Exhibit 99.1

May 20, 2016

Dear Shareholder:

On behalf of the Board of Directors, management and employees, we invite our shareholders to attend the annual general meeting (the “Meeting”) of DragonWave Inc. (“DragonWave” or the “Corporation”). This year, the Meeting will be held as follows:

|

Date: |

Wednesday, June 22, 2016 |

|

Time: |

10:00 am (Eastern Daylight Time) |

|

Place: |

Brookstreet Hotel, 525 Legget Drive, Ottawa, Ontario |

At the Meeting, you will be asked to (i) receive the consolidated financial statements of DragonWave for the fiscal year ended February 29, 2016, together with the auditors’ report thereon, and (ii) consider and vote on: (a) the election of directors; (b) the appointment of the auditor of DragonWave; and (c) such further and other business as may properly come before the Meeting or any adjournment(s) or postponement(s) thereof. The enclosed Management Proxy Circular (the “Circular”) provides a description of the proposed business of the Meeting to assist you in considering the matters to be voted upon. During the Meeting, we will present an overview of the Corporation and the Corporation’s financial performance for the fiscal year ended February 29, 2016.

Because of the importance of the matters to be considered at the Meeting, your shares should be represented whether or not you are personally able to attend. If you are unable to attend the Meeting in person, you are encouraged to complete and return the enclosed form of proxy or voting instruction form. Please note that you can revoke your proxy expressly or by executing a later proxy or by voting in person at the Meeting, all as set out in the Circular.

We hope that you will be able to attend the Meeting in person as it will be an opportunity for us to speak with you about DragonWave and for you to meet some of the members of the Board of Directors and management.

We have not prepared a formal annual report for the fiscal year ended February 29, 2016. The audited financial statements and MD&A for the fiscal year ended February 29, 2016 are available at http://investor.dragonwaveinc.com/annual-proxy.cfm. A recording of the Meeting will be available on the Corporation’s website following the Meeting.

We look forward to seeing you at the Meeting.

|

|

|

|

|

|

|

Claude Haw |

Peter Allen |

|

Chair, Board of Directors |

Director, President and Chief Executive Officer |

DragonWave Inc. 600-411 Legget Drive, Kanata, On K2K 3C9 Tel (613) 599-9991 Fax (613) 599-4225 www.dragonwaveinc.com

DragonWave Inc.

Management Proxy Circular

May 20, 2016

DRAGONWAVE INC.

MANAGEMENT PROXY CIRCULAR

This Management Proxy Circular (this “Circular”) is furnished in connection with the solicitation of proxies by and on behalf of the management of DRAGONWAVE INC. (“DragonWave”, “we”, “us”, “our” or the “Corporation”) for use at the annual general of the shareholders of the Corporation (the “Meeting”) to be held on Wednesday, the 22nd day of June, 2016 at the hour of 10:00 a.m. (EDT) at the Brookstreet Hotel located at 525 Legget Drive, Ottawa, Ontario, and at any adjournment(s) or postponement(s) thereof, for the purposes set forth in the Notice of Meeting.

All information in this Circular is presented as at May 20, 2016 unless otherwise indicated.

QUESTIONS AND ANSWERS ABOUT THE MEETING

The following are questions that you may have regarding the Meeting. These questions and answers are not meant to be a substitute for the information contained in the remainder of this Circular. You are urged to read this entire Circular, its schedule and appendices and the documents referred to in this Circular before making any decisions.

Q1. What am I voting on?

A1. You are being asked to vote on the following:

· the election of four (4) directors to the board of directors of DragonWave (the “Board” or “Board of Directors”) for the ensuing year; and

· the reappointment of Ernst & Young LLP as DragonWave’s auditor for the ensuing year at remuneration to be fixed by the Board.

In addition, you may be asked to vote in respect of any other matters that may be properly brought before the Meeting. As of the date of this Circular, management is not aware of any such other matters.

In accordance with applicable law, the financial statements of the Corporation as at February 29, 2016 and the report of the auditor thereon will be presented to the Meeting, but will not be voted on at the Meeting.

Q2. Who are management’s director nominees?

A2. DragonWave’s management has nominated the following persons for election as directors: Claude Haw (Chair), Peter Allen, Cesar Cesaratto and Lori O’Neill.

For more information on management’s proposed nominees, see “Election of Directors” in this Circular.

Q3. How does DragonWave’s Board recommend that I vote?

A3. DragonWave’s directors unanimously recommend that you VOTE FOR all of management’s proposed director nominees and resolutions, as set out in this Circular.

Q4. Who is soliciting my proxy?

A4. Management of DragonWave is soliciting your proxy for use at the Meeting. The solicitation of proxies for the Meeting will be made primarily by mail, and may be supplemented by telephone or other personal contact by the directors or officers of DragonWave or agents of DragonWave retained to assist in the solicitation of proxies. All costs of the solicitation of proxies by management of the Corporation, including the costs of any proxy solicitation agent that is retained by the Corporation, will be borne by the Corporation.

Q5. Where and when is the Meeting?

A5. The Meeting will take place at the Brookstreet Hotel located at 525 Legget Drive, Ottawa, Ontario, on Wednesday, June 22, 2016 at 10:00 a.m. (EDT).

Q6. What is a quorum?

A6. The presence at the Meeting in person or by proxy of not less than two holders of at least twenty-five percent (25%) of the outstanding common shares in the capital of the Corporation (the “Common Shares”) will constitute a quorum. A quorum must be met in order to hold the Meeting and transact any business, including voting on proposals. Proxies marked as abstaining on any matter to be acted upon by shareholders and “broker non-votes”, as described below, will be treated as present for purposes of determining if a quorum is present at the Meeting.

Q7. What are broker non-votes?

A7. A broker non-vote occurs when a broker holding shares for a non-registered shareholder submits a proxy for the Meeting, but does not vote on a particular matter because the broker does not have discretionary voting power with respect to that particular matter and has not received voting instructions from the non-registered holder. Broker non-votes will be counted as shares present for the purpose of determining the presence of a quorum at the Meeting. We encourage you to provide instructions to your broker regarding the voting of your shares.

Q8. Who can vote at the Meeting?

A8. Each shareholder is entitled to one vote for each Common Share of DragonWave registered in his or her name as of 5:00 p.m. (EDT) on May 17, 2016, the record date of the Meeting (the “Record Date”) for the purpose of determining holders of Common Shares entitled to receive notice of, attend and vote at the Meeting or any adjournment(s) or postponement(s) of the Meeting.

As of May 17, 2016, 3,620,506 Common Shares were issued and outstanding and entitled to be voted at the Meeting.

Q9. How do I vote if I am a REGISTERED shareholder?

A9. You may exercise your right to vote by attending and voting your Common Shares in person at the Meeting or by voting using any of the outlined methods on the form of proxy. Whether or not you plan to attend the Meeting you are encouraged to vote. If you have previously submitted a proxy and wish to vote at the Meeting, upon arriving at the Meeting, report to the desk of the Corporation’s registrar and transfer agent, Computershare Investor Services Inc. (the “Transfer Agent”), to sign in and revoke any proxy previously submitted by you. Your participation in person in a vote at the Meeting will automatically revoke any proxy previously given.

To vote in person, you must be a registered shareholder. If your name appears on your share certificate, you are a registered shareholder. Registered shareholders who attend the Meeting are entitled to cast one vote for each DragonWave Common Share held by them as of the Record Date.

To vote by proxy, you must vote (i) by telephone, (ii) on the Internet, (iii) by mail, or (iv) by appointing another person to go to the Meeting and vote your Common Shares for you. If you vote by proxy, your proxy form must be received by the Transfer Agent no later than 10:00 a.m. (EDT) on June 20, 2016. The Board of Directors has fixed 10:00 a.m. (EDT) on June 20, 2016, or 48 hours (excluding Saturdays, Sundays, and holidays) before the reconvening of the Meeting following an adjournment or the date of any postponed Meeting, as the time before which proxies to be used or acted upon at the Meeting, or any adjournment or postponement thereof, shall be deposited with the Transfer Agent, unless otherwise determined by the Chair of the Meeting in his sole discretion.

To vote by telephone, call 1-866-732-8683 (toll free in Canada and the United States) or 312-588-4290 (International direct dial) from a touch-tone phone and follow the instructions. You will need your 15-digit control number. You will find this number on the information sheet attached to your proxy form.

To vote on the Internet, go to the Transfer Agent’s website at www.investorvote.com and follow the instructions. You will need your 15-digit control number. You will find this number on the information sheet attached to your proxy form.

To vote by mail, send your proxy to the Transfer Agent in the enclosed envelope (postage paid for shareholders in Canada and the United States). You may also vote by delivering your proxy by hand to the Transfer Agent at: Computershare Investor Services Inc., 100 University Avenue, 8th Floor, North Tower, Toronto, Ontario M5J 2Y1, Attention: Proxy Department.

To appoint another person to go to the Meeting and vote your shares for you, this person does not have to be a shareholder. Strike out the names that are printed on the form of proxy delivered to you and write the name of the person you are appointing in the space provided. Complete your voting instructions, date and sign the form and return it to the Transfer Agent as instructed. Make sure the person you appoint is aware that he or she has been appointed and attends the Meeting. At the Meeting, he or she should speak to a representative of the Transfer Agent upon arriving at the Meeting.

Q10. How do I vote if I am a NON-REGISTERED shareholder?

A10. If you are a non-registered shareholder, you should receive a voting instruction form with this Circular. Non-registered shareholders hold their Common Shares through intermediaries, such as banks, trust companies, securities dealers or brokers. If you are a non-registered shareholder, the intermediary holding your DragonWave shares may provide you with a signed form of proxy, in place of a voting instruction form, which you must complete by using one of the methods outlined in that form. The voting instruction form or the signed form of proxy provided by your intermediary will constitute voting instructions that the intermediary must follow and should be returned in accordance with the instructions set out in the applicable form to ensure your vote is counted at the Meeting. Your voting instruction form may allow you to provide your voting instructions (i) by telephone, (ii) on the Internet, (iii) by facsimile or (iv) by mail.

If, as a non-registered shareholder, you wish to attend the Meeting and vote your Common Shares in person, or have another person attend and vote your Common Shares on your behalf, you should fill out your own name, or the name of your appointee, in the space provided in the voting instruction form or the signed form of proxy. An intermediary’s signed form of proxy will likely provide corresponding instructions to cast your vote in person. In either case, you should carefully read the instructions provided by the intermediary and contact the intermediary promptly if you need assistance.

A non-registered shareholder may revoke a proxy or voting instructions which have been previously given to an intermediary by written notice to the intermediary. In order to ensure that the intermediary acts upon a revocation, the written notice of revocation should be received by the intermediary well in advance of the Meeting.

Q11. What does it mean to appoint a proxyholder?

A11. Your proxyholder is the person that you appoint to cast your votes for you. Signing the form of proxy appoints Claude Haw, the Chair of the Board, or failing him, Peter Allen, the Chief Executive Officer of the Corporation, as your proxyholder to vote your Common Shares at the Meeting. You can choose anyone you want to be a proxyholder. A shareholder has the right to appoint a proxyholder (who is not required to be a shareholder) other than any person or company designated in the proxy, to attend and act on such shareholder’s behalf at the Meeting, either by inserting such other desired proxyholder’s name in the blank space provided on the proxy and deleting the names thereon, or by substituting another proper form of proxy. If you write the name of another person in the form of proxy, please ensure that the person that you have appointed will be attending the Meeting and is aware that he or she will be voting your Common Shares. If the proxyholder does not attend the Meeting, those votes will not be counted. Proxyholders should speak to a representative of the Transfer Agent upon arriving at the Meeting.

If you sign the form of proxy but leave the space blank, Claude Haw or Peter Allen will be authorized to act and vote for you at the Meeting. The form of proxy confers discretionary authority upon the proxyholder(s) named therein with respect to amendments or variations of matters identified in the Notice of Meeting or any adjournment or postponement of the Meeting or other matters which may properly come before the Meeting or any adjournment or postponement of the Meeting. As of the date of this Circular, management of the Corporation knows of no amendment or variation of the matters referred to in the Notice of Meeting or other business that will be presented to the Meeting.

Q12. How will my shares be voted if I give my proxy?

A12. On the form of proxy, you can indicate how you want your proxyholder to vote your Common Shares, or you can let your proxyholder decide for you. If you have specified on the proxy form how you want to vote on a particular issue (by marking VOTE FOR or WITHHOLD FROM VOTING, as applicable), then your proxyholder must vote your Common Shares accordingly.

If you have not specified how to vote on a particular matter, then your proxyholder can vote your Common Shares as he or she sees fit. Unless otherwise specified, the proxyholders designated by management on the form of proxy shall vote your Common Shares as follows:

|

x |

FOR the election as directors of the proposed nominees whose names are set out in this Circular. |

|

x |

FOR the reappointment of Ernst & Young LLP as the auditor of the Corporation at remuneration to be fixed by the Board. |

IN THE ABSENCE OF INSTRUCTIONS, THE DRAGONWAVE COMMON SHARES REPRESENTED BY A PROPERLY COMPLETED FORM OF PROXY WILL BE VOTED FOR THE ELECTION OF MANAGEMENT’S DIRECTOR NOMINEES AND THE REAPPOINTMENT OF THE AUDITOR AS INDICATED IN THIS CIRCULAR.

Q13. How do I revoke a proxy?

A13. In addition to revocation in any other manner permitted by law, a shareholder may revoke a proxy under subsection 148(4) of the Canada Business Corporations Act (the “CBCA”) by depositing an instrument in writing executed by the shareholder or by the shareholder’s attorney authorized in writing (or if the shareholder is a corporation, by an authorized officer or attorney of the corporation authorized in writing), either at DragonWave’s registered office (located at 411 Legget Drive, Suite 600, Ottawa, Ontario, Canada, K2K 3C9) at any time up to and including the close of business on the last business day preceding the day of the Meeting, or any adjournment or postponement of the Meeting, at which such proxy is to be used, or with the Chair of the Meeting on the day of the Meeting, or any adjournment or postponement of the Meeting. Upon either of such deposits the proxy will be revoked. If the instrument of revocation is deposited with the Chair of the Meeting on the day of the Meeting, or any adjournment or postponement of the Meeting, the instrument will not be effective with respect to any matter on which a vote has already been cast pursuant to such form of proxy.

Q14. Who can help answer my other questions?

A14. If you have any additional questions about the Meeting, including the procedures for voting your Common Shares, or you would like additional copies, without charge, of this Circular, you should contact the Corporation’s head office located at 411 Legget Drive, Suite 600, Ottawa, Ontario K2K 3C9, 613-599-9991. If your broker holds your Common Shares, you may also call your broker for additional information.

VOTING SHARES AND PRINCIPAL SHAREHOLDERS

The Common Shares are the only class of shares of the Corporation authorized and, therefore, the only shares eligible to vote at the Meeting. As of the date of this Circular there are 3,620,506 Common Shares issued and outstanding.

To the knowledge of the directors and executive officers of the Corporation, as of the Record Date and the date of this Circular, no person or Corporation beneficially owns, or controls or directs, directly or indirectly, Common Shares carrying more than 10% of the votes attached to the outstanding Common Shares.

FINANCIAL STATEMENTS

The audited consolidated financial statements of the Corporation for the year ended February 29, 2016, and the accompanying auditors’ report will be presented to the Meeting, in accordance with the provisions of the CBCA. Such financial statements and auditors’ report were mailed, together with management’s discussion and analysis for the year ended February 29, 2016, to shareholders who requested such financial statements, together with this Circular. In accordance with the provisions of the CBCA, the audited consolidated financial statements and the auditors’ report thereon will not be voted on at the Meeting.

ELECTION OF DIRECTORS

The number of directors to be elected at the Meeting is four. Each of the nominees listed below was elected as a director of the Corporation at the Corporation’s previous annual meeting of shareholders. Each nominee has established his or her eligibility and willingness to serve on DragonWave’s Board. The Directors are to be elected in accordance with our majority voting policy (see “Statement of Corporate Governance Practices — Majority Voting for Directors”). Directors are elected to serve until the next annual meeting of shareholders of DragonWave or until their successors are elected or appointed. The names of the proposed nominees for election as directors, together with details of their backgrounds and experience, can be found below under “Information about DragonWave’s Director Nominees”.

UNLESS OTHERWISE INSTRUCTED, THE PERSONS DESIGNATED IN THE FORM OF PROXY WILL VOTE FOR THE ELECTION OF EACH OF THE DIRECTORS WHOSE NAMES ARE SET FORTH ON THE FOLLOWING PAGES. IF, FOR ANY REASON, AT THE TIME OF THE MEETING ANY OF THE NOMINEES IS UNABLE TO SERVE, AND UNLESS OTHERWISE SPECIFIED IN THE SIGNED PROXY, THE PERSONS DESIGNATED IN THE FORM OF PROXY WILL VOTE IN THEIR DISCRETION FOR A SUBSTITUTE NOMINEE OR NOMINEES.

Information about DragonWave’s Director Nominees

The articles of the Corporation (the “Articles”) provide that the Board shall consist of not less than one (1) and not more than ten (10) directors. Notwithstanding the Articles, the CBCA requires the Corporation to have a minimum of three directors. The number of directors within the range prescribed by the Articles and the CBCA is determined, in accordance with the Corporation’s by-laws and organizational resolutions, by a resolution of the Board. In accordance with the Articles and the CBCA, the Board may, without shareholder approval, appoint one director (being one-third of the directors to be elected at the Meeting) to hold office until the next annual meeting of shareholders.

The following tables set out, among other things, the name of each person proposed to be nominated for election, as well as other pertinent information, including principal occupation or employment, all major positions and offices presently held in the Corporation, the year first elected a director of the Corporation (if applicable), the number of Common Shares and options to purchase Common Shares beneficially owned, or controlled or directed, directly or indirectly, by such person as of May 20, 2016, biographical information of each nominee, any Board committee memberships of each nominee, a record for attendance of Board and committee meetings for the fiscal year ended February 29, 2016, and information regarding directorships on other public boards of directors. For additional information see also “Compensation of Directors”.

All dollars figures are represented below in US dollars (“USD”). For payments or income earned in foreign currencies, the rates used to translate are the average rate for the 2016 fiscal year: Canadian dollars to USD is 0.7684 (1.3014); Great Britain pounds sterling to USD is 1.5149 (0.6601).

|

Claude Haw (Chair) Ottawa, Ontario, Canada

Common Shares: 1,200

Options: 4,144

Board details: · Director since 2003 · Independent |

|

Claude Haw is President of Venture Coaches, a private consulting and investment company, which he founded in 2000. From 2009 to 2011 he was President and Chief Executive Officer of the Ottawa Centre for Regional Innovation (OCRI), Ottawa’s leading economic development organization. From 2003 to early 2007, Mr. Haw was also a general partner at Skypoint Capital Corporation, an Ottawa based venture capital firm. Prior to Venture Coaches, Mr. Haw held a number of executive positions at Newbridge Networks Corporation, including Vice President of Corporate Business Development. In this role, he managed strategic investment programs in more than 20 companies. Mr. Haw has also held senior management positions at Mitel Networks Corporation and Leigh Instruments Ltd. Mr. Haw serves on the board of directors of two private companies, Signority Inc. and Rent Frock Repeat Inc., as well as on the board of a not-for-profit association, Public Services Health and Safety Association. Mr. Haw holds a Bachelor of Electrical Engineering degree from Lakehead University in Thunder Bay, Ontario, Canada and has completed the Canadian Securities Course. He has completed the ICD Director Education Program and attained the ICD.D designation in 2012. Mr. Haw was also recognized for his contribution to Canadian innovation with the Queen Elizabeth II Diamond Jubilee Medal in 2012. |

|

Board/Committee Membership |

|

Attendance |

|

Attendance (Total) |

|

Total Compensation |

| ||||

|

Board (Chair) |

|

28/28 |

|

34/34 |

|

100% |

|

Year Ended |

|

Amount |

|

|

Audit Committee |

|

4/4 |

|

|

|

|

|

February 29, 2016 |

|

$78,377 |

|

|

Compensation Committee |

|

1/1 |

|

|

|

|

|

|

|

|

|

|

Nominating and Governance Committee (Chair) |

|

1/1 |

|

|

|

|

|

|

|

|

|

|

Public Board Membership |

|

Public Board Committee |

|

Public Board Interlocks | ||

|

Edgewater Wireless Systems Inc. |

|

2012 - Present |

|

Audit Committee |

|

Nil |

|

Peter Allen Ottawa, Ontario, Canada

President and CEO, DragonWave

Common Shares: 18,346

Options: 34,806

Board details: · Director since 2004 · Not Independent (President and CEO of DragonWave) |

|

Peter Allen has served as President and CEO of DragonWave since 2004. Prior to joining DragonWave, Peter was President and CEO of Innovance Inc. (“Innovance”), a private reconfigurable optical networking company from 2000 to 2003. Prior to 2000, Mr. Allen was the Vice President of Business Development for the Optical Networks Division of Nortel Networks Limited (“Nortel”), holding leadership responsibility for Nortel’s optical components business as well as business development responsibility for system activities. At Nortel, Mr. Allen led a 5,000-employee global operation spanning R&D, manufacturing and sales and marketing. Mr. Allen has also held managerial positions at Ford Motor Company and Rothmans International plc, and has lived and worked in North America, Europe and Africa. |

|

Board/Committee Membership |

|

Attendance |

|

Attendance (Total) |

|

Total Compensation(2) |

| ||||

|

Board |

|

27/27(1) |

|

27/27 |

|

100% |

|

Year Ended |

|

Amount |

|

|

|

|

|

|

|

|

|

|

February 29, 2016 |

|

$392,670 |

|

|

Public Board Membership |

|

Public Board Committee |

|

Public Board Interlocks | ||

|

Nil |

|

— |

|

— |

|

— |

(1) One Board meeting held during the fiscal year ended February 29, 2016 was an in camera Board meeting and Mr. Allen was not entitled to participate.

(2) Includes executive compensation. Mr. Allen is not separately compensated for acting as a director. See “Summary Compensation Table” for further details with respect to Mr. Allen’s compensation.

|

Cesar Cesaratto Gatineau, Quebec, Canada

Common Shares: 1,600

Options: 2,918

Board details: · Director since June 12, 2012 · Independent |

|

Mr. Cesaratto has more than 40 years of experience in the technology industry. Mr. Cesaratto joined Nortel Networks Corporation, a communications equipment manufacturing company, in 1970 and assumed increasingly senior management roles during his 31 year career with Nortel, culminating in the role of President, Wireless Solutions for Europe, Middle East and Africa. Mr. Cesaratto retired from Nortel in 2001 and has continued to be active in the technology sector. He is currently a member of an angel investment group dedicated to the development of technology start-up companies in the Ottawa area. He was a director of Tundra Semiconductor (2007 to 2009) and Breconridge Manufacturing Solutions (2007 to 2010) and is currently Chair of the board of directors of Applied Micro Circuits Corporation and serves on the Board of two private start-up companies. Mr. Cesaratto holds a Bachelor of Engineering in Electrical Engineering from McGill University. |

|

Board/Committee Membership |

|

Attendance |

|

Attendance (Total) |

|

Total Compensation |

| ||||

|

Board |

|

28/28 |

|

34/34 |

|

100% |

|

Year Ended |

|

Amount |

|

|

Audit Committee |

|

4/4 |

|

|

|

|

|

February 29, 2016 |

|

$47,699 |

|

|

Compensation Committee (Chair) |

|

1/1 |

|

|

|

|

|

|

|

|

|

|

Nominating and Governance Committee |

|

1/1 |

|

|

|

|

|

|

|

|

|

|

Public Board Membership |

|

Public Board Committee |

|

Public Board Interlocks | ||

|

Applied Micro Circuits Corporation |

|

April 2002 - Present |

|

Chair of the board, member of the Compensation and Governance and Nominating Committees |

|

Nil |

|

Lori O’Neill Ottawa, Ontario, Canada

Common Shares: 800

Options: 2,150

Board details: · Director since June 13, 2013 · Independent |

|

Lori O’Neill is a Chartered Professional Accountant and Certified Public Accountant (Illinois) and currently provides consulting services to growth companies. She retired from partnership in the global professional services firm Deloitte & Touche LLP in 2012 after over 24 years serving growth companies from startups to multinationals, supporting complex transactions, private and public equity offerings, mergers and acquisitions in Canada and the U.S. Ms. O’Neill serves as board member and chair of the Audit and Risk Management Committee of the Ontario Lottery and Gaming Corporation, board member and chair of the Audit Committee of Defence Construction Canada, member of the board of directors of Hydro Ottawa, the University of Ottawa Heart Institute, Startup Canada, PageCloud Inc. and the board of governors of Ashbury College. Ms. O’Neill graduated from Carleton University with a Bachelor of Commerce Highest Honours in 1988, achieved her CA designation in 1990, her CPA designation in 2003, was recognized as “Top Forty under Forty” in 1999 by the Ottawa Business Journal, and completed the ICD Director Education Program attaining the ICD.D designation in 2012. |

|

Board/Committee Membership |

|

Attendance |

|

Attendance (Total) |

|

Total Compensation |

| ||||

|

Board |

|

28/28 |

|

33/33 |

|

100% |

|

Year Ended |

|

Amount |

|

|

Audit Committee (Chair) |

|

4/4 |

|

|

|

|

|

February 29, |

|

$41,992 |

|

|

Compensation Committee |

|

n/a |

(1) |

|

|

|

|

2016 |

|

|

|

|

Nominating and Governance Committee |

|

1/1 |

|

|

|

|

|

|

|

|

|

|

Public Board Membership |

|

Public Board Committee |

|

Public Board Interlocks | ||

|

Nil |

|

— |

|

— |

|

— |

(1) Ms. O’Neill joined the Compensation Committee in April 2015 and there were no subsequent meetings of the Compensation Committee during the fiscal year ended February 29, 2016.

Cease Trade Orders and Bankruptcies

Cesar Cesaratto, was a director of Metconnex Canada Inc. and Metconnex US Inc. from 2005 to 2006. The names of Metconnex Canada Inc. and Metconnex US Inc. were subsequently changed to 4061101 Canada Inc. (“406”) and 422875 Delaware Corp., respectively. On September 28, 2006, 406 filed a Notice of Intention to Make a Proposal naming Doyle Salewski Inc. as Trustee. On October 11, 2006, Doyle Salewski Inc. was appointed Interim Receiver of 406 pursuant to an Order of the Superior Court of Justice (Ontario). The assets of 406 were realized upon by the Interim Receiver and excess funds after payment to all secured creditors were paid to the proposal Trustee to fulfill the terms of the proposal filed by 406 on March 27, 2007.

None of the proposed nominees for director or the officers of the Corporation have been subject to a corporate cease trade or similar order.

Director Independence

The following table summarizes the independence status under National Instrument 52-110 - Audit Committees and National Policy 58-201 - Corporate Governance Guidelines, and NASDAQ rules (including for members of the Audit Committee, the independence requirements under Rule 10A-3 of the United States Securities Exchange Act of 1934, as amended), as determined by the Board, of the nominees for the Corporation’s Board and provides further details regarding those directors who are deemed “not independent”.

|

Name of Director |

|

Independent |

|

Not Independent |

|

Reasons Not Independent |

|

Claude Haw (Chair) |

|

ü |

|

|

|

|

|

Peter Allen |

|

|

|

ü |

|

President and Chief Executive Officer of the Corporation |

|

Cesar Cesaratto |

|

ü |

|

|

|

|

|

Lori O’Neill |

|

ü |

|

|

|

|

Other Information Regarding Director Nominees

See the sections titled “Compensation of Directors” and “Statement of Corporate Governance Practices” below for further information regarding the Board.

REAPPOINTMENT OF INDEPENDENT AUDITOR

On the recommendation of the Audit Committee, management proposes to present a resolution to appoint Ernst & Young LLP, Chartered Accountants, as the auditor of the Corporation for the fiscal year ending February 28, 2017, to hold office until the close of the next annual meeting of shareholders at remuneration to be fixed by the Board. Ernst & Young LLP was first appointed as auditor of the Corporation in 2000.

Directors’ Recommendation

The Board of Directors recommends a vote FOR the appointment of Ernst & Young LLP as DragonWave’s auditor for the ensuing year at remuneration to be fixed by the Board.

THE PERSONS NAMED IN THE FORM OF PROXY WILL, UNLESS SPECIFICALLY INSTRUCTED OTHERWISE, VOTE FOR THE REAPPOINTMENT OF ERNST & YOUNG LLP AS THE AUDITOR OF THE CORPORATION. IN ORDER TO BE EFFECTIVE, THE RESOLUTION APPOINTING THE AUDITOR MUST BE APPROVED BY A MAJORITY OF THE VOTES CAST AT THE MEETING.

COMPENSATION OF DIRECTORS

General Compensation Principles for Directors

Compensation for directors of the Corporation is determined by the full Board, based on recommendations from the Compensation Committee of the Board. In determining appropriate compensation for directors, the Board and the Compensation Committee consider risks and responsibilities assumed by the directors as well as prevailing market conditions and practices. The Compensation Committee takes a broad approach to assessing comparative market references and applies

its business judgment in making compensation decisions. The Board and the Compensation Committee also take into account factors such as the director’s committee membership(s), the time commitment associated with acting in this capacity, and the director’s background experience and skill set. Accordingly, compensation may vary by director.

Compensation Review

The charter for the Compensation Committee of the Board provides that the Compensation Committee shall periodically, but at least every third year, review and make a recommendation to the Board regarding the compensation of the Board. Previously, the Compensation Committee assessed the Corporation’s director compensation policy in February 2010, when the Compensation Committee reviewed the policy with a view to aligning overall directors’ compensation with prevailing market conditions. To assist in this review, the Corporation retained Towers Watson & Co. (“Towers Watson”) in April, 2010 to make recommendations and perform a compensation benchmarking study (the “Towers Watson Report”). As a result of the Compensation Committee’s review in 2010 of director compensation, and after taking account of the Towers Watson Report and other factors, the Board concluded to re-align directors’ cash compensation for the fiscal year ended February 28, 2011 such that the directors receive a retainer and additional amounts depending on their committee roles and participation and number of meetings attended.

On May 8, 2013, the Board, on the recommendation of the Compensation Committee, approved a new policy with respect to options to purchase Common Shares granted to independent directors which provides that, as of May 8, 2013, the vesting provisions of new grants of options to independent directors will provide for full vesting of such options in connection with a change of control of the Corporation. The Board believes that this vesting policy is in keeping with industry standards and is required in order to attract and retain high quality candidates for the Board. No change of control of the Corporation is currently contemplated.

In May 2014, the Compensation Committee conducted an internal review of management and director compensation, and based on that review, recommended the following:

1. the adoption of the Share Based Compensation Plan to provide for, among other equity incentives to employees and other eligible participants, the ability to issue restricted share units (“RSUs”) to non-employee directors in lieu of a portion of cash compensation (which was approved by shareholders at the annual and special meeting of shareholders held on June 20, 2014); and

2. a further review of management and Board compensation to be completed during the first half of the fiscal year ending February 28, 2015.

During the first half of fiscal year 2015 the Compensation Committee asked management to assemble and present benchmark data and analysis to the Compensation Committee for review. While an independent consultant was not used for this purpose, the scope and type of data collected and analyzed was similar to that included in previous external benchmarking reviews. The compensation for executives and directors was benchmarked against fourteen other relevant companies chosen based on their similarity of industry, reporting issuer status and size. As the Corporation was undertaking a number of measures to control expenses, the Board did not feel that adding costs for external compensation review was the best use of funds in the near term. The conclusions reached by the Compensation Committee for both executives and directors were that compensation had fallen significantly below market levels.

Following the review in the first half of fiscal year 2015, the Board confirmed that each element of cash compensation should be targeted at the 50th percentile of the benchmark companies identified in the 2015 review, and in keeping with its charter, the Compensation Committee reviewed the compensation of the Board. Based on that review, the Compensation Committee recommended that several changes be made to board compensation to reflect market norms and to move toward the 50th percentile level of compensation of these benchmark companies. As such, the annual retainers for participation on the board of directors and the various committees were updated as follows:

|

|

CAD$ |

75,000 |

| |

|

|

|

|

| |

|

Board member |

|

CAD$ |

30,000 |

|

|

|

|

|

| |

|

Chair of Audit Committee |

|

CAD$ |

12,000 |

|

|

|

|

|

| |

|

Chair of the Compensation Committee |

|

CAD$ |

10,000 |

|

|

|

|

|

| |

|

Chair of the Nominating and Governance Committee |

|

CAD$ |

8,000 |

|

Other members of the Audit Committee, Compensation Committee, and Nominating and Governance Committees are to receive CAD$5,000 per committee per annum. The annual fees include participation in up to twelve meetings of the board of directors and four meetings for each committee. If the number of meetings attended by a director exceeds this number of meetings, the director receives additional compensation at the rate of CAD$1,000 per meeting.

In addition, the compensation policy with respect to share based compensation was updated such that each director is to receive share based compensation equivalent to a Black Scholes amount of CAD$50,000 per annum. This amount could be a combination of restricted share units and stock options at the discretion of the Compensation Committee and the Board.

The last review of the compensation of the Board took place in the first half of fiscal year 2015. On November 12, 2015, the Board decided to temporarily reduce compensation for executives and directors in light of the Corporation’s cash position. This step was taken in light of the significant decrease in revenues, and the Corporation’s overall effort in reducing operating expenses in order to limit cash burn. The directors’ cash compensation was reduced by 50%. In conjunction with this reduction, each of the independent directors received an option grant on November 23, 2015.

As provided in the Compensation Committee’s charter, the Compensation Committee will conduct further periodic reviews of director compensation in the future and may recommend further adjustments based on then-prevailing market conditions, succession planning, the scope of a director’s duties, the Corporation’s cash position, and other relevant factors.

In the fiscal years ended February 29, 2012 through February 29, 2016, no fees were paid to any consultant or advisors for services related to compensation matters.

DragonWave has not, since the completion of its fiscal year ended February 29, 2016, retained any consultant or advisor to assist the Board or the Compensation Committee in determining compensation for any of its directors or executive officers.

Director Compensation Table for Fiscal Year Ended February 29, 2016

The following table sets forth all amounts of compensation earned by the directors of the Corporation, other than Peter Allen and Russell Frederick (who was an officer and director of the Corporation until August 26, 2015), who were not separately compensated for their service as directors. Mr. Allen’s and Mr. Frederick’s compensation is reflected in the “Summary Compensation Table” under “Information on Executive Compensation” below) for the financial year ended February 29, 2016.

|

Name of Director |

|

Fees |

|

Option |

|

Share |

|

Non-equity |

|

Pension Value |

|

All other |

|

Total |

| ||||

|

Claude Haw (Chair) |

|

$ |

65,890 |

|

$ |

4,024 |

|

$ |

8,462 |

|

Nil |

|

Nil |

|

Nil |

|

$ |

78,377 |

|

|

Cesar Cesaratto |

|

$ |

36,979 |

|

$ |

2,258 |

|

$ |

8,462 |

|

Nil |

|

Nil |

|

Nil |

|

$ |

47,699 |

|

|

Lori O’Neill |

|

$ |

31,600 |

|

$ |

1,929 |

|

$ |

8,462 |

|

Nil |

|

Nil |

|

Nil |

|

$ |

41,992 |

|

|

Robert Pons(4)(5) |

|

$ |

12,000 |

|

Nil |

|

Nil |

|

Nil |

|

Nil |

|

Nil |

|

$ |

12,000 |

| ||

(1) All compensation, with the exception of Mr. Pons, was paid in CAD dollars. The amount disclosed above is the USD equivalent of the Canadian dollar amount paid based on an average exchange rate for the 2016 fiscal year of 0.7684 (1.3014).

(2) Option based award values are calculated at their market value established using the Black-Scholes methodology, which has been chosen as the method to value options as it is the most widely recognized methodology and is accepted as a US generally accepted accounting standard. The Black-Scholes methodology considers various factors including historical share prices, price volatility and interest rates.

(3) Represents the value of restricted share units that vested based on the fair market value of the Common Shares on the vesting date of CAD$13.75, and an exchange rate of CAD to USD of 0.7693.

(4) Mr. Pons resigned as a director of the Corporation effective on April 14, 2015.

(5) Mr. Pons’ compensation was paid in USD dollars.

Outstanding Option-Based Awards for Directors as at February 29, 2016

The following table sets forth all unexercised options outstanding as of February 29, 2016 for each director of the Corporation, other than Peter Allen and Russell Frederick (who was an officer and director of the Corporation until August 26, 2015). Mr. Allen and Mr. Frederick’s unexercised options are reflected in the table titled “Outstanding Option-Based Awards and Share-Based Awards as at February 29, 2016” under “Information on Executive Compensation” below).

|

Name of Director |

|

Number of |

|

Option exercise |

|

Option |

|

Aggregate value of |

| |

|

Claude Haw (Chair) |

|

2,793 |

|

$ |

3.00 |

|

November 23, 2020 |

|

Nil |

|

|

|

|

231 |

|

$ |

53.75 |

|

July 18, 2019 |

|

|

|

|

|

|

580 |

|

$ |

56.00 |

|

May 8, 2018 |

|

|

|

|

|

|

540 |

|

$ |

73.50 |

|

July 11, 2017 |

|

|

|

|

Cesar Cesaratto |

|

1,567 |

|

$ |

3.00 |

|

November 23, 2020 |

|

Nil |

|

|

|

|

231 |

|

$ |

53.75 |

|

July 18, 2019 |

|

|

|

|

|

|

580 |

|

$ |

56.00 |

|

May 8, 2018 |

|

|

|

|

|

|

540 |

|

$ |

73.50 |

|

July 11, 2017 |

|

|

|

|

Lori O’Neill |

|

1,339 |

|

$ |

3.00 |

|

November 23, 2020 |

|

Nil |

|

|

|

|

231 |

|

$ |

53.75 |

|

July 18, 2019 |

|

|

|

|

|

|

580 |

|

$ |

70.00 |

|

June 13, 2018 |

|

|

|

|

Robert Pons(3) |

|

Nil |

|

Nil |

|

Nil |

|

Nil |

| |

(1) The closing market price of the Common Shares on the Toronto Stock Exchange (the “TSX”) on February 29, 2016 was CAD$2.81 per Common Share.

(2) Foreign currency is translated at the closing rate for the 2016 fiscal year. CAD to USD is 0.7395 (1.3523).

(3) Mr. Pons resigned as a director of the Corporation effective on April 14, 2015.

Incentive Plan Awards — Value Vested by Directors During the Fiscal Year ended February 29, 2016

The following table sets forth the value vested by each director of the Corporation, other than Peter Allen and Russell Frederick (who was an officer and director of the Corporation until August 26, 2015). Mr. Allen and Mr. Frederick’s value vested option-based awards are reflected in the table titled “Incentive Plan Awards — Value Vested or Earned During the Year Ended February 29, 2016” under “Information on Executive Compensation” below) during the year ended February 29, 2016.

|

Name of Director |

|

Option-based awards — Value vested during the year |

|

Share-based Awards (RSUs) –Value vested during the |

| |

|

Claude Haw (Chair) |

|

Nil |

|

$ |

8,462 |

|

|

Cesar Cesaratto |

|

Nil |

|

$ |

8,462 |

|

|

Lori O’Neill |

|

Nil |

|

$ |

8,462 |

|

|

Robert Pons(3) |

|

Nil |

|

Nil |

| |

(1) Represents the aggregate dollar value that would have been realized had the options under the option-based award been exercised on the vesting date. Calculated as the difference between the market price of the underlying securities on the vesting date and the exercise price of the options under the option-based award plan multiplied by the amount of options vesting.

(2) Foreign currency is translated at the average rate for the 2016 fiscal year. CAD to USD is 0.7684 (1.3014).

(3) Mr. Pons resigned as a director of the Corporation effective on April 14, 2015.

DIRECTORS’ AND OFFICERS’ INSURANCE AND INDEMNIFICATION

The Corporation’s by-laws provide for the indemnification by the Corporation of the Corporation’s directors and officers from and against liability and costs in respect of any action or suit against them in connection with the execution of their duties of office, subject to certain limitations. The Corporation has also entered into contractual indemnities in favour of each of its directors, and certain of the directors of its principal subsidiaries, that provide, to the full extent allowed by law, that the Corporation shall indemnify and save harmless each director, his estate, executors, administrators, legal representatives and lawful heirs, from and against any and all costs, charges or expenses (including, but not limited to, an amount paid to settle any action or to satisfy any judgment, legal fees on a solicitor and client basis, other professional fees, out-of-pocket expenses for attending proceedings including discoveries, trials, hearings and meetings, and any amount for which he is liable by reason of any statutory provision whether civil, criminal or otherwise (“indemnifiable costs”)), suffered or incurred by the director or such other indemnified parties, directly or indirectly, as a result of or by reason of the director: (i) being or having been a director or officer of the Corporation or an affiliate of the Corporation or by reason of any action taken by the director in his capacity as a director or officer of the Corporation or an affiliate of the Corporation; (ii) being or having been a member of a committee of the board of directors of the Corporation or an affiliate of the Corporation; or (iii) acting as a member of the administrator pursuant to the Share Based Compensation Plan, subject to certain conditions being satisfied including that the director: (a) acted honestly and in good faith with a view to the best interests of the Corporation, or the best interests of the Corporation’s affiliate, as the case may be; and (b) in the case of a criminal or administrative action, proceeding, investigation, inquiry or hearing that is enforced by monetary penalty, he had reasonable grounds for believing that his conduct was lawful. The indemnities also provide that indemnifiable costs will be paid by the Corporation immediately, with the agreement that, in the event it is ultimately determined that the indemnified party was not entitled to be so indemnified, such amounts shall be refunded to the Corporation.

The Corporation has purchased insurance referred to in subsection 124(6) of the CBCA for the benefit of its directors and officers in respect of certain liabilities that may be incurred by them in such capacities. The directors’ and officers’ insurance coverage is contained in policies issued on June 1, 2015 to May 31, 2016. The policies carry a combined annual limit of $40 million with a deductible ranging between nil to $250,000 for each claim. The effective annual premium of $438,770 has been paid by the Corporation. The Corporation expects to renew its directors’ and officers’ insurance policy on June 1, 2016.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

No director, executive officer or employee or former director, executive officer or employee of the Corporation, or any associate of any such person, was indebted to the Corporation or its subsidiaries at any time during the fiscal year ended February 29, 2016 and/or as at the date of this Circular.

INFORMATION ON EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Overview

Recent Developments

In light of the challenges facing the Corporation during the last half of the fiscal year, the Compensation Committee recommended to the Board that changes be made to the compensation of the directors and executive officers. These changes included a salary reduction for our executives. This was one of many initiatives implemented by the Corporation to reduce operational expenses in light of reduced revenues. See “Fiscal 2016 Compensation Modifications” below. As noted above under “Compensation of Directors”, in November 2015, the Corporation also implemented a reduction in compensation for directors.

The Compensation Committee

The Compensation Committee assists in carrying out the Board’s oversight responsibility for the Corporation’s human resources and compensation policies and processes, including executive compensation. The current members of the Compensation Committee are Cesar Cesaratto (Chair), Claude Haw and Lori O’Neill. Ms. O’Neill joined the Compensation Committee upon the resignation of Robert Pons as a director in April 2015. The responsibilities of the Compensation Committee are discussed in detail in the Compensation Committee’s charter, which is available on the Corporation’s website at www.dragonwaveinc.com or may be obtained free of charge upon request from Investor Relations at the Corporation’s

head office located at 411 Legget Drive, Suite 600, Ottawa, Ontario, K2K 3C9. As set forth in its Charter, the Compensation Committee’s responsibilities include:

· annually assessing and making a recommendation to the Board on the competitiveness and appropriateness of the total compensation package for the Chief Executive Officer and the Corporation’s executive officers, including the “Named Executive Officers”, being the Corporation’s President and Chief Executive Officer (Peter Allen), the Corporation’s Vice President, Finance and Chief Financial Officer (Patrick Houston) and the three other most highly compensated executive officers of the Corporation and its subsidiaries that earned total annual compensation during the year ended February 29, 2016 that exceeded $150,000 (Barry Dahan, Erik Boch and Dave Farrar);

· annually reviewing the performance goals and criteria for the Chief Executive Officer and evaluating the performance of the Chief Executive Officer against such goals and criteria, and recommending to the Board the amount of regular and incentive compensation to be paid to the Chief Executive Officer;

· annually reviewing and making a recommendation to the Board regarding the Chief Executive Officer’s performance evaluations of the other Named Executive Officers and his recommendations with respect to the amount of regular and incentive compensation to be paid to such Named Executive Officers;

· annually considering the implications of the risks associated with the compensation policies and practices of the Corporation; and

· reviewing and making recommendations to the Board regarding any employment contracts or arrangements with any Named Executive Officers, including any retiring allowance arrangements or similar arrangements to take effect in the event of a termination of employment.

As noted above under “Compensation of Directors”, during the first half of the fiscal year ending February 28, 2015, the Compensation Committee undertook a comprehensive review of the competitiveness and appropriateness of the total compensation packages for the Corporation’s Named Executive Officers. Following such review, the Compensation Committee made recommendations to the Board with respect to the compensation packages for the Named Executive Officers. See below under “Fiscal 2015 Compensation Review”.

Objectives of Compensation Program

The purpose of the Corporation’s compensation program is to attract and retain highly competent executives in a competitive marketplace. The program is intended to provide the Named Executive Officers with compensation that is industry competitive, internally equitable and commensurate with their skills, knowledge, experience and responsibilities. The primary objective of the program, however, is to firmly align total executive compensation with the attainment of the Corporation’s performance goals.

Elements of Compensation

The key components of compensation for executives of DragonWave, including the Named Executive Officers, are base salary, short-term incentives in the form of bonuses and long-term incentives in the form of stock options and the ability to participate in DragonWave’s Employee Share Purchase Plan (the “ESPP”), as further described in the table below. Benefits are the remaining compensation component and comprise a small portion of total annual compensation.

|

Element |

|

Form |

|

Period |

|

Program Objectives |

|

Base Salary |

|

Cash |

|

Annual |

|

· Reflect executives’ scope of responsibility, capability, knowledge, experience, performance and maturity in role |

|

Variable Compensation |

|

|

|

|

|

|

|

Short-term Incentive |

|

Cash and/or share based compensation |

|

Annual |

|

· Reward executive for achievement of annual corporate performance goals |

|

Long-term Incentive |

|

Stock Options |

|

4 year vesting Performance based vesting |

|

· Align interests of executives and shareholders · Motivate and reward executives for creating increased shareholder value |

|

|

|

ESPP participation |

|

N/A |

|

· Attract and retain key talent |

|

Benefits |

|

Group health, dental, long-term disability and life insurance benefits |

|

N/A |

|

· Provide competitive benefit programs that protect the health and well-being of executives |

In establishing the overall award level each year, the Compensation Committee considers each compensation element separately, and in combination, to determine the appropriate level of total compensation for the year. In reaching this determination, the Compensation Committee considers a broad range of both objective and subjective measures for each compensation element, and also takes into account peer group comparables when determined incentive compensation. The Corporation’s approach has been to have a portion of total cash compensation at risk such that the appropriate incentive is in place for the executives to achieve, and over-achieve, the growth and profitability objectives in the program.

Fiscal 2011 Compensation Review

In light of the rapid revenue growth that the Corporation experienced during the fiscal year ended February 28, 2010 and the listing of the Corporation’s Common Shares on NASDAQ in October, 2009, the Compensation Committee determined that it was advisable to retain an external compensation consultant to review executive compensation for selected executive positions, including the positions held by the Named Executive Officers, as well as the compensation of the Board and its committees. Towers Watson was retained to perform the review and prepare the Towers Watson Report, which was completed early in the 2011 fiscal year.

The Towers Watson Report included an assessment of the competitive positioning of the Corporation’s compensation practices relative to a group of comparator companies. The peer group agreed to by the Corporation and Towers Watson for the purpose of this study was Acme Packet Inc., Blue Coat Systems Inc., Bridgewater Systems Corp., COM DEV International Ltd., DALSA Corp., Harris Stratex Networks (now known as Aviat Networks Inc.), International Datacasting Corporation, March Networks Corporation, Redknee Solutions Inc., Redline Communications Group Inc., Riverbed Technology Inc., RuggedCom Inc., Sandvine Corporation, Vecima Networks Inc. and Zarlink Semiconductor Inc. Based on the Towers Watson Report, the Compensation Committee concluded that in certain respects the compensation of the Named Executive Officers did not reflect market comparables. In particular, Towers Watson found that the base salaries for the Named Executive Officers were below the 50th percentile. After reviewing the Towers Watson Report, the Compensation Committee determined that a better balance between base salary and bonus compensation would be appropriate. As a result, for fiscal 2011, the Board approved increases to the base salaries for the Named Executive Officers to CAD$375,000 for Mr. Allen, CAD$250,000 for Mr. Frederick, CAD$250,000 for Mr. Boch, and CAD$250,000 for Mr. Farrar. These new base salaries, when combined with the bonus opportunity, were intended to fall at approximately the 50th percentile level compared to the Corporation’s peer group.

Fiscal 2015 Compensation Review

During the first half of fiscal year 2015 the Compensation Committee asked management to assemble and present benchmark type data and analysis to the Compensation Committee for review. While an independent consultant was not used for this purpose, the scope and type of data collected and analyzed was similar to that included in previous external benchmarking reviews. The compensation for executives and directors was benchmarked against fourteen other relevant companies chosen based on their similarity of industry, reporting issuer status and size. The relevant companies were identified as: Nordion (Canada) Inc., Aviat Networks Inc., COM Dev International Ltd., Mitel Networks Corporation, Sandvine Corporation, Sierra Wireless, Inc., Redknee Solutions Inc., Redline Communications Group Inc., Vecima Networks Inc., ADTRAN, Inc., Anaren, Inc., Calix, Inc., Riverbed Technology Inc., and ShoreTel, Inc. The conclusions reached by the Compensation Committee for both executives and directors were that compensation had fallen significantly below market levels.

In July 2014, adjustments to management compensation were approved by the Board of Directors based on the recommendation of the Compensation Committee. As a result, effective July 10, 2014, the Board approved increases to the base salaries for the Named Executive Officers to CAD$426,000 for Mr. Allen, CAD$264,000 for Mr. Frederick, CAD$264,000 for Mr. Boch, and CAD$264,000 for Mr. Farrar. These new base salaries were determined based on the estimated mid-point between the prior base salary and 50th percentile of the peer group of companies. As a result, the new base salaries were still below market norms, as the Board of Directors determined that this was appropriate in light of the cash consumption constraints faced by the Corporation. In the case of Mr. Allen, the payment of his incremental salary was not processed until after the end of fiscal 2015.

Fiscal 2016 Compensation Modifications

A benchmarking review of compensation was not undertaken during the fiscal year ended 2016. However, as a result of the ongoing challenges faced by the Corporation, the Board, with the consent of the individual directors and executives, reduced director and executive compensation in November 2015 in the range of 30% to 50%. As of the date of this Circular, these salary reductions are still in place. Cash costs of executive compensation to the Corporation in fiscal year 2016 was reduced by approximately 20% when compared to fiscal year 2015 as a result of the salary reduction as well as the continued appreciation of the US dollar versus the Canadian dollar and the British pound.

Compensation in the form of base salary for the President and Chief Executive Officer was reduced by 50%. Base salary for six other executives was reduced by 30%.

Jointly with the salary reduction, the Corporation granted stock options to executives. The Compensation Committee recommended the grant of stock options, and the Board approved the grants, to provide a long-term incentive to the executives affected by the salary reduction.

The Compensation Committee will continue to review the appropriateness of the salary reductions during fiscal 2017 as the Corporation makes progress towards its financial objectives.

Further detail regarding each element of compensation is set forth below.

Base Salary

As noted above, the Compensation Committee evaluates the performance of the Corporation’s Chief Executive Officer, and recommends to the Board the Chief Executive Officer’s compensation package including base salary, in light of that evaluation. The Chief Executive Officer’s base salary is determined pursuant to the terms of an employment agreement, with annual increases at the discretion of the Board. The Compensation Committee considers the following factors in evaluating the Chief Executive Officer’s performance:

· the degree to which he has displayed leadership for the senior management team and the organization as a whole;

· strategic planning and the execution of the Corporation’s strategic plans;

· the Corporation’s financial results; and

· communications and relations with shareholders, the Board, senior management and employees.

The Corporation’s budget for funding base salary increases is also considered.

The base salary of each executive officer is determined by the terms of their respective employment agreement, with annual increases at the discretion of the Board. Base salaries of Named Executive Officers other than the Chief Executive Officer are reviewed by the Compensation Committee after consultation with, and upon the recommendation of, the Chief Executive Officer for approval by the Board. After evaluating each executive officer’s performance over the year in light of (i) the Corporation’s overall financial performance, (ii) the individual’s performance during the year and contributions to the Corporation, and (iii) other relevant factors (for example, market conditions), the Chief Executive Officer may deem it appropriate to recommend executive officer base salary adjustments to the Compensation Committee. The Compensation Committee exercises judgment in weighing these and other factors and recommending base salary levels for the executive officers. As noted above, in fiscal year 2015, the Compensation Committee and the Board also considered a review of relevant companies in deciding to increase the base salary of each executive officer. The Corporation’s budget for funding base salary increases is also considered.

Also, as noted above, Mr. Allen’s base salary was reduced, effective November 2015, by 50%, and the base salary of the other Named Executive Officers was reduced by 30%.

Variable Compensation (Short Term) — Annual Cash Bonuses

The second element of the Corporation’s compensation program is an annual cash bonus. Under their employment agreements, all of the Corporation’s executive officers are entitled to receive an annual cash bonus based on corporate performance. In a typical fiscal year, the amounts of bonuses are based on achievement of corporate performance goals (such as annual revenue and income) relative to the Board’s approved plan for each of those measures for the fiscal year (the “Plan”).

The Corporation does not disclose specific corporate performance measures because it considers that the information about these specific targets would place it at a significant competitive disadvantage if the targets became known. The targets are aspirational and confidential in nature, and are set as part of the annual budget and strategic planning process. The targets form the basis not only for incentivizing our executives but also for directing new business development and growth opportunities. The annual budget and strategic planning processes are heavily influenced by the experiences and achievements of the Corporation in previous fiscal years, and information on how the Named Executive Officers performance scaled to historical targets would reveal commercially sensitive information to our competitors, including key elements of our longer-term objectives. This could seriously prejudice and negatively impact our competitive advantage in the market as we expect that our competitors would use this information to attempt to disrupt these plans.

The Compensation Committee is responsible for recommending to the Board the annual cash bonus payable to the Chief Executive Officer. Employment agreements with the Named Executive Officers set out the parameters for the amount of such bonuses with the Chief Executive Officer being entitled to an on-Plan performance bonus equal to 75% of his annual base salary and each of the Corporation’s other Named Executive Officers being entitled to an on-Plan bonus equal to 50% of his annual base salary. For example, if actual performance exceeds the Plan, the bonus is proportionately increased, with accelerators for exceptional above-Plan performance. Similarly, if actual performance is below Plan, the bonus is proportionately decreased, and at certain levels below Plan the bonus opportunity goes to zero. The Board believes these bonuses play a key role in enabling the Corporation to attract, retain and motivate executive officers.

The Compensation Committee set corporate performance objectives for fiscal year 2016. The actual financial performance of the Corporation in the fiscal year was not consistent with the Plan objectives, and accordingly, no regular bonuses were awarded for fiscal year 2016.

Variable Compensation (Long Term) — Equity Compensation

The third element of the Corporation’s compensation program is equity compensation. Equity compensation is intended to more closely align annual incentive compensation, as well as total compensation, with the financial interests of shareholders. The equity compensation component of the Corporation’s compensation program is based upon: (1) awards of stock options or other share based awards under the Corporation’s Share Based Compensation Plan and (2) the ability to participate in the Corporation’s ESPP.

Share Based Compensation

The Corporation’s Compensation Committee administers the Share Based Compensation Plan. The purpose of the Share Based Compensation Plan is to advance the interests of the Corporation by encouraging employees, consultants and non-employee directors to receive equity-based compensation and incentives, thereby (i) increasing the proprietary interests of such persons in the Corporation, (ii) aligning the interests of such persons with the interests of the Corporation’s shareholders generally, (iii) encouraging such Persons to remain associated with the Corporation, and (iv) furnishing such persons with additional incentive in their efforts on behalf of the Corporation. The Board also contemplates that through the Share Based Compensation Plan, the Corporation will be better able to compete for and retain the services of the individuals needed for the continued growth and success of the Corporation.

In determining whether to grant options or other share based awards and how many awards to grant to eligible persons under the Share Based Compensation Plan, consideration is given to each individual’s past performance and contribution to the Corporation as well as that individual’s expected ability to contribute to the Corporation in the future. Prior grants of awards are taken into account when determining whether to grant share based awards to an executive officer of the Corporation.

Employee Share Purchase Plan (ESPP)

The Corporation’s ESPP was implemented in the 2008 fiscal year following the approval of shareholders obtained at the Corporation’s annual general and special meeting held on July 17, 2008. The purpose of the ESPP is to give employees of the Corporation access to an equity participation vehicle, in addition to the Share Based Compensation Plan, through the purchase of Common Shares by payroll deduction and the issuance of matching shares. The ESPP is intended to encourage employees to use their combined best efforts on behalf of the Corporation to improve its profits through increased sales, reduction of costs and increased efficiency.

In the fiscal year ended February 29, 2016, two of the Named Executive Officers participated in the ESPP. From March 1, 2016 to May 20, 2016, none of the Named Executive Officers participated in the ESPP.

Benefits

No material additional benefits or perquisites are currently provided to members of management that are not available to employees of the Corporation generally. Benefits which are generally extended to all employees include health, long-term disability, dental and group life insurance.

The Board retains the discretion to make further adjustments to the base salaries and other compensation of the Named Executive Officers as market conditions and other circumstances warrant.

Managing Compensation-Related Risk

During the fiscal year ended February 29, 2016, the Compensation Committee, in keeping with its charter, considered the implications of the risks associated with the Corporation’s compensation policies and practices. For the fiscal year ended February 29, 2016, the Compensation Committee did not identify any risks arising from the Corporation’s compensation policies and practices that are reasonably likely to have a material adverse effect on the Corporation.

In connection with managing any compensation-related risk, the Compensation Committee reviews and manages the policies and practices of the Corporation and ensures that they are aligned with the interests of the shareholders. As discussed above, the Compensation Committee reviews, among other things, the compensation and the annual salary increases of the executive

officers of the Corporation while keeping as a reference the financial performance of the Corporation. The Board as a whole also addresses risk related to compensation policies in the context of compensation mechanisms that are linked to the achievement of certain goals or projects. The Board is involved in the supervision of the key projects and initiatives of the Corporation and the manner in which they are being carried out. Consequently, the Board is in a position where it can control the risks that may be taken by the Corporation’s management and ensures that those risks remain appropriate and that members of the management do not expose the Corporation to excessive risks.

Related to managing the risks associated with compensation policies and practices, on May 2, 2012, the Board amended the Corporation’s Insider Trading Policy to specifically prohibit directors and officers from purchasing financial instruments, including for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by the officer or director.

The Board believes that the following practices discourage or mitigate excessive risk-taking:

· Incentive awards are based on multiple metrics, including both relative and absolute metrics;

· There is an appropriate compensation mix, including fixed and performance based compensation with short and longer term performance conditions and multiple forms of compensation;

· The Compensation Committee has discretion in assessing a portion of the annual incentive performance; and

· There membership of the Compensation and Audit Committees overlap, which assists the Compensation Committee in having a comprehensive understanding of the Corporation’s financial-related risks.

Purchase of Financial Instruments

As noted above, the Insider Trading Policy contains provisions such that Named Executive Officers and directors are not permitted to purchase financial instruments, including, for greater certainty, prepaid variable forward contracts, equity swaps, collars, or units of exchange funds, that are designed to hedge or offset a decrease in market value of equity securities granted as compensation or held, directly or indirectly, by a Named Executive Officer or director.

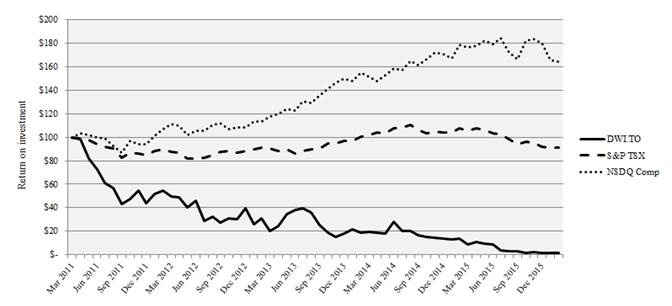

Performance Graph

The following graph compares the cumulative shareholder return of the Common Shares to the cumulative returns of the S&P/TSX Composite Index and the NASDAQ Composite Index for the period commencing on March 1, 2011 and ending on February 29, 2016. The graph assumes an investment of $100 on March 1, 2011 in the Corporation’s Common Shares.

The Named Executive Officers’ compensation is not based on performance of the Corporation’s stock price, and therefore the Named Executive Officers’ compensation may not directly compare to the trend shown above. As discussed above, compensation for the Corporation’s executive officers is comprised of different elements. These include elements relating to factors that do not directly correlate to the market price of the Common Shares, such as base salary, as well as elements that more closely correlate to the Corporation’s performance and changes in the market price of its Common Shares, such as annual incentive awards and awards of stock options (the value of which fluctuates with the share price).

Comparing fiscal 2016 to fiscal 2015, the overall compensation to the Named Executive Officers has decreased, largely as a result of reductions in the value of equity compensation (stock options) awarded to the Named Executive Officers and base salary decreases. Given recent financial constraints facing the Corporation, and in agreement with the Named Executive Officers, the base salary of each Named Executive Officer has been decreased as of November, 2015. While a decreasing trend in executive compensation aligns with decreases in total shareholder return during the same period, there is not a direct correlation.

Summary Compensation Table

The following table sets forth compensation information for the fiscal year ended February 28, 2014, the fiscal year ended February 28, 2015 and the fiscal year ended February 29, 2016 for the Corporation’s Named Executive Officers.

|

|

|

|

|

|

|

|

|

|

|

Non-equity |

|

|

|

|

|

|

| |||||||

|

|

|

Fiscal |

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

Share- |

|

Option- |

|

|

|

|

|

|

|

| |||||||||

|

|

|

|

|

|

|

|

Annual |

|