Accelerating CIT’s Strategic Plan Acquisition of Mutual of Omaha Bank August 13, 2019 Exhibit 99.2

Important Notice This presentation contains forward-looking statements within the meaning of applicable federal securities laws that are based upon our current expectations and assumptions concerning future events, which are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. The words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “commence,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or the negative of any of those words or similar expressions is intended to identify forward-looking statements. All statements contained in this presentation, other than statements of historical fact, including without limitation, statements about our plans, strategies, prospects and expectations regarding future events and our financial performance, are forward-looking statements that involve certain risks and uncertainties. In particular, any projections or expectations regarding the proposed acquisition by CIT of Mutual of Omaha Bank described herein, our future revenues, expenses, earnings, capital expenditures, deposits or stock price, as well as the assumptions on which such expectations are based, are such forward-looking statements reflecting only our current judgment and are not guarantees of future performance or results. While these statements represent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results, and our actual results may differ materially. Important factors that could cause our actual results to be materially different from our expectations include, among others, the risk that (i) CIT is unsuccessful in implementing its strategy and business plan, including, planned or potential acquisitions or divestitures, (ii) CIT is unable to react to and address key business and regulatory issues, (iii) CIT is unable to achieve the projected revenue growth from its new business initiatives or the projected expense reductions from efficiency improvements, (iv) CIT becomes subject to liquidity constraints and higher funding costs; (v) the parties to the proposed transaction described in this presentation do not obtain regulatory or other approvals or satisfy closing conditions to the transaction on a timely basis, or at all, or approvals are subject to conditions that are not anticipated; (vi) CIT experiences (A) difficulties and delays in integrating CIT’s and Mutual of Omaha Bank’s respective businesses or fully realizing cost savings and other benefits, or (B) business disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities; and (vii) changes in asset quality, credit risk, interest rates, capital markets or other economic conditions. We further describe these and other risks that could affect our results in Item 1A, “Risk Factors,” of our latest Annual Report on Form 10-K for the year ended December 31, 2018, which was filed with the Securities and Exchange Commission. Accordingly, you should not place undue reliance on the forward-looking statements contained in this presentation. These forward-looking statements speak only as of the date on which the statements were made. CIT undertakes no obligation to update publicly or otherwise revise any forward-looking statements, except where expressly required by law. Non-GAAP Financial Measures This presentation contains references to non-GAAP financial measures, which provide additional information and insight regarding operating results and financial position of the business, including financial information that is presented to rating agencies and other users of financial information. These non-GAAP measures are not in accordance with, or a substitute for, GAAP and may be different from or inconsistent with non-GAAP financial measures used by other companies. The definitions of these measures and reconciliations of non-GAAP to GAAP financial information are available in this presentation. This presentation is to be used solely as part of CIT management’s continuing investor communications program. This presentation shall not constitute an offer or solicitation in connection with any securities. Unaudited GAAP financial data of CIT and Mutual of Omaha Bank as well as projected financial data based on unaudited CIT and Mutual of Omaha Bank data are as of June 30, 2019, unless otherwise stated.

Enhances Deposit and Commercial Banking Capabilities Immediately enhances core deposit and commercial banking capabilities $6.8 billion in low-cost deposits, 73 bps weighted average cost in 2Q19 $4.5 billion of Homeowners Association (“HOA”) deposits $2.3 billion of commercial and retail deposits in 26 financial centers $3.9 billion(2) in middle-market commercial loans in targeted metro markets Accelerates Strategic Plan Accelerates CIT’s strategy by enhancing deposit franchise, extending commercial banking reach and deploying capital Establishes leadership in HOA banking, with leading market share and differentiated technology-enabled solutions Stable, scalable base of low-cost HOA deposits diversifies funding Expands commercial banking franchise and geographic reach in attractive metro markets Adds middle-market commercial banking with experienced lenders and deep customer relationships Strengthens Profitability Transaction strengthens profitability and drives shareholder value creation Optimizes Funding – Decreases cost of deposits by 20 bps and lowers Loan & Lease to Deposit ratio Enhances Profitability – Expands 2020E ROTCE(3) by 80 bps increasing to 100+ bps in 2 years Accelerates Earnings – Double-digit EPS accretion by 2023 Fully phased-in 2020E EPS(4) accretion of 2% 20+% IRR Attractive Purchase Price Purchase price compares favorably to recent bank transactions 4.0% core deposit premium(5) 11.6x 2020E earnings 1.38x tangible book value(6) Acquisition Creates Significant Financial and Strategic Value 1 Excludes Synergy One mortgage banking business Excludes $234 million mortgage warehouse line Full year impact assuming fully phased-in cost savings, excludes impact of CECL and merger and integration costs Based on CIT’s consensus estimates using full year impact and fully phased-in cost savings. Excludes impact of CECL and merger and integration costs Excludes jumbo CDs $725 million TBV at closing CIT is acquiring Mutual of Omaha Bank(1) for $1 billion

Top 10 National Direct Bank 64 Branches in the Top MSAs in Southern California More than $30 billion of Consumer Deposits Top 10 arranger of middle-market sponsored deals(3) Top 3 arranger of Power & Renewable projects(4) Top 4 Bank Provider of Equipment Financing Top 4 Provider of Railcar Leasing Top Provider of Factoring Services Focused Commercial Real Estate Lender CIT Today: A Leading National Commercial Bank CIT has accomplished a significant transformation over the past three years Commercial Banking Financial Highlights ($ billions) $50.6 Assets $38.6 Total Loans & Leases $35.3 Deposits Consumer Savings Transformation Highlights Source: Company filings Cumulative share repurchases and common dividends since 2015 $150 million reduction over the last three years Based on Thomson Reuters League Table rankings as of 1H 2019 for deals of $300 million or less in size Based on Acuris League Table rankings as of 1H 2019 for deals of $300 million or less in size Positioned CIT as a leading commercial bank Divested over $14 billion in non-core assets Commercial Air, Financial Freedom, NACCO Optimized funding and capital composition Deposits comprise 85% of total funding (from 68%) Returned $6.4 billion of capital to shareholders(1) Reduced operating expenses by $150 million(2) Strengthened risk management practices and reduced risk profile Improved portfolio mix supported by stronger collateral Built an experienced and diverse leadership team 2

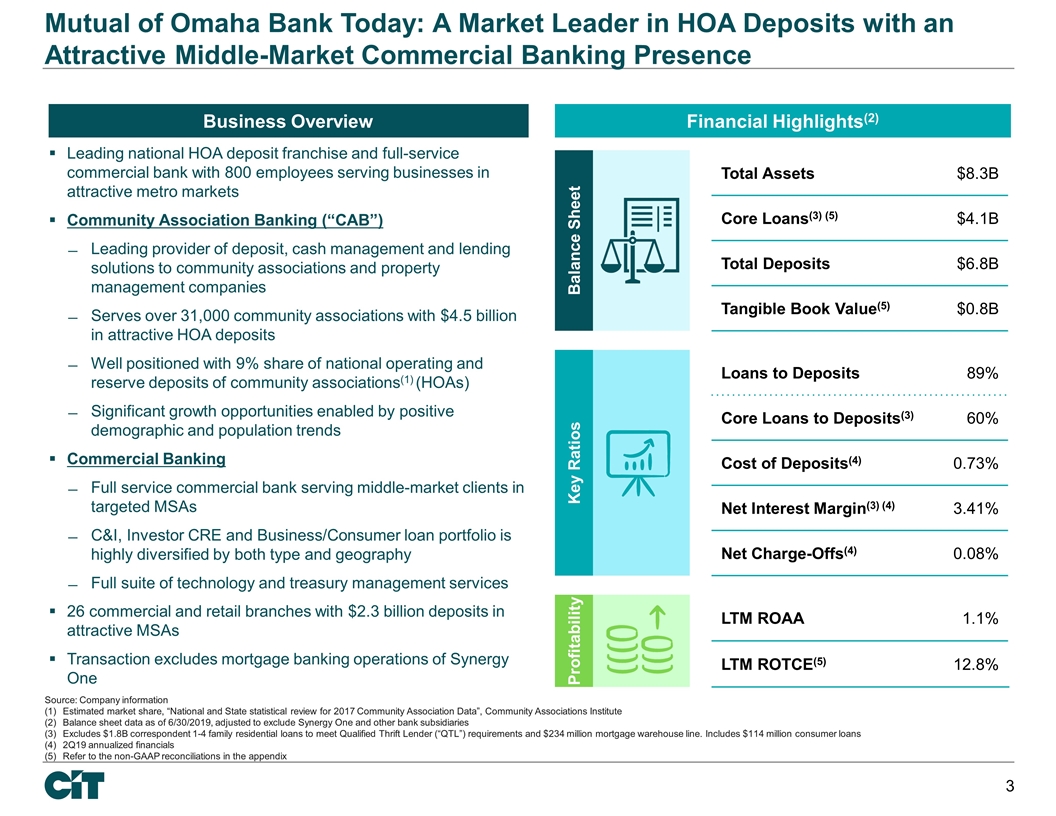

Mutual of Omaha Bank Today: A Market Leader in HOA Deposits with an Attractive Middle-Market Commercial Banking Presence Financial Highlights(2) Source: Company information Estimated market share, “National and State statistical review for 2017 Community Association Data”, Community Associations Institute Balance sheet data as of 6/30/2019, adjusted to exclude Synergy One and other bank subsidiaries Excludes $1.8B correspondent 1-4 family residential loans to meet Qualified Thrift Lender (“QTL”) requirements and $234 million mortgage warehouse line. Includes $114 million consumer loans 2Q19 annualized financials Refer to the non-GAAP reconciliations in the appendix Business Overview Leading national HOA deposit franchise and full-service commercial bank with 800 employees serving businesses in attractive metro markets Community Association Banking (“CAB”) Leading provider of deposit, cash management and lending solutions to community associations and property management companies Serves over 31,000 community associations with $4.5 billion in attractive HOA deposits Well positioned with 9% share of national operating and reserve deposits of community associations(1) (HOAs) Significant growth opportunities enabled by positive demographic and population trends Commercial Banking Full service commercial bank serving middle-market clients in targeted MSAs C&I, Investor CRE and Business/Consumer loan portfolio is highly diversified by both type and geography Full suite of technology and treasury management services 26 commercial and retail branches with $2.3 billion deposits in attractive MSAs Transaction excludes mortgage banking operations of Synergy One Balance Sheet Total Assets $8.3B Core Loans(3) (5) $4.1B Total Deposits $6.8B Tangible Book Value(5) $0.8B Key Ratios Loans to Deposits 89% Core Loans to Deposits(3) 60% Cost of Deposits(4) 0.73% Net Interest Margin(3) (4) 3.41% Net Charge-Offs(4) 0.08% Profitability LTM ROAA 1.1% LTM ROTCE(5) 12.8% 3

Adds New Core HOA Channel Increases CIT’s Commercial and Consumer Deposits Attractive HOA Deposits Brings Strong CAB Franchise and Established HOA Deposit Leader to CIT Highly attractive national HOA market, characterized by strong, scalable growth of stable low-cost deposits $4.5B Long Duration Stable Deposits Source: Company information 2017 data. Estimated market share, “National and State statistical review for 2017 Community Association Data”, Community Associations Institute, Deluxe Payment Advisory Services 4 0.63% Cost Mutual of Omaha Bank’s Leadership 9% 17% 17% Community Association Market(1) Market Share(1) CAGR: 11.4% Demonstrated Track Record of Growth Mutual of Omaha Bank’s HOA Deposits ($B) 347,000 HOAs Nationwide 26 million Households ~7,500 Property Mgmt Companies 31,000+ ~4.5mm 1,281 Online Branch HOA Commercial 9% ~$50B Operating & Reserve Deposits $4.5B Mutual of Omaha Bank CAB $ $ $ $

Favorable Industry Dynamics The industry has approximately 347,000 HOAs nationwide and over $50 billion in deposits 61% of new housing built-for-sale are in a community association Property management companies (“PMCs”) oversee 80% of deposits; administrative pain points are numerous Value added services to HOAs and PMCs such as tenant portals, digital services and e-procurement solutions address pain points, add incremental revenue streams and promote relationship stickiness Proprietary Technology and Superior Client Service Proprietary, tech-enabled solutions platform differentiates Mutual of Omaha Bank from competitors OneSource – Software to integrate HOA and PMC accounting systems, providing a full suite of payment and reporting capabilities MutualPay Property Pay – Provides homeowners with robust tools to pay assessments electronically Mutual VIP – Enables property management firms to pay vendors efficiently and electronically Mutual View Point – Robust digital portal to seamlessly interact with the bank electronically High-touch client service and implementation model Target Rich Geographies and Adjacent Channels Mutual of Omaha Bank has previously underpenetrated significant HOA markets due to growth constraints placed by Parent Opportunities exist to expand in 5 out of the top 9 markets and 8 of the next 12 Current model is scalable with plans to add talent to support growth Growth opportunity in adjacent deposit channels Harnessing the CAB Growth Opportunity 5 A multi-prong approach to winning market share by solving HOA and PMC pain points Detailed business plan to double HOA and adjacent market deposits in 5 – 7 years

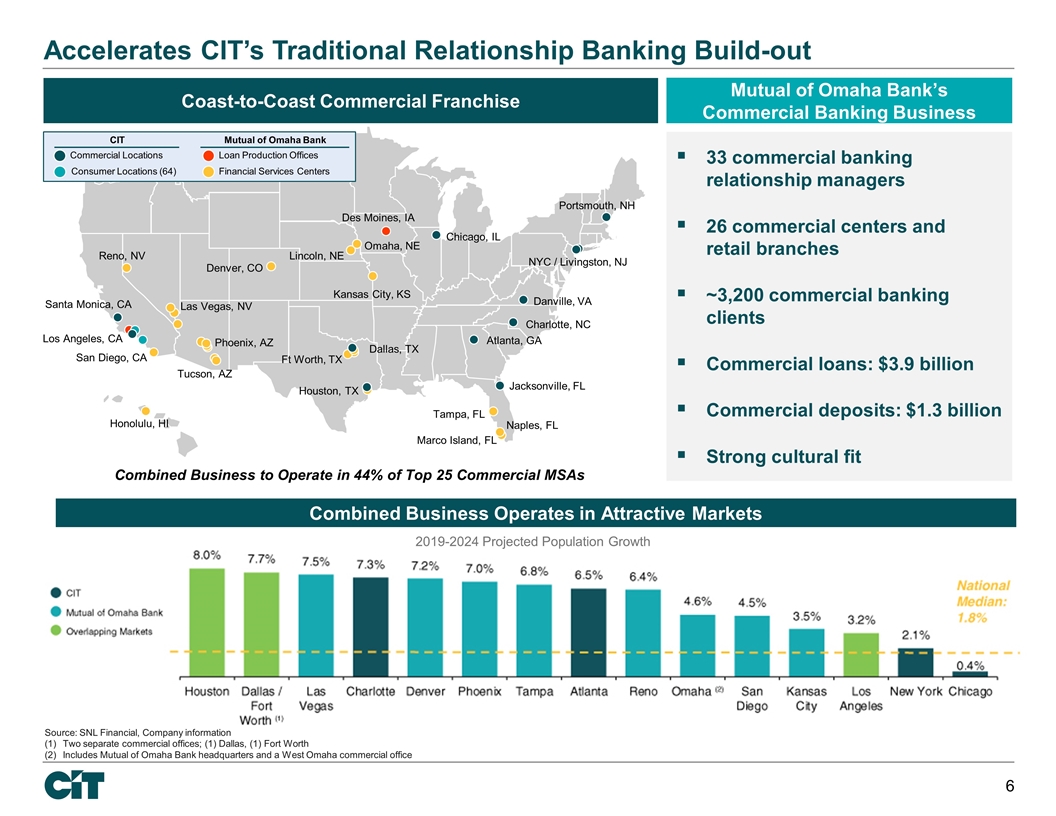

Accelerates CIT’s Traditional Relationship Banking Build-out 6 Mutual of Omaha Bank’s Commercial Banking Business Coast-to-Coast Commercial Franchise Combined Business Operates in Attractive Markets 2019-2024 Projected Population Growth Dallas, TX Naples, FL Marco Island, FL Tampa, FL San Diego, CA Reno, NV Tucson, AZ Phoenix, AZ Las Vegas, NV Denver, CO Lincoln, NE Des Moines, IA Omaha, NE Kansas City, KS Honolulu, HI Houston, TX Ft Worth, TX Atlanta, GA Charlotte, NC Chicago, IL Danville, VA Jacksonville, FL Portsmouth, NH NYC / Livingston, NJ Santa Monica, CA Los Angeles, CA Combined Business to Operate in 44% of Top 25 Commercial MSAs Source: SNL Financial, Company information Two separate commercial offices; (1) Dallas, (1) Fort Worth Includes Mutual of Omaha Bank headquarters and a West Omaha commercial office Loan Production Offices Financial Services Centers Commercial Locations Consumer Locations (64) CIT Mutual of Omaha Bank 33 commercial banking relationship managers 26 commercial centers and retail branches ~3,200 commercial banking clients Commercial loans: $3.9 billion Commercial deposits: $1.3 billion Strong cultural fit

Complementary Commercial Offerings to Win and Deepen Client Relationships Leverage CIT’s expertise across industry, asset classes, and capital markets to deliver deeper solutions to Mutual of Omaha Bank’s client base Leverage Mutual of Omaha Bank’s differentiated treasury management and payment product solutions to extend CIT’s reach to deposit-rich sectors CIT Commercial Finance(1) Mutual of Omaha Bank Client Profile Event-driven or asset-based Limited deposit opportunities Privately held mid-sized companies Full-service banking model Deposit-rich sectors Origination Strategy Industry or asset-backed Largely sourced through: Intermediaries Sponsors Direct calling in key industry and specialized verticals National focus Direct calling via local relationship teams Geographically targeted Complementary Products, Services and Expertise Syndications and capital markets Equipment finance Vendor programs ABL & Factor services Foreign exchange Deep sector knowledge including Healthcare, Aerospace & Defense, Government Contracting, Power & Energy, Transportation, and TMT Proprietary and tech-enabled solutions for small & medium enterprises and depository rich channels including: PayFAC Online revolving lines of credit Partner loans Alternative investment options Specialized treasury management services Commercial Finance is a division of Commercial Banking. Does not include Rail, Business Capital, or Real Estate Finance 7

Meaningfully Enhances CIT’s Pro Forma Business Mix CIT Mutual of Omaha Bank Pro Forma By Type Cost: 1.97% L&LDR: 109% Cost: 0.73% L&LDR: 89% / 60% (2) Cost: 1.77% L&LDR: 101% (2) Source: SNL Financial as of 2Q19, Company information, Mutual of Omaha Bank Includes commercial branch from Mutual of Omaha Bank Excludes $1.8B correspondent 1-4 family residential loans to meet QTL requirements and $234 million mortgage warehouse line Includes mortgage warehouse line Includes owner-occupied CRE Includes CRE from Mutual of Omaha Bank Includes HOA and C&I from Mutual of Omaha Bank $35.3B $6.8B $42.1B Loans and Leases Yield: 5.95% Yield: 4.71% Yield: 5.78% $38.6B $6.1B 8 By Channel $35.3B $6.8B $42.1B Deposits (1) (4) (3)

Substantial Upside Potential Financially Attractive Strategically Compelling Accelerates CIT’s Commercial Banking Strategy Quality franchise with strong risk culture National and scalable HOA channel diversifies funding Improves risk profile of CIT’s consolidated loan and deposit portfolios Stable, low-cost deposits will immediately enhance deposit and liquidity profile Entry into attractive major metro markets with appealing demographics and sizeable commercial banking opportunities Adds 33 talented commercial bankers skilled in relationship banking and deposit taking plus differentiated new products and technology Attractive purchase price Deposit funding and cost synergies drive meaningful long-term EPS accretion 63 bps of low cost HOA deposits with scalable growth Cost savings materially enhance profitability Expands fully phased-in ROTCE(1) Strong opportunities in HOA business and adjacent deposit channels with path from $4.5 to $9 billion of deposits over 5 – 7 years Lower cost deposits and new market / customer reach enables traditional middle-market relationship banking expansion Diversifies funding sources and reduces reliance on marginal higher cost deposits for growth, improving enterprise risk profile $4.5B HOA Deposits CoD Reduced by 20 bps +80 bps 2020E ROTCE 100+ bps (in 2 years) 4% Core Deposit Premium Expands Commercial Banking Target Market 11% HOA Historical Deposit CAGR HOA: stable, low beta deposits Double-Digit Long-Term EPS Accretion Commercial Bank Valuation Upside 9 (1) Full year impact assuming fully phased-in cost savings, excludes impact of CECL and merger and integration costs

Structure CIT Bank, N.A. to acquire Mutual of Omaha Bank Excludes Mutual of Omaha Bank’s mortgage banking operations (Synergy One) Transaction Value $1.0 billion Consideration Up to $150 million in CIT shares to Parent (at the option of CIT) Transaction Multiples 4.0% core deposit premium 1.38x TBV 11.6x 2020E Earnings Anticipated Closing Q1 2020, subject to regulatory approval Earnings and Synergies Mutual of Omaha Bank full year, standalone earnings: $86 million 2020E Cost savings: 28% or $54 million(2) pre-tax (phased in 30% in Year 1, 85% in Year 2 and 100% thereafter) HOA and adjacent deposit verticals planned to double over 5-7 years and be deployed into middle-market lending Funding benefits: growing HOA deposits and diversifying into lower risk middle-market commercial banking will drive lower marginal deposit and funding costs across CIT’s entire franchise Financial Impact EPS accretion(3): 2020E: 2%; 2021E: 3%; 2022E: 8%; double-digits thereafter, relative to CIT’s consensus estimates which include share repurchases 5.5%(4) dilutive to tangible book value per share with 4.9 year crossover earnback 20%+ IRR Capital Accelerates deployment of capital to reach 10.5% CET1 target CET1 at closing of 10%, growing to 10.5% within 12 months Share repurchases suspended until 10.5% CET1 target reached Transaction Summary 10 Precedent Transactions(1) Core Deposit Premium: 19% P / TBV: 2.2x P / NTM EPS: 17.2x Source: SNL Financial, Company information Recent transactions based on median of $750mm – $2bn bank mergers and acquisitions announced since January 1, 2017 $57 million net of $3 million FDIC dis-synergy Based on CIT’s consensus estimates using full year impact and fully phased-in cost savings. Excludes impact of CECL and merger and integration costs Upfront dilution includes all one-time costs

Standalone Earnings Per Share CIT’s 2020 consensus estimate of $5.32 per share Financing Common: up to $150 million at CIT’s option Preferred: $200 million Subordinated debt: $100 million Senior unsecured debt: ~$550 million Estimated Marks on Mutual of Omaha Bank’s Balance Sheet Loan mark: net $30 million negative mark; negative $74 million (1.15% of loans) for credit and a positive $44 million (0.7% of loans) for rate Securities mark: $23 million positive mark (1.25% of securities); equivalent to 6/30/19 AOCI Estimated Goodwill and Intangibles Goodwill: $56 million Core deposit intangible: $85 million (1.25% of core deposits), amortized over 7 years using straight line method Transaction is structured as an asset sale for tax purposes, and therefore all intangibles created are deductible for tax purposes Estimated Merger & Integration Costs $110 million merger and integration costs (2.0x cost saves) Under GAAP, merger and integration costs will be incurred over time Due Diligence Comprehensive due diligence review with 3rd party advisors on key focus areas: deposits, credit quality, accounting, compliance, risk, technology, operations, legal and regulatory Key conclusions: well-managed, conservative franchise 3rd party deposit specialist hired to evaluate HOA deposit franchise Key conclusions: low beta, long duration, cost efficient, differentiated product and service offering 300 CIT personnel participated in due diligence Transaction Detail 11

Accelerates CIT’s Strategic Plan Pillars Our Strategy Mutual of Omaha Bank Transaction Benefits Grow Core Businesses Deepen client relationships Innovate with value ü Acquiring small and middle-market customers Leading HOA franchise Acquiring proprietary payment technologies and tech-enabled solutions to serve HOA and other adjacent channels Optimize Balance Sheet Enhance funding and deposits Optimize capital structure ü Accelerates strategic deployment of capital Adds new stable HOA deposit channel Immediately reduces deposit costs Enhance Operating Efficiency Maintain vigilance on expenses Improve operating leverage ü 28% cost savings enhances pro forma profitability Improves 2020E ROTCE by 80 bps(1) increasing to 100+ bps in 2 years Maintain Strong Risk Management Maintain credit discipline on structures while focusing on strong collateral Maintain strong liquidity and capital risk management practices ü Traditional middle-market bank profile Average NCOs of 12 bps p.a. over last 5 years Enhances liquidity profile and funding with low cost, stable deposits 12 Full year impact assuming fully phased-in cost savings, excludes impact of CECL and merger and integration costs

Appendix

Earnings Per Share Accretion Calculation 13 All figures annualized for 2020 full-year impact $mm Millions of diluted shares CIT 2020 earnings consensus median estimate $456 86 Projected Mutual of Omaha Bank’s Q2–Q4 2020 earnings annualized 89 $545 After-tax adjustments Fully phased-in cost savings(1) $42 Cost of financing (29) Income attributable to suspension of CIT share repurchases 5 Other merger-related adjustments(2) (4) Accretion of fair value mark (16) Accretion of securities mark (5) Estimated core deposit intangible amortization(3) (9) Projected 2020 CIT net income $531 98 (4) CIT 2020 standalone EPS $5.32 Projected combined EPS(5) $5.42 $ EPS accretion to CIT $0.10 % EPS accretion to CIT 1.9% Note: Certain balances may not sum due to rounding. Projected adjustments assume 26% marginal tax rate. Share repurchases suspended until 10.5% CET1 target reached $57 million pre-tax fully phased-in reduction in combined company’s total noninterest expense base Includes FDIC dis-synergy Assumes $85 million of core deposit intangibles (1.25% of Mutual of Omaha Bank's total deposits, excluding jumbo CDs and brokered deposits) are amortized over seven years utilizing the straight-line method Projected diluted shares outstanding include CIT shares issued to Mutual of Omaha and reflect the suspension of repurchases Excludes impact of CECL and merger and integration costs

Tangible Book Value Per Share Dilution Calculation 14 Note: Certain balances may not sum due to rounding. Projected adjustments assume 26% marginal tax rate. Share repurchases suspended until 10.5% CET1 target reached CIT tangible book value equal to common shareholders equity less goodwill and other intangible assets. Refer to the non-GAAP reconciliations in the appendix Based on when pro forma tangible book value per share crosses over and begins to exceed projected stand alone CIT tangible book value per share $ millions Millions of basic shares $ per share CIT standalone CIT tangible book value as of December 31, 2018(1) $5,163 101 $51.15 (+) Consensus earnings prior to close 584 (–) Consensus per share common dividends (155) (–) Share repurchases completed YTD (341) (–) Additional projected consensus share repurchases through close (395) (+) Amortization of intangibles 29 (+) Change in AOCI through June 30, 2019 113 Projected standalone CIT tangible book value at close $4,998 88 $56.77 Projected Projected standalone CIT tangible book value at close $4,998 88 (+) Suspension of projected consensus share repurchases through close 395 (+) Standalone Mutual of Omaha tangible book value at close 725 (–) Elimination of Mutual of Omaha Bank’s marked equity capital and intangibles (859) (+) Equity consideration issued to Mutual of Omaha 111 (+) Other purchase accounting adjustments 91 (–) Goodwill and other intangibles created (141) (–) After-tax merger and integration costs expensed at or prior to close (14) Projected CIT tangible book value at close $5,305 98 $54.31 (–) After-tax merger and integration costs expensed after close (67) Projected CIT tangible book value, including merger and integration costs expensed after close $5,238 98 $53.63 $ dilution to CIT, including post-close merger and integration costs ($3.14) % dilution to CIT, including post-close merger and integration costs (5.5%) Tangible book value per share earnback (2) 4.9 years

Non-GAAP Reconciliation 15 CIT Mutual of Omaha Bank As of the last twelve months ended: $mm December 31, 2018 June 30, 2019 Total capital $5,622 $952 (–) Goodwill and intangible assets (459) (177) Tangible common equity (non-GAAP) $5,163 $775 Average tangible common equity (non-GAAP) 5,740 716 Net income 92 ROTCE (non-GAAP) 12.8% Tangible Book Value Core Loans Mutual of Omaha Bank $bn As of June 30, 2019 Loans $6.1 (–) Correspondent 1–4 family residential loans (1.8) (–) Mortgage warehouse line (0.2) Core loans (non-GAAP) $4.1 Note: Certain balances may not sum due to rounding

Standalone Balance Sheet Mutual of Omaha Bank, excluding Synergy One and OMAFIN subsidiaries Source: Unaudited company data as of June 30, 2019 Note: Certain balances may not sum due to rounding (1) Includes $234 million warehouse line to Synergy One, to be excluded from the transaction 16