Table of Contents

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-228975

The information in this preliminary prospectus supplement is not complete and may be changed. A registration statement relating to these securities has been declared effective by the Securities and Exchange Commission. This preliminary prospectus supplement and the accompanying prospectus are not an offer to sell these securities, and are not soliciting an offer to buy these securities, in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 20, 2019

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated February 13, 2019)

$

Molecular Templates, Inc.

Common Stock

Series A Convertible Preferred Stock

We are offering shares of our common stock and shares of our Series A Convertible Preferred Stock, which we refer to as our Series A Preferred Stock, with an aggregate public offering price of $ . Our common stock is listed on The Nasdaq Capital Market under the symbol “MTEM.” On November 19, 2019, the last reported sale price for our common stock on The Nasdaq Capital Market was $8.11 per share. We do not intend to list our Series A Preferred Stock on any securities exchange or trading system.

Each share of Series A Preferred Stock is convertible into 1,000 shares of our common stock at any time at the option of the holder, provided that the holder will be prohibited from converting the Series A Preferred Stock into shares of our common stock if, as a result of such conversion, the holder, together with its affiliates, would own more than 9.99% of the total number of shares of our common stock then issued and outstanding. In the event of our liquidation, dissolution, or winding up, holders of our Series A Preferred Stock will receive a payment equal to $0.001 per share of Series A Preferred Stock before any proceeds are distributed to the holders of our common stock. The Series A Preferred Stock has no voting rights, except as required by law and except that the consent of the Series A Preferred Stock holders will be required to amend the terms of the Series A Preferred Stock.

Investing in our common stock and our Series A Preferred Stock involves a high degree of risk. Please read “Risk Factors” on page S-7 of this prospectus supplement and under similar headings in the documents incorporated by reference into this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved these securities or determined if this prospectus supplement or the accompanying prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

| Per Share of Common Stock |

Per Share of Series A Preferred Stock |

Total | ||||||||||

| Public offering price |

$ | $ | $ | |||||||||

| Underwriting discounts and commissions(1) |

$ | $ | $ | |||||||||

| Proceeds, before expenses, to us |

$ | $ | $ | |||||||||

| (1) | We have agreed to reimburse the underwriters for certain expenses. See “Underwriting.” |

Certain of our existing stockholders and their affiliated entities, including affiliates of our directors, have indicated an interest in purchasing up to an aggregate of approximately $15.0 million of our shares in this offering at the public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares of common stock to any of these existing stockholders and their affiliated entities, and any of these existing stockholders and affiliated entities could determine to purchase more, less or no shares of common stock in this offering.

We have granted the underwriters an option for a period of 30 days from the date of this prospectus supplement to purchase up to an additional shares of our common stock at the public offering price, less the underwriting discounts and commissions. See “Underwriting” for more information.

The underwriters expect to deliver the securities to investors on or about , 2019.

Joint Book-Running Managers

| Cowen | Barclays | Stifel |

The date of this prospectus supplement is , 2019.

Table of Contents

PROSPECTUS SUPPLEMENT

| S-ii | ||||

| S-iv | ||||

| S-1 | ||||

| S-7 | ||||

| S-10 | ||||

| S-11 | ||||

| S-12 | ||||

| S-14 | ||||

| MATERIAL U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS |

S-16 | |||

| S-20 | ||||

| S-25 | ||||

| S-25 | ||||

| S-25 | ||||

| S-25 |

PROSPECTUS

| 2 | ||||

| 5 | ||||

| 6 | ||||

| 8 | ||||

| 9 | ||||

| 11 | ||||

| 12 | ||||

| 13 | ||||

| 19 | ||||

| 20 | ||||

| 22 | ||||

| CERTAIN PROVISIONS OF DELAWARE LAW AND OF THE COMPANY’S CERTIFICATE OF INCORPORATION AND BYLAWS |

24 | |||

| 27 | ||||

| 28 | ||||

| 29 | ||||

| 30 |

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus relate to an offering of shares of our common stock and Series A Preferred Stock. Before buying any shares of our common stock and Series A Preferred Stock that we are offering, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated by reference as described under the headings “Where You Can Find Additional Information” and “Incorporation of Certain Information by Reference” in this prospectus supplement. These documents contain important information that you should consider when making your investment decision.

Unless the context otherwise requires, “Molecular Templates,” “Molecular,” “MTEM,” “the Company,” “we,” “us,” “our” and similar terms refer to Molecular Templates, Inc., a company incorporated under the laws of Delaware, together with its subsidiaries.

This document contains two parts. The first part is this prospectus supplement, which describes the terms of this offering of shares of our common stock and Series A Preferred Stock and also adds to, updates and changes information contained in the accompanying prospectus and the documents incorporated by reference. The second part is the accompanying prospectus, which gives more general information. To the extent the information contained in this prospectus supplement differs from or conflicts with the information contained in the accompanying prospectus or any document incorporated by reference, the information in this prospectus supplement will control. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference into the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

This prospectus supplement is part of a registration statement that we filed with the Securities and Exchange Commission, or SEC, using a “shelf” registration process. Under the shelf registration process, we may from time to time offer and sell any combination of the securities described in the accompanying prospectus up to a total dollar amount of $200.0 million, of which this offering is a part.

We are responsible for the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus and in any free writing prospectus we prepare or authorize. We have not, and the underwriters have not, authorized anyone to provide you with information different from that which is contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we have authorized for use in connection with this offering and we take no responsibility for any other information others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information contained in this prospectus supplement is accurate as of the date on the front cover of this prospectus supplement only and that any information we have incorporated by reference or included in the accompanying prospectus is accurate only as of the date given in the document incorporated by reference or as of the date of the prospectus, as applicable, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus, any related free writing prospectus, or any sale of shares of our common stock or Series A Preferred Stock. Our business, financial condition, results of operations and prospects may have changed since that date.

For investors outside the United States: Neither we, nor the underwriters, have done anything that would permit this offering or possession or distribution of this prospectus supplement or the accompanying prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about, and to observe any restrictions relating to, this offering and the distribution of this prospectus supplement and the accompanying prospectus.

S-ii

Table of Contents

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus supplement, the accompanying prospectus and the information incorporated herein and therein by reference include trademarks, service marks and trade names owned by us or other companies. All trademarks, service marks and trade names included or incorporated by reference into this prospectus are the property of their respective owners.

Information contained on, or that can be accessed through, our website does not constitute part of this prospectus supplement, the accompanying prospectus or any related free writing prospectus.

S-iii

Table of Contents

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the prospectus and the documents we have filed with the SEC that are incorporated by reference contain “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Exchange Act of 1934, as amended, or the Exchange Act, that involve substantial risks and uncertainties. In some cases, forward-looking statements are identified by the words “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “future,” “goals,” “intend,” “likely,” “may,” “might,” “ongoing,” “objective,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “strategy,” “will” and “would” or the negative of these terms, or other comparable terminology intended to identify statements about the future. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements.

Although we believe that we have a reasonable basis for each forward-looking statement contained in this prospectus supplement and the documents that we have filed with the SEC that are incorporated by reference herein, such statements are based on a combination of facts and factors currently known by us and our expectations of the future, about which we cannot be certain. Forward-looking statements include statements about:

| ∎ | the implementation of our business strategies, including our ability to pursue development pathways and regulatory strategies for MT-3724 and other engineered toxin body, or ETB, product candidates; |

| ∎ | the timing and our ability to advance the development of our product candidates; |

| ∎ | our plans to pursue discussions with regulatory authorities, and the anticipated timing, scope and outcome of related regulatory actions or guidance; |

| ∎ | our ability to establish and maintain potential new partnering or collaboration arrangements for the development and commercialization of ETB product candidates; |

| ∎ | our financial condition, including our ability to obtain the funding necessary to advance the development of our product candidates; |

| ∎ | the anticipated progress of our product candidate development programs, including whether our ongoing and potential future clinical trials will achieve clinically relevant results; |

| ∎ | our ability to generate data and conduct analyses to support the regulatory approval of our product candidates; |

| ∎ | our ability to establish and maintain intellectual property rights for our product candidates; |

| ∎ | whether any product candidates that we are able to commercialize are safer or more effective than other marketed products, treatments or therapies; |

| ∎ | our ability to discover and develop additional product candidates suitable for clinical testing; |

| ∎ | our ability to identify, in-license or otherwise acquire additional product candidates and development programs; |

| ∎ | our anticipated research and development activities and projected expenditures; |

| ∎ | our ability to complete preclinical and clinical testing successfully for new product candidates that we may develop or license; and |

| ∎ | the sufficiency of our cash resources. |

You should refer to the section titled “Risk Factors” of this prospectus supplement and in our other filings with the SEC, including our Annual Report on Form 10-K for the year ended December 31, 2018 and our subsequent Quarterly Reports on Form 10-Q, for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure that the forward-looking statements in this

S-iv

Table of Contents

prospectus supplement or the documents we have filed with the SEC that are incorporated by reference will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, these statements should not be regarded as representations or warranties by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus supplement, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements as predictions of future events.

You should read this prospectus supplement, the underlying prospectus, the documents that we have incorporated by reference herein and the documents we have filed as exhibits to the registration statement, completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

S-v

Table of Contents

This summary highlights selected information contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus. This summary does not contain all the information you should consider before investing in our common stock and Series A Preferred Stock. You should read and consider carefully the more detailed information in this prospectus supplement and the accompanying prospectus, including the factors described under the heading “Risk Factors” in this prospectus supplement and the financial and other information incorporated by reference in this prospectus supplement and the accompanying prospectus, as well as the information included in any free writing prospectus that we have authorized for use in connection with this offering, before making an investment decision.

Overview

We are a clinical-stage biopharmaceutical company focused on the discovery and development of differentiated, targeted, biologic therapeutics for cancer. We utilize our proprietary biologic drug platform to design and generate ETBs, which we believe provides a differentiated mechanism of action that may be beneficial in patients resistant to currently available cancer therapeutics. ETBs use a genetically engineered version of the Shiga-like Toxin A subunit, or SLTA, a ribosome inactivating bacterial protein. In its wild-type form, SLTA is thought to induce its own entry into a cell when proximal to the cell surface membrane, self-route to the cytosol, and enzymatically and irreversibly shut down protein synthesis via ribosome inactivation. SLTA is normally coupled to its cognate Shiga-like Toxin B subunit, or SLTB, to target the CD77 cell surface marker, a non-internalizing glycosphingolipid. In our scaffold, a genetically engineered SLTA subunit with no cognate SLTB component is genetically fused to antibody domains or fragments specific to a cancer target, resulting in a biologic therapeutic that can identify the particular target and specifically kill the cancer cell. The antibody domains may be substituted with other antibody domains having different specificities to potentially allow for the rapid development of new drugs to selected targets in cancer.

ETBs combine the specificity of an antibody with SLTA’s potent mechanism of cell destruction. Based on the disease setting, we have created ETBs that have reduced immunogenicity and are capable of delivering additional payloads into a target cell. Immunogenicity is the ability of a foreign substance to provoke an immune response in a host. ETBs have relatively predictable pharmacokinetic, or PK, and absorption, distribution, metabolism and excretion, or ADME, profiles and can be rapidly screened for desired activity in robust cell-based and animal-model assays. Because SLTA can induce internalization against non- and poorly-internalizing receptors, the universe of targets for ETBs should be substantially larger than that seen with antibody drug conjugates, or ADCs, which are not likely to be effective if the target does not readily internalize the ADC payload.

ETBs have a differentiated mechanism of cell-kill in cancer therapeutics (the inhibition of protein synthesis via ribosome destruction), and we have preclinical and clinical data demonstrating the utility of these molecules in chemotherapy-refractory cancers. ETBs have shown good tolerability in multiple animal models as well as in our clinical studies to date. We believe the target specificity of ETBs, their ability to self-internalize, their potent and differentiated mechanism of cell kill and their tolerability profile provide opportunities for the clinical development of these agents to address multiple cancer types.

Our initial approach to drug development in oncology involves the selection of lead compounds to validated targets in cancer. We have developed ETBs for various targets, including CD20, CD38, HER2, and PD-L1. CD20 is central to B cell malignancies and is clinically validated as a target for the treatment of lymphomas and autoimmune disease. CD38 has been validated as a meaningful clinical

S-1

Table of Contents

target in the treatment of multiple myeloma. PD-L1 is central to immune checkpoint pathways and is a target expressed in a variety of solid tumor cancers.

Our lead compound, MT-3724, is an ETB that recognizes CD20, a B cell marker and is currently in multiple Phase II studies. The dose escalation portion of our first Phase I clinical trial has been completed for MT-3724 and was followed by the initiation of a Phase Ib expansion cohort, which was initiated in the fourth quarter of 2017. Results of the Phase I/Ib study are scheduled to be presented at the American Society of Hematology (ASH) Annual Meeting, December 7-10, 2019 in Orlando, FL.

In the first quarter of 2019, we initiated a Phase II monotherapy study with MT-3724, which has the potential to be a pivotal study. We have also initiated a Phase II combination study with MT-3724 and chemotherapy (gemcitabine and oxaliplatin) in earlier lines of relapsed and refractory diffuse large B-cell lymphoma, or DLBCL, and a second Phase II combination study with MT-3724 and Revlimid® (lenalidomide) in earlier lines of DLBCL. We expect to provide an update on all three Phase II studies of MT-3724 in the fourth quarter of 2019.

We filed an IND for MT-5111, our ETB targeting HER2, in March 2019 and the IND was accepted in April 2019. We began dosing patients in a Phase I study of MT-5111 in the fourth quarter of 2019. We anticipate providing an update on this study in the fourth quarter of 2019. Takeda filed an IND for TAK-169, our jointly discovered ETB targeting CD38, in May 2019 and the IND was accepted in June 2019. Phase I dosing for TAK-169 is expected to start in the second half of 2019. We anticipate starting a Phase I study for our ETB targeting PD-L1 in 2020.

We have built up multiple core competencies around the creation and development of ETBs. We developed the ETB technology in-house and continue to make iterative improvements in the scaffold and identify new uses of the technology. We also developed the proprietary process for manufacturing ETBs under Good Manufacturing Process, or GMP standards and continue to make improvements to its manufacturing processes.

We have conducted multiple GMP manufacturing runs with our lead compound and believe this process is robust and could support commercial production with gross margins that are similar to those seen with antibodies.

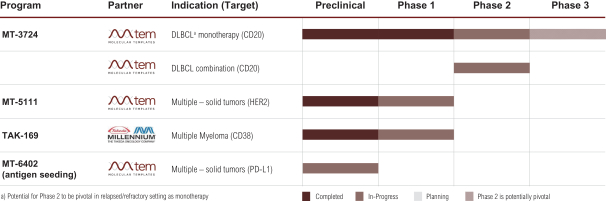

Molecular’s Oncology Pipeline With Novel MOAs Driven by ETB Platform

S-2

Table of Contents

Recent Developments

Vertex Collaboration Agreement

On November 18, 2019, we entered into a Master Collaboration Agreement, or the Collaboration Agreement, with Vertex Pharmaceuticals Incorporated, or Vertex, pursuant to which the parties agreed to enter into a strategic research collaboration to leverage our ETB technology platform to discover and develop novel targeted biologic therapies for applications outside of oncology.

Pursuant to the terms of the Collaboration Agreement, we granted Vertex an exclusive option to obtain an exclusive license under our licensed technology to exploit one or more ETB products that are discovered by us against up to two designated targets. Vertex has selected an initial target and has the option to designate one additional target within specified time limits.

Pursuant to the Collaboration Agreement, Vertex has paid us an upfront payment of $38.0 million, consisting of $23.0 million in cash and a $15.0 million equity investment pursuant to a share purchase agreement described further below. In addition to the upfront payments, we may also receive an additional $22.0 million through the exercise of the options to license ETB products or to add an additional target. We shall provide, and Vertex will reimburse us for, certain mutually agreed manufacturing technology transfer activities.

We may, for each target under the Collaboration Agreement, receive up to an additional $180.0 million in milestone payments upon the achievement of certain development and regulatory milestone events and up to an additional $70.0 million in milestone payments upon the achievement of certain sales milestone events. We will also be entitled to receive, subject to certain reductions, tiered mid-single digit royalties as percentages of calendar year net sales, if any, on any licensed product.

We will be responsible for conducting the research activities through the designation, if any, of one or more development candidates. Upon the exercise by Vertex of its option for a development candidate, Vertex will be responsible for all development, manufacturing, regulatory and commercialization activities with respect to that development candidate.

Unless earlier terminated, the Collaboration Agreement will expire (i) on a country-by-country basis and licensed product-by-licensed product basis on the date of expiration of all payment obligations under the Collaboration Agreement with respect to such licensed product in such country and (ii) in its entirety upon the expiration of all payment obligations thereunder with respect to all licensed products in all countries or upon Vertex’s decision not to exercise any option on or prior to the applicable deadlines. Vertex has the right to terminate the Collaboration Agreement for convenience upon prior written notice to us. Either party has the right to terminate the Collaboration Agreement (a) for the insolvency of the other party or (b) subject to specified cure periods, in the event of the other party’s uncured material breach.

In connection with the Collaboration Agreement, we and Vertex entered into the share purchase agreement, dated November 18, 2019, pursuant to which Vertex purchased 1,666,666 shares of our common stock at a price per share of $9.00.

Updated Cash Runway Statement

Including the upfront payment from our entry into the Collaboration Agreement described above and the related equity investment, we expect that our existing cash and cash equivalents are sufficient to fund our operating expenses and capital expenditure requirements through approximately the first half of 2021.

S-3

Table of Contents

Corporate Information and History

We were originally incorporated in the State of Delaware in October 2001 under the name “Threshold Pharmaceuticals, Inc.” On August 1, 2017, Molecular Templates, Inc., formerly known as Threshold Pharmaceuticals, Inc. (Nasdaq: THLD), or Threshold, completed its business combination with then-private Molecular Templates, Inc., or Private Molecular, formerly D5 Pharma Inc., in accordance with the terms of the Agreement and Plan of Merger and Reorganization, dated as of March 16, 2017, by and among Threshold, Trojan Merger Sub, Inc., or Merger Sub, and Private Molecular, or the “Merger Agreement, pursuant to which Merger Sub merged with and into Private Molecular, with Private Molecular surviving as a wholly owned subsidiary of Threshold, or the Merger. On August 1, 2017, in connection with, and prior to the completion of, the Merger, Threshold effected a 11:1 reverse stock split of its common stock and on August 1, 2017, immediately after completion of the Merger, Threshold changed its name to “Molecular Templates, Inc.” (Nasdaq: MTEM).

Our corporate headquarters are located at 9301 Amberglen Boulevard, Suite 100, Austin, Texas 78729 and our telephone number is (512) 869-1555. We maintain a website at www.mtem.com, to which we regularly post copies of our press releases as well as additional information about us. The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website address in this prospectus solely as an inactive textual reference.

All brand names or trademarks appearing in this prospectus are the property of their respective holders. Use or display by us of other parties’ trademarks, trade dress, or products in this prospectus is not intended to, and does not, imply a relationship with, or endorsements or sponsorship of, us by the trademark or trade dress owners. As used herein, the words “Molecular Templates,” “Molecular,” “MTEM,” the “Company,” “we,” “us,” and “our” refer to Molecular Templates, Inc. and our subsidiaries. Our subsidiary Molecular Templates OpCo, Inc. was incorporated in Delaware in February 2009.

S-4

Table of Contents

The Offering

Common Stock

| Common stock offered by us |

shares |

| Underwriters’ option to purchase additional shares |

We have granted the underwriters an option for a period of up to 30 days from the date of this prospectus supplement to purchase up to an additional shares of common stock at the public offering price less the underwriting discounts and commissions. |

| Common stock to be outstanding immediately after this offering |

shares (or shares if the underwriters exercise their option to purchase additional shares in full). |

Series A Preferred Stock

Series A Preferred Stock offered by us

| shares |

| Conversion |

Each share of our Series A Preferred Stock is convertible into 1,000 shares of our common stock at any time at the option of the holder, provided that the holder will be prohibited from converting Series A Preferred Stock into shares of our common stock if, as a result of such conversion, the holder, together with its affiliates, would own more than 9.99% of the total number of shares of our common stock then issued and outstanding. The holder of such shares of Series A Preferred Stock can change this requirement, upon 61 days’ notice to us. |

| Liquidation Preference |

In the event of our liquidation, dissolution, or winding up, holders of our Series A Preferred Stock will receive a payment equal to $0.001 per share of Series A Preferred Stock before any proceeds are distributed to the holders of our common stock. |

| Voting Rights |

Shares of Series A Preferred Stock will generally have no voting rights, except as required by law and except that the consent of the holders of the outstanding Series A Preferred Stock will be required to amend the terms of the Series A Preferred Stock. |

S-5

Table of Contents

| Use of proceeds |

We intend to use the net proceeds, together with our existing cash and cash equivalents, from this offering to fund: our ongoing Phase II clinical studies for MT-3724; our ongoing Phase I clinical study of MT-5111; our share of development expenses in our CD38 collaboration with Takeda; our program PD-L1 (including our anticipated upcoming Phase I clinical study for PD-L1); further preclinical development and drug discovery activities in our other programs; and for working capital and general corporate purposes. See “Use of Proceeds.” |

| Risk factors |

An investment in our securities involves a high degree of risk. See the information contained in or incorporated by reference under “Risk Factors” on page S-7 of this prospectus supplement and under similar headings in the other documents that are incorporated by reference herein and therein. |

| Nasdaq Capital Market Symbol |

Our common stock is listed on The Nasdaq Capital Market under the symbol “MTEM.” |

The number of shares of common stock expected to be outstanding after this offering and, unless otherwise indicated, the information in this prospectus supplement are based on 36,954,510 shares of common stock outstanding as of September 30, 2019, and excludes:

| ∎ | 4,599,243 shares issuable upon the exercise of outstanding stock options issued pursuant to our 2018 Equity Incentive Plan, or the 2018 Plan, at a weighted average exercise price of $6.09 per share, as of September 30, 2019; |

| ∎ | 8,636 shares of common stock reserved for issuance under the Amended and Restated 2004 Employee Stock Purchase Plan as of September 30, 2019; |

| ∎ | 962,394 shares of common stock reserved for issuance under the 2018 Plan as of September 30, 2019; |

| ∎ | 3,521,731 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2019; and |

| ∎ | 1,666,666 shares of common stock issued to Vertex on November 18, 2019 pursuant to its equity investment in MTEM as part of our collaboration. |

Except as otherwise indicated, we have presented the information in this prospectus supplement assuming:

| ∎ | no exercise by the underwriters in this offering of their option to purchase additional shares; and |

| ∎ | no exercise of outstanding options described above. |

Certain of our existing stockholders and their affiliated entities, including affiliates of our directors, have indicated an interest in purchasing up to an aggregate of approximately $15.0 million of our shares of common stock in this offering at the public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares of common stock to any of these existing stockholders and their affiliated entities, and any of these existing stockholders and affiliated entities could determine to purchase more, less or no shares of common stock in this offering.

S-6

Table of Contents

Investing in our securities involves a high degree of risk. Our business, prospects, financial condition or operating results could be materially adversely affected by the risks identified below, as well as other risks not currently known to us or that we currently consider immaterial. The trading price of our common stock could decline due to any of these risks, and you may lose all or part of your investment. Before deciding whether to invest in our securities, you should consider carefully the risk factors discussed below and those contained in our most recent annual report on Form 10-K and our quarterly reports on Form 10-Q which are on file with the SEC and are incorporated herein by reference, and which may be amended, supplemented or superseded from time to time by other reports we file with the SEC in the future.

Risks Related to this Offering

Management will have broad discretion as to the use of the net proceeds from this offering, and we may not use the proceeds effectively.

Our management will have broad discretion in the application of the net proceeds from this offering and could spend the proceeds in ways that do not improve our results of operations or enhance the value of our common stock. Our failure to apply these funds effectively could have a material adverse effect on our business, delay the development of our product candidates and cause the price of our common stock to decline.

If certain of our existing stockholders participate in this offering, the available public float for our common stock will be reduced and the liquidity of our common stock may be adversely affected.

Certain of our existing stockholders and their affiliated entities, including affiliates of our directors, have indicated an interest in purchasing up to an aggregate of approximately $15.0 million of our shares of common stock in this offering at the initial public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares of common stock to any of these existing stockholders and their affiliated entities, and any of these existing stockholders and affiliated entities could determine to purchase more, less or no shares of common stock in this offering. Any shares of our common stock purchased by these entities in this offering will reduce the available public float for our common stock, and certain of such shares of our common stock may be subject to a 90-day lock-up agreement with the underwriters. As a result, any purchase of shares by these entities in this offering may reduce the liquidity of our shares of common stock relative to what it would have been had these shares been purchased by other investors or not subject to lock-up agreements.

If you purchase securities in this offering, you will suffer immediate and substantial dilution.

If you purchase securities in this offering, you will incur immediate and substantial dilution in the as adjusted net tangible book value of the common stock that you purchase, or that is issuable upon conversion of the Series A Preferred Stock, of $ per share as of September 30, 2019, based on the public offering price of $ per share, because the price that you pay will be substantially greater than the net tangible book value per share of the shares you acquire. You will experience additional dilution upon the exercise of options, including those options currently outstanding and those granted in the future, and the issuance of restricted stock or other equity awards under our stock incentive plans.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of common stock or other securities convertible into or exchangeable for our shares of common stock at prices that may not be the same as the prices per share in this offering. We may sell shares or other securities in any other

S-7

Table of Contents

offering at a price per share that is less than the price per share paid by investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing shareholders. The price per share at which we sell additional shares of common stock, or securities convertible or exchangeable into shares of common stock, in future transactions may be higher or lower than the price per share of common stock paid by investors in this offering.

Because we do not anticipate paying any cash dividends on our capital stock in the foreseeable future, capital appreciation, if any, will be your sole source of gain.

We have never paid or declared any cash dividends on our capital stock. We currently intend to retain earnings, if any, to finance the growth and development of our business and we do not anticipate paying any cash dividends in the foreseeable future. As a result, only appreciation of the price of our common stock will provide a return to our stockholders.

Sales of a substantial number of our common stock by our existing shareholders in the public market could cause our stock price to fall.

If our existing shareholders sell, or indicate an intention to sell, substantial amounts of our common stock in the public market, the trading price of our common stock could decline. In addition, a substantial number of shares of common stock are subject to outstanding options or will become eligible for sale in the public market to the extent permitted by the provisions of various vesting schedules. If these additional shares of common stock are sold, or if it is perceived that they will be sold, in the public market, the trading price of our common stock could decline.

We, our executive officers and directors and certain of our existing shareholders have agreed that, subject to certain exceptions, during the period ending 90 days after the date of this prospectus supplement, we and they will not offer, sell, contract to sell, pledge or otherwise dispose of, directly or indirectly, any of our common stock or securities convertible into or exchangeable or exercisable for any of our common stock, enter into a transaction that would have the same effect, or enter into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic consequences of ownership of our common stock, whether any of these transactions are to be settled by delivery of our common stock or other securities, in cash or otherwise, or publicly disclose the intention to make any offer, sale, pledge or disposition, or to enter into any transaction, swap, hedge or other arrangement, without, in each case, the prior written consent of Cowen and Company, LLC, Barclays Capital Inc. and Stifel, Nicolaus & Company, Incorporated, who may release any of the securities subject to these lock-up agreements at any time without notice. Exceptions to the lock-up restrictions are described in more detail in this prospectus supplement under the caption “Underwriting.”

Anti-takeover provisions in our charter documents and under Delaware law could make an acquisition of us, which may be beneficial to our stockholders, more difficult and may prevent attempts by our stockholders to replace or remove our current management.

Provisions in our amended and restated certificate of incorporation, as amended, and amended and restated bylaws may delay or prevent an acquisition of us or a change in our management. These provisions include:

| ∎ | authorizing the issuance of “blank check” preferred stock, the terms of which may be established and shares of which may be issued without stockholder approval; |

| ∎ | creating a staggered board of directors; |

| ∎ | prohibiting stockholder action by written consent, thereby requiring all stockholder actions to be taken at a meeting of our stockholders; and |

| ∎ | establishing advance notice requirements for nominations for election to the board of directors or for proposing matters that can be acted upon at stockholder meetings. |

S-8

Table of Contents

In addition, because we are incorporated in Delaware, we are governed by the provisions of Section 203 of the Delaware General Corporation Law, which limits the ability of stockholders owning in excess of 15% of our outstanding voting stock to merge or combine with us. Although we believe these provisions collectively provide for an opportunity to obtain greater value for stockholders by requiring potential acquirers to negotiate with our board of directors, they would apply even if an offer rejected by our board were considered beneficial by some stockholders. In addition, these provisions may frustrate or prevent any attempts by our stockholders to replace or remove our current management by making it more difficult for stockholders to replace members of our board of directors, which is responsible for appointing the members of our management.

S-9

Table of Contents

We estimate that we will receive net proceeds of approximately $ million (or approximately $ million if the underwriters’ option to purchase additional shares is exercised in full) from the sale of the shares of common stock and Series A preferred stock offered by us in this offering, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering, together with our existing cash and cash equivalents, as follows:

| ∎ | to fund our ongoing Phase II clinical studies for MT-3724; |

| ∎ | to fund our ongoing Phase I clinical study of MT-5111; |

| ∎ | our share of development expenses in our CD38 collaboration with Takeda; |

| ∎ | to fund our program PD-L1 (including our anticipated upcoming Phase I clinical study for PD-L1); |

| ∎ | to fund further preclinical development and drug discovery activities in our other programs; and |

| ∎ | for working capital and general corporate purposes. |

We believe opportunities may exist from time to time to expand our current business through acquisitions or in-licensing of complementary companies, medicines or technologies. While we have no current agreements, commitments or understandings for any specific acquisitions or in-licensing at this time, we may use a portion of the net proceeds for these purposes.

Our expected use of the net proceeds from this offering represents our current intentions based upon our present plans and business conditions. Although we currently anticipate that we will use the net proceeds from this offering as described above, there may be circumstances where a reallocation of funds is necessary. Due to the uncertainties inherent in the product development process, it is difficult to estimate with certainty the exact amounts of the net proceeds from this offering that may be used for the above purposes. The amounts and timing of our actual expenditures will depend upon numerous factors, including the factors described in “Risk Factors.” Accordingly, our management will have broad discretion in applying the net proceeds from this offering. An investor will not have the opportunity to evaluate the economic, financial or other information on which we base our decisions on how to use the proceeds.

Based on our current plans, we believe that our existing cash and cash equivalents, together with the net proceeds from this offering, will be sufficient to enable us to fund our operating expenses and capital expenditure requirements into .

We have based this estimate on assumptions that may prove to be wrong, and we could use our available capital resources sooner than we currently expect. We do not expect the net proceeds from this offering and our existing cash and cash equivalents to be sufficient to fund the development of our product candidates through regulatory approval and commercialization. We will need to raise substantial additional funds for further development and before we can expect to commercialize any products, if approved. We may satisfy our future cash needs through the sale of equity securities, debt financings, working capital lines of credit, corporate collaborations or license agreements, grant funding, interest income earned on invested cash balances or a combination of one or more of these sources.

Pending these uses, we intend to invest the net proceeds in high quality, investment grade instruments, certificates of deposit or direct or guaranteed obligations of the U.S. government, or hold such proceeds as cash.

S-10

Table of Contents

The following table sets forth our cash and cash equivalents and capitalization as of September 30, 2019:

| ∎ | on an actual basis; and |

| ∎ | on an as adjusted basis, giving effect to the sale of shares of common stock by us in this offering and our sale of shares of Series A Preferred Stock by us in this offering for aggregate net proceeds of $ million, after deducting underwriting discounts and commissions and estimated offering expenses payable by us. |

| As of September 30, 2019 |

||||||||

| Actual | As Adjusted |

|||||||

| ($ in thousands, except share and per share data) |

||||||||

| Cash and cash equivalents |

$ | 15,268 | $ | |||||

|

|

|

|

|

|||||

| Short-term marketable securities |

$ | 36,147 | $ | |||||

|

|

|

|

|

|||||

| Long term debt, including current portion |

$ | 3,602 | $ | |||||

| Shareholders’ equity: |

||||||||

| Common stock, $0.001 par value per share; 150,000,000 authorized; 36,954,510 issued and outstanding, actual; shares issued and outstanding, as adjusted |

37 | |||||||

| Preferred stock, $0.001 par value per share, 2,000,000 authorized; none issued and outstanding, actual; shares issued and outstanding, as adjusted |

— | |||||||

| Additional paid-in-capital |

201,203 | |||||||

| Accumulated other comprehensive income |

20 | |||||||

| Accumulated deficit |

(148,244 | ) | ||||||

|

|

|

|

|

|||||

| Total shareholders’ equity |

53,016 | |||||||

|

|

|

|

|

|||||

| Total capitalization |

$ | 56,618 | $ | |||||

The table above excludes:

| ∎ | 4,599,243 shares issuable upon the exercise of outstanding stock options issued pursuant to our 2018 Equity Incentive Plan, or the 2018 Plan, at a weighted average exercise price of $6.09 per share, as of September 30, 2019; |

| ∎ | 8,636 shares of common stock reserved for issuance under the Amended and Restated 2004 Employee Stock Purchase Plan as of September 30, 2019; |

| ∎ | 962,394 shares of common stock reserved for issuance under the 2018 Plan as of September 30, 2019; |

| ∎ | 3,521,731 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2019; and |

| ∎ | 1,666,666 shares of common stock issued to Vertex on November 18, 2019, pursuant to its equity investment in MTEM as part of our collaboration and $38.0 million of upfront payments from Vertex to us, consisting of the $15.0 million in proceeds from this equity investment and a $23.0 million upfront cash payment. |

The above also assumes the following:

| ∎ | no exercise by the underwriters in this offering of their option to purchase additional shares; and |

| ∎ | no exercise of outstanding options described above. |

S-11

Table of Contents

If you invest in our securities in this offering, your ownership interest will be diluted to the extent of the difference between the price per share you pay in this offering and the net tangible book value per share of our common stock immediately after this offering. The net tangible book value of our common stock as of September 30, 2019 was approximately $47,250,000 million, or approximately $1.28 per share of common stock based upon 36,954,510 shares outstanding as of September 30, 2019. Net tangible book value per share is equal to our total tangible assets, less our total liabilities, divided by the total number of shares outstanding. This discussion assumes that all purchasers in this offering elect to purchase common stock or to convert their shares of Series A Preferred Stock into common stock.

After giving effect to the sale by us of shares of common stock at the public offering price of $ per share and shares of Series A Preferred Stock at the public offering price of $ per share, and after deducting underwriting discounts and commissions and estimated offering expenses payable by us, our net tangible book value as of September 30, 2019 would have been approximately $ million, or $ per share of common stock. This amount represents an immediate increase in net tangible book value of $ per share to existing stockholders and an immediate dilution of $ per share to purchasers in this offering. The following table illustrates the dilution:

| Public offering price per share of preferred stock |

$ | |||||||

| Public offering price per share of common stock |

$ | |||||||

| Net tangible book value per share as of September 30, 2019 |

$ | 1.28 | ||||||

| Increase per share attributable to new investors |

$ | |||||||

|

|

|

|||||||

| As adjusted net tangible book value per share as of September 30, 2019, after giving effect to this offering |

$ | |||||||

|

|

|

|||||||

| Dilution per share to new investors purchasing shares in this offering |

$ | |||||||

|

|

|

The number of shares of common stock expected to be outstanding after this offering and, unless otherwise indicated, the information in this prospectus supplement are based on 36,954,510 shares of common stock outstanding as of September 30, 2019, and excludes:

| ∎ | 4,599,243 shares issuable upon the exercise of outstanding stock options issued pursuant to our 2018 Equity Incentive Plan, or the 2018 Plan, at a weighted average exercise price of $6.09 per share, as of September 30, 2019; |

| ∎ | 8,636 shares of common stock reserved for issuance under the Amended and Restated 2004 Employee Stock Purchase Plan as of September 30, 2019; |

| ∎ | 962,394 shares of common stock reserved for issuance under the 2018 Plan as of September 30, 2019; |

| ∎ | 3,521,731 shares of common stock issuable upon the exercise of warrants outstanding as of September 30, 2019; and |

| ∎ | 1,666,666 shares of common stock issued to Vertex on November 18, 2019, pursuant to its equity investment in MTEM as part of our collaboration and $38.0 million of upfront payments from Vertex to us, consisting of the $15.0 million in proceeds from this equity investment and a $23.0 million upfront cash payment. |

The above also assumes the following:

| ∎ | no exercise by the underwriters in this offering of their option to purchase additional shares; and |

| ∎ | no exercise of outstanding options described above. |

S-12

Table of Contents

If the underwriters exercise their option to purchase shares of common stock in full, the as adjusted net tangible book value after this offering would be approximately $ per share, representing an increase in net tangible book value of approximately $ per share to existing stockholders and immediate dilution in net tangible book value of approximately $ per share to investors purchasing our common stock in this offering at the public offering price.

Certain of our existing stockholders and their affiliated entities, including affiliates of our directors, have indicated an interest in purchasing up to an aggregate of approximately $15.0 million of our shares of common stock in this offering at the public offering price. However, because indications of interest are not binding agreements or commitments to purchase, the underwriters could determine to sell more, less or no shares of common stock to any of these existing stockholders and their affiliated entities, and any of these existing stockholders and affiliated entities could determine to purchase more, less or no shares of common stock in this offering.

S-13

Table of Contents

DESCRIPTION OF SERIES A PREFERRED STOCK

Series A Preferred Stock

General. Our board of directors has designated of the 2,000,000 authorized shares of preferred stock as Series A Convertible Preferred Stock, or the Series A Preferred Stock.

Rank. The shares of Series A Preferred Stock rank:

| ∎ | senior to all of our common stock; |

| ∎ | senior to any class or series of our capital stock hereafter created specifically ranking by its terms junior to the Series A Preferred Stock; |

| ∎ | on parity to any class or series of our capital stock hereafter created specifically ranking by its terms on parity with the Series A Preferred Stock; and |

| ∎ | junior to any class or series of our capital stock hereafter created specifically ranking by its terms senior to the Series A Preferred Stock; |

in each case, as to distributions of assets upon our liquidation, dissolution or winding up whether voluntarily or involuntarily and/or the right to receive dividends.

Conversion. Each share of the Series A Preferred Stock is convertible into 1,000 shares of our common stock (subject to adjustment as provided in the certificate of designation for our Series A Preferred Stock, or the Series A Certificate of Designation) at any time at the option of the holder, provided that the holder is prohibited from converting Series A Preferred Stock into shares of our common stock if, as a result of such conversion, the holder, together with its affiliates and any other persons whose beneficial ownership of our common stock would be aggregated with such holder’s for purposes of Section 13(d) or Section 16 of the Exchange Act, and the applicable regulations of the SEC, would own more than 9.99% of the total number of shares of our common stock then issued and outstanding. The holder of such shares of Series A Preferred Stock can, upon 61 days’ notice to us, change this requirement to a higher or lower percentage, not to exceed 9.99% of the number of shares of our common stock outstanding immediately after giving effect to such conversion. At any time following notice of a Fundamental Transaction (as defined in the Series A Certificate of Designation), the holder of such shares of Series A Preferred Stock may waive and/or change the 9.99% ownership limitation effective immediately upon written notice to us.

Liquidation Preference. Each holder of shares of Series A Preferred Stock is entitled to receive, in preference to any distributions of any of the assets or surplus funds of the Company to the holders of our common stock and any of our securities that by their terms are junior to the Series A Preferred Stock and pari passu with any distribution to the holders of any securities having (by their terms) parity with the Series A Preferred Stock, an amount equal to $0.001 per share of Series A Preferred Stock, plus an additional amount equal to any dividends declared but unpaid on such shares, before any payments shall be made or any assets distributed to holders of any class of common stock or any of our securities that by their terms are junior to the Series A Preferred Stock. If, upon any such liquidation, dissolution or winding up of the Company, the assets of the Company shall be insufficient to pay the holders of shares of the Series A Preferred Stock the amount required under the preceding sentence, then all remaining assets of the Company shall be distributed ratably to holders of the shares of the Series A Preferred Stock and any securities having (by their terms) parity with the Series A Preferred Stock. After such preferential payment, each holder of shares of Series A Preferred Stock shall be entitled to participate pari passu with the holders of common stock (on an as-converted basis, without regard to the 9.99% beneficial ownership limitation) and any securities having (by their terms) parity with the Series A Preferred Stock, in the remaining distribution of the net assets of the Company available for distribution.

S-14

Table of Contents

Voting Rights. Shares of Series A Preferred Stock generally have no voting rights, except as required by law and except that the consent of the holders of the outstanding Series A Preferred Stock is required to amend the terms of the Series A Preferred Stock.

Dividends. Shares of Series A Preferred Stock are entitled to receive any dividends payable to holders of our common stock.

Redemption. We are not obligated to redeem or repurchase any shares of Series A Preferred Stock. Shares of Series A Preferred Stock are not entitled to any redemption rights or mandatory sinking fund or analogous fund provisions.

Listing. Our Series A Preferred Stock is not currently listed on any securities exchange or other trading system. We expect the common stock issuable upon conversion of the Series A Preferred Stock to be listed on The Nasdaq Capital Market.

S-15

Table of Contents

MATERIAL U.S. FEDERAL TAX CONSIDERATIONS FOR NON-U.S. HOLDERS

The following discussion is a summary of the material U.S. federal income tax considerations applicable to non-U.S. holders (as defined below) with respect to their ownership and disposition of shares of our common stock or Series A Preferred Stock issued pursuant to this offering. For purposes of this discussion, a non-U.S. holder means a beneficial owner of our common stock that is for U.S. federal income tax purposes:

| ∎ | a non-resident alien individual; |

| ∎ | a foreign corporation or any other foreign organization taxable as a corporation for U.S. federal income tax purposes; |

| ∎ | a foreign estate, the income of which is not subject to U.S. federal income tax on a net income basis; or |

| ∎ | a trust, (A) that does not have a valid election in effect under applicable U.S. Treasury regulations to be treated as a United States Person, and (B) either (i) which is not subject to the primary supervision of a court within the United States, or (ii) for which one or more United States persons do not have the authority to control all substantial decisions. |

This discussion does not address the tax treatment of partnerships or other entities that are pass-through entities for U.S. federal income tax purposes or persons that hold their common stock through partnerships or other pass-through entities. A partner in a partnership or other pass-through entity that will hold our common stock or Series A Preferred Stock should consult his, her or its own tax advisor regarding the tax consequences of acquiring, holding and disposing of our common stock through a partnership or other pass-through entity, as applicable.

This discussion is based on current provisions of the U.S. Internal Revenue Code of 1986, as amended, which we refer to as the Code, existing and proposed U.S. Treasury Regulations promulgated thereunder, current administrative rulings and judicial decisions, all as in effect as of the date of this prospectus and, all of which are subject to change or to differing interpretation, possibly with retroactive effect. Any such change or differing interpretation could alter the tax consequences to non-U.S. holders described in this prospectus. There can be no assurance that the Internal Revenue Service, which we refer to as the IRS, will not challenge one or more of the tax consequences described herein. We assume in this discussion that a non-U.S. holder holds shares of our common stock or Series A Preferred Stock as a capital asset, generally held for investment purposes.

This discussion does not address all aspects of U.S. federal income that may be relevant to a particular non-U.S. holder in light of that non-U.S. holder’s individual circumstances nor does it address any aspects of any U.S. state, local or non-U.S. taxes, the alternative minimum tax, any tax considerations resulting from a non-U.S. holder having a functional currency other than the U.S. dollar, the Medicare tax on net investment income; or any other U.S. federal tax other than the income tax. This discussion also does not consider any specific facts or circumstances that may apply to a non-U.S. holder and does not address the special tax rules applicable to particular non-U.S. holders, such as:

| ∎ | insurance companies; |

| ∎ | tax exempt or governmental organizations; |

| ∎ | financial institutions; |

| ∎ | brokers or dealers in securities; |

| ∎ | regulated investment companies; |

| ∎ | pension plans; |

S-16

Table of Contents

| ∎ | “controlled foreign corporations,” “passive foreign investment companies,” and corporations that accumulate earnings to avoid U.S. federal income tax; |

| ∎ | “qualified foreign pension funds,” or entities wholly owned by a “qualified foreign pension fund”; |

| ∎ | persons deemed to sell our common stock or Series A Preferred Stock under the constructive sale provisions of the Code; |

| ∎ | persons that hold our common stock or Series A Preferred Stock as part of a straddle, hedge, conversion transaction, synthetic security or other integrated investment; |

| ∎ | persons who hold or receive our common stock or Series A Preferred Stock pursuant to the exercise of any employee stock option or otherwise as compensation |

| ∎ | persons for whom common stock or Series A Preferred Stock constitutes “qualified small business stock” within the meaning of Section 1202 of the Code; and |

| ∎ | certain U.S. expatriates. |

This discussion is for general information only and is not tax advice. Accordingly, all prospective non-U.S. holders of our common stock or Series A Preferred Stock should consult their own tax advisors with respect to the U.S. federal, state, local and non-U.S. tax consequences of the purchase, ownership and disposition of our common stock or Series A Preferred Stock.

Distributions on Our Common Stock or Series A Preferred Stock

Distributions, if any, on our common stock or Series A Preferred Stock generally will constitute dividends for U.S. federal income tax purposes to the extent paid from our current or accumulated earnings and profits, as determined under U.S. federal income tax principles. If a distribution exceeds our current and accumulated earnings and profits, the excess will be treated as a tax-free return of the non-U.S. holder’s investment, up to such holder’s tax basis in the common stock or Series A Preferred Stock. Any remaining excess will be treated as capital gain, subject to the tax treatment described below in “Gain on sale, or other taxable disposition of our common stock or Series A Preferred Stock.” Any such distributions will also be subject to the discussion below under the section titled “Withholding and Information Reporting Requirements—FATCA.”

Subject to the discussion in the following two paragraphs in this section, dividends paid to a non-U.S. holder generally will be subject to withholding of U.S. federal income tax at a 30% rate or such lower rate as may be specified by an applicable income tax treaty between the United States and such holder’s country of residence.

Dividends that are treated as effectively connected with a trade or business conducted by a non-U.S. holder within the United States and, if an applicable income tax treaty so provides, that are attributable to a permanent establishment or a fixed base maintained by the non-U.S. holder within the United States, are generally exempt from the 30% withholding tax if the non-U.S. holder satisfies applicable certification and disclosure requirements. However, such U.S. effectively connected income, net of specified deductions and credits, is taxed at the same graduated U.S. federal income tax rates applicable to United States persons (as defined in the Code). Any U.S. effectively connected income received by a non-U.S. holder that is a corporation may also, under certain circumstances, be subject to an additional “branch profits tax” at a 30% rate or such lower rate as may be specified by an applicable income tax treaty between the United States and such holder’s country of residence.

A non-U.S. holder of our common stock or Series A Preferred Stock who claims the benefit of an applicable income tax treaty between the United States and such holder’s country of residence generally will be required to provide a properly executed IRS Form W-8BEN or W-8BEN-E (or successor form) and satisfy applicable certification and other requirements. Non-U.S. holders are urged to consult their tax advisors regarding their entitlement to benefits under a relevant income tax treaty. A non-U.S. holder that is eligible for a reduced rate of U.S. withholding tax under an income tax

S-17

Table of Contents

treaty may obtain a refund or credit of any excess amounts withheld by timely filing a U.S. tax return with the IRS.

Gain on Sale or Other Taxable Disposition of Our Common Stock or Series A Preferred Stock

Subject to the discussion below under “Backup Withholding and Information Reporting” and “Withholding and Information Reporting Requirements—FATCA,” a non-U.S. holder generally will not be subject to any U.S. federal income or withholding tax on any gain realized upon such holder’s sale or other taxable disposition of shares of our common stock or Series A Preferred Stock unless:

| ∎ | the gain is effectively connected with the non-U.S. holder’s conduct of a U.S. trade or business and, if an applicable income tax treaty so provides, is attributable to a permanent establishment or a fixed-base maintained by such non-U.S. holder in the United States, in which case the non-U.S. holder generally will be taxed on a net income basis at the graduated U.S. federal income tax rates applicable to United States persons (as defined in the Code) and, if the non-U.S. holder is a foreign corporation, the branch profits tax described above in “Distributions on Our Common Stock or Series A Preferred Stock” also may apply; |

| ∎ | the non-U.S. holder is a nonresident alien individual who is present in the United States for 183 days or more in the taxable year of the disposition and certain other conditions are met, in which case the non-U.S. holder will be subject to a 30% tax (or such lower rate as may be specified by an applicable income tax treaty between the United States and such holder’s country of residence) on the net gain derived from the disposition, which may be offset by certain U.S. source capital losses of the non-U.S. holder, if any (even though the individual is not considered a resident of the United States), provided that the non-U.S. holder has timely filed U.S. federal income tax returns with respect to such losses; or |

| ∎ | our common stock or Series A Preferred Stock constitutes a U.S. real property interest by reason of our status as a “U.S. real property holding corporation,” or a USRPHC, for U.S. federal income tax purposes, at any time within the shorter of the five-year period preceding the disposition or the Non-U.S. Holder’s holding period for our common stock. We believe we are not currently and do not anticipate becoming a USRPHC. However, because the determination of whether we are a USRPHC depends on the fair market value of our U.S. real property interests relative to the fair market value of our other business assets, there can be no assurance that we will not become a USRPHC in the future. Even if we become a USRPHC, however, gain arising from the sale or other taxable disposition by a Non-U.S. Holder of our common stock or Series A Preferred Stock will not be subject to U.S. federal income tax as long as our common stock is “regularly traded”, as defined by applicable Treasury Regulations, on an established securities market and such Non-U.S. Holder does not, actually or constructively, hold more than five percent of our common stock at any time during the applicable period that is specified in the Code. If the foregoing exception does not apply, then if we are or were to become a USRPHC a purchaser may be required to withhold 15% of the proceeds payable to a Non-U.S. Holder from a sale of our common stock and such Non-U.S. Holder generally will be subject to U.S. federal income tax on its net gain derived from the disposition at the graduated U.S. federal income tax rates applicable to United States persons (as defined in the Code). |

Backup Withholding and Information Reporting

We must report annually to the IRS and to each non-U.S. holder the gross amount of the distributions on our common stock paid to such holder and the tax withheld, if any, with respect to such distributions. Non-U.S. holders may have to comply with specific certification procedures to establish that the holder is not a United States person (as defined in the Code) in order to avoid backup withholding at the applicable rate, currently 24%, with respect to dividends on our common stock. Dividends paid to non-U.S. holders subject to withholding of U.S. federal income tax, as described

S-18

Table of Contents

above in “Distributions on Our Common Stock or Series A Preferred Stock,” generally will be exempt from U.S. backup withholding.

Information reporting and backup withholding will generally apply to the proceeds of a disposition of our common stock by a non-U.S. holder effected by or through the U.S. office of any broker, U.S. or foreign, unless the holder certifies its status as a non-U.S. holder and satisfies certain other requirements, or otherwise establishes an exemption. Generally, information reporting and backup withholding will not apply to a payment of disposition proceeds to a non-U.S. holder where the transaction is effected outside the United States through a non-U.S. office of a broker. However, for information reporting purposes, dispositions effected through a non-U.S. office of a broker with substantial U.S. ownership or operations generally will be treated in a manner similar to dispositions effected through a U.S. office of a broker. Non-U.S. holders should consult their own tax advisors regarding the application of the information reporting and backup withholding rules to them. Copies of information returns may be made available to the tax authorities of the country in which the non-U.S. holder resides or is incorporated under the provisions of a specific treaty or agreement. Backup withholding is not an additional tax. Any amounts withheld under the backup withholding rules from a payment to a non-U.S. holder can be refunded or credited against the non-U.S. holder’s U.S. federal income tax liability, if any, provided that an appropriate claim is filed with the IRS in a timely manner.

Withholding and Information Reporting Requirements—FATCA

The Foreign Account Tax Compliance Act, or FATCA, generally imposes a U.S. federal withholding tax at a rate of 30% on certain payments made to a foreign entity unless (i) if the foreign entity is a “foreign financial institution,” such foreign entity undertakes certain due diligence, reporting, withholding, and certification obligations, (ii) if the foreign entity is not a “foreign financial institution,” such foreign entity identifies certain of its U.S. investors, if any, or (iii) the foreign entity is otherwise exempt under FATCA.

FATCA currently applies to dividends paid on our common stock or Series A Preferred Stock. The U.S. Treasury Department recently released proposed regulations under FATCA providing for the elimination of the federal withholding tax of 30% applicable to gross proceeds of a sale or other disposition of our common stock or Series A Preferred Stock. Under these proposed U.S. Treasury Regulations (which may be relied upon by taxpayers prior to finalization), FATCA will not apply to gross proceeds from sales or other dispositions of our common stock or Series A Preferred Stock.

Non-U.S. holders should consult their tax advisors regarding the possible implications of this legislation on their investment in our securities and the entities through which they hold our securities, including, without limitation, the process and deadlines for meeting the applicable requirements to prevent the imposition of the 30% withholding tax under FATCA.

THE PRECEDING DISCUSSION OF U.S. FEDERAL TAX CONSIDERATIONS IS FOR GENERAL INFORMATION ONLY. IT IS NOT TAX ADVICE. EACH PROSPECTIVE INVESTOR SHOULD CONSULT ITS OWN TAX ADVISOR REGARDING THE PARTICULAR U.S. FEDERAL, STATE, LOCAL AND FOREIGN TAX CONSEQUENCES OF PURCHASING, HOLDING AND DISPOSING OF OUR SECURITIES, INCLUDING THE CONSEQUENCES OF ANY PROPOSED CHANGE IN APPLICABLE LAWS.

S-19

Table of Contents

We and the underwriters for the offering named below have entered into an underwriting agreement with respect to the common stock and Series A Preferred Stock being offered. Subject to the terms and conditions of the underwriting agreement, each underwriter has severally agreed to purchase from us the number of shares of our common stock and our Series A Preferred Stock set forth opposite its name below. Cowen and Company, LLC, Barclays Capital Inc. and Stifel, Nicolaus & Company, Incorporated are acting as the representatives of the underwriters.

| Underwriter |

Number of Shares of Common Stock |

Number of Shares of Series A Preferred Stock |

||||||

| Cowen and Company, LLC |

||||||||

| Barclays Capital Inc. |

||||||||

| Stifel, Nicolaus & Company, Incorporated |

||||||||

| Total |

||||||||

The underwriting agreement provides that the obligations of the underwriters are subject to certain conditions precedent and that the underwriters have agreed, severally and not jointly, to purchase all of the shares sold under the underwriting agreement if any of these shares are purchased, other than those shares covered by the overallotment option described below. If an underwriter defaults, the underwriting agreement provides that the purchase commitments of the non-defaulting underwriters may be increased or the underwriting agreement may be terminated.

We have agreed to indemnify the underwriters against specified liabilities, including liabilities under the Securities Act, and to contribute to payments the underwriters may be required to make in respect thereof.

The underwriters are offering the shares, subject to prior sale, when, as and if issued to and accepted by them, subject to approval of legal matters by their counsel and other conditions specified in the underwriting agreement. The underwriters reserve the right to withdraw, cancel or modify offers to the public and to reject orders in whole or in part.

Overallotment Option to Purchase Additional Shares. We have granted to the underwriters an option to purchase up to additional shares of common stock at the public offering price, less the underwriting discount. This option is exercisable for a period of 30 days. The underwriters may exercise this option solely for the purpose of covering overallotments, if any, made in connection with the sale of common stock offered hereby. To the extent that the underwriters exercise this option, the underwriters will purchase additional shares from us in approximately the same proportion as shown in the table above.

Discounts and Commissions. The following table shows the public offering price, underwriting discount and proceeds, before expenses to us. These amounts are shown assuming both no exercise and full exercise of the underwriters’ option to purchase additional shares.

S-20

Table of Contents

We estimate that the total expenses of the offering, excluding the underwriting discount, will be approximately $ , which includes $30,000 that we have agreed to reimburse the underwriters for certain of their expenses incurred in connection with the offering.

| Total | ||||||||||||||||

| Per Share of Common Stock |

Per Share of Series A Preferred Stock |

Without Over- Allotment |

With Over Allotment |

|||||||||||||

| Public offering price |

||||||||||||||||

| Underwriting discount |

||||||||||||||||

| Proceeds, before expenses, to us |

||||||||||||||||

The underwriters propose to offer the shares of common stock and Series A Preferred Stock to the public at the public offering price set forth on the cover of this prospectus. The underwriters may offer the shares of common stock and Series A Preferred Stock to securities dealers at the public offering price less a concession not in excess of $ per share. If all of the shares are not sold at the public offering price, the underwriters may change the offering price and other selling terms.

Discretionary Accounts. The underwriters do not intend to confirm sales of the shares to any accounts over which they have discretionary authority.