As filed with the Securities and Exchange Commission on June 21, 2024

Registration No. 333-[●]

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

(Exact name of registrant as specified in its charter)

| 5084 | ||||

| (State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

44370 Old Warm Springs Blvd.,

Fremont, CA 94538

(510) 668-0881

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Dr. Uttam Patil

Chief Executive Officer

44370 Old Warm Springs Blvd.,

Fremont, CA 94538

(510) 668-0881- telephone

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

|

Louis Taubman, Esq. Joan Wu, Esq. |

| Hunter Taubman Fischer & Li LLC |

| 950 Third Avenue, 19th Floor |

| New York, New York 10022 |

| (917) 512-0827- telephone |

| Louis Taubman, Esq. |

Approximate date of commencement of proposed sale of the securities to the public: As soon as practicable after this registration statement is declared effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | ||

| ☒ | Smaller reporting company | ||||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. Neither we nor the Selling Stockholders may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED June 21, 2024

PRELIMINARY PROSPECTUS

1,000,000 shares of Common Stock Underlying Common Stock Purchase Warrant

This prospectus relates to the resale, from time to time, by the selling stockholders identified in this prospectus under the caption “Selling Stockholders,” of up to 1,000,000 shares of Common Stock of ABVC BioPharma, Inc., a Nevada corporation (the “Company”), $0.001 par value (the “Common Stock”). These shares include1,000,000 shares of Common Stock underlying a common stock purchase warrant (the “New Lind Warrant”) pursuant to a letter agreement entered into on May 22, 2024 with Lind Global Fund II, LP.

For the details about the selling stockholder, please see “Selling Stockholders.” The selling stockholder may sell these shares from time to time in the principal market on which our Common Stock is traded at the prevailing market price, in negotiated transactions, or through any other means described in the section titled “Plan of Distribution.” The selling stockholder may be deemed an underwriter within the meaning of the Securities Act of 1933, as amended, of the shares of Common Stock that they are offering. We will pay the expenses of registering these shares. We will not receive proceeds from the sale of our shares by the selling stockholder that are covered by this prospectus.

The shares are being registered to permit the selling stockholder, or its respective pledgees, donees, transferees or other successors-in-interest, to sell the shares from time to time in the public market. We do not know when or in what amount the selling stockholder may offer the securities for sale. The selling stockholder may sell some, all or none of the securities offered by this prospectus.

Our common stock is quoted on the Nasdaq Capital Markets under the symbol ABVC. On June 18, 2024, the closing price of our common stock was $0.723 per share.

The Selling Stockholders may sell their shares of Common Stock described in this prospectus in a number of different ways, at prevailing market prices or privately negotiated prices and there is no termination date of the Selling Stockholders’ offering.

You should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information by Reference” and “Where You Can Find More Information”, carefully before you invest in any of our securities.

Investing in our securities involves a high degree of risk. See “Risk Factors” starting on page 9 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is June 21, 2024

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus or in any free writing prospectus that we may specifically authorize to be delivered or made available to you. We and our Underwriter have not authorized anyone to provide you with any information other than that contained in this prospectus or in any free writing prospectus we may authorize to be delivered or made available to you. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. This prospectus may only be used where it is legal to offer and sell our securities. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or any sale of our securities. Our business, financial condition, results of operations and prospects may have changed since that date. We are not making an offer of these securities in any jurisdiction where the offer is not permitted.

Unless the context otherwise requires, the terms “ABVC,” “we,” “us” and “our” in this prospectus refer to ABVC BIOPHARMA, INC., and “this offering” refers to the offering contemplated in this prospectus.

i

PROSPECTUS CONVENTIONS

Except where the context otherwise requires and for purposes of this prospectus only:

“American BriVision Corporation” refers to a Delaware corporation and wholly-owned subsidiary of ABVC;

“APR” or “annual percentage rate” refers to the annual rate that is charged to borrowers, including a fixed interest rate and a transaction fee rate, expressed as a single percentage number that represents the actual yearly cost of borrowing over the life of a loan;

“BioKey” means BioKey, Inc. refers to a California corporation and wholly-owned subsidiary of ABVC;

“BioLite” means BioLite Holding, Inc. refers to a Nevada corporation and a wholly-owned subsidiary of ABVC;

The “Board” or “Board of Directors” refers to the board of directors of the Company;

“China” and “P.R.C.” refer to the People’s Republic of China, including Hong Kong Special Administrative Region or Macau Special Administrative Region, unless referencing specific laws and regulations adopted by the PRC and other legal or tax matters only applicable to mainland China, excluding Taiwan for purposes of this prospectus;

“Common Stock” is the Common Stock of ABVC Biopharma, Inc., par value US$0.001 per share;

“Merger Agreement” means the Agreement and Plan of Merger dated as of January 31, 2018, pursuant to which the Company, BioLite, BioKey, “BioLite Acquisition Corp.” a Nevada corporation, and BioKey Acquisition Corp.” a California corporation completed a business combination on February 8, 2019 where ABVC acquired BioLite and BioKey via the issuance of additional shares of Common Stock to the stockholders of BioLite and BioKey;

“Lind” refers to Lind Global Fund II, LP;

“Series A Convertible Preferred Stock” is the Series A convertible preferred stock of ABVC Biopharma, Inc., par value US$0.001 per share;

The terms “we,” “us,” “our,” “the Company,” “our Company” or “ABVC” refers to ABVC Biopharma, Inc., a Nevada corporation, and all of the Subsidiaries as defined herein unless the context specifies;

“R.O.C.” or “Taiwan” refers to Taiwan, the Republic of China;

“Subsidiary” or “Subsidiaries,” refer to American BriVision Corporation, sometimes referred to as “BriVision”, BioLite Holding, Inc. or BioLite and BioKey, Inc. or BioKey;

All references to “NTD” and “New Taiwan Dollars” are to the legal currency of R.O.C.; and

All references to “U.S. dollars”, “dollars”, and “$” are to the legal currency of the U.S.

This prospectus specifies certain NTD amounts and in parenthesis the approximate U.S. dollar amounts at the exchange rate on the date of this prospectus. The conversion rates regarding NTD and U.S. dollars are subject to change and, therefore, we can provide no assurance that U.S. dollar amounts specified in this prospectus will not change.

For clarification, this prospectus follows English naming convention of first name followed by last name, regardless of whether an individual’s name is Chinese or English.

ii

INDUSTRY AND MARKET DATA

This prospectus includes information with respect to market and industry conditions and market share from third-party sources or based upon estimates using such sources when available. We have not, directly or indirectly, sponsored or participated in the publication of any of such materials. We believe that such information and estimates are reasonable and reliable. We also assume the information extracted from publications of third-party sources has been accurately reproduced. We understand that the Company would be liable for the information included in this prospectus if any part of the information was incorrect, misleading or imprecise to a material extent.

iii

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus and does not contain all of the information that you should consider in making your investment decision. Before investing in our securities, you should carefully read this entire prospectus, including our financial statements and the related notes and the information set forth under the headings “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in each case included elsewhere in this prospectus.

Company Overview

Our Mission

We devote our resources to building a sophisticated biotech company and becoming a pioneer in the biopharmaceutical industry. Dr. Uttam Patil, our Chief Executive Officer, and Dr. Tsung-Shann Jiang, the founder and majority shareholder of the Company, understand the challenges and opportunities of the biotech industry and intend to provide therapeutic solutions to significant unmet medical needs and to improve health and quality of human life by developing innovative botanical drugs to treat central nervous system (“CNS”) and oncology/ hematology diseases.

Business Overview

As of the date hereof, the Company’s minimal revenue has come from the sale of CDMO services through BioKey. However, the Company’s focus is on developing a pipeline of products by carefully tracking new medical discoveries or medical device technologies in research institutions in the Asia-Pacific region. Pre-clinical, disease animal model and Phase I safety studies are examined closely by the Company’s scientists and other specialists known to the Company to identify drugs or medical devices that it believes demonstrate efficacy and safety based on the Company’s internal qualifications. Once a drug or medical device is shown to be a good candidate for further development and ultimately commercialization, ABVC licenses the drug or medical device from the original researchers and introduces the drug or medical device clinical trial plan to highly respected principal investigators in the United States, Australia and Taiwan. In almost all cases, ABVC has found that research institutions in each of those countries are eager to work with the Company to move forward with Phase II clinical trials.

Institutions that have or are now conducting phase II clinical trials in partnership with ABVC include:

| ● | Drug: ABV-1504, Major Depressive Disorder (MDD), Phase II completed. NCE drug Principal Investigators: Charles DeBattista M.D. and Alan F. Schatzberg, MD, Stanford University Medical Center, Cheng-Ta Li, MD, Ph.D – Taipei Veterans General Hospital |

| ● | Drug: ABV-1505, Adult Attention-Deficit Hyperactivity Disorder (ADHD), Phase II Part 1 completed. Principal Investigators: Keith McBurnett, Ph.D. and Linda Pfiffner, Ph.D., University of California San Francisco (UCSF), School of Medicine. Phase II, Part 2 clinical study sites include UCSF and 5 locations in Taiwan. The Principal Investigators are Keith McBurnett, Ph.D. and Linda Pfiffner, Ph.D., University of California San Francisco (UCSF), School of Medicine; Susan Shur-Fen Gau, M.D., National Taiwan University Hospital; Xinzhang Ni, M.D. Linkou Chang Gung Memorial Hospital; Wenjun Xhou, M.D.; Kaohsiung Chang Gung Memorial Hospital; Ton-Ping Su, M.D., Cheng Hsin General Hospital; Cheng-Ta Li, M.D., Taipei Veterans General Hospital. Phase II, Part 2 began in the 1st quarter of 2022 at the 5 Taiwan sites. The UCSF site joined the study in the 2nd quarter of 2023. The subjects enrolled in the study has reached the number for interim analysis in 2023 December, and the interim analysis of the study is in progress. |

| ● | Drug: ABV-1601, Major Depression in Cancer Patients, Phase I/II, NCE drug Principal Investigator: Scott Irwin, MD, Ph.D. – Cedars Sinai Medical Center (CSMC). The Phase I clinical study will be initiated in the 1st quarter of 2024. |

| ● | Medical Device: ABV-1701, Vitargus® in vitrectomy surgery, Phase II Study has been initiated in Australia and Thailand, Principal Investigator: Duangnate Rojanaporn, M.D., Ramathibodi Hospital; Thuss Sanguansak, M.D., Srinagarind Hospital of the two Thailand Sites and Professor/Dr. Matthew Simunovic, Sydney Eye Hospital; Dr. Elvis Ojaimi, East Melbourne Eye Group & East Melbourne Retina. The Phase II study started in the 2nd quarter of 2023, and the company is working on improvements to the Vitargus Product through the new batch of investigational product. |

The following trials are expected to begin in the third quarter of 2024:

| ● | Drug: ABV-1519, Non-Small Cell Lung Cancer treatment, Phase I/II Study in Taiwan, Principal Investigator: Dr. Yung-Hung Luo, M.D., Taipei Veterans General Hospital (TVGH) |

| ● | Drug: ABV-1703, Advanced Inoperable or Metastatic Pancreatic Cancer, Phase II, Principal Investigator: Andrew E. Hendifar, MD – Cedars Sinai Medical Center (CSMC) |

Upon successful completion of a Phase II trial, ABVC will seek a partner, typically a large pharmaceutical company, to complete a Phase III study and commercialize the drug or medical device upon approval by the US FDA, Taiwan TFDA and other country regulatory authorities.

1

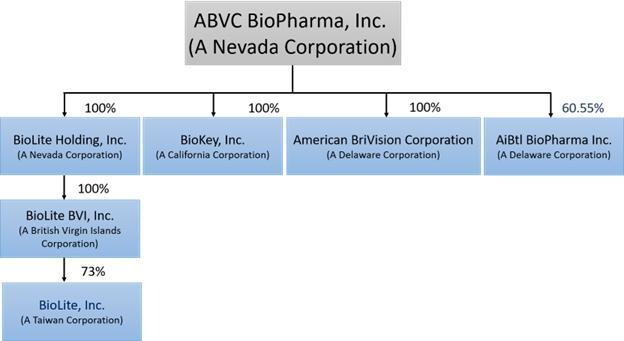

Corporate Structure

ABVC was incorporated under the laws of the State of Nevada on February 6, 2002 and has three wholly-owned Subsidiaries: BriVision, BioLite Holding, Inc. and BioKey, Inc. BriVision was incorporated in July 2015 in the State of Delaware and is in the business of developing pharmaceutical products in North America.

BioLite Holding was incorporated under the laws of the State of Nevada on July 27, 2016, with 500,000,000 shares authorized, par value $0.0001. Its key Subsidiaries include BioLite BVI, Inc. (“BioLite BVI”) that was incorporated in the British Virgin Islands on September 13, 2016 and BioLite Inc. (“BioLite Taiwan”), a Taiwanese corporation that was founded in February 2006. BioLite Taiwan has been in the business of developing new drugs for over twelve years. Certain shareholders of BioLite Taiwan exchanged approximately 73% of equity securities in BioLite Taiwan for the Common Stock in BioLite Holding in accordance with a share purchase/ exchange agreement (the “Share Purchase/ Exchange Agreement”). As a result, BioLite Holding owns via BioLite BVI approximately 73% of BioLite Taiwan. The other shareholders who did not enter this Share Purchase/ Exchange Agreement retain their equity ownership in BioLite Taiwan.

Incorporated in California on November 20, 2000, BioKey has chosen to initially focus on developing generic drugs to ride the opportunity of the booming industry.

Upon closing of the Mergers on February 8, 2019, BioLite and BioKey became two wholly-owned subsidiaries of ABVC.

In November 2023, the Company and one of its subsidiaries, BioLite, Inc. (“BioLite”) each entered into a multi-year, global licensing agreement with AiBtl BioPharma Inc. (“AIBL”) for the Company and BioLite’s CNS drugs with the indications of MDD (Major Depressive Disorder) and ADHD (Attention Deficit Hyperactivity Disorder) (the “Licensed Products”). The license covers the Licensed Products’ clinical trial, registration, manufacturing, supply, and distribution rights. The parties are determined to collaborate on the global development of the Licensed Products. The parties are also working to strengthen new drug development and business collaboration, including technology, interoperability, and standards development. As per each of the respective agreements, each of ABVC and BioLite received 23 million shares of AIBL stock at $10 per share, and if certain milestones are met, each may receive $3,500,000 and royalties equaling 5% of net sales, up to $100 million. Upon the issuance of the shares, AIBL became a subsidiary of ABVC.

The following chart illustrates the corporate structure of ABVC:

Effective March 5, 2022, the Company’s Board for Directors approved amending the Company’s Bylaws to remove Section 2.8, which permitted cumulative voting for directors since cumulative voting is specifically prohibited by our Articles of Incorporation. Since it is not otherwise stated in our Articles of Incorporation or Bylaws, directors shall be elected by a plurality of the votes cast at the election, as provided in the Nevada Revised Statutes.

Effective March 14, 2024, the Company’s Board for Directors approved amending Section 2.8 of the Company’s Bylaws to revise the number of shares needed to establish a quorum at shareholder meetings. The amendment changes the quorum requirement from a majority to 33-1/3% of the votes entitled to be cast on a matter. The full text of our current Bylaws, as amended is attached hereto as Exhibit 3.2.

2

Recent Developments

On May 23, 2024, the Company entered into a definitive agreement with OncoX BioPharma, Inc., a private company registered in the British Virgin Islands (“Oncox”), pursuant to which the Company will grant Oncox an exclusive right to develop and commercialize ABVC’s BLEX 404 single-herb botanical drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Myelodysplastic Syndrome (the “Licensed Products”), within a certain territory, specified as 50% of the Worldwide Markets for 20 years (the “Oncox Agreement”). In consideration thereof, Oncox shall pay ABVC a total of $6,250,000 (or 1,250,000 Oncox shares valued at $5 per share1) 30 days after entering the Oncox Agreement, with an additional milestone payment of $625,000 in cash after OncoX’s next round of fundraising, of which there can be no guarantee. Oncox may remit cash payments of at least $100,000 towards the licensing fees and deductible from the second milestone payment; ABVC is also entitled to royalties of 5% of Net Sales, as defined in the Oncox Agreement, from the first commercial sale of the Licensed Product in the noted territory, which remains uncertain. Oncox may use its revenue to fund the licensing fees. Oncox entered into the same agreement with ABVC’s affiliate, Biolite, Inc.

On May 14, 2024, the Company entered into a definitive agreement with OncoX, pursuant to which the Company will grant Oncox an exclusive right to develop and commercialize ABVC’s BLEX 404 single-herb botanical drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Tripple Negative Breast Cancer (the “Licensed Products”), within a certain territory, specified as 50% of the Worldwide Markets for 20 years (the “Oncox Agreement”). In consideration thereof, Oncox shall pay ABVC a total of $6,250,000 (or 1,250,000 Oncox shares valued at $5 per share1) 30 days after entering into the Oncox Agreement, with an additional milestone payment of $625,000 in cash after OncoX’s next round of fundraising, of which there can be no guarantee. Oncox may remit cash payments of at least $100,000 towards the licensing fees and deductible from the second milestone payment; ABVC is also entitled to royalties of 5% of Net Sales, as defined in the Oncox Agreement, from the first commercial sale of the Licensed Product in the noted territory, which remains uncertain. The Company will permit Oncox to pay the license fee in installments or in a lump sum and will allow Oncox to use its revenue to fund such payments. Oncox entered into the same agreement with ABVC’s affiliate, Biolite, Inc.

On May 8, 2024, the Company entered into a definitive agreement with OncoX, pursuant to which the Company will grant Oncox an exclusive right to develop and commercialize ABVC’s BLEX 404 single-herb botanical drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Pancreatic Cancer (the “May 8 Licensed Products”), within a certain territory, specified as 50% of the Worldwide Marketsfor 20 years (the “Oncox Agreement”). In consideration thereof, Oncox shall pay ABVC a total of $6,250,000 (or 1,250,000 Oncox shares valued at $5 per share1) within 30 days of entering into the Oncox Agreement, with an additional milestone payment of $625,000 in cash after OncoX’s next round of fundraising, of which there can be no guarantee. Oncox may remit cash payments of at least $100,000 towards the licensing fees and deductible from the second milestone payment; ABVC is also entitled to royalties of 5% of Net Sales, as defined in the Oncox Agreement, from the first commercial sale of the May 8 Licensed Product in the noted territory, which remains uncertain. The Company will permit Oncox to pay the license fee in installments or in a lump sum and will allow Oncox to use its revenue to fund such payments. Oncox entered into the same agreement with ABVC’s affiliate, Rgene Corporation.

On April 16, 2024, the Company entered into a definitive agreement with OncoX BioPharma, Inc., a private company registered in the British Virgin Islands (“Oncox”), pursuant to which the Company will grant Oncox an exclusive right to develop and commercialize ABVC’s single-herb botanical drug extract from the dry fruit body of Maitake Mushroom (Grifola Frondosa) for treatment of Non-Small Cell Lung Cancer (the “April Licensed Products”), within North America for 20 years (the “Oncox Agreement”). In consideration thereof, Oncox shall pay ABVC $6,250,000 (or 1,250,000 Oncox shares valued at $5 per share1) 30 days after entering into the Oncox Agreement and $625,000 30 days following the completion of Oncox’s next round of fundraising, of which there is no guarantee; ABC is also entitled to 5% royalties based on the Net Sales, as defined in the Oncox Agreement, from the first commercial sale of the April Licensed Product in North America. Oncox entered into the same agreement with ABVC’s affiliate, Rgene Corporation.

On March 25, 2024, we, and one of our co-development partners, BIOFIRST CORPORATION, a company registered in Taiwan (“BIOFIRST”), each entered into a twenty-year, global definitive licensing agreement (the “Licensing Agreement”) with ForSeeCon Eye Corporation, a company registered in the British Virgin Islands (“FEYE”) for the products in the Company and BIOFIRST’s Ophthalmology pipeline, including Vitargus (the “Licensed Products”). The license covers the Licensed Products’ clinical trial, registration, manufacturing, supply, and distribution rights; FEYE also has the rights to sublicense or partner with a third party to develop the Licensed Products.

As per each of the respective Agreements, each of the Company and BIOFIRST shall receive a total licensing fee of $33,500,000, composed of an upfront payment of $30,000,000, which can instead be paid with 5 million shares of FEYE stock at $6/share within 30 days after the execution of the Agreement, and a $3,500,000 cash milestone payment, due 30 days upon completion of next round fundraising, of which there can be no guarantee. Additionally, each of the Company and BIOFIRST are eligible to receive royalties of 5% of net sales.

3

NASDAQ Listing

On August 5, 2021, we closed a public offering (the “Offering”) of 1,100,000 units (the “Units”), with each Unit consisting of one share of our common stock (the “Common Stock”), one Series A warrant (the “Series A Warrants”) to purchase one share of common stock at an exercise price equal to $6.30 per share, exercisable until the fifth anniversary of the issuance date, and one Series B warrant (the “Series B Warrants,” and together with the Series A Warrants, the “Public Warrants”) to purchase one share of common stock at an exercise price equal to $10.00 per share, exercisable until the fifth anniversary of the issuance date; the exercise price of the Public Warrants are subject to certain adjustment and cashless exercise provisions as described therein. The Company completed the Offering pursuant to its registration statement on Form S-1 (File No. 333-255112), originally filed with the Securities and Exchange Commission (the “SEC”) on April 8, 2021 (as amended, the “Original Registration Statement”), that the SEC declared effective on August 2, 2021 and the registration statement on Form S-1 (File No. 333-258404) that was filed and automatically effective on August 4, 2021 (the “S-1MEF,” together with the Original Registration Statement, the “Registration Statement”). The Units were priced at $6.25 per Unit, before underwriting discounts and offering expenses, resulting in gross proceeds of $6,875,000. The Offering was conducted on a firm commitment basis. The Common Stock was approved for listing on The Nasdaq Capital Market and commenced trading under the ticker symbol “ABVC” on August 3, 2021.

On August 19, 2022, we received a deficiency letter from the Nasdaq Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) notifying us that, for the last 30 consecutive business days, the closing bid price for our common stock was below the minimum $1.00 per share required for continued listing on The Nasdaq Capital Market pursuant to Nasdaq Listing Rule 5550(a)(2) (“Rule 5550(a)(2)”). In accordance with Nasdaq Listing Rule 5810(c)(3)(A), we were initially given until February 14, 2023 to regain compliance with Rule 5550(a)(2). Since we did not regain compliance by such date, we requested and received an additional 180 days, until August 14, 2023, to comply with Rule 5550(a)(2).

On May 24, 2023, the Company received a deficiency letter from the Nasdaq Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it was not in compliance with the minimum stockholders’ equity requirement, or the alternatives of market value of listed securities or net income from continuing operations, for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule 5550(b)(1) requires listed companies to maintain stockholders’ equity of at least $2,500,000, and the Company’s stockholders’ equity was $1,734,507 as of March 31, 2023. In accordance with Nasdaq rules, the Company had 45 calendar days, or until July 10, 2023, to submit a plan to regain compliance. In response to the submitted plan, Nasdaq granted us an extension until August 31, 2023 to evidence compliance. Following several transactions we then completed, on September 6, 2023, Nasdaq informed us that they determined that we are in compliance with Nasdaq Listing Rule 5550(b)(1).

| 1 | J Cancer Res Clin Oncol (2009) 135:1215-1221 |

On May 24, 2023, the Company received a deficiency letter from the Nasdaq Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”) notifying the Company that it was not in compliance with the minimum stockholders’ equity requirement, or the alternatives of market value of listed securities or net income from continuing operations, for continued listing on the Nasdaq Capital Market. Nasdaq Listing Rule 5550(b)(1) requires listed companies to maintain stockholders’ equity of at least $2,500,000, and the Company’s stockholders’ equity was $1,734,507 as of March 31, 2023. In accordance with Nasdaq rules, the Company had 45 calendar days, or until July 10, 2023, to submit a plan to regain compliance. In response to the submitted plan, Nasdaq granted us an extension until August 31, 2023 to evidence compliance. Following several transactions we then completed, on September 6, 2023, Nasdaq informed us that they determined that we are in compliance with Nasdaq Listing Rule 5550(b)(1).

Strategy

Key elements of our business strategy include:

| ● | Advancing to the pivotal trial phase of ABV-1701 Vitargus® for the treatments of Retinal Detachment or Vitreous Hemorrhage, which we expect to generate revenues in the future. |

| ● | Focusing on licensing ABV-1504 for the treatment of major depressive disorder, MDD, after the successful completion of its Phase II clinical trials. |

| ● | Completing Phase II, Part 2 clinical trial for ABV-1505 for the treatment of attention deficit hyperactivity disorder, ADHD. |

| ● | Out licensing drug candidates and medical device candidates to major pharmaceutical companies for phase III and pivotal clinical trials, as applicable, and further marketing if approved by the FDA. |

We plan to augment our core research and development capability and assets by conducting Phase I and II clinical trials for investigational new drugs and medical devices in the fields of CNS, Hematology/Oncology and Ophthalmology.

Our management team has extensive experiences across a wide range of new drug and medical device development and we have in-licensed new drug and medical device candidates from large research institutes and universities in both the U.S. and Taiwan. Through an assertive product development approach, we expect that we will build a substantial portfolio of Oncology/ Hematology, CNS and Ophthalmology products. We primarily focus on Phase I and II research of new drug candidates and out license the post-Phase-II products to pharmaceutical companies; we do not expect to devote substantial efforts and resources to building the disease-specific distribution channels.

4

Material Risks and Challenges

We face substantial competition from a great many established and emerging pharmaceutical and biotech companies that develop, distribute or sell therapeutics to treat the same indications that our drug candidates are designed to treat. Our current and potential competitors include large pharmaceutical and biotechnology companies, and specialty pharmaceutical and generic drug companies. Many of our current and potential competitors have substantially greater financial, technical and human resources than we do and significantly more experience in the marketing, commercialization, discovery, development and regulatory approvals of products, which could place us at a significant competitive disadvantage or deny our marketing exclusivity rights. Typically, our competitors will most likely have more capital resources to support their products than we do. In addition, you should carefully consider the risks described under the “Risk Factors” section beginning on page 9 before investing in us. Some of these risks are:

| ● | Risk associated with our profitability including, but not limited to: |

| ○ | We have never generated revenue and will continue to be unprofitable in the foreseeable future. |

| ○ | Our business, operations and plans and timelines could be adversely affected by the effects of health epidemics, including the recent COVID-19 pandemic. |

| ● | Risk associated with clinical trials and the development of our products, including but not limited to: |

| ○ | Clinical trials are expensive and time consuming, and their outcome is uncertain. |

| ○ | Our clinical trials could be delayed or unsuccessful, and we may not be able to obtain regulatory approval for any of our drug candidates when expected, or at all. |

| ○ | We may experience delays in our clinical trials that could adversely affect our business and operations. |

| ○ | We rely on third parties to conduct our preclinical studies and clinical trials and if such third parties do not meet our deadlines or otherwise conduct the studies as required, we may be delayed in progressing, or ultimately may not be able to progress, our drug candidates to clinical trials. |

| ○ | We may not be able to secure and maintain research institutions to conduct our future trials. |

| ○ | We may not be able to secure co-developers or partners to further post-Phase II clinical trials and eventually commercialize our drug candidates. |

| ○ | We may need to prioritize the development of our most promising candidates at the expense of the development of other products. |

| ○ | Physicians, patients, third-party payors or others in the medical community may not be receptive to our products, and we may not generate any future revenue from the sale or licensing of our products. |

| ● | Risks associated with intellectual property including but not limited to: |

| ○ | We may not be successful in obtaining or maintaining patent or other relating rights necessary to the development of our drug candidates in the pipeline; |

| ○ | The intellectual property rights underlying our exclusive licensing rights may expire or be terminated due to lack of maintenance; |

| ● | Risks associated with competition and manufacturing including, but not limited to: |

| ○ | We face competition from entities that have developed or are developing products for our target disease indications, including companies developing novel treatments and technologies similar to ours; and |

| ○ | We depend primarily upon a sole supplier of our key extract for three drug candidates and could incur significant costs and delays if we are unable to promptly find a replacement for such supplier if the supplier fails to deliver the extract pursuant to our orders. |

5

| ● | Risks associated with government regulations including without limitation: |

| ○ | If we do not obtain the necessary governmental approvals, we will be unable to sub-license or commercialize our pharmaceutical products; and |

| ○ | Even if we obtain regulatory approval for a drug candidate, our products may remain subject to regulatory scrutiny. |

| ● | Risk associated with our Common Stock including without limitation: |

| ○ | The market prices and trading volumes of the Common may be volatile and may be affected by economic conditions beyond our control; and, |

| ○ | There is only a limited trading market for our Common Stock and such market may never develop. |

These and other risks described in this prospectus could materially and adversely impact our business, financial condition, operating results and cash flow, which could cause the trading price of our Common Stock to decline and could result in a loss of your investment.

Summary Risk Factors

The below is a summary of principal risks to our business and risks associated with this offering. It is only a summary. You should read the more detailed discussion of risks set forth below and elsewhere in this prospectus for a more complete discussion of the risks listed below and other risks.

| ● | Risk associated with our competition, including, but not limited to: |

| ○ | Many of our current and potential competitors have substantially greater financial, technical and human resources than we do, which could place us at a significant competitive disadvantage or deny our marketing exclusivity rights. |

| ○ | Many of our current and potential competitors have significantly more experience in the marketing, commercialization, discovery, development and regulatory approvals of products, which could place us at a significant competitive disadvantage or deny our marketing exclusivity rights |

| ● | Risk associated with our profitability including, but not limited to: |

| ○ | We have never generated revenue and will continue to be unprofitable in the foreseeable future. |

| ○ | Our business, operations and plans and timelines could be adversely affected by the effects of health epidemics, including the recent COVID-19 pandemic. |

| ● | Risk associated with clinical trials and the development of our products, including but not limited to: |

| ○ | Clinical trials are expensive and time consuming, and their outcome is uncertain. |

| ○ | Our clinical trials could be delayed or unsuccessful, and we may not be able to obtain regulatory approval for any of our drug candidates when expected, or at all. |

| ○ | We may experience delays in our clinical trials that could adversely affect our business and operations. |

| ○ | We rely on third parties to conduct our preclinical studies and clinical trials and if such third parties do not meet our deadlines or otherwise conduct the studies as required, we may be delayed in progressing, or ultimately may not be able to progress, our drug candidates to clinical trials. |

| ○ | We may not be able to secure and maintain research institutions to conduct our future trials. |

| ○ | We may not be able to secure co-developers or partners to further post-Phase II clinical trials and eventually commercialize our drug candidates. |

| ○ | We may need to prioritize the development of our most promising candidates at the expense of the development of other products. |

| ○ | Physicians, patients, third-party payors or others in the medical community may not be receptive to our products, and we may not generate any future revenue from the sale or licensing of our products. |

6

| ● | Risks associated with intellectual property including but not limited to: |

| ○ | We may not be successful in obtaining or maintaining patent or other relating rights necessary to the development of our drug candidates in the pipeline; |

| ○ | The intellectual property rights underlying our exclusive licensing rights may expire or be terminated due to lack of maintenance; |

| ● | Risks associated with competition and manufacturing including, but not limited to: |

| ○ | We face competition from entities that have developed or are developing products for our target disease indications, including companies developing novel treatments and technologies similar to ours; and |

| ○ | We depend primarily upon a sole supplier of our key extract for three drug candidates and could incur significant costs and delays if we are unable to promptly find a replacement for such supplier if the supplier fails to deliver the extract pursuant to our orders. |

| ● | Risks associated with government regulations including without limitation: |

| ○ | If we do not obtain the necessary governmental approvals, we will be unable to sub-license or commercialize our pharmaceutical products; and |

| ○ | Even if we obtain regulatory approval for a drug candidate, our products may remain subject to regulatory scrutiny. |

| ● | Risk associated with our Common Stock including without limitation: |

| ○ | The market prices and trading volumes of the Common may be volatile and may be affected by economic conditions beyond our control; and, |

| ○ | There is only a limited trading market for our Common Stock and such market may never develop. |

These and other risks described in this prospectus could materially and adversely impact our business, financial condition, operating results and cash flow, which could cause the trading price of our Common Stock to decline and could result in a loss of your investment. In addition, you should carefully consider the risks described under “Risk Factors” beginning on page 9.

Corporate Information

ABVC was incorporated under the laws of the State of Nevada on February 6, 2002. BriVision was incorporated in the State of Delaware on July 21, 2015. BioLite was incorporated in the State of Nevada on July 27, 2016. BioKey was incorporated in the State of California on November 20, 2000. BriVision, BioLite and BioKey are three operating subsidiaries that are wholly owned by the Company.

The Company’s shareholders approved an amendment to the Company’s Articles of Incorporation to change the Company’s corporate name from American BriVision (Holding) Corporation to ABVC BioPharma, Inc. and approved and adopted the Certificate of Amendment to affect same at the 2020 annual meeting of shareholders (the “Annual Meeting”). The name change amendment to the Company’s Articles of Incorporation was filed with Nevada’s Secretary of State and became effective on March 8, 2021 and FINRA approved our application for the name change as of May 3, 2021.

The Common Stock was approved for listing on The Nasdaq Capital Market and commenced trading under the ticker symbol “ABVC” on August 3, 2021. The Company’s CUSIP number is 0091F106.

Our principal executive office is located at 44370 Old Warm Springs Blvd., Fremont, CA 94538. Our telephone number at our principal executive office is (510)-668-0881. Our corporate website of BriVision is http://www.abvcpharma.com. The information on our corporate website is not part of, and is not incorporated by reference into, this prospectus.

7

THE OFFERING

| Common Stock being offered by Selling Stockholders |

Up to 1,000,000 shares of Common Stock underlying the New Lind Warrant, which can be exercised at a price of $1.00 per share.

The Selling Stockholders may sell their shares of Common Stock at prevailing market prices or privately negotiated prices. We will not receive any proceeds from the sales by the Selling Stockholders. |

| Use of Proceeds | We will not receive any proceeds from the sale of shares by the Selling Stockholders. |

| Trading Symbol | ABVC |

| Risk Factors | The securities offered by this prospectus are speculative and involve a high degree of risk and investors purchasing securities should not purchase the securities unless they can afford the loss of their entire investment. You should read “Risk Factors,” beginning on page 9 for a discussion of factors to consider before deciding to invest in our securities. |

| Transfer Agent | VStock Transfer, LLC |

8

RISK FACTORS

Investing in our securities includes a high degree of risk. Prior to making a decision about investing in our securities, you should consider carefully the specific factors discussed below, together with all of the other information contained in this prospectus. If any of the following risks actually occurs, our business, financial condition, results of operations and future prospects would likely be materially and adversely affected. This could cause the market price of our Common Stock to decline and could cause you to lose all or part of your investment.

Risks Related to the Company’s Business

Unfavorable global economic conditions, including as a result of health and safety concerns, could adversely affect our business, financial condition or results of operations.

Our results of operations could be adversely affected by general conditions in the global economy, including conditions that are outside of our control, such as the impact of health and safety concerns from the current outbreak of the COVID-19 coronavirus (“COVID-19”). The spread of the COVID-19, which was declared a pandemic by the World Health Organization in March 2020, has caused different countries and cities to mandate curfews, including “shelter-in-place” and closures of most non-essential businesses as well as other measures to mitigate the spread of the virus.

The negative impact of COVID-19 on our operations is ongoing and the extent of which remains uncertain and potentially wide-spread, including:

| ● | our ability to successfully execute our long-term growth strategy during these uncertain times; |

| ● | our ability to recruit the necessary number of patients to complete future clinical trials; | |

| ● | supply chain disruptions in projects ABV-1504, ABV-1505 and ABV-1601, resulting from reduced workforces, scarcity of raw materials, and scrutiny or embargoing of goods produced in infected areas; |

| ● | our ability to perform on-site due-diligence for project ABV-1505 (MDD Phase II completed new drug candidate) and ABV-1701 (Vitargus FIH completed medical device) with our potential partners/collaborators in US, Mainland China, and Japan; |

| ● | our ability to access capital sources, as well as the ability of our key customers, suppliers, and vendors to do the same in regard to their own obligations; and |

| ● | diversion of management and employee attention and resources from key business activities and risk management outside of COVID-19 response efforts, including maintenance of internal controls. |

The COVID-19 pandemic remains highly volatile and continues to evolve on a daily basis and therefore, despite our efforts and developments to combat the virus, there can be no assurance that these measures will prove successful. The extent to which COVID-19 continues to impact the Company’s business, sales, and results of operations will depend on future developments, which are highly uncertain and cannot be predicted.

The Company is a development stage biopharmaceutical company and is thus subject to the risks associated with new businesses in that industry.

The Company acquired the sole licensing rights to develop and commercialize for therapeutic purposes six compounds from BioLite and the right to co-develop with BioFirst a medical device (collectively the “ABVC Pipeline Products”). As such, the Company is a clinical stage biopharmaceutical company with operations that generate unsubstantial revenues. The Company is establishing and implementing many important functions necessary to operate a business, including the clinical research and development of the ABVC Pipeline Products, further establishment of the Company’s managerial and administrative structure, accounting systems and internal financial controls

BioLite and BioKey are expected to continue to have limited revenue and remain unprofitable for an indefinite period of time.

Accordingly, you should consider the Company’s prospects in light of the risks and uncertainties that a pharmaceutical company with a limited operating history and revenue faces. In particular, potential investors should consider that there are significant risks that the Company will not be able to:

| ● | implement or execute its current business plan, or generate profits; |

| ● | attract and maintain a skillful management team; |

| ● | raise sufficient funds in the capital markets or otherwise to effectuate its business plan; |

| ● | determine that the processes and technologies that it has developed are commercially viable; and/or |

| ● | enter into contracts with commercial partners, such as licensors and suppliers. |

9

If any of the above risks occurs, the Company’s business may fail, in which case you may lose the entire amount of your investment in the Company. The Company cannot assure that any of its efforts in business operations will be successful or result in the timely development of new products, or ultimately produce any material revenue and profits.

As a pre-profit biopharmaceutical company, the Company needs to transition from a company with a research and development focus to a company capable of supporting commercial activities. The Company may not be able to reach such transition point or make such a transition, which would have affect our business, financial condition, results of operations and prospects.

If the Company fails to raise additional capital, its ability to implement its business model and strategy could be compromised.

The Company has limited capital resources and operations. The CDMO services provided by BioKey generates a limited amount of revenue that can only partially support the operations of the Company. To date, the Company’s operations have been funded partially from the proceeds from financings or loans from its shareholders . From time to time, we may seek additional financing to provide the capital required to expand research and development (“R&D”) initiatives and/or working capital, as well as to repay outstanding loans if cash flow from operations is insufficient to do so. We cannot predict with certainty the timing or amount of any such capital requirements.

If the Company does not raise sufficient capital to fund its ongoing development activities, it is likely that it will be unable to carry out its business plans, including R&D development and expansion of production facilities. Currently, the Company has had to put several projects on hold due to a lack of funding. Even if the Company obtains financing for near term operations and product development, the Company may require additional capital beyond the near term. Furthermore, additional capital may not be available in sufficient amounts or on reasonable terms, if at all, and our ability to raise additional capital may be adversely impacted by potential worsening global economic conditions and the recent disruptions to and volatility in the credit and financial markets in the United States and worldwide resulting from the ongoing COVID-19 pandemic. If the Company is unable to raise capital when needed, its business, financial condition and results of operations would be materially adversely affected, and it could be forced to reduce or discontinue our operations.

The Company has no history in obtaining regulatory approval for, or commercializing, any new drug candidate.

With limited operating history, the Company has never obtained regulatory approval for, or commercialized, any new drug candidate. It is possible that the FDA may refuse to accept our planned New Drug Application (or “NDA”) for any of the six drug products for substantive review or may conclude after review of our data that our application is insufficient to obtain regulatory approval of the new drug candidates or the medical device. Although our CDMO strategic business department has experience in obtaining abbreviated new drug application (or “ANDA”) approvals, the processes and timelines of obtaining an NDA approval and ANDA approval can differentiate substantially. If the FDA does not accept or approve our planned NDA for our product candidates, it may require that we conduct additional clinical, preclinical or manufacturing validation studies, which may be costly. Depending on the FDA required studies, approval of any NDA or application that we submit may be significantly delayed, possibly for several years, or may require us to expend more resources than we have. Any delay in obtaining, or inability to obtain, regulatory approvals of any of our drug candidate will prevent us from sublicensing such product. It is also possible that additional studies, if performed and completed, may not be considered sufficient by the FDA. If any of these outcomes occurs, we may be forced to abandon our planned NDA for such drug candidate, which materially adversely affects our business and could potentially cause us to cease operations. We face similar regulatory risks in a foreign jurisdiction.

Our growth is dependent on our ability to successfully develop, acquire or license new drugs.

Our growth is supported by continuous investment in time, resources and capital to identify and develop new products or new formulations for the market and market penetration. If we are unable to either develop new products on our own or acquire licenses for new products from other parties, our ability to grow revenues and market share will be adversely affected. In addition, we may not be able to recover our investment in the development of new drugs and medical devices, given that projects may be interrupted, unsuccessful, not as profitable as initially contemplated or we may not be able to obtain necessary financing for such development. Similarly, there is no assurance that we can successfully secure such rights from third parties on an economically feasible basis.

Our current products have certain side effects. If the side effects associated with our current or future products are not identified prior to their marketing and sale, we may be required to withdraw such products from the market, perform lengthy additional clinical trials or change the labeling of our products, any of which could adversely impact our growth.

The Company researches and develops the following seven drug products and one medical device: ABV-1501, ABV-1504, ABV-1505, ABV-1519, ABV-1702, ABV-1601 and ABV-1703. Each of these seven products may cause serious adverse effects to their users. For example, the API of ABV-1501, ABV-1702 and ABV-1703 is Maitake mushroom extract. Side effects, or adverse events, associated with Maitake mushroom extract include blood bilirubin increase, lymphocyte count decrease, neutrophil count decrease, platelet count decrease, white blood cell decrease, headache, and hyperglycemia. Serious adverse events (collectively, the “SAE”) associated with this compound include leukocytosis, platelet count decrease, eye disorders, abdominal pain, gastrointestinal disorders, aphonia, lung infection, muscle weakness right-sided, confusion, edema cerebral, stroke, dyspnea, wheezing, and pruritus.

10

ABV-1504 and ABV-1505 have the same API, “Radix Polygala”, which is known as Polygala tenuifolia Willd or PDC-1421 Capsule (“Polygala tenuifolia Willd”). Side effects, or adverse events, associated with ABV-1504 and ABV-1505, coming from administration of the trial medicine or examination procedure such as the procedure of taking blood (fainting, pain and/or bruising), may lead to gastrointestinal disorders (abdominal fullness and constipation), nervous system disorders (drowsiness, sleepiness, and oral ulcer). In addition, long-term use may cause miscarriages.

The safety and preliminary efficacy findings from this study, combined with the unique properties of ABV-1701, are supportive of further investigation for its use following vitrectomy surgery in patients requiring vitreous replacement. However, new serious side effects of ABV-1701 may be uncovered as the clinical trials continue.

The occurrence of any of those adverse events would harm our future sales of these medicines and substantially increase the costs and expenses of marketing these medicines, which in turn could cause our revenues and net income to decline. In addition, the reputation and sales of our future medicines could be adversely affected due to the severe side effects discovered.

We may be subject to product liability claims in the future, which could divert our resources, cause us to incur substantial liabilities and limit commercialization of any products that we may develop.

We face an inherent business risk of exposure to product liability claims in the event that the uses of our products are alleged to have caused adverse side effects. Side effects or marketing or manufacturing problems pertaining to any of our products could result in product liability claims or adverse publicity. These risks will exist for those products in clinical development and with respect to those products that receive regulatory approval for commercial sale. Furthermore, although we have not historically experienced any problems associated with claims by users of our products, we do not currently maintain product liability insurance and there could be no assurance that we are able to acquire product liability insurance with terms that are commercially feasible.

We face an inherent risk of product liability claims as a result of the clinical testing of our products and potentially commercially selling any products that we may develop. For example, we may be sued if any product we develop allegedly causes injury or is found to be otherwise unsuitable during clinical testing, manufacturing, marketing or sale. Any such product liability claims may include allegations of defects in manufacturing, defects in design, a failure to warn of dangers inherent in the product, negligence, strict liability or a breach of warranties. Claims could also be asserted under state consumer protection acts. If we cannot successfully defend ourselves against product liability claims, we may incur substantial liabilities or be required to limit commercialization of our product candidate. Regardless of the merits or eventual outcome, liability claims may result in:

| ● | decreased demand for our product candidates or products that we may develop; | |

| ● | injury to our reputation and significant negative media attention; |

| ● | withdrawal of clinical trial participants; |

| ● | significant costs to defend resulting litigation; | |

| ● | substantial monetary awards to trial participants or patients; | |

| ● | loss of revenue; | |

| ● | reduced resources of our management to pursue our business strategy; and | |

| ● | the inability to commercialize any products that we may develop. |

We currently have insurance policies to cover liabilities under the clinic trials but do not maintain general liability insurance; and even if we have a general liability insurance in the future, this insurance may not fully cover potential liabilities that we may incur. The cost of any product liability litigation or other proceeding, even if resolved in our favor, could be substantial. We would need to increase our insurance coverage if and when we begin selling any product candidate that receives marketing approval. In addition, insurance coverage is becoming increasingly expensive. If we are unable to obtain or maintain sufficient insurance coverage at an acceptable cost or to otherwise protect against potential product liability claims, it could prevent or inhibit the development and commercial production and sale of our product candidate, which could adversely affect our business, financial condition, results of operations and prospects.

We have conducted, and may in the future conduct, clinical trials for certain of our product candidates at sites outside the United States, and the FDA may not accept data from trials conducted in such locations.

We have conducted and may in the future choose to conduct one or more of our clinical trials outside the United States. Although the FDA may accept data from clinical trials conducted outside the United States, acceptance of this data is subject to certain conditions imposed by the FDA. For example, the clinical trial must be well designed and conducted and performed by qualified investigators in accordance with ethical principles. The trial population must also adequately represent the U.S. population, and the data must be applicable to the U.S. population and U.S. medical practice in ways that the FDA deems clinically meaningful. In addition, while these clinical trials are subject to the applicable local laws, FDA acceptance of the data will be dependent upon its determination that the trials also complied with all applicable U.S. laws and regulations. There can be no assurance that the FDA will accept data from trials conducted outside of the United States. If the FDA does not accept the data from any of our clinical trials that we determine to conduct outside the United States, it would likely result in the need for additional trials, which would be costly and time-consuming and delay or permanently halt our development of the product candidate.

11

In addition, the conduct of clinical trials outside the United States could have a significant impact on us. Risks inherent in conducting international clinical trials include:

| ● | foreign regulatory requirements that could restrict or limit our ability to conduct our clinical trials; | |

| ● | administrative burdens of conducting clinical trials under multiple foreign regulatory schema; | |

| ● | foreign exchange fluctuations; and | |

| ● | diminished protection of intellectual property in some countries. |

If clinical trials of our product candidates fail to demonstrate safety and efficacy to the satisfaction of the FDA and comparable non-U.S. regulators, we may incur additional costs or experience delays in completing, or ultimately be unable to complete the development and commercialization of our product candidates.

We are not permitted to commercialize, market, promote or sell any product candidate in the United States without obtaining marketing approval from the FDA. Comparable non-U.S. regulatory authorities impose similar restrictions. We may never receive such approvals. We must complete extensive preclinical development and clinical trials to demonstrate the safety and efficacy of our product candidate in humans before we will be able to obtain these approvals.

Clinical testing is expensive, difficult to design and implement, can take many years to complete and is inherently uncertain as to outcome. Any inability to successfully complete preclinical and clinical development could result in additional costs to us and impair our ability to generate revenues from product sales, regulatory and commercialization milestones and royalties. In addition, if (1) we are required to conduct additional clinical trials or other testing of our product candidate beyond the trials and testing that we contemplate, (2) we are unable to successfully complete clinical trials of our product candidate or other testing, (3) the results of these trials or tests are unfavorable, uncertain or are only modestly favorable, or (4) there are unacceptable safety concerns associated with our product candidate, we, in addition to incurring additional costs, may:

| ● | be delayed in obtaining marketing approval for our product candidates; |

| ● | not obtain marketing approval at all; |

| ● | obtain approval for indications or patient populations that are not as broad as we intended or desired; |

| ● | obtain approval with labeling that includes significant use or distribution restrictions or significant safety warnings, including boxed warnings; |

| ● | be subject to additional post-marketing testing or other requirements; or |

| ● | be required to remove the product from the market after obtaining marketing approval. |

Even if any of our product candidates receives marketing approval, it may fail to achieve the degree of market acceptance by physicians, patients, third party payors and others in the medical community necessary for commercial success and the market opportunity for the product candidate may be smaller than we estimate.

We have never completed a new drug or new medical device FDA application process from Phase I to FDA approval and commercialization. Even if our products are approved by the appropriate regulatory authorities for marketing and sale, they may nonetheless fail to gain sufficient market acceptance by physicians, patients, third party payors and others in the medical community. For example, physicians are often reluctant to switch their patients from existing therapies even when new and potentially more effective or convenient treatments enter the market. Further, patients often acclimate to the therapy that they are currently taking and do not want to switch unless their physicians recommend switching products or they are required to switch therapies due to lack of reimbursement for existing therapies.

The potential market opportunities for our products are difficult to estimate precisely. Our estimates of the potential market opportunities are predicated on many assumptions, including industry knowledge and publications, third party research reports and other surveys. While we believe that our internal assumptions are reasonable, these assumptions involve the exercise of significant judgment on the part of our management, are inherently uncertain and the reasonableness of these assumptions has not been assessed by an independent source. If any of the assumptions proves to be inaccurate, the actual markets for our products could be smaller than our estimates of the potential market opportunities.

12

We may seek to enter into collaborations with third parties for the development and commercialization of our product candidates. If we fail to enter into such collaborations, or such collaborations are not successful, we may not be able to capitalize on the market potential of our product candidates.

We may seek third-party collaborators for development and commercialization of our products. Our likely collaborators for any marketing, distribution, development, licensing or broader collaboration arrangements include large and mid-size pharmaceutical companies, regional and national pharmaceutical companies, non-profit organizations, government agencies, and biotechnology companies. Our ability to generate revenues from these arrangements will depend on our collaborators’ abilities to successfully perform the functions assigned to them in these arrangements.

Collaborations involving our products will pose the following risks to us:

| ● | collaborators may have significant discretion in determining the efforts and resources that they will apply to these collaborations; |

| ● | collaborators may not pursue development and commercialization of our product candidate or may elect not to continue or renew development or commercialization programs based on preclinical or clinical trial results, changes in the collaborators’ strategic focus or available funding, or external factors such as an acquisition that diverts resources or creates competing priorities; |

| ● | collaborators may delay clinical trials, provide insufficient funding for a clinical trial program, stop a clinical trial or abandon a product candidate, repeat or conduct new clinical trials or require a new formulation of a product candidate for clinical testing; |

| ● | collaborators could independently develop, or develop with third parties, products that compete directly or indirectly with our product candidate if the collaborators believe that competitive products are more likely to be successfully developed or can be commercialized under terms that are more economically attractive than ours; |

| ● | collaborators with marketing and distribution rights to one or more products may not commit sufficient resources to the marketing and distribution of such product or products; |

| ● | collaborators may not properly maintain or defend our intellectual property rights or may use our proprietary information in such a way as to invite litigation that could jeopardize or invalidate our intellectual property or proprietary information or expose us to potential litigation; |

| ● | collaborators may infringe the intellectual property rights of third parties, which may expose us to litigation and potential liability; |

| ● | disputes may arise between the collaborators and us that result in the delay or termination of the research, development or commercialization of our product candidate or that result in costly litigation or arbitration that diverts management attention and resources; and |

| ● | collaborations may be terminated and, if terminated, may result in a need for additional capital to pursue further development or commercialization of the applicable product candidates. |

Collaborative agreements may not lead to development or commercialization of our product candidate in the most efficient manner or at all. If a collaborator of ours were to be involved in a business combination, the continued pursuit and emphasis on our product development or commercialization program could be delayed, diminished or terminated.

ABVC, through BioLite, may not be able to receive the full amounts available under the collaboration agreement by and between BioLite, Inc. and BioHopeKing, which could increase its burden to seek additional capital to fund the business operations.

In February and December 2015, BioLite, Inc., a subsidiary of BioLite, entered into a total of three collaboration agreements with BioHopeKing to jointly develop ABV-1501 for TNBC (or BLI-1401-2 as used by BioLite internally) and ABV-1504 for MDD (or BLI-1005 as used by BioLite internally) in most Asian countries and BLI-1006, which has been later replaced with BLI-1008 for ADHD in Asia, excluding Japan. ABVC and BioLite are co-developing ABV-1501 for TNBC and ABV-1504 for MDD pursuant to the Collaboration Agreement and its Addendum entered by and between BriVision and BioLite Taiwan where ABVC and BriVision are responsible for the clinical trials of such two new drug candidates. In accordance with the terms of the BioHopeKing Collaboration Agreement for ABV-1501 or BLI-1401-2 and the Addendum thereto, BioLite shall receive payments of a total of $10 million in cash and equity of BioHopeKing or equity securities owned by it at various stages on a schedule dictated by BioLite’s achievements of certain milestones and twelve per cent (12%) of net sales of the drug products when ABV-1501 or BLI-1401-2 is approved for sale in the licensed territories. If BioLite fails to reach any of the milestones in a timely manner, it may not receive the rest of the payments from BioHopeKing. As a result of BioLite’s potential inability to receive the full payments under those collaboration agreements with BioHopeKing, ABVC may have to seek other sources of financing to fund its operation activities.

13

ABVC and its Subsidiaries may not be successful in establishing and maintaining additional strategic partnerships, which could adversely affect ABVC’s ability to develop and commercialize products, negatively impacting its operating results.

In addition to ABVC’s current collaboration with BioHopeKing for selected Asian markets, a part of its strategy is to evaluate and, as deemed appropriate, enter into additional partnerships in the future with major biotechnology or pharmaceutical companies. ABVC’s products may prove to be difficult to effectively license out as planned. Various regulatory, commercial and manufacturing factors may impact ABVC’s ability to seek co-developers of or grow revenues from licensing out any of the seven products in the pipeline, none of which has been fully licensed out. Specifically, ABVC may encounter difficulty by virtue of:

| ● | its inability to effectively identify and align with commercial partners in the U.S. to collaborate the development of ABV-1504 for the treatment of Major Depressive Disorder, ABV-1505 to treat Attention-Deficit Hyperactivity Disease, ABV-1501 for the treatment of Triple Negative Breast Cancer, ABV-1519 to treat of Non-Small Cell Lung Cancer, ABV-1703 to the treatment of Pancreatic Cancer, ABV-1601 to treat Depression in Cancer Patients and ABV-1702 to treat Myelodysplastic syndromes and ABV-1701 Vitargus for the treatments of Retinal Detachment or Vitreous Hemorrhage; |

| ● | its inability to secure appropriate contract research organizations (“CRO”s) to conduct data analysis, lab research and FDA communication; and |

| ● | its inability to effectively continue clinical studies on and secure positive research results of all of our investigational new drugs to attract additional commercial collaborators outside the U.S. |

ABVC faces significant competition in seeking appropriate partners for its therapeutic candidates, and the negotiation process is time-consuming and complex. In order for ABVC to successfully partner its autoimmune, CNS and hematology therapeutic candidates, as well as Vitargus, its medical device, potential partners must view these medicinal candidates as economically valuable in markets they determine to be attractive in light of the terms that ABVC is seeking and compared to other available products for licensing by other companies. Even if ABVC is successful in its efforts to establish new strategic partnerships, the terms that ABVC agrees upon may not be favorable, and it may not be able to maintain such strategic partnerships if, for example, development or approval of an autoimmune therapeutic is delayed or sales of an approved product are disappointing. Any delay in entering into new strategic partnership agreements related to any of ABVC’s therapeutic candidates could delay the development and commercialization of such candidates and reduce its competitiveness even if it reaches the market.

If ABVC fails to establish and maintain additional strategic partnerships or collaboration related to its therapeutic candidates that have not been fully licensed, it will bear all of the risk and costs related to the development of any such drug candidate, and it may need to seek additional financing, hire additional employees and otherwise develop expertise for which it has not budgeted. This could negatively affect the development of any incompletely partnered new drug candidates.

ABVC’s licensors may choose to terminate any of the license agreements with ABVC. As a result, ABVC’s research and development of new drug candidates that contain the underlying API may be terminated abruptly.

If ABVC’s Subsidiary BioLite materially breaches any license agreements it has with Yukiguni Maitake Co. (“Yukiguni”), Medical and Pharmaceutical Industry Technology and Development Center (“MPITDC”) or Industrial Technology Research Institute (“ITRI”), or any of such license agreement terminates unexpectedly, BioLite may not be able to continue its research and development of the new drug candidate which contains the underlying API whose license has been terminated. Pursuant to the Yukiguni License Agreement, if BioLite fails to meet the milestone sales requirement or submit certain applications to the appropriate health authorities on a schedule prescribed therein, Yukiguni shall have the right to terminate the Yukiguni License Agreement. If the Yukiguni License Agreement is terminated involuntarily, BioLite will be forced to discontinue its new drug development of ABV-1703, ABV-1502 and ABV-1501 and terminate the collaboration agreements relating to the three new drug candidates. The termination of the right to use the underlying API will materially disrupt the operations of ABVC. Pursuant to the license agreement between BioLite Taiwan and ITRI, if BioLite Taiwan fails to complete the research submission milestones according to the schedule set forth therein without reasons or with reasons unstatisfied with ITRI, ITRI shall have the right to terminate the license agreement with BioLite Taiwan without refund to BioLite Taiwan. BioLite Taiwan and BioLite have submitted the IND for PDC-1421 and subsequently conducted Phase II clinical trials of two drug candidiates developed from PDC-1421 according to the schedule listed in the license agreement between BioLite Taiwan and MPITDC.

ABVC’s Subsidiary BioLite depends on one supplier for the API of ABV-1703, ABV-1519, ABV-1502 and ABV-1501 and any failure of such supplier to deliver sufficient quantities of the API that meets its quality standard could have a material adverse effect on its research of these four drug candidates.

Currently BioLite relies primarily on Yukiguni, a Japanese supplier, to provide Yukiguni Maitake Extract 404, the API which is contained in ABV-1703, ABV-1519, ABV-1502 and ABV-1501, four of the seven drug candidates in BioLite’s oncology/hematology portfolio. It has entered into the Yukiguni License Agreement, among other things, for the delivery of Yukiguni Maitake Extract 404. BioLite agrees to fulfill its demand of the Yukiguni Maitake Extract 404 by purchasing first from Yukiguni respecting the therapeutic products and Yukiguni represents that it will provide sufficient quantities of such API that meets cGMP standards. If the supplies of Yukiguni Maitake Extract 404 were interrupted for any reason, BioLite’s research and development activities of these four drug candidates could be delayed. These delays could be extensive and expensive, especially in situations where a substitution is not readily available.