| Name of Fund: |

| Fund Address: | 100 Bellevue Parkway, Wilmington, DE 19809 |

|

JANUARY 31, 2023 |

| 2023 Semi-Annual Report (Unaudited) | ||

| Not FDIC Insured • May Lose Value • No Bank Guarantee |

| Total Returns as of January 31, 2023 | ||||

| 6‑Month | 12‑Month | |||

| U.S. large cap equities (S&P 500® Index) |

(0.44)% | (8.22)% | ||

| U.S. small cap equities (Russell 2000® Index) |

3.25 | (3.38) | ||

| International equities (MSCI Europe, Australasia, Far East Index) |

9.52 | (2.83) | ||

| Emerging market equities (MSCI Emerging Markets Index) |

4.92 | (12.12) | ||

| 3‑month Treasury bills (ICE BofA 3‑Month U.S. Treasury Bill Index) |

1.58 | 1.79 | ||

| U.S. Treasury securities (ICE BofA 10‑Year U.S. Treasury Index) |

(5.60) | (11.62) | ||

| U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) |

(2.37) | (8.36) | ||

| Tax‑exempt municipal bonds (Bloomberg Municipal Bond Index) |

0.73 | (3.25) | ||

| U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) |

1.46 | (5.22) | ||

| Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. | ||||

| 2 | T H I S P A G E I S N O T P A R T O F Y O U R F U N D R E P O R T |

| Page | ||||

| 2 | ||||

| Semi-Annual Report: |

||||

| 4 | ||||

| 5 | ||||

| 5 | ||||

| 6 | ||||

| Financial Statements: |

||||

| 12 | ||||

| 38 | ||||

| 39 | ||||

| 40 | ||||

| 42 | ||||

| 43 | ||||

| 46 | ||||

| 56 | ||||

| 59 | ||||

| 3 |

| During the 12 months ended January 31, 2023, municipal bond funds experienced net outflows totaling $141 billion (based on data from the Investment Company Institute), marking the largest outflow cycle on record. As a result, elevated bid‑wanted activity weighed on the market as investors raised cash to meet redemptions. At the same time, the market absorbed $347 billion in issuance, below the $453 billion issued during the prior 12‑months. New issue oversubscriptions waned as sentiment turned less constructive. |

Bloomberg Municipal Bond Index Total Returns as of January 31, 2023 6 months: 0.73% 12 months: (3.25)% | |

|

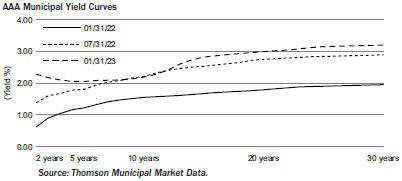

From January 31, 2022, to January 31, 2023, yields on AAA‑rated 30‑year municipal bonds increased by 125 basis points (“bps”) from 1.95% to 3.20%, while ten‑year rates increased by 64 bps from 1.55% to 2.19% and five-year rates increased by 83 bps from 1.22% to 2.05% (as measured by Thomson Municipal Market Data). As a result, the municipal yield curve flattened over the 12‑month period with the spread between two‑ and 30‑year maturities flattening by 2 bps. However, the curve remained relatively steep compared to the deeply inverted U.S. Treasury curve, which flattened by 150 bps. The selloff experienced in early 2022 helped restore value to the asset class before outperformance in the latter half of the year stretched valuations across the curve. Municipal‑to‑Treasury ratios now sit below their 5‑year averages, most notably in the front end of the curve. |

| 4 | 2 0 2 3 B L A C K R O C K S E M I - A N N U A L R E P O R T T O S H A R E H O L D E R S |

| T H E B E N E F I T S A N D R I S K S O F L E V E R A G I N G / D E R I V A T I V E F I N A N C I A L I N S T R U M E N T S |

5 |

| Trust Summary as of January 31, 2023 | BlackRock Municipal Income Quality Trust (BYM) |

| Symbol on New York Stock Exchange |

BYM | |

| Initial Offering Date |

October 31, 2002 | |

| Yield on Closing Market Price as of January 31, 2023 ($11.82)(a) |

3.86% | |

| Tax Equivalent Yield(b) |

6.52% | |

| Current Monthly Distribution per Common Share(c) |

$0.0380 | |

| Current Annualized Distribution per Common Share(c) |

$0.4560 | |

| Leverage as of January 31, 2023(d) |

36% |

| (a) | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| (c) | The distribution rate is not constant and is subject to change. |

| (d) | Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

| 01/31/23 | 07/31/22 | Change | High | Low | ||||||||||||||||

| Closing Market Price |

$ | 11.82 | $ | 13.34 | (11.39 | )% | $ | 14.00 | $ | 10.18 | ||||||||||

| Net Asset Value |

13.09 | 13.56 | (3.47 | ) | 13.65 | 11.41 | ||||||||||||||

| Average Annual Total Returns | ||||||||||||||||

| 6‑month | 1 Year | 5 Years | 10 Years | |||||||||||||

| Trust at NAV(a)(b) |

(1.06 | )% | (8.13 | )% | 2.01 | % | 3.18 | % | ||||||||

| Trust at Market Price(a)(b) |

(9.18 | ) | (11.56 | ) | 2.03 | 1.93 | ||||||||||

| |

||||||||||||||||

| Customized Reference Benchmark(c) |

0.57 | (3.55 | ) | 2.25 | N/A | |||||||||||

| Bloomberg Municipal Bond Index(d) |

0.73 | (3.25 | ) | 2.07 | 2.38 | |||||||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Trust’s use of leverage. |

| (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | The Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (90%) and the Bloomberg Municipal Bond: High Yield ex AMT (non‑Investment Grade) Total Return Index (10%). The Customized Reference Benchmark commenced on September 30, 2016. |

| (d) | An unmanaged index that tracks the U.S. long term tax‑exempt bond market, including state and local general obligation bonds, revenue bonds, pre‑refunded bonds, and insured bonds. |

| 6 | 2 0 2 3 B L A C K R O C K S E M I - A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Trust Summary as of January 31, 2023 (continued) | BlackRock Municipal Income Quality Trust (BYM) |

| Sector(a)(b) | 01/31/23 | |||

| County/City/Special District/School District |

22.2 | % | ||

| Transportation |

19.4 | |||

| Health |

18.0 | |||

| State |

12.4 | |||

| Utilities |

9.5 | |||

| Tobacco |

6.3 | |||

| Education |

5.7 | |||

| Housing |

4.1 | |||

| Corporate |

2.4 | |||

| Calendar Year Ended December 31,(a)(c) | Percentage | |||

| 2023 | 9.5 | % | ||

| 2024 | 6.4 | |||

| 2025 | 13.3 | |||

| 2026 | 5.3 | |||

| 2027 | 8.3 | |||

| Credit Rating(a)(d) | 01/31/23 | |||

| AAA/Aaa |

10.3 | % | ||

| AA/Aa |

41.3 | |||

| A |

23.9 | |||

| BBB/Baa |

9.8 | |||

| BB/Ba |

2.6 | |||

| B |

0.3 | |||

| N/R(e) |

11.8 | |||

| (a) | Excludes short-term securities. |

| (b) | For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector sub‑classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub‑classifications for reporting ease. |

| (c) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| (d) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (e) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of January 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents 1.4% of the Trust’s total investments. |

| T R U S T S U M M A R Y |

7 |

| Trust Summary as of January 31, 2023 | BlackRock Municipal Income Trust II (BLE) |

| Symbol on New York Stock Exchange |

BLE | |

| Initial Offering Date |

July 30, 2002 | |

| Yield on Closing Market Price as of January 31, 2023 ($10.99)(a) |

4.04% | |

| Tax Equivalent Yield(b) |

6.82% | |

| Current Monthly Distribution per Common Share(c) |

$0.0370 | |

| Current Annualized Distribution per Common Share(c) |

$0.4440 | |

| Leverage as of January 31, 2023(d) |

38% |

| (a) | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| (c) | The monthly distribution per Common Share, declared on March 1, 2023, was decreased to $0.0340 per share. The yield on closing market price, tax equivalent yield, current monthly distribution per Common Share, and current annualized distribution per Common Share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. |

| (d) | Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

| 01/31/23 | 07/31/22 | Change | High | Low | ||||||||||||||||

| Closing Market Price |

$ | 10.99 | $ | 11.77 | (6.63 | )% | $ | 11.95 | $ | 9.43 | ||||||||||

| Net Asset Value |

12.28 | 12.60 | (2.54 | ) | 12.72 | 10.62 | ||||||||||||||

| Average Annual Total Returns | ||||||||||||||||

| 6‑month | 1 Year | 5 Years | 10 Years | |||||||||||||

| Trust at NAV(a)(b) |

(0.05 | )% | (9.36 | )% | 1.27 | % | 2.92 | % | ||||||||

| Trust at Market Price(a)(b) |

(4.24 | ) | (17.13 | ) | 0.71 | 1.51 | ||||||||||

| |

||||||||||||||||

| National Customized Reference Benchmark(c) |

0.57 | (3.59 | ) | 2.24 | N/A | |||||||||||

| Bloomberg Municipal Bond Index(d) |

0.73 | (3.25 | ) | 2.07 | 2.38 | |||||||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Trust’s use of leverage. |

| (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non‑Investment Grade) Total Return Index (10%). The National Customized Reference Benchmark commenced on September 30, 2016. |

| (d) | An unmanaged index that tracks the U.S. long term tax‑exempt bond market, including state and local general obligation bonds, revenue bonds, pre‑refunded bonds, and insured bonds. |

| 8 | 2 0 2 3 B L A C K R O C K S E M I - A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Trust Summary as of January 31, 2023 (continued) | BlackRock Municipal Income Trust II (BLE) |

| Sector(a)(b) | 01/31/23 | |||

| Transportation |

22.3 | % | ||

| Health |

15.7 | |||

| State |

13.2 | |||

| County/City/Special District/School District |

12.4 | |||

| Corporate |

10.5 | |||

| Utilities |

7.6 | |||

| Education |

7.1 | |||

| Housing |

5.7 | |||

| Tobacco |

5.3 | |||

| Other* |

0.2 | |||

| Calendar Year Ended December 31,(a)(c) | Percentage | |||

| 2023 | 14.6 | % | ||

| 2024 | 6.6 | |||

| 2025 | 5.8 | |||

| 2026 | 5.5 | |||

| 2027 | 6.3 | |||

| Credit Rating(a)(d) | 01/31/23 | |||

| AAA/Aaa |

3.6 | % | ||

| AA/Aa |

32.4 | |||

| A |

36.3 | |||

| BBB/Baa |

13.7 | |||

| BB/Ba |

2.6 | |||

| B |

0.9 | |||

| N/R(e) |

10.5 | |||

| (a) | Excludes short-term securities. |

| (b) | For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector sub‑classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub‑classifications for reporting ease. |

| (c) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| (d) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (e) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of January 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents 2.0% of the Trust’s total investments. |

| * | Includes one or more investment categories that individually represents less than 1.0% of the Trust’s total investments. Please refer to the Schedule of Investments for details. |

| T R U S T S U M M A R Y |

9 |

| Trust Summary as of January 31, 2023 | BlackRock MuniVest Fund, Inc. (MVF) |

| Symbol on New York Stock Exchange |

MVF | |

| Initial Offering Date |

September 29, 1988 | |

| Yield on Closing Market Price as of January 31, 2023 ($7.15)(a) |

3.52% | |

| Tax Equivalent Yield(b) |

5.95% | |

| Current Monthly Distribution per Common Share(c) |

$0.0210 | |

| Current Annualized Distribution per Common Share(c) |

$0.2520 | |

| Leverage as of January 31, 2023(d) |

35% |

| (a) | Yield on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. Past performance is not an indication of future results. |

| (b) | Tax equivalent yield assumes the maximum marginal U.S. federal tax rate of 40.8%, which includes the 3.8% Medicare tax. Actual tax rates will vary based on income, exemptions and deductions. Lower taxes will result in lower tax equivalent yields. |

| (c) | The distribution rate is not constant and is subject to change. |

| (d) | Represents VMTP Shares and TOB Trusts as a percentage of total managed assets, which is the total assets of the Trust, including any assets attributable to VMTP Shares and TOB Trusts, minus the sum of its accrued liabilities. Does not reflect derivatives or other instruments that may give rise to economic leverage. For a discussion of leveraging techniques utilized by the Trust, please see The Benefits and Risks of Leveraging and Derivative Financial Instruments. |

| 01/31/23 | 07/31/22 | Change | High | Low | ||||||||||||||||

| Closing Market Price |

$ | 7.15 | $ | 7.81 | (8.45 | )% | $ | 7.87 | $ | 6.35 | ||||||||||

| Net Asset Value |

8.06 | 8.37 | (3.70 | ) | 8.44 | 7.16 | ||||||||||||||

| Average Annual Total Returns | ||||||||||||||||

| 6‑month | 1 Year | 5 Years | 10 Years | |||||||||||||

| Trust at NAV(a)(b) |

(1.42 | )% | (10.73 | )% | 1.52 | % | 2.79 | % | ||||||||

| Trust at Market Price(a)(b) |

(6.28 | ) | (14.69 | ) | (0.52 | ) | 0.96 | |||||||||

| |

||||||||||||||||

| National Customized Reference Benchmark(c) |

0.57 | (3.59 | ) | 2.24 | N/A | |||||||||||

| Bloomberg Municipal Bond Index(d) |

0.73 | (3.25 | ) | 2.07 | 2.38 | |||||||||||

| (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. Performance results reflect the Trust’s use of leverage. |

| (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| (c) | The National Customized Reference Benchmark is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (90%) and the Bloomberg Municipal Bond: High Yield (non‑Investment Grade) Total Return Index (10%). The National Customized Reference Benchmark commenced on September 30, 2016. |

| (d) | An unmanaged index that tracks the U.S. long term tax‑exempt bond market, including state and local general obligation bonds, revenue bonds, pre‑refunded bonds, and insured bonds. |

| 10 | 2 0 2 3 B L A C K R O C K S E M I - A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Trust Summary as of January 31, 2023 (continued) | BlackRock MuniVest Fund, Inc. (MVF) |

| Sector(a)(b) | 01/31/23 | |||

| Transportation |

23.1 | % | ||

| Health |

17.9 | |||

| County/City/Special District/School District |

13.6 | |||

| Education |

11.0 | |||

| State |

10.8 | |||

| Utilities |

7.1 | |||

| Corporate |

7.0 | |||

| Tobacco |

5.2 | |||

| Housing |

4.3 | |||

| Other* |

— | |||

| Calendar Year Ended December 31,(a)(c) | Percentage | |||

| 2023 | 12.0 | % | ||

| 2024 | 6.5 | |||

| 2025 | 7.5 | |||

| 2026 | 7.2 | |||

| 2027 | 17.4 | |||

| Credit Rating(a)(d) | 01/31/23 | |||

| AAA/Aaa |

4.7 | % | ||

| AA/Aa |

39.9 | |||

| A |

23.9 | |||

| BBB/Baa |

10.6 | |||

| BB/Ba |

4.0 | |||

| B |

2.0 | |||

| N/R(e) |

14.9 | |||

| (a) | Excludes short-term securities. |

| (b) | For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector sub‑classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub‑classifications for reporting ease. |

| (c) | Scheduled maturity dates and/or bonds that are subject to potential calls by issuers over the next five years. |

| (d) | For financial reporting purposes, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (e) | The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors and individual investments. Using this approach, the investment adviser has deemed certain of these unrated securities as investment grade quality. As of January 31, 2023, the market value of unrated securities deemed by the investment adviser to be investment grade represents 2.2% of the Trust’s total investments. |

| * | Includes one or more investment categories that individually represents less than 1.0% of the Trust’s total investments. Please refer to the Schedule of Investments for details. |

| T R U S T S U M M A R Y |

11 |

| Schedule of Investments (unaudited) January 31, 2023 |

BlackRock Municipal Income Quality Trust (BYM) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Municipal Bonds |

| |||||||

| Alabama — 0.4% |

| |||||||

| City of Birmingham Alabama, GO, CAB, Series A‑1, Convertible, 5.00%, 09/01/25(a) |

$ | 1,165 | $ | 1,241,037 | ||||

| |

|

|||||||

| Arizona(b) — 1.1% | ||||||||

| Arizona Industrial Development Authority, RB 4.38%, 07/01/39 |

725 | 687,407 | ||||||

| Series A, 5.00%, 07/01/39 |

610 | 587,966 | ||||||

| Series A, 5.00%, 07/01/49 |

690 | 629,369 | ||||||

| Series A, 5.00%, 07/01/54 |

530 | 473,716 | ||||||

| Industrial Development Authority of the County of Pima, Refunding RB, 5.00%, 06/15/52 |

595 | 538,948 | ||||||

| Maricopa County Industrial Development Authority, Refunding RB 5.00%, 07/01/39 |

255 | 252,475 | ||||||

| 5.00%, 07/01/54 |

590 | 547,791 | ||||||

| |

|

|||||||

| 3,717,672 | ||||||||

| California — 15.5% | ||||||||

| California Community Housing Agency, RB, M/F Housing(b) |

||||||||

| 3.00%, 08/01/56 |

155 | 110,229 | ||||||

| Series A, 5.00%, 04/01/49 |

265 | 237,914 | ||||||

| Series A‑2, 4.00%, 08/01/47 |

1,715 | 1,420,488 | ||||||

| California Health Facilities Financing Authority, Refunding RB |

||||||||

| Series A, 3.00%, 10/01/47 |

2,795 | 2,200,755 | ||||||

| Sub‑Series A‑2, 5.00%, 11/01/47 |

1,465 | 1,704,533 | ||||||

| California Infrastructure & Economic Development Bank, RB, Series A, 1st Lien, (AMBAC), 5.00%, 01/01/28(a) |

10,100 | 11,491,325 | ||||||

| California State Public Works Board, RB, Series I, 5.50%, 11/01/33 |

1,415 | 1,450,306 | ||||||

| California Statewide Communities Development Authority, Refunding RB, 4.00%, 03/01/48 |

3,175 | 3,020,543 | ||||||

| CMFA Special Finance Agency XII, RB, M/F Housing, Series A, 3.25%, 02/01/57(b) |

150 | 110,323 | ||||||

| CSCDA Community Improvement Authority, RB, M/F Housing(b) |

||||||||

| 5.00%, 09/01/37 |

130 | 127,326 | ||||||

| 4.00%, 10/01/56 |

195 | 167,630 | ||||||

| 4.00%, 12/01/56 |

230 | 170,527 | ||||||

| Series A, 4.00%, 06/01/58 |

1,170 | 980,908 | ||||||

| Senior Lien, 3.13%, 06/01/57 |

690 | 484,125 | ||||||

| Series A, Senior Lien, 4.00%, 12/01/58 |

1,055 | 819,549 | ||||||

| Los Angeles County Facilities, Inc., RB, Series A, 4.00%, 12/01/48 |

3,370 | 3,373,043 | ||||||

| Mount San Antonio Community College District, Refunding GO, CAB, CAB, Series A, Convertiable, Election 2008, 6.25%, 08/01/28(c) |

1,580 | 1,563,958 | ||||||

| Regents of the University of California Medical Center Pooled Revenue, RB, Series P, 4.00%, 05/15/53 |

4,100 | 4,082,120 | ||||||

| Riverside County Redevelopment Successor Agency, Refunding TA, Series A, (BAM), 4.00%, 10/01/39 |

3,700 | 3,748,392 | ||||||

| San Diego County Regional Airport Authority, RB, Series A, Subordinate, 4.00%, 07/01/51 |

2,730 | 2,697,846 | ||||||

| San Diego Unified School District, GO, Series C, Election 2008, 0.00%, 07/01/38(d) |

2,000 | 1,147,660 | ||||||

| Security | Par (000) |

Value | ||||||

| California (continued) | ||||||||

| San Diego Unified School District, GO, CAB(d) |

||||||||

| Series K‑2, 0.00%, 07/01/38 |

$ | 1,745 | $ | 953,189 | ||||

| Series K‑2, 0.00%, 07/01/39 |

2,115 | 1,097,199 | ||||||

| Series K‑2, 0.00%, 07/01/40 |

2,715 | 1,343,249 | ||||||

| Series G, Election 2008, 0.00%, 01/01/24(a) |

3,425 | 1,744,028 | ||||||

| San Diego Unified School District, Refunding GO, CAB, Series R‑1, 0.00%, 07/01/31(d) |

1,400 | 1,116,419 | ||||||

| Yosemite Community College District, GO, Series D, Election 2004, 0.00%, 08/01/37(d) |

10,000 | 6,136,690 | ||||||

| |

|

|||||||

| 53,500,274 | ||||||||

| Colorado — 1.9% | ||||||||

| City & County of Denver Colorado Airport System Revenue, Refunding ARB, Series B, 5.25%, 11/15/53 |

5,000 | 5,604,745 | ||||||

| Sabell Metropolitan District, GO, Series A, 5.00%, 12/01/50(b) |

1,055 | 916,449 | ||||||

| |

|

|||||||

| 6,521,194 | ||||||||

| Delaware — 0.8% | ||||||||

| County of Kent Delaware, RB |

||||||||

| Series A, 5.00%, 07/01/40 |

770 | 751,103 | ||||||

| Series A, 5.00%, 07/01/48 |

2,110 | 2,003,928 | ||||||

| |

|

|||||||

| 2,755,031 | ||||||||

| District of Columbia — 3.2% | ||||||||

| District of Columbia Tobacco Settlement Financing Corp., Refunding RB, 6.75%, 05/15/40 |

9,500 | 9,791,688 | ||||||

| Washington Metropolitan Area Transit Authority, RB, Series B, 5.00%, 07/01/37 |

1,140 | 1,229,400 | ||||||

| |

|

|||||||

| 11,021,088 | ||||||||

| Florida — 5.9% | ||||||||

| Brevard County Health Facilities Authority, Refunding RB, 5.00%, 04/01/39 |

1,795 | 1,844,424 | ||||||

| Capital Trust Agency, Inc., RB(b) |

||||||||

| Series A, 5.00%, 06/01/45 |

615 | 548,658 | ||||||

| Series A, 5.50%, 06/01/57 |

220 | 200,976 | ||||||

| County of Miami-Dade Seaport Department, RB, Series A, 6.00%, 10/01/23(a) |

2,770 | 2,829,561 | ||||||

| Florida Development Finance Corp., RB |

||||||||

| 6.50%, 06/30/57(b) |

420 | 423,011 | ||||||

| Series A, 5.00%, 06/15/56 |

580 | 566,405 | ||||||

| Florida Development Finance Corp., Refunding RB, 5.00%, 09/15/40(b) |

340 | 305,878 | ||||||

| Miami-Dade County Educational Facilities Authority, Refunding RB, Series A, 5.00%, 04/01/40 |

3,910 | 4,013,615 | ||||||

| Miami-Dade County Health Facilities Authority, Refunding RB, 5.00%, 08/01/42 |

685 | 716,261 | ||||||

| Orange County Health Facilities Authority, RB, 4.00%, 10/01/52 |

4,000 | 3,788,508 | ||||||

| Orange County Health Facilities Authority, Refunding RB |

||||||||

| 5.00%, 08/01/41 |

630 | 655,577 | ||||||

| 5.00%, 08/01/47 |

1,845 | 1,918,759 | ||||||

| Preserve at South Branch Community Development District, SAB |

||||||||

| 4.00%, 11/01/39 |

300 | 266,694 | ||||||

| 4.00%, 11/01/50 |

500 | 403,920 | ||||||

| Reedy Creek Improvement District, GO, Series A, 5.25%, 06/01/23(a) |

1,340 | 1,350,861 | ||||||

| 12 | 2 0 2 3 B L A C K R O C K S E M I - A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (unaudited) (continued) January 31, 2023 |

BlackRock Municipal Income Quality Trust (BYM) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Florida (continued) | ||||||||

| Westside Community Development District, Refunding SAB(b) |

||||||||

| 4.10%, 05/01/37 |

$ | 260 | $ | 239,012 | ||||

| 4.13%, 05/01/38 |

260 | 237,827 | ||||||

| |

|

|||||||

| 20,309,947 | ||||||||

| Georgia — 1.7% | ||||||||

| East Point Business & Industrial Development Authority, RB, Series A, 5.25%, 06/15/62(b) |

245 | 228,416 | ||||||

| Gainesville & Hall County Hospital Authority, Refunding RB, Series A, (GTD), 5.50%, 02/15/25(a) |

545 | 578,907 | ||||||

| Georgia Housing & Finance Authority, RB, S/F Housing |

||||||||

| Series A, 3.95%, 12/01/43 |

275 | 276,487 | ||||||

| Series A, 4.00%, 12/01/48 |

410 | 411,436 | ||||||

| Main Street Natural Gas, Inc., RB |

||||||||

| Series A, 5.00%, 05/15/38 |

595 | 623,037 | ||||||

| Series A, 5.00%, 05/15/43 |

775 | 787,849 | ||||||

| Series A, 4.00%, 09/01/52(e) |

3,065 | 3,064,752 | ||||||

| |

|

|||||||

| 5,970,884 | ||||||||

| Idaho — 0.5% | ||||||||

| Idaho Housing & Finance Association, RB, (GTD), 5.50%, 05/01/57 |

1,510 | 1,592,079 | ||||||

| |

|

|||||||

| Illinois — 11.7% | ||||||||

| Chicago Board of Education, GO |

||||||||

| Series A, 5.00%, 12/01/34 |

1,620 | 1,692,378 | ||||||

| Series A, 5.00%, 12/01/40 |

1,540 | 1,562,730 | ||||||

| Series A, 5.00%, 12/01/47 |

1,055 | 1,058,699 | ||||||

| Chicago O’Hare International Airport, RB, Series D, Senior Lien, 5.25%, 01/01/42 |

3,300 | 3,519,793 | ||||||

| Chicago Transit Authority Sales Tax Receipts Fund, RB, 5.25%, 12/01/49 |

3,500 | 3,573,140 | ||||||

| Cook County Community College District No. 508, GO |

||||||||

| 5.13%, 12/01/38 |

7,700 | 7,833,056 | ||||||

| 5.50%, 12/01/38 |

1,000 | 1,020,331 | ||||||

| Illinois Finance Authority, RB |

||||||||

| Series A, 5.00%, 02/15/47 |

565 | 564,207 | ||||||

| Series A, 5.00%, 02/15/50 |

310 | 301,118 | ||||||

| Illinois Finance Authority, Refunding RB |

||||||||

| Series B, 4.00%, 08/15/41 |

900 | 895,809 | ||||||

| Series C, 4.13%, 08/15/37 |

3,130 | 3,048,301 | ||||||

| Series C, 5.00%, 08/15/44 |

390 | 392,525 | ||||||

| Illinois Housing Development Authority, RB, S/F Housing, Series A, (FHLMC, FNMA, GNMA), 3.75%, 10/01/43 |

3,000 | 2,802,174 | ||||||

| Illinois State Toll Highway Authority, RB, Series A, 5.00%, 01/01/40 |

7,020 | 7,285,981 | ||||||

| Metropolitan Pier & Exposition Authority, RB, Series A, 5.00%, 06/15/57 |

670 | 673,330 | ||||||

| State of Illinois, GO 5.50%, 07/01/33 |

880 | 889,640 | ||||||

| 5.50%, 07/01/38 |

1,475 | 1,490,508 | ||||||

| 5.50%, 05/01/39 |

1,840 | 2,003,892 | ||||||

| |

|

|||||||

| 40,607,612 | ||||||||

| Security | Par (000) |

Value | ||||||

| Indiana — 0.1% | ||||||||

| Indiana Finance Authority, RB, Series A, 4.00%, 11/01/51 |

$ | 525 | $ | 504,822 | ||||

| |

|

|||||||

| Iowa — 1.0% | ||||||||

| Iowa Finance Authority, RB, 5.50%, 07/01/23(a) |

3,000 | 3,033,912 | ||||||

| Iowa Tobacco Settlement Authority, Refunding RB, CAB, Series B2, Subordinate, 0.00%, 06/01/65(d) |

3,760 | 470,767 | ||||||

| |

|

|||||||

| 3,504,679 | ||||||||

| Massachusetts — 1.9% | ||||||||

| Massachusetts Development Finance Agency, RB |

||||||||

| 5.00%, 10/01/48 |

1,970 | 1,829,559 | ||||||

| Series A, 5.00%, 01/01/47 |

2,370 | 2,404,400 | ||||||

| Massachusetts Development Finance Agency, Refunding RB |

||||||||

| 5.00%, 07/01/37 |

190 | 192,664 | ||||||

| 5.00%, 09/01/43 |

1,750 | 1,784,284 | ||||||

| Massachusetts Housing Finance Agency, RB, M/F Housing, Series A, 3.85%, 06/01/46 |

490 | 436,718 | ||||||

| |

|

|||||||

| 6,647,625 | ||||||||

| Michigan — 3.0% | ||||||||

| Michigan Finance Authority, RB, Series S, 5.00%, 11/01/44 |

3,640 | 3,719,822 | ||||||

| Michigan Finance Authority, Refunding RB, 5.00%, 11/15/41 |

2,235 | 2,309,504 | ||||||

| Michigan State Housing Development Authority, RB, M/F Housing, Series A, AMT, 3.80%, 10/01/38 |

3,965 | 3,936,309 | ||||||

| Western Michigan University, Refunding RB, (AGM), 5.00%, 11/15/23(a) |

430 | 438,149 | ||||||

| |

|

|||||||

| 10,403,784 | ||||||||

| Minnesota — 0.4% | ||||||||

| City of Minneapolis Minnesota, Refunding RB, Series A, 5.00%, 11/15/49 |

1,315 | 1,360,607 | ||||||

| |

|

|||||||

| Nevada — 0.7% | ||||||||

| City of Las Vegas Nevada Special Improvement District No. 611, SAB |

||||||||

| 4.00%, 06/01/40 |

450 | 367,440 | ||||||

| 4.13%, 06/01/50 |

1,145 | 848,345 | ||||||

| Tahoe-Douglas Visitors Authority, RB |

||||||||

| 5.00%, 07/01/40 |

760 | 776,209 | ||||||

| 5.00%, 07/01/45 |

530 | 533,612 | ||||||

| |

|

|||||||

| 2,525,606 | ||||||||

| New Hampshire — 0.1% | ||||||||

| New Hampshire Business Finance Authority, Refunding RB, Series A, 3.63%, 07/01/43(b)(e) |

450 | 375,208 | ||||||

| |

|

|||||||

| New Jersey — 8.4% | ||||||||

| Camden County Improvement Authority, RB, 6.00%, 06/15/62 |

500 | 526,193 | ||||||

| New Jersey Economic Development Authority, RB |

||||||||

| Series DDD, 5.00%, 06/15/42 |

375 | 389,375 | ||||||

| Series WW, 5.25%, 06/15/33 |

170 | 180,071 | ||||||

| Series WW, 5.00%, 06/15/34 |

225 | 237,087 | ||||||

| Series WW, 5.00%, 06/15/36 |

1,395 | 1,461,717 | ||||||

| Series WW, 5.25%, 06/15/40 |

380 | 394,966 | ||||||

| New Jersey Economic Development Authority, Refunding RB, Sub‑Series A, 4.00%, 07/01/32 |

930 | 947,077 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

13 |

| Schedule of Investments (unaudited) (continued) January 31, 2023 |

BlackRock Municipal Income Quality Trust (BYM) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| New Jersey (continued) | ||||||||

| New Jersey Health Care Facilities Financing Authority, RB, 3.00%, 07/01/51 |

$ | 3,525 | $ | 2,783,410 | ||||

| New Jersey Health Care Facilities Financing Authority, Refunding RB, 5.00%, 10/01/37 |

1,605 | 1,699,730 | ||||||

| New Jersey Transportation Trust Fund Authority, RB |

||||||||

| Series AA, 5.25%, 06/15/33 |

1,660 | 1,674,839 | ||||||

| Series BB, 4.00%, 06/15/50 |

3,000 | 2,843,487 | ||||||

| Series D, 5.00%, 06/15/32 |

900 | 936,600 | ||||||

| Series S, 5.25%, 06/15/43 |

2,150 | 2,284,162 | ||||||

| New Jersey Transportation Trust Fund Authority, RB, CAB(d) |

||||||||

| Series A, 0.00%, 12/15/35 |

4,050 | 2,349,089 | ||||||

| Series A, 0.00%, 12/15/38 |

5,845 | 2,859,649 | ||||||

| New Jersey Transportation Trust Fund Authority, Refunding RB |

||||||||

| Series A, 5.00%, 12/15/36 |

340 | 364,077 | ||||||

| Series A, 4.00%, 06/15/40 |

1,690 | 1,681,506 | ||||||

| South Jersey Port Corp., RB, Series A, 5.00%, 01/01/49 |

720 | 735,600 | ||||||

| Tobacco Settlement Financing Corp., Refunding RB |

||||||||

| Series A, 5.00%, 06/01/35 |

1,750 | 1,861,121 | ||||||

| Series A, 5.25%, 06/01/46 |

1,725 | 1,796,991 | ||||||

| Sub‑Series B, 5.00%, 06/01/46 |

1,130 | 1,143,075 | ||||||

| |

|

|||||||

| 29,149,822 | ||||||||

| New Mexico — 0.1% | ||||||||

| City of Santa Fe New Mexico, RB, Series A, 5.00%, 05/15/49 |

220 | 190,462 | ||||||

| |

|

|||||||

| New York — 9.3% | ||||||||

| City of New York New York, GO, Series B, 5.25%, 10/01/47 |

100 | 114,631 | ||||||

| Metropolitan Transportation Authority, Refunding RB |

||||||||

| Series C‑1, 5.25%, 11/15/55 |

1,135 | 1,170,136 | ||||||

| Series C‑1, 5.00%, 11/15/56 |

1,690 | 1,709,395 | ||||||

| New York City Municipal Water Finance Authority, RB |

||||||||

| Series AA‑1, 4.00%, 06/15/51 |

12,400 | 12,122,178 | ||||||

| Series AA‑1, 5.25%, 06/15/52 |

230 | 260,657 | ||||||

| New York City Transitional Finance Authority Future Tax Secured Revenue, RB, Series A‑1, Subordinate, 4.00%, 08/01/48 |

1,320 | 1,311,928 | ||||||

| New York Liberty Development Corp., Refunding RB, Series 1, 5.00%, 11/15/44(b) |

1,240 | 1,236,890 | ||||||

| New York State Thruway Authority, Refunding RB, Series A‑1, 4.00%, 03/15/54 |

4,115 | 3,963,008 | ||||||

| Port Authority of New York & New Jersey, Refunding RB, Series 198, 5.25%, 11/15/56 |

2,555 | 2,705,206 | ||||||

| State of New York Mortgage Agency, Refunding RB, Series 211, 3.75%, 10/01/43 |

2,810 | 2,539,181 | ||||||

| Triborough Bridge & Tunnel Authority, RB, Series D‑2, Senior Lien, 5.50%, 05/15/52 |

4,340 | 5,038,627 | ||||||

| |

|

|||||||

| 32,171,837 | ||||||||

| North Dakota — 0.1% | ||||||||

| North Dakota Housing Finance Agency, RB, S/F Housing, Class A, 3.70%, 01/01/46 |

495 | 461,936 | ||||||

| |

|

|||||||

| Ohio — 4.2% | ||||||||

| Buckeye Tobacco Settlement Financing Authority, Refunding RB Series A‑2, 3.00%, 06/01/48 |

4,495 | 3,391,069 | ||||||

| Security | Par (000) |

Value | ||||||

| Ohio (continued) | ||||||||

| Buckeye Tobacco Settlement Financing Authority, Refunding RB (continued) |

||||||||

| Series A‑2, 4.00%, 06/01/48 |

$ | 4,625 | $ | 4,250,592 | ||||

| Series B‑2, 5.00%, 06/01/55 |

4,410 | 4,206,787 | ||||||

| Northwest Local School District/Hamilton & Butler Counties, GO, 4.00%, 12/01/50 |

2,645 | 2,633,484 | ||||||

| |

|

|||||||

| 14,481,932 | ||||||||

| Oregon — 0.6% | ||||||||

| Clackamas County School District No. 12 North Clackamas, GO, CAB, Series A, (GTD), 0.00%, 06/15/38(d) |

1,115 | 577,130 | ||||||

| Oregon State Facilities Authority, RB, Series A, 4.13%, 06/01/52 |

650 | 623,392 | ||||||

| Washington & Multnomah Counties School District No. 48J Beaverton, GO, CAB, Series D, Convertible, (GTD), 5.00%, 06/15/36 |

945 | 1,039,992 | ||||||

| |

|

|||||||

| 2,240,514 | ||||||||

| Pennsylvania — 6.3% | ||||||||

| Bucks County Industrial Development Authority, RB |

||||||||

| 4.00%, 07/01/46 |

105 | 85,023 | ||||||

| 4.00%, 07/01/51 |

100 | 78,340 | ||||||

| Commonwealth Financing Authority, RB, (AGM), 4.00%, 06/01/39 |

3,230 | 3,255,272 | ||||||

| Montgomery County Higher Education and Health Authority, Refunding RB, Series A, 4.00%, 09/01/49 |

1,145 | 1,066,722 | ||||||

| Pennsylvania Economic Development Financing Authority, Refunding RB, Series A, 4.00%, 02/15/52 |

800 | 748,072 | ||||||

| Pennsylvania Higher Educational Facilities Authority, RB, 4.00%, 08/15/49 |

5,000 | 4,815,940 | ||||||

| Pennsylvania Higher Educational Facilities Authority, Refunding RB, Series A, 5.25%, 09/01/50 |

4,245 | 4,319,614 | ||||||

| Pennsylvania Housing Finance Agency, RB, S/F Housing, Series 2022, 4.25%, 10/01/47 |

2,415 | 2,321,214 | ||||||

| Pennsylvania Turnpike Commission, RB |

||||||||

| Series A, 5.00%, 12/01/38 |

695 | 727,202 | ||||||

| Series B, 5.00%, 12/01/40 |

1,060 | 1,108,345 | ||||||

| Series C, 5.50%, 12/01/23(a) |

630 | 644,493 | ||||||

| Series A, Subordinate, 4.00%, 12/01/46 |

1,605 | 1,569,778 | ||||||

| Pennsylvania Turnpike Commission, Refunding RB, Series A‑1, 5.00%, 12/01/40 |

850 | 886,787 | ||||||

| |

|

|||||||

| 21,626,802 | ||||||||

| Puerto Rico — 4.7% | ||||||||

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, RB |

||||||||

| Series A‑1, Restructured, 4.75%, 07/01/53 |

5,112 | 4,869,180 | ||||||

| Series A‑1, Restructured, 5.00%, 07/01/58 |

6,950 | 6,847,488 | ||||||

| Series A‑2, Restructured, 4.78%, 07/01/58 |

349 | 332,208 | ||||||

| Series A‑2, Restructured, 4.33%, 07/01/40 |

1,688 | 1,614,204 | ||||||

| Series B‑1, Restructured, 4.75%, 07/01/53 |

536 | 511,012 | ||||||

| Series B‑2, Restructured, 4.78%, 07/01/58 |

520 | 494,311 | ||||||

| Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue, RB, CAB, Series A‑1, Restructured, 0.00%, 07/01/46(d) |

6,226 | 1,728,885 | ||||||

| |

|

|||||||

| 16,397,288 | ||||||||

| Rhode Island — 1.5% | ||||||||

| Tobacco Settlement Financing Corp., Refunding RB, Series B, 4.50%, 06/01/45 |

5,085 | 5,094,987 | ||||||

| |

|

|||||||

| 14 | 2 0 2 3 B L A C K R O C K S E M I - A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (unaudited) (continued) January 31, 2023 |

BlackRock Municipal Income Quality Trust (BYM) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| South Carolina — 5.5% | ||||||||

| South Carolina Jobs-Economic Development Authority, RB(b) |

||||||||

| 5.00%, 01/01/55 |

$ | 1,095 | $ | 963,378 | ||||

| 7.50%, 08/15/62 |

505 | 502,690 | ||||||

| South Carolina Public Service Authority, RB |

||||||||

| Series A, 5.50%, 12/01/54 |

6,960 | 7,080,492 | ||||||

| Series E, 5.50%, 12/01/53 |

1,610 | 1,637,748 | ||||||

| South Carolina Public Service Authority, Refunding RB |

||||||||

| 5.00%, 12/01/38 |

2,360 | 2,404,802 | ||||||

| Series B, (AGM‑CR), 5.00%, 12/01/56 |

2,845 | 2,938,911 | ||||||

| Spartanburg Regional Health Services District, Refunding RB, Series A, 4.00%, 04/15/43 |

3,500 | 3,361,540 | ||||||

| |

|

|||||||

| 18,889,561 | ||||||||

| South Dakota — 0.5% | ||||||||

| City of Rapid City South Dakota Sales Tax Revenue, RB, 4.00%, 12/01/26(a) |

1,760 | 1,867,942 | ||||||

| |

|

|||||||

| Tennessee — 1.2% | ||||||||

| Metropolitan Government Nashville & Davidson County Health & Educational Facilities Board, RB, Series A, 5.00%, 07/01/40 |

35 | 36,148 | ||||||

| Tennergy Corp., RB, Series A, 5.50%, 10/01/53(e) |

1,575 | 1,706,728 | ||||||

| Tennessee Housing Development Agency, RB, S/F Housing, Series 2, 4.35%, 01/01/48 |

2,500 | 2,468,373 | ||||||

| |

|

|||||||

| 4,211,249 | ||||||||

| Texas — 18.6% | ||||||||

| Arlington Higher Education Finance Corp., RB(b) |

||||||||

| 7.50%, 04/01/62 |

530 | 566,756 | ||||||

| 7.88%, 11/01/62 |

450 | 468,498 | ||||||

| City of Lubbock Texas Electric Light & Power System Revenue, Refunding RB, 4.00%, 04/15/51 |

5,200 | 4,907,614 | ||||||

| Coppell Independent School District, Refunding GO, (PSF), 0.00%, 08/15/30(d) |

10,030 | 8,169,475 | ||||||

| County of Harris Texas, Refunding GO(d) |

||||||||

| (NPFGC), 0.00%, 08/15/25 |

7,485 | 7,057,936 | ||||||

| (NPFGC), 0.00%, 08/15/28 |

10,915 | 9,525,237 | ||||||

| Dallas Fort Worth International Airport, Refunding RB, Series F, 5.25%, 11/01/33 |

1,090 | 1,111,170 | ||||||

| Grand Parkway Transportation Corp., RB, CAB, Series B, Convertible, 5.80%, 10/01/23(c) |

2,365 | 2,534,715 | ||||||

| Harris County Cultural Education Facilities Finance Corp., Refunding RB, 3.00%, 10/01/51 |

3,900 | 2,955,541 | ||||||

| Harris County-Houston Sports Authority, Refunding RB(d) |

||||||||

| Series A, 3rd Lien, (NPFGC), 0.00%, 11/15/24(a) |

5,965 | 2,494,760 | ||||||

| Series A, 3rd Lien, (NPFGC), 0.00%, 11/15/38 |

10,925 | 4,411,723 | ||||||

| Series H, Junior Lien, (NPFGC), 0.00%, 11/15/38 |

5,785 | 2,442,346 | ||||||

| Series H, Junior Lien, (NPFGC), 0.00%, 11/15/39 |

6,160 | 2,433,730 | ||||||

| Katy Independent School District, GO, (PSF), 4.00%, 02/15/52 |

3,000 | 2,990,538 | ||||||

| Leander Independent School District, Refunding GO, CAB, Series D, (PSF), 0.00%, 08/15/24(a)(d) |

3,775 | 1,862,944 | ||||||

| Midland County Fresh Water Supply District No. 1, RB, CAB, Series A, 0.00%, 09/15/27(a)(d) |

2,340 | 1,329,707 | ||||||

| New Hope Cultural Education Facilities Finance Corp., RB, Series A, 5.00%, 08/15/50(b) |

580 | 530,780 | ||||||

| Security | Par (000) |

Value | ||||||

| Texas (continued) | ||||||||

| New Hope Cultural Education Facilities Finance Corp., Refunding RB, Series A, 4.00%, 08/15/40 |

$ | 4,000 | $ | 4,034,832 | ||||

| North Texas Tollway Authority, RB(a) |

||||||||

| Series B, 0.00%, 09/01/31(d) |

1,975 | 986,633 | ||||||

| Series C, Convertible, 6.75%, 09/01/31 |

2,500 | 3,346,092 | ||||||

| Texas City Industrial Development Corp., RB, Series 2012, 4.13%, 12/01/45 |

330 | 314,116 | ||||||

| |

|

|||||||

| 64,475,143 | ||||||||

| Utah(b) — 0.2% | ||||||||

| Utah Charter School Finance Authority, RB, Series A, 5.00%, 06/15/49 |

235 | 223,950 | ||||||

| Utah Charter School Finance Authority, Refunding RB, 5.00%, 06/15/55 |

450 | 407,513 | ||||||

| |

|

|||||||

| 631,463 | ||||||||

| Virginia — 6.1% | ||||||||

| Hampton Roads Transportation Accountability Commission, RB, Series A, 4.00%, 07/01/52 |

5,215 | 5,141,500 | ||||||

| Henrico County Economic Development Authority, RB, Class A, 5.00%, 10/01/47 |

5,750 | 6,041,381 | ||||||

| Tobacco Settlement Financing Corp., Refunding RB, Series B‑1, 5.00%, 06/01/47 |

1,225 | 1,190,614 | ||||||

| Virginia Beach Development Authority, Refunding RB |

||||||||

| 5.00%, 09/01/44 |

1,375 | 1,318,624 | ||||||

| 4.00%, 09/01/48 |

885 | 703,587 | ||||||

| Virginia College Building Authority, RB, 4.00%, 02/01/42 |

5,000 | 5,164,580 | ||||||

| Virginia Housing Development Authority, RB, M/F Housing |

||||||||

| Series B, 4.00%, 06/01/53 |

895 | 858,588 | ||||||

| Series G, 5.15%, 11/01/52 |

505 | 535,091 | ||||||

| |

|

|||||||

| 20,953,965 | ||||||||

| Washington — 3.2% | ||||||||

| Washington Health Care Facilities Authority, Refunding RB, 5.00%, 10/01/38 |

3,885 | 4,018,982 | ||||||

| Washington State Convention Center Public Facilities District, RB, Class B, 3.00%, 07/01/58 |

8,690 | 5,726,006 | ||||||

| Washington State Housing Finance Commission, Refunding RB, 5.00%, 01/01/38(b) |

1,400 | 1,403,783 | ||||||

| |

|

|||||||

| 11,148,771 | ||||||||

| West Virginia — 0.8% | ||||||||

| West Virginia Hospital Finance Authority, RB, Series A, 4.00%, 06/01/51 |

3,050 | 2,809,349 | ||||||

| |

|

|||||||

| Wisconsin — 1.9% | ||||||||

| Public Finance Authority, RB 5.00%, 10/15/51(b) |

270 | 245,092 | ||||||

| Class A, 5.00%, 06/15/51(b) |

305 | 260,330 | ||||||

| Class A, 6.00%, 06/15/52 |

175 | 171,798 | ||||||

| Class A, 5.00%, 06/15/56(b) |

400 | 334,822 | ||||||

| Class A, 6.13%, 06/15/57 |

200 | 196,948 | ||||||

| Series A, 5.00%, 07/15/39(b) |

120 | 118,145 | ||||||

| Series A, 5.00%, 10/15/40(b) |

1,260 | 1,216,420 | ||||||

| Series A, 5.00%, 07/15/49(b) |

455 | 423,773 | ||||||

| Series A, 5.00%, 07/15/54(b) |

215 | 196,152 | ||||||

| Series A, 5.00%, 07/01/55(b) |

395 | 354,690 | ||||||

| Series A‑1, 4.50%, 01/01/35(b) |

685 | 615,805 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

15 |

| Schedule of Investments (unaudited) (continued) January 31, 2023 |

BlackRock Municipal Income Quality Trust (BYM) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Wisconsin (continued) | ||||||||

| Public Finance Authority, Refunding RB, 5.00%, 09/01/39(b) |

$ | 375 | $ | 338,402 | ||||

| Wisconsin Health & Educational Facilities Authority, Refunding RB, 5.00%, 04/01/44 |

1,895 | 2,014,419 | ||||||

| |

|

|||||||

| 6,486,796 | ||||||||

| |

|

|||||||

| Total Municipal Bonds — 123.1% (Cost: $418,587,085) |

425,848,968 | |||||||

| |

|

|||||||

| Municipal Bonds Transferred to Tender Option Bond Trusts(f) |

| |||||||

| California — 2.9% |

||||||||

| San Francisco City & County Public Utilities Commission Power Revenue, Refunding RB, Series B, 4.00%, 11/01/51 |

10,000 | 10,046,335 | ||||||

| |

|

|||||||

| Florida — 1.1% |

||||||||

| City of Miami Beach Florida, RB, 5.00%, 09/01/45 |

3,500 | 3,626,714 | ||||||

| |

|

|||||||

| Illinois — 0.9% |

||||||||

| Illinois State Toll Highway Authority, RB, Series A, 5.00%, 01/01/40 |

3,046 | 3,160,887 | ||||||

| |

|

|||||||

| Indiana — 3.0% |

||||||||

| Indiana Finance Authority, RB, Series A, 4.00%, 11/01/51 |

10,685 | 10,274,319 | ||||||

| |

|

|||||||

| Kansas — 1.7% |

||||||||

| Wyandotte County Unified School District No.500 Kansas City, GO, Series A, 5.50%, 09/01/47 |

5,363 | 5,966,752 | ||||||

| |

|

|||||||

| Maryland — 1.0% |

||||||||

| City of Baltimore Maryland, RB, Series A, 5.00%, 07/01/41 |

3,139 | 3,344,407 | ||||||

| |

|

|||||||

| Michigan — 1.0% |

||||||||

| Michigan Finance Authority, RB, Series A, 5.00%, 11/01/44 |

2,220 | 2,269,151 | ||||||

| Michigan State Building Authority, Refunding RB, Series I, 5.00%, 10/15/45 |

960 | 998,494 | ||||||

| |

|

|||||||

| 3,267,645 | ||||||||

| Nebraska — 1.6% |

||||||||

| Central Plains Energy Project, RB, Series 1, 5.00%, 05/01/53 |

5,220 | 5,511,361 | ||||||

| |

|

|||||||

| New York — 11.4% |

||||||||

| Metropolitan Transportation Authority, RB, Sub-Series D‑1, 5.25%, 11/15/44 |

3,850 | 3,885,715 | ||||||

| New York City Municipal Water Finance Authority, Refunding RB, Series DD, 5.00%, 06/15/35 |

1,845 | 1,917,967 | ||||||

| New York City Transitional Finance Authority Future Tax Secured Revenue, RB, Series B‑1, Subordinate, 4.00%, 08/01/36 |

7,350 | 7,788,902 | ||||||

| New York State Dormitory Authority, Refunding RB, Series C, 4.00%, 07/01/49 |

8,955 | 8,991,559 | ||||||

| New York State Urban Development Corp., RB, Series A‑1, 5.00%, 03/15/43 |

5,720 | 5,736,714 | ||||||

| Port Authority of New York & New Jersey, Refunding ARB, Series 230, 5.25%, 12/01/52(g) |

10,000 | 11,264,996 | ||||||

| |

|

|||||||

| 39,585,853 | ||||||||

| Security | Par (000) |

Value | ||||||

| Pennsylvania — 1.5% | ||||||||

| Pennsylvania Turnpike Commission, RB, Series A, 5.50%, 12/01/42 |

$ | 4,997 | $ | 5,308,401 | ||||

| |

|

|||||||

| Virginia — 2.3% | ||||||||

| Hampton Roads Transportation Accountability Commission, RB, Series A, 4.00%, 07/01/57 |

4,000 | 3,957,662 | ||||||

| Virginia Small Business Financing Authority, Refunding RB, Series A, 4.00%, 12/01/49 |

4,307 | 4,080,758 | ||||||

| |

|

|||||||

| 8,038,420 | ||||||||

| |

|

|||||||

| Total Municipal Bonds Transferred to Tender Option Bond Trusts — 28.4% (Cost: $96,523,077) |

98,131,094 | |||||||

| |

|

|||||||

| Total Long-Term Investments — 151.5% (Cost: $515,110,162) |

523,980,062 | |||||||

| |

|

|||||||

| Shares | ||||||||

| Short-Term Securities | ||||||||

| Money Market Funds — 3.3% | ||||||||

| BlackRock Liquidity Funds, MuniCash, Institutional Class, 1.39%(h)(i) |

11,472,710 | 11,475,005 | ||||||

| |

|

|||||||

| Total Short-Term Securities — 3.3% (Cost: $11,471,999) |

11,475,005 | |||||||

| |

|

|||||||

| Total Investments — 154.8% (Cost: $526,582,161) |

535,455,067 | |||||||

| Other Assets Less Liabilities — 1.2% |

3,940,287 | |||||||

| Liability for TOB Trust Certificates, Including Interest Expense and Fees Payable — (16.3)% |

|

(56,269,849 | ) | |||||

| VMTP Shares at Liquidation Value, Net of Deferred Offering Costs — (39.7)% |

|

(137,200,000 | ) | |||||

| |

|

|||||||

| Net Assets Applicable to Common Shares — 100.0% |

|

$ | 345,925,505 | |||||

| |

|

|||||||

| (a) | U.S. Government securities held in escrow, are used to pay interest on this security as well as to retire the bond in full at the date indicated, typically at a premium to par. |

| (b) | Security exempt from registration pursuant to Rule 144A under the Securities Act of 1933, as amended. These securities may be resold in transactions exempt from registration to qualified institutional investors. |

| (c) | Step coupon security. Coupon rate will either increase (step‑up bond) or decrease (step-down bond) at regular intervals until maturity. Interest rate shown reflects the rate currently in effect. |

| (d) | Zero-coupon bond. |

| (e) | Variable rate security. Interest rate resets periodically. The rate shown is the effective interest rate as of period end. Security description also includes the reference rate and spread if published and available. |

| (f) | Represent bonds transferred to a TOB Trust in exchange of cash and residual certificates received by the Trust. These bonds serve as collateral in a secured borrowing. See Note 4 of the Notes to Financial Statements for details. |

| (g) | All or a portion of the security is subject to a recourse agreement. The aggregate maximum potential amount the Trust could ultimately be required to pay under the agreement, which expires on June 1, 2030, is $6,934,789. See Note 4 of the Notes to Financial Statements for details. |

| (h) | Affiliate of the Trust. |

| (i) | Annualized 7‑day yield as of period end. |

| 16 | 2 0 2 3 B L A C K R O C K S E M I - A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (unaudited) (continued) January 31, 2023 |

BlackRock Municipal Income Quality Trust (BYM) |

| Affiliated Issuer | Value at 07/31/22 |

Purchases at Cost |

Proceeds from Sales |

Net Realized Gain (Loss) |

Change in Unrealized Appreciation (Depreciation) |

Value at 01/31/23 |

Shares Held at 01/31/23 |

Income | Capital Gain Distributions from Underlying Funds |

|||||||||||||||||||||||||||

| BlackRock Liquidity Funds, MuniCash, Institutional Class |

$ | — | $ | 11,472,189 | (a) | $ | — | $ | (190 | ) | $ | 3,006 | $ | 11,475,005 | 11,472,710 | $ | 92,797 | $ | — | |||||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|||||||||||||||||||||||||||

| (a) | Represents net amount purchased (sold). |

| Description | Number of Contracts |

Expiration Date |

Notional Amount (000) |

Value/ Unrealized Appreciation (Depreciation) |

||||||||||||

| Short Contracts |

||||||||||||||||

| 10‑Year U.S. Treasury Note |

67 | 03/22/23 | $ | 7,692 | $ | (91,232 | ) | |||||||||

| U.S. Long Bond |

115 | 03/22/23 | 15,018 | (300,630 | ) | |||||||||||

| 5‑Year U.S. Treasury Note |

66 | 03/31/23 | 7,224 | (71,845 | ) | |||||||||||

| |

|

|||||||||||||||

| $ | (463,707 | ) | ||||||||||||||

| |

|

|||||||||||||||

| Commodity Contracts |

Credit Contracts |

Equity Contracts |

Foreign Currency Exchange Contracts |

Interest Rate Contracts |

Other Contracts |

Total | ||||||||||||||||||||||

| Liabilities — Derivative Financial Instruments |

||||||||||||||||||||||||||||

| Futures contracts |

||||||||||||||||||||||||||||

| Unrealized depreciation on futures contracts(a) |

$ | — | $ | — | $ | — | $ | — | $ | 463,707 | $ | — | $ | 463,707 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| (a) | Net cumulative unrealized appreciation (depreciation) on futures contracts and centrally cleared swaps, if any, are reported in the Schedule of Investments. In the Statements of Assets and Liabilities, only current day’s variation margin is reported in receivables or payables and the net cumulative unrealized appreciation (depreciation) is included in accumulated earnings (loss). |

| Commodity Contracts |

Credit Contracts |

Equity Contracts |

Foreign Currency Exchange Contracts |

Interest Rate Contracts |

Other Contracts |

Total | ||||||||||||||||||||||

| Net Realized Gain (Loss) from: |

||||||||||||||||||||||||||||

| Futures contracts |

$ | — | $ | — | $ | — | $ | — | $ | 1,728,364 | $ | — | $ | 1,728,364 | ||||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Net Change in Unrealized Appreciation (Depreciation) on: |

||||||||||||||||||||||||||||

| Futures contracts |

$ | — | $ | — | $ | — | $ | — | $ | (126,836 | ) | $ | — | $ | (126,836 | ) | ||||||||||||

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||||

| Futures contracts: |

||||

| Average notional value of contracts — short |

$ | 44,324,680 |

| S C H E D U L E O F I N V E S T M E N T S |

17 |

| Schedule of Investments (unaudited) (continued) January 31, 2023 |

BlackRock Municipal Income Quality Trust (BYM) |

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Assets |

| |||||||||||||||

| Investments |

| |||||||||||||||

| Long-Term Investments |

||||||||||||||||

| Municipal Bonds |

$ | — | $ | 425,848,968 | $ | — | $ | 425,848,968 | ||||||||

| Municipal Bonds Transferred to Tender Option Bond Trusts |

— | 98,131,094 | — | 98,131,094 | ||||||||||||

| Short-Term Securities |

||||||||||||||||

| Money Market Funds |

11,475,005 | — | — | 11,475,005 | ||||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| $ | 11,475,005 | $ | 523,980,062 | $ | — | $ | 535,455,067 | |||||||||

| |

|

|

|

|

|

|

|

|||||||||

| Derivative Financial Instruments(a) |

||||||||||||||||

| Liabilities |

| |||||||||||||||

| Interest Rate Contracts |

$ | (463,707 | ) | $ | — | $ | — | $ | (463,707 | ) | ||||||

| |

|

|

|

|

|

|

|

|||||||||

| (a) | Derivative financial instruments are futures contracts. Futures contracts are valued at the unrealized appreciation (depreciation) on the instrument. |

| Level 1 | Level 2 | Level 3 | Total | |||||||||||||

| Liabilities |

| |||||||||||||||

| Loan for TOB Trust Certificates |

$ | — | $ | (646,800 | ) | $ | — | $ | (646,800 | ) | ||||||

| TOB Trust Certificates |

— | (55,285,145 | ) | — | (55,285,145 | ) | ||||||||||

| VMTP Shares at Liquidation Value |

— | (137,200,000 | ) | — | (137,200,000 | ) | ||||||||||

| |

|

|

|

|

|

|

|

|||||||||

| $ | — | $ | (193,131,945 | ) | $ | — | $ | (193,131,945 | ) | |||||||

| |

|

|

|

|

|

|

|

|||||||||

| 18 | 2 0 2 3 B L A C K R O C K S E M I - A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (unaudited) January 31, 2023 |

BlackRock Municipal Income Trust II (BLE) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Municipal Bonds |

| |||||||

| Alabama — 4.1% |

| |||||||

| Black Belt Energy Gas District, RB, 4.00%, 10/01/52(a) |

$ | 2,925 | $ | 2,921,516 | ||||

| County of Jefferson Alabama Sewer Revenue, Refunding RB |

||||||||

| Series A, Senior Lien, (AGM), 5.00%, 10/01/44 |

540 | 558,294 | ||||||

| Series A, Senior Lien, (AGM), 5.25%, 10/01/48 |

1,320 | 1,361,424 | ||||||

| Series D, Sub Lien, 7.00%, 10/01/51 |

4,335 | 4,654,936 | ||||||

| Health Care Authority of the City of Huntsville, RB, Series B1, (AGM), 3.00%, 06/01/50 |

2,375 | 1,845,359 | ||||||

| Lower Alabama Gas District, RB, Series A, 5.00%, 09/01/46 |

1,170 | 1,239,107 | ||||||

| Southeast Energy Authority A Cooperative District, RB(a) |

||||||||

| Series A, 4.00%, 11/01/51 |

5,290 | 5,315,434 | ||||||

| Series A‑1, 5.50%, 01/01/53 |

1,960 | 2,142,588 | ||||||

| Series B, 4.00%, 12/01/51 |

4,305 | 4,349,751 | ||||||

| |

|

|||||||

| 24,388,409 | ||||||||

| Arizona — 2.6% | ||||||||

| Arizona Industrial Development Authority, RB(b) |

||||||||

| 4.38%, 07/01/39 |

225 | 213,333 | ||||||

| Series A, 5.00%, 07/01/39 |

190 | 183,137 | ||||||

| Series A, 5.00%, 07/01/49 |

210 | 191,547 | ||||||

| Series A, 5.00%, 07/01/54 |

165 | 147,478 | ||||||

| Arizona Industrial Development Authority, Refunding RB, Series A, 5.38%, 07/01/50(b) |

1,185 | 1,185,321 | ||||||

| Glendale Industrial Development Authority, RB 5.00%, 05/15/41 |

100 | 96,581 | ||||||

| 5.00%, 05/15/56 |

400 | 367,402 | ||||||

| Industrial Development Authority of the City of Phoenix Arizona, RB 5.00%, 07/01/59 |

465 | 454,281 | ||||||

| Series A, 5.00%, 07/01/46(b) |

1,825 | 1,749,115 | ||||||

| Industrial Development Authority of the City of Phoenix Arizona, Refunding RB, Series A, 5.00%, 07/01/35(b) |

275 | 276,148 | ||||||

| Industrial Development Authority of the County of Pima, RB, 5.00%, 07/01/49(b) |

350 | 330,716 | ||||||

| Maricopa County Industrial Development Authority, Refunding RB 5.00%, 07/01/39(b) |

100 | 99,010 | ||||||

| 5.00%, 07/01/54(b) |

210 | 194,977 | ||||||

| Series A, 4.13%, 09/01/38 |

820 | 827,122 | ||||||

| Maricopa County Pollution Control Corp., Refunding RB, Series B, 3.60%, 04/01/40 |

1,250 | 1,101,064 | ||||||

| Salt Verde Financial Corp., RB 5.00%, 12/01/32 |

5,635 | 6,112,014 | ||||||

| 5.00%, 12/01/37 |

2,000 | 2,123,186 | ||||||

| |

|

|||||||

| 15,652,432 | ||||||||

| Arkansas(b) — 0.5% | ||||||||

| Arkansas Development Finance Authority, RB |

||||||||

| Series A, AMT, 4.50%, 09/01/49 |

1,920 | 1,730,035 | ||||||

| Series A, AMT, 4.75%, 09/01/49 |

1,175 | 1,100,846 | ||||||

| |

|

|||||||

| 2,830,881 | ||||||||

| California — 12.7% | ||||||||

| Bay Area Toll Authority, Refunding RB, 4.00%, 04/01/42 |

3,355 | 3,405,375 | ||||||

| Security | Par (000) |

Value | ||||||

| California (continued) |

||||||||

| California Community Choice Financing Authority, RB, Series B‑1, 4.00%, 02/01/52(a) |

$ | 11,505 | $ | 11,671,799 | ||||

| California County Tobacco Securitization Agency, Refunding RB, Series A, 5.00%, 06/01/36 |

350 | 350,004 | ||||||

| California Educational Facilities Authority, RB, Series U‑7, 5.00%, 06/01/46 |

2,315 | 2,822,751 | ||||||

| California Health Facilities Financing Authority, RB, 4.00%, 11/15/45 |

1,460 | 1,390,371 | ||||||

| California Health Facilities Financing Authority, Refunding RB 5.00%, 08/01/55 |

1,500 | 1,555,246 | ||||||

| Series A, 5.00%, 07/01/23(c) |

1,765 | 1,782,338 | ||||||

| Series A, 4.00%, 03/01/39 |

890 | 891,224 | ||||||

| California Municipal Finance Authority, RB, AMT, Senior Lien, 4.00%, 12/31/47 |

780 | 674,025 | ||||||

| California Municipal Finance Authority, RB, S/F Housing |

||||||||

| Series A, 5.25%, 08/15/39 |

205 | 207,746 | ||||||

| Series A, 5.25%, 08/15/49 |

510 | 515,799 | ||||||

| California Pollution Control Financing Authority, RB, Series A, AMT, 5.00%, 11/21/45(b) |

2,130 | 2,131,259 | ||||||

| California School Finance Authority, Refunding RB, Series A, 5.00%, 07/01/51(b) |

1,700 | 1,712,974 | ||||||

| California State Public Works Board, RB |

||||||||

| Series F, 5.25%, 09/01/33 |

2,015 | 2,050,696 | ||||||

| Series I, 5.50%, 11/01/31 |

3,100 | 3,176,672 | ||||||

| Series I, 5.50%, 11/01/33 |

1,500 | 1,537,426 | ||||||

| Series I, 5.00%, 11/01/38 |

1,065 | 1,088,049 | ||||||

| California Statewide Communities Development Authority, Refunding RB(b) |

||||||||

| Series A, 5.00%, 06/01/36 |

990 | 991,612 | ||||||

| Series A, 5.00%, 06/01/46 |

1,220 | 1,177,650 | ||||||

| City of Los Angeles Department of Airports, RB, AMT, 5.25%, 05/15/47 |

4,400 | 4,784,613 | ||||||

| City of Los Angeles Department of Airports, Refunding RB |

||||||||

| AMT, 4.00%, 05/15/39 |

435 | 438,194 | ||||||

| AMT, 4.00%, 05/15/40 |

470 | 471,504 | ||||||

| AMT, 4.00%, 05/15/41 |

550 | 548,655 | ||||||

| AMT, Subordinate, 5.00%, 11/15/31(c) |

5 | 5,821 | ||||||

| AMT, Subordinate, 5.00%, 05/15/46 |

1,265 | 1,349,470 | ||||||

| CMFA Special Finance Agency XII, RB, M/F Housing, Series A, 3.25%, 02/01/57(b) |

525 | 386,130 | ||||||

| CSCDA Community Improvement Authority, RB, M/F Housing(b) 4.00%, 10/01/56 |

245 | 210,613 | ||||||

| 4.00%, 12/01/56 |

355 | 263,204 | ||||||

| Series A, 4.00%, 06/01/58 |

1,500 | 1,257,575 | ||||||

| Senior Lien, 3.13%, 06/01/57 |

1,290 | 905,103 | ||||||

| Series A, Senior Lien, 4.00%, 12/01/58 |

755 | 586,502 | ||||||

| Fremont Union High School District, Refunding GO, Series A, 4.00%, 08/01/46 |

1,700 | 1,711,130 | ||||||

| Indio Finance Authority, Refunding RB, Series A, (BAM), 4.50%, 11/01/52 |

2,405 | 2,445,729 | ||||||

| Kern Community College District, GO, Series C, 5.50%, 11/01/23(c) |

2,155 | 2,202,593 | ||||||

| Regents of the University of California Medical Center Pooled Revenue, RB, Series P, 4.00%, 05/15/53 |

3,810 | 3,793,385 | ||||||

| S C H E D U L E O F I N V E S T M E N T S |

19 |

| Schedule of Investments (unaudited) (continued) January 31, 2023 |

BlackRock Municipal Income Trust II (BLE) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| California (continued) |

||||||||

| Regents of the University of California Medical Center Pooled Revenue, Refunding RB |

||||||||

| Series J, 5.25%, 05/15/23(c) |

$ | 3,905 | $ | 3,934,569 | ||||

| Series J, 5.25%, 05/15/38 |

1,110 | 1,119,053 | ||||||

| Riverside County Public Financing Authority, RB, 5.25%, 11/01/25(c) |

2,000 | 2,163,586 | ||||||

| Riverside County Transportation Commission, Refunding RB, Class B1, Senior Lien, 4.00%, 06/01/46 |

2,255 | 2,183,300 | ||||||

| San Francisco City & County Airport Comm‑San Francisco International Airport, Refunding ARB |

||||||||

| Series A, AMT, 5.50%, 05/01/28 |

720 | 723,938 | ||||||

| Series A, AMT, 5.25%, 05/01/33 |

560 | 563,431 | ||||||

| San Marcos Unified School District, GO, CAB(d) |

||||||||

| Series B, Election 2010, 0.00%, 08/01/33 |

3,000 | 2,240,256 | ||||||

| Series B, Election 2010, 0.00%, 08/01/43 |

2,500 | 1,143,920 | ||||||

| Stockton Public Financing Authority, RB, Series A, 6.25%, 10/01/23(c) |

490 | 501,844 | ||||||

| Washington Township Health Care District, GO, Series B, Election 2004, 5.50%, 08/01/40 |

830 | 864,433 | ||||||

| |

|

|||||||

| 75,931,567 | ||||||||

| Colorado — 3.1% | ||||||||

| Arapahoe County School District No. 6 Littleton, GO, Series A, (SAW), 5.50%, 12/01/43 |

1,915 | 2,155,298 | ||||||

| Centerra Metropolitan District No. 1, TA, 5.00%, 12/01/47(b) |

250 | 224,279 | ||||||

| City & County of Denver Colorado Airport System Revenue, RB |

||||||||

| Series B, 5.25%, 11/15/32 |

1,750 | 1,788,939 | ||||||

| Series A, AMT, 5.50%, 11/15/28 |

500 | 509,851 | ||||||

| Series A, AMT, 5.50%, 11/15/30 |

225 | 229,483 | ||||||

| Series A, AMT, 5.50%, 11/15/31 |

270 | 275,402 | ||||||

| City & County of Denver Colorado Airport System Revenue, Refunding ARB, Series A, AMT, 4.13%, 11/15/53 |

1,290 | 1,206,111 | ||||||

| City & County of Denver Colorado Airport System Revenue, Refunding RB, Series D, AMT, 5.75%, 11/15/45 |

1,315 | 1,517,955 | ||||||

| City & County of Denver Colorado Pledged Excise Tax Revenue, RB, CAB, Series A‑2, 0.00%, 08/01/38(d) |

1,835 | 967,599 | ||||||

| Colorado Educational & Cultural Facilities Authority, RB, 5.00%, 03/01/50(b) |

320 | 313,751 | ||||||

| Colorado Educational & Cultural Facilities Authority, Refunding RB, Class A, 5.00%, 10/01/59(b) |

425 | 387,900 | ||||||

| Colorado Health Facilities Authority, RB 5.25%, 11/01/39 |

595 | 651,564 | ||||||

| 5.50%, 11/01/47 |

370 | 404,019 | ||||||

| 5.25%, 11/01/52 |

920 | 985,581 | ||||||

| Colorado Health Facilities Authority, Refunding RB |

||||||||

| Series A, 4.00%, 08/01/44 |

1,945 | 1,814,530 | ||||||

| Series A, 4.00%, 08/01/49 |

3,920 | 3,588,788 | ||||||

| Denver Convention Center Hotel Authority, Refunding RB, 5.00%, 12/01/40 |

1,325 | 1,334,557 | ||||||

| Denver International Business Center Metropolitan District No. 1, GO, Series A, 4.00%, 12/01/48 |

495 | 450,561 | ||||||

| |

|

|||||||

| 18,806,168 | ||||||||

| Connecticut — 0.5% | ||||||||

| State of Connecticut, GO, Series A, 4.00%, 01/15/37 |

3,015 | 3,103,219 | ||||||

| |

|

|||||||

| Security | Par (000) |

Value | ||||||

| Delaware — 0.2% |

||||||||

| Delaware Transportation Authority, RB, 5.00%, 06/01/55 |

$ | 1,260 | $ | 1,295,049 | ||||

| |

|

|||||||

| District of Columbia — 4.2% | ||||||||

| District of Columbia Tobacco Settlement Financing Corp., Refunding RB, 6.75%, 05/15/40 |

11,500 | 11,853,096 | ||||||

| District of Columbia, Refunding RB |

||||||||

| 5.00%, 04/01/35 |

465 | 499,249 | ||||||

| Series A, 6.00%, 07/01/23(c) |

820 | 830,953 | ||||||

| Catholic Health Services, 5.00%, 10/01/48 |

2,525 | 2,601,081 | ||||||

| District of Columbia, TA, 5.13%, 06/01/41 |

690 | 691,415 | ||||||

| Metropolitan Washington Airports Authority Dulles Toll Road Revenue, Refunding RB |

||||||||

| Class B, Subordinate, (AGM), 4.00%, 10/01/53 |

2,990 | 2,905,957 | ||||||

| Series B, Subordinate, 4.00%, 10/01/49 |

5,985 | 5,639,959 | ||||||

| |

|

|||||||

| 25,021,710 | ||||||||

| Florida — 5.5% | ||||||||

| Brevard County Health Facilities Authority, Refunding RB, Series A, 5.00%, 04/01/52 |

3,310 | 3,504,612 | ||||||

| Capital Projects Finance Authority, RB |

||||||||

| Series A‑1, 5.00%, 10/01/32 |

215 | 227,212 | ||||||

| Series A‑1, 5.00%, 10/01/33 |

240 | 252,377 | ||||||

| Series A‑1, 5.00%, 10/01/34 |

240 | 250,679 | ||||||

| Series A‑1, 5.00%, 10/01/35 |

80 | 82,872 | ||||||

| Capital Trust Agency, Inc., RB |

||||||||

| Series A, 5.00%, 06/01/45(b) |

190 | 169,504 | ||||||

| Series A, 5.00%, 12/15/49 |

140 | 134,262 | ||||||

| Series A, 5.00%, 12/15/54 |

125 | 119,623 | ||||||

| Series A, 5.50%, 06/01/57(b) |

100 | 91,353 | ||||||

| Celebration Pointe Community Development District No. 1, SAB 5.00%, 05/01/32 |

215 | 215,678 | ||||||

| 5.00%, 05/01/48 |

530 | 497,855 | ||||||

| Collier County Health Facilities Authority, Refunding RB, Series A, 5.00%, 05/01/45 |

1,450 | 1,475,000 | ||||||

| County of Broward Florida Airport System Revenue, RB, Series A, AMT, 5.00%, 10/01/45 |

575 | 587,871 | ||||||

| County of Miami-Dade Florida Water & Sewer System Revenue, Refunding RB, Series B, 5.25%, 10/01/23(c) |

500 | 508,289 | ||||||

| County of Miami-Dade Seaport Department, RB(c) |

||||||||

| Series A, 5.50%, 10/01/23 |

2,125 | 2,163,696 | ||||||

| Series A, 6.00%, 10/01/23 |

7,515 | 7,676,588 | ||||||

| Series B, AMT, 6.00%, 10/01/23 |

1,775 | 1,807,551 | ||||||

| Series B, AMT, 6.25%, 10/01/23 |

310 | 316,705 | ||||||

| County of Miami-Dade Seaport Department, Refunding RB |

||||||||

| Series A, AMT, 5.25%, 10/01/52(e) |

1,455 | 1,554,075 | ||||||

| Series D, AMT, 6.00%, 10/01/23(c) |

735 | 748,581 | ||||||

| County of Osceola Florida Transportation Revenue, Refunding RB, CAB(d) |

||||||||

| Series A‑2, 0.00%, 10/01/46 |

1,665 | 444,796 | ||||||

| Series A‑2, 0.00%, 10/01/47 |

1,610 | 418,038 | ||||||

| Series A‑2, 0.00%, 10/01/48 |

1,135 | 277,310 | ||||||

| Series A‑2, 0.00%, 10/01/49 |

935 | 219,698 | ||||||

| Florida Development Finance Corp., RB 6.50%, 06/30/57(b) |

750 | 755,377 | ||||||

| Series A, 5.00%, 06/15/40 |

240 | 242,238 | ||||||

| Series A, 5.00%, 06/15/50 |

795 | 780,890 | ||||||

| 20 | 2 0 2 3 B L A C K R O C K S E M I - A N N U A L R E P O R T T O S H A R E H O L D E R S |

| Schedule of Investments (unaudited) (continued) January 31, 2023 |

BlackRock Municipal Income Trust II (BLE) (Percentages shown are based on Net Assets) |

| Security | Par (000) |

Value | ||||||

| Florida (continued) |

||||||||

| Florida Development Finance Corp., RB (continued) |

||||||||

| Series A, 5.00%, 06/15/55 |

$ | 475 | $ | 463,955 | ||||

| AMT, 5.00%, 05/01/29(b) |

180 | 169,319 | ||||||

| Florida Development Finance Corp., Refunding RB, Series C, 5.00%, 09/15/50(b) |

105 | 89,642 | ||||||

| Hillsborough County Aviation Authority, Refunding RB, Sub‑Series A, AMT, 5.50%, 10/01/23(c) |

1,170 | 1,187,810 | ||||||

| Lakewood Ranch Stewardship District, SAB 5.25%, 05/01/37 |

180 | 182,424 | ||||||

| 5.38%, 05/01/47 |

185 | 185,891 | ||||||

| Lee County Housing Finance Authority, RB, S/F Housing, Series A‑2, AMT, (FHLMC, FNMA, GNMA), 6.00%, 09/01/40 |

15 | 15,026 | ||||||

| Orange County Health Facilities Authority, Refunding RB, 5.00%, 08/01/41 |

1,000 | 1,040,598 | ||||||

| Osceola Chain Lakes Community Development District, SAB 4.00%, 05/01/40 |

270 | 239,030 | ||||||

| 4.00%, 05/01/50 |

260 | 210,979 | ||||||

| Palm Beach County Health Facilities Authority, RB |