CONFIDENTIAL

Paul O’Connor

Managing Director

312-269-0346

paul.oconnor@ryanbeck.com

December 9, 2004

Fairness Review

For Nicolet Bankshares, Inc.

Private and Confidential

The attached materials have been compiled and prepared by Ryan Beck & Co., Inc. solely for

the use and information of the board of directors and management of Nicolet Bankshares, Inc.

Such materials are not intended for viewing by any other person or party for any purpose, and

no such review should be undertaken without the prior written consent of Ryan Beck & Co., Inc.

through one or more of its authorized officers.

Portions of the information contained herein are not publicly available and are not intended for

public dissemination. The public disclosure or personal use of such information may be

actionable under applicable federal and/or state securities laws.

Table of Contents

Page 3

1.

Transaction Summary

2.

Nicolet Bankshares, Inc. Overview

3.

Valuation of Nicolet Bankshares, Inc.

n

Discounted Dividend Analysis

n

Peer Group Comparison

4.

Control Premium Valuation

5.

Repurchase Analysis

6.

Conclusion

7.

Ryan Beck Relationship

8.

Fairness Opinion Letter

Tab 1

Transaction Summary

Nicolet Bankshares, Inc. (“NBIC” or “Nicolet”) has engaged Ryan Beck & Co. to

assist it in de-registering from the SEC. NBIC intends to de-register from the SEC

due to the costs associated with SEC filing requirements and Sarbanes Oxley.

Additionally, being a registered company has brought very limited benefit to NBIC

relative to the trading in its stock. It is management’s assessment that Nicolet can

serve its customers and enhance its returns to shareholders better without the

burdens placed upon it by the SEC.

Nicolet management realizes that its projected asset growth rate may require it to

raise additional capital in the future. If additional capital is needed, management

has determined that it will first raise trust preferred capital and then, if necessary,

common equity through a private placement with existing shareholders.

NBIC is represented by Powell Goldstein Frazer & Murphy LLP, Atlanta, Georgia,

and Ryan Beck is represented by Pitney Hardin.

Page 5

Transaction Summary

The objective will be accomplished by using a cash-out merger to reduce the number of

current shareholders to below 300 (the “Transaction”).

NBIC has requested our opinion as investment bankers of the fair value of

233,229 shares, the amount to be repurchased as part of the cash-out merger, of

Nicolet Bankshares, Inc. common stock. The number of shares to be eliminated

through the Transaction is equal to approximately 8.0% of the outstanding

shares. The consummation of the Transaction will reduce Nicolet’s shareholder

base by 266 shareholders, a 53.0% reduction in the number of current

shareholders. The Transaction will target shareholders owning less than 1,500

shares.

The fair value range that we provide will be used by Nicolet’s Board of Directors

to support their determination of an offer price for its shareholders that will be

cashed-out as a result of the Transaction.

We believe we have followed the court rulings for determining fair value to arrive

at our range. However, courts have not provided a precise formula. It is

ultimately the responsibility of the board to set the cash-out merger price.

Page 6

Transaction Summary

Page 7

Transaction Summary

We have been advised by Nicolet’s Wisconsin counsel, Liebman, Conway,

Olejniczak & Jerry S.C. (“Liebman”), that Nicolet shareholders are entitled to

statutory dissenters rights under the cash-out merger plan. According to

Liebman, under Chapter 180, subchapter XIII, a shareholder may dissent from

and obtain payment of the “fair value” of his or her shares in the event of

certain corporate actions.

Liebman stated that “Fair Value” is defined in Section 180.1301(4), Wisconsin

Statutes as:

“Fair Value,” with respect to a dissenter’s shares other than a business

combination, means the value of the shares immediately before the effectuation

of the control action to which the dissenter objects, excluding any appreciation

or depreciation in anticipation of the corporate action unless exclusion would be

inequitable. “Fair Value,” with respect to a dissenter’s shares in a business

combination means market value, as define in Section 180.1130(9)(a)1-4.”

According to Liebman, Section 180.1130(9)(a)4, Wisconsin Statutes provides

that with regard to shares that are not listed on an exchange or quoted on a

quotation system, as is the case with Nicolet, market value means: “… fair

market value as determined in good faith by the Board of Directors of the

resident domestic corporation.”

Since the Transaction is not voluntary, the valuation criteria must reflect the

June 2000 decision by the Wisconsin Supreme Court in the JMO-W Inc. v.

SSM Healthcare Systems case. The Supreme Court of Wisconsin ruled that

“Where there is no objective market data available, the appraisal process is

not intended to reconstruct the pro forma sale, but to assume that the

shareholder was willing to maintain his investment position, however slight,

had the merger not occurred… To fail to accord to a minority shareholder the

full proportionate value of his shares imposes a penalty for lack of control, and

unfairly enriches the majority shareholders who may reap a windfall from the

appraisal process by cashing out a dissenting shareholder, a clearly

undesirable result.”

Transaction Summary

Page 8

As part of our analysis, we asked Nicolet’s Wisconsin legal counsel whether

Wisconsin Statutes and/or Wisconsin published court decisions specifically

addresses the applicability of a control premium in connection with the

determination of fair value under Wisconsin law. According to Nicolet’s

Wisconsin legal counsel, it has conducted a cursory review of Wisconsin

statutes and published Wisconsin Court decisions and found no Wisconsin

Statute or published Wisconsin Court decision that addresses the applicability

of a control premium with respect to fair value. We have prepared our fair

value valuation assuming a control premium but not an acquisition premium.

Transaction Summary

Page 9

As part of the valuation process, Ryan Beck has:

Performed a thorough due diligence of the company to identify the company’s

strengths/weaknesses and future prospects.

Discussed with management the financial condition, businesses, assets, earnings

and management’s views about the future performance of the company.

Reviewed certain publicly available financial information, both audited and

unaudited, as well as other internally generated financial reports.

Reviewed certain financial forecasts and projections of Nicolet Bankshares

prepared by its management.

Reviewed certain information about the market prices and trading history of the

common stock of Nicolet Bankshares.

Reviewed certain aspects of the financial performance of Nicolet Bankshares and

compared it to similar available financial and stock trading data for a peer group of

selected financial institutions.

Reviewed the terms and conditions of the plan to reduce the number of

shareholders to below 300.

Page 10

Transaction Summary

The entire cost of this transaction will be financed with senior debt. The cost

of the debt is estimated at the three year forward rate for one-month LIBOR

(4.40%) plus 200 bps equaling 6.40%. There is no agreed upon repayment

schedule, however management has indicated that they will pay down the

debt based upon the level of excess cash generated from year to year.

One-time expenses have been estimated and included in the total cost of the

cash-out merger. They are summarized as follows:

Legal: $35,000

Accounting: $5,000

Ryan Beck: $75,000

Printing: $5,000

Other: $5,000

Total: $125,000

Page 11

Transaction Summary

Page 12

Transaction Summary

Nicolet Bankshares has provided an estimated range of cost savings related

to the de-registration of their securities with $400,000 being at the low end and

$700,000 being at the high end. We have chosen to include the low end of

that range to be conservative in our analysis.

By factoring in a control premium to the fair market value of Nicolet common

stock, we were able to determine a fair value range of $17.25 to $18.75 per

share. The last traded price was $15.00 per share. As previously stated,

Nicolet does not trade on any exchange, the OTC Bulletin Board or the Pink

Sheets. Management has kept a record of trades of which it is aware. During

the last twelve months, 25,660 shares (0.87% of outstanding shares) have

traded. All shares have been exchanged at $15.00 per share.

Transaction Summary

(1) Based on the closing share price of $15.00 on November 30th, 2004, the last trade date.

Page 13

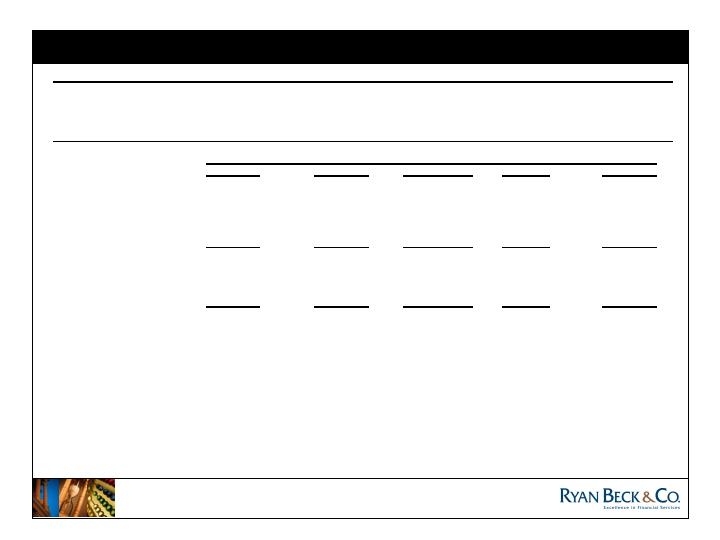

Transaction Valuation Summary

(dollars in thousands except per share data)

Repurchase Amount:

7.89%

(as a % of shares outstanding)

Current

(1)

15.00%

20.00%

25.00%

Nicolet Bankshares Repurchase Price

$15.00

$17.25

$18.00

$18.75

Cost of Repurchase

$4,148

$4,323

$4,498

Shares Repurchased

233

233

233

Price/ 2005 Diluted Est. EPS

15.0x

15.5x

16.2x

16.9x

EPS Accretion

11.09%

10.93%

10.77%

Price/ Book Value

133.56%

161.68%

169.73%

177.87%

Price/ Tangible Book Value

134.77%

163.35%

171.49%

179.74%

Tangible Equity/ Assets

8.81%

7.68%

7.64%

7.60%

Leverage Ratio

10.91%

8.03%

7.99%

7.94%

Tier 1 Risk-Based Capital Ratio

12.38%

11.08%

11.03%

10.98%

Total Risk-Based Capital Ratio

13.57%

12.21%

12.16%

12.11%

ROAE (based on 2005 net income)

9.24%

10.84%

10.89%

10.94%

Premium to Last Trade

Tab 2

Nicolet Bankshares, Inc. Overview

Corporate Summary

Page 15

Nicolet Bankshares, Inc.

http://www.nicoletbank.com/

Bank

Green Bay, WI

Number of Branches

2

States of Operation

WI(2)

Pricing

11/30/04 Closing Price

$15.00

Insider Ownership

40.60%

Market Capitalization

$44MM

Institutional Ownership

0.00%

LTM Price Range

NA

Retail Ownership

59.40%

Current Dividend Yield

0.00%

Top 5 Institutional Holders

Quarterly Dividend Rate

$0.000

LTM Dividend Payout Ratio

0.00%

Price/2004E EPS

30.00x

Price/LTM EPS

41.66x

Price/Book

133.56%

Price/Tangible Book

134.77%

Balance Sheet

Profitability - LTM

Asset Quality

Net Loans

$296,967

Return on Assets

0.31%

NPLs/Loans

0.33%

Investment Securities

32,760

Return on Equity

3.25%

Reserve/NPLs

373.63%

Total Intangible Assets

298

Net Interest Margin

2.91%

Reserves/Loans

1.22%

Total Assets

373,673

Non Interest Income/Tot Rev

24.69%

NPAs/Assets

0.28%

Efficiency Ratio

64.57%

Deposits

326,697

Yield on Int Earn Assets

NA

Balance Sheet Ratios

Borrowings

11,419

Cost of Int Bear Liabilities

NA

Equity/Assets

8.89%

Total Liabilities

339,957

Yield/Cost Spread

NA

Tangible Equity/Assets

8.82%

Intangibles/Equity

0.90%

Trust Preferred

6,000

Share Information

Borrowings/Assets

3.06%

Preferred Equity

0

Shares Outstanding

2,957,654

Tier 1 Leverage Ratio

10.45%

Common Equity

33,217

Shares Subject to Options

205,750

Tier 1 Capital Ratio

12.38%

Total Equity

33,217

Weighted Average Exercise Price

$10.31

Total Capital Ratio

13.57%

Loan Composition

1-4 Family Loans

18.22%

5+ Family Loans

0.05%

Const & Dev Loans

15.34%

Commercial Real Estate Loans

24.71%

Consumer Loans

2.08%

Commercial Loans

39.59%

Deposit Composition

Non-Interest Bearing Deposits

10.66%

Transaction Accounts

18.90%

MMDA & Savings

15.28%

CD's > $100,000

58.43%

Total CD's

65.82%

Core Deposits

41.57%

Note: Dollars in thousands except per share data, data is as of or for the period ended 09/30/04.

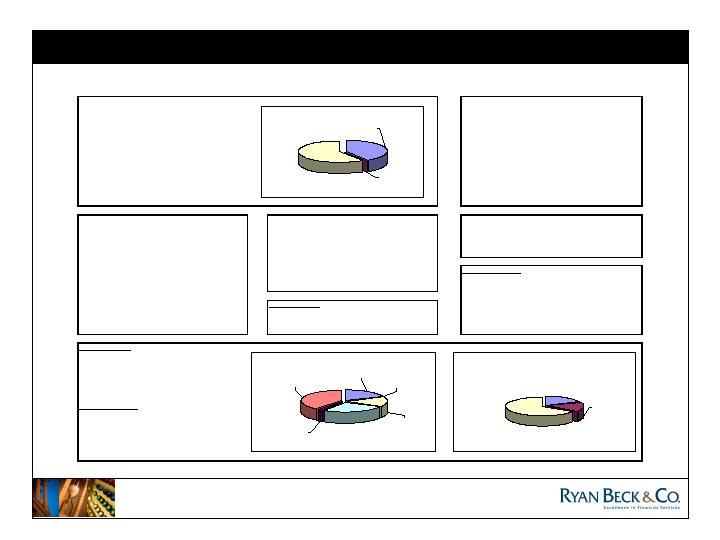

Ownership Profile

Ownership Profile

Insider

Ownership

40.6%

Retail Ownership

59.4%

Institutional

Ownership

0.0%

Loan Composition

Commercial Real

Estate Loans

24.7%

Consumer Loans

2.1%

Commercial Loans

39.6%

1-4 Family Loans

18.2%

Const & Dev Loans

15.3%

5+ Family Loans

0.1%

Deposit Composition

Transaction

Accounts

18.9%

Total CD's

65.8%

MMDA & Savings

15.3%

Financial Highlights

Page 16

(Dollars in Thousands)

As of for the 12

months ended

2000

2001

2002

2003

9/30/2004

Balance Sheet Highlights

Total Assets

$44,677

$171,124

$248,406

$336,954

$373,673

Asset Growth Rate (%)

NA

283.02

45.16

35.65

20.84

Total Loans

$25,582

$126,468

$215,390

$263,595

$302,699

Loan Growth Rate (%)

NA

394.36

70.31

22.38

17.62

Loans/Assets (%)

57.26

73.90

86.71

78.23

81.01

Total Deposits

$27,132

$149,579

$205,132

$288,640

$326,697

Deposit Growth Rate (%)

NA

451.3

37.14

40.71

19.98

Loans/Deposits (%)

94.29

84.55

105.00

91.32

92.65

Performance Measures

Net Income

-$1,183

$70

$58

$978

$1,062

ROAA (%)

NA

0.06

0.03

0.33

0.31

ROAE (%)

NA

0.41

0.24

3.37

3.25

Noninterest Income/AA (%)

NA

0.47

0.76

0.99

0.94

Noninterest Expense/AA (%)

NA

2.97

2.45

2.47

2.51

Net Interest Margin (%)

NA

3.05

2.67

2.87

2.91

Efficiency Ratio (%)

302.33

87.22

76.81

67.40

64.57

Capitalization

Equity Capital

$17,290

$17,300

$31,248

$32,229

$33,217

Equity Capital/Total Assets (%)

38.70

10.11

12.58

9.56

8.89

Tang Equity/Tang Assets (%)

38.70

10.11

12.58

9.47

8.82

Tier 1 Risk Based Capital Ratio (%)

58.16

13.76

13.86

11.53

12.38

Total Risk Based Capital Ratio (%)

56.91

12.59

15.05

12.66

13.57

Leverage Ratio (%)

104.73

10.69

11.07

10.12

10.45

As of or for the years ended December 31,

Financial Highlights

Page 17

(Dollars in Thousands)

As of for the 12

months ended

2000

2001

2002

2003

9/30/2004

Loan Composition

Constr & Dev/Tot Lns (%)

0.84

14.27

12.37

13.39

15.34

1-4 Family/Tot Lns (%)

6.27

15.31

16.78

18.94

18.22

Multifamily/Tot Lns (%)

0.00

0.06

0.25

0.17

0.05

Cmrcl RE Loans/Tot Lns (%)

32.00

29.87

28.66

28.64

24.71

Total RE Loans/Tot Lns (%)

39.11

59.52

58.12

61.44

58.32

Tot C&I Loans/Tot Lns (%)

59.71

38.88

39.94

36.36

39.59

Tot Consumer Loans/Tot Lns (%)

1.18

1.55

1.48

2.03

2.08

Deposit Composition

Nonint Bear Deps/Total Deposits (%)

11.43

7.06

7.97

14.75

10.66

Trans Accts/Total Deposits (%)

19.12

11.46

11.47

21.22

34.18

Retail CDs/Total Deposits (%)

2.65

3.72

6.77

7.38

7.40

Jumbo CDs/Total Deposits (%)

59.41

78.27

72.37

59.85

58.43

Asset Quality

NPLs/ Total Loans (%)

0.00

0.00

1.06

0.92

0.33

NPAs/Total Assets (%)

0.00

0.00

0.92

0.72

0.28

NPAs + 90s/Total Assets (%)

0.00

0.00

0.92

0.72

0.28

Reserves/Loans (%)

1.56

1.27

1.23

1.18

1.22

Reserves/NPAs (%)

NA

NA

115.70

128.67

360.19

NCOs/Average Loans (%)

NA

0.00

NA

0.77

0.80

As of or for the years ended December 31,

Ownership Profile

Page 18

Total Insider Ownership of Nicolet Bankshares, Inc.:

40.6%

All Directors and Executive Officers

of the Company

Shares Held

% Held

Robert Atwell

106,000

3.3

Michael Daniels

102,789

3.2

Wendell Ellsworth

97,577

3.1

Jacqui Engebos

23,333

0.7

Deanna Favre

87,500

2.7

Michael Felhofer

67,500

2.1

James Halron

57,500

1.8

Philip Hendrickson

105,000

3.3

Andrew Hetzel, Jr.

100,000

3.1

Terrence Lemerond

117,500

3.7

Donald Long, Jr.

71,900

2.3

Susan Merkatoris

6,000

0.2

Wade Micoley

107,450

3.4

Ronald Miller

77,500

2.4

Sandra Renard

100,000

3.1

Robert Weyers

65,500

2.1

Totals:

1,293,049

40.6

Source: March 23, 2004 Proxy Statement

Tab 3

Valuation of Nicolet Bankshares, Inc.

Discounted Dividend Analysis

Peer Group Comparison

Discounted Dividend Analysis

Page 21

Discounted Dividend Analysis

Nicolet Bankshares Provided Assumptions:

5 years of earnings projections were provided:

2005: $3.0 million

2006: $3.5 million

2007: $4.0 million

2008: $4.6 million

2009: $5.3 million

Resulting 5-year CAGR from earnings projections of 15.0%

We note that management’s earnings estimates are aggressive in relation to

historical results. Their projections show an expanding net interest margin, lower

provision for loan losses and minimal increase in operating expenses. Additionally,

management has willingly tied a portion of its incentive pay to meeting the earnings

projections.

Asset growth rate of 12.0%.

Tax rate of 28%.

Page 22

Discounted Dividend Analysis

Discounted Dividend Analysis Assumptions Cont.

A minimum capital ratio of 7.0% to reflect NBIC’s asset growth rate and increased regulatory

scrutiny.

To derive an appropriate discount rate range, we first looked at Nicolet’s current ROAE.

Nicolet’s current ROAE of 3.25%, driven by their significant growth and limited profitability, is

not a reasonable proxy for a discount rate in this analysis. Therefore, we reviewed a peer

group of banks with assets between $200 million and $1 billion to determine an appropriate

discount rate range. The median ROAE range for the group was 11.0% - 13.0%.

The terminal multiple range of 13.0x – 15.0x is based on historical trading multiples of the

banking industry.

Discounted Dividend Analysis

Page 23

(Dollars in thousands, except per share data)

MAINTAIN TANGIBLE EQUITY RATIO OF 7.00%.

NICOLET BANKSHARES, INC. EARNINGS AS ESTIMATES

ASSUMES NO RESTRUCTURING CHARGE

Five Year Projections

2005

2006

2007

2008

2009

Beginning Equity (a)

$25,923

$28,936

$32,318

$36,113

$40,372

Unadjusted Net Income (a,b)

3,042

3,475

3,997

4,596

5,285

After Tax Income Impact (c)

(184)

(180)

(178)

(178)

(182)

Synergies/Restructuring Charge (d)

0

0

0

0

0

Adjusted Net Income (e)

$2,858

$3,295

$3,819

$4,418

$5,103

Dividends (f)

155

86

(23)

(159)

(277)

Ending Equity

28,936

32,318

36,113

40,372

45,198

Intangibles (g)

228

158

88

18

0

Ending Tangible Equity

$28,708

$32,160

$36,025

$40,354

$45,198

Net Change in Equity (h)

155

86

(23)

(159)

(277)

Cumulative Change in Equity

(7,139)

(7,052)

(7,076)

(7,235)

(7,512)

Total Assets (a,b)

$410,345

$459,587

$514,737

$576,506

$645,686

Asset Growth Rate

9.81%

12.00%

12.00%

12.00%

12.00%

Net Income Growth Rate (i)

NM

15.31%

15.88%

15.68%

15.51%

Return on Average Assets

0.74%

0.80%

0.82%

0.84%

0.86%

Adjusted ROAA

0.70%

0.76%

0.78%

0.81%

0.84%

Adjusted ROAE

10.42%

10.76%

11.16%

11.55%

11.93%

Equity / Assets

7.05%

7.03%

7.02%

7.00%

7.00%

Tangible Equity/ Tangible Assets

7.00%

7.00%

7.00%

7.00%

7.00%

Discounted Dividend Analysis

Page 24

Aggregate Net Present Value - Per Share (j)

Discount Rate:

11.00%

12.00%

13.00%

Terminal Year

13.00

$15.61

$15.06

$14.53

Multiple of

Earnings

14.00

$16.58

$15.99

$15.42

Adj. for Goodwill

Amortization (k)

15.00

$17.56

$16.91

$16.31

Discounted Dividend Analysis

Page 25

Footnotes

Methodology:

The Discounted Dividend Analysis produces values given earnings estimates and projections of achievable synergies, over a range

of discount rates and terminal year earnings multiples. An initial dividend for tangible capital in excess of a specified target is assumed; earnings in

subsequent years are adjusted to reflect the opportunity cost of this distribution. Earnings in excess of those required to maintain

Nicolet Bankshares, Inc.'s tangible equity ratio at the specified targets are dividendable. It should be noted that "Synergies" is defined as cost

savings and revenue enhancements which are assumed to approximate 0.00% of Nicolet Bankshares, Inc.'s non-interest expenses in 2006.

* Present value = NPV of dividend stream plus terminal year multiple applied to net income less intangible amortization.

(a) Beginning equity for Nicolet Bankshares, Inc. represents total equity for the period ended September 30, 2004, after an initial dividend to reduce

Nicolet Bankshares, Inc.'s tangible equity to assets to specified target tangible capital levels.

(b) Earnings assumption based on Nicolet Bankshares, Inc. projections for 2005, and are assumed to grow at 15.00% per annum thereafter.

Asset projections are assumed to grow at an annual rate of 12.00%.

(c) Assumes a pre-tax rate of 3.50% is earned/(lost) on any capital retained/(dividended) in excess of assumed regular dividend payout.

Assumes a tax rate of 28.00%.

(d) No synergies/revenue enhancements are assumed.

(e) Adjusted for income impact of paying dividends in excess of assumed regular dividend payout ratio.

(f) Assumed to pay the maximum dividend possible while maintaining a tangible equity/asset ratio of 7.00%.

(g) Intangibles assumed to be amortized at a rate of $70,000 per year.

(h) Represents dividends paid in excess of estimated payout ratio of 0.00%.

(i) Includes income impact of cumulative increase (decrease) in equity.

(j) Per share data is based on 3,030,700 diluted shares outstanding, assuming options are cashed out at $15.99 per share.

(k) The terminal year multiple, when applied to terminal year adjusted earnings produces a value which approximates

the net present value of the earnings in perpetuity, given certain assumptions regarding growth rates and discount rates.

Peer Group Comparison

Peer Group Comparison

Page 27

We chose the following peer group based upon these parameters:

Publicly traded.

Comparable profitability – LTM ROAA between 0.00% and 0.50%.

Comparable asset quality – NPL’s/Loans < 0.50%

Assets between $200 million and $700 million.

Excludes companies that have entered into an agreement to be

acquired.

Query resulted in 16 companies.

Page 28

(1) For the latest 12 months period.

(2) The highest rank is 1 (from best performer in category to worst).

Nicolet

Bankshares,

Inc.

(1)

Peer

Median

(1)

Rank

(2)

# in

Sample

Capitalization

Total Assets (000s)

$373,673

$293,770

5

17

Total Deposits (000s)

326,697

233,219

4

17

Total Shareholders' Equity (000s)

33,217

26,696

7

17

Total Equity / Assets

8.89

%

8.51

%

8

17

Tangible Equity / Tangible Assets

8.82

7.43

7

17

Leverage Ratio

10.45

9.17

6

17

Tier I Capital / Risk-Adj Assets

12.38

10.70

6

17

Total Capital / Risk-Adj Assets

13.57

11.69

6

17

Asset Quality

Non-Performing Loans / Loans

0.33

0.14

14

17

Non-Performing Loans + 90 Days Past Due / Loans

0.33

0.19

13

17

Loan Loss Reserves / NPLs

373.63

481.09

7

11

Loan Loss Reserves / NPLs + 90 Days Past Due

373.63

526.18

10

15

Loan Loss Reserves / Loans

1.22

1.13

8

17

Non-Performing Assets / Assets

0.28

0.20

10

17

Non-Performing Assets + 90 Days Past Due / Assets

0.28

0.20

10

17

Non-Performing Assets / Equity

3.10

1.89

10

17

Loan & Deposit Composition

Total Loans / Total Assets

81.01

69.18

2

17

Total Loans / Deposits

92.65

91.68

9

17

1-4 Family Loans / Total Loans

18.22

17.24

9

17

5+ Family Loans / Total Loans

0.05

0.99

15

17

Construction & Developmental Loans / Total Loans

15.34

14.46

8

17

Other Real Estate Loans / Total Loans

24.71

38.17

13

17

Real Estate Loans/Total Loans

58.32

72.28

13

17

Consumer Loans / Total Loans

2.08

1.95

9

17

Commercial Loans / Total Loans

39.59

18.70

1

17

Non-Interest Bearing Deposits/Total Deposits

10.66

22.05

15

17

Transaction Accounts/Total Deposits

34.18

68.15

17

17

Total CD's/Total Deposits

65.82

31.85

17

17

Time Deposits > $100,000 / Total Deposits

58.43

12.93

17

17

Peer Group Comparison

Page 29

(1) For the latest 12 months period.

(2) The highest rank is 1 (from best performer in category to worst).

Nicolet

Bankshares,

Inc.

(1)

Peer

Median

(1)

Rank

(2)

# in

Sample

Performance

Return on Average Assets

0.31

%

0.34

%

12

17

Return on Average Equity

3.25

4.64

10

17

Net Interest Margin

2.91

3.54

15

17

Non Interest Income / Average Assets

0.94

0.64

7

17

Non Interest Expense/Avg Assets

2.51

3.42

3

17

Salary Expense/Total Revenue

36.10

43.58

2

17

Efficiency Ratio

64.57

83.48

1

17

Growth Rates

Asset Growth

20.84

12.13

6

17

Loan Growth Rate

17.62

22.19

10

17

Deposit Growth Rate

19.98

11.56

7

17

Revenue Growth Rate

28.35

5.62

3

14

EPS Growth Rate

11.87

(36.25)

2

10

Market Statistics

Stock Price at November 30, 2004

$15.00

Price / LTM EPS

41.66

x

30.38

x

4

12

Price / 2004E EPS

30.00

34.87

2

2

Price / 2005E EPS

15.00

24.74

3

3

Price / Book Value

133.56

%

138.89

%

12

16

Price / Tangible Book Value

134.77

150.43

14

16

Market Capitalization ($M)

$44.36

$36.26

8

17

Dividend Yield

0.00

%

0.00

%

8

17

Peer Group Comparison

Page 30

Peer Group Comparison

Number

States

Total

of

of

Assets

Short Name

Ticker

State

Offices

Operation

($000)

Bank Holdings (The)

TBHS

NV

4

NV(3),CA(1)

244,041

Carrollton Bancorp

CRRB

MD

12

MD(12)

306,614

Community Bank Shares of Indiana, Inc.

CBIN

IN

16

IN(11),KY(5)

566,552

Community Bank, National Association

CMYC

PA

12

PA(12)

314,116

Community Shores Bank Corporation

CSHB

MI

3

MI(3)

203,373

Cowlitz Bancorporation

CWLZ

WA

8

WA(5),OR(3)

268,439

FirstFed Bancorp, Inc.

FFDB

AL

8

AL(8)

212,274

Long Island Financial Corporation

LICB

NY

12

NY(12)

537,886

Millennium Bankshares Corporation

MBVA

VA

6

VA(6)

349,870

Monarch Bank

MNRK

VA

5

VA(5)

216,677

National Mercantile Bancorp

MBLA

CA

4

CA(4)

405,458

North State Bancorp

NSBC

NC

3

NC(3)

298,619

Old Florida Bankshares, Inc.

OFBS

FL

3

FL(3)

203,092

Rancho Bank

RBSD

CA

4

CA(4)

222,838

Sterling Bank

STNJ

NJ

6

NJ(6)

288,920

Vail Banks, Inc.

VAIL

CO

23

CO(23)

624,982

Average

8

328,984

Median

6

293,770

Nicolet Bankshares, Inc.

WI

2

WI(2)

373,673

Page 31

In reviewing Nicolet’s financial performance against this peer group, the

results have shown that NBIC ranks in the middle overall with respect to

balance sheet statistics and performance measures.

We noted that there were only two estimates in the peer group for 2004 EPS

and three estimates for 2005 EPS. Therefore, we did not recognize the

implied values for Nicolet on these bases.

The average of the implied values for Nicolet produced by the peer group is

$14.43 per share.

Peer Group Comparison

Price/

LTM EPS

Price/BV

Price/TBV

Average

Group Median

30.38x

1.39x

1.50x

Nicolet

$0.36

$11.23

$11.13

Implied Value Per Share

$10.94

$15.60

$16.74

$14.43

Page 32

Market Value Conclusion

Implied Value Per Share

Discounted Dividend Analysis

$15.99

Peer Group Analysis

$14.43

Trading History

$15.00

Average

$15.14

By taking the average of the implied values produced from the discounted

dividend analysis, the peer group analysis and the recent trading history of

Nicolet common stock, we believe that the fair market value of Nicolet

common stock is $15.14 per share.

Tab 4

Control Premium Valuation

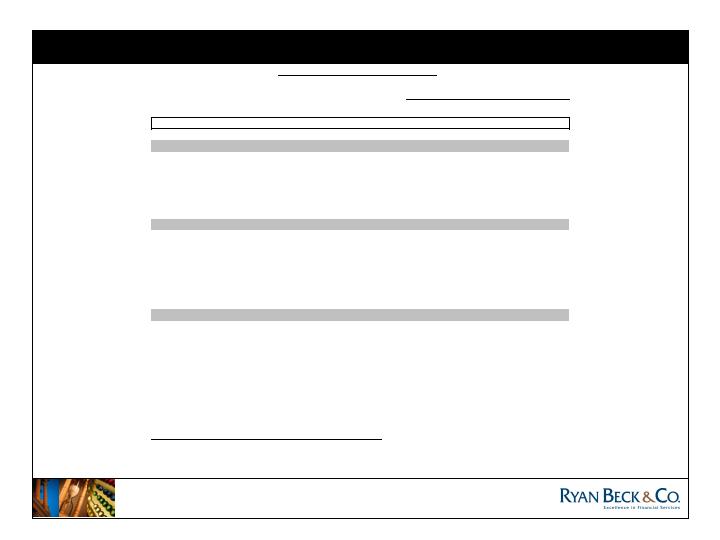

Page 34

A typical control premium falls in the range of 10.0% - 20.0% of current

fair market value. Applying this range to the fair market value of

Nicolet’s common stock established in the previous section results in

the following per share values.

Current market value = $15.14

Implied value per share based on:

10% Premium = $16.65

15% Premium = $17.41

20% Premium = $18.17

Control Premium Valuation

Page 35

Based on Nicolet’s most recent trading price of $15.00, the Company is

trading at 15.0x 2005E EPS. We have assumed a terminal multiple

range of 15.5x – 17.5x to factor in a control premium.

Incorporating a control premium into to the terminal multiple range

while keeping all other assumptions the same produced the following

per share price range.

Control Premium Valuation – Discounted Dividend Analysis

Aggregate Net Present Value - Per Share (j)

Discount Rate:

11.00%

12.00%

13.00%

Terminal Year

15.50

$18.04

$17.38

$16.75

Multiple of

Earnings

16.50

$19.01

$18.31

$17.64

Adj. for Goodwill

Amortization (k)

17.50

$19.98

$19.24

$18.53

Page 36

Control Premium Valuation – Discounted Dividend Analysis

(Dollars in thousands, except per share data)

MAINTAIN TANGIBLE EQUITY RATIO OF 7.00%.

NICOLET BANKSHARES, INC. EARNINGS AS ESTIMATES

ASSUMES NO RESTRUCTURING CHARGE

Five Year Projections

2005

2006

2007

2008

2009

Beginning Equity (a)

$25,923

$28,936

$32,318

$36,113

$40,372

Unadjusted Net Income (a,b)

3,048

3,475

3,997

4,596

5,285

After Tax Income Impact (c)

(184)

(180)

(178)

(178)

(182)

Synergies/Restructuring Charge (d)

0

0

0

0

0

Adjusted Net Income (e)

$2,864

$3,295

$3,819

$4,418

$5,103

Dividends (f)

149

87

(23)

(159)

(277)

Ending Equity

28,936

32,318

36,113

40,372

45,198

Intangibles (g)

228

158

88

18

0

Ending Tangible Equity

$28,708

$32,160

$36,025

$40,354

$45,198

Net Change in Equity (h)

149

87

(23)

(159)

(277)

Cumulative Change in Equity

(7,145)

(7,058)

(7,081)

(7,240)

(7,517)

Total Assets (a,b)

$410,345

$459,587

$514,737

$576,506

$645,686

Asset Growth Rate

9.81%

12.00%

12.00%

12.00%

12.00%

Net Income Growth Rate (i)

NM

15.07%

15.89%

15.68%

15.52%

Return on Average Assets

0.74%

0.80%

0.82%

0.84%

0.86%

Adjusted ROAA

0.70%

0.76%

0.78%

0.81%

0.84%

Adjusted ROAE

10.44%

10.76%

11.16%

11.55%

11.93%

Equity / Assets

7.05%

7.03%

7.02%

7.00%

7.00%

Tangible Equity/ Tangible Assets

7.00%

7.00%

7.00%

7.00%

7.00%

Page 37

Control Premium Valuation – Discounted Dividend Analysis

Footnotes

Methodology:

The Discounted Dividend Analysis produces values given earnings estimates and projections of achievable synergies, over a range

of discount rates and terminal year earnings multiples. An initial dividend for tangible capital in excess of a specified target is assumed; earnings in

subsequent years are adjusted to reflect the opportunity cost of this distribution. Earnings in excess of those required to maintain

Nicolet Bankshares, Inc.'s tangible equity ratio at the specified targets are dividendable. It should be noted that "Synergies" is defined as cost

savings and revenue enhancements which are assumed to approximate 0.00% of Nicolet Bankshares, Inc.'s non-interest expenses in 2006.

* Present value = NPV of dividend stream plus terminal year multiple applied to net income less intangible amortization.

(a) Beginning equity for Nicolet Bankshares, Inc. represents total equity for the period ended September 30, 2004, after an initial dividend to reduce

Nicolet Bankshares, Inc.'s tangible equity to assets to specified target tangible capital levels.

(b) Earnings assumption based on Nicolet Bankshares, Inc. projections for 2005, and are assumed to grow at 15.00% per annum thereafter.

Asset projections are assumed to grow at an annual rate of 12.00%.

(c) Assumes a pre-tax rate of 3.50% is earned/(lost) on any capital retained/(dividended) in excess of assumed regular dividend payout.

Assumes a tax rate of 28.00%.

(d) No synergies/revenue enhancements are assumed.

(e) Adjusted for income impact of paying dividends in excess of assumed regular dividend payout ratio.

(f) Assumed to pay the maximum dividend possible while maintaining a tangible equity/asset ratio of 7.00%.

(g) Intangibles assumed to be amortized at a rate of $70,000 per year.

(h) Represents dividends paid in excess of estimated payout ratio of 0.00%.

(i) Includes income impact of cumulative increase (decrease) in equity.

(j) Per share data is based on 3,047,537 diluted shares outstanding, assuming options are cashed out at $18.31 per share.

(k) The terminal year multiple, when applied to terminal year adjusted earnings produces a value which approximates

the net present value of the earnings in perpetuity, given certain assumptions regarding growth rates and discount rates.

Tab 5

Repurchase Analysis

Repurchase Analysis

Page 39

Financials as of 09/30/04.

7.89%

7.89%

7.89%

Repurchase Data

Current

Repurchase Price

$15.00

$17.25

$18.00

$18.75

Premium to Market Price

15.00%

20.00%

25.00%

Source of Cash and Amount

Debt

$4,148

$4,323

$4,498

After-tax Cost of Cash

2.52%

2.52%

2.52%

2.52%

After-tax Cost of Debt

4.61%

4.61%

4.61%

4.61%

Shares Repurchased

233

233

233

Basic Shares Outstanding

2,958

2,724

2,724

2,724

Diluted Shares Outstanding

3,022

2,789

2,789

2,789

Discounted Cash Flow Value of Common Stock

$18.31

$20.61

$20.53

$20.46

Weighted Average Value per Share

$20.34

$20.33

$20.33

Internal Rate of Return*

13.94%

12.55%

11.24%

*Terminal Value Multiple of Earnings of 16.50x is Assumed

Income Statement Data

Net Income (2005 Est. of $1 per share)

$3,022

$3,022

$3,022

$3,022

Income Adjustment 1/

76

72

67

Proforma Net Income

3,098

3,093

3,089

Balance Sheet Data

Assets

373,673

374,525

374,350

374,175

Average Assets

355,314

356,165

355,990

355,815

Risk-adjusted Assets

313,100

313,814

313,667

313,520

Equity

33,217

29,068

28,893

28,718

Goodwill and Intangible Assets

298

298

298

298

Tangible Equity

32,919

28,771

28,596

28,421

Average Equity

32,723

28,574

28,399

28,225

Trust Preferred

6,000

6,000

6,000

6,000

Senior Debt

-

5,000

5,000

5,000

Diluted Share Data

Basic Shares Outstanding

2,958

2,724

2,724

2,724

Diluted Shares Outstanding

3,022

2,789

2,789

2,789

Footnotes

1/ Includes estimated cost savings of $400,000 pre-tax.

(dollars in thousands except per share data)

Repurchased at Price of

Proforma for Stock Repurchase of

Repurchase Analysis

Page 40

Current

7.89%

7.89%

7.89%

Repurchase Price

$15.00

$17.25

$18.00

$18.75

Market Value Data

Price / 2005 Diluted Est. EPS (x)

15.0

15.5

16.2

16.9

Price / Stated Book - Current & Pro Forma 1/

133.56%

161.68%

169.73%

177.87%

Price / Tangible Book - Current & Pro Forma 1/

134.77%

163.35%

171.49%

179.74%

Market Capitalization 1/

$44,365

$46,996

$49,039

$51,083

Fully Diluted Per Share Data

Diluted Net Income (2005 Est.) 2/

$1.00

$1.11

$1.11

$1.11

Percent Change

11.09%

10.93%

10.77%

Stated Book Value

$11.23

$10.67

$10.61

$10.54

Percent Change

-5.00%

-5.57%

-6.14%

Tangible Book Value

$11.13

$10.56

$10.50

$10.43

Percent Change

-5.12%

-5.70%

-6.27%

Ratios

Equity/Assets

8.89%

7.76%

7.72%

7.68%

Tangible Equity/Assets

8.81%

7.68%

7.64%

7.60%

Leverage Ratio

10.91%

8.03%

7.99%

7.94%

Tier 1 Ratio

12.38%

11.08%

11.03%

10.98%

Total Capital Ratio

13.57%

12.21%

12.16%

12.11%

ROAA (based on 2005 net income)

0.85%

0.87%

0.87%

0.87%

ROAE (based on 2005 net income)

9.24%

10.84%

10.89%

10.94%

Footnotes

Note: Company earnings estimate used.

1/ Assumes stock price stays at repurchase price.

2/ Includes estimated cost savings of $400,000 pre-tax.

(dollars in thousands except per share data)

Proforma for Stock Repurchase of

Tab 6

Conclusion

Page 42

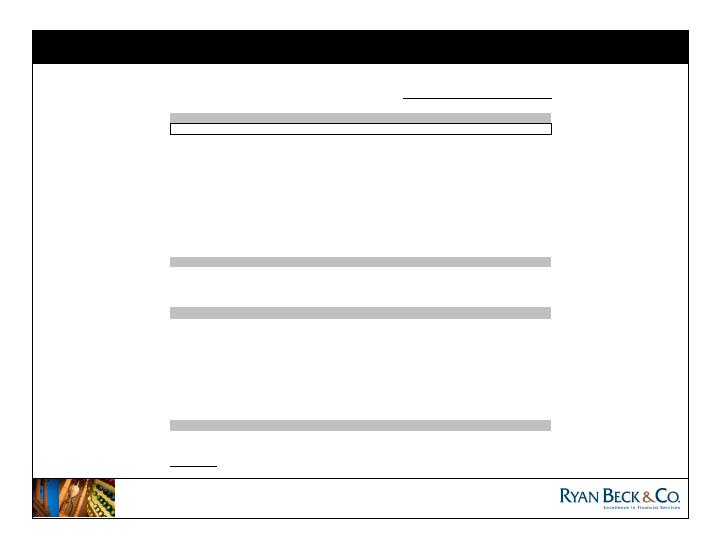

Summary of Control Premium Values

High

Low

Midpoint

Discounted Dividend Analysis

$19.98

$16.75

$18.31

Stock Price Premium Analysis

10%

15%

20%

Current Market Value - $15.14

$16.65

$17.41

$18.17

Page 43

Conclusion

Our opinion is directed to the Board of Directors of Nicolet solely for their

use in valuing Nicolet common stock. We have not considered, nor are we

expressing any opinion herein with respect to the price at which Nicolet

common stock will trade subsequent to the share repurchase and de-

registration from the SEC.

It is the opinion of Ryan Beck that:

THE FAIR VALUE OF THE 233,229 SHARES, THE AMOUNT TO BE

REPURCHASED AS PART OF THE CASH-OUT MERGER, OF NICOLET

BANKSHARES, INC. COMMON STOCK IS WITHIN A RANGE OF

$17.25 AND $18.75 PER SHARE.

Tab 7

Ryan Beck Relationship

Ryan Beck has not had a prior Investment Banking relationship with Nicolet

Bankshares. Ryan Beck’s research department does not provide published

investment analysis on Nicolet Bankshares. Ryan Beck does not act as a market

maker in Nicolet Bankshares common stock.

In the ordinary course of our business as a broker-dealer, we may actively trade

equity securities of Nicolet Bankshares for our own account and the account of our

customers and, accordingly, may at any time hold long or short positions in such

securities.

Page 45

Relationship with Ryan Beck

Tab 8

Fairness Opinion Letter