Exhibit 1.1

This document is important and requires your immediate attention. If you are in any doubt as to how to deal with it, you should consult your investment advisor, stockbroker, bank manager, accountant, lawyer or other professional advisor.

This document does not constitute an offer or a solicitation to any person in any jurisdiction in which such offer or solicitation is unlawful. The Offer is not being made to, nor will deposits be accepted from or on behalf of, Shareholders in any jurisdiction in which the making or acceptance of the Offer would not be in compliance with the laws of such jurisdiction. However, Alamos or its agents may, in Alamos’ sole discretion, take such action as Alamos may deem necessary to make the Offer in any jurisdiction and extend the Offer to Shareholders in such jurisdiction.

The Offer has not been approved or disapproved by any securities regulatory authority, nor has any securities regulatory authority passed upon the fairness or merits of the Offer or upon the adequacy of the information contained in this document. Any representation to the contrary is an offence.

Information has been incorporated by reference in the Offer and Circular from documents filed with the securities commissions or similar authorities in Canada. Copies of the documents incorporated herein by reference may be obtained on request without charge from the Vice-President, Legal of Alamos at Suite 2200, 130 Adelaide Street West, Toronto, Ontario M5H 3P5 and (telephone (416) 368-9932) and are also available electronically on SEDAR at www.sedar.com.

January 14, 2013

ALAMOS GOLD INC.

OFFER TO PURCHASE

all of the outstanding common shares of

AURIZON MINES LTD.

for consideration per Common Share of, at the election of each holder,

Cdn$4.65 in cash (the “Cash Alternative”) or

0.2801 of an Alamos Share (the “Share Alternative”),

subject, in each case, to pro-ration as set out herein

Alamos Gold Inc. (“Alamos”) hereby offers (the “Offer”) to purchase, on the terms and subject to the conditions set out herein, all of the issued and outstanding common shares (the “Common Shares”) of Aurizon Mines Ltd. (“Aurizon”), other than any Common Shares held directly or indirectly by Alamos and its affiliates, and including any Common Shares that may become issued and outstanding after the date hereof but before the Expiry Time (as defined herein) upon the exercise, exchange or conversion of any Convertible Securities (as defined herein).

Each holder of Common Shares (each, a “Shareholder” and, collectively, the “Shareholders”) may elect to receive either the Cash Alternative or the Share Alternative in respect of all of the Shareholder’s Common Shares deposited under the Offer. The total amount of cash available under the Offer is limited to $305,000,000 and the total number of common shares of Alamos (the “Alamos Shares”) available for issuance under the Offer is limited to 23,500,000 Alamos Shares. Assuming that all Shareholders tendered to either the Cash Alternative or the Share Alternative, each Shareholder would be entitled to receive $2.04 in cash and 0.1572 of an Alamos Share for each Common Share tendered (based on 175,431,302 Common Shares issued and outstanding on a fully diluted basis), subject to adjustment for fractional shares.

See Section 1 of the Offer, “The Offer”. In light of the total amount of Alamos Shares available under the Offer relative to the size of the Offer, it is unlikely that Shareholders who elect the Share Alternative will receive only share consideration for their Common Shares.

As of the date hereof, Alamos holds 26,507,283 Common Shares, over 16% of the issued and outstanding Common Shares. See Section 11 of the Circular, “Holdings of Securities of Aurizon” and Section 12 of the Circular “Trading in Securities of Aurizon”.

| The Offer is open for acceptance until 5:00 p.m. (Toronto time) on Tuesday, February 19,

2013 (the “Expiry Time”), unless extended or withdrawn. |

The Alamos Shares are listed on the Toronto Stock Exchange (the “TSX”) under the symbol “AGI” and the OTC Pink Marketplace (the “OTC”) in the United States under the symbol “AGIGF”. Alamos has applied to the TSX to list the Alamos Shares offered hereunder on the TSX and has applied to list all of the Alamos Shares (including the Alamos Shares offered hereunder) on the New York Stock Exchange (the “NYSE”) under the symbol “AGI”. The Common Shares are listed on the TSX under the symbol “ARZ” and on the NYSE MKT under the symbol “AZK”.

The Offer represents a premium of approximately 40% and 39% based on the respective closing prices of $3.33 and US$3.39 for the Common Shares on the TSX and the NYSE MKT on January 9, 2013. The Offer represents a premium of approximately 37% based on the volume-weighted average price of the Common Shares on the TSX and the NYSE MKT for the 20 trading days ended January 9, 2013.

| The Depositary and Information Agent for the Offer is:

KINGSDALE SHAREHOLDER SERVICES INC. |

The Dealer Manager for the Offer is:

DUNDEE CAPITAL MARKETS |

The Offer is subject to certain conditions, including, among other things, there being validly deposited under the Offer and not withdrawn at the Expiry Time that number of Common Shares which, together with the Common Shares held by Alamos and its affiliates, represents not less than 662/3% of the issued and outstanding Common Shares (calculated on a fully diluted basis). Subject to applicable laws, Alamos reserves the right to extend, withdraw or terminate the Offer and to not take up and pay for any Common Shares deposited under the Offer unless each of the conditions of the Offer is satisfied or waived at or prior to the Expiry Time. See Section 4 of the Offer, “Conditions of the Offer”.

An investment in Alamos Shares is subject to certain risks. In assessing the Offer, Shareholders should carefully consider the risks described in Section 24 of the Circular, “Risk Factors Related to the Offer” and the risks described in Alamos’ annual information form dated March 29, 2012 for the year ended December 31, 2011, which is incorporated by reference in the Offer and Circular (as defined herein).

Persons whose Common Shares are registered in the name of an investment advisor, stockbroker, bank, trust company or other nominee should contact such nominee for assistance if they wish to accept the Offer in order to take the necessary steps to be able to deposit such Common Shares under the Offer. Intermediaries likely have established tendering cut-off times that are up to 48 hours prior to the Expiry Time. Shareholders must instruct their brokers or other intermediaries promptly if they wish to tender.

Registered Shareholders who wish to accept the Offer must properly complete and execute the accompanying Letter of Transmittal (printed on YELLOW paper), or a manually executed facsimile thereof, and deposit it, at or prior to the Expiry Time, together with certificate(s) or Direct Registration System (DRS) Advices representing their Common Shares and all other required documents, with Kingsdale Shareholder Services Inc. (the “Depositary and Information Agent”) at its office in Toronto, Ontario specified in the Letter of Transmittal, in accordance with the instructions set out in the Letter of Transmittal (as set out in Section 3 of the Offer, “Manner of Acceptance — Letter of Transmittal”). Alternatively, registered Shareholders may accept the Offer by (i) following the procedures for book-entry transfer of Common Shares set out in Section 3 of the Offer, “Manner of Acceptance — Acceptance by Book-Entry Transfer”, or (ii) following the procedure for guaranteed delivery set out in Section 3 of the Offer, “Manner of Acceptance — Procedure for Guaranteed Delivery”, using the accompanying Notice of Guaranteed Delivery (printed on GREEN paper), or a manually executed facsimile thereof. Shareholders who hold their Common Shares with a bank, broker or other financial intermediary will not receive a Letter of Transmittal or Notice of Guaranteed Delivery, and should follow the instructions set out by such intermediary to tender their Common Shares.

Shareholders will not be required to pay any fee or commission if they accept the Offer by depositing their Common Shares directly with the Depositary and Information Agent or if they make use of the services of a Soliciting Dealer (as defined herein) to accept the Offer.

The cash payments to Shareholders will be denominated in Canadian dollars. However, Shareholders can also elect to receive payment of the cash to which they are entitled under the Offer in U.S. dollars by checking Box 2, Choice A of the Letter of Transmittal, in which case each such Shareholder will have acknowledged and agreed that the exchange rate for one Canadian dollar expressed in U.S. dollars will be based on the exchange rate available to the Depositary and Information Agent at its typical banking institution on the date the funds are converted. A Shareholder electing to receive payment of the cash to which it is entitled under the Offer made in U.S. dollars will have further acknowledged and agreed that any change to the currency exchange rates of the United States or Canada will be at the sole risk of such Shareholder.

Questions and requests for assistance may be directed to the Depositary and Information Agent, Kingsdale Shareholder Services Inc., who can be contacted at 1-866-851-3214 toll free in North America or at 416-867-2272 outside of North America or by e-mail at contactus@kingsdaleshareholder.com; or Dundee Capital Markets (the “Dealer Manager”) and additional copies of this document, the Letter of Transmittal and the Notice of Guaranteed Delivery may be obtained, without charge, upon request from the Depositary and Information Agent or the Dealer Manager at their respective offices shown on the last page of this document, and are accessible on the Canadian Securities Administrators’ website at www.sedar.com. This website address is provided for informational purposes only and no information contained on, or accessible from, this website is incorporated by reference herein unless otherwise provided.

The information contained in this document speaks only as of the date of this document. Alamos does not undertake to update any such information except as required by applicable Law. Information in the Offer and Circular related to Aurizon has been compiled from public sources.

No broker, dealer, salesperson or other person has been authorized to give any information or make any representation other than those contained in this document, and, if given or made, such information or representation must not be relied upon as having been authorized by Alamos, the Depositary and Information Agent or the Dealer Manager.

NOTICE TO SHAREHOLDERS OUTSIDE CANADA

The Offer is subject to Section 14(d) of the U.S. Exchange Act, Regulation 14D promulgated by the SEC thereunder, Section 14(e) of the U.S. Exchange Act and Regulation 14E promulgated by the SEC thereunder. The offering of Alamos Shares pursuant to the Offer, however, is made by a Canadian issuer that is permitted, under a multi-jurisdictional disclosure system adopted by the United States, to prepare the Offer and Circular in accordance with the disclosure requirements of Canada. The Offer is subject to applicable disclosure requirements in Canada. Shareholders should be aware that such requirements are different from those of the United States and may differ from those in other jurisdictions. Financial statements included or incorporated by reference herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board and are subject to Canadian auditing standards and auditor independence rules, and thus may not be comparable to financial statements of United States companies or companies incorporated in other jurisdictions.

Shareholders in the United States should be aware that the disposition of Common Shares by them as described herein may have tax consequences in the United States, Canada and other jurisdictions. Such consequences may not be fully described herein and such holders are urged to consult their tax advisors. See Section 19 of the Circular, “Principal Canadian Federal Income Tax Considerations” and Section 20 of the Circular, “U.S. Federal Income Tax Considerations”.

The enforcement by Shareholders of civil liabilities under U.S. federal or state securities laws or applicable laws in other jurisdictions may be affected adversely by the fact that Alamos is governed by the laws of Canada, that some of its officers and directors are residents of jurisdictions other than the United States, that the Dealer Manager and some of the experts named in the Circular are Canadian residents and that all or a substantial portion of the assets of Alamos and such persons may be located outside the United States or such other jurisdictions. The enforcement by Shareholders of civil liabilities under the securities laws of the United States or applicable laws in other jurisdictions may also be affected adversely by the fact that some of Aurizon’s officers and directors are resident outside the United States or such other jurisdictions and that all or a substantial portion of the assets of Aurizon and Aurizon’s officers and directors may be located outside the United States or such other jurisdictions. It may be difficult to compel Alamos or any of the aforementioned persons to subject itself to the judgment of a court in the United States or any such other jurisdiction.

THE ALAMOS SHARES AND THE OFFER HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION, NOR HAS THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION OR ANY STATE SECURITIES COMMISSION PASSED UPON THE ACCURACY OR ADEQUACY OF THE OFFER AND CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENCE.

Alamos has filed with the United States Securities and Exchange Commission (the “SEC”) a Registration Statement on Form F–10 (the “Registration Statement”), a Tender Offer Statement on Schedule TO (the “Tender Offer Statement”) and other documents and information, and expects to mail the Offer and Circular to Shareholders. SHAREHOLDERS ARE URGED TO READ THE REGISTRATION STATEMENT, THE TENDER OFFER STATEMENT AND THE OFFER AND CIRCULAR AND ANY OTHER RELEVANT DOCUMENTS TO BE FILED WITH THE SEC, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and Shareholders will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov. In addition, documents filed with the SEC by Alamos will be available free of charge from Alamos. You should direct requests for documents to the Vice-President, Legal of Alamos at Suite 2200, 130 Adelaide Street West, Toronto, Ontario M5H 3P5, telephone (416) 368-9932. To obtain timely delivery, such documents should be requested not later than February 11, 2013, five business days before the Expiry Date.

This document does not generally address the income tax consequences of the Offer to Shareholders in any jurisdiction outside Canada or the United States. Shareholders in a jurisdiction outside Canada or the United States should be aware that the disposition of Common Shares may have tax consequences which may not be described herein. Accordingly, Shareholders outside Canada and the United States should consult their own tax advisors with respect to tax considerations applicable to them.

The Offer does not constitute an offer to sell or a solicitation of an offer to buy any securities in any state in the United States or any other jurisdiction in which such offer or solicitation is unlawful. The Offer is not being made or directed to, nor is this document being mailed to, nor will deposits of Common Shares be accepted from or on behalf of, Shareholders in any state in the United States or any other jurisdiction in which the making or acceptance of the Offer would not be in compliance with the laws of such state or other jurisdiction. Alamos or its agents may, in its or their sole discretion, take such action as it or they may deem desirable to extend the Offer to Shareholders in any such state or other jurisdiction. Notwithstanding the foregoing, Alamos or its agents may elect not to complete such action in any given instance. Accordingly, Alamos cannot at this time assure Shareholders that otherwise valid tenders can or will be accepted from holders resident in all states in the United States and all other jurisdictions.

Unless otherwise indicated, all resource and reserve estimates included or incorporated by reference into the Offer and Circular have been prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) – CIM Definition Standards on Mineral Resources and Mineral Reserves, adopted by the CIM Council, as amended. NI 43-101 is a rule developed by the Canadian Securities

Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. The terms “mineral reserve”, “proven mineral reserve” and “probable mineral reserve” are Canadian mining terms as defined in accordance with NI 43-101 and the CIM standards. These definitions differ from the definitions in SEC Industry Guide 7 (“SEC Industry Guide 7”) under the U.S. Securities Act and the U.S. Exchange Act. Under SEC Industry Guide 7 standards, a “final” or “bankable” feasibility study is required to report reserves, the three-year historical average price is used in any reserve or cash flow analysis to designate reserves and the primary environmental analysis or report must be filed with the appropriate governmental authority.

In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101 and the CIM standards; however, these terms are not defined terms under SEC Industry Guide 7 and are normally not permitted to be used in reports and registration statements filed with the SEC. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into reserves. “Inferred mineral resources” have a great amount of uncertainty as to their existence, and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre–feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. See Section 24 of the Circular, “Risk Factors Related to the Offer — There are differences in U.S. and Canadian practices for reporting mineral reserves and resources”.

These standards differ significantly from the requirements of the SEC, and mineral reserve and mineral resource information contained or incorporated by reference herein may not be comparable to similar information disclosed by United States companies.

NOTICE TO HOLDERS OF CONVERTIBLE SECURITIES

The Offer is made only for Common Shares and is not made for any options or any other rights to acquire Common Shares (collectively, “Convertible Securities”). Any holder of Convertible Securities who wishes to accept the Offer should, subject to and to the extent permitted by the terms of such Convertible Securities and applicable Law, exercise, exchange or convert such Convertible Securities in order to obtain certificates representing Common Shares and deposit such Common Shares in accordance with the Offer. See Section 1 of the Offer, “The Offer”. Any such exercise, exchange or conversion must be completed sufficiently in advance of the Expiry Time to ensure that the holder of such Convertible Securities will have received certificates representing the Common Shares issuable upon such exercise, exchange or conversion in time for deposit prior to the Expiry Time, or in sufficient time to comply with the procedures described in Section 3 of the Offer, “Manner of Acceptance — Procedure for Guaranteed Delivery”.

The tax consequences to holders of Convertible Securities of exercising or not exercising such securities are not described in the Offer and Circular. Holders of such Convertible Securities should consult their own tax advisors with respect to the potential income tax consequences to them in connection with the decision to exercise or not exercise such securities.

REPORTING CURRENCY AND CURRENCY EXCHANGE RATE INFORMATION

Unless otherwise indicated, all references to “$”, “Cdn$” or “dollars” in the Offer and Circular are to Canadian dollars.

The following table sets forth the high and low exchange rates for one U.S. dollar expressed in Canadian dollars for each period indicated, the average of the exchange rate for each period indicated and the exchange rate at the end of such period, based upon the noon buying rates provided by the Bank of Canada:

| Year Ended December 31 | ||||||||||||

| 2012 | 2011 | 2010 | ||||||||||

| High |

1.0418 | 1.0604 | 1.0778 | |||||||||

| Low |

0.9710 | 0.9449 | 0.9946 | |||||||||

| Rate at end of period |

0.9949 | 1.0170 | 0.9946 | |||||||||

| Average rate for period |

0.9996 | 0.9891 | 1.0299 | |||||||||

The Bank of Canada noon rate of exchange on January 9, 2013 for Canadian dollars was US$1.00 = Cdn$0.9868.

NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements in the Summary, the Offer and Circular, including under Section 3 of the Circular, “Background to the Offer”; Section 4 of the Circular, “Reasons to Accept the Offer”; Section 5 of the Circular, “Purpose of the Offer and Alamos’ Plans for Aurizon”; Section 15 of the Circular, “Acquisition of Common Shares Not Deposited Under the Offer”; and Section 18 of the Circular, “Effect of the Offer on the Market for and Listing of Common Shares and Status as a Reporting Issuer”, in addition to certain statements contained elsewhere in the Offer and Circular or incorporated by reference herein, are forward-looking statements, including within the meaning of the U.S. Exchange Act. All statements other than statements of historical fact included in the Offer and Circular or incorporated by reference herein, including, without limitation, statements regarding forecast gold production, gold grades, recoveries, waste-to-ore ratios, total cash costs, potential mineralization and reserves, exploration results, and future plans and objectives of Alamos, are forward-looking statements that involve various risks and uncertainties. These forward-looking statements include, but are not limited to, statements with respect to mining and processing of mined ore, achieving projected recovery rates, anticipated production rates and mine life, operating efficiencies, costs and expenditures, changes in mineral resources and conversion of mineral resources to proven and probable reserves, and other information that is based on forecasts of future operational or financial results, estimates of amounts not yet determinable and assumptions of management.

Exploration results that include geophysics, sampling, and drill results on wide spacings may not be indicative of the occurrence of a mineral deposit. Such results do not provide assurance that further work will establish sufficient grade, continuity, metallurgical characteristics and economic potential to be classed as a category of mineral resource. A mineral resource that is classified as “inferred” or “indicated” has a great amount of uncertainty as to its existence and economic and legal feasibility. It cannot be assumed that any or part of an “indicated mineral resource” or “inferred mineral resource” will ever be upgraded to a higher category of resource. Investors are cautioned not to assume that all or any part of mineral deposits in these categories will ever be converted into proven and probable reserves.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be “forward-looking statements”. Forward-looking statements are subject to a variety of risks and uncertainties that could cause actual events or results to differ from those reflected in the forward-looking statements.

There can be no assurance that forward-looking statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from Alamos’ expectations include risks related to the Offer, fluctuations in the value of the consideration; integration issues; the effect of the Offer on the market price of Alamos Shares; the exercise of dissent rights in connection with a Compulsory Acquisition or Subsequent Acquisition Transaction; the liquidity of the Common Shares; risks associated with Aurizon becoming a subsidiary of Alamos; differences in Shareholder interests; the reliability of the information regarding Aurizon; change of control provisions; risks associated with obtaining governmental and regulatory approvals; failure to maintain effective internal controls; the liquidity of Alamos Shares on the NYSE; the effect of the Offer on non-Canadian Shareholders; and risks related to the on-going business of Alamos, including risks related to international operations; the actual results of current exploration activities; conclusions of economic evaluations and changes in project parameters as plans continue to be refined as well as future prices of gold and silver, as well as those risk factors described in Section 24 of the Circular, “Risk Factors Related to the Offer” and in the section entitled “Risk Factors” that is included in Alamos’ annual information form dated March 29, 2012 incorporated by reference herein. Although Alamos has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

NOTICE REGARDING AURIZON INFORMATION

Except as otherwise indicated herein, the information concerning Aurizon contained in the Offer and Circular has been taken from or is based upon publicly available information filed with Canadian securities regulators and other public sources available as at January 11, 2013. Aurizon has not reviewed the Offer and Circular and has not confirmed the accuracy and completeness of the information in respect of Aurizon contained herein. Neither Alamos, nor any person acting jointly or in concert with Alamos, nor any of the directors or officers of Alamos or such persons, assumes any responsibility for the accuracy or completeness of such information or any failure by Aurizon to disclose events or facts which may have occurred or which may affect the significance or accuracy of any such information but which are unknown to Alamos or such persons. Except as otherwise indicated herein, Alamos has no means of verifying the accuracy or completeness of any of the information contained herein that is derived from publicly available information regarding Aurizon or whether there has been any failure by Aurizon to disclose events or facts that may have occurred or may affect the significance or accuracy of any such information.

TABLE OF CONTENTS

| Page | ||||||

| SUMMARY TERM SHEET |

I | |||||

| SUMMARY |

i | |||||

| OFFER |

1 | |||||

| 1. |

The Offer | 1 | ||||

| 2. |

Time for Acceptance | 3 | ||||

| 3. |

Manner of Acceptance | 4 | ||||

| 4. |

Conditions of the Offer | 8 | ||||

| 5. |

Extension, Variation or Change of the Offer | 12 | ||||

| 6. |

Take-up of and Payment for Deposited Common Shares | 13 | ||||

| 7. |

Return of Deposited Common Shares | 14 | ||||

| 8. |

Withdrawal of Deposited Common Shares | 14 | ||||

| 9. |

Notices and Delivery | 16 | ||||

| 10. |

Changes in Capitalization, Dividends, Distributions and Liens | 16 | ||||

| 11. |

Mail Service Interruption | 17 | ||||

| 12. |

Other Terms of the Offer | 17 | ||||

| CIRCULAR |

19 | |||||

| 1. |

Alamos | 19 | ||||

| 2. |

Aurizon | 20 | ||||

| 3. |

Background to the Offer | 21 | ||||

| 4. |

Reasons to Accept the Offer | 22 | ||||

| 5. |

Purpose of the Offer and Alamos’ Plans for Aurizon | 23 | ||||

| 6. |

Share Purchase Agreements | 24 | ||||

| 7. |

Source of Funds | 26 | ||||

| 8. |

Summary of Alamos Historical and Pro Forma Financial Information | 26 | ||||

| 9. |

Certain Information Concerning Securities of Alamos | 28 | ||||

| 10. |

Certain Information Concerning Securities of Aurizon | 32 | ||||

| 11. |

Holdings of Securities of Aurizon | 35 | ||||

| 12. |

Trading in Securities of Aurizon | 35 | ||||

| 13. |

Commitments to Acquire Common Shares | 36 | ||||

| 14. |

Other Material Facts about Aurizon | 36 | ||||

| 15. |

Acquisition of Common Shares Not Deposited Under the Offer | 36 | ||||

| 16. |

Agreements, Commitments or Understandings | 40 | ||||

| 17. |

Regulatory Matters | 41 | ||||

| 18. |

Effect of the Offer on the Market for and Listing of Common Shares and Status as a Reporting Issuer | 43 | ||||

-i-

TABLE OF CONTENTS

(continued)

| Page | ||||||

| 19. |

Principal Canadian Federal Income Tax Considerations | 44 | ||||

| 20. |

U.S. Federal Income Tax Considerations | 53 | ||||

| 21. |

U.S. Securities Act and U.S. Exchange Act Requirements | 59 | ||||

| 22. |

Documents Incorporated by Reference | 59 | ||||

| 23. |

Documents Filed as Part of the Registration Statement | 60 | ||||

| 24. |

Risk Factors Related to the Offer | 60 | ||||

| 25. |

Statutory Rights | 64 | ||||

| 26. |

Financial Advisor, Dealer Manager and Soliciting Dealer Group | 64 | ||||

| 27. |

Depositary and Information Agent | 65 | ||||

| 28. |

Experts | 65 | ||||

| 29. |

Legal Matters | 65 | ||||

| 30. |

Directors Approval | 65 | ||||

| GLOSSARY |

66 | |||||

| SCHEDULE “A” DESCRIPTION OF THE KIRAZLI & AĞI DAĞI GOLD PROJECT |

A-1 | |||||

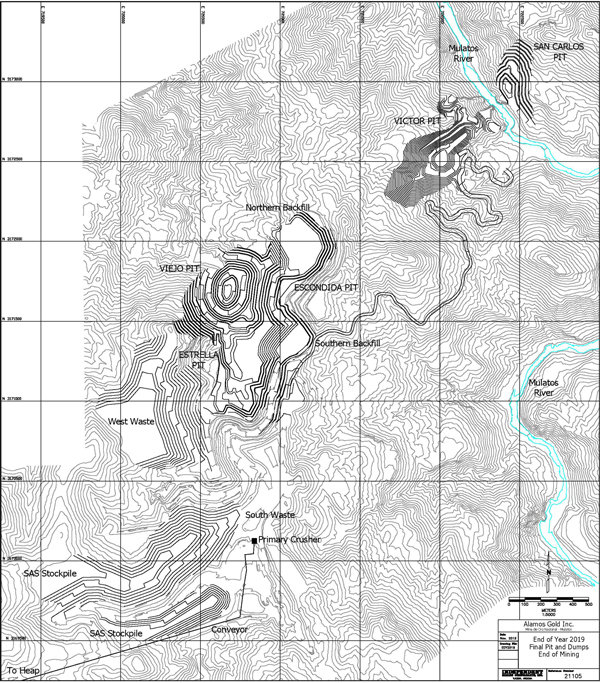

| SCHEDULE “B” DESCRIPTION OF THE MULATOS MINE |

B-1 | |||||

| SCHEDULE “C” COMPULSORY ACQUISITION PROVISIONS OF SECTION 300 OF THE BCBCA |

C-1 | |||||

| SCHEDULE “D” UNAUDITED PRO FORMA CONSOLIDATED FINANCIAL STATEMENTS |

D-1 | |||||

| SCHEDULE “E” CERTAIN INFORMATION REGARDING THE DIRECTORS AND EXECUTIVE OFFICERS OF ALAMOS |

E-1 | |||||

| CONSENT OF TORYS LLP |

F-1 | |||||

| CONSENT OF ERNST & YOUNG LLP |

G-1 | |||||

| CERTIFICATE OF ALAMOS GOLD INC. |

H-1 | |||||

-ii-

SUMMARY TERM SHEET

The following sets forth material information with respect to the Offer. The questions and answers below are not meant to be a substitute for the more detailed description and information contained in the Offer and Circular, the Letter of Transmittal and the Notice of Guaranteed Delivery. You are urged to read the entire Offer and Circular, the Letter of Transmittal and the Notice of Guaranteed Delivery carefully prior to making any decision regarding whether or not to tender your Common Shares. We have included cross-references in this section to other sections of the Offer and Circular where you will find more complete descriptions of the topics mentioned below. Unless otherwise defined herein, capitalized terms have the meanings given to them in the Glossary.

Who is offering to buy my Common Shares?

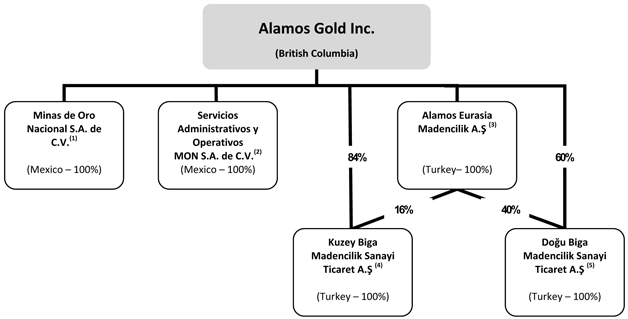

Alamos, a corporation existing under the Laws of the Province of British Columbia, is a Canadian-based gold producer that owns and operates the Mulatos Mine in Mexico, and has exploration and development activities in Mexico and Turkey. The Alamos Shares are listed and trade on the TSX under the symbol “AGI” and are quoted on the OTC under the symbol “AGIGF”. Alamos’ head office is located at Suite 2200, 130 Adelaide Street West, Toronto, Ontario M5H 3P5 and its registered and records office is located at Suite 3350, Four Bentall Centre, 1055 Dunsmuir Street, P.O. Box 49222, Vancouver, British Columbia V7X 1L2.

See Section 1 of the Circular, “Alamos”.

What is Alamos proposing?

Alamos is offering to purchase all of the issued and outstanding Common Shares not currently held by Alamos and its affiliates, subject to the terms and conditions set forth in the Offer and Circular.

See Section 1 of the Offer, “The Offer” and Section 4 of the Offer, “Conditions of the Offer”.

What would I receive in exchange for my Common Shares?

For each Common Share you hold, Alamos is offering:

| (a) | $4.65 in cash under the Cash Alternative; or |

| (b) | 0.2801 of an Alamos Share under the Share Alternative, |

in each case as elected by you in the applicable Letter of Transmittal or Notice of Guaranteed Delivery, and subject to pro-ration as more fully described in Section 1 of the Offer, “The Offer”.

The total amount of cash available under the Offer is limited to $305,000,000 and the total number of Alamos Shares available for issuance under the Offer is limited to 23,500,000 Alamos Shares. Assuming that all Shareholders tendered to either the Cash Alternative or the Share Alternative, each Shareholder would be entitled to receive $2.04 in cash and 0.1572 of an Alamos Share for each Common Share tendered (based on 175,431,302 Common Shares issued and outstanding on a fully diluted basis), subject to adjustment for fractional shares. For greater certainty, unless a Shareholder receives only cash consideration or only share consideration for all Common Shares tendered by the Shareholder, in all circumstances a Shareholder will receive a proportionate amount of cash and Alamos Shares as consideration for the Common Shares tendered by such Shareholder under the Offer. Applicable U.S. securities laws do not permit Alamos to have more than one Take-Up Date as a result of pro rating the consideration offered under the Offer. Alamos currently intends to seek such relief as may be available to permit it to take up Common Shares on more than one Take-Up Date; although, there can be no assurances that Alamos will be granted such relief.

Shareholders can also elect to receive payment of the cash to which they are entitled under the Offer in U.S. dollars based on the exchange rate available to the Depositary and Information Agent at its typical banking institution on the date the funds are converted.

See Section 1 of the Offer, “The Offer”.

I

What are some of the significant conditions to the Offer?

The Offer is subject to several conditions, some of the most important of which are as follows:

| • | There being validly deposited under the Offer and not withdrawn at the Expiry Time, such number of Common Shares which, together with Common Shares directly or indirectly held by Alamos and its affiliates, constitutes at least 662/3% of the total issued and outstanding Common Shares (calculated on a fully diluted basis); |

| • | Alamos having obtained all requisite approvals, including under the Competition Act, the HSR Act and requisite stock exchanges, and the applicable waiting period having expired or been terminated; and |

| • | Alamos having determined that there does not exist and there has not occurred, a Material Adverse Change. |

The Offer is not subject to any financing condition.

See Section 4 of the Offer, “Conditions of the Offer”, for additional conditions of the Offer.

Why is Alamos making the Offer?

Alamos is making the Offer because it wants to acquire control of, and ultimately the entire equity interest in, Aurizon. If Alamos completes the Offer but does not then own 100% of the Common Shares, Alamos currently intends to acquire any Common Shares not deposited under the Offer in a second-step transaction. This transaction will take the form of a Compulsory Acquisition or a Subsequent Acquisition Transaction.

See Section 3 of the Circular, “Background to the Offer”, and Section 15 of the Circular, “Acquisition of Common Shares Not Deposited Under the Offer”.

Why should Shareholders accept Alamos’ offer to buy Aurizon?

Alamos believes that the Offer will deliver superior value to Shareholders because:

| • | Alamos is offering a significant premium to the market price for the Common Shares at the time Alamos’ intention to make an offer was announced; |

| • | the transaction will immediately create a new leading intermediate gold mining company with increased diversification, scale and liquidity; |

| • | Alamos offers the Shareholders the benefits of both the project development and operation expertise of the Alamos management team with a solid track record and proven experience in the gold industry as well as access to pro forma combined estimated cash and cash equivalents and short-term investments of approximately US$209.7 million with which to advance projects without any near-term dilution; |

| • | Alamos’ balance sheet and operating cash flow will be available to support the strong growth profile of the combined company without an expectation of a need for any equity capital raisings; and |

| • | Shareholders who tender to the Offer for Alamos Shares will gain exposure to the world-class projects of Alamos including the producing Mulatos Mine in Mexico, one of the world’s most profitable gold mines, the advanced-stage Ağı Dağı and Kirazlı projects in Turkey and other earlier-stage exploration properties in both Mexico and Turkey, any future increases in value associated with the continued exploration and development of Aurizon’s portfolio of assets, as well as production at Aurizon’s flagship Casa Berardi Gold Mine. |

See Section 4 of the Circular, “Reasons to Accept the Offer”.

What securities are being sought in the Offer?

Alamos is offering to purchase all of the issued and outstanding Common Shares. Based on publicly available information, Alamos believes that, as of December 18, 2012, there were 175,431,302 Common Shares issued and outstanding (on a fully diluted basis). The Offer includes Common Shares that may become outstanding after the date of the Offer, but prior to the Expiry Time, upon the exercise of any Convertible Securities. The Offer is not being made for any Convertible Securities or other rights to acquire Common Shares.

II

See Section 1 of the Offer, “The Offer”.

How will Convertible Securities be treated in the Offer?

The Offer being is made only for outstanding Common Shares and not for any Convertible Securities. Any holder of such securities who wishes to accept the Offer must, to the extent permitted by the terms thereof and applicable Law, fully exercise, exchange or convert such securities sufficiently in advance of the Expiry Time of the Offer in order to obtain Common Shares that may be deposited in accordance with the terms of the Offer.

If Alamos takes up and pays for Common Shares tendered under the Offer and not validly withdrawn, it currently intends to implement a Compulsory Acquisition, a Subsequent Acquisition Transaction, or take such other action as may be available to Alamos. In the event that Alamos implements a Subsequent Acquisition Transaction, it may be structured in such a manner that the holders of Convertible Securities will, pursuant to the terms thereof, receive Alamos Shares upon the proper exercise or conversion of the Convertible Securities. The number of Alamos Shares to be issued and the exercise price therefor will reflect the exchange ratio used in the Offer. Alternatively, Alamos may take any other actions available to it to cause the exercise or termination of any remaining Convertible Securities.

Will fractional shares be issued in the Offer?

No. Alamos will not issue fractional Alamos Shares. Instead, where a Shareholder is to receive Alamos Shares as consideration under the Offer and the aggregate number of Alamos Shares to be issued to such Shareholder would result in a fraction of an Alamos Share being issuable, the number of Alamos Shares to be received by such Shareholder will be rounded down to the nearest whole Alamos Share and the amount of cash to be received by such Shareholder will correspondingly be rounded down to the nearest whole cent.

How many Alamos Shares could be issued pursuant to the Offer?

Alamos expects to issue approximately 23,500,000 Alamos Shares under the Offer based on the number of Common Shares issued and outstanding on a fully diluted basis as of January 9, 2013, as publicly disclosed by Aurizon and assuming that all of the Common Shares issued and outstanding as at January 9, 2013 (other than Common Shares held by Alamos or its affiliates) are acquired upon completion of the Offer and any Compulsory Acquisition or Subsequent Acquisition Transaction, and assuming that all of the holders of in-the-money options of Aurizon elect to exercise their options in advance of the successful completion of the Offer.

See Section 1 of the Offer, “The Offer”.

Will my ownership and voting rights as a shareholder of Alamos be the same as my ownership and voting rights as a shareholder of Aurizon?

As noted above, Alamos expects to issue approximately 23,500,000 Alamos Shares in connection with the Offer, which would result in there being a total of approximately 150,955,788 Alamos Shares issued and outstanding (based on the number of Alamos Shares issued and outstanding as at January 9, 2013), with Shareholders holding approximately 15.6% of the Alamos Shares on an issued basis. Each Common Share carries the right to one vote at meetings of Shareholders. Each Alamos Share carries the right to one vote at meetings of Alamos shareholders.

See Section 9 of the Circular, “Certain Information Concerning Alamos – Authorized and Outstanding Share Capital” and Section 25 of the Circular, “Risk Factors Related to the Offer”.

How long do I have to decide whether to tender to the Offer?

The Offer is open for acceptance until 5:00 p.m. (Toronto time) on February 19, 2013, or until such other time and date as is set out in a notice of variation of the Offer as Alamos determines, issued at any time and from time to time at its discretion.

See Section 2 of the Offer, “Time for Acceptance”.

III

Can the Expiry Time for the Offer be extended?

Yes. Alamos may, in its sole discretion, elect to extend the Expiry Time for the Offer from the time referenced in the answer to the previous question. Under certain circumstances, Alamos may be required to extend the Expiry Time for the Offer under applicable Canadian and U.S. securities laws. If Alamos elects or is required to extend the Expiry Time for the Offer, it will publicly announce the variation and, if required by applicable Law, Alamos will mail you a copy of the notice of variation.

See Section 5 of the Offer, “Extension, Variation or Change to the Offer”.

Alamos may also elect and reserve the right to provide a Subsequent Offering Period for the Offer. A Subsequent Offering Period, if one is provided, will be an additional period of time of no less than 10 days beginning after Alamos has accepted for purchase all Common Shares previously tendered during the Offer, during which period Shareholders may tender their Common Shares. There would be no condition to the Offer to purchase these tendered Common Shares. See “Time for Acceptance” in Section 2 of the Offer. Alamos will permit withdrawal of Common Shares tendered during a Subsequent Offering Period, if there is one, until such time as they are taken up.

See Section 8 of the Offer, “Withdrawal of Deposited Common Shares”.

How do I tender my Common Shares?

If you hold Common Shares in your own name, you may accept the Offer by depositing certificates representing your Common Shares, together with a duly completed and signed Letter of Transmittal and all other documents required by the instructions to the Letter of Transmittal, at the office of the Depositary and Information Agent specified in the Letter of Transmittal. If your Common Shares are registered in the name of a nominee (commonly referred to as “in street name” or “street form”), you should contact your broker, investment dealer, bank, trust company or other nominee for assistance in tendering your Common Shares to the Offer. You should request your nominee to effect the transaction.

Shareholders may also accept the Offer pursuant to the procedures for book-entry transfer detailed in the Offer and Circular and have your Common Shares tendered by your nominee through CDS or DTC, as applicable. Shareholders are invited to contact the Depositary and Information Agent for further information regarding how to accept the Offer. The Depositary and Information Agent can be contacted at 1-866-851-3214 toll free in North America or at 416-867-2272 outside of North America or by e-mail at contactus@kingsdaleshareholder.com.

See Section 3 of the Offer, “Manner of Acceptance”.

What if I have lost my Common Share certificate(s) but wish to tender my Common Shares to the Offer?

You should complete your Letter of Transmittal as fully as possible and state in writing the circumstances surrounding the loss and forward the documents to the Depositary and Information Agent. The Depositary and Information Agent will forward a copy to the transfer agent for the Common Shares and such transfer agent will advise you of the replacement requirements, which must be completed and returned before the Expiry Time.

See Section 3 of the Offer, “Manner of Acceptance”.

Will I be able to trade the Alamos Shares I receive?

You will be able to trade the Alamos Shares that you will receive under the Offer. Statutory exemptions allow such trading in Canada and upon the Registration Statement becoming effective in the United States, non–“affiliates” (as defined in Rule 144 under the U.S. Securities Act) of Alamos will be able to trade their Alamos Shares received under the Offer in the United States. Alamos has applied to list the Alamos Shares offered to Shareholders pursuant to the Offer on the TSX and all of the Alamos Shares (including the Alamos Shares offered hereunder) on the NYSE.

If I accept the Offer, when will I receive the consideration for my Common Shares?

If the conditions of the Offer are satisfied or waived, and if Alamos consummates the Offer and takes up your Common Shares, you will receive the consideration for the Common Shares tendered to the Offer, based on whether you elected the Cash Alternative or the Share Alternative (subject to pro ration), promptly after the Expiry Time.

IV

See Section 6 of the Offer, “Take-Up and Payment for Deposited Common Shares”.

Who is the Depositary and Information Agent under the Offer?

Kingsdale Shareholder Services Inc. is acting as Depositary and Information Agent under the Offer. The Depositary and Information Agent will be responsible for receiving certificates representing Common Shares and accompanying Letters of Transmittal and other documents. The Depositary and Information Agent is also responsible for receiving Notices of Guaranteed Delivery, giving notices, if required, and making payment for all Common Shares purchased by Alamos under the terms of the Offer. The Depositary and Information Agent will also facilitate book-entry tenders of Common Shares. Kingsdale Shareholder Services Inc. can be contacted at 1-866-851-3214 toll free in North America or at 416-867-2272 outside of North America or by e-mail at contactus@kingsdaleshareholder.com.

See Section 27 of the Circular, “Depositary and Information Agent”.

Will I be able to withdraw previously tendered Common Shares?

Yes. You may withdraw Common Shares previously tendered by you at any time (i) before Common Shares deposited under the Offer are taken up by Alamos under the Offer (including during any Subsequent Offering Period), (ii) if your Common Shares have not been paid for by Alamos within three business days after having been taken up, and (iii) in certain other circumstances.

See Section 8 of the Offer, “Withdrawal of Deposited Common Shares”.

How do I withdraw previously tendered Common Shares?

You must send a notice of withdrawal to the Depositary and Information Agent prior to the occurrence of certain events and within the time periods set forth in Section 8 of the Offer, “Withdrawal of Deposited Common Shares”, and the notice must contain specific information outlined therein.

See Section 8 of the Offer, “Withdrawal of Deposited Common Shares”.

Will I have to pay any fees or commissions?

If you are the registered owner of your Common Shares and you tender your Common Shares directly to the Depositary and Information Agent, you will not have to pay brokerage fees or incur similar expenses. If you own your Common Shares through a broker or other nominee and your broker tenders the Common Shares on your behalf, your broker or nominee may charge you a fee for doing so. You should consult your broker or nominee to determine whether any charges will apply.

What will happen if the Offer is withdrawn?

Unless all of the conditions to the Offer have been satisfied or waived at or prior to the Expiry Time, Alamos will not be obligated to take up and purchase Common Shares tendered to the Offer and Alamos may withdraw the Offer. If the Offer is withdrawn in this manner, all of your Common Shares that were deposited and not withdrawn will be returned to you with no payment.

How will a Shareholder be treated for Canadian federal income tax purposes?

A Shareholder who is a resident of Canada, who holds Common Shares as capital property and who sells such shares pursuant to the Offer will realize a capital gain (or capital loss) to the extent that the proceeds of disposition of such shares exceed (or are less than) the total of the adjusted cost base to the Shareholder of such shares and any reasonable costs of disposition. However, a Shareholder who is an Eligible Holder and who elects (or is deemed to elect) the Share Alternative or elects the Cash Alternative but the prorating provisions of the Offer apply may, depending on the circumstances, obtain a full or partial tax-deferred “rollover” by making a joint election with Alamos in prescribed form pursuant to subsection 85(1) or, where the Shareholder is a partnership, subsection 85(2) of the Tax Act (and the corresponding provisions of any applicable provincial legislation). A Shareholder who elects the Share Alternative may in certain circumstances obtain an automatic tax-deferred “rollover”.

V

A Shareholder who is not a resident of Canada generally will not be subject to tax under the Tax Act on any capital gain realized on a disposition of such Shareholder’s Common Shares to the Offer unless such Common Shares are “taxable Canadian property” and are not “treaty-protected property” of such Shareholder.

The foregoing is a brief summary of Canadian federal income tax consequences only and is qualified by the description of Canadian federal income tax considerations in Section 19 of the Circular, “Principal Canadian Federal Income Tax Considerations”. Shareholders are urged to consult their own tax advisors to determine the particular tax consequences to them of a sale of Common Shares pursuant to the Offer or a disposition of Common Shares pursuant to any Compulsory Acquisition or Subsequent Acquisition Transaction.

How will U.S. Holders of Common Shares be treated for U.S. federal income tax purposes?

Unless Aurizon amalgamates with a subsidiary of Alamos and certain other requirements are met, the disposition of Common Shares pursuant to the Offer for Alamos Shares and/or cash generally will be a taxable transaction for U.S. federal income tax purposes, and a U.S. Holder will recognize gain or loss on such disposition of Common Shares in an amount equal to the difference between (i) the sum of the fair market value of the Alamos Shares and cash received (both determined in U.S. dollars) and (ii) such U.S. Holder’s adjusted tax basis in the Common Shares surrendered. If Aurizon amalgamates with a subsidiary of Alamos and certain other requirements are met, then, although there is limited authority and thus substantial uncertainty, the disposition of Common Shares pursuant to the Offer should qualify as an exchange pursuant to a tax-deferred reorganization under Section 368(a) of the Code, in which event a U.S. Holder would only recognize gain to the extent of cash (determined in U.S. dollars) received but would not recognize any loss. In addition, the specific U.S. federal income tax consequences to a U.S. Holder will depend on whether Aurizon has been a PFIC during a U.S. Holder’s holding period for its Common Shares.

The foregoing summary is qualified in its entirety by the more detailed information under Section 20 of the Circular, “U.S. Federal Income Tax Considerations”. Each U.S. Holder should consult an independent tax advisor regarding the U.S. federal income tax consequences of a disposition of Common Shares pursuant to the Offer.

Is Alamos’ financial condition relevant to my decision to tender my Common Shares to the Offer?

Yes. Alamos Shares will be issued to Shareholders who validly tender their Common Shares, so you should consider Alamos’ financial condition before you decide to tender your Common Shares to the Offer. In considering Alamos’ financial condition, you should review the documents included and incorporated by reference in the Offer and Circular because they contain detailed business, financial and other information about Alamos.

See Section 1 of the Circular, “Alamos”.

If I decide not to tender, how will my Common Shares be affected?

If Alamos takes up and pays for the Common Shares validly tendered under the Offer, Alamos currently intends to take such action as is necessary, including effecting a Compulsory Acquisition or a Subsequent Acquisition Transaction, to acquire any Common Shares not tendered. It is Alamos’ current intention that the consideration to be offered for Common Shares under such Compulsory Acquisition or Subsequent Acquisition Transaction will be the same consideration offered pursuant to the Offer. In connection with such a transaction, you may have dissent rights. However, Alamos reserves the right not to complete a Compulsory Acquisition or a Subsequent Acquisition Transaction.

See Section 15 of the Circular, “Acquisition of Common Shares Not Deposited Under the Offer”.

Will Aurizon continue as a public company?

If, as a result of the Offer and any subsequent transaction, the number of Shareholders is sufficiently reduced, Aurizon may become eligible to cease to be a reporting issuer in Canada and/or the United States. To the extent permitted by applicable Law, Alamos intends to delist the Common Shares from the TSX and the NYSE MKT and, where applicable, to cause Aurizon to cease to be a public company in Canada and the United States. The rules and regulations of the TSX and NYSE MKT could also, upon the consummation of the Offer and/or a subsequent transaction, lead to the delisting of the Common Shares from such exchanges.

See Section 5 of the Circular, “Purpose of the Offer and Alamos’ Plans for Aurizon”.

VI

What is the market value of my Common Shares?

On January 9, 2013, the closing price of the Common Shares listed on the TSX and NYSE MKT was $3.33 and US$3.39, respectively. The volume-weighted average price of the Common Shares on the TSX and NYSE MKT for the 20 trading days ended January 9, 2013 was $3.40 and US$3.45, respectively. Based on the closing prices of the Alamos Shares on the TSX on January 9, 2013, the Offer represented a premium of approximately 40% over the closing prices of the Common Shares on the TSX on the same date. Based on the volume-weighted average price of the Alamos Shares on the TSX and NYSE MKT for the 20 trading days ended January 9, 2013, the Offer represented a premium of approximately 37% over the volume-weighted average price of the Common Shares on the TSX and NYSE MKT for the same period.

Alamos urges you to obtain recent quotations for the Common Shares and Alamos Shares before deciding whether or not to tender your Common Shares to the Offer.

See Section 18 of the Circular, “Effect of the Offer on the Market for and Listing of Common Shares and Status as a Reporting Issuer”.

If the Offer is successful will the board of directors and management of Aurizon change?

If the Offer is successful, it is anticipated that the current management of Alamos will manage Aurizon in place of Aurizon’s current management, and that the board of directors of Aurizon will be replaced by nominees of Alamos.

See Section 5 of the Circular, “Purpose of the Offer and Alamos’ Plans for Aurizon”.

Who can I call with questions about the Offer or for more information?

You can call our Depositary and Information Agent, Kingsdale Shareholder Services Inc., if you have questions or requests for additional copies of the Offer and Circular. Questions and requests should be directed to the following telephone numbers:

The Depositary and Information Agent for the Offers is:

| By Registered Mail | By Hand or by Courier | |

| The Exchange Tower 130 King Street West, Suite 2950, P.O. Box 361 Toronto, Ontario M5X 1E2 |

The Exchange Tower 130 King Street West, Suite 2950, Toronto, Ontario M5X 1E2 | |

North American Toll Free Phone:

1-866-851-3214

VII

E-mail: contactus@kingsdaleshareholder.com

Facsimile: 416-867-2271

Toll Free Facsimile: 1-866-545-5580

Outside North America, Banks and Brokers Call Collect: 416-867-2272

VIII

SUMMARY

The following is a summary only and is qualified in its entirety by the detailed provisions contained in the Offer and Circular. You should read the Offer and Circular in their entirety. Certain capitalized and other terms used in this summary, where not otherwise defined herein, are defined in the Glossary. All currency amounts expressed herein, unless otherwise indicated, are in Canadian dollars.

Except as otherwise indicated herein, the information concerning Aurizon contained in the Offer and Circular has been taken from or is based upon publicly available information filed with Canadian securities regulators and other public sources available as at January 11, 2013. Aurizon has not reviewed the Offer and Circular and has not confirmed the accuracy and completeness of the information in respect of Aurizon contained herein. Neither Alamos, nor any person acting jointly or in concert with Alamos, nor any of the directors or officers of Alamos or such persons, assumes any responsibility for the accuracy or completeness of such information or any failure by Aurizon to disclose events or facts which may have occurred or which may affect the significance or accuracy of any such information but which are unknown to Alamos or such persons. Except as otherwise indicated herein, Alamos has no means of verifying the accuracy or completeness of any of the information contained herein that is derived from publicly available information regarding Aurizon or whether there has been any failure by Aurizon to disclose events or facts that may have occurred or may affect the significance or accuracy of any such information.

The Offer

Alamos is offering to purchase, on the terms and subject to the conditions of the Offer, all of the issued and outstanding Common Shares, other than any Common Shares held directly or indirectly by Alamos and its affiliates, and including, for greater certainty, any Common Shares that may become issued and outstanding upon the exercise, exchange or conversion of Convertible Securities after the date hereof but prior to the Expiry Time, for consideration per Common Share of, at the election of the Shareholder:

| (a) | $4.65 in cash for each Common Share; or |

| (b) | 0.2801 of an Alamos Share for each Common Share, |

subject, in each case, to pro-ration as set forth herein. The Offer is made only for Common Shares, and is not made for any other securities.

Assuming that all Shareholders tendered their Common Shares to either the Cash Alternative or the Share Alternative, each Shareholder would be entitled to receive $2.04 in cash and 0.1572 of an Alamos Share for each Common Share tendered (based on 175,431,302 Common Shares issued and outstanding on a fully diluted basis), subject to adjustment for fractional shares, as described herein. For greater certainty, unless a Shareholder receives only cash consideration or only share consideration for all Common Shares tendered by the Shareholder, in all circumstances a Shareholder will receive a proportionate amount of cash and Alamos Shares as consideration for the Common Shares tendered by such Shareholder under the Offer. Applicable U.S. securities laws do not permit Alamos to have more than one Take-Up Date as a result of pro rating the consideration offered under the Offer. Alamos currently intends to seek such relief as may be available to permit it to take up Common Shares on more than one Take-Up Date; although, there can be no assurances that Alamos will be granted such relief.

The cash payments to Shareholders will be denominated in Canadian dollars. However, Shareholders can also elect to receive payment of the cash to which they are entitled under the Offer in U.S. dollars by checking Box 2, Choice A of the Letter of Transmittal, in which case each such Shareholder will have acknowledged and agreed that the exchange rate for one Canadian dollar expressed in U.S. dollars will be based on the exchange rate available to the Depositary and Information Agent at its typical banking institution on the date the funds are converted. A Shareholder electing to receive payment of the cash to which it is entitled under the Offer made in U.S. dollars will have further acknowledged and agreed that any change to the currency exchange rates of the United States or Canada will be at the sole risk of such Shareholder. The Depositary and Information Agent may receive a fee from its banking institution for referring foreign exchange transactions to it.

See Section 1 of the Offer, “The Offer”.

The obligation of Alamos to take up and pay for Common Shares pursuant to the Offer is subject to certain conditions. See Section 4 of the Offer, “Conditions of the Offer”.

i

Time for Acceptance

The Offer is open for acceptance during the period commencing on the date hereof and ending at 5:00 p.m. (Toronto time) on Tuesday, February 19, 2013, or such later time or times and date or dates to which the Offer may be extended from time to time by Alamos, in accordance with Section 5 of the Offer, “Extension, Variation or Change of the Offer”, unless the Offer is withdrawn by Alamos. Any decision to extend the Offer, including for how long, will be made prior to the Expiry Time. See Section 2 of the Offer, “Time for Acceptance”.

Alamos

Alamos is a gold mining and exploration company engaged in exploration, mine development, and the mining and extraction of precious metals, primarily gold. Alamos’ operating asset is the Mulatos Mine which was acquired in February 2003, and is located within the 30,536-hectare Salamandra Concessions in the state of Sonora, Mexico. In January 2010, Alamos acquired the development-stage Ağı Dağı and Kirazlı Projects in the Biga district of northwestern Turkey. In 2011, Alamos discovered the Çamyurt project, located approximately three kilometers from the Ağı Dağı Project, which Alamos believes has the potential to become a stand-alone mining project. Alamos is a public corporation that is listed on the TSX under the symbol “AGI” and has a quoted market value of approximately $2.0 billion as of the close of trading on January 9, 2013. Alamos has applied to list the Alamos Shares on the NYSE under the symbol “AGI”. Alamos is also quoted on the OTC under the symbol “AGIGF”. Alamos expects that the Alamos Shares will cease being quoted on the OTC upon its listing on the NYSE.

Since the start of operations at the Mulatos Mine in Mexico in 2006, Alamos has focused on continued operating improvements and conducting exploration programs to increase reserves and resources. In 2012, the Mulatos Mine produced 200,000 ounces of gold. This represents the fifth consecutive year in which the Mulatos Mine has produced in excess of 150,000 ounces of gold. In the fiscal year ended December 31, 2012, Alamos generated revenues of $329.4 million, compared to $227.4 million in 2011. As at December 31, 2012, Alamos had in excess of $350 million in cash and cash equivalents and short-term investments. As of the date hereof, Alamos owns 26,507,283 Common Shares. See Section 1 of the Circular, “Alamos”.

Aurizon

Aurizon is a Canadian-based gold producer with operations and development activities in the Abitibi region of northwestern Québec. Since 1988, Aurizon has been involved in the acquisition, exploration, development and operation of a number of gold properties in North America. Aurizon owns 100% of the producing Casa Berardi Gold Mine and also owns a 100% interest in the Joanna Gold development project, a development-stage gold property on which a feasibility study has been commissioned for the Hosco deposit. In addition, Aurizon has staked mineral claims, and/or entered into agreements with junior exploration companies to acquire interests in several early stage exploration projects. Aurizon is a public corporation that is listed on the TSX under the symbol “ARZ” and on the NYSE MKT under the symbol “AZK” and has a quoted market value on the TSX and the NYSE MKT of approximately $548 million and US$558 million, respectively, as of the close of trading on January 9, 2013.

Aurizon’s productions from the Casa Berardi Gold Mine in 2011, 2010 and 2009 were 163,845 ounces, 141,116 ounces and 159,261 ounces, respectively. Aurizon’s principal product is gold, with gold sales currently accounting for all of Aurizon’s revenues. See Section 2 of the Circular, “Aurizon”.

Reasons to Accept the Offer

Shareholders should consider the following factors in making a decision to accept the Offer:

| • | Significant Premium. Based on the closing price of $16.60 per Alamos Share on the TSX on January 9, 2013, the consideration offered under the Offer has a value of $4.65 per Common Share, representing a premium of approximately 40% and 39%, respectively, over the closing price of $3.33 and US$3.39 per Common Share on the TSX and NYSE MKT on January 9, 2013. Based on the volume-weighted average price of Alamos Shares on the TSX for the 20 trading days ended January 9, 2013, the Offer represents a premium of approximately 37% over the volume-weighted average price of the Common Shares on the TSX and NYSE MKT for the same period. |

| • | Creation of a Leading Intermediate Gold Company. The combination of Alamos and Aurizon will immediately create a new leading intermediate gold mining company with increased diversification, scale and liquidity. The combined entity is anticipated to have an estimated market capitalization of approximately US$2.6 billion, with enhanced visibility among the international investor community as well as continued exposure |

ii

| to the North American capital markets through listings on both the TSX and the NYSE. The combined company, with two steady producing, low cost mines located in stable jurisdictions, will be strongly positioned for growth. |

| • | Established, Well-funded, Shareholder Focused Team in Place. Alamos offers Shareholders the benefits of both the project development and operation expertise of the Alamos management team as well as access to pro forma combined estimated cash and cash equivalents and short-term investments of approximately US$209.7 million with which to advance projects without any near-term dilution. Alamos will continue to be guided by a board of directors and management team with extensive project development, acquisition, operation and other relevant industry experience necessary to advance projects from the exploration stage through production and to create shareholder value by doing so. |

| • | Financial Capability to Secure Future of Aurizon’s Assets. Alamos’s balance sheet and operating cash flow will be available to support the strong growth profile of the combined company without an expectation of a need for any equity capital raisings. Alamos will remain unhedged and debt-free. Alamos is also well placed to take advantage of the exploration potential of the combined entity to unlock the upside potential for all shareholders. The Offer provides a much needed growth profile for Shareholders. Alamos expects to continue its strong dividend policy. |

| • | Exposure to Other Attractive Mineral Projects. Shareholders who tender to the Offer will gain exposure to the world-class projects of Alamos, including the producing Mulatos Mine in Mexico, one of the world’s most profitable gold mines. Alamos also owns a 100% interest in the advanced-stage gold projects – the Ağı Dağı Project and the Kirazlı Project – in Turkey and has other earlier-stage exploration properties in both Mexico and Turkey. The significant production profile of the combined companies will allow Shareholders who receive Alamos Shares to increase their exposure to the strong gold price environment over the short to mid-term. |

| • | Management Track Record in Developing World-Class Gold Projects. Alamos has a management team with a solid track record and proven experience in the gold industry. The Alamos management team has demonstrated its ability, via the Mulatos Mine in Mexico, to identify, explore, finance, construct, commission and operate a world-class gold mine. It is also applying this experience to the development of Ağı Dağı Project and the Kirazlı Project in Turkey, which remain on track and on budget. |

| • | Opportunity for Continued Participation in Aurizon’s Assets. To the extent that Shareholders receive Alamos Shares as part of their consideration under the Offer, they will benefit from any future increases in value associated with the continued exploration and development of Aurizon’s portfolio of assets, as well as production at Aurizon’s flagship Casa Berardi Gold Mine. |

| • | Opportunity to Elect Consideration. The Offer provides Shareholders with the opportunity to determine the consideration that they receive under the Offer, either the Cash Alternative or the Share Alternative, subject in each case to pro-ration. The Cash Alternative permits Shareholders to elect to receive up to 100% in cash consideration (subject to pro-ration) in exchange for their Common Shares to lock in the premium offered under the terms of the Offer, while the Share Alternative permits Shareholders to elect to receive up to 100% in Alamos Shares (subject to pro-ration) in exchange for their Common Shares and thereby maintain maximum exposure to the significant upside potential of the combined Alamos and Aurizon company going forward. |

| • | Opportunity to Defer Canadian Taxation on Capital Gains. To the extent that Shareholders receive Alamos Shares as consideration under the Offer, certain Shareholders will be entitled, depending on the circumstances, to a full or partial deferral of Canadian taxation on capital gains. |

See Section 4 of the Circular, “Reasons to Accept the Offer”.

Purpose of the Offer and Alamos’ Plans for Aurizon

The purpose of the Offer is to enable Alamos to acquire, on the terms and subject to the conditions of the Offer, all of the issued and outstanding Common Shares (other than Common Shares held directly or indirectly by Alamos and its affiliates, and which includes Common Shares which may become outstanding on the exercise, exchange or conversion of Convertible Securities prior to the Expiry Time).

iii

If the conditions of the Offer are satisfied or waived and Alamos takes up and pays for the Common Shares validly deposited under the Offer and not properly withdrawn, Alamos intends to acquire any Common Shares not deposited under the Offer through a Compulsory Acquisition, if available, or to propose a Subsequent Acquisition Transaction, in each case for consideration per Common Share at least equal in value to and in the same form as the consideration paid by Alamos per Common Share under the Offer. The exact timing and details of any such transaction will depend upon a number of factors, including the number of Common Shares acquired pursuant to the Offer. Although Alamos intends to propose either a Compulsory Acquisition or a Subsequent Acquisition Transaction generally on the terms described herein, it is possible that, as a result of delays in Alamos’ ability to effect such a transaction, information subsequently obtained by Alamos, changes in general economic or market conditions or in the business of Aurizon or other currently unforeseen circumstances, such a transaction may not be proposed, may be delayed or abandoned or may be proposed on different terms. Accordingly, Alamos reserves the right not to propose a Compulsory Acquisition or a Subsequent Acquisition Transaction, or to propose a Subsequent Acquisition Transaction on terms other than as described in the Circular. See Section 15 of the Circular, “Acquisition of Common Shares Not Deposited Under the Offer”.

If the Offer is successful, it is anticipated that the current management of Alamos will manage Aurizon in place of Aurizon’s current management, and that the board of directors of Aurizon will be replaced by nominees of Alamos. With the exception of the foregoing, Alamos has not developed any specific proposals with respect to Aurizon or its operations, or any changes in its assets, business strategies, management or personnel following the acquisition of the Common Shares pursuant to the Offer. Alamos believes there is strong cultural and professional compatibility between Aurizon’s and Alamos’ respective employees and it is Alamos’ intention to integrate both teams following its acquisition of Aurizon.

If permitted by applicable Law, subsequent to the completion of the Offer and a Compulsory Acquisition or any Subsequent Acquisition Transaction, if necessary, Alamos intends to delist the Common Shares from the TSX and the NYSE MKT and to cause Aurizon to cease to be a reporting issuer under the securities laws of each of the provinces and territories of Canada in which it has such status and cease to be registered under the U.S. Exchange Act. See Section 18 of the Circular, “Effect of the Offer on the Market for and Listing of Common Shares and Status as a Reporting Issuer”.

See Section 5 of the Circular, “Purpose of the Offer and Alamos’ Plans for Aurizon” and Section 18 of the Circular, “Effect of the Offer on the Market Price for and Listing of Common Shares and Status as a Reporting Issuer”.

Manner of Acceptance

A Shareholder who wishes to accept the Offer must properly complete and execute the accompanying Letter of Transmittal (printed on YELLOW paper) and deposit it, at or prior to the Expiry Time, together with certificate(s) representing their Common Shares and all other required documents, with the Depositary and Information Agent at its offices in Toronto, Ontario specified in the Letter of Transmittal in accordance with the instructions in the Letter of Transmittal. See Section 3 of the Offer, “Manner of Acceptance — Letter of Transmittal”.

The cash payments to Shareholders will be denominated in Canadian dollars. However, Shareholders can also elect to receive payment of the cash to which they are entitled under the Offer in U.S. dollars by checking the box set out in Box 2, Choice A of the Letter of Transmittal, in which case each such Shareholder will have acknowledged and agreed that the exchange rate for one Canadian dollar expressed in U.S. dollars will be based on the exchange rate available to the Depositary and Information Agent at its typical banking institution on the date the funds are converted. A Shareholder electing to receive payment of the cash to which it is entitled under the Offer made in U.S. dollars will have further acknowledged and agreed that any change to the currency exchange rates of the United States or Canada will be at the sole risk of such Shareholder. The Depositary and Information Agent may receive a fee from its banking institution for referring foreign exchange transactions to it.

If a Shareholder wishes to accept the Offer and deposit its Common Shares under the Offer and the certificate(s) representing such Shareholder’s Common Shares is (are) not immediately available, or if the certificate(s) and all other required documents cannot be provided to the Depositary and Information Agent at or prior to the Expiry Time, such Common Shares nevertheless may be validly deposited under the Offer in compliance with the procedures for guaranteed delivery using the accompanying Notice of Guaranteed Delivery (printed on

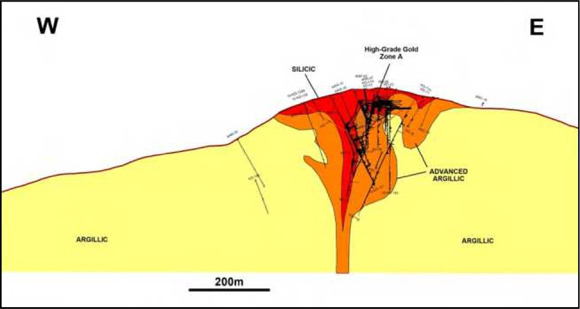

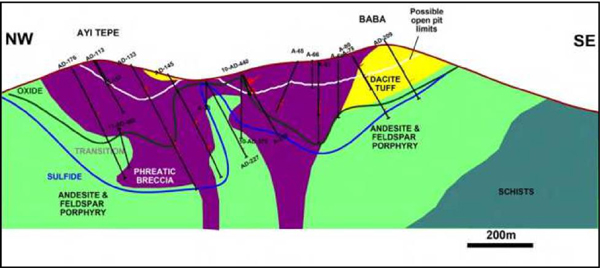

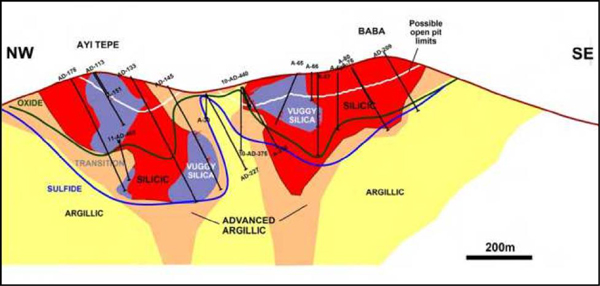

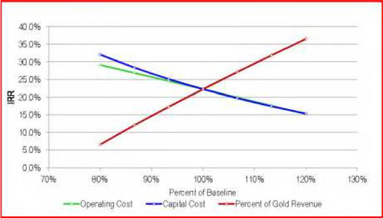

iv