Document

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________________________

FORM 10-Q

__________________________________________________________

|

| |

ý | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2017

OR

|

| |

¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number: 001-35004

__________________________________________________________

FleetCor Technologies, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________________________

|

| | |

Delaware | | 72-1074903 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

| | |

5445 Triangle Parkway, Norcross, Georgia | | 30092 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (770) 449-0479

__________________________________________________________

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one:)

|

| | | |

Large accelerated filer | ý | Accelerated filer | ¨ |

Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | ¨ |

Emerging growth company | ¨ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No ý

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

Class | | Outstanding at April 24, 2017 |

Common Stock, $0.001 par value | | 92,257,881 |

FLEETCOR TECHNOLOGIES, INC. AND SUBSIDIARIES

FORM 10-Q

For the Three Month Period Ended March 31, 2017

INDEX

|

| | |

| | Page |

PART I—FINANCIAL INFORMATION |

| | |

Item 1. | | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

PART II—OTHER INFORMATION | |

| | |

Item 1. | | |

| | |

Item 1A. | | |

| | |

Item 2. | | |

| | |

Item 3. | | |

| | |

Item 4. | | |

| | |

Item 5. | | |

| | |

Item 6. | | |

| | |

| |

PART I—FINANCIAL INFORMATION

Item 1. Financial Statements

FleetCor Technologies, Inc. and Subsidiaries

Consolidated Balance Sheets

(In Thousands, Except Share and Par Value Amounts)

|

| | | | | | | | |

| | March 31, 2017 | | December 31, 2016 |

| | (Unaudited) | | |

Assets | | | | |

Current assets: | | | | |

Cash and cash equivalents | | $ | 546,560 |

| | $ | 475,018 |

|

Restricted cash | | 188,433 |

| | 168,752 |

|

Accounts receivable (less allowance for doubtful accounts of $40,985 and $32,506 at March 31, 2017 and December 31, 2016, respectively) | | 1,360,833 |

| | 1,202,009 |

|

Securitized accounts receivable—restricted for securitization investors | | 676,000 |

| | 591,000 |

|

Prepaid expenses and other current assets | | 110,265 |

| | 90,914 |

|

Total current assets | | 2,882,091 |

|

| 2,527,693 |

|

Property and equipment | | 271,534 |

| | 253,361 |

|

Less accumulated depreciation and amortization | | (122,497 | ) | | (110,857 | ) |

Net property and equipment | | 149,037 |

|

| 142,504 |

|

Goodwill | | 4,227,472 |

| | 4,195,150 |

|

Other intangibles, net | | 2,633,651 |

| | 2,653,233 |

|

Investments | | 40,763 |

| | 36,200 |

|

Other assets | | 76,940 |

| | 71,952 |

|

Total assets | | $ | 10,009,954 |

|

| $ | 9,626,732 |

|

Liabilities and stockholders’ equity | | | | |

Current liabilities: | | | | |

Accounts payable | | $ | 1,246,182 |

| | $ | 1,151,432 |

|

Accrued expenses | | 213,999 |

| | 238,812 |

|

Customer deposits | | 589,387 |

| | 530,787 |

|

Securitization facility | | 676,000 |

| | 591,000 |

|

Current portion of notes payable and other obligations | | 731,708 |

| | 745,506 |

|

Other current liabilities | | 43,389 |

| | 38,781 |

|

Total current liabilities | | 3,500,665 |

|

| 3,296,318 |

|

Notes payable and other obligations, less current portion | | 2,460,629 |

| | 2,521,727 |

|

Deferred income taxes | | 666,572 |

| | 668,580 |

|

Other noncurrent liabilities | | 40,276 |

| | 56,069 |

|

Total noncurrent liabilities | | 3,167,477 |

|

| 3,246,376 |

|

Commitments and contingencies (Note 12) | |

| |

|

Stockholders’ equity: | | | | |

Common stock, $0.001 par value; 475,000,000 shares authorized; 121,680,903 shares issued and 92,257,881 shares outstanding at March 31, 2017; and 121,259,960 shares issued and 91,836,938 shares outstanding at December 31, 2016 | | 122 |

| | 121 |

|

Additional paid-in capital | | 2,114,560 |

| | 2,074,094 |

|

Retained earnings | | 2,342,414 |

| | 2,218,721 |

|

Accumulated other comprehensive loss | | (572,789 | ) | | (666,403 | ) |

Less treasury stock 29,423,022 shares at March 31, 2017 and December 31, 2016, respectively | | (542,495 | ) | | (542,495 | ) |

Total stockholders’ equity | | 3,341,812 |

|

| 3,084,038 |

|

Total liabilities and stockholders’ equity | | $ | 10,009,954 |

|

| $ | 9,626,732 |

|

FleetCor Technologies, Inc. and Subsidiaries

Unaudited Consolidated Statements of Income

(In Thousands, Except Per Share Amounts)

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2017 | | 2016¹ |

Revenues, net | | $ | 520,433 |

| | $ | 414,262 |

|

Expenses: | | | | |

Merchant commissions | | 24,384 |

| | 28,233 |

|

Processing | | 101,824 |

| | 79,814 |

|

Selling | | 38,837 |

| | 26,553 |

|

General and administrative | | 95,434 |

| | 67,594 |

|

Depreciation and amortization | | 64,866 |

| | 36,328 |

|

Other operating, net | | 20 |

| | (215 | ) |

Operating income | | 195,068 |

|

| 175,955 |

|

Equity method investment loss | | 2,377 |

| | 2,193 |

|

Other expense, net | | 2,196 |

| | 659 |

|

Interest expense, net | | 23,127 |

| | 16,191 |

|

Total other expense | | 27,700 |

|

| 19,043 |

|

Income before income taxes | | 167,368 |

| | 156,912 |

|

Provision for income taxes | | 43,675 |

| | 45,822 |

|

Net income | | $ | 123,693 |

|

| $ | 111,090 |

|

Earnings per share: | | | | |

Basic earnings per share | | $ | 1.34 |

| | $ | 1.20 |

|

Diluted earnings per share | | $ | 1.31 |

| | $ | 1.17 |

|

Weighted average shares outstanding: | | | | |

Basic weighted average shares outstanding | | 92,108 |

| | 92,516 |

|

Diluted weighted average shares outstanding | | 94,560 |

| | 95,030 |

|

|

|

1 Reflects the impact of the Company's adoption of Accounting Standards Update 2016-09, Compensation-Stock Compensation (Topic 718): Improvements to Employee Share-Based Payment Accounting, to simplify several aspects of the accounting for share-based compensation, including the income tax consequences. |

See accompanying notes to unaudited consolidated financial statements. |

FleetCor Technologies, Inc. and Subsidiaries

Consolidated Statements of Comprehensive Income

(In Thousands)

|

| | | | | | | | | |

| | Three Months Ended

March 31, | |

| | 2017 | | 2016 | |

Net income | | $ | 123,693 |

| | $ | 111,090 |

| |

Other comprehensive income: | | | | | |

Foreign currency translation gains, net of tax | | 93,614 |

| | 31,202 |

| |

Total other comprehensive income | | 93,614 |

|

| 31,202 |

|

|

Total comprehensive income | | $ | 217,307 |

|

| $ | 142,292 |

|

|

See accompanying notes to unaudited consolidated financial statements.

FleetCor Technologies, Inc. and Subsidiaries

Unaudited Consolidated Statements of Cash Flows

(In Thousands)

|

| | | | | | | | |

| | Three Months Ended

March 31, |

| | 2017 | | 2016 |

Operating activities | | | | |

Net income | | $ | 123,693 |

| | $ | 111,090 |

|

Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

Depreciation | | 10,667 |

| | 7,976 |

|

Stock-based compensation | | 23,093 |

| | 15,186 |

|

Provision for losses on accounts receivable | | 12,988 |

| | 6,836 |

|

Amortization of deferred financing costs and discounts | | 1,914 |

| | 1,822 |

|

Amortization of intangible assets | | 52,654 |

| | 27,362 |

|

Amortization of premium on receivables | | 1,544 |

| | 990 |

|

Deferred income taxes | | (3,453 | ) | | (2,128 | ) |

Equity method investment loss | | 2,377 |

| | 2,193 |

|

Other non-cash operating income | | — |

| | (215 | ) |

Changes in operating assets and liabilities (net of acquisitions): | | | | |

Restricted cash | | (19,283 | ) | | 23,743 |

|

Accounts receivable | | (236,564 | ) | | (182,761 | ) |

Prepaid expenses and other current assets | | (16,453 | ) | | (2,086 | ) |

Other assets | | (2,673 | ) | | (11,696 | ) |

Accounts payable, accrued expenses and customer deposits | | 103,711 |

| | 124,311 |

|

Net cash provided by operating activities | | 54,215 |

|

| 122,623 |

|

Investing activities | | | | |

Acquisitions, net of cash acquired | | — |

| | (4,092 | ) |

Purchases of property and equipment | | (14,796 | ) | | (11,739 | ) |

Other | | (6,327 | ) | | (4,914 | ) |

Net cash used in investing activities | | (21,123 | ) |

| (20,745 | ) |

Financing activities | | | | |

Proceeds from issuance of common stock | | 15,230 |

| | 387 |

|

Borrowings (payments) on securitization facility, net | | 85,000 |

| | (63,000 | ) |

Principal payments on notes payable | | (33,363 | ) | | (25,875 | ) |

Borrowings from revolver – A Facility | | 90,000 |

| | 40,000 |

|

Payments on revolver – A Facility | | (159,949 | ) | | (110,000 | ) |

Borrowings on swing line of credit, net | | 21,639 |

| | — |

|

Other | | 537 |

| | (19 | ) |

Net cash provided by (used in) financing activities | | 19,094 |

|

| (158,507 | ) |

Effect of foreign currency exchange rates on cash | | 19,356 |

| | 8,795 |

|

Net increase (decrease) in cash and cash equivalents | | 71,542 |

| | (47,834 | ) |

Cash and cash equivalents, beginning of period | | 475,018 |

| | 447,152 |

|

Cash and cash equivalents, end of period | | $ | 546,560 |

|

| $ | 399,318 |

|

Supplemental cash flow information | | | | |

Cash paid for interest | | $ | 33,190 |

| | $ | 15,310 |

|

Cash paid for income taxes | | $ | 88,503 |

| | $ | 11,824 |

|

See accompanying notes to unaudited consolidated financial statements.

FleetCor Technologies, Inc. and Subsidiaries

Notes to Unaudited Consolidated Financial Statements

March 31, 2017

1. Summary of Significant Accounting Policies

Basis of Presentation

Throughout this report, the terms “our,” “we,” “us,” and the “Company” refers to FleetCor Technologies, Inc. and its subsidiaries. The Company prepared the accompanying interim consolidated financial statements in accordance with Rule 10-01 of Regulation S-X. Accordingly, they do not include all of the information and footnotes required by accounting principles generally accepted in the United States (“GAAP”). The unaudited consolidated financial statements reflect all adjustments considered necessary for fair presentation. These adjustments consist primarily of normal recurring accruals and estimates that impact the carrying value of assets and liabilities. Actual results may differ from these estimates. Operating results for the three month period ended March 31, 2017 are not necessarily indicative of the results that may be expected for the year ending December 31, 2017.

The unaudited interim consolidated financial statements should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2016.

Foreign Currency Translation

Assets and liabilities of foreign subsidiaries are translated into U.S. dollars at the rates of exchange in effect at period-end. The related translation adjustments are made directly to accumulated other comprehensive income. Income and expenses are translated at the average monthly rates of exchange in effect during the period. Gains and losses from foreign currency transactions of these subsidiaries are included in net income. The Company recognized foreign exchange losses of $1.5 million and $0.7 million for the three months ended March 31, 2017 and 2016, respectively, which are recorded within other expense, net in the Unaudited Consolidated Statements of Income. The Company recognized net gains on intra-entity foreign currency transactions that are of a long-term-investment nature of approximately $36 million and $19 million in the three months ended March 31, 2017 and 2016, respectively, in the statements of comprehensive income.

Adoption of New Accounting Standards

Revenue Recognition

In May 2014, the FASB issued Accounting Standards Codification ("ASC") 606, “Revenue from Contracts with Customers”, which amends the guidance in former ASC 605, Revenue Recognition. This amended guidance requires revenue to be recognized in an amount that reflects the consideration to which the company expects to be entitled for those goods and services when the performance obligation has been satisfied. This amended guidance also requires enhanced disclosures regarding the nature, amount, timing and uncertainty of revenue and related cash flows arising from contracts with customers. In August 2015, the FASB issued ASU 2015-14, “Revenue from Contracts with Customers: Deferral of the Effective Date”, which defers the effective date of the new revenue recognition standard by one year. In March 2016, the FASB issued ASU 2016-08, “Revenue from Contracts with Customers: Principal versus Agent Considerations (Reporting Revenue Gross versus Net)”, which clarifies how an entity should identify the unit of accounting for the principal versus agent evaluation and how it should apply the control principle to certain types of arrangements. In April 2016, the FASB issued ASU 2016-10, "Identifying Performance Obligations and Licensing", which clarifies the accounting for intellectual property licenses and identifying performance obligations. In May 2016, the FASB issued ASU 2016-11, "Rescission of SEC Guidance Because of Accounting Standards Updates 2014-09 and 2014-16 Pursuant to Staff Announcements at the March 3, 2016 EITF Meeting", which rescinds certain SEC guidance in response to announcements made by the SEC staff at the EITF's March 3, 2016 meeting and ASU 2016-12, "Revenue from Contracts with Customers (Topic 606): Narrow-Scope Improvements and Practical Expedients", which clarifies the guidance on collectibility, non-cash consideration, the presentation of sales and other similar taxes collected from customers and contract modifications and completed contracts at transition. Additionally, ASU 2016-12 clarifies that entities electing the full retrospective transition method would no longer be required to disclose the effect of the change in accounting principle on the period of adoption; however, entities would still be required to disclose the effects on preadoption periods that were retrospectively adjusted. These ASUs are effective for the Company for reporting periods beginning after December 15, 2017, but permit companies the option to adopt as of the original effective date. In the first quarter of 2017, the Company continued its assessment of the new standard with a focus on identifying the performance obligations included within its revenue arrangements with customers and evaluating its methods of estimating the amount of and timing of variable consideration. The guidance permits the use of either a retrospective or cumulative effect transition method. The Company anticipates selecting the modified retrospective method, which would result in an adjustment to retained earnings for the cumulative effect, if any, of applying the standard to contracts in process as of the adoption date. Under this method, the Company would not restate the prior financial statements presented; therefore the new standard requires the Company to

provide additional disclosures of the amount by which each financial statement line item is affected in the current reporting period during 2018, as compared to the guidance that was in effect before the change, and an explanation of the reasons for significant changes, if any. The Company continues its assessment to evaluate the impact of the provisions of ASC 606 on the results of operations, financial condition, and cash flows. Based upon our assessment to date, which is ongoing, we have not identified significant changes to our current processes, systems and revenue recognition practices.

Accounting for Leases

In February 2016, the FASB issued ASU 2016-02, “Leases”, which requires lessees to recognize a right-of-use asset and a lease liability on the balance sheet for all leases with the exception of short-term leases. This ASU also requires disclosures to provide additional information about the amounts recorded in the financial statements. This ASU is effective for the Company for annual periods beginning after December 15, 2018 and interim periods therein. Early adoption is permitted. The new standard must be adopted using a modified retrospective transition and requires application of the new guidance for leases that exist or are entered into after the beginning of the earliest comparative period presented. The Company is currently evaluating the impact of this ASU on the results of operations, financial condition, or cash flows.

Accounting for Employee Stock-Based Payment

In March 2016, the FASB issued ASU 2016-09, "Compensation-Stock Compensation: Improvements to Employee Share-Based Payment Accounting", which requires excess tax benefits recognized on stock-based compensation expense be reflected in the consolidated statements of operations as a component of the provision for income taxes on a prospective basis. ASU 2016-09 also requires excess tax benefits recognized on stock-based compensation expense be classified as an operating activity in the consolidated statements of cash flows rather than a financing activity. Companies can elect to apply this provision retrospectively or prospectively. ASU 2016-09 also requires entities to elect whether to account for forfeitures as they occur or estimate expected forfeitures over the course of a vesting period. This ASU is effective for the Company for annual periods beginning after December 15, 2016. Early adoption is permitted.

During the third quarter of 2016, the Company elected to early adopt ASU 2016-09. The adoption of this ASU resulted in excess tax benefits being recorded as a reduction of income tax expense prospectively for all periods during 2016, rather than additional paid in capital, and an increase in the number of dilutive shares outstanding at the end of each period, which resulted in an increase to diluted earnings per share during the respective period. As required by ASU 2016-09, excess tax benefits recognized on stock-based compensation expense are classified as an operating activity in our consolidated statements of cash flows on a prospective basis within changes in accounts payable, accrued expenses and customer deposits. In accordance with ASU 2016-09, prior periods related to the classification of excess tax benefits have not been adjusted. The Company also elected to account for forfeitures as they occur, rather than estimate expected forfeitures over the course of a vesting period. As a result of the adoption of ASU 2016-09, the net cumulative effect of this change was not material.

The following table shows the impact of retrospectively applying ASU 2016-09 to the previously issued consolidated statements of operations for the three month period ended March 31 (in thousands, except per share amounts):

|

| | | | | | | | | | | | |

| | Three Months Ended March 31, 2016 |

| | As Previously Reported | | Adjustments | | As Recast |

Income before income taxes | | $ | 156,912 |

| | $ | — |

| | $ | 156,912 |

|

Provision for income taxes | | 46,940 |

| | (1,118 | ) | | 45,822 |

|

Net income | | $ | 109,972 |

| | $ | 1,118 |

| | $ | 111,090 |

|

Earnings per share: | | | | | | |

Basic earnings per share | | $ | 1.19 |

| | $ | 0.01 |

| | $ | 1.20 |

|

Diluted earnings per share | | $ | 1.17 |

| | $ | — |

| | $ | 1.17 |

|

Weighted average common shares outstanding: | | | | | | |

Basic | | 92,516 |

| | — |

| | 92,516 |

|

Diluted | | 94,329 |

| | 701 |

| | 95,030 |

|

The following table shows the impact of retrospectively applying this guidance to the Consolidated Statement of Cash flows for the three months ended March 31, 2016 (in thousands):

|

| | | | | | | | | | | | |

| | Three Months Ended March 31, 2016 |

| | As Previously Reported | | Adjustments | | As Recast |

Net cash provided by operating activities | | $ | 121,505 |

| | $ | 1,118 |

| | $ | 122,623 |

|

Net cash used in investing activities | | (20,745 | ) | | — |

| | (20,745 | ) |

Net cash used in financing activities | | (157,389 | ) | | (1,118 | ) | | (158,507 | ) |

Effect of foreign currency exchange rates on cash | | 8,795 |

| | — |

| | 8,795 |

|

Net (decrease) increase in cash | | $ | (47,834 | ) | | $ | — |

| | $ | (47,834 | ) |

Accounting for Breakage

In March 2016, the FASB issued ASU 2016-04, “Liabilities-Extinguishments of Liabilities: Recognition of Breakage for Certain Prepaid Stored-Value Products”, which requires entities that sell prepaid stored value products redeemable for goods, services or cash at third-party merchants to derecognize liabilities related to those products for breakage. This ASU is effective for the Company for reporting periods beginning after December 15, 2017. Early adoption is permitted. The ASU must be adopted using either a modified retrospective approach with a cumulative effect adjustment to retained earnings as of the beginning of the period of adoption or a full retrospective approach. The Company’s adoption of this ASU is not expected to have a material impact on the results of operations, financial condition, or cash flows.

Cash Flow Classification

In August 2016, the FASB issued ASU 2016-15, "Classification of Certain Cash Receipts and Cash Payments", which amends the guidance in ASC 230, Statement of Cash Flows. This amended guidance reduces the diversity in practice that has resulted from the lack of consistent principles related to the classification of certain cash receipts and payments in the statement of cash flows. This ASU is effective for the Company for reporting periods beginning after December 15, 2017. Early adoption is permitted. Entities must apply the guidance retrospectively to all periods presented but may apply it prospectively from the earliest date practicable if retrospective application would be impracticable. The Company’s adoption of this ASU is not expected to have a material impact on the results of operations, financial condition, or cash flows.

In November 2016, the FASB issued ASU 2016-18, "Statement of Cash Flows (Topic 230): Restricted Cash", which amends the guidance in ASC 230, Statement of Cash Flows, on the classification and presentation of restricted cash in the statement of cash flows. This ASU is effective for the Company for reporting periods beginning after December 15, 2017. Early adoption is permitted. If an entity early adopts the amendments in an interim period, any adjustments should be reflected as of the beginning of the fiscal year that includes that interim period. The amendments in this ASU should be applied using a retrospective transition method to each period presented. The Company’s adoption of this ASU is not expected to have a material impact on the results of operations, financial condition, or cash flows.

Intangibles - Goodwill and Other Impairment

In January 2017, the FASB issued ASU 2017-04, "Simplifying the Test for Goodwill Impairment, which eliminates the requirement to calculate the implied fair value of goodwill (i.e., Step 2 of the goodwill impairment test) to measure a goodwill impairment charge. Instead, entities will record an impairment charge based on the excess of a reporting unit’s carrying amount

over its fair value (i.e., measure the charge based on Step 1). The standard has tiered effective dates, starting in 2020 for calendar-year public business entities that meet the definition of an SEC filer. Early adoption is permitted for interim and annual goodwill impairment testing dates after January 1, 2017. The Company’s adoption of this ASU is not expected to have a material impact on the results of operations, financial condition, or cash flows.

Definition of a Business

In January 2017, the FASB issued ASU 2017-01, "Clarifying the Definition of a Business", which amends the definition of a business to assist entities with evaluating when a set of transferred assets and activities is a business. The guidance requires an entity to evaluate if substantially all of the fair value of the gross assets acquired is concentrated in a single identifiable asset or a group of similar identifiable assets. If so, the set of transferred assets and activities is not a business.The guidance also requires a business to include at least one substantive process and narrows the definition of outputs.The guidance is effective for the Company for reporting periods beginning after December 15, 2017, and interim periods within those years. Early adoption is permitted. The Company’s adoption of this ASU is not expected to have a material impact on the results of operations, financial condition, or cash flows.

2. Accounts Receivable

The Company maintains a $950 million revolving trade accounts receivable Securitization Facility. Accounts receivable collateralized within our Securitization Facility relate to trade receivables resulting from charge card activity. Pursuant to the terms of the Securitization Facility, the Company transfers certain of its domestic receivables, on a revolving basis, to FleetCor Funding LLC (Funding) a wholly-owned bankruptcy remote subsidiary. In turn, Funding sells, without recourse, on a revolving basis, up to $950 million of undivided ownership interests in this pool of accounts receivable to a multi-seller, asset-backed commercial paper conduit (Conduit). Funding maintains a subordinated interest, in the form of over-collateralization, in a portion of the receivables sold to the Conduit. Purchases by the Conduit are financed with the sale of highly-rated commercial paper.

The Company utilizes proceeds from the sale of its accounts receivable as an alternative to other forms of financing to reduce its overall borrowing costs. The Company has agreed to continue servicing the sold receivables for the financial institution at market rates, which approximates the Company’s cost of servicing. The Company retains a residual interest in the accounts receivable sold as a form of credit enhancement. The residual interest’s fair value approximates carrying value due to its short-term nature. Funding determines the level of funding achieved by the sale of trade accounts receivable, subject to a maximum amount.

The Company’s consolidated balance sheets and statements of income reflect the activity related to securitized accounts receivable and the corresponding securitized debt, including interest income, fees generated from late payments, provision for losses on accounts receivable and interest expense. The cash flows from borrowings and repayments, associated with the securitized debt, are presented as cash flows from financing activities.

The Company’s accounts receivable and securitized accounts receivable include the following at March 31, 2017 and December 31, 2016 (in thousands):

|

| | | | | | | | |

| | March 31, 2017 | | December 31, 2016 |

Gross domestic accounts receivable | | $ | 629,629 |

| | $ | 529,885 |

|

Gross domestic securitized accounts receivable | | 676,000 |

| | 591,000 |

|

Gross foreign receivables | | 772,189 |

| | 704,630 |

|

Total gross receivables | | 2,077,818 |

|

| 1,825,515 |

|

Less allowance for doubtful accounts | | (40,985 | ) | | (32,506 | ) |

Net accounts and securitized accounts receivable | | $ | 2,036,833 |

|

| $ | 1,793,009 |

|

A rollforward of the Company’s allowance for doubtful accounts related to accounts receivable for three months ended March 31 is as follows (in thousands):

|

| | | | | | | | |

| | 2017 | | 2016 |

Allowance for doubtful accounts beginning of period | | $ | 32,506 |

| | $ | 21,903 |

|

Provision for bad debts | | 12,988 |

| | 6,836 |

|

Write-offs | | (4,509 | ) | | (4,706 | ) |

Allowance for doubtful accounts end of period | | $ | 40,985 |

| | $ | 24,033 |

|

Foreign receivables are not included in the Company’s accounts receivable securitization program.

3. Fair Value Measurements

Fair value is a market-based measurement that reflects assumptions that market participants would use in pricing an asset or liability. GAAP discusses valuation techniques, such as the market approach (comparable market prices), the income approach (present value of future income or cash flow), and the cost approach (cost to replace the service capacity of an asset or replacement cost). These valuation techniques are based upon observable and unobservable inputs. Observable inputs reflect market data obtained from independent sources, while unobservable inputs reflect the Company’s market assumptions.

As the basis for evaluating such inputs, a three-tier value hierarchy prioritizes the inputs used in measuring fair value as follows:

| |

• | Level 1: Observable inputs such as quoted prices for identical assets or liabilities in active markets. |

| |

• | Level 2: Observable inputs other than quoted prices that are directly or indirectly observable for the asset or liability, including quoted prices for similar assets or liabilities in active markets; quoted prices for similar or identical assets or liabilities in markets that are not active; and model-derived valuations whose inputs are observable or whose significant value drivers are observable. |

| |

• | Level 3: Unobservable inputs for which there is little or no market data, which require the reporting entity to develop its own assumptions. The fair value hierarchy also requires an entity to maximize the use of observable inputs and minimize the use of unobservable inputs when measuring fair value. |

The following table presents the Company’s financial assets and liabilities which are measured at fair values on a recurring basis as of March 31, 2017 and December 31, 2016, (in thousands).

|

| | | | | | | | | | | | | | | | |

| | Fair Value | | Level 1 | | Level 2 | | Level 3 |

March 31, 2017 | | | | | | | | |

Assets: | | | | | | | | |

Repurchase agreements | | $ | 286,921 |

| | $ | — |

| | $ | 286,921 |

| | $ | — |

|

Money market | | 50,254 |

| | — |

| | 50,254 |

| | — |

|

Certificates of deposit | | 3,549 |

| | — |

| | 3,549 |

| | — |

|

Total cash equivalents | | $ | 340,724 |

|

| $ | — |

|

| $ | 340,724 |

|

| $ | — |

|

| | | | | | | | |

December 31, 2016 | | | | | | | | |

Assets: | | | | | | | | |

Repurchase agreements | | $ | 232,131 |

| | $ | — |

| | $ | 232,131 |

| | $ | — |

|

Money market | | 50,179 |

| | — |

| | 50,179 |

| | — |

|

Certificates of deposit | | 48 |

| | — |

| | 48 |

| | — |

|

Total cash equivalents | | $ | 282,358 |

|

| $ | — |

|

| $ | 282,358 |

|

| $ | — |

|

The Company has highly liquid investments classified as cash equivalents, with original maturities of 90 days or less, included in our Consolidated Balance Sheets. The Company utilizes Level 2 fair value determinations derived from directly or indirectly observable (market based) information to determine the fair value of these highly liquid investments. The Company has certain cash and cash equivalents that are invested on an overnight basis in repurchase agreements, money markets and certificates of deposit. The value of overnight repurchase agreements is determined based upon the quoted market prices for the treasury securities associated with the repurchase agreements. The value of money market instruments is the financial institutions' month-end statement, as these instruments are not tradeable and must be settled directly by us with the respective financial institution. Certificates of deposit are valued at cost, plus interest accrued. Given the short term nature of these instruments, the carrying value approximates fair value.

The level within the fair value hierarchy and the measurement technique are reviewed quarterly. Transfers between levels are deemed to have occurred at the end of the quarter. There were no transfers between fair value levels during the periods presented for 2017 and 2016.

The Company’s nonfinancial assets that are measured at fair value on a nonrecurring basis and are evaluated with periodic testing for impairment include property, plant and equipment, investments, goodwill and other intangible assets. Estimates of the fair value of assets acquired and liabilities assumed in business combinations are generally developed using key inputs such as management’s projections of cash flows on a held-and-used basis (if applicable), discounted as appropriate, management’s

projections of cash flows upon disposition and discount rates. Accordingly, these fair value measurements are in Level 3 of the fair value hierarchy.

The fair value of the Company’s cash, accounts receivable, securitized accounts receivable and related facility, prepaid expenses and other current assets, accounts payable, accrued expenses, customer deposits and short-term borrowings approximate their respective carrying values due to the short-term maturities of the instruments. The carrying value of the Company’s debt obligations approximates fair value as the interest rates on the debt are variable market based interest rates that reset on a quarterly basis. These are each Level 2 fair value measurements, except for cash, which is a Level 1 fair value measurement.

4. Stockholders' Equity

On February 4, 2016, the Company's Board of Directors approved a stock repurchase program (the "Program") under which the Company may begin purchasing up to an aggregate of $500 million of its common stock over the following 18 month period. Any stock repurchases may be made at times and in such amounts as deemed appropriate. The timing and amount of stock repurchases, if any, will depend on a variety of factors including the stock price, market conditions, corporate and regulatory requirements, and any additional constraints related to material inside information the Company may possess. Any repurchases have been and are expected to be funded by available cash flow from the business and working capital. Since the beginning of the Program, 1,670,311 shares, for an aggregate purchase price of $240.1 million have been repurchased. There were no shares repurchased under the Program during the three months ended March 31, 2017. In May 2017, the Company repurchased 411,166 common shares totaling $52.4 million under the Program.

5. Stock-Based Compensation

The Company has Stock Incentive Plans (the Plans) pursuant to which the Company’s board of directors may grant stock options or restricted stock to employees. The table below summarizes the expense recognized related to share-based payments recognized for the three month periods ended March 31 (in thousands):

|

| | | | | | | | | |

| | Three Months Ended

March 31, | |

| | 2017 | | 2016 | |

Stock options | | $ | 12,089 |

| | $ | 9,244 |

| |

Restricted stock | | 11,004 |

| | 5,942 |

| |

Stock-based compensation | | $ | 23,093 |

|

| $ | 15,186 |

|

|

The tax benefits recorded on stock based compensation were $15.0 million and $6.2 million for the three month periods ended March 31, 2017 and 2016, respectively.

The following table summarizes the Company’s total unrecognized compensation cost related to stock-based compensation as of March 31, 2017 (cost in thousands):

|

| | | | | | |

| | Unrecognized Compensation Cost | | Weighted Average Period of Expense Recognition (in Years) |

Stock options | | $ | 101,535 |

| | 1.60 |

Restricted stock | | 26,310 |

| | 0.76 |

Total | | $ | 127,845 |

| | |

Stock Options

Stock options are granted with an exercise price estimated to be equal to the fair market value of the Company's stock on the date of grant as authorized by the Company’s board of directors. Options granted have vesting provisions ranging from one to six years and vesting of the options is generally based on the passage of time or performance. Stock option grants are subject to forfeiture if employment terminates prior to vesting.

The following summarizes the changes in the number of shares of common stock under option for the three month period ended March 31, 2017 (shares and aggregate intrinsic value in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | |

| | Shares | | Weighted Average Exercise Price | | Options Exercisable at End of Period | | Weighted Average Exercise Price of Exercisable Options | | Weighted Average Fair Value of Options Granted During the Period | | Aggregate Intrinsic Value |

Outstanding at December 31, 2016 | | 6,146 |

| | $ | 91.20 |

| | 3,429 |

| | $ | 55.00 |

| | | | $ | 309,238 |

|

Granted | | 1,598 |

| | 150.85 |

| | | | | | $ | 37.58 |

| | |

Exercised | | (236 | ) | | 64.65 |

| | | | | | | | 20,443 |

|

Forfeited | | (17 | ) | | 142.33 |

| | | | | | | | |

Outstanding at March 31, 2017 | | 7,491 |

| | $ | 104.65 |

| | 3,833 |

| | $ | 65.23 |

| | | | $ | 350,477 |

|

Expected to vest as of March 31, 2017 | | 7,491 |

| | $ | 104.65 |

| | | | | | | | |

The aggregate intrinsic value of stock options exercisable at March 31, 2017 was $330.4 million. The weighted average remaining contractual term of options exercisable at March 31, 2017 was 5.4 years.

The fair value of stock option awards granted was estimated using the Black-Scholes option pricing model during the three months ended March 31, 2017 and 2016, with the following weighted-average assumptions for grants or modifications during the period:

|

| | | | | | |

| | March 31 |

| | 2017 | | 2016 |

Risk-free interest rate | | 1.83 | % | | 1.11 | % |

Dividend yield | | — |

| | — |

|

Expected volatility | | 27.31 | % | | 27.36 | % |

Expected life (in years) | | 4.2 |

| | 3.3 |

|

Restricted Stock

Awards of restricted stock and restricted stock units are independent of stock option grants and are subject to forfeiture if employment terminates prior to vesting. The vesting of shares granted is generally based on the passage of time or performance, or a combination of these. Shares vesting based on the passage of time have vesting provisions of one year.

The following table summarizes the changes in the number of shares of restricted stock and restricted stock units for the three months ended March 31, 2017 (shares in thousands):

|

| | | | | | | |

| | Shares | | Weighted Average Grant Date Fair Value |

Outstanding at December 31, 2016 | | 379 |

| | $ | 140.39 |

|

Granted | | 129 |

| | 153.94 |

|

Vested | | (203 | ) | | 136.77 |

|

Cancelled | | (31 | ) | | 152.71 |

|

Outstanding at March 31, 2017 | | 274 |

| | $ | 158.06 |

|

6. Acquisitions

2017 Acquisitions

On April 28, 2017, the Company signed a definitive agreement to acquire Cambridge Global Payments (“Cambridge”) for approximately $675 million, a leading business to business (B2B) international payments provider. Cambridge processes over $20 billion in B2B cross-border payments annually, helping 13,000 business clients make international payments to suppliers and employees. The purpose of this acquisition is to further expand the Company's corporate payments footprint. This acquisition is expected to be completed in third quarter of 2017.

2016 Acquisitions

STP

On August 31, 2016, the Company acquired all of the outstanding stock of Serviços e Tecnologia de Pagamentos S.A. (“STP”), for approximately $1.23 billion, net of cash acquired of $40.2 million. STP is an electronic toll payments company in Brazil and provides cardless fuel payments at a number of Shell sites throughout Brazil. The purpose of this acquisition was to expand the Company's presence in the toll market in Brazil.The Company financed the acquisition using a combination of existing cash and borrowings under its existing credit facility. Results from the acquired business have been reported in the Company's international segment since the date of acquisition. The following table summarizes the preliminary acquisition accounting for STP (in thousands):

|

| | | |

Trade and other receivables | $ | 243,157 |

|

Prepaid expenses and other | 6,998 |

|

Deferred tax assets | 9,365 |

|

Property and equipment | 38,732 |

|

Other long term assets | 14,280 |

|

Goodwill | 645,766 |

|

Customer relationships and other identifiable intangible assets | 584,274 |

|

Liabilities assumed | (315,082 | ) |

Aggregate purchase price | $ | 1,227,490 |

|

| |

The estimated fair value of intangible assets acquired and the related estimated useful lives consisted of the following (in thousands):

|

| | | | |

| Useful Lives (in Years) | Value |

Customer relationships | 8.5-17 | $ | 349,310 |

|

Trade names and trademarks - indefinite | N/A | 189,547 |

|

Technology | 6 | 45,417 |

|

| | $ | 584,274 |

|

In connection with the STP acquisition, the Company recorded contingent liabilities aggregating $13.5 million in the consolidated balance sheet, recorded within other noncurrent liabilities and accrued expenses in the consolidated balance sheet at the date of acquisition. A portion of these acquired liabilities have been indemnified by the respective sellers. As a result, an indemnification asset of $13.0 million was recorded within prepaid and other current assets and other long term assets in the consolidated balance sheet. The contingent liabilities and the indemnification asset are included in the preliminary acquisition accounting for STP at the date of acquisition. The potential range of acquisition related contingent liabilities that the Company estimates would be incurred and ultimately recoverable is $13.5 million to $18.6 million. Along with the Company's acquisition of STP, the Company signed noncompete agreements with certain parties for approximately $21.6 million.

The purchase price allocation related to this acquisition is preliminary as the Company is still completing the valuation for intangible assets, income taxes, certain acquired contingencies and the working capital adjustment period remains open. Goodwill recognized is comprised primarily of expected synergies from combining the operations of the Company and STP and assembled workforce. The allocation of the goodwill to the reporting units has not been completed. The goodwill and definite lived intangibles acquired with this business is expected to be deductible for tax purposes.

Other

During 2016, the Company acquired additional fuel card portfolios in the U.S. and the United Kingdom, additional Shell fuel card markets in Europe and Travelcard in the Netherlands totaling approximately $76.7 million, net of cash acquired of $11.1 million. The following table summarizes the preliminary acquisition accounting for these acquisitions (in thousands):

|

| | | |

Trade and other receivables | $ | 27,810 |

|

Prepaid expenses and other | 5,097 |

|

Property and equipment | 992 |

|

Goodwill | 28,540 |

|

Other intangible assets | 61,823 |

|

Deferred tax asset | 146 |

|

Liabilities assumed | (42,550 | ) |

Deferred tax liabilities | (5,123 | ) |

Aggregate purchase prices | $ | 76,735 |

|

The estimated fair value of intangible assets acquired and the related estimated useful lives consisted of the following (in thousands):

|

| | | | |

| Useful Lives (in Years) | Value |

Customer relationships and other identifiable intangible assets | 10-18 | $ | 61,823 |

|

| | $ | 61,823 |

|

The other 2016 acquisitions were not material individually or in the aggregate to the Company’s consolidated financial statements. The accounting for certain of these acquisitions is preliminary as the Company is still completing the valuation of intangible assets, income taxes and evaluation of acquired contingencies.

7. Goodwill and Other Intangible Assets

A summary of changes in the Company’s goodwill by reportable business segment is as follows (in thousands):

|

| | | | | | | | | | | | | | | | | | | |

| | December 31, 2016 | | Acquisitions/ Dispositions | Acquisition Accounting Adjustments | | Foreign Currency | | March 31, 2017 |

Segment | | | | | | | | | |

North America | | $ | 2,640,409 |

| | $ | — |

| $ | — |

| | $ | — |

| | $ | 2,640,409 |

|

International | | 1,554,741 |

| |

|

| (13,522 | ) | | 45,844 |

| | 1,587,063 |

|

| | $ | 4,195,150 |

|

| $ | — |

| $ | (13,522 | ) |

| $ | 45,844 |

|

| $ | 4,227,472 |

|

As of March 31, 2017 and December 31, 2016, other intangible assets consisted of the following (in thousands):

|

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | March 31, 2017 | | December 31, 2016 |

| | Weighted- Avg Useful Lives (Years) | | Gross Carrying Amounts | | Accumulated Amortization | | Net Carrying Amount | | Gross Carrying Amounts | | Accumulated Amortization | | Net Carrying Amount |

Customer and vendor agreements | | 16.9 | | $ | 2,471,625 |

| | $ | (499,199 | ) | | $ | 1,972,426 |

| | $ | 2,449,389 |

| | $ | (458,118 | ) | | $ | 1,991,271 |

|

Trade names and trademarks—indefinite lived | | N/A | | 518,505 |

| | — |

| | 518,505 |

| | 510,952 |

| | — |

| | 510,952 |

|

Trade names and trademarks—other | | 14.7 | | 2,757 |

| | (2,056 | ) | | 701 |

| | 2,746 |

| | (2,021 | ) | | 725 |

|

Software | | 5.3 | | 213,289 |

| | (94,968 | ) | | 118,321 |

| | 211,331 |

| | (85,167 | ) | | 126,164 |

|

Non-compete agreements | | 5.0 | | 36,505 |

| | (12,807 | ) | | 23,698 |

| | 35,191 |

| | (11,070 | ) | | 24,121 |

|

Total other intangibles | | | | $ | 3,242,681 |

|

| $ | (609,030 | ) |

| $ | 2,633,651 |

|

| $ | 3,209,609 |

|

| $ | (556,376 | ) |

| $ | 2,653,233 |

|

Changes in foreign exchange rates resulted in a $33.1 million increase to the carrying values of other intangible assets in the three months ended March 31, 2017. Amortization expense related to intangible assets for the three months ended March 31, 2017 and 2016 was $52.7 million and $27.4 million, respectively.

8. Debt

The Company’s debt instruments consist primarily of term notes, revolving lines of credit and a Securitization Facility as follows (in thousands):

|

| | | | | | | | |

| | March 31, 2017 | | December 31, 2016 |

Term notes payable—domestic(a), net of discounts | | $ | 2,606,684 |

| | $ | 2,639,279 |

|

Revolving line of credit A Facility—domestic(a) | | 425,000 |

| | 465,000 |

|

Revolving line of credit A Facility—foreign(a) | | 94,907 |

| | 123,412 |

|

Revolving line of credit A Facility—swing line(a) | | 48,577 |

| | 26,608 |

|

Other debt(c) | | 17,169 |

| | 12,934 |

|

Total notes payable and other obligations | | 3,192,337 |

|

| 3,267,233 |

|

Securitization Facility(b) | | 676,000 |

| | 591,000 |

|

Total notes payable, credit agreements and Securitization Facility | | $ | 3,868,337 |

|

| $ | 3,858,233 |

|

Current portion | | $ | 1,407,708 |

| | $ | 1,336,506 |

|

Long-term portion | | 2,460,629 |

| | 2,521,727 |

|

Total notes payable, credit agreements and Securitization Facility | | $ | 3,868,337 |

|

| $ | 3,858,233 |

|

______________________

| |

(a) | On October 24, 2014, the Company entered into a $3.36 billion Credit Agreement, which provides for senior secured credit facilities consisting of (a) a revolving A credit facility in the amount of $1.0 billion, with sublimits for letters of credit, swing line loans and multi-currency borrowings, (b) a revolving B facility in the amount of $35 million for loans in Australian Dollars or New Zealand Dollars, (c) a term loan A facility in the amount of $2.02 billion and (d) a term loan B facility in the amount of $300 million. On August 22, 2016, the Company entered into the first Amendment to the existing Credit Agreement, which established an incremental term A loan in the amount of $600 million under the Credit Agreement accordion feature. The proceeds from the additional $600 million in term A loans were used to partially finance the STP acquisition. The Amendment also established an accordion feature for borrowing an additional $500 million in term A, term B or revolver A debt. On January 20, 2017, the Company entered into the second amendment to the Credit Agreement, which established a new term B loan (Term B-2 loan) in the amount of $245.0 million to replace the existing Term B loan. Interest on the Term B-2 loan facility accrues based on the Eurocurrency Rate or the Base Rate, except that the applicable margin is fixed at 2.25% for Eurocurrency Loans and at 1.25% for Base Rate Loans. In addition, the Company pays a quarterly commitment fee at a rate per annum ranging from 0.20% to 0.40% of the daily unused portion of the credit facility. |

The stated maturity dates for the term A loans, revolving loans, and letters of credit under the Credit Agreement is November 14, 2019 and November 14, 2021 for the term loan B. The Company has unamortized debt discounts of $5.6 million related to the term A facility and $0.9 million related to the term B facility at March 31, 2017.

| |

(b) | The Company is party to a $950 million receivables purchase agreement (Securitization Facility) that was amended and restated on December 1, 2015. There is a program fee equal to one month LIBOR and the Commercial Paper Rate of 0.98% plus 0.90% and 0.85% plus 0.90% as of March 31, 2017 and December 31, 2016, respectively. The unused facility fee is payable at a rate of 0.40% per annum as of March 31, 2017 and December 31, 2016. |

| |

(c) | Other debt includes the long-term portion of contingent consideration and deferred payments associated with certain of our businesses. |

The Company was in compliance with all financial and non-financial covenants at March 31, 2017.

9. Income Taxes

The provision for income taxes differs from amounts computed by applying the U.S. federal tax rate of 35% to income before income taxes for the three months ended March 31, 2017 and 2016 due to the following (in thousands):

|

| | | | | | | | | | | | | | |

| | 2017 | | 2016 |

Computed tax expense at the U.S. federal tax rate | | $ | 58,579 |

| | 35.0 | % | | $ | 54,919 |

| | 35.0 | % |

Changes resulting from: | | | | | | | | |

Foreign income tax differential | | (5,843 | ) | | (3.5 | )% | | (4,769 | ) | | (3.0 | )% |

Excess tax benefits related to stock-based compensation | | (8,721 | ) | | (5.2 | )% | | (1,118 | ) | | (0.7 | )% |

State taxes net of federal benefits | | 1,607 |

| | 1.0 | % | | 1,832 |

| | 1.1 | % |

Foreign-sourced nontaxable income | | (603 | ) | | (0.4 | )% | | (2,178 | ) | | (1.4 | )% |

Other | | (1,344 | ) | | (0.8 | )% | | (2,864 | ) | | (1.8 | )% |

Provision for income taxes | | $ | 43,675 |

| | 26.1 | % | | $ | 45,822 |

| | 29.2 | % |

The adoption of ASU 2016-09, "Compensation-Stock Compensation: Improvements to Employee Share-Based Payment Accounting" resulted in excess tax benefits being recorded as a reduction of income tax expense beginning January 1, 2016, rather than additional paid in capital as discussed in the summary of significant accounting policies footnote.

10. Earnings Per Share

The Company reports basic and diluted earnings per share. Basic earnings per share is computed by dividing net income attributable to shareholders of the Company by the weighted average number of common shares outstanding during the reported period. Diluted earnings per share reflect the potential dilution related to equity-based incentives using the treasury stock method. The calculation and reconciliation of basic and diluted earnings per share for the three months ended March 31 (in thousands, except per share data) follows:

|

| | | | | | | | | |

| | Three Months Ended

March 31, | |

| | 2017 | | 2016 | |

Net income | | $ | 123,693 |

| | $ | 111,090 |

| |

Denominator for basic earnings per share | | 92,108 |

| | 92,516 |

| |

Dilutive securities | | 2,452 |

| | 2,514 |

| |

Denominator for diluted earnings per share | | 94,560 |

|

| 95,030 |

|

|

Basic earnings per share | | $ | 1.34 |

| | $ | 1.20 |

| |

Diluted earnings per share | | $ | 1.31 |

| | $ | 1.17 |

| |

There were 0.8 million antidilutive shares during the three month period ended March 31, 2017. Diluted earnings per share for the three month period ended March 31, 2016 excludes the effect of 1.8 million shares of common stock that may be issued upon the exercise of employee stock options because such effect would be antidilutive. Diluted earnings per share also excludes the effect of 0.2 million and 0.3 million shares of performance based restricted stock for which the performance criteria have not yet been achieved for the three month period ended March 31, 2017 and 2016, respectively.

11. Segments

The Company reports information about its operating segments in accordance with the authoritative guidance related to segments. The Company’s reportable segments represent components of the business for which separate financial information is evaluated regularly by the chief operating decision maker in determining how to allocate resources and in assessing performance. The Company operates in two reportable segments, North America and International. There were no inter-segment sales.

The Company’s segment results are as follows for the three month periods ended March 31 (in thousands):

|

| | | | | | | | | |

| | Three Months Ended

March 31, | |

| | 2017 | | 2016 | |

Revenues, net: | | | | | |

North America | | $ | 329,948 |

| | $ | 303,548 |

| |

International | | 190,485 |

| | 110,714 |

| |

| | $ | 520,433 |

|

| $ | 414,262 |

|

|

Operating income: | | | | | |

North America | | $ | 120,972 |

| | $ | 113,850 |

| |

International | | 74,096 |

| | 62,105 |

| |

| | $ | 195,068 |

|

| $ | 175,955 |

|

|

Depreciation and amortization: | | | | | |

North America | | $ | 33,177 |

| | $ | 31,432 |

| |

International | | 31,689 |

| | 4,896 |

| |

| | $ | 64,866 |

|

| $ | 36,328 |

|

|

Capital expenditures: | | | | | |

North America | | $ | 9,632 |

| | $ | 7,942 |

| |

International | | 5,164 |

| | 3,797 |

| |

| | $ | 14,796 |

|

| $ | 11,739 |

|

|

12. Commitments and Contingencies

In the ordinary course of business, the Company is involved in various pending or threatened legal actions. The Company has recorded reserves for certain legal proceedings. The amounts recorded are estimated and as additional information becomes available, the Company will reassess the potential liability related to legal actions and revise its estimate in the period that information becomes known. In the opinion of management, the amount of ultimate liability, if any, with respect to these actions will not have a material adverse effect on the Company’s consolidated financial position, results of operations, or liquidity.

13. Assets Held for Sale

On March 3, 2017, the Company signed a definitive agreement to contribute our Stored Value Solutions (SVS) prepaid card services and gift card program management assets into a venture with First Data’s core gift card business, Transactions Wireless, Inc. and Gyft, that will consolidate these various gift solutions to drive new value for clients. First Data will own 57.5% percent of the joint venture and the Company will own 42.5% percent once the venture closes, which is expected in the second half of 2017, subject to customary regulatory approvals.

At March 31, 2017, the carrying value of current assets, goodwill and intangibles at SVS is approximately $54.7 million, $183.9 million and $218.0 million, respectively. SVS revenues were $48 million and $42 million in the three months ended March 31, 2017 and 2016. The results of the SVS businesses are included in our North America segment. The results of operations associated with the SVS assets will remain in continuing operations as the contribution of assets does not represent a significant shift in our corporate strategy and does not have a major effect on our operations and financial results.

|

| |

Item 2. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with the unaudited consolidated financial statements and related notes appearing elsewhere in this report. In addition to historical information, this discussion contains forward-looking statements that involve risks, uncertainties and assumptions that could cause actual results to differ materially from management’s expectations. See “Special Cautionary Notice Regarding Forward-Looking Statements”. All foreign currency amounts that have been converted into U.S. dollars in this discussion are based on the exchange rate as reported by OANDA for the applicable periods.

This management’s discussion and analysis should also be read in conjunction with the management’s discussion and analysis and consolidated financial statements and related notes included in our Annual Report on Form 10-K for the year ended December 31, 2016.

General Business

Fleetcor is the global leader in workforce payment products. We primarily go to market with our fuel card payments product solutions, corporate payments products, toll products, lodging cards and gift cards. Our products are used in 53 countries around the world, with our primary geographies in the U.S., Brazil and the U.K., which accounted for approximately 92% of our revenue in 2016. Our core products are primarily sold to businesses, retailers, major oil companies and marketers and government entities. Our payment programs enable our customers to better manage and control their commercial payments, card programs, and employee spending and provide card-accepting merchants with a high volume customer base that can increase their sales and customer loyalty. We also provide a suite of fleet related and workforce payment solution products, including mobile telematics services, fleet maintenance management and employee benefit and transportation related payments. In 2016, we processed approximately 2.2 billion transactions on our proprietary networks and third-party networks (which includes approximately 1.3 billion transactions related to our SVS product, acquired with Comdata). We believe that our size and scale, geographic reach, advanced technology and our expansive suite of products, services, brands and proprietary networks contribute to our leading industry position.

We provide our payment products and services in a variety of combinations to create customized payment solutions for our customers and partners. We collectively refer to our suite of product offerings as workforce productivity enhancement products for commercial businesses. We sell a range of customized fleet and lodging payment programs directly and indirectly to our customers through partners, such as major oil companies, leasing companies and petroleum marketers. We refer to these major oil companies, leasing companies, petroleum marketers, value-added resellers (VARs) and other referral partners with whom we have strategic relationships as our “partners.” We provide our customers with various card products that typically function like a charge card to purchase fuel, lodging, food, toll, transportation and related products and services at participating locations. While we refer to companies with whom we have strategic relationships as "partners", our legal relationships with these companies are contractual, and do not constitute legal partnerships.

We support our products with specialized issuing, processing and information services that enable us to manage card accounts, facilitate the routing, authorization, clearing and settlement of transactions, and provide value-added functionality and data, including customizable card-level controls and productivity analysis tools. In order to deliver our payment programs and services and process transactions, we own and operate proprietary “closed-loop” networks through which we electronically connect to merchants and capture, analyze and report customized information in North America and internationally. We also use third-party networks to deliver our payment programs and services in order to broaden our card acceptance and use. To support our payment products, we also provide a range of services, such as issuing and processing, as well as specialized information services that provide our customers with value-added functionality and data. Our customers can use this data to track important business productivity metrics, combat fraud and employee misuse, streamline expense administration and lower overall workforce and fleet operating costs. Depending on our customers’ and partners’ needs, we provide these services in a variety of outsourced solutions ranging from a comprehensive “end-to-end” solution (encompassing issuing, processing and network services) to limited back office processing services.

Executive Overview

We operate in two segments, which we refer to as our North America and International segments. Our revenue is reported net of the wholesale cost for underlying products and services. In this report, we refer to this net revenue as “revenue.” See “Results of Operations” for additional segment information.

For the three months ended March 31, 2017 and 2016, our North America and International segments generated the following revenue:

|

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| | 2017 | | 2016 |

(Unaudited) (in millions) | | Revenues, net | | % of

total

revenues, net | | Revenues, net | | % of

total

revenues, net |

North America | | $ | 329.9 |

| | 63.4 | % | | $ | 303.5 |

| | 73.3 | % |

International | | 190.5 |

| | 36.6 | % | | 110.7 |

| | 26.7 | % |

| | $ | 520.4 |

| | 100.0 | % | | $ | 414.3 |

| | 100.0 | % |

Revenues, net, Net Income and Net Income Per Diluted Share. Set forth below are revenues, net, net income and net income per diluted share for the three months ended March 31, 2017 and 2016.

|

| | | | | | | | |

(Unaudited) | | Three Months Ended March 31, |

(in thousands, except per share amounts) | | 2017 | | 2016 |

Revenues, net | | $ | 520,433 |

| | $ | 414,262 |

|

Net income | | $ | 123,693 |

| | $ | 111,090 |

|

Net income per diluted share | | $ | 1.31 |

| | $ | 1.17 |

|

Sources of Revenue

Transactions. In both of our segments, we derive revenue from transactions. As illustrated in the diagram below, a transaction is defined as a purchase by a customer. Our customers include holders of our card products and those of our partners, for whom we manage card programs, members of our proprietary networks who are provided access to our products and services and commercial businesses to whom we provide workforce payment productivity solutions. Revenue from transactions is derived from our merchant and network relationships, as well as our customers and partners. Through our merchant and network relationships we primarily offer fuel cards, corporate cards, virtual cards, purchasing cards, T&E cards, gift cards, stored value payroll cards, vehicle maintenance, food, fuel, toll and transportation cards and vouchers and lodging services to our customers.

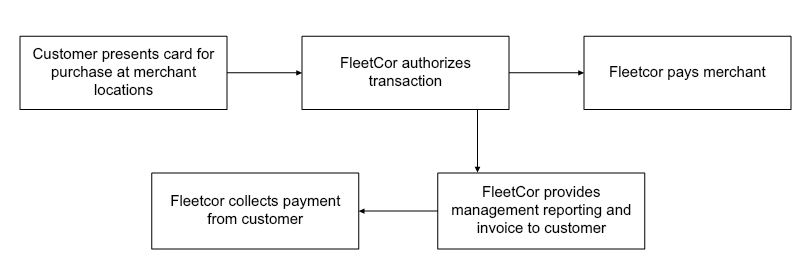

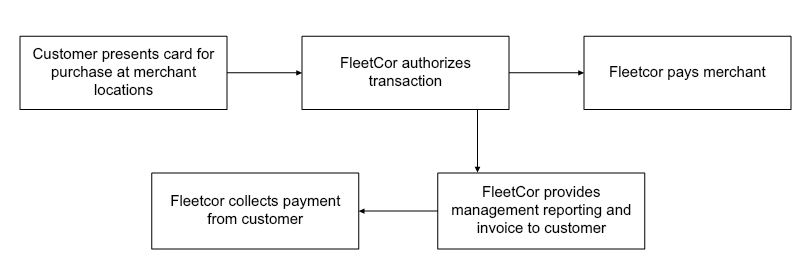

The following diagram illustrates a typical transaction flow, for our fuel card, vehicle maintenance, lodging and food, toll and transportation card and voucher products.. This illustration is not applicable to all of our businesses.

Illustrative Transaction Flow

From our customers and partners, we derive revenue from a variety of program fees, including transaction fees, card fees, network fees and charges, which can be fixed fees, cost plus a mark-up or based on a percentage discount from retail prices. Our programs include other fees and charges associated with late payments and based on customer credit risk.

From our merchant and network relationships, we derive revenue mostly from the difference between the price charged to a customer for a transaction and the price paid to the merchant or network for the same transaction, as well as network fees and charges in certain businesses. As illustrated in the table below, the price paid to a merchant or network may be calculated as

(i) the merchant’s wholesale cost of the product plus a markup; (ii) the transaction purchase price less a percentage discount; or (iii) the transaction purchase price less a fixed fee per unit.

The following table presents an illustrative revenue model for transactions with the merchant, which is primarily applicable to fuel based product transactions, but may also be applied to our vehicle maintenance, lodging and food, fuel, toll and transportation card and voucher products, substituting transactions for gallons. This representative model may not include all of our businesses.

Illustrative Revenue Model for Fuel Purchases

(unit of one gallon)

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Merchant Payment Methods |

Retail Price | | $ | 3.00 |

| | i) Cost Plus Mark-up: | | ii) Percentage Discount: | | iii) Fixed Fee: |

Wholesale Cost | | (2.86 | ) | | Wholesale Cost | | $ | 2.86 |

| | Retail Price | | $ | 3.00 |

| | Retail Price | | $ | 3.00 |

|

| | | | Mark-up | | 0.05 |

| | Discount (3%) | | (0.09 | ) | | Fixed Fee | | (0.09 | ) |

FleetCor Revenue | | $ | 0.14 |

| | | | | | | | | | | | |

Merchant Commission | | $ | (0.05 | ) | | Price Paid to Merchant | | $ | 2.91 |

| | Price Paid to Merchant | | $ | 2.91 |

| | Price Paid to Merchant | | $ | 2.91 |

|

Price Paid to Merchant | | $ | 2.91 |

| | | | | | | | | | | | |

Revenues by geography, product and source. Set forth below are further breakdowns of revenue by geography, product and source for the three months ended March 31, 2017 and 2016 (in millions):

|

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

Revenue by Geography* | | 2017 | | 2016 |

(Unaudited) | | Revenues, net | | % of total revenues, net | | Revenues, net | | % of total revenues, net |

United States | | $ | 330 |

| | 63 | % | | $ | 304 |

| | 73 | % |

United Kingdom | | 54 |

| | 10 |

| | 59 |

| | 14 |

|

Brazil | | 93 |

| | 18 |

| | 17 |

| | 4 |

|

Other | | 43 |

| | 8 |

| | 35 |

| | 8 |

|

Consolidated revenues, net | | $ | 520 |

| | 100 | % | | $ | 414 |

| | 100 | % |

*Columns may not calculate due to impact of rounding.

|

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

Revenue by Product Category* | | 2017 | | 2016 |

(Unaudited) | | Revenues, net | | % of total revenues, net | | Revenues, net | | % of total revenues, net |

Fuel cards | | $ | 258 |

| | 50 | % | | $ | 241 |

| | 58 | % |

Corporate Payments | | 47 |

| | 9 |

| | 41 |

| | 10 |

|

Tolls | | 77 |

| | 15 |

| | 2 |

| | 1 |

|

Lodging | | 24 |

| | 5 |

| | 21 |

| | 5 |

|

Gift | | 48 |

| | 9 |

| | 42 |

| | 10 |

|

Other | | 66 |

| | 13 |

| | 67 |

| | 16 |

|

Consolidated revenues, net | | $ | 520 |

| | 100 | % | | $ | 414 |

| | 100 | % |

*Columns may not calculate due to impact of rounding.

|

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

Major Sources of Revenue* | | 2017 | | 2016 |

(Unaudited) | | Revenues, net | | % of total revenues, net | | Revenues, net | | % of total revenues, net |

Customer | | | | | | | | |

Processing and program revenue1 | | $ | 244 |

| | 47 | % | | $ | 173 |

| | 42 | % |

Late fees and finance charges2 | | 37 |

| | 7 | % | | 27 |

| | 7 | % |

Miscellaneous fees3 | | 34 |

| | 6 | % | | 28 |

| | 7 | % |

| | 315 |

| | 61 | % | | 228 |

| | 55 | % |

Merchant | | | | | | | | |

Discount revenue (fuel)4 | | 80 |

| | 15 | % | | 68 |

| | 16 | % |

Discount revenue (nonfuel)5 | | 41 |

| | 8 | % | | 37 |

| | 9 | % |

Tied to fuel-price spreads6 | | 50 |

| | 10 | % | | 52 |

| | 12 | % |

Program revenue7 | | 34 |

| | 7 | % | | 30 |

| | 7 | % |

| | 205 |

| | 39 | % | | 186 |

| | 45 | % |

Consolidated revenues, net | | $ | 520 |

| | 100 | % | | $ | 414 |

| | 100 | % |

|

|

1Includes revenue from customers based on accounts, cards, devices, transactions, load amounts and/or purchase amounts, etc. for participation in our various fleet and workforce related programs; as well as, revenue from partners (e.g., major retailers, leasing companies, oil companies, petroleum marketers, etc.) for processing and network management services. Primarily represents revenue from North American trucking, lodging, prepaid benefits, telematics, gift cards and toll related businesses. |

2Fees for late payment and interest charges for carrying a balance charged to a customer. |

3Non-standard fees charged to customers based on customer behavior or optional participation, primarily including high credit risk surcharges, over credit limit charges, minimum processing fees, printing and mailing fees, environmental fees, etc. |

4Interchange revenue directly influenced by the absolute price of fuel and other interchange related to fuel products. |

5Interchange revenue related to nonfuel products. |

6Revenue derived from the difference between the price charged to a fleet customer for a transaction and the price paid to the merchant for the same transaction. |

7Revenue derived primarily from the sale of equipment, software and related maintenance to merchants. |

*We may not be able to precisely calculate revenue by source, as certain estimates were made in these allocations. Columns may not calculate due to impact of rounding. |

Revenue per transaction. Set forth below is revenue per transaction information for the three months ended March 31, 2017 and 2016:

|

| | | | | | | | | |

| | Three Months Ended March 31, | |

(Unaudited) | | 2017 | | 2016 | |

Transactions (in millions) | | | | | |

North America | | 474.0 |

| | 434.5 |

| |

International | | 270.9 |

| | 52.5 |

| |

Total transactions | | 744.9 |

|

| 487.0 |

|

|

Revenue per transaction | |

| |

| |

North America | | $ | 0.70 |

| | $ | 0.70 |

| |

International | | 0.70 |

| | 2.11 |

| |

Consolidated revenue per transaction | | 0.70 |

| | 0.85 |

| |

For the three months ended March 31, 2017, total transactions increased from 487.0 million to 744.9 million, an increase of 257.9 million, or 52.9%. North American segment transactions increased approximately 9% in the three months ended March 31, 2017 as compared to 2016 due primarily to growth in our SVS and fuel card businesses. Transaction volumes in our international segment increased by 415.6% over the comparable period in 2016, primarily due to the acquisition of STP and Travelcard during the third quarter of 2016.

Set forth below is further breakdown of revenue and revenue per transaction, by product category for the three months ended March 31, 2017 and 2016 (in millions except revenues, net per transaction): |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | As Reported | | Pro Forma and Macro Adjusted2 |

(Unaudited) | | Three Months Ended March 31, | | Three Months Ended March 31, |

| | 2017 | | 2016 | | Change | | % Change | | 20173 | | 20164 | | Change | | % Change |

FUEL CARDS | | | | | | | | | | | | | | | | |

'- Transactions | | 114.4 |

| | 103.0 |

| | 11.4 |

| | 11 | % | | 114.4 |

| | 106.1 |

| | 8.3 |

| | 8 | % |

'- Revenues, net per transaction | | $ | 2.26 |

| | $ | 2.34 |

| | $ | (0.08 | ) | | (3 | )% | | $ | 2.27 |

| | $ | 2.23 |

| | $ | 0.05 |

| | 2 | % |

'- Revenues, net | | $ | 258.3 |

| | $ | 240.7 |

| | $ | 17.6 |

| | 7 | % | | $ | 260.1 |

| | $ | 236.4 |

| | $ | 23.7 |

| | 10 | % |

CORPORATE PAYMENTS | | | | | | | | | | | | | | | | |

'- Transactions | | 9.5 |

| | 8.9 |

| | 0.6 |

| | 6 | % | | 9.5 |

| | 8.9 |

| | 0.6 |

| | 6 | % |

'- Revenues, net per transaction | | $ | 4.93 |

| | $ | 4.61 |