UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

| o | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12 (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended August 31, 2019 |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from __________________ to ______________________ |

| o | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| Date of event requiring this shell company report ______________________________ |

Commission File Number 001-32500

TANZANIAN GOLD CORPORATION

(Formerly known as TANZANIAN ROYALTY EXPLORATION COMPANY)

(Exact Name of Registrant as Specified in Its Charter)

ALBERTA, CANADA

(Jurisdiction of Incorporation or Organization)

Bay Adelaide Centre, East Tower

22 Adelaide Street West, Suite 3400

Toronto, Ontario

M5H 4E3

(Address of Principal Executive Offices)

James Sinclair

Executive Chairman

Tanzanian Gold Corporation

Bay Adelaide Centre, East Tower

22 Adelaide Street West, Suite 3400

Toronto, Ontario

M5H 4E3

Telephone: 1.844.364.1830

Fax: 860.799.0350

Email: j.sinclair@tangoldcorp.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Common Shares, without Par Value | NYSE American | |

| (Title of Class) | Name of Each Exchange on Which Registered |

Securities registered or to be registered pursuant to Section 12(g) of the Act: NONE

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: NONE

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 150,391,558 (as of August 31, 2019).

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. o Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 2.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or emerging growth company. See definition of “accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer o Accelerated filer x Non-accelerated filer o Emerging Growth Company o

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP o

International Financial Reporting Standards as issued by the International Accounting Standards Board x

Other o

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the Company has elected to follow.

| Item 17 o | Item 18 o |

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). o Yes x No

TABLE OF CONTENTS

| Cautionary Note to U.S. Investors Concerning Estimates of Mineral Resources | 1 |

| Currency | 1 |

| Foreign Private Issuer Filings | 1 |

| Glossary of Technical Terms | 2 |

| PART I | |

| Item 1. Identity of Directors, Senior Management and Advisors | 6 |

| A. Directors and Senior Management: | 6 |

| B. Advisers | 6 |

| Item 2. Offer Statistics and Expected Timetable | 6 |

| Item 3. Key Information | 6 |

| A. Selected Financial Data | 6 |

| B. Capitalization and Indebtedness | 7 |

| C. Reasons for the Offer and Use of Proceeds | 7 |

| D. Risk Factors | 7 |

| Item 4. Information on the Company | 17 |

| A. History and Development of the Company | 17 |

| B. Business Overview | 17 |

| Plan of Operations | 18 |

| Governmental Regulations | 36 |

| C. Organizational Structure | 37 |

| D. Property, Plant and Equipment | 37 |

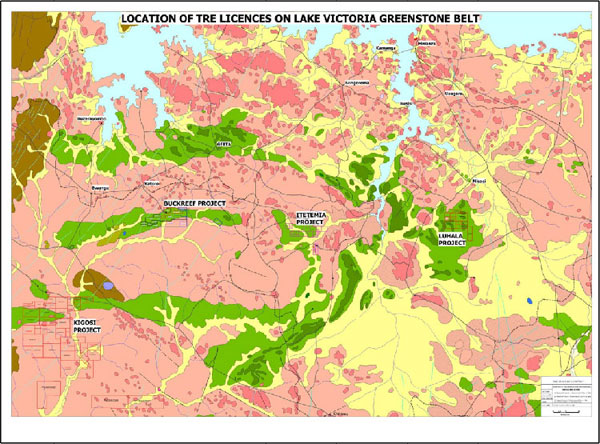

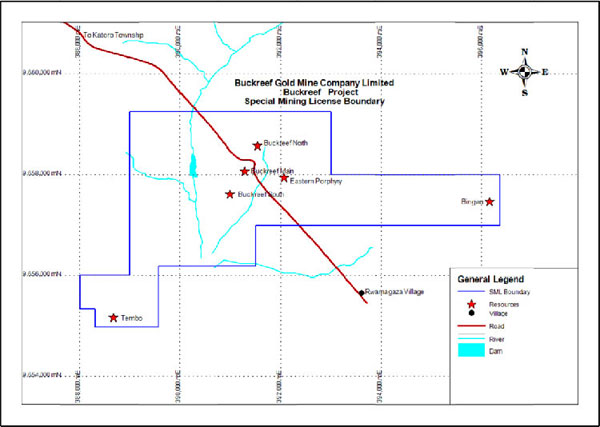

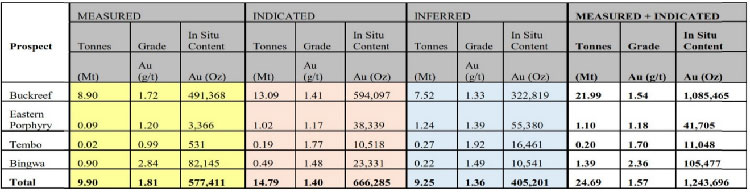

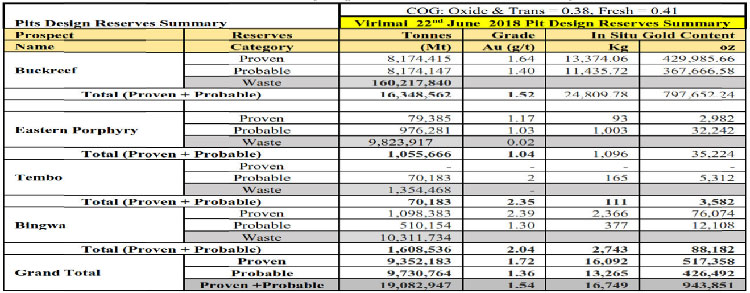

| Buckreef Project | 38 |

| Kigosi Project | 47 |

| Lunguya Project Area | 51 |

| Itetemia Property | 53 |

| Luhala Property | 57 |

| Item 4A. Unresolved Staff Comments | 58 |

| Item 5. Operating and Financial Review and Prospects | 59 |

| A. Operating Results | 59 |

| B. Liquidity and Capital Resources | 60 |

| C. Research and Development, Patents and License, etc. | 66 |

| D. Trend Information | 66 |

| E. Off Balance Sheet Arrangements | 66 |

| F. Tabular Disclosure of Contractual Obligations | 66 |

| Item 6. Directors, Senior Management and Employees | 66 |

| A. Directors and Senior Management | 66 |

| B. Executive Compensation | 71 |

| C. Board Practices | 76 |

| D. Employees | 81 |

| E. Share Ownership | 81 |

| Item 7. Major Shareholders and Related Party Transactions | 82 |

| A. Major Shareholders | 82 |

| B. Related Party Transactions | 82 |

| C. Interests of Experts and Counsel | 83 |

| Item 8. Financial Statements | 83 |

| A. Consolidated Statements and Other Financial Information | 83 |

| B. Significant Changes | 84 |

| Item 9. The Offering and Listing | 84 |

| A. Offering and Listing Details | 84 |

| B. Plan of Distribution | 84 |

| C. Markets | 84 |

| D. Selling Shareholders | 84 |

| E. Dilution | 84 |

| F. Expenses of the Issue | 84 |

i

| Item 10. Additional Information | 84 |

| A. Share Capital | 84 |

| B. Articles of Association and Bylaws | 85 |

| C. Material Contracts | 87 |

| D. Exchange Controls | 89 |

| E. Taxation | 90 |

| F. Dividends and Paying Agents | 99 |

| G. Statement by Experts | 99 |

| H. Documents on Display | 99 |

| I. Subsidiary Information | 99 |

| Item 11. Quantitative and Qualitative Disclosures About Market Risk | 99 |

| Item 12. Description of Securities Other than Equity Securities | 99 |

| Part II | |

| Item 13. Defaults, Dividend Arrears and Delinquencies | 99 |

| Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds | 100 |

| Item 15. Controls and Procedures | 100 |

| Item 16 A. Audit Committee Financial Expert | 101 |

| Item 16 B. Code of Ethics | 101 |

| Item 16 C. Principal Accountant Fees and Services | 101 |

| Item 16 D. Exemptions from the Listing Standards for Audit Committees | 102 |

| Item 16 E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 102 |

| Item 16 F. Change in Registrant’s Certifying Accountant | 102 |

| Item 16 G. Corporate Governance | 102 |

| Item 16 H. Mine Safety Disclosure | 102 |

| Part III | |

| Item 17. Financial Statements | 102 |

| Item 18. Financial Statements | 103 |

| Item 19. Exhibits | 103 |

ii

Cautionary Note to U.S. Investors Concerning Estimates of Mineral Resources

As an Alberta corporation, Tanzanian Gold Corporation (the “Company”) is subject to certain rules and regulations issued by Canadian Securities Administrators. The Company files this Annual Report on Form 20-F as its Annual Information Form (“AIF”) with the British Columbia, Alberta and Ontario Securities Commissions via the System for Electronic Document Analysis and Retrieval (“SEDAR”). Under the filing requirements for an AIF, the Company is required to provide detailed information regarding its properties including mineralization, drilling, sampling and analysis, security of samples, and mineral resource and mineral reserve estimates, if any. Further, the Company may describe its properties utilizing terminology such as “Proven Mineral Reserve” or “Probable Mineral Reserve” or “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” that are permitted by Canadian securities regulations.

U.S. investors are cautioned not to assume that any part of the mineral deposits, if any, in the “Proven Mineral Reserve” or “Probable Mineral Reserve” or “Measured Mineral Resources”, “Indicated Mineral Resources” and “Inferred Mineral Resources” categories will ever be converted into reserves. Further, these terms are not defined terms under SEC Industry Guide 7 and are not permitted to be used in reports and registration statements filed with the United States Securities and Exchange Commission (“SEC”). The definitions of proven and probable reserves used in NI 43-101 differ from the definitions in SEC Industry Guide 7. Under SEC Industry Guide 7, as interpreted by the staff of the SEC, mineralization may not be classified as a “reserve” for United States reporting purposes unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or issuance imminent in order to classify mineralized material as reserves under the SEC guidelines. In addition, NI 43-101 permits disclosure of “contained ounces” of mineralization. In contrast, the SEC only permits issuers to report mineralization as in place tonnage and grade without reference to unit measures.

United States investors are cautioned not to assume that any part or all of the mineral deposits identified as an “indicated mineral resource,” “measured mineral resource” or “inferred mineral resource” will ever be converted to reserves as defined in SEC Industry Guide 7. Further, “inferred mineral resources” have a great amount of uncertainty as to their existence and economic and legal feasibility. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Under Canadian securities legislation, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, or economic studies. U.S. investors are cautioned not to assume that part or all of an inferred mineral resource exists, or is economically or legally mineable.

For clarification, the Company has no properties that contain “Proven (Measured) Reserves” or “Probable (Indicated) Reserves” as defined by SEC securities regulations.

Currency

All references to dollar amounts are expressed in the currency of Canada, unless otherwise specifically stated.

Foreign Private Issuer Filings

As a foreign private issuer registered under section 12(b) of the Securities Exchange Act of 1934 (the “Exchange Act”), the Company is subject to section 13 of the Exchange Act, and is required to file an Annual Report on Form 20-F and Reports of Foreign Private Issuer on Form 6-K with the SEC. However, the Company is exempt from the proxy rules under section 14 of the Exchange Act, and the short-swing profit and other rules regarding disclosures of directors, officers and principal stockholders under section 16 of the Exchange Act.

1

Glossary of Technical Terms

| alteration | Mineralogical change at low pressures due to invading fluids or the influence of chemical reactions in a rock mass resulting from the passage of hydrothermal fluids. |

| anomaly | Any concentration of metal noticeably above or below the average background concentration. |

| assay | An analysis to determine the presence, absence or quantity of one or more components. |

| Au | The elemental symbol for gold. |

| background | Traces of elements found in sediments, soils, and plant material that are unrelated to any mineralization and which come from the weathering of the natural constituents of the rocks. |

| Barrick | Barrick Gold Corp. |

| CIL | Carbon-in-leach |

| dyke | A tabular body of igneous rock that has been injected while molten into a fissure. |

| fault | A planar fracture or discontinuity in a volume of rock, across which there has been significant displacement. |

| feasibility study | A feasibility study is a comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately detailed assessments of applicable modifying factors together with any other relevant operational factors and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of a pre-feasibility study. |

| fracture | Any local separation or discontinuity plane in a geologic formation, such as a joint or a fault that are commonly caused by stress exceeding the rock strength. |

| grade | The concentration of each ore metal in a rock sample, usually given as weight percent. Where extremely low concentrations are involved, the concentration may be given in grams per tonne (g/t or gpt) or ounces per ton (oz/t). The grade of an ore deposit is calculated, often using sophisticated statistical procedures, as an average of the grades of a very large number of samples collected from throughout the deposit. |

| hectare or ha | An area totalling 10,000 square metres. |

| hydrothermal | Hot fluids, usually mainly water, in the earth’s crust which may carry metals and other compounds in solution to the site of ore deposition or wall rock alteration. |

| IP | Induced polarization survey, a form of geophysical survey used in the exploration for minerals. |

| intrusive | A rock mass formed below earth’s surface from magma which has intruded into a pre-existing rock mass. |

| JORC | The Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia. |

| JV | A joint venture, which is a term for a contractual relationship between parties, usually for a single purpose, which is not a partnership. |

| kilometres or km | Metric measurement of distance equal to 1,000 metres (or 0.6214 miles). |

2

| mill | A facility for processing ore to concentrate and recover valuable minerals. |

| mineral reserve | That part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. |

| mineralization | The hydrothermal deposition of economically important metals in the formation of ore bodies or “lodes”. |

| net smelter or NSR royalty | Payment of a percentage of net mining profits based on returns from the smelter, after deducting applicable smeltering charges. |

| NI 43-101 | National Instrument 43-101, “Standards of Disclosure for Mineral Projects”, as adopted by the Canadian Securities Administrators, as the same may be amended or replaced from time to time, and shall include any successor regulation or legislation. |

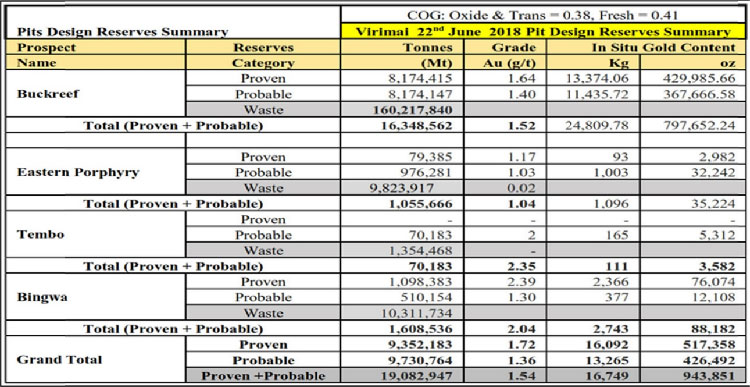

| NI 43-101 ITR | Amended and Updated Buckreef Pre-Feasibility Independent Technical Report prepared by Virimai Projects (QP) with effective date of 28th June 2018 as filed on SEDAR. |

| ore | A mineral or an aggregate of minerals from which a valuable constituent, especially a metal, can be profitably mined or extracted. |

| outcrop | An exposure of rock at the earth’s surface. |

| porphyry | A variety of igneous rock consisting of large-grained crystals, such as feldspar or quartz, dispersed in a fine-grained feldspathic matrix or groundmass. |

| Pre-feasibility study (preliminary feasibility study) | A pre-feasibility study is a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based on reasonable assumptions on the modifying factors and the evaluation of any other relevant factors which are sufficient for a qualified person, acting reasonably, to determine if all or part of the Mineral Resource may be converted to a Mineral Reserve at the time of reporting. A pre-feasibility study is at a lower confidence level than a feasibility study. |

| Pyrrhotite | A bronze coloured mineral of metallic lustre that consists of ferrous sulphide and is attracted by a magnet. |

| pyrite | Iron sulphide mineral. |

| Qualified Person | An individual who is an engineer or geoscientist with at least five years of experience in mineral exploration, mine development or operation or mineral project assessment, or any combination of these; has experience relevant to the subject matter of the mineral project and the technical report; and is a member or licensee in good standing of a professional association. |

| quartz | Silica or SiO2, a common constituent of veins, especially those containing gold and silver mineralization. |

| RAB | Rotary air blast drilling. |

| RC | Reverse circulation drilling. |

| reef | A geological discontinuity which served as a trap or conduit for hydrothermal mineralizing fluids to form an ore deposit. |

| silicification | Replacement and or impregnation of the constituent of a rock by quartz rich hydrothermal fluids or (silica). |

3

| Sloane | Sloane Developments Ltd., a corporation based in the United Kingdom. |

| Songshan | Songshan Mining Company. |

| Stamico | State Mining Corporation of Tanzania. |

| Tancan | Tancan Mining Company Limited, a wholly-owned Tanzanian subsidiary of the Company. |

| Tanzam | Tanzania American International Development Corporation 2000 Limited, a wholly-owned Tanzanian subsidiary of the Company. |

| ton | Imperial measurement of weight equivalent to 2,000 pounds (sometimes called a “short ton”). |

| tonne | Metric measurement of weight equivalent to 1,000 kilograms (or 2,204.6 pounds). |

| tuff | A rock comprised of fine fragments and ash particles ejected from a volcanic vent. |

| veins | Distinct sheetlike body of crystallized mineral constituents carried by hydrothermal aqueous solutions that are deposited through precipitation within the host country rock. These bodies are often the source of mineralisation either in or proximal to the veins. |

Canadian Terminology

The following terms may be used in the Company’s technical reports to describe its mineral properties and have been used in this Annual Report (see “Cautionary Note to U.S. Investors Concerning Estimates of Measured and Indicated Mineral Resources”). These definitions have been published by the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) as the CIM Standards on Mineral Resources and Reserves Definitions and Guidelines adopted by the CIM Council on May 10, 2014, and have been approved for use by Canadian reporting issuers by the Canadian Securities Administrators under NI 43-101, and as those definitions may be amended:

| Mineral Resource | A concentration or occurrence of diamonds, natural solid inorganic material, or natural solid fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

A Mineral Resource is an inventory of mineralization that under realistically assumed and justifiable technical and economic conditions might become economically extractable.

|

Inferred Mineral Resource

|

That part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

Confidence in the estimate is insufficient to allow the meaningful application of technical and economic parameters or to enable an evaluation of economic viability worthy of public disclosure. |

4

| Indicated Mineral Resource | An Indicated Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated with sufficient confidence to allow the application of Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit.

Geological evidence is derived from adequately detailed and reliable exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of observation.

An Indicated Mineral Resource has a lower level of confidence than that applying to a Measured Mineral Resource and may only be converted to a Probable Mineral Reserve.

|

| Measured Mineral Resource | A Measured Mineral Resource is that part of a Mineral Resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated with confidence sufficient to allow the application of Modifying Factors to support detailed mine planning and final evaluation of the economic viability of the deposit.

Geological evidence is derived from detailed and reliable exploration, sampling and testing and is sufficient to confirm geological and grade or quality continuity between points of observation.

|

| A Measured Mineral Resource has a higher level of confidence than that applying to either an Indicated Mineral Resource or an Inferred Mineral Resource. It may be converted to a Proven Mineral Reserve or to a Probable Mineral Reserve. | |

| Mineral Reserve | A Mineral Reserve is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

Mineral resources are sub-divided in order of increasing confidence into Probable Mineral Reserves and Proven Mineral Reserves. A Probable Mineral Reserve has a lower level of confidence than a Proven Mineral Reserve. The term “mineral reserve” need not necessarily signify that extraction facilities are in place or operative or that all governmental approvals have been received. It does signify that there are reasonable expectations of such approvals.

|

| Probable Mineral Reserve | Is the economically mineable part of an Indicated and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. |

| Proven Mineral Reserve | Is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

The term should be restricted to that part of the deposit where production planning is taking place and for which any variation in the estimate would not significantly affect potential economic viability. |

5

PART I

| Item 1. | Identity of Directors, Senior Management and Advisers |

A. Directors and Senior Management:

Not applicable.

B. Advisers

Not applicable.

| Item 2. | Offer Statistics and Expected Timetable |

Not applicable.

| Item 3. | Key Information |

A. Selected Financial Data

The audited financial statements for the Company’s fiscal years ended August 31, 2019, 2018, 2017, 2016 and 2015 are prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. The following selected financial data is based on financial statements prepared in accordance with IFRS and is presented for the five most recent financial years. Unless stated otherwise, reference to dollar amounts in this Annual Report shall mean Canadian dollars.

For each of the years in the five year periods ended August 31, the information in the tables was extracted from the more detailed audited financial statements of the Company.

The selected financial data should be read in conjunction with Item 5, “Operating and Financial Review and Prospects” and in conjunction with the consolidated financial statements of the Company and the notes thereto contained elsewhere in this Annual Report.

The following is a summary of certain selected financial information for the Company’s five most recently completed fiscal years (in Canadian dollars, except number of shares):

| For the year ended August 31, | ||||||||||||||||||||

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Operations: | ||||||||||||||||||||

| Revenues | - | - | - | - | ||||||||||||||||

| Net loss | $ | (29,317,517 | ) | $ | (6,897,397 | ) | $ | (6,434,112 | ) | $ | (12,781,902 | ) | $ | (8,995,697 | ) | |||||

| Basic and diluted loss per share | (0.22 | ) | (0.06 | ) | (0.05 | ) | (0.12 | ) | (0.09 | ) | ||||||||||

6

| 2019 | 2018 | 2017 | 2016 | 2015 | ||||||||||||||||

| Balance sheet: | ||||||||||||||||||||

| Working Capital (deficiency) | (9,095,970 | ) | (12,010,685 | ) | (6,552,376 | ) | (11,836,214 | ) | (4,684,253 | ) | ||||||||||

| Total Assets | 38,118,925 | 53,235,140 | 51,353,088 | 49,885,545 | 53,108,859 | |||||||||||||||

| Net Assets | 19,663,791 | 34,326,005 | 36,254,043 | 35,156,483 | 46,072,190 | |||||||||||||||

| Share Capital | 142,251,909 | 127,003,132 | 125,174,377 | 122,380,723 | 120,532,634 | |||||||||||||||

| Number of Shares | 150,391,558 | 125,162,803 | 121,784,619 | 109,068,492 | 107,853,554 | |||||||||||||||

| Deficit | $ | 132,462,683 | $ | 103,263,959 | $ | 96,566,577 | $ | 90,600,819 | $ | 77,970,955 | ||||||||||

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

An investment in the Company’s common shares involves a high degree of risk and should be considered speculative. You should carefully consider the following risks set out below and other information before investing in the Company’s common shares. If any event arising from these risks occurs, the Company’s business, prospects, financial condition, results of operations or cash flows could be adversely affected, the trading price of common shares could decline and all or part of any investment may be lost.

The operations of the Company are highly speculative due to the high-risk nature of its business, which include the acquisition, financing, exploration and, if warranted, development of mineral properties. The risks and uncertainties set out below are not the only ones facing the Company. Additional risks and uncertainties not currently known to the Company, or that the Company currently deems immaterial, may also impair the Company’s operations. If any of the risks actually occur, the Company’s business, financial condition and operating results could be adversely affected. As a result, the trading price of the Company’s common shares could decline and investors could lose part or all of their investment. The Company’s business is subject to significant risks and past performance is no guarantee of future performance.

Risks Relating to the Company

The Company has incurred net losses since its inception and expects losses to continue.

The Company has not been profitable since its inception. For the fiscal year ended August 31, 2019, the Company had a comprehensive loss of $29,317,517, and an accumulated deficit of $132,462,683. The Company has never generated revenues and does not expect to generate revenues until one of its properties are placed in production. There is a risk that none of the Company’s properties will be placed into production.

The Company needs additional capital.

As at August 31, 2019, the Company had cash of approximately $3,389,319 and working capital deficiency of approximately $9,095,970. The Company will continue to incur exploration and development costs to fund its plan of operations and will need to raise capital to build a mining plant at the Buckreef Project. Ultimately, the Company’s ability to continue its exploration activities depends in part on the Company’s ability to commence operations and generate revenues or to obtain financing through joint ventures, debt financing, equity financing, production sharing agreements or some combination of these or other means. Further the raising of additional capital by the Company may dilute existing

7

shareholders. Traditionally, the Company has relied on issuing equity securities and debt securities that may be converted into equity securities to raise capital. No assurance can be given that the Company can continue to raise capital in this manner. Further, the issuance of equity securities or debt securities that may be convertible into equity securities will have a dilutive effect.

Substantial doubt about the Company’s ability to continue as a going concern.

Based on the Company’s current funding sources and taking into account the working capital position and capital requirements at August 31, 2019, these factors indicate the existence of a material uncertainty that raises substantial doubt about the Company’s ability to continue as a going concern and is dependent on the Company raising additional debt or equity financing. The Company must obtain additional funding in fiscal 2019 in order to continue development and construction of the Buckreef Project. Furthermore, the Company is currently negotiating project financing terms with a number of lending institutions, which the Company believes will result in the Company obtaining the project financing required to fund the construction of a mill at the Buckreef Project. However there is no assurance that such additional funding and/or project financing will be obtained or obtained on commercially favourable terms.

The Company has no cash flow from operations and has historically depended on the proceeds from equity financings for its operations.

The Company’s current operations do not generate any revenues or cash flow. Any work on the Company’s properties will require additional equity financing. If the Company seeks funding from existing or new joint venture partners, its project interests will be diluted. If the Company seeks additional equity financing, the issuance of additional shares will dilute the current interests of the Company’s current shareholders. The Company may not be able to obtain additional funding to allow the Company to fulfill its obligations on existing exploration properties. The Company’s failure to obtain such additional financing could result in delay or indefinite postponement of further exploration and development and the possible partial or total loss of the Company’s potential interest in certain properties or dilution of the Company’s interest in certain properties.

We are subject to litigation which could cause a dilutive effect to our shareholders and require us to incur legal expenses.

On January 19, 2018, Crede CG III, LTD (“Crede”) filed suit against the Company in the Supreme Court of the State of New York, County of New York, claiming, among other things, breach of contract for failure to allow Crede to exercise 1,300,000 Series A Warrants, as described in Note 5, to acquire 3,100,751 common shares. The Series A Warrants were issued, along with Series B Warrants (the Series A Warrants and Series B Warrants, collectively “Warrants), in connection with a Securities Purchase Agreement entered into on September 1, 2016. In response to the complaint, our attorneys initiated correspondence with Crede’s attorneys regarding Crede’s January 19, 2018 complaint. On February 27, 2018, Crede dismissed its complaint against us without prejudice. On March 12, 2018, Crede filed suit against us in the Supreme Court of the State of New York, County of New York (Index No. 651156/2018) (“State Claim”), claiming breach of contract (including specific performance and injunctive relief); declaratory judgment that the Securities Purchase Agreement and Warrants are binding obligations; and, in the event injunctive and declaratory relief is not ordered, awarding compensatory and punitive damages, and attorney fees and costs for failure to allow Crede to exercise 500,000 Series B Warrants to acquire 1,332,222 common shares. On August 21, 2019, we filed a notice of appeal and seeking a stay of the summary judgement order in the State Claim pending appeal. On October 17, 2019, the court in the State Claim order the delivery of 1,332,222 shares of common stock with an officer designated by the court and that a bond of US$200,000 be posted. We do not believe that the New York Supreme Court of the State of New York in the State Claim had the authority to require to post a bond in the amount US$200,000. Accordingly, we have appealed the Supreme Court of the State of New York’s authority to require us to post a bond. In the event that we are required to post the US$200,000 and we are unable to do so, Crede will have right to sell the 1,332,222 common shares and to exercise its rights under the Securities Purchase Agreement notwithstanding our appeal. This potential right for Crede to sell its common shares and exercise its rights under the Securities Purchase Agreement could have detrimental affect on the price of our common shares. As discussed below, the Supreme Court of the State of New York’s decision does not affect our Federal Claim against Crede for market manipulation, among other claims, as discussed below.

On May 10, 2018, the Company filed a complaint in the United States District Court Southern District of New York against Crede and certain of its principals, and Wellington Shields & Co who acted as the broker in the sale of securities pursuant to the Securities Purchase Agreement alleging, among other things, violation of Section 10 and Rule 10b-5 promulgated thereunder of the Exchange Act, violation of Section 13(d) and Rule 13d-1 promulgated thereunder of the Exchange Act, and breach of contract (“Federal Claim”). On July 17, 2018, we filed a first amended complaint in the United States District Court Southern District of New York, seeking, in addition to the relief sought in the initial

8

complaint, declaratory relief that Securities Purchase Agreement and related agreements, including the Warrants, are void based on a violation of Section 29(b) of the Exchange Act. On March 26, 2019, in response to a motion to dismiss by the defendants in the action in Federal Claim, the District Court dismissed certain of our claims against the defendants, but allowed our claims under Section 10(b) of the Securities Exchange Act of 1934 and Rule 10b-5 promulgated thereunder of market manipulation against, and our claim of breach of the covenant of good faith and fair dealing by Crede to continue.

The Federal Claim is in its initial stage and discovery has been initiated. In the event that we are forced to allow Crede to exercise the Warrants pursuant to the Supreme Court of the State of New York’s order and/or are subject to damages, we may be required to issue additional common shares under the Securities Purchase Agreement. Under the terms of the Securities Purchase Agreement, the maximum number of common shares that may be issued in the transaction is limited to 21,704,630, of which 10,344,487 have been issued. Pursuant to the Securities Purchase Agreement, we have also agreed to register the common shares that may be issued to Crede pursuant to a registration rights agreement. The issuance of additional common shares will have a dilutive effect to our shareholders and the payment of damages and legal expenses may adversely affect our financial condition.

As of August 31, 2019, our internal control over financial reporting were ineffective, and if we continue to fail to improve such controls and procedures, investors could lose confidence in our financial and other reports, the price of our shares of common stock may decline, and we may be subject to increased risks and liabilities.

As a public company, we are subject to the reporting requirements of the Exchange Act and the Sarbanes-Oxley Act of 2002. The Exchange Act requires, among other things, that we file annual reports with respect to our business and financial condition. Section 404 of the Sarbanes-Oxley Act requires, among other things, that we include a report of our management on our internal control over financial reporting. We are also required to include certifications of our management regarding the effectiveness of our disclosure controls and procedures. For the year ended August 31, 2019, our management has concluded that our disclosure controls and procedures and internal control over financial reporting were ineffective due to the following material weaknesses: (i) review and approval of certain supplier and vendor invoices and the related oversight and accuracy of recording the associated charges in the Company’s books; and (ii) lack of adequate oversight related to the development and performance of internal controls. . , We intend to implement changes and procedures to address these issues; any proposed changes to address the material weaknesses will take time to implement due to, among other things, a limited number of staff at the Company. If we cannot effectively and efficiently improve our controls and procedures, we could suffer material misstatements in our financial statements and other information we report and fail to meet our reporting obligations, which would likely cause investors to lose confidence in our reported financial and other information. This could lead to a decline in the trading price of our common shares.

The Company has issued a number of gold and cash loans which at the option of holder are convertible into common shares, may be repaid through the issuance of gold, are secured by the Company’s assets and may be subject to annual renewal.

To finance the Company’s operations and prior exploration, as of August 31, 2019, the Company has issued $6,927,371 loans in the aggregate. Of this amount, $4,998,127 was in the form of gold bullion loans. The principal and interest on the gold bullion loans may be, at the election of the holder, repaid in cash, gold bullion or convertible into common shares. In the event the gold loan holder elects repayment in gold bullion and the Company does not have the gold bullion, it may be required to purchase gold bullion on the open market in order to repay the loans. As a result, the Company may be at risk in the event the price of gold increases and the Company is required to purchase gold bullion to repay the loan. Further, the holders of the gold bullion loans may elect to convert the principal and interest of such loans into common shares at exercise prices ranging from US$0.26 and US$0.5320 per share, which has the effect of diluting the ownership of existing shareholders.

In addition, as of August 31, 2019, the Company has issued $1,929,244 in convertible loans. The principal and interest on the convertible loans may be, at the election of the holder, repaid in cash or convertible into our common shares at exercise prices ranging from US$0.26 to US$0.3446 per share. In the event that the holder of the convertible loans elects to convert the principal and interest of such loans into common shares, such conversion will have the effect of diluting the ownership of existing shareholders.

Further, the gold and cash loans are secured by certain assets of the Company, including its CIL plant, pad loadings, gold on pads, gold in form of dore, gold in plan process and gold at refinery. In the event of default, the Company may lose its rights to these assets which could adversely affect its operations.

9

Finally, these loans are subject to annual renewal. Although many of these holders of loan have renewed the loans on an annual basis, no assurance can be given they will continue to annually renew the loans.

The Company’s exploration activities are highly speculative and involve substantial risks.

With the exception of one project, the Buckreef Project, all of the other Company’s properties are in the exploration stage and no proven mineral reserves have been established. The Company’s exploration work may not result in the discovery of mineable deposits of ore in a commercially economical manner. There may be limited availability of water, which is essential to milling operations, and interruptions may be caused by adverse weather conditions. The Company’s future operations, if any, are subject to a variety of existing laws and regulations relating to exploration and development, permitting procedures, safety precautions, property reclamation, employee health and safety, air quality standards, pollution and other environmental protection controls.

The Company has uninsurable risks.

The Company may be subject to unforeseen hazards such as unusual or unexpected formations and other conditions. The Company may become subject to liability for pollution, cave-ins or hazards against which it cannot insure or against which it may elect not to insure. The payment of such liabilities may have a material adverse effect on the Company’s financial position.

The Company depends on key management personnel.

The success of the operations and activities of the Company is dependent to a significant extent on the efforts and abilities of its management, including James E. Sinclair, Executive Chairman. Investors must be willing to rely to a significant extent on their discretion and judgment. The Company does not have an employment contract with the Executive Chairman. The Company does not maintain key-man life insurance on the Executive Chairman.

The Company may be characterized as a passive foreign investment company.

The Company may be characterized as a passive foreign investment company (“PFIC”). If the Company is determined to be a PFIC, its U.S. shareholders may suffer adverse tax consequences. Under the PFIC rules, for any taxable year that the Company’s passive income or its assets that produce passive income exceed specified levels, the Company will be characterized as a PFIC for U.S. federal income tax purposes. This characterization could result in adverse U.S. tax consequences for the Company’s U.S. shareholders, which may include having certain distributions on its common shares and gains realized on the sale of its common shares treated as ordinary income, rather than as capital gains income, and having potentially punitive interest charges apply to the proceeds of sales of the Company’s common shares and certain distributions.

Certain elections may be made to reduce or eliminate the adverse impact of the PFIC rules for holders of the Company’s common shares, but these elections may be detrimental to the shareholder under certain circumstances. The PFIC rules are extremely complex and U.S. investors are urged to consult independent tax advisers regarding the potential consequences to them of the Company’s classification as a PFIC. See “Certain United States Federal Income Tax Considerations.”

Foreign corrupt practices legislation.

The Company is subject to the Foreign Corrupt Practices Act (the “FCPA”), the Corruption of Foreign Public Officials Act (Canada) (“CFPOA”), and other laws that prohibit improper payments or offers of payments to foreign governments and their officials and political parties by persons and issuers as defined by the statutes, for the purpose of obtaining or retaining business. It is the Company’s policy to implement safeguards to discourage these practices by its employees; however, its existing safeguards and any future improvements may prove to be less than effective and the Company’s employees, consultants, sales agents or distributors may engage in conduct for which the Company might be held responsible. Any such violation could result in substantial fines, sanctions, civil and/or criminal penalties, curtailment of operations in certain jurisdictions, and might adversely affect our business, results of operations or financial condition. In addition, actual or alleged violations could damage our reputation and ability to do business. Furthermore, detecting, investigating, and resolving actual or alleged violations is expensive and could consume significant time and attention of our management.

10

Security breaches and other disruptions could compromise the Company’s information and expose it to liability, which would cause its business and reputation to suffer.

In the ordinary course of the Company’s business, it collects and stores sensitive data, including intellectual property, its proprietary business information and that of its business partners, and personally identifiable information of its employees in its data centers and on its networks. The secure processing, maintenance and transmission of this information is critical to the Company’s operations and business strategy. Despite its security measures, the information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance or other disruptions. Any such breach could compromise the Company’s networks and the information stored there could be accessed, publicly disclosed, lost or stolen. Any such access, disclosure or other loss of information could result in legal claims or proceedings, potential liability under laws that protect the privacy of personal information, and potential regulatory penalties, disrupt the Company’s operations and damage its reputation, and cause a loss of confidence in the Company, which could adversely affect its business and competitive position.

Risks Relating to the Mining Industry

The Company cannot accurately predict whether commercial quantities of ores as estimated or projected in the pre-feasibility study will be established once commercial production commences.

Whether an ore body will be commercially viable depends on a number of factors beyond the control of the Company, including the particular attributes of the deposit such as size, grade and proximity to infrastructure, as well as mineral prices and government regulations, including regulations relating to permitting, prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The Company cannot accurately predict the exact effect of these factors, but the combination of these factors may result in a mineral deposit being unprofitable. The Company has no mineral producing properties at this time. Although the mineral resource estimates included herein have been prepared by the Company, or, in some instances have been prepared, reviewed or verified by independent mining experts, these amounts are estimates only and there is a risk that a particular level of recovery of gold or other minerals from mineral resource will not in fact be realized or that an identified mineralized deposit, if any, will never qualify as a commercially mineable or viable reserve.

The exploration for and development of mineral deposits involves significant risks.

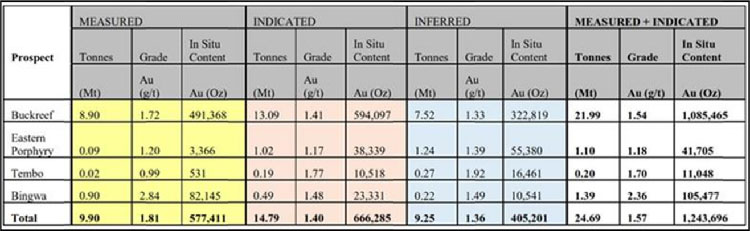

Mineral resource exploration is a speculative business and involves a high degree of risk. The Company has completed several diamond and reverse circulation drilling programs on the Buckreef Project and independent qualified persons have reviewed the results of the drilling program in the context of analyzing the economic significance of the open-pittable mineral resources at the Buckreef Project using current gold prices. However, the exploration for and development of mineral deposits involves significant risks, which even a combination of careful evaluation, experience and knowledge may not eliminate. Significant expenditures will be required to locate further and/or upgrade mineral resources from inferred category to measured and Indicated category, to revise and/or upgrade the recently established mineral reserves, to develop metallurgical processes, to purchase, construct and run a test 60tph pilot process plant and to finalize on a bankable feasibility study to construct mining and processing facilities at the Buckreef Project site.

The Company may not be able to establish the presence of minerals on a commercially viable basis.

The Company’s ability to generate revenues and profits, if any, is expected to occur through exploration and development of its existing properties as well as through acquisitions of interests in new properties. The Company will need to incur substantial expenditures in an attempt to establish the economic feasibility of mining operations by identifying mineral deposits and establishing ore reserves through drilling and other techniques, developing metallurgical processes to extract metals from ore, designing facilities and planning mining operations. The economic feasibility of a project depends on numerous factors beyond the Company’s control, including the cost of mining and production facilities required to extract the desired minerals, the total mineral deposits that can be mined using a given facility, the proximity of the mineral deposits to a user of the minerals, and the market price of the minerals at the time of sale. The Company’s existing or future exploration programs or acquisitions may not result in the identification of deposits that can be mined profitably.

11

The Company depends on consultants and engineers for its exploration programs.

The Company has relied on and may continue to rely upon consultants for exploration development, construction and operating expertise. Substantial expenditures are required to construct mines, to establish ore reserves through drilling, to carry out environmental and social impact assessments, to develop metallurgical processes to extract the metal from the ore and, in the case of new properties, to develop the exploration infrastructure at any site chosen for exploration. The Company may not be able to discover minerals in sufficient quantities to justify commercial operation, and the Company may not be able to obtain funds required for exploration on a timely basis.

The Company may not have clear title to its properties.

Acquisition of title to mineral properties is a very detailed and time-consuming process, and the Company’s title to its properties may be affected by prior unregistered agreements or transfers, or undetected defects. Several of the Company’s prospecting licenses are currently subject to renewal by the Ministry of Energy and Minerals of Tanzania. There is a risk that the Company may not have clear title to all its mineral property interests, their licenses may not be renewed or they may be subject to challenge or impugned in the future. See “Mineral Properties”. In other instances, the Company might not have immediate access to some of its mineral properties due to the ever revolving statutory requirements and regulations as enacted by the Government of Tanzania and enforced by the various ministries.

During fiscal 2019, the Company received a notice of cancellation of mining license relating to the Kigosi mining license for failure to satisfy the issues raised in the default notice. The notice sent by the Ministry of Energy and Minerals of Tanzania did not follow due process under Tanzania law and the Company filed an appeal to this notification subsequent to fiscal year-end. Further, during fiscal 2019, the Company received a notice of rejection of the mining license application for Itetemia, for failure to have complied with certain regulations. The notice sent by the government did not follow due process under Tanzania law and the Company filed an appeal to this notification subsequent to year-end. The Company remains confident that they will be successful in the appeals. However, although the Company believes that it will be successful in appealing the notice of cancellation of the Kigosi mining license and appeal of notice of rejection of the mining license application for Itetemia, in the event the Company loses either appeal, the Company may lose its rights to either the Kigosi mining license or Itetemia mining license.

The Company’s properties have been and may continue to be subject to illegal mining.

During 2015, illegal miners, consisting primarily of artisanal miners, invaded and forced occupation at the Buckreef Project. As a result, these illegal miners disrupted the Company’s activities. As a result of these illegal miners’ activities, the Company provided a notice of force majeure under its agreement with Stamico and did not allow Tanzam, the Company’s joint venture operator, to continue mining activities at the Company’s property until this issue was resolved. Although the Company worked out an agreement with Deputy Minister of Energy and Minerals to provide an area for artisanal mining, no assurance can be given that no more illegal mining activities will occur at the Company’s properties or disrupt its operations. Recently, the Company has requested for and been provided with a police detail from the Ministry of Home Affairs, through the offices of the Inspector General of Police (Tanzania) permanently stationed and patrolling the Buckreef Project as further efforts by the Company to deter illegal Mining on the main project site.

During the fiscal year, there has been some attempted invasion in and around the Buckreef Project. The Company has requested and been granted the presence of Tanzanian police at the camp site and is negotiating a Memorandum of Understanding with the Tanzanian Inspector General Police, to have a permanent security detail from the police force.

Mining exploration, development and operating activities are inherently hazardous.

The Company has not paid all annual license fees on its properties and it may be subject to penalties.

In order to maintain the existing site of mining and exploration licenses, the Company is required to pay annual license fees. The Company has been making efforts to pay off certain of its outstanding annual license fees since October 2014 for all its active licenses. The Ministry of Mines has put into effect a requirement that even though a license is forfeited, the outstanding annual fees are still due and considered a liability. As at August 31, 2019, an accrual of $707,000 (August 31, 2018 - $260,000) has been recorded relating to unpaid license fees. For active licenses, these licenses remain in good standing until a letter of demand is received from Ministry of Mines requesting payment of any unpaid license fees plus 50% penalty, and the Company fails to respond within 30 days. The Company has not received a letter of demand from the Ministry of Mines on its active licenses. The current penalty estimate relating to unpaid license fees is

12

approximately $219,000 (August 31, 2018 - $125,000). The Company has not recorded an accrual for all valid and active mining licenses but only from the forfeited licenses list as stated above.

The Company may be subject to additional payments to the Tanzanian government because it has not brought the Buckreef Project into production by a certain date.

The Company’s joint venture agreement with Stamico contains an obligation clause regarding the commissioning date for the plant. The clause becomes effective only in the event the property is not brought into production before a specified future date which was originally estimated to be in December 2015. Under the agreement, the Company is entitled to extend the date for one additional year: (i) for the extension year; on payment to Stamico of US$500,000; (ii) for the second extension year, on payment to Stamico of US$625,000; and (iii) for each subsequent extension year, on payment to Stamico of US$750,000.

The Company has received a request letter from Stamico regarding the status of the penalty payment and has responded that no penalty is due at this time. The Company has received a subsequent letter from Stamico regarding request for payment. It remains the Company’s position that no penalty is due at this time, but the Company and Stamico have been engaged in settlement discussions to resolve this issue, and a payment of $172,330 has been made in connection with the settlement discussions to be applied towards the amount owing with the remainder to be paid out of proceeds of production.

No assurance can be given that Stamico will not demand additional money from the Company because the Company has not brought the Buckreef Project into production by a certain date.

If the Company experiences mining accidents or other adverse conditions, the Company’s mining operations could be materially adversely affected.

The Company’s exploration activities may be interrupted by any or all of the following mining accidents such as cave-ins, rock falls, rock bursts, pit wall failures, fires or flooding. In addition, exploration activities may be reduced if unfavorable weather conditions, ground conditions or seismic activity are encountered, ore grades are lower than expected, the physical or metallurgical characteristics of the ore are less amenable than expected to mining or treatment, dilution increases or electrical power is interrupted. Occurrences of this nature and other accidents, adverse conditions or operational problems in future years may result in the Company’s failure to achieve current or future exploration and production estimates.

Development of the Company’s projects is based on estimates and the Company cannot guarantee that its projects, if any, will be placed into production.

Any potential production and revenues based on production from any of the Company’s properties are estimates only. Estimates are based on, among other things, mining experience, resource estimates, assumptions regarding ground conditions and physical characteristics of ores (such as hardness and presence or absence of certain metallurgical characteristics) and estimated rates and costs of mining and processing. The Company’s actual production from the Buckreef Project, if it ever achieves production, may be lower than its production estimates. Each of these factors also applies to future development properties not yet in production at the Company’s other projects. In the case of mines the Company may develop in the future, it does not have the benefit of actual experience in its estimates, and there is a greater likelihood that the actual results will vary from the estimates. In addition, development and expansion projects are subject to unexpected construction and start-up problems and delays.

The Company’s exploration activities are subject to various federal, state and local laws and regulations.

Laws and regulation govern the exploration, mining development, mine production, importing and exporting of minerals; taxes; labor standards; occupational health; waste disposal; protection of the environment; mine safety; toxic substances; and other matters. The Company requires licenses and permits to conduct exploration and mining operations. Amendments to current laws and regulations governing operations and activities of mining companies or more stringent implementation thereof could have a substantial adverse impact on the Company. Applicable laws and regulations will require the Company to make certain capital and operating expenditures to initiate new operations. Under certain circumstances, the Company may be required to close an operation once it is started until a particular problem is remedied or to undertake other remedial actions.

13

The Buckreef Project is held through a special mining license expiring June 11, 2027 granted pursuant to the Mining Act, 2010 (Tanzania). The Company’s has other mineral interests in Tanzania that are held under prospecting licenses granted under that Act. There are initial application fees, registration fees, preparation fees and annual rental fees for prospecting licenses based on the total area of the license. Renewals of prospecting licenses can take many months and possibly even years to process by the regulatory authority in Tanzania and there is no guarantee that they will be granted. With each renewal at least 50% of the licensed area, if greater than 20 square kilometers, must be relinquished and if the Company wishes to keep the relinquished one-half portion, it must file a new application for the relinquished portion. There is no guarantee on the timing for processing the new application and whether it will be successful.

In addition, any new license (PL, ML & SML) applications and renewals are also now subject to the recently enacted of the Ministry of Mines Local Content Regulations GN 3 of 2018 that is enforced by the newly enacted and established 6-member Tanzanian Mining Commission that now oversees the Mining Commissioner and all license applications. The new regulations reflect a strong will to foster diversification and linkages to the local economy, create jobs through the use of Tanzanian expertise, goods and services, businesses and financing in the mining value chain. Not only does it force licensees and contractors to use indigenous Tanzanian companies for the procurement of goods and services, but also requires a physical presence in Tanzania.

Risks Relating to the Market

The Company’s competition is intense in all phases of the Company’s business.

The mining industry in which the Company is engaged is in general, highly competitive. Competitors include well-capitalized mining companies, independent mining companies and other companies having financial and other resources far greater than those of the Company. The Company competes with other mining companies in connection with the acquisition of gold and other precious metal properties. In general, properties with a higher grade of recoverable mineral and/or which are more readily mineable afford the owners a competitive advantage in that the cost of production of the final mineral product is lower. Thus, a degree of competition exists between those engaged in the mining industries to acquire the most valuable properties. As a result, the Company may eventually be unable to acquire attractive gold mining properties.

The Company is subject to the volatility of metal and mineral prices.

The economics of developing metal and mineral properties are affected by many factors beyond the Company’s control, including, without limitation, the cost of operations, variations in the grade ore or resource mined, and the price of such resources. The market prices of the metals for which the Company is exploring are highly speculative and volatile. Depending on the price of gold or other resources, the Company may determine that it is impractical to commence or continue commercial production. Gold prices fluctuate widely and are affected by numerous factors beyond the Company’s control, including central bank purchases and sales, producer hedging and de-hedging activities, expectations of inflation, the relative exchange rate of the U.S. dollar with other major currencies, interest rates, global and regional demand, political and economic conditions, production costs in major gold-producing regions, speculative positions taken by investors or traders in gold and changes in supply, including worldwide production levels. The price of gold and other metals and minerals may not remain stable, and such prices may not be at levels that will make it feasible to continue the Company’s exploration activities, or commence or continue commercial production. The aggregate effect of these factors is impossible to predict with accuracy.

The Company’s business activities are conducted in Tanzania.

The Company’s principal exploration and mine development properties are currently located in the United Republic of Tanzania, Africa, under which the Company has obtained a license to explore, develop and operate the properties. Although the Company believes that the Tanzania government is a stable, multi-party democracy, there is no guarantee that this will continue. Tanzania is surrounded by unstable countries enduring political and civil unrest, and in some cases, civil war. There is no guarantee that the surrounding unrest will not affect the Tanzanian government and people, and therefore, the Company’s mineral exploration activities. Any such effect is beyond the control of the Company and may materially adversely affect its business.

Further, the operator of the Buckreef Project is Tanzam, a joint venture that is 55% owned by one of the Company’s subsidiaries and 45% is owned by the Stamico, a governmental agency of the Tanzania. Therefore, the government of Tanzania will have a substantial input at the Company’s operations at the Buckreef Project.

14

Additionally, the Company may be affected in varying degrees by political stability and government regulations relating to the mining industry and foreign investment in Tanzania. The government of Tanzania may institute regulatory policies that adversely affect the exploration and mine development (if any) of the Company’s properties. Any changes in regulations or shifts in political conditions in this country are beyond the control of the Company and may materially adversely affect its business. Investors should assess the political and regulatory risks related to the Company’s foreign country investments. The Company’s operations in Tanzania are also subject to various levels of economic, social and other risks and uncertainties that are different from those encountered in North America. The Company’s operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, restrictions on foreign exchange and repatriation, income taxes, expropriation of property, environmental legislation and mine safety. Other risks and uncertainties include extreme fluctuations in currency exchange rates, high rates of inflation, labor unrest, risks of war or civil unrest, government and civil unrest, regional expropriation and nationalization, renegotiation or nullification of existing concessions, licenses, permits and contracts, illegal mining, corruption, hostage taking, civil war and changing political conditions and currency controls. Infectious diseases (including Ebola virus, malaria, HIV/AIDS and tuberculosis) are also major health care issues where the Company operates.

Mineral exploration in Tanzania is affected by local climatic and economic conditions.

The Company’s properties in Tanzania have year round access, although seasonal winter rains from December to March may result in flooding in low lying areas, which are dominated by mbuga, a black organic rich laustrine flood soil. Further, most lowland areas are under active cultivation for corn, rice, beans and mixed crops by subsistence farmers. As a result, the area has been deforested by local agricultural practices for many years. The seasonal rains and deforested areas can create a muddy bog in some areas, which can make access more difficult, and could impede or even prevent the transport of heavy equipment to the Company’s mineral properties at certain times of the year between December and March.

The Company’s operations are subject to issues relating to security and human rights.

Civil disturbances and criminal activities such as trespass, illegal mining, theft and vandalism may cause disruptions at the Company’s operations in Tanzania which may result in the suspension of operations. There is no guarantee that such incidents will not occur in the future. Such incidents may halt or delay exploration, increase operating costs, result in harm to employees or trespassers, decrease operational efficiency, increase community tensions or result in criminal and/or civil liability for the Company or its employees and/or financial damages or penalties. The manner in which the Company’s personnel respond to civil disturbances and criminal activities can give rise to additional risks where those responses are not conducted in a manner that is consistent with international standards relating to the use of force and respect for human rights. The failure to conduct security operations in accordance with these standards can result in harm to employees or community members, increase community tensions, reputational harm to the Company and its partners or result in criminal and/or civil liability for the Company or its employees and/or financial damages or penalties. It is not possible to determine with certainty the future costs that the Company may incur in dealing with the issues described above at its operations.

Risks relating to the Securities of the Company

As a foreign private issuer, the Company is subject to different U.S. securities laws and rules than a domestic U.S. issuer, which may limit the information publicly available to U.S. shareholders.

The Company is a foreign private issuer under applicable U.S. federal securities laws. As a result, the Company does not file the same reports that a U.S. domestic issuer would file with the SEC, although the Company is required to file with or furnish to the SEC the continuous disclosure documents that the Company is required to file in Canada under Canadian securities laws. In addition, the Company’s officers, directors, and principal shareholders are exempt from the reporting and “short swing” profit rules of Section 16 of the Exchange Act. Therefore, shareholders may not know on as timely a basis when the Company’s officers, directors and principal shareholders purchase or sell common shares, as the reporting dates under the corresponding Canadian insider reporting requirements are longer. In addition, as a foreign private issuer, the Company is exempt from the proxy rules under the Exchange Act.

15

The Company may lose its foreign private issuer status in the future, which could result in significant additional costs and expenses.

In order to maintain the Company’s current status as a foreign private issuer, a majority of its common shares must be either directly or indirectly owned by non-residents of the United States, unless the Company also satisfies one of the additional requirements necessary to preserve this status. The Company may in the future lose its foreign private issuer status if a majority of its common shares is held in the United States and it fails to meet the additional requirements necessary to avoid loss of foreign private issuer status. The regulatory and compliance costs under U.S. federal securities laws as a U.S. domestic issuer may be significantly more than the costs incurred as a Canadian foreign private issuer eligible to use the multijurisdictional disclosure system (“MJDS”). If the Company is not a foreign private issuer, it would not be eligible to use the MJDS or other foreign issuer forms and would be required to file periodic and current reports and registration statements on U.S. domestic issuer forms with the SEC, which are more detailed and extensive than the forms available to a foreign private issuer. In addition, the Company may lose the ability to rely upon certain exemptions from NYSE American corporate governance requirements that are available to foreign private issuers.

U.S. investors may not be able to obtain enforcement of civil liabilities against the Company.

The enforcement by investors of civil liabilities under the United States federal or state securities laws may be affected adversely by the fact that the Company is governed by the Business Corporations Act (Alberta), that the some of the Company’s officers and directors are residents of Canada or otherwise reside outside the United States, and that all, or a substantial portion of their assets and a substantial portion of the Company’s assets, are located outside the United States. It may not be possible for investors to effect service of process within the United States on certain of the Company’s directors and officers or enforce judgments obtained in the United States courts against the Company, certain of its directors and officers based upon the civil liability provisions of United States federal securities laws or the securities laws of any state of the United States.

Common share prices will likely be highly volatile, and your investment could decline in value or be lost entirely.

The market price of the common shares is likely to be highly volatile and may fluctuate significantly in response to various factors and events, many of which the Company cannot control. The stock market in general, and the market for mining company stocks in particular, has historically experienced significant price and volume fluctuations. Volatility in the market price for a particular issuer’s securities has often been unrelated or disproportionate to the operating performance of that issuer. Market and industry factors may depress the market price of the Company’s securities, regardless of operating performance. Volatility in the Company’s securities price also increases the risk of securities class action litigation.

The Company’s common shares must meet the requirements of the NYSE American.

The NYSE American rules provides that the NYSE American may, in its discretion, at any time, and without notice, suspend dealings in or remove any security from listing or unlisted trading privileges, if, among other things, where the financial condition and/or operating results of the issuer appear to be unsatisfactory or it appears that the extent of public distribution or the aggregate market value of the security has become so reduced as to make further dealings on the NYSE American inadvisable. Although the Company has received no indication or notification that its common shares may be delisted, in light of the current per common share price and the Company’s financial losses, there is no assurance that the Company’s common shares will continue to be listed on the NYSE American.

Offers or availability for sale of a substantial number of common shares may cause the price of the Company’s common shares to decline.

In the future, in connection with current and future financings, the Company could have sales of a significant number of its common shares in the public market which could harm the market price of its common shares and make it more difficult for the Company to raise funds through future offerings of common shares. The Company’s shareholders may sell substantial amounts of its common shares in the public market. The availability of these common shares for resale in the public market has the potential to cause the supply of its common shares to exceed investor demand, thereby decreasing the price of the common shares.

In addition, the fact that the Company’s shareholders can sell substantial amounts of its common shares in the public market, whether or not sales have occurred or are occurring, could make it more difficult for the Company to raise

16

additional financing through the sale of equity or equity-related securities in the future at a time and price that it deems reasonable or appropriate.

| Item 4. | Information on the Company |

A. History and Development of the Company

The Company was originally incorporated under the name “424547 Alberta Ltd.” in the Province of Alberta on July 5, 1990, under the Business Corporations Act (Alberta). The name was changed to “Tan Range Exploration Corporation” on August 13, 1991. The name of the Company was again changed to “Tanzanian Royalty Exploration Corporation” on February 28, 2006 and to Tanzanian Gold Corporation on April 17, 2019.

The Company is also registered in the Province of Ontario as an extra-provincial company under the Business Corporations Act (Ontario).

The principal executive office of the Company is located at Bay Adelaide Centre, East Tower, 22 Adelaide Street West, Suite 3400, Toronto, Ontario, M5H 4E3, and its telephone number is (844) 364-1830. Our internet address is www.tangoldcorp.com.

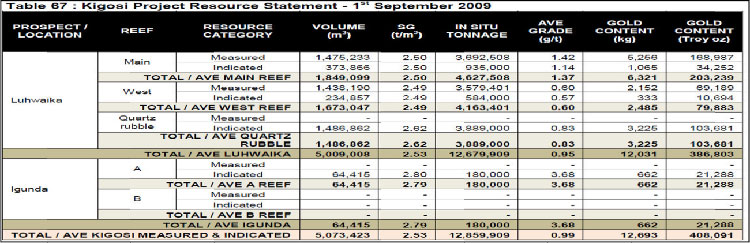

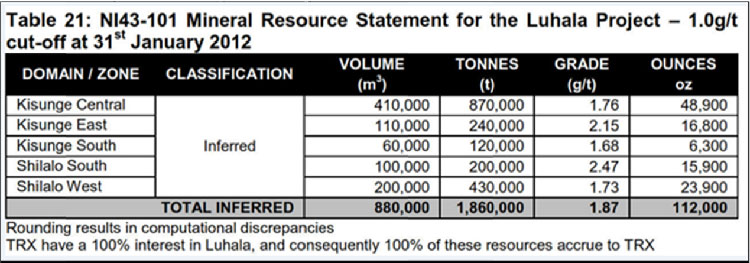

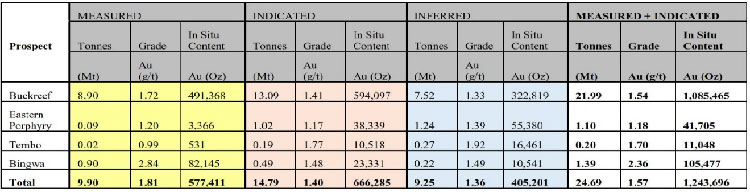

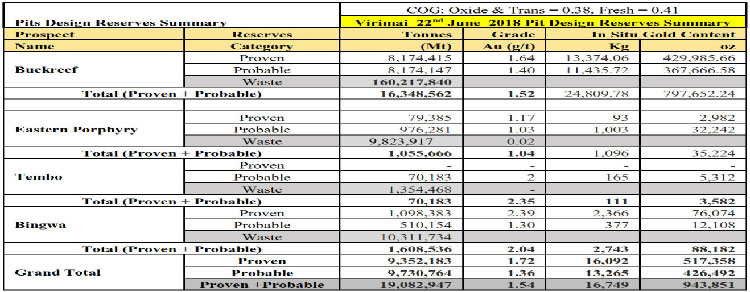

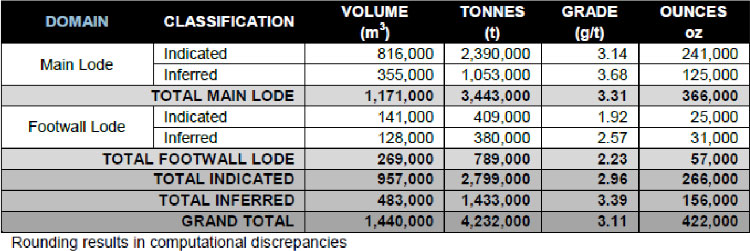

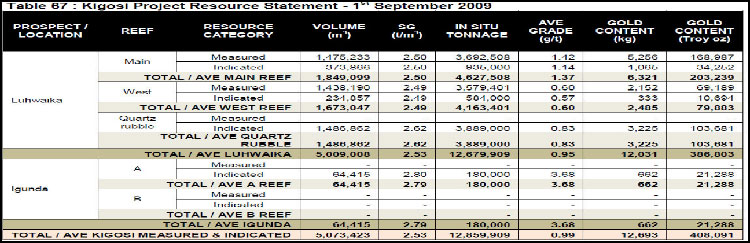

For the year ended August 31, 2019, the Company reported a net loss of $29,317,517. Included in the net loss is $22,229,752 of mineral properties and deferred exploration expenses that were written off primarily relating to the Kigosi, Itetemia and Luhala properties. In light of the Company’s strategic focus on the Buckreef Project, the Kigosi, Itetemia and Luhala properties were placed in a care and maintenance phase for potential development in the future. The Company incurred deferred exploration expenditures of $3,137,557 during the year ended August 31, 2019.