Filed Pursuant to Rule 424(b)(5)

Registration Nos. 333-249906 and 333-249906-04

PROSPECTUS

$1,500,000,000

Volkswagen Auto Lease Trust 2024-A

Issuing Entity

Central Index Key Number: 0002010414

| Volkswagen Auto Lease/Loan Underwritten

Funding, LLC Depositor Central Index Key Number: 0001182534 |

VW Credit, Inc. Sponsor and Servicer Central Index Key Number: 0000833733 |

| You should carefully read the “risk factors” beginning on page 13 of this prospectus. |

| The notes are asset backed securities. The notes will be the sole obligation of the issuing entity only and will not be obligations of or guaranteed by VW Credit, Inc., VW Credit Leasing, Ltd., Volkswagen Auto Lease/Loan Underwritten Funding, LLC or any of their affiliates. |

The following notes(1) are being offered by this prospectus:

| Principal Amount | Interest Rate | Final Scheduled

Payment Date | ||||||||

| Class A-1 Notes | $ | 258,000,000 | 5.516% | March 20, 2025 | ||||||

| Class A-2-A Notes | $ | 289,500,000 | 5.40% | December 21, 2026 | ||||||

| Class A-2-B Notes | $ | 289,500,000 | SOFR Rate + 0.47%(2) | December 21, 2026 | ||||||

| Class A-3 Notes | $ | 579,000,000 | 5.21% | June 21, 2027 | ||||||

| Class A-4 Notes | $ | 84,000,000 | 5.20% | December 20, 2028 | ||||||

| Total | $ | 1,500,000,000 | ||||||||

| Price to Public(3) | Underwriting

Discount | Proceeds

to the Depositor(4) | ||||||||

| Per Class A-1 Note | $ | 258,000,000.00 | 0.100% | 99.90000% | ||||||

| Per Class A-2-A Note | $ | 289,490,822.85 | 0.150% | 99.84683% | ||||||

| Per Class A-2-B Note | $ | 289,500,000.00 | 0.150% | 99.85000% | ||||||

| Per Class A-3 Note | $ | 578,951,479.80 | 0.220% | 99.77162% | ||||||

| Per Class A-4 Note | $ | 83,985,190.80 | 0.267% | 99.71537% | ||||||

| Total | $ | 1,499,927,493.45 | $ 2,624,580.00 | $1,497,302,913.45 | ||||||

| (1) | All or a portion of one or more classes of notes may be initially retained by the depositor or an affiliate thereof. |

| (2) | The Class A-2-B notes will accrue interest at a floating rate based on a benchmark, which initially will be the “SOFR Rate” plus a spread. If the sum of the SOFR Rate + 0.47% is less than 0.00% for any interest period, then the interest rate for the Class A-2-B notes for such interest period will be deemed to be 0.00%. For a description of how interest will be calculated on the Class A-2-B notes, see “The Notes–Payments of Interest”. For a description of how the benchmark may change in certain situations after the closing date, see “The Notes–Payments of Interest–Effect of Benchmark Transition Event”. |

| (3) | Plus accrued interest, if any, from the closing date. |

| (4) | The proceeds to the depositor exclude expenses, estimated at $1,000,000. |

| · | The notes are payable solely from the assets of the issuing entity, which consist primarily of a special unit of beneficial interest, or “SUBI”, in a pool of retail automobile leases and the related Volkswagen and Audi leased vehicles, payments due on the lease contracts, proceeds from the sale of the leased vehicles and funds on deposit in the reserve account. | |

| · | The issuing entity will pay interest and principal on the notes on the 20th day of each month, or, if the 20th is not a business day, the next business day, starting on April 22, 2024. | |

| · | Credit enhancement for the notes offered hereby will consist of (a) a reserve account with an initial deposit equal to at least 0.25% of the initial aggregate securitization value of the assets allocated to the Transaction SUBI as of the cutoff date and (b) overcollateralization in an initial amount of $244,186,117.32. | |

| · | The issuing entity will issue the notes described in the table above. The issuing entity will also issue a certificate that represents a fractional undivided interest in the issuing entity, will not bear interest, and is not being offered hereby. |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| J.P. Morgan | TD Securities | US Bancorp | Wells

Fargo Securities |

| BofA Securities | RBC Capital Markets | ||

The date of this prospectus is March 19, 2024

TABLE OF CONTENTS

Page

i

TABLE

OF CONTENTS

(continued)

Page

ii

TABLE

OF CONTENTS

(continued)

Page

iii

TABLE

OF CONTENTS

(continued)

Page

| LEGAL PROCEEDINGS | 149 | ||

| LEGAL MATTERS | 149 | ||

| INDEX OF PRINCIPAL TERMS | 150 | ||

| APPENDIX A STATIC POOL INFORMATION REGARDING CERTAIN PREVIOUS SECURITIZATIONS | A-1 | ||

| APPENDIX B ASSUMED CASHFLOWS | B-1 |

iv

The capitalized terms used in this prospectus, unless defined elsewhere in this prospectus, have the meanings set forth in the glossary at the end of this prospectus.

WHERE TO FIND INFORMATION IN THIS PROSPECTUS

This prospectus provides information about the issuing entity and the notes offered by this prospectus.

You should rely only on the information contained in this prospectus, or information expressly incorporated by reference into this prospectus, including all appendices hereto. We have not authorized anyone to provide you with other or different information. If you receive any other information, you should not rely on it. We are not offering the notes in any jurisdiction where the offer is not permitted. We do not claim that the information in this prospectus is accurate on any date other than the date stated on the front cover page.

We have started with two introductory sections in this prospectus describing the notes and the issuing entity in abbreviated form, followed by a more complete description of the terms of the offering of the notes. The introductory sections are:

| · | Summary of Terms—provides important information concerning the amounts and the payment terms of each class of notes and gives a brief introduction to the key structural features of the issuing entity; and |

| · | Risk Factors—describes briefly some of the risks to investors in the notes. |

We include cross-references in this prospectus to captions where you can find additional related information. You can find the page numbers on which these captions are located under the Table of Contents in this prospectus. You can also find a listing of the pages where the principal terms are defined under “Index of Principal Terms” beginning on page 150 of this prospectus.

If you have received a copy of this prospectus in electronic format, and if the legal prospectus delivery period has not expired, you may obtain at no cost a paper copy of this prospectus from the depositor or from the underwriters.

In this prospectus, the terms “we,” “us” and “our” refer to Volkswagen Auto Lease/Loan Underwritten Funding, LLC.

WHERE YOU CAN FIND MORE INFORMATION

Volkswagen Auto Lease/Loan Underwritten Funding, LLC, as depositor, has filed a registration statement with the Securities and Exchange Commission (the “SEC”) relating to the notes. This prospectus is a part of our registration statement. This prospectus does not contain all of the information in our registration statement. For further information, please see our registration statement and the accompanying exhibits which we have filed with the SEC. This prospectus summarizes certain contracts and/or other documents. For further information, please see the copy of the contract or other document filed as an exhibit to the registration statement. Annual reports on Form 10-K, distribution reports on Form 10-D, current reports on Form 8-K and amendments to those reports will be prepared, signed and filed with the SEC by the depositor or the servicer on behalf of the issuing entity. You can obtain copies of the registration statement free of charge upon written request to VW Credit, Inc., 1950 Opportunity Way, Suite 1500, Reston, Virginia 20190. In addition, the SEC also maintains a site on the World Wide Web at http//www.sec.gov at which users can view and download copies of reports, proxy and information statements and other information filed electronically through the EDGAR system. Our SEC filings may be located by using the SEC Central Index Key (CIK) for the depositor, 0001182534. For purposes of any electronic version of this prospectus, the preceding uniform resource locator, or URL, is an inactive textual reference only. We have taken steps to ensure that this URL was inactive at the time we created any electronic version of this prospectus.

v

The SEC allows us to “incorporate by reference” information we file with the SEC, which means that we can disclose important information to you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus. Information that we file later with the SEC will automatically update the information in this prospectus. In all cases, you should rely on the most recently filed information rather than contradictory information included in this prospectus. Information that will be incorporated by reference will be filed under the name of the issuing entity.

As a recipient of this prospectus, you may request a copy of any document we incorporate by reference, except exhibits to the documents (unless the exhibits are specifically incorporated by reference), at no cost, by writing us at Volkswagen Auto Lease/Loan Underwritten Funding, LLC, 1950 Opportunity Way, Suite 1500, Reston, Virginia 20190 or calling us at (703) 364-7000.

After the notes are issued, unaudited monthly servicing reports containing information concerning the issuing entity, the notes and the leases and leased vehicles will be prepared by VW Credit, Inc. (“VW Credit”) and sent on behalf of the issuing entity to the indenture trustee, who will forward the same to Cede & Co., as nominee of The Depository Trust Company (“DTC”).

Owners of the notes may receive the reports by submitting a written request to the indenture trustee. In the written request you must state that you are an owner of notes and you must include payment for expenses associated with the distribution of the reports. The indenture trustee will also make such reports (and, at its option, any additional files containing the same information in an alternative format) available to noteholders each month via its Internet website, which is presently located at www.sf.citidirect.com. The indenture trustee will forward a hard copy of the reports to each noteholder promptly after it becomes aware that the reports are not accessible on its Internet website. Assistance in using this Internet website may be obtained by calling the indenture trustee’s customer service desk at (888) 855-9695. The indenture trustee is obligated to notify the noteholders in writing of any changes in the address or means of access to the Internet website where the reports are accessible.

The reports do not constitute financial statements prepared in accordance with generally accepted accounting principles. VW Credit, the depositor and the issuing entity do not intend to send any of their financial reports to the beneficial owners of the notes. The issuing entity will file with the SEC all required annual reports on Form 10-K, distribution reports on Form 10-D and current reports on Form 8-K. Those reports will be filed with the SEC under the name “Volkswagen Auto Lease Trust 2024-A” and file number 333-249906-04.

EU SECURITIZATION REGULATION AND UK SECURITIZATION REGULATION

PROSPECTIVE INVESTORS SHOULD NOTE THAT ALTHOUGH VW CREDIT WILL RETAIN CREDIT RISK IN ACCORDANCE WITH REGULATION RR AS DESCRIBED IN THIS PROSPECTUS UNDER “THE SPONSOR—CREDIT RISK RETENTION”, NONE OF VW CREDIT, THE DEPOSITOR, THE UNDERWRITERS OR ANY OTHER PARTY TO THE TRANSACTION DESCRIBED IN THIS PROSPECTUS OR ANY OF THEIR RESPECTIVE AFFILIATES WILL RETAIN OR COMMIT TO RETAIN A 5% MATERIAL NET ECONOMIC INTEREST WITH RESPECT TO THIS TRANSACTION IN ACCORDANCE WITH THE EU SECURITIZATION REGULATION OR THE UK SECURITIZATION REGULATION, OR MAKES OR INTENDS TO MAKE ANY REPRESENTATION OR AGREEMENT THAT IT OR ANY OTHER PARTY IS UNDERTAKING OR WILL UNDERTAKE TO TAKE OR REFRAIN FROM TAKING ANY ACTION TO FACILITATE OR ENABLE COMPLIANCE BY EU AFFECTED INVESTORS WITH THE EU DUE DILIGENCE REQUIREMENTS, BY UK AFFECTED INVESTORS WITH THE UK DUE DILIGENCE REQUIREMENTS, OR BY ANY PERSON WITH THE REQUIREMENTS OF ANY OTHER LAW OR REGULATION NOW OR HEREAFTER IN EFFECT IN THE EUROPEAN UNION (THE “EU”), ANY EUROPEAN ECONOMIC AREA (THE “EEA”) MEMBER STATE OR THE UNITED KINGDOM (THE “UK”) IN RELATION TO RISK RETENTION, DUE DILIGENCE AND MONITORING, CREDIT GRANTING STANDARDS OR ANY OTHER CONDITIONS WITH RESPECT TO INVESTMENTS IN SECURITIZATION TRANSACTIONS. THE ARRANGEMENTS DESCRIBED IN THIS PROSPECTUS UNDER “THE SPONSOR—CREDIT RISK

vi

RETENTION” HAVE NOT BEEN STRUCTURED WITH THE OBJECTIVE OF ENSURING COMPLIANCE WITH THE REQUIREMENTS OF THE EU SECURITIZATION REGULATION OR THE UK SECURITIZATION REGULATION BY ANY PERSON. THE TRANSACTION DESCRIBED IN THIS PROSPECTUS IS STRUCTURED IN A WAY THAT IS UNLIKELY TO ALLOW AFFECTED INVESTORS TO COMPLY WITH THE APPLICABLE DUE DILIGENCE REQUIREMENTS.

FAILURE BY AN AFFECTED INVESTOR TO COMPLY WITH THE APPLICABLE DUE DILIGENCE REQUIREMENTS WITH RESPECT TO AN INVESTMENT IN THE NOTES MAY RESULT IN THE IMPOSITION OF A PENALTY REGULATORY CAPITAL CHARGE ON SUCH INVESTMENT OR OF OTHER REGULATORY SANCTIONS BY THE COMPETENT AUTHORITY OF SUCH AFFECTED INVESTOR, OR A REQUIREMENT TO TAKE CORRECTIVE ACTION.

CONSEQUENTLY THE NOTES MAY NOT BE A SUITABLE INVESTMENT FOR AN AFFECTED INVESTOR, AND THIS MAY AFFECT THE SECONDARY MARKET FOR THE NOTES.

PROSPECTIVE INVESTORS ARE RESPONSIBLE FOR ANALYZING THEIR OWN REGULATORY POSITION AND SHOULD CONSULT WITH THEIR OWN INVESTMENT AND LEGAL ADVISORS REGARDING THE APPLICATION OF THE EU SECURITIZATION REGULATION, THE UK SECURITIZATION REGULATION OR OTHER APPLICABLE REGULATIONS AND THE SUITABILITY OF THE NOTES FOR INVESTMENT.

SEE “LEGAL INVESTMENT—REQUIREMENTS FOR CERTAIN EU AND UK REGULATED INVESTORS AND AFFILIATES” IN THIS PROSPECTUS.

NOTICE TO INVESTORS: UNITED KINGDOM

THIS PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSES OF THE UK PROSPECTUS REGULATION (AS DEFINED BELOW). THIS PROSPECTUS HAS BEEN PREPARED ON THE BASIS THAT ANY OFFERS OF NOTES IN THE UK WILL BE MADE ONLY TO A PERSON OR LEGAL ENTITY QUALIFYING AS A QUALIFIED INVESTOR AS DEFINED IN ARTICLE 2 OF THE UK PROSPECTUS REGULATION (A “UK QUALIFIED INVESTOR”). ACCORDINGLY, ANY PERSON MAKING OR INTENDING TO MAKE AN OFFER IN THE UK OF NOTES WHICH ARE THE SUBJECT OF THE OFFERING CONTEMPLATED IN THIS PROSPECTUS MAY ONLY DO SO TO ONE OR MORE UK QUALIFIED INVESTORS. NONE OF THE ISSUING ENTITY, THE DEPOSITOR OR ANY OF THE UNDERWRITERS HAS AUTHORIZED, NOR DO THEY AUTHORIZE, THE MAKING OF ANY OFFER OF NOTES IN THE UK TO ANY PERSON OR LEGAL ENTITY THAT DOES NOT QUALIFY AS A UK QUALIFIED INVESTOR. THE EXPRESSION “UK PROSPECTUS REGULATION” MEANS REGULATION (EU) 2017/1129 (AS AMENDED) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (AS AMENDED, THE “EUWA”) AND AS AMENDED.

THE NOTES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE IN THE UK TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE IN THE UK TO ANY UK RETAIL INVESTOR. FOR THESE PURPOSES, A “UK RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2 OF COMMISSION DELEGATED REGULATION (EU) 2017/565 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA AND AS AMENDED; OR (II) A CUSTOMER WITHIN THE MEANING OF THE PROVISIONS OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (AS AMENDED, THE “FSMA”) AND ANY RULES OR REGULATIONS MADE UNDER THE FSMA (SUCH RULES AND REGULATIONS AS AMENDED) TO IMPLEMENT DIRECTIVE (EU) 2016/97 (AS AMENDED), WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2(1) OF REGULATION (EU) NO 600/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA AND AS AMENDED; OR (III) NOT A UK QUALIFIED INVESTOR. CONSEQUENTLY NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (AS AMENDED) AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA AND AS AMENDED (THE “UK PRIIPS REGULATION”) FOR OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE IN THE UK TO UK RETAIL INVESTORS HAS BEEN PREPARED, AND THEREFORE,

vii

OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE IN THE UK TO ANY UK RETAIL INVESTOR MAY BE UNLAWFUL UNDER THE UK PRIIPS REGULATION.

THIS PROSPECTUS MAY ONLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED IN THE UK TO (1) PERSONS HAVING PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS WHO ARE AUTHORIZED TO CARRY ON A REGULATED ACTIVITY UNDER THE FSMA OR OTHERWISE QUALIFY AS INVESTMENT PROFESSIONALS UNDER ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005, AS AMENDED (THE “ORDER”), OR (2) PERSONS WHO FALL WITHIN ARTICLE 49(2)(A)-(D) (AS HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.) OF THE ORDER OR (3) ANY OTHER PERSON TO WHOM THIS PROSPECTUS MAY OTHERWISE LAWFULLY BE COMMUNICATED OR CAUSED TO BE COMMUNICATED.

NEITHER THIS PROSPECTUS NOR THE NOTES ARE OR WILL BE AVAILABLE TO OTHER CATEGORIES OF PERSONS IN THE UK AND NO ONE IN THE UK FALLING OUTSIDE SUCH CATEGORIES IS ENTITLED TO RELY ON, AND THEY MUST NOT ACT ON, ANY INFORMATION IN THIS PROSPECTUS. THE COMMUNICATION OF THIS PROSPECTUS TO ANY PERSON IN THE UK OTHER THAN PERSONS IN THE CATEGORIES STATED ABOVE IS UNAUTHORIZED AND MAY BE UNLAWFUL.

THE CLASS A-1 NOTES HAVE NOT BEEN AND WILL NOT BE OFFERED IN THE UK OR TO UK PERSONS AND NO PROCEEDS OF THE CLASS A-1 NOTES WILL BE RECEIVED IN THE UK.

NOTICE TO INVESTORS: EUROPEAN ECONOMIC AREA

THIS PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSES OF THE EU PROSPECTUS REGULATION (AS DEFINED BELOW). THIS PROSPECTUS HAS BEEN PREPARED ON THE BASIS THAT ANY OFFERS OF NOTES IN ANY MEMBER STATE OF THE EEA (EACH, A “RELEVANT MEMBER STATE”) WILL BE MADE ONLY TO A PERSON OR LEGAL ENTITY QUALIFYING AS A QUALIFIED INVESTOR (AS DEFINED IN ARTICLE 2 OF THE EU PROSPECTUS REGULATION (AN “EU QUALIFIED INVESTOR”)). ACCORDINGLY, ANY PERSON MAKING OR INTENDING TO MAKE AN OFFER IN A RELEVANT MEMBER STATE OF NOTES WHICH ARE THE SUBJECT OF THE OFFERING CONTEMPLATED IN THIS PROSPECTUS MAY ONLY DO SO TO ONE OR MORE EU QUALIFIED INVESTORS. NONE OF THE ISSUING ENTITY, THE DEPOSITOR OR ANY OF THE UNDERWRITERS HAS AUTHORIZED, NOR DO THEY AUTHORIZE, THE MAKING OF ANY OFFER OF NOTES IN A RELEVANT MEMBER STATE TO ANY PERSON OR LEGAL ENTITY THAT DOES NOT QUALIFY AS AN EU QUALIFIED INVESTOR. THE EXPRESSION “EU PROSPECTUS REGULATION” MEANS REGULATION (EU) 2017/1129 (AS AMENDED).

THE NOTES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY EEA RETAIL INVESTOR IN A RELEVANT MEMBER STATE. FOR THESE PURPOSES, AN “EEA RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF: (I) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU (AS AMENDED, “MIFID II”); OR (II) A CUSTOMER WITHIN THE MEANING OF DIRECTIVE (EU) 2016/97 (AS AMENDED), WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN POINT (10) OF ARTICLE 4(1) OF MIFID II; OR (III) NOT AN EU QUALIFIED INVESTOR. CONSEQUENTLY NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (AS AMENDED, THE “EU PRIIPS REGULATION”) FOR OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO EEA RETAIL INVESTORS IN A RELEVANT MEMBER STATE HAS BEEN PREPARED, AND THEREFORE, OFFERING OR SELLING THE NOTES OR OTHERWISE MAKING THEM AVAILABLE TO ANY EEA RETAIL INVESTOR IN A RELEVANT MEMBER STATE MAY BE UNLAWFUL UNDER THE EU PRIIPS REGULATION.

viii

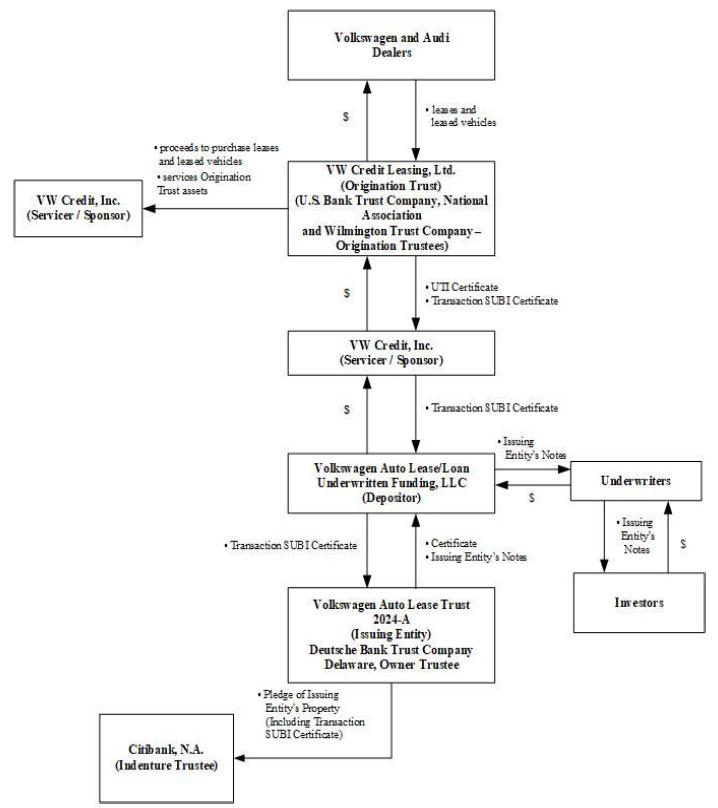

SUMMARY OF STRUCTURE AND FLOW OF FUNDS

This structural summary briefly describes certain major structural components, the relationship among the parties, the flow of funds and certain other material features of the transaction. This structural summary does not contain all of the information that you need to consider in making your investment decision. You should carefully read this entire prospectus to understand all the terms of this offering.

| · | The special unit of beneficial interest, or SUBI, represents a beneficial interest in specific Origination Trust assets. The Origination Trust assets consist of a pool of closed-end Volkswagen and Audi vehicle leases and the related Volkswagen and Audi leased vehicles. | |

| · | The UTI represents Origination Trust assets not allocated to the SUBI or any other special unit of beneficial interest similar to the SUBI and the issuing entity has no rights in the UTI, the UTI assets or the assets related to any other SUBI of the Origination Trust. |

ix

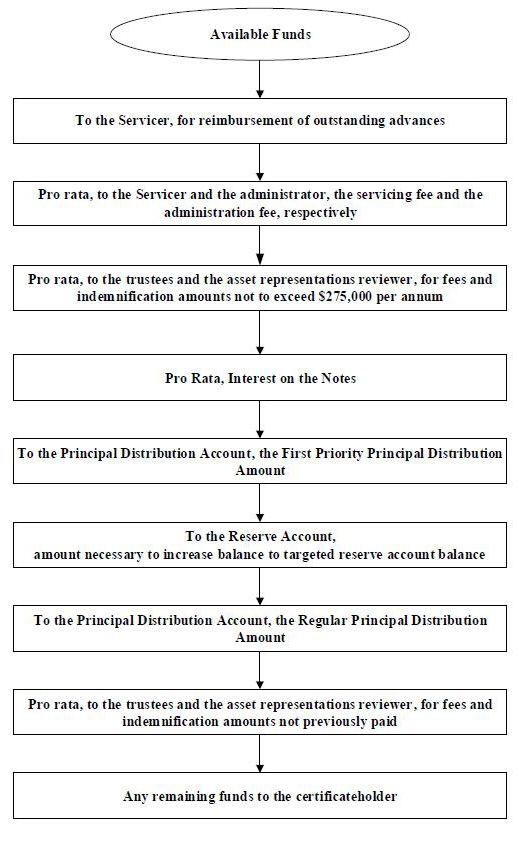

Flow of Funds*

(Prior to an Acceleration after an Indenture Default)

| * | For more information regarding priority of payments, see “Description of the Transaction Documents—Priority of Payments.” |

x

This summary highlights selected information from this prospectus and does not contain all of the information that you need to consider in making your investment decision. This summary provides an overview of certain information to aid your understanding. You should carefully read this entire prospectus to understand all of the terms of the offering.

THE PARTIES

Issuing Entity/Trust

Volkswagen Auto Lease Trust 2024-A, a Delaware statutory trust, will be the “issuing entity” of the notes. The principal asset of the issuing entity will be the beneficial interest in a pool of closed-end, retail automobile leases, the related new Volkswagen and Audi leased vehicles and related assets.

Depositor

Volkswagen Auto Lease/Loan Underwritten Funding, LLC, a Delaware limited liability company and a wholly owned special purpose subsidiary of VW Credit, is the “depositor” of the issuing entity and the seller of the beneficial interest in the pool of leases and related leased vehicles to the issuing entity. The depositor will be the initial holder of the issuing entity’s certificate, which represents the residual interest in the issuing entity.

You may contact the depositor by mail at 1950 Opportunity Way, Suite 1500, Reston, Virginia 20190, or by calling (703) 364-7000.

Servicer/Sponsor

VW Credit, Inc., a Delaware corporation, referred to as “VW Credit” or the “servicer,” will service the pool of leases and related leased vehicles owned by the origination trust and beneficially held by the issuing entity and is the “sponsor” of the transaction described in this prospectus. The servicer will be entitled to receive a servicing fee for each collection period. The “servicing fee” for any payment date will be an amount equal to the product of (1) 1.00%; (2) one-twelfth (or, in the case of the first payment date, one-sixth); and (3) the aggregate securitization value of the leases and related leased vehicles as of the first day of the related collection period (or as of the cutoff date, in the case of the first collection period). As additional compensation, the servicer will be entitled to retain all supplemental servicing fees. The servicing fee, together with any portion of the servicing fee that remains unpaid from prior payment dates, will be payable on each payment date from funds on deposit in the collection account with respect to the collection period preceding such payment date, including funds, if any,

deposited into the collection account from the reserve account.

Origination Trust

VW Credit Leasing, Ltd., a Delaware statutory trust, is the “origination trust.” Motor vehicle dealers in the Volkswagen and Audi network of dealers have assigned closed-end retail lease contracts and the related leased vehicles to the origination trust.

Administrator

VW Credit will be the “administrator” of the issuing entity, and in such capacity will provide administrative and ministerial services for the issuing entity.

Trustees

Citibank, N.A., a national banking association, will be the “indenture trustee.”

Deutsche Bank Trust Company Delaware, a Delaware banking corporation, will be the “owner trustee.”

U.S. Bank Trust Company, National Association, a national banking association, is the “UTI trustee,” “SUBI trustee” and “administrative trustee” of the origination trust.

Wilmington Trust Company, a Delaware trust company, is the “Delaware trustee” of the origination trust.

The UTI trustee, administrative trustee, SUBI trustee and Delaware trustee are each referred to in this prospectus as an “origination trustee” and, collectively, as the “origination trustees.” The indenture trustee, the owner trustee and the origination trustees are collectively referred to as the “trustees.”

Asset Representations Reviewer

Clayton Fixed Income Services LLC, a Delaware limited liability company, will be the “asset representations reviewer”.

1

THE OFFERED NOTES

The issuing entity will issue and offer the following notes:

| Class of Notes(1) | Principal Amount | Interest Rate | Final

Scheduled Payment Date | |||

| Class A-1 | $258,000,000 | 5.516% | March 20, 2025 | |||

| Class A-2-A | $289,500,000 | 5.40% | December 21, 2026 | |||

| Class A-2-B | $289,500,000 | SOFR Rate + 0.47%(2) | December 21, 2026 | |||

| Class A-3 | $579,000,000 | 5.21% | June 21, 2027 | |||

| Class A-4 | $84,000,000 | 5.20% | December 20, 2028 |

| (1) | All or a portion of one or more classes of notes may be initially retained by the depositor or an affiliate thereof. | |

| (2) | The Class A-2-B notes will accrue interest at a floating rate based on a benchmark, which initially will be the “SOFR Rate” plus a spread. If the sum of the SOFR Rate + 0.47% is less than 0.00% for any interest period, then the interest rate for the Class A-2-B notes for such interest period will be deemed to be 0.00%. For a description of how interest will be calculated on the Class A-2-B notes, see “The Notes–Payments of Interest”. However, the benchmark may change in certain situations after the closing date. For more information on the circumstances under which the benchmark may change, see “The Notes–Payments of Interest—Effect of Benchmark Transition Event”. |

The Class A-2-A notes and the Class A-2-B notes are sometimes referred to as the “Class A-2 notes.” The Class A-2-A notes rank pari passu with the Class A-2-B notes.

The interest rate for each class of notes will be a fixed rate or a combination of a fixed and floating rate if that class has both a fixed rate tranche and a floating rate tranche. For example, the Class A-2 notes are divided into fixed and floating rate tranches, and the Class A-2-A notes are the fixed rate notes and the Class A-2-B notes are the floating rate notes. We refer in this prospectus to notes that bear interest at a floating rate as “floating rate notes,” and to notes that bear interest at a fixed rate as “fixed rate notes.”

The notes are issuable in a minimum denomination of $1,000 and integral multiples of $1,000 in excess thereof.

The issuing entity will also issue a subordinated and non-interest bearing “certificate,” which represents an equity interest in the issuing entity and is not offered hereby. The certificateholder will be entitled on each payment date only to amounts remaining after payments on the notes and payments of issuing entity expenses and other required amounts on such payment date.

The issuing entity expects to issue the notes on March 27, 2024 which we refer to as the “closing date.”

PRINCIPAL AND INTEREST

The issuing entity will pay interest on the notes monthly, on the 20th day of each month (or, if that day is not a business day, on the next business day), which we refer to as the “payment date.” The first payment date is April 22, 2024. On each payment date, payments on the notes will be made to holders of record as of the close of business on the last business day preceding that payment date (except in limited circumstances where definitive notes are issued), which we refer to as the “record date.”

Interest Payments

| · | Interest on the Class A-1 notes and the Class A-2-B notes will accrue from and including the prior payment date (or, with respect to the first payment date, from and including the closing date) to but excluding the related payment date. |

| · | Interest on the Class A-2-A notes, the Class A-3 notes and the Class A-4 notes will accrue from and including the 20th day of the calendar month preceding each payment date (or, with respect to the first payment date, from and including the closing date) to but excluding the 20th day of the month in which such payment date occurs. |

| · | Interest accrued as of any payment date but not paid on that payment date will be payable on the next payment date, together with interest on such amount at the applicable interest rate (to the extent permitted by law). |

| · | The issuing entity will pay interest on the Class A-1 notes and the Class A-2-B notes on the basis of the actual number of days elapsed during the period for which interest is payable but assuming a 360-day year. This means that the interest due on each payment date for the Class A-1 notes and the Class A-2-B notes will be the product of (i) the outstanding principal amount of the related class of notes, before giving effect to any payments made on that payment date, (ii) the applicable interest rate and (iii) the actual number of days from and including the previous payment date (or, in the case of the first payment date, from and including the closing date) to but excluding the current payment date divided by 360. |

| · | The issuing entity will pay interest on the Class A-2-A notes, the Class A-3 notes and the Class A-4 notes on the basis of a 360-day year consisting of twelve 30-day months. This means that the interest due on each payment date for the Class A-2-A notes, the Class A-3 notes and the Class A-4 notes will be the product of (i) the outstanding principal amount of the |

2

related class of notes before giving effect to any payments made on that payment date, (ii) the applicable interest rate and (iii) 30 (or in the case of the first payment date, the number of days from and including the closing date, to but excluding April 20, 2024 (assuming a 30-day calendar month)), divided by 360.

| · | Interest payments on all classes of notes will have the same priority. |

| · | The indenture trustee will obtain the SOFR Rate for the Class A-2-B notes using the method described under “The Notes—Payments of Interest”. If the administrator has determined prior to the relevant reference time that a benchmark transition event and its related benchmark replacement date have occurred, the administrator will determine an alternative benchmark in accordance with the benchmark replacement provisions described under “The Notes—Payments of Interest—Effect of Benchmark Transition Event.” |

| · | If the sum of the SOFR Rate and the applicable spread set forth on the front cover of this prospectus is less than 0.00% for any interest period, then the interest rate for the Class A-2-B notes for such interest period will be deemed to be 0.00%. |

Principal Payments

| · | The issuing entity will generally pay principal on the notes monthly on each payment date in accordance with the payment priorities described below under “—Priority of Payments.” |

| · | The issuing entity will make principal payments on the notes based on the amount of collections and defaults on the leases during the prior collection period. |

| · | This prospectus describes how available funds and amounts on deposit in the reserve account are allocated to principal payments of the notes. |

| · | On each payment date, prior to the acceleration of the notes following an indenture default, which is described below under “—Interest and Principal Payments after an Indenture Default,” the issuing entity will distribute funds available to pay principal of the notes in the following order of priority: |

| (1) | first, to the Class A-1 notes, until the Class A-1 notes are paid in full; |

| (2) | second, to the Class A-2 notes, pro rata among the Class A-2-A notes and Class A-2-B notes, until the Class A-2 notes are paid in full; |

| (3) | third, to the Class A-3 notes, until the Class A-3 notes are paid in full; and |

| (4) | fourth, to the Class A-4 notes, until the Class A-4 notes are paid in full. |

| · | All outstanding principal of a class of notes will be due on the related final scheduled payment date for that class. |

Interest and Principal Payments after an Indenture Default

On each payment date after an indenture default occurs and the notes are accelerated, after payment of certain amounts to the trustees, the servicer and the asset representations reviewer, interest on the notes will be paid ratably to each class of notes and principal payments of each class of notes will be made first to the Class A-1 noteholders until the Class A-1 notes are paid in full. Next, the noteholders of all other classes of notes will receive principal payments, ratably, based on the aggregate outstanding principal amount of each remaining class of notes. Payments of the foregoing amounts will be made from available funds and other amounts, including all amounts held on deposit in the reserve account. See “Description of the Transaction Documents—Priority of Payments May Change Upon an Indenture Default” in this prospectus.

If an indenture default has occurred but the notes have not been accelerated, then interest and principal payments will be made in the priority set forth above under “—Interest Payments” and “—Principal Payments.”

Optional Redemption of the Notes

The depositor will have the right at its option to exercise an “optional purchase” and to purchase the Transaction SUBI Certificate from the issuing entity on any payment date if, either before or after giving effect to any payment of principal required to be made on that payment date, the aggregate outstanding principal amount of the notes is less than or equal to 10% of the aggregate initial principal amount of the notes. If the depositor exercises this option, any notes that are outstanding at that time will be prepaid in whole at a redemption price equal to their unpaid principal amount plus accrued and unpaid interest up to but not including the date of redemption. It is expected that at the time this option becomes available to the depositor, only the Class A-3 notes and the Class A-4 notes will be outstanding.

3

Additionally, each of the notes is subject to redemption in whole, but not in part, on any payment date on which the sum of the amounts in the reserve account and the amount of available funds after payment of the amounts set forth in clauses first through fifth under “—Priority of Payments” below would be sufficient to pay in full the aggregate unpaid principal amount of all of the outstanding notes as determined by the servicer. On such payment date, (i) the indenture trustee upon written direction from the servicer shall transfer all amounts on deposit in the reserve account to the collection account and (ii) the outstanding notes shall be redeemed in whole, but not in part.

Notice of redemption under the indenture must be given by the indenture trustee not later than 10 days prior to the applicable redemption date to each holder of notes. All notices of redemption will state: (i) the redemption date; (ii) the redemption price; (iii) that payments will be made only upon presentation and surrender of those notes, and the place where those notes are to be surrendered for payment of the redemption price; (iv) that the record date otherwise applicable to that redemption date is not applicable; (v) that on the redemption date, the redemption price will become due and payable upon each note and that interest on those notes will cease to accrue from and after the redemption date; and (vi) the CUSIP number (if applicable for the notes).

INDENTURE DEFAULTS

The occurrence and continuation of any one of the following events will be an “indenture default” under the indenture:

| · | a default in the payment of any interest on any note when the same becomes due, and such default shall continue for a period of five days or more; |

| · | a default in the payment of principal of a note on the related final scheduled payment date or the redemption date; |

| · | a default in the observance or performance in any material respect of any material covenant or agreement of the issuing entity in the indenture, or any representation or warranty of the issuing entity made in the indenture or any related certificate or writing delivered pursuant to the indenture proves to have been incorrect in any material respect at the time made, which default or inaccuracy materially and adversely affects the interests of the noteholders, and the continuation of that default or inaccuracy for a period of 90 days after written notice thereof is given to the issuing entity by the indenture trustee or to the issuing entity and the indenture trustee by the holders |

| of not less than a majority of the outstanding principal amount of the notes (excluding any notes owned by the issuing entity, the depositor, the servicer (so long as VW Credit or one of its affiliates is the servicer), the administrator or any of their respective affiliates); or |

| · | the occurrence of certain events (which, if involuntary, remain unstayed for more than 90 days) of bankruptcy, insolvency, receivership or liquidation of the issuing entity; |

provided, however, that a delay in or failure of performance referred to in the first three bullet points above for a period of 120 days will not constitute an indenture default if that delay or failure was caused by force majeure or other similar occurrence.

The amount of principal required to be paid to noteholders under the indenture, however, generally will be limited to amounts available to make such payments in accordance with the priority of payments. Thus, the failure to pay principal of a class of notes due to a lack of amounts available to make such a payment will not result in the occurrence of an indenture default until the final scheduled payment date or the redemption date for that class of notes.

ISSUING ENTITY PROPERTY

The primary asset of the issuing entity will be the Transaction SUBI Certificate, which is described below, and will entitle the issuing entity to receive the monthly payments under the leases and the amounts realized from sales of the related leased vehicles.

The Leases and the Leased Vehicles

The leased vehicles allocated to the Transaction SUBI are new automobiles, minivans and sport utility vehicles titled in the name of the origination trust. The leases allocated to the Transaction SUBI are the related retail closed-end leases that were originated by Volkswagen and Audi motor vehicle dealers. The leases provide for substantially equal monthly payments that amortize an adjusted “capitalized cost” (which may exceed the manufacturer’s suggested retail price) to a stated residual value of the related leased vehicle which is established at the time of origination of the lease. The “securitization value” of each lease and the related leased vehicle will be the sum of (i) the present value (discounted at the securitization rate) of the remaining monthly payments payable under the lease and (ii) the present value (discounted at the securitization rate) of the “base residual value” of the leased vehicle, which is the lowest of (a) the residual value estimate produced by Automotive

4

Lease Guide at the time of origination of the lease without making a distinction between value adding options and non-value adding options, (b) an estimate of the expected residual value at the related maturity date produced by Automotive Lease Guide in January/February 2024 as the “mark-to-market” value, without making a distinction between value adding options and non-value adding options and (c) the stated residual value estimate established at the time the lease was originated (or if subsequently revised in connection with an extension of a lease, in accordance with customary servicing practices).

The “issuing entity property” will include the following:

| · | Transaction SUBI Certificate; |

| · | Transaction SUBI; |

| · | amounts on deposit in the accounts owned by the issuing entity and permitted investments of those amounts; |

| · | rights under certain transaction documents; and |

| · | the proceeds of any and all of the above. |

Lease Information

The statistical information in this prospectus is based on the pool of leases and leased vehicles that will be allocated to the Transaction SUBI, as of January 31, 2024, which we refer to as the “cutoff date.”

The pool of leases and the related leased vehicles described in this prospectus had the following characteristics as of the close of business on the cutoff date:

| · | an aggregate securitization value of $1,744,186,117.32, of which $906,478,055.88 (approximately 51.97%) represented the discounted base residual values of the leased vehicles; |

| · | a weighted average original lease term(1) of approximately 38.69 months; and |

| · | a weighted average remaining lease term(1) of approximately 28.36 months. |

| (1) | Weighted average by securitization value. |

In connection with the offering of the notes, the depositor has performed a review of the pool of leases and leased vehicles that will be allocated to the Transaction SUBI, and certain disclosure in this prospectus relating to those

leases and leased vehicles, as described under “The Leases—Review of Pool Assets” in this prospectus.

As described in “The Sponsor—Underwriting Procedures” in this prospectus, under VW Credit’s origination process, credit applications are evaluated when received and are either automatically approved, automatically rejected or forwarded for review by a VW Credit credit analyst based on VW Credit’s electronic decisioning model. Applications that are not automatically approved are ultimately reviewed by a VW Credit credit analyst with appropriate approval authority. As of the cutoff date, 35,933 leases, having an aggregate securitization value of approximately $1,172,410,702.01 (approximately 67.22% of the aggregate securitization value as of the cutoff date) were automatically approved, while 17,294 leases, having an aggregate securitization value of approximately $571,775,415.31 (approximately 32.78% of the aggregate securitization value as of the cutoff date) were evaluated and approved by a VW Credit credit analyst with appropriate authority in accordance with VW Credit’s written underwriting guidelines. None of the leases in the pool were originated with exceptions to VW Credit’s written underwriting guidelines, nor were any leases in the pool approved after being automatically rejected by the electronic decisioning model.

The Transaction SUBI Certificate

The origination trust will issue a special unit of beneficial interest, which is also called the “Transaction SUBI,” constituting a beneficial interest in the leases and the related vehicles assigned to the origination trust and allocated to a separate pool of assets related to this transaction.

The Transaction SUBI will be represented by a “Transaction SUBI Certificate” representing a beneficial interest in the origination trust relating solely to the assets included in the Transaction SUBI, which are the leases and related vehicles related to this transaction. The Transaction SUBI Certificate will be transferred by the depositor to the issuing entity on the closing date. The Transaction SUBI Certificate is not offered under this prospectus.

The Transaction SUBI Certificate will evidence a beneficial interest, not a direct ownership interest, in the related assets included in the Transaction SUBI. The Transaction SUBI Certificate will not evidence an interest in any assets of the origination trust other than those assets, and payments made on or in respect of any other origination trust assets will not be available to make payments on the notes. By holding the Transaction SUBI Certificate, the issuing entity is entitled to receive an

5

amount equal to all payments made on or in respect of the assets included in the Transaction SUBI.

For more information regarding the issuing entity’s property, you should refer to “The Transaction SUBI” and “The Leases” in this prospectus.

In addition to the purchase of the Transaction SUBI from the issuing entity in connection with the depositor’s exercise of its “optional purchase” option as described above under “—Principal and Interest—Optional Redemption of the Notes,” the beneficial interest in any affected leases and related leased vehicles must be purchased from the issuing entity by VW Credit, in connection with the breach of certain representations and warranties concerning the characteristics of the leases and leased vehicles, and by the servicer, in connection with the breach of certain servicing covenants or in connection with the grant of a postmaturity term extension with respect to a lease, as described under “The Leases—Representations, Warranties and Covenants” in this prospectus.

LEASE REPRESENTATIONS AND WARRANTIES

In the SUBI sale agreement, VW Credit will make representations and warranties to the depositor regarding the characteristics of each lease as of the cutoff date. On the closing date, the depositor will assign all of its rights under the SUBI sale agreement to the issuing entity. Breach of these representations and warranties may, subject to certain conditions, result in VW Credit being obligated to cause the applicable lease and related leased vehicle to be reallocated to the UTI, and to deposit a corresponding repurchase payment into the collection account. Any inaccuracy in the representations or warranties will be deemed not to have a material and adverse effect if such inaccuracy does not affect the ability of the issuing entity to receive or retain payment in full on the beneficial interest in the applicable lease and related leased vehicle. See “The Leases—Representations, Warranties and Covenants.” If the issuing entity, the indenture trustee or the owner trustee requests that VW Credit repurchase and reallocate any lease and related leased vehicle due to a breach of a representation or warranty as described above, and the repurchase request has not been fulfilled to the reasonable satisfaction of the requesting party within 180 days of the receipt of notice of the request by VW Credit, the requesting party will have the right to refer the matter, at its discretion, to either mediation or third party arbitration, as applicable, as described under “Description of the Transaction Documents—Requests to Repurchase and Dispute Resolution.”

As more fully described in “Description of the Transaction Documents—Asset Representations Review,” if the aggregate amount of delinquent leases exceeds a specified threshold then, subject to certain conditions, noteholders representing at least a majority of the voting noteholders may direct the asset representations reviewer to perform a review of the specified delinquent leases for compliance with the representations and warranties made by VW Credit. See “Description of the Transaction Documents—Asset Representations Review” in this prospectus.

PRIORITY OF PAYMENTS

On each payment date, except after the acceleration of the notes following an indenture default, the indenture trustee will make the following payments and deposits from available funds in the collection account (including funds, if any, deposited into the collection account from the reserve account) in the following amounts and order of priority:

| · | first, to the servicer, the sum of all outstanding advances made by the servicer prior to that payment date; |

| · | second, pro rata, to the servicer and the administrator, the servicing fee and administration fee, respectively, together with any unpaid servicing fees and administration fees in respect of one or more prior collections periods, respectively; |

| · | third, pro rata, to the indenture trustee, the SUBI trustee, the owner trustee and the asset representations reviewer, required fees and indemnification amounts due and owing under the transaction documents which have not been previously paid, provided, that the amounts payable pursuant to this clause will be limited to $275,000 per annum in the aggregate; |

| · | fourth, pro rata, to the noteholders, to pay interest due on the outstanding notes on that payment date (including overdue interest), and, to the extent permitted under applicable law, interest on any overdue interest at the applicable interest rate; |

| · | fifth, to the principal distribution account, the “first priority principal distribution amount,” which will be an amount not less than zero, equal to the excess of: (x) the aggregate outstanding principal amount of the notes as of the preceding payment date (after giving effect to any principal payments made on the notes on that preceding payment date), over (y) the aggregate securitization value of the leases and leased vehicles allocated to the Transaction SUBI as |

6

| of the last day of the related collection period, which amount will be allocated to pay principal on the notes in the amounts and order of priority described under “The Notes—Payments of Principal”; |

| · | sixth, to the reserve account, any additional amounts required to increase the amount on deposit in the reserve account up to the targeted reserve account balance, as defined in “—Credit Enhancement—Reserve Account” below; |

| · | seventh, to the principal distribution account, the “regular principal distribution amount,” which will be an amount not less than zero equal to the excess of: |

(i) the aggregate outstanding principal amount of the notes as of the preceding payment date (after giving effect to any principal payments made on the notes on that preceding payment date) over

| (ii) | the difference between |

| (1) | the aggregate securitization value of the leases and leased vehicles allocated to the Transaction SUBI as of the last day of the related collection period, and |

| (2) | the targeted overcollateralization amount; provided, that this amount will be reduced by any amounts previously deposited in the principal distribution account in accordance with the fifth clause above; |

| · | eighth, pro rata, to pay any required fees or indemnification amounts due to the indenture trustee, the SUBI trustee, the owner trustee and the asset representations reviewer pursuant to clause third above to the extent not paid in such clause; and |

| · | ninth, any remaining funds will be distributed to or at the direction of the holder of the issuing entity’s certificate (which initially will be the depositor). |

The final distribution to any noteholder will be made only upon surrender and cancellation of its notes at an office or agency of the indenture trustee specified in a notice from the indenture trustee, in the name of and on behalf of the issuing entity. If any notes are not surrendered for cancellation, any funds held by the indenture trustee or any paying agent for the payment of any amount due with respect to any note after the indenture trustee has taken certain measures to locate the related noteholders and those measures have failed, will be distributed to the holder of the issuing entity’s certificate.

Amounts deposited in the principal distribution account will be paid to the noteholders of the notes as described above under “Principal and Interest—Principal Payments” and in “The Notes—Payments of Principal” in this prospectus.

For a description of the priority of payments following an indenture default and an acceleration of the notes, see “Description of the Transaction Documents—Priority of Payments May Change Upon an Indenture Default.”

CREDIT ENHANCEMENT

The credit enhancement provides protection for the notes against losses and delays in payment or other shortfalls of cash flow. The credit enhancement for the notes will be overcollateralization and the reserve account.

If the credit enhancement is not sufficient to cover all amounts payable on the notes, notes having a later scheduled final maturity date generally will bear a greater risk of loss than notes having an earlier final scheduled maturity date. See also “Description of the Transaction Documents—Priority of Payments” in this prospectus.

Reserve Account

As a source of credit enhancement, the issuing entity will establish a reserve account in the name of the indenture trustee. The reserve account will be fully funded on the closing date with a deposit equal to at least 0.25% of the initial aggregate securitization value of the assets allocated to the Transaction SUBI as of the cutoff date. We refer to the amount deposited to the reserve account on the closing date as the “targeted reserve account balance.”

On each payment date, any excess collections remaining after required interest and certain principal payments on the notes and various other obligations and expenses of the issuing entity have been paid will be deposited into the reserve account if the funds in the reserve account are less than the targeted reserve account balance.

On each payment date, after all appropriate deposits and withdrawals are made to and from the reserve account, the indenture trustee will distribute any amounts on deposit in the reserve account in excess of the targeted reserve account balance to or at the direction of the holder of the issuing entity’s certificate.

Available amounts in the reserve account on each payment date (including investment income earned on those amounts) will be distributed to cover shortfalls, if any, in the amount available to make the payments in

7

clauses first through fifth under “—Priority of Payments” above.

For more information regarding the reserve account, you should refer to “Description of the Transaction Documents—The Accounts—The Reserve Account” in this prospectus.

Overcollateralization

Overcollateralization is the amount by which the aggregate securitization value of the assets allocated to the Transaction SUBI exceeds the aggregate outstanding principal amount of the notes. Overcollateralization means that there will be additional assets generating collections that will be available to cover credit losses and residual losses on the leases and related leased vehicles allocated to the Transaction SUBI. The initial amount of overcollateralization will be $244,186,117.32, or 14.00% of the initial aggregate securitization value of the Transaction SUBI assets as of the cutoff date.

TAX STATUS

On the closing date, Mayer Brown LLP, special federal tax counsel to the depositor, will deliver an opinion, subject to the assumptions and qualifications therein, to the effect that (i) for U.S. federal income tax purposes, the issuing entity will not be classified as an association (or publicly traded partnership) taxable as a corporation and (ii) the notes (other than notes, if any, owned by: (A) the issuing entity or a person considered to be the same person as the issuing entity for U.S. federal income tax purposes, (B) a member of an expanded group (as defined in Treasury Regulation section 1.385-1(c)(4) or any successor regulation then in effect) that includes the issuing entity (or a person considered to be the same person as the issuing entity for U.S. federal income tax purposes), (C) a “controlled partnership” (as defined in Treasury Regulation Section 1.385-1(c)(1) or any successor regulation then in effect) of such expanded group or (D) a disregarded entity owned directly or indirectly by a person described in preceding clause (B) or (C)) will be characterized as indebtedness for U.S. federal income tax purposes.

Each holder of a note, by acceptance of a note, will agree to treat the note as indebtedness for federal, state and local income and franchise tax purposes.

We encourage you to consult your own tax advisor regarding the U.S. federal income tax consequences of the purchase, ownership and disposition of the notes and the tax consequences arising under the laws of any state or other taxing jurisdiction.

See “Material Federal Income Tax Consequences” in this prospectus.

CERTAIN ERISA CONSIDERATIONS

Subject to the considerations disclosed in “Certain Considerations for ERISA and Other U.S. Employee Benefit Plans” in this prospectus, the notes may be purchased by employee benefit plans and accounts. An employee benefit plan, any other retirement plan, and any entity deemed to hold “plan assets” of any employee benefit plan or other plan should consult with its counsel before purchasing the notes.

See “Certain Considerations for ERISA and Other U.S. Employee Benefit Plans” in this prospectus.

MONEY MARKET INVESTMENT

The Class A-1 notes will be structured to be “eligible securities” for purchase by money market funds as defined in paragraph (a)(11) of Rule 2a-7 under the Investment Company Act of 1940, as amended (the “Investment Company Act”). Rule 2a-7 includes additional criteria for investments by money market funds, including additional requirements and clarifications relating to portfolio credit risk analysis, maturity, liquidity and risk diversification. If you are a money market fund contemplating a purchase of Class A-1 notes, you or your advisor should review the Class A-1 notes for eligibility and consider these requirements before making a purchase.

CERTAIN INVESTMENT CONSIDERATIONS

The issuing entity is being structured so as not to constitute a “covered fund” as defined in the final regulations issued December 10, 2013 implementing the statutory provision known as the “Volcker Rule” (Section 619 of the Dodd–Frank Wall Street Reform and Consumer Protection Act).

RATINGS

The depositor expects that the notes will receive credit ratings from two nationally recognized statistical rating organizations hired by the sponsor to rate the notes (the “Hired Agencies”). Although the Hired Agencies are not contractually obligated to monitor the ratings on the notes, we believe that the Hired Agencies will continue to monitor the transaction while the notes are outstanding. The Hired Agencies’ ratings on the notes may be lowered, qualified or withdrawn at any time. In addition, a rating agency not hired by the sponsor to rate the transaction may provide an unsolicited rating that differs from (or is

8

lower than) the ratings provided by the Hired Agencies. A rating is based on each rating agency’s evaluation of the leases and the availability of any credit enhancement for the notes. A rating, or a change or withdrawal of a rating, by one rating agency will not necessarily correspond to a rating, or a change or a withdrawal of a rating, from any other rating agency.

See “Risk Factors—General Risk Factors—The ratings of the notes may be withdrawn or lowered, or the notes may receive an unsolicited rating, which may have an adverse effect on the liquidity or the market price of the notes” in this prospectus.

CREDIT RISK RETENTION

Pursuant to the SEC’s credit risk retention rules, 17 C.F.R. Part 246 (“Regulation RR”), VW Credit, as sponsor, is required to retain an economic interest in the credit risk of the leases and leased vehicles, either directly or through a majority-owned affiliate. VW Credit intends to satisfy this obligation through the retention by the depositor, its wholly-owned affiliate, of an “eligible horizontal residual interest” in an amount equal to at least 5% of the fair value, as of the closing date, of the notes and the certificate issued by the issuing entity on the closing date.

The eligible horizontal residual interest retained by the depositor will take the form of the issuing entity’s certificate. VW Credit expects the certificate to have an approximate fair value of $321,170,669, which is approximately 17.64% of the fair value, as of the closing date, of all of the notes and the certificate issued by the issuing entity on the closing date. The certificate represents 100% of the beneficial interest in the issuing entity. For a description of the valuation methodology used to calculate the fair values of the notes and the certificate and of the eligible horizontal residual interest set forth in this paragraph, see “The Sponsor—Credit Risk Retention” in this prospectus. The material terms of the notes are described in this prospectus under “The Notes,” and the material terms of the certificate are described in this prospectus under “The Issuing Entity—Capitalization and Liabilities of the Issuing Entity.”

In addition, the depositor or an affiliate thereof may retain some or all of one or more classes of notes.

The depositor may transfer all or a portion of the eligible horizontal residual interest to another majority-owned affiliate of VW Credit on or after the closing date.

The portion of the depositor’s retained economic interest that is intended to satisfy the requirements of Regulation RR will not be transferred or hedged except as permitted by applicable law.

EU SECURITIZATION REGULATION AND UK SECURITIZATION REGULATION

Although VW Credit will retain credit risk in accordance with Regulation RR as described in this prospectus under “The Sponsor—Credit Risk Retention”, none of VW Credit, the depositor, the underwriters or any other party to the transaction described in this prospectus or any of their respective affiliates (a) will retain or commit to retain a 5% material net economic interest with respect to this transaction in accordance with the EU Securitization Regulation or the UK Securitization Regulation or (b) makes or intends to make any representation or agreement that it or any other party is undertaking or will undertake to take or refrain from taking any action to facilitate or enable compliance by EU Affected Investors with the EU Due Diligence Requirements, by UK Affected Investors with the UK Due Diligence Requirements, or by any person with the requirements of any other law or regulation now or hereafter in effect in the EU, any EEA member state or the UK, in relation to risk retention, due diligence and monitoring, transparency, credit granting standards or any other conditions with respect to investments in securitization transactions. The arrangements described in this prospectus under “The Sponsor—Credit Risk Retention” have not been structured with the objective of ensuring compliance with the requirements of the EU Securitization Regulation or the UK Securitization Regulation by any person. The transaction described in this prospectus is structured in a way that is unlikely to allow Affected Investors to comply with the applicable Due Diligence Requirements.

Failure by an Affected Investor to comply with the applicable Due Diligence Requirements with respect to an investment in the notes may result in the imposition of a penalty regulatory capital charge on such investment or of other regulatory sanctions by the competent authority of such Affected Investor, or a requirement to take corrective action.

Consequently, the notes may not be a suitable investment for Affected Investors, and this may affect the price and liquidity of the notes.

Prospective investors are responsible for analyzing their own regulatory position and should consult with their own investment and legal advisors regarding the application of the EU Securitization Regulation, the UK Securitization Regulation or other applicable regulations and the suitability of the notes for investment.

For further information regarding the EU Securitization Regulation and the UK Securitization Regulation, see “Legal Investment—Requirements for Certain EU and UK Regulated Investors and Affiliates” in this prospectus.

9

REGISTRATION UNDER THE SECURITIES ACT

The depositor has filed a registration statement relating to the notes with the SEC on Form SF-3. The depositor has met the requirements for registration on Form SF-3 contained in General Instruction I.A.1 to Form SF-3.

10

SUMMARY OF RISK FACTORS

| · | A deterioration in economic conditions and certain economic factors could adversely affect the ability and willingness of lessees to meet their payment obligations under the leases, which could impact the issuing entity’s ability to make payments on your notes. No prediction or assurance can be made as to the effect of an economic downturn or economic growth on the rate of delinquencies, prepayments and/or losses on the leases, and all of these factors could result in losses on your notes. |

| · | Because of the concentration of the leases in certain states, any adverse economic conditions, natural disasters, extreme weather conditions (including an increase in the frequency of extreme weather conditions as a result of climate change), periods of civil unrest or other factors affecting these states in particular, may have a greater effect on the performance of the notes than if the concentration did not exist. |

| · | Because of the concentration of the leases to particular models, any adverse change in the value of a specific model type would reduce proceeds received at disposition, which could result in losses on your notes. |

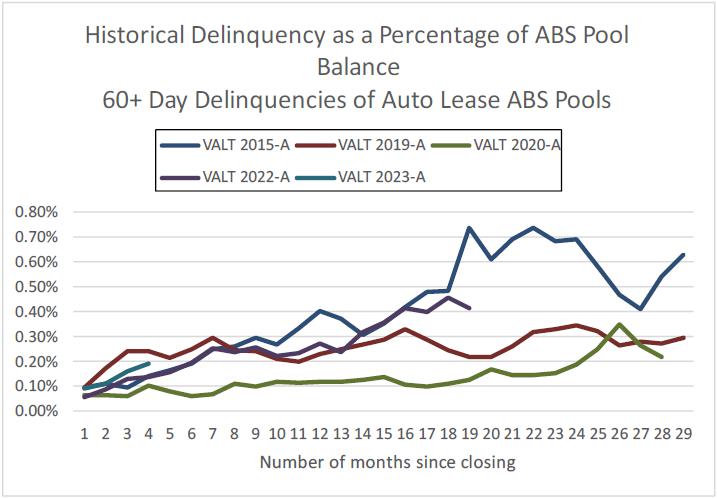

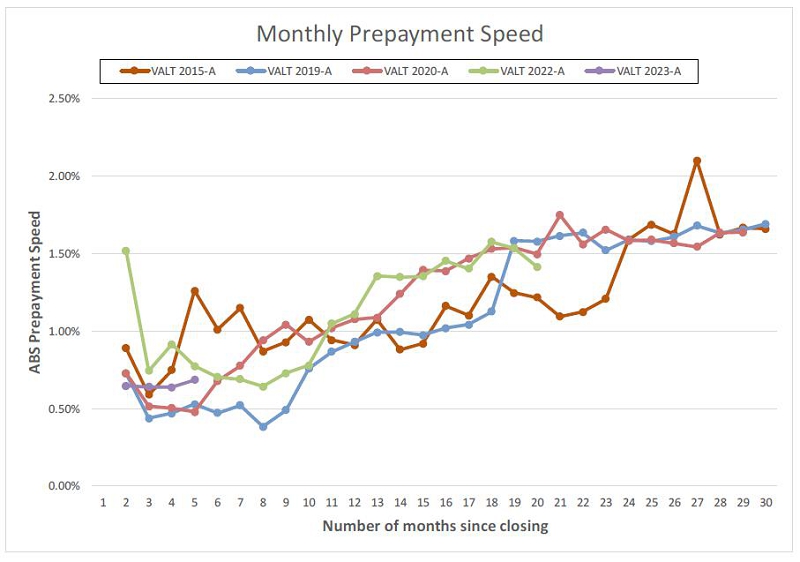

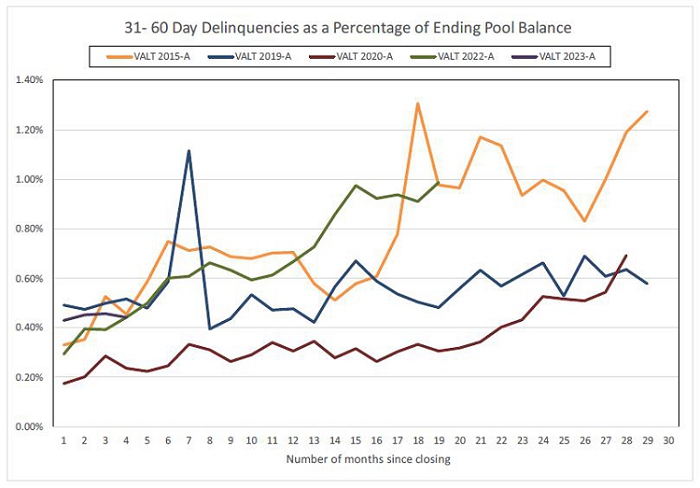

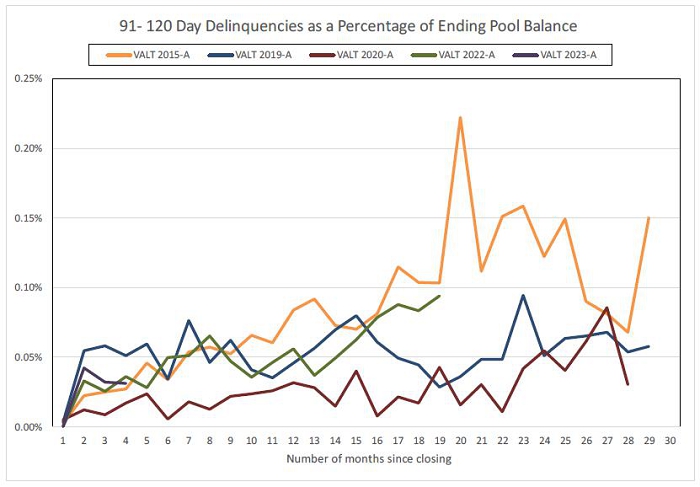

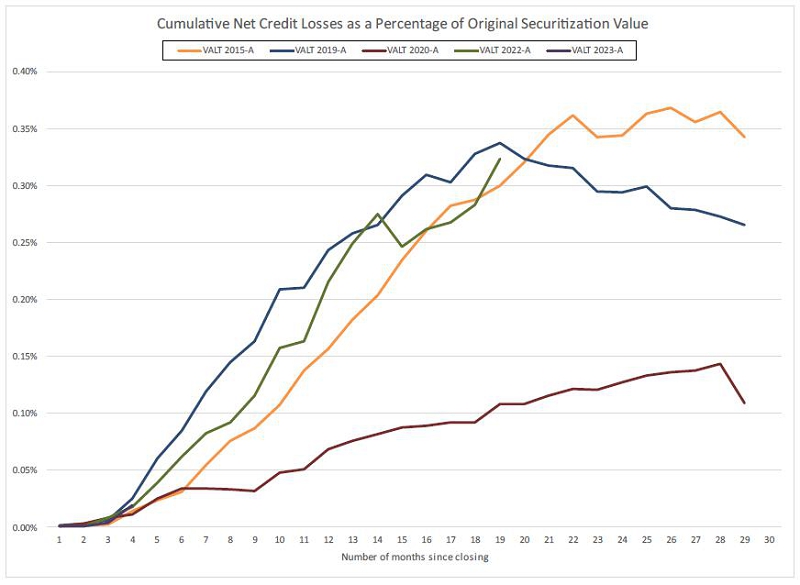

| · | The credit scores of the lessees and the historical loss and delinquency information presented in this prospectus may not accurately predict the performance of the leases, and there can be no assurance that the future delinquency or net loss experience calculated and presented in this prospectus with respect to VW Credit’s managed portfolio of leases will reflect actual experience with respect to the leases allocated to the Transaction SUBI. |

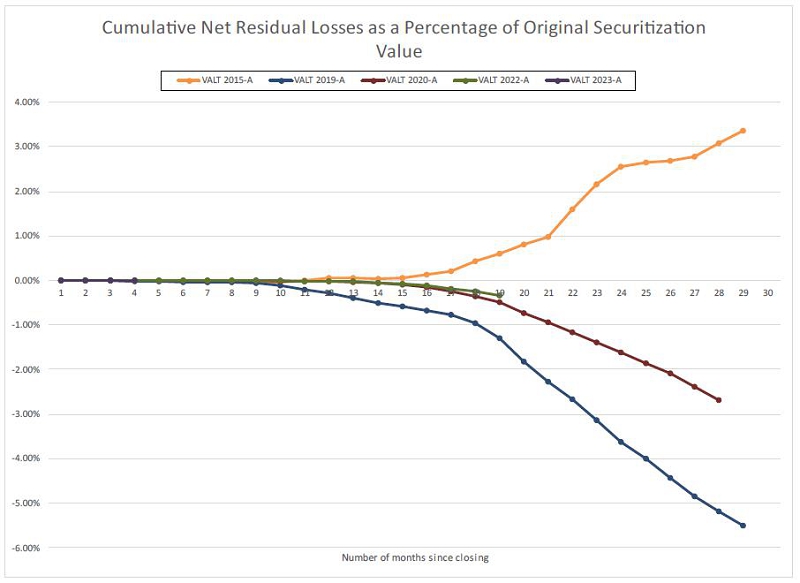

| · | The residual value of leased vehicles may be adversely affected by several factors, including discount pricing incentives, the supply of new and used vehicles, marketing incentive programs and economic developments, which may depress the prices at which off-lease vehicles may be sold. Economic factors will influence the affordability of used vehicles. All of these factors could have a negative impact on the resale value of a vehicle. As a result, the proceeds realized upon the disposition of leased vehicles may be lower than the residual values originally established by VW Credit, and you may suffer a loss on your notes. |

| · | Increased turn-in rates by lessees who decide not to purchase the related vehicles at the expiration of the related lease could result in losses on your notes. |

| · | The notes represent obligations solely of the issuing |

| entity and will not be insured or guaranteed by any entity. Accordingly, you will rely primarily upon collections on the leases and the related leased vehicles allocated to the Transaction SUBI owned by the issuing entity and amounts on deposit in the collection account and the reserve account. However, if delinquencies and losses create shortfalls which exceed the available credit enhancement, you may experience delays in payments due to you and you could suffer a loss. You will have no claim to any amounts properly distributed to the depositor or others from time to time. |

| · | Each lease requires the lessee to maintain physical damage insurance on the leased vehicle with the origination trust named as the loss payee. In the event insurance coverage is not maintained by lessees, then insurance recoveries may not be available in the event of losses or damages to leased vehicles included in the pool, and you could suffer a loss on your investment. |

| · | Vehicle recalls may have an adverse effect on the leases and your notes. |

| · | Adverse legal or regulatory developments with respect to VW Credit or its affiliates could have an adverse effect on your notes. |

| · | Adverse events with respect to VW Credit or its affiliates or third party providers to whom VW Credit outsources its activities could affect the timing of payments on your notes or have other adverse effects on your notes. |

| · | The servicer’s commingling of funds with its own funds could result in a loss. |

| · | The servicer’s discretion over the servicing of the leases may impact the amount and timing of funds available to make payments on the notes. |

| · | The servicer, on behalf of the origination trust, has contracted with a third-party to originate and maintain custody of certain contracts in electronic form. If the origination trust’s interest in such electronic contracts is not perfected by “control”, that could affect the priority of the origination trust’s interests in such leases. |

| · | The issuing entity will not have a direct ownership interest in the leases or a direct ownership interest or perfected security interest in the related leased vehicles, which will be titled in the name of the origination trust or the origination trustee on behalf of the origination trust. It is therefore possible that a claim against or lien on the leased vehicles or the other assets of the origination trust could limit the amounts payable in respect of the Transaction SUBI Certificate to less than the amounts received from the |

11

| lessees of the leased vehicles or received from the sale or other disposition of the leased vehicles. |

| · | If ERISA liens are placed on the origination trust assets, you could suffer a loss. |

| · | Following a bankruptcy or insolvency of the sponsor or the depositor, a court could conclude that the Transaction SUBI Certificate is owned by the sponsor or the depositor, instead of the issuing entity. If this were to occur, you could experience delays or losses in payments due to you. |

| · | The servicer will be required to maintain liability insurance coverage on behalf of the origination trust. In the event the servicer fails to maintain this liability insurance coverage, the deductible is not satisfied or the insurance coverage protecting the origination trust is insufficient to cover, or does not cover, a material claim, that claim could be satisfied out of the proceeds of the leased vehicles and leases allocated to the Transaction SUBI and you could incur a loss on your notes. |

| · | Federal and state financial regulatory reform could have a significant impact on the servicer, the sponsor, the depositor or the issuing entity. Compliance with the implementing regulations under the Dodd-Frank Act or the oversight of the SEC, CFPB or other government entities, as applicable, may impose costs on, create operational constraints for, or place limits on pricing with respect to finance companies such as VW Credit. These factors could adversely affect the timing and amount of payments on your notes. |

| · | The failure by the origination trust to comply with applicable law may give rise to liabilities on the part of the origination trust or the issuing entity (as owner of the Transaction SUBI). |

| · | Changes to federal or state bankruptcy or debtor relief laws may impede collection efforts or alter the timing and amount of collections, which may result in acceleration of or reduction in payment on your notes. |

| · | Retention of some or all of one or more classes of notes by the depositor or an affiliate of the depositor may reduce the liquidity of such notes. |

| · | The failure to make principal payments on any notes will generally not result in an indenture default until the applicable final scheduled payment date. |

| · | VW Credit, the servicer, the depositor and their affiliates are not obligated to make any payments to you on your notes. However, VW Credit and the depositor will make representations and warranties about certain characteristics of the leases and leased vehicles allocated to the related Transaction SUBI, a breach of which will result in certain repurchase |

| obligations under certain conditions. There can be no assurance that any entity will financially be in a position to fund its repurchase obligation. |

| · | Returns on your investments may be reduced by prepayments on the leases, default, optional redemption of the notes or reallocations of the leases and leased vehicles from the Transaction SUBI. |

| · | The use of SOFR in asset-backed securities transactions is relatively new, and there may be unanticipated problems in the use, calculation or performance of SOFR. |

| · | Uncertainty about SOFR’s differences from LIBOR, including its composition, characteristics and market acceptance, may have an adverse impact on the Class A-2-B notes. |

| · | A negative SOFR Rate (or replacement benchmark) would reduce the rate of interest on the Class A-2-B notes. |

| · | The issuing entity may issue floating rate notes, but the issuing entity will not enter into any interest rate swaps and you may suffer losses on your notes if interest rates rise. |

| · | Changes to or elimination of SOFR or the determinations made by the administrator may adversely affect the Class A-2-B notes. |

| · | Risk of loss or delay in payment may result from delays in the transfer of servicing due to the servicing fee structure. |

| · | You may experience a loss or a delay in receiving payments on the notes if the assets of the issuing entity are liquidated. |

| · | Prepayments, potential losses and a change in the order of priority of principal payments may result from an indenture default. |

| · | The absence of, or lack of liquidity in, a secondary market may limit your ability to sell your notes. |

| · | The ratings of the notes may be withdrawn or lowered, or the notes may receive an unsolicited rating, which may have an adverse effect on the liquidity or the market price of the notes. In addition, a rating agency may have a conflict of interest because the sponsor will pay the fees charged by such rating agency. |

| · | Because the notes are in book-entry form, your rights can only be exercised indirectly. |

| · | Foreign persons investing in notes could be treated as engaged in a trade or business within the United States for U.S. federal income tax purposes on account of their own activities. |

12

An investment in the notes involves significant risks. Before you decide to invest, we recommend that you carefully consider the following risk factors.

Risks Relating to Economic Conditions and Other Factors

| Recent and future economic developments may adversely affect the performance of the leases, which could result in losses on your notes. |

A deterioration in economic conditions and certain economic factors, such as reduced business activity, high unemployment, interest rates, rising or falling oil prices, housing prices, lack of available credit, the rate of inflation and consumer perceptions of the economy, as well as other factors, such as terrorist events, cyberattacks, civil unrest, public health emergencies (including COVID-19 or similar outbreaks), extreme weather conditions or political instability (such as the military conflict between Ukraine and Russia and the armed conflict in the Middle East), or significant changes in the political environment and/or public policy, or an increase of lessees’ payment obligations under other indebtedness incurred by the lessees, could adversely affect the ability and willingness of lessees to meet their payment obligations under the leases and the market value of the leased vehicles. Lessees may be unable to make timely payments or the servicer may elect to, or be required to, implement forbearance programs in connection with lessees suffering a hardship. Further, labor shortages could result in staffing problems in various industries and businesses, including industries critical to the business and operations of VW Credit and the servicing of the leases, which could adversely affect the ability of VW Credit and other transaction parties to perform their respective obligations under the transaction documents. All of the foregoing could affect the issuing entity’s ability to make payments on your notes.

The United States has in the past experienced, and in the future may experience, a recession or period of economic contraction or volatility. During the recession that resulted from the initial outbreak of COVID-19, the United States experienced an unprecedented level of unemployment claims, economic volatility, inflation, and a decline in consumer confidence and spending. The long-term impacts of social, economic and financial disruptions caused (directly and indirectly) by COVID-19 are unknown. The outlook for the U.S. economy remains uncertain, which may adversely affect the performance of the leases and the performance and market value of your notes. Periods of economic slowdown or recession are often characterized by high unemployment and diminished availability of credit, generally resulting in increases in delinquencies, defaults and losses on automobile leases and repossessions of the related leased vehicles, as well as decreased consumer demand for automobiles and reduced vehicle prices, which may increase the amount of a loss in the event of a default by a lessee. See “—Risks Relating to the Leases, the Lessees and the Related Leased Vehicles—The residual value of leased vehicles may be adversely affected by discount pricing incentives, marketing incentive programs and economic developments” below.

Further, periods of economic slowdown may also be accompanied by decreased consumer demand for automobiles, increased turn-in rates and declining market values of off-lease vehicles, which could increase the amount of a loss in the event of a default by a lessee. Significant increases in the inventory of used automobiles during periods of economic slowdown or recession may also depress the prices at which repossessed and off-lease automobiles may be sold or delay the timing of these sales. Vehicle sales |

13

and other activity in the consumer automotive market continue to be impacted by supply of new vehicles.