Exhibit 99.1

1

FOR IMMEDIATE RELEASE

CIT REPORTS FIRST QUARTER 2016 NET INCOME OF $147 MILLION ($0.73 PER DILUTED SHARE)

INCOME FROM CONTINUING OPERATIONS OF $152 MILLION ($0.75 PER DILUTED SHARE)

- Advanced Portfolio Optimization – Sold U.K. platform, Commercial Air separation and remaining Non-Strategic Portfolio exits progressing; transferred international business air assets to held for sale;

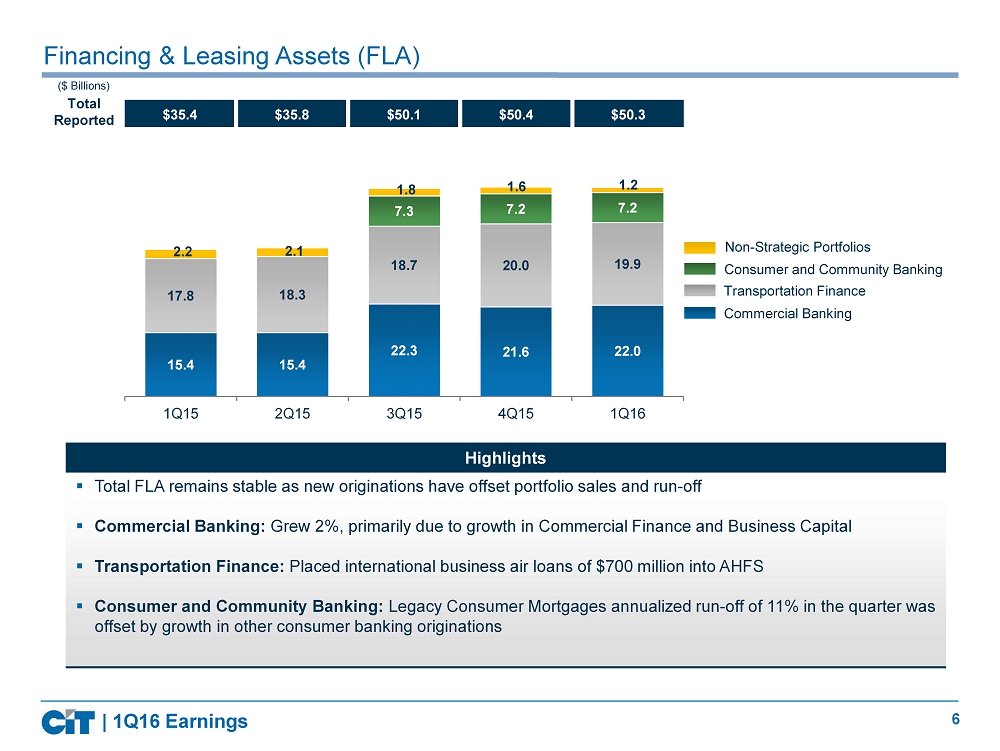

- Grew Commercial Portfolio - Financing and leasing assets in Commercial Banking were up 2% from the prior quarter;

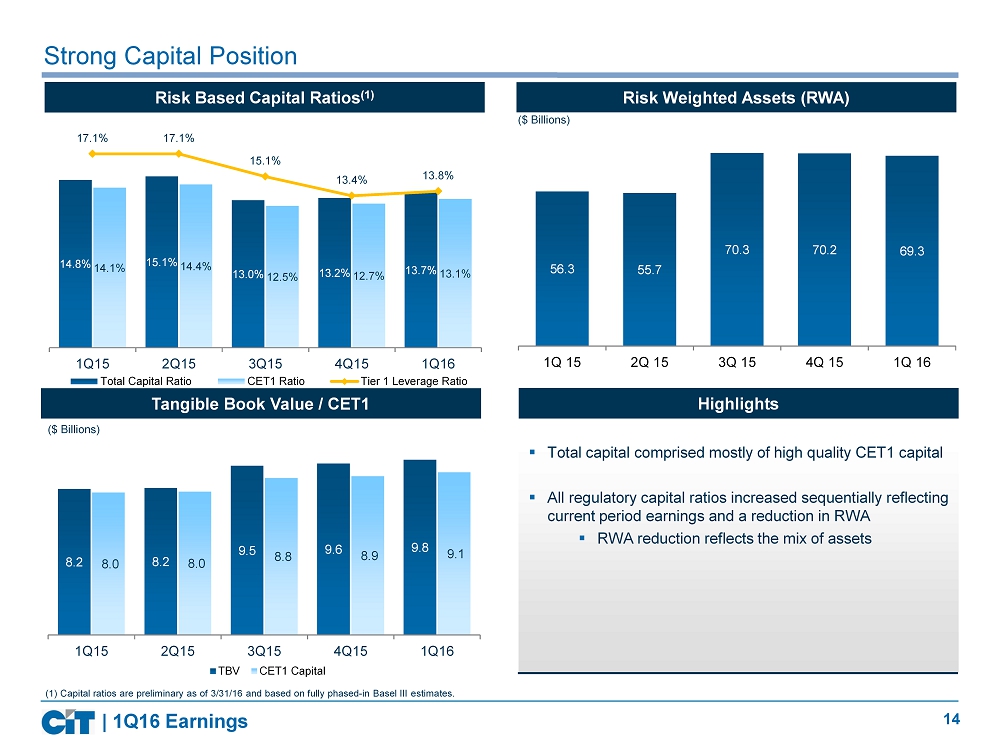

- Maintained Strong Capital Ratios – Common Equity Tier 1 of 13.1% and Total Capital Ratio of 13.7%

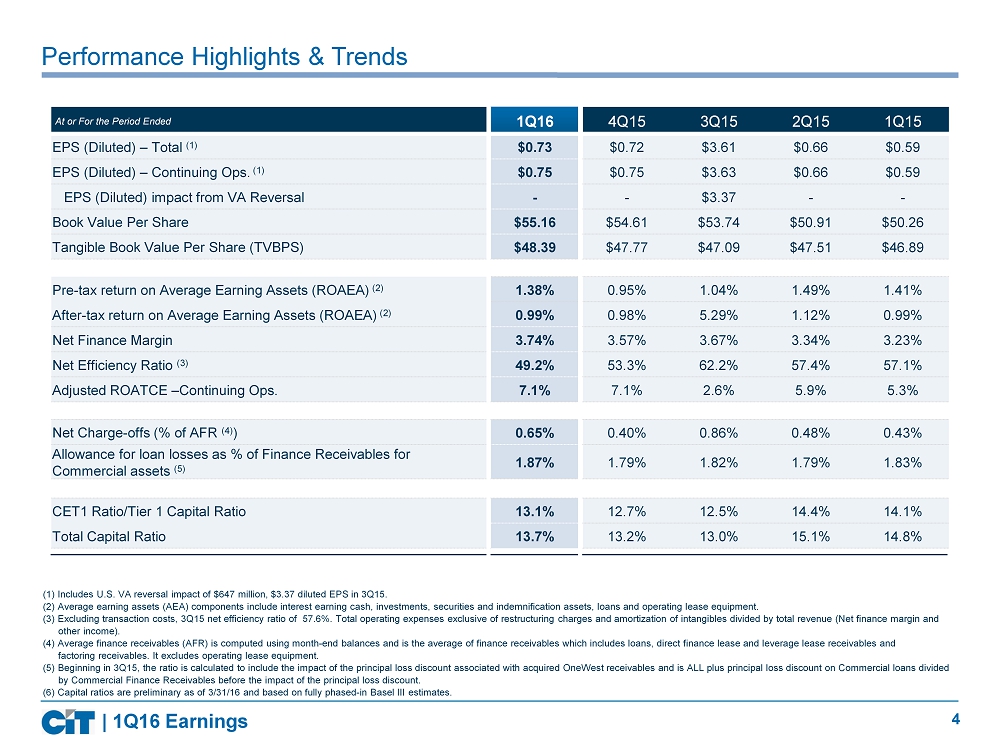

NEW YORK, NY – April 28, 2016 – CIT Group Inc. (NYSE: CIT) cit.com, a leading provider of commercial lending and leasing services, today reported net income of $147 million, $0.73 per diluted share for the first quarter of 2016, compared to net income of $104 million, $0.59 per diluted share, for the year-ago quarter, which reflects results prior to the acquisition of OneWest Bank. Income from continuing operations for the first quarter was $152 million, $0.75 per diluted share, compared to $104 million, $0.59 per diluted share in the year-ago quarter.

“Since I recently became CEO and defined our strategy to become a leading national middle market bank, our team has been very focused on executing on our plan to improve returns as we grow our core businesses and maintain strong risk management practices,” said Ellen Alemany, Chief Executive Officer.

“This year we expect to complete the separation of Commercial Air and other portfolio optimization initiatives, integrate the remaining OneWest Bank systems, build out deposit and commercial treasury services capabilities, execute on initiatives to reduce operating expenses and return excess capital to shareholders.”

2

Summary of First Quarter Financial Results from Continuing Operations

All references in this section relate to continuing operations and therefore do not include any of the assets or results of operations of the discontinued operations.

On August 3, 2015, CIT acquired IMB HoldCo LLC, the parent company of OneWest Bank, which impacts the comparability of current results to prior periods. The current and prior quarters reflect a full quarter of OneWest Bank’s results of operations while the prior-year period does not include any results from OneWest Bank.

Selected Financial Highlights (Continuing Operations)

| Change from: | ||||||||||||||||||||

| 1Q16 | 4Q15 | 1Q15 | Prior Quarter* | Prior Year* | ||||||||||||||||

| ($ in millions, except per share data) | ||||||||||||||||||||

| Pre-tax income | $ | 204 | $ | 141 | $ | 148 | $ | 63 | $ | 57 | ||||||||||

| Net income | $ | 152 | $ | 151 | $ | 104 | $ | 1 | $ | 48 | ||||||||||

| Diluted earnings per share (EPS) | $ | 0.75 | $ | 0.75 | $ | 0.59 | $ | (0.00 | ) | $ | 0.16 | |||||||||

| Pre-tax return on average earning assets (ROAEA) | 1.38 | % | 0.95 | % | 1.41 | % | 0.43 | % | -0.03 | % | ||||||||||

| Return on average earning assets (ROAEA) | 1.02 | % | 1.02 | % | 0.99 | % | 0.00 | % | 0.03 | % | ||||||||||

| Adjusted return on tangible common (ROTCE) equity | 7.08 | % | 7.08 | % | 5.26 | % | 0.00 | % | 1.82 | % | ||||||||||

| Net finance margin | 3.74 | % | 3.57 | % | 3.23 | % | 0.16 | % | 0.51 | % | ||||||||||

| Net efficiency ratio | 49.2 | % | 53.3 | % | 57.1 | % | -4.1 | % | -7.9 | % | ||||||||||

| Tangible book value per share (TBVPS) | $ | 48.39 | $ | 47.77 | $ | 46.89 | $ | 0.62 | $ | 1.50 | ||||||||||

| CET 1 Ratio(1) | 13.1 | % | 12.7 | % | 14.1 | % | 0.4 | % | -1.0 | % | ||||||||||

| Total Capital Ratio(1) | 13.7 | % | 13.2 | % | 14.8 | % | 0.5 | % | -1.1 | % | ||||||||||

| Net charge-offs as % of AFR | 0.65 | % | 0.40 | % | 0.43 | % | 0.25 | % | 0.22 | % | ||||||||||

| Allowance for loan losses as % of finance receivables | 1.29 | % | 1.14 | % | 1.83 | % | 0.15 | % | -0.55 | % | ||||||||||

| Average earning assets | $ | 59,206 | $ | 59,141 | $ | 41,841 | $ | 65 | $ | 17,365 | ||||||||||

| Financing and leasing assets | $ | 50,286 | $ | 50,381 | $ | 35,369 | $ | (96 | ) | $ | 14,917 | |||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

| (1) Ratios based on the fully phased-in basis. | ||||||||||||||||||||

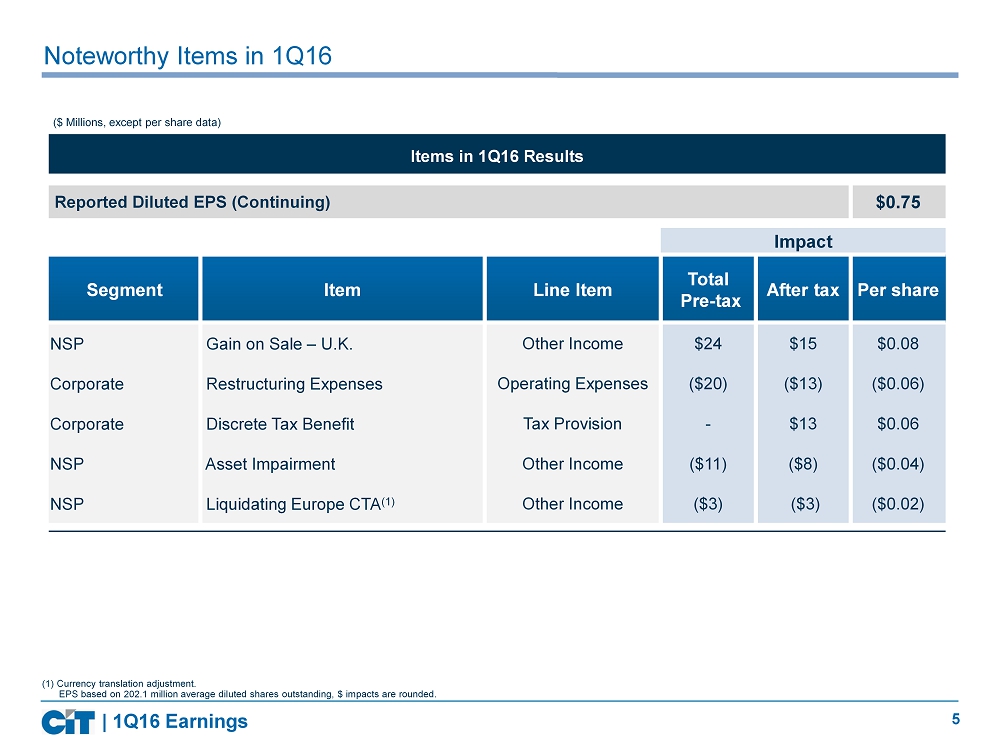

Income from continuing operations of $152 million includes net after-tax benefits of $4 million from discrete items related to our strategic initiatives. Discrete items include benefits from the sale of the U.K. Equipment Finance platform and a discrete tax item related to an international portfolio previously sold, which were partially offset by restructuring charges resulting from operating expense reduction initiatives, an impairment on the Non-Strategic Portfolio and currency translation adjustment (“CTA”) charges. In addition to these items, income this quarter included higher credit loss provisions for the oil and gas, and maritime portfolios which were partially offset by a mark-to-market benefit on the total return swap (“TRS”).

Tangible book value per share1 increased to $48.39 reflecting net income for the quarter. Estimated Common Equity Tier 1 and Total Capital ratios at March 31, 2016 increased to 13.1% and 13.7%, respectively, as calculated under the fully phased-in Regulatory Capital Rules. Average earning assets2 for the March 31, 2016 quarter were relatively flat at $59.2 billion reflecting growth in commercial businesses offset by run-off in the

1 Tangible book value and tangible book value per share are non-GAAP measures. See “Non-GAAP Measurements” at the end of this press release and page 24 for reconciliation of non-GAAP to GAAP financial information.

2 Average earning asset components include interest earning cash, investments, securities and indemnification assets. See “Non-GAAP Measurements” at the end of this press release and page 24 for reconciliation of Earning Assets non-GAAP to GAAP financial information.

3

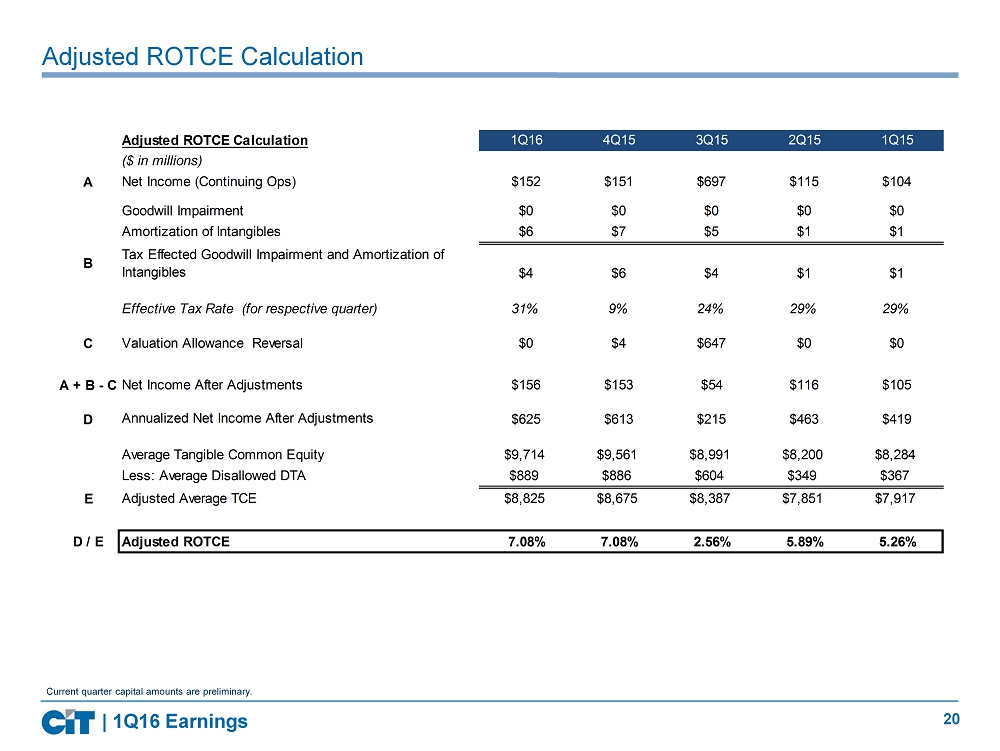

liquidating portfolios. The ROTCE3 of 7.08% was flat from the prior quarter while the increase from the year-ago quarter reflects the lower capital levels primarily due to the acquisition of OneWest Bank.

Income Statement Highlights:

| Net Finance Revenue* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Interest income | $ | 495 | $ | 510 | $ | 281 | $ | (15 | ) | $ | 214 | |||||||||

| Rental income on operating leases | 575 | 551 | 531 | 25 | 45 | |||||||||||||||

| Finance revenue | 1,071 | 1,061 | 812 | 9 | 259 | |||||||||||||||

| Interest expense | (286 | ) | (287 | ) | (271 | ) | 0 | (15 | ) | |||||||||||

| Depreciation on operating lease equipment | (175 | ) | (167 | ) | (157 | ) | (9 | ) | (19 | ) | ||||||||||

| Maintenance and other operating lease expenses | (56 | ) | (80 | ) | (46 | ) | 23 | (10 | ) | |||||||||||

| Net finance revenue | $ | 553 | $ | 528 | $ | 337 | $ | 25 | $ | 216 | ||||||||||

| Average earning assets | $ | 59,206 | $ | 59,141 | $ | 41,841 | $ | 65 | $ | 17,365 | ||||||||||

| Net finance margin | 3.74 | % | 3.57 | % | 3.23 | % | 0.16 | % | 0.51 | % | ||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

Net finance revenue4 was $553 million in the current quarter, compared to $528 million in the prior quarter and $337 million in the year-ago quarter. Average earning assets were essentially flat compared to the prior quarter reflecting growth in Rail, Commercial Finance, Business Capital and other consumer mortgage lending portfolios offset by run-off in the Legacy Consumer Mortgage portfolio and the sale of the U.K. Equipment Finance business. The increase in average earning assets from the year-ago quarter reflects the acquisition of OneWest Bank.

Net finance revenue as a percentage of average earning assets (“net finance margin”) increased from both the prior and year-ago quarters. The increase from the prior quarter was driven primarily by lower maintenance and other operating lease costs and elevated collections on remarketed aircraft in Transportation Finance offset by change in mix of assets resulting from the run-off or sale of higher yielding assets. The increase from the year-ago quarter reflects the benefits from the OneWest Bank acquisition.

| Other Income* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Factoring commissions | $ | 26 | $ | 29 | $ | 30 | $ | (3 | ) | $ | (3 | ) | ||||||||

| Fee revenues | 33 | 35 | 23 | (2 | ) | 10 | ||||||||||||||

| Gains on sales of leasing equipment | 11 | 17 | 32 | (6 | ) | (21 | ) | |||||||||||||

| (Losses) gains on loan and portfolio sales | 0 | (41 | ) | 7 | 42 | (6 | ) | |||||||||||||

| (Losses) gains on investments | (4 | ) | (6 | ) | 1 | 2 | (5 | ) | ||||||||||||

| Gains (losses) on OREO sales | 2 | (2 | ) | - | 4 | 2 | ||||||||||||||

| Net gain (losses) on derivatives and foreign currency exchange | 9 | 2 | (10 | ) | 8 | 19 | ||||||||||||||

| Impairment on assets held for sale | (22 | ) | (15 | ) | (10 | ) | (7 | ) | (12 | ) | ||||||||||

| Other revenues | 46 | 12 | 15 | 34 | 31 | |||||||||||||||

| Total other income | $ | 101 | $ | 30 | $ | 86 | $ | 71 | $ | 15 | ||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

3 Adjusted Return on Tangible Common Equity, which adjusts tangible common equity for the reversal of the valuation allowance and the amortization of intangibles in the numerator and the disallowed deferred tax asset related to regulatory capital in the denominator, is a non-GAAP measure. See “Non-GAAP Measurements” at the end of this press release and page 24 for reconciliation of non-GAAP to GAAP financial information.

4 Net finance revenue, net finance margin and net operating lease revenue are non-GAAP measures. See “Non-GAAP Measurements” at the end of this press release and page 24 for reconciliation of non-GAAP to GAAP financial information.

4

Other income of $101 million includes approximately $10 million of net benefits from international business exits including a $24 million gain on the sale of the U.K. platform recorded in Other Revenue partially offset by impairment of $11 million in the Non-Strategic Portfolios in held for sale and the recognition of CTA losses. In addition, the current quarter includes an $18 million benefit from the mark-to-market on the total return swap (TRS). The prior quarter included a loss on the sale of the Brazil platform primarily related to the recognition of $51 million of CTA losses. The year-ago quarter benefited from the sale of aircraft and a benefit on the termination of a defaulted contract, which were partially offset by a CTA charge in the U.K. and additional impairment charges on the Non-Strategic Portfolios.

| Operating Expenses* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Compensation and benefits | $ | (172 | ) | $ | (152 | ) | $ | (147 | ) | $ | (21 | ) | $ | (26 | ) | |||||

| Technology | (30 | ) | (33 | ) | (22 | ) | 2 | (8 | ) | |||||||||||

| Professional fees | (39 | ) | (43 | ) | (20 | ) | 5 | (19 | ) | |||||||||||

| Net occupancy expense | (18 | ) | (18 | ) | (9 | ) | (1 | ) | (9 | ) | ||||||||||

| Advertising and marketing | (5 | ) | (8 | ) | (9 | ) | 3 | 4 | ||||||||||||

| Other expenses | (57 | ) | (44 | ) | (35 | ) | (13 | ) | (21 | ) | ||||||||||

| Operating expenses before provision for severance and facilities exiting and intangible asset amortization | (322 | ) | (298 | ) | (242 | ) | (24 | ) | (80 | ) | ||||||||||

| Provision for severance and facilities exiting activities | (20 | ) | (53 | ) | 1 | 33 | (21 | ) | ||||||||||||

| Intangible asset amortization | (6 | ) | (7 | ) | (1 | ) | 1 | (6 | ) | |||||||||||

| Total operating expenses | $ | (349 | ) | $ | (358 | ) | $ | (242 | ) | $ | 9 | $ | (107 | ) | ||||||

| Net efficiency ratio | 49.2 | % | 53.3 | % | 57.1 | % | 4.1 | % | 7.9 | % | ||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

Operating expenses excluding restructuring costs and intangible asset amortization were $322 million in the current quarter. Expenses reflect the sale of Non-Strategic Portfolios and the streamlining of the management structure, however these benefits were partially offset by annual benefit restarts and costs associated with the strategic initiatives, primarily costs associated with the OneWest Bank integration and the Commercial Air separation. The prior quarter reflected lower compensation and benefits from adjusting accruals related to incentive compensation and changes to benefit plans. The increase from the prior year reflects the addition of OneWest Bank. The net efficiency ratio5 improved to 49% reflecting higher other income and to a lesser extent, an increase in net finance revenue partially offset by higher operating expenses. Headcount at March 31, 2016 was 4,740 down from 4,900 in the prior quarter reflecting strategic initiatives and up from 3,360 a year-ago due to the OneWest addition. Restructuring costs this quarter relate to strategic initiatives to reduce operating expenses, while the amortization of intangibles is primarily due to the OneWest Bank acquisition.

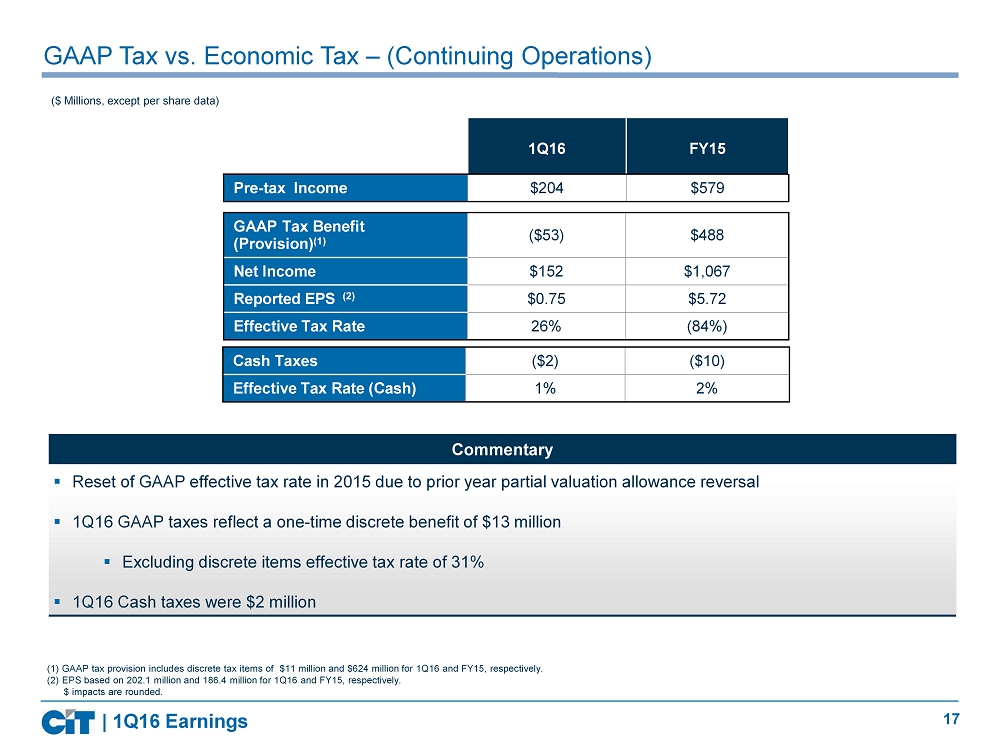

Income Taxes

The provision for income taxes of $53 million for the quarter included $13 million of discrete tax benefits from the resolution of a tax position on an international portfolio that had been previously sold. The prior quarter was an income tax benefit of $10 million reflecting $15 million in discrete benefits from the resolution of a tax position on an international portfolio previously sold and included a positive impact from the year-end true up to reflect the full year actual geographic mix of earnings. The current effective tax rate was 26% and excluding

5 Net efficiency ratio is a non-GAAP measure. See “Non-GAAP Measurements” at the end of this press release and page 24 for reconciliation of non-GAAP to GAAP financial information.

5

discrete items was 31% for the quarter. Cash taxes were $2 million compared to net receipt of $17 million in the prior quarter and net payment of $14 million in the year-ago quarter.

Balance Sheet Highlights:

| Earning Assets* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Loans (including assets held for sale) | $ | 33,475 | $ | 33,671 | $ | 20,203 | $ | (197 | ) | $ | 13,272 | |||||||||

| Operating lease equipment, net (including assets held for sale) | 16,811 | 16,710 | 15,167 | 101 | 1,645 | |||||||||||||||

| Financing and Leasing Assets | 50,286 | 50,381 | 35,369 | (96 | ) | 14,917 | ||||||||||||||

| Interest bearing cash | 7,135 | 6,820 | 5,393 | 315 | 1,742 | |||||||||||||||

| Investment securities | 2,897 | 2,954 | 1,347 | (57 | ) | 1,549 | ||||||||||||||

| Indemnification assets | 389 | 415 | - | (25 | ) | 389 | ||||||||||||||

| Securities purchased under agreements to resell | - | - | 450 | - | (450 | ) | ||||||||||||||

| Credit balances of factoring clients | (1,361 | ) | (1,344 | ) | (1,505 | ) | (17 | ) | 144 | |||||||||||

| Total Earning Assets | $ | 59,346 | $ | 59,226 | $ | 41,055 | $ | 120 | $ | 18,291 | ||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

Earning assets at March 31, 2016 rose slightly from the prior quarter, reflecting growth in interest bearing cash, and financing and leasing assets previously noted. The increase from the year-ago quarter principally reflects the assets acquired from OneWest Bank.

Total cash and investment securities, including non-interest bearing cash, were $11.0 billion at March 31, 2016, and consisted of $8.1 billion of cash and $2.9 billion of debt and FHLB stock and equity securities. Of this total, $1.3 billion was at the bank holding company, $8.3 billion was at CIT Bank (excluding $0.1 billion of restricted cash), and the remaining $1.1 billion represented cash at operating subsidiaries and other restricted balances.

| Deposits and Borrowings* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Total Deposits | $ | 32,893 | $ | 32,782 | $ | 16,758 | $ | 111 | $ | 16,135 | ||||||||||

| Unsecured borrowings | $ | 10,587 | $ | 10,636 | $ | 10,681 | $ | (49 | ) | $ | (93 | ) | ||||||||

| Secured borrowings | 7,425 | 7,806 | 5,856 | (380 | ) | 1,569 | ||||||||||||||

| Total Borrowings | $ | 18,013 | $ | 18,442 | $ | 16,537 | $ | (429 | ) | $ | 1,476 | |||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

Deposits rose modestly from the prior quarter. The decline in unsecured borrowings reflects a modest amount of repurchases, and the decline in secured borrowings relates to the amortization and maturities of structured financings. The increase in borrowings from March 31, 2015 primarily reflected deposits and FHLB borrowings related to the acquisition of OneWest Bank in the third quarter of 2015. At March 31, 2016, deposits represented approximately 65% of CIT’s funding, with unsecured and secured borrowings comprising 21% and 14% of the funding mix, respectively, reflecting the ongoing shift from unsecured borrowings to deposit funding. The weighted average coupon rate on outstanding deposits and borrowings was 2.22% at March 31, 2016, unchanged from December 31, 2015 and down from 3.04% at March 31, 2015.

6

| Capital* | Change from: | |||||||||||||||||||

| ($ in millions, except per share data) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Common Stockholders' Equity | $ | 11,126 | $ | 10,978 | $ | 8,759 | $ | 148 | $ | 2,367 | ||||||||||

| Tangible Common Equity | $ | 9,760 | $ | 9,604 | $ | 8,172 | $ | 157 | $ | 1,589 | ||||||||||

| Total risk-based capital(1) | $ | 9,524 | $ | 9,289 | $ | 8,348 | $ | 235 | $ | 1,176 | ||||||||||

| Risk-weighted assets(1) | $ | 69,320 | $ | 70,239 | $ | 56,340 | $ | (919 | ) | $ | 12,980 | |||||||||

| Book value per share (BVPS) | $ | 55.16 | $ | 54.61 | $ | 50.26 | $ | 0.55 | $ | 4.90 | ||||||||||

| Tangible book value per share (TBVPS) | $ | 48.39 | $ | 47.77 | $ | 46.89 | $ | 0.62 | $ | 1.50 | ||||||||||

| CET 1 Ratio(1) | 13.1 | % | 12.7 | % | 14.1 | % | 0.4 | % | -1.0 | % | ||||||||||

| Total Capital Ratio(1) | 13.7 | % | 13.2 | % | 14.8 | % | 0.5 | % | -1.1 | % | ||||||||||

| Tier 1 Leverage Ratio(1) | 13.8 | % | 13.4 | % | 17.1 | % | 0.4 | % | -3.3 | % | ||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

| (1) Balances and ratios based on the fully phased-in basis. | ||||||||||||||||||||

The sequential increase in common stockholders’ equity and tangible common equity primarily reflects the current period earnings, while the acquisition of OneWest Bank was a principal contributor to the increase from March 31, 2015, primarily due to the issuance of common shares and the reversal of the valuation allowance on our Federal deferred tax asset in the third quarter. The lower increase in tangible common equity from March 31, 2015 also reflects the increase in goodwill and intangibles resulting from the acquisition of OneWest Bank. While regulatory capital also increased, the amount was less than the common equity increase since the majority of the deferred tax asset balance is disallowed for regulatory capital purposes. As a result, capital ratios declined from March 31, 2015 as the benefit from the increase in regulatory capital was more than offset by the increase in the risk-weighted assets acquired.

All regulatory capital ratios increased from the prior quarter resulting from current period earnings and a reduction in risk weighted assets reflecting the mix of assets while the decline from the prior year reflects the acquisition of OneWest Bank. The ratios presented are estimated Common Equity Tier 1 and Total Capital ratios under the fully phased-in Regulatory Capital Rules.

Book value per share and tangible book value per share increased sequentially, to $55.16 and $48.39, respectively, reflecting earnings in the first quarter. Both amounts also increased from March 31, 2015, as the increase in equity outpaced the increase in shares outstanding.

In April 2016, the Board approved a $0.15 cash dividend payable on May 27, 2016 to common shareholders of record as of May 13, 2016.

7

Asset Quality

| Asset Quality* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Net charge-offs (NCO) | $ | 51 | $ | 32 | $ | 21 | $ | 19 | $ | 30 | ||||||||||

| NCO % of AFR | 0.65 | % | 0.40 | % | 0.43 | % | 0.25 | % | 0.22 | % | ||||||||||

| Non-accrual | $ | 295 | $ | 268 | $ | 184 | $ | 27 | $ | 112 | ||||||||||

| OREO | $ | 100 | $ | 122 | $ | - | $ | (22 | ) | $ | 100 | |||||||||

| Provision for credit losses | $ | 99 | $ | 58 | $ | 35 | $ | 42 | $ | 65 | ||||||||||

| Total Portfolio Allowance as a % of Finance Receivables (FR) | 1.29 | % | 1.14 | % | 1.83 | % | 0.15 | % | -0.55 | % | ||||||||||

| Allowance for loan losses plus principal loss discount as % of FR (before principal loss discount) / Commercial | 1.87 | % | 1.79 | % | 1.83 | % | 0.08 | % | 0.04 | % | ||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

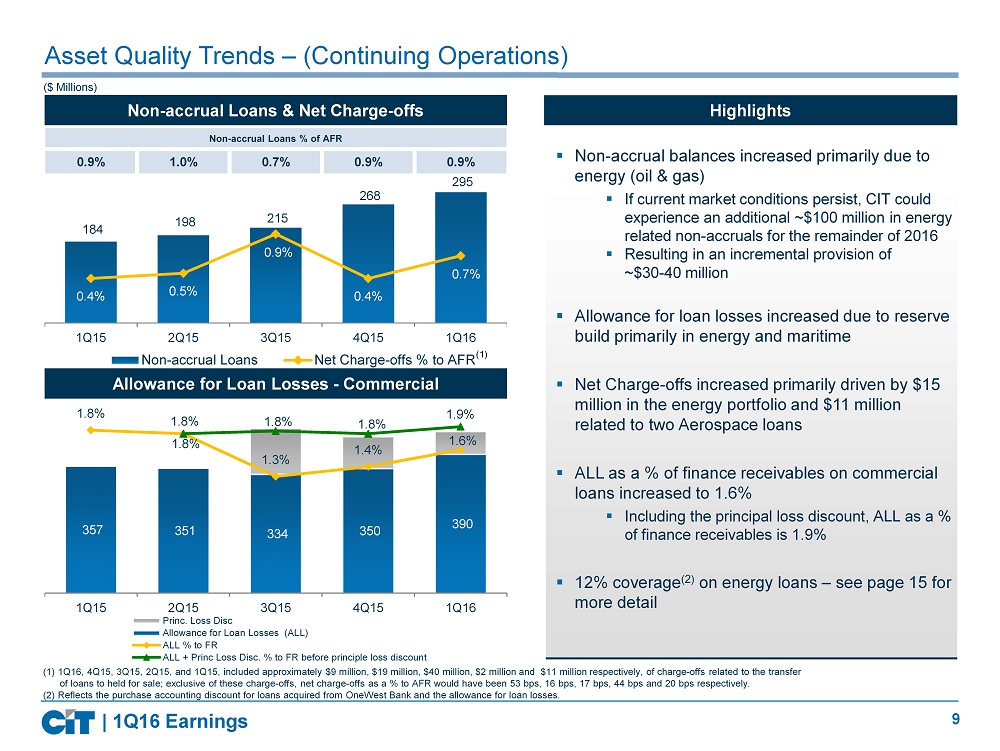

Excluding the impact relating to assets transferred to held for sale in all periods, net charge-offs were $42 million (0.53% of average finance receivables), compared to $13 million (0.16%) in the prior quarter and $10 million (0.20%) in the year-ago quarter. The current quarter net charge offs includes $15 million in the energy (oil and gas) portfolio and $11 million related to two Aerospace loans. Recoveries of $5 million were down slightly from the prior and year-ago quarters.

Non-accrual loans of $295 million increased over the prior quarter and the year-ago quarter, primarily due to increases in the energy portfolio. The provision for credit losses increased over both the prior quarter and the year-ago quarter and includes $31 million related to the energy portfolio, $14 million related to the maritime portfolio and discrete charge-offs of $11 million in the Aerospace loan portfolio noted above.

The allowance for loan losses was $405 million (1.29% of finance receivables, 1.52% excluding loans subject to loss sharing agreements with the FDIC) at March 31, 2016, compared to $360 million (1.14% of finance receivables, 1.35% excluding loans subject to loss sharing agreements with the FDIC) at December 31, 2015 and $357 million (1.83% of finance receivables) at March 31, 2015. The increase from the prior and year-ago quarters is concentrated in the energy and maritime portfolios, although there were also modest increases across other industries. Including the impact of the principal loss discount on credit impaired loans, which is essentially a reserve for credit losses on the discounted loans, the commercial loan allowance to finance receivables was 1.87% compared to 1.79% at December 31, 2015. The consumer loans ratio was 7.86% at March 31, 2016 and 8.62% at December 31, 2015, respectively, as most of the consumer loans purchased were credit impaired and are partially covered by loss sharing agreements with the FDIC. The decrease over prior quarter is driven by the shift in asset mix as new originations offset the run-off of the purchased credit impaired portfolio.

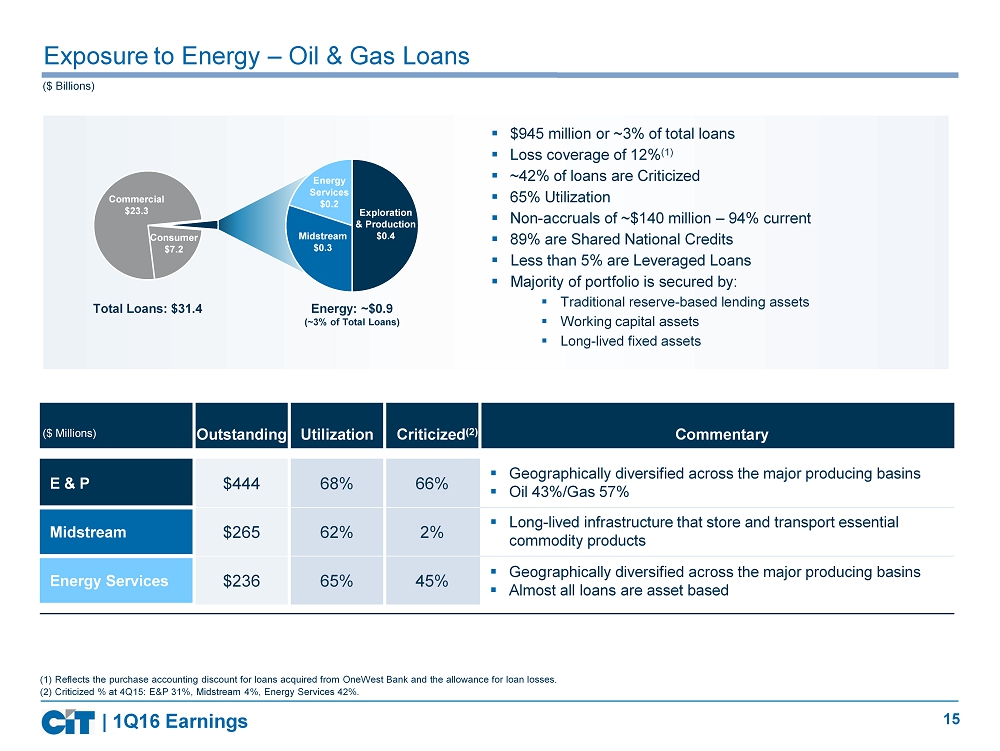

CIT’s loans to the oil and gas industry totaled $0.9 billion or 3% of total loans at March 31, 2016 of which 42% are criticized. The portfolio has loss coverage of 12% of the principal balance reflecting the purchase accounting discount for loans acquired from OneWest Bank and the allowance for loan losses. If market conditions remain the same, the portfolio will likely experience additional downward credit migration.

8

Segment Highlights:

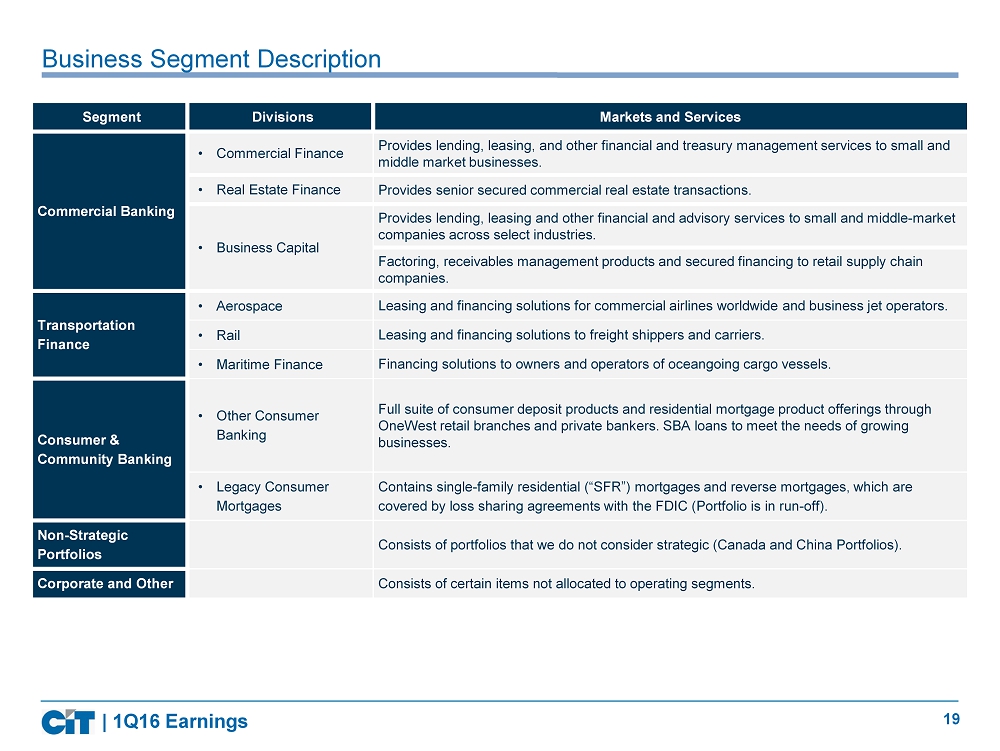

We changed our segment reporting effective January 1, 2016, following the previously announced reorganized management structure. CIT manages its business and reports its financial results in four operating segments: Commercial Banking, Transportation Finance, Consumer and Community Banking, and Non-Strategic Portfolios (“NSP”), and a fifth non-operating segment, Corporate and Other.

The following summarizes changes to our segment presentation from December 31, 2015:

| · | Commercial Banking (formerly North America Banking or “NAB”) no longer includes the Consumer Banking division or the Canadian lending and equipment finance business. Commercial Banking is comprised of three divisions, Commercial Finance, Real Estate Finance, and Business Capital. Business Capital includes the former Equipment Finance and Commercial Services divisions. |

| · | Transportation Finance (formerly Transportation & International Finance or “TIF”) no longer includes the China and the U.K. businesses. Transportation Finance is comprised of three divisions, Aerospace, Rail, and Maritime Finance. |

| · | Consumer and Community Banking is a new segment that includes Legacy Consumer Mortgages (the former LCM segment) and other banking divisions that were included in the former NAB segment (Consumer Banking, Mortgage Lending, Wealth Management, and SBA Lending). |

| · | NSP includes businesses that we no longer consider strategic, including those in Canada and China and recently exited U.K., that had been included in the former NAB and TIF segments. Historic data will also include other businesses and portfolios that have been sold, such as Mexico and Brazil. |

All prior period comparisons are conformed to the current period presentation.

9

Commercial Banking

| Earnings Summary* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Interest income | $ | 287 | $ | 286 | $ | 181 | $ | 2 | $ | 106 | ||||||||||

| Rental income on operating leases | 27 | 26 | 23 | 1 | 4 | |||||||||||||||

| Interest expense | (74 | ) | (68 | ) | (65 | ) | (6 | ) | (9 | ) | ||||||||||

| Depreciation on operating lease equipment | (20 | ) | (19 | ) | (17 | ) | (1 | ) | (3 | ) | ||||||||||

| Net finance revenue | 221 | 224 | 122 | (4 | ) | 98 | ||||||||||||||

| Other income | 56 | 69 | 64 | (13 | ) | (8 | ) | |||||||||||||

| Provision for credit losses | (74 | ) | (45 | ) | (24 | ) | (28 | ) | (49 | ) | ||||||||||

| Operating expenses | (158 | ) | (146 | ) | (131 | ) | (12 | ) | (27 | ) | ||||||||||

| Income before income taxes | $ | 44 | $ | 102 | $ | 30 | $ | (58 | ) | $ | 14 | |||||||||

| Select Average Balances | ||||||||||||||||||||

| Average finance receivables | $ | 21,131 | $ | 21,463 | $ | 14,986 | $ | (332 | ) | $ | 6,145 | |||||||||

| Average earning assets | $ | 20,727 | $ | 20,944 | $ | 14,357 | $ | (217 | ) | $ | 6,371 | |||||||||

| Statistical Data | ||||||||||||||||||||

| Pre-tax ROAEA | 0.85 | % | 1.95 | % | 0.84 | % | -1.09 | % | 0.01 | % | ||||||||||

| Net finance margin | 4.26 | % | 4.29 | % | 3.41 | % | -0.03 | % | 0.85 | % | ||||||||||

| New business volume | $ | 1,581 | $ | 2,165 | $ | 1,296 | $ | (583 | ) | $ | 285 | |||||||||

| Net efficiency ratio | 56.8 | % | 49.0 | % | 70.3 | % | -7.8 | % | 13.5 | % | ||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

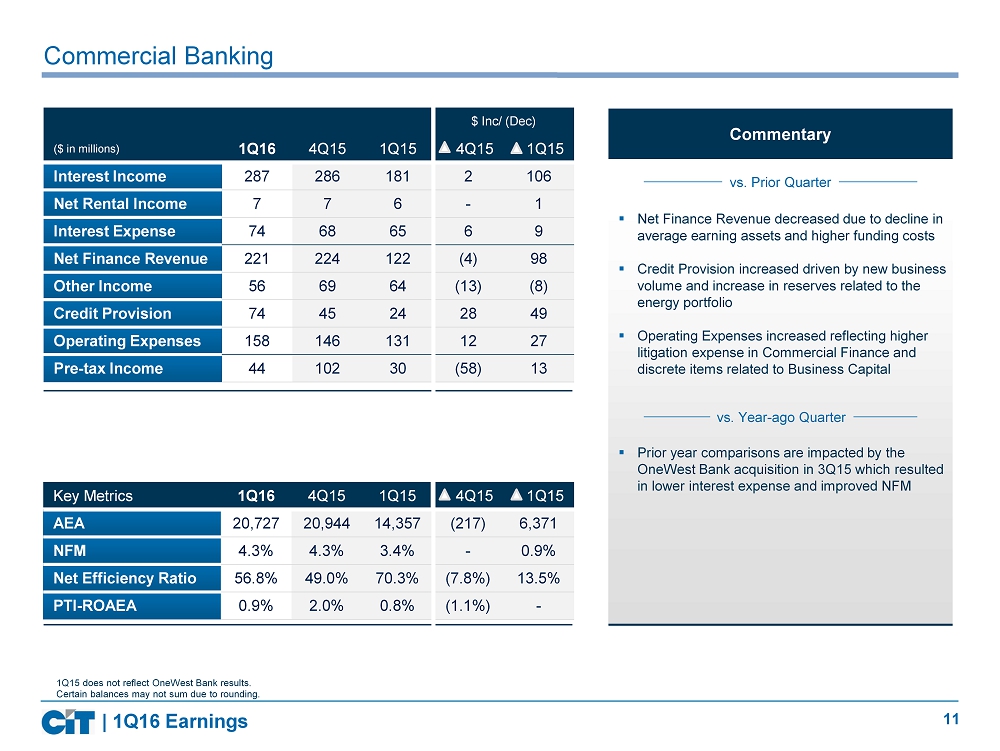

Commercial Banking pre-tax earnings declined from the prior quarter due to higher credit costs and operating expenses and lower other income, while the increase from the year-ago quarter also reflects the addition from OneWest Bank.

Financing and leasing assets (“FLA”), which comprise the majority of earning assets, were $22.0 billion at March 31, 2016, up 2% from December 31, 2015, reflecting new business volume and slower prepayment activity, and up 43% from a year-ago, reflecting the acquisition of OneWest Bank. New lending and leasing volume was down from the prior quarter but increased from the year-ago quarter in all divisions while factored volume was down from both the prior and year-ago quarters.

Net finance revenue decreased slightly from the prior quarter due to the decline in average earning assets and higher funding costs. The increase from the year-ago quarter reflects higher earning assets and purchase accounting accretion on loans acquired from OneWest Bank. Net finance margin was 4.26%, down slightly from the prior quarter and up from the year-ago quarter, benefiting from purchase accounting accretion on acquired loans and higher yields on certain new originations.

Other income declined from the prior and year-ago quarters primarily reflecting lower gains on asset sales, while the decrease in other income from the year-ago quarter was partially offset by higher fee income.

Operating expenses increased from the prior quarter, reflecting higher legal expense in Commercial Finance and discrete items related to Business Capital. The increase from the year-ago quarter reflects the acquisition of OneWest Bank.

Net charge-offs were $32 million (0.60% of average finance receivables), consistent with the prior quarter and up from $19 million (0.52%) in the year-ago quarter. Excluding assets transferred to held for sale in all periods, net charge-offs were $30 million in the current quarter, up from $13 million in the prior quarter and $8 million in the year-ago quarter. The increase in the current period relates to energy loans. Non-accrual loans were $215 million

10

(1.00% of finance receivables), compared to $191 million (0.91%) at December 31, 2015, and $105 million (0.69%) a year-ago. The increase in balance from the prior quarters was primarily related to loans in the energy sector. The provision for credit losses increased from the prior periods from new business volume, increases in reserves related to the energy portfolio and modest increases across other industries

Transportation Finance

| Earnings Summary* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Interest income | $ | 53 | $ | 50 | $ | 43 | $ | 3 | $ | 10 | ||||||||||

| Rental income on operating leases | 545 | 518 | 497 | 26 | 48 | |||||||||||||||

| Interest expense | (148 | ) | (143 | ) | (151 | ) | (5 | ) | 3 | |||||||||||

| Depreciation on operating lease equipment | (155 | ) | (148 | ) | (136 | ) | (7 | ) | (19 | ) | ||||||||||

| Maintenance and other operating lease expenses | (56 | ) | (80 | ) | (46 | ) | 23 | (10 | ) | |||||||||||

| Net finance revenue | 238 | 197 | 207 | 41 | 31 | |||||||||||||||

| Other income | 19 | 25 | 35 | (6 | ) | (17 | ) | |||||||||||||

| Provision for credit losses | (23 | ) | (9 | ) | (6 | ) | (14 | ) | (16 | ) | ||||||||||

| Operating expenses | (61 | ) | (50 | ) | (67 | ) | (11 | ) | 7 | |||||||||||

| Income before income taxes | $ | 173 | $ | 163 | $ | 169 | $ | 10 | $ | 5 | ||||||||||

| Select Average Balances | ||||||||||||||||||||

| Average finance receivables | $ | 3,333 | $ | 3,447 | $ | 2,929 | $ | (113 | ) | $ | 405 | |||||||||

| Average operating leases | $ | 16,364 | $ | 15,698 | $ | 14,618 | $ | 666 | $ | 1,746 | ||||||||||

| Average earning assets | $ | 20,620 | $ | 19,784 | $ | 18,881 | $ | 835 | $ | 1,739 | ||||||||||

| Statistical Data | ||||||||||||||||||||

| Pre-tax ROAEA | 3.36 | % | 3.30 | % | 3.57 | % | 0.06 | % | -0.21 | % | ||||||||||

| Net finance margin | 4.61 | % | 3.98 | % | 4.38 | % | 0.63 | % | 0.23 | % | ||||||||||

| New business volume | $ | 246 | $ | 1,620 | $ | 420 | $ | (1,374 | ) | $ | (174 | ) | ||||||||

| Net efficiency ratio | 23.7 | % | 22.1 | % | 27.7 | % | -1.6 | % | 4.0 | % | ||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

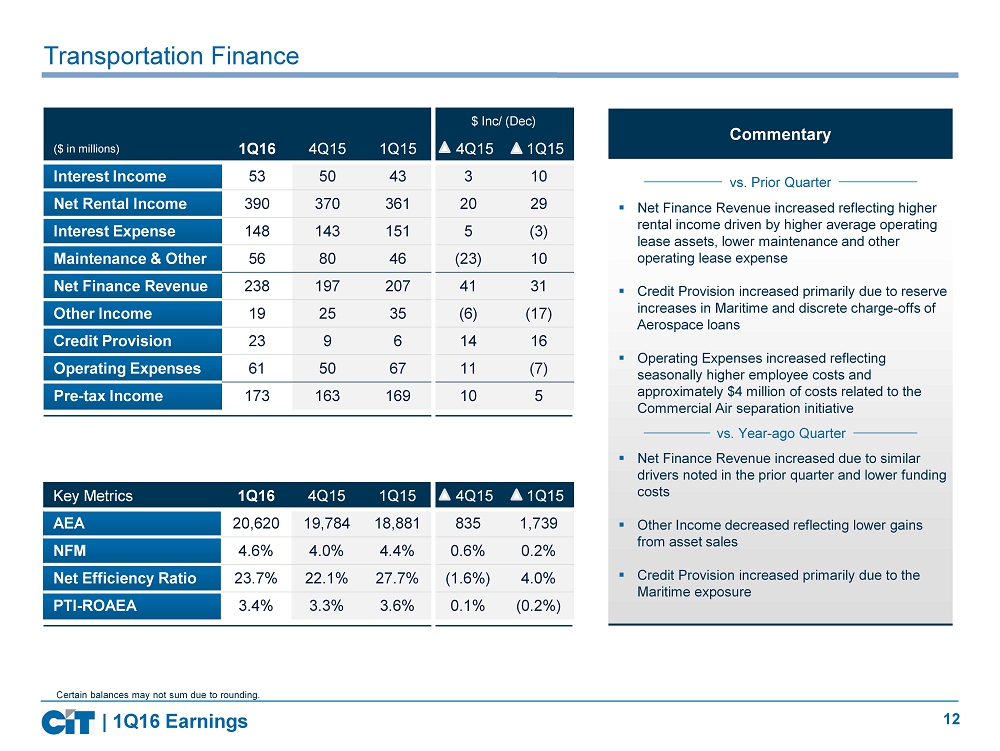

Transportation Finance pre-tax earnings were up from the prior and year-ago quarters, reflecting increased net finance revenue on higher average earning assets, with the comparison to the prior quarter also reflecting lower equipment maintenance and operating lease expenses. The current quarter also reflects a higher credit provision due to two discrete Aerospace loan charge-offs and increased reserves in Maritime.

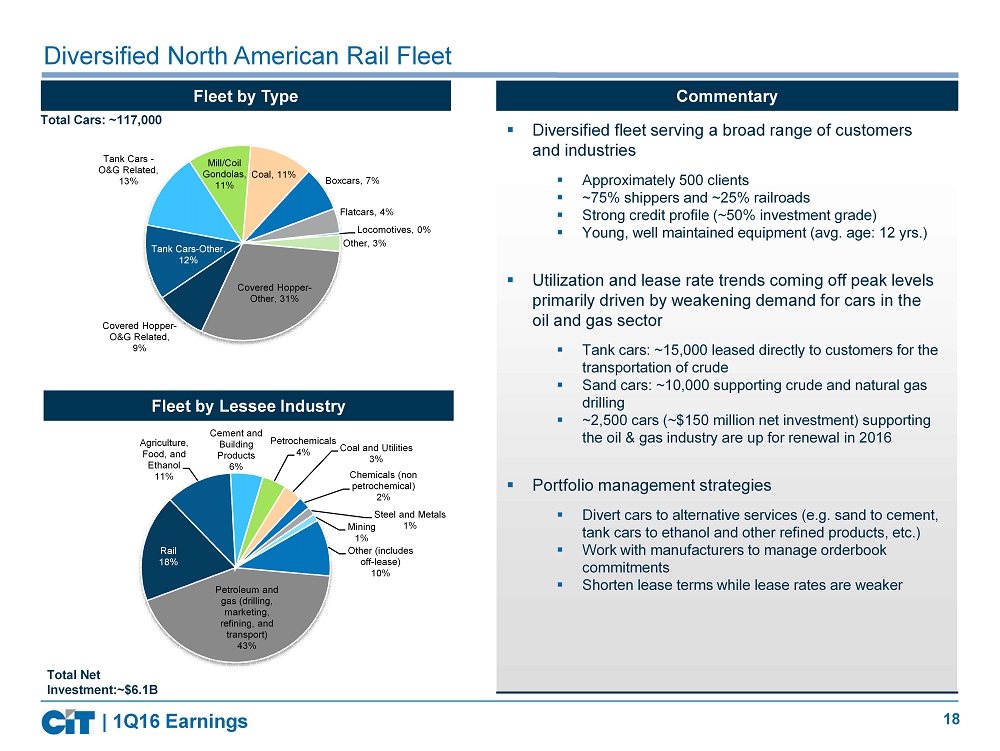

Financing and leasing assets totaled $19.9 billion, essentially unchanged from December 31, 2015 and up from $17.8 billion at March 31, 2015. Compared to the prior quarter, Rail assets increased, Aerospace assets decreased and Maritime assets were essentially unchanged. The increase from the prior year reflects growth in all three divisions. Assets held for sale increased to $0.8 billion, reflecting the addition of the international business air portfolio. New business volume for the quarter totaled $0.2 billion, down significantly from the prior quarter due to only one aircraft delivery compared to 14 aircraft last quarter and lower loan volume.

Net finance revenue was up from the prior and year-ago quarters, reflecting higher rental income driven by higher average operating lease assets and elevated collections on remarketed aircraft and loan prepayments. The sequential comparison also included lower costs associated with the air and rail operating lease portfolios. Net finance margin was up reflecting the noted net finance revenue trends and a slight reduction in funding costs from the prior year. Gross yields in Aerospace were up slightly from the prior quarter to 11.2%, while gross yields in Rail of 13.7% were flat with the prior quarter as the impact of lower utilization was offset by higher interim rents.

11

Other income declined from the prior and year-ago quarters reflecting lower gains from equipment sales.

Operating expenses increased from the prior quarter, reflecting seasonally higher employee costs and approximately $4 million of costs related to the commercial air separation initiative. Operating expenses were down from the year-ago quarter.

Net charge-offs, excluding assets transferred to held for sale, of $13 million (1.53% of average finance receivables) related to the Aerospace loan portfolio compared to net charge-offs of less than $1 million (0.09%) in the prior quarter. Non-accrual loans of $22 million (0.78% of finance receivables) increased from $15 million (0.43%) at December 30, 2015 and $0.1 million a year-ago, and principally consisted of business aircraft loans in each of the periods. The provision for credit losses increased from the prior quarters largely reflecting general reserve increases in Maritime and the Aerospace loan charge-offs noted above.

Utilization trends were mixed compared to the prior quarter. Aircraft utilization remained unchanged from year-end with all aircraft on lease or under a commitment at quarter-end, while Rail utilization declined from 96% to 94%, reflecting pressures mostly from the crude, coal and steel industries. All but two of our aircraft scheduled for delivery in the next 12 months and 40% of the total railcar order-book have lease commitments.

12

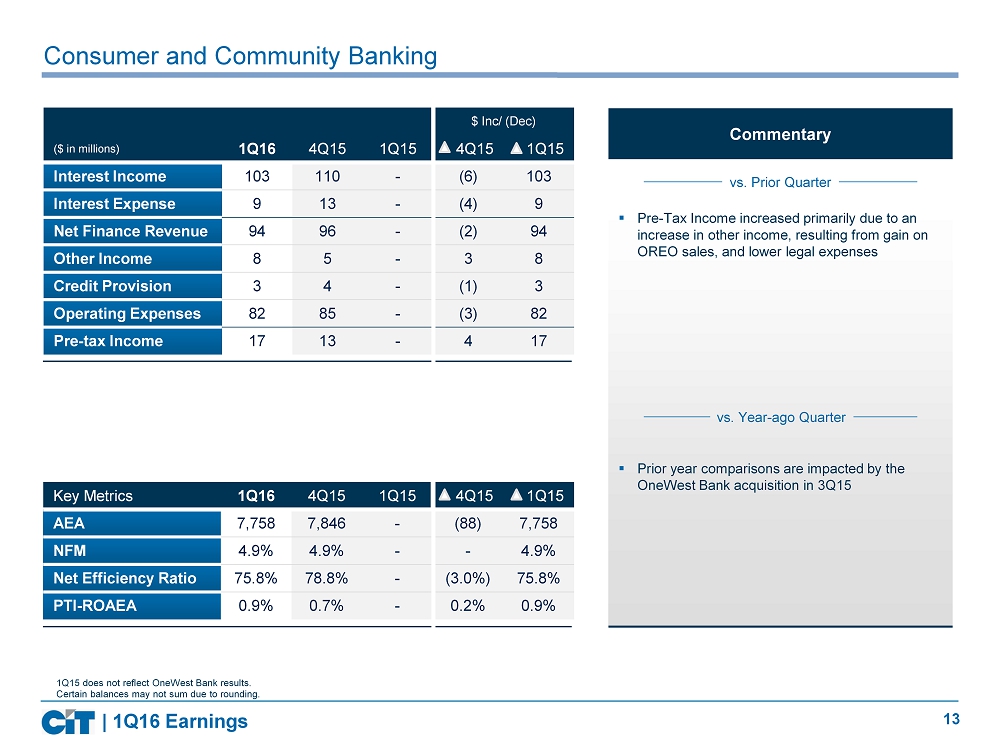

Consumer and Community Banking

| Earnings Summary* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Interest income | $ | 103 | $ | 110 | $ | - | $ | (6 | ) | $ | 103 | |||||||||

| Interest expense | (9 | ) | (13 | ) | - | 4 | (9 | ) | ||||||||||||

| Net finance revenue | 94 | 96 | - | (2 | ) | 94 | ||||||||||||||

| Other income | 8 | 5 | - | 3 | 8 | |||||||||||||||

| Provision for credit losses | (3 | ) | (4 | ) | - | 1 | (3 | ) | ||||||||||||

| Operating expenses | (82 | ) | (85 | ) | - | 3 | (82 | ) | ||||||||||||

| Income before income taxes | $ | 17 | $ | 13 | $ | - | $ | 4 | $ | 17 | ||||||||||

| Select Average Balances | ||||||||||||||||||||

| Average finance receivables | $ | 7,160 | $ | 7,205 | $ | - | $ | (44 | ) | $ | 7,160 | |||||||||

| Average earning assets | $ | 7,758 | $ | 7,846 | $ | - | $ | (88 | ) | $ | 7,758 | |||||||||

| Statistical Data | ||||||||||||||||||||

| Pre-tax ROAEA | 0.88 | % | 0.68 | % | - | 0.20 | % | 0.88 | % | |||||||||||

| Net finance margin | 4.86 | % | 4.91 | % | - | -0.05 | % | 4.86 | % | |||||||||||

| New business volume | $ | 215 | $ | 220 | $ | - | $ | (6 | ) | $ | 215 | |||||||||

| Net efficiency ratio | 75.8 | % | 78.8 | % | - | -3.0 | % | 75.8 | % | |||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

This segment includes our consumer banking and lending businesses, which offers traditional depository and lending products to consumers and small businesses. In addition, the segment includes legacy portfolios of certain single family residential mortgage loans and reverse mortgage loans (collectively LCM), both of which will run-off over time. In aggregate, these portfolios total $5.4 billion, approximately $4.8 billion of which are mostly covered by loss sharing agreements with the FDIC, the benefit of which is recorded as an indemnification asset whose current carrying value is approximately $390 million.

Consumer and Community Banking pre-tax earnings increased from the prior quarter primarily due to an increase in other income resulting from gains on OREO and lower legal expenses.

Financing and leasing assets totaled $7.2 billion at March 31, 2016, flat with December 31, 2015, as the run-off of the LCM portfolios offset new volume.

Non-accrual loans were $7 million (0.10% of finance receivables) at March 31, 2016, slightly up from $5 million (0.07%) at December 31, 2015.The provision reflects reserves established on new business, in addition to slight credit deterioration in the LCM portfolio.

13

Non-Strategic Portfolios (NSP)

| Earnings Summary* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Interest income | $ | 25 | $ | 40 | $ | 53 | $ | (15 | ) | $ | (28 | ) | ||||||||

| Rental income on operating leases | 4 | 7 | 11 | (3 | ) | (7 | ) | |||||||||||||

| Interest expense | (15 | ) | (22 | ) | (38 | ) | 8 | 24 | ||||||||||||

| Depreciation on operating lease equipment | - | - | (4 | ) | - | 4 | ||||||||||||||

| Net finance revenue | 14 | 25 | 22 | (10 | ) | (8 | ) | |||||||||||||

| Other income | 15 | (54 | ) | (6 | ) | 69 | 21 | |||||||||||||

| Provision for credit losses | - | - | (4 | ) | - | 4 | ||||||||||||||

| Operating expenses | (12 | ) | (26 | ) | (37 | ) | 14 | 25 | ||||||||||||

| Income (loss) before income taxes | $ | 17 | $ | (56 | ) | $ | (25 | ) | $ | 73 | $ | 42 | ||||||||

| Select Average Balances | ||||||||||||||||||||

| Average earning assets | $ | 1,517 | $ | 1,954 | $ | 2,718 | $ | (437 | ) | $ | (1,202 | ) | ||||||||

| Statistical Data | ||||||||||||||||||||

| Pre-tax ROAEA | 4.38 | % | -11.49 | % | -3.68 | % | 15.86 | % | 8.06 | % | ||||||||||

| Net finance margin | 3.77 | % | 5.02 | % | 3.24 | % | -1.24 | % | 0.53 | % | ||||||||||

| New business volume | $ | 44 | $ | 167 | $ | 201 | $ | (123 | ) | $ | (157 | ) | ||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

NSP pre-tax earnings reflects the gain of $24 million from the sale of the U.K. business partially offset by an $11 million impairment charge on assets held for sale, compared to pre-tax losses in the prior quarter and year-ago quarter. The pre-tax loss in the prior quarter reflected the completion of the sale of our Brazil business and a resulting loss, mainly due to the recognition of a $51 million CTA loss. The year-ago pre-tax loss was driven by the higher level of operating expenses reflective of the remaining businesses at that time. Financing and leasing assets at March 31, 2016 totaled $1.2 billion, down from $1.6 billion at December 31, 2015 and $2.2 billion March 31, 2015. Our remaining businesses include Canada and China, and these portfolios are classified as held for sale.

14

Corporate & Other

| Earnings Summary* | Change from: | |||||||||||||||||||

| ($ in millions) | 1Q16 | 4Q15 | 1Q15 | Prior Quarter | Prior Year | |||||||||||||||

| Interest income | $ | 27 | $ | 26 | $ | 4 | $ | 1 | $ | 23 | ||||||||||

| Interest expense | (41 | ) | (40 | ) | (18 | ) | (1 | ) | (23 | ) | ||||||||||

| Net finance revenue | (14 | ) | (14 | ) | (14 | ) | 0 | (0 | ) | |||||||||||

| Other income | 4 | (14 | ) | (6 | ) | 18 | 10 | |||||||||||||

| Operating expenses | (37 | ) | (53 | ) | (6 | ) | 16 | (31 | ) | |||||||||||

| Loss before income taxes | $ | (47 | ) | $ | (81 | ) | $ | (26 | ) | $ | 35 | $ | (20 | ) | ||||||

| Select Average Balances | ||||||||||||||||||||

| Average earning assets | $ | 8,585 | $ | 8,614 | $ | 5,885 | $ | (28 | ) | $ | 2,700 | |||||||||

| Statistical Data | ||||||||||||||||||||

| Pre-tax ROAEA | -2.17 | % | -3.77 | % | -1.78 | % | 1.60 | % | -0.39 | % | ||||||||||

| Net finance margin | -0.65 | % | -0.65 | % | -0.93 | % | 0.00 | % | 0.28 | % | ||||||||||

| * Certain balances may not sum due to rounding. | ||||||||||||||||||||

Certain items are not allocated to operating segments and are included in Corporate and Other, including interest expense, primarily related to corporate liquidity costs, mark-to-market on certain derivatives, restructuring charges, certain legal costs and other operating expenses. Interest income increased from both prior and year-ago quarters primarily related to income generated from the investment portfolio. Other income included a $18 million mark-to-market benefit on the TRS derivative in the current quarter, compared to a small benefit of $1 million in the prior quarter and a negative mark-to-market adjustment of $1 million in the year-ago quarter. Operating expenses for the quarter reflect restructuring charges of $20 million, compared to $53 million in the prior quarter, reflecting our previously announced organizational changes, and a net reversal of $1 million in the year-ago quarter.

Discontinued Operations

Income from discontinued operations, net of taxes, was a loss of $5 million in the current quarter compared to a loss of $7 million in the prior quarter. Discontinued operations predominantly relate to third-party reverse mortgage servicing activity, known as Financial Freedom, which the Company acquired in the OneWest Bank acquisition.

15

Conference Call and Webcast

Chairman and Chief Executive Officer Ellen Alemany and Chief Financial Officer Carol Hayles will discuss these results on a conference call and audio webcast today, April 28, at 8:00 a.m. (EST). Interested parties may access the conference call live by dialing 888-317-6003 for U.S., 866-284-3684 for Canadian callers or 412-317-6061 for international callers and reference access code “2728263” or access the audio webcast at cit.com/investor. An audio replay of the call will be available until 11:59 p.m. (EST) on May 28, 2016, by dialing 877-344-7529 for U.S. callers, 855-669-9658 for Canadian callers or 412-317-0088 for international callers with the access code “10084072”, or at cit.com/investor.

About CIT

Founded in 1908, CIT (NYSE: CIT) is a financial holding company with more than $65 billion in assets. Its principal bank subsidiary, CIT Bank, N.A., (Member FDIC, Equal Housing Lender) has more than $30 billion of deposits and more than $40 billion of assets. It provides financing, leasing and advisory services principally to middle market companies across a wide variety of industries primarily in North America, and equipment financing and leasing solutions to the transportation sector. It also offers products and services to consumers through its Internet bank franchise and a network of retail branches in Southern California, operating as OneWest Bank, a division of CIT Bank, N.A. cit.com

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of applicable federal securities laws that are based upon our current expectations and assumptions concerning future events, which are subject to a number of risks and uncertainties that could cause actual results to differ materially from those anticipated. The words “expect,” “anticipate,” “estimate,” “forecast,” “initiative,” “objective,” “plan,” “goal,” “project,” “outlook,” “priorities,” “target,” “intend,” “evaluate,” “pursue,” “commence,” “seek,” “may,” “would,” “could,” “should,” “believe,” “potential,” “continue,” or the negative of any of those words or similar expressions is intended to identify forward-looking statements. All statements contained in this press release, other than statements of historical fact, including without limitation, statements about our plans, strategies, prospects and expectations regarding future events and our financial performance, are forward-looking statements that involve certain risks and uncertainties. While these statements represent our current judgment on what the future may hold, and we believe these judgments are reasonable, these statements are not guarantees of any events or financial results, and our actual results may differ materially. Important factors that could cause our actual results to be materially different from our expectations include, among others, the risk that CIT is unsuccessful in implementing its strategy and business plan, the risk that CIT is unable to react to and address key business and regulatory issues, the risk that CIT is unable to achieve the projected revenue growth from its new business initiatives or the projected expense reductions from efficiency improvements, and the risk that CIT becomes subject to liquidity constraints and higher funding costs. We describe these and other risks that could affect our results in Item 1A, “Risk Factors,” of our latest Annual Report on Form 10-K for the year ended December 31, 2015, which was filed with the Securities and Exchange Commission. Accordingly, you should not place undue reliance on the forward-looking statements contained in this press release. These forward-looking statements speak only as of the date on which the statements were made. CIT undertakes no obligation to update publicly or otherwise revise any forward-looking statements, except where expressly required by law.

Non-GAAP Measurements

Net finance revenue, net operating lease revenue and average earning assets are non-GAAP measurements used by management to gauge portfolio performance. Operating expenses excluding restructuring costs and intangible amortization is a non-GAAP measurement used by management to compare period over period expenses. Net efficiency ratio measures operating expenses (net of restructuring costs and intangible amortization) to our level of total net revenues. Total assets from continuing operations is a non-GAAP measurement used by management to analyze the total asset change on a more consistent basis. Tangible book value and tangible book value per share are non-GAAP metrics used to analyze banks.

###

| CIT MEDIA RELATIONS: | CIT INVESTOR RELATIONS: |

| Matt Klein | Barbara Callahan |

| Vice President, Media Relations | Senior Vice President |

|

(973) 597-2020 Matt.Klein@cit.com

|

(973) 740-5058 Barbara.Callahan@cit.com |

###

16

CIT GROUP INC. AND SUBSIDIARIES

Unaudited Consolidated Statements of Income

(dollars in millions, except per share data)

| Quarters Ended | ||||||||||||

| March 31, | December 31, | March 31, | ||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| Interest income | ||||||||||||

| Interest and fees on loans | $ | 464.5 | $ | 480.1 | $ | 272.4 | ||||||

| Other Interest and dividends | 30.9 | 30.3 | 8.6 | |||||||||

| Total interest income | 495.4 | 510.4 | 281.0 | |||||||||

| Interest expense | ||||||||||||

| Interest on borrowings | (186.9 | ) | (187.5 | ) | (202.3 | ) | ||||||

| Interest on deposits | (99.5 | ) | (99.2 | ) | (69.0 | ) | ||||||

| Total interest expense | (286.4 | ) | (286.7 | ) | (271.3 | ) | ||||||

| Net interest revenue | 209.0 | 223.7 | 9.7 | |||||||||

| Provision for credit losses | (99.3 | ) | (57.6 | ) | (34.6 | ) | ||||||

| Net interest revenue, after credit provision | 109.7 | 166.1 | (24.9 | ) | ||||||||

| Non-interest income | ||||||||||||

| Rental income on operating leases | 575.4 | 550.9 | 530.6 | |||||||||

| Other income | 100.9 | 30.4 | 86.4 | |||||||||

| Total non-interest income | 676.3 | 581.3 | 617.0 | |||||||||

| Non-interest expenses | ||||||||||||

| Depreciation on operating lease equipment | (175.3 | ) | (166.8 | ) | (156.8 | ) | ||||||

| Maintenance and other operating lease expenses | (56.2 | ) | (79.6 | ) | (46.1 | ) | ||||||

| Operating expenses | (348.5 | ) | (357.8 | ) | (241.6 | ) | ||||||

| Loss on debt extinguishment | (1.6 | ) | (2.2 | ) | - | |||||||

| Total other expenses | (581.6 | ) | (606.4 | ) | (444.5 | ) | ||||||

| Income from continuing operations before (provision) benefit for income taxes | 204.4 | 141.0 | 147.6 | |||||||||

| (Provision) benefit for income taxes | (52.7 | ) | 10.2 | (44.0 | ) | |||||||

| Income from continuing operations, before attribution of noncontrolling interests | 151.7 | 151.2 | 103.6 | |||||||||

| Net loss attributable to noncontrolling interests, after tax | - | - | 0.1 | |||||||||

| Income from continuing operations | 151.7 | 151.2 | 103.7 | |||||||||

| Discontinued operation | ||||||||||||

| Loss from discontinued operation | (7.4 | ) | (11.2 | ) | - | |||||||

| Benefit for income taxes | 2.6 | 4.5 | - | |||||||||

| Loss from discontinued operation, net of taxes | (4.8 | ) | (6.7 | ) | - | |||||||

| Net income | $ | 146.9 | $ | 144.5 | $ | 103.7 | ||||||

| Basic income per common share | ||||||||||||

| Income from continuing operations | $ | 0.75 | $ | 0.75 | $ | 0.59 | ||||||

| Loss from discontinued operation, net of taxes | (0.02 | ) | (0.03 | ) | - | |||||||

| Basic income per common share | $ | 0.73 | $ | 0.72 | $ | 0.59 | ||||||

| Average number of common shares - basic (thousands) | 201,394 | 200,987 | 176,260 | |||||||||

| Diluted income per common share | ||||||||||||

| Income from continuing operations | $ | 0.75 | $ | 0.75 | $ | 0.59 | ||||||

| Loss from discontinued operation, net of taxes | (0.02 | ) | (0.03 | ) | - | |||||||

| Diluted income per common share | $ | 0.73 | $ | 0.72 | $ | 0.59 | ||||||

| Average number of common shares - diluted (thousands) | 202,136 | 201,376 | 177,072 | |||||||||

17

CIT GROUP INC. AND SUBSIDIARIES

Unaudited Consolidated Balance Sheets

(dollars in millions, except per share data)

| March 31, | December 31, | March 31, | ||||||||||

| 2016* | 2015 | 2015 | ||||||||||

| Assets | ||||||||||||

| Total cash and deposits | $ | 8,141.8 | $ | 8,301.5 | $ | 6,306.9 | ||||||

| Securities purchased under agreements to resell | - | - | 450.0 | |||||||||

| Investment securities | 2,896.8 | 2,953.8 | 1,347.4 | |||||||||

| Assets held for sale | 2,211.2 | 2,092.4 | 1,051.9 | |||||||||

| Loans | 31,408.6 | 31,671.7 | 19,429.3 | |||||||||

| Allowance for loan losses | (404.6 | ) | (360.2 | ) | (356.5 | ) | ||||||

| Loans, net of allowance for loan losses | 31,004.0 | 31,311.5 | 19,072.8 | |||||||||

| Operating lease equipment, net | 16,665.7 | 16,617.0 | 14,887.8 | |||||||||

| Indemnification assets | 389.4 | 414.8 | - | |||||||||

| Goodwill | 1,195.1 | 1,198.3 | 563.6 | |||||||||

| Intangible assets | 170.3 | 176.3 | 23.2 | |||||||||

| Unsecured counterparty receivable | 556.3 | 537.8 | 537.1 | |||||||||

| Other assets | 3,377.5 | 3,297.6 | 2,054.1 | |||||||||

| Assets of discontinued operation | 489.5 | 500.5 | - | |||||||||

| Total assets | $ | 67,097.6 | $ | 67,401.5 | $ | 46,294.8 | ||||||

| Liabilities | ||||||||||||

| Deposits | $ | 32,892.7 | $ | 32,782.2 | $ | 16,758.1 | ||||||

| Credit balances of factoring clients | 1,361.0 | 1,344.0 | 1,505.3 | |||||||||

| Other liabilities | 3,020.2 | 3,158.7 | 2,735.2 | |||||||||

| Borrowings | ||||||||||||

| Unsecured borrowings | 10,587.4 | 10,636.3 | 10,680.8 | |||||||||

| Structured financings | 4,308.9 | 4,687.9 | 5,769.6 | |||||||||

| FHLB advances | 3,116.3 | 3,117.6 | 86.7 | |||||||||

| Total borrowings | 18,012.6 | 18,441.8 | 16,537.1 | |||||||||

| Liabilities of discontinued operation | 684.8 | 696.2 | - | |||||||||

| Total liabilities | 55,971.3 | 56,422.9 | 37,535.7 | |||||||||

| Equity | ||||||||||||

| Stockholders' equity | ||||||||||||

| Common stock | 2.1 | 2.0 | 2.0 | |||||||||

| Paid-in capital | 8,739.4 | 8,718.1 | 8,598.0 | |||||||||

| Retained earnings | 2,673.7 | 2,557.4 | 1,692.3 | |||||||||

| Accumulated other comprehensive loss | (117.4 | ) | (142.1 | ) | (163.1 | ) | ||||||

| Treasury stock, at cost | (172.0 | ) | (157.3 | ) | (1,370.6 | ) | ||||||

| Total common stockholders' equity | 11,125.8 | 10,978.1 | 8,758.6 | |||||||||

| Noncontrolling interests | 0.5 | 0.5 | 0.5 | |||||||||

| Total equity | 11,126.3 | 10,978.6 | 8,759.1 | |||||||||

| Total liabilities and equity | $ | 67,097.6 | $ | 67,401.5 | $ | 46,294.8 | ||||||

| Book Value Per Common Share | ||||||||||||

| Book value per common share | $ | 55.16 | $ | 54.61 | $ | 50.26 | ||||||

| Tangible book value per common share | $ | 48.39 | $ | 47.77 | $ | 46.89 | ||||||

| Outstanding common shares (in thousands) | 201,702 | 201,022 | 174,280 | |||||||||

* Preliminary

18

CIT GROUP INC. AND SUBSIDIARIES

Average Balances and Rates

(dollars in millions)

| Quarters Ended | ||||||||||||||||||||||||

| March 31, 2016 | December 31, 2015 | March 31, 2015 | ||||||||||||||||||||||

| Average Balance | Rate | Average Balance | Rate | Average Balance | Rate | |||||||||||||||||||

| Assets | ||||||||||||||||||||||||

| Interest bearing deposits | $ | 7,114.0 | 0.47 | % | $ | 6,671.6 | 0.32 | % | $ | 5,951.6 | 0.27 | % | ||||||||||||

| Securities purchased under agreements to resell | - | - | 25.0 | 0.49 | % | 575.0 | 0.49 | % | ||||||||||||||||

| Investments | 2,923.5 | 3.08 | % | 3,334.9 | 3.00 | % | 1,497.2 | 1.04 | % | |||||||||||||||

| Loans (including held for sale) | ||||||||||||||||||||||||

| U.S. | 32,091.5 | 5.74 | % | 32,467.3 | 5.71 | % | 17,908.2 | 5.36 | % | |||||||||||||||

| Non-U.S. | 1,291.0 | 8.18 | % | 1,707.8 | 9.46 | % | 2,235.3 | 9.38 | % | |||||||||||||||

| Total Loans | 33,382.5 | 5.84 | % | 34,175.1 | 5.90 | % | 20,143.5 | 5.84 | % | |||||||||||||||

| Total interest earning assets / interest income | 43,420.0 | 4.74 | % | 44,206.6 | 4.80 | % | 28,167.3 | 4.22 | % | |||||||||||||||

| Operating lease equipment, net (including held for sale) | ||||||||||||||||||||||||

| U.S. | 8,831.3 | 8.41 | % | 8,534.7 | 7.58 | % | 7,769.5 | 9.15 | % | |||||||||||||||

| Non-U.S. | 7,890.0 | 8.02 | % | 7,538.7 | 7.58 | % | 7,420.0 | 8.08 | % | |||||||||||||||

| Total operating lease equipment, net | 16,721.3 | 8.23 | % | 16,073.4 | 7.58 | % | 15,189.5 | 8.63 | % | |||||||||||||||

| Indemnification assets | 401.7 | -3.09 | % | 445.8 | -0.72 | % | - | - | ||||||||||||||||

| Total earning assets | 60,543.0 | 5.67 | % | 60,725.8 | 5.51 | % | 43,356.8 | 5.82 | % | |||||||||||||||

| Non-interest earning assets | ||||||||||||||||||||||||

| Cash and due from banks | 1,331.4 | 1,636.4 | 903.6 | |||||||||||||||||||||

| Allowance for loan losses | (371.5 | ) | (338.3 | ) | (347.7 | ) | ||||||||||||||||||

| All other non-interest bearing assets | 5,298.4 | 5,334.2 | 3,190.6 | |||||||||||||||||||||

| Assets of discontinued operation | 495.1 | 506.9 | - | |||||||||||||||||||||

| Total Average Assets | $ | 67,296.4 | $ | 67,865.0 | $ | 47,103.3 | ||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||

| Borrowings | ||||||||||||||||||||||||

| Deposits | $ | 31,829.1 | 1.25 | % | $ | 31,538.3 | 1.26 | % | $ | 16,275.6 | 1.70 | % | ||||||||||||

| Borrowings | 18,210.4 | 4.11 | % | 18,805.9 | 3.99 | % | 17,477.4 | 4.63 | % | |||||||||||||||

| Total interest-bearing liabilities | 50,039.5 | 2.29 | % | 50,344.2 | 2.28 | % | 33,753.0 | 3.22 | % | |||||||||||||||

| Non-interest bearing deposits | 1,080.2 | 1,125.9 | 106.6 | |||||||||||||||||||||

| Credit balances of factoring clients | 1,337.5 | 1,584.5 | 1,501.4 | |||||||||||||||||||||

| Other non-interest bearing liabilities | 3,063.7 | 3,231.1 | 2,870.6 | |||||||||||||||||||||

| Liabilities of discontinued operation | 690.2 | 674.6 | - | |||||||||||||||||||||

| Noncontrolling interests | 0.5 | 0.5 | (3.9 | ) | ||||||||||||||||||||

| Stockholders' equity | 11,084.8 | 10,904.2 | 8,875.6 | |||||||||||||||||||||

| Total Average Liabilities and Stockholders' Equity | $ | 67,296.4 | $ | 67,865.0 | $ | 47,103.3 | ||||||||||||||||||

19

CIT GROUP INC. AND SUBSIDIARIES

Select Accounts

(dollars in millions)

| Quarters Ended | ||||||||||||

| March 31, | December 31, | March 31, | ||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| OTHER INCOME | ||||||||||||

| Fee revenues | $ | 32.7 | $ | 34.7 | $ | 22.6 | ||||||

| Factoring commissions | 26.4 | 29.1 | 29.5 | |||||||||

| Gains on sales of leasing equipment | 11.2 | 16.9 | 32.0 | |||||||||

| Net gain (losses) on derivatives and foreign currency exchange | 9.3 | 1.8 | (9.7 | ) | ||||||||

| Gain (loss) on OREO sales | 1.7 | (2.2 | ) | - | ||||||||

| (Loss) gains on loan and portfolio sales | 0.3 | (41.3 | ) | 6.6 | ||||||||

| (Losses) gains on investments | (4.1 | ) | (5.6 | ) | 0.7 | |||||||

| Impairment on assets held for sale | (22.1 | ) | (14.9 | ) | (10.1 | ) | ||||||

| Other revenues | 45.5 | 11.9 | 14.8 | |||||||||

| Total other income | $ | 100.9 | $ | 30.4 | $ | 86.4 | ||||||

| OPERATING EXPENSES | ||||||||||||

| Compensation and benefits | $ | (172.2 | ) | $ | (151.5 | ) | $ | (146.5 | ) | |||

| Professional fees | (38.8 | ) | (43.4 | ) | (19.5 | ) | ||||||

| Technology | (30.4 | ) | (32.7 | ) | (22.3 | ) | ||||||

| Net occupancy expense | (18.4 | ) | (17.9 | ) | (9.4 | ) | ||||||

| Advertising and marketing | (5.4 | ) | (8.1 | ) | (9.1 | ) | ||||||

| Other expenses | (56.6 | ) | (44.0 | ) | (35.2 | ) | ||||||

| Operating expenses, before provision for severance and facilities exiting and intangible asset amortization | (321.8 | ) | (297.6 | ) | (242.0 | ) | ||||||

| Provision for severance and facilities exiting activities | (20.3 | ) | (53.0 | ) | 1.0 | |||||||

| Intangible asset amortization | (6.4 | ) | (7.2 | ) | (0.6 | ) | ||||||

| Total operating expenses | $ | (348.5 | ) | $ | (357.8 | ) | $ | (241.6 | ) | |||

| March 31, | December 31, | March 31, | ||||||||||

| 2016* | 2015 | 2015 | ||||||||||

| TOTAL CASH AND INVESTMENT SECURITIES | ||||||||||||

| Total cash and deposits | $ | 8,141.8 | $ | 8,301.5 | $ | 6,306.9 | ||||||

| Securities purchased under agreements to resell | - | - | 450.0 | |||||||||

| Investment securities | 2,896.8 | 2,953.8 | 1,347.4 | |||||||||

| Total cash and investment securities | $ | 11,038.6 | $ | 11,255.3 | $ | 8,104.3 | ||||||

| OTHER ASSETS | ||||||||||||

| Current and deferred federal and state tax assets | $ | 1,197.4 | $ | 1,252.5 | $ | 460.7 | ||||||

| Deposits on commercial aerospace equipment | 774.3 | 696.0 | 750.6 | |||||||||

| Tax credit investments and investments in unconsolidated subsidiaries | 237.9 | 223.9 | 75.2 | |||||||||

| Property, furniture and fixtures | 192.1 | 197.2 | 123.4 | |||||||||

| Other counterparty receivables | 179.6 | 59.0 | 25.2 | |||||||||

| Tax receivables, other than income taxes | 105.7 | 98.2 | 101.9 | |||||||||

| Other real estate owned and repossessed assets | 105.4 | 127.3 | 0.6 | |||||||||

| Fair value of derivative financial instruments | 97.4 | 140.7 | 199.4 | |||||||||

| Other | 487.7 | 502.8 | 317.1 | |||||||||

| Total other assets | $ | 3,377.5 | $ | 3,297.6 | $ | 2,054.1 | ||||||

| OTHER LIABILITIES | ||||||||||||

| Equipment maintenance reserves | $ | 1,042.2 | $ | 1,012.4 | $ | 965.2 | ||||||

| Accrued expenses and accounts payable | 563.6 | 628.1 | 385.6 | |||||||||

| Current and deferred taxes payable | 354.5 | 363.1 | 340.9 | |||||||||

| Fair value of derivative financial instruments | 196.5 | 103.0 | 67.5 | |||||||||

| Security and other deposits | 179.9 | 263.0 | 379.7 | |||||||||

| Accrued interest payable | 161.0 | 209.6 | 171.7 | |||||||||

| Valuation adjustment relating to aerospace commitments | 73.1 | 73.1 | 117.1 | |||||||||

| Other liabilities | 449.4 | 506.4 | 307.5 | |||||||||

| Total other liabilities | $ | 3,020.2 | $ | 3,158.7 | $ | 2,735.2 | ||||||

* Preliminary

20

CIT GROUP INC. AND SUBSIDIARIES

Financing and Leasing Assets

(dollars in millions)

| March 31, | December 31, | March 31, | ||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| Commercial Banking | ||||||||||||

| Commercial Finance | ||||||||||||

| Loans | $ | 9,329.4 | $ | 9,118.6 | $ | 6,552.0 | ||||||

| Assets held for sale | 203.4 | 313.6 | 87.6 | |||||||||

| Financing and leasing assets | 9,532.8 | 9,432.2 | 6,639.6 | |||||||||

| Real Estate Finance | ||||||||||||

| Loans | 5,348.5 | 5,300.6 | 1,813.9 | |||||||||

| Assets held for sale | 14.4 | 57.0 | - | |||||||||

| Financing and leasing assets | 5,362.9 | 5,357.6 | 1,813.9 | |||||||||

| Business Capital | ||||||||||||

| Loans | 6,759.3 | 6,510.0 | 6,693.0 | |||||||||

| Operating lease equipment, net | 292.6 | 259.0 | 225.4 | |||||||||

| Assets held for sale | 11.9 | 44.3 | - | |||||||||

| Financing and leasing assets | 7,063.8 | 6,813.3 | 6,918.4 | |||||||||

| Total Segment | ||||||||||||

| Loans | 21,437.2 | 20,929.2 | 15,058.9 | |||||||||

| Operating lease equipment, net | 292.6 | 259.0 | 225.4 | |||||||||

| Assets held for sale | 229.7 | 414.9 | 87.6 | |||||||||

| Financing and leasing assets | 21,959.5 | 21,603.1 | 15,371.9 | |||||||||

| Transportation Finance | ||||||||||||

| Aerospace | ||||||||||||

| Loans | 1,031.9 | 1,762.3 | 1,750.8 | |||||||||

| Operating lease equipment, net | 9,594.3 | 9,765.2 | 8,822.7 | |||||||||

| Assets held for sale | 723.8 | 34.7 | 234.5 | |||||||||

| Financing and leasing assets | 11,350.0 | 11,562.2 | 10,808.0 | |||||||||

| Rail | ||||||||||||

| Loans | 118.1 | 120.9 | 126.7 | |||||||||

| Operating lease equipment, net | 6,778.8 | 6,592.8 | 5,800.1 | |||||||||

| Assets held for sale | 0.4 | 0.7 | 1.0 | |||||||||

| Financing and leasing assets | 6,897.3 | 6,714.4 | 5,927.8 | |||||||||

| Maritime Finance | ||||||||||||

| Loans | 1,636.7 | 1,658.9 | 1,066.6 | |||||||||

| Assets held for sale | 30.5 | 19.5 | 19.1 | |||||||||

| Financing and leasing assets | 1,667.2 | 1,678.4 | 1,085.7 | |||||||||

| Total Segment | ||||||||||||

| Loans | 2,786.7 | 3,542.1 | 2,944.1 | |||||||||

| Operating lease equipment, net | 16,373.1 | 16,358.0 | 14,622.8 | |||||||||

| Assets held for sale | 754.7 | 54.9 | 254.6 | |||||||||

| Financing and leasing assets | 19,914.5 | 19,955.0 | 17,821.5 | |||||||||

| Consumer and Community Banking | ||||||||||||

| Other Consumer Banking | ||||||||||||

| Loans | 1,879.5 | 1,770.0 | - | |||||||||

| Assets held for sale | 2.6 | 3.9 | - | |||||||||

| Financing and leasing assets | 1,882.1 | 1,773.9 | - | |||||||||

| Legacy Consumer Mortgages | ||||||||||||

| Loans | 5,305.2 | 5,430.4 | - | |||||||||

| Assets held for sale | 48.0 | 41.2 | - | |||||||||

| Financing and leasing assets | 5,353.2 | 5,471.6 | - | |||||||||

| Total Segment | ||||||||||||

| Loans | 7,184.7 | 7,200.4 | - | |||||||||

| Assets held for sale | 50.6 | 45.1 | - | |||||||||

| Financing and leasing assets | 7,235.3 | 7,245.5 | - | |||||||||

| Non-Strategic Portfolios | ||||||||||||

| Loans | - | - | 1,426.3 | |||||||||

| Operating lease equipment, net | - | - | 39.6 | |||||||||

| Assets held for sale | 1,176.2 | 1,577.5 | 709.7 | |||||||||

| Financing and leasing assets | 1,176.2 | 1,577.5 | 2,175.6 | |||||||||

| Total financing and leasing assets | $ | 50,285.5 | $ | 50,381.1 | $ | 35,369.0 | ||||||

21

CIT GROUP INC. AND SUBSIDIARIES

Credit Metrics

(dollars in millions)

| Quarters Ended | ||||||||||||||||||||||||

| March 31, 2016 | December 31, 2015 | March 31, 2015 | ||||||||||||||||||||||

| Gross Charge-offs to Average Finance Receivables | ||||||||||||||||||||||||

| Transportation Finance(1) | $ | 19.6 | 2.35 | % | $ | 0.9 | 0.10 | % | $ | - | - | |||||||||||||

| Commercial Banking(2) | 35.8 | 0.68 | % | 37.0 | 0.69 | % | 22.6 | 0.60 | % | |||||||||||||||

| Consumer and Community Banking | 0.7 | 0.04 | % | (0.3 | ) | -0.02 | % | - | - | |||||||||||||||

| Non-Strategic Portfolios | - | - | 0.2 | - | 4.0 | 1.10 | % | |||||||||||||||||

| Total CIT | $ | 56.1 | 0.71 | % | $ | 37.8 | 0.47 | % | $ | 26.6 | 0.55 | % | ||||||||||||

| Quarters Ended | ||||||||||||||||||||||||

| March 31, 2016 | December 31, 2015 | March 31, 2015 | ||||||||||||||||||||||

| Net Charge-offs to Average Finance Receivables | ||||||||||||||||||||||||

| Transportation Finance(1) | $ | 19.6 | 2.35 | % | $ | 0.8 | 0.09 | % | $ | - | - | |||||||||||||

| Commercial Banking(2) | 31.8 | 0.60 | % | 31.8 | 0.59 | % | 19.3 | 0.52 | % | |||||||||||||||

| Consumer and Community Banking | (0.1 | ) | -0.01 | % | (0.9 | ) | -0.05 | % | - | - | ||||||||||||||

| Non-Strategic Portfolios | - | - | 0.2 | - | 1.6 | 0.44 | % | |||||||||||||||||

| Total CIT | $ | 51.3 | 0.65 | % | $ | 31.9 | 0.40 | % | $ | 20.9 | 0.43 | % | ||||||||||||

| Non-accruing Loans to Finance Receivables(3) | March 31, 2016 | December 31, 2015 | March 31, 2015 | |||||||||||||||||||||

| Transportation Finance | $ | 21.7 | 0.78 | % | $ | 15.4 | 0.43 | % | $ | 0.1 | 0.00 | % | ||||||||||||

| Commercial Banking | 215.2 | 1.00 | % | 191.1 | 0.91 | % | 104.6 | 0.69 | % | |||||||||||||||

| Consumer and Community Banking | 7.1 | 0.10 | % | 5.2 | 0.07 | % | - | - | ||||||||||||||||

| Non-Strategic Portfolios(3) | 51.1 | (3 | ) | 56.0 | (3 | ) | 78.8 | 5.52 | % | |||||||||||||||

| Total CIT | $ | 295.1 | 0.94 | % | $ | 267.7 | 0.85 | % | $ | 183.5 | 0.94 | % | ||||||||||||

| PROVISION AND ALLOWANCE COMPONENTS | ||||||||||||

| Provision for Credit Losses | ||||||||||||

| Quarters Ended | ||||||||||||

| March 31, | December 31, | March 31, | ||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| Specific allowance - impaired loans | $ | 21.8 | $ | 0.9 | $ | 2.4 | ||||||

| Non-specific allowance | 26.2 | 24.8 | 11.3 | |||||||||

| Net charge-offs | 51.3 | 31.9 | 20.9 | |||||||||

| Totals | $ | 99.3 | $ | 57.6 | $ | 34.6 | ||||||

| Allowance for Loan Losses | ||||||||||||

| March 31, | December 31, | March 31, | ||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| Specific allowance - impaired loans | $ | 40.2 | $ | 27.8 | $ | 14.8 | ||||||

| Non-specific allowance | 364.4 | 332.4 | 341.7 | |||||||||

| Totals | $ | 404.6 | $ | 360.2 | $ | 356.5 | ||||||

| Allowance for loan losses as a percentage of total finance receivables | 1.29 | % | 1.14 | % | 1.83 | % | ||||||

| Allowance for loan losses as a percent of finance receivables/Commercial | 1.61 | % | 1.43 | % | 1.83 | % | ||||||

| Allowance for loan losses plus principal loss discount as a percent of finance receivables (before the principal loss discount)/Commercial | 1.87 | % | 1.79 | % | 1.83 | % | ||||||

| Allowance for loan losses plus principal loss discount as a percent of finance receivables (before the principal loss discount)/Consumer | 7.86 | % | 8.62 | % | - | |||||||

In certain instances, we use the term finance receivables synonymously with “Loans”, as presented on the balance sheet.

1) Transportation Finance charge-offs related to the transfer of receivables to assets held for sale for the quarter ended March 31, 2016 totaled $7 million, and none in the other quarters presented.

2) Commercial Banking charge-offs related to the transfer of receivables to assets held for sale for the quarters ended March 31, 2016, December 31, 2015 and March 31, 2015 totaled $2 million, $19 million and $11 million, respectively.

3) Non-accrual loans include loans held for sale. NSP non-accrual loans reflected loans held for sale; since portfolio loans were insignificant, no % is displayed.

22

CIT GROUP INC. AND SUBSIDIARIES

Segment Results

(dollars in millions)

| Quarters Ended | ||||||||||||

| March 31, | December 31, | March 31, | ||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| Commercial Banking | ||||||||||||

| Total interest income | $ | 287.1 | $ | 285.5 | $ | 181.3 | ||||||

| Total interest expense | (73.6 | ) | (68.1 | ) | (64.8 | ) | ||||||

| Provision for credit losses | (73.5 | ) | (45.4 | ) | (24.4 | ) | ||||||

| Rental income on operating leases | 27.1 | 25.8 | 23.1 | |||||||||

| Other income | 55.5 | 68.9 | 63.6 | |||||||||

| Depreciation on operating lease equipment | (20.0 | ) | (18.8 | ) | (17.2 | ) | ||||||

| Operating expenses | (158.4 | ) | (146.0 | ) | (131.3 | ) | ||||||

| Income before provision for income taxes | $ | 44.2 | $ | 101.9 | $ | 30.3 | ||||||

| Funded new business volume | $ | 1,581.4 | $ | 2,164.7 | $ | 1,296.2 | ||||||

| Average Earning Assets | $ | 20,727.0 | $ | 20,944.0 | $ | 14,356.5 | ||||||

| Average Finance Receivables | $ | 21,130.8 | $ | 21,463.2 | $ | 14,985.5 | ||||||

| Transportation Finance | ||||||||||||

| Total interest income | $ | 52.7 | $ | 49.8 | $ | 42.7 | ||||||

| Total interest expense | (148.1 | ) | (143.4 | ) | (150.6 | ) | ||||||

| Provision for credit losses | (22.7 | ) | (8.6 | ) | (6.4 | ) | ||||||

| Rental income on operating leases | 544.5 | 518.2 | 496.7 | |||||||||

| Other income | 18.8 | 24.8 | 35.4 | |||||||||

| Depreciation on operating lease equipment | (155.3 | ) | (148.0 | ) | (136.0 | ) | ||||||

| Maintenance and other operating lease expenses | (56.2 | ) | (79.6 | ) | (46.1 | ) | ||||||

| Operating expenses / loss on debt extinguishment | (60.7 | ) | (50.2 | ) | (67.2 | ) | ||||||

| Income before provision for income taxes | $ | 173.0 | $ | 163.0 | $ | 168.5 | ||||||

| Funded new business volume | $ | 245.9 | $ | 1,619.5 | $ | 419.5 | ||||||

| Average Earning Assets | $ | 20,619.5 | $ | 19,784.2 | $ | 18,880.8 | ||||||

| Average Finance Receivables | $ | 3,333.4 | $ | 3,446.7 | $ | 2,928.8 | ||||||

| Consumer and Community Banking | ||||||||||||

| Total interest income | $ | 103.2 | $ | 109.5 | $ | - | ||||||

| Total interest expense | (8.9 | ) | (13.2 | ) | - | |||||||

| Provision for credit losses | (3.1 | ) | (3.6 | ) | - | |||||||

| Other income | 8.1 | 5.3 | - | |||||||||

| Operating expenses | (82.2 | ) | (84.7 | ) | - | |||||||

| Income before provision for income taxes | $ | 17.1 | $ | 13.3 | $ | - | ||||||

| Funded new business volume | $ | 214.5 | $ | 220.3 | $ | - | ||||||

| Average Earning Assets | $ | 7,757.8 | $ | 7,845.9 | $ | - | ||||||

| Average Finance Receivables | $ | 7,160.4 | $ | 7,204.8 | $ | - | ||||||

| Non-Strategic Portfolios | ||||||||||||

| Total interest income | $ | 25.0 | $ | 39.6 | $ | 52.8 | ||||||

| Total interest expense | (14.5 | ) | (22.0 | ) | (38.0 | ) | ||||||

| Provision for credit losses | - | - | (3.8 | ) | ||||||||

| Rental income on operating leases | 3.8 | 6.9 | 10.8 | |||||||||

| Other income | 14.5 | (54.4 | ) | (6.2 | ) | |||||||

| Depreciation on operating lease equipment | - | - | (3.6 | ) | ||||||||

| Operating expenses | (12.2 | ) | (26.2 | ) | (37.0 | ) | ||||||

| Income (loss) before provision for income taxes | $ | 16.6 | $ | (56.1 | ) | $ | (25.0 | ) | ||||

| Funded new business volume | $ | 44.3 | $ | 167.0 | $ | 201.4 | ||||||

| Average Earning Assets | $ | 1,516.8 | $ | 1,953.8 | $ | 2,718.4 | ||||||

| Average Finance Receivables | $ | - | $ | - | $ | 1,457.6 | ||||||

| Corporate and Other | ||||||||||||

| Total interest income | $ | 27.4 | $ | 26.0 | $ | 4.2 | ||||||

| Total interest expense | (41.3 | ) | (40.0 | ) | (17.9 | ) | ||||||

| Other income | 4.0 | (14.2 | ) | (6.4 | ) | |||||||

| Operating expenses / loss on debt extinguishment | (36.6 | ) | (52.9 | ) | (6.1 | ) | ||||||

| Loss before provision for income taxes | $ | (46.5 | ) | $ | (81.1 | ) | $ | (26.2 | ) | |||

| Average Earning Assets | $ | 8,585.3 | $ | 8,613.5 | $ | 5,885.4 | ||||||

| Total CIT | ||||||||||||

| Total interest income | $ | 495.4 | $ | 510.4 | $ | 281.0 | ||||||

| Total interest expense | (286.4 | ) | (286.7 | ) | (271.3 | ) | ||||||

| Provision for credit losses | (99.3 | ) | (57.6 | ) | (34.6 | ) | ||||||

| Rental income on operating leases | 575.4 | 550.9 | 530.6 | |||||||||

| Other income | 100.9 | 30.4 | 86.4 | |||||||||

| Depreciation on operating lease equipment | (175.3 | ) | (166.8 | ) | (156.8 | ) | ||||||

| Maintenance and other operating lease expenses | (56.2 | ) | (79.6 | ) | (46.1 | ) | ||||||

| Operating expenses / loss on debt extinguishment | (350.1 | ) | (360.0 | ) | (241.6 | ) | ||||||

| Income from continuing operations before provision for income taxes | $ | 204.4 | $ | 141.0 | $ | 147.6 | ||||||

| Funded new business volume | $ | 2,086.1 | $ | 4,171.5 | $ | 1,917.1 | ||||||

| Average Earning Assets | $ | 59,206.4 | $ | 59,141.4 | $ | 41,841.1 | ||||||

| Average Finance Receivables | $ | 31,624.6 | $ | 32,114.7 | $ | 19,371.9 | ||||||

23

CIT GROUP INC. AND SUBSIDIARIES

Segment Margin

(dollars in millions)

| Quarters Ended | ||||||||||||

| March 31, | December 31, | March 31, | ||||||||||

| 2016 | 2015 | 2015 | ||||||||||

| Commercial Banking | ||||||||||||

| Total Segment | ||||||||||||

| AEA | $ | 20,727.0 | $ | 20,944.0 | $ | 14,356.5 | ||||||

| Net Finance Revenue | 220.6 | 224.4 | 122.4 | |||||||||

| Gross yield | 6.06 | % | 5.95 | % | 5.69 | % | ||||||

| Net Finance Margin | 4.26 | % | 4.29 | % | 3.41 | % | ||||||

| Average Earning Assets (AEA) | ||||||||||||

| Commercial Finance | $ | 9,545.4 | $ | 9,979.3 | $ | 6,706.4 | ||||||

| Real Estate Finance | 5,334.6 | 5,159.2 | 1,777.7 | |||||||||

| Business Capital | 5,847.0 | 5,805.5 | 5,872.4 | |||||||||

| Net Finance Revenue | ||||||||||||

| Commercial Finance | 90.6 | 98.5 | 44.0 | |||||||||

| Real Estate Finance | 54.4 | 51.4 | 10.0 | |||||||||

| Business Capital | 75.6 | 74.5 | 68.4 | |||||||||

| Gross yield | ||||||||||||

| Commercial Finance | 5.03 | % | 5.08 | % | 4.41 | % | ||||||

| Real Estate Finance | 5.44 | % | 5.23 | % | 3.94 | % | ||||||

| Business Capital | 8.32 | % | 8.07 | % | 7.69 | % | ||||||

| Net Finance Margin | ||||||||||||

| Commercial Finance | 3.80 | % | 3.95 | % | 2.62 | % | ||||||

| Real Estate Finance | 4.08 | % | 3.99 | % | 2.25 | % | ||||||

| Business Capital | 5.17 | % | 5.13 | % | 4.66 | % | ||||||

| Transportation Finance | ||||||||||||

| Total Segment | ||||||||||||

| AEA | $ | 20,619.5 | $ | 19,784.2 | $ | 18,880.8 | ||||||

| Net Finance Revenue | 237.6 | 197.0 | 206.7 | |||||||||

| Gross yield | 11.59 | % | 11.48 | % | 11.43 | % | ||||||

| Net Finance Margin | 4.61 | % | 3.98 | % | 4.38 | % | ||||||

| Average Earning Assets (AEA) | ||||||||||||

| Aerospace | $ | 12,050.9 | $ | 11,594.3 | $ | 11,907.7 | ||||||

| Rail | 6,882.4 | 6,599.3 | 5,923.9 | |||||||||

| Maritime Finance | 1,686.2 | 1,590.6 | 1,049.2 | |||||||||

| Net Finance Revenue | ||||||||||||

| Aerospace | $ | 119.6 | $ | 92.8 | $ | 101.7 | ||||||

| Rail | 100.2 | 89.0 | 96.2 | |||||||||

| Maritime Finance | 17.8 | 15.2 | 8.8 | |||||||||

| Gross yield | ||||||||||||

| Aerospace | 11.18 | % | 11.07 | % | 10.41 | % | ||||||

| Rail | 13.73 | % | 13.71 | % | 14.64 | % | ||||||

| Maritime Finance | 5.75 | % | 5.24 | % | 5.00 | % | ||||||

| Net Finance Margin | ||||||||||||

| Aerospace | 3.97 | % | 3.20 | % | 3.42 | % | ||||||

| Rail | 5.82 | % | 5.39 | % | 6.50 | % | ||||||

| Maritime Finance | 4.25 | % | 3.82 | % | 3.35 | % | ||||||

| Consumer and Community Banking | ||||||||||||

| Total Segment | ||||||||||||

| AEA | $ | 7,757.8 | $ | 7,845.9 | $ | - | ||||||

| Net Finance Revenue | 94.3 | 96.3 | - | |||||||||

| Gross yield | 5.32 | % | 5.58 | % | - | |||||||

| Net Finance Margin | 4.86 | % | 4.91 | % | - | |||||||

| Average Earning Assets (AEA) | ||||||||||||

| Other Consumer Banking | $ | 1,941.8 | $ | 1,840.5 | $ | - | ||||||

| Legacy Consumer Mortgages | 5,816.0 | 6,005.4 | - | |||||||||

| Net Finance Revenue | ||||||||||||

| Other Consumer Banking | $ | 34.0 | $ | 28.4 | $ | - | ||||||

| Legacy Consumer Mortgages | 60.3 | 67.9 | - | |||||||||

| Gross yield | ||||||||||||

| Other Consumer Banking | 3.65 | % | 3.78 | % | - | |||||||

| Legacy Consumer Mortgages | 5.87 | % | 6.13 | % | - | |||||||

| Net Finance Margin | ||||||||||||