PRAA-2014.6.30-10Q

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended June 30, 2014.

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 000-50058

Portfolio Recovery Associates, Inc. (Exact name of registrant as specified in its charter)

|

| | |

Delaware | | 75-3078675 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| |

120 Corporate Boulevard, Norfolk, Virginia | | 23502 |

(Address of principal executive offices) | | (zip code) |

(888) 772-7326

(Registrant’s telephone number, including area code) Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ý NO ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ý NO ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” “non-accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

| | | | | | |

Large accelerated filer | | ý | | Accelerated filer | | ¨ |

| | | |

Non-accelerated filer | | ¨ | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). YES ¨ NO ý

The number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

Class | | Outstanding as of July 31, 2014 |

Common Stock, $0.01 par value | | 50,075,049 |

PORTFOLIO RECOVERY ASSOCIATES, INC.

INDEX

Part I. FINANCIAL INFORMATION

Item 1. Financial Statements

PORTFOLIO RECOVERY ASSOCIATES, INC.

CONSOLIDATED BALANCE SHEETS

June 30, 2014 and December 31, 2013

(unaudited)

(Amounts in thousands, except per share amounts)

|

| | | | | | | |

| June 30,

2014 | | December 31,

2013 |

Assets | | | |

Cash and cash equivalents | $ | 270,526 |

| | $ | 162,004 |

|

Finance receivables, net | 1,219,595 |

| | 1,239,191 |

|

Accounts receivable, net | 12,458 |

| | 12,359 |

|

Income taxes receivable | 6,072 |

| | 11,710 |

|

Net deferred tax asset | 1,404 |

| | 1,361 |

|

Property and equipment, net | 38,902 |

| | 31,541 |

|

Goodwill | 105,122 |

| | 103,843 |

|

Intangible assets, net | 13,805 |

| | 15,767 |

|

Other assets | 27,478 |

| | 23,456 |

|

Total assets | $ | 1,695,362 |

| | $ | 1,601,232 |

|

Liabilities and Equity | | | |

Liabilities: | | | |

Accounts payable | $ | 20,396 |

| | $ | 14,819 |

|

Accrued expenses and other liabilities | 33,594 |

| | 27,655 |

|

Accrued compensation | 14,320 |

| | 27,431 |

|

Net deferred tax liability | 226,011 |

| | 210,071 |

|

Borrowings | 448,785 |

| | 451,780 |

|

Total liabilities | 743,106 |

| | 731,756 |

|

Commitments and contingencies (Note 9) |

| |

|

Stockholders’ equity: | | | |

Preferred stock, par value $0.01, authorized shares, 2,000, issued and outstanding shares - 0 | — |

| | — |

|

Common stock, par value $0.01, 100,000 authorized shares, 50,073 issued and outstanding shares at June 30, 2014, and 49,840 issued and outstanding shares at December 31, 2013 | 501 |

| | 498 |

|

Additional paid-in capital | 137,512 |

| | 135,441 |

|

Retained earnings | 807,852 |

| | 729,505 |

|

Accumulated other comprehensive income | 6,391 |

| | 4,032 |

|

Total stockholders’ equity | 952,256 |

| | 869,476 |

|

Total liabilities and equity | $ | 1,695,362 |

| | $ | 1,601,232 |

|

The accompanying notes are an integral part of these consolidated financial statements.

PORTFOLIO RECOVERY ASSOCIATES, INC.

CONSOLIDATED INCOME STATEMENTS

For the three and six months ended June 30, 2014 and 2013

(unaudited)

(Amounts in thousands, except per share amounts)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Revenues: | | | | | | | |

Income recognized on finance receivables, net | $ | 182,518 |

| | $ | 168,570 |

| | $ | 360,488 |

| | $ | 323,362 |

|

Fee income | 14,825 |

| | 14,391 |

| | 30,777 |

| | 29,158 |

|

Total revenues | 197,343 |

| | 182,961 |

| | 391,265 |

| | 352,520 |

|

Operating expenses: | | | | | | | |

Compensation and employee services | 52,461 |

| | 48,202 |

| | 103,846 |

| | 93,199 |

|

Legal collection fees | 11,371 |

| | 10,609 |

| | 22,204 |

| | 21,138 |

|

Legal collection costs | 25,429 |

| | 22,717 |

| | 51,962 |

| | 43,218 |

|

Agent fees | 1,464 |

| | 1,280 |

| | 2,914 |

| | 2,889 |

|

Outside fees and services | 12,113 |

| | 8,634 |

| | 22,904 |

| | 16,081 |

|

Communications | 7,958 |

| | 6,675 |

| | 17,112 |

| | 14,754 |

|

Rent and occupancy | 2,219 |

| | 1,824 |

| | 4,366 |

| | 3,511 |

|

Depreciation and amortization | 4,211 |

| | 3,534 |

| | 8,158 |

| | 6,900 |

|

Other operating expenses | 7,653 |

| | 5,660 |

| | 13,745 |

| | 11,117 |

|

Total operating expenses | 124,879 |

| | 109,135 |

| | 247,211 |

| | 212,807 |

|

Income from operations | 72,464 |

| | 73,826 |

| | 144,054 |

| | 139,713 |

|

Other income and (expense): | | | | | | | |

Interest income | 1 |

| | — |

| | 2 |

| | — |

|

Interest expense | (5,068 | ) | | (2,923 | ) | | (9,928 | ) | | (5,612 | ) |

Other expense | (6,224 | ) | | — |

| | (6,224 | ) | | — |

|

Income before income taxes | 61,173 |

| | 70,903 |

| | 127,904 |

| | 134,101 |

|

Provision for income taxes | 23,666 |

| | 27,489 |

| | 49,557 |

| | 52,170 |

|

Net income | $ | 37,507 |

| | $ | 43,414 |

| | $ | 78,347 |

| | $ | 81,931 |

|

Adjustment for loss attributable to redeemable noncontrolling interest | — |

| | 185 |

| | — |

| | 268 |

|

Net income attributable to Portfolio Recovery Associates, Inc. | $ | 37,507 |

| | $ | 43,599 |

| | $ | 78,347 |

| | $ | 82,199 |

|

Net income per common share attributable to Portfolio Recovery Associates, Inc: | | | | | | | |

Basic | $ | 0.75 |

| | $ | 0.86 |

| | $ | 1.57 |

| | $ | 1.62 |

|

Diluted | $ | 0.74 |

| | $ | 0.85 |

| | $ | 1.55 |

| | $ | 1.60 |

|

Weighted average number of shares outstanding: | | | | | | | |

Basic | 50,065 |

| | 50,751 |

| | 49,997 |

| | 50,781 |

|

Diluted | 50,437 |

| | 51,183 |

| | 50,400 |

| | 51,228 |

|

The accompanying notes are an integral part of these consolidated financial statements.

PORTFOLIO RECOVERY ASSOCIATES, INC.

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

For the three and six months ended June 30, 2014 and 2013

(unaudited)

(Amounts in thousands)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Net income | $ | 37,507 |

| | $ | 43,414 |

| | $ | 78,347 |

| | $ | 81,931 |

|

Other comprehensive income/(loss): | | | | | | | |

Foreign currency translation adjustments | 1,911 |

| | (6 | ) | | 2,359 |

| | (4,424 | ) |

Total other comprehensive income/(loss) | 1,911 |

| | (6 | ) | | 2,359 |

| | (4,424 | ) |

Comprehensive income | 39,418 |

| | 43,408 |

| | 80,706 |

| | 77,507 |

|

Comprehensive loss attributable to noncontrolling interest | — |

| | 185 |

| | — |

| | 268 |

|

Comprehensive income attributable to Portfolio Recovery Associates, Inc. | $ | 39,418 |

| | $ | 43,593 |

| | $ | 80,706 |

| | $ | 77,775 |

|

The accompanying notes are an integral part of these consolidated financial statements.

PORTFOLIO RECOVERY ASSOCIATES, INC.

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’ EQUITY

For the six months ended June 30, 2014

(unaudited)

(Amounts in thousands)

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Accumulated | | |

| | | | | Additional | | | | Other | | Total |

| Common Stock | | Paid-in | | Retained | | Comprehensive | | Stockholders’ |

| Shares | | Amount | | Capital | | Earnings | | Income | | Equity |

Balance at December 31, 2013 | 49,840 |

| | $ | 498 |

| | $ | 135,441 |

| | $ | 729,505 |

| | $ | 4,032 |

| | $ | 869,476 |

|

Components of comprehensive income: | | | | | | | | | | | |

Net income attributable to Portfolio Recovery Associates, Inc. | — |

| | — |

| | — |

| | 78,347 |

| | — |

| | 78,347 |

|

Foreign currency translation adjustment | — |

| | — |

| | — |

| | — |

| | 2,359 |

| | 2,359 |

|

Vesting of nonvested shares | 233 |

| | 3 |

| | (3 | ) | | — |

| | — |

| | — |

|

Amortization of share-based compensation | — |

| | — |

| | 5,437 |

| | — |

| | — |

| | 5,437 |

|

Income tax benefit from share-based compensation | — |

| | — |

| | 4,152 |

| | — |

| | — |

| | 4,152 |

|

Employee stock relinquished for payment of taxes | — |

| | — |

| | (7,515 | ) | | — |

| | — |

| | (7,515 | ) |

Balance at June 30, 2014 | 50,073 |

| | $ | 501 |

| | $ | 137,512 |

| | $ | 807,852 |

| | $ | 6,391 |

| | $ | 952,256 |

|

The accompanying notes are an integral part of these consolidated financial statements.

PORTFOLIO RECOVERY ASSOCIATES, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the six months ended June 30, 2014 and 2013

(unaudited)

(Amounts in thousands) |

| | | | | | | |

| Six Months Ended June 30, |

| 2014 | | 2013 |

Cash flows from operating activities: | | | |

Net income | $ | 78,347 |

| | $ | 81,931 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | |

Amortization of share-based compensation | 5,437 |

| | 6,651 |

|

Depreciation and amortization | 8,158 |

| | 6,900 |

|

Amortization of debt discount | 2,005 |

| | — |

|

Deferred tax expense | 15,940 |

| | 2,488 |

|

Changes in operating assets and liabilities: | | | |

Other assets | (3,874 | ) | | (1,284 | ) |

Accounts receivable | (34 | ) | | (46 | ) |

Accounts payable | 5,480 |

| | (2,633 | ) |

Income taxes receivable/payable, net | 5,665 |

| | (5,748 | ) |

Accrued expenses | 5,886 |

| | 7,313 |

|

Accrued compensation | (20,635 | ) | | 1,757 |

|

Net cash provided by operating activities | 102,375 |

| | 97,329 |

|

Cash flows from investing activities: | | | |

Purchases of property and equipment | (13,224 | ) | | (6,639 | ) |

Acquisition of finance receivables, net of buybacks | (252,168 | ) | | (407,347 | ) |

Collections applied to principal on finance receivables | 272,153 |

| | 248,498 |

|

Net cash provided by/(used in) investing activities | 6,761 |

| | (165,488 | ) |

Cash flows from financing activities: | | | |

Income tax benefit from share-based compensation | 4,152 |

| | 2,659 |

|

Proceeds from line of credit | — |

| | 217,000 |

|

Principal payments on line of credit | — |

| | (128,000 | ) |

Repurchases of common stock | — |

| | (8,506 | ) |

Cash paid for purchase of portion of noncontrolling interest | — |

| | (1,150 | ) |

Distributions paid to noncontrolling interest | — |

| | (51 | ) |

Principal payments on long-term debt | (5,000 | ) | | (2,768 | ) |

Net cash (used in)/provided by financing activities | (848 | ) | | 79,184 |

|

Effect of exchange rate on cash | 234 |

| | (253 | ) |

Net increase in cash and cash equivalents | 108,522 |

| | 10,772 |

|

Cash and cash equivalents, beginning of period | 162,004 |

| | 32,687 |

|

Cash and cash equivalents, end of period | $ | 270,526 |

| | $ | 43,459 |

|

Supplemental disclosure of cash flow information: | | | |

Cash paid for interest | $ | 7,634 |

| | $ | 5,581 |

|

Cash paid for income taxes | 25,414 |

| | 52,809 |

|

Supplemental disclosure of non-cash information: | | | |

Adjustment of the noncontrolling interest measurement amount | $ | — |

| | $ | (245 | ) |

Distributions payable relating to noncontrolling interest | — |

| | 2 |

|

Purchase of noncontrolling interest | — |

| | 9,162 |

|

Employee stock relinquished for payment of taxes | (7,515 | ) | | (4,025 | ) |

The accompanying notes are an integral part of these consolidated financial statements.

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

| |

1. | Organization and Business: |

Portfolio Recovery Associates, Inc., a Delaware corporation, and its subsidiaries (collectively, the “Company”) is a financial and business service company operating principally in the United States and the United Kingdom. The Company’s primary business is the purchase, collection and management of portfolios of defaulted consumer receivables. The Company also services receivables on behalf of clients and provides class action claims settlement recovery services and related payment processing to corporate clients.

On July 16, 2014, the Company, through a wholly owned subsidiary, completed the purchase of the outstanding equity of Aktiv Kapital AS (“Aktiv”), a Norway-based company specializing in the acquisition and servicing of non-performing consumer loans throughout Europe and in Canada, for a purchase price of approximately $872.6 million, and assumed approximately $431.3 million of Aktiv’s corporate debt, resulting in an acquisition of estimated total enterprise value of $1.3 billion.

A publicly traded company from 1997 until early 2012 (traded on the Oslo Stock Exchange under the symbol "AIK"), Aktiv has developed a mixed in-house and outsourced collection strategy. This acquisition will provide the Company entry into thirteen new markets, providing additional geographical diversity in portfolio purchasing and collection. Aktiv maintains in-house servicing platforms in eight markets, and owns portfolios in fifteen markets. Aktiv has more than 20 years of experience and data in a wide variety of consumer asset classes, across an extensive geographic background. Refer to Note 12 "Subsequent Events" for more information.

The consolidated financial statements of the Company are prepared in accordance with U.S. generally accepted accounting principles ("GAAP") and include the accounts of all of its subsidiaries. All significant intercompany accounts and transactions have been eliminated. Under the guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 280 “Segment Reporting” (“ASC 280”), the Company has determined that it has several operating segments that meet the aggregation criteria of ASC 280, and therefore, it has one reportable segment, accounts receivable management, based on similarities among the operating units including homogeneity of services, service delivery methods and use of technology.

The following table shows the amount of revenue generated for the three and six months ended June 30, 2014 and 2013 and long-lived assets held at June 30, 2014 and 2013 by geographical location (amounts in thousands):

|

| | | | | | | | | | | | | | | |

| As Of And For The | | As Of And For The |

| Three Months Ended June 30, 2014 | | Three Months Ended June 30, 2013 |

| Revenues | | Long-Lived Assets | | Revenues | | Long-Lived Assets |

United States | $ | 193,726 |

| | $ | 36,537 |

| | $ | 180,350 |

| | $ | 25,685 |

|

United Kingdom | 3,617 |

| | 2,365 |

| | 2,611 |

| | 1,593 |

|

Total | $ | 197,343 |

| | $ | 38,902 |

| | $ | 182,961 |

| | $ | 27,278 |

|

| | | | | | | |

| As Of And For The | | As Of And For The |

| Six Months Ended June 30, 2014 | | Six Months Ended June 30, 2013 |

| Revenues | | Long-Lived Assets | | Revenues | | Long-Lived Assets |

United States | $ | 384,914 |

| | $ | 36,537 |

| | $ | 347,279 |

| | $ | 25,685 |

|

United Kingdom | 6,351 |

| | 2,365 |

| | 5,241 |

| | 1,593 |

|

Total | $ | 391,265 |

| | $ | 38,902 |

| | $ | 352,520 |

| | $ | 27,278 |

|

Revenues are attributed to countries based on the location of the related operations. Long-lived assets consist of net property and equipment.

The accompanying unaudited consolidated financial statements of the Company have been prepared in accordance with Rule 10-01 of Regulation S-X promulgated by the Securities and Exchange Commission (“SEC”) and, therefore, do not include all information and disclosures required by U.S. GAAP for complete financial statements. In the opinion of the Company, however, the accompanying unaudited consolidated financial statements contain all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the Company’s consolidated balance sheet as of June 30, 2014, its consolidated income statements and statements of comprehensive income for the three and six months ended June 30, 2014 and 2013, its consolidated statement of changes in stockholders’ equity for the six months ended June 30, 2014, and its consolidated statements

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

of cash flows for the six months ended June 30, 2014 and 2013. The consolidated income statements of the Company for the three and six months ended June 30, 2014 may not be indicative of future results. Certain reclassifications have been made to prior year amounts to conform to the current year presentation. These unaudited consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s 2013 Annual Report on Form 10-K, filed on February 28, 2014.

| |

2. | Finance Receivables, net: |

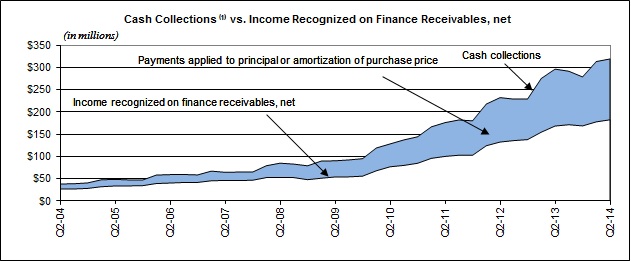

Changes in finance receivables, net for the three and six months ended June 30, 2014 and 2013 were as follows (amounts in thousands):

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Balance at beginning of period | $ | 1,253,961 |

| | $ | 1,169,747 |

| | $ | 1,239,191 |

| | $ | 1,078,951 |

|

Acquisitions of finance receivables, net of buybacks | 102,081 |

| | 194,958 |

| | 252,168 |

| | 407,347 |

|

Foreign currency translation adjustment | 309 |

| | (19 | ) | | 389 |

| | (941 | ) |

Cash collections | (319,274 | ) | | (296,397 | ) | | (632,641 | ) | | (571,860 | ) |

Income recognized on finance receivables, net | 182,518 |

| | 168,570 |

| | 360,488 |

| | 323,362 |

|

Cash collections applied to principal | (136,756 | ) | | (127,827 | ) | | (272,153 | ) | | (248,498 | ) |

Balance at end of period | $ | 1,219,595 |

| | $ | 1,236,859 |

| | $ | 1,219,595 |

| | $ | 1,236,859 |

|

At the time of acquisition, the life of each pool is generally estimated to be between 60 and 96 months based on projected amounts and timing of future cash collections using the proprietary models of the Company. At June 30, 2014, the weighted average remaining life of the Company's pools is estimated to be approximately 78 months. Based upon current projections, cash collections applied to principal on finance receivables as of June 30, 2014 are estimated to be as follows for the twelve months in the periods ending (amounts in thousands):

|

| | | |

June 30, 2015 | $ | 431,771 |

|

June 30, 2016 | 344,914 |

|

June 30, 2017 | 246,198 |

|

June 30, 2018 | 150,081 |

|

June 30, 2019 | 42,713 |

|

June 30, 2020 | 3,918 |

|

| $ | 1,219,595 |

|

During the three and six months ended June 30, 2014, the Company purchased approximately $0.97 billion and $2.88 billion, respectively, in face value of charged-off consumer receivables. During the three and six months ended June 30, 2013, the Company purchased approximately $3.19 billion and $5.04 billion, respectively, in face value of charged-off consumer receivables. At June 30, 2014, the estimated remaining collections (“ERC”) on the receivables purchased in the three and six months ended June 30, 2014, were $196.4 million and $409.9 million, respectively. At June 30, 2014, the ERC on the receivables purchased in the three and six months ended June 30, 2013, were $250.4 million and $502.9 million, respectively. At June 30, 2014, the Company had unamortized purchased principal (purchase price) in pools accounted for under the cost recovery method of $24.5 million; at December 31, 2013, the amount was $26.1 million.

Accretable yield represents the amount of income recognized on finance receivables the Company can expect to generate over the remaining life of its existing portfolios based on estimated future cash flows as of the balance sheet date. Additions represent the original expected accretable yield, on portfolios purchased during the period, to be earned by the Company based on its proprietary buying models. Net reclassifications from nonaccretable difference to accretable yield primarily result from the Company’s increase in its estimate of future cash flows. When applicable, net reclassifications to nonaccretable difference from accretable yield result from the Company’s decrease in its estimates of future cash flows and allowance charges that exceed the Company’s increase in its estimate of future cash flows. Changes in accretable yield for the three and six months ended June 30, 2014 and 2013 were as follows (amounts in thousands):

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Balance at beginning of period | $ | 1,451,001 |

| | $ | 1,317,144 |

| | $ | 1,430,067 |

| | $ | 1,239,674 |

|

Income recognized on finance receivables, net | (182,518 | ) | | (168,570 | ) | | (360,488 | ) | | (323,362 | ) |

Additions | 98,423 |

| | 167,185 |

| | 204,620 |

| | 349,690 |

|

Net reclassifications from nonaccretable difference | 114,721 |

| | 85,028 |

| | 206,357 |

| | 138,792 |

|

Foreign currency translation adjustment | 199 |

| | 119 |

| | 1,270 |

| | (3,888 | ) |

Balance at end of period | $ | 1,481,826 |

| | $ | 1,400,906 |

| | $ | 1,481,826 |

| | $ | 1,400,906 |

|

A valuation allowance is recorded for significant decreases in expected cash flows or a change in the expected timing of cash flows which would otherwise require a reduction in the stated yield on a pool of accounts. In any given period, the Company may be required to record valuation allowances due to pools of receivables underperforming previous expectations. Factors that may contribute to the recording of valuation allowances include both internal as well as external factors. External factors that may have an impact on the collectability, and subsequently on the overall profitability of purchased pools of defaulted consumer receivables would include: new laws or regulations relating to collections, new interpretations of existing laws or regulations, and the overall condition of the economy. Internal factors that may have an impact on the collectability, and subsequently the overall profitability of purchased pools of defaulted consumer receivables, would include: necessary revisions to initial and post-acquisition scoring and modeling estimates, non-optimal operational activities (which relate to the collection and movement of accounts on both the collection floor of the Company and external channels), as well as decreases in productivity related to turnover and tenure of the Company’s collection staff. The following is a summary of activity within the Company’s valuation allowance account, all of which relates to loans acquired with deteriorated credit quality, for the three and six months ended June 30, 2014 and 2013 (amounts in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2014 | | Three Months Ended June 30, 2013 |

| Core Portfolio (1) | | Purchased Bankruptcy

Portfolio (2) | | Total | | Core Portfolio (1) | | Purchased Bankruptcy

Portfolio (2) | | Total |

Valuation allowance - finance receivables: |

| |

| |

| | | | | | |

Beginning balance | $ | 63,923 |

| | $ | 25,225 |

| | $ | 89,148 |

| | $ | 72,100 |

| | $ | 23,196 |

| | $ | 95,296 |

|

Allowance charges | 925 |

| | 461 |

| | 1,386 |

| | — |

| | 600 |

| | 600 |

|

Reversal of previous recorded allowance charges | (3,315 | ) | | (370 | ) | | (3,685 | ) | | (1,750 | ) | | (35 | ) | | (1,785 | ) |

Net allowance (reversals)/charges | (2,390 | ) | | 91 |

| | (2,299 | ) | | (1,750 | ) | | 565 |

| | (1,185 | ) |

Ending balance | $ | 61,533 |

| | $ | 25,316 |

| | $ | 86,849 |

| | $ | 70,350 |

| | $ | 23,761 |

| | $ | 94,111 |

|

Finance Receivables, net: | $ | 747,249 |

| | $ | 472,346 |

| | $ | 1,219,595 |

| | $ | 655,010 |

| | $ | 581,849 |

| | $ | 1,236,859 |

|

| | | | | | | | | | | |

| Six Months Ended June 30, 2014 | | Six Months Ended June 30, 2013 |

| Core Portfolio (1) | | Purchased Bankruptcy

Portfolio (2) | | Total | | Core Portfolio (1) | | Purchased Bankruptcy

Portfolio (2) | | Total |

Valuation allowance - finance receivables: | | | | | | | | | | | |

Beginning balance | $ | 65,626 |

| | $ | 25,475 |

| | $ | 91,101 |

| | $ | 74,500 |

| | $ | 18,623 |

| | $ | 93,123 |

|

Allowance charges | $ | 2,312 |

| | $ | 461 |

| | $ | 2,773 |

| | $ | 300 |

| | $ | 5,260 |

| | $ | 5,560 |

|

Reversal of previous recorded allowance charges | $ | (6,405 | ) | | $ | (620 | ) | | $ | (7,025 | ) | | $ | (4,450 | ) | | $ | (122 | ) | | $ | (4,572 | ) |

Net allowance (reversals)/charges | $ | (4,093 | ) | | $ | (159 | ) | | $ | (4,252 | ) | | $ | (4,150 | ) | | $ | 5,138 |

| | $ | 988 |

|

Ending balance | $ | 61,533 |

| | $ | 25,316 |

| | $ | 86,849 |

| | $ | 70,350 |

| | $ | 23,761 |

| | $ | 94,111 |

|

Finance Receivables, net: | $ | 747,249 |

| | $ | 472,346 |

| | $ | 1,219,595 |

| | $ | 655,010 |

| | $ | 581,849 |

| | $ | 1,236,859 |

|

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

| |

(1) | “Core” accounts or portfolios refer to accounts or portfolios that are defaulted consumer receivables and are not in a bankrupt status upon purchase. For this table, the Core Portfolio also includes accounts purchased in the United Kingdom. These accounts are aggregated separately from purchased bankruptcy accounts. |

| |

(2) | “Purchased bankruptcy” accounts or portfolios refer to accounts or portfolios that are in bankruptcy status when purchased, and as such, are purchased as a pool of bankrupt accounts. |

The Company's borrowings consisted of the following as of the dates indicated (in thousands):

|

| | | | | | | |

| June 30, 2014 | | December 31, 2013 |

Line of credit, term loan | $ | 190,000 |

| | $ | 195,000 |

|

Convertible notes | 287,500 |

| | 287,500 |

|

Less: Debt discount | (28,715 | ) | | (30,720 | ) |

Total | $ | 448,785 |

| | $ | 451,780 |

|

Domestic Revolving Credit and Term Loan Facility

On December 19, 2012, the Company entered into a credit agreement with Bank of America, N.A., as administrative agent, and a syndicate of lenders named therein (the “Credit Agreement”). The credit facility contained an accordion loan feature that allowed the Company to request an increase of up to $214.5 million in the amount available for borrowing under the facility, whether from existing or new lenders, subject to terms of the Credit Agreement. The Credit Agreement was amended and modified during 2013 and on April 1, 2014. On April 1, 2014, the Company entered into a Lender Joinder Agreement and Lender Commitment Agreement (collectively, the “Commitment Increase Agreements”) to exercise the accordion feature. The Commitment Increase Agreements expanded the maximum amount of revolving credit availability under the Credit Agreement by $214.5 million, elevated the revolving credit commitments of certain lenders and added three new lenders to the Credit Agreement. Giving effect to the $214.5 million increase in the amount of revolving credit availability pursuant to the Commitment Increase Agreements, the total credit facility under the Credit Agreement now includes an aggregate principal amount of $840.0 million (subject to compliance with a borrowing base), which consists of (i) a fully-funded $190.0 million term loan, (ii) a $630 million domestic revolving credit facility, of which $630 million is available to be drawn, and (iii) a $20 million multi-currency revolving credit facility, of which $20 million is available to be drawn, all of which mature on December 19, 2017. The term and revolving loans accrue interest, at the option of the Company, at either the base rate or the Eurodollar rate (as defined in the Credit Agreement) for the applicable term plus 2.50% per annum in the case of the Eurodollar rate loans and 1.50% in the case of the base rate loans. The base rate is the highest of (a) the Federal Funds Rate (as defined in the Credit Agreement) plus 0.50%, (b) Bank of America’s prime rate, and (c) the Eurodollar rate plus 1.00%. The Company’s revolving credit facility includes a $20 million swingline loan sublimit, a $20 million letter of credit sublimit and a $20 million alternative currency equivalent sublimit.

Effective as of June 5, 2014, the Company entered into a Third Amendment to the Credit Agreement to amend a provision of the Credit Agreement to increase a basket for permitted indebtedness for the issuance of senior, unsecured convertible notes or other unsecured financings from an aggregate amount not to exceed $300 million to an aggregate amount not to exceed $500 million.

The Credit Agreement is secured by a first priority lien on substantially all of the Company’s assets. The Credit Agreement, as amended and modified, contains restrictive covenants and events of default including the following:

| |

• | borrowings may not exceed 33% of the ERC of all eligible asset pools plus 75% of eligible accounts receivable; |

| |

• | the consolidated leverage ratio (as defined in the Credit Agreement) cannot exceed 2.0 to 1.0 as of the end of any fiscal quarter; |

| |

• | consolidated tangible net worth (as defined in the Credit Agreement) must equal or exceed $455.1 million plus 50% of positive cumulative consolidated net income for each fiscal quarter beginning with the quarter ended December 31, 2012, plus 50% of the cumulative net proceeds of any equity offering; |

| |

• | capital expenditures during any fiscal year cannot exceed $40 million; |

| |

• | cash dividends and distributions during any fiscal year cannot exceed $20 million; |

| |

• | stock repurchases during the term of the agreement cannot exceed $250 million and cannot exceed $100 million in a single fiscal year; |

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

| |

• | investments in loans and/or capital contributions cannot exceed $950 million to consummate the acquisition of the equity of Aktiv; |

| |

• | permitted acquisitions (as defined in the Credit Agreement) during any fiscal year cannot exceed $250 million except for the fiscal year ending December 31, 2014, during which fiscal year permitted acquisitions (excluding the Aktiv acquisition) cannot exceed $25 million; |

| |

• | indebtedness in the form of senior, unsecured convertible notes or other unsecured financings cannot exceed $500 million in the aggregate (without respect to the Company’s 3.00% Convertible Senior Notes due 2020); |

| |

• | the Company must maintain positive consolidated income from operations (as defined in the Credit Agreement) during any fiscal quarter; and |

| |

• | restrictions on changes in control. |

The revolving credit facility also bears an unused line fee of 0.375% per annum, payable quarterly in arrears.

The Company's borrowings on its credit facility at June 30, 2014 consisted of $190.0 million outstanding on the term loan with an annual interest rate as of June 30, 2014 of 2.65%. At December 31, 2013, the Company's borrowings on its credit facility consisted of $195.0 million outstanding on the term loan with an annual interest rate as of December 31, 2013 of 2.67%.

Convertible Senior Notes

On August 13, 2013, the Company completed the private offering of $287.5 million in aggregate principal amount of the Company’s 3.00% Convertible Senior Notes due 2020 (the “Notes”). The Notes were issued pursuant to an Indenture, dated August 13, 2013 (the "Indenture") between the Company and Wells Fargo Bank, National Association, as trustee. The Indenture contains customary terms and covenants, including certain events of default after which the Notes may be due and payable immediately. The Notes are senior unsecured obligations of the Company. Interest on the Notes is payable semi-annually, in arrears, on February 1 and August 1 of each year, beginning on February 1, 2014. Prior to February 1, 2020, the Notes will be convertible only upon the occurrence of specified events. On or after February 1, 2020, the Notes will be convertible at any time. Upon conversion, the Notes may be settled, at the Company’s option, in cash, shares of the Company’s common stock, or any combination thereof. Holders of the Notes have the right to require the Company to repurchase all or some of their Notes at 100% of their principal amount, plus any accrued and unpaid interest, upon the occurrence of a fundamental change (as defined in the Indenture). In addition, upon the occurrence of a make-whole fundamental change (as defined in the Indenture), the Company may, under certain circumstances, be required to increase the conversion rate for the Notes converted in connection with such a make-whole fundamental change. The conversion rate for the Notes is initially 15.2172 shares per $1,000 principal amount of Notes, which is equivalent to an initial conversion price of approximately $65.72 per share of the Company’s common stock, and is subject to adjustment in certain circumstances pursuant to the Indenture. The Company does not have the right to redeem the Notes prior to maturity. As of June 30, 2014, none of the conditions allowing holders of the Notes to convert their Notes had occurred.

As noted above, upon conversion, holders of the Notes will receive cash, shares of the Company’s common stock or a combination of cash and shares of the Company’s common stock, at the Company’s election. However, the Company’s current intent is to settle conversions through combination settlement (i.e., the Notes will be converted into cash up to the aggregate principal amount, and shares of the Company’s common stock or a combination of cash and shares of the Company’s common stock, at the Company’s election, for the remainder). As a result, and in accordance with authoritative guidance related to derivatives and hedging and earnings per share, only the conversion spread is included in the diluted earnings per share calculation, if dilutive. Under such method, the settlement of the conversion spread has a dilutive effect when the average share price of the Company’s common stock during any quarter exceeds $65.72.

The net proceeds from the sale of the Notes were approximately $279.3 million, after deducting the initial purchasers’ discounts and commissions and the estimated offering expenses payable by the Company. The Company used $174.0 million of the net proceeds from this offering to repay the outstanding balance on its revolving credit facility and used $50.0 million to repurchase shares of its common stock.

The Company determined that the fair value of the Notes at the date of issuance was approximately $255.3 million, and designated the residual value of approximately $32.2 million as the equity component. Additionally, the Company allocated approximately $7.3 million of the $8.2 million original Notes issuance cost as debt issuance cost and the remaining $0.9 million as equity issuance cost.

ASC 470-20, "Debt with Conversion and Other Options" (“ASC 470-20”), requires that, for convertible debt instruments that may be settled fully or partially in cash upon conversion, issuers must separately account for the liability and equity components

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

in a manner that will reflect the entity’s nonconvertible debt borrowing rate when interest cost is recognized in subsequent periods. Additionally, debt issuance costs are required to be allocated in proportion to the allocation of the liability and equity components and accounted for as debt issuance costs and equity issuance costs, respectively.

The balances of the liability and equity components of all of the Notes outstanding were as follows as of the dates indicated (in thousands):

|

| | | | | | | | |

| | June 30, 2014 | | December 31, 2013 |

Liability component - principal amount | | $ | 287,500 |

| | $ | 287,500 |

|

Unamortized debt discount | | (28,715 | ) | | (30,720 | ) |

Liability component - net carrying amount | | 258,785 |

| | 256,780 |

|

Equity component | | $ | 31,306 |

| | $ | 31,306 |

|

The debt discount is being amortized into interest expense over the remaining life of the Notes using the effective interest rate, which is 4.92%.

Interest expense related to the Notes was as follows for the periods indicated (in thousands):

|

| | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, 2014 | | Three Months Ended June 30, 2013 | | Six Months Ended June 30, 2014 | | Six Months Ended June 30, 2013 |

Interest expense - stated coupon rate | | $ | 2,156 |

| | $ | — |

| | $ | 4,312 |

| | $ | — |

|

Interest expense - amortization of debt discount | | 1,007 |

| | — |

| | 2,005 |

| | — |

|

Total interest expense - convertible notes | | $ | 3,163 |

|

| $ | — |

| | $ | 6,317 |

| | $ | — |

|

The Company was in compliance with all covenants under its financing arrangements as of June 30, 2014 and December 31, 2013.

The following principal payments are due on the Company's borrowings as of June 30, 2014 for the twelve month periods ending (amounts in thousands):

|

| | | |

June 30, 2015 | $ | 12,500 |

|

June 30, 2016 | 17,500 |

|

June 30, 2017 | 30,000 |

|

June 30, 2018 | 130,000 |

|

June 30, 2019 | — |

|

Thereafter | 287,500 |

|

Total | $ | 477,500 |

|

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

| |

4. | Property and Equipment, net: |

Property and equipment, at cost, consisted of the following as of the dates indicated (amounts in thousands):

|

| | | | | | | |

| June 30, 2014 | | December 31, 2013 |

Software | $ | 37,523 |

| | $ | 34,108 |

|

Computer equipment | 19,280 |

| | 17,072 |

|

Furniture and fixtures | 9,961 |

| | 8,616 |

|

Equipment | 12,279 |

| | 10,351 |

|

Leasehold improvements | 13,131 |

| | 11,147 |

|

Building and improvements | 7,046 |

| | 7,026 |

|

Land | 1,269 |

| | 1,269 |

|

Accumulated depreciation and amortization | (61,587 | ) | | (58,048 | ) |

Property and equipment, net | $ | 38,902 |

| | $ | 31,541 |

|

Depreciation and amortization expense relating to property and equipment for the three and six months ended June 30, 2014, was $3.1 million and $5.9 million, respectively. Depreciation and amortization expense relating to property and equipment for the three and six months ended June 30, 2013, was $2.4 million and $4.6 million, respectively.

The Company, in accordance with the guidance of FASB ASC Topic 350-40 “Internal-Use Software” (“ASC 350-40”), capitalizes qualifying computer software costs incurred during the application development stage and amortizes them over their estimated useful life of three to seven years on a straight-line basis beginning when the project is completed. Costs associated with preliminary project stage activities, training, maintenance and all other post implementation stage activities are expensed as incurred. The Company’s policy provides for the capitalization of certain direct payroll costs for employees who are directly associated with internal use computer software projects, as well as external direct costs of services associated with developing or obtaining internal use software. Capitalizable personnel costs are limited to the time directly spent on such projects. As of June 30, 2014 and December 31, 2013, the Company incurred and capitalized approximately $11.9 million and $10.3 million, respectively, of these direct payroll costs and external direct costs related to software developed for internal use. Of these costs, at June 30, 2014 and December 31, 2013, approximately $2.2 million and $1.7 million, respectively, were for projects that were in the development stage and, therefore are a component of “Other Assets.” Once the projects are completed, the costs are transferred to Software and amortized over their estimated useful life. Amortization expense for the three and six months ended June 30, 2014, was approximately $0.5 million and $0.9 million, respectively. Amortization expense for the three and six months ended June 30, 2013, was approximately $0.3 million and $0.7 million, respectively. The remaining unamortized costs relating to internally developed software at June 30, 2014 and December 31, 2013 were approximately $4.6 million and $4.4 million, respectively.

| |

5. | Goodwill and Intangible Assets, net: |

In connection with the Company’s previous business acquisitions, the Company acquired certain tangible and intangible assets. Intangible assets purchased included client and customer relationships, non-compete agreements, trademarks and goodwill. Pursuant to ASC 350, goodwill is not amortized but rather is reviewed at least annually for impairment. During the fourth quarter of 2013, the Company underwent its annual review of goodwill. Based upon the results of this review, which was conducted as of October 1, 2013, no impairment charges to goodwill or the other intangible assets were necessary as of the date of this review. The Company believes that no events have occurred or circumstances have changed that would more likely than not reduce the fair value of a reporting unit below its carrying amount since the review was performed through June 30, 2014, and thereby necessitate further evaluation of goodwill or other intangible assets. The Company expects to perform its next annual goodwill review during the fourth quarter of 2014.

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

At June 30, 2014 and December 31, 2013, the carrying value of goodwill was $105.1 million and $103.8 million, respectively. The following table represents the changes in goodwill for the three and six months ended June 30, 2014 and 2013 (amounts in thousands):

|

| | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, |

| 2014 | | 2013 | | 2014 | | 2013 |

Balance at beginning of period | $ | 104,086 |

| | $ | 106,912 |

| | $ | 103,843 |

| | $ | 109,488 |

|

Foreign currency translation adjustment | 1,036 |

| | 41 |

| | 1,279 |

| | (2,535 | ) |

Balance at end of period | $ | 105,122 |

| | $ | 106,953 |

| | $ | 105,122 |

| | $ | 106,953 |

|

Intangible assets, excluding goodwill, consist of the following at June 30, 2014 and December 31, 2013 (amounts in thousands):

|

| | | | | | | | | | | | | | | |

| June 30, 2014 | | December 31, 2013 |

| Gross Amount | | Accumulated Amortization | | Gross Amount | | Accumulated Amortization |

Client and customer relationships | $ | 41,212 |

| | $ | 28,558 |

| | $ | 40,870 |

| | $ | 26,581 |

|

Non-compete agreements | 3,913 |

| | 3,807 |

| | 3,880 |

| | 3,723 |

|

Trademarks | 3,526 |

| | 2,481 |

| | 3,491 |

| | 2,170 |

|

Total | $ | 48,651 |

| | $ | 34,846 |

| | $ | 48,241 |

| | $ | 32,474 |

|

Total intangible asset amortization expense for the three and six months ended June 30, 2014 was $1.1 million and $2.2 million, respectively. Total intangible asset amortization expense for the three and six months ended June 30, 2013 was $1.2 million and $2.4 million, respectively. The Company reviews these intangible assets for possible impairment if an event occurs or circumstances change that would more likely than not reduce the fair value of a reporting unit below its carrying amount and thereby necessitate further evaluation of these intangible assets.

| |

6. | Share-Based Compensation: |

The Company has an Omnibus Incentive Plan to assist the Company in attracting and retaining selected individuals to serve as employees and directors, who are expected to contribute to the Company's success and to achieve long-term objectives that will benefit stockholders of the Company. The 2013 Omnibus Incentive Plan (the “Plan”) was approved by the Company's stockholders at the 2013 Annual Meeting of Stockholders. The Plan enables the Company to award shares of the Company's common stock to select employees and directors, as described in the Plan, not to exceed 5,400,000 shares as authorized by the Plan. The Plan replaced the 2010 Stock Plan.

As of June 30, 2014, total future compensation costs related to nonvested awards of nonvested shares (not including nonvested shares granted under the Long-Term Incentive ("LTI") Program) is estimated to be $6.0 million with a weighted average remaining life for all nonvested shares of 1.7 years (not including nonvested shares granted under the LTI program). As of June 30, 2014, there are no future compensation costs related to stock options and there are no remaining vested stock options to be exercised.

Total share-based compensation expense was $2.6 million and $5.4 million for the three and six months ended June 30, 2014, respectively. Total share-based compensation expense was $3.6 million and $6.7 million for the three and six months ended June 30, 2013, respectively. Tax benefits resulting from tax deductions in excess of share-based compensation expense (windfall tax benefits) recognized under the provisions of ASC Topic 718 "Compensation-Stock Compensation" ("ASC 718") are credited to additional paid-in capital in the Company's Consolidated Balance Sheets. Realized tax shortfalls, if any, are first offset against the cumulative balance of windfall tax benefits, if any, and then charged directly to income tax expense. The total tax benefit realized from share-based compensation was approximately $0.3 million and $7.8 million for the three and six months ended June 30, 2014, respectively. The total tax benefit realized from share-based compensation was approximately $0.9 million and $4.9 million for the three and six months ended June 30, 2013, respectively.

All share amounts presented in this Note 6 have been adjusted to reflect the three-for-one stock split by means of a stock dividend declared by the Company's board of directors on June 10, 2013.

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Nonvested Shares

With the exception of the awards made pursuant to the LTI program and a few employee and director grants, the nonvested shares vest ratably over three to five years and are expensed over their vesting period.

The following summarizes all nonvested share transactions, excluding those related to the LTI program, from December 31, 2012 through June 30, 2014 (share amounts in thousands):

|

| | | | | | |

| Nonvested Shares Outstanding | | Weighted-Average Price at Grant Date |

December 31, 2012 | 288 |

| | $ | 20.84 |

|

Granted | 110 |

| | 37.31 |

|

Vested | (143 | ) | | 19.75 |

|

Cancelled | (29 | ) | | 20.57 |

|

December 31, 2013 | 226 |

| | 29.58 |

|

Granted | 80 |

| | 49.57 |

|

Vested | (107 | ) | | 28.83 |

|

Cancelled | (2 | ) | | 21.90 |

|

June 30, 2014 | 197 |

| | $ | 38.18 |

|

The total grant date fair value of shares vested during the three and six months ended June 30, 2014, was $0.7 million and $3.1 million, respectively. The total grant date fair value of shares vested during the three and six months ended June 30, 2013, was $0.4 million and $2.5 million, respectively.

Pursuant to the Plan, the Compensation Committee may grant time-vested and performance based nonvested shares. All shares granted under the LTI program were granted to key employees of the Company. The following summarizes all LTI program share transactions from December 31, 2012 through June 30, 2014 (share amounts in thousands):

|

| | | | | | |

| Nonvested LTI Shares Outstanding | | Weighted-Average Price at Grant Date |

December 31, 2012 | 497 |

| | $ | 21.71 |

|

Granted at target level | 124 |

| | 34.59 |

|

Adjustments for actual performance | 108 |

| | 17.91 |

|

Vested | (279 | ) | | 19.10 |

|

Cancelled | (16 | ) | | 25.01 |

|

December 31, 2013 | 434 |

| | 25.79 |

|

Granted at target level | 97 |

| | 48.09 |

|

Adjustments for actual performance | 95 |

| | 25.17 |

|

Vested | (225 | ) | | 25.17 |

|

June 30, 2014 | 401 |

| | $ | 31.39 |

|

The total grant date fair value of shares vested during the three and six months ended June 30, 2014, was $0.0 million and $5.7 million, respectively. The total grant date fair value of shares vested during the three and six months ended June 30, 2013, was $0.0 million and $2.6 million, respectively.

At June 30, 2014, total future compensation costs, assuming the current estimated performance levels are achieved, related to nonvested share awards granted under the LTI program are estimated to be approximately $7.6 million. The Company assumed a 7.5% forfeiture rate for these grants and the remaining shares have a weighted average life of 1.1 years at June 30, 2014.

The Company follows the guidance of FASB ASC Topic 740 “Income Taxes” (“ASC 740”) as it relates to the provision for income taxes and uncertainty in income taxes. The guidance prescribes a recognition threshold and measurement attribute for the financial statement recognition and measurement of a tax position taken or expected to be taken in a tax return. There were no unrecognized tax benefits at June 30, 2014 and 2013.

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

The Internal Revenue Service ("IRS") examined the Company's tax returns for the 2005 calendar year. The IRS concluded the audit and on March 19, 2009 issued Form 4549-A, Income Tax Examination Changes, for tax years ended December 31, 2007, 2006 and 2005. The IRS has asserted that tax revenue recognition using the cost recovery method does not clearly reflect taxable income. The Company believes it has sufficient support for the technical merits of its positions and that it is more likely than not these positions will ultimately be sustained; therefore, a reserve for uncertain tax positions is not required. The Company believes cost recovery to be an acceptable tax revenue recognition method for companies in the bad debt purchasing industry. For tax purposes, collections on finance receivables are applied first to principal to reduce the finance receivables to zero before any taxable income is recognized. On April 22, 2009, the Company filed a formal protest of the findings contained in the examination report prepared by the IRS. On August 26, 2011, the IRS issued a Notice of Deficiency for the tax years ended December 31, 2007, 2006, and 2005. The Company subsequently filed a petition in the United States Tax Court to which the IRS responded on January 12, 2012. If the Company is unsuccessful in the United States Tax Court, it can appeal to the federal Circuit Court of Appeals. Payment of the assessed taxes and interest could have an adverse effect on the Company’s financial condition, be material to the Company’s results of operations, and possibly require additional financing from other sources. In accordance with the Internal Revenue Code, underpayments of federal tax accrue interest, compounded daily, at the applicable federal short term rate plus three percentage points. An additional two percentage points applies to large corporate underpayments of $100,000 or more to periods after the applicable date as defined in the Internal Revenue Code. The Company files taxes in multiple state jurisdictions; therefore, any underpayment of state tax will accrue interest in accordance with the respective state statute. On June 30, 2011, the Company was notified by the IRS that the audit period will be expanded to include the tax years ended December 31, 2009 and 2008. On July 7, 2014, the Company received a Notice of Deficiency for tax years ended December 31, 2012, 2011, 2010, 2009 and 2008. The deficiencies relate to cost recovery.

At June 30, 2014, the tax years subject to examination by the major taxing jurisdictions, including the IRS, are 2003, 2005 and subsequent years. The 2003 tax year remains open to examination because of a net operating loss that originated in that year but was not fully utilized until the 2005 tax year. The examination periods for the 2007, 2006 and 2005 tax years were extended through December 31, 2011; however, because the IRS issued the Notice of Deficiency prior to December 31, 2011, the period for assessment is suspended until a decision of the Tax Court becomes final. The statute of limitations for the 2010, 2009 and 2008 tax years has been extended to September 26, 2014.

ASC 740 requires the recognition of interest if the tax law would require interest to be paid on the underpayment of taxes, and recognition of penalties if a tax position does not meet the minimum statutory threshold to avoid payment of penalties. No interest or penalties were accrued or reversed in the three or six months ended June 30, 2014 or 2013.

Basic earnings per share (“EPS”) are computed by dividing net income available to common stockholders of Portfolio Recovery Associates, Inc. by weighted average common shares outstanding. Diluted EPS are computed using the same components as basic EPS with the denominator adjusted for the dilutive effect of the Notes and nonvested share awards, if dilutive. For the Notes, only the conversion spread is included in the diluted earnings per share calculation, if dilutive. Under such method, the settlement of the conversion spread has a dilutive effect when the average share price of the Company’s common stock during any quarter exceeds $65.72, which did not occur during the period from which the Notes were issued on August 13, 2013 through June 30, 2014. The Notes were not outstanding during the three or six months ended June 30, 2013. Share-based awards that are contingent upon the attainment of performance goals are not included in the computation of diluted EPS until the performance goals have been attained. The dilutive effect of nonvested shares is computed using the treasury stock method, which assumes any proceeds that could be obtained upon the vesting of nonvested shares would be used to purchase common shares at the average market price for the period. The assumed proceeds include the windfall tax benefit that would be realized upon assumed exercise.

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

The following tables reconcile the computation of basic EPS and diluted EPS for the three and six months ended June 30, 2014 and 2013 (amounts in thousands, except per share amounts):

|

| | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended June 30, |

| 2014 | | 2013 |

| Net Income attributable to Portfolio Recovery Associates, Inc. | | Weighted Average Common Shares | | EPS | | Net Income attributable to Portfolio Recovery Associates, Inc. | | Weighted Average Common Shares | | EPS |

Basic EPS | $ | 37,507 |

| | 50,065 |

| | $ | 0.75 |

| | $ | 43,599 |

| | 50,751 |

| | $ | 0.86 |

|

Dilutive effect of nonvested share awards | | | 372 |

| | | | | | 432 |

| | |

Diluted EPS | $ | 37,507 |

| | 50,437 |

| | $ | 0.74 |

| | $ | 43,599 |

| | 51,183 |

| | $ | 0.85 |

|

| | | | | | | | | | | |

| For the Six Months Ended June 30, |

| 2014 | | 2013 |

| Net Income attributable to Portfolio Recovery Associates, Inc. | | Weighted Average Common Shares | | EPS | | Net Income attributable to Portfolio Recovery Associates, Inc. | | Weighted Average Common Shares | | EPS |

Basic EPS | $ | 78,347 |

| | 49,997 |

| | $ | 1.57 |

| | $ | 82,199 |

| | 50,781 |

| | $ | 1.62 |

|

Dilutive effect of nonvested share awards | | | 403 |

| | | | | | 447 |

| | |

Diluted EPS | $ | 78,347 |

| | 50,400 |

| | $ | 1.55 |

| | $ | 82,199 |

| | 51,228 |

| | $ | 1.60 |

|

There were no antidilutive options outstanding for the three or six months ended June 30, 2014 and 2013.

| |

9. | Commitments and Contingencies: |

Business Acquisitions:

Aktiv Kapital, A.S.

On July 16, 2014, the Company, through a wholly owned subsidiary, completed the purchase of the outstanding equity of Aktiv, for a purchase price of approximately $872.6 million, and assumed approximately $431.3 million of Aktiv’s corporate debt, resulting in an acquisition of estimated total enterprise value of $1.3 billion. The Company financed the transaction with cash of $217.7 million, $169.9 million in financing from an affiliate of the seller (which bears interest at a variable rate equal to LIBOR plus 3.75% per annum and matures on July 16, 2015), and $485.0 million from the Company’s domestic, revolving credit facility. The Company anticipates total transaction costs of approximately $15 million of which $4.1 million and $8.5 million were incurred during the three and six months ended June 30, 2014, respectively. Additionally, the Company recorded an unrealized foreign currency transaction loss as a result of entering into foreign currency exchange rate forward contracts during the second quarter of 2014 to acquire 518 million Euros in anticipation of closing the acquisition of Aktiv. As a result of the strengthening U.S. dollar relative to the Euro as of June 30, 2014 relative to the period during which the contracts were entered into, an unrealized loss of $6.2 million on the forward contracts was recognized during the quarter. A corresponding liability was recorded and included in Accrued Expenses and Other Liabilities as of June 30, 2014. In the third quarter of 2014, the Company recorded an additional $2.0 million foreign currency transaction loss upon the settlement of these foreign currency exchange rate forward contracts.

Pamplona Capital Management, LLP

On July 1, 2014, the Company acquired certain operating assets from Pamplona Capital Management, LLP ("PCM"). These assets include PCM’s IVA Master Servicing Platform as well as other operating assets associated with PCM’s IVA business. The purchase price of these assets was approximately $5 million and was paid from the Company’s existing cash balances.

Employment Agreements:

The Company has employment agreements, most of which expire on December 31, 2014, with all of its executive officers and with several members of its senior management group. Such agreements provide for base salary payments as well as bonuses

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

which are based on the attainment of specific management goals. At June 30, 2014, the estimated future compensation under these agreements is approximately $6.4 million. The agreements also contain confidentiality and non-compete provisions.

Leases:

The Company is party to various operating leases with respect to its facilities and equipment. The future minimum lease payments at June 30, 2014 total approximately $31.5 million.

Forward Flow Agreements:

The Company is party to several forward flow agreements that allow for the purchase of defaulted consumer receivables at pre-established prices. The maximum remaining amount to be purchased under forward flow agreements at June 30, 2014 is approximately $159.6 million.

Contingent Purchase Price:

The asset purchase agreement entered into in connection with the acquisition of certain finance receivables and certain operating assets of National Capital Management, LLC ("NCM") in 2012, includes an earn-out provision whereby the sellers are able to earn additional cash consideration for achieving certain cash collection thresholds over a five year period. The maximum amount of earn-out during the period is $15.0 million. The Company paid the year one earn-out during December 2013 in the amount of $6.2 million. As of June 30, 2014, the Company has recorded a present value amount for the expected remaining liability of $4.3 million.

Finance Receivables:

Certain agreements for the purchase of finance receivables portfolios contain provisions that may, in limited circumstances, require the Company to refund a portion or all of the collections subsequently received by the Company on particular accounts. The potential refunds as of the balance sheet date are not considered to be significant.

Litigation:

The Company is from time to time subject to routine legal claims and proceedings, most of which are incidental to the ordinary course of its business. The Company initiates lawsuits against customers and is occasionally countersued by them in such actions. Also, customers, either individually, as members of a class action, or through a governmental entity on behalf of customers, may initiate litigation against the Company in which they allege that the Company has violated a state or federal law in the process of collecting on an account. From time to time, other types of lawsuits are brought against the Company. Additionally, the Company receives subpoenas and other requests or demands for information from regulators or governmental authorities who are investigating the Company's debt collection activities. The Company makes every effort to respond appropriately to such requests.

The Company accrues for potential liability arising from legal proceedings when it is probable that such liability has been incurred and the amount of the loss can be reasonably estimated. This determination is based upon currently available information for those proceedings in which the Company is involved, taking into account the Company's best estimate of such losses for those cases for which such estimates can be made. The Company's estimate involves significant judgment, given the varying stages of the proceedings (including the fact that many of them are currently in preliminary stages), the number of unresolved issues in many of the proceedings (including issues regarding class certification and the scope of many of the claims), and the related uncertainty of the potential outcomes of these proceedings. In making determinations of the likely outcome of pending litigation, the Company considers many factors, including, but not limited to, the nature of the claims, the Company's experience with similar types of claims, the jurisdiction in which the matter is filed, input from outside legal counsel, the likelihood of resolving the matter through alternative mechanisms, the matter's current status and the damages sought or demands made. Accordingly, the Company's estimate will change from time to time, and actual losses could be more than the current estimate.

Subject to the inherent uncertainties involved in such proceedings, the Company believes, based upon its current knowledge and after consultation with counsel, that the legal proceedings currently pending against it, including those that fall outside of the Company's routine legal proceedings, should not, either individually or in the aggregate, have a material adverse impact on the Company's financial condition. However, it is possible in light of the uncertainties involved in such proceedings or due to unexpected future developments, that an unfavorable resolution of a legal proceeding or claim could occur which may be material to the Company's financial condition, results of operations, or cash flows for a particular period.

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

Excluding the matters described below and other putative class action suits which the Company believes are not material, the high end of the range of potential litigation losses in excess of the amount accrued is estimated by management to be less than $1,000,000 as of June 30, 2014. Notwithstanding our attempt to estimate a range of possible losses in excess of the amount accrued based on current information, actual future losses may exceed both the Company's accrual and the range of potential litigation losses disclosed above.

In certain legal proceedings, the Company may have recourse to insurance or third party contractual indemnities to cover all or portions of its litigation expenses, judgments, or settlements. Loss estimates and accruals for potential liability related to legal proceedings are exclusive of potential recoveries, if any, under the Company's insurance policies or third party indemnities. The Company has not recorded any potential recoveries under the Company's insurance policies or third party indemnities.

The matters described below fall outside of the normal parameters of the Company’s routine legal proceedings.

Telephone Consumer Protection Act Litigation

The Company has been named as defendant in a number of putative class action cases, each alleging that the Company violated the Telephone Consumer Protection Act ("TCPA") by calling consumers' cellular telephones without their prior express consent. On December 21, 2011, the United States Judicial Panel on Multi-District Litigation entered an order transferring these matters into one consolidated proceeding in the United States District Court for the Southern District of California (the "Court"). On November 14, 2012, the putative class plaintiffs filed their amended consolidated complaint in the matter, now styled as In re Portfolio Recovery Associates, LLC Telephone Consumer Protection Act Litigation, case No. 11-md-02295 (the “MDL action”). On May 20, 2014, the Court stayed this litigation until such time as the FCC has ruled on various petitions concerning the TCPA.

Internal Revenue Service Audit

The IRS examined the Company's tax returns for the 2005 calendar year. The IRS concluded the audit and on March 19, 2009 issued Form 4549-A, Income Tax Examination Changes, for tax years ended December 31, 2007, 2006 and 2005. The IRS has asserted that tax revenue recognition using the cost recovery method does not clearly reflect taxable income. The Company believes it has sufficient support for the technical merits of its positions and that it is more likely than not these positions will ultimately be sustained; therefore, a reserve for uncertain tax positions is not required. On April 22, 2009, the Company filed a formal protest of the findings contained in the examination report prepared by the IRS. On August 26, 2011, the IRS issued a Notice of Deficiency for the tax years ended December 31, 2007, 2006, and 2005. The Company subsequently filed a petition in the United States Tax Court to which the IRS responded on January 12, 2012. If the Company is unsuccessful in the United States Tax Court, it can appeal to the federal Circuit Court of Appeals. On July 7, 2014, the IRS issued a Notice of Deficiency for the tax years ended December 31, 2012, 2011, 2010, 2009 and 2008. Refer to Note 7 “Income Taxes” for additional information.

| |

10. | Fair Value Measurements and Disclosures: |

In accordance with the disclosure requirements of FASB ASC Topic 825, “Financial Instruments” (“ASC 825”), the table below summarizes fair value estimates for the Company’s financial instruments. The total of the fair value calculations presented does not represent, and should not be construed to represent, the underlying value of the Company. The carrying amounts in the table are recorded in the Consolidated Balance Sheets at June 30, 2014 and December 31, 2013, under the indicated captions (amounts in thousands):

|

| | | | | | | | | | | | | | | |

| June 30, 2014 | | December 31, 2013 |

| Carrying Amount | | Estimated Fair Value | | Carrying Amount | | Estimated Fair Value |

Financial assets: | | | | | | | |

Cash and cash equivalents | $ | 270,526 |

| | $ | 270,526 |

| | $ | 162,004 |

| | $ | 162,004 |

|

Finance receivables, net | 1,219,595 |

| | 1,740,864 |

| | 1,239,191 |

| | 1,722,100 |

|

Financial liabilities: | | | | | | | |

Term loans | 190,000 |

| | 190,000 |

| | 195,000 |

| | 195,000 |

|

Convertible debt | 258,785 |

| | 344,100 |

| | 256,780 |

| | 316,857 |

|

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)

As of June 30, 2014, and December 31, 2013, the Company did not account for any financial assets or financial liabilities at fair value. As defined by FASB ASC Topic 820, “Fair Value Measurements and Disclosures” (“ASC 820”), fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC 820 also requires the consideration of differing levels of inputs in the determination of fair values. Those levels of input are summarized as follows:

•Level 1 - Quoted prices in active markets for identical assets and liabilities.

| |

• | Level 2 - Observable inputs other than level 1 quoted prices, such as quoted prices for similar instruments in active markets, quoted prices for identical or similar instruments in markets that are not active, and model-based valuation techniques for which all significant assumptions are observable in the market. |

| |

• | Level 3 - Unobservable inputs that are supported by little or no market activity. Level 3 assets and liabilities include financial instruments whose value is determined using pricing models, discounted cash flow methodologies, or similar techniques as well as instruments for which the determination of fair value requires significant management judgment or estimation. |

The level in the fair value hierarchy within which a fair value measurement in its entirety falls is based on the lowest level input that is significant to the fair value measurement in its entirety.

Disclosure of the estimated fair values of financial instruments often requires the use of estimates. The Company uses the following methods and assumptions to estimate the fair value of financial instruments:

Cash and cash equivalents: The carrying amount approximates fair value and quoted prices for identical assets can be found in active markets. Accordingly, the Company estimates the fair value of cash and cash equivalents using level 1 inputs.

Finance receivables, net: The Company records purchased receivables at cost, which represents a significant discount from the contractual receivable balances due. The Company computed the estimated fair value of these receivables using proprietary pricing models that the Company utilizes to make portfolio purchase decisions. Accordingly, the Company's fair value estimates use level 3 inputs as there is little observable market data available and management is required to use significant judgment in its estimates.

Term loans: The carrying amount approximates fair value due to the short-term nature of the interest rate periods and the observable quoted prices for similar instruments in active markets. Accordingly, the Company uses level 2 inputs for its fair value estimates.

Convertible debt: The Notes are carried at historical cost, adjusted for the debt discount. The fair value estimates for these Notes incorporates quoted market prices which were obtained from secondary market broker quotes which were derived from a variety of inputs including client orders, information from their pricing vendors, modeling software, and actual trading prices when they occur. Accordingly, the Company uses level 2 inputs for its fair value estimates.

| |

11. | Recent Accounting Pronouncements: |

In March 2013, the FASB issued ASU 2013-05, "Foreign Currency Matters (Topic 830): Parent's Accounting for the Cumulative Translation Adjustment upon Derecognition of Certain Subsidiaries or Groups of Assets within a Foreign Entity or of an Investment in a Foreign Entity," ("ASU 2013-05") which defines the treatment of the release of cumulative translation adjustments upon derecognition of certain subsidiaries or groups of assets within a foreign entity or of an investment in a foreign entity. ASU 2013-05 is effective for fiscal years, and interim periods within those years, beginning after December 15, 2013. Early adoption is permitted and prior periods should not be adjusted. The Company adopted ASU 2013-05 in the first quarter of 2014 which had no material impact on its Consolidated Financial Statements.

In April 2014, FASB issued ASU 2014-08, "Reporting Discontinued Operations and Disclosures of Disposals of Components of an Entity" (“ASU 2014-08”) that amends the requirements for reporting discontinued operations. ASU 2014-08 requires the disposal of a component of an entity or a group of components of an entity to be reported in discontinued operations if the disposal represents a strategic shift that will have a major effect on the entity’s operations and financial results. ASU 2014-08 also requires additional disclosures about discontinued operations and disclosures about the disposal of a significant component of an entity that does not qualify as a discontinued operation. ASU 2014-08 is effective prospectively for reporting periods beginning after December 15, 2014, with early adoption permitted. The Company is evaluating the potential impacts of the new standard.

PORTFOLIO RECOVERY ASSOCIATES, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(unaudited)