UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under Rule 14a-12

Filed by a Party other than the Registrant o

Check the appropriate box:

o Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

þ Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material under Rule 14a-12

CROSSTEX ENERGY, L.P.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

þ No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| 1) | Title of each class of securities to which transaction applies: | ||

| 2) | Aggregate number of securities to which transaction applies: | ||

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | ||

| 4) | Proposed maximum aggregate value of transaction: | ||

| 5) | Total fee paid: | ||

| o | Fee paid previously with preliminary materials. | |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| 1) | Amount Previously Paid: | ||

| 2) | Form, Schedule or Registration Statement No.: | ||

| 3) | Filing Party: | ||

| 4) | Date Filed: | ||

CROSSTEX ENERGY, L.P

2501 Cedar Springs Rd.

Dallas, Texas 75201

2501 Cedar Springs Rd.

Dallas, Texas 75201

NOTICE OF SPECIAL MEETING OF

UNITHOLDERS

To Be Held On May 7, 2009

To Be Held On May 7, 2009

To the Unitholders of Crosstex Energy, L.P.:

The special meeting of unitholders of Crosstex Energy, L.P., a

Delaware limited partnership (the “Partnership”), will

be held on Thursday, May 7, 2009, at 9:00 a.m., local

time, at the Company’s offices located at 2501 Cedar

Springs Rd., Dallas, Texas 75201 for the following purposes:

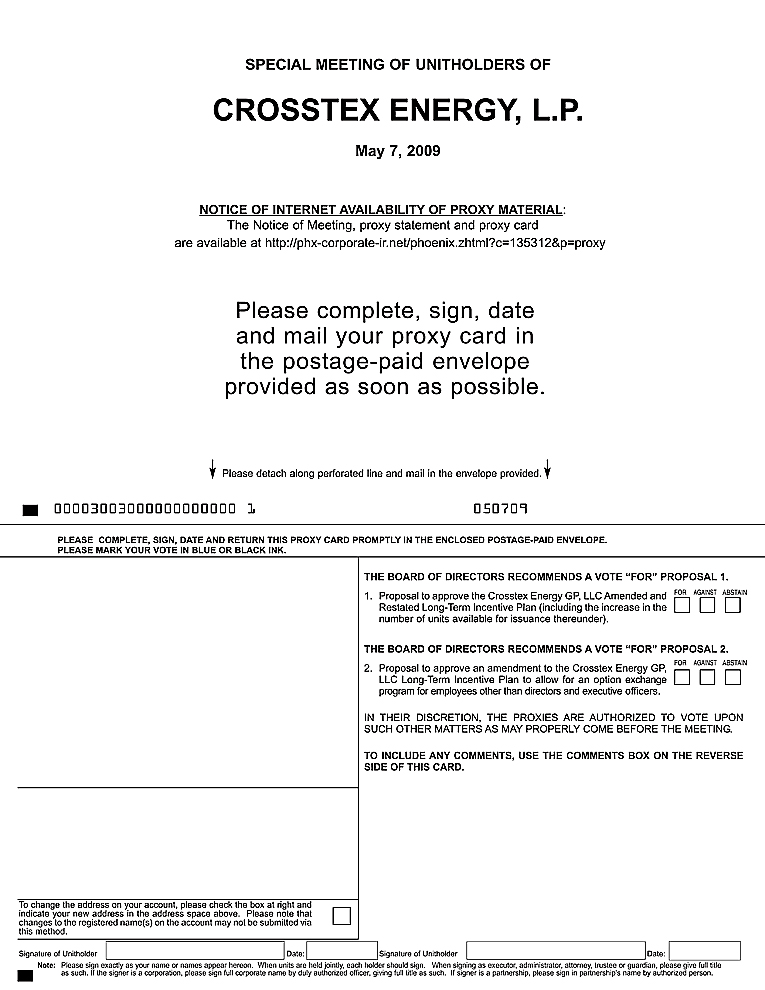

1. To consider and vote upon a proposal to approve the

Crosstex Energy GP, LLC Amended and Restated Long-Term Incentive

Plan; and

2. To consider and vote upon a proposal to approve an

amendment to the Amended and Restated Long-Term Incentive Plan

to allow for an option exchange program for employees other than

directors and executive officers, under which outstanding

options would be exchanged for a grant of fewer options at a

lower exercise price.

Your Board of Directors recommends that you vote

“FOR” the approval of the Company’s

Amended and Restated Long-Term Incentive Plan and

“FOR” the amendment to the Amended and Restated

Long-Term Incentive Plan to allow for an option exchange program

for employees, which the Board of Directors believes are

important tools to attract and retain qualified individuals who

are essential to the future success of the Partnership.

The Board of Directors of Crosstex Energy GP, LLC, the general

partner of Crosstex Energy GP, L.P., the general partner of the

Partnership (which we refer to as our Board of Directors), has

fixed the close of business on March 17, 2009 as the record

date for the determination of unitholders entitled to notice of

and to vote at the special meeting or any adjournment or

postponement thereof. Holders of record of common units

representing limited partnership interests of the Partnership

and senior subordinated Series D units representing limited

partnership interests of the Partnership at the close of

business on the record date are entitled to notice of and to

vote at the meeting.

Your vote is important. All unitholders are cordially invited to

attend the meeting. We urge you, whether or not you plan to

attend the meeting, to submit your proxy by voting over the

Internet or, if you received a paper copy of a proxy or voting

instruction card by mail, by completing, signing, dating and

mailing the proxy or voting instruction card in the postage-paid

envelope provided. If a unitholder who has submitted a proxy

attends the meeting in person, such unitholder may revoke the

proxy and vote in person on all matters submitted at the meeting.

By Order of the Board of Directors

Barry E. Davis

President and

Chief Executive Officer

President and

Chief Executive Officer

March 26, 2009

Important

Notice Regarding the Availability of Proxy Materials

for the Special Meeting of Unitholders to be Held on May 7, 2009:

for the Special Meeting of Unitholders to be Held on May 7, 2009:

This Proxy

Statement and the accompanying Special Report to Unitholders are

available at:

http://phx.corporate-ir.net/phoenix.zhtml?c=135312&p=proxy

CROSSTEX

ENERGY, L.P.

2501 Cedar Springs Rd.

Dallas, Texas 75201

2501 Cedar Springs Rd.

Dallas, Texas 75201

PROXY

STATEMENT

For

Special Meeting of Unitholders

To Be Held On May 7, 2009

To Be Held On May 7, 2009

GENERAL

These proxy materials have been made available on the Internet

or delivered in paper copy to unitholders of Crosstex Energy,

L.P. (the “Partnership”) in connection with the

solicitation by the Board of Directors of Crosstex Energy GP,

LLC, the general partner of Crosstex Energy GP, L.P., the

general partner of the Partnership (the “Board of

Directors”), of proxies for use at the special meeting of

unitholders to be held at the time and place and for the

purposes set forth in the accompanying notice. The approximate

date this proxy statement is first furnished to unitholders is

March 26, 2009. If you received a paper copy of these

materials by mail, the proxy materials also include a proxy card

or a voting instruction card for the special meeting.

Proxies

and Voting Instructions

We have elected to use the Securities and Exchange Commission

(“SEC”) rule that allows companies to furnish their

proxy materials over the Internet. As a result, we are mailing

to many of our unitholders a notice about the Internet

availability of the proxy materials instead of a paper copy of

the proxy materials. All unitholders receiving the notice will

have the ability to access the proxy materials over the Internet

and may request to receive a paper copy of the proxy materials

by mail. Instructions on how to access the proxy materials over

the Internet or to request a paper copy may be found on the

notice. In addition, the notice contains instructions on how

unitholders may request to receive proxy materials in printed

form by mail or electronically by

e-mail on an

ongoing basis. We are providing some of our unitholders,

including unitholders who have previously requested to receive

paper copies of the proxy materials, with paper copies of the

proxy materials instead of a notice about the Internet

availability of the proxy materials. All unitholders who do not

receive the notice will receive a paper copy of the proxy

materials by mail.

If you hold common units representing limited partnership

interests of the Partnership (“Common Units”) or

senior subordinated Series D units representing limited

partnership interests of the Partnership (“Series D

Units,” and together with the Common Units,

“Units”) in your name, you can submit your proxy in

the following manners:

| • | By Internet — Unitholders who received a notice about the Internet availability of the proxy materials may submit proxies over the Internet by following the instructions on the notice. Unitholders who have received a paper copy of a proxy card or voting instruction card by mail may submit proxies over the Internet by following the instructions on the proxy card or voting instruction card. | |

| • | By Mail — Unitholders who have received a paper copy of a proxy card or voting instruction card by mail may submit proxies by completing, signing and dating their proxy card or voting instruction card and mailing it in the accompanying postage paid envelope. Proxy cards must be received by us before voting begins at the special meeting. |

If you hold Units through someone else, such as a bank, broker

or other nominee, you may receive material from them asking you

how you want to vote your Units.

You may revoke your proxy at any time prior to its exercise by:

| • | Giving written notice of the revocation to our corporate secretary; | |

| • | Appearing and voting in person at the special meeting; | |

| • | Voting again by Internet before 11:59 p.m., Eastern Time, on May 6, 2009; or | |

| • | Properly submitting a later-dated proxy by delivering a later-dated proxy card to our corporate secretary. |

If you attend the special meeting in person without voting, this

will not automatically revoke your proxy. If you revoke your

proxy during the meeting, this will not affect any vote

previously taken. If you hold Units through someone else, such

as a bank, broker or other nominee, and you desire to revoke

your proxy, you should follow the instructions provided by your

nominee.

Voting

Procedures and Tabulation

We will appoint one or more inspectors of election to act at the

special meeting and to make a written report thereof. Prior to

the special meeting, the inspectors will sign an oath to perform

their duties in an impartial manner and according to the best of

their ability. The inspectors will ascertain the number of Units

outstanding and the voting power of each, determine the Units

represented at the special meeting and the validity of proxies

and ballots, count all votes and ballots and perform certain

other duties as required by law. The determination of the

inspectors as to the validity of proxies will be final and

binding.

Abstentions and broker non-votes (i.e., proxies submitted by

brokers that do not indicate a vote for a proposal because they

do not have discretionary voting authority and have not received

instructions as to how to vote on the proposal) are counted as

present in determining whether the quorum requirement for the

special meeting is satisfied. For purposes of determining the

outcome of any matter to be voted upon as to which the broker

has indicated on the proxy that the broker does not have

discretionary authority to vote, these Units will be treated as

not present at the meeting and not entitled to vote with respect

to that matter, even though those Units are considered to be

present at the meeting for quorum purposes and may be entitled

to vote on other matters. Abstentions, on the other hand, are

considered to be present at the meeting and entitled to vote on

the matter abstained from.

Crosstex Energy, Inc. (“CEI”), the owner of our

general partner, owned 16,414,830, or approximately 34%, of our

Units as of March 17, 2009 (the “CEI Units”). CEI

has stated its intention to vote the CEI Units in favor of both

proposals. Because the approval of the proposals by CEI is not

sufficient to approve the proposals, we encourage you to take

part in the decision process by voting by proxy or at the

special meeting.

VOTING

SECURITIES

Only holders of record of Common Units and Series D Units

at the close of business on March 17, 2009, the record date

for the special meeting, are entitled to notice of and to vote

at the special meeting. On the record date for the special

meeting, there were 44,961,385 Common Units and 3,875,340

Series D Units outstanding and entitled to be voted at the

special meeting, totaling 48,836,725 Units outstanding and

entitled to be voted at the special meeting. The holders of the

Units will vote together as a single class. A majority of such

Units, present in person or represented by proxy, is necessary

to constitute a quorum. Each Unit is entitled to one vote.

2

PROPOSAL ONE:

APPROVAL OF THE CROSSTEX ENERGY GP, LLC

AMENDED AND RESTATED LONG-TERM INCENTIVE PLAN

AMENDED AND RESTATED LONG-TERM INCENTIVE PLAN

General

Description of Amendment and Restatement

Our Board of Directors believes that it is important to have

equity-based incentives available to attract and retain

qualified directors, employees and independent contractors who

are essential to the success of the Partnership and its

affiliates and that it is important to link the interests and

efforts of such persons to the long-term interest of the

unitholders of the Partnership. Accordingly, in 2002, our Board

of Directors adopted the Crosstex Energy GP, LLC Long-Term

Incentive Plan (as it may be amended and restated from time to

time, the “Plan”), which has been amended and restated

since its initial adoption.

As of March 17, 2009, approximately 2,050,000 Common Units

remained available for future issuance under the Plan to

employees and directors. Therefore, on March 17, 2009,

subject to unitholder approval, our Board of Directors approved

the Amended and Restated Long-Term Incentive Plan (the

“Amended and Restated Plan”), including an increase in

the number of Common Units authorized for issuance under the

plan by 800,000 Common Units to an aggregate of 5,600,000 Common

Units, which will increase the number of Common Units available

for awards to employees, contractors and directors under the

Plan to 2,850,000 Common Units. In addition, the Plan has been

amended and restated to modify certain provisions of the Plan

and delete other provisions to make certain other administrative

and regulatory changes, including providing that all options

will be granted with an exercise price per Common Unit of no

less than fair market value per Common Unit on the date of grant

and allowing for the “net settlement” of options in

the discretion of the Compensation Committee of our Board of

Directors.

Our unitholders are being requested to approve the Amended and

Restated Plan, including the increase in the number of Common

Units authorized for issuance under the Plan, at the special

meeting.

Description

of the Plan

The following summary of the principal features of the Plan is

qualified in its entirety by the specific language of the

Amended and Restated Plan, a copy of which is attached as

Exhibit A to this proxy statement. The Amended and

Restated Plan attached as Exhibit A includes the

amendment to the Plan relating to the option exchange that is

the subject of Proposal Two below. If Proposal Two is

not approved by our unitholders but Proposal One is

approved, the amendment to the Plan adding a new

Section 6(a)(vi) described in Proposal Two will not be

included in the Amended and Restated Plan.

General

The purposes of the Plan are to promote the interests of the

Partnership by providing to employees and directors of our

general partner and its affiliates who perform services for the

Partnership incentive compensation based on Common Units, to

enhance the ability of our general partner and its affiliates to

attract and retain the services of individuals who are essential

for the growth and profitability of the Partnership and to

encourage them to devote their best efforts to the business of

the Partnership, thereby advancing the interests of the

Partnership and its partners. Awards to participants under the

Plan may be made in the form of unit options or restricted unit

awards.

Units

Subject to Plan

Under the Plan, a maximum of 4,800,000 Common Units may be

issued to participants. As of March 17, 2009, approximately

2,050,000 Common Units remained available under the Plan for

future issuance to participants.

As amended and restated, the Plan provides for the award of unit

options and restricted units (collectively “Awards”)

for up to 5,600,000 Common Units. The maximum number of Common

Units set forth above is subject to appropriate adjustment in

the event of a recapitalization of the capital structure of the

Partnership or a reorganization of the Partnership. Common Units

underlying Awards that are forfeited, terminated or expire

unexercised become immediately available for additional Awards

under the Plan.

As of March 17, 2009, the last reported sale price of

Common Units on the Nasdaq Global Select Market was $2.31.

3

Administration

and Eligibility

The Compensation Committee of our Board of Directors administers

the Plan. The administrator has the power to determine the terms

of the options or other Awards granted, including the exercise

price of the options or other Awards, the number of Common Units

subject to each option or other Award, the exercisability

thereof and the form of consideration payable upon exercise. In

addition, the administrator has the authority to grant waivers

of Plan terms, conditions, restrictions and limitations, and to

amend, suspend or terminate the Plan, provided that no such

change in any Award may materially reduce the benefit to a

participant without the consent of such participant. Awards may

be granted to employees or consultants of our general partner

and its affiliates and to outside directors serving on our Board

of Directors. As of March 17, 2009, approximately 700

individuals (of which we expect up to 650 to participate) would

be eligible for Awards under the Plan.

Awards

The Compensation Committee will determine the type or types of

Awards made under the Plan and will designate the individuals

who are to be the recipients of Awards. Each Award may be

embodied in an agreement containing such terms, conditions and

limitations as determined by the Compensation Committee. Awards

may be granted singly or in combination. Awards to participants

may also be made in combination with, in replacement of, or as

alternatives to, grants or rights under the Plan or any other

employee benefit plan of the Company. All or part of an Award

may be subject to conditions established by the Compensation

Committee, including continuous service with the Company.

The types of Awards to participants that may be made under the

Plan are as follows:

| • | Unit Options. Unit options are rights to purchase a specified number of Common Units at a specified price. Options granted pursuant to the Plan are nonqualified unit options. All options granted under the Plan must have an exercise price per unit that is not less than 100% of the fair market value of the Common Units underlying the option on the date of grant. | |

| • | Restricted Unit Awards. Unit Awards consist of restricted Common Units of the Partnership. The Compensation Committee will determine the terms, conditions and limitations applicable to any Awards of restricted unit. Rights to distributions or distribution equivalents may be extended to and made part of any Award of restricted units at the discretion of the Compensation Committee. Awards of restricted units will have a vesting period established in the sole discretion of the Compensation Committee, which may include, without limitation, accelerated vesting upon the achievement of specified performance goals. |

In the event of a “change of control” of the Company

as defined in the Plan, all Awards automatically vest and become

payable or exercisable, as the case may be, in full and all

restricted periods with respect to restricted units will

terminate and any performance criteria shall be deemed to have

been achieved at the maximum level.

Other

Provisions

Our Board may amend, alter, suspend, discontinue or terminate

the Plan in any manner without the consent of any partner,

participant, other holder or beneficiary of an Award or other

Person.

In the event of any transaction such as a merger, consolidation,

reorganization, recapitalization, separation, dividend, split,

reverse split, split up, spin-off or other distribution of

securities or property of the Partnership, the Compensation

Committee shall, in such manner as it may deem equitable, adjust

any or all of: (i) the number and type of units with

respect to which Awards may be granted under the Plan,

(ii) the number and type of units subject to outstanding

Awards and (iii) the grant or exercise price with respect

to any outstanding Awards, or if deemed appropriate, make

provision for a cash payment to the holder of an outstanding

Award; provided, that the number of units subject to any Award

shall always be a whole number.

Plan

Benefits

Because the granting of Awards under the Plan is at the

discretion of the Compensation Committee, it is not now possible

to determine which persons (including directors, officers,

employees, and consultants of our general

4

partner) may be granted Awards. Also, it is not now possible to

estimate the number of Common Units that may be awarded.

Interested

Persons

Employees of the Partnership, CEI, Crosstex Energy GP, LLC (the

general partner of our general partner) and our general partner

or any of their affiliates, as well as the non-employee members

of our Board of Directors and consultants, will be eligible to

receive awards under the Amended and Restated Plan if it is

approved. Accordingly, the members of our Board of Directors and

the executive officers of the Partnership have an interest in

the passage of Proposal One.

U.S.

Federal Income Tax Consequences

The following is a general discussion of the current Federal

income tax consequences of Awards under the Plan to participants

who are classified as United States residents for Federal income

tax purposes. Different or additional rules may apply to

participants who are subject to income tax in a foreign

jurisdiction

and/or are

subject to state or local income tax in the United States. Each

participant should rely on his or her own tax advisers regarding

Federal income tax treatment under the Plan.

Unit

Options

The grant of a nonqualified unit option will not result in

taxable income to the participant and the individual’s

employer will not be entitled to an income tax deduction. Upon

the exercise of a nonqualified unit option, a participant will

realize ordinary taxable income on the date of exercise. Such

taxable income will equal the difference between the option

price and the fair market value of the Common Units underlying

the option on the date of exercise. The entity employing the

participant will be entitled to an income tax deduction equal to

the amount included in the participant’s ordinary income.

Restricted

Units

The grant of restricted units does not result in taxable income

to the participant. At each vesting event, the participant will

recognize taxable ordinary income equal to the excess of the

fair market value of the Common Units that become vested over

the exercise price (if any) paid for such Common Units. However,

if a participant makes a timely election under

section 83(b) of the Code, the participant will recognize

taxable ordinary income in the taxable year of the grant equal

to the excess of the fair market value of the Common Units

underlying the restricted unit Award at the time of grant over

the exercise price (if any) paid for such Common Units.

Furthermore, the participant will not recognize ordinary income

on such restricted units when it subsequently vests.

In all cases, the participant’s ordinary income is subject

to applicable withholding taxes. The participant’s employer

will be allowed an income tax deduction in the taxable year the

participant recognizes ordinary income, in an amount equal to

such ordinary income.

Recommendation

and Required Affirmative Vote

The affirmative vote of the holders of a majority of our Units

outstanding as of the record date and entitled to vote at the

special meeting is required for approval of the proposal to

adopt the Amended and Restated Plan. Our Board of Directors

believes that the Amended and Restated Plan is in the best

interests of the Partnership and its unitholders.

Accordingly, our Board of Directors recommends that you vote

FOR approval of Proposal One.

5

PROPOSAL TWO:

APPROVAL OF AN AMENDMENT TO THE AMENDED AND RESTATED

LONG-TERM INCENTIVE PLAN TO ALLOW FOR AN OPTION EXCHANGE PROGRAM FOR EMPLOYEES OTHER THAN DIRECTORS AND EXECUTIVE OFFICERS

LONG-TERM INCENTIVE PLAN TO ALLOW FOR AN OPTION EXCHANGE PROGRAM FOR EMPLOYEES OTHER THAN DIRECTORS AND EXECUTIVE OFFICERS

General

Description of Option Exchange

In addition to the amendments to the Plan described in

Proposal One, we are seeking unitholder approval of an

amendment to the Plan to allow for an option exchange program.

If implemented, the exchange program would allow us to cancel

certain options currently held by some of our employees in

exchange for the grant of a lesser amount of options with lower

exercise prices. Outstanding options with an exercise price that

equal or exceed $10.00 will be eligible to be exchanged, and we

anticipate that such options will be exchanged at a ratio of one

new option for every three currently outstanding eligible

options. The exercise price threshold is designed to ensure that

only outstanding options that are substantially

“underwater” (meaning the exercise prices of the

options are greater than our current Common Unit price) are

eligible for the exchange program. The exchange ratio is

designed to minimize the difference, if any, between the fair

value of the replacement options and the fair value of the

options that are surrendered. The members of our Board of

Directors and our executive officers, which includes our named

executive officers and other senior officers, will not be

eligible to participate in the option exchange program.

Unitholder approval is required for this proposal under the

NASDAQ listing rules. If our unitholders approve this

Proposal Two, our Board of Directors intends to commence

the exchange program as soon as practicable after the special

meeting.

Overview

Our Common Unit price has experienced a significant decline

since the first half of 2008 and beginning of 2009. Global

financial markets and economic conditions have been, and

continue to be, disrupted and volatile. Numerous events during

2008 have severely restricted current liquidity in the capital

markets throughout the United States and around the world.

The ability to raise money in the debt and equity markets has

diminished significantly and, if available, the cost of funds

has increased substantially. One of the features driving

investments in master limited partnerships (“MLPs”),

including us, over the past few years has been the distribution

growth offered by MLPs due to liquidity in the financial markets

for capital investments to grow distributable cash flow through

development projects and acquisitions. Future growth

opportunities have been and are expected to continue to be

constrained by the lack of liquidity in the financial markets.

In addition, our business has been significantly impacted by the

substantial decline in crude oil and natural gas prices,

hurricanes Gustav and Ike and two fires at operating facilities

during the last half of 2008.

In response to these recent events, we adjusted our business

strategy in the fourth quarter 2008 and for 2009 to focus on

maximizing our liquidity, maintaining a stable asset base,

improving the profitability of our assets by increasing their

utilization while controlling costs and reducing our capital

expenditures. However, our efforts have not yet had a

significant impact on the trading price of our Common Units,

which remains at a relatively low level.

Consequently, our employees hold a significant number of options

to purchase Common Units with exercise prices that greatly

exceed the current market price of our Common Units. Further,

there can be no assurance that our efforts to achieve our

revised business strategy will ultimately result in significant

increases in the trading price of our Common Units in the

near-term, if at all. Thus, our Board of Directors and the

Compensation Committee believe these underwater options no

longer provide the long-term incentive and retention objectives

that they were intended to provide. Our Board of Directors and

the Compensation Committee believe the exchange program is an

important component in our strategy to align employee and

unitholder interests through our equity compensation programs.

We believe that the exchange program is important because it

will permit us to:

| • | Provide renewed incentives to our employees who participate in the exchange program. As of March 17, 2009, we had approximately 1.2 million outstanding unit options and 100% of such unit options were underwater. The weighted average exercise price of these underwater options was $30.64 as compared to a $2.31 closing price of our Common Units on March 17, 2009. As a result, these options do not currently provide meaningful retention or incentive value to our employees. We believe the exchange program will enable us to enhance long-term unitholder value by providing greater assurance that we will be able to retain |

6

| experienced and productive employees, by improving the morale of our employees generally, and by aligning the interests of our employees more fully with the interests of our unitholders. |

| • | Meaningfully reduce our total number of outstanding options, or “overhang,” represented by outstanding options that have high exercise prices and may no longer provide adequate incentives to our employees. These underwater options currently create an equity award overhang to our unitholders of approximately 1.2 million Common Units. As of March 17, 2009, the total number of Common Units outstanding was approximately 45 million. Keeping these underwater options outstanding does not serve the interests of our unitholders and does not provide the benefits intended by our Plan. By replacing the eligible options with a lesser number of options with a lower exercise price, our overhang will be decreased. | |

| • | Recapture value from compensation costs that we already are incurring with respect to outstanding underwater options. These options were granted at the then fair market value of our Common Units. Under applicable accounting rules, we will have to recognize a total of approximately $8.1 million in compensation expense related to these underwater options, $6.5 million of which has already been expensed as of December 31, 2008 and $1.6 million of which we will continue to be obligated to expense, even if these options are never exercised because the majority remain underwater. We believe it is not an efficient use of the Company’s resources to recognize compensation expense on options that are not perceived by our employees as providing value. By replacing options that have little or no retention or incentive value with options that will provide both retention and incentive value while not creating additional compensation expense (other than immaterial expense that might result from fluctuations in the trading price of our Common Units after the exchange ratio has been set but before the exchange actually occurs), we will be making efficient use of our resources. |

If our unitholders do not approve the amendment to the Plan

authorizing the exchange program, eligible options will remain

outstanding and in effect in accordance with their existing

terms. We will continue to recognize compensation expense for

these eligible options, even though the options may have little

or no retention or incentive value.

Summary

of Material Terms

If our unitholders approve the requisite amendment to our Plan,

the material terms of the exchange program will include

eligibility, the exchange ratio to be applied to eligible

options and the vesting schedule to apply to replacement options

granted pursuant to the exchange program. These terms are

summarized here and described in further detail below.

| • | The exchange program will be open to all employees, except as described below, who are employed by us as of the start of the exchange program and remain employees through the date the exchange program ends. Eligible employees will be permitted to exchange all or none of their eligible options for replacement options. | |

| • | The members of our Board of Directors and our executive officers, which includes our named executive officers and other senior officers, will not be eligible to participate in the exchange program. | |

| • | The exchange ratio of Common Units subject to eligible options surrendered in exchange for replacement options granted will be established by our Board of Directors shortly before the start of the exchange program. We anticipate that such options will be exchanged at a ratio of one new option for every three currently outstanding eligible options. | |

| • | Each replacement option will have an exercise price per Common Unit equal to the greater of (i) $3.00, (ii) 120% of the average closing price of our Common Units on the Nasdaq Global Select Market for the five trading days prior to the date of grant or (iii) the closing price of our Common Units on the date of grant of the replacement options. | |

| • | Each replacement option will have a new 10-year term. |

7

| • | None of the replacement options will be vested on the date of grant, even if the options exchanged for such replacement options were fully or partially vested. The replacement options will be scheduled to vest in two equal annual installments beginning 12 months after the grant date. | |

| • | The exchange program will begin within six months of the date of unitholder approval. Our Board of Directors and the Compensation Committee will determine the actual start date within that time period, which we expect to be as soon as practicable following the special meeting if unitholder approval is obtained. | |

| • | The Common Units subject to the eligible options will be listed on the Nasdaq Global Select Market. |

While the terms of the exchange program are expected to be

materially similar to the terms described in this proposal, our

Board of Directors and the Compensation Committee may change the

terms of the exchange program in their sole discretion to take

into account a change in circumstances, as described below, and

may determine not to implement the exchange program even if

unitholder approval is obtained.

Background

Considerations

We believe that an effective and competitive employee incentive

program is imperative for the success of our business. We rely

on our experienced and productive employees and their efforts to

help us achieve our business objectives. Options constitute a

key component of our incentive and retention program because our

Board of Directors and the Compensation Committee believe that

equity compensation encourages participants to act like owners

of the business, motivating them to work toward our success and

rewarding their contributions by allowing them to benefit from

increases in the value of our Common Units. Our long-term

incentive compensation program is broad-based, with over

650 employees at all levels receiving grants.

Due to the significant decline of our Common Unit price since

the first half of 2008, many of our employees now hold options

with exercise prices significantly higher than the current

market price of our Common Units. For example, the closing price

of our Common Units on the NASDAQ Global Select Market on

March 17, 2009 was $2.31, whereas, the weighted average

exercise price of all outstanding options held by our employees

was $30.64. As of March 17, 2009, 100% of outstanding unit

options held by our employees were underwater. Although we

continue to believe that unit options are an important component

of our employees’ total compensation, many of our employees

view their existing options as having little or no value due to

the significant difference between the exercise prices and the

current market price of our Common Units. As a result, for many

employees, these options are ineffective at providing the

incentives and retention value that our Board of Directors and

the Compensation Committee believe is necessary to motivate and

retain our employees.

Alternatives

Considered

When considering how best to continue to incent and reward our

employees who have underwater options, we considered the

following alternatives:

| • | Increase cash compensation. We considered whether we could increase base and target bonus cash compensation to replace equity incentives. However, in response to recent events, we adjusted our business strategy in the fourth quarter of 2008 and for 2009 to focus on, among other things, improving the profitability of our assets by increasing their utilization while controlling costs. These increases in cash compensation would substantially increase our compensation expenses and reduce our cash flow from operations, which could adversely affect our business and operating results. In addition, these increases would not reduce our overhang. | |

| • | Grant additional equity awards. We also considered special grants of additional options at current market prices or another form of equity award. However, any meaningful additional grants would substantially increase our overhang and the dilution to our unitholders. | |

| • | Exchange options for cash. We also considered implementing a program to exchange underwater options for cash payments. However, an exchange program for cash would increase our compensation expenses and reduce our cash flow from operations, which could adversely affect our business and operating results. In addition, we do not believe that such a program would have a significant long-term retention value. |

8

Reasons

for the Option Exchange Program

After considering other alternatives, we determined that a

program under which our employees could exchange options with

higher exercise prices for a lesser number of options with a

lower exercise price was the most attractive alternative for a

number of reasons, including the following:

| • | The exchange program offers a reasonable, balanced and meaningful incentive for our eligible employees. Under the exchange program, participating employees will surrender eligible underwater options for replacement options covering fewer units with a lower exercise price and that will vest in two equal annual installments beginning 12 months after the replacement option grant date. | |

| • | The exchange ratio will be calculated to return value to our unitholders. We will calculate the exchange ratio to result in a fair value, for accounting purposes, of the replacement options that will be approximately equal to the fair value of the eligible options that are exchanged, which we believe will have no significant adverse impact on our reported earnings. We believe this combination of fewer units subject to options with lower exercise prices, granted with no expected significant adverse impact on our reported earnings, together with a new 24-month minimum vesting requirement, represents a reasonable and balanced exchange program with the potential for a significant positive impact on employee retention, motivation and performance. Additionally, options will provide value to employees only if our Common Unit increases over time thereby aligning employee and unitholder interests. | |

| • | The exchange program will reduce our equity award overhang. Not only do the underwater options have little or no retention value, they cannot be removed from our equity award overhang until they are exercised, expire or the employee who holds them leaves our employment. An exchange, such as the exchange program, will reduce our overhang while eliminating the ineffective options that are currently outstanding. Because employees who participate in the exchange program will receive fewer Common Units, Common Units subject to all outstanding equity awards will be reduced, thereby reducing our overhang. Based on the assumptions described below, if all eligible options are exchanged, options to purchase approximately 1.2 million Common Units will be surrendered and cancelled, while replacement options covering approximately 400,000 Common Units will be granted, resulting in a net reduction in the equity award overhang by approximately 800,000 Common Units. The total number of Common Units subject to outstanding equity awards as of March 17, 2009 would have been approximately 980,000 Common Units, including the approximately 400,000 replacement options. As of March 17, 2009, the total number of Common Units outstanding was approximately 45 million. All eligible options that are not exchanged will remain outstanding and in effect in accordance with their existing terms. | |

| • | The reduced number of Common Units subject to the replacement options will conserve our equity pool. Under the exchange program, Common Units subject to eligible options that are surrendered in exchange for a lesser number of replacement options will return to the pool of Common Units available for future grant under our Amended and Restated Plan. This return of Common Units will constitute an efficient use of the Common Units available for future issuance. | |

| • | Members of our Board of Directors and our executive officers will not be eligible to participate in the exchange program. Although our directors and executive officers, which includes our named executive officers and certain other designated senior officers, also hold options that are significantly underwater, these individuals are not eligible to participate in the exchange program. |

Description

of the Option Exchange Program

Implementing

the Exchange Program

We have not commenced the exchange program and will not do so

unless our unitholders approve this Proposal Two. If we

receive unitholder approval of the amendment to the Plan

permitting the exchange program, the exchange program may

commence at a time determined by our Board of Directors or the

Compensation Committee, on terms expected to be materially

similar to those described in this Proposal Two. Even if

our unitholders approve this proposal, our Board of Directors or

the Compensation Committee may still later determine not to

implement the

9

exchange program. It is currently anticipated that the exchange

program will commence as soon as practicable following approval

of this proposal by our unitholders at the special meeting.

Upon commencement of the exchange program, employees holding

eligible options would receive written materials (the

“offer to exchange”) explaining the precise terms and

timing of the exchange program. Employees would be given at

least 20 business days (or such longer period as we may elect to

keep the exchange program open) to elect to exchange all or none

of their eligible options for replacement options. After the

offer to exchange is closed, the eligible options surrendered

for exchange would be cancelled, and the Compensation Committee

would approve grants of replacement options to participating

employees in accordance with the applicable exchange ratio. All

such replacement options would be granted under the Plan and

would be subject to the terms of the Plan.

At or before commencement of the exchange program, we will file

the offer to exchange and other related documents with the SEC

as part of a tender offer statement on Schedule TO.

Employees, as well as unitholders and members of the public,

will be able to access the offer to exchange and other documents

we file with the SEC free of charge from the SEC’s web site

at www.sec.gov or on our web site at

www.crosstexenergy.com.

If you are both a unitholder and an employee holding eligible

options, please note that voting to approve the equity plan

amendments authorizing the exchange program does not constitute

an election to participate in the exchange program.

Eligible

Options

To be eligible for exchange under the exchange program, an

underwater option, as of a date specified by the terms of the

offer to exchange (which date will be not more than 20 business

days prior to the date that the exchange program commences),

must have an exercise price equal to or greater than $10.00 per

Common Unit.

Eligible

Participants

The exchange program will be open to all employees who hold

eligible options, except as described below. To be eligible, an

individual must be employed on the date the offer to exchange

commences and must remain employed through the date that

replacement options are granted. The exchange program will not

be open to members of our Board of Directors or executive

officers. For purposes of the exchange program, our executive

officers will include our named executive officers and any other

senior officers that the Compensation Committee shall designate.

As of March 17, 2009, there were approximately

600 employees eligible to participate in the exchange

program (based on the assumptions below).

Exchange

Ratio

The exchange ratio will be designed to minimize the difference,

if any, between the fair value, for accounting purposes, of the

replacement options and the fair value of the eligible options

that are surrendered in the exchange (based on valuation

assumptions made when the offer to exchange commences). The

actual exchange ratio will be determined by the Compensation

Committee shortly before the start of the exchange program. This

will reduce or potentially eliminate any additional compensation

cost that we must recognize on the replacement options. Although

the exchange ratio cannot be determined now, we anticipate that

every three outstanding underwater options will be exchanged for

one new replacement option.

The total number of replacement options a participating employee

will receive with respect to a surrendered eligible option will

be determined by converting the number of Common Units

underlying the surrendered eligible option according to the

applicable exchange ratio and rounding down to the nearest whole

Common Unit. Assuming a

three-for-one

exchange ratio, that all eligible options are tendered and that

the Amended and Restated Plan is adopted by our unitholders

pursuant to Proposal One, there will be approximately

3.6 million Common Units available for grant under the

Plan, 420,000 million options outstanding and

560,000 million restricted units outstanding (including

184,437 performance units at target, which could result in

grants of restricted units in the future). The new outstanding

options would have a weighted average exercise price of not less

than $3 and a weighted average remaining term of 10 years.

10

Election

to Participate

Participation in the exchange program will be voluntary.

Eligible employees will be permitted to exchange all or none of

the eligible options for replacement options.

Exercise

Price of Replacement Options

All replacement options will be granted with an exercise price

equal to the greater of (i) $3.00, (ii) 120% of the

average closing price of our Common Units on the Nasdaq Global

Select Market for the five trading days prior to the date of

grant or (iii) the closing price of our Common Units on the

date of grant of the replacement options.

Vesting

of Replacement Options

The replacement options will vest in two equal annual

installments beginning 12 months after the replacement

option grant date.

Term

of the Replacement Options

The replacement options will have a

10-year term.

Other

Terms and Conditions of the Replacement Options

The other terms and conditions of the replacement options will

be set forth in an option agreement to be entered into as of the

replacement option grant date. Any additional terms and

conditions will be comparable to the other terms and conditions

of the eligible options. All replacement options will be

nonstatutory unit options granted under our Plan.

Return

of Eligible Options Surrendered

The eligible options surrendered for exchange will be cancelled

and all Common Units that were subject to such surrendered

options will again become available for future awards under the

Plan.

Accounting

Treatment

Under SFAS 123(R), the exchange of options under the option

exchange program is treated as a modification of the existing

options for accounting purposes. Accordingly, we will recognize

the unamortized compensation cost of the surrendered options, as

well as the incremental compensation cost of the replacement

options granted in the exchange program, ratably over the

vesting period of the replacement options. The incremental

compensation cost will be measured as the excess, if any, of the

fair value of each replacement option granted to employees in

exchange for surrendered eligible options, measured as of the

date the replacement options are granted, over the fair value of

the surrendered eligible options in exchange for the replacement

options, measured immediately prior to the cancellation. Because

the exchange ratio will be calculated to result in the fair

value of surrendered eligible options being equal to the fair

value of the options replacing them, we do not expect to

recognize any significant incremental compensation expense for

financial reporting purposes as a result of the exchange

program. In the event that any of the replacement options are

forfeited prior to their vesting due to termination of service,

the incremental compensation cost for the forfeited replacement

options will not be recognized; however, we would recognize any

unamortized compensation expense from the surrendered options

which would have been recognized under the original vesting

schedule.

U.S.

Federal Income Tax Consequences

The following is a summary of the anticipated material

U.S. federal income tax consequences of participating in

the exchange program. A more detailed summary of the applicable

tax considerations to participating employees will be provided

in the offer to exchange. We believe the exchange of eligible

options for replacement options pursuant to the exchange program

should be treated as a non-taxable exchange and neither we nor

any of our partners should recognize any income for

U.S. federal income tax purposes upon the surrender of

eligible options and the grant of replacement options. However,

the tax consequences of the exchange program are not entirely

certain, and the Internal Revenue Service is not precluded from

adopting a contrary position. The law and regulations themselves

are also subject to

11

change. All holders of eligible options are urged to consult

their own tax advisors regarding the tax treatment of

participating in the exchange program under all applicable laws

prior to participating in the exchange program.

Potential

Modification to Terms to Comply with Governmental

Requirements

The terms of the exchange program will be described in an offer

to exchange that will be filed with the SEC. Although we do not

anticipate that the SEC will require us to materially modify the

exchange program’s terms, it is possible that we will need

to alter the terms of the exchange program to comply with

comments from the SEC. Changes in the terms of the exchange

program may also be required for tax purposes for participants

as the tax treatment of the exchange program is not entirely

certain. The Compensation Committee will retain the discretion

to make any such necessary or desirable changes to the terms of

the exchange program for purposes of complying with comments

from the SEC or optimizing the U.S. federal tax

consequences.

Plan

Benefits

Because participation in the exchange program is voluntary and

we are not able to predict who or how many participants will

elect to participate, how many options will be surrendered for

exchange or the number of replacement options that may be

granted, the benefits or amounts that will be received by any

participant if this proposal is approved and the exchange

program is implemented are not currently determinable. None of

the members of our Board of Directors or our executive officers

will be eligible to participate in the exchange program. Based

on the assumptions described above, including a

three-for-one

exchange ratio, the maximum number of Common Units underlying

options that would be cancelled would be approximately

1.2 million Common Units, and the maximum number of Common

Units underlying new options that would be granted would be

approximately 400,000 Common Units.

Effect on

Unitholders

We are unable to predict the precise impact of the exchange

program on our unitholders because we are unable to predict how

many or which employees will exchange their eligible options.

Based on the assumptions described above, including a

three-for-one

exchange ratio, the maximum number of Common Units underlying

options that would be cancelled would be approximately

1.2 million Common Units, and the maximum number of Common

Units underlying new options that would be granted would be

approximately 400,000 Common Units. Following the exchange

program, if all eligible options are exchanged, we will have

approximately 420,000 options outstanding, with a weighted

average exercise price of approximately $4.15 and a weighted

average remaining term of 9.8 years. The total number of

Common Units subject to outstanding equity awards as of

March 17, 2009, including the replacement options, would be

approximately 980,000 Common Units. As of March 17, 2009,

the total number of our Common Units outstanding was

approximately 45 million.

Text of

Amendment to the Plan

In order to permit the Company to implement the unit option

exchange program in compliance with the Plan and applicable

NASDAQ listing rules, the Board of Directors approved an

amendment to add a new Section 6(a)(vi) to the Plan,

subject to approval of the amendment by our unitholders, to

allow for the exchange program, which amendment will read as

follows:

Option Exchanges. The Committee shall have the

authority to implement a program under which

(i) outstanding Awards are surrendered or cancelled in

exchange for Awards of the same type (which may have lower

exercise prices and different terms), Awards of a different type

and/or cash,

and/or

(ii) the exercise price of an outstanding Award is reduced.

The terms and conditions of any exchange program will be

determined by the Committee in its sole discretion.

If Proposal Two is not approved by our unitholders but

Proposal One is approved, the amendment to add a new

Section 6(a)(vi) of the Plan described above will not be

included in the Amended and Restated Plan. If this

Proposal Two is approved but Proposal One is not

approved, then the amendment to add a new Section 6(a)(vi)

of the Plan described above will amend the existing Plan.

12

Summary

of the Plan

Please see the summary of the Plan under Proposal One.

Recommendation

and Required Affirmative Vote

The affirmative vote of the holders of a majority of our Units

outstanding as of the record date and entitled to vote at the

special meeting is required for approval of the proposal to

adopt the Amended and Restated Plan. Our Board of Directors

believes that the Amended and Restated Plan is in the best

interests of the Partnership and its unitholders.

Accordingly, our Board of Directors recommends that you vote

FOR approval of Proposal Two.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Crosstex

Energy, L.P. Ownership

The following table shows the beneficial ownership of units of

Crosstex Energy, L.P. as of February 16, 2009, held by:

| • | each person who beneficially owns 5% or more of any class of units then outstanding; | |

| • | all the directors of Crosstex Energy GP, LLC; | |

| • | each named executive officer of Crosstex Energy GP, LLC; and | |

| • | all the directors and executive officers of Crosstex Energy GP, LLC as a group. |

Percentages reflected in the table are based upon a total of

44,958,955 common units and 3,875,340 senior subordinated

series D units as of February 16, 2009.

|

Percentage of |

||||||||||||||||||||||||

|

Subordinated |

Subordinated |

Percentage |

||||||||||||||||||||||

|

Common |

Percentage of |

Series D |

Series D |

of Total |

||||||||||||||||||||

|

Units |

Common Units |

Units |

Units |

Total Units |

Units |

|||||||||||||||||||

|

Beneficially |

Beneficially |

Beneficially |

Beneficially |

Beneficially |

Beneficially |

|||||||||||||||||||

|

Name of Beneficial Owner(1)

|

Owned | Owned | Owned | Owned | Owned | Owned | ||||||||||||||||||

|

Crosstex Energy, Inc.

|

16,414,830 | 36.51 | % | 16,414,830 | 33.62 | % | ||||||||||||||||||

|

Kayne Anderson Capital Advisors, LP(2)

|

6,044,069 | 13.44 | % | 6,044,069 | 12.38 | % | ||||||||||||||||||

|

Tortoise Capital Advisors, LLC(3)

|

2,594,681 | 5.77 | % | 775,068 | 20.00 | % | 3,369,749 | 6.90 | % | |||||||||||||||

|

Chieftain Capital Management, Inc.(4)

|

3,112,076 | 6.92 | % | 3,112,076 | 6.37 | % | ||||||||||||||||||

|

Lehman Brothers MLP Opportunity Fund L.P

|

0 | * | 968,835 | 25.00 | % | 968,835 | 1.98 | % | ||||||||||||||||

|

Fiduciary/Claymore MLP Opportunity Fund

|

0 | * | 387,534 | 10.00 | % | 387,534 | * | |||||||||||||||||

|

ING Life Insurance & Annuity Company(5)

|

0 | * | 705,312 | 18.20 | % | 705,312 | 1.44 | % | ||||||||||||||||

|

Citigroup Global Markets Inc.

|

0 | * | 775,068 | 20.00 | % | 775,068 | 1.59 | % | ||||||||||||||||

|

Barry E. Davis(6)

|

65,716 | * | 65,716 | * | ||||||||||||||||||||

|

William W. Davis(6)

|

28,975 | * | 28,975 | * | ||||||||||||||||||||

|

Robert S. Purgason(6)

|

16,853 | * | 16,853 | * | ||||||||||||||||||||

|

Joe A. Davis(6)

|

17,548 | * | 17,548 | * | ||||||||||||||||||||

|

Rhys J. Best

|

17,010 | * | 17,010 | * | ||||||||||||||||||||

|

Leldon E. Echols

|

0 | * | 0 | * | ||||||||||||||||||||

|

Bryan H. Lawrence(6)

|

0 | * | 0 | * | ||||||||||||||||||||

|

Sheldon B. Lubar(6)(7)

|

316,932 | * | 316,932 | * | ||||||||||||||||||||

|

Cecil E. Martin

|

17,010 | * | 17,010 | * | ||||||||||||||||||||

|

Kyle D. Vann

|

11,010 | * | 11,010 | * | ||||||||||||||||||||

|

All directors and executive officers as a group (10 persons)

|

491,054 | 1.10 | % | 0 | 0.00 | % | 491,054 | 1.00 | % | |||||||||||||||

| * | Less than 1% |

13

| (1) | The address of each person listed above is 2501 Cedar Springs, Suite 100, Dallas, Texas 75201, except for Mr. Lawrence, which is 410 Park Avenue, New York, New York 10022; Chieftain Capital Management, FAC, which is 12 East 49th Street, New York, New York 10017; Kayne Anderson Capital Advisors, L.P., which is 1800 Avenue of the Stars, Second Floor, Los Angeles, California 90067; Tortoise Capital Advisors LLC, which 11550 Ash Street, Suite 300, Leawood, Kansas 66211; Lehman Brothers MLP Opportunity Fund L.P., which is 745 7th Avenue, New York, New York 10019; Fiduciary/Claymore MLP Opportunity Fund which is 8112 Maryland Avenue, Ste 400, St. Louis, Missouri 63105; ING Life Insurance & Annuity Company which is 5780 Powers Ferry Road NW, Ste 300, Atlanta, Georgia 30327-4349; and Citigroup Global Markets Inc. which is 390 Greenwich Street, 3rd Floor, New York, New York 10013. | |

| (2) | As reported on Schedule 13G filed with the SEC in a joint filing with Richard A. Kayne. | |

| (3) | As reported on Schedule 13G filed with the SEC in a joint filing with Tortoise Energy Capital Corporation. | |

| (4) | As reported on Schedule 13G filed with the SEC. | |

| (5) | Reported jointly with ING USA Annuity and Life Insurance Company. | |

| (6) | These individuals each hold an ownership interest in Crosstex Energy, Inc. as indicated in the following table. | |

| (7) | Sheldon B. Lubar is a general partner of Lubar Nominees, which holds an ownership interest in Crosstex Energy, Inc. (as indicated in the following table). Mr. Lubar is also a director of the manager of Lubar Equity Fund, LLC, which holds an ownership interest in Crosstex Energy, Inc. (as indicated in the following table) and owns 285,100 Common Units of Crosstex Energy, L.P. |

Crosstex

Energy, Inc. Ownership

The following table shows the beneficial ownership of Crosstex

Energy, Inc. as of February 16, 2009, held by:

| • | each person who beneficially owns 5% or more of the stock then outstanding; | |

| • | all the directors of Crosstex Energy Inc.; | |

| • | each named executive officer of Crosstex Energy Inc.; and | |

| • | all the directors and executive officers of Crosstex Energy Inc. as a group. |

Percentages reflected in the table below are based on a total of

46,472,805 shares of common stock outstanding as of

February 16, 2009.

|

Shares of |

||||||||

|

Name of Beneficial Owner(1)

|

Common Stock | Percent | ||||||

|

Chieftain Capital Management, Inc.(2)

|

6,485,903 | 13.96 | % | |||||

|

ClearBridge Advisors, LLC(2)

|

3,016,018 | 6.49 | % | |||||

|

Barclays Global Investors, NA(3)

|

5,089,146 | 10.95 | % | |||||

|

Lubar Nominees(4)

|

1,991,877 | 4.29 | % | |||||

|

Lubar Equity Fund, LLC(4)

|

468,210 | 1.01 | % | |||||

|

Barry E. Davis

|

1,337,745 | 2.88 | % | |||||

|

William W. Davis

|

168,819 | * | ||||||

|

Robert S. Purgason(5)

|

31,357 | * | ||||||

|

Joe A. Davis

|

30,757 | * | ||||||

|

James C. Crain(6)

|

6,000 | * | ||||||

|

Leldon E. Echols

|

0 | * | ||||||

|

Bryan H. Lawrence

|

1,720,267 | 3.70 | % | |||||

|

Sheldon B. Lubar(4)

|

15,000 | * | ||||||

|

Cecil E. Martin

|

0 | * | ||||||

|

Robert F. Murchison(7)

|

227,395 | * | ||||||

|

All directors and executive officers as group (10 persons)

|

5,997,427 | 12.91 | % | |||||

14

| * | Less than 1%. | |

| (1) | The address of each person listed above is 2501 Cedar Springs, Suite 100, Dallas, Texas 75201, except for Chieftain Capital Management, Inc., which is 12 East 49th Street, New York, New York 10017; Mr. Lawrence, which is 410 Park Avenue, New York, New York 10022; ClearBridge Advisors, LLC which is 620 8th Avenue, New York, New York 10018; and Barclays Global Investors, NA which is 45 Fremont Street, San Francisco, California 94105. | |

| (2) | As reported on Schedule 13G filed with the SEC. | |

| (3) | As reported on Schedule 13G filed with the SEC in a joint filing with Barclays Global Fund Advisors and Barclays Global Investors Japan Limited. | |

| (4) | As reported on Schedule 13D filed with the SEC. Sheldon B. Lubar is a general partner of Lubar Nominees and director of the manager of Lubar Equity Fund, LLC, and may be deemed to beneficially own the shares held by these entities. | |

| (5) | 600 of these shares are held by the M. I. Purgason Trust, of which Mr. Purgason serves as co-trustee. | |

| (6) | 1,000 of these shares are held by the James C. Crain Trust. | |

| (7) | 169,462 shares are held by Murchison Capital Partners, L.P. Mr. Murchison is the President of the Murchison Management Corp., which serves as the general partner of Murchison Capital Partners, L.P. |

Beneficial

Ownership of General Partner Interest

Crosstex Energy GP, L.P. owns all of our 2% general partner

interest and all of our incentive distribution rights. Crosstex

Energy GP, L.P. is owned 0.001% by its general partner, Crosstex

Energy GP, LLC and 99.999% by Crosstex Energy, Inc.

Equity

Compensation Plan Information

The following table provides information regarding our equity

compensation plan as of December 31, 2008.

|

Number of Securities |

||||||||||||

|

Remaining Available for |

||||||||||||

|

Number of Securities to |

Future Issuance Under |

|||||||||||

|

be Issued Upon Exercise |

Weighted-Average Price |

Equity Compensation Plan |

||||||||||

|

of Outstanding Options, |

of Outstanding Options, |

(Excluding Securities |

||||||||||

|

Plan Category

|

Warrants, and Rights | Warrants and Rights | Reflected in Column(a)) | |||||||||

| (a) | (b) | (c) | ||||||||||

|

Equity Compensation Plans Approved By Security Holders

|

N/A | N/A | N/A | |||||||||

|

Equity Compensation Plans Not Approved By Security Holders

|

2,002,760 | (1)(2) | $ | 30.64 | (3) | 1,915,696 | ||||||

| (1) | Our general partner has adopted and maintains a long term incentive plan for our officers, employees and directors. See the summary of the plan under Proposal One. The plan currently provides for issuance of a total of 4,800,000 Common Unit options and restricted units. | |

| (2) | The number of securities includes (i) 477,858 restricted units that have been granted under our long-term incentive plan that have not vested, and (ii) 220,708 performance units which could result in grants of restricted units in the future. | |

| (3) | The exercise prices for outstanding options under the plan as of December 31, 2008 range from $10.00 to $37.31 per unit. |

15

EXECUTIVE

COMPENSATION

Compensation

Discussion and Analysis

We do not directly employ any of the persons responsible for

managing our business. Crosstex Energy GP, LLC, the general

partner of our general partner, manages our operations and

activities, and its board of directors and officers make

decisions on our behalf. The compensation of the directors,

officers and employees of Crosstex Energy GP, LLC is determined

by the Compensation Committee of the board of directors of

Crosstex Energy GP, LLC. Our named executive officers also serve

as executive officers of Crosstex Energy, Inc. and the

compensation of the named executive officers discussed below

reflects total compensation for services to all Crosstex

entities. We reimburse all expenses incurred on our behalf,

including the costs of employee, officer and director

compensation and benefits, as well as all other expenses

necessary or appropriate to the conduct of our business. Our

partnership agreement provides that our general partner will

determine the expenses allocable to us in any reasonable manner

determined by our general partner in its sole discretion.

Crosstex Energy, Inc. currently pays a monthly fee to us to

cover its portion of administrative and compensation costs,

including compensation costs relating to the named executive

officers.

Based on the information that we track regarding the amount of

time spent by each of our named executive officers on business

matters relating to Crosstex Energy, L.P., we estimate that such

officers devoted the following percentage of their time to the

business of Crosstex Energy, L.P. and to Crosstex Energy, Inc.,

respectively, for 2008:

|

Percentage of Time |

Percentage of Time |

|||||||

|

Devoted to Business of |

Devoted to Business of |

|||||||

|

Executive Officer or Director

|

Crosstex Energy, L.P. | Crosstex Energy, Inc. | ||||||

|

Barry E. Davis

|

83 | % | 17 | % | ||||

|

Jack M. Lafield*

|

100 | % | 0 | % | ||||

|

William W. Davis

|

74 | % | 26 | % | ||||

|

Robert S. Purgason

|

100 | % | 0 | % | ||||

|

Joe A. Davis

|

88 | % | 12 | % | ||||

| * | Mr. Lafield departed from his position as Executive Vice President-Corporate Development with Crosstex Energy GP, LLC effective January 16, 2009. |

Crosstex Energy GP, LLC’s Compensation Committee assists

the board of directors in discharging its responsibilities

relating to compensation of executive officers and has overall

responsibility for approval, evaluation and oversight of all

compensation plans, policies and programs of Crosstex Energy GP,

LLC. Each member of the Crosstex Energy GP, LLC’s

Compensation Committee is an independent director in accordance

with NASDAQ standards. The responsibilities of Crosstex Energy

GP, LLC’s Compensation Committee, as stated in its charter,

include the following:

| • | reviewing and making recommendations to the board of directors, on at least an annual basis, with respect to general compensation policies of Crosstex Energy GP, LLC relating to all officers and other key executives; | |

| • | reviewing and making recommendations to the board of directors, on at least an annual basis, for the annual base salary, award of options, awards under incentive compensation and equity-based plans, employment agreements, severance agreements, and change in control agreements and any special or supplemental benefits for senior executives; | |

| • | reviewing and making recommendations to the board of directors with respect to goals and objectives relevant to the compensation of senior executives, evaluating the senior executives’ performance in light of these goals and objectives and recommending compensation levels based on this evaluation; and | |

| • | reviewing and reassessing the adequacy of the Compensation Committee’s charter, on at least an annual basis, and recommending any proposed changes to the board of directors. |

Compensation Philosophy and Policies. The

primary objectives of Crosstex Energy GP, LLC’s

compensation program, including compensation of the named

executive officers, are to attract and retain highly qualified

16

officers, employees and directors and to reward individual

contributions to our success. Crosstex Energy GP, LLC considers

the following policies in determining the compensation of the

named executive officers:

| • | total compensation is related to performance of the individual executive and the performance of the executive’s division/executive team (measured against both financial and non-financial goals); | |

| • | incentive compensation represents a significant portion of the executive’s total compensation; | |

| • | compensation levels are designed to be competitive to ensure that we will be able to attract and motivate highly qualified executive officers; | |

| • | payments under retention plans are designed to retain highly qualified officers during challenging times; | |

| • | incentive compensation balances long and short-term performance achievement; and | |

| • | compensation is related to improving unitholder value. |

Compensation Methodology. The elements

of Crosstex Energy GP, LLC’s compensation program for named

executive officers are intended to provide a total incentive

package designed to drive performance and reward contributions

in support of business strategies at the entity and individual

performance. All compensation determinations are discretionary

and, as noted above, subject to the decision-making authority of

Crosstex Energy GP, LLC.

Compensation Consultant. In 2008,

Crosstex Energy GP, LLC’s Compensation Committee retained

Mercer Human Resource Consulting (“Mercer”) as its

independent compensation consultant to conduct a compensation

study and advise the Compensation Committee on certain matters

relating to compensation programs applicable to the named

executive officers and other employees of Crosstex Energy GP,

LLC. Mercer provided a presentation to the Compensation

Committee regarding the compensation programs of the Crosstex

entities in February 2008.

With respect to compensation objectives and decisions regarding

the named executive officers the Compensation Committee has

reviewed market data with respect to peer companies provided by

Mercer in determining relevant compensation levels and

compensation program elements for our named executive officers,

including establishing base salaries, for fiscal 2008. Mercer

has provided guidance on current industry best practices to the

Compensation Committee. The market data that we reviewed

included the base salaries paid to executive officers in similar

positions at our peer companies, as well as a comparison of the

mix of total compensation (including base salary, bonus

structure, bonus methodology and short and long-term

compensation elements) paid to executive officers in similar

positions at such companies. For 2008, our peer companies

consisted of the following: Energy Transfer Partners, L.P.,

Enbridge Energy Partners, L.P., ONEOK Partners, L.P., Southern

Union, Magellan Midstream Holdings, L.P., NuStar Energy, L.P.,

Copano Energy, LLC, Regency Energy Partners, L.P., MarkWest

Energy Partners, L.P., Boardwalk Pipeline Partners, L.P., Atmos

Energy Corporation, El Paso Corporation, Questar

Corporation, Equitable Resources, Inc., Pioneer Natural

Resources Company, Plains Exploration & Production

Company, Cabot Oil & Gas Corporation, St. Mary

Land & Exploration Company and Range Resources

Corporation. We believe that this group of companies is

representative of the industry in which we operate and the

individual companies were chosen because of such companies’

relative position in our industry, their relative size/market

capitalization, the relative complexity of the business, similar