UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Annual Report

FORM 20-F

|

☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

X |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2018 |

OR

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from __________ to ________

Commission file number 333-98397

LINGO MEDIA CORPORATION

(FORMERLY LINGO MEDIA INC.)

(Exact name of Registrant as specified in its charter)

Ontario, Canada

(Jurisdiction of incorporation or organization)

151 Bloor Street West, Suite 703, Toronto, Ontario, Canada M5S 1S4

(Address of principal executive offices)

Gali Bar-Ziv, President & CEO

Tel: (416) 927-7000 x33 Fax: (416) 927-1222 Email: investor@lingomedia.com

Lingo Media Corporation 151 Bloor Street West, Suite 703, Toronto, Ontario, Canada M5S 1S4

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

|

Common Shares |

LM |

TSX Venture Exchange |

|

Common Shares |

LMDCF |

OTC Markets |

|

Common Shares |

LIMA |

Frankfurt Stock Exchange |

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Shares, without par value

(Title of Class)

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer's classes of capital or common stock as of the close of the period covered by the annual report. 35,529,192

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act

Yes ___ No X

If this report is an annual transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ___ No X

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes X No ___

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File rerquiredd to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ___ No X

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act (Check one):

| Large accelerated filer ___ | Accelerated Filer ___ | Non-accelerated filer X | ||

|

Emerging growth company ___ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ___

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ____ International Financial Reporting Standards as issued by the International Accounting Standards Board X Other ____

If “Other” has been checked in response to the previous question mark, indicate by check mark which financial statement item the registrant has elected to follow: Item 17 Item 18 ___

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ___ No X

LINGO MEDIA CORPORATION

FORM 20-F ANNUAL REPORT

TABLE OF CONTENTS

|

PART I |

||

|

Item 1. |

Identity of Directors, Senior Management and Advisors |

4 |

|

Item 2. |

Offer Statistics and Expected Timetable |

4 |

|

Item 3. |

Key Information |

4 |

|

Item 4. |

Information on the Company |

12 |

|

Item 4A. |

Unresolved Staff Comments |

20 |

|

Item 5. |

Operating and Financial Review and Prospects |

20 |

|

Item 6. |

Directors, Senior Management and Employees |

29 |

|

Item 7. |

Major Shareholders and Related Party Transactions |

38 |

|

Item 8. |

Financial Information |

39 |

|

Item 9. |

The Offer and Listing |

48 |

|

Item 10. |

Additional Information |

43 |

|

Item 11. |

Quantitative and Qualitative Disclosures about Market Risk |

53 |

|

Item 12. |

Description of Securities Other Than Equity Securities |

55 |

|

PART II |

||

|

Item 13. |

Default, Dividend Arrearages and Delinquencies |

55 |

|

Item 14. |

Material Modifications to the Rights of Security Holders and Use of Proceeds |

55 |

|

Item 15. |

Controls and Procedures |

55 |

|

Item 16. |

Reserved |

57 |

|

Item 16A. |

Audit Committee Financial Expert |

57 |

|

Item 16B. |

Code of Ethics |

57 |

|

Item 16C. |

Principal Accountant Fees and Services |

58 |

|

Item 16D. |

Exemptions from the Listing Standards for Audit Committees |

58 |

|

Item 16E. |

Purchase of Equity Security by the Issuer and Affiliated Purchasers |

58 |

|

Item 16F. |

Change in Registrant’s Certifying Accountant |

58 |

|

Item 16G. |

Corporate Governance |

58 |

|

Item 16H. |

Mine Safety Disclosure |

58 |

|

PART III |

||

|

Item 17. |

Financial Statements |

58 |

|

Item 18. |

Financial Statements |

59 |

|

Item 19. |

Exhibits |

59 |

Forward-Looking Statements

This Annual Report on Form 20-F contains certain forward-looking statements, which reflect management’s expectations regarding the Company’s results of operations, performance, growth, and business prospects and opportunities.

Statements about the Company’s future plans and intentions, results, levels of activity, performance, goals or achievements or other future events constitute forward-looking statements. Wherever possible, words such as "may," "will," "should," "could," "expect," "plan," "intend," "anticipate," "believe," "estimate," "predict," or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management’s current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. These factors should be considered carefully and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this Annual Report are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this Annual Report, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law. Many factors could cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements that may be expressed or implied by such forward-looking statements, including: general economic and market segment conditions, competitor activity, product capability and acceptance, international risk and currency exchange rates and technology changes. More detailed assessment of the risks that could cause actual results to materially differ than current expectations is contained in the sections entitled "Risk Factors", “Information on the Company” and “Operating and Financial Review and Prospects”.

PART I

ITEM 1. Identity of Directors, Senior Management and Advisors

Not applicable

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

Lingo Media Corporation (“Lingo Media” or the “Company”) is a publicly listed company incorporated in Canada with limited liability under the legislation of the Province of Ontario and its shares are listed on the TSX Venture Exchange and inter-listed on the OTC Marketplace. The consolidated financial statements of the Company as at and for the year ended December 31, 2018 comprise the Company and its wholly owned subsidiaries: Lingo Learning Inc., ELL Technologies Ltd., Vizualize Technologies Corporation, ELL Technologies Limited, Speak2Me Inc., Parlo Corporation and Lingo Group Limited (the “Group”).

Lingo Media is an EdTech company that is ‘Changing the way the world learns English’. The Company provides online and print-based solutions through its two distinct business units: ELL Technologies Ltd. (“ELL Technologies”) and Lingo Learning Inc. (“Lingo Learning”). ELL Technologies is a global English language learning multi-media and online training company. Lingo Learning is a print-based publisher of English language learning school programs in China.

The head office, principal address and registered and records office of the Company is located at 151 Bloor Street West, Suite 703, Toronto, Ontario, Canada, M5S 1S4.

3.A Selected Financial Data

The consolidated financial statements of the Company have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”).

The selected financial data should be read in conjunction with the consolidated financial statements and other financial information included elsewhere in the Annual Report.

The Company has not declared any dividends since incorporation and does not anticipate that it will do so in the foreseeable future. The present policy of the Company is to retain any future earnings for use in its operations and the expansion of its business.

The following data for the fiscal years ended December 31, 2018, 2017, 2016, 2015, and 2014 is derived from our consolidated financial statements prepared in accordance with IFRS as issued by the IASB and all are expressed in Canadian Dollars.

|

Fiscal Year Ended December 31

|

||||||||||||||||||||

|

2018 |

2017 |

2016 |

2015 |

2014 |

||||||||||||||||

|

Revenue |

$ | 1,940,182 | $ | 2,776,768 | $ | 3,195,221 | $ | 4,925,735 | $ | 2,512,464 | ||||||||||

|

Profit/(Loss) from Operations |

98,925 | (5,839,868 | ) | 434,319 | 2,601,824 | 523,736 | ||||||||||||||

|

Total Comprehensive Profit/(Loss) |

(71,954 | ) | (6,262,792 | ) | 124,420 | 2,374,699 | 107,406 | |||||||||||||

|

Total Assets |

1,302,004 | 1,534,072 | 7,176,192 | 5,232,951 | 2,423,438 | |||||||||||||||

|

Current Assets |

1,248,840 | 1,503,383 | 3,709,077 | 2,858,710 | 1,411,416 | |||||||||||||||

|

Issued Share Capital |

35,529,192 | 35,529,192 | 35,529,192 | 29,518,343 | 22,379,177 | |||||||||||||||

|

Weighted Average Number of Common Shares Outstanding |

35,529,192 | 35,529,192 | 33,987,383 | 26,288,889 | 21,986,300 | |||||||||||||||

|

Total Equity |

558,594 | 553,754 | 6,445,033 | 4,046,784 | 743,956 | |||||||||||||||

|

Dividends per Common Share |

NIL |

NIL |

NIL |

NIL |

NIL |

|||||||||||||||

|

Earnings/(Loss) per Share |

||||||||||||||||||||

|

Basic |

$ | (0.00 | ) | $ | (0.18 | ) | $ | 0.00 | $ | 0.10 | $ | 0.01 | ||||||||

|

Diluted |

$ | (0.00 | ) | $ | (0.18 | ) | $ | 0.00 | $ | 0.09 | $ | 0.01 | ||||||||

3.A.3. Exchange Rates

In this Annual Report, unless otherwise specified, all dollar amounts are expressed in Canadian Dollars ($). The Government of Canada permits a floating exchange rate to determine the value of the Canadian Dollar against the U.S. Dollar (USD).

The table sets forth the rate of exchange for the Canadian Dollar at the end of the five most recent fiscal periods ended December 31st, the average rates for the period and the range of high and low rates for the period. The data for each month during the previous twelve months is also provided.

Table No. 4

U.S. Dollar/Canadian Dollar

|

Average |

High |

Low |

Close |

|||||||||||||

|

Mar-19 |

1.3368 | 1.3471 | 1.3128 | 1.3342 | ||||||||||||

|

Feb-19 |

1.3206 | 1.3343 | 1.3066 | 1.3165 | ||||||||||||

|

Jan-19 |

1.3301 | 1.3664 | 1.3116 | 1.3142 | ||||||||||||

|

Dec-18 |

1.3432 | 1.3664 | 1.3157 | 1.3644 | ||||||||||||

|

Nov-18 |

1.3200 | 1.3362 | 1.3047 | 1.3285 | ||||||||||||

|

Oct-18 |

1.3010 | 1.3173 | 1.2780 | 1.3124 | ||||||||||||

|

Sept-18 |

1.3037 | 1.3228 | 1.2882 | 1.2921 | ||||||||||||

|

Aug-18 |

1.3041 | 1.3176 | 1.2885 | 1.3077 | ||||||||||||

|

Jul-18 |

1.3130 | 1.3291 | 1.2983 | 1.3014 | ||||||||||||

|

Jun-18 |

1.3129 | 1.3387 | 1.2857 | 1.3141 | ||||||||||||

|

May-18 |

1.2873 | 1.3049 | 1.2727 | 1.2966 | ||||||||||||

|

Apr-18 |

1.2733 | 1.2945 | 1.2524 | 1.2817 | ||||||||||||

|

Fiscal Yr Ended December 31, 2018 |

1.2961 | 1.3642 | 1.2552 | 1.3644 | ||||||||||||

|

Fiscal Yr Ended December 31, 2017 |

1.2986 | 1.3743 | 1.2128 | 1.2545 | ||||||||||||

|

Fiscal Yr Ended December 31, 2016 |

1.3219 | 1.4691 | 1.2458 | 1.3433 | ||||||||||||

|

Fiscal Yr Ended December 31, 2015 |

1.1048 | 1.1643 | 1.0614 | 1.1601 | ||||||||||||

|

Fiscal Yr Ended December 31, 2014 |

1.0302 | 1.0697 | 0.9839 | 1.0636 | ||||||||||||

3.B. Capitalization and Indebtedness

Not applicable

3.C. Reasons for the Offer and Use of Proceeds

Not applicable

3.D. Risk Factors

Financial risk management objectives and policies

The financial risk arising from the Company’s operations are currency risk, liquidity risk and credit risk. These risks arise from the normal course of operations and all transactions undertaken are to support the Group’s ability to continue as a going concern. The risks associated with accounts receivable and the policies on how to mitigate these risks are as follows:

Management manages and monitors these exposures to ensure appropriate measures are implemented on a timely and effective manner. The Company’s Management oversees these risks. The Board of Directors reviews and agrees on policies for managing each of these risks are as follows:

Foreign Currency Risk

Foreign currency risk is the risk that the fair value or future cash flows of a financial instrument will fluctuate because of changes in foreign exchange rates. The Company’s exposure to the risk of changes in foreign exchange rates relates primarily to the Company’s monetary assets and liabilities denominated in currencies other than the Canadian Dollar and the Company’s net investments in foreign subsidiaries.

The Company operates internationally and is exposed to foreign exchange risk as certain expenditures are denominated in non-Canadian Dollar currencies.

The Company has been exposed to this fluctuation and has not implemented a program against these foreign exchange fluctuations.

A 10% strengthening of the US Dollars against Canadian Dollars would have increased the net equity by approximately $63,030 (2017 - $67,000) due to reduction in the value of net liability balance. A 10% weakening of the US Dollar against Canadian Dollar at December 31, 2018 would have had the equal but opposite effect. The significant financial instruments of the Company, their carrying values and the exposure to other denominated monetary assets and liabilities, as of December 31, 2018 and 2017 are as follows:

|

2018 |

2017 |

|||||||

|

USD |

USD |

|||||||

|

Cash |

14,741 | 122,319 | ||||||

|

Accounts receivable |

660,704 | 518,999 | ||||||

|

Accounts payable |

189,586 | 104,225 | ||||||

|

Accrued liabilities |

23,882 | - | ||||||

Liquidity Risk

The Company manages its liquidity risk by preparing and monitoring forecasts of cash expenditures to ensure that it will have sufficient liquidity to meet liabilities when due. The Company’s accounts payable and accrued liabilities generally have maturities of less than 90 days. At December 31, 2018, the Company had cash of $233,843 (2017 - $327,434), accounts and grants receivable of $913,458 (2017 - $970,467) to settle current liabilities of $743,410 (2017 - $980,318).

Credit Risk

Credit risk refers to the risk that one party to a financial instrument will cause a financial loss for the counterparty by failing to discharge an obligation. The Company is primarily exposed to credit risk through accounts receivable. The maximum credit risk exposure is limited to the reported amounts of these financial assets. Credit risk is managed by ongoing review of the amount and aging of accounts receivable balances. As at December 31, 2018, the Company has outstanding receivables of $913,458 (2017 - $970,467). New impairment requirements use an 'expected credit loss' ('ECL') model to recognize an allowance. Impairment is measured using a 12-month ECL method unless the credit risk on a financial instrument has increased significantly since initial recognition in which case the lifetime ECL method is adopted. For receivables, a simplified approach to measuring expected credit losses using a lifetime expected loss allowance is available. The Company deposits its cash with high credit quality financial institutions, with the majority deposited within Canadian Tier 1 Banks.

Dependence on Major Customer

The Company had sales to a major customer in 2018 and 2017, a government agency of the People’s Republic of China. The total percentage of sales to this customer during the year was 80% (2017 – 59%, 2016 – 54%) and the total percentage of accounts receivable at December 31, 2018 was 89% (2017 – 84%, 2016 – 52%).

Market Trends and Business Uncertainties

Lingo Media believes that the global market trends in English language learning are strong and will continue to grow. Developing countries around the world, specifically in Latin America and Asia are expanding their mandates for the teaching of English amongst students, young professionals and adults. The British Council suggests that there are 1.6 billion people learning English globally. English language learning products and services are currently a US$56.3 billion global market notes Ambient Insight.

GlobalEnglish forecasts the global eLearning market to grow to $37.6 billion by 2020, while experiencing exponential growth to reach $325 billion worldwide by 2025.

Markets and Markets forecasts the global EdTech market to grow from US$43.27 billion in 2015 to US$93.76 billion to 2019, or at a CAGR or 16.72%.

Latin American Region

The Inter-American Dialogue recently noted that while English language training programs exist in various forms throughout Latin American region, there are three key factors that these programs must address to be successful: ensuring continuity, developing a strong monitoring and evaluation framework that informs adaptation, and addressing the lack of sufficient quality teachers. Students attending English language training (“ELT”) classes in Latin America accounted for approximately 14 per cent of worldwide revenues, or US$321-million in 2017. Growth has been very rapid in the Latin American region and represents a particularly strong opportunity moving forward relative to other geographic regions.

Asia-Pacific Region

Technavio forecasts the English language training (ELT) market in China to be worth $75 billion by 2022, growing at a CAGR of 22%. The growth of the ELT market in China is driven by more people desiring to learn English, the adaptation of smartphones, increasing levels of disposable income, and the inherent advantages of online education. Technavio also notes that 49% of the growth in the global digital English language learning market will come from the Asia-Pacific region.

Lingo Media is positioned to take advantage of the market opportunity for English language training in Latin America and Asia, with its scalable digital language learning technology and solutions. Although the market outlook remains positive, there can be no assurance that this trend will continue or that the Company will benefit from this trend.

Competitive Markets

We operate in competitive and evolving markets locally, nationally and globally. These markets are subject to rapid technological change and changes in customer preferences and demand. There can be no assurance that we will be able to obtain market acceptance or compete for market share. We must be able to keep current with the rapidly changing technologies, to adapt our services to evolving industry standards and to improve the performance and reliability of our services. New technologies could enable competitive product offerings and adversely affect us and our failure to adapt to such changes could seriously harm our business.

Failure of Delivery Infrastructure to Perform Consistently

Our success as a business depends, in part, on our ability to provide consistently high-quality online services to users via the delivery infrastructure. There is no guarantee that the Company’s delivery infrastructure and/or its software will not experience problems or other performance issues. If the delivery infrastructure or software fails or suffers performance problems, then it would likely affect the quality and interrupt the continuation of our services and significantly harm the business.

The Company’s delivery infrastructure is susceptible to natural or man-made disasters such as earthquakes, floods, fires, power loss and sabotage, as well as interruptions from technology malfunctions, computer viruses and hacker attacks. Other potential service interruptions may result from unanticipated demands on network infrastructure, increased traffic or problems in customer service. Significant disruptions in the delivery infrastructure could harm the Company’s goodwill and its brands and ultimately could significantly and negatively impact the amount of revenue it may earn from its service. Like all Internet transmissions, our services may be subject to interception and malicious attack. Pirates may be able to obtain or copy our products without paying fees. The delivery infrastructure is exposed to spam, viruses, worms, trojan horses, malware, spyware, denial of service or other attacks by hackers and other acts of malice. The Company uses security measures intended to make theft of its software more difficult. However, if the Company is required to upgrade or replace existing security technology, the cost of such security upgrades or replacements could have a material adverse effect on our financial condition, profitability and cash flows.

Limited Intellectual Property Protection

The Company relies on a combination of copyright and trademark laws, trade secrets, confidentiality procedures and contractual provisions to protect its proprietary rights. In addition, our success may depend, in part, on its ability to obtain patent protection and operate without infringing the rights of third parties. There can be no assurance that, once filed, the Company’s patent applications will be successful, that we will develop future proprietary products that are patentable, that any issued patents will provide us with any competitive advantages or will not be successfully challenged by any third parties or that the patents of others will not have an adverse effect on the ability of the Company to do business. In addition, there can be no assurance that others will not independently develop similar products, duplicate some or all of our products or, if patents are issued, design their products so as to circumvent the patent protection held by the Company. We protect our product documentation and other written materials under trade secret and copyright laws which afford only limited protection. Despite precautions taken by the Company, it may be possible for unauthorized third parties to copy aspects of our business and marketing plans or future strategic documents or to obtain and use information that we regard as proprietary. There can be no assurance that the Company’s means of protecting its proprietary rights will be adequate or that our competitors will not independently develop similar or superior technology. Litigation may be necessary in the future to enforce our intellectual property rights, to protect trade secrets or to determine the validity and scope of the propriety rights of others. Such litigation could result in substantial costs and diversion of resources, and there can be no guarantee of the ultimate success thereof.

Government Regulation and Licensing

The Company’s operations may be subject to Canadian and foreign provincial and/or state and federal regulations and licensing. There can be no assurance that we will be able to comply with the regulations or secure and maintain the required licensing for its operations. Government regulation and licensing could seriously impact our ability to achieve its financial and operational objectives. The Company is subject to local, provincial and/or state, federal, and international laws affecting companies conducting business on the Internet, including user privacy laws, laws giving special protection to children, regulations prohibiting unfair and deceptive trade practices and laws addressing issues such as freedom of expression, pricing and access charges, quality of products and services, taxation, advertising, intellectual property rights and information security. The restrictions imposed by and the costs of complying with, current and possible future laws and regulations related to its business could limit our growth and reduce client base and revenue.

Operating in Foreign Jurisdictions

The Company’s current and future development opportunities relate to geographical areas outside of Canada. There are a number of risks inherent in international business activities, including government policies concerning the import and export of goods and services, costs of localizing products and subcontractors in foreign countries, costs associated with the use of foreign agents, potentially adverse tax consequences, limits on repatriation of earnings, the burdens of complying with a wide variety of foreign laws, nationalization and possible social, labor, political and economic instability. There can be no assurance that such risks will not adversely affect the business, financial condition and results of operations. Furthermore, a portion of expenditures and revenues will be in currencies other than the Canadian Dollar. Foreign exchange exposure may change over time with changes in the geographic mix of its business activities. Foreign currencies may be unfavorably impacted by global developments, country-specific events and many other factors. As a result, future results may be adversely affected by significant foreign exchange fluctuations.

Economic Conditions

Unfavorable economic and market conditions could increase our financing costs, reduce demand for our products and services, limit access to capital markets and negatively impact any access to future credit facilities. Expenditures by educational institution, government and corporation tend to be cyclical, reflecting overall economic conditions as well as budgeting and purchasing patterns.

Working Capital

We may need to raise additional funds in order to finance our operations and growth strategy. The Company expects that corporate growth will be funded from cash flow equity and/or debt financing(s) to help generate any required capital. Insuring that capital is available to increase production; sales and marketing capacity; and to provide support materials and training in the market place and to expand is essential to success. There can be no assurance that financing will be available on terms favorable to us, or at all. If adequate funds are not available on acceptable terms, we may be forced to curtail or cease our operations. Even if we are able to continue our operations, the failure to obtain financing could have a substantial adverse effect on our business and financial results.

Uncertainty of Assumptions Underlying Business Plan

The Company’s business plan is based upon numerous assumptions that may later prove to be incorrect. The Company’s ability to adhere to its business plan will depend upon a variety of factors, many of which are beyond the Company’s control. Likewise, the Company’s management is not bound to follow its business plan, and may elect to adopt other strategies and courses of action based upon changes in circumstances and/or market conditions. The Company cannot assure that the actual results of the Company’s operations will materially conform to its business plan.

Success Dependent on Key Management Personnel

The success of the Company is highly dependent on the skills, experience and successful performance of the Company’s management team. The loss of such services could adversely affect development of the Company’s business, revenues, cash flows and profitability.

Managing Growth

The Company must expand its business to achieve greater profitability. Any further expansion of the Company’s business may strain its current managerial, financial, operational, and other resources. Success in managing this expansion and growth will depend, in part, upon the ability of senior management to manage growth effectively. Any failure to do so may lead to inefficiencies and redundancies, and result in reduced growth prospects. As a result, the Company’s profitability, if any, may be curtailed or eliminated.

Supply Failures

The Company relies on third parties for the timely supply of maintenance services. Although the Company actively manages these third-party relationships to ensure continuity of services on time and to its required specifications, some events beyond its control could result in the complete or partial failure of services or services not being delivered on time. Any such failure could negatively affect the Company’s operating results.

Our Public Trading Market is Highly Volatile

The Company's common shares trade on the TSX Venture Exchange under the symbol "LM", and had previously traded on the OTC Markets under the symbol “LMDCF”.

The market price of our common shares could fluctuate substantially due to:

|

■ |

Quarterly fluctuations in operating results; |

|

■ |

Announcements of new products or services by us or our competitors; |

|

■ |

Technological innovations by us or our competitors; |

|

■ |

General market conditions or market conditions specific to our or our customer’s industries; or |

|

■ |

Changes in earning estimates or recommendations by analysts. |

Penny Stock Rules

Our common shares had previously been quoted on the OTC Marketplace; a quotation system for equity securities. It is a more limited trading market than the NASDAQ, and timely, accurate quotations of the price of our common shares may not always be available. You may expect trading volume to be low in such a market. Consequently, should trading resume on such market, the activity of only a few shares may affect the market and may result in wide swings in price and in volume.

Our common shares had been listed on the OTC Marketplace, and had been subject to the requirements of Rule 15(g)- 9, promulgated under the Securities Exchange Act. Under such rule, broker-dealers who recommend low-priced securities to persons other than established customers and accredited investors must satisfy special sales practice requirements, including a requirement that they make an individualized written suitability determination for the purchaser and receive the purchaser’s consent prior to the transaction. The Securities Enforcement Remedies and Penny Stock Reform Act of 1990 also requires additional disclosure in connection with any trade involving a stock defined as a penny stock. Generally, the Commission defines a penny stock as any equity security not traded on an exchange or quoted on NASDAQ that has a market price of less than $5.00 per share. The required penny stock disclosures include the delivery, prior to any transaction, of a disclosure schedule explaining the penny stock market and the risks associated with it. Such requirements could severely limit the market liquidity of the securities and the ability of purchasers to sell their securities in the secondary market.

The stock market has experienced significant price and volume fluctuations, and the market prices of companies, have been highly volatile. Investors may not be able to sell their shares at or above the then current price. In addition, our results of operations during future fiscal periods might fail to meet the expectations of stock market analysts and investors. This failure could lead the market price of our common shares to decline.

There is Uncertainty as to the Company’s Shareholders’ Ability to Enforce Civil Liabilities Both Within and Outside of the United States

The preponderance of our assets are located outside the United States and are held through companies incorporated under the laws of Canada, Hong Kong, China, and the United Kingdom and representative office in China. In addition, all of our directors and officers are nationals and/or residents of countries other than the United States. All or a substantial portion of the assets of these persons are located outside the United States. As a result, it may be difficult for shareholders to effect service of process within the United States upon these persons. In addition, investors may have difficulty enforcing, both in and outside the United States, judgments based upon the civil liability provisions of the securities laws of the United States or any State thereof.

ITEM 4. INFORMATION ON THE COMPANY

4.A. History and Development of the Company

Incorporation and Name Changes

The Company was incorporated under the name Alpha Publishing Inc. pursuant to the Business Corporations Act (Alberta) on April 22, 1996. The name was changed to Alpha Ventures Inc. on May 24, 1996. Pursuant to Articles of Continuance effective April 22, 1998, the Company was continued as an Ontario company under the provisions of the Business Corporations Act (Ontario) under the name, Alpha Communications Corp. The name was changed to Lingo Media Inc. on July 4, 2000, and changed to Lingo Media Corporation on October 16, 2007.

The Company currently has two active segments: Lingo Learning Inc. ("LLI") and ELL Technologies Ltd. (“ELL Technologies”)

Lingo Learning Inc. was incorporated pursuant to the Business Corporations Act (Ontario) on November 21, 1994 under the name Alpha Corporation. Alpha Corporation changed its name to Lingo Media Ltd. on August 25, 2000 and again on March 6, 2008 to Lingo Learning Inc.

ELL Technologies Limited was incorporated pursuant to the Companies Act of United Kingdom under the name The Q Group Limited. On April 29, 2010, the Company changed its name to ELL Technologies Limited.

ELL Technologies Ltd. was incorporated pursuant to the Business Corporations Act (Ontario) on February 23, 2012 under the name 2318041 Ontario Inc. 2318041 Ontario Inc. changed its name to ELL Technologies Ltd. on January 15, 2014.

Vizualize Technologies Corporation was incorporated pursuant to the Business Corporation Act (Ontario) on March 22, 2010.

Speak2Me Inc. was incorporated pursuant to the Business Corporations Act (Ontario) on February 22, 2007.

Parlo Corporation was incorporated pursuant to the Business Corporations Act (Ontario) on September 24, 2009.

The Company’s Executive Office is located at:

151 Bloor Street West

Suite 703

Toronto, Ontario, Canada M5S 1S4

Telephone: (416) 927-7000

Facsimile: (416) 927-1222

E-mail: investor@lingomedia.com

Website: www.lingomedia.com

The Company’s Beijing Representative Office is located at:

8 Xiao Yun Road, Suite 201, Unit 083A

Chao Yang District, Beijing China 100020

The Company's fiscal year ends on December 31st.

The Company's common shares trade on the TSX Venture Exchange under the symbol "LM", are quoted on the Frankfurt Stock Exchange under the symbol “LIMA” and the German securities code is (WKN) 121226, and had previously been on the OTC Market under the symbol “LMDCF”.

4.B. BUSINESS OVERVIEW

Background

Lingo Media (“Lingo Media,” the “Company,” “we” or” us”) is an EdTech company that is ‘Changing the way the world learns Languages’ through the combination of education with technology. The Company is focused on online and print-based technologies and solutions through its two subsidiaries: Lingo Learning Inc. (Lingo Learning”) and ELL Technologies Ltd. (“ELL Technologies”). Through its two distinct business units, Lingo Media develops, markets and supports a suite of English language learning solutions consisting of web-based software licensing subscriptions, online and professional services, audio practice tools and multi-platform applications. The Company continues to operate its legacy textbook publishing business from which it collects recurring royalty revenues.

Lingo Media’s two distinct operating units include ELL Technologies and Lingo Learning. ELL Technologies is a web-based educational technology (“EdTech”) English language learning training and assessment company that creates innovative software-as-a-service e-learning solutions. Lingo Learning is a print-based publisher of English language learning textbook programs in China. The Company has formed successful relationships with key government and industry organizations, establishing a strong presence in China’s education market of more than 500 million students. Lingo Media is extending its global reach, with an initial market expansion into Latin America and continues to expand its product offerings and technology applications.

As of December 31, 2018, the Company operated two distinct business segments as follows:

Print-Based English Language Learning

The Company continues to maintain its legacy textbook publishing business through Lingo Learning, a print-based publisher of English language learning programs in China since 2001. Lingo Learning has an established presence in China’s education market of over 300 million students. To date, it has co-published more than 671 million units from its library of program titles.

China Publishing

Lingo Media has spent 19 years developing English Language Learning (ELL), products, programs, and relationships in the Chinese market. Learning to communicate in English is seen as a top priority for Chinese school students and young adult learners. Along with learning how to use a PC, English skills are perceived as a key determinant of their future levels of prosperity. The Company’s ELL books, audio and CD-based programs are unique in that they have a special focus on the spoken language. In addition to developing learning materials, considerable resources have been expended on the development of relationships with leading Chinese publishers, both in the education and trade sectors, as well as in extensive marketing of Lingo Media’s programs.

The Company is capitalizing on its co-development approach in the Chinese market. Lingo Media sees its relationships with leading Chinese publishers; its Canadian and Chinese author teams; and its original custom-developed content as key factors in opening up the Chinese educational market. The Company has secured long-term publishing contracts for the Kindergarten to Grade 12 (K-12) and higher educational markets, which it anticipates will generate ongoing revenue streams from the sale of its programs.

Co-Publishing Partner in China

People's Education Press

People's Education Press (“PEP”) a division of China's State Ministry of Education, publishes more than 60% of educational materials for the Kindergarten to Grade 12 (“K-12”) market throughout China, for all subjects, including English Language Learning. PEP has a readership of more than 120 million students. Lingo Learning has two programs with PEP. These series target the elementary market of 100 million students: PEP Primary English (for Grades 3-6; Chinese students now begin learning English in Grade 3); and Starting Line (Grades 1-6); All series include the core textbooks in addition to supplemental activity books, audiocassettes, teacher resource books, and other materials.

Seasonality

The Company may experience some seasonal trends in the sale of its publications. For example, sales of educational published materials experience seasonal fluctuations with higher sales in the Spring (second calendar quarter) and Fall (fourth calendar quarter).

Online English Language Learning

ELL Technologies offers more than 2,000 hours of interactive learning through a number of product offerings that include Winnie’s World, English Academy, Campus, English for Success, Master and Business in addition to offering custom solutions. ELL Technologies is primarily marketed in Latin America through a network of distributors and earns its revenues from online and offline licensing fees from its suite of web-based language learning products and applications.

ELL Technologies had an extensive existing product line which required substantial revisions in the technology platform and user interface. Over the past five years, our development team has engineered an eLearning platform and has been introducing new products to the market since the beginning of 2015, integrating cutting-edge technologies, solutions, content and pedagogy.

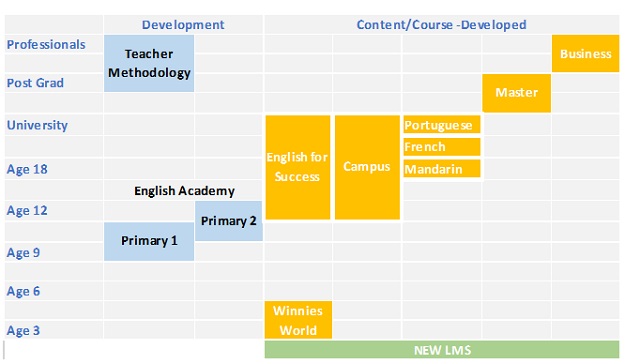

ELL Technologies’ high-tech, easy to implement eLearning Software-as-a-Service solutions have positioned the Company to provide learners of all ages and levels of English proficiency with a platform to further their language learning development. See our “Correlation Table”:

The horizontal axis contains our product information and correlates to the vertical axis which contains the ages and levels of proficiency that our solutions target.

Segmented Information (Before Other Financial Items Below)

The Company operates two distinct reportable business segments as follows:

License of intellectual property: Lingo Learning is a print-based publisher of English language learning textbook programs in China. It earns significantly higher royalties from Licensing Sales compared to Finished Product Sales.

Online and offline Language Learning: ELL Technologies is a global web-based educational technology (“EdTech”) language learning, training, and assessment company. The Company provides the right to access to hosted software over a contract term without the customer taking possession of the software. The Company also provides Offline licenses for the right to use perpetual language-learning.

Transactions between operating segments and reporting segment are recorded at the exchange amount and eliminated upon consolidation.

|

2018 |

Online English Language Learning |

Print-Based English Language Learning |

Head Office |

Total |

||||||||||||

|

Segmented assets |

$ | 141,238 | $ | 1,087,463 | $ | 73,303 | $ | 1,302,004 | ||||||||

|

Segmented liabilities |

348,214 | 160,750 | 234,446 | 743,410 | ||||||||||||

|

Segmented revenue - online |

206,955 | - | - | 206,955 | ||||||||||||

|

Segmented revenue – offline |

8,012 | - | 8,012 | |||||||||||||

|

Segmented revenue – royalty |

38,701 | 1,686,514 | 1,725,215 | |||||||||||||

|

Segmented direct costs |

180,832 | 90,188 | - | 271,020 | ||||||||||||

|

Segmented selling, general & administrative |

348,436 | 64,580 | 787,750 | 1,200,766 | ||||||||||||

|

Segmented other expense |

10,918 | 196,079 | 905 | 207,902 | ||||||||||||

|

Segmented profit (loss) |

(475,131 | ) | 1,335,666 | (788,655 | ) | 71,879 | ||||||||||

|

2017 |

Online English Language Learning |

Print-Based English Language Learning |

Head Office |

Total |

||||||||||||

|

Segmented assets |

$ | 189,200 | $ | 1,257,239 | $ | 87,633 | $ | 1,534,072 | ||||||||

|

Segmented liabilities |

228,418 | 164,294 | 587,606 | 980,318 | ||||||||||||

|

Segmented revenue |

1,088,197 | 1,688,571 | - | 2,776,768 | ||||||||||||

|

Segmented direct costs |

134,695 | 90,923 | - | 225,618 | ||||||||||||

|

Segmented selling, general & administrative |

455,915 | 97,404 | 814,834 | 1,368,153 | ||||||||||||

|

Segmented intangible amortization |

1,051,928 | - | - | 1,051,928 | ||||||||||||

|

Segmented other expense |

1,074 | 182,461 | 1,131 | 184,666 | ||||||||||||

|

Segmented impairment |

2,087,700 | - | 2,087,700 | |||||||||||||

|

Segmented profit (loss) |

(6,148,195 | ) | 1,317,783 | (815,965 | ) | (5,646,377 | ) | |||||||||

|

2016 |

Online English Language Learning |

Print-Based English Language Learning |

Head Office |

Total |

||||||||||||

|

Segmented assets |

$ | 4,521,560 | $ | 1,675,740 | $ | 978,892 | $ | 7,176,192 | ||||||||

|

Segmented liabilities |

206,784 | 198,315 | 326,059 | 731,158 | ||||||||||||

|

Segmented revenue |

1,456,421 | 1,738,800 | - | 3,195,221 | ||||||||||||

|

Segmented direct costs |

167,597 | 217,787 | - | 385,384 | ||||||||||||

|

Segmented selling, general & administrative |

168,161 | 295,549 | 901,025 | 1,364,735 | ||||||||||||

|

Segmented intangible amortization |

1,003,485 | - | - | 1,003,485 | ||||||||||||

|

Segmented other expense |

806 | 192,658 | 1,539 | 195,003 | ||||||||||||

|

Segmented profit |

116,372 | 1,032,806 | (902,564 | ) | 246,614 | |||||||||||

|

Segmented intangible addition |

1,798,687 | - | - | 1,798,687 | ||||||||||||

|

2015 |

Online English Language Learning |

Print-Based English Language Learning |

Head Office |

Total |

||||||||||||

|

Segmented assets |

$ | 3,503,171 | $ | 1,306,848 | $ | 422,932 | $ | 5,232,951 | ||||||||

|

Segmented liabilities |

158,399 | 96,536 | 931,232 | 1,186,167 | ||||||||||||

|

Segmented revenue |

2,954,614 | 1,971,121 | - | 4,925,735 | ||||||||||||

|

Segmented direct costs |

276,049 | 106,822 | - | 382,871 | ||||||||||||

|

Segmented selling, general & administrative |

273,078 | 68,248 | 718,377 | 1,059,703 | ||||||||||||

|

Segmented intangible amortization |

721,720 | - | - | 721,720 | ||||||||||||

|

Segmented other expense |

2,187 | 315,161 | 1,520 | 318,868 | ||||||||||||

|

Segmented profit |

1,681,580 | 1,480,891 | (719,897 | ) | 2,442,574 | |||||||||||

|

Segmented intangible addition |

2,071,440 | - | - | 2,071,440 | ||||||||||||

|

2014 |

Online English Language Learning |

Print-Based English Language Learning |

Head Office |

Total |

||||||||||||

|

Segmented assets |

$ | 928,893 | $ | 975,891 | $ | 518,654 | $ | 2,423,438 | ||||||||

|

Segmented liabilities |

234,160 | 82,097 | 1,363,225 | 1,679,482 | ||||||||||||

|

Segmented revenue |

831,650 | 1,680,814 | - | 2,512,464 | ||||||||||||

|

Segmented direct costs |

286,945 | 95,649 | - | 382,594 | ||||||||||||

|

Segmented selling, general & administrative |

148,974 | 164,567 | 636,688 | 950,229 | ||||||||||||

|

Segmented intangible amortization |

582,857 | - | - | 582,857 | ||||||||||||

|

Segmented other expense |

3,339 | 272,246 | 920 | 276,505 | ||||||||||||

|

Segmented profit |

(190,466 | ) | 1,148,352 | (637,607 | ) | 320,279 | ||||||||||

|

Segmented intangible addition |

544,635 | - | - | 544,635 | ||||||||||||

| Other Financial Items | 2018 | 2017 | 2016 | 2015 | 2014 | |||||||||||||||

|

Print-Based English Language Learning segmented income |

$ | 1,335,666 | $ | 1,317,783 | $ | 1,032,806 | $ | 1,480,891 | $ | 1,148,352 | ||||||||||

|

Online English Language Learning segmented income (loss) |

(475,131 | ) | (6,148,195 | ) | 116,372 | 1,681,580 | (190,466 | ) | ||||||||||||

|

Head Office |

(788,655 | ) | (815,965 | ) | (902,564 | ) | (719,897 | ) | (637,607 | ) | ||||||||||

|

Foreign exchange gain (loss) |

38,351 | (189,783 | ) | (146,599 | ) | 399,314 | 106,437 | |||||||||||||

|

Interest and other financial |

(51,898 | ) | (53,709 | ) | (35,768 | ) | (158,792 | ) | (217,040 | ) | ||||||||||

|

Share-based payments |

(162,489 | ) | (371,513 | ) | - | (151,038 | ) | (65,663 | ) | |||||||||||

|

Other comprehensive loss |

32,202 | (1,410 | ) | 60,173 | (157,358 | ) | (36,607 | ) | ||||||||||||

|

Total Comprehensive Income /(Loss) |

$ | (71,954 | ) | $ | (6,262,792 | ) | $ | 124,420 | $ | 2,374,699 | $ | 107,406 | ||||||||

Revenue by Geographic Region

|

2018 |

2017 |

2016 |

2015 |

2014 |

||||||||||||||||

|

Latin America |

$ | 187,008 | $ | 997,661 | $ | 821,762 | $ | 2,660,535 | $ | 424,892 | ||||||||||

|

China |

1,702,249 | 1,712,079 | 2,252,170 | 2,069,253 | 1,822,660 | |||||||||||||||

|

Other |

50,925 | 67,028 | 121,289 | 195,947 | 264,912 | |||||||||||||||

| $ | 1,940,182 | $ | 2,776,768 | $ | 3,195,221 | $ | 4,925,735 | $ | 2,512,464 | |||||||||||

Identifiable Non-Current Assets by Geographic Region

| 2018 | 2017 | 2016 | 2015 | 2014 | ||||||||||||||||

|

Canada |

$ | 52,131 | $ | 29,804 | $ | 3,467,115 | $ | 2,374,241 | $ | 1,004,424 | ||||||||||

|

China |

1,033 | 885 | - | - | 7,598 | |||||||||||||||

| $ | 53,164 | $ | 30,689 | $ | 3,467,115 | $ | 2,374,241 | $ | 1,012,022 | |||||||||||

|

Intangibles |

Software and Web Development |

Content Platform |

Content Development |

Total |

||||||||||||

|

Cost, January 1, 2014 |

$ | 7,225,065 | $ | 1,477,112 | $ | - | $ | 8,702,177 | ||||||||

|

Additions |

544,635 | - | - | 544,635 | ||||||||||||

|

Effect of foreign exchange |

11,911 | - | - | 11,911 | ||||||||||||

|

Cost, December 31, 2014 |

7,781,611 | 1,477,112 | - | 9,258,723 | ||||||||||||

|

Additions |

782,945 | - | 1,288,495 | 2,071,440 | ||||||||||||

|

Effect of foreign exchange |

66,450 | - | - | 66,450 | ||||||||||||

|

Cost, December 31, 2015 |

8,631,006 | 1,477,112 | 1,288,495 | 11,396,613 | ||||||||||||

|

Additions |

613,163 | - | 1,185,525 | 1,798,687 | ||||||||||||

|

Effect of foreign exchange |

(5,081 | ) | - | - | (5,081 | ) | ||||||||||

|

Cost, December 31, 2016 |

9,239,088 | 1,477,112 | 2,474,020 | 13,190,219 | ||||||||||||

|

Cost, December 31, 2017 and 2018 |

$ | 9,239,088 | $ | 1,477,112 | $ | 2,474,020 | $ | 13,190,219 | ||||||||

|

Intangibles |

Software and Web Development |

Content Platform |

Content Development |

Total |

||||||||||||

|

Accumulated depreciation, January 1, 2014 |

$ | 6,763,414 | $ | 1,061,868 | $ | - | $ | 7,955,282 | ||||||||

|

Charge for the year |

287,435 | 295,422 | - | 582,857 | ||||||||||||

|

Effect of foreign exchange |

2,986 | - | - | 2,986 | ||||||||||||

|

Accumulated depreciation, December 31, 2014 |

7,053,835 | 1,357,290 | - | 8,411,125 | ||||||||||||

|

Intangibles |

Software and Web Development |

Content Platform |

Content Development |

Total |

||||||||||||

|

Charge for the year |

$ | 510,366 | $ | 119,822 | $ | 91,532 | $ | 721,720 | ||||||||

|

Effect of foreign exchange |

58,024 | - | - | 58,024 | ||||||||||||

|

Accumulated depreciation, December 31, 2015 |

7,622,225 | 1,477,112 | 91,532 | 9,190,869 | ||||||||||||

|

Charge for the year |

611,865 | - | 391,620 | 1,003,485 | ||||||||||||

|

Effect of foreign exchange |

(4,144 | ) | - | - | (4,144 | ) | ||||||||||

|

Accumulated depreciation, December 31, 2016 |

8,229,946 | 1,477,112 | 483,152 | 10,190,210 | ||||||||||||

|

Charge for the year |

557,124 | - | 494,804 | 1,051,928 | ||||||||||||

|

Impairment |

452,018 | - | 1,496,064 | 1,948,082 | ||||||||||||

|

Accumulated depreciation, December 31, 2017 and 2018 |

$ | 9,239,088 | $ | 1,477,112 | $ | 2,474,020 | $ | 13,190,219 | ||||||||

|

Net book value, December 31, 2014 |

$ | 727,776 | $ | 119,822 | $ | - | $ | 847,598 | ||||||||

|

Net book value, December 31, 2015 |

$ | 1,008,781 | $ | - | $ | 1,196,963 | $ | 2,205,744 | ||||||||

|

Net book value, December 31, 2016 |

$ | 1,009,142 | $ | - | $ | 1,990,867 | $ | 3,000,009 | ||||||||

|

Net book value, December 31, 2017 and 2018 |

$ | - | $ | - | $ | - | $ | - | ||||||||

4.C. Organization Structure

See 4.A. “History and Development of the Company” for more information.

| Name of subsidiary | Principal activity |

Place of incorporation |

Proportion of ownership interest and voting rights held |

||

|

and operation |

December 31, 2018 |

December 31, 2017 |

December 31, 2016 |

||

|

Lingo Learning Inc. |

Developer and publisher of English language learning print and audio-based products |

Canada |

100% |

100% |

100% |

|

ELL Technologies Ltd. |

English language learning multi-media & online training service |

Canada |

100% |

100% |

100% |

|

ELL Technologies Limited |

English language learning multi-media & online training service |

U.K. |

100% |

100% |

100% |

|

Speak2Me Inc. |

Free English language learning online service |

Canada |

100% |

100% |

100% |

|

Parlo Corporation |

Fee-based online English language learning training and assessment service |

Canada |

100% |

100% |

100% |

4.D. Property and Equipment

The Company’s executive offices are located in rented premises of approximately 4,270 sq. ft. at 151 Bloor Street West, Suite 703, Toronto, Ontario, M5S 1S4 Canada. The Company began occupying these facilities, through its subsidiary Lingo Learning Inc. in March 2006.

The Company’s Beijing representative offices are located in rented premises of approximately 2,174 sq. ft. at 6 Chao Wai Street, Vantone Center, Tower A, Suite 401, Chaoyang District, Beijing, China 100020

The Company has office equipment, furniture and computer equipment located in these offices and for the fiscal years ended December 31, 2018, 2017, 2016, 2015, and 2014, they have a net carrying value of $53,164, $30,689, $27,488, $28,879, and $24,806, respectively.

ITEM 4A. UNRESOLVED STAFF COMMENTS

None.

ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS

The following discussion for the fiscal years ended December 31, 2018, December 31, 2017, and December 31, 2016 should be read in conjunction with the consolidated financial statements of the Company and the notes thereon.

The following discussion contains forward-looking statements that are subject to significant risks and uncertainties. Readers should carefully review the risk factors described herein and in other documents the Company files from time to time with the Securities and Exchange Commission.

5.A Operating Results

On January 1, 2018, the Company adopted the new rules IFRS 15, Revenue Recognition from Contracts with Customers (“IFRS 15”) retrospectively with the cumulative effect of initially applying the rules recognized at the date of initial application.

The following table summarize the impacts of adopting IFRS 15 on operating results.

|

December 31, 2018 |

As reported |

Adjustments |

Amounts without adoption of IFRS 15 |

|||||||||

|

Assets |

||||||||||||

|

Prepaid and other receivables |

$ | 101,539 | $ | 25,610 | $ | 75,929 | ||||||

|

Total Assets |

1,302,004 | 25,610 | 1,276,394 | |||||||||

|

Liabilities |

||||||||||||

|

Contract liabilities |

217,259 | 217,259 | - | |||||||||

|

Total Liabilities |

743,410 | 217,259 | 526,151 | |||||||||

|

Equity |

||||||||||||

|

Deficit |

(25,040,050 | ) | (191,649 | ) | (24,848,402 | ) | ||||||

|

Total equity |

558,594 | (191,649 | ) | 750,243 | ||||||||

|

Total equity and liabilities |

1,302,004 | 25,610 | 1,276,394 | |||||||||

Impact on the consolidated statement of comprehensive income (loss)

|

For the year ended December 31, 2018 |

As reported |

Adjustments |

Amounts without adoption of IFRS 15 |

|||||||||

|

Revenue |

$ | 1,940,182 | $ | (126,400 | ) | $ | 2,066,582 | |||||

|

Direct costs |

271,020 | (20,445 | ) | 291,465 | ||||||||

|

Net Profit / (Loss) for the Year |

(104,156 | ) | 105,955 | 1,799 | ||||||||

|

Total Comprehensive Income (Loss) |

(71,954 | ) | 105,955 | 34,001 | ||||||||

Fiscal Year Ended December 31, 2018 vs. Fiscal Year Ended December 31, 2017

Revenues from Print-Based English language learning for the period were $1,686,514 compared to $1,688,571 in 2017 as a result of foreign exchange fluctuations in the Chinese RMB and Canadian Dollar vs. the US Dollar. Direct costs associated with publishing revenue are relatively modest and have been consistent throughout the years. The Company continues to maintain its relationship with PEP and is investing in the development of its existing and new programs and marketing activities to maintain and increase its royalty revenues.

During 2018, Lingo Media recorded revenues of $1,940,182 as compared to $2,776,768 in 2017, a decrease of 30%. Net loss was $104,156 as compared to $6,261,382 in 2017 resulting in a $0.00 loss per share as compared to $0.18 loss per share in 2017.

Selling, General and Administrative Costs

Selling, general and administrative expenses were $1,200,766 compared to $1,368,153 in 2017. Selling, general and administrative expenses for the two segments are segregated below.

(i) Print-Based English Language Learning

Selling, general and administrative cost for print-based publishing decreased from $97,404 in 2017 to $64,580 in 2018 due to the increase in government grants and general admin expense recovery. The following is a breakdown of selling, general and administrative costs directly related to print-based English language learning:

|

For the Year Ended December 31 |

2018 |

2017 |

||||||

|

Sales, marketing & administration |

$ | 72,154 | $ | 38,022 | ||||

|

General admin expense recovery |

(82,464 | ) | (9,673 | ) | ||||

|

Consulting fees & salaries |

246,783 | 167,708 | ||||||

|

Travel |

48,465 | 37,951 | ||||||

|

Premises |

11,577 | 83,550 | ||||||

|

Professional fees |

10,878 | 12,259 | ||||||

|

Less: Grants |

(242,813 | ) | (232,413 | ) | ||||

| $ | 64,580 | $ | 97,404 | |||||

(ii) Online English Language Learning

Selling, general and administrative costs related to online English language learning was $348,436 for the year compared to $455,915 in 2017. Selling, general and administrative costs for this operating unit decreased in 2018 as compared to 2017, which is the result of managing expenses.

|

For the Year Ended December 31 |

2018 |

2017 |

||||||

|

Sales, marketing & administration |

$ | 120,629 | $ | 189,698 | ||||

|

Consulting fees and salaries |

146,202 | 165,940 | ||||||

|

Travel |

18,593 | 36,759 | ||||||

|

Premises |

48,000 | 48,000 | ||||||

|

Professional fees |

15,012 | 15,518 | ||||||

| $ | 348,436 | $ | 455,915 | |||||

|

(iii) |

Head Office |

Selling, general and administrative costs related to head office was $787,750 for the year compared to $814,834 in 2017. Selling, general and administrative costs for this reporting unit decreased in 2018 as compared to 2017, which is the result of decrease on expenditures related to shares holder services and professional fees.

|

For the Year Ended December 31 |

2018 |

2017 |

||||||

|

Sales, marketing & administration |

$ | 117,538 | $ | 57,230 | ||||

|

Consulting fees & salaries |

481,574 | 354,112 | ||||||

|

Travel |

9,322 | 11,861 | ||||||

|

Shareholder services |

76,240 | 137,517 | ||||||

|

Professional fees |

103,076 | 254,114 | ||||||

| $ | 787,750 | $ | 814,834 | |||||

| Total Selling and Administrative Expenses | $ | 1,200,766 | $ | 1,368,153 | ||||

Government Grants

Included as a reduction of selling, general and administrative expenses are government grants of $242,813 (2017 - $232,413), relating to the Company’s publishing and software projects. At the end of the year, $nil (2017 - $22,556) is included in accounts and grants receivable.

The government grant for the print-based English language learning segment is repayable in the event that the segment’s annual net income before tax for the current year and the previous two years exceeds 15% of revenue. During 2018 and 2017, the conditions for the repayment of grants did not arise and no liability was recorded.

Segmented Information

Total comprehensive loss for the Company was $71,954 for the year ended December 31, 2018 as compared to total comprehensive loss $6,262,792 in 2017. Total comprehensive loss can be attributed to the two operating segments as shown below:

|

Online English Language Learning (“ELL”) |

2018 |

2017 |

||||||

|

Revenue |

$ | 253,668 | $ | 1,088,197 | ||||

|

Expenses: |

||||||||

|

Direct costs |

180,832 | 134,695 | ||||||

|

General & administrative |

348,436 | 455,915 | ||||||

|

Bad debt expense |

(293,379 | ) | 732,254 | |||||

|

Amortization of property & equipment |

1,605 | 894 | ||||||

|

Amortization of development costs |

- | 1,051,928 | ||||||

|

Development costs |

481,992 | 2,692,009 | ||||||

|

Loss on acquisition |

- | 80,818 | ||||||

|

Impairment loss – goodwill |

- | 139,618 | ||||||

|

Impairment – intangible assets |

- | 1,948,081 | ||||||

|

Income taxes and other taxes |

9,313 | 180 | ||||||

| 728,799 | 7,236,392 | |||||||

|

Segmented Loss – Online ELL |

(475,131 | ) | (6,148,195 | ) | ||||

| Print-Based English Language Learning | ||||||||

|

Revenue |

1,686,514 | 1,688,571 | ||||||

|

Expenses: |

||||||||

|

Direct costs |

90,188 | 90,923 | ||||||

|

Selling, general & administrative |

64,580 | 97,404 | ||||||

|

Amortization of property & equipment |

15,859 | 4,619 | ||||||

|

Income taxes and other taxes |

180,221 | 177,842 | ||||||

| 350,848 | 370,788 | |||||||

| Segmented Profit – Print-Based ELL | 1,335,666 | 1,317,783 | ||||||

|

Head Office |

||||||||

|

Expenses: |

||||||||

|

General & administrative |

787,750 | 814,834 | ||||||

|

Amortization of property & equipment |

905 | 1,131 | ||||||

| 788,655 | 815,965 | |||||||

|

Total Segmented Profit (Loss) |

$ | 71,880 | $ | ( 5,646,377 | ) | |||

|

Other |

||||||||

|

Foreign exchange |

38,351 | (189,783 | ) | |||||

|

Interest and other financial expenses |

(51,898 | ) | (53,709 | ) | ||||

|

Share-based payment |

(162,489 | ) | (371,513 | ) | ||||

|

Other comprehensive income (loss) |

32,202 | (1,410 | ) | |||||

| (143,834 | ) | (616,415 | ) | |||||

|

Total Comprehensive Loss |

$ | (71,954 | ) | $ | (6,262,792 | ) | ||

Share-Based Payments

The Company amortizes share-based payments with a corresponding increase to the contributed surplus account. During the year, the Company recorded an expense of $162,489 compared to $371,513 in 2017.

Foreign Exchange

The Company recorded foreign exchange gain of $38,351 as compared to foreign exchange loss of $189,783 in 2017, relating to the Company's currency risk through its activities denominated in foreign currencies as the Company is exposed to foreign exchange risk as a significant portion of its revenue and expenses are denominated in Chinese Renminbi and US Dollars.

Income Tax Expense

The Company recorded a tax expense of $189,534 for the year ended December 31, 2018 compared to a tax expense of $178,022 in 2017. This tax is a withholding tax paid on revenues earned in China and repatriated outside of China.

Net Profit (Loss) for the Year

The Company reported a net loss of $104,156 for the year as compared to $6,261,382 in 2017. The loss per share is $0.00.

Fiscal Year Ended December 31, 2017 vs. Fiscal Year Ended December 31, 2016

Revenues from print-based English language learning for the year ended December 31, 2017 were $1,688,571 compared to $1,738,800 for fiscal 2016, a decrease of 3%. This decrease is due to foreign exchange fluctuation, a decrease in both the Chinese RMB and the Canadian Dollar vs. the US Dollar.

Direct costs associated with publishing revenue are relatively modest and have been consistent throughout the years. The Company continues to maintain its relationship with Peoples’ Education Press and is investing in the development of its existing and new programs and marketing activities to maintain and increase its royalty revenues.

In 2017, Lingo Media generated $1,088,197 in online English language learning revenue as compared to $1,456,421 in 2016, a decrease of 25%. The decrease in revenue is a result of extended sales cycles in securing contracts and time shifting of the sales pipeline.

Selling, General and Administrative Costs

Selling, general and administrative expenses were $1,368,153 in fiscal 2017 compared to $1,364,735 for fiscal 2016. Selling, general and administrative expenses for the operating and reporting segments are segregated below.

(i) Print-Based English Language Learning

Selling, general and administrative cost for print-based publishing decreased from $295,549 in 2016 to $97,404 in 2017 due to the decreases in sales, marketing and administration, travel, and rent. The following is a breakdown of selling, general and administrative costs directly related to print-based English language learning:

|

For the Year Ended December 31 |

2017 |

2016 |

||||||

|

Sales, marketing & administration |

$ | 38,022 | $ | 185,177 | ||||

|

General admin expense recovery |

(9,673 | ) | - | |||||

|

Consulting fees & salaries |

167,708 | 149,081 | ||||||

|

Travel |

37,951 | 55,069 | ||||||

|

Premises |

83,550 | 126,632 | ||||||

|

Professional fees |

12,259 | 9,283 | ||||||

|

Less: Grants |

(232,413 | ) | (229,694 | ) | ||||

| $ | 97,404 | $ | 295,549 | |||||

ii) Online English Language Learning

Selling, general and administrative costs related to online English language learning was $455,915 for the year compared to $168,161 in 2016. Selling, general and administrative costs for this operating unit increased in 2017 as compared to 2016, which included the increase of sales, marketing and administrative expenses, and consulting fees.

|

For the Year Ended December 31 |

2017 |

2016 |

||||||

|

Sales, marketing & administration |

$ | 189,698 | $ | 28,722 | ||||

|

Consulting fees and salaries |

165,940 | 56,988 | ||||||

|

Travel |

36,759 | 35,791 | ||||||

|

Premises |

48,000 | 48,000 | ||||||

|

Professional fees |

15,518 | (1,340 | ) | |||||

| $ | 455,915 | $ | 168,161 | |||||

iii) Head Office

Selling, general and administrative costs related to head office was $814,834 for the year compared to $901,025 in 2016. Selling, general and administrative costs for this reporting unit decreased in 2017 as compared to 2016, which is the result of decrease on expenditures related to marketing, consulting fees, and shareholder services.

|

For the Year Ended December 31 |

2017 |

2016 |

||||||

|

Sales, marketing & administration |

$ | 57,230 | $ | 175,744 | ||||

|

General and admin expense recovery |

- | (175,131 | ) | |||||

|

Consulting fees & salaries |

354,112 | 457,841 | ||||||

|

Travel |

11,861 | 48,542 | ||||||

|

Shareholder services |

137,517 | 292,035 | ||||||

|

Professional fees |

254,114 | 101,995 | ||||||

| $ | 814,834 | $ | 901,025 | |||||

| Total Selling and Administrative Expenses | $ | 1,368,153 | $ | 1,364,736 | ||||

Government Grants

Lingo Media makes applications to the Canadian government for various types of grants to support its publishing and international marketing activities. Each year, the amount of any grant may vary depending on certain eligibility criteria (including prior year revenues) and the monies available to and the number of eligible candidates. These government grants are recorded as a reduction of general and administrative expenses to offset direct costs funded by the grant. During 2017, the Company recorded $232,413 of such grants.

One government grant for the print-based English language learning segment is repayable in the event that the segment’s annual net income before tax for the current year and the previous two years exceeds 15% of revenue. During 2017 and 2016, the conditions for the repayment of grants did not arise and no liability was recorded.

One grant, relating to the Company’s “Development of Comprehensive, Interactive Phonetic English Learning Solution” project, is repayable semi-annually at a royalty rate of 2.5% per year’s gross sales derived from this project until 100% of the grant is repaid. No royalty was paid in 2017, 2016 or 2015 as no sales were generated from this project.

Segmented Information

Total comprehensive loss for the Company was $6,262,792 for the year ended December 31, 2017 as compared to a total comprehensive income of $124,420 in 2016. Total comprehensive loss can be attributed to the business segments as shown below:

|

Online English Language Learning |

2017 |

2016 |

||||||

|

Revenue |

$ | 1,088,197 | $ | 1,456,421 | ||||

|

Expenses: |

||||||||

|

Direct costs |

134,695 | 167,597 | ||||||

|

General & administrative |

455,915 | 168,161 | ||||||

|

Bad debt expense |

732,254 | - | ||||||

|

Amortization of property & equipment |

894 | - | ||||||

|

Amortization of development costs |

1,051,928 | 1,003,485 | ||||||

|

Development costs |

2,692,009 | - | ||||||

|

Loss on acquisition |

80,818 | - | ||||||

|

Impairment loss – goodwill |

139,618 | - | ||||||

|

Impairment – intangible assets |

1,948,081 | - | ||||||

|

Income taxes and other taxes |

180 | 806 | ||||||

| 7,236,392 | 1,340,049 | |||||||

|

Segmented Loss - Online ELL |

$ | (6,148,195 | ) | $ | 116,372 | |||

|

Print-Based English Language Learning |

||||||||

|

Revenue |

$ | 1,688,571 | $ | 1,738,800 | ||||

|

Expenses: |

||||||||

|

Direct costs |

90,923 | 217,787 | ||||||

|

Selling, general & administrative |

97,404 | 295,549 | ||||||

|

Amortization of property & equipment |

4,619 | 5,758 | ||||||

|

Income taxes and other taxes |

177,842 | 186,900 | ||||||

| $ | 370,788 | $ | 705,994 | |||||

|

Segmented Income – Print-Based ELL |

$ | 1,317,783 | $ | 1,032,806 | ||||

|

Head Office |

||||||||

|

Expenses: |

||||||||

|

General & administrative |

$ | 814,834 | $ | 901,025 | ||||

|

Amortization of property & equipment |

1,131 | 1,539 | ||||||

| 815,965 | 902,564 | |||||||

|

Total Segmented Profit (Loss) |

$ | (5,646,377 | ) | $ | 246,614 | |||

|

Other |

||||||||

|

Foreign exchange |

$ | (189,783 | ) | $ | (146,599 | ) | ||

|

Interest and other financial expenses |

(53,709 | ) | (35,768 | ) | ||||

|

Share-based compensation |

(371,513 | ) | - | |||||

|

Other comprehensive loss |

(1,410 | ) | 60,173 | |||||

| (616,415 | ) | (122,194 | ) | |||||

|

Total Comprehensive Income (Loss) |

$ | (6,262,792 | ) | $ | 124,420 | |||

Share-Based Payments

The Company amortizes share-based payments with a corresponding increase to the contributed surplus account. During 2017, the Company recorded an expense of $371,513 compared to $Nil in 2016.

Foreign Exchange

The Company recorded foreign exchange loss of $189,783 as compared to $146,599 in 2016, relating to the Company's currency risk through its activities denominated in foreign currencies as the Company is exposed to foreign exchange risk as a significant portion of its revenue and expenses are denominated in Chinese Renminbi and US Dollars.

Income Tax Expense

The Company recorded a tax expense of $178,022 for the year ended December 31, 2017 compared to a tax expense of $187,705 in 2016. This tax is a withholding tax paid on revenues earned in China and repatriated outside of China.

Net Profit for the Year

The Company reported a net loss of $6,261,382 for the year as compared to $64,247 in 2016. The loss per share is $0.18 per share and is primarily due to an impairment of intangible assets and goodwill of $2,087,700 and development costs of $2,692,009 in addition to recording an allowance for bad debts of $732,254. The impairment arose primarily as a result of weakened market conditions in the online English Language Learning segment.

5.B Liquidity and Capital Resources

Financial information for the years ended December 31, 2018, 2017 and 2016 was prepared in accordance with IFRS as issued by the IASB.

As at December 31, 2018, the Company had cash of $233,843 compared to $327,434 in 2017. Accounts and grants receivable of $913,458 were outstanding at the end of the year compared to $970,467 in 2017. With 89% of the receivables from PEP and the balance due from ELL Technologies’ customers, the Company does not anticipate an effect on its liquidity. Total current assets amounted to $1,248,840 (2017 - $1,503,383) with current liabilities of $743,410 (2017 - $980,318) resulting in working capital of $505,430 (2017 - $523,065).