Exhibit 99.1

SUNWORKS ANNOUNCES THIRD QUARTER 2023 RESULTS

PROVO, UT., November 10, 2023 - Sunworks, Inc. (Nasdaq: SUNW), a leading provider of solar power, battery storage, and electric vehicle charging solutions for residential, agriculture, commercial, industrial, and public works markets, today announced financial results for the three months ended September 30, 2023.

THIRD QUARTER 2023 RESULTS

(As compared to the Third Quarter 2022)

| ● | Total revenue of $28.7 million, a 29.5% decline |

| ● | Residential Solar segment revenue of $20.3 million, a 44.5% decline |

| ● | Commercial Solar Energy segment revenue of $8.3 million, a 105.9% increase |

| ● | Total backlog of $66.5 million, a 39.7% decline |

For the three months ended September 30, 2023, Sunworks reported total revenue of $28.7 million, versus $40.7 million in the prior-year period. The Company reported a net loss of ($36.4) million in the third quarter of 2023, or ($0.84) per share, versus a net loss of ($5.4) million in the prior-year period, or ($0.16) per share. The third quarter 2023 net loss includes a ($26.0) million, or ($.60) per share, non-cash impairment of goodwill.

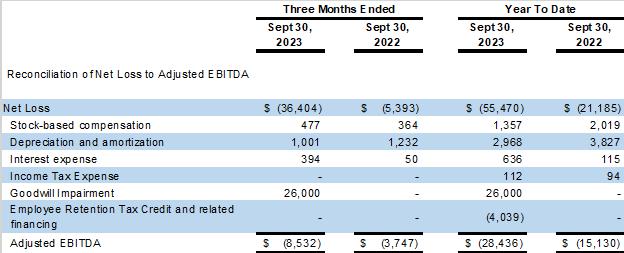

Adjusted EBITDA was a loss of $8.5 million in the third quarter 2023, compared to a loss of $3.7 million in the third quarter 2022. A reconciliation of GAAP to non-GAAP financial measures is provided in the appendix of this release.

MARKET UPDATE

Demand conditions within Sunworks’ Commercial Solar Energy segment remain healthy. Over the past 18 months, the Company set a long-term strategy of diversifying its customer base and developing relationships with multi-site commercial entities. While order timing may depend on jurisdictional approval and other external factors, indications of interest from commercial entities and public works entities are at elevated levels. In the third quarter, Commercial Solar Energy segment revenue increased 12.2% sequentially and 105.9% on year over year basis.

Following strong residential origination activity in the first quarter, demand conditions in the Residential Solar Energy segment began to weaken in the second quarter and continued to decline in the current quarter. An increase in interest rates and lower activity levels in California following the net energy metering “NEM” 3.0 transition are driving lower residential solar adoption. In response to the demand decline, the Company has lowered headcount and exited several underperforming markets. The Company is focusing sales and marketing efforts in a smaller regional footprint to drive scale and operating efficiencies. In the third quarter, Residential Solar segment revenue declined 25.2% sequentially and 44.5% on a year over year basis.

MANAGEMENT COMMENTARY

“The long-term economics of residential and commercial solar remain attractive, positively influenced by the provisions in the Inflation Reduction Act and rising utility costs,” stated Mark Trout, Chief Executive Officer of Sunworks. “Our team remains committed to empowering customers by delivering on-demand access to clean, reliable and cost-effective solar and storage solutions that reduce reliance on traditional, third-party energy sources.”

“While longer-term solar demand fundamentals remain intact, our residential solar business continues to face challenges,” continued Trout. “The combination of higher interest rates across the country and less favorable residential solar economics in California following the NEM 3.0 transition negatively impacted originations during the quarter. As a result, we have right sized our cost structure, including a reduction in force, as well as closing non-strategic and underutilized markets. Additionally, we have refocused our sales team in markets in which we can drive scale, including markets with strong competitive positions and have favorable homeowner economics. We believe these actions, along with other cost reductions will reduce our cash burn and best position the Company for a recovery in 2024.”

“Within our commercial solar business, we’re seeing a strong pipeline of potential new opportunities with larger commercial organizations, including independent power producers,” continued Trout. “While project timing can vary from quarter-to-quarter, we remain positive about our growing addressable market, including our first order for a commercial grade electric vehicle system. Execution within our commercial business continued to be strong in the third quarter, as revenue more than doubled on a year-over-year basis and operated at a materially higher gross margin.”

“As before, the market opportunity for solar remains significant across our geographic footprint, positioning Sunworks to play a leading role in the transition toward affordable, clean, and independent energy production and storage” concluded Trout. “We believe the actions taken to prioritize markets and build scale, best positions us to rebuild momentum in our business entering 2024.”

NON-GAAP FINANCIAL MEASURES

EBITDA is a non-GAAP financial measure defined as net income (loss) excluding interest, other financing fees, employee retention tax credit received, taxes and depreciation and amortization. Adjusted EBITDA is further adjusted for non-cash stock-based compensation expense, goodwill impairment and acquisition transaction expenses. Adjusted EBITDA is a key measure used by the Company to evaluate operating performance, generate future operating plans and make strategic decisions for the allocation of capital. The Company presents Adjusted EBITDA to provide information that may assist investors in understanding its financial results. However, Adjusted EBITDA is not intended to be a substitute for net income (loss).

Certain non-GAAP financial measures are presented in this press release, including Adjusted EBITDA, to provide information that may assist investors in understanding the Company’s financial results and assessing its prospects for future performance. We believe these non-GAAP financial measures are important indicators of our operating performance because they exclude items that are unrelated to, and may not be indicative of, our core operating results. These non-GAAP financial measures, as we calculate them, may not be comparable to similarly titled measures of other companies and may not be appropriate measures for comparing the performance of other companies relative to the Company. These non-GAAP financial results are not intended to represent and should not be considered to be more meaningful measures than, or alternatives to, measures of operating performance as determined in accordance with GAAP. To the extent we utilize such non-GAAP financial measures in the future, we expect to calculate them using a consistent method from period to period. A reconciliation of Adjusted EBITDA to the most directly comparable GAAP financial measure is provided below.

THIRD QUARTER 2023 CONFERENCE CALL

A conference call will be held today at 12:00 P.M. ET to review the Company’s financial results, discuss recent events and conduct a question-and-answer session.

A webcast of the conference call and accompanying presentation materials will be available in the Investor Relations section of Sunworks’ website at https://ir.sunworksusa.com/. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download and install any necessary audio software.

To participate in the live teleconference on November 10, 2023:

| Domestic Live Dial-In: | 1-877-407-0789 |

| International Live Dial-In: | 1-201-689-8562 |

To listen to a replay of the teleconference through November 24, 2023:

| Domestic Live Replay: | 1-844-512-2921 |

| International Live Replay: | 1-412-317-6671 |

| Access Code: | 13742499 |

ABOUT SUNWORKS

Sunworks has been providing high-performance solar and battery storage solutions for over a decade. The Company acquired Solcius in 2021 to extend its national presence and provide high-quality, performance-oriented solutions to sectors ranging from residential to agricultural, commercial, industrial, federal, and public works. Today, Sunworks is proudly paving the way toward the democratization of renewable energy for all with their agile, partner-centric, and technology-agnostic network that has installed over 200 MW of solar and battery storage systems. Their dependable, solutions-oriented teams are recognized in the industry for their commitment to customer service and renewable energy advancement. Sunworks was recently recognized by Solar Power World as a leading solar supplier and is a member of the Solar Energy Industries Association (SEIA). For more information, visit www.sunworksusa.com and www.solcius.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to statements regarding the impact of higher financing costs on solar adoption, the Company’s ability to refocus sales efforts in more attractive markets, growth of the Company’s commercial pipeline, the Company’s ability to increase margins, the strength of demand for the Company’s products, the Company’s ability to reduce cash burn, and the impact of the Inflation Reduction Act and the Company’s ability to diversify sourcing of materials. These forward-looking statements are based upon the current beliefs and expectations of management and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of Sunworks. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties. Factors that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in Sunworks’ reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available on the SEC’s Internet site (http://www.sec.gov). We undertake no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise.

IR

CONTACT

385.497.6955

IR@sunworksusa.com

SUNWORKS, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

AS OF SEPTEMBER 30, 2023 AND DECEMBER 31, 2022

(in thousands, except share and per share data)

| September 30, 2023 | December 31, 2022 | |||||||

| (Unaudited) | ||||||||

| Assets | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 2,197 | $ | 7,807 | ||||

| Restricted cash | 250 | 248 | ||||||

| Accounts receivable, net | 10,203 | 13,873 | ||||||

| Inventory | 16,379 | 26,401 | ||||||

| Contract assets | 16,714 | 20,699 | ||||||

| Other current assets | 3,557 | 5,824 | ||||||

| Total Current Assets | 49,300 | 74,852 | ||||||

| Property and equipment, net | 1,156 | 2,154 | ||||||

| Finance lease right-of-use assets, net | 4,156 | 2,487 | ||||||

| Operating lease right-of-use assets, net | 2,203 | 2,779 | ||||||

| Deposits | 202 | 192 | ||||||

| Intangible assets, net | 4,300 | 5,290 | ||||||

| Goodwill | 6,186 | 32,186 | ||||||

| Total Assets | $ | 67,503 | $ | 119,940 | ||||

| Liabilities and Shareholders’ Equity | ||||||||

| Current Liabilities: | ||||||||

| Accounts payable and accrued liabilities | $ | 18,587 | $ | 24,567 | ||||

| Contract liabilities | 19,280 | 24,960 | ||||||

| Finance lease liabilities, current portion | 1,115 | 631 | ||||||

| Operating lease liabilities, current portion | 915 | 1,098 | ||||||

| Total Current Liabilities | 39,897 | 51,256 | ||||||

| Long-Term Liabilities: | ||||||||

| Finance lease liabilities, net of current portion | 2,933 | 1,470 | ||||||

| Operating lease liabilities, net of current portion | 1,288 | 1,681 | ||||||

| Warranty liability | 1,776 | 1,596 | ||||||

| Total Long-Term Liabilities | 5,997 | 4,747 | ||||||

| Total Liabilities | 45,894 | 56,003 | ||||||

| Commitments and contingencies | ||||||||

| Shareholders’ Equity: | ||||||||

| Preferred stock Series B, $0.001 par value, 5,000,000 authorized shares; no shares issued and outstanding | ||||||||

| Common stock, $0.001 par value; 100,000,000 authorized shares; 48,934,447 and 35,374,978 shares issued and outstanding, at September 30, 2023 and December 31, 2022, respectively | 49 | 35 | ||||||

| Additional paid-in capital | 220,501 | 207,373 | ||||||

| Accumulated deficit | (198,941 | ) | (143,471 | ) | ||||

| Total Shareholders’ Equity | 21,609 | 63,937 | ||||||

| Total Liabilities and Shareholders’ Equity | $ | 67,503 | $ | 119,940 | ||||

SUNWORKS, INC.

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

For the three and nine months ended September 30, 2023 and 2022

(in thousands, except share and per share data)

| Three Months Ended | Nine Months Ended | |||||||||||||||

| September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 | |||||||||||||

| Revenue, net | $ | 28,696 | $ | 40,713 | $ | 101,234 | $ | 108,306 | ||||||||

| Cost of Goods Sold | 20,522 | 21,204 | 69,696 | 59,030 | ||||||||||||

| Gross Profit | 8,174 | 19,509 | 31,538 | 49,276 | ||||||||||||

| Operating Expenses: | ||||||||||||||||

| Selling and marketing | 7,801 | 14,773 | 31,847 | 41,320 | ||||||||||||

| General and administrative | 9,441 | 8,718 | 28,057 | 24,025 | ||||||||||||

| Goodwill impairment | 26,000 | - | 26,000 | - | ||||||||||||

| Stock-based compensation | 477 | 364 | 1,357 | 2,019 | ||||||||||||

| Depreciation and amortization | 623 | 1,056 | 1,868 | 3,177 | ||||||||||||

| Total Operating Expenses | 44,342 | 24,911 | 89,129 | 70,541 | ||||||||||||

| Operating Loss | (36,168 | ) | (5,402 | ) | (57,591 | ) | (21,265 | ) | ||||||||

| Other Income (Expense) | ||||||||||||||||

| Other income (expense), net | 54 | (6 | ) | 4,103 | 46 | |||||||||||

| Interest expense | (394 | ) | (50 | ) | (636 | ) | (115 | ) | ||||||||

| Gain (Loss) on disposal of property and equipment | 104 | 65 | (1,234 | ) | 243 | |||||||||||

| Total Other Income (Expense), net | (236 | ) | 9 | 2,233 | 174 | |||||||||||

| Loss before Income Taxes | (36,404 | ) | (5,393 | ) | (55,358 | ) | (21,091 | ) | ||||||||

| Income Tax Expense | - | - | 112 | 94 | ||||||||||||

| Net Loss | $ | (36,404 | ) | $ | (5,393 | ) | $ | (55,470 | ) | $ | (21,185 | ) | ||||

| LOSS PER SHARE: | ||||||||||||||||

| Basic and Diluted | $ | (0.84 | ) | $ | (0.16 | ) | $ | (1.43 | ) | $ | (0.66 | ) | ||||

| WEIGHTED-AVERAGE COMMON SHARES OUTSTANDING | ||||||||||||||||

| Basic | 43,569,953 | 33,626,405 | 38,867,833 | 32,027,304 | ||||||||||||