As filed with the Securities and Exchange Commission on October 11, 2019

Registration No. 333-232020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1

to

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

DRONE AVIATION HOLDING CORP.

(Exact name of registrant as specified in its charter)

| Nevada | 3721 | 46-5538504 | ||

|

(State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

11651 Central Parkway, #118

Jacksonville, Florida 32224

(904) 834-4400

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Daniyel Erdberg

Chief Executive Officer

Drone Aviation Holding Corp.

11651 Central Parkway, #118

Jacksonville, Florida 32224

(904) 834-4400

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copies to:

|

Laura Anthony, Esq. Craig D. Linder, Esq. Anthony L.G., PLLC 625 N. Flagler Drive, Suite 600 West Palm Beach, Florida 33401 Telephone: (561) 514-0936 |

Barry I. Grossman, Esq. Sarah E. Williams, Esq. Ellenoff Grossman & Schole LLP 1345 Avenue of the Americas New York, New York 10105 Telephone: (212) 370-1300 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on the Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |

| Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee | ||||||

| Units(2) | $ | 11,500,000 | $ | 1,492.70 | ||||

| Common stock, par value $0.0001 per share, included in the units | — | (4) | — | (4) | ||||

| Warrants to purchase common stock, par value $0.0001 per share, included in the units | — | (4) | — | (4) | ||||

| Common stock, par value $0.0001 per share, underlying the warrants included in the units(3) | $ | 13,800,000 | $ | 1,791.24 | ||||

| TOTAL | $ | 25,300,000 | $ | 3,283.94 | (5) | |||

| (1) | Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Each unit consists of one share of common stock, par value $0.0001 per share and one warrant to purchase one share of common stock, par value $0.0001 per share. Includes 180,722 shares of common stock and/or warrants to purchase 180,722 shares of common stock, which may be issued upon exercise of a 45-day option granted to the underwriters to cover over-allotments, if any. |

| (3) | The warrants are exercisable at a per share exercise price equal to 120% of the public offering price per share of common stock. The proposed maximum aggregate public offering price of the shares of common stock issuable upon exercise of the warrants was calculated to be $13,800,000 (which is 120% of $11,500,000 since each investor will receive a warrant to purchase one share of common stock for each share of common stock purchased in this offering). Pursuant to Rule 416, the registrant is also registering an indeterminate number of additional shares of common stock that are issuable by reason of the anti-dilution provisions of the warrants. |

| (4) | Included in the price of the units. No fee required pursuant to Rule 457(g) under the Securities Act. |

| (5) | $606.00 has already been paid. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to Section 8(a) may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | DATED OCTOBER 11, 2019 |

1,204,819 Units

Each Unit Consisting of

One share of Common Stock (par value $0.0001)

And

One Warrant to Purchase One Share of Common Stock

This is a firm commitment public offering of 1,204,819 units of Drone Aviation Holding Corp., a Nevada corporation, at an assumed public offering price of $8.30 per unit. The actual number of units we will offer will be determined based on the actual public offering price. Each unit consists of one share of our common stock, par value $0.0001 per share, and one warrant to purchase one share of our common stock, par value $0.0001 per share, at an exercise price per share of $9.96 based on the assumed public offering price (120% of the public offering price of one unit in this offering). The warrants will expire on the five year anniversary of the initial exercise date. The shares of our common stock and the warrants are immediately separable and will be issued and tradeable separately, but will be purchased together as a unit in this offering. The offering also includes the shares of common stock issuable from time to time upon exercise of the warrants.

Our common stock is presently quoted on the OTCQB under the symbol “DRNE”. At present, there is a very limited market for our common stock. On October 9, 2019, the last reported sale price for our common stock on the OTCQB was $8.30 ($0.83 pre-reverse split) per share. Quotes of stock trading prices on an over-the-counter marketplace may not be indicative of the market price on a national securities exchange. Prior to this offering, there has been no public market for our warrants on the OTC Markets or any other trading market. We have applied to list our common stock and warrants on The NASDAQ Capital Market under the symbols “DRNE” and “DRNEW,” respectively. The approval of our listing on the NASDAQ Capital Market is a condition of closing this offering.

On June 5, 2019, our board of directors and stockholders holding a majority of our outstanding voting power, approved resolutions authorizing a reverse stock split of the outstanding shares of our common stock in the range from one-for-five (1-for-5) to one-for-ten (1-for-10), which ratio will be selected by the board of directors. The board of directors will set the ratio of the reverse stock split, and the reverse stock split will become effective following approval by FINRA of the reverse stock split, prior to the effective date of the registration statement (of which this prospectus forms a part). The reverse stock split is intended to allow us to meet the minimum share price requirement of the NASDAQ Capital Market.

Except as otherwise indicated and except in our financial statements and the notes thereto, all references to our common stock, share data, per share data and related information depict an assumed reverse stock split ratio of 1-for-10 (“Reverse Stock Split”) until final determination by the board of directors as if it was effective and as if it had occurred at the beginning of the earliest period presented. The Reverse Stock Split, when effective, will combine each ten shares of our outstanding common stock into one share of common stock, without any change in the par value per share, and the Reverse Stock Split correspondingly will adjust, among other things, the exercise rate of our warrants and options into our common stock. No fractional shares will be issued in connection with the Reverse Stock Split, and any fractional shares resulting from the Reverse Stock Split will be rounded up to the nearest whole share.

Persons effecting transactions in these securities should confirm the registration of these securities under the securities laws of the states in which transactions occur or the existence of applicable exemptions from such registration.

THE SECURITIES BEING OFFERED ARE SPECULATIVE AND INVOLVE A HIGH DEGREE OF RISK. THEY SHOULD BE CONSIDERED ONLY BY PERSONS WHO CAN AFFORD THE LOSS OF THEIR ENTIRE INVESTMENT. SEE “RISK FACTORS” BEGINNING ON PAGE 19 OF THIS PROSPECTUS FOR A DISCUSSION OF INFORMATION THAT SHOULD BE CONSIDERED IN CONNECTION WITH AN INVESTMENT IN OUR SECURITIES.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

| Per Unit | Total | |||||||

| Public offering price (1) | $ | $ | ||||||

| Underwriting discounts and commissions (2) | $ | $ | ||||||

| Proceeds, before expenses, to us (3) | $ | $ | ||||||

| (1) | The public offering price and underwriting discount and commissions in respect of each unit correspond to a public offering price per share of common stock of $____ ($____ pre-reverse split) and a public offering price per accompanying warrant of $___ ($____ pre-reverse split). |

| (2) | See “Underwriting” beginning on page 76 for disclosure regarding compensation payable to the underwriters by us. |

| (3) | We estimate the total expenses of this offering will be approximately $459,284. Assumes no exercise of the over-allotment option we have granted to the underwriters as described below. |

We have granted Roth Capital Partners and Aegis Capital Corp., as representatives of the underwriters, an option for a period of 45 days from the date of this prospectus to purchase up to an additional 180,722 shares of common stock and/or warrants to purchase 180,722 shares of common stock at the public offering price less the underwriting discount and commissions solely to cover over-allotments, if any.

The underwriters expect to deliver our securities to purchasers in the offering on or about __________, 2019.

| Co-Book-Running Manager | Co-Book-Running Manager |

| Roth Capital Partners | Aegis Capital Corp. |

The date of this prospectus is ____________, 2019

TABLE OF CONTENTS

No dealer, salesperson or other individual has been authorized to give any information or to make any representation other than those contained in this prospectus in connection with the offer made by this prospectus and, if given or made, such information or representations must not be relied upon as having been authorized by us. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities in any jurisdiction in which such an offer or solicitation is not authorized or in which the person making such offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make such offer or solicitation. Neither the delivery of this prospectus nor any sale made hereunder shall, under any circumstances, create any implication that there has been no change in our affairs or that information contained herein is correct as of any time subsequent to the date hereof.

For investors outside the United States: We have not done anything that would permit this offering or possession or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come into possession of this prospectus must inform themselves, and observe any restrictions relating to, the offering of the shares of our common stock and the distribution of this prospectus outside the United States.

i

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This prospectus includes “forward-looking statements” within the meaning of the federal securities laws that involve risks and uncertainties. Forward-looking statements include statements we make concerning our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs and other information that is not historical information. Some forward-looking statements appear under the headings “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” When used in this prospectus, the words “estimates,” “expects,” “anticipates,” “projects,” “forecasts,” “plans,” “intends,” “believes,” “foresees,” “seeks,” “likely,” “may,” “might,” “will,” “should,” “goal,” “target” or “intends” and variations of these words or similar expressions (or the negative versions of any such words) are intended to identify forward-looking statements. All forward-looking statements are based upon information available to us on the date of this prospectus.

These forward-looking statements are subject to risks, uncertainties and other factors, many of which are outside of our control, that could cause actual results to differ materially from the results discussed in the forward-looking statements, including, among other things, the matters discussed in this prospectus in the sections captioned “Prospectus Summary,” “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and “Business.” Some of the factors that we believe could affect our results include:

| ● | limitations on our ability to continue operations and implement our business plan; |

| ● | our history of operating losses; |

| ● | the timing of and our ability to obtain financing on acceptable terms; |

| ● | the effects of changing economic conditions; |

| ● | the loss of members of the management team or other key personnel; |

| ● | competition from larger, more established companies with greater economic resources than we have; |

| ● | costs and other effects of legal and administrative proceedings, settlements, investigations and claims, which may not be covered by insurance; |

| ● | costs and damages relating to pending and future litigation; |

| ● | the impact of additional legal and regulatory interpretations and rulemaking and our success in taking action to mitigate such impacts; |

| ● | control by our principal equity holders; and |

| ● | the other factors set forth herein, including those set forth under “Risk Factors.” |

There are likely other factors that could cause our actual results to differ materially from the results referred to in the forward-looking statements. Forward-looking statements should not be read as a guarantee of future performance or results and will not necessarily be accurate indications of whether, or the times by which, our performance or results may be achieved. Forward-looking statements are based on information available at the time those statements are made and management’s belief as of that time with respect to future events and are subject to risks and uncertainties that could cause actual performance or results to differ materially from those expressed in or suggested by the forward-looking statements. All forward-looking statements attributable to us in this prospectus apply only as of the date of this prospectus and are expressly qualified in their entirety by the cautionary statements included in this prospectus. We undertake no obligation to publicly update or revise forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events, except as required by law.

ii

We are responsible for the disclosure in this prospectus. However, this prospectus includes industry data that we obtained from internal surveys, market research, publicly available information and industry publications. The market research, publicly available information and industry publications that we use generally state that the information contained therein has been obtained from sources believed to be reliable. The information therein represents the most recently available data from the relevant sources and publications and we believe remains reliable. We did not fund and are not otherwise affiliated with any of the sources cited in this prospectus. Forward-looking information obtained from these sources is subject to the same qualifications and additional uncertainties regarding the other forward-looking statements in this prospectus.

iii

This summary highlights material information concerning our business and this offering. This summary does not contain all of the information that you should consider before making your investment decision. You should carefully read the entire prospectus and the information incorporated by reference into this prospectus, including the information presented under the section entitled “Risk Factors” and the financial data and related notes, before making an investment decision. This summary contains forward-looking statements that involve risks and uncertainties. Our actual results may differ significantly from future results contemplated in the forward-looking statements as a result of factors such as those set forth in “Risk Factors” and “Cautionary Statement Regarding Forward-Looking Statements.” Unless otherwise indicated, except for our financial statements and the notes thereto, all references to our common stock, share data, per share data and related information depict as if the Reverse Stock Split was effective.

In this prospectus, unless the context indicates otherwise, “DRNE,” the “Company,” “we,” “our,” “ours” or “us” refer to Drone Aviation Holding Corp., a Nevada corporation, and its subsidiaries.

Business Overview

We design, develop, market, sell and provide logistical services for specialized tethered aerial monitoring and communications platforms serving national defense and security customers for use in applications including intelligence, surveillance and reconnaissance (“ISR”) and communications. We focus primarily on the development of a tethered aerostat known as the Winch Aerostat Small Platform (“WASP”) which is principally designed for military and security applications where they can provide secure and reliable aerial monitoring for extended durations while being tethered to the ground via a high strength armored tether.

We have steadfastly pursued a vision that rapid, persistent, mobile access to altitude is a force multiplier for military and national security operations. Our unique WASP technology fills what we believe to be significant gaps in the marketplace between the expensive military drones and large, non-mobile aerostat systems.

As a result of recent capital contributions from a select group of management and non-management investors and the elimination of a majority of our outstanding debt, we believe we are better able to position our business to seize opportunities that lay ahead. This investment also allowed us to provide much-needed increased production capacity, through a strategic relationship with an established ISO 9001-certified manufacturer and new production in Florida through the lease of an additional facility.

Highlighted by a $3.8 million WASP award, followed by $1.1 million award for WASP Lite systems and a recent contract valued at approximately $1.7 million gross revenue from the prime contractor as a follow-on to the $3.8 million contract awarded in December 2018, we have announced in excess of approximately $6.6 million gross revenue in new business in the first six months of 2019. Assuming receipt of this revenue, this will represent a 144% increase over the approximately $2.7 million gross revenue reported the entire twelve months of 2018. These awards support our belief that the WASP is well positioned to address the challenges facing tier-one end users, including the U.S. Department of Defense and the Department of Homeland Security.

For the fiscal years ended December 31, 2018 and 2017, we generated revenues of $2,722,713 and $562,078, respectively; and reported net losses of $8,475,313 and $10,323,992, respectively, and negative cash flow from operating activities of $2,387,731 and $3,326,022, respectively. For the six months ended June 30, 2019, we generated revenues of $1,380,497; and reported net losses of $1,049,360, and negative cash flow from operating activities of $3,465,878. As noted in our consolidated financial statements, we had an accumulated deficit of approximately $39,521,450 and recurring losses from operations through June 30, 2019 and a modest income of $53,814 for the quarter ended June 30, 2019. See “Risk Factors” – “We incurred a net loss in in the first six months of 2019 and the fiscal years of 2018 and 2017 with negative cash flows and we cannot assure you as to when, or if, we will become profitable and generate positive cash flows.”

1

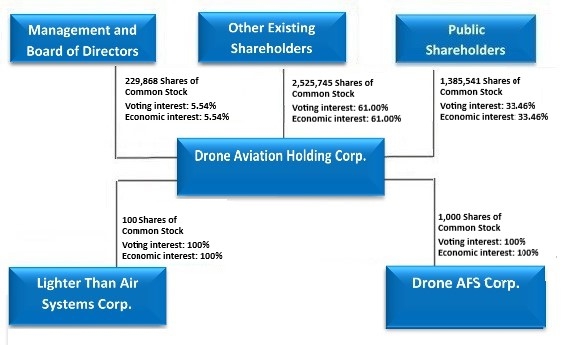

Organization

Drone Aviation Holding Corp. has two wholly owned subsidiaries: Lighter Than Air Systems Corp. (“LTAS”) and Drone AFS Corp. (“AFS”). Drone Aviation Holding Corp. was incorporated in Nevada on April 17, 2014, as a wholly owned subsidiary of MacroSolve, Inc., an Oklahoma corporation (“MacroSolve”), and effective April 30, 2014, in order to consolidate our operations into an entity incorporated in Nevada, MacroSolve merged with and into us. On June 3, 2014, we acquired Drone Aviation Corp. through a share exchange transaction, and on March 26, 2015, Drone Aviation Corp. merged with and into us. As a result of the share exchange and merger with Drone Aviation Corp., we acquired Drone Aviation Corp.’s subsidiary, LTAS. AFS became our subsidiary upon its formation on July 9, 2015.

Products

WASP TACTICAL AEROSTATS

The Company’s core aerostat products are designed to provide real-time, semi-persistent situational awareness to various military and national security customers such as the Department of Defense (DoD) and units of the Department of Homeland Security (DHS) such as the Customs and Border Protection (CBP) to improve security at the nation’s ports and borders. The WASP tethered aerostat system provides customers with tactical, highly mobile and cost-effective aerial monitoring and communications capabilities in remote or austere locations where existing infrastructure is lacking or not accessible. Current WASP products include the WASP tactical aerostat and WASP Lite, a rapidly deployable, compact aerostat system. WASP aerostats are either self-contained on a trailer that can be towed by a military all-terrain vehicle, or “MATV,” or mine resistant ambush protected vehicle (“MRAP”) or other standard vehicle, operated from the bed of a pickup truck, UTV or mounted to a building rooftop. They are designed to provide semi-persistent, mobile, real-time day/night high definition video for intelligence, surveillance and reconnaissance (ISR), detection of improvised explosive devices, border security and other governmental and civilian uses. We believe that all our products can also be utilized for disaster response missions by supporting two-way and cellular communications and acting as a repeater or provider of wireless networking.

Both the WASP and WASP Lite aerostat systems employ a tethered envelope filled with helium gas for lift and carry either a stabilized ISR or communications payload, portable ground control station and a datalink between the ground station and the envelope. Hovering between 500 and 1,500 feet above the ground, the systems provide surveillance, communications and communications capabilities with relatively low acquisition and operating costs. The systems require an operational crew of a minimum of two personnel, relatively simple maintenance procedures, and feature quick retrieval and helium top-off for re-inflation.

| ● | The WASP is a mobile, tactical-sized aerostat capable of carrying a variety of payloads in support of military operations helping troops in the field gain a tactical edge while communicating over greater distances. The WASP leverages aerostat technology to elevate network payloads up to 130 pounds to an advantaged height of up to 1,500 feet, to enable persistent network connectivity while reducing risk to units conducting missions. U.S. Army WASP tactical aerostats previously acquired from us have successfully completed a number of field tests and exercises including the U.S. Department of Defense (“DoD”) CyberQuest, Enterprise Challenge, Storm Force, and various Army Network Integration Evaluations (NIE), which allows the U.S. Government to evaluate, among other things, the WASP’s ability to provide secure communications and capture and relay real-time, high definition video to various handheld devices, tablet computers and other deployed systems. In October 2016, we were awarded contracts from a prime contractor to provide a U.S. Military customer with integrated advanced communication solutions and optical payloads into their WASP aerostats which were delivered in March 2017. In October 2017, we received an award in excess of $800,000 gross revenue from a prime contractor for a multi-mission capable WASP, including secure voice and data network range extension, from an existing DoD customer, which was delivered in February 2018. In March 2018, we received our largest single DoD contract award to date for approximately $1.7 million gross revenue from a prime contractor for a multi-mission capable tactical WASP. The March 2018 order, which was delivered in October 2018, was the third repeat order awarded to us for WASP as the result of a growing number of successful international military deployments. In July 2018, we entered into an exclusive teaming agreement with a U.S. Government prime contractor which is the recipient of a previously awarded IDIQ (indefinite delivery/indefinite quantity) prime contract from of the Department of Homeland Security (“DHS”), Customs and Border Protection (“CBP”). In December 2018, the prime contractor awarded us a subcontract valued at approximately $3.8 million gross revenue for six WASP aerostat systems, which award was announced in January 2019. These WASP powered surveillance systems are expected to be deployed at a CBP Border Patrol Sector on the southern border of the United States beginning in September 2019. There are 20 Border Patrol Sectors along U.S. borders, 9 of which are located along the U.S. Southern border. We have begun production of the initial units at our facilities in Florida and at our ISO 9001-certified manufacturing strategic partner’s facility. Deliveries began late in the second quarter of 2019 and will continue throughout 2019. In June 2019, we were awarded a contract valued at approximately $1.7 million gross revenue from the prime contractor as a follow-on to the $3.8 million gross revenue contract such prime contractor awarded us in December 2018. We are working closely with the prime contractor to explore additional product and services opportunities in DHS and CBP under our exclusive teaming agreement. |

2

| ● | The WASP Lite is a recently developed system that utilizes the proven fieldability of our larger WASP aerostat system incorporated into a small footprint design. It is a compact, non-trailer based, cost effective aerostat system that is highly mobile and can be setup and deployed virtually anywhere from the bed of a pickup truck to a rooftop while anchored or moored. WASP Lite can move while deployed up to 40 mph and supports a wide range of lighter payloads including ISR, communications, and signal intelligence (SIGINT). In May 2019, the U.S. Army selected Drone Aviation’s enhanced WASP Lite Aerostat System for multi-unit award valued at approximately $1.1 million gross revenue. Deliveries under this award commenced in July 2019. |

Market and Product Strengths

The demand for our lighter-than-air (LTA) advanced tethered aerostats and tethered drones has grown significantly over the last several years driven by the increasing need for aerial-based, real-time situational awareness by the military and those responsible for national security operations. Also contributing to the growth in aerial monitoring is technology advances in visual monitoring and communications payloads such as electro-optical camera systems and waveform radios which are delivering enhanced capabilities in smaller, lighter packages.

In terms of the military market, in response to the changing nature of modern warfare, ground forces today are smaller and nimbler. Most importantly, these units are now becoming interlinked in a “networked battlefield” whereby information collected from a growing number of sensors – satellites, manned aircraft and drones and soldiers on the ground - are all aggregated and shared in real-time.

In line with the 2020 U.S. Defense Budget Request, “Army modernization is essential to build a more lethal force foundational for the Joint Force” which states modernization of the Army Network as one of six priorities. The Army Network is defined in the budget request as “a tactical communications network that enables the Army to fight cohesively in any environment where the electromagnetic spectrum is denied or degraded. The network includes electronic warfare; information technology; and assured position, navigation, and timing systems and software with a low signature.” Further evidence of this commitment can be seen through various technology integration and evaluation programs like the Army’s Enterprise Challenge and Network Integration Evaluations (NIEs). Through these programs, the Army is seeking innovative ways to collect, aggregate and disseminate critical information and data across the battlefield.

In national security operations, specifically, those conducted by the DHS and in-line with the priorities stated by the President of the United States and current administration in Washington, border security is a critical area for investment. Based upon news reports and statements directly from the DHS and CBP, the situation at the southern border of the U.S. and Mexico is in crisis as surging border crossings of immigrants and increasing levels of illegal activities such as drug traffic are surpassing available security resources.

3

The challenges faced by the CBP are many since the southern border with Mexico stretches over 1,950 miles from California to Texas, most of which is a barren, austere environment dominated by rough and dusty terrain and is subject to high heat and windy conditions. Currently, CBP monitoring of the border is conducted by agents on foot, on horses, in vehicles, planes, helicopters, and boats. Aerial surveillance on the border is currently conducted via helicopters, aircraft, and drones, however, these platforms are limited due to a lack of persistence and costly operation. Additionally, the CBP operates a network of large aerostats– Tethered Aerostat Radar System (TARS), Persistent Threat Detection System (PTDS), and Persistent Ground Surveillance Systems (PGSS) – however, these systems are limited due to their large size, cost and fixed installation requirements, leaving vast border areas unmonitored.

To address the situation, the U.S. government has allocated significant resources and DHS budget to increase manpower and improve border security via fencing and the adoption of “smart wall technology” including aerial monitoring as well as communications and sensors.

The potential markets for our systems on a stand-alone basis and/or combined with other payloads relates to the following applications, among others:

Governmental Markets:

| ● | International, federal, state and local governments and agencies thereof, including DoD, U.S. Drug Enforcement Agency, U.S. Homeland Security, U.S. Customs and Border Protection, U.S. Environmental Protection Agency, U.S. Department of State, U.S. Federal Emergency Management Agency, U.S. and state Departments of Transportation, penitentiaries, and police forces; |

| ● | Military, including the Army, Marines, National Guard, Navy and U.S. Air Force installations; |

| ● | Intelligence community, including the United States Special Operations Forces; |

| ● | Border security monitoring, including U.S. Homeland Security, to deter and detect illegal entry; |

| ● | Drug enforcement along U.S. borders; |

| ● | Monitoring environmental pollution and sampling air emissions; and |

| ● | Vehicle traffic monitoring by state and local law enforcement agencies. |

Commercial Markets:

| ● | TV and media production mobile communications systems, expanding on-site reporting capabilities to include aerial videography and photography; |

| ● | Agriculture monitoring, including monitoring crop health and fields monitoring to reduce costs and increase yields; |

| ● | Security for large events, including crowd management; |

| ● | Natural disaster instant infrastructure to support first responders; |

| ● | Oil pipeline monitoring and exploration; and |

| ● | Atmospheric and climate research. |

4

Distribution

We primarily sell our products through distribution agreements with firms such as Atlantic Diving Supply, Inc. (ADS, Inc.), a leading value-added logistics and supply chain solutions provider that serves the U.S. military, federal, state and local government organizations, law enforcement agencies, first responders, partner nations and the defense industry. In addition, we sell our products through several prime contractors and our products are included in the U.S. Government’s GSA Schedule, which allows government customers to directly negotiate and acquire products and services from commercially listed suppliers.

Competition and Market Advantage

We believe the current market competitors to the WASP aerostat system include a large number of companies ranging from small “mom and pop” tethered aerostat and balloon companies to large defense contractors, including TCOM, Raytheon, Lockheed Martin, ISL, ILC Dover, Compass Systems, Raven Aerostar, Carolina Unmanned Vehicles, American Blimp Corporation, and RT Aerostat Systems, Inc., the American subsidiary of Israeli aerostat company RT LTA. We believe there are numerous commercial drone companies, such as DJI and Parrot, offering free flying drones for pleasure and commercial use, as well as many larger drone manufactures, such as Northrop Grumman, AeroVironment, Inc. and Boeing, offering military grade free flying drones to the U.S. Government, which could compete with the WASP. There are fewer commercial grade tethered drone competitors for our WATT tethered drone system that remain tethered to the ground via a high strength armored tether, including Aria Insights (formerly Cyphy Works Inc.) located in Danvers, MA, Elistair located in Lyon, France, Hoverfly Technologies, Inc. located in Orlando, Florida, and Skysapience located in Yokneam, Israel.

Many of our LTA aerostat competitors have received considerable funding from government or government-related sources to develop and build LTA aerostats. Most of these organizations and many of our other competitors have greater financial, technical, manufacturing, marketing and sales resources and capabilities than we do. We anticipate increasing competition as a result of defense industry consolidation, which has enabled companies to enhance their competitive position and ability to compete against us. In addition, other companies may introduce competing aerostats or solutions based on alternative technologies that may adversely affect our competitive position. As a result, our products may become less or non-competitive or obsolete. For further discussion of certain risks relating to competition, see “Risk Factors” of this prospectus.

We believe that the principal competitive factors in the markets for the Company’s tethered systems, specifically, aerostats, include product performance, features, acquisition cost, lifetime operating cost, including maintenance and support, ease of use, integration with existing equipment, size, mobility, quality, reliability, customer support, brand and reputation.

Our proprietary and recently patented tethering technology, in particular, our tension control winch system, is an important competitive differentiator in the market. The winch systems utilized in our products have undergone extensive testing and continued refinement through coordination with customers, including the U.S. Army. To date, our products have been purchased through our prime contractors by a number of key customers including the U.S. Army and DHS/CBP.

Our products provide critical observation and communication capabilities serving the increased demand for ISR and communications, including real-time tactical reconnaissance, tracking, combat assessment and geographic data, while reducing the risks to our troops in theatre. Finally, in a highly constrained fiscal environment, we believe the typically lower acquisition and use/maintenance costs of LTA advanced aerostats make them more appealing compared to their heavier than air manned or larger LTA unmanned system alternatives.

Technology, Research and Development

We conduct the development, commercialization and manufacturing of our products in-house at our facilities in Jacksonville and Holly Hill, Florida.

Our research and development efforts are largely focused on the LTA aerostat systems, including developing miniature WASP systems and the management and recovery of helium gas, software development, electronic energy systems, and electronic data transmission systems. We have developed an aerostat system called WASP LITE for use in commercial or governmental applications which do not require the same level of durability and ruggedness as the WASP, and we continue to work on different models with different payloads for various applications.

5

For the six months ended June 30, 2019 and for the years ended December 31, 2018 and 2017, we spent $53,971, $107,015 and $351,768, respectively, on research and development activities. Research and development expenditures are not borne directly by customers nor are the costs accounted for in our pricing models. Throughout the remainder of 2019, we do not anticipate significant increases in research and development expenses from levels reported in 2018 as we focus activities on continual, incremental improvement to the WASP platform in order to increase its features and capabilities.

Strategic Partners

We are party to several agreements with strategic partners and distributors to assist us with the marketing and sales of various products, as we currently have limited in-house sales capabilities. Current relationships include:

| ● | A sales and distribution working relationship with U.S. government prime contractor ADS Inc.; and |

| ● | An exclusive teaming agreement with a non-affiliate U.S. government prime contractor that is the recipient of a previously awarded IDIQ (indefinite delivery/indefinite quantity) prime contract from of the Department of Homeland Security, Customs and Border Protection. |

Intellectual Property

On September 18 and 19, 2014, we filed provisional patent application numbers “62/052,289” and “62/052,946” entitled “Tethered Portable Aerial Media broadcast System” based on the tethered drone system. On September 18, 2015, we filed a utility patent application claiming a priority date of the two provisional patent applications and having application Serial Number “14858467” entitled “Apparatus and Methods for Tethered Aerial Platform and System.” On July 7, 2015, we filed a provisional patent application number “62/189,341” entitled “Apparatus, Methods and System for Tethered Aerial Platform.” On September 20, 2016, the United States Patent and Trademark Office (“USPTO”) issued patent number 9,446,858 entitled “Apparatus and methods for tethered aerial platform and system.” This new patent on our electric tethered aerial platform (“ETAP”) technologies covers the core systems currently incorporated into the WATT and BOLT products.

On December 5, 2016, we filed provisional patent application number “62/430,195” entitled “Converting an Onboard Battery Powered Drone to a Ground Powered Tethered Drone”. On December 5, 2017, we filed a non-provisional patent application number “15/832,209” entitled “System for Converting a Safeguarded Free Flight Onboard Battery-Powered Drone to a Ground-Powered Tethered Drone”. On August 26, 2019, we received a Notice of Allowance and are currently awaiting the issuance and the patent.

On April 19, 2016, we filed an application for registration of the trademark “Taming Altitude”. On August 7, 2018, the USPTO issued trademark number 5,532,648 entitled “Taming Altitude”.

In addition, the Company’s intellectual property portfolio includes an exclusive commercial license to vision-based navigation and advanced autonomous flight management software that it acquired in 2015 and exclusive commercial licenses to a number of unmanned vehicle technologies developed by Georgia Tech Research Corporation, including “GUST” (Georgia Tech UAV Simulation Tool) autopilot system.

Our success and ability to compete depends in part on our ability to develop and maintain our intellectual property and proprietary technology and to operate without infringing on the proprietary rights of others. As we continue the development of our aerial products, we expect that we will rely on patents, trade secrets, copyrights, trademarks, non-disclosure agreements and other contractual provisions. We have also registered the trademark “Blimp in a Box.” In certain cases, when appropriate, we opt to protect our intellectual property through trade secrets as opposed to filing for patent protection in order to preserve confidentiality. All of our employees are subject to non-disclosure agreements and other contractual provisions to establish and maintain our proprietary rights. For further discussion of risks relating to intellectual property, see “Risk Factors” of this prospectus. For further discussion about the intellectual property rights and licenses and minimum royalties, see Note 14 – Commitments and Contingencies in the notes to 2018 audited financial statements.

Dependence on a Few Customers and Regulatory Matters

We believe there is a large, growing market for our tethered aerial products, but anticipate that the majority of our revenue will be derived from our LTA aerostat products sales, at least in the foreseeable future, which will come from U.S. Government and Government-related entities, including the DHS and other departments and agencies. Government programs that we may seek to participate in compete with other programs for consideration during Congress’s budget and appropriations hearings and may be affected by changes not only in political power and appointments, but also general economic conditions and other factors beyond our control. Reductions, extensions or terminations in a program that we are seeking to participate in or overall defense spending or delays in Government funding such as occurred in late December 2018 which shutdown certain departments and agencies, could adversely affect our ability to generate revenues and realize any profits. We cannot predict whether potential changes in security, defense and intelligence priorities will afford opportunities for our business in terms of research and development or product contracts, but any reduction in government spending on such programs could negatively impact our ability to generate revenues.

6

We have registered as a contractor with the U.S. Government and are required to comply with and will be affected by laws and regulations relating to the award, administration and performance of U.S. Government contracts. Government contract laws and regulations affect how we will do business with customers, and in some instances, will impose added costs on our business. A violation of specific laws and regulations could result in the imposition of fines and penalties, the termination of any then existing contracts, or the inability to bid on future contracts. For further discussion of the risks relating to U.S. Government contracts and FAA rules and regulations, see “Risk Factors” of this prospectus.

During fiscal years ended 2018 and 2017, we received a substantial portion of our revenues from a limited number of customers, and the loss of, or a significant reduction in usage by, one or more of our major customers would result in lower revenues. For further discussion about our dependence on a few major customers see Note 15 – Concentrations in the notes to the 2018 audited financial statements.

International sales of our products may also be subject to U.S. laws, regulations and policies like the U.S. Department of State restrictions on the transfer of technology, International Traffic in Arms Regulations (“ITAR”) and other export laws and regulations and may be subject to first obtaining licenses, clearances or authorizations from various regulatory entities. Although we are not currently pursuing international sales, we may deploy working capital towards expansion into foreign markets. This may limit our ability to sell our products abroad and the failure to comply with any of these regulations could adversely affect our ability to conduct business and generate revenues as well as increase our operating costs. Our products may also be subject to regulation by the National Telecommunications and Information Administration and the Federal Communications Commission, which regulate wireless communications.

Sources and Availability of Components

Certain materials and equipment for our products are custom made for those products and are available only from a limited number of suppliers. Failure of a supplier could cause delays in delivery of the products if another supplier cannot promptly be found or if the quality of such replacement supplier’s components is inferior or unacceptable. For further discussion of the risks relating to sources and availability of components, see “Risk Factors” of this prospectus.

Corporate History

Drone Aviation Holding Corp. was incorporated in Nevada on April 17, 2014, as a wholly owned subsidiary of MacroSolve, Inc., an Oklahoma corporation (“MacroSolve”), and effective April 30, 2014, in order to consolidate our operations into an entity incorporated in Nevada, MacroSolve merged with and into us. On June 3, 2014, we acquired Drone Aviation Corp. through a share exchange transaction, and on March 26, 2015, Drone Aviation Corp. merged with and into us. As a result of the share exchange and merger with Drone Aviation Corp., we acquired Drone Aviation Corp.’s subsidiary, LTAS. AFS became our subsidiary upon its formation on July 9, 2015.

Our authorized capital stock consists of 400,000,000 shares, of which 300,000,000 are shares of common stock, $0.0001 par value per share, and 100,000,000 are shares of preferred stock, $0.0001 par value per share. As of October 11, 2019, there were 2,755,613 (27,556,121 pre-reverse split) shares of common stock outstanding and no shares of preferred stock outstanding.

The Board of Directors and shareholders holding a majority of the Company’s voting capital approved and adopted the 2015 Equity Incentive Plan (the “2015 Plan”) on September 4, 2015 and October 1, 2015, respectively. At the annual shareholder meeting on December 6, 2016, shareholder’s approved the 2015 Plan and an amendment to the plan to (i) increase the number of shares of our common stock with may be granted under the plan from 25,000 (250,000 pre-reverse split) to 88,300 (883,000 pre-reverse split) and (ii) reduce the automatic increase in the Share Limit provided for in Section 7.1.(b) of the 2015 Plan from 20% to 10% with such amount rounded down to the nearest 100 (1,000 pre-reverse split) shares.

7

On October 29, 2015, we effected a 1-for-40 reverse stock split of our issued and outstanding common stock. As a result of the reverse stock split, every 40 shares of our pre-reverse split common stock was combined and reclassified into one share of our common stock, and fractional shares were rounded up to the next highest number of whole shares of our common stock.

On September 29, 2016, the Company issued a convertible promissory note (the “Convertible Promissory Notes Series 2016”) which was due October 1, 2017 in the aggregate principal amount of $3,000,000 in a private placement to the former Chairman of the Board and the Chairman of the Strategic Advisory Board of the Company, both of whom are greater than 10% shareholders of the Company. On December 21, 2018, the Company issued 617,742 (6,177,411 pre-reverse split) shares of common stock to the note holders in full settlement of the $3,000,000 principal balance and $88,705 accrued interest.

During the year ended December 31, 2016, the Company issued a net total of 355,664 (3,556,635 pre-reverse split) shares of common stock as follows:

| (a) | On January 12, 2016, the Company issued 250 (2,500 pre-reverse split) shares of common stock pursuant to conversions of an aggregate of 1,000 shares of Series A preferred stock. |

| (b) | On January 12, 2016, the Company issued 18,347 (183,468 pre-reverse split) shares of common stock pursuant to conversions of an aggregate of 73,387 shares of Series C preferred stock. |

| (c) | On January 12, 2016, the Company issued 5,000 (50,000 pre-reverse split) shares of common stock pursuant to conversions of an aggregate of 2,000,000 shares of Series D preferred stock. |

| (d) | On January 12, 2016, the Company issued 5,000 (50,000 pre-reverse split) shares of common stock pursuant to conversions of an aggregate of 1,999,998 shares of Series F preferred stock. |

| (e) | On January 12, 2016, the Company issued 5,000 (50,000 pre-reverse split) shares of common stock pursuant to conversions of an aggregate of 2,000,000 shares of Series G preferred stock. |

| (f) | On April 27, 2016, the Company issued 10,000 (100,000 pre-reverse split) shares of common stock to Lt. Gen. Michael T. Flynn, a newly appointed director. Lt. Gen. Flynn resigned as a director on December 31, 2016 due to his appointment as National Security Advisor to President Donald Trump. Lt. General Flynn forfeited 6,667 (66,667 pre-reverse split) unvested shares and disclaimed 3,333 (33,333 pre-reverse split) vested shares. |

| (g) | On April 27, 2016, the Company issued an aggregate of 115,000 (1,150,000 pre-reverse split) shares of common stock to Jay Nussbaum, Felicia Hess, Daniyel Erdberg, Kendall Carpenter, and Kevin Hess pursuant to stock award agreements. |

| (h) | On May 2, 2016, the Company issued 15,000 (150,000 pre-reverse split) shares of common stock to Strategic Advisory Board members, Dr. Philip Frost and Steven Rubin, for 12 months of services. |

| (i) | On June 3, 2016, the Company issued 5,000 (50,000 pre-reverse split) shares of common stock to Adaptive Flight Inc (AFI) due to the triggering of a ‘make whole’ provision in the value of escrowed shares. |

| (j) | On September 26, 2016, the Company issued 133,900 (1,339,000 pre-reverse split) shares of restricted common stock to employees Jay Nussbaum, Felicia Hess, Daniyel Erdberg, Kendall Carpenter, Mike Silverman and Lt. Gen. Michael Flynn pursuant to stock award agreements. Lt. Gen. Flynn resigned as a director on December 31, 2016 due to his appointment as National Security Advisor to President Donald Trump. Lt. Gen. Flynn forfeited 2,500 (25,000 pre-reverse split) unvested shares. |

8

| (k) | On September 26, 2016, the Company issued 3,500 (35,000 pre-reverse split) shares of common stock to Reginald Brown pursuant to stock award agreement for consulting services. |

| (l) | On September 26, 2016, the Company issued 2,500 (25,000 pre-reverse split) shares of common stock to a member of the Strategic Advisory Board. |

| (m) | On September 29, 2016, the Company issued 49,667 (496,667 pre-reverse split) shares of common stock to twelve investors, including 40,667 (406,666 pre-reverse split) shares to four affiliate investors. These investors purchased stock at $50.00 ($5.00 pre-reverse split) per share and under the purchase agreement received twelve months of price protection. The Convertible Promissory Notes Series 2016 due October 1, 2017 included a $30.00 ($3.00 pre-reverse split) per share conversion factor, thereby triggering the price protection feature. |

During the year ended December 31, 2016, the Company granted 6,500 (65,000 pre-reverse split) common stock options to employees for service provided with exercise prices between $29.10 ($2.91 pre-reverse split) and $37.70 ($3.77 pre-reverse split).

During the year ended December 31, 2016, the Company granted 6,000 (60,000 pre-reverse split) common stock warrants to consultants for service provided with an exercise price of $29.10 ($2.91 pre-reverse split).

During the year ended December 31, 2017, the Company issued a total of 50,025 (500,250 pre-reverse split) shares of common stock as follows:

| (a) | On April 24, 2017, the holder of Series A preferred stock converted a total of 100,100 shares of Series A for an aggregate of 25,025 (250,250 pre-reverse split) shares of restricted common stock in accordance with their conversion rights which includes a blocker with respect to individual ownership percentages. |

| (b) | On August 3, 2017, the Company issued 25,000 (250,000 pre-reverse split) shares of restricted common stock to two members of the Strategic Advisory Board as compensation for their extended service agreement from May 1, 2017 until April 30, 2018. |

During the year ended December 31, 2017, the Company issued a total of 751,000 (7,510,000 pre-reverse split) options to purchase common stock as follows:

| (a) | On January 9, 2017, the Company issued an option to a director to purchase 10,000 (100,000 pre-reverse split) shares of common stock with an exercise price of $29.00 ($2.90 pre-reverse split) per share. |

| (b) | On August 3, 2017, the Company issued options to purchase an aggregate of 521,000 (5,210,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to officers, directors and employees for services provided with an exercise price of $10.00 ($1.00 pre-reverse split) per share. |

| (c) | On November 9, 2017, the Company issued options to purchase an aggregate of 200,000 (2,000,000 pre-reverse split) shares of its common stock outside its 2015 Equity Plan to officers and directors, and for services provided with an exercise price of $13.50 ($1.35 pre-reverse split) per share. |

| (d) | On December 13, 2017, the Company issued options to purchase an aggregate of 20,000 (200,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to two newly-appointed directors with an exercise price of $10.00 ($1.00 pre-reverse split). |

During the year ended December 31, 2017, the Company issued a total of 205,000 (2,050,000 pre-reverse split) warrants to purchase common stock as follows:

9

| (a) | On August 3, 2017, the Company issued warrants to purchase an aggregate of 3,000 (30,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to consultants for services provided with an exercise price of $10.00 ($1.00 pre-reverse split) per share. |

| (b) | On August 3, 2017, the Company issued a warrant to purchase 200,000 (2,000,000 pre-reverse split) shares of the Company’s common stock to Dr. Philip Frost for services to be provided under the terms of his service to the Strategic Advisory Board through April 2018 with an exercise price of $10.00 ($1.00 pre-reverse split) per share. |

| (c) | On November 9, 2017, the Company issued a warrant to purchase 2,000 (20,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to consultants for services provided with an exercise price of $13.50 ($1.35 pre-reverse split) per share. |

On August 2, 2017, the Company issued a promissory note to City National Bank of Florida (“CNB”) in the principal amount of $2,000,000, the CNB Note, with a maturity date of August 2, 2018. On September 26, 2018, the Company and CNB agreed to extend the maturity date of the CNB Note to August 2, 2019. On August 29, 2019, the Company and CNB agreed to extend the maturity date of the promissory note to August 2, 2020.

On August 3, 2017, the Company issued a secured promissory note (the “Secured Convertible Promissory Note Series 2017”) due August 2, 2018 in the aggregate principal amount of $2,000,000 in a private placement to Frost Nevada Investments Trust (“Frost Nevada”) of which Dr. Phillip Frost, an affiliate shareholder of the Company, is the trustee. On September 26, 2018, the Company and Frost Nevada agreed to extend the maturity date of the Secured Convertible Promissory Note Series 2017 to August 2, 2019. On December 21, 2018, the Company issued 403,074 (4,030,740 pre-reverse split) shares of common stock to Frost Nevada in full settlement of the $2,000,000 principal balance and $15,370 accrued interest.

In October 2017, we received an award in excess of $800,000 gross revenue from a prime contractor for a multi-mission capable WASP, including secure voice and data network range extension from an existing DoD customer, which was delivered in February 2018.

In March 2018, we received an approximately $1.7 million gross revenue award, our largest single DoD award to date from a prime contractor for a multi-mission capable tactical WASP. The March 2018 order, which was delivered in October 2018, was the third repeat order awarded to us for WASP as the result of a growing number of successful international military deployments.

During the year ended December 31, 2018, the Company issued a total of 1,445,816 (14,458,151 pre-reverse split) shares of common stock as follows:

| (a) | On October 25, 2018, the Company issued 25,000 (250,000 pre-reverse split) shares of restricted common stock to two members of the Strategic Advisory Board as compensation for their extended service agreement from November 1, 2018 until October 31, 2019. |

| (b) | On October 24, 2018, the Company commenced an offering of up to 1,000,000 (10,000,000 pre-reverse split) shares of its common stock (the “Offered Shares”) in a private placement of up to $5,500,000 to certain accredited investors at a purchase price of $5.50 ($0.55 pre-reverse split) per share pursuant to a Stock Purchase Agreement (the “SPA”). Closing of the offering pursuant to the SPA is conditioned upon certain, limited customary representations and warranties, as well as the Company having received an aggregate of $4,000,000 in new orders from a prime government contractor or directly from the U.S. government at any time commencing after October 9, 2018 (the “Qualifying Sales Order”). As required under the SPA, upon receipt by the Company of a Qualifying Sales Order, the Company will give written notice to the investors notifying them that the Company intends to close on the purchase of the Offered Shares pursuant to the SPA. Within three days after the delivery of the notice to the investors, the Company and the investors will then close under the SPA and at closing, the Company will issue to each purchasing investor the number of shares subscribed for by each Investor. |

| (c) | On December 21, 2018, the Board approved an Amended and Restated Stock Purchase Agreement (the “Amended SPA”) relating to the Offered Shares to reduce the purchase price in the Offering to $5.00 ($0.50 pre reverse split) per share, reduce the maximum offering amount from $5,500,000 to $5,000,000, extend the initial closing date of the Offering to January 15, 2019 and permit sales of the Common Stock for a period of 30 days after the initial closing in order to attract a greater number of investors. In addition, the Amended and Restated Stock Purchase Agreement revised the definition of the event triggering the initial closing date to the date when the Company enters into an agreement with a prime government contractor at any time commencing after October 8, 2018 whereby the Company agrees to provide a minimum of $4,000,000 in goods and services to such contractor. |

10

| (d) | On December 21, 2018, the Company issued 617,742 (6,177,411 pre-reverse split) shares of common stock pursuant to conversion of the Convertible Promissory Notes Series 2016 and 403,074 (4,030,740 pre-reverse split) shares of common stock pursuant to conversion of the Secured Convertible Promissory Note Series 2017. |

| (e) | On December 27, 2018, the Company completed the sale of 400,000 (4,000,000 pre-reverse split) shares of its common stock pursuant to the Amended SPA at $5.00 ($0.50 pre-reverse split) per share for an aggregate of $2,000,000, of which 100,000 shares (1,000,000 pre-reverse split) shares were issued to Jay Nussbaum, the Company’s former Chief Executive Officer and Chairman of the Board of Directors, and 300,000 (3,000,000 pre-reverse split) shares were issued to Frost Gamma Investment Trust, of which Dr. Phillip Frost, an affiliate shareholder of the Company, is the trustee. On January 25, 2019, the Company completed the sale of 401,550 (4,015,500 pre-reverse split) shares of its common stock pursuant to the Amended SPA at $5.00 ($0.50 pre-reverse split) per share for an aggregate of $2,007,750. The aggregate consideration consisted of (1) cash in the aggregate amount of $1,432,750, (2) a promissory note from a single non-affiliate investor in the aggregate principal amount of $500,000, which was repaid on February 8, 2019 including $575 in accrued interest, (3) a full-recourse promissory note payable with a maturity date of January 25, 2020 by Dan Erdberg, the Company’s CEO and President, in the amount of $50,000 which was cancelled on April 30, 2019 pursuant to Stock Redemption and Note Cancellation Agreements, and (4) a full-recourse promissory note payable with a maturity date of January 25, 2020 by Kendall Carpenter, the Company’s Executive Vice President and Chief Financial Officer, in the amount of $25,000 which was reduced by $7,500 in January 2019, leaving a principal balance of $17,500 which was repaid in full on April 30, 2019, including $134 in accrued interest. Each note bore an interest rate at a fixed rate of 3% per annum and principal and interest under the notes could be prepaid at any time without penalty. |

During the year ended December 31, 2018, the Company issued a net total of 656,000 (6,560,000 pre-reverse split) options to purchase common stock as follows:

| (a) | On March 28, 2018, the Company issued options to purchase an aggregate of 10,000 (100,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to a newly-appointed directors with an exercise price of $10.00 ($1.00 pre-reverse split). |

| (b) | On May 16, 2018, the Company issued options to purchase an aggregate of 46,000 (460,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to four employees with an exercise price of $10.00 ($1.00 pre-reverse split). |

| (c) | On August 22, 2018, the Company granted options to purchase an aggregate of 500,000 (5,000,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to five management employees and four directors at an exercise price of $10.00 ($1.00 pre-reverse split) per share. On September 26, 2018, the Board resolved to cancel these options which had not vested. |

| (d) | On September 26, 2018, the Company granted options to purchase an aggregate of 600,000 (6,000,000 pre-reverse split) shares of Company common stock outside its 2015 Equity Plan to five management employees and four directors at an exercise price of $6.50 ($0.65 pre-reverse split) per share. |

During the year ended December 31, 2018, the Company issued a total of 10,000 (100,000 pre-reverse split) warrants to purchase common stock as follows:

| (a) | On September 26, 2018, the Company issued a warrant to purchase 10,000 (100,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to Global Security Innovative Strategies, LLC for services at an exercise price of $10.00 ($1.00 pre-reverse split) per share. |

11

In July 2018, we entered into an exclusive teaming agreement with a U.S. Government prime contractor which is the recipient of a previously awarded IDIQ (indefinite delivery/indefinite quantity) prime contract from of the Department of Homeland Security (“DHS”), Customs and Border Protection (“CBP”). Under the terms of the teaming agreement:

| ● | We agreed to work together to propose retrofit and new production of surveillance systems developed under the prime contract; and |

| ● | We agreed to provide the WASP aerostat, engineering support for WASP system integration, Field Service Representatives personnel support for WASP aerostat maintenance, training, WASP deployment, retrieval and movement, and warranty for WASP. |

In December 2018, the prime contractor awarded us a subcontract valued at approximately $3.8 million gross revenue for six WASP aerostat systems. These WASP powered surveillance systems are expected to be deployed at a CBP Border Patrol Sector on the southern border of the United States commencing in September 2019. There are 20 Border Patrol Sectors along U.S. borders, 9 of which are located along the U.S. Southern border. We have begun production of the initial units at our facilities in Florida and at our ISO 9001-certified manufacturing strategic partner’s facility. Deliveries began late in the second quarter of 2019 and will continue throughout 2019. We are working closely with the prime contractor to explore additional product and services opportunities in DHS and CBP under our exclusive teaming agreement.

Our marketing efforts include submission of bids on several government procurement projects. In the past, we also showcased our products and technologies at numerous conferences and live demonstrations, including the 2017 Special Operations Forces Industry Conference, Warrior Expo East and took part in a series of tests conducted on the southern border of the United States, State of Florida HURREX exercise, CyberQuest 2017, and presentations to a variety of federal and state government agencies. We have also increased marketing efforts and announced the following:

| ● | On August 13, 2019, we announced that we delivered the initial set of WASP Aerostat systems in support of the United States Border Patrol; U.S. Customs and Border Protection. The initial award valued at approximately $3.8 million gross revenue was announced in January 2019 and the follow-on order of approximately $1.7 million gross revenue was announced in June 2019. Due to customer-related confidentiality considerations, we were not permitted to provide additional information about those awards at the time of the announcements. |

| ● | On July 18, 2019, we announced that we delivered our first contract award for the Ultra-Tactical WASP Lite System, valued in excess of $1.1 million, from prime contractor ADS, Inc. to a U.S. Army customer. The award was originally announced on May 7, 2019. |

| ● | On February 14, 2019, we announced that we had commenced the communications upgrade of a U.S. Army-owned WASP tactical aerostat. The upgrade will enable secure communications links utilizing advanced waveforms connecting soldiers on the battlefield. |

| ● | On January 31, 2019, we announced that we secured an additional $2.0 million in capital, completing a private placement raising an aggregate of $4.0 million which will be used to expand production and staffing. |

| ● | On January 22, 2019, we announced the conclusion of training for a U.S. Army unit on the next generation WASP ERS tactical aerostat. The delivery of the $1.7 million order itself was announced on October 15, 2018. |

| ● | On January 15, 2019, we announced the expansion of our manufacturing capacity. |

| ● | On December 27, 2018, we announced that we had eliminated over 70% of our existing debt in support of our planned growth. |

During the six months ended June 30, 2019, the Company issued a total of 391,550 (3,915,500 pre-reverse split) shares of common stock as follows:

| (a) | On January 25, 2019, the Company completed the sale of 401,550 (4,015,500 pre-reverse split) shares of its common stock pursuant to the Amended SPA at a purchase price of $5.00 ($0.50 pre-reverse split) per share, for an aggregate purchase price of $2,007,750. The aggregate consideration consisted of (1) cash in the aggregate amount of $1,432,750, (2) a promissory note from a single non-affiliate investor in the aggregate principal amount of $500,000, (3) a full-recourse promissory note payable by Dan Erdberg in the amount of $50,000 and (4) a full-recourse promissory note payable by Kendall Carpenter in the amount of $25,000. The principal amount of the Carpenter note was reduced by $7,500 on January 28, 2019 leaving a principal balance of $17,500. On April 30, 2019, Kendall Carpenter, the Company’s Executive Vice President and Chief Financial Officer, repaid the entire principal balance of the $17,500 note described above in Footnote #8 to the March 31, 2019 unaudited financial statements, including $134 in accrued interest. On April 30, 2019, Daniyel Erdberg, the Company’s CEO and President, entered into a Stock Redemption and Note Cancellation Agreement whereby the Company redeemed 10,000 (100,000 pre-reverse split) shares of common stock paid pursuant to the note described above in Footnote #8 to the June 30, 2019 unaudited financial statements and cancelled the $50,000 note and the related $267 in accrued interest. |

On February 8, 2019, the non-affiliate investor repaid the $500,000 principal due on the promissory note and on February 11, 2019, the $575 accrued interest.

On April 30, 2019, the Company entered into a Stock Redemption and Note Cancellation Agreement with Daniyel Erdberg to redeem 10,000 (100,000 pre-reverse split) shares in exchange for cancellation of the $50,000 note.

12

On April 30, 2019, the Carpenter note was repaid in full, including principal of $17,500 and accrued interest of $134.

During the six months ended June 30, 2019, the Company issued a net total of 13,000 (130,000 pre-reverse split) options to purchase common stock as follows:

| (a) | On March 20, 2019, the Company issued options to purchase an aggregate of 13,000 (130,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to two employees for services provided with an exercise price of $10.60 ($1.06 pre-reverse split) per share. |

During the six months ended June 30, 2019, the Company issued a net total of 5,000 (50,000 pre-reverse split) warrants to purchase common stock as follows:

| (a) | On March 20, 2019, the Company issued a warrant to purchase 5,000 (50,000 pre-reverse split) shares of the Company’s common stock outside its 2015 Equity Plan to a contractor for services provided with an exercise price of $10.60 ($1.06 pre-reverse split) per share. |

On March 21, 2019, concurrent with the resignation of Kevin Hess, the Company’s prior Chief Technology Officer, the Company and Cognitive Carbon Corporation (“CCC”), a related party, entered into an agreement pursuant to which CCC agreed to provide Chief Technology Officer services, sales and marketing services and outsourced software and platform development services to be provided personally by Kevin Hess or third-party development firms of his choosing for outsourced development. CCC will receive $19,750 per month for one year for the Chief Technology Officer services and potential bonuses and an amount up to $120,000 for outsourced software and platform development. Felicia Hess, the Company’s Chief Quality Officer, who is married to Kevin Hess, is the President and Director of CCC.

Recent Developments

On July 18, 2019, we announced that we delivered our first contract award for the Ultra-Tactical WASP Lite System from prime contractor ADS, Inc. to a U.S. Army customer. The order was originally announced on May 7, 2019. Under the terms of the award, valued in excess of $1.1 million gross revenue, we will supply multiple WASP Lite aerostat systems capable of enhancing and extending the modern networked battlefield supporting specialized waveform communications equipment and day/night ISR (Intelligence, Surveillance and Reconnaissance) payloads. The WASP Lite employs the same proprietary, advanced tethering technologies found in our Winch Aerostat Small Platform (“WASP”) tactical aerostat for secure power and data transmission. Deliveries under this award commenced in July 2019.

On August 13, 2019, we announced that we delivered the initial set of WASP Aerostat systems in support of the United States Border Patrol; U.S. Customs and Border Protection. The initial award valued at approximately $3.8 million gross revenue was announced in January 2019 and the follow-on order of approximately $1.7 million gross revenue was announced in June 2019. Due to customer-related confidentiality considerations, we were not permitted to provide additional information about those awards at the time of the announcements.

On August 31, 2019, Jay H. Nussbaum, the Company’s Chairman of the Board and Chief Executive Officer, passed away.

On September 4, 2019, the Company’s Board appointed Mr. Aguilar, who has served as a member of the Board since 2017, as Chairman of the Board. On September 4, 2019, in connection with Mr. Aguilar’s appointment as Chairman of the Board, the parties to the 2017 Director Agreement agreed to amend the 2017 Director Agreement (“2017 Amendment”) pursuant to which the Company agreed to pay Mr. Aguilar an annual fee of $120,000 in exchange for his services as Chairman of the Board. See footnote regarding Mr. Aguilar in “Executive Compensation – Director Compensation Table” in this prospectus.

On September 4, 2019, the Board appointed Daniyel Erdberg as the Company’s Chief Executive Officer and as a member of the Board to fill the vacancy created by Mr. Nussbaum’s death. Mr. Erdberg also continues to serve as the Company’s President since his appointment to that position on October 2, 2015. In connection with Mr. Erdberg’s appointment as Chief Executive Officer and director, the Company and Mr. Erdberg entered into Amendment No. 6 (“Amendment No. 6”) to the Employment Agreement with Mr. Erdberg on September 4, 2019. Pursuant to the terms of Amendment No. 6, the term of employment was extended to December 31, 2020 and the annual base salary payable under the Employment Agreement was increased from $175,000 to $250,000. See “Executive Compensation - Employment Contracts and Potential Payments Upon Termination or Change in Control” in this prospectus.

On September 4, 2019, Robert Guerra resigned as a director and member of the Board’s committees, effective immediately. Mr. Guerra’s resignation was not the result of any disagreement with the Company on any matter relating to its operation, policies or practices. On September 4, 2019, the Company redeemed 10,000 (100,000 pre-reverse split) shares of its common stock, which are now Treasury Stock, pursuant to a Redemption Agreement at $5.00 ($0.50 pre-reverse split) per share for an aggregate of $50,000 which were issued to Mr. Guerra, the Company’s former director.

As a result of these changes to the composition of the board and its committees and the officers on September 4, 2019, the Company’s officers and directors are as follows since September 5, 2019:

| Name | Age | Positions and Offices | |||

| Daniyel Erdberg | 41 | Chief Executive Officer, President and Director | |||

| Kendall Carpenter | 63 | Executive Vice President, Chief Financial Officer, Secretary and Treasurer | |||

| Felicia Hess | 52 | Chief Quality Officer | |||

| David Aguilar | 63 | Chairman of the Board | |||

| Timothy Hoechst | 53 | Director and Chairman of the Compensation Committee | |||

| John E. Miller | 78 | Director and Chairman of the Audit Committee |

13

Going Concern