NovaGold Resources Inc.: Exhibit 1 - Filed by newsfilecorp.com

NOVAGOLD RESOURCES INC.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED NOVEMBER 30, 2011

February 22, 2012

NOVAGOLD RESOURCES INC.

(the “Company”)

ANNUAL INFORMATION FORM

TABLE OF CONTENTS

- i -

Preliminary Notes

Cautionary Statement Regarding Forward-Looking

Information

This Annual Information Form for NovaGold Resources Inc.

(“NovaGold” or “the Company”) contains statements of forward-looking

information. These forward-looking statements may include statements regarding

perceived merit of properties, exploration results and budgets, mineral reserves

and resource estimates, work programs, capital expenditures, operating costs,

cash flow estimates, production estimates and similar statements relating to the

economic viability of a project, timelines, strategic plans, including the

Company’s plans and expectations relating to its Galore Creek and Ambler

projects, completion of transactions, market prices for precious and base

metals, or other statements that are not statements of fact. These statements

relate to analyses and other information that are based on forecasts of future

results, estimates of amounts not yet determinable and assumptions of

management. Statements concerning mineral resource estimates may also be deemed

to constitute “forward-looking statements” to the extent that they involve

estimates of the mineralization that will be encountered if the property is

developed.

Any statements that express or involve discussions with respect

to predictions, expectations, beliefs, plans, projections, objectives,

assumptions or future events or performance (often, but not always, identified

by words or phrases such as “expects”, “is expected”, “anticipates”, “believes”,

“plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”,

“objectives”, “potential”, “possible” or variations thereof or stating that

certain actions, events, conditions or results “may”, “could”, “would”,

“should”, “might” or “will” be taken, occur or be achieved, or the negative of

any of these terms and similar expressions) are not statements of historical

fact and may be forward-looking statements.

Forward-looking statements are based on a number of material

assumptions, including those listed below, which could prove to be significantly

incorrect:

- our ability to achieve production at any of the Company’s mineral

exploration and development properties;

- estimated capital costs, operating costs, production and economic returns;

- estimated metal pricing, metallurgy, mineability, marketability and

operating and capital costs, together with other assumptions underlying the

Company’s resource and reserve estimates;

- our expected ability to develop adequate infrastructure and that the cost

of doing so will be reasonable;

- assumptions that all necessary permits and governmental approvals will be

obtained;

- assumptions made in the interpretation of drill results, the geology,

grade and continuity of the Company’s mineral deposits;

- our expectations regarding demand for equipment, skilled labour and

services needed for exploration and development of mineral properties; and

- our activities will not be adversely disrupted or impeded by development,

operating or regulatory risks.

Forward-looking statements are subject to a variety of known

and unknown risks, uncertainties and other factors that could cause actual

events or results to differ from those reflected in the forward-looking

statements, including, without limitation:

- uncertainty of whether there will ever be production at the Company’s

mineral exploration and development properties;

- uncertainty of estimates of capital costs, operating costs, production and

economic returns;

- uncertainties relating to the assumptions underlying the Company’s

resource and reserve estimates, such as metal pricing, metallurgy,

mineability, marketability and operating and capital costs;

- risks related to the Company’s ability to commence production and generate

material revenues or obtain adequate financing for its planned exploration and

development activities;

- risks related to the Company’s ability to finance the development of its

mineral properties through external financing, strategic alliances, the sale

of property interests or otherwise;

- risks related to the third parties on which the Company depends for its

exploration and development activities;

- dependence on cooperation of joint venture partners in exploration and

development of properties;

- credit, liquidity, interest rate and currency risks;

- ii -

- risks related to market events and general economic conditions;

- uncertainty related to inferred mineral resources;

- risks and uncertainties relating to the interpretation of drill results,

the geology, grade and continuity of the Company’s mineral deposits;

- risks related to lack of infrastructure;

- mining and development risks, including risks related to infrastructure,

accidents, equipment breakdowns, labor disputes or other unanticipated

difficulties with or interruptions in development, construction or production;

- the risk that permits and governmental approvals necessary to develop and

operate mines on the Company’s properties will not be available on a timely

basis or at all;

- commodity price fluctuations;

- risks related to governmental regulation and permits, including

environmental regulation;

- risks related to the need for reclamation activities on the Company’s

properties and uncertainty of cost estimates related thereto;

- uncertainty related to title to the Company’s mineral properties;

- uncertainty related to unsettled aboriginal rights and title in British

Columbia;

- the Company’s history of losses and expectation of future losses;

- uncertainty as to the outcome of potential litigation;

- uncertainty inherent in litigation including the effects of discovery of

new evidence or advancement of new legal theories, the difficulty of

predicting decisions of judges and juries and the possibility that decisions

may be reversed on appeal;

- risks related to default under the Company’s unsecured convertible notes;

- risks related to the Company’s majority shareholder;

- risks related to increases in demand for equipment, skilled labor and

services needed for exploration and development of mineral properties, and

related cost increases;

- increased competition in the mining industry;

- the Company’s need to attract and retain qualified management and

technical personnel;

- risks related to the Company’s current practice of not using hedging

arrangements;

- uncertainty as to the Company’s ability to acquire additional commercially

mineable mineral rights;

- risks related to the integration of potential new acquisitions into the

Company’s existing operations;

- risks related to unknown liabilities in connection with acquisitions;

- risks related to conflicts of interests of some of the directors of the

Company;

- risks related to global climate change;

- risks related to adverse publicity from non-governmental organizations;

- uncertainty as to the Company’s ability to maintain the adequacy of

internal control over financial reporting as per the requirements of the

Sarbanes-Oxley Act;

- uncertainty relating to the timing and ability to complete the spin-off of

NovaCopper to the Company’s shareholders;

- increased regulatory compliance costs relating to the Dodd-Frank Act; and

- increased regulatory compliance costs related to the Company’s loss of its

foreign private issuer status in the event of a disposition of the Galore

Creek project.

This list is not exhaustive of the factors that may affect any

of the Company’s forward-looking statements. Forward-looking statements are

statements about the future and are inherently uncertain, and actual

achievements of the Company or other future events or conditions may differ

materially from those reflected in the forward-looking statements due to a

variety of risks, uncertainties and other factors, including, without

limitation, those referred to in this Annual Information Form under the heading

“Risk Factors” and elsewhere.

The Company’s forward-looking statements are based on the

beliefs, expectations and opinions of management on the date the statements are

made, and the Company does not assume any obligation to update forward-looking

statements if circumstances or management’s beliefs, expectations or opinions

should change, except as required by law. For the reasons set forth above,

investors should not place undue reliance on forward-looking statements.

- iii -

Cautionary Note to U.S. Investors – Information

Concerning Preparation of Resource and Reserve Estimates

This Annual Information Form has been prepared in accordance

with the requirements of the securities laws in effect in Canada, which differ

from the requirements of U.S. securities laws. Unless otherwise indicated, all

resource and reserve estimates included in this Annual Information Form have

been prepared in accordance with National Instrument 43-101 Standards of

Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of

Mining and Metallurgy Classification System. NI 43-101 is a rule developed by

the Canadian Securities Administrators which establishes standards for all

public disclosure an issuer makes of scientific and technical information

concerning mineral projects.

Canadian standards, including NI 43-101, differ significantly

from the requirements of the United States Securities and Exchange Commission

(“SEC”), and resource and reserve information contained herein may not be

comparable to similar information disclosed by U.S. companies. In particular,

and without limiting the generality of the foregoing, the term “resource” does

not equate to the term “reserves”. Under U.S. standards, mineralization may not

be classified as a “reserve” unless the determination has been made that the

mineralization could be economically and legally produced or extracted at the

time the reserve determination is made. The SEC’s disclosure standards normally

do not permit the inclusion of information concerning “measured mineral

resources”, “indicated mineral resources” or “inferred mineral resources” or

other descriptions of the amount of mineralization in mineral deposits that do

not constitute “reserves” by U.S. standards in documents filed with the SEC.

U.S. investors should also understand that “inferred mineral resources” have a

great amount of uncertainty as to their existence and great uncertainty as to

their economic and legal feasibility. It cannot be assumed that all or any part

of an “inferred mineral resource” will ever be upgraded to a higher category.

Under Canadian rules, estimated “inferred mineral resources” may not form the

basis of feasibility or pre-feasibility studies except in rare cases. Investors

are cautioned not to assume that all or any part of an “inferred mineral

resource” exists or is economically or legally mineable. Disclosure of

“contained ounces” in a resource is permitted disclosure under Canadian

regulations; however, the SEC normally only permits issuers to report

mineralization that does not constitute “reserves” by SEC standards as in-place

tonnage and grade without reference to unit measures. The requirements of NI

43-101 for identification of “reserves” are also not the same as those of the

SEC, and reserves reported by the Company in compliance with NI 43-101 may not

qualify as “reserves” under SEC standards. Accordingly, information concerning

mineral deposits set forth herein may not be comparable with information made

public by companies that report in accordance with U.S. standards.

Glossary and Defined Terms

The following is a glossary of certain mining terms used in

this Annual Information Form.

| aggregate |

Any of several hard, inert materials, such as sand,

gravel, slag or crushed stone, mixed with a cement or bituminous material

to form concrete, mortar or plaster, or used alone, as in railroad ballast

or graded fill. |

| |

|

| alluvial |

A placer formed by the action of running water, as in a

stream channel or alluvial fan; also said of the valuable mineral (e.g.

gold or diamond) associated with an alluvial placer. |

| |

|

| arsenopyrite |

The common arsenic mineral and principal ore of arsenic;

occurs in many sulfide ore deposits, particularly those containing lead,

silver and gold. |

| |

|

| alteration |

Refers to the process of hydrothermal fluids (hot water)

changing primary rock minerals (such as quartz, feldspar and hornblende)

to secondary minerals (quartz, carbonate and clay minerals). |

| |

|

| breccia |

A rock in which angular fragments are surrounded by a

mass of fine-grained minerals. |

| |

|

| CIM |

Canadian Institute of Mining, Metallurgy and Petroleum.

|

| |

|

| contained ounces |

Represents ounces in the ground before reduction of

ounces not able to be recovered by the applicable metallurgical process.

|

| |

|

| dike |

A tabular igneous intrusion that cuts across the bedding

or foliation of the country rock. |

- iv -

| g/t |

Grams per metric tonne. |

| |

|

| illite |

A group of three-layer mica-like clays. |

| |

|

| mafic |

Igneous rocks composed mostly of dark, iron- and

magnesium-rich minerals. |

| |

|

| masl |

Meters above sea level. |

| |

|

mineral resource,

measured mineral

resource, indicated

mineral resource, inferred

mineral resource |

Under CIM standards, a mineral resource is a

concentration or occurrence of natural, solid, inorganic or fossilized

organic material in or on the earth’s crust in such form and quantity and

of such a grade or quality that it has reasonable prospects for economic

extraction. The location, quantity, grade, geological characteristics and

continuity of a mineral resource are known, estimated or interpreted from

specific geological evidence and knowledge. |

| |

|

|

The terms “mineral resource”, “measured mineral

resource”, “indicated mineral resource”, and “inferred mineral resource”

used in this Annual Information Form are mining terms defined under CIM

standards and used in accordance with NI 43-101. They are not defined

terms under U.S. standards and generally may not be used in documents

filed with the SEC by U.S. companies. See “Cautionary Note to U.S.

Investors – Information Concerning Preparation of Resource and Reserve

Estimates”. |

| |

|

|

A mineral resource estimate is based on information on

the geology of the deposit and the continuity of mineralization.

Assumptions concerning economic and operating parameters, including

cut-off grades and economic mining widths, based on factors typical for

the type of deposit, may be used if these factors have not been

specifically established for the deposit at the time of the mineral

resource estimate. A mineral resource is categorized on the basis of the

degree of confidence in the estimate of quantity and grade or quality of

the deposit, as follows: |

| |

|

|

Inferred mineral resource: Under CIM standards, an

inferred mineral resource is that part of a mineral resource for which

quantity and grade or quality can be estimated on the basis of geological

evidence and limited sampling and reasonably assumed, but not verified,

geological and grade continuity. The estimate is based on limited

information and sampling gathered through appropriate techniques from

locations such as outcrops, trenches, pits, workings and drill holes.

|

| |

|

|

Indicated mineral resource: Under CIM standards, an

indicated mineral resource is that part of a mineral resource for which

quantity, grade or quality, densities, shape and physical characteristics

can be estimated with a level of confidence sufficient to allow the

appropriate application of technical and economic parameters to support

mine planning and evaluation of the economic viability of the deposit. The

estimate is based on detailed and reliable exploration and testing

information gathered through appropriate techniques from locations such as

outcrops, trenches, pits, workings and drill holes that are spaced closely

enough for geological and grade continuity to be reasonably assumed.

|

| |

|

|

Measured mineral resource: Under CIM standards, a

measured mineral resource is that part of a mineral resource for which

quantity, grade or quality, densities, shape and physical characteristics

are so well established that they can be estimated with confidence

sufficient to allow the appropriate application of technical and economic

parameters to support production planning and evaluation of the economic

viability of the deposit. The estimate is based on detailed and reliable

exploration, sampling and testing information gathered through appropriate

techniques from locations such as outcrops, trenches, pits, workings and

drill holes that are spaced closely enough to confirm both geological and

grade continuity. |

- v -

mineral reserve,

proven mineral

reserve,

probable mineral reserve |

Under CIM standards, a mineral reserve is the

economically mineable part of a measured or indicated mineral resource

demonstrated by a preliminary feasibility study or feasibility study. This

study must include adequate information on mining, processing,

metallurgical, economic and other relevant factors that demonstrate, at

the time of reporting, that economic extraction can be justified. A

mineral reserve includes diluting materials and allowances for losses that

may occur when the material is mined. |

| |

|

|

The terms “mineral reserve”, “proven mineral reserve” and

“probable mineral reserve” used in this Annual Information Form are mining

terms defined under CIM standards and used in accordance with NI 43-101.

Mineral reserves, proven mineral reserves and probable mineral reserves

presented under CIM standards may not conform with the definitions of

“reserves”, “proven reserves” or “probable reserves” under U.S. standards.

See “Cautionary Note to U.S. Investors – Information Concerning

Preparation of Resource and Reserve Estimates”. |

| |

|

|

Mineral reserves under CIM standards are those parts of

mineral resources which, after the application of all mining factors,

result in an estimated tonnage and grade which, in the opinion of the

Qualified Person(s) (as defined in NI 43-101) making the estimates, is the

basis of an economically viable project after taking account of all

relevant processing, metallurgical, economic, marketing, legal,

environment, socio-economic and governmental factors. Mineral reserves are

inclusive of diluting material that will be mined in conjunction with the

mineral reserves and delivered to the treatment plant or equivalent

facility. The term “mineral reserve” need not necessarily signify that

extraction facilities are in place or operative or that all governmental

approvals have been received. It does signify that there are reasonable

expectations of such approvals. |

| |

|

|

Under CIM standards, mineral reserves are subdivided in

order of increasing confidence into probable mineral reserves and proven

mineral reserves. A probable mineral reserve has a lower level of

confidence than a proven mineral reserve. |

| |

|

|

Proven mineral reserve: A proven mineral reserve is the

economically mineable part of a measured mineral resource demonstrated by

at least a preliminary feasibility study. This study must include adequate

information on mining, processing, metallurgical, economic and other

relevant factors that demonstrate, at the time of reporting, that the

economic extraction can be justified. |

| |

|

|

Probable mineral reserve: A probable mineral reserve is

the economically mineable part of an indicated and, in some circumstances,

a measured mineral resource demonstrated by at least a preliminary

feasibility study. This study must include adequate information on mining,

processing, metallurgical, economic and other relevant factors that

demonstrate, at the time of reporting, that the economic extraction can be

justified. |

| |

|

| mineralization |

An anomalous occurrence of metal or other commodity of

value defined by any method of sampling (surface outcrops, drill core,

underground channels). Under SEC standards, such a deposit does not

qualify as a reserve until comprehensive evaluation, based on unit cost,

grade, recoveries and other factors, concludes that the mineralization

could be legally and economically produced or extracted at the time the

reserve determination is made. |

| |

|

| net present value (“NPV”) |

The sum of the value on a given date of a series of

future cash payments and receipts, discounted to reflect the time value of

money and other factors such as investment risk. |

| |

|

| ore |

Rock containing metallic or non-metallic materials that

can be mined and processed at a profit. |

| |

|

| patent |

The ultimate stage of holding a mineral claim, after

which no more assessment work is necessary; determines that all mineral

rights, both surface and underground, have been earned. |

| |

|

| placer |

An alluvial deposit of sand and gravel, which may contain

valuable metals. |

| |

|

| pyrite |

An iron sulfide mineral (FeS2 ), the most

common naturally occurring sulfide mineral. |

- vi -

| reverse circulation (“RC”) |

A type of drilling using dual-walled drill pipe in which

the material drilled, water and mud are circulated up the center pipe

while air is blown down the outside pipe. |

| |

|

| schist |

A medium-to-course grained foliated metamorphic rock, the

grains of which have a roughly parallel arrangement; generally developed

by shearing. |

| |

|

| sill |

An intrusive sheet of igneous rock of roughly uniform

thickness that has been forced between the bedding planes of existing

rock. |

| |

|

| stockwork |

A three-dimensional network of closely spaced planar to

irregular veinlets. |

| |

|

| strike |

The direction, or bearing from true north, of a vein or

rock formation measured on a horizontal surface. |

| |

|

| sulfide |

A compound of sulfur and some other metallic element.

|

| |

|

| tpd |

Metric tonnes per day. |

Currency and Exchange Rates

All dollar amounts in this Annual Information Form are

expressed in Canadian dollars unless otherwise indicated. The noon rate of

exchange as reported by the Bank of Canada for the conversion of Canadian

dollars into U.S. dollars on February 21, 2012 was C$0.9955 per US$1.00

and on November 30, 2011 was C$1.0197 per US$1.00.

The following table sets forth (i) the rate of exchange for the

Canadian dollar, expressed in U.S. dollars, in effect at the end of the periods

indicated; (ii) the average exchange rates for the Canadian dollar, on the last

day of each month during such periods; and (iii) the high and low exchange rates

for the Canadian dollar, expressed in U.S. dollars, during such periods, each

based on the noon rate of exchange as reported by the Bank of Canada for

conversion of Canadian dollars into U.S. dollars:

| |

|

2011 |

|

|

2010 |

|

|

2009 |

|

| |

|

|

|

|

|

|

|

|

|

| Rate at end of period |

|

0.9807 |

|

|

0.9743 |

|

|

0.9457 |

|

| Average rate based on last day each month |

|

1.0155 |

|

|

0.9673 |

|

|

0.8643 |

|

| High for period |

|

1.0583 |

|

|

1.0039 |

|

|

0.9716 |

|

| Low for period |

|

0.9430 |

|

|

0.9278 |

|

|

0.7692 |

|

Metric Equivalents

The following table sets forth the factors for converting

Imperial measurements into metric equivalents:

| To convert from Imperial |

|

To Metric |

|

|

Multiply By |

|

| |

|

|

|

|

|

|

| Acres |

|

Hectares |

|

|

0.404686 |

|

| Feet |

|

Meters |

|

|

0.304800 |

|

| Miles |

|

Kilometers |

|

|

1.609344 |

|

| Tons |

|

Tonnes |

|

|

0.907185 |

|

| Ounces (troy)/ton |

|

Grams/Tonne |

|

|

34.28570 |

|

- 1 -

NOVAGOLD RESOURCES INC.

ANNUAL INFORMATION FORM

for its financial year ended November 30, 2011

ITEM 1 CORPORATE STRUCTURE

Name, Address and Incorporation

The Company was incorporated by memorandum of association on

December 5, 1984, under the Companies Act (Nova Scotia) as 1562756 Nova

Scotia Limited. On January 14, 1985, the Company changed its name to NovaCan

Mining Resources (l985) Limited and on March 20, 1987, the Company changed its

name to NovaGold Resources Inc. The Company is in good standing under the laws

of the Province of Nova Scotia. The registered office of the Company is located

at Suite 1300 – 1969 Upper Water Street, Halifax, Nova Scotia, Canada, B3J 3R7.

The Company’s principal office is located at Suite 2300, 200 Granville Street,

Vancouver, BC, Canada, V6C 1S4.

Intercorporate Relationships

As at the end of its most recently completed financial year,

the Company had the following material, direct and indirect, wholly-owned

subsidiaries: NovaGold Resources Alaska, Inc., NovaGold (Bermuda) Alaska Limited

and NovaGold Resources (Bermuda) Limited and NovaGold Canada Inc.

The following chart depicts the corporate structure of the

Company together with the jurisdiction of incorporation of each of the Company’s

material subsidiaries and related holding companies. All ownership is 100%

unless otherwise indicated.

All of the above companies are

sometimes referred to collectively herein as the “Company” or “NovaGold”.

- 2 -

ITEM 2 GENERAL DEVELOPMENT OF THE BUSINESS

Description of the Business

NovaGold is engaged in the exploration and development of

mineral properties. NovaGold is focused on advancing its flagship property,

Donlin Gold (formerly Donlin Creek). NovaGold has one of the largest mineral

reserve/resource bases among junior and mid-tier gold exploration companies. The

Company is also committed to maximizing the value of its non-core assets,

including its interest in the Galore Creek copper-gold-silver project, which the

Company is currently exploring opportunities to sell, in whole or in part.

NovaGold has an established track record of expanding deposits through

exploration and of forging collaborative partnerships, both with local

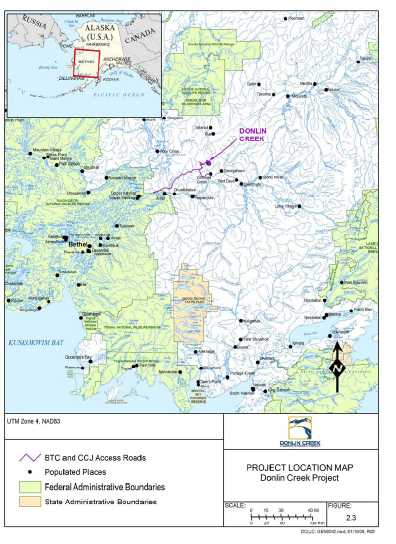

communities and with major mining companies. The Donlin Gold project in Alaska,

one of the world’s largest known undeveloped gold deposits, is held by a limited

liability company owned equally by wholly-owned subsidiaries of NovaGold and

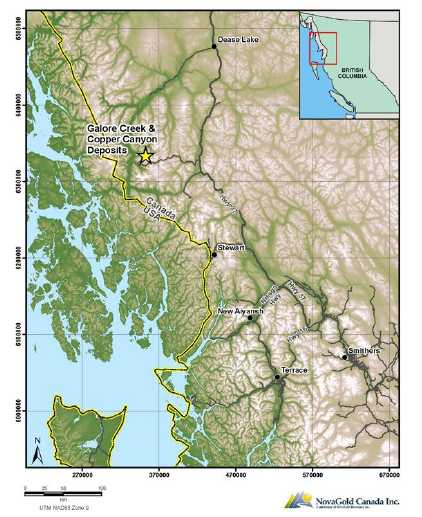

Barrick Gold Corporation (“Barrick”). The Galore Creek project in British

Columbia, a large copper-gold-silver deposit, is held by a partnership owned

equally by wholly-owned subsidiaries of NovaGold and Teck Resources Limited

(“Teck”). NovaGold holds a 100% interest in the Ambler project, which contains

the high-grade Arctic copper-zinc-lead-gold-silver deposit in northern Alaska,

subject to a back-in right held by NANA Regional Corporation Inc. (“NANA”).

NovaGold also has other earlier-stage exploration properties. The Company’s

portfolio of properties includes:

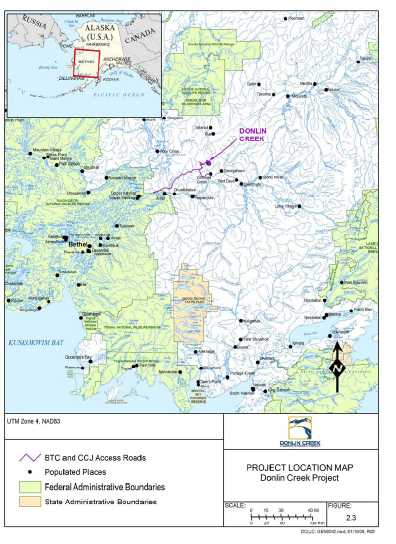

| |

|

Donlin Gold, one of the world’s largest known undeveloped

gold deposits, is held by Donlin Gold LLC (formerly Donlin Creek LLC), a

limited liability company that is owned 50% by NovaGold Resources Alaska,

Inc. and 50% by Barrick Gold U.S. Inc. On December 5, 2011, NovaGold

announced the completion of a Feasibility Study for Donlin Gold (the

“Donlin Gold FS”). The Donlin Gold FS was compiled by AMEC Americas Ltd.

(“AMEC”) and revises the feasibility study completed in April 2009 (“2009

Feasibility Study”) with updated mineral reserves and resources, capital

costs and operating cost estimates. The Study is currently under review by

the Board of Directors of Donlin Gold LLC and has not yet been approved

pending clarification of certain outstanding issues. The Donlin Gold FS

also utilizes natural gas as the primary power source for the project

rather than the original diesel option. Donlin Gold is located in

southwestern Alaska on private Alaskan native-owned lands and Alaska state

mining claims totalling 81,361 acres (32,926 hectares). The property has

estimated proven and probable mineral reserves of 505 million tonnes

grading 2.09 grams per tonne gold for 33.8 million ounces of gold. This

represents an approximate 16% increase from the mineral reserve estimate

outlined in the 2009 Feasibility Study and is broadly comparable to the

March 2010 mineral reserve and resource update released by NovaGold. The

property hosts estimated measured and indicated mineral resources

(inclusive of mineral reserves) of 541 million tonnes grading 2.24 grams

per tonne gold for 39 million ounces of gold and inferred mineral

resources of 92 million tonnes grading 2.02 grams per tonne gold for 6.0

million ounces of gold. The total capital cost estimate for Donlin Gold is

US$6.7 billion, including costs related to the natural gas pipeline and a

contingency of US$984 million. The project’s estimated after-tax net

present value (NPV5% ) is US$547 million using the base case

gold price of US$1,200/oz, US$4.58 billion using a gold price of

US$1,700/oz and US$6.72 billion using a gold price of US$2,000/oz. The

corresponding Internal Rate of Returns (“IRR”) after-tax were estimated at

6.0%, 12.3% and 15.1%, respectively. Donlin Gold, if put into production

in accordance with the Donlin Gold FS, would average 1.46 million ounces

of gold production in each year of its first five years of operation at an

average cash cost of US$409/oz and an average of 1.13 million ounces of

gold per year over its projected 27 year mine life with an average cash

cost of US$585/oz. Mineral resources that are not mineral reserves do not

have demonstrated economic viability. The project is expected to be a

conventional truck and shovel open-pit operation. The mine life is

estimated to be 27 years based on a nominal processing rate of 53,500

tonnes per day. NovaGold believes that significant exploration potential

remains in the Donlin Gold district, with prospects to increase mine life

and/or justify future production expansions. NovaGold anticipates that

Donlin Gold will commence formal project permitting in the first half of

2012 following approval by the Board of Donlin Gold LLC. |

- 3 -

| |

|

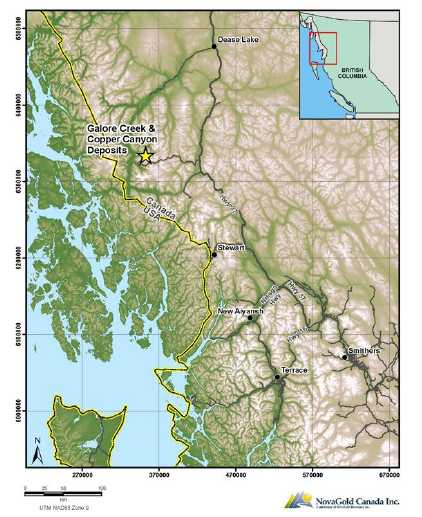

Galore Creek, a large copper-gold-silver project located

in northwestern British Columbia, is held by a partnership (the “Galore

Creek Partnership”) in which NovaGold Canada Inc. and Teck Metals Ltd.

each own a 50% interest and is managed by Galore Creek Mining Corporation

(“GCMC”). The 293,837 acre (118,912 hectare) property holds a large,

porphyry-related copper-gold-silver deposit. The Pre-feasibility Study

(“PFS”) completed in July 2011 for the Galore Creek project estimates that

the project has proven and probable mineral reserves of 528 million tonnes

grading 0.59% copper, 0.32 grams per tonne gold and 6.02 grams per tonne

silver for estimated contained metal of 6.8 billion pounds of copper, 5.45

million ounces of gold and 102.1 million ounces of silver. In addition,

the property has estimated measured and indicated mineral resources

(exclusive of mineral reserves) of 286.7 million tonnes grading 0.33%

copper, 0.27 grams per tonne gold and 3.64 grams per tonne silver, for

estimated contained metal of 2.07 billion pounds of copper, 2.53 million

ounces of gold and 33.54 million ounces of silver and estimated inferred

mineral resources of 346.6 million tonnes grading 0.42% copper, 0.24 grams

per tonne gold and 4.28 grams per tonne silver, for estimated contained

metal of 3.23 billion pounds of copper, 2.70 million ounces of gold and

47.73 million ounces of silver. The PFS total capital cost estimate for

the Galore Creek project is $5.2 billion dollars. The PFS estimated net

present value (NPV7% ), using the base case metal price

assumptions set forth below, was assessed at $837 million and $137 million

on a pre-tax and post-tax basis, respectively. The corresponding post-tax

IRR of the project was estimated at 7.4%. Using the July 27, 2011 current

price case set forth below, the pre-tax and post-tax NPV7% of

the project were estimated at $4.7 billion and $2.7 billion, respectively,

with a post-tax IRR estimated at 14%. Base case metal prices used in the

PFS were US$2.65/lb copper, US$1,100/oz gold and US$18.50/oz silver with a

foreign exchange rate of US$0.91 = Cdn$1.00. The current price case used

metal prices on July 27, 2011 of US$4.44/lb copper, US$1,613/oz gold and

US$40.34/oz silver with a foreign exchange rate of US$1.05 = Cdn$1.00.

Mineral resources that are not mineral reserves do not have demonstrated

economic viability. NovaGold announced on November 16, 2011, that it is

exploring opportunities to sell all or a part of its interest in the

Galore Creek Partnership.

|

| |

|

|

| |

|

Ambler, which hosts the high-grade

copper-zinc-lead-gold-silver Arctic deposit, is, subject to a back-in

right held by NANA, 100% owned by a wholly-owned subsidiary of NovaGold.

Ambler is an exploration- stage property located in Alaska comprising

90,315 acres (36,549 hectares) of Federal patented mining claims and State

of Alaska mining claims, within which volcanogenic massive sulfide (“VMS”)

mineralization can be found. A mineral resource estimate for the Arctic

deposit shows an indicated mineral resource of 16.8 million tonnes grading

4.1% copper, 6.0% zinc, 0.83 grams/tonne gold and 59.62 grams/tonne silver

for estimated contained metal of 1.5 billion pounds of copper, 2.2 billion

pounds of zinc, 350.3 million pounds of lead, 447,000 ounces of gold and

32.3 million ounces of silver. In addition, the estimate shows an inferred

mineral resource of 12.1 million tonnes grading 3.5% copper, 4.9% zinc,

0.67 grams/tonne gold, and 48.04 grams/tonne silver containing 939.9

million pounds of copper, 1.3 billion pounds of zinc, 211.6 million pounds

of lead, 260,000 ounces of gold and 18.7 million ounces of silver. On

April 14, 2011, NovaGold announced the results of a preliminary economic

assessment (“PEA”) for the Arctic deposit. The project’s net present value

(NPV8% ) using the PEA base case metal price assumptions set

forth below was estimated at US$718 million and US$505 million on a

pre-tax and post-tax basis, respectively. The corresponding IRR were

estimated at 30% and 25%. Using the metal prices set forth below, the

pre-tax and post-tax NPV8% were estimated at US$2.2 billion and

US$1.6 billion, respectively, with corresponding IRRs estimated at 59% and

50%. Base case metal price assumptions used were US$2.50/lb copper,

US$1.05/lb zinc, US$1.00/lb lead, US$1,100/oz for gold and US$20/oz

silver. The metal price assumptions used were US$4.31/lb copper,

US$1.20/lb zinc, US$1.20/lb lead, US$1,425/oz gold and US$36/oz silver.

Mineral resources that are not mineral reserves do not have demonstrated

economic viability. On November 16, 2011, NovaGold announced that it

intends to distribute the shares of NovaCopper Inc. to its shareholders.

NovaCopper Inc. owns the Ambler project through its wholly-owned

subsidiary, NovaCopper US Inc. |

NovaGold also holds earlier-stage exploration projects that

have not advanced to the resource definition stage and the Rock Creek project

which is in the closure stage. For the purposes of NI 43-101, NovaGold’s

material properties are Donlin Gold and Galore Creek.

- 4 -

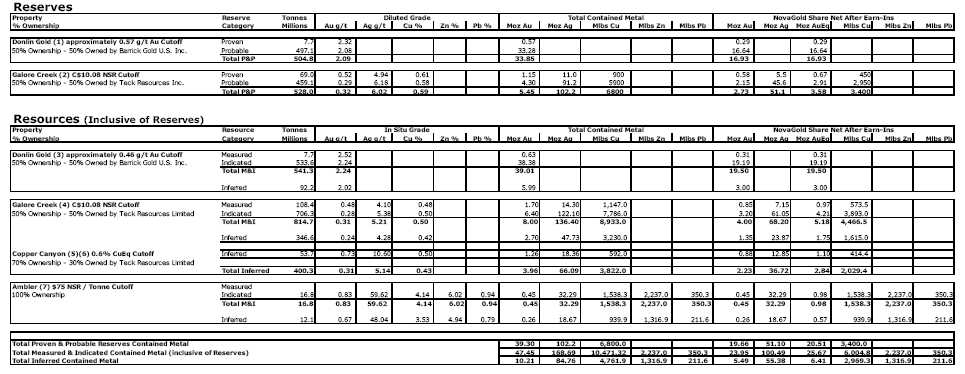

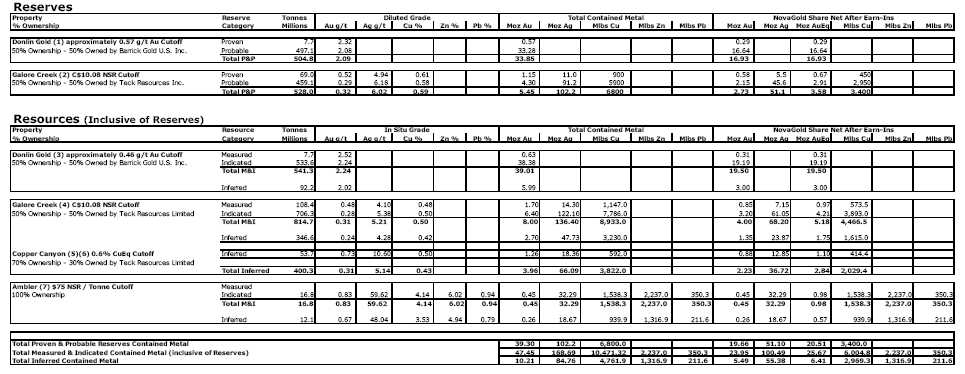

NovaGold Resources

Inc.

Proven and Probable

Mineral Reserves, Measured, Indicated and

Inferred Mineral Resources for Gold (Au), Silver

(Ag), Copper (Cu), Zinc (Zn) and Lead (Pb)

As at December5, 2011

- 5 -

Notes:

a. These resource estimates have been

prepared in accordance with NI43-101 and the CIM Definition Standard, unless

otherwise noted.

b. See numbered footnotes below on resource information.

c. AuEq - gold equivalent is calculated using gold and silver in the ratio

of gold + silver ÷ (US$1023 Au ÷ US$17 Ag) 2008 - 2010 average metal prices.

d. Rounding as required by reporting guidelines may result in apparent

summation differences between tonnes, grade and contained metal content

e.

Tonnage and grade measurements are in metric units. Contained gold and silver

ounces are reported as troy ounces, contained copper, zinc, and lead pounds as

imperial pounds

Resource Footnotes:

(1) Mineral

Reserves are contained within Measured and Indicated pit designs, and supported

by a mine plan, featuring variable throughput rates, stockpiling and cut-off

optimization. The pit designs and mine plan were optimized on diluted grades

using the following economic and technical parameters: Metal price for gold of

US$975/oz; reference mining cost of US$1.67/t incremented US$0.0031/ t/m with

depth from the 220 m elevation (equates to an average mining cost of US$2.14/t),

variable processing cost based on the formula 2.1874 x (S%) + 10.65 for each

US$/t processed; general and administrative cost of US$2.27/t processed;

stockpile rehandle costs of US$0.19/t processed assuming that 45% of mill feed

is rehandled; variable recoveries by rocktype, ranging from 86.66% in shale to

94.17% in intrusive rocks in the Akivik domain; refining and freight charges of

US$1.78/oz gold; royalty considerations of 4.5%; and variable pit slope angles,

ranging from 23º to 43º. Mineral Reserves are reported using an optimized net

sales return value based on the following equation: Net Sales Return = Au grade

* Recovery * (US$975/oz – (1.78 + (US$975/oz – 1.78) * 0.045)) - (10.65 + 2.1874

* (S%) + 2.27 + 0.19) and reported in US$/tonne. The life of mine strip ratio is

5.48. The assumed life-of-mine throughput rate is 53.5 kt/d.

(2) Mineral Reserves are contained within Measured and

Indicated pit designs using metal prices for copper, gold and silver of

US$2.50/lb, US$1,050/oz, and US$16.85/oz, respectively. Appropriate mining

costs, processing costs, metal recoveries and inter ramp pit slope angles

varying from 42º to 55º were used to generate the pit phase designs. Mineral

Reserves have been calculated using a 'cashflow grade' ($NSR/SAG mill hr)

cut-off which was varied from year to year to optimize NPV. The net smelter

return (NSR) was calculated as follows: NSR = Recoverable Revenue – TCRC (on a

per tonne basis), where: NSR = Net Smelter Return; TCRC = Transportation and

Refining Costs; Recoverable Revenue = Revenue in Canadian dollars for

recoverable copper, recoverable gold, and recoverable silver using metal prices

of US$2.50/lb, US$1,050/oz, and US$16.85/oz for copper, gold, and silver,

respectively, at an exchange rate of CDN$1.1 to US$1.0; Cu Recovery = Recovery

for copper based on mineral zone and total copper grade; for Mineral Reserves

this NSR calculation includes mining dilution. SAG throughputs were modeled by

correlation with alteration types. Cashflow grades were calculated as the

product of NSR value in $/t and throughput in t/hr. The life of mine strip ratio

is 2.16.

(3) Mineral Resources are inclusive of Mineral Reserves.

Mineral Resources that are not Mineral Reserves do not have demonstrated

economic viability. Mineral Resources are contained within a conceptual

Measured, Indicated and Inferred optimized pit shell using the following

assumptions: gold price of US$1,200/oz; variable process cost based on 2.1874 *

(sulphur grade) + 10.65; administration cost of US$2.29/t; refining, freight

& marketing (selling costs) of US$1.85/oz recovered; stockpile rehandle

costs of US$0.20/t processed assuming that 45% of mill feed is rehandled;

variable royalty rate, based on royalty of 4.5% – (Au price – selling cost).

Mineral Resources have been estimated using a constant Net Sales Return cut-off

of US$0.001/t milled. The Net Sales Return was calculated using the formula: Net

Sales Return = Au grade * Recovery * (US$1200/oz – (1.85 + ((US$1200/oz – 1.85)

* 0.045))) (10.65 + 2.1874 * (S%) + 2.29 + 0.20) and reported in US$/tonne. See

"Cautionary Note Concerning Reserve & Resource Estimates" .

(4) Mineral Resources are inclusive of Mineral Reserves.

Mineral resources are contained within a conceptual Measured, Indicated and

Inferred optimized pit shell using the same economic and technical parameters as

used for Mineral Reserves. Tonnages are assigned based on proportion of the

block below topography. The overburden/bedrock boundary has been assigned on a

whole block basis. Mineral resources have been estimated using a constant NSR

cut-off of C$10.08/t milled. The Net Smelter Return (NSR) was calculated as

follows: NSR = Recoverable Revenue – TCRC (on a per tonne basis), where: NSR =

Diluted Net Smelter Return; TCRC = Transportation and Refining Costs;

Recoverable Revenue = Revenue in Canadian dollars for recoverable copper,

recoverable gold, and recoverable silver using silver using the economic and

technical parameters mentioned above. The mineral resource includes material

within the conceptual M&I pit that is not scheduled for processing in the

mine plan but is above cutoff. See "Cautionary Note Concerning Reserve &

Resource Estimates" .

(5) The copper-equivalent grade was calculated as follows: CuEq

= Recoverable Revenue ÷ 2204.62 * 100 ÷ 1.55. Where: CuEq = Copper equivalent

grade; Recoverable Revenue = Revenue in US dollars for recoverable copper,

recoverable gold and recoverable silver using metal prices of US$1.55/lb,

US$650/oz, and US$11/oz for copper, gold, and silver, respectively; Cu Recovery

= 100%. Mineral Resources that are not Mineral Reserves do not have demonstrated

economic viability. Inferred Resources are in addition to Measured and Indicated

Resources. Inferred Resources have a great amount of uncertainty as to their

existence and whether they can be mined legally or economically. It cannot be

assumed that all or any part of the Inferred Resources will ever be upgraded to

a higher category. See "Cautionary Note Concerning Reserve & Resource

Estimates" .

(6) NovaGold Canada Inc. has agreed to transfer its 60% joint

venture interest in the Copper Canyon property to the Galore Creek Partnership,

which is equally owned by NovaGold Canada Inc. and a subsidiary of Teck

Resources Limited. The remaining 40% joint venture interest in the Copper Canyon

property is owned by another wholly owned subsidiary of NovaGold.

(7) Resources stated as contained within a potentially

economically minable underground shapes above a US$75.00/t NSR cut-off. NSR

calculation is based on assumed metal prices of US$2.50/lb for copper,

US$1,000/oz for gold, US$16.00/oz for silver, US$1.00/lb for zinc and US$1.00/lb

for lead. A mining cost of US$45.00/t and combined processing and G&A costs

of US$31.00 were assumed to form the basis for the resource NSR cut-off

determination. Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability. Inferred Resources are in addition to Measured

and Indicated Resources. Inferred Resources have a great amount of uncertainty

as to their existence and whether they can be mined legally or economically. It

cannot be assumed that all or any part of the Inferred Resources will ever be

upgraded to a higher category. See "Cautionary Note Concerning Reserve &

Resource Estimates" .

- 6 -

Cautionary Note Concerning

Reserve & Resource Estimates

This summary table uses the term “resources”, “measured

resources”, “indicated resources” and “inferred resources” . United States

investors are advised that, while such terms are recognized and required by

Canadian securities laws, the United States Securities and Exchange Commission

(the “SEC”) does not recognize them. Under United States standards,

mineralization may not be classified as a “reserve” unless the determination has

been made that the mineralization could be economically and legally produced or

extracted at the time the reserve determination is made. Mineral resources that

are not mineral reserves do not have demonstrated economic viability. United

States investors are cautioned not to assume that all or any part of measured or

indicated resources will ever be converted into reserves. Further, inferred

resources have a great amount of uncertainty as to their existence and as to

whether they can be mined legally or economically. It cannot be assumed that all

or any part of the inferred resources will ever be upgraded to a higher

category. Therefore, United States investors are also cautioned not to assume

that all or any part of the inferred resources exist, or that they can be mined

legally or economically. Disclosure of “contained ounces” is permitted

disclosure under Canadian regulations, however, the SEC normally only permits

issuers to report “resources” as in place tonnage and grade without reference to

unit measures. Accordingly, information concerning descriptions of

mineralization and resources contained in this release may not be comparable to

information made public by United States companies subject to the reporting and

disclosure requirements of the SEC.

NI 43-101 is a rule developed by the Canadian Securities

Administrators, which established standards for all public disclosure an issuer

makes of scientific and technical information concerning mineral projects.

Unless otherwise indicated, all resource estimates contained in this circular

have been prepared in accordance with NI 43-101 and the CIM Definition

Standards.

Technical Reports and

Qualified Persons

The documents referenced below provide supporting technical

information for each of NovaGold's projects.

| Project |

Qualified Person(s) |

Most Recent Disclosure &

Filing Date |

| Donlin Gold |

Tony Lipiec, P. Eng., AMEC |

Donlin Creek Gold Project |

| |

Gordon Seibel R.M. SME, AMEC |

Alaska, USA |

| |

Kirk Hanson P.E., AMEC |

NI 43-101 Technical Report on

Second Updated Feasibility Study |

| |

|

amended filing on January 23,

2012 |

| |

|

|

| Galore Creek |

Robert Gill, P.Eng., AMEC |

Galore Creek Copper–Gold Project,

|

| |

Jay Melnyk, P.Eng., AMEC |

British Columbia, NI 43-101

Technical Report on Pre-Feasibility Study, |

| |

Greg Kulla, P.Geo., AMEC |

filed on September 12, 2011

|

| |

Greg Wortman, P.Eng., AMEC |

|

| |

Dana Rogers, P.Eng., Lemley International |

|

| |

|

|

| Copper Canyon |

Erin Workman, P.Geo., NovaGold Resources Inc.

|

Not publicly released - updated

March 2008 |

| |

|

|

| Ambler |

Russ White, P.Geo., SRK Consulting |

NI 43-101 Preliminary Economic

Assessment, Ambler Project - May 9, 2011 |

| |

Neal Rigby, C.Eng., MIMMM, Ph.D., SRK

Consulting |

|

- 7 -

General Development of the Business – Three Year History

Changes to Senior Management

On November 16, 2011, the Company announced that Mr. Gregory A.

Lang had accepted the position of President and Chief Executive Officer of the

Company effective January 9, 2012. Mr. Lang was previously the President of

Barrick Gold North America, a wholly-owned subsidiary of Barrick. As the

President of Barrick Gold North America, Mr. Lang had executive responsibility

for Barrick’s nine operations in the United States, Canada and the Dominican

Republic, including the Donlin Gold project.

Effective January 9, 2012, Mr. Rick Van Nieuwenhuyse stepped

down from his position as President and Chief Executive Officer of the Company

and assumed the position of President and Chief Executive Officer of NovaCopper

Inc., a subsidiary. Mr. Van Nieuwenhuyse will continue to serve as a member of

the Board of Directors of NovaGold and will serve as senior advisor to Mr. Lang

for a period of one year.

Donlin Gold Feasibility Study and Updates

Donlin Gold (formerly Donlin Creek) is located in southwestern

Alaska on private Alaskan native-owned lands and Alaska state mining claims

totalling 81,431 acres (32,954 hectares).

On April 28, 2009, NovaGold announced it had commissioned AMEC

Americas Limited (“AMEC”) to provide an independent Qualified Person’s Review

and Technical Report for the Donlin Gold project based on information contained

in the 2009 Feasibility Study. Based on the 2009 Feasibility Study, the Donlin

Gold mine has been designed as a year-round, open-pit operation with a mill

throughput of 53,500 tonnes per day. While the 2009 Feasibility Study

anticipated a mine life of 21 years using the original 29.3 million ounce gold

reserve base, the reserve update in March 2010 (see below) to 33.6 million

ounces resulted in an anticipated mine life extension to 25 years. During the

first 5 full years, production is expected to average 1.6 million ounces with an

average total cash cost of US$394/oz. Gold production for the first 12 full

years is expected to average nearly 1.5 million ounces annually at an average

total cash cost of US$444/oz. Life of mine (“LOM”) production is estimated at an

average of 1.25 million ounces of gold annually. These production levels would

make Donlin Gold one of the world’s largest gold-producing mines. Donlin Gold

LLC continues to review the mine plan in light of prevailing gold prices.

Additional exploration potential remains in the Donlin Gold district.

As outlined in the 2009 Feasibility Study, the total estimated

cost to design and build the Donlin Gold project was US$4.5 billion, including

an owner-provided mining fleet and self-performed pre-development costs.

Sustaining capital requirements totaled US$803.0 million over the 20+ year mine

life; these will be recalculated for the longer mine life in the feasibility

revision. All costs from the 2009 Feasibility Study are expressed in Q4 2008

U.S. dollars with no allowances for taxes, duties or interest during

construction. LOM operating costs, including allocations for mining, processing,

administration and refining, were estimated at US$30.03/t milled and US$4.60/t

mined. The operating cost estimates were assembled by area and component, based

on estimated staffing levels, consumables and expenditures, according to the

mine plan and process design.

The project was expected to generate positive net cash flow at

the base case gold price assumption of US$725/oz used for the 2009 reserve

estimate. At a gold price of US$1,000/oz the project would generate US$8.4

billion in pre-tax cash flow and have a pre-tax net present value (NPV5% )

of US$2.7 billion with a pre-tax internal rate of return (“IRR”) of 12.3% .

The 2009 Feasibility Study included a reserve/resource estimate

in which a majority of the mineral resources were converted to mineral reserves.

Using a long-term gold price assumption of US$725/oz and US$850/oz respectively,

mineral reserves and mineral resources were estimated at 29.3 million ounces of

proven and probable gold reserves, with an additional 6.0 million ounces of

measured and indicated gold resources and 4.0 million ounces of inferred gold

resources.

- 8 -

On March 22, 2010, NovaGold announced an updated

reserve/resource estimate for the Donlin Gold project. The estimate was completed by an

independent engineering firm under the supervision of Donlin Gold LLC using a

gold price of US$825/oz, increasing the in-situ gold reserve by 4.3 million

ounces to 33.6 million ounces of gold on a 100% basis. NovaGold’s 50% interest

totals 16.8 million ounces of gold reserves, with an additional 2.1 million

ounces of measured and indicated gold resources and 2.2 million ounces of

inferred gold resources. The Donlin Gold reserve/resource estimate incorporates

results from 62 new drill holes totalling 25,094 meters for total drilling in the

reserve/resource model of 1,740 drill holes totalling 370,000 meters. The new pit

model used similar parameters to the resource model used in the 2009 Feasibility

Study. The new reserve estimate represented a 15% increase over the 29.3 million

ounce reserve estimate contained in the 2009 Feasibility Study, and was based on

the inclusion of additional drilling and a US$100/oz increase in long-term gold

price assumptions from those used in 2009. The increase in reserves was expected

to extend the mine life from 21 years to 25 years at the feasibility production

rate, and did not materially change the 2009 Feasibility Study. It is believed

that the additional storage capacity provided for in the 2009 Feasibility Study

will accommodate the increase in tailings and that the waste rock storage

facility can be modified to contain the additional unmineralized rock material.

On May 5, 2010, NovaGold announced the Donlin Gold FS had been

initiated at the Donlin Gold project to consider the construction and operation

of an underground 12-inch pipeline approximately 505 km (315 miles) from the

upper Cook Inlet area to the proposed Donlin Gold mine site. Gas from the

pipeline would be used to produce electricity at site, and the capital cost of

the pipeline could be partially offset by cost savings from elimination of the

wind cogeneration facility, the potential for a shorter access road and a

significant reduction in requirements for diesel storage, with some additional

cost reduction opportunities.

On December 5, 2011 NovaGold announced the completion of the

Donlin Gold FS. The Donlin Gold FS revises the 2009 Feasibility Study with

updated mineral reserves and resources, capital costs and operating cost

estimates. This updated study also looked at specific design aspects of the

project. One specific design change in the Donlin Gold FS is utilization of

natural gas as the primary power source for the project rather than diesel. The

property has estimated proven and probable mineral reserves of 505 million

tonnes grading 2.09 grams per tonne gold for 33.8 million ounces of gold. This

represents an approximate 16% increase from the mineral reserve estimate

outlined in the 2009 Feasibility Study and is broadly comparable to the March

2010 mineral reserve and resource update released by NovaGold. The property

hosts estimated measured and indicated mineral resources (inclusive of mineral

reserves) of 541 million tonnes grading 2.24 grams per tonne gold for 39 million

ounces of gold and inferred mineral resources of 92 million tonnes grading 2.02

grams per tonne gold for 6.0 million ounces of gold.

The total capital cost estimate for Donlin Gold is US$6.7

billion including costs related to the natural gas pipeline and a contingency of

US$984 million. The project’s estimated after-tax net present value

(NPV5%) is US$547 million using the base case gold price

of US$1,200/oz, US$4.58 billion using a gold price of US$1,700/oz and US$6.72

billion using a gold price of US$2,000/oz. The corresponding IRR after-tax were

estimated at 6.0%, 12.3% and 15.1%, respectively. Donlin Gold, if put into

production in accordance with the Donlin Gold FS, would average 1.46 million

ounces of gold production in each of its first five years of operation at an

average cash cost of US$409/oz and would average 1.13 million ounces of gold per

year over its projected 27 year mine life with an average cash cost of

US$585/oz.

The project is expected to be a conventional truck and shovel

open-pit operation. The mine life is estimated to be 27 years based on a nominal

processing rate of 53,500 tonnes per day.

NovaGold believes that significant exploration potential

remains in the Donlin Gold district, with prospects to increase mine life and/or

justify future production expansions.

Galore Creek Pre-Feasibility Study

Galore Creek, a large copper-gold-silver project located in

northwestern British Columbia, is held by a partnership in which NovaGold Canada

Inc. and Teck Metals Ltd. each own a 50% interest and is managed by GCMC. The

Galore Creek property comprises 293,837 acres (118,912 hectares) and hosts a

large, porphyry-related copper-gold-silver deposit.

During 2010, GCMC had reviewed a number of optimization

scenarios for the Galore Creek copper-gold-silver project with the objective of

expanding throughput, relocating the project facilities to allow for easier

construction and future expansion, and reducing the risks associated with

construction and operations. Based on these studies, GCMC has identified a preferred project design, and on April

20, 2010 NovaGold announced the PFS is underway with completion targeted for Q2

2011. The purpose of the PFS was to provide capital cost estimates using higher

copper and gold prices than used in previous studies, as well as possible

permitting, construction and production timelines.

- 9 -

Primary changes to the project include:

- Relocation of the tailings facility allowing for construction of a

conventional tailings dam;

- Relocation of the processing facilities allowing for future expansion;

- Realignment of the tunnel and access road; and

- Increase of daily throughput to approximately 90,000 tonnes per day.

Plans envision the ore being crushed in the valley and then

conveyed through the tunnel and along the access road to the processing plant.

From there, concentrate would be piped along the remainder of the access road to

Hwy 37. A trade off study will identify the best alternative for transport of

concentrate to market. The project would primarily use electric power, with a

power line built along the access road to tie into the 287-kV transmission line,

that the British Columbia and Canadian governments have announced their

intention to build. Some components of the revised Galore Creek mine plan, such

as the mill and tailings location, would require new permits or amendments to

existing permits. The majority of permits required for road construction remain

in good standing. GCMC may continue with road and bridge work as the project

moves through the feasibility stage, with the objective of shortening the

construction timeline and reducing the need for helicopter support.

On June 23, 2011, NovaGold announced the approval by the Galore

Creek Partnership of a $30.5 million budget to carry out further work at the

Galore Creek project during the remainder of 2011. Planned work included infill

drilling to convert inferred mineral resources to measured and indicated

categories, geotechnical drilling on the tunnel alignment and geotechnical

drilling to confirm open pit slopes in areas targeted for conversion of inferred

mineral resources. In June 2011, Teck completed its funding requirements of

$373.3 million to earn its 50% interest in the Galore Creek project. From the

date of completion of Teck’s earn-in, NovaGold and Teck are equally funding

further Galore Creek expenditures.

On July 27, 2011, NovaGold announced the results of the PFS for

the Galore Creek project. The PFS estimates the Galore Creek property has proven

and probable mineral reserves of 528 million tonnes grading 0.59% copper, 0.32

grams/tonne gold and 6.02 grams/tonne silver for estimated contained metal of

6.8 billion pounds of copper, 5.45 million ounces of gold and 102.1 million

ounces of silver. In addition, the property has estimated measured and indicated

mineral resources (exclusive of mineral reserves) of 286.7 million tonnes

grading 0.33% copper, 0.27 grams/tonne gold and 3.64 grams/tonne silver for

estimated contained metal of 2.07 billion pounds of copper, 2.53 million ounces

of gold and 33.54 million ounces of silver, and estimated inferred mineral

resources of 346.6 million tonnes grading 0.42% copper, 0.24 grams/tonne gold

and 4.28 grams/tonne silver for estimated contained metal of 3.23 billion pounds

of copper, 2.70 million ounces of gold and 47.73 million ounces of silver. The

PFS total capital cost estimate for the Galore Creek project was $5.2 billion

dollars. Capital costs are estimated with an accuracy range of +25% / -20%

(including contingency). The project’s estimated net present value (NPV7%),

using the PFS base case metal price assumptions set forth below, was assessed at

$837 million and $137 million on a pre-tax and post-tax basis, respectively. The

corresponding post-tax IRR of the project was estimated at 7.4% . Using the July

27, 2011 current price case set forth below, the pre-tax and post-tax NPV7%of

the project were estimated at $4.7 billion and $2.7 billion, respectively, with

a post-tax IRR estimated at 14%. Base case metal prices used in the PFS were

US$2.65/lb copper, US$1,100/oz gold and US$18.50/oz silver with a foreign

exchange rate of US$0.91 = Cdn$1.00. The current price case used metal prices on

July 27, 2011 of US$4.44/lb copper, US$1,613/oz gold and US$40.34/oz silver with

foreign exchange rate of US$1.05 = Cdn$1.00. Mineral resources that are not

mineral reserves do not have demonstrated economic viability.

Mining of the Galore Creek deposit is planned as a conventional

truck-shovel open-pit mining operation with a nominal 95,000 tonne-per-day

throughput. Life of mine throughput average is approximately 84,000 tonnes per

day due to the milling circuit constraining throughput as harder rock is

encountered deeper in the open pits. The current 528 million tonne mineral

reserve estimate is expected to support a mine life of approximately 18 years.

NovaGold believes there is potential to extend the mine life with additional

infill drilling and exploration. Using a conventional grinding and flotation circuit, the project would produce a

high-quality copper concentrate with significant gold and silver credits.

- 10 -

On November 16, 2011, NovaGold announced its interest in

exploring opportunities to sell all or part of its 50% interest in the Galore

Creek project.

Purchase of Copper Canyon Resources Ltd.

On December 20, 2010, NovaGold announced its intention to offer

to purchase all of the issued and outstanding common shares of Copper Canyon

Resources Ltd. (“Copper Canyon”), a junior exploration company whose principal

asset is its 40% joint venture interest in the Copper Canyon copper-gold-silver

property that is adjacent to the Galore Creek project. A wholly-owned subsidiary

of NovaGold held the remaining 60% joint venture interest in the Copper Canyon

property. Under the terms of the offer, each holder of Copper Canyon common

shares received 0.0425 of a NovaGold common share for each Copper Canyon common

share properly deposited under the offer. NovaGold subsequently filed and mailed

its Offer to Purchase and Circular on January 18, 2011. The offer was open for

acceptance until 5:00pm Eastern time on February 23, 2011.

Given the difficult topography, the small size and inferred category of the

known resources and the low copper grade on the Copper Canyon property, the

Copper Canyon resources are not currently and not anticipated to be part of the

mine plan for Galore Creek.

On May 20, 2011, NovaGold completed the acquisition of Copper

Canyon, and as a result, Copper Canyon is now a wholly-owned subsidiary of

NovaGold. NovaGold issued a total of 4,171,303 common shares under the

arrangement, representing approximately 1.7% of the number of NovaGold common

shares then outstanding and paid cash of $2.6 million. Under the arrangement,

Copper Canyon transferred to a new company, Omineca Mining and Metals Ltd.

(“Omineca”), substantially all of its assets other than certain cash and its 40%

interest in the Copper Canyon property. NovaGold holds and exercises control

over an aggregate of 1,725,858 common shares of Omineca, representing

approximately 10.8% of Omineca’s outstanding common shares. The Omineca shares

are being held by NovaGold as a portfolio investment.

Ambler Property Purchase and Preliminary Economic

Analysis

On January 7, 2010, NovaGold and AGC completed the purchase

from Kennecott Exploration Company and Kennecott Arctic Company (collectively

“Kennecott”) of a 100% interest in the Ambler property in northern Alaska, which

hosts the high-grade copper-zinc-gold-silver Arctic deposit. The Ambler property

comprises 90,315 acres (36,549 hectares) of State of Alaska mining claims and

Federal patented mining claims and hosts a number of deposits. NovaGold agreed

to pay Kennecott a total purchase price of US$29.0 million for the Ambler

property to be paid as: US$5.0 million by the issuance of 931,098 NovaGold

shares and two installments of US$12.0 million each, due in January 2011 and

January 2012, respectively. The NovaGold shares were issued in January 2010, the

first US$12 million payment was made on January 7, 2011 and the second US$12

million payment was made early on August 5, 2011. Kennecott retained a 1% net

smelter return royalty that NovaGold can purchase at any time for a one-time

payment of US$10.0 million. The agreement terminated the exploration agreement

between NovaGold and Kennecott dated March 22, 2004, as amended, under which

NovaGold had the ability to earn a 51% interest in the Ambler property.

On April 14, 2011, NovaGold announced the results of the PEA

for the Ambler project which focused on the Arctic deposit. The project’s net

present value (NPV8%) using the PEA base case metal price assumptions was

assessed at US$718 million and US$505 million on a pre-tax and post-tax basis,

respectively. The corresponding Internal Rates of Return (“IRR”) were estimated

at 30% and 25%. Using recent metal prices, the pre-tax and post-tax NPV8%were

estimated at US$2.2 billion and US$1.6 billion, respectively, with corresponding

IRRs estimated at 59% and 50%.

Based on the PEA, mining of the Ambler deposit is envisioned as

an underground operation processing up to 4,000 tonnes of material per day. The

current estimated mineral resource base of 16.8 million tonnes of indicated

mineral resources and 12.1 million tonnes of inferred mineral resources support

a 25-year mine life. The mine is anticipated to produce three concentrates: a

copper concentrate with gold byproduct, a lead concentrate with silver and gold

byproducts and a zinc concentrate with silver byproduct, with copper cash costs,

net of byproducts at long-term metal prices, estimated at $0.89/lb copper.

Average annual payable metal production is forecast at 67 million pounds of

copper, 80 million pounds of zinc, 12 million pounds of lead, 11,000 ounces of

gold and 866,000 ounces of silver. LOM payable metal production is

estimated at 1.7 billion pounds of copper, 2.0 billion pounds of zinc, 291

million pounds of lead, 266,000 ounces of gold and 22 million ounces of silver.

The production schedule is based on processing average-grade material through

the life of the operation, with potential upside to be obtained by mining

higher-grade ore during the early years of the project.

- 11 -

On October 19, 2011, NovaCopper US Inc. (“NovaCopper US”), a

wholly-owned subsidiary of NovaCopper Inc. (“NovaCopper”), entered into an

Exploration Agreement and Option to Lease (the “NANA Agreement”) with NANA

Regional Corporation, Inc. (“NANA”) for the cooperative development of their

respective resource interests in the Ambler mining district of Northwest Alaska.

The NANA Agreement consolidates NovaCopper’s and NANA’s land holdings into an

approximately [146,500 hectare] land package and provides a framework for the

exploration and development of this high-grade and prospective poly-metallic

belt.

The NANA Agreement provides NovaCopper US with the nonexclusive

right to enter on, and the exclusive right to explore, the Bornite Lands and the

ANCSA Lands (each as defined in the NANA Agreement) and in connection therewith,

to construct and utilize temporary access roads, camps, airstrips and other

incidental works. In consideration for this right, NovaCopper US paid to NANA

US$4 million in cash. NovaCopper US will also be required to make payments to

NANA for scholarship purposes in accordance with the terms of the NANA

Agreement. NovaCopper US has further agreed to use reasonable commercial efforts

to train and employ NANA shareholders to perform work for NovaCopper US in

connection with its operations on the Bornite Lands, ANCSA Lands and Ambler

Lands (as defined in the NANA Agreement) (collectively, the “Lands”).

On November 16, 2011, NovaGold announced its intention to

spin-out its wholly-owned subsidiary, NovaCopper by way of a Plan of Arrangement

(the “Plan”). Pursuant to the terms of the proposed Plan, common shares of

NovaCopper will be distributed to the shareholders of NovaGold as a return of

capital through a statutory Plan of Arrangement under the Companies Act

(Nova Scotia). The Plan will be voted on at a Special Meeting of Shareholders of

NovaGold to be held in early 2012 and will be subject to numerous conditions

including shareholder and court approval, approval by, and listing of, the

common shares of NovaCopper on the Toronto Stock Exchanges (“TSX”) and NYSE Amex

LLC (“NYSE Amex”) and completion of all required regulatory filings. The record

date for shareholders entitled to receive shares of NovaCopper under the Plan

will be the effective date of the Plan which is expected to be in the first half

of 2012.

NovaCopper owns the Ambler project and will have the right to

develop any mining project in the recently consolidated, approximately 146,500

hectare property located in the Ambler district of northwestern Alaska, subject

to the rights of NANA Corporation under the NANA Agreement.

Sale of Murray Brook Mine

Effective October 16, 2009, the Company sold its wholly-owned

subsidiary, Murray Brook Resources Inc., to Murray Brook Minerals Inc. (“MBM”).

The Company received $150,000 on the sale and MBM assumed all reclamation

liabilities on the Murray Brook property. The Company also subscribed for

$500,000 of MBM shares at a price of $0.35 per share in cash. MBM also has

early-stage mineral properties in Switzerland.

Financing

On January 22, 2009, the Company completed the sale of

53,134,616 units for a purchase price of US$1.30 per unit for gross proceeds of

approximately US$69.0 million. Electrum Strategic Resources LLC (“Electrum”)

purchased 46,153,847 units and several institutional investors purchased

6,980,769 units. On January 26, 2009, the Company completed the sale of

4,557,692 units to several institutional investors for gross proceeds of

approximately US$5.9 million. The total gross proceeds to NovaGold of these two

unit financings was US$75.0 million. Each unit consisted of one common share of

NovaGold and one common share purchase warrant of NovaGold. Each warrant

entitles the holder thereof to acquire one common share of NovaGold for an

exercise price of US$1.50 prior to 5:00 pm EST on January 21, 2013. Upon closing

of the private placement, Electrum became NovaGold’s largest shareholder,

currently owning approximately 19% of the issued and outstanding common shares

of the Company. Electrum also holds NovaGold warrants which, if exercised, would

increase its holdings a further 9% if no other shares were issued. See “Risk

Factors”.

- 12 -

Electrum has the right, for four years, to participate pro-rata

(on a fully diluted basis) in any future offering by NovaGold of equity

securities or any securities which are exercisable, exchangeable or convertible

into equity securities so long as Electrum and its affiliates own more than

15,000,000 common shares of NovaGold. This right of participation is subject to

certain exceptions including exceptions relating to a grant or exercise of

options issued under the Company’s stock option plan, issuances of common shares

on the exercise of outstanding warrants and convertible securities, issuance of

securities in connection with a strategic acquisition or transaction by

NovaGold, the primary purpose of which is not to raise equity, and the issuance

of securities in connection with an investment by, or partnership or joint

venture with, one or more strategic investors. Any exercise of such rights will

be subject to applicable TSX rules and NYSE Amex rules. NovaGold has also

entered into registration rights agreements with Electrum under which Electrum

may require NovaGold to qualify certain common shares for distribution in Canada

and/or the United States. NovaGold provided Electrum with the right to designate

an observer at all meetings of the Board of Directors of NovaGold and any

committee thereof so long as Electrum and its affiliates hold not less than 15%

of the Company’s common shares. Electrum designated Igor Levental as its

observer at NovaGold Board of Directors meetings, and in July 2010 NovaGold

appointed Igor Levental as a Director of NovaGold.

In March 2010, the Company completed the sale of 18,181,818

common shares of the Company at a price of US$5.50 per common share to

investment funds managed by Paulson & Co. Inc. and 13,636,364 common shares