CIDM-03.31.15-10K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

x ANNUAL REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal period ended: March 31, 2015

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from --- to ---

Commission File Number: 000-31810

___________________________________

Cinedigm Corp.

(Exact name of registrant as specified in its charter)

___________________________________

|

| | |

Delaware | | 22-3720962 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

902 Broadway, 9th Floor New York, NY | | 10010 |

(Address of principal executive offices) | | (Zip Code) |

(212) 206-8600

(Registrant’s telephone number, including area code)

|

| | |

Securities registered pursuant to Section 12(b) of the Act: | | |

| | |

Title of each class | | Name of each exchange on which registered |

CLASS A COMMON STOCK, PAR VALUE $0.001 PER SHARE | | NASDAQ GLOBAL MARKET |

| | |

Securities registered pursuant to Section 12(g) of the Act: | | NONE |

|

| |

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. | Yes o No x |

| |

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. | Yes o No x |

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes x No o |

| |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes x No o |

| |

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. | x |

| |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. | o |

|

| | | | |

Large accelerated filer o | Accelerated filer x | Non-accelerated filer o | Smaller reporting company o |

| | (Do not check if a smaller reporting company) | | |

| | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | Yes o No x |

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the issuer based on a price of $1.55 per share, the closing price of such common equity on the Nasdaq Global Market, as of September 30, 2014, was $100,593,799. For purposes of the foregoing calculation, all directors, officers and shareholders who beneficially own 10% of the shares of such common equity have been deemed to be affiliates, but the Company disclaims that any of such persons are affiliates.

As of June 22, 2015, 74,491,762 shares of Class A Common Stock, $0.001 par value were outstanding, which number includes 11,791,384 shares subject to our forward purchase transaction.

DOCUMENTS INCORPORATED BY REFERENCE

None.

CINEDIGM CORP.

TABLE OF CONTENTS

|

| | |

| Page |

FORWARD-LOOKING STATEMENTS | |

|

PART I |

ITEM 1. | Business | |

ITEM 1A. | Risk Factors | |

ITEM 2. | Property | |

ITEM 3. | Legal Proceedings | |

ITEM 4. | Mine Safety Disclosures | |

|

PART II |

ITEM 5. | Market for Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities | |

ITEM 6. | Selected Financial Data | |

ITEM 7. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

ITEM 8. | Financial Statements and Supplementary Data | |

ITEM 9. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | |

ITEM 9A. | Controls and Procedures | |

ITEM 9B. | Other Information | |

|

PART III |

ITEM 10. | Directors, Executive Officers and Corporate Governance | |

ITEM 11. | Executive Compensation | |

ITEM 12. | Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters | |

ITEM 13. | Certain Relationships and Related Transactions | |

ITEM 14. | Principal Accountant Fees and Services | |

|

PART IV |

ITEM 15. | Exhibits, Financial Statement Schedules | |

| |

SIGNATURES | |

FORWARD-LOOKING STATEMENTS

Various statements contained in this report or incorporated by reference into this report constitute “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements are based on current expectations and are indicated by words or phrases such as “believe,” “expect,” “may,” “will,” “should,” “seek,” “plan,” “intend” or “anticipate” or the negative thereof or comparable terminology, or by discussion of strategy. Forward-looking statements represent as of the date of this report our judgment relating to, among other things, future results of operations, growth plans, sales, capital requirements and general industry and business conditions applicable to us. Such forward-looking statements are based largely on our current expectations and are inherently subject to risks and uncertainties. Our actual results could differ materially from those that are anticipated or projected as a result of certain risks and uncertainties, including, but not limited to, a number of factors, such as:

| |

• | successful execution of our business strategy, particularly for new endeavors; |

| |

• | the performance of our targeted markets; |

| |

• | competitive product and pricing pressures; |

| |

• | changes in business relationships with our major customers; |

| |

• | successful integration of acquired businesses; |

| |

• | the content we distribute through our in-theatre, on-line and mobile services may expose us to liability; |

| |

• | general economic and market conditions; |

| |

• | the effect of our indebtedness on our financial condition and financial flexibility, including, but not limited to, the ability to obtain necessary financing for our business; and |

| |

• | the other risks and uncertainties that are set forth in Item 1, “Business”, Item 1A "Risk Factors" and Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. |

These factors are not necessarily all of the important factors that could cause actual results to differ materially from those expressed in any of our forward-looking statements. Other unknown or unpredictable factors could also have material adverse effects on future results. Except as otherwise required to be disclosed in periodic reports required to be filed by public companies with the Securities and Exchange Commission (“SEC”) pursuant to the SEC's rules, we have no duty to update these statements, and we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In light of these risks and uncertainties, we cannot assure you that the forward-looking information contained in this report will in fact transpire.

In this report, “Cinedigm,” “we,” “us,” “our” and the “Company” refers to Cinedigm Corp. and its subsidiaries unless the context otherwise requires.

PART I

ITEM 1. BUSINESS

OVERVIEW

Cinedigm Corp. was incorporated in Delaware on March 31, 2000 (“Cinedigm”, and collectively with its subsidiaries, the “Company”). We are (i) a leading distributor and aggregator of independent movie, television and other short form content managing a library of distribution rights to close to 50,000 titles and episodes released across digital, physical, and home and mobile entertainment platforms as well as (ii) a leading servicer of digital cinema assets on over 12,000 domestic and foreign movie screens.

Since our inception, we have played a significant role in the digital distribution revolution that continues to transform the media landscape. In addition to our pioneering role in transitioning over 12,000 movie screens from traditional analog film prints to digital distribution, we have become a leading distributor of independent content, both through organic growth and acquisitions. We distribute products for major brands such as the Discovery Networks, National Geographic and Scholastic as well as leading international and domestic content creators, movie producers, television producers and other short form digital content producers. We collaborate with producers, major brands and other content owners to market, source, curate and distribute quality content to targeted audiences through (i) existing and emerging digital home entertainment platforms, including but not limited to, iTunes, Amazon Prime, Netflix, Hulu, Xbox, PlayStation, and cable video-on-demand ("VOD") and (ii) physical goods, including DVD and Blu-ray Discs. In addition, we operate a growing number of branded and curated over-the-top ("OTT") entertainment channels, including Docurama, CONtv and Dove Entertainment Channel, which is expected to launch in late summer 2015.

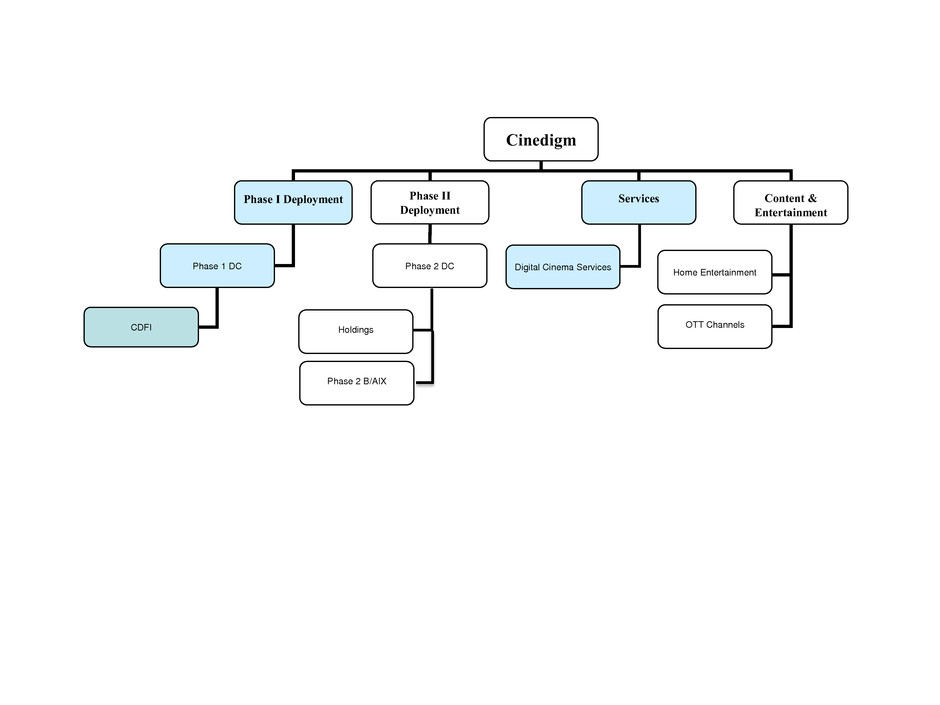

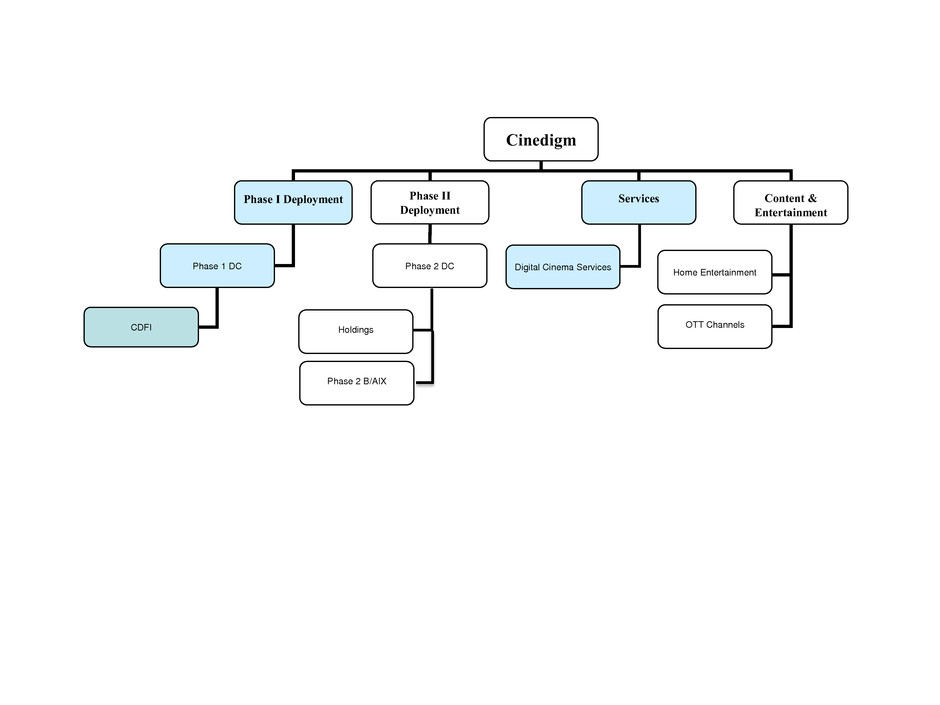

We report our financial results in four primary segments as follows: (1) the first digital cinema deployment (“Phase I Deployment”), (2) the second digital cinema deployment (“Phase II Deployment”), (3) digital cinema services (“Services”) and (4) media content

and entertainment group (“Content & Entertainment” or "CEG"). The Phase I Deployment and Phase II Deployment segments are the non-recourse, financing vehicles and administrators for our digital cinema equipment (the “Systems”) installed in movie theatres throughout the United States and Canada, and in Australia and New Zealand. Our Services segment provides fee-based support to over 12,000 movie screens in our Phase I Deployment and Phase II Deployment segments as well as directly to exhibitors and other third party customers in the form of monitoring, billing, collection and verification services. Our Content & Entertainment segment is a market leader in: (1) ancillary market aggregation and distribution of entertainment content, and (2) branded and curated OTT digital network business providing entertainment channels and applications.

We are structured so that our digital cinema business (collectively, our Phase I Deployment, Phase II Deployment and Services segments) operates independently from our Content & Entertainment business. As of March 31, 2015, we had approximately $157.5 million of non-recourse outstanding debt principal that relates to and is serviced by, our digital cinema business. We also have approximately $47.5 million of outstanding debt principal, as of March 31, 2015 that is attributable to our Content & Entertainment and Corporate segments.

CONTENT & ENTERTAINMENT

Content Distribution and our OTT Entertainment Channels and Applications

Cinedigm Entertainment Group, or CEG, is a leading independent content distributor in the United States as well as an innovator and leader in the quickly evolving OTT digital network business. We are unique among most independent distributors because of our direct relationships with thousands of physical retail locations and digital platforms, including Walmart, Target, iTunes, Netflix and Amazon, as well as the national Video on Demand platforms. Our library of films and television episodes encompass award-winning documentaries from Docurama Films®, next-gen Indies from Flatiron Film Company®, acclaimed independent films and festival picks through partnerships with the Sundance Institute and Tribeca Films, and a wide range of content from brand name suppliers, including National Geographic, Discovery, Scholastic, NFL, Shout! Factory, Hallmark and Jim Henson.

Additionally, we are leveraging our infrastructure, technology, content and distribution expertise to rapidly and cost effectively build and expand our OTT digital network business. Our first channel, Docurama, launched in May 2014 as an advertising-supported video on demand service ("AVOD") across most Internet connected devices and now contains nearly 800 documentary films for download. In March 2015, Wizard World, Inc. and we launched CONtv, a targeted lifestyle channel and "Freemium" service with both AVOD and subscription video on demand offerings ("SVOD"). Our Freemium business model provides users with free content and the ability to upgrade to a selection of premium services by paying subscription fees. CONtv is one of the largest Freemium OTT channels available in terms of hours of content, with thousands of hours of content, including original programs and behind the scenes footage direct from Wizard World Comic Con gatherings. Docurama and CONtv are available across most major platforms, including Apple iOS, Google Android, Roku players and TV, Samsung SmartHub devices and we expect more devices to come to market. In the fall of 2015, we expect to introduce our third OTT channel, Dove Entertainment Channel, which will be a freemium service targeted to families and kids seeking high quality and family friendly content approved by the Dove Foundation. In early 2015, we also announced a partnership with TV4 Entertainment to diversify our OTT offerings and we continue to search for other branded partners to launch additional channels.

CEG has focused its activities in the areas of: (1) ancillary market aggregation and distribution of entertainment content, and (2) branded and curated over-the-top OTT digital network business providing entertainment channels and applications. With these complementary entertainment distribution capabilities, we believe that we are capitalizing on the key drivers of value that we believe are critical to success in content distribution going forward.

In April 2012, we acquired New Video Group, Inc. ("New Video"), an independent home entertainment distributor of quality packaged and digital content that provided distribution services in the DVD, Blu-ray, Digital and VOD channels for more than 500 independent rights holders.

In October 2013, we acquired a division of Gaiam Americas, Inc. and Gaiam, Inc. (together, “Gaiam”) that maintained exclusive distribution rights agreements with large independent studios/content providers, and distributed entertainment content through home video, digital and television distribution channels (“GVE” or the “GVE Acquisition”).

Our acquisitions of New Video and GVE have made our CEG segment one of the leading independent content distributors in the United States, holding direct relationships with thousands of physical storefronts and digital retailers, including Walmart, Target, iTunes, Netflix, and Amazon, as well as all the national cable and satellite television VOD platforms.

Our Strategy

Direct to consumer digital distribution of film and television content over the Internet is rapidly growing. We believe that our large library of film and television episodes, long-standing digital relationships with platforms, and up-to-date technologies, will allow us to build and successfully launch a diversified portfolio of narrowcast OTT channels that generate recurring revenue streams from advertising, merchandising and subscriptions. We plan to launch niche channels that make use of our existing library of titles, while partnering with strong brands that bring name recognition, marketing support and an existing customer base.

Rapid changes in the entertainment landscape require that we continually refine our strategy to adapt to new technologies and consumer behaviors. For example, we have shifted our acquisitions of home entertainment content to focus on long-term partnerships with producers of high quality, cast-driven, genre content, rather than traditional catalog based titles. In fiscal year 2015, we acquired the distribution rights to a variety of new and original films. In addition, we have accelerated our efforts to be a leader in the OTT digital network business, where we can leverage our existing infrastructure and library, in partnership with well-known brands, to distribute our content direct-to-consumers.

To market the films that we distribute, we have the films appear in a limited number of theatres, while simultaneously being available on VOD. This non-traditional, film-releasing model has allowed us to maximize publicity and make the film available to a large national audience.

We believe that we are well positioned to succeed in the OTT channel business for several key reasons:

| |

• | The enormous depth and breadth of our almost 50,000 title film and television episode library, |

| |

• | Our digital assets and deep, long-standing relationships as launch partners that cover the major digital platforms and devices, |

| |

• | Our marketing expertise, |

| |

• | Our flexible releasing strategies, which differ from larger entertainment companies that need to protect their legacy businesses, and |

| |

• | Our strengthened capital base |

Intellectual Property

We own certain copyrights, trademarks and Internet domain names in connection with the Content & Entertainment business. We view these proprietary rights as valuable assets. We maintain registrations, where appropriate, to protect them and monitor them on an ongoing basis.

Customers

For the fiscal year ended March 31, 2015, two customers, Walmart and Amazon, represented 10% or more of CEG's revenues and one of these customers represented approximately 12% of our consolidated revenues.

Competition

Numerous companies are engaged in various forms of producing and distributing independent movies and alternative content. These competitors may have significantly greater financial, marketing and managerial resources than we do, may have generated greater revenue and may be better known than we are at this time.

Competitors to our Content & Entertainment segment are as follows:

| |

• | Anchor Bay Entertainment |

| |

• | Entertainment One (eOne) Ltd. |

| |

• | Image Entertainment, Inc. |

| |

• | Lions Gate Entertainment |

| |

• | Roadside Attractions LLC |

DEPLOYMENT

Our Phase I Deployment and Phase II Deployment segments consist of the following:

|

| | |

Operations of: | | Products and services provided: |

Cinedigm Digital Funding I, LLC (“Phase 1 DC”) | | Financing vehicles and administrators for our 3,724 Systems installed nationwide in Phase 1 DC's deployment to theatrical exhibitors, for which we retain ownership of the Systems and the residual cash flows related to the Systems after the repayment of all non-recourse debt at the expiration of exhibitor, master license agreements.

|

Access Digital Cinema Phase 2 Corp. (“Phase 2 DC”) | | Financing vehicles and administrators for our 8,904 Systems installed in the second digital cinema deployment and international deployments, through Phase 2 DC. We retain no ownership of the residual cash flows and digital cinema equipment after the completion of cost recoupment and at the expiration of the exhibitor master license agreements. |

In June 2005, we formed our Phase I Deployment segment in order to purchase up to 4,000 Systems under an amended framework agreement with Christie Digital Systems USA, Inc. (“Christie”). As of March 31, 2015, Phase I Deployment had 3,724 Systems installed.

In October 2007, we formed our Phase II Deployment segment for the administration of up to 10,000 additional Systems. As of March 31, 2015, Phase II Deployment had 8,904 of such Systems installed.

Our Phase I Deployment and Phase II Deployment segments own and license Systems to theatrical exhibitors and collect virtual print fees ("VPFs") from motion picture studios and distributors, as well as alternative content fees ("ACFs") from alternative content providers and theatrical exhibitors, when content is shown on exhibitors' screens. We have licensed the necessary software and technology solutions to the exhibitor and have facilitated the industry's transition from analog (film) to digital cinema. As part of the Phase I Deployment of our Systems, we have agreements with nine motion picture studios and certain smaller independent studios and exhibitors, allowing us to collect VPFs and ACFs when content is shown in theatres, in exchange for having facilitated and financed the deployment of Systems. Phase 1 DC has agreements with sixteen theatrical exhibitors that license our Systems in order to show digital content distributed by the motion picture studios and other providers, including Content & Entertainment, which is described below.

Our Phase II Deployment segment has entered into digital cinema deployment agreements with eight motion picture studios, and certain smaller independent studios and exhibitors, to distribute digital movie releases to exhibitors equipped with our Systems, for which we and our wholly owned, non-consolidated subsidiary Cinedigm Digital Funding 2, LLC ("CDF2 Holdings") earn VPFs. As of March 31, 2015, our Phase II Deployment segment also entered into master license agreements with 434 exhibitors and CDF2 covering 8,992 screens, whereby the exhibitors agreed to install our Systems. As of March 31, 2015, we had 8,904 Phase 2 DC Systems installed, including 6,414 screens under the exhibitor-buyer structure ("Exhibitor-Buyer Structure"), 1,046 screens covering 10 exhibitors through non-recourse financing provided by KBC Bank NV (“KBC”), 1,421 screens covering 179 exhibitors through CDF2, and 23 screens under other arrangements with two exhibitors.

Exhibitors paid us an installation fee of up to $2.0 thousand per screen out of the VPFs collected by our Services segment. We manage the billing and collection of VPFs and remit to exhibitors all VPFs collected, less an administrative fee of approximately 10%. For Phase 2 DC Systems we own and finance on a non-recourse basis, we typically received a similar installation fee of up to $2.0 thousand and an ongoing administrative fee of approximately 10% of VPFs collected. We have recorded no debt, property and equipment, financing costs or depreciation in connection with Systems covered under the Exhibitor-Buyer Structure and CDF2 Holdings.

VPFs are earned pursuant to contracts with movie studios and distributors, whereby amounts are payable to our Phase I and Phase II deployment businesses according to fixed fee schedules, when movies distributed by studios are displayed in movie theatres using our installed Systems. One VPF is payable to us upon the initial booking of a movie, for every movie title displayed per System. Therefore, the amount of VPF revenue that we earn depends on the number of unique movie titles released and displayed using our Systems. Our Phase II Deployment segment earns VPF revenues only for Systems that it owns.

Our Phase II Deployment agreements with distributors require payment of VPFs for ten years from the date that each system is installed; however, we may no longer collect VPFs once “cost recoupment”, as defined in the contracts with movie studios and distributors, is achieved. Cost recoupment will occur once the cumulative VPFs and other cash receipts collected by us have equaled the total of all cash outflows, including the purchase price of all Systems, all financing costs, all “overhead and ongoing costs”, as defined, subject to maximum agreed upon amounts during the four-year roll-out period and thereafter. Furthermore, if

cost recoupment occurs before the end of the eighth contract year, a one-time “cost recoupment bonus” is payable to us by the studios. Cash flows, net of expenses, received by our Phase II Deployment business, following the achievement of cost recoupment, must be returned to the distributors on a pro-rata basis. At this time, we cannot estimate the timing or probability of the achievement of cost recoupment.

Customers

Phase I and Phase II Deployment customers are mainly motion picture studios and theatrical exhibitors. For the fiscal year ended March 31, 2015, six customers, 20th Century Fox, Warner Brothers, Disney Worldwide Services, Universal Pictures, Sony Pictures Releasing Corporation and Lions Gate Entertainment, each represented 10% or more of Phase 1 DC's revenues and together generated 69%, 71% and 35% of Phase 1 DC's, Phase 2 DC's and consolidated revenues, respectively. No single Phase 1 DC or Phase 2 DC customer comprised more than 10% of our consolidated accounts receivable. We expect to continue to conduct business with each of these customers during the fiscal year ending March 31, 2016.

Seasonality

Revenues earned by our Phase I and Phase II Deployment segments from the collection of VPFs from motion picture studios are seasonal, coinciding with the timing of releases of movies by the motion picture studios. Generally, motion picture studios release the most marketable movies during the summer and the winter holiday season. The unexpected emergence of a hit movie during other periods can alter the traditional trend. The timing of movie releases can have a significant effect on our results of operations, and the results of one quarter are not necessarily indicative of results for the next quarter or any other quarter. The seasonality of motion picture exhibition; however, has become less pronounced as the motion picture studios are releasing movies somewhat more evenly throughout the year.

SERVICES

Our Services segment provides monitoring, billing, collection, verification and other management services to Phase 1 DC and Phase 2 DC as well as to exhibitor-buyers who purchase their own equipment. Our Services segment provides such services to the 3,724 screens in the Phase 1 Deployment for a monthly service fee equal to 5% of the VPFs earned by Phase 1 DC and an incentive service fee equal to 2.5% of the VPFs earned by Phase 1 DC. The Services segment also provides services to the 8,904 Phase 2 Systems deployed, for which we typically receive a monthly fee of approximately 10% of the VPFs earned by Phase 2 DC. The total Phase 2 service fees are subject to an annual limitation under the terms of our agreements with motion picture studios, and are determined based upon the respective Exhibitor-Buyer Structure, KBC or CDF2 agreements. Unpaid services fees in any period remain an obligation to Phase 2 DC in the cost recoupment framework. Such fees are not recognized as income or accrued as an asset on our balance sheet given the uncertainty of the receipt and the timing thereof as future movie release and bookings are not known. Service fees are accrued and recognized only on deployed Phase 2 Systems. As a result, the annual service fee limitation is variable until these fees are paid.

In February 2013, we (i) assigned to our wholly owned subsidiary, Cinedigm DC Holdings LLC (“DC Holdings ”), the right and obligation to service the digital cinema projection systems from the Phase I Deployment and certain systems that were part of the Phase II Deployment, (ii) delegated to DC Holdings the right and obligation to service certain other systems that were part of the Phase II Deployment and (iii) assigned to DC Holdings the right to receive servicing fees from the Phase I and Phase II Deployments. We also transferred to DC Holdings certain of our operational staff whose responsibilities and activities relate solely to the operation of the servicing business and to provide DC Holdings with the right to use the supporting software and other intellectual property associated with the operation of the servicing business.

Our Services segment also has international servicing partnerships in Australia and New Zealand with the Independent Cinema Association of Australia and is currently servicing 530 screens as of March 31, 2015.

Customers

For the fiscal year ended March 31, 2015, no customer comprised more than 10% of Services' revenues or accounts receivable.

Competition

Our Services segment faces limited competition domestically in its digital cinema services business as the major Hollywood movie studios have only signed digital cinema deployment agreements with five entities, including us, and the deployment period in North America is now complete. Competitors include: Digital Cinema Implementation Partners (“DCIP”), a joint venture of three large exhibitors (Regal Entertainment Group, AMC Entertainment Holdings, Inc. and Cinemark Holdings, Inc. focused on

managing the conversions of those three exhibitors; Sony Digital Cinema, to support the deployment of Sony projection equipment; Christie Digital USA, Inc., to support the deployment of Christie equipment; and GDC, Inc., to support the deployment of GDC equipment. We have a significantly greater market share than all other competitors except for the DCIP consortium, which services approximately 16,000 total screens representing its consortium members.

As we expand our servicing platform internationally, an additional competitors beyond those listed above consist of Arts Alliance, Inc., a leading digital cinema servicer focused on the European markets, GDC, as well as other potential local start-ups seeking to service a specific international market. We typically seek to partner with a leading local entity to combine our efficient servicing infrastructure and strong studio relationships with the necessary local market expertise and exhibitor relationships.

DISCONTINUED OPERATIONS

During the fiscal year ended March 31, 2014, we made the strategic decision to discontinue and exit our software business, Hollywood Software, Inc. d/b/a Cinedigm Software (“Software”), our direct, wholly owned subsidiary, in order to focus on our CEG segment. Furthermore, we believe that Software, which was previously included in our Services segment, no longer complemented our continuing operations because we were often in competition with Software customers.

On September 23, 2014, we completed the sale of Software to a third party. See Note 1 - Nature of Operations and Note 3 - Discontinued Operations to the Consolidated Financial Statements within Item 8, Financial Statements and Supplementary Data for further information.

ENVIRONMENTAL

The nature of our business does not subject us to environmental laws in any material manner.

EMPLOYEES

As of March 31, 2015, we had 141 employees, with 14 part-time and 127 full-time, of which 33 are in sales and marketing, 43 are in operations, and 51 are in executive, finance, technology and administration functions.

AVAILABLE INFORMATION

Our Internet website address is www.cinedigm.com. We will make available, free of charge at the “About Us - Investor Relations - Financial Information” section of its website, our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, proxy statements and all amendments to those reports and statements filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended, as soon as reasonably practicable after such reports are electronically filed with, or furnished to, the SEC.

In addition, the SEC maintains a website that contains reports, proxy and information statements, and other information regarding companies that file electronically with the Commission. This information is available at www.sec.gov, the SEC's Public Reference Room at 100 F Street, NE, Washington, DC 20549 or by calling 1-800-SEC-0330.

ITEM 1A. RISK FACTORS

Risks Related to our Business

An inability to obtain necessary financing may have a material adverse effect on our financial position, operations and prospects if unanticipated capital needs arise.

Our capital requirements may vary significantly from what we currently project and be affected by unforeseen delays and expenses. We may experience problems, delays, expenses and difficulties frequently encountered by similarly situated companies, as well as difficulties as a result of changes in economic, regulatory or competitive conditions. If we encounter any of these problems or difficulties or have underestimated our operating losses or capital requirements, we may require significantly more financing than we currently anticipate. We cannot assure you that we will be able to obtain any required additional financing on terms acceptable to us, if at all. An inability to obtain necessary financing could have a material adverse effect on our financial position, operations and prospects.

Our credit agreement (the “Cinedigm Credit Agreement”) with Société Générale (“SG”) and certain other lenders contains a debt service, coverage ratio test and a $5.0 million minimum liquidity covenant. The Cinedigm Credit Agreement is with full recourse to us.

Our Phase I credit agreement (the “Phase I Credit Agreement”) with SG and certain other lenders contains certain restrictive covenants that restrict our indirect subsidiary, Cinedigm Digital Funding I, LLC (“CDF I”) and its subsidiaries from, among other things, (with certain specified exceptions) making certain capital expenditures, incurring other indebtedness or liens, engaging in a new line of business, selling certain assets, acquiring, consolidating with, or merging with or into other companies and entering into transactions with affiliates. The Phase I Credit Agreement is non-recourse to Cinedigm and our other subsidiaries.

In February 2013, Cinedigm DC Holdings LLC (“DC Holdings LLC”), our wholly owned subsidiary to which we transferred our business of servicing digital cinema projection systems, entered into a term loan agreement (the “Prospect Loan”) with Prospect Capital Corporation (“Prospect”) which restricts DC Holdings LLC and its subsidiaries (including CDF I) from, among other things, (with certain specified exceptions) making certain capital expenditures, incurring other indebtedness or liens, engaging in a new line of business, selling certain assets, acquiring, consolidating with, or merging with or into other companies and entering into transactions with affiliates. The Prospect Loan is non-recourse to Cinedigm and our other subsidiaries, except for Access DM (which is a wholly owned subsidiary of DC Holdings LLC) and Access Digital Cinema Phase 2, Corp. (“ADCP2”), each of which guaranteed the obligations of DC Holdings LLC to Prospect. In addition, Cinedigm provided a limited recourse guaranty pursuant to which Cinedigm guaranteed certain representations and warranties and performance obligations with respect to the Prospect Loan in favor of the collateral agent and the administrative agent for the Prospect Loan.

Our indirect subsidiary, Phase 2 B/AIX has entered into several credit agreements (the “KBC Agreements”) with KBC pursuant to which KBC has financed the acquisition of digital cinema projection systems purchased from Barco, Inc. to be installed at various theatre locations. The KBC Agreements are non-recourse to us and our subsidiaries other than Phase 2 B/AIX and are consolidated by us similarly to CDF I. The KBC Agreements restrict Phase 2 B/AIX from, among other things, (with certain specified exceptions) incurring liens, disposing of certain assets outside the ordinary course of business, merging or consolidating with other entities, changing its line of business and making payments (including dividends) to affiliates. In October 2011, we began earning fees under a management services agreement with CDF2 Holdings, an indirect wholly owned, non-consolidated variable interest entity that is intended to be a special purpose, bankruptcy remote entity, and CDF2, a wholly owned subsidiary of CDF2 Holdings. The revenues under this management service agreement were assigned to DC Holdings LLC as of February 28, 2013. CDF2 financed certain digital systems under its credit agreement with SG and certain other lenders (the “Phase II Credit Agreement”). The Phase II Credit Agreement contains certain restrictive covenants that restrict CDF2 Holdings, CDF2 and their subsidiaries from, among other things, (with certain specified exceptions) making certain capital expenditures, incurring other indebtedness or liens, engaging in a new line of business, selling certain assets, acquiring, consolidating with, or merging with or into other companies and entering into transactions with affiliates. The Phase II Credit Agreement is non-recourse to us and our other subsidiaries. The digital cinema projection systems that CDF2 partially finances by borrowing under the Phase II Credit Agreement are acquired directly from the manufacturers and are sold to and leased back by CDF2 Holdings from CHG-Meridian U.S. Finance, Ltd. (“CHG”) pursuant to a Master Lease Agreement and related documents (the “CHG Lease”). The CHG Lease contains certain restrictive covenants that restrict CDF2 Holdings from, among other things, (with certain specified exceptions) incurring liens on the leased digital cinema systems and from subleasing, assigning, modifying or altering such systems. The CHG Lease is non-recourse to us and our other subsidiaries. CDF2 Holdings is not consolidated by us, as we do not exercise control over CDF2 Holdings. CDF2 Holdings is managed and controlled exclusively by the three managers, including, a third party, which also has a variable interest in CDF2 Holdings, along with an independent third party manager, that must approve, among other

things, the annual operating budget and capital budget, engaging in new business or activities and certain transactions that significantly impact CDF2 Holdings’ economic performance. Our risk is limited to our initial investment and revenues that could be earned under the management services agreement (which revenues have, as mentioned above, been assigned to DC Holdings LLC), and constitutes part of the non-recourse debt.

We face the risks of doing business in new and rapidly evolving markets and may not be able successfully to address such risks and achieve acceptable levels of success or profits.

We have encountered and may continue to encounter the challenges, uncertainties and difficulties frequently experienced in new and rapidly evolving markets, including:

| |

• | limited operating experience; |

| |

• | lack of sufficient customers or loss of significant customers; |

| |

• | a changing business focus; and |

| |

• | difficulties in managing potentially rapid growth. |

We expect competition to be intense. If we are unable to compete successfully, our business and results of operations will be seriously harmed.

The markets for the digital cinema business and the content distribution business are competitive, evolving and subject to rapid technological and other changes. We expect the intensity of competition in each of these areas to increase in the future. Companies willing to expend the necessary capital to create facilities and/or capabilities similar to ours may compete with our business. Increased competition may result in reduced revenues and/or margins and loss of market share, any of which could seriously harm our business. In order to compete effectively in each of these fields, we must differentiate ourselves from competitors.

Many of our current and potential competitors have longer operating histories and greater financial, technical, marketing and other resources than we do, which may permit them to adopt aggressive pricing policies. As a result, we may suffer from pricing pressures that could adversely affect our ability to generate revenues and our results of operations. Many of our competitors also have significantly greater name and brand recognition and a larger customer base than us. If we are unable to compete successfully, our business and results of operations will be seriously harmed.

Our plan to acquire additional businesses involves risks, including our inability to complete an acquisition successfully, our assumption of liabilities, dilution of your investment and significant costs.

Strategic and financially appropriate acquisitions are a key component of our growth strategy. Although there are no other acquisitions identified by us as probable at this time, we may make further acquisitions of similar or complementary businesses or assets. Even if we identify appropriate acquisition candidates, we may be unable to negotiate successfully the terms of the acquisitions, finance them, integrate the acquired business into our then existing business and/or attract and retain customers. Completing an acquisition and integrating an acquired business may require a significant diversion of management time and resources and involves assuming new liabilities. Any acquisition also involves the risks that the assets acquired may prove less valuable than expected and/or that we may assume unknown or unexpected liabilities, costs and problems. If we make one or more significant acquisitions in which the consideration consists of our capital stock, your equity interest in the Company could be diluted, perhaps significantly. If we were to proceed with one or more significant acquisitions in which the consideration included cash, we could be required to use a substantial portion of our available cash, or obtain additional financing to consummate them.

Our previous acquisitions involve risks, including our inability to integrate successfully the new businesses and our assumption of certain liabilities.

Our acquisition of these businesses and their respective assets also involved the risks that the businesses and assets acquired may prove to be less valuable than we expected and/or that we may assume unknown or unexpected liabilities, costs and problems. In addition, we assumed certain liabilities in connection with these acquisitions and we cannot assure you that we will be able to satisfy adequately such assumed liabilities. Other companies that offer similar products and services may be able to market and sell their products and services more cost-effectively than we can.

We have recorded goodwill impairment charges and may be required to record additional charges to future earnings if our goodwill becomes further impaired or our intangible assets become impaired.

We are required under generally accepted accounting principles to review our goodwill and definite-lived intangible assets for impairment when events or changes in circumstances indicate the carrying value may not be recoverable. Goodwill must be tested for impairment at least annually. Factors that may be considered a change in circumstances indicating that the carrying value of our reporting units and intangible assets may not be recoverable include a decline in stock price and market capitalization, slower growth rates in our industry or our own operations, and/or other materially adverse events that have implications on the profitability of our business. In the fourth quarter of the fiscal year ended March 31, 2015, we recorded a goodwill impairment charge of $6.0 million in our Content & Entertainment operating segment. See Note 2 - Summary of Significant Accounting Policies of our financial statements included in Item 8 of this Annual Report on Form 10-K for details. We may be required to record additional charges to earnings during any period in which a further impairment of our goodwill or other intangible assets is determined which could adversely affect our results of operations.

If we do not manage our growth, our business will be harmed.

We may not be successful in managing our growth. Past growth has placed, and future growth will continue to place, significant challenges on our management and resources, related to the successful integration of the newly acquired businesses. To manage the expected growth of our operations, we will need to improve our existing, and implement new, operational and financial systems, procedures and controls. We may also need to expand our finance, administrative, client services and operations staffs and train and manage our growing employee base effectively. Our current and planned personnel, systems, procedures and controls may not be adequate to support our future operations. Our business, results of operations and financial position will suffer if we do not effectively manage our growth.

If we are not successful in protecting our intellectual property, our business will suffer.

We depend heavily on technology to operate our business. Our success depends on protecting our intellectual property, which is one of our most important assets. We have intellectual property consisting of:

| |

• | rights to certain domain names; |

| |

• | registered service marks on certain names and phrases; |

| |

• | various unregistered trademarks and service marks; |

| |

• | rights to certain logos. |

If we do not adequately protect our intellectual property, our business, financial position and results of operations would be harmed. Our means of protecting our intellectual property may not be adequate. Unauthorized parties may attempt to copy aspects of our intellectual property or to obtain and use information that we regard as proprietary. In addition, competitors may be able to devise methods of competing with our business that are not covered by our intellectual property. Our competitors may independently develop similar technology, duplicate our technology or design around any intellectual property that we may obtain.

Although we hold rights to various web domain names, regulatory bodies in the United States and abroad could establish additional top-level domains, appoint additional domain name registrars or modify the requirements for holding domain names. The relationship between regulations governing domain names and laws protecting trademarks and similar proprietary rights is unclear. We may be unable to prevent third parties from acquiring domain names that are similar to or diminish the value of our proprietary rights.

Our substantial debt and lease obligations could impair our financial flexibility and restrict our business significantly.

We now have, and will continue to have, significant debt obligations. In October 2013, we entered into the Cinedigm Credit Agreement pursuant to which we borrowed Term Loans in the aggregate amount of $25.0 million and may borrow revolving loans and have letters of credit issued in an aggregate amount at any one time outstanding not to exceed $30.0 million. In April 2015, we repaid and terminated the term loan in its entirety. The obligations under the Cinedigm Credit Agreement, as amended and restated, are with full recourse to Cinedigm. As of March 31, 2015, principal amount outstanding under the Cinedigm Credit Agreement was $18.2 million. Additionally, in October 2013, we issued $5.0 million aggregate principal amount of subordinated notes (the “2013 Notes”), which debt is unsecured and subordinate to the debt under the Cinedigm Credit Agreement. In April 2015, Cinedigm issued $64.0 million aggregate principal amount of 5.5% Convertible Senior Notes due 2035 (the “Convertible Notes”), which debt is unsecured, subordinate to the debt under the Cinedigm Credit Agreement and senior to the 2013 Notes.

As of March 31, 2015, total indebtedness of our consolidated subsidiaries (not including guarantees of our debt) was $157.3 million, none of which is guaranteed by Cinedigm Corp. or our subsidiaries, other than CDF I with respect to the Phase I Credit Agreement, DC Holdings LLC, AccessDM and ADCP2 with respect to the Prospect Loan, Phase 2 B/AIX with respect to the KBC Agreements. In connection with the Prospect Loan, we provided a limited recourse guaranty pursuant to which Cinedigm guaranteed certain representations and warranties and performance obligations with respect to the Prospect Loan in favor of the collateral agent and the administrative agent for the Prospect Loan. Cinedigm Corp. has provided a limited recourse guaranty in respect of a portion of this indebtedness ($68.0 million as of March 31, 2015) pursuant to which it agreed to become a primary obligor of such indebtedness in certain specified circumstances, none of which have occurred as of the date hereof.

We also had capital lease obligations covering a facility and computer equipment with an aggregate principal amount of $5.5 million as of March 31, 2015. In May 2011,we completed the sale of certain assets and liabilities of the Pavilion Theatre and from that point forward, it has not been operated by us. We have remained the primary obligor on the Pavilion capital lease and therefore, the capital lease obligation and the related assets under the capital lease continue to remain on our Consolidated Balance Sheets as of March 31, 2015 and 2014. However, we have entered into a sub-lease agreement with the unrelated third party purchaser that makes all payments related to the lease and as such, we have no continuing involvement in the operation of the Pavilion Theatre.

In February 2013, DC Holdings LLC, our wholly owned subsidiary, entered into the Prospect Loan in the aggregate principal amount of $70.0 million. Additionally, in February 2013, CDF I, our indirect wholly owned subsidiary that is intended to be a special purpose, bankruptcy remote entity, amended and restated the Phase I Credit Agreement, pursuant to which it borrowed $130.0 million of which $5.0 million was assigned to DC Holding LLC. Phase 2 B/AIX, our indirect wholly owned subsidiary, has entered into the KBC Agreements pursuant to which it has borrowed $65.3 million in the aggregate. As of March 31, 2015, the outstanding principal balance under the KBC Agreements was $27.0 million in the aggregate.

The obligations and restrictions under the Cinedigm Credit Agreement, the Phase I Credit Agreement, the Prospect Loan, the KBC Agreements and our other debt obligations could have important consequences for us, including:

| |

• | limiting our ability to obtain necessary financing in the future; and |

| |

• | requiring us to dedicate a substantial portion of our cash flow to payments on our debt obligations, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other corporate requirements or expansion of our business. |

CDF2 and CDF2 Holdings are our indirect wholly owned, non-consolidated VIEs that are intended to be special purpose, bankruptcy remote entities. CDF2 has entered into the Phase II Credit Agreement, pursuant to which it borrowed $63.2 million in the aggregate. As of March 31, 2015, the outstanding balance under the Phase II Credit Agreement, which includes interest payable, was $44.4 million. CDF2 Holdings has entered into the CHG Lease pursuant to which CHG provided sale/leaseback financing for digital cinema projection systems that were partially financed by the Phase II Credit Agreement in an amount of approximately $57.2 million in the aggregate. These facilities are non-recourse to Cinedigm and our subsidiaries, excluding our VIE, CDF2 and CDF2 Holdings, as the case may be. Although the Phase II financing arrangements undertaken by CDF2 and CDF2 Holdings are important to us with respect to the success of our Phase II Deployment, our financial exposure related to the debt of CDF2 and CDF2 Holdings is limited to the $2.0 million initial investment it made into CDF2 and CDF2 Holdings. CDF2 Holding’s total stockholder’s deficit at March 31, 2015 was $6.7 million. We have no obligation to fund the operating loss or the deficit beyond its initial investment, and accordingly, we carried our investment in CDF2 Holdings at $0.

The obligations and restrictions under the Phase II Credit Agreement and the CHG Lease could have important consequences for CDF2 and CDF2 Holdings, including:

| |

• | Limiting our ability to obtain necessary financing in the future; and |

| |

• | requiring them to dedicate a substantial portion of their cash flow to payments on their debt obligations, thereby reducing the availability of their cash flow for other uses. |

If we are unable to meet our lease and debt obligations, we could be forced to restructure or refinance our obligations, to seek additional equity financing or to sell assets, which we may not be able to do on satisfactory terms or at all. As a result, we could default on those obligations and in the event of such default, our lenders could accelerate our debt or take other actions that could restrict our operations.

The foregoing risks would be intensified to the extent we borrow additional money or incur additional debt.

The agreements governing the financing of our Phase I Deployment and part of our Phase II Deployment, the Cinedigm Credit Agreement and the Prospect Loan impose certain limitations on us.

The Cinedigm Credit Agreement restricts our ability and the ability of our subsidiaries that have guaranteed the obligations under the Cinedigm Credit Agreement, subject to certain exceptions, to, among other things:

| |

• | make certain capital expenditures and investments; |

| |

• | incur other indebtedness or liens; |

| |

• | create or acquire subsidiaries which do not guarantee the obligations or foreign subsidiaries; |

| |

• | engage in a new line of business; |

| |

• | amend certain agreements; |

| |

• | acquire, consolidate with, or merge with or into other companies; and |

| |

• | enter into transactions with affiliates. |

The Phase I Credit Agreement governing the financing of our Phase I Deployment restricts the ability of CDF I and its existing and future subsidiaries to, among other things:

| |

• | make certain capital expenditures and investments; |

| |

• | incur other indebtedness or liens; |

| |

• | engage in a new line of business; |

| |

• | acquire, consolidate with, or merge with or into other companies; and |

| |

• | enter into transactions with affiliates. |

One or more of the KBC Agreements governing part of the financing of our Phase II Deployment restrict the ability of Phase 2 B/AIX to, among other things:

| |

• | dispose of or incur other liens on the digital cinema projection systems financed by KBC; |

| |

• | engage in a new line of business; |

| |

• | sell assets outside the ordinary course of business or on other than arm’s length terms; |

| |

• | make payments to majority owned affiliated companies; and |

| |

• | consolidate with, or merge with or into other companies. |

The agreements governing the Prospect Loan restrict the ability of DC Holdings LLC and its subsidiaries, subject to certain exceptions, to, among other things:

| |

• | make certain capital expenditures and investments; |

| |

• | incur other indebtedness or liens; |

| |

• | engage in a new line of business; |

| |

• | acquire, consolidate with, or merge with or into other companies; and |

| |

• | enter into transactions with affiliates. |

The agreements governing the financing of other parts of our Phase II Deployment impose certain limitations, which may affect our Phase 2 deployment.

The Phase II Credit Agreement governing part of the financing of part of our Phase II Deployment that has not been financed by the KBC Agreements restricts the ability of CDF2, CDF2 Holdings and their existing and future subsidiaries to, among other things:

| |

• | make certain capital expenditures and investments; |

| |

• | incur other indebtedness or liens; |

| |

• | engage in a new line of business; |

| |

• | acquire, consolidate with, or merge with or into other companies; and |

| |

• | enter into transactions with affiliates. |

The CHG Lease governing part of the financing of part of our Phase II Deployment restricts the ability of CDF2 Holdings to, among other things:

| |

• | incur liens on the digital cinema projection systems financed; and |

| |

• | sublease, assign or modify the digital cinema projection systems financed. |

We may not be able to generate the amount of cash needed to fund our future operations.

Our ability either to make payments on or to refinance our indebtedness, or to fund planned capital expenditures and research and development efforts, will depend on our ability to generate cash in the future. Our ability to generate cash is in part subject to general economic, financial, competitive, regulatory and other factors that are beyond our control.

Based on our current level of operations, we believe our cash flow from operations, available borrowings and loan and credit agreement terms will be adequate to meet our future liquidity needs through at least March 31, 2016. Significant assumptions underlie this belief, including, among other things, that there will be no material adverse developments in our business, liquidity or capital requirements. If we are unable to service our indebtedness, we will be forced to adopt an alternative strategy that may include actions such as:

| |

• | reducing capital expenditures; |

| |

• | reducing research and development efforts; |

| |

• | restructuring or refinancing our remaining indebtedness; and |

| |

• | seeking additional funding. |

We cannot assure you, however, that our business will generate sufficient cash flow from operations, or that we will be able to make future borrowings in amounts sufficient to enable us to pay the principal and interest on our current indebtedness or to fund our other liquidity needs. We may need to refinance all or a portion of our indebtedness on or before maturity. We cannot assure you that we will be able to refinance any of our indebtedness on commercially reasonable terms or at all.

We have incurred losses since our inception.

We have incurred losses since our inception in March 2000 and have financed our operations principally through equity investments and borrowings. As of March 31, 2015, we had negative working capital, defined as current assets less current liabilities, of $30.9 million, and cash and cash equivalents and restricted cash totaling $25.8 million; we had an accumulated deficit of $19.1 million; however, during the fiscal year ended March 31, 2015, we generated $9.2 million of net cash from operating activities.

Our net losses and cash outflows may increase as and to the extent that we increase the size of our business operations, increase our sales and marketing activities, increase our content distribution rights acquisition activities, enlarge our customer support and professional services and acquire additional businesses. These efforts may prove to be more expensive than we currently anticipate which could further increase our losses. We must continue to increase our revenues in order to become profitable. We cannot reliably predict when, or if, we will become profitable. Even if we achieve profitability, we may not be able to sustain it. If we cannot generate operating income or positive cash flows in the future, we will be unable to meet our working capital requirements.

Many of our corporate actions may be controlled by our officers, directors and principal stockholders; these actions may benefit these principal stockholders more than our other stockholders.

As of March 31, 2015, our directors, executive officers and principal stockholders, those known by us to beneficially own more than 5% of the outstanding shares of the Class A common stock, beneficially own, directly or indirectly, in the aggregate, approximately 27.1% of our outstanding Class A common stock. In particular, Chris McGurk, our Chairman and Chief Executive Officer, owns 367,400 shares of Class A common stock and has stock options to purchase 6,000,000 shares of Class A common stock, of which 5,000,000 options are vested and 1,000,000 options vest in equal amounts in March of each of 2016 and 2017. If all the options were exercised, Mr. McGurk would own 6,367,400 shares or approximately 7.6% of the then-outstanding Class A common stock. In addition, an affiliate of Sageview Capital L.P. (“Sageview”) owns 268,687 shares of Class A common stock and warrants to purchase 16,000,000 shares of Class A common stock. If such warrants were exercised, Sageview would own 16,268,687 shares or approximately 17.4% of the then-outstanding Class A common stock. Laura Nisonger Sims, a member of our board of directors, is a principal of Sageview.

These stockholders will have significant influence over our business affairs, with the ability to control matters requiring approval by our security holders, including elections of directors and approvals of mergers or other business combinations. In addition, certain corporate actions directed by our officers may not necessarily inure to the proportional benefit of our other stockholders.

Our success will significantly depend on our ability to hire and retain key personnel.

Our success will depend in significant part upon the continued performance of our senior management personnel and other key technical, sales and creative personnel. We do not currently have significant “key person” life insurance policies for any of our employees. We have entered into employment agreements with four of our top executive officers. If we lose one or more of our key employees, we may not be able to find a suitable replacement(s) and our business and results of operations could be adversely affected. In addition, competition for key employees necessary to create and distribute our entertainment content and software products is intense and may grow in the future. Our future success will also depend upon our ability to hire, train, integrate and retain qualified new employees and our inability to do so may have an adverse impact upon our business, financial condition, operating results, liquidity and prospects for growth.

While we believe we currently have effective internal control over financial reporting, we are required to assess our internal control over financial reporting on an annual basis and any future adverse results from such assessment could result in a loss of investor confidence in our financial reports and have an adverse effect on our stock price.

Section 404 of the Sarbanes-Oxley Act of 2002 and the accompanying rules and regulations promulgated by the SEC to implement it required us to include in our Form 10-K annual reports by our management regarding the effectiveness of our internal control over financial reporting. The report included, among other things, an assessment of the effectiveness of our internal control over financial reporting as of the end of our fiscal year. The assessment did not result in the disclosure of any material weaknesses in our internal control over financial reporting identified by management. During this process, if our management identified one or more material weaknesses in our internal control over financial reporting that cannot be remediated in a timely manner, we would not be unable to assert such internal control as effective. While we currently believe our internal control over financial reporting is effective, the effectiveness of our internal controls in future periods is subject to the risk that our controls may become inadequate because of changes in conditions, and, as a result, the degree of compliance of our internal control over financial reporting with the applicable policies or procedures may deteriorate. If, in the future, we are unable to conclude that our internal control over financial reporting is effective (or if our independent auditors disagree with our conclusion), we could lose investor confidence in the accuracy and completeness of our financial reports, which could have an adverse effect on our stock price.

If we do not respond to future advances in technology and changes in customer demands, our financial position, prospects and results of operations may be adversely affected.

The demand for our Systems and other assets in connection with our digital cinema business (collectively, our “Digital Cinema Assets”) may be affected by future advances in technology and changes in customer demands. We cannot assure you that there will be continued demand for our Digital Cinema Assets. Our profitability depends largely upon the continued use of digital presentations at theatres. Although we have entered into long term agreements with major motion picture studios and independent studios (the “Studio Agreements”), there can be no assurance that these studios will continue to distribute digital content to movie theatres. If the development of digital presentations and changes in the way digital files are delivered does not continue or technology is used that is not compatible with our Systems, there may be no viable market for our Systems and related products. Any reduction in the use of our Systems and related products resulting from the development and deployment of new technology may negatively impact our revenues and the value of our Systems.

The demand for DVD products is declining, and we anticipate that this decline will continue. We anticipate, however, that the distribution of DVD products will continue to generate positive cash flows for the Company. Should a decline in consumer demand be greater than we anticipate, our business could be adversely affected.

We have concentration in our digital cinema business with respect to our major motion picture studio customers, and the loss of one or more of our largest studio customers could have a material adverse effect on us.

Our Studio Agreements account for a significant portion of our revenues within Phase 1 DC and Phase 2 DC. Together these studios generated 69%, 71%, and 35% of Phase 1 DC’s, Phase 2 DC’s and our consolidated revenues, respectively, for the fiscal year ended March 31, 2015.

The Studio Agreements are critical to our business. If some of the Studio Agreements were terminated prior to the end of their terms or found to be unenforceable, or if our Systems are not upgraded or enhanced as necessary, or if we had a material failure of our Systems, it may have a material adverse effect on our revenue, profitability, financial condition and cash flows. The Studio

Agreements also generally provide that the VPF rates and other material terms of the agreements may not be more favorable to one studio as compared to the others.

One content provider represents a significant portion of our Content & Entertainment business.

Our Content & Entertainment business has an exclusive agreement, with one content provider, to distribute certain non-music related video products, in physical format only, the sales of which represent approximately 11% of the segment's revenues. A change in this arrangement, or the failure to renew this agreement when it expires, could have an adverse effect on the Content & Entertainment business.

Termination of the MLAs and MLAAs could damage our revenue and profitability.

The master license agreements with each of our licensed exhibitors (the “MLAs”) are critical to our business as are master license administrative agreements (the “MLAAs”). The MLAs have terms, which expire in 2020 through 2022 and provide the exhibitor with an option to purchase our Systems or to renew for successive one-year periods up to ten years thereafter. The MLAs also require our suppliers to upgrade our Systems when technology necessary for compliance with DCI Specification becomes commercially available and we may determine to enhance the Systems, which may require additional capital expenditures. If any one of the MLAs were terminated prior to the end of its term, not renewed at its expiration or found to be unenforceable, or if our Systems are not upgraded or enhanced as necessary, it would have a material adverse effect on our revenue, profitability, financial condition and cash flows. Additionally, termination of MLAAs could adversely impact our servicing business.

We have concentration in our business with respect to our major licensed exhibitors, and the loss of one or more of our largest exhibitors could have a material adverse effect on us.

Approximately 64% of Phase 1 DC’s Systems and 19% of total systems are under MLA in theatres owned or operated by one large exhibitor. The loss of this exhibitor or another of our major licensed exhibitors could have a negative impact on the aggregate receipt of VPF revenues as a result of the loss of any associated MLAs. Although we do not receive revenues from licensed exhibitors and we have attempted to limit our licenses to only those theatres, which we believe are successful, each MLA with our licensed exhibitors is important, depending on the number of screens, to our business since VPF revenues are generated based on screen turnover at theatres. If the MLA with a significant exhibitor was terminated prior to the end of its term, it would have a material adverse effect on our revenue, profitability, financial condition and cash flows. There can be no guarantee that the MLAs with our licensed exhibitors will not be terminated prior to the end of its term.

An increase in the use of alternative movie distribution channels and other competing forms of entertainment could drive down movie theatre attendance, which, if causing significant theatre closures or a substantial decline in motion picture production, may lead to reductions in our revenues.

Various exhibitor chains, which are our distributors, face competition for patrons from a number of alternative motion picture distribution channels, such as DVD, network and syndicated television, VOD, pay-per-view television and downloading utilizing the Internet. These exhibitor chains also compete with other forms of entertainment competing for patrons’ leisure time and disposable income such as concerts, amusement parks and sporting events. An increase in popularity of these alternative movie distribution channels and competing forms of entertainment could drive down movie theatre attendance and potentially cause certain of our exhibitors to close their theatres for extended periods of time. Significant theatre closures could in turn have a negative impact on the aggregate receipt of our VPF revenues, which in turn may have a material adverse effect on our business and ability to service our debt.

An increase in the use of alternative movie distribution channels could also cause the overall production of motion pictures to decline, which, if substantial, could have an adverse effect on the businesses of the major studios with which we have Studio Agreements. A decline in the businesses of the major studios could in turn force the termination of certain Studio Agreements prior to the end of their terms. The Studio Agreements with each of the major studios are critical to our business, and their early termination may have a material adverse effect on our revenue, profitability, financial condition and cash flows.

Our success depends on external factors in the motion picture and television industry.

Our success depends on the commercial success of movies and television programs, which is unpredictable. Operating in the motion picture and television industry involves a substantial degree of risk. Each movie and television program is an individual artistic work, and inherently unpredictable audience reactions primarily determine commercial success. Generally, the popularity of movies and television programs depends on many factors, including the critical acclaim they receive, the format of their initial release, for example, theatrical or direct-to-video, the actors and other key talent, their genre and their specific subject matter. The

commercial success of movies and television programs also depends upon the quality and acceptance of movies or programs that our competitors release into the marketplace at or near the same time, critical reviews, the availability of alternative forms of entertainment and leisure activities, general economic conditions and other tangible and intangible factors, many of which we do not control and all of which may change. We cannot predict the future effects of these factors with certainty, any of which could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects. In addition, because a movie’s or television program’s performance in ancillary markets, such as home video and pay and free television, is often directly related to its box office performance or television ratings, poor box office results or poor television ratings may negatively affect future revenue streams. Our success will depend on the experience and judgment of our management to select and develop new content acquisition and investment opportunities. We cannot make assurances that movies and television programs will obtain favorable reviews or ratings, will perform well at the box office or in ancillary markets or that broadcasters will license the rights to broadcast any of our television programs in development or renew licenses to broadcast programs in our library. The failure to achieve any of the foregoing could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Our business involves risks of liability claims for media content, which could adversely affect our business, results of operations and financial condition.

As a distributor of media content, we may face potential liability for:

| |

• | copyright or trademark infringement (as discussed above); and |

| |

• | other claims based on the nature and content of the materials distributed. |

These types of claims have been brought, sometimes successfully, against producers and distributors of media content. Any imposition of liability that is not covered by insurance or is in excess of insurance coverage could have a material adverse effect on our business, financial condition, operating results, liquidity and prospects.

Our revenues and earnings are subject to market downturns.

Our revenues and earnings may fluctuate significantly in the future. General economic or other conditions could cause lower than expected revenues and earnings within our digital cinema, technology or content and entertainment businesses. The global economic turmoil of recent years has caused a general tightening in the credit markets, lower levels of liquidity, increases in the rates of default and bankruptcy, an unprecedented level of intervention from the U.S. federal government and other foreign governments, decreased consumer confidence, overall slower economic activity and extreme volatility in credit, equity and fixed income markets. While the ultimate outcome of these events cannot be predicted, a decrease in economic activity in the U.S. or in other regions of the world in which we do business could adversely affect demand for our movies, thus reducing our revenue and earnings. While stabilization has continued, it remains a slow process and the global economy remains subject to volatility. Moreover, financial institution failures may cause us to incur increased expenses or make it more difficult either to financing of any future acquisitions, or financing activities. Any of these factors could have a material adverse effect on our business, results of operations and could result in significant additional dilution to shareholders.

Changes in economic conditions could have a material adverse effect on our business, financial position and results of operations.

Our operations and performance could be influenced by worldwide economic conditions. Uncertainty about current global economic conditions poses a risk as consumers and businesses may postpone spending in response to tighter credit, negative financial news and/or declines in income or asset values, which could have a material negative effect on the demand for the our products and services. Other factors that could influence demand include continuing increases in fuel and other energy costs, conditions in the residential real estate and mortgage markets, labor and healthcare costs, access to credit, consumer confidence, and other macroeconomic factors affecting consumer-spending behavior. These and other economic factors could have a material adverse effect on demand for our products and services and on our financial condition and operating results. Uncertainty about current global economic conditions could also continue to increase the volatility of our stock price.

Changes to existing accounting pronouncements or taxation rules or practices may affect how we conduct our business and affect our reported results of operations.

New accounting pronouncements or tax rules and varying interpretations of accounting pronouncements or taxation practice have occurred and may occur in the future. A change in accounting pronouncements or interpretations or taxation rules or practices can have a significant effect on our reported results and may even affect our reporting of transactions completed before the change is effective. Changes to existing rules and pronouncements, future changes, if any, or the questioning of current practices or interpretations may adversely affect our reported financial results or the way we conduct our business.

We are subject to counterparty risk with respect to a forward stock purchase transaction entered into subsequent to March 31, 2015.