UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

[X] ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended May 31, 2015

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from _____________to _____________.

Commission file number: 000-51775

STERLING GROUP VENTURES,

INC.

(Exact name of registrant as specified in its

charter)

| Nevada | 72-1535634 |

| (State or other jurisdiction of incorporation or | (I.R.S. Employer Identification No.) |

| organization) | |

| 802-1067 Marinaside Cr. | |

| Vancouver BC Canada | V6Z 3A4 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code (604) 684-1001

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered |

| None | None |

Securities registered pursuant to Section 12(g) of the Act:

Common Stock, par value $0.001

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes [ ] No [ X ]

Indicate by check mark if the registrant is not required to file reports

pursuant to Section 13 or 15(d) of the Act.

Yes [

] No [X]

Indicate by check mark whether the registrant (1) has filed all

reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the

registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days.

Yes [X] No

[ ]

Indicate by check mark whether the registrant has submitted

electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation

S–T (§ 232.405 of this chapter) during the preceding 12 months (or for such

shorter period that the registrant was required to submit and post such

files).

Yes [X] No [ ]

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell

company (as defined in Rule 12b-2 of the Act).

Yes [

] No [X]

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was sold, or the average bid and asked prices of such common equity, as of the last business day of the registrant's most recently completed second fiscal quarter.

The aggregate market value of the voting and non-voting share of Common Stock held by non-affiliates of the registrant was approximately $1,086,407 based on the closing trading price for the common equity as of November 28, 2014 (at $0.02).

The number of shares of common stock, par value $0.001 per share, outstanding as of August 26, 2015 was 75,730,341.

Documents incorporated by reference: None.

1

STERLING GROUP VENTURES INC.

MAY 31, 2015 ANNUAL

REPORT ON FORM 10-K

TABLE OF CONTENTS

2

Cautionary Statement Regarding Forward-Looking Statements

Safe Harbor Statement under the United States Private Securities Litigation Reform Act of 1995: Except for the statements of historical fact contained herein, the information constitutes "forward-looking statements" within the meaning of the Private Securities Litigation reform Act of 1995. Such forward looking statements, including but not limited to those with respect to the price of phosphate, potassium, nitrogen, and other commodities, the timing and amount of estimated production, costs of production, reserve determination and reserve conversion rates, involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievement of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. Such factors include, among others, risks relating to the integration of the acquisition, risks relating to international operations, risks relating to joint venture operations, the actual results of current exploration activities, the actual results of current reclamation activities, conclusions of economic evaluations, changes in project parameters as plans continue to be refined, future prices of phosphate, potassium, nitrogen, fertilizer and other commodities, as well as those factors affecting the mineral industry. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

This annual report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. Some discussions in this report may contain forward-looking statements that involve risk and uncertainty. A number of important factors could cause our actual results to differ materially from those expressed in any forward-looking statements made by us in this report. Forward-looking statements are often identified by words like: “believe”, “expect”, “estimate”, “anticipate”, “intend”, “project” and similar expressions or words which, by their nature, refer to future events.

In some cases, you can also identify forward-looking statements by terminology such as “may”, “will”, “should”, “plans”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled "Risk Factors", which may cause our or our industry's actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States Dollars (US$) and are prepared in accordance with United States Generally Accepted Accounting Principles. All references to “ $” refer to US Dollars, all references to “CA $” refer to Canadian Dollars, all references to “RMB” refer to Chinese Yuan and all references to "common shares" refer to the common shares in our capital stock.

As used in this annual report, the terms "we", "us", "our", “the Company” and "Sterling" mean Sterling Group Ventures, Inc., unless otherwise indicated.

Sterling is a mining and exploration company, involved in the development of Gaoping property, a phosphate deposit through its acquisition of Chenxi County Hongyu Mining Co. Ltd. (Hongyu) in Hunan, China, and is developing a mining operation on the Gaoping property. There is no assurance we will be able to commercially develop mineral deposits on the claims that we have under option. Further exploration may be required before a final evaluation as to the economic and legal feasibility of the claims is determined.

3

PART I

ITEM 1. BUSINESS.

General

We were incorporated in the state of Nevada on September 13, 2001 and established a fiscal year end of May 31. Since our incorporation, we have engaged in the business of mining exploration and development. On January 20, 2004, Sterling completed the acquisition of all of the issued and outstanding shares of Micro Express Ltd. ("Micro"), which was incorporated on July 27, 1994 and engaged in exploration and development of Lithium. Pursuant to the transaction, the Company issued an aggregate of 25,000,000 shares of Sterling's common stock to the stockholders of Micro in exchange for 100% of the outstanding shares of Micro's common stock. The business combination was accounted for as a reverse acquisition whereby the purchase method of accounting was used with Micro being the accounting parent and the Company being the accounting subsidiary. The Company has since terminated the joint venture agreements related to the Lithium projects in 2011 as more fully described herein. On July 8, 2011, Sterling acquired a 90% interest in Chenxi County Hongyu Mining Co. Ltd. ("Hongyu") , and the other 10% of Hongyu was transferred to the nominees of Sterling. Pursuant to the transaction, Sterling issued 10,000,000 shares of its common stock to the existing Hongyu shareholders.

We are a mining company principally engaged in the search, exploration and development of phosphate and related minerals through our recent acquisition of Chenxi County Hongyu Mining Co. Ltd. Our statutory registered agent's office is located at 123 West Nye Lane, Suite 129, Carson City, Nevada 89706 and our business office is located at 802-1067 Marinaside Cr., Vancouver, B.C., Canada, V6Z 3A4. Our telephone and fax number is (604) 684-1001.

Phosphate Overview

Phosphate rock is a general description applied to several kinds of rock which contain significant concentrations of phosphate minerals, which are minerals that contain the phosphate ion in their chemical structure, and is the eleventh most abundant element in the lithosphere.

Many kinds of rock contain mineral components containing phosphate or other phosphorus compounds in small amounts. However, rocks which contain phosphate in quantity and concentration which are economic to mine as ore, for their phosphate content, are not particularly common. The two main sources for phosphate are guano, formed from bird droppings, and rocks containing concentrations of the calcium phosphate mineral, apatite.

In general, lower concentrations of phosphate and lower quality deposits require increasing amounts of energy and chemicals in order to produce phosphate and can represent a significant increase in costs.

Phosphorus, P in the table of elements, is present in every living cell in both plants and animals and is essential to the process of photosynthesis in plants. As such, phosphorus, among other fertilizers, is essential to plant growth. Plants absorb phosphorus through the soil as various forms of phosphate. Besides nitrogen and potassium, phosphorus is one of the three nutrients required for plant growth and cannot be substituted. It is also insoluble so that it can be washed easily.

Phosphate content in currently mined rocks can range anywhere from 5% to 40%. Thus, the rocks must be processed to remove the bulk of the contained minerals and impurities normally through washing as the initial step thus increasing phosphate grades.

Gaoping Phosphate Project

On October 18, 2010, Sterling Group Ventures, Inc. (“Sterling”) signed two agreements (the “Agreements”) with Chenxi County Hongyu Mining Co. Ltd. (“Hongyu”) and its shareholders (“Hongyu Shareholders”) regarding the Gaoping phosphate mine (the “GP Property”) located in Tanjiachang village, Chenxi County, Hunan Province, China and other phosphate resources in Hunan Province.

Hongyu is a Chinese private mining company with connections and resources in Hunan, China. Hongyu was an inactive company holding a mining permit and a deposit of $122,134 placed with local land administrative bureau for undertaking the restoration of land to its present condition when the lease term expires after the property is mined. Hongyu is interested in exploring, developing and expanding its Phosphate business. Hongyu is the holder of a mining permit (the "Permit") in the GP Property located in Tanjiachang village, Chenxi County, Hunan Province, China. Due to lack of funds, Hongyu was inactive without current operations being conducted. The GP Property is a sedimentary phosphate type deposit. The number of the mining permit is 4300002009116120048322 and it is valid until November 10, 2014. On April 29, 2015, Hongyu obtained the renewal of the mining permit, which is valid until April 2, 2018. The area covered by the Permit is 0.4247 km2 (42.47 hectares). The mining permit allows initial production up to 100,000 tonnes of phosphate rock per year.

4

The Agreements required an investment company to be incorporated in Hong Kong (the “Investment Company”) which is to be owned 20% by the Hongyu Shareholders and 80% by Sterling. On October 13, 2010, the Investment Company was incorporated in Hong Kong under the name Silver Castle Investments Ltd. (“Silver Castle”). Silver Castle acquired 90% of Hongyu with the other 10% of Hongyu transferred to the nominees of Sterling. Upon completion of this acquisition, Hongyu became a Hong Kong / China joint venture company. Sterling received all required approvals from Chinese authorities for the completion of its acquisition of Hongyu pursuant to the Agreements dated October 18, 2010. The Company paid a total RMB 2,000,000 ($310,438) to the Hongyu Shareholders with RMB 200,000 (US$30,934) paid as down payment on December 14, 2010 and the remaining RMB1,800,000 ($279,504) paid on July 8, 2011 for completion of the transaction.

Pursuant to the Agreements, Hongyu agreed to surrender its future exclusive cooperative rights to Sterling, and the Hongyu Shareholders agreed that Sterling shall have all Hongyu's title and interest in any phosphate properties, including but not limited to the GP Property, and Sterling should arrange for the financing of building a mining and processing plant on the GP Property together with other facilities required for a mining operation thereon.

When requested by Sterling, the Hongyu Shareholders agreed to sell their 20% interest in the Investment Company to Sterling for the issuance of 10,000,000 common shares of Sterling’s capital stock. On July 5, 2011, Sterling issued 10,000,000 shares to the Hongyu Shareholders with the closing market price of the shares at $0.22 for acquiring the remaining 20% equity interest in Silver Castle from the Hongyu Shareholders. As a result of this transaction, Sterling effectively controls 100% of Hongyu through its wholly owned subsidiary, Silver Castle Investments Ltd. which holds 90% of Hongyu with the other 10% held by the nominees of Sterling.

Sterling through its subsidiary company, Silver Castle Investments Ltd., also signed a letter of intent for a larger area known as Tanjiachang Exploration Concession with Chenxi County Merchants Bureau, Hunan Province, China. Tanjiachang Exploration Concession is surrounding the Gaoping Mining permit.

As mining license was obtained for the Gaoping Phosphate Property and a Chinese engineering report was completed, Hongyu is making progress on this property as follows. On February 13, 2012, Hongyu received approval for installing the power line for the Gaoping Phosphate Property. Hongyu also reached understanding for land rental with local village committee on March 17, 2012. Hongyu signed and completed land rental agreement with each family in the mining area on March 27, 2012. On April 1, 2012, Hongyu also received conditional safety approval from Supervision and Management Bureau for Safety Operation of Chenxi County and the project is essentially ready to begin production on a small scale basis to be further ramped up as the development and production plan takes effect. On April 22, 2012, Hongyu signed a mining agreement with the mining contractor, Yichang Rongchang Mining Co. Ltd., to be the operator of the mining and production activities on the project. On June 16, 2012, Hongyu completed power line construction. On July 19, 2012, Hongyu received the explosive operation permit. Accommodation for mining people has been built. An onsite office and accommodation for workers and mining management are complete. The water supply for the mining operation and living quarters is connected to the site. The road to the mining site has been completed. Three adits have been dug and they will be used to access the phosphorite along its strike length.

On March 10, 2013, Hongyu signed a profit sharing agreement with Yichang Baolin Mining Engineering Co. Ltd ("Baolin") for mining and processing phosphate rock from the Project. Baolin has a processing plant using a scrubbing processing which can process up to 100,000 t/a. However, Baolin has also built a new simple washing processing plant near Gaoping property to reduce the transportation cost. Hongyu has also signed an agreement with the Yichang Yinuo Biotech Co. Ltd ("Yinuo") to jointly produce and market bio-phosphate fertilizer. Yinuo has its own microbial inoculants and its fertilizer market brand is Mingxinglinde which is an organic biofertilizer. The aforementioned progress is presented as an interim measure to gauge the ease and efficiency of the mining process together with the efficacy of the contractual arrangements made to produce and market the phosphate rock.

As a substantial decrease of phosphate rock and phosphate fertilizer market pricing has occurred, Hongyu has halted further exploration and development since August 2013 until the world market prices rebound and has kept the property in care and maintenance mode. Such an action preserves the phosphate rock in situ and saves operating capital while world prices for phosphate rock are in a depressed state. The Company's capital contributions to the project were held to a minimum by its contracting the mining and washing functions to Yichang Baolin Mining Engineering Co. Ltd.

5

The Company has continued the services of several key employees in China to review other mining properties and opportunities. In pursuit of one such opportunity, Hongyu has obtained a registration code from Customs of People's Republic of China for the import and export business which may afford the Company the opportunity to act as an agent or distributor for the importation and exportation of fertilizer products. Hongyu is also continuously reviewing and looking other opportunities in mining.

As of May 31, 2015, the Gaoping mineral property is still an exploration stage property as it does not yet have proven reserves.

The Company will monitor the production and marketing with the goal of increasing production and sales over time in a measured and economically viable manner. Currently due to the downturn in world market prices for phosphate rock and concentrate, the Company has decided to curtail the stockpiling of phosphate rock until world prices and world sales increase. Such an action preserves the phosphate rock in situ and saves operating capital while world prices of phosphate rock are in a depressed state.

Employees

At present, we have 9 employees in China. We have no employees in Canada, other than our officers and directors. Our officers and directors do not have employment agreements with us, except consulting agreements which can be cancelled on 30-days notice.

ITEM 1A. RISK FACTORS

We have sought to identify what we believe to be the most significant risks to our business. However, we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our Common Stock. We provide the following cautionary discussion of risks, uncertainties and possible inaccurate assumptions relevant to our business. These are factors that we think could cause our actual results to differ materially from expected results. Other factors besides those listed here could adversely affect us.

Factors That May Affect Future Results and Market Price of Stock

The business of the Company involves a number of risks and uncertainties that could cause actual results to differ materially from results projected in any forward-looking statement, or statements, made in this report. These risks and uncertainties include, but are not necessarily limited to the risks set forth below. The Company's securities are speculative and investment in the Company's securities involves a high degree of risk and the possibility that the investor will suffer the loss of the entire amount invested.

There is Substantial Doubt About the Company’s Ability to Continue as a Going Concern

Sterling is engaged in acquisition, exploration and development of mineral properties. The Company has acquired the Gaoping phosphate properties located in Chenxi County, Hunan Province, China. The Company has not yet achieved profitable operations and is dependent on its ability to raise capital from shareholders or other sources to meet its obligations and repay its liabilities arising from normal business operations when they come due. These factors raise substantial doubt that the Company will be able to continue as a going concern.

Lack of Technical Training of Management

The Management of our Company has academic and scientific experience related to mining issues but lacks technical training and experience exploring for, commissioning and operating a mine. With no direct training or experience in these areas, management may not be fully aware of many of the specific requirements related to working within this industry. The decisions and choices may not take into account standard engineering or managerial approaches mineral exploration companies commonly use. Consequently, operations, earnings and the ultimate financial success of the Company could suffer irreparable harm due to management's lack of experience in this industry. The company has hired an experienced mining engineer.

6

Exploration Risk

Development of mineral properties is contingent upon obtaining satisfactory exploration results. Mineral exploration and development involves substantial expenses and a high degree of risk, which even a combination of experience, knowledge and careful evaluation may not be able to adequately mitigate.

The Gaoping property has been examined in the field by professional geologists/mining engineers. The Company received the National Instrument 43-101 report (Canadian Standard) entitled "Property Evaluation Report" (PER). The production decision announced was based on Chinese Technical Reports and the PER and not based on a Preliminary Economic Assessment (PEA) or mining study (a Prefeasibility or Feasibility Study) of mineral reserves demonstrating economic and technical viability. Resources that are not reserves do not have demonstrated economic viability. There is an increased risk of technical and economic failure because the development decision was based on inferred resources, without a preliminary economic analysis or mining study as defined by NI 43-101. Professional geologists also made an exploration proposal for the Tanjiachang Exploration Concession which is surrounding the Gaoping property which is under letter of intent with Chenxi County Merchants Bureau, Hunan Province, China. There is no assurance that the exploration license for the Tanjiachang Exploration Concession will be issued. There is no assurance that commercial quantities of ore will be discovered on the Tanjiachang Exploration Concession. There is also no assurance that, even if commercial quantities of ore are discovered, the Tanjiachang Exploration Concession will be brought into commercial production. Since 2012, the Central Government made its move to change the mining laws to provincial jurisdiction. The new application process was held. Previously issued licenses are being honored.

The discovery of mineral deposits is dependent upon a number of factors not the least of which is the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit, once discovered, is also dependent upon a number of factors, some of which are the particular attributes of the deposit, such as size, grade and proximity to infrastructure, metal prices and government regulations, including regulations relating to royalties, allowable production, importing and exporting of minerals, and environmental protection. In addition, assuming discovery of a commercial ore body, depending on the type of mining operation involved, several years can elapse from the initial phase of drilling until commercial operations are commenced. Most of the above factors are beyond the control of the Company.

The properties may need exploration and such exploration processes shall be conducted in phases. When each phase of a particular project is completed, and upon analysis of the results thereto, the Company will make a decision on whether to proceed with each successive phase of the exploration program. There is no assurance that projects will be carried to completion.

Limited Management Resource Development Experience

The Company does not have a track record of exploration and mining operation history. The Company's management has limited experience in mineral resource development and exploitation, and has relied on and may continue to rely upon consultants and others for development and operation expertise. The company hired an experienced mining engineer.

Limited Financial Resources

Furthermore, the Company has limited financial resources with no assurance that sufficient funding will be available to it for future exploration and development or to fulfill its obligations under current agreements. There is no assurance that the Company will be able to obtain adequate financing in the future or that the terms of such financing will be favorable. Failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and development of its projects.

Limited Public Market, Possible Volatility of Share Price

The Company's Common Stock is currently quoted on the OTCQB marketplace under the ticker symbol SGGV. As of May 31, 2015, there were 75,730,341 shares of common stock outstanding. There can be no assurance that a trading market will be sustained in the future.

Dependence on Executive Officers and Technical Personnel

The success of our business plan depends on attracting qualified personnel, and failure to retain the necessary personnel could adversely affect our business. Competition for qualified personnel is intense, and we may need to pay premium wages to attract and retain personnel. Attracting and retaining qualified personnel is critical to our business. Inability to attract and retain the qualified personnel necessary would limit our ability to implement our business plan successfully.

7

Need for Additional Financing

The Company believes it has sufficient capital to meet its needs for at least the next 12 months, including the costs of compliance with the continuing reporting requirements of the Securities Exchange Act of 1934. However, if losses continue, it may have to seek loans or equity placements to cover longer-term cash needs to continue operations and expansion.

No commitments to provide additional funds have been made by management or other stockholders. Accordingly, there can be no assurance that any additional funds will be available to the Company to allow it to cover operation expenses.

If future operations are unprofitable, the Company will be forced to develop another line of business, or to finance its operations through the sale of assets it has, or enter into the sale of stock for additional capital, none of which may be feasible when needed. The Company has no specific management ability or financial resources or plans to enter any other business as of this date.

Dilution to the Existing Shareholders

The Company has no other capital resources other than the ability to use its common stock to raise additional capital or the exercise of the warrants by the unit holders, which will significantly dilute the Company's stockholders.

Market Risk and Political Risks

The Company does not hold any derivatives or other investments that are subject to market risk. The carrying values of any financial instruments, approximate fair value as of those dates because of the relatively short-term maturity of these instruments, which eliminates any potential market risk associated with such instruments.

The market in China is monitored by the government, which could impose taxes or restrictions at any time which would make operations unprofitable and infeasible and cause a write-off of investment in the mineral properties. Other factors include political policy on foreign ownership, political policy to open the doors to foreign investors, and political policy on mineral claims and metal prices.

The disruptions in the financial markets and economic conditions have adversely affected the US and the world economy. Turmoil in global credit markets and turmoil in the geopolitical environment in many parts of the world have adversely affected global economic conditions. There can be no assurances that government responses to the disruptions in financial markets will restore investor confidence and economic activity. This could affect our ability to raise capital.

Additionally, the uncertain economic environment may cause farmers to use less fertilizer to cut costs, which will adversely affect the demand for phosphate. A similar situation occurred in 2008 leading to a sharp decline in phosphate prices.

The Hongyu’s phosphate deposit is located in China which, as a result of its operations, exposes the Company to political and market risks in China. Exports of phosphate rock are currently subject to an export tax due to domestic phosphate requirements.

Other Risks and Uncertainties

The business of mineral deposit exploration and development involves a high degree of risk. Few properties that are explored are ultimately developed into production. Other risks facing the Company include competition, reliance on third parties and joint-venture partners, environmental and insurance risks, political and environmental instability, statutory and regulatory requirements, fluctuations in mineral prices and foreign currency, share price volatility, title risks, and uncertainty of additional financing.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

8

ITEM 2. PROPERTY

Gaoping Phosphate Property

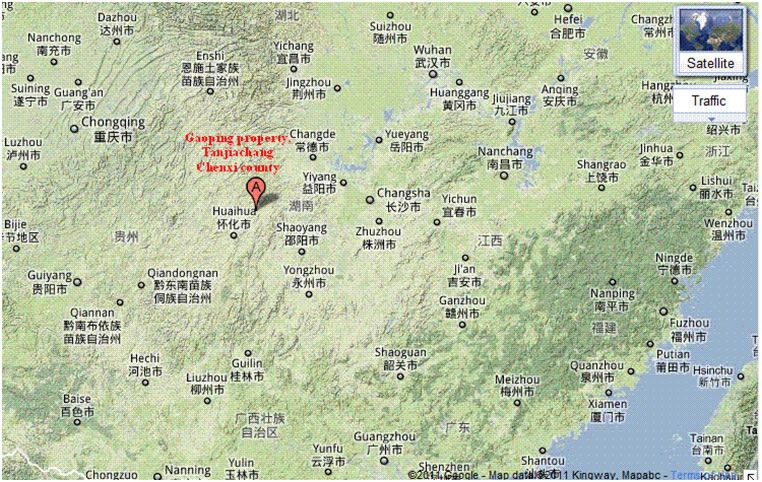

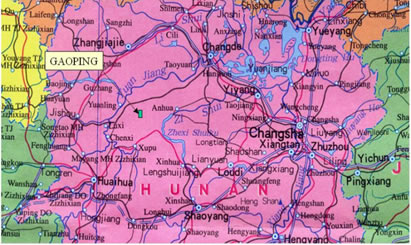

Gaoping Phosphate Property which is surrounded by Tanjiachang Phosphate Exploration Concession is located in NEE 80°direction of Chenxi County town with distance 38 km and is under jurisdiction of Tanjiachang village, Chenxi county of Hunan Province.

Geographical coordinates of mining permit’s ranges:

Longitude East 110°26 ′15 ″~110°27 ′05″, Latitude North 28°01

′49″~28°03′14″.

Geological coordinates of Tanjiachang Phosphate Exploration

Concession’s ranges:

Longitude East 110° 25 ′15 ″~ 110° 30 ′00″, Latitude

North 28°00 ′00″~28° 07′30″. The area is about 32 km2.

The location of the property is shown in the following map.

The property is located in Hunan Province in South Eastern China some 250 kilometers west of the Provincial Capital of Changsha and 120 kilometers north east of the regional center of Huaihua and 38 kilometers east of the County seat at Chenxi. There are several flights per day into Changsha from Beijing or Shanghai and three flights per week into Huaihua. Several daily bus schedules are available from Changsha to Huaihua and Chenxi. Huaihua is a city of about six million people. The County of Chenxi has a population of five million and the city of Chenxi is the county seat. Chenxi has no air service and is quite agrarian in its culture. Currently high speed trains are available in Huaihua city.

The Gaoping Phosphate property consists of a mining permit outlined by the following UTM Coordinates:

| 1. X=3102000 Y=37444690 | 2. X=3102985 Y=37444925 |

| 3. X=3103920 Y=37445430 | 4. X=3104210 Y=37445300 |

| 5. X=3104593 Y=37445604 | 6. X=3104555 Y=37445715 |

| 7. X=3104215 Y=37445465 | 8. X=3103910 Y=37445600 |

| 9. X=3102915 Y=37445065 | 10. X=3102000 Y=37444850 |

The Gaoping mining permit was issued on November 10, 2009 and valid until November 10, 2014. On April 29, 2015, Hongyu obtained the renewal of the mining permit, which is valid until April 2, 2018. The number of the permit is 4300002009116120048322. The permit is 0.4247 km2 and the elevation is from +600 m to +510m. These 10 boundary points of Gaoping mining permit are surveyed by official land surveyors.

The mining permit allows initial production up to 100,000 tonnes phosphate ore per year. In order to acquire more resources under the mining permit, Hongyu needs to invest not less than RMB 20 million Yuan in county including paying resource fees to the Chinese government according to related Chinese regulations and applies to expand the scale of current mining permit through the legal process in China.

9

The Tanjiachang phosphate district is located in the Xiuxi-Luojiawan anticlinorium and Tanjiachang syncline. The strata generally occur in an undeformed or weak monoclinal structure. Strata outcropping in Tanjiachang region ranges from Banxi Group of Upper Proterozoic to Cambrian of the Lower Paleozoic.

Strata outcropping in the mine area includes Jiangkou Formation, Xiangmeng Formation and Hongjiang Formation of Lower Sinian and Jinjiadong Formation, Liuchapo Formation of Upper Sinian and Xiaoyanxi Formation of Lower Cambrian. The phosphorite deposits lie in the middle part of Jinjiadong Formation. The phosphorite is Interbedded with argillaceous & silty platy shale. The deposit is in shallow marine sediment deposit type.

The regional geological structure is relatively complicated and the main structure is Xiuxi- Luojiawan Anticlinorium with many cross faults. Geological structure of mine area is relatively simple in general. The strata strikes NNE and dips SEE.

The main mineral resource with industrial significance in this region is the phosphorite, and is the middle to lower part of Jinjiadong Formation, Upper Sinian. Some Pb- Zn mineralization has been discovered in the lower part of the Jinjiadong Formation and Cu mineralization has been discovered in middle part of the sandy slabby shale beds. The lower part is green grey laminar sandy slate. Manganese carbonate within black platy shale of Xiangmeng Formation could set up local industry scale operations. Manganese carbonate is easy to process, with good market conditions, providing realistic opportunities to do exploration and development.

There is a history of mining in the Gaoping area. In the past, numerous artisanal lead zinc mines have been worked. In the permit area the phosphorite has been mined for many years and there are at least ten adits old and new, which have accessed the phosphorite and where the local artisanal miners have harvested this material for sale to the local agriculture industry.

Regional Geology Survey with scale of 1:200,000 had been done by Regional Geology Survey Team of Hunan Provincial Geology in 1970’s and Mineral Resources Bureau and Regional Geology Survey Report (in scale of 1:200,000) and Regional Mineral Resources Report have been submitted. The No. 407 Geology Team from Hunan Provincial Geology and Mineral Resources Bureau launched the General Survey for Pb-Zn Mineralization in Upper-Jingzhuxi, Lower-Jingzhuxi inside Tanjiachang mining area and Dabanlin outside of Tanjiachang, etc in 1980s. They drilled five boreholes but the data is unavailable for data collection. Chemical Geology Exploration Institute, Hunan Province had organized early stage big area scouting and field trips in September to October 1992 and chose Jingzhuxi section as the General Geology Survey working area in the year of 1993 which has been defined as Tanjiachang.As the General Geology Survey work moving forward, Tanjiachang Phosphorite Mining Area becomes enlarged step by step and it has been divided into three sections of Jingzhuxi, Gaoping and Wenshuitang.

The following table summarizes the geological works conducted by Chemical Geology Exploration Institute, Hunan Province.

| Item | unit | Quantity | sub-total | Remarks | ||

| 1993 | 1994 | 1995 | ||||

| 1:10000 Geology Mapping | km2 | 10.9 | 10.5 | 10.5 | 31.9 | |

| 1:1000 Onsite Geology Section Mapping | m | 2305 | 2212 | 1,450 | 5,967 | 5 lines |

| Trenching and Logging | m3 | 1,521.3 | 1,200 | 1,125 | 3,846.3 | 47 lines |

| Channel Sampling & Basic Assay | 121 | 126 | 144 | 391 | ||

| Identification of Rock and Minerals | 30 | 22 | 21 | 73 | ||

| Small Weight Sample Testing | 30 | 20 | 25 | 75 | ||

| Basic Chemical Assay | 121 | 126 | 144 | 391 | ||

| Assembly Assay | 6 | 6 | 12 | |||

10

Trenches have been created to disclose the phosphorite ore layers with spacing 400m (mainly 300- 500m) and a total of 47 trenches have been finished with earthwork volume of 3,846.3 m3. The operation of trenches is accurate and the spacing is tried to be placed evenly. All the trenches have demonstrated good surface control effects on ore layers except for TC20 (the surface cover is too thick and it can’t control ore layers) and TC 47 (ore layers are missing due to fault) according to Chemical Geology Exploration Institute, Hunan Province. The trenches and sampling are all following State Code of Original Geology Logging General Principles for Solid Mineral Exploration Registration (china) and data has been logged in time.

Basic assay samples all came from channel sampling of trench projects and the samples are representative and following China State Code and Geology Standard. The scale of channel sampling is 5cm*3cm and the length is mainly 1m, separately sampled from different layers. Totally, 391 samples have been sampled from ore layers and their top and bottom plates. The samples have been prepared in time according with ID, tag, record and onsite logs. Small weight samples have been collected with representative year by year in history and certain related relationship has been detected between density of phosphorite and P2O5 content. In general, the density and grade are with positive correlation. The petrology identification and testing samples are coming during onsite geology section survey to determine the lithology and mineral compositions. Totally, 73 samples have been collected. Based on basic assay results, composite sample has been made on backup samples from selected representatives 12 trenches to determine the useful and harmful components in the ore.

There are at least ten exploration adits driven into favorable locations along the mountain side. The artisans essentially find an outcrop move six to ten meters below the bed and drive into the mountain. Those adits, intersect the phosphorite and are turned into producing mines. By building a chute off the end of the waste pile at the entrance to the adit, the infrastructure for an artisanal mining operation is complete. The transportation infrastructures is completed by building a service road under the chute and loading the phosphorite onto the truck for haulage to the buyer in Chenxi. Contract haulers do the hauling. No drilling has been done on the property. Some exploratory trenching has been done at the various outcrops along the sidehill to test the validity of the above described adit exploration methods. Five samples were collected by Norm Tribe - an independent geologist from the active adits along the strike of the phosphorite bed. The results vary from 19.40%P2O5to 32.86% P2O5. The assays of the samples collected serve to verify the existence and grade of the deposit.

Hunan has a humid, subtropical climate. The monsoon rain falls mostly in April, May, and June. July and August are hot and humid. Annual rainfall is 1,250 - 1,750 millimeters (49.2 to 68.9 inches) in Chenxi and is probably higher at the property due to an increase in elevation. Temperatures are 4oC to 8oC in January and 26oC to 30oC in July. The area is said to have a variety of animals including 70 kinds of mammals, including tigers, bears and macaques, 310 kinds of birds, over 70 kinds of creeping animals and over 160 kinds of fish. The mining permit is in mountainous terrain with steep hill sides forested with native species and some planted pine forest. No wildlife was noted in the area. The valley bottoms are developed into terraced rice paddies. The coincident phosphate deposits which have been cut by the erosion of the steeply incised valleys has rendered these valley bottoms very fertile. Local infrastructure is at a low level but adequate for small mining. The roads are adequate for start up, the population is moderate with a collection of experienced miners available in the area. A moderate level power line passes through the property but would require upgrading for heavy industrial use. Artisanal miners working the property at this time are using readily available trucking contractors, to haul their product to the railhead. Railhead infrastructure is available 58 kilometers away at Chenxi. Water is abundant in the valley bottoms but will require some infrastructure to accommodate the mining. Telecommunication is very good. Cellular phone can be accessed in the property area. Transportation is good and truck can arrive in the property area.

As of May 31, 2015, the Company has incurred mineral property costs of $1,074,701 on the Gaoping Phosphate property.

ITEM 3. LEGAL PROCEEDINGS

None.

ITEM 4. MINE SAFETY DISCLOSURES

None.

11

PART II

ITEM 5. MARKET FOR THE REGISTRANT'S COMMON EQUITY, RELATED STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

Common Stock

Our common stock is traded on the OTCQB Marketplace under the symbol "SGGV". The table below sets forth the high and low sales prices for the Company's common stock for the fiscal years ended May 31, 2014 & 2015. The quotations below reflect inter-dealer prices, without retail markup, markdown or commission and may not represent actual transactions.

| Quarter Ended | High ($) | Low ($) |

| August 31, 2013 | 0.09 | 0.06 |

| November 30, 2013 | 0.13 | 0.07 |

| February 28, 2014 | 0.08 | 0.03 |

| May 31, 2014 | 0.08 | 0.03 |

| August 31, 2014 | 0.06 | 0.02 |

| November 30, 2014 | 0.02 | 0.01 |

| February 28, 2015 | 0.02 | 0.01 |

| May 31, 2015 | 0.03 | 0.01 |

Pacific Stock Transfer Company is the registrar and transfer agent for our common shares, and is located at 6725 Via Austi Pkwy, Suite 300 Las Vegas, NV 89119 (Telephone: (702) 361-3033; Facsimile: (702) 433-1979).

On August 26, 2015, we had 75,730,341 shares of common stock outstanding and we had approximately 50 stockholders of record plus common shares held by brokerage clearing houses, depositories or other entity.

Dividend Policy

We currently intend to retain all future earnings to fund the development and growth of our business. We have not paid dividends on our common stock and do not anticipate paying cash dividends in the immediate future. We did not repurchase any of our equity securities and have not adopted a stock repurchase program.

Recent Sales of Unregistered Securities

None

Equity Compensation Plan Information

On February 3, 2004, the Board of Directors of the Company approved the 2004 Stock Option Plan, which was also approved at the Company’s Annual Meeting of Shareholders on January 17, 2005, and registered on May 12, 2004. Pursuant to the stock option plan, the number of shares that may be issued under the plan may not exceed 15% of the issued and outstanding shares of the company. As of May 31, 2015, 15% of the issued and outstanding shares of the Company were 11,359,551.

On April 27, 2011, the Company granted 4,700,000 stock options to directors, officers and consultants at an exercise price of $0.25 each expiring on February 3, 2019. The options were vested immediately.

On November 3, 2011, the Company granted 500,000 stock options to a consultant at an exercise price of $0.25 each expiring on February 3, 2019. The options were vested immediately.

12

At May 31, 2015, there were 5,200,000 stock options outstanding with an exercise price at $0.25 each expiring on February 3, 2019. The option plan was approved by the shareholders of the Company.

| Number of securities to be issued upon exercise of outstanding options |

Weighted-average exercise price of outstanding options |

Number of securities remaining available for future issuance under equity compensation plans |

| 5,200,000 | $0.25 | 6,159,551 |

Share Purchase Warrants

As of May 31, 2015, the Company has a total of 3,817,500 and 20,752,500 Series "A" and "D" share purchase warrants outstanding, respectively.

Each Series “A” warrant entitles the holder thereof the right to purchase one common share at $0.50 per share expiring on the earlier of:

| 1) |

February 17, 2015; or |

| 2) |

The 30th day after the day on which the weighted average trading price of the Company's shares exceeds $0.80 per share for 20 consecutive trading days. |

Upon exercise of the Series "A" Share Purchase Warrant at $0.50 each, the holder will receive one Common Share of the Company and a Series "B" Share Purchase Warrant exercisable at $1.00 expiring one year after the occurrence of either (1) or (2) as described above.

On February 10, 2015, the Company re-extended the expiry date of 3,817,500 Series "A" share purchase warrants from February 17, 2015 to the earlier of February 17, 2017 or the close of business on the 30th day after a takeover bid for the Company's issued and outstanding share capital has been made by a third party and approved by the shareholders of the Company. Upon exercise of the Series "A" Share Purchase Warrants at $0.50 each, the holder will receive one Common Share of the Company and a Series "B" Share Purchase Warrant exercisable at $1.00 for another year.

On February 10, 2015, the Company re-extended the expiry date of the 20,752,500 Series "D" Share Purchase Warrants (the "D" Warrants) from February 17, 2015 to the earlier of February 17, 2017 or the close of business on the 30th day after a takeover bid for the Company's issued and outstanding share capital has been made by a third party and approved by the shareholders of the Company. The exercise price of the "D" Warrants remains unchanged at $0.15 per share.

ITEM 6. SELECTED FINANCIAL DATA

Not applicable.

ITEM 7. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Introduction

The information presented here should be read in conjunction with Sterling Group Venture Inc.'s financial statements and other information included in this Form 10-K. When used in this Form 10-K, the words "expects," "anticipates," "estimates" and similar expressions are intended to identify forward-looking statements. Such statements are subject to risks and uncertainties, including those set forth below under "Risks and Uncertainties," that could cause actual results to differ materially from those projected. These forward-looking statements speak only as of the date hereof. The Company expressly disclaims any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in the Company's expectations with regard thereto or any change in events, conditions or circumstances on which any statement is based. .

Overview

Sterling is a mining company, and its objective is to become a recognized leader in mineral property acquisition, exploration, development and production.

13

On October 18, 2010, Sterling signed two agreements (the "Agreements") with Chenxi County Hongyu Mining Co. Ltd. ("Hongyu") and its shareholders ("Hongyu Shareholders") regarding the Gaoping phosphate mine (the "GP Property") located in Tanjiachang village, Chenxi County, Hunan Province, China and other phosphate resources in Hunan Province. Hongyu holds a business license and a mining permit in the GP Property which is in effect until November 10, 2014 and covers 42.5 hectares. On April 29, 2015, Hongyu obtained the renewal of the mining permit, which is valid until April 2, 2018.

The Agreements required an investment company to be incorporated in Hong Kong (the "Investment Company") which is to be owned 20% by the Hongyu Shareholders and 80% by Sterling. On October 13, 2010, the Investment Company was incorporated in Hong Kong under the name Silver Castle Investments Ltd. ("Silver Castle"). Silver Castle acquired 90% of Hongyu with the other 10% of Hongyu transferred to the nominees of Sterling. Upon completion of this acquisition, Hongyu became a Hong Kong / China joint venture company. Sterling received all required approvals from Chinese authorities for the completion of its acquisition of Hongyu pursuant to the Agreements dated October 18, 2010. Sterling paid a total RMB 2,000,000 ($310,438) to the Hongyu Shareholders with RMB 200,000 (US$30,934) paid as down payment on December 14, 2010 and the remaining RMB1,800,000 ($279,504) paid on July 8, 2011 for completion of the transaction.

Pursuant to the Agreements, Hongyu agreed to surrender its future exclusive cooperative rights to Sterling, and the Hongyu Shareholders agreed that Sterling shall have all Hongyu's title and interest in any phosphate properties, including but not limited to the GP Property, and Sterling should arrange for the financing of building a mining and processing plant on the GP Property together with other facilities required for a mining operation thereon.

When requested by Sterling, the Hongyu Shareholders agreed to sell their 20% interest in the Investment Company to Sterling for the issuance of 10,000,000 common shares of Sterling’s capital stock. On July 5, 2011, Sterling issued 10,000,000 shares to the Hongyu Shareholders with the closing market price of the shares at $0.22 for acquiring the remaining 20% equity interest in Silver Castle from the Hongyu Shareholders. As a result of this transaction, Sterling effectively controls 100% of Hongyu through its wholly owned subsidiary, Silver Castle Investments Ltd. which holds 90% of Hongyu with the other 10% held by the nominees of Sterling.

Sterling through its subsidiary company, Silver Castle Investments Ltd., also signed a letter of intent for a larger area known as Tanjiachang Exploration Concession with Chenxi County Merchants Bureau, Hunan Province, China. Tanjiachang Exploration Concession is surrounding the Gaoping Mining permit.

As mining license was obtained for the Gaoping Phosphate Property and a Chinese engineering report was completed, Hongyu is making progress on this property as follows. On February 13, 2012, Hongyu received approval for installing the power line for the Gaoping Phosphate Property. Hongyu also reached understanding for land rental with local village committee on March 17, 2012. Hongyu signed and completed land rental agreement with each family in the mining area on March 27, 2012. On April 1, 2012, Hongyu also received conditional safety approval from Supervision and Management Bureau for Safety Operation of Chenxi County and the project is essentially ready to begin production on a small scale basis to be further ramped up as the development and production plan takes effect. On April 22, 2012, Hongyu signed a mining agreement with the mining contractor, Yichang Rongchang Mining Co. Ltd., to be the operator of the mining and production activities on the project. On June 16, 2012, Hongyu completed power line construction. On July 19, 2012, Hongyu received the explosive operation permit. Accommodation for mining people has been built. An onsite office and accommodation for workers and mining management are complete. The water supply for the mining operation and living quarters is connected to the site. The road to the mining site has been completed. Three adits have been dug and they will be used to access the phosphorite along its strike length.

As a substantial decrease of phosphate rock and phosphate fertilizer market pricing has occurred, Hongyu has halted further exploration and development since August 2013 until the world market prices rebound.

The Company will monitor the production and marketing with the goal of increasing production and sales over time in a measured and economically viable manner. Currently due the downturn in world market prices for phosphate rock and concentrate, the Company has decided to curtail the stockpiling of phosphate rock until world prices and world sales increase. Such an action preserves the phosphate rock in situ and saves operating capital while world prices of phosphate rock are in a depressed state.

Hongyu applied to local government for halting further development until market rebound. Hongyu received the approval for such application from Supervision and Management Bureau for Safety Operation of Chenxi County on February 26, 2014.

14

Results of Operations

The Company had no operating revenue except interest income of $21,017 for the year ended May 31, 2015 compared with interest income of $8,124 and other income of $6,015 from sale of phosphate rock extracted during the work done for the preparation of production for the year ended May 31, 2014. The comprehensive loss decreased to $370,332 for the year ended May 31, 2015, as compared to $397,306 for the year ended May 31, 2014 mainly due to the decreased mineral property cost of $153,538 which offset the non-cash stock-based compensation expenses of $107,006 for year ended May 31, 2015 due to the extension of Series "A" and "D" warrants.

Finance expense increased by $107,006 for the year ended May 31, 2015 when compared to the year ended May 31, 2014. This mainly related to the stock-based compensation increasing to $107,006 in the year ended May 31, 2015 compared with stock-based compensation of $Nil in the year ended May 31, 2014. The stock-based compensation arose due to the extension of share purchase warrants during the year ended May 31, 2015.

Accounting, audit, legal and professional fees decreased by $2,206 for the year ended May 31, 2015 when compared to the year ended May 31, 2014.

Foreign exchange gain increased by $36,056 for the year ended May 31, 2015 when compared to the year ended May 31, 2014, because of the exchange rate fluctuation among US dollar, Canadian dollar and RMB.

Mineral property costs decreased by $84,003 for the year ended May 31, 2015 when compared to the year ended May 31, 2014, because developing the Gaoping phosphate property and building the mining facility was paused during the period ended May 31, 2015 due to ongoing challenges on the phosphate market.

The Company expects the trend of losses to continue until we can achieve commercial production at the Gaoping phosphate project, of which there can be no assurance as described in Risk Factors.

Liquidity and Working Capital

As of May 31, 2015 the Company had total current assets of $1,445,871, and total current liabilities of $420,973. As of May 31, 2015, the Company had cash of $1,433,109 and working capital of $1,024,898. A balance of approximately $1,233,000 of cash is held on deposit in China as at May 31, 2015. As well, the Company has the ability to repatriate its cash held on deposit in China.

Cash used in operating activities for the year ended May 31, 2015 was $204,966 as compared with $345,529 for the year ended May 31, 2014. The decrease in cash used in operating activities for the year ended May 31, 2015 was primarily due to the decrease of mineral property cost.

The Company has no other capital resources other than the ability to use its common stock to raise additional capital or the exercise of the warrants by the unit holders. If all warrants outstanding are exercised, the Company will receive approximately $5 million in cash. The Company's current cash can meet its needs for at least the next 12 months. The cash will be mainly used for mining property exploration and development, general administrative, corporate (accounting, audit, and legal), financing and management.

No other commitments to provide additional funds have been made by management or other stockholders except as set forth above. Accordingly, there can be no assurance that any additional funds will be available to the Company to allow it to cover operation expenses. This raises substantial doubt that the Company will be able to continue as a going concern. In order to continue as a going concern, we require additional financing.

Off-Balance Sheet Arrangements

As of May 31, 2015, we were not involved in any form of off-balance sheet arrangement.

Application of Critical Accounting Policies

Our consolidated financial statements are prepared in accordance with accounting principles generally accepted in the United States. The preparation of these financial statements requires that we make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenue and expenses during the reporting period. We base our estimates on historical experience and on various other assumptions that we believe to be reasonable under the circumstances. We evaluate our estimates and assumptions on an ongoing basis. Our actual results may differ significantly from these estimates under different assumptions or conditions. There have been no material changes to these estimates for the periods presented in this report.

15

We believe that of our significant accounting policies, which are described in Note 2 to our annual financial statements, the following accounting policies involve a greater degree of judgment and complexity. Accordingly, the following policies are the most critical to aid in fully understanding and evaluating our financial condition and results of operations.

Mineral Property Costs

Costs of acquiring mineral properties are capitalized by the project area. Costs to maintain mineral rights and leases are expensed as incurred. When a property reaches the production state, the related capitalized costs are amortized using the unit of production method on the basis of annual estimates of ore reserves. The Company does not consider a resource property to be at the development stage until such time as either mineral reserve are proven or permits to operate the mineral resource property are received and financing to complete the development has been obtained. Development expenditures incurred subsequent to a development decision, and to increase or to extend the life of existing production, are capitalized and amortized on the unit of production method based upon estimated proven and probable reserves or resources.

Management reviews the carrying value of mineral properties at least annually and will recognize impairment in value based upon current exploration results, and any impairment or subsequent losses are charged to operations at the time of impairment. If a property is abandoned or sold, its capitalized costs are charged to operations. Mineral property exploration costs are expensed as incurred. Exploration activities conducted jointly with others are reflected at the Company's proportionate interest in such activities. As at May 31, 2015 and 2014, the Company did not have proven or probable ore reserves.

Stock-based Compensation

On June 1, 2006, the Company accounts for stock-based compensation in accordance with ASC Topic 718-10, Compensation - Stock Compensation – Overall.

In accordance with ASC 718-10, the compensation expense is amortized on a straight- line basis over the requisite service period which approximates the vesting period. ASC Topic 718-10 requires excess tax benefits to be reported as a financing cash inflow rather than as a reduction of taxes paid. The Company has elected to use the Black-Scholes option pricing model to determine the fair value of options and the extension of the expiry date of share purchase warrants previously granted. The Company has estimated the fair value of share purchase warrants and options for the years ended May 31, 2015 and 2014 using the assumptions more fully described in Note 6 (c) to the financial statements.

Foreign Currency Translation

Our functional and reporting currency is U.S. dollars. Our consolidated financial statements are translated to U.S. dollars in accordance with ASC 830, “Foreign Currency Matters”. Monetary assets and liabilities denominated in foreign currencies are translated using the exchange rate prevailing at the balance sheet date. Gains and losses arising on translation or settlement of foreign currency denominated transactions or balances are included in the determination of income. We have not, to the date of these consolidated financial statements, entered into derivative instruments to offset the impact of foreign currency fluctuations.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenditures during the reporting period. Actual results could differ from these estimates.

Going Concern

The Company's financial statements have been prepared on a going concern basis which assumes that adequate sources of financing will be obtained as required, and that our assets will be realized and liabilities settled in the ordinary course of business. These consolidated financial statements do not include any adjustments related to the recoverability of assets and classification of assets and liabilities that might be necessary if we are unable to continue as a going concern.

16

In order to continue as a going concern, we require additional financing. There can be no assurance that additional financing will be available to us when needed or, if available, that it can be obtained on commercially reasonable terms. If we are not able to continue as a going concern, we would likely be unable to realize the carrying value of our assets reflected in the balances set out in the preparation of the consolidated financial statements.

At May 31, 2015, the Company had not yet achieved profitable operations and has accumulated losses of $7,229,917 since its inception and expects to incur further losses in the development of its business, all of which casts substantial doubt about the Company's ability to continue as a going concern. The Company's ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that the Company will be able to obtain additional funds by equity financing and/or related party advances, however there is no assurance of additional funding being available.

Sterling is involved in the development of Phosphate in Hunan, China. The projects are not yet commercial and have not reached profitability.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

In addition to the U.S. Dollar, we conduct our business in Chinese Yuan (RMB) and Canadian Dollar and, therefore, are subject to foreign currency exchange risk on cash flows related to expenses and investing transactions. In July 2005, the Chinese government began to permit the Chinese Yuan to float against the U.S. Dollar. All of our costs to operate our Chinese project are paid in Chinese Yuan and all of our costs to operate our principal executive office in Canada are paid in Canadian dollar. Our exploration costs in China may be incurred under contracts denominated in Chinese Yuan or U.S. Dollars. If the Chinese Yuan continues to appreciate with respect to the U.S. Dollar, our costs in China may increase. If the Canadian Dollar continues to appreciate with respect to the U.S. Dollar, our costs in Canada may increase and vice versa. To date we have not engaged in hedging activities to hedge our foreign currency exposure. In the future, we may enter into hedging instruments to manage our foreign currency exchange risk or continue to be subject to exchange rate risk. If the exchange rate increased by 10% , it is estimated that our costs would have been approximately $28,000 lower in the year ended May 31, 2015. If the exchange rate were 10% lower during the fiscal year, our costs would increase by approximately $34,000.

Although inflation has not materially impacted our operations in the recent past, increased inflation in China or Canada could have a negative impact on our operating and general and administrative expenses, as these costs could increase. China has recently experienced inflationary pressures, which could increase our costs associated with our operations in China. If there are material changes in our costs, we may seek to raise additional funds earlier than anticipated.

ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

17

|

Tel: 604 688 5421 | BDO Canada LLP |

| Fax: 604 688 5132 | 600 Cathedral Place | |

| www.bdo.ca | 925 West Georgia Street | |

| Vancouver BC V6C 3L2 Canada |

| Report of Independent Registered Public Accounting Firm |

To the Stockholders of Sterling Group Ventures, Inc.

We have audited the accompanying consolidated balance sheets of Sterling Group Ventures, Inc. (the "Company") and its subsidiaries as of May 31, 2015 and 2014, and the related consolidated statements of operations, changes in stockholders' equity and cash flows for the years then ended. These financial statements are the responsibility of the Company's management. Our responsibility is to express an opinion on these financial statements based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. The Company is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Company's internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of Sterling Group Ventures, Inc. and its subsidiaries as of May 31, 2015 and 2014, and the results of its operations and its cash flows for the years then ended, in conformity with accounting principles generally accepted in the United States.

The accompanying financial statements have been prepared assuming that the Company will continue as a going concern. As discussed in Note 1 to the consolidated financial statements, the Company has incurred a net loss of $370,332 during the year ended May 31, 2015 and has a cumulative deficit of $7,229,917 and expects to incur further losses in the development of its business. These factors, along with other matters as set forth in Note 1, raise substantial doubt about the Company's ability to continue as a going concern. The financial statements do not include any adjustments that might result from the outcome of this uncertainty.

/s/ "BDO Canada LLP"

Chartered Professional Accountants

August 27, 2015

Vancouver, BC Canada

BDO Canada LLP, a Canadian limited liability partnership, is a member of BDO International Limited, a UK company limited by guarantee, and forms part of the international BDO network of independent member firms.

18

STERLING GROUP VENTURES, INC.

CONSOLIDATED BALANCE

SHEETS

May 31, 2015 and 2014

| Stated in U.S. dollars | May 31, 2015 | May 31, 2014 | ||||

| ASSETS | ||||||

| Current Assets | ||||||

| Cash and cash equivalents | $ | 1,433,109 | $ | 1,673,448 | ||

| GST receivable | 4,888 | 20,116 | ||||

| Prepaid expenses and other receivable | 7,874 | 9,163 | ||||

| Total current assets | 1,445,871 | 1,702,727 | ||||

| Equipment - Note 4 | 108,309 | 151,397 | ||||

| Environmental deposit - Note 3(a) | 127,393 | 126,366 | ||||

| Mineral Properties - Note 3(a) | 3,148,740 | 3,148,740 | ||||

| Total Assets | $ | 4,830,313 | $ | 5,129,230 | ||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||

| Current Liabilities | ||||||

| Accounts payable and other accrued liabilities - Note 5 | $ | 420,973 | $ | 456,564 | ||

| Deferred income tax liability | 732,687 | 732,687 | ||||

| Total Liabilities | 1,153,660 | 1,189,251 | ||||

| Stockholders' Equity | ||||||

| Common Stock : $0.001 Par

Value - Note 6 Authorized : 500,000,000 Issued and Outstanding : 75,730,341 (May 31, 2014: 75,730,341) |

75,730 | 75,730 | ||||

| Additional Paid In Capital - Note 6 | 10,831,422 | 10,724,416 | ||||

| Accumulated Other Comprehensive Loss | (582 | ) | (582 | ) | ||

| Accumulated deficit | (7,229,917 | ) | (6,859,585 | ) | ||

| Total Stockholders' Equity | 3,676,653 | 3,939,979 | ||||

| Total Liabilities and Stockholders' Equity | $ | 4,830,313 | $ | 5,129,230 |

See accompanying notes to consolidated financial statements

19

STERLING GROUP VENTURES, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS

For the years ended May 31, 2015 and

2014

| Year ended May 31, | ||||||

| Stated in U.S. dollars | 2015 | 2014 | ||||

| Expenses | ||||||

| Accounting, audit, legal and professional fees | $ | 76,334 | $ | 78,540 | ||

| Bank charges | 636 | 401 | ||||

| Consulting fees - Notes 5 | 22,750 | 24,477 | ||||

| Depreciation - Note 4 | 44,777 | 46,111 | ||||

| Filing fees and transfer agent | 9,752 | 11,146 | ||||

| General and administrative | 1,161 | 2,058 | ||||

| Mineral property costs - Note 3 | 153,538 | 237,541 | ||||

| Shareholder information and investor relations | 8,359 | 7,374 | ||||

| Travel and entertainment | - | 705 | ||||

| (317,307 | ) | (408,353 | ) | |||

| Other items | ||||||

| Interest income | 21,017 | 8,124 | ||||

| Finance expense - Note 6 (c) | (107,006 | ) | - | |||

| Foreign exchange gain(loss) | 32,964 | (3,092 | ) | |||

| Other income - Note 3(a) | - | 6,015 | ||||

| (53,025 | ) | 11,047 | ||||

| Net loss and Comprehensive loss for the year | $ | (370,332 | ) | $ | (397,306 | ) |

| Basic and diluted loss per share | $ | (0.00 | ) | $ | (0.01 | ) |

| Weighted average number of shares outstanding | 75,730,341 | 75,730,341 | ||||

See accompanying notes to consolidated financial statements

20

STERLING GROUP VENTURES, INC.

CONSOLIDATED

STATEMENT OF CHANGES IN STOCKHOLDERS' EQUITY

For the years ended May

31, 2015 and 2014

| Deficit | ||||||||||||||||||

| Accumulated | Accumulated | |||||||||||||||||

| Stock | Additional | Other | During The | |||||||||||||||

| Common | Amount At | Paid In | Comprehensive | Exploration | ||||||||||||||

| Stated in U.S. dollars | Shares | Par Value | Capital | Loss | Stage | Total | ||||||||||||

| Balance, May 31, 2013 | 75,730,341 | $ | 75,730 | $ | 10,724,416 | $ | (582 | ) | $ | (6,462,279 | ) | $ | 4,337,285 | |||||

| Net loss for the year | - | - | - | - | (397,306 | ) | (397,306 | ) | ||||||||||

| Balance, May 31, 2014 | 75,730,341 | $ | 75,730 | $ | 10,724,416 | $ | (582 | ) | $ | (6,859,585 | ) | $ | 3,939,979 | |||||

| Revaluation of share purchase warrants | - | - | 107,006 | - | - | 107,006 | ||||||||||||

| Net loss for the year | - | - | - | - | (370,332 | ) | (370,332 | ) | ||||||||||

| Balance, May 31, 2015 | 75,730,341 | $ | 75,730 | $ | 10,831,422 | $ | (582 | ) | $ | (7,229,917 | ) | $ | 3,676,653 |

See accompanying notes to consolidated financial statements

21

STERLING GROUP VENTURES, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

For the years ended May 31, 2015 and

2014

| Year ended May 31, | ||||||

| Stated in U.S. dollars | 2015 | 2014 | ||||

| Cash flows from operating activities | ||||||

| Net loss for the year | $ | (370,332 | ) | $ | (397,306 | ) |

| Adjustments to

reconcile net loss to net cash used in operating activities |

||||||

| Depreciation | 44,777 | 46,111 | ||||

| Stock based compensation | 107,006 | - | ||||

| Foreign exchange | (2,388 | ) | 5,070 | |||

| Changes in non-cash working capital items | ||||||

| GST receivable | 15,228 | (6,169 | ) | |||

| Prepaid expenses and other receivable | 1,358 | 15,202 | ||||

| Accounts payable and accrued liabilities | (615 | ) | (8,437 | ) | ||

| Net cash used in operating activities | (204,966 | ) | (345,529 | ) | ||

| Cash flows from investing activities | ||||||

| Additions to equipment | (397 | ) | (3,895 | ) | ||

| Net cash used in investing activities | (397 | ) | (3,895 | ) | ||

| Cash flows from financing activities | ||||||

| Amounts (repaid to) a director | (34,976 | ) | (13,933 | ) | ||

| Net cash used in financing activities | (34,976 | ) | (13,933 | ) | ||

| Net decrease in cash and cash equivalents | (240,339 | ) | (363,357 | ) | ||

| Cash and cash equivalents - beginning of the year | 1,673,448 | 2,036,805 | ||||

| Cash and cash equivalents - end of the year | $ | 1,433,109 | $ | 1,673,448 | ||

| Supplemental Information : | ||||||

| Cash paid for : | ||||||

| Interest | $ | - | $ | - | ||

| Income taxes | $ | - | $ | - | ||

See accompanying notes to consolidated financial statements

22

Sterling Group Ventures, Inc.

Notes to Consolidated

Financial Statements

May 31, 2015

(Stated in US Dollars)

| Note 1 | Nature of Operations and Ability to Continue as a Going Concern |

Sterling Group Ventures, Inc. was incorporated in the State of Nevada on September 13, 2001 and its fiscal year-end is May 31. On January 20, 2004, the Company acquired all of the issued and outstanding shares of Micro Express Ltd. (“Micro”), which was incorporated on July 27, 1994. The business combination was accounted for as a reverse acquisition whereby the purchase method of accounting was used with Micro being the accounting acquirer and the Company being the accounting subsidiary.

Sterling Group Ventures, Inc. (the “Company”) is in the exploration stage. The Company has entered into joint venture agreements to explore and develop mineral properties located in China and has not yet determined whether these properties contain reserves that are economically recoverable. The recoverability of amounts from these properties will be dependent upon the discovery of economically recoverable reserves, the ability of the Company to obtain necessary financing to satisfy the expenditure requirements under the joint venture agreements and to complete the development of the properties and upon future profitable production or proceeds from the sale thereof.

These consolidated financial statements have been prepared in accordance with generally accepted accounting principles applicable to a going concern, which assumes that the Company will be able to meet its obligations and continue its operations for its next fiscal year. Realization values may be substantially different from carrying values as shown as these financial statements do not give effect to adjustments that would be necessary to the carrying values and classification of assets and liabilities should the Company be unable to continue as a going concern. The Company incurred a net loss of $370,332 during the year ended May 31, 2015 and, as at that date, had a cumulative loss of $7,229,917 since its inception and expects to incur further losses in the development of its business, all of which casts substantial doubt about the Company’s ability to continue as a going concern. The Company’s ability to continue as a going concern is dependent upon its ability to generate future profitable operations and/or to obtain the necessary financing to meet its obligations and repay its liabilities arising from normal business operations when they come due. Management has no formal plan in place to address this concern but considers that the Company will be able to obtain additional funds by equity financing and/or related party advances; however there is no assurance of additional funding being available.