit committee, nominating, governance and social responsibility committee, compensation and talent development committee and the innovation committee, of Altria Group, Inc. (NYSE) and previously served on our Board from 2013 to 2014.

Director Skills and Qualifications:

Ms. Connelly’s extensive experience in the financial services industry with publicly traded, global companies qualifies her to serve on our Board.

|

|

Information Technology/Data Governance/ Cybersecurity Experience | |||||

|

Financial Industry |

|

International/Global | |||

|

Public Company |

|

Risk Oversight | |||

Public Company Directorships:

| • | Altria Group, Inc. |

Education:

| • | Advanced Management Program, Harvard Business School |

| • | B.A., Political Science, University of Delaware |

Age: 64

Independent

Mr. Fredrickson, who is retired, has over 30 years of experience in the financial industry predominantly in executive roles with oversight of most key functions. He has served as Chairman of the Board since April 1, 2020, when he retired from the Company. From June 2017 until March 31, 2020, he served as the Company’s Executive Chairman to support the transition of the CEO role and expand the Company’s presence in Europe. Mr. Fredrickson was Chairman and CEO from 2002 until June 2017 and also served as the Company’s President from 1996 to August 2015. Prior to co-founding the Company in 1996, Mr. Fredrickson held leadership roles with Household International (“HI”) in various business units responsible for distressed consumer, commercial and commercial real estate debt. Before joining HI, Mr. Fredrickson specialized in corporate and real estate workouts at Continental Bank of Chicago.

Director Skills and Qualifications:

Mr. Fredrickson’s leadership of the Company in his current and previous roles as Chairman, Executive Chairman, President and CEO, and his extensive industry knowledge qualify him to serve on our Board.

|

Financial Industry |

|

International/Global | |||

|

Public Company |

|

Risk Oversight | |||

|

|

||||||

Education:

| • | M.B.A., Finance, School of Business, University of Illinois |

| • | B.S., Business Administration, University of Denver |

| 2024 Proxy Statement | PRA Group 13 |

Director Nominees

Age: 62

Independent

Committee: Audit

Ms. Gadhia founded the financial technology company Snoop in 2019 and served as its Executive Chair until July 2023 when she retired. She is a Chartered Accountant who began her career with Ernst & Young LLP and later joined Norwich Union (now Aviva) as a Senior Manager before founding Virgin Direct in 1995, which was acquired by the Royal Bank of Scotland (“RBS”) in 2001. She subsequently spent five years at RBS before returning to Virgin Money as CEO from 2007 to 2018. Following the sale of Virgin Money, Ms. Gadhia joined Salesforce as CEO – United Kingdom and Ireland from 2019 until 2021, when she joined Snoop full-time.

Ms. Gadhia has served as Chair of the Boards of His Majesty’s Revenue & Customs since 2020, MoneyFarm, an online investment advisor and digital wealth management company, since 2022; and Ozone API since 2024. She has also served as Senior Advisor for Vanquis Banking Group PLC (LSE), which acquired Snoop, since 2023 and previously as Senior Advisor for UniCredit from 2023 – 2024.

Ms Gadhia was awarded Commander of the Order of the British Empire (“CBE”) in 2013 for her services to banking and the community, Dame CBE in 2019 for her services to the financial industry in general and women in the financial industry in particular and Commander of the Royal Victorian Order in 2022.

Director Skills and Qualifications:

Ms. Gadhia’s extensive financial industry experience, including as a founder of two financial services companies, as well as her leadership roles in public companies, qualifies her to serve on our Board.

|

Financial Industry |

|

Government & Regulatory | |||

|

International/Global |

|

Public Company | |||

|

Risk Oversight |

|

Strategic Planning | |||

Education:

| • | B.A., History, University of London |

Age: 67

Independent

Committee: Risk

Mr. Marino has over 30 years of experience in the consumer finance industry and served most recently as Executive Vice President, Chief Commercial Officer and CEO of the Payment Solutions business at Synchrony Financial, Inc. (“Synchrony”), (NYSE) a publicly traded financial services company. Prior to the spin-off of Synchrony by General Electric Corporation (“GE”) in 2014, Marino served as CEO of Sales Finance from 2002 until 2014 for GE’s North American retail finance business. He also previously served as President of Monogram Credit Services, a joint venture between GE and Bank One Corporation (now part of JPMorgan Chase) and Chief Risk Officer – Consumer Cards Services for GE Capital. Since 2020, Mr. Marino has served on the board of directors of Upbound Group, Inc. (formerly Rent-A-Center, Inc.), (NASDAQ), a publicly traded, lease-to-own provider, including on its audit, nominating and corporate governance and compensation committees.

Director Skills and Qualifications:

Mr. Marino’s executive leadership roles and strong consumer finance background, including positions in risk, business development and operations qualify him to serve on our Board.

|

Financial Industry |

|

Public Company | |||

|

Risk Oversight |

|

Strategic Planning | |||

Public Company Directorships:

| • | Upbound Group, Inc. |

Education:

| • | M.B.A., Finance, School of Business, University of Michigan |

| • | B.S., Biology, Syracuse University |

| 14 PRA Group | 2024 Proxy Statement |

Director Nominees

Age: 51

Independent

Committee: Nominating and Corporate Governance

Mr. Olsen has served as the CEO of Andenes Investments, a private investment company focusing on finance and technology since 2018. He was the CEO and a board member of Aktiv Kapital, AS, a leading European consumer debt purchaser, from September 2011 until its acquisition by the Company in 2014. From August 2014 until January 2016, Mr. Olsen served as the CEO of PRA Group Europe. Prior to Aktiv Kapital, Mr. Olsen held various leadership roles in sales, marketing and strategy with Cisco Systems and Tandberg, a Norwegian company that Cisco acquired in 2010. He also advised financial services and technology companies as a consultant at McKinsey & Company for five years prior to joining Tandberg. In 2013, Mr. Olsen cofounded Ubon Partners, an investment company focused on early-stage companies in technology and financial services, and was a partner until December 2018. He is currently a board member for various private portfolio companies such as Avida Finans, First Fondene AS, Molo Finance and Huma AS. He is also a director of Pexip ASA, a Norwegian technology company listed on the Oslo Stock Exchange.

Director Skills and Qualifications:

Mr. Olsen’s in-depth understanding of the European consumer finance and debt purchase markets and experience in using technology to transform businesses qualify him to serve on our Board.

|

Financial Industry |

|

International/Global | |||

|

Public Company |

|

Risk Oversight | |||

|

Strategic Planning | |||||

Public Company Directorships:

| • | Pexip ASA |

Education:

| • | Master of Economics, Norwegian School of Economics |

Age: 55

Independent

Committees: Audit, Compensation (Chair)

Mr. Paschke is Managing Partner of WinForest Partners, a private equity firm focused on investments in healthcare, technology and services. Before transitioning to a full-time role with WinForest in December 2023, Mr. Paschke served as a Senior Director of Investment Banking for William Blair & Company, a leading global investment banking firm focused on serving high quality growth companies (“William Blair”) from January 2023 to December 2023, having previously served as Vice Chair of Investment Banking at William Blair from 2021 to January 2023. Mr. Paschke joined William Blair in 1997 and served in roles of increasing responsibility, including leader of the Equity Capital Markets Group from 2009 to 2020. Since 2021 Mr. Paschke has served on the board of directors and audit committee for Duluth Holdings Inc. (Nasdaq).

Director Skills and Qualifications:

Mr. Paschke’s executive leadership roles and extensive experience working with public companies and particularly his role as a leader of William Blair’s Equity Capital Markets and Public Company Investment Banking, provide him with the requisite management experience and business expertise to serve on our Board.

|

Financial Industry |

|

International/Global | |||

|

Public Company |

|

Strategic Planning | |||

Public Company Directorships:

| • | Duluth Holdings Inc. |

Education:

| • | M.B.A, Harvard Business School |

| • | B.A., Politics, Princeton University |

| 2024 Proxy Statement | PRA Group 15 |

Director Nominees

Age: 65

Independent

Committees: Audit, Risk (Chair)

Mr. Tabakin is an executive-level consultant, advising boards and management teams on strategy, capital raising, capital structures and exit strategies. He was a certified public accountant and has 40 years of public company and healthcare industry experience, which includes service as Executive Vice President and CFO of Value Options, Inc. (acquired by Anthem, Inc., NYSE); Executive Vice President and CFO of Bravo Health, Inc. (acquired by Cigna Corporation, NYSE); Executive Vice President and CFO of AMERIGROUP Corporation (NYSE, acquired by Anthem, Inc.); Executive Vice President and CFO of Beverly Enterprises, Inc. (NYSE, now known as Golden Gate National Senior Care, LLC); and as an executive with Ernst & Young LLP.

Director Skills and Qualifications:

Mr. Tabakin’s experiences, including his tenure as the CFO of two large publicly traded companies, provide him with a comprehensive understanding of the complex financial and legal issues facing public companies and qualify him to serve on our Board.

|

Financial Industry |

|

Government & Regulatory | |||

|

Public Company |

|

Risk Oversight | |||

|

Strategic Planning | |||||

Education:

| • | B.S., Accounting, University of Illinois |

Age: 62

Independent

Committees: Nominating and Corporate Governance, Risk

Ms. Turner has served as Vice President and Executive Advisor of the Social Innovation Department of Toyota Motors North America (“Toyota Motors”) since January 2022. Prior to her current position, she served as Vice President of Lexus Guest Retention and Loyalty from 2019 to 2022, Vice President of Lexus Guest Experience from 2012 to 2019 and Vice President of Toyota Customer Relations from 2011 to 2012. Ms. Turner joined Toyota Motors in 1991 and held various positions related to parts, customer service, new business development, procurement, supply chain management and real estate before becoming Vice President, Toyota Customer Relations in 2011.

Director Skills and Qualifications:

Ms. Turner’s executive leadership experience and her significant experience developing and executing on initiatives focused on maximizing customer experience qualify her to serve on our board.

|

International/Global |

|

Public Company | |||

|

Strategic Planning | |||||

Education:

| • | B.A., University of California Irvine |

| • | M.B.A., Loyola Marymount University |

| 16 PRA Group | 2024 Proxy Statement |

Director Nominees

Age: 69

Lead Independent Director

Committees: Nominating and Corporate Governance (Chair)

Mr. Weaver serves as the Lead Independent Director and is an accomplished consumer financial services executive with nearly 40 years of experience across the consumer lending, mortgage and credit card asset classes. He has served as an advisor to financial services companies, including Visa Inc. (NYSE), Citigroup (NYSE), Total System Services, Inc. and Apollo Global Management, Inc., and was President, Money Cards for Virgin Money Holdings in the U.K. from 2013 until his retirement in 2015. Before holding these positions, Mr. Weaver’s experience includes serving as President of EMEA Card Services for Bank of America Corporation (NYSE); service on the senior management team of MBNA Corporation for 15 years; and executive leadership roles with Citigroup, Wells Fargo & Company (NYSE) and Maryland National Bank. From 2017 to 2020, Mr. Weaver served on the board of directors of Internap Corporation, a leading provider of high-performance data center services including high-density colocation and value-added services such as managed hosting, cloud and network connectivity.

Director Skills and Qualifications:

Mr. Weaver’s international experiences in the financial services industry along with his experience working for complex, highly regulated, publicly traded organizations qualify him to serve on our Board.

|

Financial Industry |

|

Government & Regulatory | |||

|

International/Global |

|

Public Company | |||

|

Risk Oversight | |||||

Education:

| • | B.S., Marketing, Georgetown University |

| 2024 Proxy Statement | PRA Group 17 |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm

The Audit Committee is responsible for the engagement, compensation and oversight of our independent registered public accounting firm. The Audit Committee is also directly involved in the selection of the lead engagement partner from our independent registered public accounting firm in conjunction with the periodic mandated rotation of the lead partner. As ratified by stockholders at the 2023 Annual Meeting, the Audit Committee appointed Ernst & Young LLP (“EY”) to serve as our independent registered public accounting firm for the year ended December 31, 2023.

In evaluating the performance and considering the engagement of our independent registered public accounting firm, including whether to rotate firms, the Audit Committee considers various factors, including the firm’s capability and expertise in handling the scope and complexity of our audit, information related to audit effectiveness, fees and the potential impact of changing firms. Based on these factors, the Audit Committee has determined that the continued engagement of EY as our independent registered public accounting firm is in the best interests of the Company and its stockholders. As a result, the Audit Committee has selected EY to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2024.

Although not required to do so, our Board is submitting the appointment of EY for ratification by our stockholders as a matter of good corporate governance practice. The Audit Committee is not required to take any action based on the outcome of the vote on this Proposal 2. However, if our stockholders do not ratify the appointment of EY, the Audit Committee will consider whether to select a different independent registered public accounting firm. Even if the selection of EY is ratified by our stockholders, the Audit Committee, in its discretion, may appoint a different independent registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

Representatives of EY are expected to attend the Annual Meeting, will have an opportunity to make a statement if they desire to do so and will be available to respond to appropriate stockholder questions.

|

| OUR BOARD RECOMMENDS THAT YOU VOTE “FOR” THE RATIFICATION OF

|

| 18 PRA Group | 2024 Proxy Statement |

Proposal 2: Ratification of Appointment of Independent Registered Public Accounting Firm

Fees Paid to EY

The following table sets forth the fees billed by EY for the years ended December 31, 2022, and December 31, 2023.

|

|

2022 | 2023 | ||||||

| Audit Fees(1) |

$ | 4,460,500 | $ | 4,303,500 | ||||

| Audit-Related Fees(2) |

$ | 60,000 | $ | — | ||||

| Tax Fees(3) |

$ | 16,200 | $ | 12,000 | ||||

| All Other Fees(4) |

$ | 2,500 | $ | 18,500 | ||||

| Total |

$ | 4,539,200 | $ | 4,334,000 | ||||

|

(1) Audit Fees relate primarily to professional services rendered for the audits of our annual consolidated financial statements and effectiveness of our internal control over financial reporting and reviews of the quarterly consolidated financial statements included in our Quarterly Reports on Form 10-Q as well as statutory audit fees related to our wholly-owned foreign subsidiaries. (2) Audit-Related Fees relate primarily to accounting consultations. (3) Tax Fees relate primarily to permitted tax-related advisory services. (4) All Other Fees relate to professional services rendered for permitted advisory services. |

| |||||||

Audit Committee Pre-Approval Policies and Procedures

The Audit Committee has adopted policies and procedures that require the pre-approval of audit, audit-related and permissible non-audit services provided by our independent registered public accounting firm. In the event that the Audit Committee Chair provides such pre-approval, the Audit Committee Chair will report any pre-approval decisions to the Audit Committee at its next meeting. During 2023, all audit, audit-related and permissible non-audit services provided by EY were pre-approved by the Audit Committee or Audit Committee Chair. The Audit Committee has considered the provision of these services by EY and has determined that the services were compatible with EY maintaining its independence.

Responsibilities