UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

For the fiscal year ended December 31 , 2022

For the transition period from ________ to ________

Commission File Number: 000-50058

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||||||||

(888 ) 772-7326

(Address of principal executive offices, zip code, telephone number)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15 (d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or emerging growth company. See the definitions of "large accelerated filer", "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one): Large accelerated filer ☑ Accelerated filer ☐ Non-accelerated filer ☐ Smaller reporting company ☐ Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the common stock held by non-affiliates of the registrant as of June 30, 2022 was $1,409,925,939 based on the $36.36 closing price as reported on the NASDAQ Global Select Market.

The number of shares of the registrant's Common Stock outstanding as of February 23, 2023 was 38,980,115 .

Documents incorporated by reference

Table of Contents

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| Item 9C. | ||||||||

| Item 10. | ||||||||

| continued | ||||||||

2

Table of Contents

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

| Signatures | ||||||||

3

All references in this Annual Report on Form 10-K ("Form 10-K") to "PRA Group," "our," "we," "us," the "Company" or similar terms are to PRA Group, Inc. and its subsidiaries.

Forward-Looking Statements:

This report contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Statements other than statements of historical fact are forward-looking statements, including statements regarding overall cash collection trends, operating cost trends, liquidity and capital needs and other statements of expectations, beliefs, future plans, strategies and anticipated events or trends. Our results could differ materially from those expressed or implied by such forward-looking statements, or our forward-looking statements could be wrong, as a result of risks, uncertainties and assumptions including the following:

•a deterioration in the economic or inflationary environment in the markets in which we operate;

•our inability to replace our portfolios of nonperforming loans with additional portfolios sufficient to operate efficiently and profitably and/or purchase nonperforming loans at appropriate prices;

•our inability to collect sufficient amounts on our nonperforming loans to fund our operations, including as a result of restrictions imposed by local, state, federal and international laws and regulations;

•changes in accounting standards and their interpretations;

•the recognition of significant decreases in our estimate of future recoveries on nonperforming loans;

•the impact of a disease outbreak, such as the COVID-19 pandemic, on the markets in which we operate and our inability to successfully manage the challenges associated with a disease outbreak, including epidemics, pandemics or similar widespread public health concerns;

•the occurrence of goodwill impairment charges;

•loss contingency accruals that are inadequate to cover actual losses;

•our inability to manage risks associated with our international operations;

•changes in local, state, federal or international laws or the interpretation of these laws, including tax, bankruptcy and collection laws;

•changes in the administrative practices of various bankruptcy courts;

•our inability to comply with existing and new regulations of the collection industry;

•investigations, reviews, or enforcement actions by governmental authorities, including the Consumer Financial Protection Bureau ("CFPB");

•our inability to comply with data privacy regulations such as the General Data Protection Regulation ("GDPR");

•adverse outcomes in pending litigation or administrative proceedings;

•our inability to retain, expand, renegotiate or replace our credit facilities and our inability to comply with the covenants under our financing arrangements;

•our inability to manage effectively our capital and liquidity needs, including as a result of changes in credit or capital markets;

•changes in interest or exchange rates;

•default by or failure of one or more of our counterparty financial institutions;

•disruptions of business operations caused by cybersecurity incidents or the underperformance or failure of information technology infrastructure, networks or communication systems; and

•the "Risk Factors" in Item 1A of this Form 10-K and in our other filings with the Securities and Exchange Commission ("SEC").

You should assume that the information appearing in this Form 10-K is accurate only as of the date it was issued. Our business, financial condition, results of operations and prospects may have changed since that date. The future events, developments or results described in, or implied by, this Form 10-K could turn out to be materially different. Except as required by law, we assume no obligation to publicly update or revise our forward-looking statements after the date of this Form 10-K and you should not expect us to do so.

4

PART I

Item 1. Business.

General

PRA Group Inc. is a global financial and business services company with operations in the Americas, Europe and Australia.

Our primary business is the purchase, collection and management of portfolios of nonperforming loans. The accounts we purchase are primarily the unpaid obligations of individuals owed to credit originators, which include banks and other types of consumer, retail and auto finance companies. We purchase portfolios of nonperforming loans at a discount in two broad categories: Core and Insolvency. Our Core operation specializes in purchasing and collecting nonperforming loans, which we purchased since either the credit originators and/or other third-party collection agencies have been unsuccessful in collecting the full balance owed. Our Insolvency operation consists primarily of purchasing and collecting on nonperforming loan accounts where the customer is involved in a bankruptcy proceeding or the equivalent in some European countries. We also provide fee-based services on class action claims recoveries and by servicing consumer bankruptcy accounts in the United States ("U.S.").

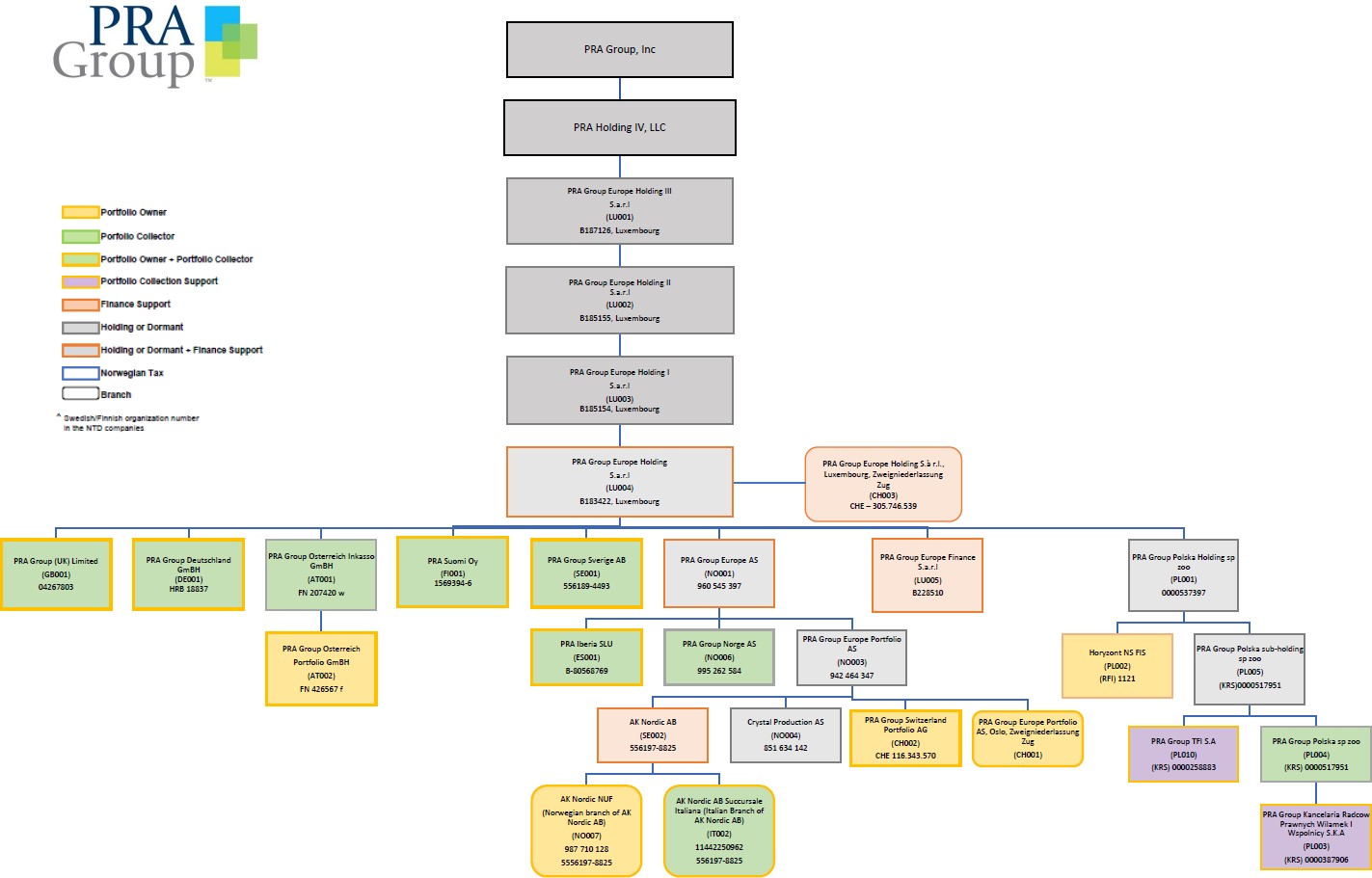

As part of our strategic plans, we have expanded through various acquisitions and organic growth. In 2014, we acquired Aktiv Kapital AS, a Norway-based company specializing in the purchase, collection and management of portfolios of nonperforming loans throughout Europe and Canada. In 2015, we expanded into South America by acquiring 55% of the equity interest in RCB Investimentos S.A. ("RCB"), a servicing platform for nonperforming loans and established a business that purchases nonperforming loans in Brazil. Our subsequent sale of 79% of our interest in RCB to Banco Bradesco S.A., completed in 2019, had no impact on the nonperforming loan purchasing business we established. RCB continues to service and/or manage our Brazilian portfolios, of which, the fees are included within Agency fees in our Consolidated Income Statements. In 2016, we acquired DTP S.A., a Polish-based debt collection company, furthering our in-house collection efforts in Poland. In 2021, we began purchasing nonperforming loans in Australia, leveraging an entity we established in 2011.

We have one reportable segment based on similarities among the operating segments, including economic characteristics, the nature of the products and services, the nature of the production processes, the types or classes of customers for our products and services, the methods used to distribute our products and services and the nature of the regulatory environment.

Nonperforming Loan Portfolio Acquisitions

To identify purchasing opportunities, we maintain an extensive marketing effort with our senior officers contacting known and prospective sellers of nonperforming loans. From these sellers, we have acquired a variety of nonperforming loans including Visa® and MasterCard® credit cards, private label and other credit cards, installment loans, lines of credit, deficiency balances of various types, legal judgments and trade payables. Sellers of nonperforming loans include major banks, credit unions, consumer finance companies, retailers, utilities, automobile finance companies and other credit originators. The price at which we purchase portfolios depends on the age of the portfolio, whether it is a Core or Insolvency portfolio, geographic region, the seller's selection criteria, our historical experience with a certain asset type or credit originator and other similar factors.

We purchase portfolios of nonperforming loans from credit originators through auctions and negotiated sales. In an auction process, the seller will assemble a portfolio of nonperforming loans and will seek purchase prices from specifically invited bidders. In a privately negotiated sale process, the credit originator will contact one or more purchasers directly, receive a bid and negotiate the terms of sale. In either case, typically, invited purchasers will have already successfully completed a qualification process that can include the seller's review of any or all of the following: the purchaser's experience, reputation, financial standing, operating procedures, business practices and compliance oversight.

We purchase portfolios of nonperforming loans through either single portfolio transactions, referred to as spot sales, or through the pre-arranged purchase of multiple portfolios over time, referred to as forward flow sales. Under a forward flow contract, we agree to purchase statistically similar nonperforming loan portfolios from credit originators on a periodic basis, at a negotiated price over a specified time period, typically from three to 12 months.

5

Nonperforming Loan Portfolio Collection Operations

Call Center Operations

In higher volume markets, our collection efforts leverage internally staffed call centers. In some newer markets or in markets that have less consistent debt purchasing patterns, most notably outside the U.S., we may utilize external vendors to do some or all of this work. Whether the accounts are being worked internally or externally, we utilize our proprietary analysis to proportionally direct work efforts to those customers most likely to pay. The analysis driving those decisions relies on models and variables that have the highest correlation to profitable collections from call activity.

Legal Recovery - Core Portfolios

An important component of our collections effort involves our legal recovery operations and the judicial collection of balances from customers who, in general, we believe have the ability, but not the willingness, to resolve their obligations. There are some markets in which the collection process follows a prescribed, time-sensitive and sequential set of legal actions, but in the majority of instances, we use models and analysis to select those accounts reflecting a high propensity to pay in a legal environment. Depending on the characteristics of the account and the applicable local collection laws, we determine whether to commence legal action to judicially collect on the account. The legal process can take an extended period of time and can be costly, but when accounts are selected properly, it usually generates net cash collections that likely would not have been realized otherwise. We use a combination of internal staff (attorney and support) and external staff to pursue legal collections under certain circumstances, as we deem appropriate.

Insolvency Operations

Accounts that are in an insolvent or bankrupt status are managed by our Insolvency operations team. These accounts fall under insolvency plans ranging from Individual Voluntary Arrangements ("IVAs") and Trust Deeds in the United Kingdom ("UK"), to Consumer Proposals in Canada, to various forms of bankruptcy plans in the U.S., Canada, Germany and the UK. We file claims or claim transfers securing our creditor rights in plans, and actively manage these accounts through the entire life cycle of the insolvency proceeding to ensure that we participate in any distributions to creditors. The accounts we manage are derived from two sources: (1) our purchased portfolios of insolvent nonperforming loans and (2) our Core purchased portfolios of nonperforming loans where our customers filed for protection under the insolvency or bankruptcy laws after being purchased by us. We purchase these types of accounts in the U.S., Canada, Germany and the UK.

These accounts are filed under the relevant country's insolvency or bankruptcy codes and may have an associated payment plan that generally ranges from three to seven years in duration. Accounts which are purchased while insolvent can be purchased at any stage in the insolvency or bankruptcy plan life cycle. Portfolios sold close to the filing of the insolvency or bankruptcy plan may take months to generate cash flow; however, aged portfolios sold years after the filing of the insolvency or bankruptcy plan will typically generate cash flows immediately.

Digital

As a complement to our collection operations, we have developed digital capabilities to support our collection efforts. We have developed these platforms in all of our operating markets that provide for inbound collections, as well as outbound collections where the regulatory environment allows us to operate in such a manner. In an effort to meet our customers in the channel which they prefer, we have developed digital capabilities to support our collection efforts. We have developed inbound collections capabilities in all of our operating markets, as well as outbound collections where the regulatory environment allows.

Equity Investments

We have an 11.7% equity interest in RCB, a servicer of nonperforming loans in Brazil.

Fee-Based Services

In addition to the purchase, collection and management of portfolios of nonperforming loans, we provide fee-based services including class action claims recovery purchasing and servicing through our subsidiary, Claims Compensation Bureau, LLC ("CCB"), and third-party servicing of bankruptcy accounts in the U.S.

Seasonality

Customer payment patterns in all of the countries in which we operate can be affected by seasonal employment trends, income tax refunds, and holiday spending habits. Typically, cash collections in the Americas tend to be higher in the first half

6

of the year due to the high volume of income tax refunds received by individuals in the U.S., and trend lower as the year progresses. In the first half of 2022, this spike was not as pronounced. Additionally, 2021 and 2020 deviated from usual seasonal patterns due to the impact of the COVID-19 pandemic.

Competition

Competition is derived from both third-party contingent fee collection agencies and purchasers of debt that manage their own nonperforming loans or outsource such servicing. Regulatory complexity and burdens, combined with seller preference for experienced portfolio purchasers, create barriers to successful entry for new competitors particularly in the U.S. While both remain competitive, the contingent fee industry is more fragmented than the purchased portfolio industry.

We compete in purchasing of nonperforming loans on the basis of price, reputation, industry experience and performance. We believe that our competitive strengths include our disciplined and proprietary underwriting process, the extensive data set we have developed since our founding in 1996, our ability to bid on portfolios at appropriate prices, our capital position, our reputation from previous portfolio purchase transactions, our ability to close transactions in a timely fashion, our strong relationships with credit originators, our team of well-trained collectors who provide quality customer service while complying with applicable collection laws and our ability to efficiently and effectively collect on various asset types.

Government Regulation

We are subject to a variety of federal, state, local and international laws that establish specific guidelines and procedures that debt collectors must follow when collecting customer accounts, including laws relating to the collection, use, retention, security and transfer of personal information. It is our policy to comply with applicable federal, state, local and international laws in all our activities. To promote compliance with applicable laws and regulations, we provide extensive training upon hire and additional training at least annually. We also continuously monitor and evaluate our collectors in order to provide meaningful and prompt feedback. Our compliance management system and related controls that are embedded in business processes are also tested regularly by our compliance and internal audit departments to foster compliance with laws, regulations and internal policy.

Our failure to comply with these laws could result in enforcement action against us, the payment of significant fines and penalties, restrictions upon our operations or our inability to recover amounts owed to us. Significant laws and regulations applicable to our business include the following:

•Fair Debt Collection Practices Act ("FDCPA"), which imposes certain obligations and restrictions on the practices of debt collectors, including specific restrictions regarding the time, place and manner of the communications.

•Fair Credit Reporting Act ("FCRA"), which obligates credit information providers to verify the accuracy of information provided to credit reporting agencies and investigate consumer disputes concerning the accuracy of such information.

•Gramm-Leach-Bliley Act ("GLBA"), which requires that certain financial institutions, including collection companies, develop policies to protect the privacy of consumers' private financial information and provide notices to consumers advising them of their privacy policies.

•Electronic Funds Transfer Act, which regulates electronic fund transfer transactions, including a consumer’s right to stop payments on a pre-approved fund transfer and right to receive certain documentation of the transaction.

•Telephone Consumer Protection Act ("TCPA"), which, along with similar state laws, places certain restrictions on users of certain automated dialing equipment and pre-recorded messages that place telephone calls to consumers.

•Servicemembers Civil Relief Act ("SCRA"), which gives U.S. military service personnel relief from credit obligations they may have incurred prior to entering military service and may also apply in certain circumstances to obligations and liabilities incurred by a servicemember while serving on active duty.

•Health Insurance Portability and Accountability Act, which provides standards to protect the confidentiality of patients' personal healthcare and financial information in the U.S.

•U.S. Bankruptcy Code, which prohibits certain contacts with consumers after the filing of bankruptcy petitions and dictates what types of claims will or will not be allowed in a bankruptcy proceeding including how such claims may be discharged.

•Americans with Disabilities Act, which requires that telecommunications companies operating in the U.S. take steps to ensure functionally equivalent services are available for their consumers with disabilities, and requires accommodation of consumers with disabilities, such as the implementation of telecommunications relay services.

7

•U.S. Foreign Corrupt Practices Act ("FCPA"), United Kingdom Bribery Act ("UK Bribery Act") and Similar Laws. Our operations outside the U.S. are subject to various U.S. and international laws and regulations, such as the FCPA and the UK Bribery Act, which prohibit corrupt payments to governmental officials and certain other individuals. The FCPA prohibits U.S. companies and their agents and employees from providing anything of value to a foreign official for the purposes of influencing any act or decision of these individuals in order to obtain an unfair advantage or help obtain or retain business. Although similar to the FCPA, the UK Bribery Act is broader in scope and covers bribes given to or received by any person with improper intent.

•Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act"), which restructured the regulation and supervision of the financial services industry in the U.S. and created the CFPB. The CFPB has rulemaking, supervisory, and enforcement authority over larger consumer debt collectors. The Dodd-Frank Act, along with the Unfair, Deceptive, or Abusive Acts or Practices ("UDAAP") provisions included therein, and the Federal Trade Commission Act, prohibit unfair, deceptive, and/or abusive acts and practices.

•International data protection and privacy laws, which include relevant country specific legislation in the UK and other European countries where we operate that regulate the processing of information relating to individuals, including the obtaining, holding, use or disclosure of such information; the Personal Information Protection and Electronic Documents Act, which aims to protect personal information that is collected, used or disclosed in certain circumstances for purposes of electronic commerce in Canada; and the GDPR, which regulates the processing and free movement of personal data within the European Union ("EU") and transfer of such data outside the EU.

•Consumer Credit Act 1974 (and its related regulations), Unfair Terms in Consumer Contracts Regulations of 1999 and the Financial Conduct Authority's consumer credit conduct of business rules, which apply to our UK operations and govern consumer credit agreements.

In addition, certain of our EU subsidiaries are subject to capital adequacy, liquidity and other requirements imposed by regulators, such as the Swedish Financial Supervisory Authority.

Human Capital

As of December 31, 2022, we employed 3,277 full-time equivalents globally across 18 countries, with approximately 73% of our workforce distributed across the Americas and Australia and 27% in Europe. Our employees share a common set of values and commitments that define how we treat each other, how we relate to our customers and the responsibilities we have to shareholders, regulators, clients and others. We refer to this shared set of values as C.A.R.E.S, which stands for Committed, Accountable, Respectful, Ethical and Successful. These values are intended to foster a high performing workforce and sense of belonging by working together to build an equitable and inclusive culture where employees can be themselves, to be their best.

In support of these values we offer comprehensive total rewards programs, which include competitive pay and bonus structures, health and wellness benefits, retirement plans and an employee assistance program. Additionally, we offer tuition reimbursement assistance and have a robust suite of training and development offerings, both in person and through virtual learning technology for employees across the globe, many available in multiple languages.

Management considers our employee relations to be good. While none of our North American employees are represented by a union or covered by a collective bargaining agreement, in Europe we work closely with a number of works councils, and in countries where it is the customary local practice, such as Finland and Spain, we have collective bargaining agreements.

Available Information

We make available on or through our website, www.pragroup.com, certain reports that we file with or furnish to the SEC in accordance with the Securities Exchange Act of 1934, as amended (the "Exchange Act"). These include our Annual Reports on Form 10-K, our Quarterly Reports on Form 10-Q, our Current Reports on Form 8-K and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act ("SEC Filings"). We make this information available on our website free of charge as soon as reasonably practicable after we electronically file the information with, or furnish it to, the SEC. The SEC maintains a website that contains reports, proxy and information statements and other information regarding issuers that file electronically with the SEC at: www.sec.gov.

The information contained on, or that can be accessed through our website, is not, and shall not be deemed to be a part of this Form 10-K or incorporated into any of our other SEC Filings.

8

Reports filed with, or furnished to, the SEC are also available free of charge upon request by contacting our corporate office at:

PRA Group, Inc.

Attn: Investor Relations

120 Corporate Boulevard, Suite 100

Norfolk, Virginia 23502

Item 1A. Risk Factors.

You should carefully read the following discussion of material factors, events and uncertainties when evaluating our business and the forward-looking information contained in this Form 10-K. The events and consequences discussed in these risk factors could materially and adversely affect our business, operating results, liquidity and financial condition. While we believe we have identified and discussed below the material risk factors affecting our business, these risk factors do not identify all the risks we face, and there may be additional risks and uncertainties that we do not presently know or that we do not currently believe to be material that may have an adverse effect on our business, performance or financial condition in the future.

Operational and Industry Risks

A deterioration in the economic or inflationary environment in the countries in which we operate could have an adverse effect on our business and results of operations.

Our performance may be adversely affected by economic, political or inflationary conditions in any market in which we operate. These conditions could include regulatory developments, changes in global or domestic economic policy, legislative changes, and sovereign debt crises. Deterioration in economic conditions, or a significant rise in inflation could cause personal bankruptcy and insolvency filings to increase, and the ability of consumers to pay their debts could be adversely affected. This may in turn adversely impact our business and financial results.

If global credit market conditions and the stability of global banks deteriorate, the amount of consumer or commercial lending and financing could be reduced, thus reducing the volume of nonperforming loans available for purchase, which could adversely affect our business, financial results and ability to succeed in the markets in which we operate.

Other economic factors that could influence our performance include the financial stability of the lenders on our credit facilities and our access to capital and credit. For example, deterioration in the financial markets, including as a result of a disease outbreak, such as the COVID-19 pandemic, could contribute to the insolvency of lending institutions, notably those providing our credit facilities, or the tightening of credit markets, which could make it difficult or impossible for us to obtain credit on favorable terms or at all. These and other economic factors could have an adverse effect on our financial condition and results of operations.

We may not be able to continually replace our nonperforming loans with additional portfolios sufficient to operate efficiently and profitably, and/or we may not be able to purchase nonperforming loans at appropriate prices.

To operate profitably, we must purchase and service a sufficient amount of nonperforming loans to generate revenue that exceeds our expenses. Costs such as salaries and other compensation expense constitute a significant portion of our overhead and, if we do not replace the nonperforming loan portfolios we service with additional portfolios, we may have to reduce the number of our collection and other administrative personnel. We may then, have to rehire staff if we subsequently obtain additional portfolios. These practices could lead to negative consequences, including the following:

•low employee morale;

•fewer experienced employees;

•higher training costs;

•disruptions in our operations;

•loss of efficiency; and

•excess costs associated with unused space in our facilities.

The availability of nonperforming loan portfolios at prices that generate an appropriate return on our investment depends on a number of factors, including the following:

•the continuation of high levels of consumer debt obligations;

9

•sales of nonperforming loan portfolios by credit originators; and

•competitive factors affecting potential purchasers and credit originators of nonperforming loans.

Furthermore, heightened regulation of the credit card and consumer lending industry or changing credit origination strategies may result in decreased availability of credit to consumers, potentially leading to a future reduction in nonperforming loans available for purchase from credit originators. We cannot predict how our ability to identify and purchase nonperforming loans and the quality of those nonperforming loans would be affected if there were a shift in lending practices, whether caused by changes in the regulations or accounting practices applicable to credit originators or purchasers, a sustained economic downturn or otherwise.

Moreover, there can be no assurance that credit originators will continue to sell their nonperforming loans consistent with historical levels or at all, or that we will be able to bid competitively for those portfolios. Because of the length of time involved in collecting on acquired portfolios and the variability in the timing of our collections, we may not be able to identify trends and make changes in our purchasing strategies in a timely manner. If we are unable to maintain our business or adapt to changing market needs as well as our current or future competitors, we may experience reduced access to nonperforming loan portfolios at appropriate prices and, therefore, reduced profitability.

We may not be able to collect sufficient amounts on our nonperforming loans to fund our operations.

Our principal business consists of purchasing and collecting nonperforming loans that consumers or others have failed to pay. The credit originators have typically made numerous attempts to recover on their accounts, often using a combination of in-house recovery efforts and third-party collection agencies. These nonperforming loans are difficult to collect, and we may not collect a sufficient amount to cover our investment and the costs of running our business.

Our collections may decrease if certain types of insolvency proceedings and bankruptcy filings involving liquidations increase.

Various economic trends and potential changes to existing legislation may contribute to an increase in the amount of personal bankruptcy and insolvency filings. Under certain of these filings, a debtor's assets may be sold to repay creditors, but because most of the accounts we collect through our collections operations are unsecured, we typically would not be able to collect on those accounts. Although our insolvency collections business could benefit from an increase in personal bankruptcies and insolvencies, we cannot ensure that our collections operations business would not decline with an increase in personal insolvencies or bankruptcy filings or changes in related regulations or practices. If our actual collection experience with respect to a nonperforming or insolvent bankrupt accounts are significantly lower than the total amount we projected when we acquired the portfolio, our financial condition and results of operations could be adversely impacted.

Goodwill impairment charges could negatively impact our net income and stockholder's equity.

We have recorded a significant amount of goodwill as a result of our business acquisitions. Goodwill is not amortized, but is tested for impairment at the reporting unit level. Goodwill is required to be tested for impairment annually and between annual tests if events or circumstances indicate that it is more likely than not that the fair value of a reporting unit is less than its carrying amount. There are numerous risks that may cause the fair value of a reporting unit to fall below its carrying amount, which could lead to the recognition of a goodwill impairment charge. These risks include:

•adverse changes in macroeconomic conditions, the business climate, or the market for the entity's products or services;

•significant variances between actual and expected financial results;

•negative or declining cash flows;

•lowered expectations of future results;

•failure to realize anticipated synergies from acquisitions;

•significant expense increases;

•a more likely-than-not expectation of selling or disposing all, or a portion of, a reporting unit;

•the loss of key personnel;

•an adverse action or assessment by a regulator;

•significant increase in discount rates; or

•a sustained decrease in the price per share of our common stock.

Our goodwill impairment testing involves the use of estimates and the exercise of judgment, including judgments regarding expected future business performance and market conditions. Significant changes in our assessment of such factors,

10

including the deterioration of market conditions, could affect our assessment of the fair value of one or more of our reporting units and could result in a goodwill impairment charge in a future period.

A disease outbreak could have an adverse effect on our business, results of operations and financial results.

We cannot predict the extent to which a disease outbreak, including epidemics, pandemics or similar widespread public health concerns, will impact our business, results of operations and financial results. A disease outbreak, such as the COVID-19 pandemic, could adversely affect our business, results of operations and financial results if:

•political, legal and regulatory actions and policies in response to disease outbreak may prevent us from performing our collection activities or result in material increases in our costs to comply with such laws and regulations;

•consumers respond to a disease outbreak by failing to pay amounts owed to us as a result of factors that impact their ability to make payments;

•we are unable to maintain staffing levels necessary to operate our business due to the continued spread of a disease outbreak causing employees to be unable or unwilling to work;

•we are unable to collect on existing nonperforming loans or experience material decreases in our cash collections; or

•we are unable to purchase nonperforming loans needed to operate our business because credit originators become unable or unwilling to sell their nonperforming loans consistent with historical levels.

Our loss contingency accruals may not be adequate to cover actual losses.

We are involved in judicial, regulatory and arbitration proceedings or investigations concerning matters arising from our business activities. We establish accruals for potential liability arising from legal proceedings when it is probable that such liability has been incurred and the amount of the loss can be reasonably estimated. However, there can be no assurance as to the ultimate outcome. We may still incur legal costs for a matter even if we have not accrued a liability. In addition, actual losses may be higher than the amount accrued for a certain matter, or in the aggregate. An unfavorable resolution of a legal proceeding or claim could adversely impact our business, financial condition, results of operations, or liquidity. For more information, refer to the "Litigation and Regulatory Matters" section of Note 14 to our Consolidated Financial Statements included in Item 8 of this Form 10-K.

International Operations Risks

Our international operations expose us to risks which could harm our business, results of operations and financial condition.

A significant portion of our operations is conducted outside the U.S. This could expose us to adverse economic, industry and political conditions that may have a negative impact on our ability to manage our existing operations or pursue alternative strategic transactions, which could have a negative effect on our business, results of operations and financial condition.

The global nature of our operations expands the risks and uncertainties described elsewhere in this section, including the following:

•changes in local political, economic, social and labor conditions in the markets in which we operate;

•foreign exchange controls on currency conversion and the transfer of funds that might prevent us from repatriating cash earned in countries outside the U.S. in a tax-efficient manner;

•currency exchange rate fluctuations, currency restructurings, inflation or deflation and our ability to manage these fluctuations through a foreign exchange risk management program;

•different employee/employer relationships, laws and regulations, union recognition and the existence of employment tribunals and works councils;

•laws and regulations imposed by international governments, including those governing data security, sharing and transfer;

•potentially adverse tax consequences resulting from changes in tax laws in the jurisdictions in which we operate or challenges to our interpretations and application of complex international tax laws;

•logistical, communications and other challenges caused by distance and cultural and language differences, each making it harder to do business in certain jurisdictions;

•volatility of global credit markets and the availability of consumer credit and financing in our international markets;

•uncertainty as to the enforceability of contract rights under local laws;

•the potential of forced nationalization of certain industries, or the impact on creditors' rights, consumer disposable income levels, flexibility and availability of consumer credit and the ability to enforce and collect aged or charged-off

11

debts stemming from international governmental actions, whether through austerity or stimulus measures or initiatives, intended to control or influence macroeconomic factors such as wages, unemployment, national output or consumption, inflation, investment, credit, finance, taxation or other economic drivers;

•the presence of varying levels of business corruption in international markets and the effect of various anti-corruption and other laws on our international operations;

•the impact on our day-to-day operations and our ability to staff our international operations given our changing labor conditions and long-term trends towards higher wages in developed and emerging international markets as well as the potential impact of union organizing efforts;

•potential damage to our reputation due to non-compliance with international and local laws; and

•the complexity and necessity of using non-U.S. representatives, consultants and other third-party vendors.

Any one of these factors could adversely affect our business, results of operations and financial condition.

Compliance with complex and evolving international and U.S. laws and regulations that apply to our international operations could increase our cost of doing business in international jurisdictions.

We operate on a global basis with offices and activities in a number of jurisdictions throughout the Americas, Europe and Australia. We face increased exposure to risks inherent in conducting business internationally, including compliance with complex international and U.S. laws and regulations that apply to our international operations, which could increase our cost of doing business in international jurisdictions. These laws and regulations include those related to taxation and anti-corruption laws such as the FCPA and the UK Bribery Act. Given the complexity of these laws, there is a risk that we may inadvertently breach certain provisions of these laws, such as through the negligent behavior of an employee or our failure to comply with certain formal documentation requirements. Violations of these laws and regulations by us, any of our employees or our third-party vendors, either inadvertently or intentionally, could result in fines and penalties, criminal sanctions, restrictions on our operations and ability to offer our products and services in one or more countries. Violations of these laws could also adversely affect our business, brand, international expansion efforts, ability to attract and retain employees and results of operations.

Additionally, new or pending international regulations, such as the EU Directive (2021/2167) on Credit Servicers and Credit Purchasers and the Financial Conduct Authority’s Consumer Duty proposals, could adversely affect our operations in Europe once they are effective and require implementation. The Organization for Economic Co-operation and Development ("OECD") recently issued Pillar Two model rules with the aim of ensuring that multinational enterprises pay a 15% effective tax rate in each jurisdiction. The EU adopted the OECD Pillar Two Directive with a beginning date of January 1, 2024. We are monitoring the enactment of Pillar Two legislation in EU countries and elsewhere to determine its potential impact on our financial results as well as monitoring U.S. amendments to the U.S. global intangible low-tax income ("GILTI"), if any. The implementation of Pillar Two and amendments to GILTI could significantly increase our U.S. and international income taxes.

Legal and Regulatory Risks

Our ability to collect and enforce our nonperforming loans may be limited under federal, state and international laws, regulations and policies.

Our operations are subject to licensing and regulation by governmental and regulatory bodies in the many jurisdictions in which we operate. U.S. federal and state laws, and the laws and regulations of the international countries in which we operate, may limit our ability to collect on and enforce our rights with respect to our nonperforming loans regardless of any act or omission on our part. Some laws and regulations applicable to credit issuers may preclude us from collecting on nonperforming loans we acquire if the credit issuer previously failed to comply with applicable laws in generating or servicing those accounts. Collection laws and regulations also directly apply to our business. Such laws and regulations are extensive and subject to change. A variety of state, federal and international laws and regulations govern the collection, use, retention, transmission, sharing and security of consumer data. Consumer protection and privacy protection laws, changes in the ways that existing rules or laws are interpreted or enforced and any procedures that may be implemented as a result of regulatory consent orders may adversely affect our ability to collect on our nonperforming loans and adversely affect our business. Our failure to comply with laws or regulations applicable to us could limit our ability to collect on our nonperforming loans, which could reduce our profitability and adversely affect our business.

Failure to comply with government regulation of the collections industry could result in penalties, fines, litigation, damage to our reputation or the suspension or termination of our ability to conduct our business.

The collections industry throughout the markets in which we operate is governed by various laws and regulations, many of which require us to be a licensed debt collector. Our industry is also at times investigated by regulators and offices of state

12

attorneys general, and subpoenas and other requests or demands for information may be issued by governmental authorities who are investigating debt collection activities. These investigations may result in enforcement actions, fines and penalties, or the assertion of private claims and lawsuits. If any such investigations result in findings that we or our vendors have failed to comply with applicable laws and regulations, we could be subject to penalties, litigation losses and expenses, damage to our reputation, or the suspension or termination of, or required modification to, our ability to conduct collections, which would adversely affect our business, results of operations and financial condition.

In a number of jurisdictions, we must maintain licenses to purchase or own debt, and/or to perform debt recovery services and must satisfy related bonding requirements. Our failure to comply with existing licensing requirements, changing interpretations of existing requirements, or adoption of new licensing requirements, could restrict our ability to collect in certain jurisdictions, subject us to increased regulation, increase our costs or adversely affect our ability to purchase, own and/or collect our nonperforming loans.

Some laws, among other things, also may limit the interest rate and the fees that a credit originator may impose on our consumers, limit the time in which we may file legal actions to enforce consumer accounts and require specific account information for certain collection activities. In addition, local requirements and court rulings in various jurisdictions may affect our ability to collect.

Regulations and statutes applicable to our industry further provide that, in some cases, consumers cannot be held liable for, or their liability may be limited with respect to, charges to their debit or credit card accounts that resulted from unauthorized use of their credit. These laws, among others, may limit our ability to recover amounts owing with respect to the nonperforming loans, whether or not we committed any wrongful act or omission in connection with the account.

If we fail to comply with any applicable laws and regulations discussed above, such failure could result in penalties, litigation losses and expenses, damage to our reputation, or otherwise impact our ability to conduct collections efforts, which could adversely affect our business, results of operations and financial condition.

Investigations, reviews or enforcement actions by governmental authorities may result in changes to our business practices; negatively impact our nonperforming loan portfolio acquisition volume; make collection of nonperforming loans more difficult; or expose us to the risk of fines, penalties, restitution payments and litigation.

Our debt collection activities and business practices are subject to review from time to time by various governmental authorities and regulators, including the CFPB, which may commence investigations, reviews or enforcement actions targeted at businesses in the financial services industry. These investigations or reviews may involve individual consumer complaints or our debt collection policies and practices generally. Such investigations or reviews could lead to assertions by governmental authorities that we are not complying with applicable laws or regulations. In such circumstances, authorities may request or seek to impose a range of remedies that could involve potential compensatory or punitive damage claims, fines, restitution payments, sanctions or injunctive relief, that if agreed to or granted, could require us to make payments or incur other expenditures that could have an adverse effect on our results of operations or financial position. The CFPB has the authority to obtain cease and desist orders (which can include orders for restitution or rescission of contracts, as well as other kinds of affirmative relief), recover costs, and impose monetary penalties (ranging from $5,000 per day to over $1 million per day, depending on the nature and gravity of the violation). In addition, where a company has violated Title X of the Dodd-Frank Act or CFPB regulations implemented thereunder, the Dodd-Frank Act empowers state attorneys general and other state regulators to bring civil actions to remedy violations under state law. Governmental authorities could also request or seek to require us to cease certain practices or institute new practices. Negative publicity relating to investigations or proceedings brought by governmental authorities could have an adverse impact on our reputation, harm our ability to conduct business with industry participants, and result in financial institutions reducing or eliminating sales of nonperforming loan portfolios to us which would harm our business and negatively impact our results of operations. Moreover, changing or modifying our internal policies or procedures, responding to governmental inquiries and investigations and defending lawsuits or other proceedings could require significant efforts on the part of management and result in increased costs to our business. In addition, such efforts could divert management's full attention from our business operations. All of these factors could have an adverse effect on our business, results of operations and financial condition.

The CFPB has issued civil investigative demands ("CIDs") to many companies that it regulates, including PRA Group, and periodically examines practices regarding the collection of consumer debt. In September 2015, Portfolio Associates, LLC ("PRA"), our wholly owned subsidiary, entered into a consent order with the CFPB settling a previously disclosed investigation of certain debt collection practices of PRA (the "Consent Order"). As further discussed in the "Litigation and Regulatory Matters" section of Note 14 to our Consolidated Financial Statements included in Item 8 of this Form 10-K, we are in discussions with the CFPB regarding CIDs and requests for information issued by the CFPB to us related to our compliance with the Consent Order and applicable law. Although we believe we have implemented the requirements of the Consent Order,

13

there can be no assurance that additional litigation or new industry regulations currently under consideration by the CFPB would not have an adverse effect on our business, results of operations and financial condition.

The regulation of data privacy in the U.S and globally could have an adverse effect on our business, results of operations and financial condition by increasing our compliance costs or exposing us to the risk of liability.

A variety of jurisdictions in which we operate have laws and regulations concerning, privacy, cybersecurity, and the protection of personal data, including the EU GDPR, the UK GDPR, the U.S. GLBA, and the California Consumer Privacy Act of 2018. These laws and regulations create certain privacy rights for individuals and impose prescriptive operational requirements for covered businesses relating to the processing and protection of personal data and may also impose substantial penalties for non-compliance.

In addition, laws and regulations relating to privacy, cybersecurity and data protection are quickly evolving, and any such proposed or new legal frameworks could significantly impact our operations, financial performance and business. The application and enforcement of these evolving legal requirements is uncertain and may require us to further change or update our information practices, and could impose additional compliance costs and regulatory scrutiny.

We may incur significant costs complying with legal obligations and inquiries, investigations or any other government actions related to privacy, cybersecurity, and data protection. Such legal requirements and government actions also may impede our development of new products, services, or businesses, make existing products, services, or businesses unprofitable, increase our operating costs, require substantial management resources, result in adverse publicity and subject us to remedies that harm our business or profitability, including penalties or orders that we change or terminate current business practices. Our insurance policies may be insufficient to insure us against such risks, and future escalations in premiums and deductibles under these policies may render them uneconomical.

Changes in tax provisions or exposures to additional tax liabilities could have an adverse tax effect on our financial condition.

We record reserves for uncertain tax positions based on our assessment of the probability of successfully sustaining tax filing positions. Management exercises significant judgment when assessing the probability of successfully sustaining tax filing positions, in determining whether a tax liability should be recorded and, if so, estimating that amount. Our tax filings are subject to audit by domestic and international tax authorities. If our tax filing positions are successfully challenged, payments could be required that are in excess of reserved amounts or we may be required to reduce the carrying amount of our net deferred tax asset, either of which could be significant to our financial condition or results of operations. Although we believe our estimates are reasonable, the ultimate tax outcome may differ from the amounts recorded in our financial statements and may adversely or beneficially affect our financial results in the period(s) for which such determination is made.

Financial and Liquidity Risks

We expect to use leverage in executing our business strategy, which may adversely affect the return on our assets.

We may incur a substantial amount of debt in the future. Our existing indebtedness is recourse to us, and we anticipate that future indebtedness will likewise be recourse. As of December 31, 2022, we had total consolidated indebtedness of approximately $2.5 billion, all of which, except for $345.0 million outstanding principal amount of our 3.50% Convertible Notes due 2023 (the "2023 Convertible Notes"), $300.0 million outstanding principal amount of our 7.375% Senior Notes due 2025 (the "2025 Notes"), and $350.0 million outstanding principal amount of our 5.00% Senior Notes due 2029 (the "2029 Notes" and together with the 2025 Notes, the "Senior Notes"), was secured indebtedness. In addition, as of December 31, 2022, we had total committed revolving borrowing capacity of $1.6 billion available under our credit facilities, all of which if borrowed would be secured indebtedness. Considering borrowing base restrictions and other covenants, the amount available to be borrowed under our credit facilities would have been $465.1 million as of December 31, 2022. Our management team will consider a number of factors when evaluating our level of indebtedness and when making decisions regarding the incurrence of any new indebtedness, including the purchase price of assets to be acquired with debt financing, the estimated market value of our assets and the ability of particular assets and the Company as a whole, to generate cash flow to cover the expected debt service.

Incurring a substantial amount of debt could have important consequences for our business, including:

•making it more difficult for us to satisfy our obligations with respect to our debt or to our trade or other creditors;

•increasing our vulnerability to adverse economic or industry conditions;

•limiting our ability to obtain additional financing to fund capital expenditures and acquisitions, particularly when the availability of financing in the capital markets is constrained;

14

•requiring a substantial portion of our cash flows from operations and reducing our ability to use our cash flows to fund working capital, capital expenditures, acquisitions and general corporate requirements;

•increasing the amount of interest expense because most of the indebtedness under our credit facilities bear interest at floating rates, which, if interest rates increase, will result in higher interest expense;

•limiting our flexibility in planning for, or reacting to, changes in our business and the industry in which we operate; and

•placing us at a competitive disadvantage to less leveraged competitors.

We cannot assure you that our business will generate sufficient cash flow from operations or that future borrowings will be available to us through capital markets financings, under credit facilities or otherwise, in an amount sufficient to enable us to repay our indebtedness, repurchase our 2023 Convertible Notes upon a fundamental change or settle conversions in cash, repurchase our Senior Notes upon a change of control or fund our other liquidity needs. We may need to refinance all or a portion of our indebtedness, at or before its scheduled maturity. We cannot assure you that we will be able to refinance any of our indebtedness on commercially reasonable terms or at all. In addition, we may incur additional indebtedness in order to finance our operations or to repay existing indebtedness. If we cannot service our indebtedness, we may have to take actions such as selling assets, seeking additional debt or equity or reducing or delaying capital expenditures, strategic acquisitions, investments and alliances. We cannot assure you that any such actions, if necessary, could be effected on commercially reasonable terms or at all, or on terms that would be advantageous to our stockholders or on terms that would not require us to breach the terms and conditions of our existing or future debt agreements.

We may not be able to generate sufficient cash flow to meet our debt service obligations.

Our ability to generate sufficient cash flow from operations to make scheduled payments on our debt obligations will depend on our current and future financial performance, which is subject to general economic, financial, competitive, legislative, regulatory and other factors that are beyond our control. In the future, we may fail to generate sufficient cash flow from the collection of nonperforming loans to meet our cash requirements. Further, our capital requirements may vary materially from those currently planned if, for example, our revenues do not reach expected levels, we have to incur unforeseen expenses, we invest in acquisitions or make other investments that we believe will benefit our competitive position. If we do not generate sufficient cash flow from operations to satisfy our debt obligations, including interest payments and the payment of principal at maturity, we may have to undertake alternative financing plans, such as refinancing or restructuring our debt, selling assets or seeking to raise additional capital. We cannot provide assurance that any refinancing would be possible, that any assets could be sold, or, if sold, of the timeliness and amount of proceeds realized from those sales, that additional financing could be obtained on acceptable terms, if at all, or that additional financing would be permitted under the terms of our various debt instruments then in effect. Furthermore, our ability to refinance would depend upon the condition of the finance and credit markets. Our inability to generate sufficient cash flow to satisfy our debt obligations, or to refinance our obligations on commercially reasonable terms or on a timely basis, would materially affect our business, financial condition or results of operations and may delay or prevent the expansion of our business.

The agreements governing our indebtedness include provisions that may restrict our financial and business operations.

Our credit facilities and the indentures that govern our 2023 Convertible Notes and our Senior Notes contain financial and other restrictive covenants, including restrictions on how we operate our business and our ability to pay dividends to our stockholders. These restrictions may interfere with our ability to engage in other necessary or desirable business activities, which could materially affect our business, financial condition or results of operations.

Failure to satisfy any one of these covenants could result in negative consequences, including the following:

•acceleration of outstanding indebtedness;

•exercise by our lenders of rights with respect to the collateral pledged under certain of our outstanding indebtedness;

•our inability to continue to purchase nonperforming loans needed to operate our business; or

•our inability to secure alternative financing on favorable terms, if at all.

Cybersecurity and Technology Risks

A cybersecurity incident could damage our reputation and adversely impact our business and financial results.

Our business is highly dependent on our ability to process and monitor a large number of transactions across markets and in multiple currencies. We rely on information technology systems to conduct our business, including systems developed and administered by third parties. Many of these systems contain sensitive and confidential information, including personal data,

15

our trade secrets and proprietary business information, and information and materials owned by or pertaining to our business customers, vendors and business partners. The secure maintenance of this information, and the information technology systems on which they reside, is critical to our business strategy as well as our operations and financial performance. As we expand geographically, and our reliance on information technology systems increases, maintaining the security of such systems and our data becomes more significant and challenging.

Although we take a number of steps to protect our information technology systems, the attacks that companies have experienced have increased in number, sophistication and complexity over the past few years.

Accordingly, we may suffer data security incidents or other cybersecurity incidents, which could compromise our systems and networks, creating system disruptions and exploiting vulnerabilities in our products and services. Any such breach or other incident also could result in the personal data or other confidential or proprietary information stored on our systems and networks, or our vendors’ systems and networks, being improperly accessed, acquired or modified, publicly disclosed, lost, or stolen, which could subject us to liability to our customers, vendors, business partners and others. We seek to detect and investigate such incidents and to prevent their recurrence where practicable through preventive and remedial measures, but such measures may not be successful.

Should a cybersecurity incident occur, we may be required to expend significant resources to notify affected parties, modify our protective measures or investigate and remediate vulnerabilities or other exposures. Additionally, such cybersecurity events could cause reputational damage and subject us to fines, penalties, litigation costs and settlements and financial losses that may not be fully covered by our cybersecurity insurance. To date, disruptions to our information technology systems, due to outages, security breaches or other causes, including cybersecurity incidents have not had a material impact on our business. However, any such disruption could have significant consequences for our business, including financial loss and reputational damage.

The underperformance or failure of our information technology infrastructure, networks or communication systems could result in loss in productivity, loss of competitive advantage and business disruption.

We depend on effective information and communication systems to operate our business. We have also acquired and expect to acquire additional systems as a result of business acquisitions. Significant resources are required to maintain or enhance our existing information and telephone systems and to replace obsolete systems. Although we periodically upgrade, streamline, and integrate our systems and have invested in strategies to prevent a failure, our systems are susceptible to outages due to natural disasters, power loss, computer viruses, security breaches, hardware or software vulnerabilities, disruptions, and similar events. Failure to adequately implement or maintain effective and efficient information systems with sufficiently advanced technological capabilities, or our failure to efficiently and effectively consolidate our information systems to eliminate redundant or obsolete applications, could cause us to lose our competitive advantage, divert management’s time, result in a loss of productivity or disrupt business operations, which could have a material adverse effect on our business, financial condition and results of operations.

Item 1B. Unresolved Staff Comments.

None.

Item 2. Properties.

Our corporate headquarters and primary domestic operations facilities are located in Norfolk, Virginia. In addition, at December 31, 2022, we had 15 operational centers in the Americas and Australia (12 leased and three owned), and nine in Europe (all leased).

Item 3. Legal Proceedings.

We and our subsidiaries are from time to time subject to a variety of routine legal and regulatory claims, inquiries and proceedings, most of which are incidental to the ordinary course of our business. We initiate lawsuits against customers and are occasionally countersued by them in such actions. Also, customers, either individually, as members of a class action, or through a governmental entity on behalf of customers, may initiate litigation against us in which they allege that we have violated a state or federal law in the process of collecting on an account. From time to time, other types of lawsuits are brought against us.

Refer to Note 14 to our Consolidated Financial Statements included in Item 8 of this Form 10-K for information regarding legal proceedings in which we are involved.

16

Item 4. Mine Safety Disclosures.

Not applicable.

17

PART II

Item 5. Market for Registrant's Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Common Stock

Our common stock is traded on Nasdaq Global Select Market under the symbol "PRAA." Based on information provided by our transfer agent and registrar, as of February 21, 2023, there were 44 holders of record.

Stock Performance

The following graph and subsequent table compare from December 31, 2017 to December 31, 2022, the cumulative stockholder returns assuming an initial investment of $100 in our common stock (PRAA), the stocks comprising the Nasdaq Financial 100 (IXF) and the stocks comprising the Nasdaq Global Market Composite Index (NQGM) at the beginning of the period. Any dividends paid during the five-year period are assumed to be reinvested.

| Ticker | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |||||||||||||||||||||||||||||||||||

| PRA Group, Inc. | PRAA | $ | 100 | $ | 73 | $ | 109 | $ | 119 | $ | 151 | $ | 102 | ||||||||||||||||||||||||||||

| Nasdaq Financial 100 | IXF | $ | 100 | $ | 92 | $ | 119 | $ | 123 | $ | 156 | $ | 119 | ||||||||||||||||||||||||||||

| Nasdaq Global Market Composite Index | NQGM | $ | 100 | $ | 94 | $ | 129 | $ | 213 | $ | 180 | $ | 100 | ||||||||||||||||||||||||||||

The comparisons of stock performance shown above are not intended to forecast or be indicative of possible future performance of our common stock. We do not make or endorse any predictions as to our future stock performance.

Dividend Policy

Our Board of Directors sets our dividend policy. We do not currently pay regular dividends on our common stock and did not pay dividends during the three years ended December 31, 2022; however, our Board of Directors may determine in the future to declare or pay dividends on our common stock. Our credit facilities and the indentures that govern our 2023 Convertible Notes, 2025 Notes and 2029 Notes contain financial and other restrictive covenants, including restrictions on how we operate our business and our ability to pay dividends to our stockholders. Any future determination as to the declaration and payment of dividends will be at the discretion of our Board of Directors and will depend on conditions then existing, including our results of operations, financial condition, contractual restrictions, capital requirements, business prospects and other factors that our Board of Directors may consider relevant.

18

Recent Sales of Unregistered Securities

None.

Share Repurchase Programs

On February 25, 2022, our Board of Directors approved a share repurchase program under which we are authorized to repurchase up to $150.0 million of our outstanding common stock. For more information, see Item 7 "Management's Discussion and Analysis of Financial Condition and Results of Operations - Liquidity and Capital Resources" of this Form 10-K.

We did not repurchase any common stock during the fourth quarter of the year ended December 31, 2022.

Item 6. [Reserved]

19

Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

Objective

This discussion is from the perspective of management and is intended to help the reader understand our financial condition, cash flows and other changes in financial condition and results of operations. It should be read in conjunction with the financial statements and notes thereto included in Item 8 of this Form 10-K. Additionally, this discussion includes material events and uncertainties known to management that are reasonably likely to cause reported financial information not to be indicative of our future operating results or of our future financial condition.

Executive Overview

We are a global financial and business services company with operations in the Americas, Europe and Australia. Our primary business is the purchase, collection and management of portfolios of nonperforming loans. For the year ended December 31, 2022 we had:

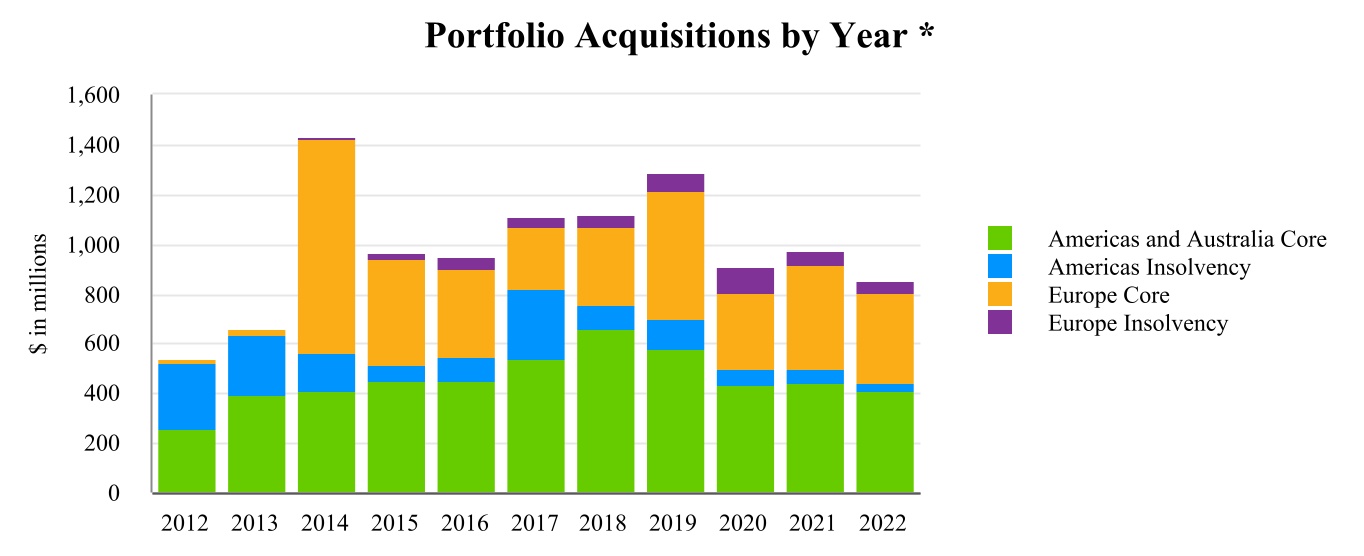

•Total portfolio purchases of $850.0 million.

•Total cash collections of $1.7 billion.

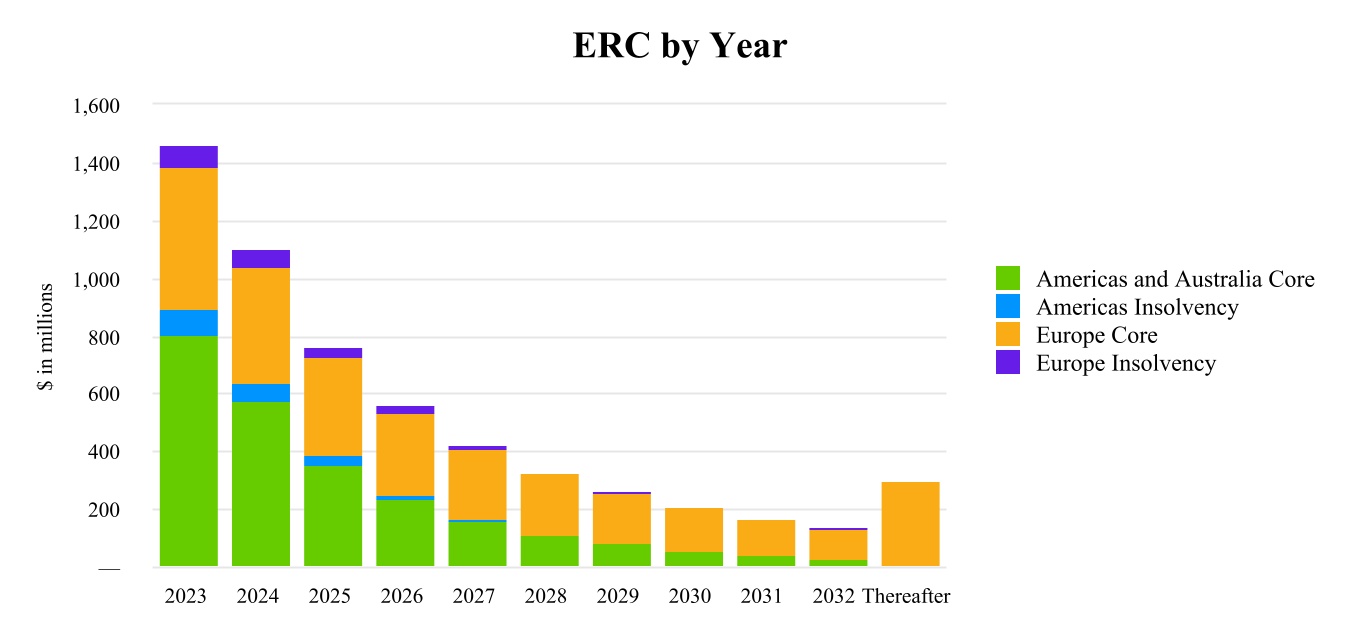

•Estimated remaining collections ("ERC") of $5.7 billion.

•Cash efficiency ratio of 61.0%.

•Diluted earnings per share of $2.94 .

Leading financial industry publications have indicated that excess consumer liquidity has resulted in lower levels of charge offs across most lending institutions, primarily in the U.S. As a result, this has caused a decrease in the supply of portfolios available for purchase in the U.S. during 2021 and 2022 resulting in a lower level of portfolio purchases and pricing pressures. We expect these trends to continue temporarily; however, consistent with our experience during previous economic cycles, we believe charge offs will increase. This should lead to a greater level of supply, which we anticipate could occur in the coming months.

Furthermore, the combination of robust demand for goods and services and lingering supply chain constraints continue to contribute to elevated levels of inflation, rising interest rates, foreign exchange rate fluctuations, and concerns of global recession. We cannot predict the full extent to which these items will impact our business, results of operations and financial condition. See Item 1A of this Form 10-K.

Frequently Used Terms

We may use the following terminology throughout this Form 10-K:

•"Buybacks" refers to purchase price refunded by the seller due to the return of ineligible accounts.

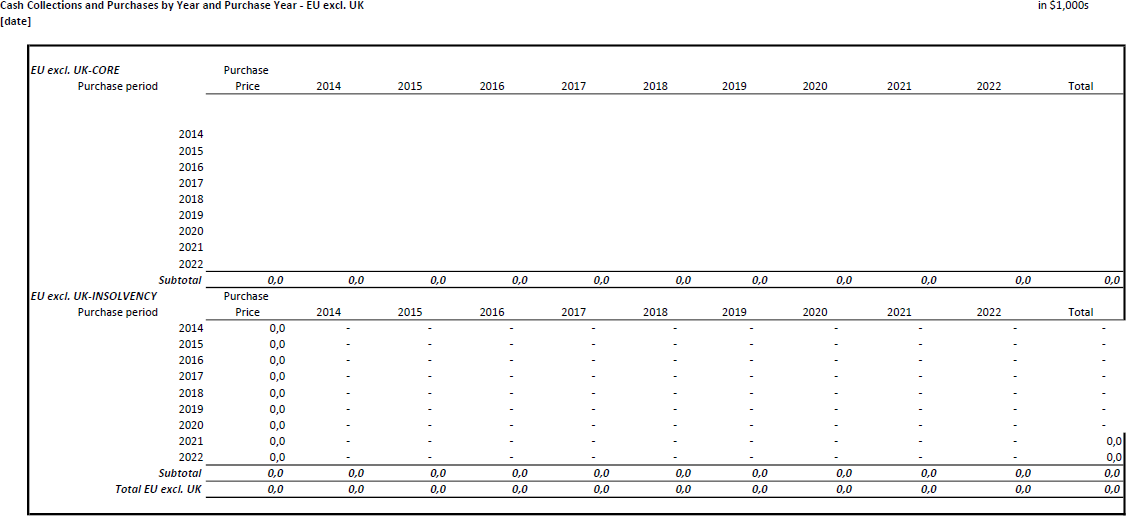

•"Cash collections" refers to collections on our nonperforming loan portfolios.

•"Cash receipts" refers to cash collections on our nonperforming loan portfolios, fees and revenue recognized from our class action claims recovery services.

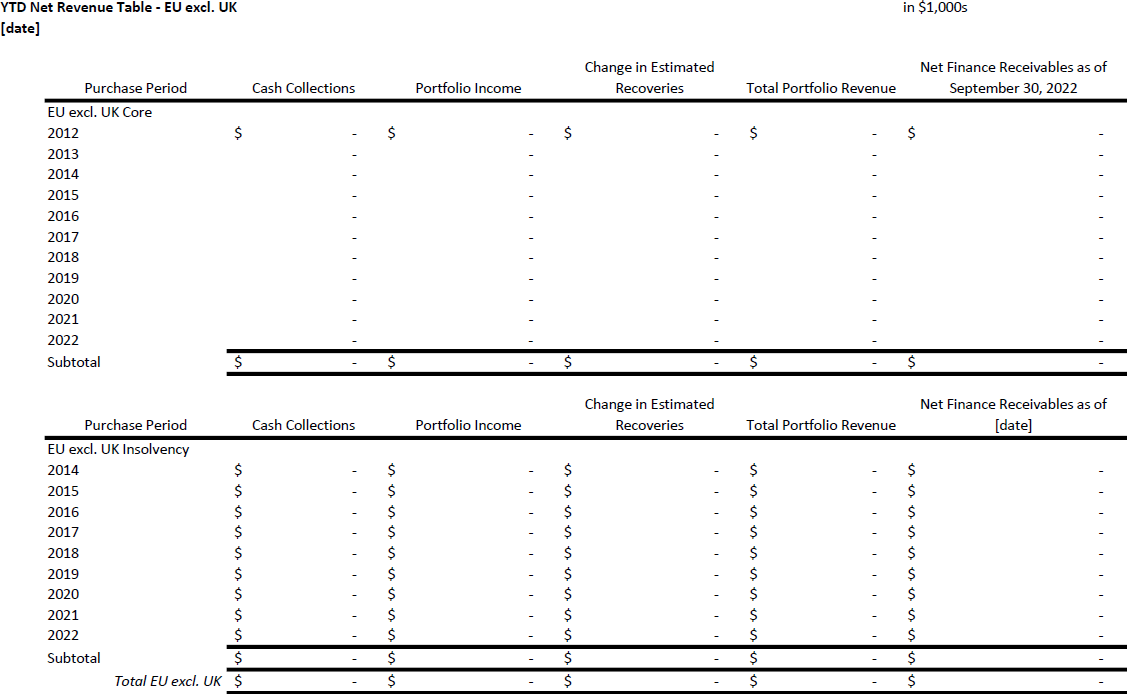

•"Change in expected recoveries" refers to the differences of actual recoveries received when compared to expected recoveries and the net present value of changes in estimated remaining collections.

•"Core" accounts or portfolios refer to accounts or portfolios that are nonperforming loans and are not in an insolvent status upon acquisition. These accounts are aggregated separately from insolvency accounts.

•"Estimated remaining collections" or "ERC" refers to the sum of all future projected cash collections on our nonperforming loan portfolios.

•"Finance receivables" or "receivables" refers to the negative allowance for expected recoveries recorded on our balance sheet as an asset.

•"Insolvency" accounts or portfolios refer to accounts or portfolios of nonperforming loans that are in an insolvent status when we purchase them and as such are purchased as a pool of insolvent accounts. These accounts include IVAs, Trust Deeds in the UK, Consumer Proposals in Canada and bankruptcy accounts in the U.S., Canada, Germany and the UK.

•"Negative Allowance" refers to the present value of expected cash collections on our finance receivables.

•"Portfolio acquisitions" refers to all nonperforming loan portfolios acquired as a result of a purchase, but also includes portfolios added as a result of a business acquisition.

20

•"Portfolio purchases" refers to all nonperforming loan portfolios purchased in the normal course of business and excludes those added as a result of business acquisitions.

•"Portfolio income" reflects revenue recorded due to the passage of time using the effective interest rate calculated based on the purchase price of nonperforming loan portfolios and estimated remaining collections.

•"Purchase price" refers to the cash paid to a seller to acquire nonperforming loans.

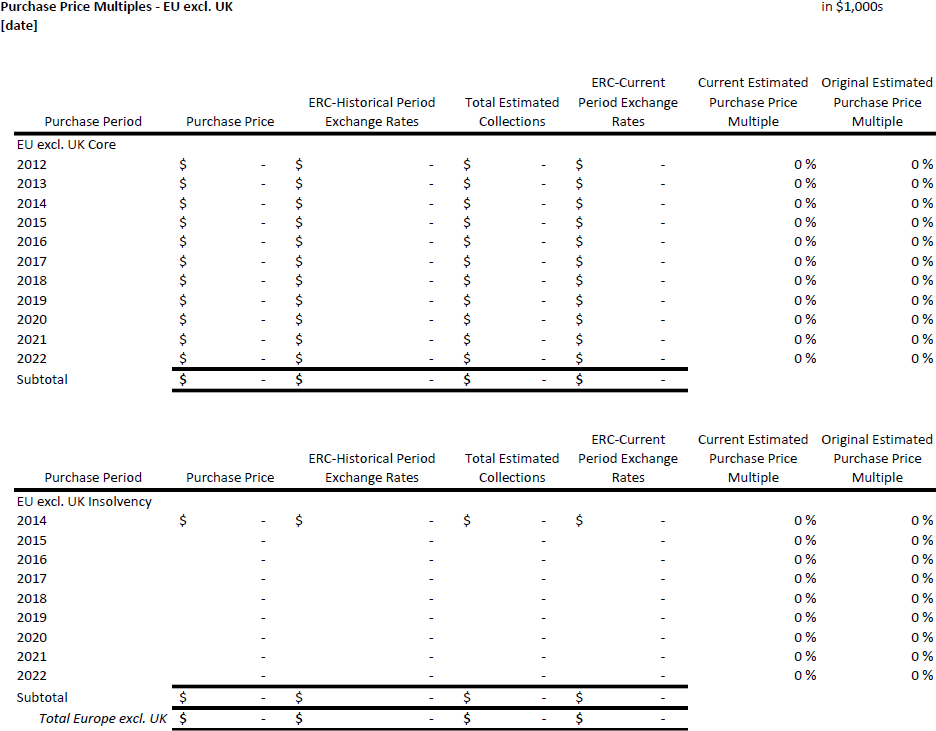

•"Purchase price multiple" refers to the total estimated collections on our nonperforming loan portfolios divided by purchase price.

•"Recoveries" refers to cash collections plus buybacks and other adjustments.

•"Total estimated collections" or "TEC" refers to actual cash collections plus estimated remaining collections on our nonperforming loan portfolios.

Unless otherwise specified, references to 2022, 2021 and 2020 are for the years ended December 31, 2022, December 31, 2021 and December 31, 2020, respectively.

21

Results of Operations

The results of operations include the financial results of the Company and all of our subsidiaries. Certain prior year amounts have been reclassified for consistency with the current year presentation. Fee Income is now included within Other revenue on our Consolidated Income Statements. The following table sets forth Consolidated Income Statement amounts as a percentage of total revenues for the periods indicated (dollars in thousands):

| 2022 | 2021 | 2020 | |||||||||||||||||||||||||||||||||

| Revenues: | |||||||||||||||||||||||||||||||||||

| Portfolio income | $ | 772,315 | 79.9 | % | $ | 875,327 | 79.9 | % | $ | 984,036 | 92.4 | % | |||||||||||||||||||||||

| Changes in expected recoveries | 168,904 | 17.5 | 197,904 | 18.1 | 69,297 | 6.5 | |||||||||||||||||||||||||||||

| Total portfolio revenue | 941,219 | 97.4 | 1,073,231 | 98.0 | 1,053,333 | 98.9 | |||||||||||||||||||||||||||||

| Other revenue | 25,305 | 2.6 | 22,501 | 2.0 | 12,081 | 1.1 | |||||||||||||||||||||||||||||

| Total revenues | 966,524 | 100.0 | 1,095,732 | 100.0 | 1,065,414 | 100.0 | |||||||||||||||||||||||||||||

| Operating expenses: | |||||||||||||||||||||||||||||||||||

| Compensation and employee services | 285,537 | 29.5 | 301,981 | 27.6 | 295,150 | 27.7 | |||||||||||||||||||||||||||||

| Legal collection fees | 38,450 | 4.0 | 47,206 | 4.3 | 53,758 | 5.1 | |||||||||||||||||||||||||||||

| Legal collection costs | 76,757 | 7.9 | 78,330 | 7.1 | 101,635 | 9.5 | |||||||||||||||||||||||||||||