NovaGold Resources Inc.: Exhibit 99.2 - Filed by newsfilecorp.com

NovaGold Resources Inc.

Second Quarter 2011

Management’s Discussion & Analysis

May 31, 2011

(Unaudited)

Table of Contents

| 2 |

NovaGold Resources Inc.

|

|

| |

Q2-2011 |

|

Management’s Discussion and Analysis

General

This Management’s Discussion and Analysis (“MD&A”) of

NovaGold Resources Inc. (“NovaGold” or “the Company”) is dated July 13, 2011 and

provides an analysis of NovaGold’s unaudited financial results for the quarter

ended May 31, 2011 compared to the same period in the previous year.

The following information should be read in conjunction with

the Company’s May 31, 2011 unaudited consolidated financial statements and

related notes and with the Company’s audited consolidated financial statements

and related notes for the year ended November 30, 2010, which were prepared in

accordance with generally accepted accounting principles in Canada (“Canadian

GAAP”). The accounting policies as outlined in the annual consolidated financial

statements have been consistently followed in preparation of the interim

consolidated financial statements. All amounts are in Canadian dollars unless

otherwise stated.

The Company’s shares are listed on the Toronto Stock Exchange

and the NYSE Amex LLC under the symbol “NG”. Additional information related to

NovaGold is available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

Description of business

NovaGold is a precious metals company engaged in the

exploration and development of mineral properties in Alaska, U.S.A. and British

Columbia, Canada. The Company conducts its operations through wholly-owned

subsidiaries, partnerships, limited liability companies and joint ventures. The

Company has assembled a portfolio of projects, with 50% interests in two of the

world’s largest undeveloped gold and copper-gold projects — Donlin Gold and

Galore Creek — 100% of the Ambler high-grade copper-zinc-gold-silver deposit and

other exploration-stage properties. The Company is primarily focused on gold

properties, some of which also have significant copper, silver and zinc

resources. NovaGold has reduced some of the development risk at its two main

projects by leveraging the development and operating expertise of its senior

partners, Barrick Gold Corporation (“Barrick”) at Donlin Gold and Teck Resources

Limited (“Teck”) at Galore Creek. In addition, NovaGold’s core properties are

located in Alaska and British Columbia, regions with low geopolitical risk that

have a long history of mining, established permitting standards and governments

supportive of resource development.

Approach to business

NovaGold is focused on advancing its two main properties,

Donlin Gold and Galore Creek, with the objective of becoming a low-cost

million-ounce-a-year gold producer and a significant copper producer. The

Company is also advancing its Ambler property and continues to explore at its

earlier-stage properties with the objective of bringing additional value to

NovaGold shareholders and building a pipeline of quality projects. NovaGold’s

business model focuses on five main steps: identifying high-quality assets and

making strategic, timely acquisitions; engaging with local communities; using

exploration expertise to expand existing deposits; advancing the projects to a

feasibility level to bring reserves to the Company and value to shareholders;

and creating strong partnerships with well-respected senior producers to advance

the projects to production. NovaGold will continue to leverage its exploration

and development expertise to bring additional resources and value to

shareholders. The Company also recognizes the value of strong partnerships and a

strong team, and looks for opportunities to acquire or partner in new projects

that can bring talented people to the Company and value to NovaGold

shareholders.

Responsible mine development and community collaboration

continues to be a trademark of NovaGold’s business strategy at all of its

projects. NovaGold published its first sustainability report in 2010 and

published its first integrated report in May 2011 with the objective of

providing an overview of the Company’s commitment and approach to

sustainability, its challenges and successes at the projects and its goals for

future years. The report demonstrates the Company’s commitment to accountability

and transparent disclosure and will allow NovaGold to more effectively monitor

progress as it strives for continuous improvement and best practices in

responsible mine development. NovaGold believes that long-lasting social and

economic benefits can flow to the communities in which it operates. Through

continuous collaboration with Alaskan Native and BC First Nation groups from the

outset at each project, NovaGold considers the long-term impacts and benefits of

operations for stakeholders when developing its projects and reduces development

risk for its shareholders.

| |

NovaGold Resources

Inc. |

3 |

| |

Q2-2011 |

|

Management’s Discussion and Analysis

Recent developments

On June 23, 2011, NovaGold announced the approval by the Galore

Creek Partnership of a $30.5 million budget to carry out further work at the

Galore Creek project during the remainder of 2011. Planned work includes infill

drilling to convert inferred mineral resources to measured and indicated

categories, geotechnical drilling on the tunnel alignment and geotechnical

drilling to confirm open pit slopes in areas targeted for conversion of inferred

mineral resources. In June 2011, Teck completed its funding requirements of

$373.3 million to earn its 50% interest in the Galore Creek project. NovaGold

and Teck will equally fund further Galore Creek development activities. Galore

Creek Mining Corporation (“GCMC”) is completing a pre-feasibility study for the

project, scheduled for completion by the end of July 2011, at which point the

partners will determine next steps to advance the project. GCMC has initiated

further environmental and engineering work at the project over the balance of

2011.

On May 20, 2011, NovaGold completed the acquisition of Copper

Canyon Resources Ltd. (“Copper Canyon”), a junior exploration company whose

principal asset is its 40% joint venture interest in the Copper Canyon

copper-gold-silver property that is adjacent to the Galore Creek project. A

wholly-owned subsidiary of NovaGold holds the remaining 60% joint venture

interest in the Copper Canyon property. Under the acquisition arrangement,

NovaGold acquired all of the issued and outstanding common shares of Copper

Canyon which it did not already hold. As a result, Copper Canyon is now a

wholly-owned subsidiary of NovaGold. NovaGold issued a total of 4,171,303 common

shares under the arrangement, representing approximately 1.7% of the number of

NovaGold common shares then outstanding and paid cash of $2,557,000. Under the

arrangement, Copper Canyon transferred to a new company, Omineca Mining and

Metals Ltd. (“Omineca”), substantially all of its assets other than certain cash

and its 40% interest in the Copper Canyon property. NovaGold holds and exercises

control over an aggregate of 1,725,858 common shares of Omineca, representing

approximately 10.8% of Omineca’s outstanding common shares. The Omineca shares

are being held by NovaGold as a portfolio investment.

On April 14, 2011, NovaGold announced the results of a

preliminary economic assessment (“PEA”) for its 100% owned Ambler project in

Alaska. The Ambler property comprises 90,624 acres (36,670 hectares) of State of

Alaska mining claims and Federal patented and unpatented mining claims and hosts

a number of deposits, including the high-grade copper-zinc-lead-gold-silver

Arctic deposit, which was the focus of the PEA. The project’s Net Present Value

(NPV8%) using the PEA base case metal price assumptions1 was assessed

at US$718 million and US$505 million on a pre-tax and post-tax basis,

respectively. The corresponding Internal Rates of Return (“IRR”) were estimated

at 30% and 25%. Using recent metal prices2 the pre-tax and post-tax

NPV8% were estimated at US$2.2 billion and US$1.6 billion, respectively, with

corresponding IRRs estimated at 59% and 50%.

Based on the PEA, mining of the Ambler deposit is envisioned as

an underground operation processing up to 4,000 tonnes of material per day. The

current estimated mineral resource base of 16.8 million tonnes of indicated

mineral resources and 12.1 million tonnes of inferred mineral resources support

a 25-year mine life. The mine is anticipated to produce three concentrates: a

copper concentrate with gold byproduct, a lead concentrate with silver and gold

byproducts and a zinc concentrate with silver byproduct, with copper cash costs,

net of byproducts at long-term metal prices, estimated at $0.89/lb copper.

Average annual payable metal production is forecast at 67 million pounds of

copper, 80 million pounds of zinc, 12 million pounds of lead, 11,000 ounces of

gold and 866,000 ounces of silver. Life-of-mine (“LOM”) payable metal production

is estimated at 1.7 billion pounds of copper, 2.0 billion pounds of zinc, 291

million pounds of lead, 266,000 ounces of gold and 22 million ounces of silver.

The production schedule is based on processing average-grade material through

the life of the operation, with potential upside to be obtained by mining

higher-grade ore during the early years of the project.3

Property review

Donlin Gold

Donlin Creek LLC has been renamed Donlin Gold LLC and the

project, formally referenced as Donlin Creek will now be referred to as Donlin

Gold.

_________________________________________________________

1Base

case metal price assumptions: US$2.50/lb copper, US$1.05/lb zinc, US$1.00/lb

lead, US$1,100/oz gold, US$20/oz silver.

2Recent metal price

assumptions US$4.31/lb copper, US$1.20/lb zinc, US$1.20/lb lead, US$1,425/oz

gold and US$36/oz silver.

3See press releases dated April 14, 2011 and May 26, 2011 available

at www.novagold.net or www.sedar.com for full details.

| 4 |

NovaGold Resources Inc.

|

|

| |

Q2-2011 |

|

Management’s Discussion and Analysis

Donlin Gold, one of the world’s largest known undeveloped gold

deposits is owned and operated by Donlin Gold LLC, a company in which

wholly-owned subsidiaries of NovaGold and Barrick each own a 50% interest. The

81,361 acre (32,926 hectare) property is located primarily on private,

Alaskan Native-owned land, with surface rights owned by The Kuskokwim

Corporation and sub-surface rights owned by Calista Corporation. Donlin Gold’s

management is committed to working with its Alaskan Native partners to establish

collaborative relationships that benefit all stakeholders as the property

advances. The Donlin Gold property hosts a number of deposits and the current

mineral reserves and resources are contained within just 3 km of the 8 km

district, with significant exploration potential remaining in the Donlin Gold

district.

A mineral reserve/resource estimate for the project totals 33.6

million ounces of proven and probable gold reserves averaging 2.2 grams per

tonne gold, 4.3 million ounces of measured and indicated mineral resources and

an additional 4.4 million ounces of inferred mineral resource. With estimated

production of more than one million ounces of gold annually for at least 25

years, Donlin Gold would be one of the world’s largest gold-producing mines.

Activities at the Donlin Gold project during 2011 have focused

on engineering and environmental studies to support the permitting process and

community outreach programs, as well as a revision to the feasibility study to

incorporate the use of natural gas as the primary power source at the mine site

rather than using diesel to generate power, as contemplated in the 2009

feasibility study. The natural gas option would require building a buried

pipeline that would run approximately 315 miles from the Cook Inlet to the

Donlin Gold site. Using natural gas to generate power could result in a

reduction to this component of operating costs. Power accounts for 25% of

estimated project operating costs in the 2009 feasibility study. The impact of

using natural gas on capital and operating costs along with an update of general

cost assumptions will be addressed in the feasibility revision, anticipated to

be completed in the second half of 2011.

Donlin Gold spent approximately US$11.9 million in the second

quarter, which was US$1.4 million under its second quarter budget of US$13.3

million due to a decrease in G&A costs. Work during the remainder of 2011

will focus on completing the feasibility study revision and preparing to file

permit applications for the project.

Due to the accounting rules under Accounting Guideline-15 for

Variable Interest Entity accounting, NovaGold continues to record its interest

in the Donlin Gold project as an equity investment, which results in all of

NovaGold’s funding being recorded in the income statement as equity loss, and

any unspent funding to Donlin Gold being recorded in the balance sheet on the

equity investment line.

Galore Creek

Galore Creek, a large copper-gold-silver project located in

northwestern British Columbia, is managed by GCMC and owned by a partnership in

which wholly-owned subsidiaries of NovaGold and Teck each own a 50% interest.

The 293,840 acre (118,912 hectare) property holds a large undeveloped

porphyry-related copper-gold-silver deposit. A mineral resource estimate for the

Galore Creek project totals measured and indicated mineral resources of 8.9

billion pounds of copper, 7.3 million ounces of gold and 123 million ounces of

silver, with additional inferred mineral resources (including the Copper Canyon

deposit of which NovaGold owns 100%) of 3.5 billion pounds of copper, 3.3

million ounces of gold and 61 million ounces of silver.

Activities during the second quarter at the Galore Creek site

focused on care and maintenance of existing infrastructure and roads and

preparations for the summer drilling season. Activities off-site focused on

finalizing the pre-feasibility study. GCMC spent approximately $6.9 million in

the second quarter, which consists of $4.0 million in care and maintenance costs

and $2.9 million on pre-feasibility study costs. Under the terms of the Galore

Creek Partnership Agreement, Teck was funding all costs for the project until

completing its earn-in obligations. At May 31, 2011, the Galore Creek

Partnership had cash of $1.8 million and Teck had approximately $0.8 million

remaining in project contributions to earn its 50% interest in the project.

Subsequent to May 31, 2011, Teck completed its earn-in and

NovaGold and Teck will be responsible to equally fund future project costs. On

June 23, 2011, the partners announced a $30.5 million budget to carry out

further work on the project during the remainder of 2011. Planned work includes

infill drilling to convert inferred mineral resources to measured and indicated

categories, geotechnical drilling on the tunnel alignment and geotechnical

drilling to confirm open pit slopes in areas targeted for conversion of inferred

mineral resources. GCMC is hiring staff and mobilizing equipment to prepare for

the summer drill program. GCMC will also complete further environmental and

engineering work in preparation for feasibility level studies.

| |

NovaGold Resources

Inc. |

5 |

| |

Q2-2011 |

|

Management’s Discussion and Analysis

Due to accounting rules under Accounting Guideline-15 for

Variable Interest Entity accounting, NovaGold continues to consolidate 100% of

the activities of GCMC on the income statement, and the Galore Creek asset and a

non-controlling interest for Teck’s contributions on the balance sheet.

Ambler

Ambler is an advanced exploration-stage property located in

Alaska comprising 90,615 acres (36,670 hectares) of Federal patented and

unpatented mining claims and State of Alaska mining claims, covering a major

portion of the precious-metal-rich Ambler volcanogenic massive sulfide belt. A

preliminary economic assessment for the development and operation of an

underground mining operation at the Arctic deposit was completed in April 2011.

Mineral resources estimated for the Arctic deposit are 16.8 million tonnes of

indicated mineral resource grading 4.1% copper and 6.0% zinc and 12.1 million

tonnes of inferred mineral resource grading 3.5% copper and 4.9% zinc for

contained metal totaling indicated mineral resource of 1.5 billion pounds of

copper, 2.2 billion pounds of zinc, 450,000 ounces of gold, 32 million ounces of

silver and 350 million pounds of lead, with additional inferred mineral resource

of 940 million pounds of copper, 1.3 billion pounds of zinc, 260,000 ounces of

gold, 19 million ounces of silver and 212 million pounds of lead. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

The Company spent approximately US$3.2 million during the

second quarter, focused on completing the preliminary economic assessment and

preparations for this summer’s field season.

Other properties

In March 2011, NovaGold sold 11,500 acres (4,654 hectares)

comprising of its Nome Gold project. NovaGold’s wholly-owned subsidiary, Alaska

Gold Company, will receive US$21.0 million in three installments over two years.

A total of US$6.1 million is due during 2011 and US$14.0 million is due in 2012.

The buyer will also provide a letter of credit for US$4.0 million as an

environmental reclamation bond.

The Company continues to explore earlier-stage exploration

projects that have not advanced to the mineral resource definition stage and

spent $1.0 million during the second quarter at an early-stage exploration

project.

Additional information concerning mineral reserves and

resources can be found in Appendix – Reserve and Resource Table.

Outlook

At May 31, 2011, the Company had cash and cash equivalents of

$111.6 million and working capital of $108.0 million.

The Donlin Gold project has an approved 2011 budget of

approximately US$43.5 million, with US$17.0 million spent to date, of which the

Company’s 50% share is approximately US$20.5 million, with US8.5 million funded

to date. The 2011 work program will focus on completing the feasibility revision

to incorporate the natural gas pipeline, and preparing permit applications for

the project. During 2011, Donlin Gold will continue to consult with stakeholders

and solicit feedback from local communities and its Alaskan Native partners as

well as State and Federal regulatory agencies. Donlin Gold has budgeted to spend

US$14.6 million in the third quarter, of which the Company’s 50% share is

approximately US$7.3 million, on community engagement, environmental studies and

feasibility revision activities. The feasibility revision should be complete in

the second half of 2011, at which point Donlin Gold is expected, subject to

approval by NovaGold and Barrick, to proceed to prepare and file permit

applications for the project.

At the Galore Creek project, GCMC spent approximately $12.3

million in the six month period ended May 31, 2011 on care and maintenance,

community engagement and completing the pre-feasibility study, and the partners

have approved a supplementary budget of $30.5 million for additional exploration

and engineering work. Teck was the sole funding partner until June 22, 2011,

when it completed its $373.3 million earn-in obligation. NovaGold and Teck will

fund the supplementary budget equally with NovaGold’s share being $15.3 million.

NovaGold expects to fund $8.3 million in the third quarter at the Galore Creek

project for exploration, geotechnical drilling and additional environmental and

engineering work to prepare for feasibility-level activities.

At the Ambler project, NovaGold has budgeted approximately

US$10.0 million for 2011 for exploration and geotechnical drilling at site and

for additional studies to determine the environmental and engineering aspects of

developing the Arctic deposit, with US$3.4 million spent to

date. The Company continues to work with NANA Corporation to establish an

agreement for collaborative development of the Ambler region, including district

consolidation and infrastructure development that would benefit both the project

and local communities. Management has been working actively with the State of

Alaska in discussions regarding the Ambler Mining District Transportation

Access. The Company expects to spend US$4.6 million in the third quarter on

exploration activities as well as environmental and engineering studies.

| 6 |

NovaGold Resources Inc.

|

|

| |

Q2-2011 |

|

Management’s Discussion and Analysis

At the Rock Creek project, the Company has budgeted

approximately US$8.5 million for 2011 with a focus on continuing to meet permit

requirements and environmental responsibilities, with US$4.8 million spent to

date. While NovaGold is soliciting offers to sell the project, the Company is

also preparing an updated closure plan for the project in the event that the

Company’s Board of Directors chooses to close and reclaim the property and has

budgeted a supplemental US$6.8 million for preparing the updated closure plan.

The Company expects to spend US$3.9 million at its Rock Creek project in the

third quarter.

Results of operations

| |

|

|

|

|

|

|

|

in thousands of Canadian dollars, |

|

| |

|

|

|

|

|

|

|

except

for per share amounts |

|

| |

|

Three months |

|

|

Three months |

|

|

Six months |

|

|

Six months |

|

| |

|

ended |

|

|

ended |

|

|

ended |

|

|

ended |

|

| |

|

May 31, 2011 |

|

|

May 31, 2010 |

|

|

May 31, 2011 |

|

|

May 31, 2010 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Asset impairment –

power transmission rights |

|

|

|

|

|

|

|

|

|

|

|

|

| Impairment

charge |

|

- |

|

|

- |

|

|

52,668 |

|

|

- |

|

| Loss attributable to non-controlling

interest |

|

- |

|

|

- |

|

|

(13,779 |

) |

|

- |

|

| Future

income tax recovery |

|

- |

|

|

- |

|

|

(9,722 |

) |

|

- |

|

| Equity loss |

|

5,562 |

|

|

4,621 |

|

|

10,183 |

|

|

7,017 |

|

| Foreign exchange (gain)

loss |

|

162 |

|

|

(3,299 |

) |

|

(830 |

) |

|

(3,177 |

) |

| General and administrative

|

|

1,553 |

|

|

1,283 |

|

|

2,374 |

|

|

2,140 |

|

| Gain on disposition

of alluvial gold properties |

|

(16,110 |

) |

|

- |

|

|

(16,110 |

) |

|

- |

|

| Interest and accretion

|

|

3,560 |

|

|

3,768 |

|

|

7,292 |

|

|

7,428 |

|

| Mineral properties

expense |

|

4,573 |

|

|

617 |

|

|

7,141 |

|

|

928 |

|

| Project care and maintenance

(Galore Creek) |

|

4,047 |

|

|

1,495 |

|

|

6,518 |

|

|

2,731 |

|

| Project care and maintenance

(Rock Creek) |

|

2,300 |

|

|

3,988 |

|

|

4,875 |

|

|

10,628 |

|

| Salaries, severance

and payroll taxes |

|

2,075 |

|

|

2,926 |

|

|

4,544 |

|

|

4,201 |

|

| Salaries – stock-based

compensation |

|

1,514 |

|

|

1,050 |

|

|

5,052 |

|

|

3,141 |

|

| Loss for the period

|

|

(10,561 |

) |

|

(16,813 |

) |

|

(77,917 |

) |

|

(36,225 |

) |

Basic and diluted loss per share attributable

to the shareholders of the Company |

|

(0.03 |

) |

|

(0.07 |

) |

|

(0.25 |

) |

|

(0.17 |

) |

For the three-month period ended May 31, 2011, the Company

reported a net loss of $10.6 million (or $0.03 basic and diluted loss per share)

compared to a net loss of $16.8 million (or $0.07 basic and diluted loss per

share) for the corresponding period in 2010. This variance was mainly due to the

gain on disposition of alluvial gold properties of $16.1 million, with no

comparable charge during the same period in 2010.

For the six-month period ended May 31, 2011, the Company

reported a net loss of $77.9 million (or $0.25 basic and diluted loss per share)

compared to a net loss of $36.2 million (or $0.17 basic and diluted loss per

share) for the corresponding period in 2010. This variance was mainly due to the

non-cash asset impairment of the power transmission rights which resulted in an

impairment charge of $52.7 million, of which $13.8 million was attributable to

non-controlling interest and $9.7 million to future income tax recovery

partially offset by the gain on disposition of alluvial gold properties of $16.1

million.

Expenses for the three-month period ended May 31, 2011 were

$27.1 million compared to $17.2 million for the same period in 2010. This

increase was primarily due to an increased exploration expense of $4.6 million

compared to $0.6 million for the same period in 2010 as the result of an

increased level of activity for the Galore Creek pre-feasibility study and

exploration work at the Ambler project. The Company also recorded $4.0 million

Galore Creek project care and maintenance expense in 2011 compared with $1.5

million in 2010, mainly due to the increased level of activity in 2011 compared to second quarter 2010 as the

project progresses by strengthening the existing access areas and upgrading its

environmental program.

| |

NovaGold Resources

Inc. |

7 |

| |

Q2-2011 |

|

Management’s Discussion and Analysis

Expenses for the six-month period ended May 31, 2011 were $49.3

million compared to $36.8 million for the same period in 2010. This was

primarily due to the increased level of activity for the gas pipeline studies at

Donlin Gold during the first half of 2011 which resulted in the increase of

equity loss to $10.2 million compared with $7.0 million in 2010. The Company

also recorded expense of $5.1 million compared with $3.1 million for stock-based

compensation during the same periods in 2011 and 2010, respectively; the

increase is due to higher valuations for the stock option and performance share

units (“PSU”) issued as a result of the higher stock price. During the first six

months of 2011, the Company granted 1,234,700 stock options and 244,000 PSUs to

employees, consultants and directors. These increases were offset by the

reduction of care and maintenance expenditures at Rock Creek, as the Company

recorded $4.8 million in the first six months in 2011 compared with $10.6

million in 2010. This was due to the decreased level of activity in 2011

compared to 2010, when the Company was improving the tailings pond

infrastructure and water treatment processes at Rock Creek.

Selected financial data

Quarterly information

The following unaudited quarterly information is prepared in

accordance with Canadian GAAP.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

in thousands of Canadian dollars, |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

except

per share amounts |

|

| |

|

05/31/11 |

|

|

02/28/11 |

|

|

11/30/10 |

|

|

8/31/10 |

|

|

5/31/10 |

|

|

2/28/10 |

|

|

11/30/09 |

|

|

8/31/09 |

|

| |

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Net revenues |

|

711 |

|

|

103 |

|

|

172 |

|

|

334 |

|

|

67 |

|

|

26 |

|

|

290 |

|

|

331 |

|

| Earnings (loss) for

the quarter |

|

(10,561 |

)

|

|

(67,356 |

) |

|

(24,462 |

) |

|

(150,875 |

) |

|

(16,813 |

) |

|

(19,412 |

) |

|

(28,845 |

) |

|

(20,435 |

) |

| Earnings (loss) per

share – basic |

|

(0.03 |

)

|

|

(0.22 |

) |

|

(0.14 |

) |

|

(0.68 |

) |

|

(0.08 |

) |

|

(0.10 |

) |

|

(0.12 |

) |

|

(0.11 |

) |

| Earnings (loss) per share – diluted |

|

(0.03 |

) |

|

(0.22 |

) |

|

(0.14 |

) |

|

(0.68 |

) |

|

(0.08 |

) |

|

(0.10 |

) |

|

(0.12 |

) |

|

(0.11 |

) |

Factors that can cause fluctuations in the Company’s quarterly

results include the timing of stock option grants, foreign exchange gains or

losses related to the Company’s U.S. dollar-denominated debt when the Canadian

dollar exchange rate fluctuates, disposal of assets or investments, and events

such as the suspension of construction activities at the Galore Creek project or

the suspension of commissioning at the Rock Creek project and subsequent

activities related thereto. During the second quarter in 2009, the Company had a

foreign exchange gain of $16.1 million. During the third quarter in 2009, the

Company incurred a total of $12.0 million in interest and accretion and care and

maintenance. During the last quarter of fiscal 2009, the Company incurred a $9.1

million loss on disposal of property, plant and equipment by GCMC as certain

road construction equipment and facilities were sold as the road progressed;

also, the Company incurred a total of $18.1 million in interest and accretion

and care and maintenance. During the first quarter of 2010, the Company incurred

$11.5 million in interest and accretion and care and maintenance. During the

second quarter of 2010, the Company incurred $13.6 million on salaries,

exploration and care and maintenance. During the third quarter of 2010, the

Company recorded an impairment loss on the Rock Creek project for the year of

$116.4 million and a $7.5 million inventory write down. During the last quarter

of fiscal 2010, the Company incurred a total of $17.9 million in care and

maintenance and exploration activities. During the first quarter of 2011, the

Company recorded an impairment loss on the Galore Creek project of $52.7 million

related to its power transmission rights. During the second quarter of 2011, the

Company had a gain on disposition of its alluvial gold properties and recorded a

gain of $16.1 million; the Company also incurred $6.4 million and $4.6 million

in care and maintenance and mineral property expense, respectively. The

Company’s properties are not yet in production; consequently, the Company

believes that its loss (and consequent loss per share) is not a primary concern

to investors in the Company.

Liquidity and capital resources

At May 31, 2011, the Company had $111.6 million in cash and

cash equivalents, of which $1.8 million was held by GCMC for the Galore Creek

project.

The Company expended $13.2 million on operating activities

during the three-month period ended May 31, 2011, compared with expenditures of

$11.9 million for operating activities for the same periods in 2010, mostly due

to the increase in activities at the Donlin Gold and Galore Creek projects. Also

during the three-month period ended May 31, 2011, the Company generated $9.1

million in cash from financing activities compared with $176.6 million in the

same period in 2010. During the second quarter of 2011, the Company received

$8.1 million in cash from Teck’s earn-in contribution to GCMC and received $1.0

million for the exercise of stock options and warrants. The Company also

expended $13.6 million on investing activities during the three-month period

ended May 31, 2011, compared with $7.0 million in the same period in 2010. The

Company funded $6.2 million for its share of exploration costs at the Donlin

Gold project compared with $6.7 million for the same period in 2010.

| 8 |

NovaGold Resources Inc.

|

|

| |

Q2-2011 |

|

Management’s Discussion and Analysis

The Company expended $33.2 million on operating activities

during the six-month period ended May 31, 2011, compared with expenditures of

$28.2 million for operating activities for the same periods in 2010, mostly due

to the increase in activities at the Donlin Gold and Galore Creek projects.

During the six-month period ended May 31, 2011, the Company generated $12.2

million in cash from financing activities compared with $176.9 million in the

same period in 2010. The Company received $11.4 million from warrant exercises

and $12.4 million from Teck’s earn-in contribution to GCMC and paid $11.9

million for the first of two installments for the acquisition of Ambler, with no

comparative amount for the same period in 2010. The Company expended $19.2

million on investing activities during the six-month period ended May 31, 2011,

compared with $11.3 million in the same period of 2010. The Company funded $11.7

million for its share of exploration costs at the Donlin Gold project compared

to $10.2 million for the same period in 2010. In addition, the Company expended

$4.0 million on acquisition costs related to Copper Canyon, with no comparative

amount in 2010.

The Company has no material off-balance sheet arrangements.

Contractual obligated undiscounted cash flow requirements as at

May 31, 2011, excluding operating leases, are as follows.

| |

|

|

|

|

|

|

|

|

|

in

thousands of dollars of designated currency |

|

| |

Total |

|

|

< 1 Year |

|

|

1–2 Years |

|

|

2–3 Years |

|

|

3–4 Years |

|

|

4–5 Years |

|

|

Thereafter |

|

| |

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

|

$ |

|

| Accounts payable and

accrued liabilities |

CA$9,717 |

|

|

CA$9,717 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Capital leases |

CA$724 |

|

|

CA$698 |

|

|

CA$26 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Asset retirement obligations |

CA$23,857 |

|

|

CA$7,890 |

|

|

CA$2,297 |

|

|

- |

|

|

- |

|

|

- |

|

|

CA$13,670 |

|

| Other notes payable |

US$12,000 |

|

|

US$12,000 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

| Convertible notes –

interest (a) |

US$20,465 |

|

|

US$5,225 |

|

|

US$5,225 |

|

|

US$5,225 |

|

|

US$4,790 |

|

|

- |

|

|

- |

|

| Convertible notes –

holders option (a) |

US$95,000 |

|

|

- |

|

|

- |

|

|

- |

|

|

US$95,000 |

|

|

- |

|

|

- |

|

| Promissory note |

US$63,012 |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

- |

|

|

US$63,012 |

|

| (a) |

The Convertible notes (“Notes”) mature on May 1, 2015.

The holders of the Notes have the right to require the Company to

repurchase all or part of their Notes on May 1, 2013 and upon certain

fundamental corporate changes at a price equal to 100% of the principal

amount of such Notes plus any accrued and unpaid

interest. |

The future minimum payments under operating leases at May 31,

2011 are approximately as follows.

| in

thousands of Canadian dollars |

|

| |

|

Operating leases |

|

| |

|

$ |

|

| 2011 |

|

405 |

|

| 2012 |

|

629 |

|

| 2013 |

|

571 |

|

| 2014 |

|

580 |

|

| 2015 |

|

662 |

|

| Thereafter |

|

1,358 |

|

| Total |

|

4,205 |

|

The Company’s cash balances are largely invested in bank and

non-asset backed commercial paper all with the two highest possible investment

ratings and that can be easily liquidated with terms of 90 days or less.

Related party transactions

The Company has arms-length market-based agreements to provide

certain services to Tintina Resources Inc. (“Tintina”) and Alexco Resource Corp.

(“Alexco”). During the six months ended May 31, 2011, the services provided were

$6,000 (May 31, 2010: $50,000) to Tintina, a related party having one director

and a major shareholder in common with the Company; and $10,000 (May 31, 2010:

$20,000) to Alexco, a related party having two directors in common with the

Company. The Company also provided exploration and management services totaling

US$0.4 million for the six months ended May 31, 2011 (May 31, 2010: US$0.5

million) to Donlin Gold LLC. These transactions were in the normal course of

business and are measured at the exchange amount, which is the amount agreed to

by the parties. At May 31, 2011, the Company had $0.5 million receivable (May

31, 2010: $0.3 million) from related parties.

| |

NovaGold Resources

Inc. |

9 |

| |

Q2-2011 |

|

Management’s Discussion and Analysis

Financial instruments

The Company’s financial instruments are exposed to certain

financial risks, including currency risk, credit risk, liquidity risk, interest

risk and price risk.

(a) Currency risk

The Company is exposed to financial risk related to the

fluctuation of foreign exchange rates. The Company operates in Canada and the

United States and a portion of its expenses are incurred in U.S. dollars. A

significant change in the currency exchange rates between the Canadian dollar

relative to the U.S. dollar could have an effect on the Company’s results of

operations, financial position or cash flows.

The Company has not hedged its exposure to currency

fluctuations. At May 31, 2011, the Company is exposed to currency risk through

the following assets and liabilities denominated in U.S. dollars.

| |

|

in

thousands of U.S. dollars |

|

| |

|

May 31, 2011 |

|

|

November 30, 2010 |

|

| Cash and cash equivalents

|

|

100,351 |

|

|

125,164 |

|

| Accounts receivables |

|

17,882 |

|

|

148 |

|

| Reclamation deposits |

|

6,845 |

|

|

6,845 |

|

| Accounts payable and accrued liabilities |

|

(3,998 |

) |

|

(4,718 |

) |

| Other notes payable

|

|

(11,514 |

) |

|

(23,026 |

) |

| Amounts payable to Barrick – long term |

|

(63,012 |

) |

|

(61,401 |

) |

| Convertible notes |

|

(63,026 |

)

|

|

(60,278 |

) |

| Total |

|

(16,472 |

)

|

|

(17,266 |

) |

Based on the above net exposures, and assuming that all other

variables remain constant, a 10% depreciation or appreciation of the Canadian

dollar against the U.S. dollar would result in an increase/decrease of $1.6

million in the Company’s net earnings.

(b) Credit risk

Credit risk is the risk of an unexpected loss if a customer or

third party to a financial instrument fails to meet its contractual obligations.

The Company’s cash equivalents and short-term investments are

held through large Canadian financial institutions. Short-term and long-term

investments (including those presented as part of cash and cash equivalents) are

composed of financial instruments issued by Canadian banks and companies with

high investment-grade ratings. These investments mature at various dates over

the current operating period. The Company’s accounts receivables consist of

general sales tax due from the Federal Government of Canada and amounts due from

related parties.

The carrying amount of financial assets recorded in the

financial statements, net of any allowances for losses, represents the Company’s

maximum exposure to credit risk.

(c) Liquidity risk

Liquidity risk is the risk that the Company will not be able to

meet its financial obligations as they come due. The Company manages liquidity

risk through the management of its capital structure and financial leverage.

Accounts payable, accrued liabilities and coupon interest on the Notes are due

within one year from the balance sheet date.

| 10 |

NovaGold Resources Inc.

|

|

| |

Q2-2011 |

|

Management’s Discussion and Analysis

(d) Interest rate risk

Interest rate risk is the risk that the fair value or future

cash flows of a financial instrument will fluctuate because of changes in market

interest rates. The risk that the Company will realize a loss as a result of a

decline in the fair value of the short-term investments included in cash and

cash equivalents is limited because these investments, although

available-for-sale, are generally held to maturity. In respect of financial

liabilities, convertible notes and capital leases are not subject to interest

rate risk because they are at fixed rates. The promissory note owed to Barrick

is variable with the U.S. prime rate. Based on the amount owing on the

promissory note as at May 31, 2011, and assuming that all other variables remain

constant, a 1% change in the U.S. prime rate would result in an

increase/decrease of $0.6 million in the interest accrued by the Company per

annum.

(e) Price risk

The Company is exposed to price risk with respect to commodity

prices. The Company closely monitors commodity prices to determine the

appropriate course of action to be taken. The Company does not currently have

any hedging or other commodity-based risk management programs respecting its

operations.

New accounting pronouncements

The accounting policies followed by the Company are set out in

note 2 to the audited consolidated financial statements for the year ended

November 30, 2010, and have been consistently followed in the preparation of

these consolidated financial statements.

Business Combinations

In January 2009, the CICA issued CICA Handbook Section 1582,

“Business Combinations”, which replaces former guidance on business

combinations. Section 1582 establishes principles and requirements of the

acquisition method and related disclosures. In addition, the CICA issued Section

1601, “Consolidated Financial Statements”, and Section 1602, “Non-controlling

Interests”, which replace the existing guidance. Section 1601 establishes

standards for the preparation of consolidated financial statements and Section

1602 provides guidance on accounting for non-controlling interest in a

subsidiary in consolidated financial statements subsequent to a business

combination. These standards apply prospectively to business combinations for

which the acquisition date is on or after the beginning of the first annual

reporting period beginning on or after January 1, 2011, with earlier application

permitted. The Company adopted these pronouncements at December 1, 2010; the

result from this adoption led to the non-controlling interest balance classified

as shareholders’ equity on the consolidated balance sheet and loss attributable

to non-controlling interest on the statement of operations and deficit.

International Financial Reporting Standards (“IFRS”)

In 2006, the Canadian Accounting Standards Board (“AcSB”)

published a new strategic plan that will significantly affect financial

reporting requirements for Canadian companies. The AcSB strategic plan outlines

the convergence of Canadian GAAP with IFRS over an expected five-year

transitional period. In February 2008, the AcSB announced that 2011 is the

changeover date for publicly-listed companies to use IFRS, replacing Canadian

GAAP. The changeover date is for interim and annual financial statements

relating to fiscal years beginning on or after January 1, 2011. The Company’s

transition date of December 1, 2011 will require the restatement for comparative

purposes of amounts reported by the Company of our interim and annual amounts

for the fiscal year ending November 30, 2011.

The Company is currently engaged in the process to transition

from Canadian GAAP to IFRS. The transition process consists of three primary

phases:

- Scoping and diagnostic phase

- Impact analysis, evaluation and design phase

- Implementation and review phase

Completion of the scoping and diagnostic phase occurred in 2010

through the completion of a preliminary diagnostic review by an external

consultant. The preliminary diagnostic review included the determination, at a

high level, of the financial reporting differences under IFRS and the key areas

that may be impacted. From the review, a focused transition plan was created to further evaluate the areas of difference, including changes required from

existing accounting policies and the impact of changes to information systems,

internal controls and business processes.

| |

NovaGold Resources

Inc. |

11 |

| |

Q2-2011 |

|

Management’s Discussion and Analysis

The Company is currently undergoing the analysis,

quantification and evaluation phase. This phase involves specification of

changes required to existing accounting policies, together with an analysis of

policy alternatives allowed under IFRS and development of draft IFRS financial

statement content. We are completing our evaluations of the changes required to

existing accounting policies, and are currently quantifying the impact of those

changes on our opening balance sheet at the transition date. IFRS 1, “First-Time

Adoption of International Financial Reporting Standards”, provides entities

adopting IFRS for the first time with a number of optional exemptions and

mandatory exceptions, in certain areas, to the general requirement for full

retrospective application of IFRS. The Company has completed its analysis of

IFRS 1 and the exemptions it will apply on transition. Management has also

completed its first draft of the annual financial statement disclosure under

IFRS and will continue to refine its statements prior to release.

The identified impacts disclosed below highlight the

preliminary impacts and should not be regarded as final as they are subject to

change. We continue to review the impacts of our accounting policy choices and

have not yet completed the processing of approving and finalizing all policies.

The discussion below should not be regarded as a complete list of differences as

it is designed to highlight the significant impacts identified at the transition

date. We also note that the International Accounting Standards Board (“IASB”) is

currently working on several projects which may significantly impact the

Company’s decisions, most notably as discussed below.

Through our analysis and quantification of the opening balance

sheet as of December 1, 2010, the following significant impacts have been

identified to date:

| |

• |

Foreign Currency Translation – The approach to evaluating the functional

currency under IFRS focuses on determining each individual entity’s functional

currency from the entity’s viewpoint. Under Canadian GAAP, the functional

currency of a foreign subsidiary was determined based on whether the

subsidiary was self- sustaining from the parent entity. The IFRS approach

results in a change to the functional currency of several of the Company’s

foreign subsidiaries. Under IFRS 1, “First time adoption of International

Financial Reporting Standards”, an exemption is available which allows the

Company to reset its cumulative translation account to zero on the transition

date. The Company has elected to take this exemption. On transition, a net

change to shareholders’ equity of $0.3 million is expected. |

| |

|

|

| |

• |

Convertible Debt – Under Canadian GAAP, the convertible debt is bifurcated

into two separate elements, an equity component to recognize the conversion

value of the instrument and a liability component to recognize the debt value

of the instrument. As the functional currency of NovaGold is Canadian dollars

and the convertible debt is denominated in US dollars, an embedded derivative

is determined to exist under IFRS as the instrument is denominated in a

currency other than an entity’s functional currency. As a result, the Company will recognize an embedded derivative at fair value upon transition.

The expected net impact to shareholders’ equity on transition is a decrease

of $89.9 million and a corresponding increase to long term liabilities of $89.9

million. |

| |

|

|

| |

• |

Warrants – Similarly to the convertible debentures, the Company has

warrants which are denominated in a currency other than its functional currency.

Under IFRS, the warrants meet the definition of a derivative instrument recorded

at fair value at each reporting date, with movements through the statement

of operations. The warrants were treated as an equity instrument under Canadian

GAAP and recorded at fair value at inception. This treatment is similar to

the presentation disclosed by the Company under its reconciliation to US Generally

Accepted Accounting Principles. On transition, a net reduction of $658.8 million

in shareholders’ equity and a corresponding increase to long term liabilities

is expected. Irrespective of the change in accounting for the warrants, the

Company notes the warrants do not provide for settlement in cash.

|

| |

|

|

| |

• |

Asset Retirement Obligations – IFRS differs from Canadian GAAP in the

recognition of asset retirement obligations. Under IFRS, an obligation is

recognized if there is a legal obligation or a constructive obligation which

results in a more encompassing framework than Canadian GAAP. The Company has

evaluated and determined that there are no additional constructive obligations

at the transition date from the legal obligations currently recognized.

|

| |

|

|

| |

• |

Income Taxes – One of the significant changes to IFRS from Canadian

GAAP arises in the treatment of deferred taxes on the initial recognition

of an asset acquisition. The Company has had several notable asset acquisitions,

which under Canadian GAAP had an iterative deferred tax liability recognized

where the accounting basis was greater than the tax basis. Under IFRS, a prohibition

exists on the recognition of deferred taxes on acquisitions other than in

a business combination. On transition, the Company expects a reduction in

long term assets of $58.2 million, a reduction in future income tax liabilities

of $7.2 million and a reduction in shareholders’ equity of $51.0 million. |

| 12 |

NovaGold Resources Inc.

|

|

| |

Q2-2011 |

|

Management’s Discussion and Analysis

On May 12, 2011, the International Accounting Standards Board

released a set of 5 new standards including IFRS 10, Consolidated Financial

Statements; IFRS 11, Joint Arrangements; IFRS 12, Disclosure of Involvement in

Other Entities; along with amendments to the current and renamed IAS 27,

Separate Financial Statements & IAS 28, Investments in Associates and Joint

Ventures. This package of standards is effective for annual periods beginning on

or after January 1, 2013, with earlier adoption of the entire package permitted.

As a result of this recent release, the Company is continuing to assess the

determination of the accounting treatments of its interests in Donlin Gold and

Galore Creek. We expect to complete this evaluation in the third quarter.

The implementation and review phase includes execution of any

changes to information systems and business processes and completing formal

authorization processes to approve recommended accounting policy changes. It

will also include the collection of financial information necessary to compile

IFRS-compliant financial statements and audit committee approval of IFRS

financial statements. The Company has completed its analysis of its information

systems and does not anticipate significant changes arising from the transition

to IFRS. Several areas have been identified requiring changes to the Company’s

business processes which the Company is currently designing into its

processes.

Management is continuing to evaluate the differences and the

full impact on future financial reporting is not reasonably determinable or

estimable at this time.

Critical accounting estimates

The most critical accounting estimates upon which the Company’s

financial status depends are those requiring estimates of the recoverability of

its capitalized mineral property expenditures and intangible assets, impairment

of long-lived assets and the amount of future reclamation obligations.

Mineral properties and development costs

The Company expenses mineral property exploration expenditures

when incurred. When it has been established that a mineral deposit is

commercially mineable and an economic analysis has been completed, the costs

subsequently incurred to develop a mine on the property prior to the start of

mining operations are capitalized and will be amortized against future

production following commencement of commercial production, or written off if

the property is sold, allowed to lapse or abandoned. The Rock Creek project was

impaired during the year ended November 30, 2010 and an impairment loss was

proportionately allocated to mineral properties and development costs. There can

be no assurances that the subsequent decision to sell or reclaim the project

would result in a material gain on sale or accrual of closure costs, which would

be incurred when a decision is made.

The acquisition of title to mineral properties is a complicated

and uncertain process. The Company has taken steps, in accordance with industry

standards, to verify title to mineral properties in which it has an interest.

Although the Company has made efforts to ensure that legal title to its

properties is properly recorded in the name of the Company, there can be no

assurance that such title will ultimately be secured.

Reclamation costs

The amounts recorded for reclamation costs are estimates based

on independent third party engineering studies and the Company’s assessment of

the work that is anticipated to remediate old mining facilities of the Company’s

Nome Gold site, exploration and road remediation at the Galore Creek project,

and the Rock Creek mine site. An asset retirement obligation (“ARO”) is

recognized initially at fair value with a corresponding increase in the related

asset. The ARO is accreted to full value over time through periodic charges to

operations. The Galore Creek reclamation obligation has not been discounted due

to the uncertainty of timing of when the costs will be incurred. Actual costs

incurred during reclamation and the timing of when the costs will be incurred

could be materially different from these estimates.

| |

NovaGold Resources

Inc. |

13 |

| |

Q2-2011 |

|

Management’s Discussion and Analysis

Risk factors

The Company and its future business, operations and financial

condition are subject to various risks and uncertainties due to the nature of

its business and the present stage of exploration and development of its mineral

properties. Certain of these risks and uncertainties are set out below and under

the heading “Risk factors” in NovaGold’s Annual Information Form for the year

ended November 30, 2010 available on SEDAR at www.sedar.com and EDGAR at

www.sec.gov.

Ability to continue exploration activities and any future

development activities, and to continue as a going concern, will depend in part

on the ability to commence production and generate material revenues or to

obtain suitable financing

NovaGold has limited financial resources. The Company intends

to fund its plan of operations from working capital, the proceeds of financings

and revenue from land and gravel sales. In the future, the Company’s ability to

continue its exploration and development activities, if any, will depend in part

on the Company’s ability to obtain suitable financing.

There can be no assurance that the Company will commence

production at any of its mineral properties, generate sufficient revenues to

meet its obligations as they become due or obtain necessary financing on

acceptable terms, if at all. The Company’s failure to meet its ongoing

obligations on a timely basis could result in the loss or substantial dilution

of the Company’s interests (as existing or as proposed to be acquired) in its

properties. In addition, should the Company incur significant losses in future

periods, it may be unable to continue as a going concern, and realization of

assets and settlement of liabilities in other than the normal course of business

may be at amounts materially different than the Company’s estimates.

Exploration and development

Mineral exploration and development involves a high degree of

risk and few properties that are explored are ultimately developed into

producing mines. The Company has only defined or delineated reserves at its

Donlin Gold projects and none of its properties are currently under development.

The future development of any properties found to be economically feasible will

require obtaining permits, financing and construction. The Company is subject to

all the risks associated with establishing new mining operations. In addition,

there is no assurance that the Company’s mineral exploration activities will

result in any discoveries of new bodies of ore. There is also no assurance that

if further mineralization is discovered that the ore body would be economical

for commercial production. Discovery of mineral deposits is dependent upon a

number of factors and significantly influenced by the technical skill of the

exploration personnel involved. The commercial viability of a mineral deposit is

also dependent upon a number of factors that are beyond the Company’s control.

Some of these factors are the attributes of the deposit, commodity prices,

government policies and regulation and environmental protection.

Environmental laws and regulations

All of the Company’s exploration and production activities in

Canada and the United States are subject to regulation by governmental agencies

under various environmental laws. To the extent that the Company conducts

exploration activities or undertakes new mining activities in other foreign

countries, the Company will also be subject to environmental laws and

regulations in those jurisdictions. These laws address emissions into the air,

discharges into water, management of waste, management of hazardous substances,

protection of natural resources, antiquities and endangered species, and

reclamation of lands disturbed by mining operations. Environmental legislation

in many countries is evolving and the trend has been toward stricter standards

and enforcement, increased fines and penalties for non-compliance, more

stringent environmental assessments of proposed projects and increasing

responsibility for companies and their officers, directors and employees.

Compliance with environmental laws and regulations may require significant

capital outlays on behalf of the Company and may cause material changes or

delays in the Company’s intended activities. There can be no assurance that

future changes in environmental regulations will not adversely affect the

Company’s business, and it is possible that future changes in these laws or

regulations could have a significant adverse impact on some portion of the

Company’s business, causing the Company to re-evaluate those activities at that

time.

In February and March 2011, the Company’s wholly-owned

subsidiary AGC received a total of three citations and orders from the Mine

Safety Health Administration (“MSHA”) alleging certain violations of U.S.

Federal mine safety laws under the Federal Mine Safety and Health Act of

1977 (the “Mine Safety Act”) at the Rock Creek project. MSHA issued a 104(a)

citation to AGC on February 25, 2011, for an alleged minor paperwork violation

for failing to include a required paragraph in a report. The proposed penalty

for this minor alleged violation is $100. MSHA issued two 104(a) citations to

AGC on March 10, 2011 for AGC’s alleged failure to post adequate warning signs

and to conduct gas, mist, and dust surveys for an area of the mine. No penalty has yet been assessed for these violations; however, the estimated amount is

between $800 to $6,600. AGC has contested these citations and will contest the

proposed assessment when it is issued. In May 2011, AGC received a proposed

assessment for seven of the 104(a) citations issued in December 2010 totaling

$1,577. AGC has contested this assessment. Citations under Section 104(a) are

issued for situations in which the MHSA inspector determines that the operator

has violated the Mining Act or any mandatory health or safety standard, rule,

order or regulations promulgated pursuant to the Act.

| 14 |

NovaGold Resources Inc.

|

|

| |

Q2-2011 |

|

Management’s Discussion and Analysis

Reserve and resource estimates

Previous estimates of overall liability were based on a

statutory maximum penalty of up to $500,000. However, given the assessment of

outstanding citations to date of $32,805 and based on recent meetings with MSHA,

the reasonable maximum penalties for existing and outstanding penalties is

$50,000 in total estimated penalties. This estimate assumes that MSHA exercises

its special assessment authority for assessing the remaining citations. Reserve

and resource estimates

There is a degree of uncertainty attributable to the

calculation of reserves and resources and the corresponding grades. Reserve and

resource estimates are dependent partially on statistical inferences drawn from

drilling, sampling and other data. Reserve and resource figures set forth by the

Company are estimates, and there is no certainty that the mineral deposits would

yield the production of metals indicated by reserve and resource estimates.

Declines in the market price for metals may adversely affect the economics of a

deposit and may require the Company to reduce its reserve and resource

estimates. As defined by the Canadian Institute of Mining, Metallurgy and

Petroleum (CIM) and included by reference in National Instrument 43-101,

NovaGold records Proven and Probable Reserves at its projects upon completion of

a pre-feasibility or feasibility level study that demonstrates the economics of

developing the mineral deposit. This policy is generally adopted by Canadian

mining companies, but

differs from the United States policy of recognizing Proven and Probable Reserves once the majority of major development permits have been received.

Price volatility - gold, copper and other metals

The market price for gold, copper and other metals is volatile and cannot be controlled. There is no assurance that if commercial quantities of gold, copper and other metals are discovered, a profitable market may exist or continue to exist for a

production decision to be made or for the ultimate sale of the metals. As the Company is currently not in production, no sensitivity analysis for price changes has been provided or carried out.

Electrum is the Company's majority shareholder and has the ability to significantly influence the Company

Through its existing shareholding in the Company and the rights it holds to acquire additional common shares, Electrum Strategic Resources LLC ("Electrum" ) has the ability to exercise voting power to significantly influence in

determining the outcome of any corporate transaction or other matter submitted to the shareholders for approval, including mergers, consolidations and the sale of all or substantially all of the Company's assets, and other significant

corporate actions. Unless the majority of shareholders participate in such shareholder meetings, Electrum may be able to approve such matters itself. Without the consent of Electrum, the Company could be prevented from entering into transactions

that are otherwise beneficial to the Company. The interests of Electrum may differ from the interests of the Company's other shareholders.

NovaGold has been, and in the future may be, subject to legal proceedings

Due to the nature of its business, the Company may be subject to numerous regulatory investigations, claims, lawsuits and other proceedings in the ordinary course of its business. The results of these legal proceedings cannot be predicted with

certainty due to the uncertainty inherent in litigation, including the effects of discovery of new evidence or advancement of new legal theories, the difficulty of predicting decisions of judges and juries and the possibility that decisions may be

reversed on appeal. There can be no assurances that these matters will not have a material adverse effect on the Company's business.

On May 11, 2011, one claim was settled that had been filed against NovaGold in the United States Federal District Court for the District of Alaska. The settlement was paid through insurance and NovaGold did not pay any funds out of its cash balance.

The claims were originally filed in July 15, 2009 against NovaGold, AGC and other parties seeking wrongful death damages as the result of an accident on July 19, 2007, where two employees of a contractor were killed in a construction-related

accident at the Company's Rock Creek project. The Company and AGC filed an answer to the complaint denying all allegations and asserting certain affirmative defenses, and the claims against AGC were dismissed on May 19, 2010 by agreement

without any payment.

| |

NovaGold Resources

Inc. |

15 |

| |

Q2-2011 |

|

Management’s Discussion and Analysis

The settlement reached on May 11, 2011 has resolved this issue and the plaintiffs do not have any further recourse against the Company.

Increased regulatory compliance costs relating to Dodd-Frank

In July 2010, the "Dodd-Frank Wall Street Reform and

Consumer Protection Act" ("Dodd-Frank Act" ) was enacted, representing

an overhaul of the framework for regulation of U.S. financial markets. The Dodd-Frank

Act calls for various regulatory agencies, including the U.S. Securities and

Exchange Commission ("SEC" ) and the Commodities Futures Trading Commission,

to establish regulations for implementation of many of the provisions of the

Dodd-Frank Act, and the Company anticipates that these new regulations will

provide additional clarity regarding the extent of the impact of this legislation

on NovaGold. The Dodd-Frank Act also requires companies in the mining industry

to disclose in their periodic reports filed with the SEC substantial additional

information about safety issues relating to their mining operations. The Company

may also incur additional costs associated with the Company's compliance with

the new regulations and anticipated additional reporting and disclosure obligations.

While the Company is not able to assess the full impact of the Dodd-Frank Act

until all the implementing regulations have been adopted, based on the information

available to the Company at this time the Company does not believe provisions

of the regulations implementing the Dodd-Frank Act will have a material adverse

effect on the Company's financial position, results of operations or cash flows.

| 16 |

NovaGold Resources Inc.

|

|

| |

Q2-2011 |

|

Management’s Discussion and Analysis

Cautionary notes

Forward-looking statements

This Management’s Discussion and Analysis contains certain

forward-looking statements concerning anticipated developments in NovaGold’s

operations in future periods. Forward-looking statements are frequently, but not

always, identified by words such as “expects”, “anticipates”, “believes”,

“intends”, “estimates”, “potential”, “possible” and similar expressions, or

statements that events, conditions or results “will”, “may”, “could” or “should”

occur or be achieved. These forward-looking statements are set forth principally

under the heading “Outlook” and elsewhere in the Management’s Discussion and

Analysis and may include statements regarding perceived merit of properties;

ability to commence, or in the case of Rock Creek, seek shareholder value from

its properties; exploration results and budgets; mineral reserve and resource

estimates; work programs; capital expenditures; timelines; strategic plans; the

completion of transactions; market price of precious and base metals; or other

statements that are not statements of fact. Forward-looking statements are

statements about the future and are inherently uncertain, and actual

achievements of NovaGold may differ materially from those reflected in the

forward-looking statements due to a variety of risks, uncertainties and other

factors. NovaGold’s forward-looking statements are based on the beliefs,

expectations and opinions of management on the date the statements are made, and

NovaGold does not assume any obligation to update forward-looking statements if

circumstances or management’s beliefs, expectations or opinions should change

except as required by law. For the reasons set forth above, investors should not

place undue reliance on forward-looking statements. Important factors that could

cause actual results to differ materially from NovaGold’s expectations include

uncertainties involved in disputes and litigation; fluctuations in gold, copper

and other commodity prices and currency exchange rates; uncertainties relating

to interpretation of drill results and the geology, continuity and grade of

mineral deposits; uncertainty of estimates of capital and operating costs,

recovery rates, production estimates and estimated economic return; the need for

cooperation of Barrick and Teck to advance the Donlin Gold and Galore Creek

projects, respectively; the need for cooperation of government agencies and

native groups in the exploration and development of properties and the issuance

of required permits; the need to obtain additional financing to develop

properties and uncertainty as to the availability and terms of future financing;

the possibility of delay in exploration or development programs or in

construction projects and uncertainty of meeting anticipated program milestones;

uncertainty as to timely availability of permits and other governmental

approvals; and other risks and uncertainties disclosed here in under the heading

“Risk Factors” and in NovaGold’s Annual Information Form for the year ended

November 30, 2010, filed with the Canadian securities regulatory

authorities, NovaGold’s annual report on Form 40-F filed with the United States

Securities and Exchange Commission (the “SEC”), and other information released

by NovaGold and filed with the appropriate regulatory agencies.

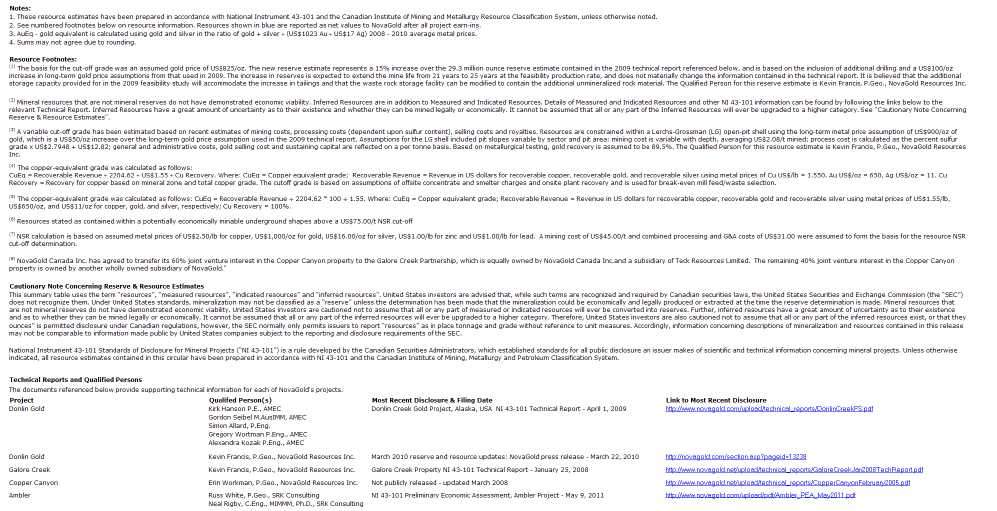

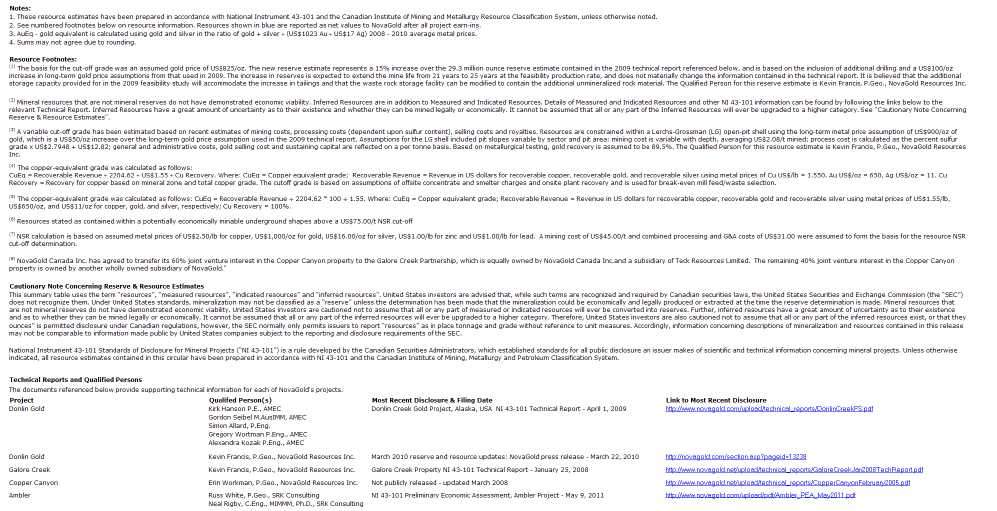

Reserve and resource estimates

This Management’s Discussion and Analysis and other

information released by NovaGold uses the terms “resources”, “measured

resources”, “indicated resources” and “inferred resources”. United States

investors are advised that, while such terms are recognized and required by

Canadian securities laws, the SEC does not recognize them. Under United States

standards, mineralization may not be classified as a “reserve” unless the

determination has been made that the mineralization could be economically and

legally produced or extracted at the time the reserve determination is made.

Mineral resources that are not mineral reserves do not have demonstrated

economic viability. United States investors are cautioned not to assume that all