QuickLinks -- Click here to rapidly navigate through this document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 20-F

o REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT

OF 1934

OR

ý ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended February 29, 2016

OR

o TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

o SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 001-34491

DRAGONWAVE INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of the Registrant's name into English)

Canada

(Jurisdiction of incorporation)

411 Legget Drive, Suite 600, Ottawa, Ontario, Canada K2K 3C9

(Address of principal executive offices)

Peter Allen

President and Chief Executive Officer

411 Legget Drive, Suite 600, Ottawa, Ontario, Canada, K2K 3C9

(613) 599-9991

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.:

Title of each class

Common Shares, no par value

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report. As at February 29, 2016, 3,020,069 common shares of the Registrant were issued and outstanding.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No ý

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such a shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of "accelerated filer and large accelerated filer" in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer o Non-accelerated filer ý

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ý International Financial Reporting Standards Other o

as issued by the International Accounting Standards Board o

If "Other" has been checked in response to the previous question, indicate by check mark which financial statement item the Registrant has elected to follow: Item 17 o Item 18 o

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes o No ý

PART I |

2 | |

ITEM 1. Identity of Directors, Senior Management and Advisers |

2 |

|

ITEM 2. Offer Statistics and Expected Timetable |

2 | |

ITEM 3. Key Information |

2 | |

ITEM 4. Information on our Company |

23 | |

ITEM 4A. Unresolved Staff Comments |

43 | |

ITEM 5. Operating and Financial Review and Prospects |

43 | |

ITEM 6. Directors, Senior Management, and Employees |

49 | |

ITEM 7. Major Shareholders and Related Party Transactions |

72 | |

ITEM 8. Financial Information |

73 | |

ITEM 9. The Offer and Listing |

74 | |

ITEM 10. Additional Information |

75 | |

ITEM 11. Quantitative and Qualitative Disclosures About Market Risk |

84 | |

ITEM 12. Description of Securities Other Than Equity Securities |

85 | |

PART II |

86 |

|

ITEM 13. Defaults, Dividend Arrearages and Delinquencies |

86 |

|

ITEM 14. Material Modifications to the Rights of Security Holders and Use of Proceeds |

86 | |

ITEM 15. Controls and Procedures |

87 | |

ITEM 16. RESERVED |

87 | |

ITEM 16A. Audit Committee Financial Expert |

87 | |

ITEM 16B. Code of Ethics |

88 | |

ITEM 16C. Principal Accountant Fees and Services |

88 | |

ITEM 16D. Exemptions from the Listing Standards for Audit Committees |

88 | |

ITEM 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers |

89 | |

ITEM 16F. Change in Registrant's Certifying Accountant |

89 | |

ITEM 16G. Corporate Governance |

89 | |

ITEM 16H. Mine Safety Disclosure |

89 | |

PART III |

90 |

|

ITEM 17. Financial Statements |

90 |

|

ITEM 18. Financial Statements |

90 | |

ITEM 19. Exhibits |

Information Contained in this Annual Report

All information in this Annual Report on Form 20-F, or our Annual Report, is presented as of February 29, 2016 unless otherwise indicated.

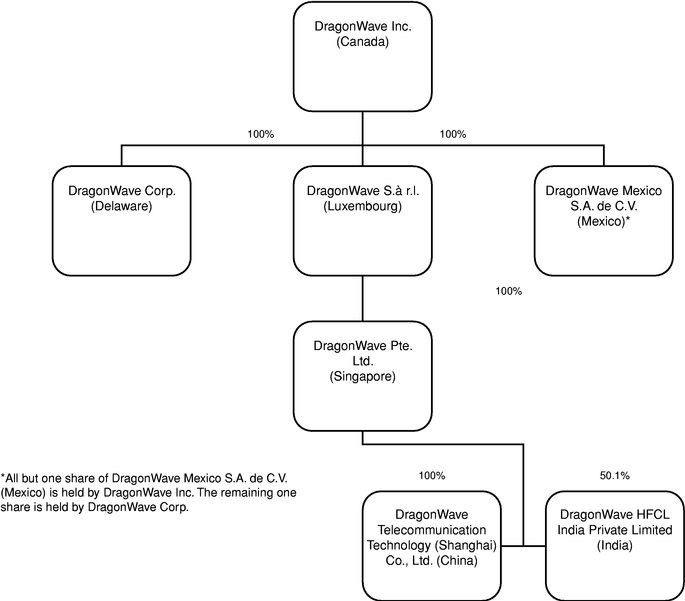

Unless the context requires otherwise, references in this Annual Report to "DragonWave", "we", "us", "our" or "the Company" include DragonWave Inc., incorporated in Canada, DragonWave Corp., incorporated in the state of Delaware, USA, DragonWave Pte. Ltd., incorporated in Singapore, DragonWave S.à r.l., incorporated in Luxembourg, DragonWave Telecommunication Technology (Shanghai) Co., Ltd., incorporated in China, DragonWave Mexico S.A. de C.V., incorporated in Mexico, Axerra Networks Asia Pacific Limited, incorporated in Hong Kong, DragonWave India Private Limited, incorporated in India and DragonWave Inc.'s majority owned subsidiary, DragonWave HFCL India Private Limited, incorporated in India.

References in this Annual Report to "Nokia" or "NSN" refer to both Nokia Solutions and Networks and its predecessor business as carried on under the name Nokia Siemens Networks. Nokia is a trademark of Nokia Corporation or its affiliates.

Words importing the singular, where the context requires, include the plural and vice versa and words importing any general include all genders.

Unless otherwise indicated, all currency amounts referenced in this Annual Report are denominated in United States dollars.

Forward-Looking Statements

This Annual Report contains "forward-looking information" and "forward-looking statements" within the meaning of applicable Canadian and United States securities laws. All statements other than statements that are reporting results or statements of historical fact are forward-looking. All forward-looking information and forward-looking statements are necessarily based on a number of estimates and assumptions that are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements, which involve assumptions and describe our future plans, strategies and expectations, are generally identifiable by use of the words "may", "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "plan" or "project" or the negative of these words or other variations on or synonyms of these words or comparable terminology. Forward-looking statements include, without limitation, statements regarding strategic plans, future production, sales and revenue estimates, cost estimates and anticipated financial results, capital expenditures, results attributable to mergers and acquisitions activities and other objectives.

There can be no assurance that forward-looking statements will prove to be accurate and actual results and outcomes could differ materially from those expressed or implied in such statements.

1

ITEM 1. Identity of Directors, Senior Management and Advisers.

Not applicable.

ITEM 2. Offer Statistics and Expected Timetable.

Not applicable.

The selected financial data set forth in the table below has been derived from our audited historical financial statements for each of the years from 2012 to 2016. The selected consolidated statement of operations data for the years 2016 and 2015 and the selected consolidated balance sheet data at February 29, 2016 and 2015 have been derived from our audited consolidated financial statements set forth in "Part III — Item 18. Financial Statements". The selected consolidated statement of operations data for the years 2012 through 2014 and the selected consolidated balance sheet data at February 29, 2012, February 28, 2013 and February 28, 2014 have been derived from our previously published audited consolidated financial statements, which are not included in this Annual Report. This selected financial data should be read in conjunction with our consolidated financial statements and are qualified entirely by reference to such consolidated financial statements. We prepare our consolidated financial statements in U.S. dollars and in accordance with United States Generally Accepted Accounting Principles ("U.S. GAAP"). You should read the consolidated financial data with the section of this Annual Report entitled "Part I — Item 5. Operating and Financial Review and Prospects" and our consolidated financial statements and the notes to those financial set forth in "Part III — Item 18. Financial Statements".

The tables are expressed in USD $000's except share and per share amounts.

Selected Consolidated Statements of Operation Data

| |

For the year ended | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Feb 29 2012 |

Feb 28 2013 |

Feb 28 2014 |

Feb 28 2015 |

Feb 29 2016 |

|||||||||||

Revenue |

45,656 | 123,877 | 90,011 | 157,766 | 86,295 | |||||||||||

Gross Profit |

16,401 | 19,501 | 10,663 | 27,994 | 13,971 | |||||||||||

Gross Profit % |

35.9% | 15.7% | 11.8% | 17.7% | 16.2% | |||||||||||

Operating Expenses |

54,956 |

76,709 |

50,236 |

47,717 |

37,776 |

|||||||||||

Loss before other items |

(38,555 | ) | (57,208 | ) | (39,573 | ) | (19,723 | ) | (23,805 | ) | ||||||

Net loss applicable to shareholders |

(33,481 | ) | (54,749 | ) | (34,242 | ) | (21,520 | ) | (42,304 | ) | ||||||

Net loss per share |

||||||||||||||||

Basic & Diluted |

(23.57 | ) | (36.50 | ) | (20.66 | ) | (7.90 | ) | (14.01 | ) | ||||||

Weighted average number of shares outstanding |

||||||||||||||||

Basic & Diluted |

1,420,267 | 1,499,832 | 1,657,535 | 2,724,467 | 3,019,259 | |||||||||||

2

Selected Consolidated Balance Sheet Data

| |

For the year ended | |||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Feb 29 2012 |

Feb 28 2013 |

Feb 28 2014 |

Feb 28 2015 |

Feb 29 2016 |

|||||||||||

Cash and cash equivalents |

52,975 | 22,959 | 18,992 | 23,692 | 4,277 | |||||||||||

Trade receivables |

9,850 | 35,452 | 17,408 | 48,626 | 18,986 | |||||||||||

Inventory |

27,043 | 32,722 | 30,416 | 24,294 | 22,702 | |||||||||||

Total other current assets |

5,570 | 19,989 | 5,978 | 5,895 | 2,777 | |||||||||||

Long term assets |

24,683 | 23,872 | 18,326 | 18,546 | 4,325 | |||||||||||

Total assets |

120,121 | 134,994 | 91,120 | 121,053 | 53,067 | |||||||||||

Total liabilities |

18,056 | 79,384 | 49,677 | 76,285 | 48,840 | |||||||||||

Shareholders' equity |

101,727 | 55,594 | 41,524 | 43,801 | 2,520 | |||||||||||

Shares issued and outstanding |

1,423,448 | 1,521,931 | 2,320,349 | 3,011,632 | 3,020,069 | |||||||||||

Share Consolidation

On February 2, 2016, following shareholder approval at a special meeting held on January 26, 2016, we confirmed the consolidation (the "Consolidation") of our common shares on the basis of twenty-five (25) pre-Consolidation shares for one (1) post-Consolidation share. Unless otherwise noted, the information contained in this Annual Report is presented on a post-Consolidation basis.

B. Capitalization and Indebtedness.

Not applicable.

C. Reasons for the Offer and Use of Proceeds.

Not applicable.

The following are some of the important factors related to our business and industry that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements:

- •

- limited cash resources and our dependence on our credit facilities and accommodations by our lenders and certain

suppliers;

- •

- our reliance on a small number of customers for a large percentage of revenue;

- •

- our need for working capital will intensify if we are successful in winning new business;

- •

- intense competition from several competitors;

- •

- competition from indirect competitors;

- •

- our history of losses;

- •

- our ability to implement our ongoing program of operating cost reductions;

- •

- our dependence on our ability to develop new products, enhance existing products and execute product roll-outs on a basis

that meets customer requirements;

- •

- our exposure to product warranty claims, and inventory and account receivables exposure in relation to recent product

quality issues;

- •

- our ability to successfully manage our resources;

- •

- our dependence on our ability to manage our workforce and recruit and retain management and other qualified personnel;

- •

- quarterly revenue and operating results that are difficult to predict and can fluctuate substantially;

3

- •

- a lengthy and variable sales cycle;

- •

- our reliance on suppliers, including outsourced manufacturing, third party component suppliers and suppliers of outsourced

services;

- •

- our ability to manage the risks related to increasingly complex engagements with channel partners and end-customers;

- •

- pressure on our pricing models from existing and potential customers and as a result of competition;

- •

- our exposure to credit risk for accounts receivable;

- •

- our dependence on the development and growth of the market for high-capacity wireless communications services;

- •

- the allocation of radio spectrum and regulatory approvals for our products;

- •

- the ability of our customers to secure a license for applicable radio spectrum;

- •

- changes in government regulation or industry standards that may limit the potential market for our products;

- •

- currency fluctuations;

- •

- our ability to protect our own intellectual property and potential harm to our business if we infringe the intellectual

property rights of others;

- •

- risks associated with software licensed by us;

- •

- a change in our tax status or assessment by domestic or foreign tax authorities;

- •

- exposure to risks resulting from our international sales and operations, including the requirement to comply with export

control and economic sanctions laws;

- •

- our exposure to potential product defects and product liability claims and health and safety risk relating to wireless

products;

- •

- the impact that general economic weakness and volatility may be having on our customers; and

- •

- disruption resulting from economic and geopolitical uncertainty.

In particular, in our most recent fiscal year ended on February 29, 2016, approximately 44% of our sales were through the Nokia channel. Recent developments within Nokia, including Nokia's combination with Alcatel-Lucent, have resulted in our conclusion that new product sales through this channel are unlikely.

See "Part I — Item 4. "Information on our Business — Mergers & Acquisitions and Joint Ventures — Acquisition of Microwave Transport Business of NSN and Relationship with Nokia".

Additional risks related specifically to our securities include:

- •

- risks associated with our outstanding warrants and the impact that the terms of such warrants have on our ability to raise

capital and to undertake certain business transactions;

- •

- risks associated with our ability to raise additional capital;

- •

- large fluctuations in the trading price of our common shares;

- •

- our actual financial results may vary from our publicly disclosed forecasts;

- •

- expense and risks associated with being a U.S. public company and possible loss of our foreign private

issuer status;

- •

- expense and risks associated with the loss of our ability to use the multi-jurisdictional disclosure system ("MJDS")

adopted by the United States and Canada;

- •

- an investor may not be able to bring actions or enforce judgment against us and certain of our directors and officers;

4

- •

- we do not currently intend to pay dividends on our common shares;

- •

- tax consequences associated with an investment in our securities;

- •

- future sales of common shares by our existing shareholders could cause our share price to fall;

- •

- our management's broad discretion over the use of proceeds of financings; and

- •

- certain Canadian laws could prevent or deter a change of control.

Readers should carefully consider the following risk factors in addition to the other information contained in this Annual Report. The risks and uncertainties below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial also may impair our business operations and cause the price of our common shares or other securities to decline. Any of the matters highlighted in the following risks could have a material adverse effect on our business, results of operations and financial condition. In that event, the trading price of our common shares or other securities could decline, and a purchaser of our common shares or other securities may lose all or part of his, her or its investment.

Risks Related to our Business and Industry

We have limited cash resources and we have had to depend on our credit facilities and accommodations by our lenders and certain suppliers.

While our objective is cash flow break-even from operations, given the volatility in our revenues we cannot accurately predict when that objective will be achieved, if at all. We intend to continue to rely on our revolving credit facilities to provide working capital to finance our operations. As discussed above, during the fiscal year ended February 29, 2016, we were in breach of certain covenants under our credit facilities and entered into a forbearance agreement with Comerica Bank. Subsequent to February 29, 2016, we entered into a new forbearance agreement which expired on May 18, 2016. We are currently negotiating a new forbearance agreement with our lenders.

We are dependent on the continued availability of these credit facilities or alternative sources of financing. Alternative sources of financing could include public or private debt or equity financings. Our ability to access our existing credit facilities and/or alternative sources of funding is heavily dependent on the rollout by our customers of large network enhancement projects which include a microwave backhaul component. If one of our current or targeted large customers significantly reduces or delays expected purchases of our products or services, our cash resources will be materially adversely affected.

In order to maintain our credit facilities in good standing, we must comply with bank covenants and carefully manage our cash. From time to time this places constraints on our ability to make investments and ramp up our operations.

In addition, we have benefited from a low interest environment. If interest rates increase, our costs of borrowing will increase, which may adversely affect our financial condition.

The Company relies on flexible payment terms from its suppliers as part of its working capital strategy. In some case, this has included extended payment terms. While we expect our suppliers to continue to support this approach, there can be no guarantee that our suppliers will continue to support the payment terms that we have relied on in the past, and any changes would result in further working capital pressures on the Company.

We rely on a small number of customers for a large percentage of our revenue.

Historically, we have relied on a small numbers of customers for a large percentage of our revenue. During the fiscal year ended February 29, 2016, we reshaped our channel strategy. Our revised strategy primarily positions our latest and new products directly to customers. We have been dependent, and expect that in at least the next twelve months we will continue to be dependent, on a small number of key customers. Nokia represented approximately 44% of our sales for the fiscal year ended February 29, 2016 and we expect this revenue to decline rapidly over time. Other key customers accounted for 15% and 11% of revenue respectively in the fiscal year ended February 29, 2016.

5

We are heavily dependent on the rollout by our customers of large network enhancement projects which include a microwave backhaul component for our revenue. These projects are capital intensive for our target customers and are subject uncertain timing and budgetary decisions. If one of our large customers significantly reduces or delays expected purchases of our products or services, our revenue will be adversely affected.

We generally supply products to our end-customers and channel partners on a purchase order basis and, accordingly, customers are under no ongoing obligation to buy our products. Our relationships with our end-customers and channel partners are generally not exclusive. To the extent that certain of our end-customers and channel partners regard us as a critical supplier of equipment, such customers and channel partners may choose to develop alternative sources of supply, such as our competitors, in order to mitigate actual or perceived risk to their own supply chains. If one or more of our end-customers or channel partners discontinues its relationship with us for any reason, or reduces or postpones current or expected purchases of our products or services, our business, results of operations and financial condition could be materially adversely affected.

Strategic transactions within the service provider market, such as consolidation as a result of mergers as well as divestitures and restructurings, may introduce uncertainty into our customers and prospective customers as they realign their businesses. This may delay orders for our products and services, cause orders to be cancelled or the use of our products to be discontinued, which would have a material adverse effect on our business, financial condition and results of operations.

Our need for working capital will intensify if we are successful in winning new business.

An increase in demand for our products, including through successfully winning new business, will increase our need for working capital to support the supply of such products to our customers. Spikes in demand as a result of the project-based nature of network deployments will strain our financial resources. To the extent that our working capital funding requirements exceed our financial resources, we will need to seek additional sources of debt or equity financing to support our working capital needs. Furthermore, additional financing may not be available on terms favorable to us, or at all. A failure to obtain additional financing could prevent us from making expenditures that may be required to respond effectively to an increase in demand for our products.

We face intense competition from several competitors and if we do not compete effectively with these competitors, our revenue may not grow and could decline.

We have experienced, and expect to continue to experience, intense competition from a number of companies. Among independent microwave vendors, we compete principally with Aviat Networks, Inc., Ceragon Networks Ltd., SIAE Microelettronica and NEC Corporation. Our existing and/or new competitors may announce new products, services or enhancements that better meet the needs of customers or changing industry standards or deeply discount the price of their products. Further, new competitors or alliances among competitors could emerge. Increased competition may cause price reductions, reduced gross margins and loss of market share, any of which could have a material adverse effect on our business, financial condition and results of operations. Our competitors may also establish or strengthen co-operative relationships with sales channel partners or other parties with whom we have strategic relationships, thereby limiting our ability to promote and sell our products. For example, certain of our competitors are included in Nokia's recently introduced microwave ecosystem.

Some of our competitors and potential competitors have significantly greater financial, technical, marketing and/or service resources than us and/or have greater geographical reach to existing and prospective customers. Some of these companies also have a larger installed base of products, longer operating histories or greater name recognition than we do. Some of our competitors have the ability to offer vendor financing to their customers which we do not currently have nor expect to have in the foreseeable future. Customers for our products are particularly concerned that their suppliers will continue to operate and provide upgrades and maintenance for their products over a long-term period. Our relatively small size and short operating history may be considered negatively by current and prospective customers. In addition, our competitors may be able to respond more quickly than us to changes in end-user requirements and devote greater resources to the enhancement, promotion and sale of their products.

6

We face competition from indirect competitors.

In addition to direct competitors, we face competition from broadband technologies that compete with wireless transmission. Our products compete to a certain extent with other high-speed communications solutions, including fiber optic lines, digital subscriber line ("DSL"), free space optics, low and medium capacity point-to-point radios and other wireless technologies. Some of these technologies utilize existing installed infrastructure and have achieved significantly greater market acceptance and penetration than high-capacity broadband wireless technologies. Our wireless products and many other wireless products require a direct line of sight between antennas, potentially limiting deployment options and the ability to deploy products in a cost-effective manner. In addition, customers may wish to use transmission frequencies for which we do not offer products and, therefore, such customers may turn to our competitors to fulfill their requirements. We expect to face increasing competitive pressures from both current and future technologies in the broadband backhaul market. In light of these factors, the market for broadband wireless solutions may fail to develop or may develop more slowly than expected. Any of these outcomes could have a material adverse effect on our business, results of operations and financial condition.

We have a history of losses and cannot provide assurance that we will achieve profitability. If we fail to do so, our share price may decline.

We expect our expenses will be managed in light of short term and long term revenue opportunities. We cannot provide assurance that we will be able to achieve profitability on a quarterly or annual basis. Our business strategies may be unsuccessful. If short term and long term revenue opportunities do not come to fruition, this will impact our ability to achieve profitability. If we are not able to achieve profitability, our share price may decline and we may require additional financing, which may not be available to us.

We depend on our ability to implement our ongoing program of operating cost reductions.

Our future success depends on both growing revenues and our ability to effectively implement our ongoing cost control and efficiency programs. There can be no guarantee that we will be able to successfully reduce our operating costs.

Our success depends on our ability to develop new products, enhance existing products, and execute product roll-outs on a basis that meets customer requirements.

The markets for our products are characterized by rapidly changing technology, evolving industry standards and increasingly sophisticated customer requirements. The introduction of products embodying new technology and the emergence of new industry standards can render our existing products obsolete and unmarketable and can exert price pressures on existing products. Our success depends on our ability to anticipate and react quickly to changes in technology or in industry standards and to successfully develop and introduce new, enhanced and competitive products on a timely basis. In particular, the continued acceptance and future success of our product offerings will depend on the capacity of those products to handle growing volumes of traffic, their reliability and security, and their cost-effectiveness compared to competitive product offerings. We cannot give assurance that we will successfully develop new products or enhance and improve our existing products, that new products and enhanced and improved existing products will achieve market acceptance, or that the introduction of new products or enhanced existing products by others will not render our products obsolete. Our inability to develop products that are competitive in technology and price and that meet customer needs could have a material adverse effect on our business, financial condition and results of operations. Accelerated product introductions and short product life cycles require high levels of expenditure for research and development that could adversely affect our operating results. Further, any new products that we develop could require long development and testing periods and may not be introduced in a timely manner or may not achieve the broad market acceptance necessary to generate significant revenue.

If a new product does receive market acceptance, it is often necessary to adapt our supply chain rapidly in order to meet customer expectations and demand. Constraints caused by component suppliers and outsourced manufacturers can slow the pace of new product rollouts, adversely affecting our business, financial condition and results of operations.

7

As we develop new products, our older products will reach the end of their lives. As we discontinue the sale of these older products, we must manage the liquidation of inventory, supplier commitments and customer expectations. Part of our inventory may be written off, which would increase our cost of sales. In addition, we may be exposed to losses on inventories purchased by our contract manufacturers. If we or our contract manufacturers are unable to properly manage the discontinuation of older products and/or if we are unable to secure customer acceptance of new products, our business, financial condition and results of operations could be materially and adversely affected.

We are subject to product warranty claims and inventory and account receivables exposure in relation to recent product quality issues.

As discussed under "Part I — Item 8. Financial Statements — A. Consolidated Financial Statements and Other Financial Information", in January 2016, an arbitration process was initiated with a customer in India to resolve a dispute over inventory shipped to them in June 2015. The value of the inventory shipped is $4.7 million. The customer has submitted their claim statement which we feel has no merit. We will submit a counter-claim for the material shipped, orders cancelled and other damages in June 2016. The arbitration hearing is set for July, 2016. As of the date of this Annual Report, the outcome of this matter is not determinable but there can be no guarantee that the arbitration decision in this matter will be favorable to us.

Future revenue opportunities through our channel partners is uncertain.

We are dependent upon our ability to establish and develop new relationships and to build on existing relationships with channel partners to sell our current and future products and services. We cannot provide assurance that we will be successful in maintaining or building on our relationships with channel partners. In addition, we cannot provide assurance that our channel partners will act in a manner that will promote the success of our products and services. Failure by channel partners to promote and support our products and services could adversely affect our business, results of operations and financial condition.

In our fiscal year ended February 29, 2016 our principal channel partner was Nokia. Our sales through the Nokia channel accounted for 44% of our revenues in the 2016 fiscal year. As discussed above, we expect sales through the Nokia channel to decrease significantly and rapidly as a result of Nokia's acquisition of Alcatel-Lucent and its competing microwave product lines. See "Part I — Item 4. "Information on our Business — Mergers & Acquisitions and Joint Ventures — Acquisition of Microwave Transport Business of NSN and Relationship with Nokia".".

Most of our channel partners also sell products and services of our competitors. If some of our competitors offer their products and services to our channel partners on more favorable terms or have more products or services available to meet their needs, there may be pressure on us to reduce the price of our products or services or increase the commissions payable to channel partners, failing which our channel partners may stop carrying our products or services or de-emphasize the sale of our products and services in favor of the products and services of our competitors.

We believe that channel partners exert significant influence on customer purchasing decisions, especially purchasing decisions by large service provider customers. In particular, large service provider customers may choose to adopt strategies to limit the number of channel partners and/or equipment vendors for their network builds, or only contract with channel partners that offer "end to end" solutions, to address interoperability concerns among other reasons. This approach may reduce our opportunities to sell directly to end-customers and increase our reliance on our channel partners. In addition, several of our channel partners have developed their own microwave solutions internally. To the extent that our channel partners have or acquire their own microwave solutions that compete with our products, our relationships with these channel partners could be materially adversely affected.

Mergers and consolidations among channel partners could disrupt our sales channels, particularly if a merger partner introduces its own internal microwave solution into one of our established channel partners.

We are also directly and indirectly exposed to developments in our channel partners' businesses. Competition in the mobile broadband infrastructure and related services market is intense. Our channel

8

partners may be unable to maintain or improve their market position or respond successfully to changes in the competitive environment. Our channel partners may fail to effectively and profitably invest in new competitive products, services, upgrades and technologies and bring them to market in a timely manner. To the extent that our business depends on our channel partners, the failure of our channel partners to adopt successful strategies and grow their own businesses could have a material adverse effect on our business, results of operations and financial condition.

Failure to successfully manage our managerial, financial and human resources through spikes in demand may adversely impact our operating results.

Given the project-based nature of deployments, we experience spikes in demand that are unpredictable and can place a strain on managerial, financial and human resources. Our ability to manage future growth will depend in large part upon a number of factors, including our ability to rapidly:

- •

- build a network of channel partners to create an expanding presence in the evolving marketplace for our products

and services;

- •

- build a sales team to keep customers and channel partners informed regarding the technical features, issues and key

selling points of our products and services;

- •

- attract and retain qualified technical personnel in order to continue to develop reliable and flexible products and

provide services that respond to evolving customer needs;

- •

- develop support capacity for customers as sales increase, so that we can provide post-sales support without diverting

resources from product development efforts; and

- •

- expand our internal management and financial controls significantly, so that we can maintain control over our operations and provide support to other functional areas.

Our inability to achieve any of these objectives could harm our business, financial condition and results of operations.

Our ability to manage our workforce, recruit and retain management and other qualified personnel is crucial to our ability to develop, market, sell and support our products and services.

We depend on the services of our key technical, sales, marketing and management personnel. The loss of any of these key persons could have a material adverse effect on our business, results of operations and financial condition. Our success is also highly dependent on our continuing ability to identify, hire, train, motivate and retain highly qualified technical, sales, marketing and management personnel. Competition for such personnel can be intense, and we cannot provide assurance that we will be able to attract or retain highly qualified technical, sales, marketing and management personnel in the future. Stock options and other share based compensation comprise a significant component of our compensation of key employees, and if our share price declines, it may be difficult to recruit and retain such individuals. The size of our pool for share based awards (including options) may limit our ability to use equity incentives as a means to recruit and retain key employees. Our inability to attract and retain the necessary technical, sales, marketing and management personnel may adversely affect our future growth and profitability. We have recently implemented reductions in the salaries of our executive officers. In the future, it may be necessary for us to increase the level of compensation paid to existing or new employees to a degree that our operating expenses could be materially increased. We do not currently maintain corporate life insurance policies on key employees.

As we expand globally, we may add to our workforce in jurisdictions where it is common or legally required for employees to be unionized. In such case, we may become dependent on maintaining good relations with our workforce in order to, among other things, minimize the possibility of strikes, lock-outs and other stoppages that could affect our operations. Relations with our employees may be impacted by changes in labour relations which may be introduced by, among other things, employee groups, unions, and the relevant governmental authorities in whose jurisdictions we carry on business. Labour disruptions that directly or indirectly affect any of our operations could have a material adverse impact on our business, results of operations and financial condition.

9

Our quarterly revenue and operating results can be difficult to predict and can fluctuate substantially.

Our revenue is difficult to forecast, is likely to fluctuate significantly and may not be indicative of our future performance from quarter to quarter. In addition, our operating results may not follow any past trends. The factors affecting our revenue and results, many of which are outside of our control, include:

- •

- competitive conditions in our industry, including strategic initiatives by us or our competitors, new products or

services, product or service announcements and changes in pricing policy by us or our competitors;

- •

- market acceptance of our products and services;

- •

- our ability to maintain existing relationships and to create new relationships with channel partners;

- •

- varying size, timing and contractual terms of orders for our products, which may delay the recognition of revenue;

- •

- the project-based nature of deployments of our products;

- •

- the discretionary nature of purchase and budget cycles of our customers and changes in their budgets for, and timing of,

equipment purchases;

- •

- strategic decisions by us or our competitors, such as acquisitions, divestitures, spin-offs, joint ventures, strategic

investments or changes in business strategy;

- •

- general weakening of the economy resulting in a decrease in the overall demand for telecommunications products and

services or otherwise affecting the capital investment levels of service providers;

- •

- timing of product development and new product initiatives; and

- •

- the length and variability of the sales cycles for our products.

Because our quarterly revenue is dependent upon a relatively small number of transactions, even minor variations in the rate and timing of conversion of our sales prospects into revenue could cause us to plan or budget inaccurately, and those variations could adversely affect our financial results. Delays or reductions in the amount or cancellations of customers' purchases would adversely affect our business, results of operations and financial condition.

We have a lengthy and variable sales cycle.

It is difficult for us to forecast the timing of revenue from sales of our products because our customers typically invest substantial time, money and other resources researching their needs and available competitive alternatives before deciding to purchase our products and services. Typically, the larger the potential sale, the more time, money and other resources will be invested by customers. As a result, it may take many months after our first contact with an end-customer before a sale can actually be completed. In addition, we rely on our channel partners to sell our products to customers and, therefore, our sales efforts are vulnerable to delays at both the channel partner and the end-customer level.

During these long sales cycles, events may occur that affect the size or timing of the order or even cause it to be cancelled, including:

- •

- purchasing decisions may be postponed, or large purchases reduced, during periods of economic uncertainty;

- •

- we or our competitors may announce or introduce new products or services;

- •

- our competitors may offer lower prices on similar products; or

- •

- budget and purchasing priorities of customers may change.

If these events were to occur, sales of our products or services may be cancelled or delayed, which would reduce our revenue.

10

We rely on our suppliers to supply components for our products and we are exposed to the risk that these suppliers will not be able to supply components on a timely basis, or at all.

The manufacturers of our products depend on obtaining adequate supplies of components on a timely basis. We source several key components used in the manufacture of our products from a limited number of suppliers, and in some instances, a single source supplier.

In addition, these components are often acquired through purchase orders and we may have no long-term commitments regarding supply or pricing from our suppliers. Lead-times for various components may lengthen, which may make certain components scarce. As component demand increases and lead-times become longer, our suppliers may increase component costs. We also depend on anticipated product orders to determine our materials requirements. Lead-times for limited-source materials and components can be as long as six months, vary significantly and depend on factors such as the specific supplier, contract terms and demand for a component at a given time. From time to time, shortages in allocations of components have resulted in delays in filling orders. Shortages and delays in obtaining components in the future could impede our ability to meet customer orders. Any of these sole source or limited source suppliers could stop producing the components, cease operations entirely, or be acquired by, or enter into exclusive arrangements with, our competitors. As a result, these sole source and limited source suppliers may stop selling their components to our outsourced manufacturers at commercially reasonable prices, or at all. Any such interruption, delay or inability to obtain these components from alternate sources at acceptable prices and within a reasonable amount of time would adversely affect our ability to meet scheduled product deliveries to our customers and reduce margins realized.

Alternative sources of components are not always available or available at acceptable prices. In addition, we rely on, but have limited control over, the quality, reliability and availability of the components supplied to us. If we cannot manufacture our products due to a lack of components, or are unable to redesign our products with other components in a timely manner, our business, results of operations and financial condition could be adversely affected.

Our dependence and exposure on component suppliers is heightened when we introduce new products. New products frequently include components that we do not use in other product lines. When we introduce new products, we must secure reliable sources of supply for those products at volumes that will be dictated by end-customer demand. Demand is often difficult to predict until the new product is better established. Constraints in our supply chain can slow the progress of new product roll-outs, adversely affecting our business, results of operations and financial condition.

We rely primarily upon two outsourced manufacturers for manufacturing and we are exposed to the risk that these manufacturers will not be able to satisfy our manufacturing needs on a timely basis.

We do not have any internal manufacturing capabilities and we rely upon a small number of outsourced manufacturers to manufacture our products. Substantially all of our products are currently manufactured by Jabil and Plexus. See "Part I — Item 4. Information on the Company — B. An Overview of our Business — Our Production and Repair Capabilities". Our ability to ship products to our customers could be delayed or interrupted as a result of a variety of factors relating to our outsourced manufacturers, including:

- •

- our outsourced manufacturers not being obligated to manufacture our products on a long-term basis in any specific quantity

or at any specific price;

- •

- early termination of, or failure to renew, contractual arrangements;

- •

- our failure to effectively manage our outsourced manufacturer relationships;

- •

- our outsourced manufacturers experiencing delays, disruptions or quality control problems in their manufacturing

operations;

- •

- lead-times for required materials and components varying significantly and being dependent on factors such as the specific

supplier, contract terms and the demand for each component at a given time;

- •

- underestimating our requirements, resulting in our outsourced manufacturers having inadequate materials and components required to produce our products, or overestimating our requirements,

11

- •

- the possible absence of adequate capacity and reduced control over component availability, quality assurances, delivery

schedules, manufacturing yields and costs; and

- •

- our outsourced manufacturers experiencing financial instability which could affect their ability to manufacture or deliver our products.

resulting in charges assessed by the outsourced manufacturers or liabilities for excess inventory, each of which could negatively affect our gross margins;

Although we believe that Jabil and Plexus have sufficient economic incentive to perform our manufacturing, the resources devoted to these activities by Jabil and Plexus are not within our control, and there can be no assurance that manufacturing problems will not occur in the future. Insufficient supply or an interruption or stoppage of supply from Jabil and Plexus or our inability to obtain additional manufacturers when and if needed, could have a material adverse effect on our business, results of operations and financial condition.

If any of our outsourced manufacturers are unable or unwilling to continue manufacturing our products in required volumes and quality levels, we will have to identify, qualify, select and implement acceptable alternative manufacturers, which would likely be time consuming and costly. In addition, an alternate source may not be available to us or may not be in a position to satisfy our production requirements at commercially reasonable prices and quality. Therefore, any significant interruption in manufacturing would result in us being unable to deliver the affected products to meet our customer orders, which could have a material adverse effect on our business, results of operations and financial condition.

Our engagements with our channel partners and end-customers are increasingly complex, particularly for large network deployments, and failure to execute may result in commercial penalties or liquidated damages.

Some of the projects for which we offer products and services are increasing in size and complexity, both on a technical level and in terms of required interaction with our channel partners. The larger and more complex such projects are, the greater the risks associated with such projects. These risks may include exposure to penalties and liabilities resulting from a breach of contract, failure to deliver on the agreed product roadmap or warranted features, failure to resolve product quality or performance issues, failure to meet delivery lead times, or failure to effectively integrate our products with third party products.

We have to reduce our prices from time to time in response to intense competition. If we are required to change our prices in future to compete successfully, our margins and operating results may be adversely affected.

The intensely competitive market in which we conduct our business has required us to reduce our prices, and may require us to do so in the future. If our competitors offer deep discounts on certain products or services in an effort to recapture or gain market share or to sell other products and services, we may be required to lower our prices or offer other favorable terms to compete successfully. In the past, certain changes in our pricing models have had a negative impact on our margins and operating results. Any such changes in the future could reduce our margins and could adversely affect our operating results.

We may be adversely affected by credit risk.

We are exposed to credit risk for accounts receivable in the event that counterparties do not meet their obligations. We attempt to mitigate our credit risk to the extent possible by performing credit reviews. Both economic and geopolitical uncertainty can influence the ultimate collectability of these receivable amounts. Failure to collect outstanding receivables could have a material adverse effect on our business, results of operations and financial condition.

Our growth is dependent on the development and growth of the market for high-capacity wireless communications services.

The market for high-capacity wireless communications services is still emerging and the market demand, price sensitivity and preferred business model to deliver these services remain highly uncertain. Our growth is dependent on, among other things, the size and pace at which the market for high-capacity wireless communications services develops. If this market does not gain widespread acceptance and declines, remains

12

constant or grows more slowly than anticipated, we may not be able to grow or sustain our growth, and our overall revenues and operating results will be materially and adversely affected.

In particular, our products are optimized for service providers that wish to deploy networks based on emerging 3G+ technologies such as High-Speed Packet Access ("HSPA"), and Long-Term Evolution ("LTE"). There can be no assurance that there will be sufficient end-user demand for services offered using these emerging network technologies. Other competing technologies may be developed that have advantages over these emerging technologies, and service providers of other networks based on these competing technologies may be able to deploy their networks at a lower cost, which may allow these service providers to compete more effectively.

Service providers that do choose to deploy emerging technologies for high-capacity wireless communications services are also dependent on suppliers other than us in order to build and operate their networks. If these third party suppliers are unsuccessful in developing the network components, subscriber equipment and other equipment required by our customers in a timely and cost-efficient manner, network deployments by our customers and demand for our products will be materially and adversely affected.

If sufficient radio spectrum is not allocated for use by our products or if we fail to obtain regulatory approval for our products, our ability to market our products may be restricted.

Radio communications are subject to significant regulation in North America, Europe, India and other jurisdictions in which we sell our products. Generally, our products must conform to a variety of national and international standards and requirements established to avoid interference among users of radio frequencies and to permit the interconnections of telecommunications equipment. In addition, our products are affected by the allocation and licensing (by auction or other means) of radio spectrum by governmental authorities. Such governmental authorities may not allocate or license sufficient radio spectrum for use by prospective customers of our products. Historically, in many developed countries, the lack of availability of commercial radio spectrum or the failure by governments to license that spectrum has inhibited the growth of wireless telecommunications networks.

In order to sell our products in any given jurisdiction, we must obtain regulatory approval for our products. Each jurisdiction in which we market our products has its own rules relating to such approval. Products that support emerging wireless telecommunications services can be marketed in a jurisdiction only if permitted by suitable radio spectrum allocations and regulations, and the process of establishing new regulations is complex and lengthy.

Any failure by regulatory authorities to allocate suitable and sufficient radio spectrum to potential customers in a timely manner could adversely and materially impact demand for our products and may result in the delay or loss of potential orders for our products. In addition, any failure by us to obtain or maintain the proper regulatory approvals for our products could have a material adverse effect on our business, financial condition and results of operations.

If our current or prospective customers are unable to secure a license for applicable radio spectrum or other regulatory approvals to operate as a service provider, the customer may not be permitted to deploy or operate a wireless network using our products.

Our products operate primarily on government-licensed radio frequencies. Users of our products must either have a spectrum license to operate and provide communications services in the applicable frequency or must acquire the right to do so from another license holder. In many jurisdictions, regulatory approvals are also required in order to operate a telecommunications or radio-communications network. Obtaining such licenses and other approvals is a lengthy process and is subject to significant uncertainties, including uncertainties as to timing and availability. There can be no assurance as to when any government may license radio spectrum or as to whether our customers will be successful in securing, maintaining or renewing any necessary spectrum licenses or other regulatory approvals.

In addition, if a license holder of such radio spectrum files for liquidation, dissolution or bankruptcy, substantial time could pass before its licenses are transferred, cancelled, reissued or made available by the

13

applicable government licensing authority. Until the licenses are transferred, cancelled, reissued or otherwise made available, other operators may be precluded from operating in such licensed spectrum, which could decrease demand for our products. In addition, if the authorities choose to revoke licenses for certain radio frequencies, demand for our products may decrease as well.

Changes in government regulation, or industry standards, may limit the potential markets for our products. We may need to modify our products, which may increase our product costs and adversely affect our ability to become profitable.

Radio frequencies are subject to extensive regulation both nationally and internationally. The emergence or evolution of regulations and industry standards for wireless products, through official standards committees or widespread use by operators, could require us to modify our systems. This may be expensive and time-consuming. Each country has different regulations and procedures for the approval of wireless communications equipment and the uses of radio spectrum in association with that equipment. If new industry standards emerge that we do not anticipate, our products could be rendered obsolete.

We may be adversely affected by currency fluctuations.

The majority of our revenue and direct cost of sales is earned and incurred in U.S. dollars, while our operating expenses are (or have been) incurred in Canadian dollars, Israeli shekels, Chinese renminbi, U.S. dollars and EUROs. Fluctuations in the exchange rate between the U.S. dollar and other currencies, such as the Canadian dollar, may have a material adverse effect on our business, financial condition and operating results. As of March 1, 2010, we adopted the U.S. dollar as our functional and reporting currency. This was a result of the shift over time of the proportion of our revenues and expenses in U.S. dollars. We do not currently engage in transactional hedging schemes but we do attempt to hedge or mitigate the risk of currency fluctuations by actively monitoring and managing our foreign currency holdings relative to our foreign currency expenses.

If our intellectual property is not adequately protected, we may lose our competitive advantage.

Our success depends in part on our ability to protect our rights in our intellectual property. We rely on various intellectual property protections, including patents, copyright, trade-mark and trade secret laws and contractual provisions, to preserve our intellectual property rights. Our present protective measures may not be adequate or enforceable to prevent misappropriation of our technology or to prevent a third party from developing the same or similar technology. Despite our precautions, it may be possible for third parties to obtain and use our intellectual property without our authorization. Policing unauthorized use of intellectual property is difficult, and some foreign laws and jurisdictions do not protect proprietary rights to the same extent as the laws of Canada or the United States.

To protect our intellectual property, we may become involved in litigation, which could result in substantial expenses, divert management's attention, cause significant delays, materially disrupt the conduct of our business or adversely affect our revenue, financial condition and results of operations.

Our business may be harmed if we infringe on the intellectual property rights of others.

Our commercial success depends, in part, upon us not infringing intellectual property rights owned by others. A number of our competitors and other third parties have been issued patents and may have filed patent applications or may obtain additional patents and proprietary rights for technologies similar to those used by us in our products. Some of these patents may grant very broad protection to the owners of the patents. We cannot determine with certainty whether any existing third party patents or the issuance of any third party patents would require us to alter our technology, obtain licenses or cease certain activities. We may become subject to claims by third parties that our technology infringes their intellectual property rights due to the growth of products in our target markets, the overlap in functionality of these products and the prevalence of products. Aggressive patent litigation is not uncommon in our industry and can be disruptive. We may become subject to these claims either directly or through indemnities against these claims that we routinely provide to our customers and channel partners. In some of our agreements we do not have a limit on our liability for such claims and therefore a successful claim could result in significant liability to us.

14

In addition, we have received, and may receive in the future, claims from third parties asserting infringement and other related claims. Litigation may be necessary to determine the scope, enforceability and validity of such third party proprietary rights or to establish our proprietary rights. Some of our competitors have, or are affiliated with companies having, substantially greater resources than us and these competitors may be able to sustain the costs of complex intellectual property litigation to a greater degree and for a longer period of time than us. Regardless of their merit, any such claims could:

- •

- be time consuming to evaluate and defend;

- •

- result in costly litigation;

- •

- cause product shipment delays or stoppages;

- •

- divert the attention and focus of our management and technical personnel away from our business;

- •

- subject us to significant damages, noting that in the United States plaintiffs may be entitled to treble damages if

intellectual property infringement is found to be willful;

- •

- subject us to significant other liabilities, including liability to indemnify end-customers pursuant to standard

contractual indemnities entered into by us in favor of those customers;

- •

- require us to enter into costly royalty or licensing agreements to avoid or settle infringement litigation; and

- •

- require us to modify, rename or stop using the infringing technology.

We may be prohibited from developing or commercializing certain technologies and products unless we obtain a license from a third party. There can be no assurance that we will be able to obtain any such license on commercially favorable terms, or at all. If we do not obtain such a license, our business, results of operations and financial condition could be materially adversely affected and we could be required to cease related business operations in some markets and to restructure our business to focus on operations in other markets.

Moreover, license agreements with third parties may not include all intellectual property rights that may be issued to or owned by the licensors, and future disputes with these parties are possible. Current or future negotiations with third parties to establish license or cross license arrangements, or to renew existing licenses, may not be successful and we may not be able to obtain or renew a license on satisfactory terms, or at all. If we cannot obtain required licenses, or if existing licenses are not renewed, litigation could result.

If we lose our rights to use software we currently license from third parties, we could be forced to seek alternative technology, which could increase our operating expenses and could adversely affect our ability to compete.

We license certain software used in our products from third parties, generally on a non-exclusive basis. The termination of any of these licenses, or the failure of the licensors to adequately maintain or update their software, could delay our ability to ship our products while we seek to implement alternative technology offered by other sources and could require significant unplanned investments on our part if we are forced to develop alternative technology internally. In addition, alternative technology may not be available to us on commercially reasonable terms from other sources. In the future, it may be necessary or desirable to obtain other third party technology licenses relating to one or more of our products or relating to current or future technologies to enhance our product offerings. There is a risk that we will not be able to obtain licensing rights to the needed technology on commercially reasonable terms, or at all.

We are subject to taxation and review by international tax authorities as we continue to operate globally, which may adversely affect our business, financial condition and results of operations.

We operate in various tax jurisdictions throughout the world and also generate revenues through international sales efforts. A change in our tax status or assessment by domestic or foreign tax authorities may adversely impact our operating results. While we believe that all of our tax positions are reasonable and correctly determined, there can be no assurance that applicable tax authorities will agree with those positions.

15

Our international sales and operations subject us to additional risks that can adversely affect our operating results.

Our business model is to sell our products across the world in jurisdictions where service providers are building new communications networks or expanding existing networks, and our sales and operations are, therefore, global in nature. As a result of the completion of the NSN Transaction (as defined below), our exposure to international markets was significantly increased. Our current and future international operations subject us to a variety of risks, including:

- •

- difficulty managing and staffing foreign offices and the increased travel, infrastructure and legal compliance costs

associated with multiple international locations;

- •

- increased time and costs to ensure adequate business interruption controls, processes and facilities;

- •

- increased time and costs to manage and evolve financial reporting systems, maintain effective financial disclosure

controls and procedures, and comply with corporate governance requirements in multiple jurisdictions;

- •

- increased costs and potential disruption of facilities transitions required in some business acquisitions;

- •

- increased exposure to global social, political and economic instability, and changes in economic conditions;

- •

- potential increased exposure to liability or damage of reputation resulting from a higher incidence of corruption or

unethical business practices in some countries;

- •

- difficulties in enforcing contracts, collecting accounts receivable and longer payment cycles, especially in emerging

markets;

- •

- the need to localize our products and licensing programs for international customers;

- •

- tariffs, trade barriers, compliance with customs regulations and other regulatory or contractual limitations on our

ability to sell or develop our products in certain foreign markets;

- •

- increased exposure to foreign currency exchange rate risk;

- •

- reduced protection and limited enforcement for intellectual property rights in some countries; and

- •

- potential increased exposure to natural disasters, epidemics and acts of war or terrorism.

Because our products are sold and marketed in different countries, the products must function in and meet the requirements of many different environments and be compatible with various systems and products. If our products fail to meet these requirements, this could negatively impact on sales and have a material adverse effect on our business, results of operation and financial condition. If we are unable to successfully address the potential risks associated with our overall international operations, our operating results and financial condition may be negatively impacted.

We are subject to government regulations concerning our products and their sale and export and our failure or inability to comply with these regulations could materially restrict our operations and subject us to penalties.

As discussed above, our sales and operations are global in nature and we must comply with applicable export control and economic sanctions laws. Canadian export control and economic sanctions laws govern any information, products or materials that we ship from Canada or otherwise provide to non-Canadian persons. On May 27, 2009 and August 14, 2009, we filed a 'non-compliance report' with Canada's Export and Import Controls Bureau ("EICB") relating to our inadvertent non-compliance with the requirement to obtain an export permit covering certain of our products and a number of export sales and electronic transfers of these products since October 2004. While there can be no assurance that the Government of Canada will not exercise its discretion to impose penalties or impose conditions with respect to the issuance of new export permits in respect of the past acts of non-compliance, since the time we first reported past non-compliance on May 27, 2009, the EICB, on November 26, 2009, granted us a broad-based export permit for a period of two years. We have subsequently been issued a new broad-based export permit that is valid until November 2017. Regardless of its past practice, if the EICB elects to decline the issuance of further export permits or deems us to be in

16

non-compliance of such permits based on continuing disclosure, our ability to continue to export our products could be restricted which could materially disrupt the conduct of our business or adversely affect our revenue, financial condition and results of operations.

Finally, although we are a Canadian company, certain of our business transactions are also governed by U.S. export control requirements, including the export of items containing more than de minimis amounts of U.S. controlled content. While we are not aware of any instances of non-compliance with U.S. licensing requirements for hardware or technology exports made during the past five years, our internal review raised questions concerning certain past internet-based transfers of software (some of which apparently contained small amounts of low-level encryption for networking), and we filed a voluntary disclosure with the U.S. Department of Commerce.

In addition to government regulations regarding sale and export, we are subject to other regulations regarding our products. For example, the SEC has adopted disclosure rules for companies that use conflict minerals in their products, with substantial supply chain verification requirements in the event that the materials come from, or could have come from, the Democratic Republic of the Congo or adjoining countries. These new rules and verification requirements may impose additional costs on us and on our suppliers, and may limit the sources or increase the prices of materials used in our products. Further, if we are unable to certify that our products are conflict free, we may face challenges with our customers, which could place us at a competitive disadvantage, and our reputation may be harmed.

Defects in our products could result in significant costs to us and could impair our ability to sell our products.

Our products are complex and, accordingly, they may contain defects or errors, particularly when first introduced or as new versions are released. We may not discover such defects or errors until after a product has been released and used by our end-customers. Defects and errors in our products could materially and adversely affect our reputation, result in significant costs to us, delay planned release dates and impair our ability to sell our products in the future. The costs we incur correcting any product defects or errors may be substantial and could adversely affect our operating margins. While we plan to continually test our products for defects and errors and work with customers through our post-sales support services to identify and correct defects and errors, defects or errors in our products may be found in the future.

During the deployment phase with a new Tier 1 customer in India we experienced an unexpected problem with our product. Our root cause analysis identified the cause of the problem and a plan was developed which would fully address the problem through a retrofit. Replacement parts for the retrofit involve a well-known and reliable technology and are readily available. The customer was advised of this solution, however the deployment has not resumed and the customer has initiated an arbitration process with the Company. We continue to pursue a resolution to this matter and we may face additional costs associated with this situation. See "Part I – Item 8. Financial Statements – A. Consolidated Financial Statements and Other Financial Information" below.

If a successful product liability claim were made against us, our business could be seriously harmed.

Our agreements with our customers typically, although not always, contain provisions designed to limit our exposure to potential product liability claims. Despite this, it is possible that these limitations of liability provisions may not be effective as a result of existing or future laws or unfavorable judicial decisions. We have not experienced a material product liability claim to date; however, the sale and support of our products may entail the risk of those claims, which are likely to be substantial in light of the use of our products in critical applications. A successful product liability claim could result in significant monetary liability to us and could seriously harm our business.

A general global economic downturn may negatively affect our customers and their ability to purchase our products. A downturn may decrease our revenues and increase our costs and may increase credit risk with our customers and impact our ability to collect accounts receivable and recognize revenue.

Since the middle of 2008, there has been global economic uncertainty, including reduced economic growth, reduced confidence in financial markets, bank failures and credit availability concerns. Disruptions in the financial markets have had and may continue to have an adverse effect on the U.S. and world economies, which

17

could adversely and materially impact business spending patterns. Tightening of credit in financial markets could adversely affect the ability of our customers and suppliers to obtain financing for significant purchases and operations and could result in a decrease in or cancellation of orders for our products.

Economic downturns may exacerbate some of the other risks that affect our business, results of operations and financial condition. A tighter credit market for consumer, business, and service provider spending may have several adverse effects, including reduced demand for our products, increased price competition or deferment of purchases and orders by our customers. Additional effects may include increased demand for customer finance, difficulties in collection of accounts receivable and increased risk of counterparty failures.

We may be negatively affected by geopolitical uncertainty.

The market for our products depends on geopolitical conditions affecting the broader market. Acts of terrorism and the outbreak of hostilities and armed conflicts between countries can create geopolitical uncertainties that may affect the global economy. We have conducted significant business in the Middle East which has recently been subject to increased political tensions and changes. Some of these changes have in fact affected our ability in recent fiscal years to do business in this region. Downturns in the economy or geopolitical uncertainties may cause our customers to delay or cancel projects, reduce their overall capital or operating budgets or reduce or cancel orders for our products, which could have a material adverse effect on our business, results of operations and financial condition.

There may be health and safety risks relating to wireless products.