UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________

FORM 10-K

__________________________________________________________

ý | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2018

OR

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period From to

Commission File Number 001-35004

__________________________________________________________

FLEETCOR TECHNOLOGIES, INC.

__________________________________________________________

DELAWARE | 72-1074903 | |

(STATE OF INCORPORATION) | (I.R.S. ID) | |

5445 Triangle Parkway, Suite 400, Peachtree Corners, Georgia 30092-2575

(770) 449-0479

Securities registered pursuant to Section 12(b) of the Act:

COMMON STOCK, $0.001 PAR VALUE PER SHARE | NEW YORK STOCK EXCHANGE | |

Securities registered pursuant to Section 12(g) of the Act:

NONE

__________________________________________________________

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes ¨ No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer | ý | Accelerated filer | ¨ | |||

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Emerging growth company | ¨ | |||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant was approximately $18,448,083,043 as of June 30, 2018, the last business day of the registrant’s most recently completed second fiscal quarter, based on the closing sale price as reported on the New York Stock Exchange.

As of February 8, 2019, there were 85,858,421 shares of common stock outstanding.

__________________________________________________________

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement to be delivered to shareholders in connection with the Annual Meeting of Shareholders to be held on June 12, 2019 are incorporated by reference into Part III of this report.

FLEETCOR TECHNOLOGIES, INC.

FORM 10-K

For The Year Ended December 31, 2018

INDEX

Page | ||

PART I | ||

Item 1. | ||

Item X. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

2

Note About Forward-Looking Statements

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the federal securities laws. Statements that are not historical facts, including statements about FLEETCOR’s beliefs, expectations and future performance, are forward-looking statements. Forward-looking statements can be identified by the use of words such as “anticipate,” “intend,” “believe,” “estimate,” “plan,” “seek,” “project” or “expect,” “may,” “will,” “would,” “could” or “should,” the negative of these terms or other comparable terminology.

These forward-looking statements are not a guarantee of performance, and you should not place undue reliance on such statements. We have based these forward-looking statements largely on our current expectations and projections about future events. Forward-looking statements are subject to many uncertainties and other variable circumstances, including those discussed in this report in Item 1A, “Risk Factors,” and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” many of which are outside of our control, that could cause our actual results and experience to differ materially from any forward-looking statement. Given these risks and uncertainties, you are cautioned not to place undue reliance on these forward-looking statements. The forward-looking statements included in this report are made only as of the date hereof. We do not undertake, and specifically disclaim, any obligation to update any such statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments.

3

PART I

ITEM 1. BUSINESS

General

FLEETCOR is a leading global provider of commercial payment solutions. We help businesses of all sizes control, simplify and secure payment of various domestic and cross-border payables using specialized payment products. We serve businesses, merchants and consumers and payment networks in North America, Latin America, Europe, and Australasia. FLEETCOR’s predecessor company was organized in the United States in 1986, and FLEETCOR had its initial public offering in 2010 (NYSE: FLT).

FLEETCOR has two reportable segments, North America and International. We report these two segments as they align with our senior executive organizational structure, reflect how we organize and manage our employees around the world, manage operating performance, contemplate the differing regulatory environments in North America versus other geographies, and help us isolate the impact of foreign exchange fluctuations on our financial results.

Our payment solutions provide our customers with a payment method designed to be superior to and more robust and effective than what they use currently, whether they use a competitor’s product or another alternative method such as cash or check. Our solutions are comprised of payment products, networks and associated services.

FLEETCOR is a global payments company primarily focused on business to business payments. We simplify the way businesses manage and pay for expenses and operate in five categories: Fuel, Lodging, Tolls, Corporate Payments and Gift. Our products are focused on delivering a better, more efficient way to pay, through specialized products, systems, and payment and merchant networks. While the actual payment mechanisms vary from category to category, they are structured to afford control and reporting to the end user. The methods of payment generally function like a charge card, prepaid card, one-time use virtual card, and electronic RFID (radio-frequency identification), etc. Each category is unique in its focus, customer base and target markets, but they also share a number of characteristics. Customers are primarily business to business, have recurring revenue models, specialized networks which create barriers to entry, have high EBITDA margins, and have similar selling systems, which can be leveraged in each business. Additionally, we provide other payment products including fleet maintenance, employee benefits and long haul transportation-related services. Our products are used in 82 countries around the world, with our primary geographies being the U.S., Brazil and the United Kingdom, which combined accounted for approximately 88% of our revenue in 2018.

FLEETCOR uses both proprietary and third-party networks to deliver our payment solutions. FLEETCOR owns and operates proprietary networks with well-established brands throughout the world, bringing incremental sales and loyalty to affiliated merchants. Third-party networks are used to broaden payment product acceptance and use. In 2018, we processed approximately 2.9 billion transactions within these networks, of which approximately 1.4 billion were related to our Gift product line.

FLEETCOR capitalizes on its products’ specialization with sales and marketing efforts by deploying product-dedicated sales forces to target specific customer segments. We market our products directly through multiple sales channels, including field sales, telesales and digital marketing, and indirectly through our partners, which include major oil companies, leasing companies, petroleum marketers, value-added resellers (VARs) and referral partners.

We believe that our size and scale, product breadth and specialization, geographic reach, proprietary networks, robust distribution capabilities and advanced technology contribute to our industry leading position.

Products and services

We offer specialized payment solutions predominately for commercial businesses. Our payment solutions are intended to provide our customers with a payment method superior to that which they formerly used, whether they used a competitor’s product or another alternative method such as cash or check. Our solutions are comprised of payment products, networks and associated services.

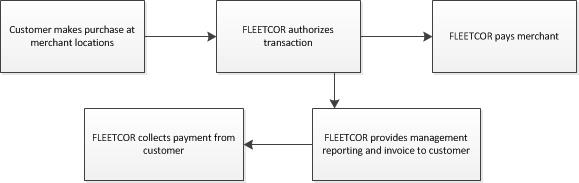

Our payment products typically function like a charge card or prepaid card. FLEETCOR provides a variety of payment mechanisms such as a plastic card, electronic tag, or other form to the customer. We issue credit to the customer (or accept prepaid funds from the customer) to allow for purchases using the payment product. FLEETCOR then reports the purchases to the customer and invoices (or debits prepaid amounts) for payment of purchases made on the customer’s account.

4

Payment networks are integral to our solutions, as they allow us to electronically connect to merchants and capture transaction data from the point of sale. We use both proprietary and third-party networks to deliver our payment solutions. For our proprietary networks, FLEETCOR provides merchant acquiring services, which may include affiliation, contract management, point-of-sale terminals, reporting and settlement. FLEETCOR owns and operates proprietary networks with well-established brands across 80 countries, bringing incremental sales and loyalty to affiliated merchants. Third-party networks include Mastercard in the U.S. and Visa in the U.K. and continental Europe, the retail outlets of various partners, and proprietary networks owned and operated by other partners. We use these third-party networks in order to broaden our payment product acceptance and use. Through our proprietary and third-party networks, we capture detailed transaction data and can often enable advanced purchase controls at the point-of-sale.

We support our payment products with specialized issuing, processing and information services that enable us to manage customer accounts, facilitate the routing, authorization, clearing and settlement of transactions, and provide value-added functionality and data, including customizable user-level controls and productivity analysis tools. Our customers can use these data, controls and tools to lower their operating costs, and combat fraud and employee misuse and streamline expense administration.

Depending on our customers’ and partners’ needs, we provide our products and services in a variety of combinations ranging from a comprehensive “end-to-end” solution (encompassing issuing, processing and network services) to limited back office processing services.

Our solutions tend to be specialized for specific spend categories, such as fuel or lodging, and/or specific customer segments, such as long haul transportation. This specialization is manifested in the purchase controls, merchant network, and reporting applicable to the spend category or customer segment. For example, a fuel card could provide controls on the type of fuel purchased, be accepted only at gas stations for fuel purchases, and provide fuel usage and efficiency reports for a customer’s fleet of vehicles. The combination of these specialized attributes allows our payment products to compete well against less specialized products such as cash or general purpose credit cards when it comes to controlling purchases within certain spend categories.

Fuel payment product line

Our fuel payment product line is our largest product category, representing approximately 45% of our revenue in 2018.

FLEETCOR offers fuel payment solutions to businesses and government entities who operate vehicle fleets, as well as to major oil companies, leasing companies and fuel marketers. Our fuel payment products are most often in the form of plastic cards, but also include other forms such as electronic RFID tags, mobile apps and paper vouchers. While predominately used to purchase fuel, many of our fuel payment products have additional purchasing capabilities to allow customers to purchase non-fuel items such as oil, vehicle maintenance supplies and services and building supplies.

Our fuel payment products, excluding paper vouchers, provide customers with tools and information to control their fuel and other fleet-related operating costs. Our proprietary processing and card management systems provide customers with customizable user-level controls, detailed transaction reporting, programmable alerts, configurable networks, contracted fuel price validation and audit, and vehicle efficiency analysis. Our customers can use these data, controls and tools to combat fraud and employee misuse, streamline expense administration and lower their vehicle fleets’ operating costs. The combination of these specialized attributes allows our fuel payment products to compete well against less specialized products such as cash or general purpose credit cards when it comes to controlling fuel purchases.

For major oil companies, leasing companies and petroleum marketers, we provide program management services, which allow these partners to outsource the sales, marketing, credit, service, and system operations of their branded fuel card portfolios. Depending on our partners’ needs and internal capabilities, we provide our products and services in a variety of combinations ranging from a comprehensive “end-to-end” solution (encompassing issuing, processing and network services) to limited back office processing services. Our fuel payment product partners include British Petroleum (BP), its subsidiary Arco, Shell, Speedway, and Casey's and over 770 fuel marketers of all sizes.

While we refer to companies with whom we have strategic relationships as “partners,” our legal relationships with these companies are contractual, and do not constitute legal partnerships. Our contracts with our major oil company partners typically have initial terms of five to ten years with current remaining terms ranging from one to eight years.

We use both proprietary and third-party networks to deliver our fuel payment solutions, including the following examples:

5

North America proprietary networks for fuel payment products

• | Fuelman network—our primary proprietary fleet card network in the U.S. We have negotiated card acceptance and settlement terms with over 9,300 individual merchants, providing the Fuelman network with approximately 55,000 fueling sites and approximately 25,000 maintenance sites across the country. |

• | Comdata network—our network of truck stops and fuel merchants for the over-the-road trucking industry. We have negotiated card acceptance and settlement terms at over 8,700 truck stops and fuel merchants across the U.S. and Canada. |

• | Commercial Fueling Network (CFN)—our “members only” fueling network in the U.S. and Canada composed of over 2,500 fueling sites owned by CFN members themselves. The majority of these fueling sites are unattended cardlock facilities located in commercial and industrial areas. |

• | Pacific Pride Fueling network—our "franchise" fueling network in the U.S. composed of over 1,100 fueling sites owned by more than 230 franchisees. The majority of these fueling sites are unattended cardlock facilities located in commercial and industrial areas. |

International proprietary networks for fuel payment products

• | Allstar network—our proprietary fleet card network in the U.K. We have negotiated card acceptance and settlement terms with approximately 2,100 individual merchants, providing this network with approximately 7,300 fueling sites. |

• | Keyfuels network—our proprietary fleet card network in the U.K. We have negotiated card acceptance and settlement terms with more than 500 individual merchants, providing the Keyfuels network with approximately 2,900 fueling sites. |

• | CCS network—our primary proprietary fleet card network in the Czech Republic and Slovakia. We have negotiated card acceptance and settlement terms with several major oil companies on a brand-wide basis, including MOL, Benzina, OMV, Slovnaft and Shell, and with approximately 1,100 other merchants, providing the CCS network at over 2,700 fueling sites and 800 other sites accepting our cards. |

• | Petrol Plus Region (PPR) network—our primary proprietary fleet card network in Russia, Poland, Ukraine, Belarus, Kazakhstan and Moldova. We have negotiated card acceptance and settlement terms with over 900 individual merchants, providing the PPR network with approximately 13,400 fueling sites across the region. |

• | Efectivale network—our proprietary fuel card and voucher network in Mexico. We have negotiated acceptance and settlement terms individual merchants, providing the network with over 7,800 fueling sites. |

• | CTF network—our proprietary fuel and fleet controls solutions in Brazil, composed of over 23,000 highway and urban fueling sites through our partners, BR Distribuidora (Petrobas), Ipiranga Distribuidora and Good Card network. |

• | Travelcard network—our proprietary fuel card network in the Netherlands. We have negotiated card acceptance and settlement terms with over 1,000 individual merchants, providing this network with approximately 4,100 fueling sites. |

• | Fleet Card network—our proprietary fuel card network in Australia. We have negotiated card acceptance and settlement terms with approximately 6,000 individual merchants, providing this network with over 90% of fuel sites across Australia. |

• | CardSmart network—our proprietary fuel card network in New Zealand. We have negotiated card acceptance and settlement terms with approximately 1,200 individual merchants, providing this network with approximately 95% of the fuel sites across New Zealand. |

Third-Party networks for fuel payments products

In addition to our proprietary “closed-loop” networks, we also utilize various third-party networks to deliver our payment programs and services. Examples of these networks include:

• | Mastercard network—In the U.S. and Canada, we issue co-branded Mastercard products, which are accepted at over 175,000 fuel sites and 469,000 maintenance locations. These Mastercard products have additional purchasing capabilities which, when enabled, allow the cards to be accepted at approximately 10.9 million locations throughout the U.S. and Canada. |

6

• | Visa network—In the U.K., we issue products that utilize the Visa payment network, which includes approximately 8,400 fuel sites and over 1,400 maintenance locations. These Visa products have additional purchasing capabilities which, when enabled, allow the cards to be accepted throughout the Visa network. |

• | Major oil and fuel marketer networks—The proprietary networks of branded locations owned by our major oil and fuel marketer partners in both North America and internationally are generally utilized to support the proprietary, branded card programs of these partners. |

• | UTA network—UNION TANK Eckstein GmbH & Co. KG (UTA) operates a network of over 61,000 points of acceptance in 40 European countries, including more than 49,000 fueling sites. The UTA network is generally utilized by European transport companies that travel between multiple countries. |

• | DKV network—DKV operates a network of over 70,000 fleet card-accepting locations across more than 40 countries throughout Europe. The DKV network is generally utilized by European transport companies that travel between multiple countries. |

• | Carnet networks—A national debit network in Mexico, which includes approximately 12,500 fueling sites across the country. |

We distribute our fuel payment solutions through direct and indirect channels to businesses of all sizes. This includes businesses with small- to medium-sized fleets, which we believe represent an attractive segment of the global commercial fleet market given their relatively high use of less efficient payment products, such as cash and general purpose credit cards. We serve customers across numerous industry verticals and particularly those verticals with significant vehicle fueling needs such as trucking, construction, manufacturing, energy, and consumer products distribution.

Our indirect channel includes our partners, such as major oil companies, leasing companies and fuel marketers. We generally provide our fuel payments solutions to our partners who offer our services under their own brands on a “white-label” basis. In turn, we leverage our partners’ brands, retail outlets, websites, and sales forces to help distribute our fuel payment products.

In Brazil, we have designed proprietary RFID equipment which, when installed at the fueling site, parking lot, fueling station and restaurant and on the vehicle and combined with our processing system, significantly reduces the likelihood of unauthorized and fraudulent transactions. We offer this product to over-the-road trucking fleets, shipping fleets and other operators of heavily industrialized equipment, including sea-going vessels, mining equipment, agricultural equipment, and locomotives. We generally co-brand this product with BR Distribuidora (Petrobas) or Ipiranga Distribuidora, depending on which fuel distributor provides fuel to our fleet clients via its retail and wholesale distribution operations.

With regard to our fuel payment products, we compete with independent fuel card issuers, major oil companies and petroleum marketers. Excluding major oil companies, our most significant competitors in this product category include WEX, U.S. Bank Voyager Fleet Systems, World Fuel Services, Edenred, Sodexo, Alelo, DKV, and Radius Payment Solutions.

Long haul transportation services

In addition to, and often in conjunction with our fuel payment product, we provide trucking companies in North America with various products and services specifically relevant to their industry, including road tax compliance analysis and reporting, permit procurement, and cash movement and disbursement. We compete with several companies in providing these products and services, including EFS (WEX), Keller, and RTS Financial.

Lodging payment product line

We offer lodging payment solutions to businesses in North America that have employees who travel overnight for work purposes. We offer two lodging payment products, a card-based solution for individual travelers and non-card based solution for crews. Our solutions can be customized to meet the specific needs of our customers, including access to a deeply discounted hotel network and customer-specific rate negotiation, the ability to customize the network to fit customers’ specific travel needs and policies, enhanced controls and reporting, and audit and tax management services.

Our lodging payment products operate on our proprietary CLC and CLS lodging networks, which use over 22,500 hotels, including 15,400 hotels in the contracted network across the U.S. and Canada. We also can secure hotel rooms outside our proprietary network if required by our customers. The size, scale and nature of our lodging customer base enable us to negotiate lodging nightly rates lower than the rates most companies could negotiate directly and far below the rates available to the general public.

7

Our customers can secure room nights with our solutions through our website or mobile app, by phone or email, or by walking into participating lodging properties and presenting their FLEETCOR lodging payment product credentials.

FLEETCOR has developed data management and payment processing systems to manage client billings and reports, which combined with our discounted hotel network, provide clients with savings and increased visibility into their lodging costs.

We distribute our lodging payment solutions mostly through direct channels to businesses of all sizes and serve customers across a wide range of industries, including trucking, railroads, construction, telecom, energy, food service, retail distribution, and emergency response services such as FEMA and the American Red Cross. We provide our custom lodging solutions to large customers under contracts.

Our lodging payment solutions compete with similar offerings from Travelliance, Egencia (Expedia), hotelengine.com, and in-house travel departments of large corporations.

Toll payment product line

In Brazil, we offer an electronic toll and parking payments product to businesses and consumers in the form of RFID tags affixed to vehicles’ windshields. Our electronic toll and parking payments product operates on our proprietary Sem Parar network, which processed toll transactions for more than 4.2 million customers on 99% of the toll roads across Brazil. Our electronic tags may also be used to purchase parking, fuel at select gas stations and meals at select restaurants.

Electronic tolling provides convenience and faster travel for customers, while also reducing manual labor and cash handling at merchants’ toll booths. At gas stations, payment via electronic tags is faster, safer and more secure for customers, which in turn increases loyalty and station throughput for merchants. Beyond these benefits, our electronic toll payment product also provides commercial customers with driver routing controls and fare auditing, mostly in the form of vehicle type and axle count configuration.

For certain commercial customers, we also offer prepaid paper vouchers as a means of payment on toll roads. We provide these vouchers to companies who contract with third-party drivers who do not have an electronic tag in their vehicles and for whom the companies are legally obligated to prepay tolls. Our electronic and paper toll vale-pedagio solutions are accepted for payment within our proprietary toll network that covers approximately 99% of national roads in Brazil.

We distribute our toll payment products through direct and indirect channels to customers of all sizes and across a broad number of industry verticals. To reach commercial customers, we utilize the same set of direct channels as our other commercially-focused product lines including field sales, telesales and digital marketing. To reach consumers, we also place proprietary manned kiosks and unmanned vending machines in areas with high consumer foot traffic, such as shopping malls.

Our indirect channel includes a range of resellers and referral partners, including retail establishments with high consumer foot traffic such as grocery stores, pharmacies and gas stations. We provide our toll payment product to these partners under our brand and, in select cases, under the partner’s brand.

Our electronic toll payment product competes with similar offerings such as Move Mais, ConectCar (Banco Itaú and Ipiranga), Veloe (Alelo), Repom (Edenred), and Visa Vale (Banco Bradesco).

Corporate payments product line

We offer a broad suite of corporate payments solutions with vertical-specific applications, which enable our customers to manage and control electronic payments across their enterprise, optimize corporate spending and offer innovative services that increase employee efficiency and customer loyalty. Our primary corporate payments products include virtual cards, purchasing cards, travel & entertainment (T&E) cards, payroll cards and cross-border payment facilitation. These products are predominately marketed in North America, with cross-border payments also offered in the United Kingdom and Australia. This collection of comprehensive solutions positions us to enable automation and savings across a user’s entire accounts payables (A/P) process, including both domestic and international payables.

A virtual card provides a single-use card number for a specific amount within a defined timeframe and serves as a highly-effective replacement for check payments. Virtual cards provide enhanced security relative to checks while reducing payment costs for our customers. Full remittance data accompanies each virtual card payment, providing significant reconciliation advantages to ACH payments. We have integrated our virtual card offering into most leading ERP systems, providing a seamless experience for accounts payable personnel to select our virtual card as the payment mechanism of choice.

8

FLEETCOR’s virtual card product operates on the Mastercard payment network. We have built a network of approximately 800,000 merchants that accept our virtual card payments. This network is managed with proprietary technology that allows us to continuously expand virtual card acceptance and optimize the amount of virtual card spend we can capture. This network, coupled with a best-in-class, in-house vendor enrollment service, is a major competitive advantage.

Our purchasing and T&E cards operate on the Mastercard payment network and are accepted at approximately 10.9 million locations throughout the United States and Canada. These card products are generally sold in conjunction with our virtual card offering to augment our customers’ purchasing capabilities. FLEETCOR also provides full A/P outsourcing services for customers who send us their entire A/P file and allow us to execute payments across all modalities, including the aforementioned products as well as ACH, wires and checks. We also provide expense management software, which combines and leverages transaction data captured from our virtual, purchasing and T&E card products to help our customers analyze and control their corporate spending.

Our virtual, purchasing and T&E card products compete with similar offerings from large financial institutions such as Bank of America, Citibank, J.P. Morgan Chase, PNC Bank, U.S. Bank, Wells Fargo and American Express.

FLEETCOR offers a payroll card product in the form of a reloadable stored value card, which operates on the Mastercard payment network and the All Point ATM network. These cards are distributed to our customers’ employees and are funded by our customers with their employees’ earned wages. As cardholders, the employees may present the payroll card as a form of payment for personal purchases, transfer funds to their bank account or withdraw funds from participating ATMs.

Our payroll card product competes with similar offerings from First Data Corporation, Fidelity National Information Services, Global Cash Card, Green Dot Financial, Total System Services, Automatic Data Processing, Paychex and Heartland Payment Systems.

FLEETCOR’s cross-border payment services are offered predominantly to commercial customers, who range from small businesses to mid-cap corporate entities. Customers generally use our cross-border payment services to pay international suppliers, foreign office and personnel expenses, capital expenditures, and profit repatriation and dividends. We administer foreign exchange trades and payment settlement with recipients through a global network of banks, enabling us to send payments to recipients in over 200 countries and in over 140 currencies. We employ rigorous compliance standards in all geographies where we are licensed. By using transaction monitoring and watch list screening systems, we ensure payments are safe, secure, and meet all applicable regulatory requirements.

Our cross-border payment services compete with similar offerings from Western Union Business Solutions, Associated Foreign Exchange (AFEX), WorldFirst, Moneycorp, HiFX, Currencies Direct, GPS Capital Markets and large financial institutions.

FLEETCOR’s corporate payment solutions are enabled by our technology and operations. Our ERP integrations, API capabilities, strategic vendor enrollment, and transaction management tools enable us to optimize our customers’ electronic payables programs.

We distribute our corporate payment solutions through direct and indirect channels to businesses of all sizes and types across a broad number of industry verticals. We serve customers across numerous industry verticals, such as retail, healthcare, construction, manufacturing, hospitality, energy, entertainment, insurance and trade finance. As FLEETCOR both issues and processes its virtual cards and commercial cards, we have the control and flexibility to meet the unique needs of customers in different verticals.

We generally provide our domestic corporate payment solutions under contracts with our customers. Pricing terms vary based on usage volumes, incentives and contract duration. When our corporate payment solutions include short term credit, our contracts for those solutions contain credit and collection terms.

Our indirect channel includes a broad range of VARs and other referral partners that expand our reach into new customer segments, new industry verticals and new geographies faster and at a significantly lower cost. We provide our corporate payments solutions to these partners who offer our services under our brands or their own brands on a “white-label” basis. For example, we provide healthcare payment solutions through healthcare networks, corporate payment solutions through software and services providers and payroll card solutions through payroll service providers.

Gift payment product line

We provide fully integrated gift card product management and processing services in 60 different countries around the world. These products come in the form of plastic and digital gift cards, carry our customers’ brands and are generally accepted exclusively within the retail network, websites, and mobile applications of each respective customer.

9

Our services include card design, production and packaging, delivery and fulfillment, card and account management, transaction processing, promotion development and management, website design and hosting, program analytics, and card distribution channel management. The combination of our products and services provides a turnkey solution to our customers, who benefit in the form of brand promotion, cardholder loyalty, increased sales, interest income on prepaid balances, and breakage on abandoned card balances.

We distribute our gift payment products and services directly through a specialized, dedicated field sales force. We serve our commercial customers in numerous industry verticals, with a focus in restaurants, supermarkets, drugstores, airlines, hotels, apparel and other retail categories. We help our commercial customers manage distribution with omni-channel strategies which include card sales through the customers’ retail outlets, websites and mobile applications, as well as through third party locations, such as supermarkets and drug stores. This third party distribution is generally provided by other companies, such as Blackhawk and InComm, who are reliant on access to our systems to meet their distribution obligations.

We compete with a number of national companies in providing gift cards, the largest of which include First Data Corporation and Vantiv. We also compete with businesses that rely on in-house solutions.

Additional products

FLEETCOR provides several other payment products that, due to their nature or size, are not considered primary product lines.

Fleet maintenance

We provide a vehicle maintenance service offering that helps fleet customers to manage their vehicle maintenance, service, and repair needs in the U.K. This product is provided through our proprietary 1link maintenance and repair network which processes transactions for fleet customers through approximately 9,100 service centers across the U.K. With regard to our fleet maintenance products, we compete with several companies including Ebbon-Dacs and Fleet on Demand.

Employee benefit payments

In Mexico, we offer prepaid food vouchers and cards that may be used as a form of payment in restaurants and grocery stores. These payment products operate on one of the following networks:

• | Efectivale network—also our proprietary food card and voucher network in Mexico. We have negotiated acceptance and settlement terms providing the network with over 45,700 food locations, 7,800 fueling sites and 5,900 restaurants. |

• | Carnet network—a national debit network in Mexico, which also includes approximately 49,000 food locations and 12,000 fueling sites across the country. |

In Brazil, we offer prepaid transportation cards and vouchers that may be used as a form of payment on public transportation such as buses, subways and trains. Our proprietary VB Servicos, Comercio e Administracao LTDA (“VB”) distribution network distributes cards and vouchers to employees on behalf of approximately 26,000 customers and negotiates with more than 1,400 public transportation agencies across Brazil.

We provide these various payment products to businesses of all sizes and industry verticals and the businesses in turn offer the products to their employees as a form of benefit. With regard to our employee benefit payment products, we compete with numerous companies, the largest of which includes Edenred, Sodexo, Chèque Déjeuner, and Alelo.

Competition

We face considerable competition in our business. The most significant competitive factors in our business are the breadth of product and service features, credit extension, payment terms, customer service and account management, and price. For certain payment-related products, we also compete on the respective size or nature (i.e., open versus closed loop) of each product’s acceptance network. For certain payment processing services, systems and technology are also significant competitive factors. We believe that we generally compete favorably with respect to each of these factors. However, we may experience competitive disadvantages with respect to each of these factors from time to time as potential customers prioritize or value these competitive factors differently. As a result, a specific offering of our products and service features, networks and pricing may serve as a competitive advantage with respect to one customer and a disadvantage for another based on the customers’ preferences. The companies with whom we compete often vary by product line and/or geography, and are therefore identified by name in the respective product line discussions.

10

Sales and marketing

We market our products and services to prospective customers in North America and internationally through multiple channels including field sales, telesales, digital marketing, direct marketing, and point-of-sale marketing. We also leverage the sales and marketing capabilities of our strategic relationships. Worldwide, our sales and marketing employees are focused on acquiring new customers and retaining existing customers for our different products. We also utilize tradeshows, advertising and other awareness campaigns to further market our products and services.

We utilize proprietary and third-party databases to develop our prospect universe and segment those prospects by various characteristics, including industry, geography, and size, to identify potential customers. We develop customized offers for different types of potential customers and work to deliver those offers through the most effective marketing channel. We actively manage prospects across our various marketing channels to optimize our results and avoid marketing channel conflicts.

Our primary means of acquiring new customers include:

• | Telesales—We have telesales representatives handling inbound and outbound sales calls. |

• | Our inbound call volume is primarily generated as a result of marketing activities, including direct marketing, point-of-sale marketing and the internet. |

• | Our outbound phone calls typically target prospects that have expressed an initial interest in our services or have been identified through database analysis as prospective customers. Our telesales teams are generally dedicated to a specific product or service category and tend to target smaller prospects. We also leverage our telesales channel to cross-sell additional products to existing customers. |

• | Digital marketing—We manage numerous marketing websites around the world which tend to fall into two categories: product-specific websites and marketing portals. |

• | Product-specific websites—Our product-specific websites, including fuelman.com, checkinncard.com, allstarcard.co.uk and semparar.com.br, focus on one or more specific products, provide the most in-depth information available online regarding those particular products, allow prospects to apply online (where appropriate) and allow customers to access and manage their accounts online. We manage product-specific websites for our own proprietary programs, as well as white labeled sites for our strategic relationships. |

• | Marketing portals—Our marketing portals, including fleetcardsUSA.com and fuelcards.co.uk, serve as information sources for fleet operators interested in fleet card products. In addition to providing helpful information on fleet management, including maintenance, tax reporting and fuel efficiency, these websites allow fleet operators to research card products, compare the features and benefits of multiple products, and identify the card product which best meets the fleet manager’s needs. |

As part of our digital marketing strategy, we monitor and modify our marketing websites to improve our search engine rankings and test our advertising keywords to optimize our banner advertising placement and costs and our pay-per-click advertising spend among the major internet search firms such as Google and Bing.

• | Direct marketing—We market directly to potential customers via mail and email. We test various program offers and promotions, and adopt the most successful features into subsequent direct marketing initiatives. We seek to enhance the sales conversion rates of our direct marketing efforts by coordinating timely follow-up calls by our telesales teams. |

• | Point-of-sale marketing—We provide marketing literature at the point-of-sale within our proprietary networks and those of our partner relationships. Literature may include “take-one” applications, pump-top advertising and in-store advertising. Our point-of-sale marketing leverages the branding and distribution reach of the physical merchant locations. |

Account management

We provide account management and customer service to our customers. Based in dedicated call centers across our key markets, these professionals handle transaction authorizations, billing questions and account changes. Customers also have the opportunity to self-service their accounts through interactive voice response and online tools. We monitor the quality of the service we provide to our customers by adhering to industry standard service levels with respect to abandon rates and answer times and through regular agent call monitoring. We also conduct regular customer surveys to ensure customers are satisfied with our products and services. We provide the following specialized services:

11

• | Implementation and activation—We have dedicated implementation teams that are responsible for establishing the system set-up for each customer account. These teams focus on successful activation and utilization of our new customers and provide training and education on the use of our products and services. Technical support resources are provided to support the accurate and timely set-up of technical integrations between our proprietary processing systems and customer systems (e.g., payroll, enterprise resource planning and point-of-sale). Larger accounts are provided dedicated program managers who are responsible for managing and coordinating customer activities for the duration of the implementation. These program managers are responsible for the successful set-up of accounts to meet stated customer objectives. |

• | Strategic account management—We assign designated account managers who serve as the single point of contact for our large accounts. Our account managers have in-depth knowledge of our programs and our customers’ operations and objectives. Our account managers train customer administrators and support them on the operation and optimal use of our programs, oversee account setup and activation, review online billing and create customized reports. Our account managers also prepare periodic account reviews, provide specific information on trends in their accounts and work together to identify and discuss major issues and emerging needs. |

• | Account retention—We have proprietary, proactive strategies to contact customers who may be at risk of terminating their relationship with us. Through these strategies we seek to address service concerns, enhance product structures and provide customized solutions to address customer issues. |

• | Customer service—Day-to-day servicing representatives are designated for customer accounts. These designated representatives are responsible for the daily service items and issue resolution of customers. These servicing representatives are familiar with the nuanced requirements and specifics of a customer’s program. Service representatives are responsible for customer training, fraud disputes, card orders, card maintenance, billing, etc. |

• | Cardholder support—We provide cardholder support for individuals utilizing our payment products. This support allows cardholders to activate cards, check balances, and resolve issues in a timely and effective fashion. Cardholder support is conducted 24 hours a day, seven days per week in multiple languages utilizing telephony, web and call center technologies to deliver comprehensive and cost effective servicing. We have rigorous operational metrics in place to increase cardholder responsiveness to corporate and customer objectives. |

• | Merchant network services—Our representatives work with merchants such as fuel, toll operators and vehicle maintenance providers to enroll them in one of our proprietary networks, install and test all network and terminal software and hardware and train them on the sale and transaction authorization process. In addition, our representatives provide transaction analysis and site reporting and address settlement issues. |

• | Call center program administrator—Off-hour call center support is provided to customers to handle time-sensitive requests and issues outside of normal business hours. |

• | Management tools—We offer a variety of online servicing tools that enable customers to identify and provide authority to program administrators to self-service their accounts. |

• | Credit underwriting and collections—We follow detailed application credit review, account management, and collections procedures for all customers of our payment solutions. We use multiple levers including billing frequency, payment terms, spending limits and security to manage risk in our portfolio. For the years ended December 31, 2018 and 2017, our bad debt expense was $64.4 million and $44.9 million, or 6 bps and 7 bps of billings, respectively. |

• | New account underwriting—We use a combination of quantitative, third-party credit scoring models and judgmental underwriting to screen potential customers and establish appropriate credit terms and spend limits. Our underwriting process provides additional scrutiny for large credit amounts and we utilize tiered credit approval authority among our management. |

• | Prepaid and secured accounts—We also offer products and services on a prepaid or fully-secured basis. Prepaid customer accounts are funded with an initial deposit and subsequently debited for each purchase transacted on the cards issued to the customer. Fully-secured customer accounts are secured with cash deposits, letters of credit and/or insurance bonds. The security is held until such time as the customer either fails to pay the account or closes its account after paying outstanding amounts. Under either approach, our prepaid and fully-secured offerings allow us to market to a broader universe of prospects, including customers who might otherwise not meet our credit standards. |

12

• | Monitoring and account management—We use fraud detection programs, including both proprietary and third-party solutions, to monitor transactions and prevent misuse of our products. We monitor the credit quality of our portfolio periodically utilizing external credit scores and internal behavior data to identify high risk or deteriorating credit quality accounts. We conduct targeted strategies to minimize exposure to high risk accounts, including reducing spending limits and payment terms or requiring additional security. |

• | Collections—As accounts become delinquent, we may suspend future transactions based on our risk assessment of the account. Our collections strategy includes a combination of internal and outsourced resources which use both manual and dialer-based calling strategies. We use a segmented collection strategy which prioritizes higher risk and higher balance accounts. For severely delinquent, high balance accounts we may pursue legal remedies. |

Technology

Our technology provides continuous authorization of transactions, processing of critical account and client information and settlement between merchants, issuing companies and individual commercial entities. We recognize the importance of state-of-the-art, secure, efficient and reliable technology in our business and have made significant investments in our applications and infrastructure. In 2018, we spent more than $210 million in capital and operating expenses to operate, protect and enhance our technology.

Our technology function is based in the United States, Europe and Brazil and has expertise in the management of applications, transaction networks and infrastructure. We operate application development centers in the United States, United Kingdom, Netherlands, Russia, Czech Republic, Brazil and New Zealand. Our distributed application architecture allows us to maintain, administer and upgrade our systems in a cost-effective and flexible manner. We integrate our systems with third-party vendor applications for certain products, sales and customer relationship management and back-office support. Our technology organization has undertaken and successfully executed large scale projects to develop or consolidate new systems, convert oil company and petroleum marketer systems and integrate acquisitions while continuing to operate and enhance existing systems.

Our technology infrastructure is supported by highly-secure data centers, with redundant locations. We operate our primary data centers, which are located in Atlanta, Georgia; Brentwood, Tennessee; Prague; Czech Republic; Las Vegas, Nevada; Lexington and Louisville, Kentucky; Sao Paulo, Brazil; Toronto, Canada and Moscow, Russia. We use only proven technology and expect no foreseeable capacity limitations. Our systems align with industry standards for security with multiple industry certifications. Our network is configured with multiple layers of security to isolate our databases from unauthorized access. We use security protocols for communication among applications, and our employees access critical components on a need-only basis. We may not be able to adequately protect our systems or the data we collect from continually evolving cybersecurity risks or other technological risks, which could subject us to liability and damage our reputation. See also "We are dependent on the efficient and uninterrupted operation of interconnected computer systems, telecommunications, data centers and call centers, including technology and network systems managed by multiple third parties, which could result in our inability to prevent disruptions in our services" and "We may experience software defects, system errors, computer viruses and development delays, which could damage customer relationships, decrease our profitability and expose us to liability" under Item 1A for further discussion of the risks we face in connection with our technology systems and potential data breach and cybersecurity risks facing the Company.

We maintain disaster recovery and business continuity plans. Our telecommunications and internet systems have multiple levels of redundancy to ensure reliability of network service. In 2018, we experienced 99.9% up-time for authorizations.

Proprietary processing systems

We operate several proprietary processing systems that provide features and functionality to run our card programs and product offerings, including our card issuing, processing and information services. Our processing systems also integrate with our proprietary networks, which provide brand awareness and connectivity to our acceptance locations that enables the “end-to-end” card acceptance, data capture and transaction authorization capabilities of our card programs. Our proprietary processing systems and aggregation software are tailored to meet the unique needs of the individual markets they serve and enable us to create and deliver commercial payment solutions and stored value programs that serve each of our industry verticals and geographies. Our technology platforms are primarily comprised of four key components, which were primarily developed and are maintained in-house: (1) a core processing platform; (2) specialized software; (3) integrated network capabilities; and (4) a cloud based architecture with proprietary APIs.

13

Intellectual property

Our intellectual property is an important element of our business. We rely on trademark, copyright, trade secret, patent and other intellectual property laws, confidentiality agreements, contractual provisions and similar measures to protect our intellectual property. Our employees involved in technology development in some of the countries in which we operate, including the United States, are required to sign agreements acknowledging that all intellectual property created by them on our behalf is owned by us. We also have internal policies regarding the protection, disclosure and use of our confidential information. Confidentiality, license or similar agreements or clauses are generally used with our business partners and vendors to control access, use and distribution of our intellectual property. Unauthorized persons may attempt to obtain our intellectual property despite our efforts and others may develop similar intellectual property independently. We own trade names, service marks, trademarks and registered trademarks supporting a number of our brands, such as FLEETCOR, Fuelman, Comdata, and Comchek (among others) in the United States. We also own trademarks and registered trademarks in various foreign jurisdictions for a number of our brands, such as Cambridge, Keyfuels, AllStar, CTF, and Sem Parar (among others). We hold a number of patents and pending applications relating to payment cards and fuel tax returns.

Acquisitions

Since 2002, we have completed over 75 acquisitions of companies and commercial account portfolios. Acquisitions have been an important part of our growth strategy, and it is our intention to continue to seek opportunities to increase our customer base and diversify our service offering through further strategic acquisitions. For a discussion of recent acquisitions, see “Management’s Discussion and Analysis of Financial Conditions and Results of Operations—Acquisitions”.

Regulatory

A substantial number of laws and regulations, both in the United States and in other jurisdictions, apply to businesses offering payment cards to customers or processing or servicing for payment cards and related accounts. These laws and regulations are often evolving and sometimes ambiguous or inconsistent, and the extent to which they apply to us is at times unclear. Failure to comply with regulations may result in the suspension or revocation of licenses or registrations, the limitation, suspension, or termination of services, and/or the imposition of civil and criminal penalties, including fines. Certain of our services are also subject to rules set by various payment networks, such as Mastercard, as more fully described below.

The following, while not exhaustive, is a description of several federal and state laws and regulations in the United States that are applicable to our business. The laws and regulations of other jurisdictions also affect us, and they may be more or less restrictive than those in the United States and may also impact different parts of our operations. In addition, the legal and regulatory framework governing our business is subject to ongoing revision, and changes in that framework could have a significant effect on us.

Money Transmission and Payment Instrument Licensing Regulations

We are subject to various U.S. laws and regulations governing money transmission and the issuance and sale of payment instruments relating to certain aspects of our business. In the United States, most states license money transmitters and issuers of payment instruments. Through our subsidiaries, we are licensed in all states where required for business. Many states exercise authority over the operations of our services related to money transmission and payment instruments and, as part of this authority, subject us to periodic examinations, which may include a review of our compliance practices, policies and procedures, financial position and related records, privacy and data security policies and procedures, and other matters related to our business. Some state agencies conduct periodic examinations and issue findings and recommendations as a result of which we make changes to our operations, such as improving our reporting processes, detailing our intercompany arrangements, and implementing new or revising existing policies and procedures such as our anti-money laundering and the U.S. Department of Treasury's Office of Foreign Assets Control ("OFAC") compliance program and complaints management process, and improvements to our documentation processes.

As a licensee, we are subject to certain restrictions and requirements, including net worth and surety bond requirements, record keeping and reporting requirements, requirements for regulatory approval of controlling stockholders, and requirements to maintain certain levels of permissible investments in an amount equal to our outstanding payment obligations. Many states also require money transmitters and issuers of payment instruments to comply with federal and/or state anti-money laundering laws and regulations. Many states require prior approval for both direct and indirect changes of control of the licensee and certain other corporate events.

Government agencies may impose new or additional requirements on money transmission and sales of payment instruments, and we expect that compliance costs will increase in the future for our regulated subsidiaries.

14

Privacy and Information Security Regulations

We provide services that may be subject to various state, federal, and foreign privacy laws and regulations, including, among others, the Financial Services Modernization Act of 1999, which we refer to as the Gramm-Leach-Bliley Act, and the General Data Protection Regulation (the "GDPR"), and the Personal Information Protection and Electronic Documents Act in Canada. In addition, the State of California adopted the California Consumer Protection Act of 2018 ("CCPA"), which will become effective in 2020 and also will regulate the collection and use of consumers' data. Compliance with the CCPA is expected to cause us to make additional updates to certain business practices and systems. These laws and their implementing regulations restrict certain collection, processing, storage, use, and disclosure of personal information, require notice to individuals of privacy practices, and provide individuals with certain rights to prevent use and disclosure of protected information. These laws also impose requirements for the safeguarding and proper destruction of personal information through the issuance of data security standards or guidelines. Certain federal, state and foreign laws and regulations impose similar privacy obligations and, in certain circumstances, obligations to notify affected individuals, state officers or other governmental authorities, the media, and consumer reporting agencies, as well as businesses and governmental agencies, of security breaches affecting personal information. In addition, there are state and foreign laws restricting the ability to collect and utilize certain types of information such as Social Security and driver’s license numbers. In February 2013, the European Commission proposed additional European Union-wide legislation regarding cyber security in the form of the proposed NIS Directive. The NIS Directive was adopted by the European Parliament in July 2016 and entered into force in August 2016. The NIS Directive provides legal measures intended to boost the overall level of cybersecurity in the EU by ensuring: (1) Member States’ preparedness by requiring them to be appropriately equipped, for example, via a Computer Security Incident Response Team and a competent national NIS authority; (2) cooperation among all the Member States, by setting up a cooperation group, in order to support and facilitate strategic cooperation and the exchange of information among Member States; and (3) a culture of security across sectors vital to the EU’s economy and society, including banking, financial market infrastructures and digital infrastructure.

As a processor of personal data of EU data subjects, we are also subject to regulation and oversight in the applicable EU Member States with regard to data protection legislation. Our EU operations are currently operating in accordance with these standards. The GDPR, which replaced in May 2018 the prior Directive 95/46/EC, also known as the existing Data Protection Directive, contains various obligations on the processing of personal data in the EU including restrictions on transferring personal data outside of the EU to countries which have not been recognized as having adequate data protection standards, unless specific conditions are met. Our EU operations are currently operating in accordance with these standards. While the core rules contained in the Data Protection Directive are retained in GDPR, there are significant enhancements with regard to the rights of data subjects (which include the right to be forgotten and the right of data portability), stricter regulation on obtaining consent to processing of personal data and sensitive personal data, stricter obligations with regard to the information to be included in privacy notices and significant enhanced requirements with regard to compliance, including a regime of “accountability” for processors and controllers and a requirement to embed compliance with GDPR into the fabric of an organization by developing appropriate policies and practices, to achieve a standard of data protection by “design and default.” The GDPR includes enhanced data security obligations (to run in parallel to those contained in NIS regulations), requiring data processors and controllers to take appropriate technical and organizational measures to protect the data they process and their systems. Organizations that process significant amounts of data may be required to appoint a Data Protection Officer responsible for reporting to highest level of management within the business. There are greatly enhanced sanctions under GDPR for failing to comply with the core principles of the GDPR or failing to secure data.

In addition, there are state laws restricting the ability to collect and utilize certain types of information such as Social Security and driver’s license numbers. Certain state laws impose similar privacy obligations as well as obligations to provide notification of security breaches of computer databases that contain personal information to affected individuals, state officers and consumer reporting agencies and businesses and governmental agencies that own data.

We may use direct email marketing and text-messaging to reach out to current or potential customers and therefore are subject to various statutes, regulations, and rulings, including the Telephone Consumer Protection Act (“TCPA”), the Controlling the Assault of Non-Solicited Pornography and Marketing Act (“CAN-SPAM Act”) and related Federal Communication Commission (“FCC”) orders. The TCPA, as interpreted and implemented by the FCC and U.S. courts imposes significant restrictions on the use of telephone calls and text messages to residential and mobile telephone numbers as a means of communication when prior consent of the person being contacted has not been obtained. Violations of the TCPA may be enforced by the FCC or by individuals through litigation, including class actions. Statutory penalties for TCPA violations range from $500 to $1,500 per violation, which has been interpreted to mean per phone call. Several states have enacted additional, more restrictive and punitive laws regulating commercial email. Foreign legislation exists as well, including Canada’s Anti-Spam Legislation and the European laws that have been enacted pursuant to European Union Directive 2002/58/EC and its amendments. We use email as a significant means of communicating with our existing and potential users. We believe that our email practices comply with the relevant regulatory requirements.

15

Certain of our products that access payment networks require compliance with Payment Card Industry (“PCI”) standards. Our subsidiary, Comdata Inc., is PCI 3.2 compliant and its Attestation of Compliance is listed on Mastercard’s compliant service provider listing. Failure to maintain compliance with updates to PCI data security standards including having effective technical and administrative safeguards and policies and procedures could result in fines and assessments from payment networks and regulatory authorities, as well as litigation.

Federal Trade Commission Act

All persons engaged in commerce, including, but not limited to, us and our bank sponsors and customers are subject to Section 5 of the Federal Trade Commission Act prohibiting unfair or deceptive acts or practices, and certain products are subject to the jurisdiction of the Consumer Financial Protection Bureau ("CFPB") regarding the prohibition of unfair, deceptive, or abusive acts and practices (both, collectively, UDAAP). Various federal and state regulatory enforcement agencies including the Federal Trade Commission (“FTC”), CFPB and the state attorneys general have authority to investigate and take action against businesses, merchants and financial institutions that are alleged to engage in UDAAP or violate other laws, rules and regulations. If we are accused of violating such laws, rules and regulations, we may be subject to enforcement actions and as a result, may incur losses and liabilities that may impact our business. A number of state laws and regulations also prohibit unfair and deceptive business practices.

Truth in Lending Act

The Truth in Lending Act, or TILA, was enacted as a consumer protection measure to increase consumer awareness of the cost of credit and to protect consumers from unauthorized charges or billing errors, and is implemented by Regulation Z. Most provisions of TILA and Regulation Z apply only to the extension of consumer credit, but a limited number of provisions apply to commercial cards as well. One example where TILA and Regulation Z are generally applicable is a limitation on liability for unauthorized use, although a business that acquires 10 or more credit cards for its personnel can agree to more expansive liability. Our cardholder agreements generally provide that these business customers waive, to the fullest extent possible, all limitations on liability for unauthorized card use.

Credit Card Accountability, Responsibility, and Disclosure Act of 2009

The Credit Card Accountability, Responsibility, and Disclosure Act of 2009 is an act that, among other things, amended provisions of TILA that affect consumer credit and also directed the Federal Reserve Board to study the use of credit cards by small businesses and to make legislative recommendations. The report concluded that it is not clear whether the potential benefits outweigh the increased cost and reduced credit availability if the disclosure and substantive restrictions applicable to consumer cards were to be applied to small business cards. Legislation has been introduced, from time to time, to increase the protections afforded to small businesses that use payment cards. If legislation of this kind were enacted, our products and services for small businesses could be adversely impacted.

Equal Credit Opportunity Act

The Equal Credit Opportunity Act, or ECOA, together with Regulation B prohibit creditors from discriminating on certain prohibited bases, such as an applicant’s sex, race, nationality, age and marital status, and further requires that creditors disclose the reasons for taking any adverse action against an applicant or a customer seeking credit.

The Fair Credit Reporting Act

The Fair Credit Reporting Act, or FCRA, regulates consumer reporting agencies and the disclosure and use of consumer reports. We may obtain consumer reports with respect to an individual who guarantees or otherwise is obligated on a commercial card.

FACT Act

The Fair and Accurate Credit Transactions Act of 2003 amended FCRA and requires creditors to adopt identity theft prevention programs to detect, prevent and mitigate identity theft in connection with covered accounts, which can include business accounts for which there is a reasonably foreseeable risk of identity theft.

Anti-Money Laundering and Counter Terrorist Regulations

The Currency and Foreign Transactions Reporting Act, which is also known as the Bank Secrecy Act (the "BSA") and which has been amended by the USA PATRIOT Act of 2001, contains a variety of provisions aimed at fighting terrorism and money

16

laundering. Our business in Canada is also subject to Proceeds of Crime (Money Laundering) and Terrorist Financing Act, or the PCTFA, which is a corollary to the BSA. Among other things, the BSA and implementing regulations issued by the U.S. Treasury Department require financial-services providers to establish anti-money laundering programs, to not engage in terrorist financing, to report suspicious activity, and to maintain a number of related records.

Non-banks that provide certain financial services are required to register with the Financial Crimes Enforcement Network of the U.S. Department of the Treasury (FinCEN) as “money services businesses” (MSBs). Through certain subsidiaries, we are registered as MSBs. As a result, we have established anti-money laundering compliance programs that include: (i) internal policies and controls; (ii) designation of a compliance officer; (iii) ongoing employee training; and (iv) an independent review function. We have developed and implemented compliance programs comprised of policies, procedures, systems and internal controls to monitor and address various legal requirements and developments.

In addition, provisions of the BSA known as the Prepaid Access Rule issued by FinCEN impose certain obligations, such as registration and collection of consumer information, on “providers” of certain prepaid access programs, including the stored value products issued by our sponsor banks for which we serve as program manager. FinCEN has taken the position that, where the issuing bank has principal oversight and control of such prepaid access programs, no other participant in the distribution chain would be required to register as a provider under the Prepaid Access Rule. Despite this position, we have opted to register as a provider of prepaid access through our subsidiary, Comdata Inc. We are also subject to certain economic and trade sanctions programs that are administered by the OFAC that prohibit or restrict transactions to or from or dealings with specified countries, their governments and, in certain circumstances, their nationals, narcotics traffickers, and terrorists or terrorist organizations.

Dodd-Frank Wall Street Reform and Consumer Protection Act

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, or the Dodd-Frank Act, effected comprehensive revisions to a wide array of federal laws governing financial institutions, financial services, and financial markets. Among its most notable provisions is the creation of the CFPB, which is charged with regulating consumer financial products or services and which is assuming much of the rulemaking authority under TILA, ECOA, FCRA, and other federal laws affecting the extension of credit. In addition to rulemaking authority over several enumerated federal consumer financial protection laws, the CFPB is authorized to issue rules prohibiting unfair, deceptive, and abusive acts and practices (UDAAP) by persons offering consumer financial products or services and their service providers, and has authority to enforce these consumer financial protection laws and CFPB rules. The CFPB has not defined what is a consumer financial product or service but has indicated informally that, in some instances, small businesses may be covered under consumer protection.

As a service provider to certain of our bank sponsors, we may be subject to direct supervision and examination by the CFPB, in connection with certain of our products and services. CFPB rules, examinations and enforcement actions may require us to adjust our activities and may increase our compliance costs.

In addition, the Durbin Amendment to the Dodd-Frank Act provided that interchange fees that a card issuer or payment network receives or charges for debit transactions will now be regulated by the Federal Reserve and must be “reasonable and proportional” to the cost incurred by the card issuer in authorizing, clearing and settling the transaction. Payment network fees may not be used directly or indirectly to compensate card issuers in circumvention of the interchange transaction fee restrictions. In July 2011, the Federal Reserve published the final rules governing debit interchange fees. The cap on interchange fees is not expected to have a material direct impact on our results of operations because we qualify for an exemption for the majority of our debit transactions.

The implementation of the Dodd-Frank Act is ongoing, and as a result, its overall impact remains unclear. Its provisions, however, are sufficiently far reaching that it is possible that we could be further directly or indirectly impacted.

Anti-Bribery Regulations

The FCPA prohibits the payment of bribes to foreign government officials and political figures and includes anti-bribery provisions enforced by the Department of Justice and accounting provisions enforced by the Securities and Exchange Commission (the "SEC"). The statute has a broad reach, covering all U.S. companies and citizens doing business abroad, among others, and defining a foreign official to include not only those holding public office but also local citizens affiliated with foreign government-run or -owned organizations. The statute also requires maintenance of appropriate books and records and maintenance of adequate internal controls to prevent and detect possible FCPA violations.

17

Payment Card Industry Rules

Banks issuing payment cards bearing the Mastercard brand, and FLEETCOR to the extent that we provide certain services in connection with those cards and fleet customers acting as merchants accepting those cards, must comply with the bylaws, regulations and requirements that are promulgated by Mastercard and other applicable payment-card organizations, including the Payment Card Industry Data Security Standard developed by Mastercard and VISA, the Mastercard Site Data Protection Program and other applicable data-security program requirements. A breach of such payment card network rules could subject us to a variety of fines or penalties that may be levied by the payment networks for certain acts or omissions. The payment networks routinely update and modify their requirements. Our failure to comply with the networks’ requirements or to pay the fines they impose could cause the termination of our registration and require us to stop processing transactions on their networks.

We are also subject to network operating rules promulgated by the National Automated Clearing House Association relating to payment transactions processed by us using the Automated Clearing House Network.

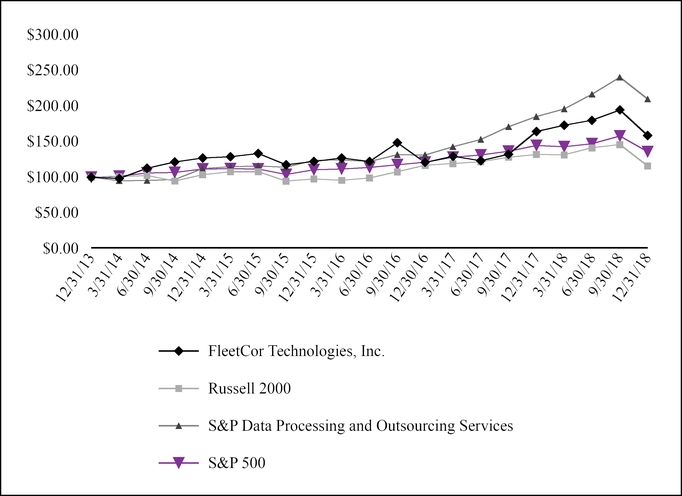

Escheat Regulations