Exhibit 99.1

Tanzanian Royalty Exploration Corporation

Unaudited Interim Condensed Consolidated

Financial Statements

For the three month periods ended

November 30, 2017 and 2016

NOTICE TO READER

Tanzanian Royalty Exploration Corporation’s independent auditors have not performed a review of these financial statements in accordance with standards established by CPA Canada for a review of interim financial statements by an entity’s auditor.

MANAGEMENT’S RESPONSIBILITY FOR FINANCIAL REPORTING

The accompanying unaudited interim consolidated financial statements of Tanzanian Royalty Exploration Corporation, are the responsibility of the management and Board of Directors of the Company.

The unaudited interim consolidated financial statements have been prepared by management, on behalf of the Board of Directors, in accordance with the accounting policies disclosed in the notes to the unaudited interim consolidated financial statements. Where necessary, management has made informed judgments and estimates in accounting for transactions which were not complete at the statement of financial position date. In the opinion of management, the interim consolidated financial statements have been prepared within acceptable limits of materiality and are in accordance with International Accounting Standard 34 Interim Financial Reporting of International Financial Reporting Standards using accounting policies consistent with International Financial Reporting Standards appropriate in the circumstances.

Management has established systems of internal control over the financial reporting process, which are designed to provide reasonable assurance that relevant and reliable financial information is produced.

The Board of Directors is responsible for reviewing and approving the unaudited interim consolidated financial statements together with other financial information of the Company and for ensuring that management fulfills its financial reporting responsibilities. An Audit Committee assists the Board of Directors in fulfilling this responsibility. The Audit Committee meets with management to review the financial reporting process and the unaudited interim consolidated financial statements together with other financial information of the Company. The Audit Committee reports its findings to the Board of Directors for its consideration in approving the unaudited interim consolidated financial statements together with other financial information of the Company for issuance to the shareholders.

Management recognizes its responsibility for conducting the Company’s affairs in compliance with established financial standards, and applicable laws and regulations, and for maintaining proper standards of conduct for its activities.

| “Jeffrey R. Duval” | “Marco Guidi” | |

| Jeffrey R. Duval | Marco Guidi | |

| Acting Chief Executive Officer | Chief Financial Officer |

| 2 |

Tanzanian Royalty Exploration Corporation

Unaudited Interim Condensed Consolidated Statements of Financial Position

(Expressed in Canadian Dollars)

| As at | November 30, 2017 | August 31, 2017 | ||||||

| Assets | ||||||||

| Current Assets | ||||||||

| Cash (Note 15) | $ | 409,147 | $ | 1,011,293 | ||||

| Other receivables (Note 11) | 330,385 | 329,008 | ||||||

| Inventory (Note 14) | 522,966 | 507,489 | ||||||

| Prepaid and other assets (Note 12) | 43,619 | 74,298 | ||||||

| 1,306,117 | 1,922,088 | |||||||

| Property, plant and equipment (Note 4) | 2,474,935 | 2,510,697 | ||||||

| Mineral properties and deferred exploration (Note 3) | 48,285,326 | 46,920,303 | ||||||

| $ | 52,066,378 | $ | 51,353,088 | |||||

| Liabilities | ||||||||

| Current Liabilities | ||||||||

| Trade, other payables and accrued liabilities (Note 13) | $ | 5,017,555 | $ | 5,216,703 | ||||

| Leases payable (Note 4) | 57,406 | 56,631 | ||||||

| Convertible loan (Note 22) | 1,414,113 | 865,656 | ||||||

| Gold bullion loans (Note 20) | 3,529,881 | 2,335,474 | ||||||

| 10,018,955 | 8,474,464 | |||||||

| Warrant liability (Note 5) | 4,850,000 | 4,850,000 | ||||||

| Gold bullion loans (Note 20) | - | 1,059,524 | ||||||

| Asset Retirement Obligation (Note 18) | 719,498 | 715,057 | ||||||

| 15,588,453 | 15,099,045 | |||||||

| Shareholders’ equity | ||||||||

| Share capital (Note 5) | 125,366,664 | 125,174,377 | ||||||

| Share based payment reserve (Note 7) | 8,566,081 | 7,674,233 | ||||||

| Warrants reserve (Note 6) | 1,248,037 | 1,248,037 | ||||||

| Accumulated other comprehensive loss | (1,206,609 | ) | (2,176,352 | ) | ||||

| Accumulated deficit | (98,206,376 | ) | (96,566,577 | ) | ||||

| Equity attributable to owners of the Company | 35,767,797 | 35,353,718 | ||||||

| Non-controlling interests (Note 19, 3(a)) | 710,128 | 900,325 | ||||||

| Total shareholders’ equity | 36,477,925 | 36,254,043 | ||||||

| $ | 52,066,378 | $ | 51,353,088 | |||||

Nature of operations and Going Concern (Note 1)

Segmented information (Note 16)

Commitments (Notes 3 and 17)

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements

| 3 |

Tanzanian Royalty Exploration Corporation

Unaudited Interim Condensed Consolidated Statements of Comprehensive Loss

(Expressed in Canadian Dollars)

| Three month periods ended November 30, | 2017 | 2016 | ||||||

| Administrative expenses | ||||||||

| Depreciation (Note 4) | $ | 98,328 | $ | 105,489 | ||||

| Consulting (Note 8) | 233,938 | 158,432 | ||||||

| Directors’ fees (Note 8) | 27,906 | 84,831 | ||||||

| Office and general | 28,245 | 43,265 | ||||||

| Shareholder information | 56,886 | 20,481 | ||||||

| Professional fees (Note 8) | 118,731 | 313,121 | ||||||

| Salaries and benefits (Note 5) | 103,528 | 110,493 | ||||||

| Share based payments (Note 5) | 849,590 | 633,088 | ||||||

| Travel and accommodation | 13,406 | 13,640 | ||||||

| (1,530,558 | ) | (1,482,840 | ) | |||||

| Other income (expenses) | ||||||||

| Foreign exchange gain | 96,016 | (150,601 | ) | |||||

| Interest, net | (3,145 | ) | (6,656 | ) | ||||

| Interest accretion (Note 20 and 22) | (257,772 | ) | (184,035 | ) | ||||

| Accretion on asset retirement obligation (Note 18) | (2,772 | ) | (2,749 | ) | ||||

| Finance costs (Note 21) | (131,777 | ) | (95,497 | ) | ||||

| Exploration costs | (3,804 | ) | (5,760 | ) | ||||

| Interest on leases (Note 4) | (2,480 | ) | (10,231 | ) | ||||

| Gain on disposal of property, plant and equipment | - | 10,133 | ||||||

| Gain (loss) on shares issued for settlement of debt (Note 5, 20 and 22) | 6,606 | (90,486 | ) | |||||

| Withholding tax costs | (310 | ) | - | |||||

| Net loss | $ | (1,829,996 | ) | $ | (2,018,722 | ) | ||

| Other comprehensive loss | ||||||||

| Foreign currency translation | 969,703 | 1,002,704 | ||||||

| Comprehensive loss | $ | (860,293 | ) | $ | (1,016,018 | ) | ||

| Loss attributable to: | ||||||||

| Parent | (1,639,799 | ) | (2,054,317 | ) | ||||

| Non-controlling interests | (190,197 | ) | 35,595 | |||||

| $ | (1,829,996 | ) | $ | (2,018,722 | ) | |||

| Comprehensive loss attributable to: | ||||||||

| Parent | (963,073 | ) | (1,033,932 | ) | ||||

| Non-controlling interests | 102,780 | 17,914 | ||||||

| $ | (860,293 | ) | $ | (1,016,018 | ) | |||

| Loss per share – basic and diluted attributable to Parent | $ | (0.01 | ) | $ | (0.02 | ) | ||

| Weighted average # of shares outstanding – basic and diluted | 122,102,191 | 114,838,325 | ||||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements

| 4 |

Tanzanian Royalty Exploration Corporation

Unaudited Interim Condensed Consolidated Statements of Changes in Equity

(Expressed in Canadian Dollars)

| Share Capital | Reserves | |||||||||||||||||||||||||||||||||||

| Number of Shares | Amount | Share based payments | Warrants | Accumulated other comprehensive income | Accumulated deficit | Owner's equity | Non-controlling interests | Total equity | ||||||||||||||||||||||||||||

| Balance at September 1, 2016 | 109,068,492 | $ | 122,380,723 | $ | 1,066,863 | $ | 941,037 | $ | - | $ | (90,600,819 | ) | $ | 33,787,804 | $ | 1,368,679 | $ | 35,156,483 | ||||||||||||||||||

| Issued for private placement, net of issuance costs | 7,197,543 | 5,589,501 | - | - | - | - | 5,589,501 | - | 5,589,501 | |||||||||||||||||||||||||||

| Warrants issued on private placement | (6,592,000 | ) | - | - | - | - | (6,592,000 | ) | - | (6,592,000 | ) | |||||||||||||||||||||||||

| Agent warrants issued on private placement | (92,000 | ) | - | 92,000 | - | - | - | - | - | |||||||||||||||||||||||||||

| Issued pursuant to Restricted Share Unit ("RSU") Plan (Note 5) | 354,137 | 482,749 | (482,749 | ) | - | - | - | - | - | - | ||||||||||||||||||||||||||

| Shares issued for interest on gold loans (Note 20) | 202,260 | 172,318 | - | - | - | - | 172,318 | - | 172,318 | |||||||||||||||||||||||||||

| Reversal of warrant liability upon change of functional currency to USD | - | - | 215,000 | - | - | 215,000 | - | 215,000 | ||||||||||||||||||||||||||||

| Reversal of derivative in gold bullion loans upon change of functional | ||||||||||||||||||||||||||||||||||||

| currency to USD | - | 5,051,000 | - | - | - | 5,051,000 | - | 5,051,000 | ||||||||||||||||||||||||||||

| Reversal of derivative in gold convertible loans upon change of | ||||||||||||||||||||||||||||||||||||

| functional currency to USD | - | 108,000 | - | - | - | 108,000 | - | 108,000 | ||||||||||||||||||||||||||||

| Share based compensation - RSU | - | 121,660 | - | - | - | 121,660 | - | 121,660 | ||||||||||||||||||||||||||||

| Share based compensation - Stock options | - | 704,000 | - | - | - | 704,000 | - | 704,000 | ||||||||||||||||||||||||||||

| RSU shares forfeited (Note 5) | - | (116,911 | ) | - | - | - | (116,911 | ) | - | (116,911 | ) | |||||||||||||||||||||||||

| Exchange on translation of foreign subsidiaries | - | - | - | 1,002,704 | - | 1,002,704 | - | 1,002,704 | ||||||||||||||||||||||||||||

| Total comprehensive income (loss) for the period | - | - | - | - | (2,054,317 | ) | (2,054,317 | ) | 35,595 | (2,018,722 | ) | |||||||||||||||||||||||||

| Balance at November 30, 2016 | 116,822,432 | $ | 121,941,291 | $ | 6,451,863 | $ | 1,248,037 | $ | 1,002,704 | $ | (92,655,136 | ) | $ | 37,988,759 | $ | 1,404,274 | $ | 39,393,033 | ||||||||||||||||||

| Issued pursuant to Restricted Share Unit ("RSU") Plan (Note 5) | 341,854 | 558,241 | (558,241 | ) | - | - | - | - | - | - | ||||||||||||||||||||||||||

| Shares issued for interest on gold loans (Note 20) | 611,829 | 370,129 | - | - | - | - | 370,129 | - | 370,129 | |||||||||||||||||||||||||||

| Issued for settlement of leases (Note 4) | 458,329 | 288,747 | - | - | - | - | 288,747 | - | 288,747 | |||||||||||||||||||||||||||

| Issued for settlement of amounts due to related parties (Note 8) | 187,321 | 131,998 | - | - | - | - | 131,998 | - | 131,998 | |||||||||||||||||||||||||||

| Issued for settlement of convertible loans (Note 22) | 83,333 | 49,166 | - | - | - | - | 49,166 | - | 49,166 | |||||||||||||||||||||||||||

| Shares issued as financing fee for convertible loans (Note 22) | 132,577 | 92,805 | - | - | - | - | 92,805 | - | 92,805 | |||||||||||||||||||||||||||

| Exercise of warrants | 3,146,944 | 1,742,000 | - | - | - | - | 1,742,000 | - | 1,742,000 | |||||||||||||||||||||||||||

| Conversion component of convertible loans (Note 22) | - | 625,000 | - | - | - | 625,000 | - | 625,000 | ||||||||||||||||||||||||||||

| Share based compensation - RSU | - | 141,271 | - | - | - | 141,271 | - | 141,271 | ||||||||||||||||||||||||||||

| Share based compensation - Stock options | - | 1,021,000 | - | - | - | 1,021,000 | - | 1,021,000 | ||||||||||||||||||||||||||||

| RSU shares forfeited (Note 5) | - | (6,660 | ) | - | - | - | (6,660 | ) | - | (6,660 | ) | |||||||||||||||||||||||||

| Exchange on translation of foreign subsidiaries | - | - | - | (3,179,056 | ) | - | (3,179,056 | ) | - | (3,179,056 | ) | |||||||||||||||||||||||||

| Total comprehensive loss for the period | - | - | - | - | (3,911,441 | ) | (3,911,441 | ) | (503,949 | ) | (4,415,390 | ) | ||||||||||||||||||||||||

| Balance at August 31, 2017 | 121,784,619 | $ | 125,174,377 | $ | 7,674,233 | $ | 1,248,037 | $ | (2,176,352 | ) | $ | (96,566,577 | ) | $ | 35,353,718 | $ | 900,325 | $ | 36,254,043 | |||||||||||||||||

| Shares issued for interest on gold loans (Note 20) | 245,197 | 100,970 | - | - | - | - | 100,970 | - | 100,970 | |||||||||||||||||||||||||||

| Shares issued as financing fee for convertible loans (Note 22) | 214,864 | 91,317 | - | - | - | - | 91,317 | - | 91,317 | |||||||||||||||||||||||||||

| Conversion component of convertible loans (Note 22) | - | 39,000 | - | - | - | 39,000 | - | 39,000 | ||||||||||||||||||||||||||||

| Share based compensation - Stock options | - | 836,000 | - | - | - | 836,000 | - | 836,000 | ||||||||||||||||||||||||||||

| Share based compensation - RSU | - | 20,768 | - | - | - | 20,768 | - | 20,768 | ||||||||||||||||||||||||||||

| RSU shares forfeited (Note 5) | - | (3,920 | ) | - | - | - | (3,920 | ) | - | (3,920 | ) | |||||||||||||||||||||||||

| Exchange on translation of foreign subsidiaries | - | - | - | 969,743 | - | 969,743 | - | 969,743 | ||||||||||||||||||||||||||||

| Total comprehensive loss for the period | - | - | - | - | (1,639,799 | ) | (1,639,799 | ) | (190,197 | ) | (1,829,996 | ) | ||||||||||||||||||||||||

| Balance at November 30, 2017 | 122,244,680 | $ | 125,366,664 | $ | 8,566,081 | $ | 1,248,037 | $ | (1,206,609 | ) | $ | (98,206,376 | ) | $ | 35,767,797 | $ | 710,128 | $ | 36,477,925 | |||||||||||||||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements

| 5 |

Tanzanian Royalty Exploration Corporation

Unaudited Interim Condensed Consolidated Statements of Cash Flow

(Expressed in Canadian Dollars)

| Three month periods ended November 30, | 2017 | 2016 | ||||||

| Operating | ||||||||

| Net loss | $ | (1,829,996 | ) | $ | (2,018,722 | ) | ||

| Adjustments to reconcile net loss to cash flow from operating activities: | ||||||||

| Depreciation | 88,796 | 105,489 | ||||||

| Share based payments | 849,590 | 633,088 | ||||||

| Accretion on asset retirement obligation | 2,772 | 2,749 | ||||||

| Interest accretion | 257,772 | 184,035 | ||||||

| Foreign exchange | (77,587 | ) | 120,423 | |||||

| Shares issued for payment of interest on bullion loans | 106,976 | 81,832 | ||||||

| (Gain) loss on shares issued for settlement of debt | (6,006 | ) | 90,486 | |||||

| Gain on sale of property, plant and equipment | - | (10,133 | ) | |||||

| Non cash directors’ fees | - | 56,938 | ||||||

| Net change in non-cash operating working capital items: | ||||||||

| Other receivables | (1,377 | ) | (40,126 | ) | ||||

| Inventory | (15,477 | ) | (30,683 | ) | ||||

| Prepaid expenses | 30,679 | 105,945 | ||||||

| Trade, other payables and accrued liabilities | (202,557 | ) | (271,284 | ) | ||||

| Cash used in operations | (796,415 | ) | (989,963 | ) | ||||

| Investing | ||||||||

| Mineral properties and exploration expenditures, net of recoveries | (227,229 | ) | (960,765 | ) | ||||

| Property, plant and equipment, net of proceeds from sale | - | 1,150 | ||||||

| Cash used in investing activities | (227,229 | ) | (959,615 | ) | ||||

| Financing | ||||||||

| Proceeds - private placements | - | 5,589,501 | ||||||

| Loans (repayment) of loans from related parties | - | (80,318 | ) | |||||

| Interest on leases | 775 | 19,336 | ||||||

| Proceeds from convertible loan | 420,723 | - | ||||||

| Cash provided by financing activities | 421,498 | 5,528,519 | ||||||

| Net increase (decrease) in cash and cash equivalents | (602,146 | ) | 3,578,941 | |||||

| Cash and cash equivalents, beginning of period | 1,011,293 | 84,913 | ||||||

| Cash and cash equivalents, end of period | $ | 409,147 | $ | 3,663,854 | ||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements

| 6 |

Tanzanian Royalty Exploration Corporation

Unaudited Interim Condensed Consolidated Statements of Cash Flow

(Expressed in Canadian Dollars)

| Supplementary information: | 2017 | 2016 | ||||||

| Non-cash transactions: | ||||||||

| Share based payments capitalized to mineral properties | $ | 3,258 | $ | 18,733 | ||||

| Shares issued pursuant to RSU plan | - | 482,749 | ||||||

| Shares issued for interest on gold loans | 100,970 | 172,318 | ||||||

| Shares issued as financing fee for convertible loans | 91,317 | - | ||||||

The accompanying notes are an integral part of these unaudited interim condensed consolidated financial statements

| 7 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 1. | Nature of Operations and Going Concern |

The Company was originally incorporated under the corporate name “424547 Alberta Ltd.” in the Province of Alberta on July 5, 1990, under the Business Corporations Act (Alberta). The name was changed to “Tan Range Exploration Corporation” on August 13, 1991. The name of the Company was again changed to “Tanzanian Royalty Exploration Corporation” (“TREC” or the “Company”) on February 28, 2006. The address of the Company’s registered office is 22 Adelaide Street West, Suite 3400, Toronto, Ontario M5H 4E3 Canada. The Company’s principal business activity is in the exploration and development of mineral property interests. The Company’s mineral properties are located in United Republic of Tanzania (“Tanzania”).

The Company is in the process of exploring and evaluating its mineral properties. The business of exploring and mining for minerals involves a high degree of risk. The underlying value of the mineral properties is dependent upon the existence and economic recovery of mineral resources and reserves, the ability to raise long-term financing to complete the development of the properties, government policies and regulations, and upon future profitable production or, alternatively, upon the Company’s ability to dispose of its interest on an advantageous basis; all of which are uncertain.

The amounts shown as mineral properties and deferred expenditures represent costs incurred to date, less amounts amortized and/or written off, and do not necessarily represent present or future values. The underlying value of the mineral properties is entirely dependent on the existence of economically recoverable reserves, securing and maintaining title and beneficial interest, the ability of the Company to obtain the necessary financing to complete development, and future profitable production.

At November 30, 2017 the Company had a working capital deficiency of $8,712,838 (August 31, 2017 – $6,552,376 working capital deficiency), had not yet achieved profitable operations, has accumulated losses of $98,206,376 (August 31, 2017 – $96,566,577) and expects to incur further losses in the development of its business. The Company will require additional financing in order to conduct its planned work programs on mineral properties, meet its ongoing levels of corporate overhead and discharge its future liabilities as they come due.

The Company’s current funding sources and taking into account the working capital position and capital requirements at November 30, 2017, indicate the existence of a material uncertainty that raises substantial doubt about the Company’s ability to continue as a going concern and is dependent on the Company raising additional debt or equity financing. The Company must obtain additional funding in order to continue development and construction of the Buckreef Project. The Company is continuing to pursue additional financing to fund the construction of the Buckreef Project and additional projects. Whilst the Company has been successful in obtaining financing in the past, there is no assurance that such additional funding and/or project financing will be obtained or obtained on commercially favourable terms.

These unaudited interim condensed consolidated financial statements do not give effect to any adjustment which would be necessary should the Company be unable to continue as a going concern and, therefore, be required to realize its assets and discharge its liabilities in other than the normal course of business and at amounts different from those reflected in the unaudited interim condensed consolidated financial statements.

| 8 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 2. | Basis of Preparation |

2.1 Statement of compliance

These unaudited interim condensed consolidated financial statements, including comparatives, have been prepared in accordance with International Accounting Standards (“IAS”) 34 ‘Interim Financial Reporting’ (“IAS 34”) using accounting policies consistent with the International Financial Reporting Standards (“IFRS”) issued by the International Accounting Standards Board (“IASB”) and Interpretations of the International Financial Reporting Interpretations Committee (“IFRIC”).

These unaudited interim condensed consolidated financial statements were approved and authorized by the Board of Directors of the Company on January 11, 2018.

2.2 Basis of presentation

The consolidated financial statements of the Company as at and for the three month periods ended November 30, 2017 and 2016 comprise of the Company and its subsidiaries (together referred to as the “Company” or “Group”).

These unaudited interim condensed consolidated financial statements have been prepared on the basis of accounting policies and methods of computation consistent with those applied in the Company’s August 31, 2017 annual financial statements.

2.3 Adoption of new and revised standards and interpretations

New standards and interpretations to be adopted in future

At the date of authorization of these Financial Statements, the IASB and IFRIC has issued the following new and revised Standards and Interpretations which are not yet effective for the relevant reporting periods and which the Company has not early adopted these standards, amendments and interpretations. However, the Company is currently assessing what impact the application of these standards or amendments will have on the consolidated financial statements of the Company.

| • | IFRS 9 Financial Instruments. IFRS 9 covers the classification and measurement, impairment and hedge accounting of financial assets and financial liabilities and the effective date is for annual periods on or after January 1, 2018, with earlier application permitted. The Company is assessing the impact of adopting IFRS 9 but does not expect it will have a significant impact on its consolidated financial statements. Amendments to IFRS 9 also provide relief from the requirement to restate comparative financial statements for the effect of applying IFRS 9. Instead, additional transition disclosures will be required to help investors understand the effect that the initial application of IFRS 9 has on the classification and measurement of financial instruments. |

| • | IFRS 15 Revenue from Contracts with Customers. In May 2014, the IASB issued IFRS 15, Revenue from Contracts with Customers. IFRS 15 specifies how and when to recognize revenue as well as requires entities to provide users of financial statements with more informative, relevant disclosures. The standard supersedes IAS 18, Revenue, IAS 11, Construction Contracts, and a number of revenue-related interpretations. Application of the standard is mandatory for all IFRS reporters and it applies to nearly all contracts with customers: the main exceptions are leases, financial instruments and insurance contracts. IFRS 15 must be applied in an entity’s first annual IFRS financial statements for periods beginning on or after January 1, 2018. Application of the standard is mandatory and early adoption is permitted. The Company has not yet determined the impact of the amendments on the Company’s financial statements. |

| 9 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 2. | Basis of Preparation (continued) |

| 2.3 | Adoption of new and revised standards and interpretations (continued) |

New standards and interpretations to be adopted in future (continued)

| • | IFRS 16 - In 2016, the IASB issued IFRS 16, Leases (“IFRS 16”), replacing IAS 17, Leases and related interpretations. The standard introduces a single on-balance sheet recognition and measurement model for lessees, eliminating the distinction between operating and finance leases. Lessors continue to classify leases as finance and operating leases. IFRS 16 becomes effective for annual periods beginning on or after January 1, 2019, and is to be applied retrospectively. Early adoption is permitted if IFRS 15, Revenue from Contracts with Customers (“IFRS 15”) has been adopted. The Company is assessing the impact of the amendments on the Company’s financial statements, but does not anticipate that the impact will be significant. |

| 3. | Mineral Properties |

The Company explores or acquires gold or other precious metal concessions through its own efforts or through the efforts of its subsidiaries. All of the Company’s concessions are located in Tanzania.

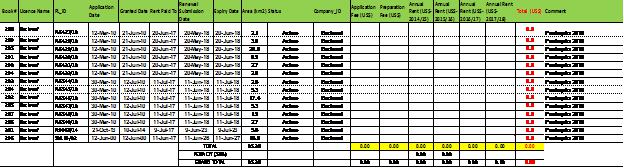

The Company’s mineral interests in Tanzania are initially held under prospecting licenses granted pursuant to the Mining Act, 2010 (Tanzania) for a period of up to four years, and are renewable two times for a period of up to two years each. Annual rental fees for prospecting licenses are based on the total area of the license measured in square kilometres, multiplied by USD$100/sq.km for the initial period, USD$150/sq.km for the first renewal and USD$200/sq.km for the second renewal. With each renewal at least 50% of the licensed area, if greater than 20 square kilometres, must be relinquished and if the Company wishes to keep the relinquished one-half portion, it must file a new application for the relinquished portion. There is also an initial one-time “preparation fee” of USD$500 per license. Upon renewal, there is a renewal fee of USD$300 per license.

Section 30 of the Mining Act states that the amount that is to be spent on prospecting operations is to be prescribed by Regulation.

| Period | Minimum expenditure (US$) |

| Initial period (4 years) | $500 per sq km for annum |

| First renewal (3 years) | $1,000 per sq km for annum |

| Second renewal (2 years) | $2,000 per sq km for annum |

Certain of the Company’s prospecting licenses are currently being renewed.

The Company assessed the carrying value of mineral properties and deferred exploration costs as at November 30, 2017 and recorded a write-down of $nil during the three month period ended November 30, 2017 (2016 - $nil).

| 10 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 3. | Mineral Properties (continued) |

The continuity of expenditures on mineral properties is as follows:

| Buckreef (a) | Kigosi (b) | Itetemia (c) | Luhala (d) | Total | ||||||||||||||||

| Balance, September 1, 2016 | $ | 24,034,731 | $ | 12,454,254 | $ | 5,962,715 | $ | 3,351,158 | $ | 45,802,858 | ||||||||||

| Exploration expenditures: | ||||||||||||||||||||

| Camp, field supplies and travel | 187,940 | 19,565 | - | - | 207,505 | |||||||||||||||

| License fees and exploration and field overhead | 2,527,005 | 67,942 | 17,738 | 5,988 | 2,618,673 | |||||||||||||||

| Geological consulting and field wages | 206,722 | - | - | - | 206,722 | |||||||||||||||

| Geophysical and geochemical | - | - | - | - | - | |||||||||||||||

| Property acquisition costs | 168,284 | - | - | - | 168,284 | |||||||||||||||

| Trenching and drilling | - | - | - | - | - | |||||||||||||||

| Recoveries | (25,408 | ) | - | - | - | (25,408 | ) | |||||||||||||

| Foreign exchange translation | (1,037,832 | ) | (513,491 | ) | (244,842 | ) | (137,449 | ) | (1,933,614 | ) | ||||||||||

| 2,026,711 | (425,984 | ) | (227,104 | ) | (131,461 | ) | 1,242,162 | |||||||||||||

| 26,061,442 | 12,028,270 | 5,735,611 | 3,219,697 | 47,045,020 | ||||||||||||||||

| Write-offs | - | (124,717 | ) | - | - | (124,717 | ) | |||||||||||||

| Balance, August 31, 2017 | $ | 26,061,442 | $ | 11,903,553 | $ | 5,735,611 | $ | 3,219,697 | $ | 46,920,303 | ||||||||||

| Exploration expenditures: | ||||||||||||||||||||

| Camp, field supplies and travel | 52,678 | 7,400 | - | - | 60,078 | |||||||||||||||

| License fees and exploration and field overhead | 159,783 | - | - | - | 159,783 | |||||||||||||||

| Geological consulting and field wages | 14,035 | - | - | - | 14,035 | |||||||||||||||

| Geophysical and geochemical | - | - | - | - | - | |||||||||||||||

| Property acquisition costs | - | - | - | - | - | |||||||||||||||

| Trenching and drilling | - | - | - | - | - | |||||||||||||||

| Recoveries | - | - | - | - | - | |||||||||||||||

| Foreign exchange translation | 628,299 | 286,944 | 138,259 | 77,625 | 1,131,127 | |||||||||||||||

| 854,795 | 294,344 | 138,259 | 77,625 | 1,365,023 | ||||||||||||||||

| 26,916,237 | 12,197,897 | 5,873,870 | 3,297,322 | 48,285,326 | ||||||||||||||||

| Write-offs | - | - | - | - | - | |||||||||||||||

| Balance, November 30, 2017 | $ | 26,916,237 | $ | 12,197,897 | $ | 5,873,870 | $ | 3,297,322 | $ | 48,285,326 | ||||||||||

| 11 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 3. | Mineral Properties (continued) |

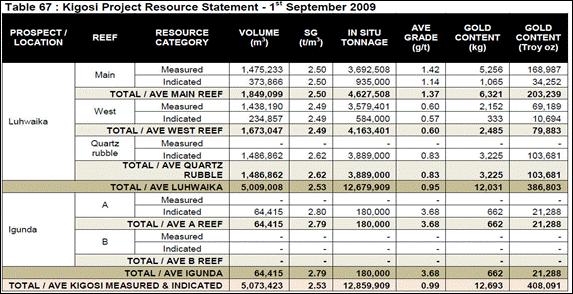

(a) Buckreef Gold Project:

On December 21, 2010, the Company announced it was the successful bidder for the Buckreef Gold Mine Re-development Project in northern Tanzania (the “Buckreef Project”). Pursuant to the agreement dated December 16, 2010, the Company paid USD $3,000,000 to the State Mining Company (“Stamico”). On October 25, 2011, a Definitive Joint Venture Agreement was entered into with Stamico for the development of the Buckreef Gold Project. Through its wholly-owned subsidiary, Tanzam, the Company holds a 55% interest in the joint venture company, Buckreef Gold Company Limited, with Stamico holding the remaining 45%.

The Company has 100% control over all aspects of the joint venture. In accordance with the joint venture agreement, the Company has to arrange financing, incur expenditures, make all decisions and operate the mine in the future. The Company’s obligations and commitments include completing a preliminary economic assessment, feasibility study and mine development. Stamico’s involvement is to contribute the licences and rights to the property and receive a 45% interest in Buckreef Project.

The joint venture agreement contains an obligation clause regarding the commissioning date for the plant. The clause becomes effective only in the event the property is not brought into production before a specified future date which was originally estimated to be in December 2015. The Company shall be entitled to extend the date for one additional year:

i) for the extension year, on payment to Stamico of US$500,000;

ii) for the second extension year, on payment to Stamico of US$625,000; and

iii) for each subsequent extension year, on payment to Stamico of US$750,000.

The Company has received a request letter from Stamico regarding the status of the penalty payment and has responded that no penalty is due at this time. The Company has received a subsequent letter from Stamico regarding request for payment. It remains the Company’s position that no penalty is due at this time, but the Company and Stamico have been engaged in settlement discussions to resolve this issue, and a payment of $172,330 has been made in connection with the settlement discussions to be applied towards the amount owing with the remainder to be paid out of proceeds of production.

The Company has recognized a non-controlling interest (NCI) in respect of Stamico’s 45% interest in the Consolidated Financial Statements based on the initial payment by the Company to Stamico and will be adjusted based on annual exploration and related expenditures. Stamico has a free carried interest and does not contribute to exploration expenses.

There is a supervisory board made up of 4 directors of Tanzam and 3 directors of Stamico, whom are updated with periodic reports and review major decisions. Amounts paid to Stamico and subsequent expenditures on the property are capitalized under Mineral Properties or Inventories for costs directly related to the extraction and processing of ore and reported under Buckreef Gold Company Limited.

| 12 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 3. | Mineral Properties (continued) |

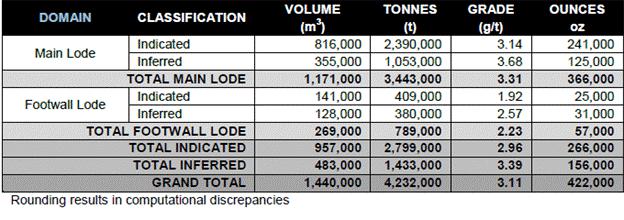

(b) Kigosi:

The Kigosi Project is principally located within the Kigosi Game Reserve controlled area. Through prospecting and mining option agreements, the Company has options to acquire interests in several Kigosi prospecting licenses. The Company has an agreement with Stamico providing Stamico a 15% carried interest in the Kigosi Project.

The Kigosi Mining License was granted by the Ministry of Energy and Minerals to Tanzam, (wholly owned subsidiary of Tanzanian Royalty). The official signing ceremony of the Kigosi Mining License was held in October 2013 and was attended by the Company and Ministry for Energy and Minerals representatives. The area remains subject to a Game Reserve Declaration Order. Upon repeal or amendment of that order by degazzeting the respective license by the Tanzanian Government, the Company will be legally entitled to exercise its rights under the Mineral Rights and Mining Licence.

During the three month period ended November 30, 2017, the Company decided to abandon certain licenses within the Kigosi project as they come up for renewal, as such, a write off of $nil was taken for these licenses related to the property (year ended August 31, 2017 - $124,717).

(c) Itetemia Project:

Through prospecting and mining option agreements, the Company has options to acquire interests in several ltetemia property prospecting licenses. The prospecting licenses comprising the Itetemia property are held by the Company; through the Company's subsidiaries, Tancan or Tanzam. In the case of one prospecting license, Tancan acquired its interest pursuant to the Stamico Venture Agreement dated July 12, 1994, as amended June 18, 2001, July 2005, and October 13, 2008.

Stamico retains a 2% royalty interest as well as a right to earn back an additional 20% interest in the prospecting license by meeting 20% of the costs required to place the property into production. The Company retains the right to purchase one-half of Stamico's 2% royalty interest in exchange for USD$1,000,000.

The Company is required to pay Stamico an annual option fee of USD$25,000 per annum until commercial production.

During the three month period ended November 30, 2017, the Company did not abandon any licenses in the area and no write off was taken in this area (year ended August 31, 2017 - $nil) related to deferred exploration costs associated with licenses the Company does not intend to renew.

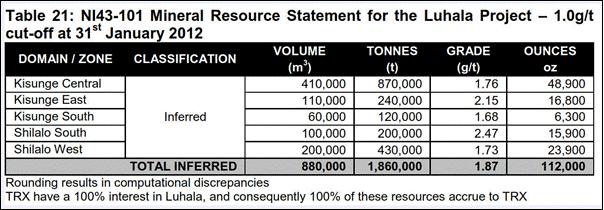

(d) Luhala Project:

The Company has selected a consultant to prepare the resource report for the Luhala Project in anticipation of filing for a Mining License for development of the site. Once funds are available the contract to engage the Consultant to carry out the work will be initiated.

During the three month period ended November 30, 2017, the Company did not abandon any licenses in the area and no write off was taken in this area (year ended August 31, 2017 - $nil).

| 13 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 4. | Property, plant and equipment |

| Drilling equipment | Automotive | Computer Equipment | Machinery and equipment | Leasehold improvements | Heap leach pads | Construction- in-progress * | Total | |||||||||||||||||||||||||

| Cost | ||||||||||||||||||||||||||||||||

| As at September 1, 2016 | $ | 464,487 | $ | 191,368 | $ | 99,636 | $ | 1,705,959 | $ | 100,328 | $ | 1,496,078 | $ | 1,379,012 | $ | 5,436,868 | ||||||||||||||||

| Disposals | - | (47,967 | ) | (32,462 | ) | (81,990 | ) | - | - | - | (162,419 | ) | ||||||||||||||||||||

| Foreign exchange | (19,662 | ) | (7,943 | ) | (4,079 | ) | (71,028 | ) | (4,215 | ) | (64,262 | ) | (62,155 | ) | (233,344 | ) | ||||||||||||||||

| As at August 31, 2017 | $ | 444,825 | $ | 135,458 | $ | 63,095 | $ | 1,552,941 | $ | 96,113 | $ | 1,431,816 | $ | 1,316,857 | $ | 5,041,105 | ||||||||||||||||

| Additions | - | - | - | - | - | - | - | - | ||||||||||||||||||||||||

| Foreign exchange | 11,052 | 3,269 | 1,548 | 37,919 | 2,368 | 36,076 | 34,775 | 127,007 | ||||||||||||||||||||||||

| As at November 30, 2017 | $ | 455,877 | $ | 138,727 | $ | 64,643 | $ | 1,590,860 | $ | 98,481 | $ | 1,467,892 | $ | 1,351,632 | $ | 5,168,112 | ||||||||||||||||

| Accumulated depreciation | ||||||||||||||||||||||||||||||||

| As at September 1, 2016 | $ | 288,172 | $ | 167,827 | $ | 93,205 | $ | 1,317,633 | $ | 66,481 | $ | 453,182 | $ | - | $ | 2,386,500 | ||||||||||||||||

| Depreciation expense | 11,754 | 3,062 | 8,728 | 87,072 | 7,036 | 304,331 | - | 421,983 | ||||||||||||||||||||||||

| Disposals | - | (35,233 | ) | (49,672 | ) | (65,741 | ) | - | - | - | (150,646 | ) | ||||||||||||||||||||

| Foreign exchange | (12,626 | ) | (7,087 | ) | (8,431 | ) | (60,080 | ) | (3,217 | ) | (35,988 | ) | - | (127,429 | ) | |||||||||||||||||

| As at August 31, 2017 | $ | 287,300 | $ | 128,569 | $ | 43,830 | $ | 1,278,884 | $ | 70,300 | $ | 721,525 | $ | - | $ | 2,530,408 | ||||||||||||||||

| Depreciation expense | 10,502 | 905 | 1,616 | 7,816 | 1,407 | 76,082 | - | 98,328 | ||||||||||||||||||||||||

| Foreign exchange | 7,291 | 3,119 | 1,209 | 30,979 | 1,740 | 20,103 | - | 64,441 | ||||||||||||||||||||||||

| As at November 30, 2017 | $ | 305,093 | $ | 132,593 | $ | 46,655 | $ | 1,317,679 | $ | 73,447 | $ | 817,710 | $ | - | $ | 2,693,177 | ||||||||||||||||

| Net book value | ||||||||||||||||||||||||||||||||

| As at August 31, 2016 | $ | 176,315 | $ | 23,541 | $ | 6,431 | $ | 388,326 | $ | 33,847 | $ | 1,042,896 | $ | 1,379,012 | $ | 3,050,368 | ||||||||||||||||

| As at August 31, 2017 | $ | 157,525 | $ | 6,889 | $ | 19,265 | $ | 274,057 | $ | 25,813 | $ | 710,291 | $ | 1,316,857 | $ | 2,510,697 | ||||||||||||||||

| As at November 30, 2017 | $ | 150,784 | $ | 6,134 | $ | 17,988 | $ | 273,181 | $ | 25,034 | $ | 650,182 | $ | 1,351,632 | $ | 2,474,935 | ||||||||||||||||

* Construction in progress represents construction of the Company’s processing plant.

| 14 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 4. | Property, plant and equipment (continued) |

Sale-leaseback transaction:

During the year ended August 31, 2015, the Company sold automotive and mining equipment for proceeds of $577,505 to various officers and directors. Pursuant to the agreements, the Company entered into 1-year lease agreements on the automotive and mining equipment with effective dates in May 2015. Per the terms of the leases, the Company agrees to purchase back the automotive and mining equipment at the end of the lease periods for a lump sum payment of USD$74,848. Based on the terms of the agreements, the Company has classified and is accounting for the leases as finance leases. The initial base payments vary between the agreements and range between $3,500 and $8,000 payable monthly. The effective interest rate on the finance lease obligations outstanding is between 20% and 30%. The gain on sale of $250,108 was deferred and is being recognized on a straight-line basis over the lease term as a reduction in amortization expense. The total deferred gain has been presented as a reduction of the finance asset. Under the lease, the Company is responsible for the costs of utilities, insurance, taxes and maintenance expenses.

Settlement through shares:

On December 1, 2016, the Company entered into settlement agreements whereby a total of $343,623 in principal and accrued interest was settled through the issuance of 458,329 shares issued at an average price of $0.63 per share for total issued value of $288,747, resulting in a gain on settlement of debt of $54,876 for the year ended August 31, 2017.

Outstanding balance:

As at November 30, 2017, the remaining balance outstanding under finance lease obligations after the settlements described above is $57,406 (August 31, 2017 - $56,631) and is repayable within 1 year, as such, the finance lease obligation is classified as a current liability.

Interest expense for the three month period ended November 30, 2017 related to the leases amounted to $2,480 (2016 - $10,231), and is recorded in the statement of comprehensive loss.

| 15 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 5. | Capital Stock |

Share Capital

The Company’s Restated Articles of Incorporation authorize the Company to issue an unlimited number of common shares. On December 8, 2014, the Board resolved that the Company authorize for issuance up to a maximum of 155,000,000 common shares, subject to further resolutions of the Company’s board of directors.

| Number | Amount ($) | |||||||

| Balance at September 1, 2016 | 109,068,492 | $ | 122,380,723 | |||||

| Issued for private placements, net of share issue costs | 7,197,543 | 5,589,501 | ||||||

| Warrants issued on private placement | - | (6,592,000 | ) | |||||

| Agent warrants issued on private placement | - | (92,000 | ) | |||||

| Issued pursuant to Restricted Share Unit Plan | 695,991 | 1,040,990 | ||||||

| Shares issued for interest on gold loans | 814,089 | 542,447 | ||||||

| Finders fees on convertible loans | 132,577 | 92,805 | ||||||

| Shares issued for settlement of lease obligations (Note 4) | 458,329 | 288,747 | ||||||

| Shares issued for settlement of amounts due to related parties (Note 8) | 187,321 | 131,998 | ||||||

| Shares issued for settlement of convertible loans (Note 22) | 83,333 | 49,166 | ||||||

| Exercise of warrants | 3,146,944 | 1,742,000 | ||||||

| Balance at August 31, 2017 | 121,784,619 | $ | 125,174,377 | |||||

| Shares issued for interest on gold and convertible loans | 245,197 | 100,970 | ||||||

| Finders fees on convertible loans | 214,864 | 91,317 | ||||||

| Balance at November 30, 2017 | 122,244,680 | $ | 125,366,664 | |||||

Activity during the three month period ended November 30, 2017:

During the three month period ended November 30, 2017, 245,197 shares were issued at an average price of $0.41 per share for total issued value of $100,970 for payment of interest of $107,576, resulting in a gain of $6,606, in connection with the gold loans and convertible loans (see Notes 20 and 22 for details).

On September 26, 2017, the Company issued 214,864 common shares at a price of $0.43 per share for total issued value of $91,317 for payment of finders fees in connection with the convertible loans (see Note 22 for details).

Activity during the year ended August 31, 2017:

On September 1, 2016, the Company closed the first tranche of a US$5 Million private placement of securities with Crede CG III, Ltd.

In the initial round of financing, the Company privately placed 1,840,400 shares of its common stock and warrants for US$1.25 million. The common stock issued in the first tranche of the financing, which closed on September 1, 2016, was priced at US$0.6792 per share. The investor also received five-year warrants to purchase 1,840,400 shares of Common Stock with an exercise price of US$0.8291 per share. If the market price of the share is lower than the exercise price the warrants allow the holder to exercise into a variable number of common shares of the Company determined based on a fixed monetary value and the Company’s share price for no consideration. As the number of shares was variable, the warrants were recognized as a derivative liability with a fair value of $1,742,000 which was determined based on the fixed monetary value. In addition, the Company paid an 8% agent fee on gross proceeds and a 5% finders’ fee on gross proceeds and the Company issued to the agents 73,616 agent warrants, each exercisable to acquire one common share at a price of US$0.8718 for a period of five years.

| 16 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 5. | Capital Stock (continued) |

On September 26, 2016, the Company closed the second tranche of the $5 million private placement of securities with Crede CG III, Ltd.

In the second round of the financing, the Company privately placed convertible notes and warrants for US$3.75 million. The convertible notes were issued in the principal amount of US$3.75 million, carried a coupon of 2.0% and matured on September 26, 2046. The Company immediately exercised its right to cause the conversion of the convertible notes, resulting in the cancellation of the notes and the issuance of 5,357,143 shares of common stock to the investor. The investor also received five-year warrants to purchase 4,017,857 shares of common stock at an exercise price of US$1.10 per share. If the market price of the share is lower than the exercise price the warrants allow the holder to exercise into a variable number of common shares of the Company determined based on a fixed monetary value and the Company’s share price for no consideration. As the number of shares was variable, the warrants were recognized as a derivative liability with a fair value of $4,850,000 which was determined based on the fixed monetary value. In addition, the Company paid an 8% agent fee on gross proceeds and the Company issued to the agents 214,285 agent warrants, each exercisable to acquire one common share at a price of US$0.9515 for a period of five years.

During the year ended August 31, 2017, 695,991 shares were issued pursuant to the Company’s Restricted Share Unit Plan at an average price of $1.50 for total issued value of $1,040,990.

During the year ended August 31, 2017, 814,089 shares were issued at an average price of $0.67 per share for total issued value of $542,447 for payment of interest in connection with the gold loans and convertible loans (see Notes 20 and 22 for details).

On April 27, 2017, the Company issued 132,577 common shares at a price of $0.70 per share for total issued value of $92,805 for payment of finders fees in connection with the gold bullion loan (see Note 20 for details).

Warrant issuances:

Activity during the three month period ended November 30, 2017:

There were no warrant issuances during the three month period ended November 30, 2017.

Activity during the year ended August 31, 2017:

On September 1, 2016 the Company issued 1,840,400 share purchase warrants in connection with the first tranche of its private placement financing as described above. Each warrant entitles the holder to acquire a common share at a price of US$0.8291. These warrants expire on September 1, 2021.

Each warrant is convertible into a variable number of common shares equal in value to a fixed monetary amount for $Nil consideration if the Company’s share price is below exercise price. As the number of shares to be received on exercise is variable, the warrants are initially recognized as derivative liabilities at fair value. Subsequent changes in fair value to the date of exercise are recognized in the loss for the year.

The warrants had a fair value of $1,742,000 on issuance, which was determined based on the fixed monetary amount.

The Company also issued 73,616 agent warrants in connection with the first tranche of its private placement financing. Each agent warrant entitles the holder to acquire a common share at a price of US$0.8718. These warrants expire on September 1, 2021.

| 17 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 5. | Capital Stock (continued) |

The warrants had a fair value of $22,000 on issuance, which was estimated using the Black-Scholes option pricing model and recorded as a transaction cost. The following assumptions were used:

| Risk-free interest rate | 0.91% | Expected volatility | 82% | |||

| Dividend yield | nil | Expected life | 5 years |

On September 26, 2016 the Company issued 4,017,857 share purchase warrants in connection with the second tranche of its private placement financing as described above. Each warrant entitles the holder to acquire a common share at a price of US$1.10. These warrants expire on September 26, 2021.

Each warrant is convertible into a variable number of common shares equal in value to a fixed monetary amount for $Nil consideration if the Company’s share price is below exercise price. As the number of shares to be received on exercise is variable, the warrants are initially recognized as derivative liabilities at fair value. Subsequent changes in fair value to the date of exercise are recognized in the loss for the year.

The warrants had a fair value of $4,850,000 on issuance, which was determined based on the fixed monetary amount.

The Company also issued 214,285 agent warrants in connection with the second tranche of its private placement financing. Each agent warrant entitles the holder to acquire a common share at a price of US$0.9515. These warrants expire on September 26, 2021.

The warrants had a fair value of $70,000 on issuance, which was estimated using the Black-Scholes option pricing model and recorded as a transaction cost. The following assumptions were used:

| Risk-free interest rate | 0.87 | % | Expected volatility | 84 | % | |||||

| Dividend yield | nil | Expected life | 5 years |

Warrants and Compensation Options outstanding:

At November 30, 2017, the following warrants and compensation options were outstanding:

| Number of Warrants | Exercise price | Expiry date | ||||||||||

| Private placement financing agent warrants - September 26, 2016 | 214,285 | USD$0.9515 | September 26, 2021 | |||||||||

| Private placement financing - September 26, 2016 | 4,017,857 | USD$1.10 | September 26, 2021 | |||||||||

| Private placement financing agent warrants - September 1, 2016 | 73,616 | USD$0.8718 | September 1, 2021 | |||||||||

| Convertible senior note financing - December 9, 2014 | 257,143 | USD$0.98 | December 9, 2019 | |||||||||

| Balance, November 30, 2017 | 4,562,901 | - | - | |||||||||

| 18 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 5. | Capital Stock (continued) |

Warrant transactions are summarized as follows:

| Number of Warrants | Weighted Average Exercise Price | |||||||

| Balance, August 31, 2016 | 657,143 | $ | 1.29 | |||||

| Warrants granted | 5,858,257 | 1.37 | ||||||

| Agent warrants granted | 287,901 | 1.25 | ||||||

| Expired warrants | (400,000 | ) | (1.30 | ) | ||||

| Warrants exercised | (1,840,400 | ) | (1.12 | ) | ||||

| Balance, August 31, 2017 and November 30, 2017 | 4,562,901 | $ | 1.36 | |||||

The outstanding warrants have weighted average price of US$1.08 and weighted average remaining contractual life of 3.72 years.

Warrant liability:

Foreign currency denominated warrants (not including compensation warrants), are considered a derivative as they are not indexed solely to the entity’s own stock.

Prior to September 1, 2016 warrant liability consist of warrants that were originally issued in private placements which had exercise prices denominated in a currency other than the Company’s functional currency, which at that time was the Canadian dollar. During the period that the Canadian dollar was the Company’s functional currency, warrants that were exercisable in U.S. dollars was classified as derivative liabilities. Upon the change in functional currency to the U.S. dollar, these derivative liabilities were no longer classified as derivatives and an amount of $215,000 was reclassified to reserve for warrants.

The warrant liability at November 30, 2017 relates to the 4,017,857 September 26, 2016 private placement warrants that are exercisable at the option of the holder into such number of shares that have a current market value of approximately $4,850,000, for no consideration. This cashless exercise right is only in effect if the current market price is less than the exercise price of USD$1.10.

The table below shows the activity for warrant liability for the three month period ended November 30, 2017 and year ended August 31, 2017:

| Period/Year ended | November 30, 2017 | August 31, 2016 | ||||||

| Balance at beginning of period/year | $ | 4,850,000 | $ | 215,000 | ||||

| Warrants issued | - | 6,592,000 | ||||||

| Warrants exercised | - | (1,742,000 | ) | |||||

| Reclassification on change of functional currency | - | (215,000 | ) | |||||

| Balance at end of period/year | $ | 4,850,000 | $ | 4,850,000 | ||||

| 19 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 5. | Capital Stock (continued) |

Employee stock ownership plan:

On May 1, 2003, the Company established a non-leveraged employee stock ownership plan (ESOP) for all eligible employees, consultants, and directors. The Company matches 100 percent of participants’ contributions up to 5 percent of the participants’ salaries and 50 percent of participants’ contributions between 6 percent and 30 percent of the participants’ salaries. All contributions vest immediately.

ESOP compensation expense for the three month period ended November 30, 2017 was $nil (2016 - $nil) and is included in salaries and benefits expenses.

Restricted share units:

The Restricted Stock Unit Plan (RSU Plan) is intended to enhance the Company’s and its affiliates’ abilities to attract and retain highly qualified officers, directors, key employees and other persons, and to motivate such officers, directors, key employees and other persons to serve the Company and its affiliates and to expend maximum effort to improve the business results and earnings of the Company, by providing to such persons an opportunity to acquire or increase a direct proprietary interest in the operations and future success of the Company. To this end, the RSU Plan provides for the grant of restricted stock units (RSUs). Each RSU represents an entitlement to one common share of the Company, upon vesting. As of November 29, 2016, the Board resolved to amend the suspension to 800,000 of the 2,500,000 common shares previously authorized for issuance under the RSU Plan, such that a maximum of 2,500,000 shares shall be authorized for issuance under the RSU Plan, until such suspension may be lifted or further amended. RSU awards may, but need not, be subject to performance incentives to reward attainment of annual or long-term performance goals in accordance with the terms of the RSU Plan. Any such performance goals are specified in the award agreement.

The Board of Directors implemented the RSU Plan under which officers, directors, employees and others are compensated for their services to the Company. Annual compensation for outside directors is $68,750 per year, plus $6,875 per year for serving on Committees, plus $3,437 per year for serving as Chair of a Committee. On April 11, 2012, the board approved that at the election of each individual director, up to one half of the annual compensation may be received in cash, paid quarterly. The remainder of the director’s annual compensation (at least one half, and up to 100%) will be awarded as RSUs in accordance with the terms of the RSU Plan and shall vest within a minimum of one (1) year and a maximum of three (3) years, at the election of the director, subject to the conditions of the RSU Plan with respect to earlier vesting. In 2012 outside directors had the option to elect to receive 100% of their compensation in RSUs. If 100% compensation in RSUs is elected, the compensation on which the number of RSUs granted in excess of the required one half shall be increased by 20%.

The Company uses the fair value method to recognize the obligation and compensation expense associated with the RSU’s. The fair value of RSU’s issued is determined on the grant date based on the market price of the common shares on the grant date multiplied by the number of RSUs granted. The fair value is expensed over the vesting term. Upon redemption of the RSU the carrying amount is recorded as an increase in common share capital and a reduction in the share based payment reserve.

The Company has a RSU Plan which allows the Company to issue RSU’s which are redeemable for the issue of common shares at prevailing market prices on the date of the RSU grant. The aggregate number of RSU’s outstanding is limited to a maximum of ten percent of the outstanding common shares. The Company has granted RSU’s to officers and key employees.

Of the 2,500,000 shares authorized for issuance under the Plan, 2,114,853 (August 31, 2017 - 2,114,853) shares have been issued as at November 30, 2017.

| 20 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 5. | Capital Stock (continued) |

Total share-based compensation expense related to the issue of RSUs was $20,768 for the three month period ended November 30, 2017 (2016 - $121,660). The amount capitalized to mineral properties for the three month period ended November 30, 2017 was $3,258 (2016 - $18,733). The amount charged to directors fees for the three month period ended November 30, 2017 was $nil (2016 - $56,938). During the three month period ended November 30, 2017 RSU’s were forfeited resulting in $3,920 (2016 - $116,911) in a reduction in share-based compensation expense related to the reversal of the expense related to forfeited RSU’s.

The following table summarizes changes in the number of RSU’s outstanding:

| Number of RSU’s | Weighted average fair value at issue date | |||||||

| Balance, August 31, 2016 | 1,275,591 | $ | 1.18 | |||||

| Redeemed for common shares | (695,991 | ) | $ | 1.50 | ||||

| Forfeited/cancelled | (59,600 | ) | $ | 2.22 | ||||

| Balance, August 31, 2017 | 520,000 | $ | 0.49 | |||||

| Forfeited/cancelled | (10,000 | ) | $ | 0.49 | ||||

| Balance, November 30, 2017 | 510,000 | $ | 0.49 | |||||

Stock options:

The Company has a stock option plan (the “Plan”) under which the Company may grant options to directors, officers, employees and consultants. The maximum number of common shares reserved for issue under the Plan at any point in time may not exceed 6% of the number of shares issued and outstanding. The purpose of the Plan is to attract, retain and motivate directors, officers, employees, and certain third party service providers by providing them with the opportunity to acquire a proprietary interest in the Company and benefit from its growth. Options granted under the Plan are non-assignable and vest over various terms up to 24 months from the date of grant. As at November 30, 2017, the Company had 2,680 (August 31, 2017 – 3,557,077) options available for issuance under the Plan.

The continuity of outstanding stock options for the three month period ended November 30, 2017 and year ended August 31, 2017 is as follows:

| Number of stock options | Weighted average exercise price per share $ | |||||||

| Balance – August 31, 2016 | - | - | ||||||

| Granted (i) | 3,750,000 | 0.71 | ||||||

| Balance – August 31, 2017 | 3,750,000 | 0.71 | ||||||

| Cancelled (i) | (3,750,000 | ) | (0.71 | ) | ||||

| Re-issued (i) | 3,750,000 | 0.40 | ||||||

| Granted (ii) | 3,582,000 | 0.43 | ||||||

| Balance – November 30, 2017 | 7,332,000 | 0.42 | ||||||

| 21 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 5. | Capital Stock (continued) |

| (i) | On November 28, 2016, the Company granted 3,750,000 stock options to directors, officers and employees of the Company. The options are exercisable at CAD$0.71 per share expiring on November 28, 2025. The resulting fair value of $2,133,000 was estimated using the Black-Scholes option pricing model with the following assumptions: expected dividend yield of 0%; expected volatility of 84%; a risk-free interest rate of 0.95% and an expected average life of 9 years. Volatility and expected life were based on historical experience. The options are subject to a vesting period whereby 1/3 of the options vest immediately, 1/3 vest on September 1, 2017 with the remaining 1/3 vesting on September 1, 2018. |

Share based payments based on the portion vested during the three month period ended November 30, 2017 amounted to $101,000 (2016 - $704,000).

Cancellation and re-issue of options:

On October 11, 2017, the Company cancelled and re-issued the options originally issued on November 28, 2016 and re-issued the same number of options at an exercise price of CAD$0.40 per share, with 1/3 of the options vesting immediately, 1/3 vest on October 11, 2018 with the remaining 1/3 vesting on October 11, 2019 and a final expiry date of October 11, 2026.

The new options issued were accounted for as modifications

in accordance with IFRS 2, where

the incremental value was recorded as additional cost measured by the difference between the fair value of the cancelled options

calculated on the modification date and the value of the

replacement options at the modification date. The amount resulted in additional $240,000 in share based payments. The

amount is recognized over the vesting period of the replacement option. Any remaining compensation cost for as yet

unvested cancelled options is also recognized over the new vesting period.

Share based payments based on the portion vested during the three month period ended November 30, 2017 amounted to $240,000 (2016 - $704,000).

| (ii) | On September 29, 2017, the Company granted 3,582,000 stock options to directors, officers and employees of the Company. The options are exercisable at CAD$0.43 per share expiring on September 29, 2026. The resulting fair value of $1,183,000 was estimated using the Black-Scholes option pricing model with the following assumptions: expected dividend yield of 0%; expected volatility of 76%; a risk-free interest rate of 1.98% and an expected average life of 9 years. Volatility and expected life were based on historical experience. The options are subject to a vesting period whereby 1/3 of the options vest immediately, 1/3 vest on September 29, 2018 with the remaining 1/3 vesting on September 29, 2019. |

Share based payments based on the portion vested during the three month period ended November 30, 2017 amounted to $495,000 (2016 - $nil).

Options to purchase common shares carry exercise prices and terms to maturity as follows:

| Remaining | ||||||||||||||

| Exercise price (1) | Number of options | Expiry | contractual | |||||||||||

| Outstanding $ | Outstanding | Exercisable | date | life (years) (1) | ||||||||||

| CAD0.40 | 3,750,000 | 1,250,000 | September 29, 2026 | 8.83 | ||||||||||

| CAD0.43 | 3,582,000 | 1,194,000 | October 11, 2026 | 8.87 | ||||||||||

| CAD0.42 | 7,332,000 | 2,444,000 | 8.85 | |||||||||||

| (1) | Total represents weighted average. |

| 22 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 6. | Reserve for warrants |

| Period/year ended | November 30, 2017 | August 31, 2017 | ||||||

| Balance at beginning of period/year | $ | 1,248,037 | $ | 941,037 | ||||

| Agent warrants issued on private placement | - | 92,000 | ||||||

| Reversal of warrant liability upon change of functional currency to USD | - | 215,000 | ||||||

| Balance at end of period/year | $ | 1,248,037 | $ | 1,248,037 | ||||

| 7. | Reserve for share based payments |

| Period/year ended | November 30, 2017 | August 31, 2017 | ||||||

| Balance at beginning of period/year | $ | 7,674,233 | $ | 1,066,863 | ||||

| Shares issued pursuant to RSU plan | - | (1,040,990 | ) | |||||

| Share based compensation – RSU’s | 20,768 | 262,931 | ||||||

| Share based compensation – Stock options | 836,000 | 1,725,000 | ||||||

| RSU shares forfeited | (3,920 | ) | (123,571 | ) | ||||

| Reversal of derivative in gold bullion loan upon change of functional currency to USD | - | 5,051,000 | ||||||

| Reversal of derivative in gold convertible loans upon change of functional currency to USD | - | 108,000 | ||||||

| Conversion component of convertible loans | 39,000 | 625,000 | ||||||

| Balance at end of period/year | $ | 8,566,081 | $ | 7,674,233 | ||||

| 8. | Related party transactions and key management compensation |

Related parties include the Board of Directors and officers, close family members and enterprises that are controlled by these individuals as well as certain consultants performing similar functions.

(a) Tanzanian Royalty Exploration Corporation entered into the following transactions with related parties:

| Three month ended November 30, | Notes | November 30, 2017 | November 30, 2016 | |||||||||

| Legal services | (i) | $Nil | $ | 82,455 | ||||||||

| Consulting | (ii) | $ | 53,348 | $ | 43,859 | |||||||

| Consulting | (iii) | $Nil | $ | 172,330 | ||||||||

(i) The Company engages a legal firm for professional services in which one of the Company’s directors is a partner. During the three month period ended November 30, 2017, the legal expense charged by the firm was $nil (2016 - $82,455). As at November 30, 2017, $355,940 remains payable (August 31, 2017 - $370,940).

(ii) During the three month period ended November 30, 2017, $53,348 (2016 - $43,859) was paid for heap leach construction consulting and website/data back-up services to companies controlled by individuals associated with the former CEO and current director.

(iii) During the three month period ended November 30, 2017, $Nil (2016 - $172,330) was paid for grade control drilling, license fees and other consulting services to Stamico, the Company’s joint venture partner on the Buckreef Gold Project.

| 23 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 8. | Related party transactions and key management compensation (continued) |

As at November 30, 2017, the Company has a receivable of $37,247 (August 31, 2017 - $37,247) from an organization associated with the Company’s President and former CEO and current director and from current officers and directors.

During the year ended August 31, 2015, the Company sold automotive and mining equipment in the amount of $243,805 to directors of the Company and $333,700 to the Company’s former CEO and current director for total proceeds of $577,505 as described in Note 4. Pursuant to the agreements, the Company entered into 1-year lease agreements on the automotive and mining equipment with effective dates in May 2015. Per the terms of the leases, the Company agrees to purchase back the automotive and mining equipment at the end of the lease periods for a lump sum payment of USD$74,848. The initial base payments vary between the agreements and range between $3,500 and $8,000 payable monthly. The effective interest rate on the capital lease obligation outstanding is between 20% and 30%.

On December 1, 2016, the Company entered into settlement agreements whereby a total of $343,623 in principal and accrued interest was settled through the issuance of 458,329 shares issued at an average price of $0.63 per share for total issued value of $288,747, resulting in a gain on settlement of debt of $54,876 for the year ended August 31, 2017.

As at November 30, 2017, the remaining balance outstanding under finance lease obligations after the settlements described above is $57,406 (August 31, 2017 - $56,631) and is repayable within 1 year, as such, the finance lease obligation is classified as a current liability.

(b) Remuneration of Directors and key management personnel (being the Company’s Chief Executive Officer, Chief Financial Officer and Chief Operating Officer) of the Company was as follows:

| Three months ended November 30, | November 30, 2017 | November 30, 2016 | ||||||||||||||

| Fees, salaries and benefits (1) | Share based payments (2), (3), (4) | Fees, salaries and benefits (1) | Share based payments (2), (3) | |||||||||||||

| Management | $ | 172,237 | $ | 765,047 | $ | 105,333 | $ | 723,090 | ||||||||

| Directors | 27,906 | 414,000 | 27,906 | 56,938 | ||||||||||||

| Total | $ | 200,143 | $ | 1,179,047 | $ | 133,239 | $ | 780,028 | ||||||||

| (1) | Salaries and benefits include director fees. The board of directors do not have employment or service contracts with the Company. Directors are entitled to director fees and RSU’s for their services and officers are entitled to cash remuneration and RSU’s for their services. |

| (2) | Compensation shares may carry restrictive legends. |

| (3) | All RSU share based compensation is based on the accounting expense recorded in the year. |

| (4) | All stock option share based compensation is based on the accounting expense recorded in the year. |

As at November 30, 2017, included in trade and other payables is $607,000 (August 31, 2017 - $638,000) due to these key management personnel with no specific terms of repayment.

The Company’s former CEO and current director provided various loans to the Company totaling $133,632. On December 1, 2016, the Company entered into settlement agreements whereby the remaining balance of $136,519 was settled through the issuance of 187,321 shares issued at an average price of $0.705 per share for total issued value of $131,998, resulting in a gain on settlement of debt of $4,521 for the year ended August 31, 2017. As at November 30, 2017 $nil (August 31, 2017 - $nil) is outstanding. The balance is payable on demand, interest free, and unsecured.

| 24 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

| 9. | Management of Capital |

The Company's objective when managing capital is to obtain adequate levels of funding to support its exploration activities, to obtain corporate and administrative functions necessary to support organizational functioning, to obtain sufficient funding to further the identification and development of precious metals deposits, and to develop and construct low cost heap leach gold production mines.

The Company manages its capital structure and makes adjustments to it, based on the funds available to the Company, in order to support the acquisition, exploration and development of mineral properties. The Board of Directors does not establish quantitative return on capital criteria for management, but rather relies on the expertise of the Company's management to sustain future development of the business. The Company defines capital to include its shareholders’ equity. In order to carry out the planned exploration and pay for administrative costs, the Company will spend its existing working capital and raise additional amounts as needed. The Company will continue to assess new properties and seek to acquire an interest in additional properties if it feels there is sufficient geologic or economic potential and if it has adequate financial resources to do so. Management reviews its capital management approach on an ongoing basis and believes that this approach, given the relative size of the Company, is reasonable. There were no changes in the Company's approach to capital management during the three month period ended November 30, 2017. The Company is not subject to externally imposed capital requirements.

The Company considers its capital to be shareholders’ equity, which is comprised of share capital, reserves, and deficit, which as at November 30, 2017 totaled $35,767,797 (August 31, 2017 - $35,353,718).

The Company raises capital, as necessary, to meet its needs and take advantage of perceived opportunities and, therefore, does not have a numeric target for its capital structure. Funds are primarily secured through equity capital raised by way of private placements, however, debt and other financing alternatives may be utilized as well. There can be no assurance that the Company will be able to continue raising equity capital in this manner.

Management reviews its capital management approach on an ongoing basis and believes that this approach, given the relative size of the Company, is reasonable.

The Company invests all capital that is surplus to its immediate operational needs in short term, liquid and highly rated financial instruments, such as cash, and short term guarantee deposits, all held with major Canadian financial institutions and Canadian treasury deposits.

| 25 |

Tanzanian Royalty Exploration Corporation

Notes to the Unaudited Interim Condensed Consolidated Financial Statements

For the Three Month Periods Ended November 30, 2017 and 2016

10. Financial Instruments

Fair Value of Financial Instruments

The Company designated warrant and derivative liabilities as FVTPL. Fair value of the warrant liabilities and gold bullion loan derivatives are categorized as Level 3 measurement as these are calculated based on unobservable market inputs. A 10% movement in volatility in the financial instruments that were classified as Level 3 measure will have an impact of approximately $nil on the consolidated statements of comprehensive loss as these amounts have been reclassified during the period on change of functional currency. Trade and other receivables and cash and cash equivalents are classified as loans and receivables, which are measured at amortized cost. Trade and other payables, leases payable and gold bullion loans are classified as other financial liabilities, which are measured at amortized cost. Fair value of trade and other payables and convertible debt are determined from transaction values that are not based on observable market data.

The carrying value of the Company’s cash and cash equivalents, trade and other receivables, trade and other payables approximate their fair value due to the relatively short term nature of these instruments.

Fair value estimates are made at a specific point in time, based on relevant market information and information about financial instruments. These estimates are subject to and involve uncertainties and matters of significant judgment, therefore cannot be determined with precision. Changes in assumptions could significantly affect the estimates.

A summary of the Company's risk exposures as they relate to financial instruments are reflected below:

Credit Risk

Credit risk is the risk of an unexpected loss if a third party to a financial instrument fails to meet its contractual obligations. The Company is subject to credit risk on the cash balances at the bank and accounts and other receivables and the carrying value of those accounts represent the Company’s maximum exposure to credit risk. The Company’s cash and cash equivalents and short-term bank investments are with Schedule 1 banks or equivalents. The accounts and other receivables consist of GST/HST and VAT receivable from the various government agencies and amounts due from related parties. The Company has not recorded an impairment or allowance for credit risk as at November 30, 2017, or August 31, 2017.

Interest Rate Risk