CIDM-06-30-14-10Q

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

x QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal period ended: June 30, 2014

o TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from --- to ---

Commission File Number: 000-31810

___________________________________

Cinedigm Corp.

(Exact name of registrant as specified in its charter)

___________________________________

|

| | |

Delaware | | 22-3720962 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | |

902 Broadway, 9th Floor New York, NY | | 10010 |

(Address of principal executive offices) | | (Zip Code) |

(212) 206-8600

(Registrant’s telephone number, including area code)

|

| | |

Securities registered pursuant to Section 12(b) of the Act: | | |

| | |

Title of each class | | Name of each exchange on which registered |

CLASS A COMMON STOCK, PAR VALUE $0.001 PER SHARE | | NASDAQ GLOBAL MARKET |

| | |

Securities registered pursuant to Section 12(g) of the Act: | | NONE |

|

| |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. | Yes x No o |

| |

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). | Yes x No o |

| |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. | |

|

| | | | |

Large accelerated filer o | Accelerated filer o | Non-accelerated filer o | Smaller reporting company x |

| | (Do not check if a smaller reporting company) | | |

| | | | |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). | Yes o No x |

As of August 11, 2014, 76,774,253 shares of Class A Common Stock, $0.001 par value were outstanding.

CINEDIGM CORP.

TABLE OF CONTENTS

|

| | |

| Page |

PART I -- | FINANCIAL INFORMATION | |

Item 1. | Financial Statements (Unaudited) | |

| Condensed Consolidated Balance Sheets at June 30, 2014 (Unaudited) and March 31, 2014 | |

| Unaudited Condensed Consolidated Statements of Operations for the Three Months ended June 30, 2014 and 2013 | |

| Unaudited Condensed Consolidated Statements of Comprehensive Income for the Three Months ended June 30, 2014 and 2013 | |

| Unaudited Condensed Consolidated Statements of Cash Flows for the Three Months ended June 30, 2014 and 2013 | |

| Notes to Unaudited Condensed Consolidated Financial Statements | |

Item 2. | Management's Discussion and Analysis of Financial Condition and Results of Operations | |

Item 4. | Controls and Procedures | |

PART II -- | OTHER INFORMATION | |

Item 1. | Legal Proceedings | |

Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

Item 3. | Defaults Upon Senior Securities | |

Item 4. | Mine Safety Disclosures | |

Item 5. | Other Information | |

Item 6. | Exhibits | |

Signatures | | |

Exhibit Index | | |

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS (UNAUDITED)

CINEDIGM CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share and per share data)

|

| | | | | | | |

| June 30, 2014 | | March 31, 2014 |

ASSETS | (Unaudited) | | |

Current assets | | | |

Cash and cash equivalents | $ | 36,742 |

| | $ | 50,215 |

|

Accounts receivable, net | 37,506 |

| | 56,863 |

|

Inventory | 2,870 |

| | 3,164 |

|

Unbilled revenue | 5,122 |

| | 5,144 |

|

Prepaid and other current assets | 8,392 |

| | 8,698 |

|

Note receivable, current portion | 101 |

| | 112 |

|

Assets of discontinued operations, net of current liabilities | — |

| | 278 |

|

Total current assets | 90,733 |

| | 124,474 |

|

Restricted cash | 6,751 |

| | 6,751 |

|

Security deposits | 269 |

| | 269 |

|

Property and equipment, net | 125,642 |

| | 134,936 |

|

Intangible assets, net | 35,757 |

| | 37,639 |

|

Goodwill | 27,944 |

| | 25,494 |

|

Deferred costs, net | 8,618 |

| | 9,279 |

|

Accounts receivable, long-term | 1,343 |

| | 1,397 |

|

Note receivable, net of current portion | 91 |

| | 99 |

|

Assets of discontinued operations, net of current portion | 6,238 |

| | 5,660 |

|

Total assets | $ | 303,386 |

| | $ | 345,998 |

|

See accompanying notes to Condensed Consolidated Financial Statements

CINEDIGM CORP.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except for share and per share data)

(continued)

|

| | | | | | | | |

| | June 30, 2014 | | March 31, 2014 |

LIABILITIES AND STOCKHOLDERS’ (DEFICIT) EQUITY | | (Unaudited) | | |

Current liabilities | | | | |

Accounts payable and accrued expenses | | $ | 55,537 |

| | $ | 72,604 |

|

Current portion of notes payable, non-recourse | | 33,540 |

| | 33,825 |

|

Current portion of notes payable | | 15,608 |

| | 19,219 |

|

Current portion of capital leases | | 609 |

| | 614 |

|

Current portion of deferred revenue | | 3,025 |

| | 3,214 |

|

Total current liabilities | | 108,319 |

| | 129,476 |

|

Notes payable, non-recourse, net of current portion | | 155,388 |

| | 164,779 |

|

Notes payable, net of current portion | | 22,499 |

| | 23,525 |

|

Capital leases, net of current portion | | 5,330 |

| | 5,472 |

|

Deferred revenue, net of current portion | | 11,899 |

| | 12,519 |

|

Total liabilities | | 303,435 |

| | 335,771 |

|

Commitments and contingencies (see Note 6) | | | | |

Stockholders’ (Deficit) Equity | | | | |

Preferred stock, 15,000,000 shares authorized;

Series A 10% - $0.001 par value per share; 20 shares authorized; 7 shares issued and outstanding at June 30, 2014 and March 31, 2014, respectively. Liquidation preference of $3,648 | | 3,559 |

| | 3,559 |

|

Class A common stock, $0.001 par value per share; 118,759,000 shares authorized; 76,656,587 and 76,571,972 shares issued and 76,605,147 and 76,520,532 shares outstanding at June 30, 2014 and March 31, 2014, respectively | | 77 |

| | 76 |

|

Class B common stock, $0.001 par value per share; 1,241,000 shares authorized; 1,241,000 shares issued and 0 shares outstanding, at June 30, 2014 and March 31, 2014, respectively | | — |

| | — |

|

Additional paid-in capital | | 275,938 |

| | 275,519 |

|

Treasury stock, at cost; 51,440 Class A shares | | (172 | ) | | (172 | ) |

Accumulated deficit | | (279,438 | ) | | (268,686 | ) |

Accumulated other comprehensive loss | | (13 | ) | | (69 | ) |

Total stockholders’ (deficit) equity | | (49 | ) | | 10,227 |

|

Total liabilities and stockholders’ (deficit) equity | | $ | 303,386 |

| | $ | 345,998 |

|

See accompanying notes to Condensed Consolidated Financial Statements

CINEDIGM CORP.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for share and per share data)

|

| | | | | | | |

| For the Three Months Ended June 30, |

| 2014 | | 2013 |

Revenues | $ | 22,857 |

| | $ | 18,537 |

|

Costs and expenses: | | | |

Direct operating (exclusive of depreciation and amortization shown below) | 8,504 |

| | 3,779 |

|

Selling, general and administrative | 7,709 |

| | 6,204 |

|

Provision for doubtful accounts | 94 |

| | 62 |

|

Transition and acquisition expenses | 946 |

| | — |

|

Depreciation and amortization of property and equipment | 9,376 |

| | 9,245 |

|

Amortization of intangible assets | 1,885 |

| | 418 |

|

Total operating expenses | 28,514 |

| | 19,708 |

|

Loss from operations | (5,657 | ) | | (1,171 | ) |

Interest expense, net | (5,035 | ) | | (4,924 | ) |

Loss on investment in non-consolidated entity | — |

| | (1,252 | ) |

Other income, net | 139 |

| | 134 |

|

Change in fair value of interest rate derivatives | (259 | ) | | 829 |

|

Loss from continuing operations | (10,812 | ) | | (6,384 | ) |

Income (loss) from discontinued operations | 149 |

| | (604 | ) |

Net loss | (10,663 | ) | | (6,988 | ) |

Preferred stock dividends | (89 | ) | | (89 | ) |

Net loss attributable to common stockholders | $ | (10,752 | ) | | $ | (7,077 | ) |

Net loss per Class A and Class B common share attributable to common shareholders - basic and diluted: | | | |

Loss from continuing operations | $ | (0.14 | ) | | $ | (0.13 | ) |

Income (loss) from discontinued operations | — |

| | (0.02 | ) |

| $ | (0.14 | ) | | $ | (0.15 | ) |

Weighted average number of Class A and Class B common shares outstanding: basic and diluted | 76,567,128 |

| | 48,357,020 |

|

See accompanying notes to Condensed Consolidated Financial Statements

CINEDIGM CORP.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(In thousands)

|

| | | | | | | | |

| | For the Three Months Ended June 30, |

| | 2014 | | 2013 |

Net loss | | $ | (10,663 | ) | | $ | (6,988 | ) |

Other comprehensive income: foreign exchange translation | | 56 |

| | — |

|

Comprehensive loss | | $ | (10,607 | ) | | $ | (6,988 | ) |

See accompanying notes to Condensed Consolidated Financial Statements

CINEDIGM CORP.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

|

| | | | | | | |

| For the Three Months Ended June 30, |

| 2014 | | 2013 |

Cash flows from operating activities | | | |

Net loss | $ | (10,663 | ) | | $ | (6,988 | ) |

Adjustments to reconcile net loss to net cash provided by operating activities: | | | |

Depreciation and amortization of property and equipment and amortization of intangible assets | 11,261 |

| | 9,700 |

|

Amortization of capitalized software costs | — |

| | 314 |

|

Amortization of debt issuance costs | 437 |

| | 288 |

|

Provision for doubtful accounts | 94 |

| | 62 |

|

Stock-based compensation and expenses | 651 |

| | 737 |

|

Change in fair value of interest rate derivatives | 259 |

| | (829 | ) |

Accretion and PIK interest expense added to note payable | 631 |

| | 472 |

|

Loss on investment in non-consolidated entity | — |

| | 1,252 |

|

Changes in operating assets and liabilities, net of acquisitions: | | | |

Accounts receivable | 19,301 |

| | (3,496 | ) |

Inventory | 294 |

| | — |

|

Unbilled revenue | 394 |

| | 3,103 |

|

Prepaid expenses and other current assets | 228 |

| | (1,314 | ) |

Other assets | 243 |

| | (599 | ) |

Accounts payable and accrued expenses | (19,823 | ) | | 7,216 |

|

Deferred revenue | (591 | ) | | (604 | ) |

Other liabilities | (292 | ) | | 364 |

|

Net cash provided by operating activities | 2,424 |

| | 9,678 |

|

Cash flows from investing activities: | | | |

Purchases of property and equipment | (331 | ) | | (141 | ) |

Purchases of intangible assets | (4 | ) | | — |

|

Additions to capitalized software costs | (483 | ) | | (731 | ) |

Restricted cash | — |

| | (2 | ) |

Net cash used in investing activities | (818 | ) | | (874 | ) |

Cash flows from financing activities: | | | |

Repayment of notes payable | (14,862 | ) | | (8,610 | ) |

Principal payments on capital leases | (147 | ) | | (31 | ) |

Costs associated with issuance of Class A common stock | (70 | ) | | — |

|

Net cash used in financing activities | (15,079 | ) | | (8,641 | ) |

Net change in cash and cash equivalents | (13,473 | ) | | 163 |

|

Cash and cash equivalents at beginning of period | 50,215 |

| | 13,448 |

|

Cash and cash equivalents at end of period | $ | 36,742 |

| | $ | 13,611 |

|

See accompanying notes to Condensed Consolidated Financial Statements

CINEDIGM CORP.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

For the fiscal periods ended June 30, 2014 and 2013

($ in thousands, except for share and per share data)

Cinedigm Corp. (formerly known as Cinedigm Digital Cinema Corp.) was incorporated in Delaware on March 31, 2000 (“Cinedigm”, and collectively with its subsidiaries, the “Company”). Cinedigm is (i) a leading distributor and aggregator of independent movie, television and other short form content managing a library of distribution rights to over 52,000 titles and episodes released across digital, physical, theatrical, home and mobile entertainment platforms as well as (ii) a leading servicer of digital cinema assets in over 12,000 movie screens in both North America and several international countries.

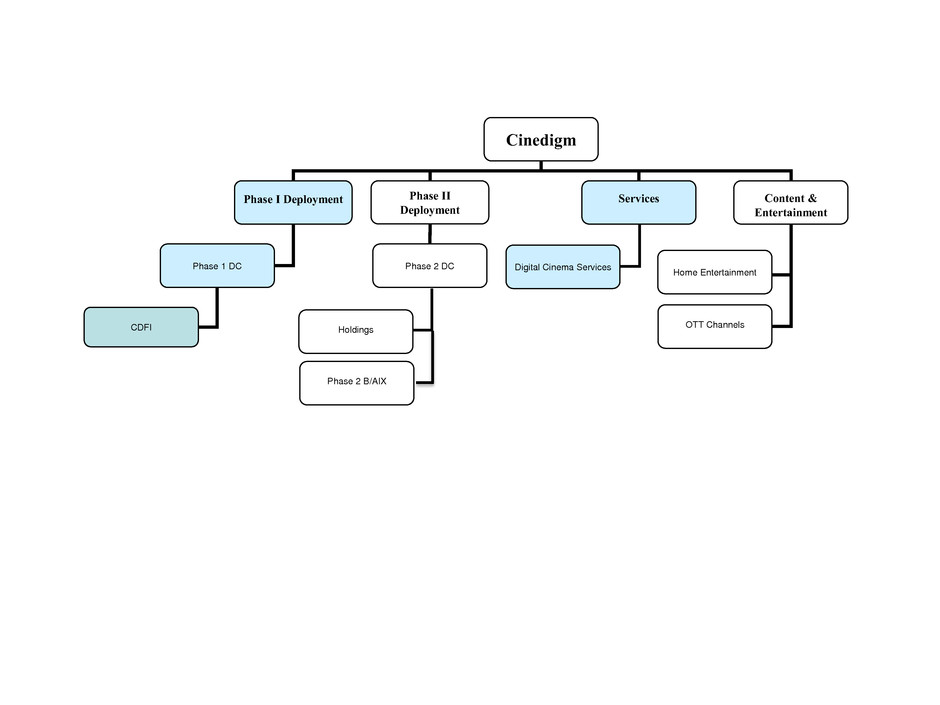

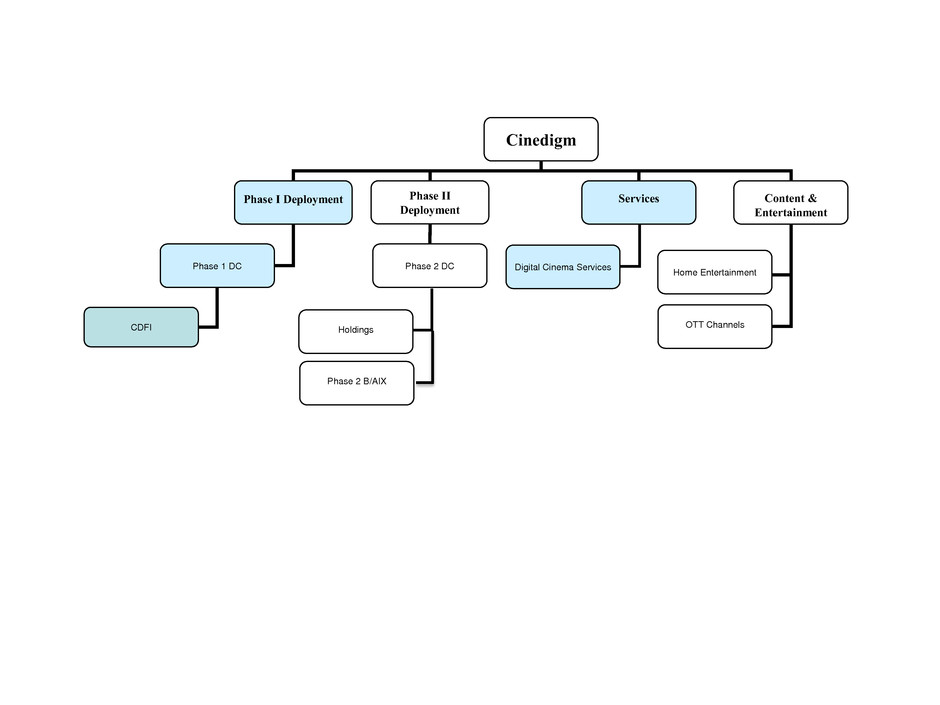

The Company reports its financial results in four primary segments as follows: (1) the first digital cinema deployment (“Phase I Deployment”), (2) the second digital cinema deployment (“Phase II Deployment”), (3) digital cinema services (“Services”) and (4) media content and entertainment (“Content & Entertainment”). The Phase I Deployment and Phase II Deployment segments are the non-recourse, financing vehicles and administrators for the Company's digital cinema equipment (the “Systems”) installed in movie theatres nationwide. The Services segment provides services and support to over 12,000 movie screens in the Phase I Deployment and Phase II Deployment segments as well as directly to exhibitors and other third party customers. Included in these services are Systems management services for a specified fee via service agreements with Phase I Deployment and Phase II Deployment as well as third party exhibitors as buyers of their own digital cinema equipment. These services primarily facilitate the conversion from analog to digital cinema and have positioned the Company at what it believes to be the forefront of a rapidly developing industry relating to the distribution and management of digital cinema and other content to theatres and other remote venues worldwide. The Content & Entertainment segment provides content marketing and distribution services in both theatrical and ancillary home entertainment markets to independent movie, television and other short form content owners and to theatrical exhibitors. As a leading distributor of independent content, the Company collaborates with producers, major brands and other content owners to market, source, curate and distribute quality content to targeted and profitable audiences through (i) existing and emerging digital home entertainment platforms, including but not limited to, iTunes, Amazon Prime, Netflix, Hulu, Xbox, Playstation, cable video-on-demand ("VOD") and curated over-the-top ("OTT") digital entertainment channels and applications, (ii) physical goods, including DVD and Blu-ray and (iii) theatrical releases.

Gaiam Acquisition

On October 21, 2013, the Company and Cinedigm Entertainment Holdings, LLC ("CHE"), a newly-formed, wholly-owned subsidiary of the Company, acquired from Gaiam Americas, Inc. and Gaiam, Inc. (together, “Gaiam”) their division ("GVE") that maintains exclusive distribution rights agreements with large independent studios/content providers, and distributes entertainment content through home video, digital and television distribution channels (the “GVE Acquisition”). The Company agreed to an aggregate purchase price of $51,500, subject to a working capital adjustment, with (i) $47,500 paid in cash and 666,978 shares of Class A Common Stock valued at $1,000 issued upon the closing of the GVE Acquisition, and (ii) $3,000 to be paid on a deferred basis, of which $1,000 was paid during the fiscal year ended March 31, 2014 and the remainder was settled through the collection of a receivable during the fiscal year ended March 31, 2014. The working capital adjustment related to the purchase price has not yet been finalized between the Company and the sellers of GVE. Pending final resolution, such working capital adjustment, if any, will be recorded as adjustments to purchase considerations during the fiscal year ending March 31, 2015. Upon the closing of the GVE Acquisition, GVE became part of the Company's Content & Entertainment segment.

Upon concluding the purchase price allocation for the GVE Acquisition during the three months ended June 30, 2014, a measurement period adjustment of $2,450 was made to write off advances on the opening balance sheet of GVE due to conditions that existed at the time of the GVE Acquisition. Such conditions, had they been identified as of March 31, 2014, would have reduced the previously reported prepaid and other current assets to $6,222 and increased goodwill to $27,944 on the consolidated balance sheets as of March 31, 2014, respectively.

The purchase price has been allocated to the identifiable net assets acquired as of the date of acquisition including any measurement period adjustments as follows pending any final working capital adjustment:

|

| | | |

Accounts receivable | $ | 15,524 |

|

Inventory | 2,224 |

|

Advances | 5,248 |

|

Other assets | 152 |

|

Content library | 17,211 |

|

Supplier contracts and relationships | 11,691 |

|

Goodwill | 19,402 |

|

Total assets acquired | 71,452 |

|

Total liabilities assumed | (19,952 | ) |

Total net assets acquired | $ | 51,500 |

|

The Company estimates the useful life of the content library and supplier contracts and relationships to be 6 years and 8 years, respectively.

The fair values assigned to intangible assets were determined through the application of various commonly used and accepted valuation procedures and methods, including the multi-period excess earnings method. These valuation methods rely on management judgment, including expected future cash flows resulting from existing customer relationships, customer attrition rates, contributory effects of other assets utilized in the business, peer group cost of capital and royalty rates, and other factors. The valuation of tangible assets was preliminarily determined to approximate book value at the time of the GVE Acquisition. Useful lives for intangible assets were determined based upon the remaining useful economic lives of the intangible assets that are expected to contribute directly or indirectly to future cash flows. Goodwill is mainly attributable to the assembled workforce and synergies expected to arise from the GVE Acquisition.

Pro forma Information Related to the Acquisition of GVE

The following unaudited consolidated pro forma summary information for the three months ended June 30, 2014 and 2013 has been prepared by adjusting the historical data as set forth in the accompanying condensed consolidated statements of operations for the three months ended June 30, 2014 and 2013 to give effect to the GVE Acquisition as if it had occurred at April 1, 2013. The pro forma information does not reflect any cost savings from operating efficiencies or synergies that could result from the GVE Acquisition, nor does the pro forma reflect additional revenue opportunities following the GVE Acquisition.

|

| | | | | | | | |

| | For the Three Months Ended June 30, |

| | 2014 | | 2013 |

Revenue | | $ | 22,857 |

| | $ | 27,006 |

|

Loss from continuing operations | | $ | (10,812 | ) | | $ | (6,606 | ) |

Net loss | | $ | (10,663 | ) | | $ | (7,210 | ) |

| | | | |

Net loss per share (basic and diluted) | | $ | (0.14 | ) | | $ | (0.15 | ) |

Sale of Software

During the fiscal year ended March 31, 2014, the Company made the strategic decision to discontinue, exit its software business and execute a plan of sale for Hollywood Software, Inc. d/b/a Cinedigm Software (“Software”), the Company's direct, wholly-owned subsidiary. Management concluded that it would be in the best interests of shareholders for the Company’s focus to be toward theatrical releasing and aggregation and distribution of independent content, digitally and in the form of DVDs and Blu-Ray discs, and VOD, along with the growth and servicing of the existing digital cinema business. Further, management believed that Software, which was previously included in our Services segment, no longer yielded the same synergies across the Company’s businesses as once existed.

As a consequence, it was determined that Software met the criteria for classification as held for sale/discontinued operations. As such, Software has been adjusted to reflect the fair value of its net assets and the consolidated financial statements and the notes to consolidated financial statements presented herein have been recast solely to reflect, for all periods presented, the adjustments resulting from these changes in classification for discontinued operations.

| |

2. | SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES |

BASIS OF PRESENTATION AND CONSOLIDATION

The Company has incurred net losses historically and has an accumulated deficit of $279,438 as of June 30, 2014. The Company also has significant contractual obligations related to its recourse and non-recourse debt for the remainder of the fiscal year ending March 31, 2015 and beyond. The Company may continue to generate net losses for the foreseeable future. Based on the Company’s cash position at June 30, 2014, and expected cash flows from operations, management believes that the Company has the ability to meet its obligations through at least June 30, 2015. Failure to generate additional revenues, raise additional capital or manage discretionary spending could have an adverse effect on the Company’s financial position, results of operations or liquidity.

The Company’s consolidated financial statements include the accounts of Cinedigm, Access Digital Media, Inc. (“AccessDM”), FiberSat Global Services, Inc. d/b/a Cinedigm Satellite and Support Services (“Satellite”), ADM Cinema Corporation (“ADM Cinema”) d/b/a the Pavilion Theatre (certain assets and liabilities of which were sold in May 2011), Christie/AIX, Inc. ("C/AIX") d/b/a Cinedigm Digital Cinema (“Phase 1 DC”), Vistachiara Productions, Inc. f/k/a The Bigger Picture, currently d/b/a Cinedigm Content and Entertainment Group, Cinedigm Entertainment Corp. f/k/a New Video Group, Inc. ("New Video"), CHE, Access Digital Cinema Phase 2 Corp. (“Phase 2 DC”), Cinedigm Digital Cinema Australia Pty Ltd, Access Digital Cinema Phase 2 B/AIX Corp. (“Phase 2 B/AIX”), Cinedigm Digital Funding I, LLC (“CDF I”) and Cinedigm DC Holdings LLC ("DC Holdings LLC"). Cinedigm Content and Entertainment Group, New Video and CHE are together referred to as CEG. Software comprises discontinued operations. All intercompany transactions and balances have been eliminated in consolidation.

The condensed consolidated balance sheet as of March 31, 2014, which has been derived from audited financial statements, and the unaudited interim condensed consolidated financial statements were prepared following the interim reporting requirements of the Securities and Exchange Commission ("SEC"). They do not include all disclosures normally made in financial statements contained in the Company’s Annual Report on Form 10-K ("Form 10-K"). In management’s opinion, all adjustments necessary for a fair presentation of financial position, the results of operations and cash flows in accordance with accounting principles generally accepted in the United States of America (“GAAP”) for the periods presented have been made. The results of operations for the respective interim periods are not necessarily indicative of the results to be expected for the full year. The accompanying condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and notes thereto included in the Company’s Form 10-K for the fiscal year ended March 31, 2014 filed with the SEC on June 26, 2014.

INVESTMENT IN NON-CONSOLIDATED ENTITY

The Company indirectly owns 100% of the common equity of CDF2 Holdings, LLC ("Holdings"), which is a Variable Interest Entity (“VIE”), as defined in Accounting Standards Codification Topic 810 ("ASC 810"), “Consolidation". Holdings, a subsidiary of Phase 2 DC, which is wholly owned by the Company, and its wholly owned limited liability company, Cinedigm Digital Funding 2, LLC, were created for the purpose of capitalizing on the conversion of the exhibition industry from film to digital technology. Holdings assists customers in procuring the necessary equipment in the conversion of their Systems by providing the necessary financing, equipment, installation and related ongoing services. Holdings is a VIE, as defined in ASC 810, indirectly wholly owned by the Company. ASC 810 requires the consolidation of VIEs by an entity that has a controlling financial interest in the VIE which entity is thereby defined as the primary beneficiary of the VIE. To be a primary beneficiary, an entity must have the power to direct the activities of a VIE that most significantly impact the VIE's economic performance, among other factors. Although Holdings is indirectly wholly owned by the Company, a third party, which also has a variable interest in Holdings, along with an independent third party manager and the Company must mutually approve all business activities and transactions that significantly impact Holdings' economic performance. The Company has thus assessed its variable interests in Holdings and determined that it is not the primary beneficiary of Holdings and therefore accounts for its investment in Holdings under the equity method of accounting. In completing our assessment, the Company identified the activities that it considers most significant to the economic performance of Holdings and determined that we do not have the power to direct those activities. As a result, Holdings' financial position and results of operations are not consolidated in the financial position and results of operations of the Company. The Company's net investment in Holdings is reflected as “Investment in non-consolidated entity, net" in the accompanying condensed consolidated balance sheets.

The Holding’s total stockholder’s deficit at June 30, 2014 was $3,512. The Company has no obligation to fund the operating loss or the deficit beyond its initial investment, and accordingly, the Company carried its investment in Holdings at $0.

Accounts receivable due from Holdings for service fees under its master service agreement as of June 30, 2014 and March 31, 2014 were $352 and $346, respectively, are included within accounts receivable, net on the accompanying condensed consolidated balance sheets.

During the three months ended June 30, 2014 and 2013, the Company received $294 and $262 in aggregate revenues through digital cinema servicing fees from Holdings, respectively, which are included in revenues on the accompanying condensed consolidated statements of operations.

RECLASSIFICATION

Certain reclassifications, principally for discontinued operations (see Note 3) have been made to the fiscal period ended June 30, 2013 condensed consolidated financial statements to conform to the current fiscal period ended June 30, 2014 presentation.

USE OF ESTIMATES

The preparation of condensed consolidated financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that affect the assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenue and expenses during the reporting period. Such estimates include the adequacy of accounts receivable reserves, return reserves, inventory reserves, recoupment of advances, minimum guarantees, assessment of goodwill and intangible asset impairment and valuation reserve for income taxes, among others. Actual results could differ from these estimates.

CASH AND CASH EQUIVALENTS

The Company considers all highly liquid investments with an original maturity of three months or less to be “cash equivalents.” The Company maintains bank accounts with major banks, which from time to time may exceed the Federal Deposit Insurance Corporation’s insured limits. The Company periodically assesses the financial condition of the institutions and believes that the risk of any loss is minimal.

ACCOUNTS RECEIVABLE

The Company maintains reserves for potential credit losses on accounts receivable. Management reviews the composition of accounts receivable and analyzes historical bad debts, customer concentrations, customer credit worthiness, current economic trends and changes in customer payment patterns to evaluate the adequacy of these reserves. Reserves are recorded primarily on a specific identification basis. Allowance for doubtful accounts amounted to $980 and $898 as of June 30, 2014 and March 31, 2014, respectively.

Within the Content & Entertainment segment, the Company recognizes the accounts receivable net of an estimated allowance for product returns and customer chargebacks at the time we recognize the original sale. We base the amount of the returns allowance and customer chargebacks upon historical experience and future expectations.

Accounts receivable, long-term result from up-front activation fees earned from the Company's Systems deployments with extended payment terms that are discounted to their present value at prevailing market rates.

ADVANCES

Advances, which are recorded within prepaid and other current assets on the condensed consolidated balance sheets, represent amounts prepaid to studios or content producers for which the Company provides content distribution services and such advances, net of any impairment charges, are estimated to be fully recoupable as of the balance sheet dates.

INVENTORY

Inventory consists of finished goods of owned physical DVD titles and is stated at the lower of cost (determined based on weighted average cost) or market. The Company identifies inventory items to be written down for obsolescence based on the item’s sales status and condition. The Company writes down discontinued or slow moving inventories based on an estimate of the markdown to retail price needed to sell through our current stock level of the inventories.

RESTRICTED CASH

In connection with the 2013 Term Loans issued in February 2013 and the 2013 Prospect Loan Agreement issued in February 2013 (collectively, see Note 4), the Company maintains cash restricted for repaying interest on the respective loans as follows:

|

| | | | | | | | |

| | As of June 30, 2014 | | As of March 31, 2014 |

Reserve account related to the 2013 Term Loans (See Note 4) | | $ | 5,751 |

| | $ | 5,751 |

|

Reserve account related to the 2013 Prospect Loan Agreement (See Note 4) | | 1,000 |

| | 1,000 |

|

| | $ | 6,751 |

| | $ | 6,751 |

|

DEFERRED COSTS

Deferred costs primarily consist of unamortized debt issuance costs related to the 2013 Term Loans, 2013 Prospect Loan and Cinedigm Credit Agreement (see Note 4) which are amortized under the effective interest rate method over the terms of the respective debt. All other unamortized debt issuance costs are amortized on a straight-line basis over the term of the respective debt. For such debt, amortization on a straight-line basis is not materially different from the effective interest method.

PROPERTY AND EQUIPMENT

Property and equipment are stated at cost, less accumulated depreciation and amortization. Depreciation expense is recorded using the straight-line method over the estimated useful lives of the respective assets as follows:

|

| |

Computer equipment and software | 3 - 5 years |

Digital cinema projection systems | 10 years |

Machinery and equipment | 3 - 10 years |

Furniture and fixtures | 3 - 6 years |

Leasehold improvements are amortized over the shorter of the lease term or the estimated useful life of the leasehold improvements. Maintenance and repair costs are charged to expense as incurred. Major renewals, improvements and additions are capitalized. Upon the sale or other disposition of any property and equipment, the cost and related accumulated depreciation and amortization are removed from the accounts and the gain or loss on disposal is included in the condensed consolidated statements of operations.

ACCOUNTING FOR DERIVATIVE ACTIVITIES

Derivative financial instruments are recorded at fair value. The Company had three separate interest rate swap agreements (the “Interest Rate Swaps”) to limit the Company’s exposure to changes in interest rates related to the 2013 Term Loans which matured in June 2013. Additionally, the Company entered into two separate interest rate cap transactions during the fiscal year ended March 31, 2013, recorded in prepaid and other current assets on the condensed consolidated balance sheets, to limit the Company's exposure to interest rates related to the 2013 Term Loans and 2013 Prospect Loan. Changes in fair value of derivative financial instruments are either recognized in accumulated other comprehensive loss (a component of stockholders' deficit) or in the condensed consolidated statements of operations depending on whether the derivative qualifies for hedge accounting. The Company has not sought hedge accounting treatment for these instruments and therefore, changes in the value of its Interest Rate Swaps and caps were recorded in the condensed consolidated statements of operations (See Note 4).

FAIR VALUE MEASUREMENTS

The fair value measurement disclosures are grouped into three levels based on valuation factors:

| |

• | Level 1 – quoted prices in active markets for identical investments |

| |

• | Level 2 – other significant observable inputs (including quoted prices for similar investments and market corroborated inputs) |

| |

• | Level 3 – significant unobservable inputs (including the Company’s own assumptions in determining the fair value of investments) |

Assets and liabilities measured at fair value on a recurring basis use the market approach, where prices and other relevant information are generated by market transactions involving identical or comparable assets or liabilities.

The following tables summarize the levels of fair value measurements of the Company’s financial assets and liabilities:

|

| | | | | | | | | | | | | | | | |

| | As of June 30, 2014 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

Restricted cash | | $ | 6,751 |

| | $ | — |

| | $ | — |

| | $ | 6,751 |

|

Interest rate derivatives | | — |

| | 519 |

| | — |

| | 519 |

|

| | $ | 6,751 |

| | $ | 519 |

| | $ | — |

| | $ | 7,270 |

|

|

| | | | | | | | | | | | | | | | |

| | As of March 31, 2014 |

| | Level 1 | | Level 2 | | Level 3 | | Total |

Restricted cash | | $ | 6,751 |

| | $ | — |

| | $ | — |

| | $ | 6,751 |

|

Interest rate derivatives | | — |

| | 787 |

| | — |

| | 787 |

|

| | $ | 6,751 |

| | $ | 787 |

| | $ | — |

| | $ | 7,538 |

|

The Company’s cash and cash equivalents, accounts receivable, unbilled revenue and accounts payable and accrued expenses are financial instruments and are recorded at cost in the condensed consolidated balance sheets. The estimated fair values of these financial instruments approximate their carrying amounts because of their short-term nature. The carrying amount of accounts receivable, long-term and notes receivable approximates fair value based on the discounted cash flows of that instrument using current assumptions at the balance sheet date. The fair value of fixed rate and variable rate debt is estimated by management based upon current interest rates available to the Company at the respective balance sheet date for arrangements with similar terms and conditions. Based on borrowing rates currently available to the Company for loans with similar terms, the carrying value of notes payable and capital lease obligations approximates fair value.

IMPAIRMENT OF LONG-LIVED AND FINITE-LIVED ASSETS

The Company reviews the recoverability of its long-lived assets and finite-lived intangible assets, when events or conditions occur that indicate a possible impairment exists. The assessment for recoverability is based primarily on the Company’s ability to recover the carrying value of its long-lived and finite-lived assets from expected future undiscounted net cash flows. If the total of expected future undiscounted net cash flows is less than the total carrying value of the assets the asset is deemed not to be recoverable and possibly impaired. The Company then estimates the fair value of the asset to determine whether an impairment loss should be recognized. An impairment loss will be recognized if the difference between the fair value and the carrying value of the asset exceeds its fair value. Fair value is determined by computing the expected future undiscounted cash flows. During the three months ended June 30, 2014 and 2013, no impairment charge from continuing operations for long-lived assets or finite-lived assets was recorded.

GOODWILL

Goodwill is the excess of the purchase price paid over the fair value of the net assets of an acquired business. The Company’s process of evaluating goodwill for impairment involves the determination of fair value of its CEG goodwill reporting unit over its carrying value. The Company conducts its annual goodwill impairment analysis during the fourth quarter of each fiscal year, measured as of March 31, unless triggering events occur which require goodwill to be tested at another date.

Information related to the goodwill allocated to the Company's Content & Entertainment segment is as follows:

|

| | | |

As of March 31, 2013 | $ | 8,542 |

|

Goodwill resulting from the GVE Acquisition | 16,952 |

|

As of March 31, 2014 | 25,494 |

|

Measurement period adjustment - GVE Acquisition | 2,450 |

|

As of June 30, 2014 | $ | 27,944 |

|

REVENUE RECOGNITION

Phase I Deployment and Phase II Deployment

Virtual print fees (“VPFs”) are earned, net of administrative fees, pursuant to contracts with movie studios and distributors, whereby amounts are payable by a studio to Phase 1 DC and to Phase 2 DC when movies distributed by the studio are displayed on screens

utilizing the Company’s Systems installed in movie theatres. VPFs are earned and payable to Phase 1 DC based on a defined fee schedule with a reduced VPF rate year over year until the sixth year at which point the VPF rate remains unchanged through the tenth year. One VPF is payable for every digital title displayed per System. The amount of VPF revenue is dependent on the number of movie titles released and displayed using the Systems in any given accounting period. VPF revenue is recognized in the period in which the digital title first plays on a System for general audience viewing in a digitally-equipped movie theatre, as Phase 1 DC’s and Phase 2 DC’s performance obligations have been substantially met at that time.

Phase 2 DC’s agreements with distributors require the payment of VPFs, according to a defined fee schedule, for ten years from the date each system is installed; however, Phase 2 DC may no longer collect VPFs once “cost recoupment,” as defined in the agreements, is achieved. Cost recoupment will occur once the cumulative VPFs and other cash receipts collected by Phase 2 DC have equaled the total of all cash outflows, including the purchase price of all Systems, all financing costs, all “overhead and ongoing costs”, as defined, and including the Company’s service fees, subject to maximum agreed upon amounts during the three-year rollout period and thereafter. Further, if cost recoupment occurs before the end of the eighth contract year, a one-time “cost recoupment bonus” is payable by the studios to the Company. Any other cash flows, net of expenses, received by Phase 2 DC following the achievement of cost recoupment are required to be returned to the distributors on a pro-rata basis. At this time, the Company cannot estimate the timing or probability of the achievement of cost recoupment.

Alternative content fees (“ACFs”) are earned pursuant to contracts with movie exhibitors, whereby amounts are payable to Phase 1 DC and to Phase 2 DC, generally either a fixed amount or as a percentage of the applicable box office revenue derived from the exhibitor’s showing of content other than feature movies, such as concerts and sporting events (typically referred to as “alternative content”). ACF revenue is recognized in the period in which the alternative content first opens for audience viewing.

Revenues are deferred for up front exhibitor contributions and are recognized over the cost recoupment period, which is expected to be ten years.

Services

Exhibitors who purchased and own Systems using their own financing in the Phase II Deployment, paid an upfront activation fee that is generally $2 thousand per screen to the Company (the “Exhibitor-Buyer Structure”). These upfront activation fees are recognized in the period in which these exhibitor owned Systems are ready for content, as the Company has no further obligations to the customer, and are generally paid quarterly from VPF revenues over approximately one year. Additionally, the Company recognizes activation fee revenue of between $1 thousand and $2 thousand on Phase 2 DC Systems and for Systems installed by Holdings upon installation and such fees are generally collected upfront upon installation. The Company will then manage the billing and collection of VPFs and will remit all VPFs collected to the exhibitors, less an administrative fee that will approximate up to 10% of the VPFs collected.

The administrative fee related to the Phase I Deployment approximates 5% of the VPFs collected and an incentive service fee equal to 2.5% of the VPFs earned by Phase 1 DC. This administrative fee is recognized in the period in which the billing of VPFs occurs, as performance obligations have been substantially met at that time.

Content & Entertainment

CEG earns fees for the distribution of content in the home entertainment markets via several distribution channels, including digital, VOD, and physical goods (e.g. DVD and Blu-ray) is typically based on the gross amounts billed to our customers less the amounts owed to the media studios or content producers under distribution agreements, and gross media sales of owned or licensed content. The fee rate earned by the Company varies depending upon the nature of the agreements with the platform and content providers. Generally, revenues are recognized at the availability date of the content for a subscription digital platform, at the time of shipment for physical goods, or point-of-sale for transactional and VOD services. Reserves for sales returns and other allowances are provided based upon past experience. If actual future returns and allowances differ from past experience, adjustments to our allowances may be required. Sales returns and allowances are reported net in accounts receivable and as a reduction of revenues.

CEG also has contracts for the theatrical distribution of third party feature movies and alternative content. CEG’s distribution fee revenue and CEG's participation in box office receipts is recognized at the time a feature movie and alternative content is viewed. CEG has the right to receive or bill a portion of the theatrical distribution fee in advance of the exhibition date, and therefore such amount is recorded as a receivable at the time of execution, and all related distribution revenue is deferred until the third party feature movies’ or alternative content’s theatrical release date.

Movie Cost Amortization

Once a movie is released, capitalized acquisition costs are amortized and participations and residual costs are accrued on an individual title basis in the proportion to the revenue recognized during the period for each title ("Period Revenue") bears to the estimated remaining total revenue to be recognized from all sources for each title ("Ultimate Revenue"). The amount of movie and other costs that is amortized each period will depend on the ratio of Period Revenue to Ultimate Revenue for each movie. The Company makes certain estimates and judgments of Ultimate Revenue to be recognized for each title. Ultimate Revenue does not include estimates of revenue that will be earned beyond 5 years of a movie’s initial theatrical release date. Movie cost amortization is a component of direct operating costs within the condensed consolidated statements of operations.

Estimates of Ultimate Revenue and anticipated participation and residual costs are reviewed periodically in the ordinary course of business and are revised if necessary. A change in any given period to the Ultimate Revenue for an individual title will result in an increase or decrease in the percentage of amortization of capitalized movie and other costs and accrued participation and residual costs relative to a previous period. Depending on the performance of a title, significant changes to the future Ultimate Revenue may occur, which could result in significant changes to the amortization of the capitalized acquisition costs.

DIRECT OPERATING COSTS

Direct operating costs consist of operating costs such as cost of goods sold, fulfillment expenses, shipping costs, property taxes and insurance on Systems, royalty expenses, marketing and direct personnel costs.

PARTICIPATIONS PAYABLE

The Company records liabilities within accounts payable and accrued expenses on the condensed consolidated balance sheet, that represent amounts owed to studios or content producers for which the Company provides content distribution services for royalties owed under licensing arrangements. The Company identifies and records as a reduction to the liability any expenses that are to be reimbursed to the Company by such studios or content producers.

STOCK-BASED COMPENSATION

During the three months ended June 30, 2014 and 2013, the Company recorded stock-based compensation from continuing operations of $618 and $684, respectively.

The weighted-average grant-date fair value of options granted during the three months ended June 30, 2014 and 2013 was $1.60 and $0.89, respectively. There were 34,443 and 42,640 stock options exercised during the three months ended June 30, 2014 and 2013, respectively.

The Company estimated the fair value of stock options at the date of each grant using a Black-Scholes option valuation model with the following assumptions:

|

| | | | | | |

| | For the Three Months Ended June 30, |

Assumptions for Option Grants | | 2014 | | 2013 |

Range of risk-free interest rates | | 1.6 - 1.7% |

| | 0.7 - 1.2% |

|

Dividend yield | | — |

| | — |

|

Expected life (years) | | 5 |

| | 5 |

|

Range of expected volatilities | | 71.7 - 72.1% |

| | 73.4 - 73.8% |

|

The risk-free interest rate used in the Black-Scholes option pricing model for options granted under the Company’s stock option plan awards is the historical yield on U.S. Treasury securities with equivalent remaining lives. The Company does not currently anticipate paying any cash dividends on common stock in the foreseeable future. Consequently, an expected dividend yield of zero is used in the Black-Scholes option pricing model. The Company estimates the expected life of options granted under the Company’s stock option plans using both exercise behavior and post-vesting termination behavior, as well as consideration of outstanding options. The Company estimates expected volatility for options granted under the Company’s stock option plans based on a measure of historical volatility in the trading market for the Company’s common stock.

Employee and director stock-based compensation expense from continuing operations related to the Company’s stock-based awards was as follows:

|

| | | | | | | |

| For the Three Months Ended June 30, |

| 2014 | | 2013 |

Direct operating | $ | 3 |

| | $ | 2 |

|

Selling, general and administrative | 615 |

| | 682 |

|

| $ | 618 |

| | $ | 684 |

|

NET LOSS PER SHARE

Basic and diluted net loss per common share has been calculated as follows:

|

| |

Basic and diluted net loss per common share = | Net loss + preferred dividends |

| Weighted average number of common stock shares outstanding during the period |

Shares issued and any shares that are reacquired during the period are weighted for the portion of the period that they are outstanding.

The Company incurred net losses for each of the three months ended June 30, 2014 and 2013 and, therefore, the impact of dilutive potential common shares from outstanding stock options and warrants, totaling 28,819,170 shares and 20,485,290 shares as of June 30, 2014 and 2013, respectively, were excluded from the computation as it would be anti-dilutive.

COMPREHENSIVE LOSS

As of June 30, 2014, the Company’s other comprehensive loss consisted of net loss and foreign currency translation adjustments.

RECENT ACCOUNTING PRONOUNCEMENTS

In April 2014, the Financial Accounting Standards Board ("FASB") issued an accounting standards update which modifies the requirements for disposals to qualify as discontinued operations and expands related disclosure requirements. The update will be effective for the Company during the fiscal year ending March 31, 2015. The adoption of the update may impact whether future disposals qualify as discontinued operations and therefore could impact the Company's financial statement presentation and disclosures.

In May 2014, the FASB issued new accounting guidance on revenue recognition. The new standard provides for a single five-step model to be applied to all revenue contracts with customers as well as requires additional financial statement disclosures that will enable users to understand the nature, amount, timing and uncertainty of revenue and cash flows relating to customer contracts. Companies have an option to use either a retrospective approach or cumulative effect adjustment approach to implement the standard. The guidance will be effective for the Company during the fiscal year ending March 31, 2018. The Company intends to evaluate the impact of the adoption of this accounting standard update on its consolidated financial statements.

| |

3. | DISCONTINUED OPERATIONS |

As discussed in Note 1, discontinued operations is principally comprised of the operations of Software. There is no tax provision or benefit related to any of the discontinued operations.

The assets and liabilities of discontinued operations were comprised of the following:

|

| | | | | | | | |

| | As of June 30, 2014 | | As of March 31, 2014 |

Current assets of discontinued operations: | | | | |

Accounts receivable, net | | $ | 1,852 |

| | $ | 1,835 |

|

Unbilled revenue | | 215 |

| | 534 |

|

Prepaid and other current assets | | 7 |

| | 11 |

|

Total current assets of discontinued operations | | 2,074 |

| | 2,380 |

|

| | | | |

Current liabilities of discontinued operations: | | | | |

Accounts payable and accrued expenses | | 422 |

| | 668 |

|

Deferred revenue | | 1,652 |

| | 1,434 |

|

Total current liabilities of discontinued operations | | 2,074 |

| | 2,102 |

|

| | | | |

Current assets of discontinued operations, net of current liabilities | | $ | — |

| | $ | 278 |

|

| | | | |

Property and equipment, net | | $ | 723 |

| | $ | 474 |

|

Capitalized software, net | | 5,346 |

| | 4,862 |

|

Unbilled revenue, net of current portion | | 169 |

| | 324 |

|

Assets of discontinued operations, net of current portion | | $ | 6,238 |

| | $ | 5,660 |

|

The results of Software have been reported as discontinued operations for all periods presented. The income (loss) from discontinued operations was as follows:

|

| | | | | | | | |

| | For the Three Months Ended June 30, |

| | 2014 | | 2013 |

Revenues | | $ | 1,049 |

| | $ | 1,088 |

|

Costs and Expenses: | | | | |

Direct operating (exclusive of depreciation and amortization shown below) | | 175 |

| | 703 |

|

Selling, general and administrative | | 532 |

| | 950 |

|

Research and development | | 9 |

| | 6 |

|

Depreciation of property and equipment | | — |

| | 30 |

|

Amortization of intangible assets | | — |

| | 7 |

|

Total operating expenses | | 716 |

| | 1,696 |

|

Income (loss) from operations | | 333 |

| | (608 | ) |

Interest income | | — |

| | 4 |

|

Other expense, net | | (85 | ) | | — |

|

Income (loss) before provision for income taxes | | 248 |

| | (604 | ) |

Provision for income taxes | | 99 |

| | — |

|

Income (loss) from discontinued operations, net of taxes | | $ | 149 |

| | $ | (604 | ) |

Notes payable consisted of the following:

|

| | | | | | | | | | | | | | | | |

| | As of June 30, 2014 | | As of March 31, 2014 |

Notes Payable | | Current Portion | | Long Term Portion | | Current Portion | | Long Term Portion |

2013 Term Loans, net of debt discount | | $ | 25,500 |

| | $ | 60,884 |

| | $ | 25,688 |

| | $ | 68,590 |

|

2013 Prospect Loan Agreement | | — |

| | 68,714 |

| | — |

| | 68,454 |

|

KBC Facilities | | 7,858 |

| | 25,098 |

| | 7,961 |

| | 27,009 |

|

P2 Vendor Note | | 110 |

| | 450 |

| | 105 |

| | 466 |

|

P2 Exhibitor Notes | | 72 |

| | 242 |

| | 71 |

| | 260 |

|

Total non-recourse notes payable | | $ | 33,540 |

| | $ | 155,388 |

| | $ | 33,825 |

| | $ | 164,779 |

|

| | | | | | | | |

Cinedigm Term Loans | | $ | 4,000 |

| | $ | 18,923 |

| | $ | 3,750 |

| | $ | 20,015 |

|

Cinedigm Revolving Loans | | 11,608 |

| | — |

| | 15,469 |

| | — |

|

2013 Notes | | — |

| | 3,576 |

| | — |

| | 3,510 |

|

Total recourse notes payable | | $ | 15,608 |

| | $ | 22,499 |

| | $ | 19,219 |

| | $ | 23,525 |

|

Total notes payable | | $ | 49,148 |

| | $ | 177,887 |

| | $ | 53,044 |

| | $ | 188,304 |

|

Non-recourse debt is generally defined as debt whereby the lenders’ sole recourse with respect to defaults by the Company is limited to the value of the asset collateralized by the debt. The 2013 Term Loans are not guaranteed by the Company or its other subsidiaries, other than Phase 1 DC. The 2013 Prospect Loan Agreement is not guaranteed by the Company or its other subsidiaries and the service fees of Phase 1 DC and Phase 2 DC were assigned by the Company to DC Holdings LLC. The KBC Facilities, the P2 Vendor Note and the P2 Exhibitor Notes are not guaranteed by the Company or its other subsidiaries, other than Phase 2 DC.

2013 Term Loans

On February 28, 2013, CDF I entered into an amended and restated credit agreement (the “2013 Credit Agreement”) with Société Générale, New York Branch, as administrative agent and collateral agent for the lenders party thereto and certain other secured parties (the “Collateral Agent”), and the lenders party thereto. The 2013 Credit Agreement amended and restated its prior credit agreement. The primary changes effected by the Amended and Restated Credit Agreement were (i) changing the aggregate principal amount of the term loans to $130,000, which included an assignment of $5,000 of the principal balance to an affiliate of CDF I, (ii) changing the interest rate (described further below) and (iii) extending the term of the credit facility to February 2018. The proceeds of the term loans ("2013 Term Loans") under the 2013 Credit Agreement were used by CDF I to refinance its prior credit agreement.

Under the 2013 Credit Agreement, each of the 2013 Term loans bears interest, at the option of CDF I and subject to certain conditions, based on the base rate (generally, the bank prime rate) or the LIBOR rate set at a minimum of 1.00%, plus a margin of 1.75% (in the case of base rate loans) or, 2.75% (in the case of LIBOR rate loans). All collections and revenues of CDF I are deposited into designated accounts, from which amounts are paid out on a monthly basis to pay certain operating expenses and principal, interest, fees, costs and expenses relating to the 2013 Credit Agreement according to certain designated priorities. On a quarterly basis, if funds remain after the payment of all such amounts, they will be applied to prepay the 2013 Term Loans. The 2013 Term Loans mature and must be paid in full by February 28, 2018. In addition, CDF I may prepay the 2013 Term Loans, in whole or in part, subject to paying certain breakage costs, if applicable, and a 1.0% prepayment premium if a prepayment is made during the first year of the 2013 Term Loans. The LIBOR rate at June 30, 2014 was 0.15%.

The 2013 Credit Agreement also requires each of CDF I’s existing and future direct and indirect domestic subsidiaries (the "Guarantors") to guarantee, under an Amended and Restated Guaranty and Security Agreement dated as of February 28, 2013 by and among CDF I, the Guarantors and the Collateral Agent (the “Guaranty and Security Agreement”), the obligations under the 2013 Credit Agreement, and all such obligations to be secured by a first priority perfected security interest in all of the collective assets of CDF I and the Guarantors, including real estate owned or leased, and all capital stock or other equity interests in C/AIX, the direct holder of CDF I’s equity, CDF I and CDF I’s subsidiaries. In connection with the 2013 Credit Agreement, AccessDM, a wholly-owned subsidiary of the Company and the direct parent of C/AIX, entered into an amended and restated pledge agreement dated as of February 28, 2013 (the “AccessDM Pledge Agreement”) in favor of the Collateral Agent pursuant to which AccessDM pledged to the Collateral Agent all of the outstanding shares of common stock of C/AIX, and C/AIX entered into an amended and

restated pledge agreement dated as of February 28, 2013 (the “C/AIX Pledge Agreement”) in favor of the Collateral Agent pursuant to which C/AIX pledged to the Collateral Agent all of the outstanding membership interests of CDF I. The 2013 Credit Agreement contains customary representations, warranties, affirmative covenants, negative covenants and events of default.

All collections and revenues of CDF I are deposited into designated accounts. These amounts are included in cash and cash equivalents in the condensed consolidated balance sheets and are only available to pay certain operating expenses, principal, interest, fees, costs and expenses relating to the 2013 Credit Agreement, according to certain designated priorities, which totaled $5,919 and $6,493 as of June 30, 2014 and March 31, 2014, respectively. The Company also set up a debt service fund under the 2013 Credit Agreement for future principal and interest payments, classified as restricted cash of $6,751 as of June 30, 2014 and March 31, 2014, respectively.

The balance of the 2013 Term Loans, net of the original issue discount, at June 30, 2014 was as follows:

|

| | | | | | | |

| As of June 30, 2014 | | As of March 31, 2014 |

2013 Term Loans, at issuance, net | $ | 125,087 |

| | $ | 125,087 |

|

Payments to date | (38,456 | ) | | (30,543 | ) |

Discount on 2013 Term Loans | (247 | ) | | (266 | ) |

2013 Term Loans, net | 86,384 |

| | 94,278 |

|

Less current portion | (25,500 | ) | | (25,688 | ) |

Total long term portion | $ | 60,884 |

| | $ | 68,590 |

|

2013 Prospect Loan Agreement

On February 28, 2013, DC Holdings LLC, AccessDM and Phase 2 DC entered into a term loan agreement (the “2013 Prospect Loan Agreement”) with Prospect Capital Corporation (“Prospect”), as administrative agent (the “Prospect Administrative Agent”) and collateral agent (the “Prospect Collateral Agent”) for the lenders party thereto, and the other lenders party thereto pursuant to which DC Holdings LLC borrowed $70,000 (the “2013 Prospect Loan”). The 2013 Prospect Loan, as subsequently amended, will bear interest annually in cash at LIBOR plus 9.00% (with a 2.00% LIBOR floor) and at 2.50% to be accrued as an increase in the aggregate principal amount of the 2013 Prospect Loan until the 2013 Credit Agreement is paid off, at which time all interest will be payable in cash.

The 2013 Prospect Loan matures on March 31, 2021. The 2013 Prospect Loan may be accelerated upon a change in control (as defined in the Term Loan Agreement) or other events of default as set forth therein and would be subject to mandatory acceleration upon an insolvency of DC Holdings LLC. The 2013 Prospect Loan is payable on a voluntary basis after the second anniversary of the initial borrowing in whole but not in part, subject to a prepayment penalty equal to 5.00% of the principal amount prepaid if the 2013 Prospect Loan is prepaid after the second anniversary but prior to the third anniversary of issuance, a prepayment penalty of 4.00% of the principal amount prepaid if the 2013 Prospect Loan is prepaid after such third anniversary but prior to the fourth anniversary of issuance, a prepayment penalty of 3.00% of the principal amount prepaid if the 2013 Prospect Loan is prepaid after such fourth anniversary but prior to the fifth anniversary of issuance, a prepayment penalty of 2.00% of the principal amount prepaid if the 2013 Prospect Loan is prepaid after such fifth anniversary but prior to the sixth anniversary of issuance, a prepayment penalty of 1.00% of the principal amount prepaid if the 2013 Prospect Loan is prepaid after such sixth anniversary but prior to the seventh anniversary of issuance, and without penalty if the 2013 Prospect Loan is prepaid thereafter, plus cash in an amount equal to the accrued and unpaid interest amount with respect to the principal amount through and including the prepayment date.

In connection with the 2013 Prospect Loan, the Company assigned to DC Holdings LLC its rights to receive servicing fees under the Company’s Phase I and Phase II deployments. Pursuant to a Limited Recourse Pledge Agreement (the “Limited Recourse Pledge”) executed by the Company and a Guaranty, Pledge and Security Agreement (the “Prospect Guaranty and Security Agreement”) among DC Holdings LLC, AccessDM, Phase 2 DC and Prospect, as Prospect Collateral Agent, the Prospect Loan is secured by, among other things, a first priority pledge of the stock of Holdings owned by the Company, the stock of AccessDM owned by DC Holdings LLC and the stock of Phase 2 DC owned by the Company, and guaranteed by AccessDM and Phase 2 DC. The Company provides limited financial support to the 2013 Prospect Loan not to exceed $1,500 per year in the event financial performance does not meet certain defined benchmarks.

The 2013 Prospect Loan Agreement contains customary representations, warranties, affirmative covenants, negative covenants and events of default. The balance of the 2013 Prospect Loan Agreement at June 30, 2014 and March 31, 2014 was as follows:

|

| | | | | | | |

| As of June 30, 2014 | | As of March 31, 2014 |

2013 Prospect Loan Agreement, at issuance | $ | 70,000 |

| | $ | 70,000 |

|

PIK Interest | 2,338 |

| | 1,906 |

|

Payments to date | (3,624 | ) | | (3,452 | ) |

2013 Prospect Loan Agreement, net | 68,714 |

| | 68,454 |

|

Less current portion | — |

| | — |

|

Total long term portion | $ | 68,714 |

| | $ | 68,454 |

|

KBC Facilities

In December 2008, Phase 2 B/AIX, a direct wholly-owned subsidiary of Phase 2 DC and an indirect wholly-owned subsidiary of the Company, began entering into multiple credit facilities to fund the purchase of Systems from Barco, Inc. to be installed in movie theatres as part of the Company’s Phase II Deployment. A summary of the credit facilities is as follows:

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | Outstanding Principal Balance | | Draw as of |

Facility1 | | Credit Facility | | Interest Rate2 | | Maturity Date | | As of June 30, 2014 | | As of March 31, 2014 | | As of June 30, 2014 |

1 |

| | $ | 8,900 |

| | 8.50 | % | | December 2016 | | $ | — |

| | $ | — |

| | $ | — |

|

2 |

| | 2,890 |

| | 3.75 | % | | December 2017 | | 212 |

| | 315 |

| | — |

|

3 |

| | 22,336 |

| | 3.75 | % | | September 2018 | | 12,764 |

| | 13,561 |

| | — |

|

4 |

| | 13,312 |

| | 3.75 | % | | September 2018 | | 8,082 |

| | 8,558 |

| | — |

|

5 |

| | 11,425 |

| | 3.75 | % | | March 2019 | | 7,752 |

| | 8,160 |

| | — |

|

6 |

| | 6,450 |

| | 3.75 | % | | December 2018 | | 4,146 |

| | 4,376 |

| | — |

|

| | $ | 65,313 |

| | | | | | $ | 32,956 |

| | $ | 34,970 |

| | $ | — |

|

1 For each facility, principal is to be repaid in twenty-eight quarterly installments.

2 The interest rate for facilities 2 through 6 are the three month LIBOR rate of 0.23% at June 30, 2014, plus the interest rate noted above.

Cinedigm Credit Agreement

On October 17, 2013, the Company entered into a credit agreement (the “Cinedigm Credit Agreement”) with Société Générale, New York Branch, as administrative agent and collateral agent for the lenders party thereto and certain other secured parties (the “Collateral Agent”). Under the Cinedigm Credit Agreement and subject to the terms and conditions thereof, the Company may borrow an aggregate principal amount of up to $55,000, including term loans of $25,000 (the “Cinedigm Term Loans”) and revolving loans of up to $30,000 (the “Cinedigm Revolving Loans”). All of the Cinedigm Term Loans, for which principal will be paid quarterly, and $15,000 of the Cinedigm Revolving Loans were drawn at closing in connection with funding the GVE Acquisition upon the Company’s contribution of such funds. Each of the Cinedigm Term Loans and the Cinedigm Revolving Loans bears interest at the base rate plus 3.0% or the eurodollar rate plus 4.0%. Base rate, per annum, is equal to the highest of (a) the rate quoted by the Wall Street Journal as the “base rate on corporate loans by at least 75% of the nation’s largest banks,” (b) 0.50% plus the federal funds rate, and (c) the eurodollar rate plus 1.0%. All collections and revenues of CEG will be deposited into a special blocked account, from which amounts are paid out on a monthly basis to pay certain operating expenses and principal, interest, fees, costs and expenses relating to the Cinedigm Credit Agreement according to certain designated priorities. On a quarterly basis, if funds remain after the payment of all such amounts, a portion of such funds will be applied to prepay the Cinedigm Term Loans. The Cinedigm Term Loans and Cinedigm Revolving Loans mature and must be paid in full by October 21, 2016. In addition, the Company may prepay the Cinedigm Term Loans and Cinedigm Revolving Loans, in whole or in part, subject to paying certain breakage costs, as applicable.

The balance of the Cinedigm Term Loans as of June 30, 2014 was as follows:

|

| | | | | | | |

| As of June 30, 2014 | | As of March 31, 2014 |

Cinedigm Term Loans, at issuance, net | $ | 25,000 |

| | $ | 25,000 |

|

Payments to date | (1,750 | ) | | (875 | ) |

Discount on Cinedigm Term Loans | (327 | ) | | (360 | ) |

Cinedigm Term Loans, net | 22,923 |

| | 23,765 |

|

Less current portion | (4,000 | ) | | (3,750 | ) |

Total long term portion | $ | 18,923 |

| | $ | 20,015 |

|

At June 30, 2014 and March 31, 2014, the balances of the Cinedigm Revolving Loans was $11,608 and $15,469, respectively.

2013 Notes

On October 17, 2013 and October 21, 2013, the Company entered into securities purchase agreements (the “Securities Purchase Agreements”) with certain investors party thereto (the “Investors”) pursuant to which the Company agreed to sell to the Investors notes in the aggregate principal amount of $5,000 (the “2013 Notes”) and warrants to purchase an aggregate of 1,500,000 shares of Class A Common Stock (the “2013 Warrants”). The sales were consummated on October 21, 2013. The proceeds of the sales of the 2013 Notes and 2013 Warrants were used for working capital and general corporate purposes, including to finance, in part, the GVE Acquisition. The Company allocated a proportional value of $1,598 to the 2013 Warrants using a Black-Scholes option valuation model with the following assumptions:

|

| | | |

Risk free interest rate | | 1.38 | % |

Dividend yield | | — |

|

Expected life (years) | | 5 |

|

Expected volatility | | 76.25 | % |

The Company has treated the proportional value of the 2013 Warrants of $1,598 as a debt discount. The debt discount of the 2013 Notes will be amortized through the maturity of the 2013 Notes as interest expense.

The principal amount outstanding under the 2013 Notes is due on October 21, 2018. The 2013 Notes bear interest at 9.0% per annum, payable in quarterly installments over the term of the 2013 Notes. The 2013 Notes entitle the Company to redeem the 2013 Notes any time on or after October 21, 2015, subject to certain premiums.

Letters of Credit

As of June 30, 2014, outstanding letters of credit amounted to $4,000. No amounts were drawn upon during the three months ended June 30, 2014.

At June 30, 2014, the Company was in compliance with all of its debt covenants.

| |

5. | STOCKHOLDERS’ (DEFICIT) EQUITY |

CAPITAL STOCK

COMMON STOCK

As of June 30, 2014 and March 31, 2014, the Company has 118,759,000 authorized shares of Class A Common Stock and 1,241,000 shares of authorized Class B Common Stock of which none remain available for issuance.

PREFERRED STOCK

Cumulative dividends in arrears on the preferred stock at June 30, 2014 and March 31, 2014 were $89 on each date. In July 2014, the Company paid its preferred stock dividends accrued at June 30, 2014 in the form of 33,531 shares of its Class A Common Stock.

CINEDIGM’S EQUITY INCENTIVE PLAN

Stock Options

Awards under the Company's equity incentive plan (the "Plan") may be in any of the following forms (or a combination thereof) (i) stock option awards; (ii) stock appreciation rights; (iii) stock or restricted stock or restricted stock units; or (iv) performance awards. The Plan provides for the granting of incentive stock options (“ISOs”) with exercise prices not less than the fair market value of the Company’s Class A Common Stock on the date of grant. ISOs granted to shareholders of more than 10% of the total combined voting power of the Company must have exercise prices of at least 110% of the fair market value of the Company’s Class A Common Stock on the date of grant. ISOs and non-statutory stock options granted under the Plan are subject to vesting provisions, and exercise is subject to the continuous service of the participant. The exercise prices and vesting periods (if any) for non-statutory options are set at the discretion of the Company’s compensation committee. Upon a change of control of the Company, all stock options (incentive and non-statutory) that have not previously vested will vest immediately and become fully exercisable. In connection with the grants of stock options under the Plan, the Company and the participants have executed stock option agreements setting forth the terms of the grants.

During the three months ended June 30, 2014, the Company granted stock options to purchase 260,000 shares of its Class A Common Stock to its employees at exercise prices ranging from $2.35 to $2.66 per share, which will vest ratably over a four year period. As of June 30, 2014, the weighted average exercise price for outstanding stock options was $1.80 and the weighted average remaining contractual life was 6.03 years.

The following table summarizes the activity of the Plan related to shares issuable pursuant to outstanding options:

|

| | | | | | |

| Shares Under Option | | Weighted Average Exercise Price Per Share |

Balance at March 31, 2014 | 6,072,986 |

| | $ | 1.74 |

|

Granted | 260,000 |

| | 2.65 |

|

Exercised | (34,443 | ) | | 1.49 |

|

Canceled | (265,248 | ) | | 1.50 |

|

Balance at June 30, 2014 | 6,033,295 |

| | 1.80 |

|

OPTIONS GRANTED OUTSIDE CINEDIGM’S EQUITY INCENTIVE PLAN

In October 2013, the Company issued options outside of the Equity Incentive Plan to 10 employees who joined the Company following the GVE Acquisition. The employees received options to purchase an aggregate of 620,000 shares of the Company's Class A Common Stock. The options have ten-year terms and an exercise price of $1.75 per share. As of June 30, 2014, there were 545,000 unvested shares outstanding.

WARRANTS

As of June 30, 2014, outstanding warrants consisted of 16,000,000 held by Sageview ("Sageview Warrants"), 525,000 held by a strategic management service provider and the 2013 Warrants.

The Sageview Warrants were exercisable beginning on September 30, 2009 at an exercise price of $1.37, contain a customary cashless exercise provision and anti-dilution adjustments, and expire on August 11, 2016 (subject to extension in limited circumstances).

The strategic management service provider warrants were issued in connection with a consulting management services agreement entered into with the Company. These warrants for the purchase of 525,000 shares of Class A common stock vested over 18 months commencing in July 2011, are subject to termination with 90 days notice in the event of termination of the consulting management services agreement and expire on July 1, 2021.

The 2013 Warrants will be exercisable through October 21, 2018 at an exercise price per share of $1.85. The 2013 Warrants and 2013 Notes are subject to certain transfer restrictions. As of June 30, 2014, 1,250,625 of the 2013 Warrants were outstanding.

| |

6. | COMMITMENTS AND CONTINGENCIES |

The Company is subject to a capital lease obligation where we have no continuing involvement other than being the primary obligor. A sub-lease agreement, through which an unrelated third party purchaser pays the capital lease, was amended during January 2013. The impact of the capital lease amendment to the Company's condensed consolidated financial statements was not material.

LITIGATION

We are subject to certain legal proceedings in the ordinary course of business. We do not expect any such items to have a significant impact on our financial position and results of operations and liquidity.

| |

7. | SUPPLEMENTAL CASH FLOW INFORMATION |

|

| | | | | | | |

| For the Three Months Ended June 30, |

| 2014 | | 2013 |

Cash interest paid | $ | 4,475 |

| | $ | 6,064 |

|

Accretion of preferred stock discount | $ | — |

| | $ | 27 |

|

Accrued dividends on preferred stock | $ | 89 |

| | $ | 89 |

|

Issuance of common stock for payment of preferred stock dividends | $ | 89 |

| | $ | — |

|

The Company is comprised of four reportable segments: Phase I Deployment, Phase II Deployment, Services and Content & Entertainment. The segments were determined based on the products and services provided by each segment and how management reviews and makes decisions regarding segment operations. Performance of the segments is evaluated on the segment’s income (loss) from continuing operations before interest, taxes, depreciation and amortization.

The Phase I Deployment and Phase II Deployment segments consist of the following:

|

| |

Operations of: | Products and services provided: |

Phase 1 DC | Financing vehicles and administrators for the Company’s 3,724 Systems installed nationwide in Phase 1 DC’s deployment to theatrical exhibitors. The Company retains ownership of the Systems and the residual cash flows related to the Systems after the repayment of all non-recourse debt at the expiration of exhibitor master license agreements. |