UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10K

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

| |

For the fiscal year ended December 31, 2014

|

| |

or

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

| |

|

| |

For the transition period from __________ to ___________

|

Commission File Number 001-31341

Platinum Underwriters Holdings, Ltd.

(Exact name of registrant as specified in its charter)

|

Bermuda

(State or other jurisdiction of incorporation or organization)

|

|

98-0416483

(I.R.S. Employer Identification No.)

|

Waterloo House

100 Pitts Bay Road

Pembroke HM 08, Bermuda

(Address of principal executive offices, including postal code)

Registrant's telephone number, including area code: (441) 295-7195

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Name of each exchange on which registered

|

|

Common Shares, par value $0.01 per share

|

New York Stock Exchange

|

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by a check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☒

|

Accelerated filer ☐

|

|

Non-accelerated filer (Do not check if a smaller reporting company) ☐

|

Smaller reporting company ☐

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of common shares held by non-affiliates of the registrant as of June 30, 2014, the last business day of our most recently completed second fiscal quarter, was $1,673,028,121 based on the closing sale price of $64.85 per common share on the New York Stock Exchange on that date. For purposes of this computation only, all executive officers, directors, and 10% beneficial owners of the registrant are deemed to be affiliates.

The registrant had 24,845,418 common shares, par value $0.01 per share, outstanding as of January 30, 2015.

PLATINUM UNDERWRITERS HOLDINGS, LTD.

TABLE OF CONTENTS

| |

|

Page

|

| |

|

| |

PART I

|

| |

|

|

Item 1.

|

Business

|

3 |

|

Item 1A.

|

Risk Factors

|

22 |

|

Item 1B.

|

Unresolved Staff Comments

|

33 |

|

Item 2.

|

Properties

|

34 |

|

Item 3.

|

Legal Proceedings

|

34 |

|

Item 4.

|

Mine Safety Disclosures

|

34 |

| |

|

|

| |

PART II

|

| |

|

|

Item 5.

|

Market For Registrant's Common Equity, Related Shareholder Matters and Issuer Purchases of Equity Securities

|

34 |

|

Item 6.

|

Selected Financial Data

|

37 |

|

Item 7.

|

Management's Discussion and Analysis of Financial Condition and Results of Operations

|

40 |

|

Item 7A.

|

Quantitative and Qualitative Disclosures about Market Risk

|

73 |

|

Item 8.

|

Financial Statements and Supplementary Data

|

74 |

|

Item 9.

|

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure

|

74 |

|

Item 9A.

|

Controls and Procedures

|

75 |

|

Item 9B.

|

Other Information

|

77 |

| |

|

|

| |

PART III

|

| |

|

|

Item 10.

|

Directors, Executive Officers and Corporate Governance

|

77 |

|

Item 11.

|

Executive Compensation

|

81 |

|

Item 12.

|

Security Ownership of Certain Beneficial Owners and Management and Related Shareholder Matters

|

121 |

|

Item 13.

|

Certain Relationships and Related Transactions, and Director Independence

|

125 |

|

Item 14.

|

Principal Accountant Fees and Services

|

126 |

| |

|

|

| |

PART IV

|

| |

|

|

Item 15.

|

Exhibits and Financial Statement Schedules

|

127 |

| |

|

|

|

Signatures

|

131 |

|

Platinum Underwriters Holdings, Ltd. and Subsidiaries Consolidated Financial Statements

|

F-1

|

|

Index to Schedules to Consolidated Financial Statements

|

S-1

|

|

Exhibits

|

|

Note On Forward-Looking Statements

This Annual Report on Form 10-K for the year ended December 31, 2014 (this "Form 10-K") of Platinum Underwriters Holdings, Ltd. contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 (the "Securities Act") and Section 21E of the Securities Exchange Act of 1934 (the "Exchange Act"). Forward-looking statements are based on our current plans or expectations that are inherently subject to significant business, economic and competitive uncertainties and contingencies. These uncertainties and contingencies can affect actual results and could cause actual results to differ materially from those expressed in any forward-looking statements made by or on behalf of us. In particular, statements using words such as "may", "should", "estimate", "expect", "anticipate", "intend", "believe", "predict", "potential", or words of similar import generally involve forward-looking statements.

The inclusion of forward-looking statements in this Form 10-K should not be considered as a representation by us or any other person that our current plans or expectations will be achieved. Numerous factors could cause our actual results to differ materially from those in forward-looking statements, including the following:

|

·

|

the occurrence of severe catastrophic events;

|

|

·

|

the effectiveness of our loss limitation methods and pricing models;

|

|

·

|

the adequacy of our ceding companies' ability to assess the risks they underwrite;

|

|

·

|

the adequacy of our estimated liability for unpaid losses and loss adjustment expenses;

|

|

·

|

the effects of emerging claim and coverage issues on our business;

|

|

·

|

our ability to maintain our A.M. Best Company, Inc. ("A.M. Best") and Standard & Poor's Ratings Services ("S&P") financial strength ratings;

|

|

·

|

our ability to raise capital on acceptable terms if necessary;

|

|

·

|

our exposure to credit loss from counterparties in the normal course of business;

|

|

·

|

the availability and cost of collateral arrangements in order to provide reinsurance;

|

|

·

|

the effect on our business of the cyclicality of the property and casualty reinsurance business;

|

|

·

|

the effect on our business of the highly competitive nature of the property and casualty reinsurance industry, including the effect of new entrants to the industry;

|

|

·

|

losses that we could face from terrorism, political unrest and war;

|

|

·

|

our dependence on the business provided to us by reinsurance brokers and our exposure to credit risk associated with our brokers during the premium and loss settlement process;

|

|

·

|

the availability of retrocessional reinsurance on acceptable terms;

|

|

·

|

foreign currency exchange rate fluctuations;

|

|

·

|

our ability to maintain and enhance effective operating procedures and internal controls over financial reporting;

|

|

·

|

our need to make many estimates and judgments in the preparation of our financial statements;

|

|

·

|

the limitations placed on our financial and operational flexibility by the representations, warranties and covenants in our debt and credit facilities;

|

|

·

|

our ability to retain key executives and attract and retain additional qualified personnel in the future;

|

|

·

|

the effect of technology breaches or failures on our business;

|

|

·

|

the performance of our investment portfolio;

|

|

·

|

the effects of changes in market interest rates on our investment portfolio;

|

|

·

|

the concentration of our investment portfolio in any particular industry, asset class or geographic region;

|

|

·

|

the risk that the proposed merger with RenaissanceRe Holdings Ltd. is not completed and the effect thereof on our business, financial results, ratings and share price;

|

|

·

|

the effect of a delay in the completion of the proposed merger with RenaissanceRe Holdings Ltd. on our share price and operating results;

|

|

·

|

the effect the expenses related to the proposed merger with RenaissanceRe Holdings Ltd. may have on our operating results;

|

|

·

|

the effect of business uncertainties and contractual restrictions while the proposed merger with RenaissanceRe Holdings Ltd. is pending;

|

|

·

|

the potential loss of management personnel or other key employees as a result of the proposed merger with RenaissanceRe Holdings Ltd.;

|

|

·

|

the impact to our shareholders of reduced ownership and voting interests after the proposed merger with RenaissanceRe Holdings Ltd.;

|

|

·

|

the impact of several "investigations of the merger" against Platinum Underwriters Holdings, Ltd. on the completion of the proposed merger with RenaissanceRe Holdings Ltd.;

|

|

·

|

the effects that the imposition of U.S. corporate income tax would have on Platinum Underwriters Holdings, Ltd. and its non-U.S. subsidiaries;

|

|

·

|

the risk that U.S. persons who hold our shares will be subject to adverse U.S. federal income tax consequences under certain circumstances;

|

|

·

|

the risk that U.S. persons who dispose of our shares may be subject to U.S. federal income taxation at the rates applicable to dividends on all or a portion of their gains, if any;

|

|

·

|

the risk that holders of 10% or more of our shares may be subject to U.S. income taxation under the "controlled foreign corporation" rules;

|

|

·

|

the effect of changes in U.S. federal income tax law on an investment in our shares;

|

|

·

|

the possibility that we may become subject to taxes in Bermuda;

|

|

·

|

the effect of income, premium or other taxes on Platinum Underwriters Holdings, Ltd. or its subsidiaries by other jurisdictions;

|

|

·

|

the effect on our business of potential changes in the regulatory system under which we operate;

|

|

·

|

the impact of regulatory regimes and changes to accounting rules on our financial results, irrespective of business operations;

|

|

·

|

the uncertain impact on our business of the Dodd–Frank Wall Street Reform and Consumer Protection Act of 2010;

|

|

·

|

the non-compliance with laws, regulations and taxation on transactions with international counter-parties;

|

|

·

|

the dependence of the cash flows of Platinum Underwriters Holdings, Ltd. on dividends, interest and other permissible payments from its subsidiaries to meet its obligations, and the fact that these dividends and other payments are often limited in amount by applicable law;

|

|

·

|

the risk that our shareholders may have greater difficulty in protecting their interests than would shareholders of a U.S. corporation; and

|

|

·

|

limitations on the ownership, transfer and voting rights of our common shares.

|

As a consequence, our future financial condition and results may differ from those expressed in any forward-looking statements made by or on behalf of us. The foregoing factors, which are discussed in more detail in Item 1A, "Risk Factors", in this Form 10-K, should not be construed as exhaustive. Additionally, forward-looking statements speak only as of the date they are made, and we undertake no obligation to revise or update forward-looking statements to reflect new information or circumstances after the date hereof or to reflect the occurrence of future events.

PART I

General Overview

Platinum Underwriters Holdings, Ltd. ("Platinum Holdings") is a holding company domiciled in Bermuda. Through our reinsurance subsidiaries we provide property and marine, casualty and finite risk reinsurance coverages, through reinsurance brokers, to a diverse clientele of insurers and select reinsurers on a worldwide basis.

Platinum Holdings and its consolidated subsidiaries (collectively, the "Company") include Platinum Holdings, Platinum Underwriters Bermuda, Ltd. ("Platinum Bermuda"), Platinum Underwriters Reinsurance, Inc. ("Platinum US"), Platinum Regency Holdings ("Platinum Regency"), Platinum Underwriters Finance, Inc. ("Platinum Finance") and Platinum Administrative Services, Inc. ("PASI"). The terms "we", "us", and "our" refer to the Company, unless the context otherwise indicates.

We operate through two licensed reinsurance subsidiaries, Platinum Bermuda, a Bermuda reinsurance company, and Platinum US, a U.S. reinsurance company. Platinum Regency is an intermediate holding company based in Ireland and a wholly owned subsidiary of Platinum Holdings. Platinum Finance is an intermediate holding company based in the U.S. and a wholly owned subsidiary of Platinum Regency. Platinum Bermuda is a wholly owned subsidiary of Platinum Holdings and Platinum US is a wholly owned subsidiary of Platinum Finance. PASI is a wholly owned subsidiary of Platinum Finance that provides administrative support services to the Company.

As of December 31, 2014 and 2013, our capital resources of $2.0 billion consisted of $1.7 billion of common shareholders' equity and $250.0 million of debt obligations. Investable assets, consisting of investments, cash and cash equivalents, accrued investment income and net balances due to and from brokers, were $3.3 billion and $3.5 billion as of December 31, 2014 and 2013, respectively. Our net premiums written were $492.1 million, $567.1 million and $565.0 million for the years ended December 31, 2014, 2013 and 2012, respectively. Our net income was $164.8 million, $223.3 million and $327.2 million for the years ended December 31, 2014, 2013 and 2012, respectively.

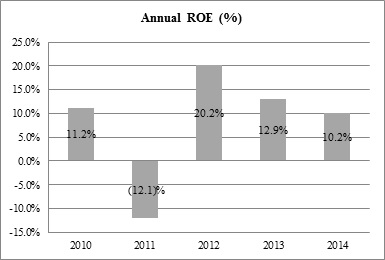

Return on equity was 10.2%, 12.9% and 20.2% for the years ended December 31, 2014, 2013 and 2012, respectively. Book value per share grew to $69.97 as of December 31, 2014, an increase of 12.7% from $62.07 as of December 31, 2013.

Return on equity and book value per share are non-GAAP measures as defined by Regulation G. See Item 6, "Selected Financial Data" in this Form 10-K for a reconciliation of these measures.

Merger Agreement

On November 23, 2014, the Company entered into an Agreement and Plan of Merger (the "Merger Agreement") with RenaissanceRe Holdings Ltd., a Bermuda exempted company ("RenaissanceRe"), and Port Holdings Ltd., a Bermuda exempted company and wholly owned subsidiary of RenaissanceRe (the "Acquisition Sub"). Subject to the terms and conditions of the Merger Agreement, Acquisition Sub will be merged with and into the Company (the "Merger"), with the Company continuing as the surviving company and as a wholly owned subsidiary of RenaissanceRe.

Pursuant to the terms of the Merger Agreement, upon the closing of the Merger, shareholders of the Company will be entitled to receive, in exchange for each share of common stock they hold at the effective time of the Merger, either stock or cash consideration with a value equal to the sum of (i) an amount of cash equal to $66.00, (ii) 0.6504 common shares of RenaissanceRe, par value $1.00 per share, or (iii) 0.2960 RenaissanceRe common shares and an amount of cash equal to $35.96, in each case less any applicable withholding taxes and without interest, plus cash in lieu of any fractional RenaissanceRe common shares such shareholder would otherwise be entitled to receive. The Merger is expected to close on March 2, 2015, subject to the receipt of shareholder approval and other customary closing conditions. There can be no assurance that all such closing conditions will be satisfied by March 2, 2015 or at any time thereafter and thus there is no assurance that the Merger will occur.

In addition, on February 10, 2015, Platinum Holdings' board of directors declared, subject to certain conditions, a special dividend of $10.00 per common share in connection with its pending Merger with RenaissanceRe. The special dividend is payable prior to the effective time of the Merger on the closing date of the Merger to shareholders of record at the close of business on the last business day prior to the closing date. The special dividend is conditioned on the Merger having been approved by the shareholders of the Company at a special meeting of its shareholders on February 27, 2015 (or any adjournment or postponement thereof).

See Part III, Item 11. "Executive Compensation" in this Form 10-K for additional information on the terms of the Merger Agreement.

The following discussion of our strategy and business does not give effect to the consummation of the Merger.

Our Strategy

We seek to achieve attractive long-term returns for our shareholders, through disciplined risk management and market leadership in selected classes of property and marine, casualty and finite risk reinsurance, through the following strategy:

|

● |

Operate as a multi-class reinsurer. We seek to offer a broad range of reinsurance coverage to our ceding companies. We believe that this approach enables us to more effectively serve our clients, diversify our risk and leverage our capital. |

|

● |

Focus on profitability, not market share. Our management team pursues a strategy that emphasizes profitability rather than market share. Key elements of this strategy are prudent risk selection, appropriate pricing and adjustment of our business mix to respond to changing market conditions. |

|

● |

Exercise disciplined underwriting and risk management. We exercise underwriting and risk management discipline by: (i) maintaining a diverse spread of risk in our book of business across product lines and geographic zones, (ii) emphasizing excess-of-loss contracts over proportional contracts, (iii) managing our aggregate catastrophe exposure through the application of sophisticated property catastrophe modeling tools and (iv) monitoring our accumulating exposures on non-property catastrophe exposed coverages. |

|

● |

Operate from a position of financial strength. Our capital is unencumbered by any potential adverse development of unpaid losses for business written prior to January 1, 2002. Our investment strategy focuses on security and stability in our investment portfolio by maintaining a portfolio that consists of diversified, high quality, predominantly investment grade fixed maturity securities. |

We believe this strategy allows us to maintain our strong financial position and to be opportunistic when market conditions are most attractive.

Operating Segments

We have organized our worldwide reinsurance business into three operating segments: Property and Marine, Casualty and Finite Risk. We generally write reinsurance in each of our operating segments on either an excess-of-loss basis or a proportional basis (which is also referred to as pro rata or quota share).

In the case of excess-of-loss reinsurance, we assume all or a specified portion of the ceding company's risks in excess of a specified claim amount, referred to as the ceding company's retention or our attachment point. We manage our underwriting risk from excess-of-loss contracts by charging reinsurance premiums at specific retention levels based upon our own underwriting assumptions. Because ceding companies typically retain a larger loss exposure under excess-of-loss contracts, we believe that they typically have a strong incentive to underwrite risks and adjust losses in a prudent manner.

In the case of proportional reinsurance, we assume a predetermined portion of the ceding company's risks under the covered primary insurance contract or contracts. The frequency of claims under a proportional contract is usually greater than under an excess-of-loss contract, since we share proportionally in all losses. Premiums for proportional reinsurance are typically a predetermined portion of the premiums the ceding company receives from its insureds.

Substantially all of the reinsurance that we underwrite is on a treaty basis, which covers a type or category of insurance policies issued by the ceding company. In limited and opportunistic circumstances, we underwrite facultative reinsurance, where we assume all or a part of a specific insurance policy or policies.

The following table sets forth our net premiums written for the years ended December 31, 2014, 2013 and 2012 by operating segment and by type of reinsurance ($ in thousands):

Net Premiums Written by Operating Segment and Type of Reinsurance

| |

|

Years Ended December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

|

2012

|

|

| |

|

Net Premiums Written

|

|

|

Percentage of Net Premiums Written

|

|

|

Net Premiums Written

|

|

|

Percentage of Net Premiums Written

|

|

|

Net Premiums Written

|

|

|

Percentage of Net Premiums Written

|

|

|

Property and Marine

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excess-of-Loss

|

|

$

|

148,825

|

|

|

|

30

|

%

|

|

$

|

173,849

|

|

|

|

31

|

%

|

|

$

|

209,919

|

|

|

|

37

|

%

|

|

Proportional

|

|

|

59,042

|

|

|

|

12

|

%

|

|

|

55,658

|

|

|

|

10

|

%

|

|

|

46,263

|

|

|

|

8

|

%

|

|

Subtotal Property and Marine

|

|

|

207,867

|

|

|

|

42

|

%

|

|

|

229,507

|

|

|

|

41

|

%

|

|

|

256,182

|

|

|

|

45

|

%

|

|

Casualty

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excess-of-Loss

|

|

|

206,036

|

|

|

|

42

|

%

|

|

|

223,170

|

|

|

|

39

|

%

|

|

|

231,379

|

|

|

|

41

|

%

|

|

Proportional

|

|

|

53,773

|

|

|

|

11

|

%

|

|

|

72,498

|

|

|

|

13

|

%

|

|

|

55,733

|

|

|

|

10

|

%

|

|

Subtotal Casualty

|

|

|

259,809

|

|

|

|

53

|

%

|

|

|

295,668

|

|

|

|

52

|

%

|

|

|

287,112

|

|

|

|

51

|

%

|

|

Finite Risk

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excess-of-Loss

|

|

|

(7

|

)

|

|

|

0

|

%

|

|

|

-

|

|

|

|

0

|

%

|

|

|

-

|

|

|

|

0

|

%

|

|

Proportional

|

|

|

24,399

|

|

|

|

5

|

%

|

|

|

41,946

|

|

|

|

7

|

%

|

|

|

21,706

|

|

|

|

4

|

%

|

|

Subtotal Finite Risk

|

|

|

24,392

|

|

|

|

5

|

%

|

|

|

41,946

|

|

|

|

7

|

%

|

|

|

21,706

|

|

|

|

4

|

%

|

|

Combined Segments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Excess-of-Loss

|

|

|

354,854

|

|

|

|

72

|

%

|

|

|

397,019

|

|

|

|

70

|

%

|

|

|

441,298

|

|

|

|

78

|

%

|

|

Proportional

|

|

|

137,214

|

|

|

|

28

|

%

|

|

|

170,102

|

|

|

|

30

|

%

|

|

|

123,702

|

|

|

|

22

|

%

|

|

Total

|

|

$

|

492,068

|

|

|

|

100

|

%

|

|

$

|

567,121

|

|

|

|

100

|

%

|

|

$

|

565,000

|

|

|

|

100

|

%

|

The following table sets forth our net premiums written for the years ended December 31, 2014, 2013 and 2012 by operating segment and by geographic location of the ceding company ($ in thousands):

Net Premiums Written by Operating Segment and Geographic Location of the Ceding Company

| |

|

Years Ended December 31,

|

|

| |

|

2014

|

|

|

2013

|

|

|

2012

|

|

| |

|

Net Premiums Written

|

|

|

Percentage of Net Premiums Written

|

|

|

Net Premiums Written

|

|

|

Percentage of Net Premiums Written

|

|

|

Net Premiums Written

|

|

|

Percentage of Net Premiums Written

|

|

|

Property and Marine

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

$

|

129,893

|

|

|

|

26

|

%

|

|

$

|

137,890

|

|

|

|

25

|

%

|

|

$

|

161,838

|

|

|

|

28

|

%

|

|

International

|

|

|

77,974

|

|

|

|

16

|

%

|

|

|

91,617

|

|

|

|

16

|

%

|

|

|

94,344

|

|

|

|

17

|

%

|

|

Subtotal Property and Marine

|

|

|

207,867

|

|

|

|

42

|

%

|

|

|

229,507

|

|

|

|

41

|

%

|

|

|

256,182

|

|

|

|

45

|

%

|

|

Casualty

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

|

232,458

|

|

|

|

47

|

%

|

|

|

264,274

|

|

|

|

46

|

%

|

|

|

258,218

|

|

|

|

46

|

%

|

|

International

|

|

|

27,351

|

|

|

|

6

|

%

|

|

|

31,394

|

|

|

|

6

|

%

|

|

|

28,894

|

|

|

|

5

|

%

|

|

Subtotal Casualty

|

|

|

259,809

|

|

|

|

53

|

%

|

|

|

295,668

|

|

|

|

52

|

%

|

|

|

287,112

|

|

|

|

51

|

%

|

|

Finite Risk

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

|

24,392

|

|

|

|

5

|

%

|

|

|

41,946

|

|

|

|

7

|

%

|

|

|

21,706

|

|

|

|

4

|

%

|

|

International

|

|

|

-

|

|

|

|

0

|

%

|

|

|

-

|

|

|

|

0

|

%

|

|

|

-

|

|

|

|

0

|

%

|

|

Subtotal Finite Risk

|

|

|

24,392

|

|

|

|

5

|

%

|

|

|

41,946

|

|

|

|

7

|

%

|

|

|

21,706

|

|

|

|

4

|

%

|

|

Combined Segments

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United States

|

|

|

386,743

|

|

|

|

78

|

%

|

|

|

444,110

|

|

|

|

78

|

%

|

|

|

441,762

|

|

|

|

78

|

%

|

|

International

|

|

|

105,325

|

|

|

|

22

|

%

|

|

|

123,011

|

|

|

|

22

|

%

|

|

|

123,238

|

|

|

|

22

|

%

|

|

Total

|

|

$

|

492,068

|

|

|

|

100

|

%

|

|

$

|

567,121

|

|

|

|

100

|

%

|

|

$

|

565,000

|

|

|

|

100

|

%

|

Additional financial information about our operating segments is set forth in Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations", in this Form 10-K.

Property and Marine

Property reinsurance protects a ceding company against financial loss arising out of damage to property or loss of its use caused by an insured peril. Property catastrophe reinsurance protects a ceding company against losses arising out of multiple claims for a single event while property per-risk reinsurance protects a ceding company against loss arising out of a single claim for a single event. The Property and Marine segment includes property and marine reinsurance coverages that are written in the United States and international markets and includes property reinsurance, crop reinsurance and marine and aviation reinsurance. The Property and Marine segment includes property catastrophe and marine excess-of-loss reinsurance contracts, along with property and marine per-risk excess-of-loss and proportional reinsurance contracts. We may from time to time write a limited amount of property facultative reinsurance. We employ underwriters and actuaries with expertise in each of the following areas:

|

● |

Property. We provide reinsurance coverage for damage to property and crops. Our catastrophe excess-of-loss reinsurance contracts provide defined limits of liability, permitting us to quantify our aggregate maximum loss exposure for various catastrophic events. Quantification of loss exposure is fundamental to our ability to manage our loss exposure through geographical zone limits, program limits and peril limits. |

|

● |

Marine. We provide reinsurance coverage for marine, offshore energy and aerospace insurance programs. Coverages reinsured include hull damage, protection and indemnity, cargo damage, satellite damage, aviation hull, aviation liability and general marine liability. |

Casualty

Casualty reinsurance protects a ceding company against financial loss arising out of the obligation to others for loss or damage to persons or property.

We generally seek to write casualty reinsurance contracts covering established books of insurance products where we believe that past experience provides a reasonable basis to price the reinsurance adequately. We underwrite new exposures selectively and perform a comprehensive evaluation of the risk and ceding company being reinsured. We employ underwriters and actuaries who have expertise in a number of areas including:

|

● |

General and Product Liability. We provide reinsurance of various third-party liability coverages to both small and large insureds in both commercial and personal lines predominantly on an excess-of-loss basis. This business includes coverage of commercial, farmowners and homeowners policies as well as third-party liability coverages such as product liability. |

|

● |

Professional Liability. We write reinsurance contracts covering professional liability programs, including directors and officers, employment practices, and errors and omissions for professionals such as accountants, lawyers, medical professionals, architects and engineers. The underlying insurance products for these lines of business are generally written on a claims made basis, which requires notification of claims related to the liabilities insured under the policy to be submitted to the insurer during a specified coverage period. |

|

● |

Umbrella Liability. We provide reinsurance of umbrella policies, which are excess insurance policies that provide coverage, typically for general liability or automobile liability, when claims, individually or in the aggregate, exceed the limit of the original policy underlying the excess policy. |

|

● |

Workers' Compensation. We reinsure workers' compensation on a catastrophic basis as well as on a per-claimant basis. We may provide full statutory coverage or coverage that is subject to specific carve-outs. Our exposure to workers' compensation would generally arise from a single occurrence, such as a factory explosion, or earthquake which involves claims from more than one employer. |

|

● |

Accident and Health. We provide accident and health reinsurance, most often covering employer self-insured or fully insured health plans, on a quota share and excess-of-loss basis. We also write reinsurance of student health insurance, sports disability, travel accident, Medicare and Medicare supplement and other forms of accident and health insurance. |

|

● |

Casualty Clash. We provide casualty clash reinsurance, which covers losses arising from a single event insured under more than one policy or where there are multiple claimants under one policy. This type of reinsurance is analogous to property catastrophe reinsurance, but written for casualty lines of business. |

|

● |

Automobile Liability. We provide automobile liability reinsurance, which relates to the risks associated with the insured's vehicle and third-party coverage for the insured's liability to other parties for injuries, for damage to the insured's property due to the use of the insured vehicle and coverage for uninsured motorists and medical payments. |

|

● |

Financial Lines. Financial lines reinsurance includes surety, trade credit and political risk. We provide surety reinsurance to companies that cover risks associated with commercial and contract surety bonds issued to third parties to guarantee the performance of an obligation by the principal under the bond. Commercial bonds guarantee compliance with obligations arising out of regulatory or statutory requirements. Contract bonds guarantee the performance of contractual obligations between two parties and include payment and performance bonds. Trade credit insurance is purchased by companies to ensure that invoices for goods and services provided to their customers are paid on time. We provide trade credit reinsurance for financial losses sustained through the failure of an insured's customers to pay for goods or services supplied to them. Political risk reinsurance covers the impairment of assets as a result of expropriation, political violence, currency inconvertibility, and the failure by sovereign countries to honor their obligations. The locations of political risks that we reinsure include Asia, Central and Eastern Europe, Latin America, Africa and the Middle East. We also write reinsurance of other types of credit or financial guaranty insurance from time to time. |

Finite Risk

Finite risk reinsurance includes principally structured reinsurance contracts with ceding companies whose needs may not be met efficiently through traditional reinsurance products. Reinsurance contracts classified as finite risk are typically structured to include significant loss limitation or loss mitigation features. In exchange for contractual features that limit our risk, reinsurance contracts that we include in our Finite Risk segment typically provide the potential for significant profit commission to the ceding company. The classes of risks underwritten through our finite risk contracts are generally consistent with the classes covered by our traditional products. The finite risk reinsurance contracts that we underwrite generally provide prospective protection, meaning coverage is provided for losses that are incurred after inception of the contract, as contrasted with retrospective coverage, which covers losses that are incurred prior to inception of the contract. Additionally, finite risk reinsurance contracts are often written on a funds held basis. The three main categories of finite risk contracts are quota share, multi-year excess-of-loss and whole account aggregate stop loss:

|

● |

Finite quota share. Under finite quota share reinsurance contracts, the reinsurer agrees to indemnify a ceding company for a percentage of its losses up to an aggregate maximum or cap in return for a percentage of the ceding company's premium, less a ceding commission. The expected benefit to the ceding company provided by finite quota share reinsurance is increased underwriting capacity of the ceding company and a sharing of premiums and losses with the reinsurer. These reinsurance contracts often provide broad protection and may cover multiple classes of a ceding company's business. Unlike traditional quota share reinsurance agreements, these contracts often provide for profit commissions that explicitly take into account investment income for purposes of calculating the reinsurer's profit on business ceded. |

|

● |

Multi-year excess-of-loss. This type of contract often carries an up-front premium plus additional premiums which are dependent on the magnitude of losses claimed by the ceding company under the contract. The expected benefit to the ceding company of multi-year excess-of-loss reinsurance is that the ceding company has the ability to negotiate specific terms and conditions that remain applicable over multiple years of coverage. These reinsurance contracts may cover multiple classes of a ceding company's business and typically provide the benefit of reducing the impact of large or catastrophic losses on a ceding company's underwriting results. The multiple year term and premium structure of multi-year excess-of-loss reinsurance contracts are not typically found in traditional reinsurance contracts. |

|

● |

Whole account aggregate stop loss. Aggregate stop loss reinsurance contracts provide broad protection against a wide range of contingencies that are difficult to address with traditional reinsurance, including inadequate pricing by a ceding company or higher frequency of claims than the ceding company expected. The reinsurer on a whole account aggregate stop loss contract agrees to indemnify a ceding company for aggregate losses in excess of a deductible specified in the contract. These contracts can be offered on a single or multi-year basis, and may provide catastrophic and attritional loss protection. The benefit of whole account aggregate stop loss contracts to ceding companies is that such contracts provide the broadest possible protection of a ceding company's underwriting results which is not generally available in the traditional reinsurance market. |

Marketing

We market our reinsurance products worldwide primarily through non-exclusive relationships with leading reinsurance brokers, as we believe that the use of reinsurance brokers enables us to operate on a more cost-effective basis and to maintain the flexibility to enter and exit reinsurance lines in a quick and efficient manner. We also believe that brokers are particularly useful in assisting with placements of excess-of-loss reinsurance programs. In addition to their role as intermediaries in placing risk, brokers perform data collection, contract preparation and other administrative tasks. We believe that by doing business largely through reinsurance brokers we are able to avoid the expense and regulatory complications of a worldwide network of offices and thereby minimize fixed costs associated with marketing activities.

The Company writes business through direct relationships with reinsurance brokers. Based on in-force premiums written as of December 31, 2014, the brokers we derived the largest portion of our business (with the approximate percentage of business derived from each of such brokers and its affiliates) were Aon Benfield for 28%, Marsh & McLennan Companies for 25%, Willis Group Holdings for 16% and Jardine Lloyd Thompson Group plc for 13%. The loss of business relationships with any of these brokers could have a material adverse effect on our business.

Underwriting and Risk Management

Overview

Our approach to underwriting and risk management emphasizes discipline and profitability rather than premium volume or market share. We seek to limit our overall exposure to risk by limiting the amount of reinsurance we write by geographic zone, peril and type of program or contract. Our risk management practices include evaluating the quality of the ceding company in connection with our review of a program proposal and using contract terms, diversification criteria, probability analysis and analysis of comparable historical loss experience. We estimate the impact of catastrophic events using information from ceding companies, reinsurance contract information, expected loss ratios, our historical loss ratios, industry loss data and catastrophe modeling software to evaluate our exposure to losses from individual contracts and in the aggregate.

Ceding Company Selection and Underwriting Evaluation

Before entering into a reinsurance contract, we consider the quality of the ceding company, including the experience and reputation of its management, its capital, its risk management and underwriting strategy and practices and its claims settlement practices and procedures. In addition, we seek to obtain information on the nature of the perils to be covered and, in the case of natural or man-made catastrophe exposures, aggregate information as to the location or locations of the risks covered under the reinsurance contract. We request information on the ceding company's loss history for the perils proposed to be covered, together with relevant underwriting considerations, which would impact our exposures. If the program meets all these initial underwriting criteria, we then evaluate the proposal's risk/reward profile to assess the adequacy of the proposed pricing and its potential impact on our overall return on capital.

Loss Limits

Reinsurance contracts generally contain limits that restrict the amount that we may be required to pay in the event of a loss. These limits may apply on a per risk, per occurrence, or aggregate basis. Contracts with per risk limits include a limit on our liability for each underlying insured for each occurrence. If multiple underlying insureds are affected by a single event, our total limit of liability, without any other mitigating contractual terms, would be the sum of the per risk limits for all the underlying insureds affected by the event up to the occurrence or aggregate limits. Per occurrence limits restrict our liability to a certain amount for each event, regardless of the number of underlying insureds involved. If multiple events occur in a single reinsurance policy period, our total limit of liability, without any other mitigating contractual terms, would be the sum of the occurrence limits for all events within the policy term. Aggregate limits provide us with a maximum amount for which we are liable, in total, for all underlying risks and all occurrences combined within the coverage period.

Our contracts typically contain a per risk limit or an occurrence limit and may contain both. Some of our contracts contain an aggregate limit. Property and marine reinsurance contracts with natural catastrophe exposure generally contain occurrence limits. In addition, our high layer property and marine reinsurance contracts generally contain aggregate limits. Casualty reinsurance contracts generally contain either a per risk or an occurrence limit. Casualty clash contracts generally contain an aggregate limit. Few of our other casualty contracts contain an aggregate limit.

Loss Modeling and Monitoring

For catastrophe coverages exposed to natural perils, we measure our exposure to aggregate catastrophic claims using catastrophe models that analyze the effect of wind speed and earthquakes on the exposed property values within our portfolio. We seek to limit the amount of capital that we expect to lose from a severe catastrophic event; however, there can be no assurance that we will successfully limit actual losses from such a catastrophic event.

We use sophisticated modeling techniques to measure and estimate loss exposure under both simulated and actual loss scenarios. We also use these models to assess the impact of both single and multiple events. We evaluate the commercial catastrophe exposure models that form the basis for our own proprietary pricing models. These computer-based loss modeling systems primarily utilize direct exposure information obtained from our clients and data compiled by A.M. Best to assess each client's potential for catastrophe losses. We believe that loss modeling is an important part of the underwriting process for catastrophe exposure pricing.

We maintain a database of our exposure in each geographic zone and estimate our probable maximum loss for each zone and for each peril (e.g. earthquakes and hurricanes) to which that zone is subject based on catastrophe models and underwriting assessments. We also use catastrophe loss modeling to review exposures from events that cross country borders, such as wind events that may affect the Caribbean and Florida or the United Kingdom and continental Europe. Our largest exposures are in the United States for hurricane and earthquake, in Japan for earthquake, and in Europe for flood and wind.

In respect of our property catastrophe exposure, we seek to limit our estimated probable maximum loss to a specific level for severe catastrophic events. We currently expect to limit the probable maximum pre-tax loss to no more than 22.5% of total capital for a severe catastrophic event in any geographic zone that could be expected to occur once in every 250 years, although we may change this threshold at any time. The estimated probable maximum loss for a catastrophic event in any geographic zone arising from a 1-in-250 year event relates to United States earthquake and was approximately $205.0 million, or 10.3% of total capital, and $220.0 million, or 11.0% of total capital, as of January 1, 2015 and 2014, respectively.

We also monitor our exposures to accumulating risks for natural perils impacting workers compensation coverage and man-made perils that affect coverage such as umbrella liability, directors' and officers' liability, surety, trade credit and terrorism.

Diversification

We seek to maintain a diversified book of business by writing business across product lines.

We write a diversified book of property and marine business and seek to further diversify our property catastrophe exposure across geographic zones and type of peril around the world in order to manage the concentration of risk. We attempt to limit our coverage for risks located in a particular zone to a predetermined level. Currently, our largest property catastrophe exposures in the United States are in Florida and the northeast for hurricane and in California and along the New Madrid fault zone for earthquake. Internationally our largest property catastrophe exposures are in Japan for earthquake and in Europe for flood and wind.

We seek to diversify our casualty exposure by writing casualty business throughout the United States and internationally. In addition, we seek to diversify our casualty exposure by writing casualty reinsurance across a broad range of product lines.

Retrocessional Reinsurance and Derivative Instruments

We buy retrocessional reinsurance, which is insurance for our own account, to reduce liability on individual risks, protect against catastrophic losses and obtain additional underwriting capacity. Our decisions with respect to purchasing retrocessional coverage take into account both the potential coverage and market conditions such as pricing, terms, conditions and availability of such coverage, with the aim of securing cost-effective protection. We may purchase industry loss warranty reinsurance, which provides retrocessional coverage when insurance industry losses for a defined event exceed a certain level. We expect that the type and level of retrocessional coverage we purchase will vary over time, reflecting our view of the changing dynamics of both the underlying exposure and the reinsurance markets. There can be no assurance that retrocessional coverage will be available on terms we find acceptable.

Retrocessional agreements do not relieve us from our obligations to the insurers and reinsurers from whom we assume business. The failure of retrocessionaires to honor their obligations would result in losses to us. Consequently, we consider the financial strength of retrocessionaires when determining whether to purchase retrocessional coverage from them. We generally obtain retrocessional coverage from companies rated "A-" or better by A.M. Best unless the retrocessionaire's obligations are collateralized. We routinely monitor the financial performance and rating status of any material retrocessionaires.

We may also use derivative instruments to reduce our exposure to catastrophe losses as an alternative to traditional retrocession. We either trade derivatives on recognized exchanges or require collateral to enhance the financial security of the derivative counterparty. We may also use derivative instruments to reduce our exposure to other types of underwriting exposures, such as on our crop portfolio.

Claims Administration

Our claims personnel administer claims arising from our reinsurance contracts, including validating and monitoring claims, posting case reserves and approving payments. Authority for establishing reserves and payment of claims is based upon the level and experience of claims personnel.

Our claims personnel, or consultants engaged by us, conduct periodic audits of specific claims and the overall claims procedures of our ceding companies at their offices. We rely on our ability to effectively monitor the claims handling and claims reserving practices of ceding companies in order to help establish the reinsurance premium for reinsurance contracts and to estimate our liability for unpaid losses and loss adjustment expenses. Moreover, prior to accepting or renewing certain risks, our underwriters may request that our claims personnel conduct pre-underwriting claims audits of ceding companies.

Unpaid Losses and Loss Adjustment Expenses

Unpaid losses and loss adjustment expenses ("LAE") are estimates of future amounts required to pay losses and LAE for claims under our assumed reinsurance contracts that have occurred at or before the balance sheet date. Unpaid losses and LAE are estimated based upon information received from ceding companies regarding our liability for unpaid losses and LAE, adjusted for our estimates of losses and LAE for which ceding company reports have not been received, our historical experience for unreported claims and industry experience for unreported claims. Unpaid losses and LAE include the cost of claims that were reported, but not yet paid, and estimates of the cost of claims incurred but not yet reported ("IBNR"). In addition, we estimate our unallocated loss adjustment expense ("ULAE") reserves based on our administrative costs of managing claims.

Unpaid losses and LAE on our consolidated balance sheets represent our best estimates, at a given point in time, of our liability to pay losses and LAE for events that have occurred on or before the balance sheet date. We do not establish liabilities for unpaid losses and LAE until the occurrence of an event that may give rise to a loss.

Estimates of losses and LAE are established after extensive consultation with individual underwriters, actuarial review of loss development patterns and comparison with industry and our own loss information. These estimates are based on predictions of future developments and trends, including predictions of claim severity and frequency. Consequently, estimates of ultimate losses and LAE, and our unpaid liability for losses and LAE, may differ materially from our initial estimates. See Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Estimates – Unpaid Losses and LAE", in this Form 10-K.

Reconciliation of Claims Reserves

The following table sets forth the changes in our liability for unpaid losses and LAE for the years ended December 31, 2014, 2013 and 2012 ($ in thousands):

| |

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

Net unpaid losses and LAE as of January 1,

|

|

$

|

1,670,171

|

|

|

$

|

1,957,685

|

|

|

$

|

2,385,659

|

|

|

Net incurred losses and LAE related to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current year

|

|

|

311,491

|

|

|

|

328,136

|

|

|

|

395,661

|

|

|

Prior years

|

|

|

(128,090

|

)

|

|

|

(160,690

|

)

|

|

|

(212,001

|

)

|

|

Net incurred losses and LAE

|

|

|

183,401

|

|

|

|

167,446

|

|

|

|

183,660

|

|

|

Net paid losses and LAE related to:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current year

|

|

|

75,511

|

|

|

|

58,958

|

|

|

|

95,808

|

|

|

Prior years

|

|

|

326,673

|

|

|

|

386,408

|

|

|

|

524,423

|

|

|

Net paid losses and LAE

|

|

|

402,184

|

|

|

|

445,366

|

|

|

|

620,231

|

|

|

Net effects of foreign currency exchange rate changes

|

|

|

(18,500

|

)

|

|

|

(9,594

|

)

|

|

|

8,597

|

|

|

Net unpaid losses and LAE as of December 31,

|

|

|

1,432,888

|

|

|

|

1,670,171

|

|

|

|

1,957,685

|

|

|

Reinsurance recoverable on unpaid losses and LAE

|

|

|

2,810

|

|

|

|

1,194

|

|

|

|

3,597

|

|

|

Gross unpaid losses and LAE as of December 31,

|

|

$

|

1,435,698

|

|

|

$

|

1,671,365

|

|

|

$

|

1,961,282

|

|

We report changes in estimates of prior years' unpaid losses and LAE, referred to as net favorable or unfavorable loss development, in our consolidated statements of operations in the period in which we make the change.

The following table sets forth the components of net incurred losses and LAE related to prior years for the years ended December 31, 2014, 2013 and 2012 ($ in thousands):

| |

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

Net favorable loss development

|

|

$

|

(127,633

|

)

|

|

$

|

(183,293

|

)

|

|

$

|

(235,543

|

)

|

|

Increase (decrease) in losses attributable to changes in premium estimates

|

|

|

(457

|

)

|

|

|

22,603

|

|

|

|

23,542

|

|

|

Net incurred losses and LAE - prior years

|

|

$

|

(128,090

|

)

|

|

$

|

(160,690

|

)

|

|

$

|

(212,001

|

)

|

Net favorable loss development was primarily attributable to a level of cumulative losses reported by our ceding companies that was lower than expected and that, in our judgment, resulted in sufficient credibility in the loss experience to change our previously selected loss ratios. Prior years' incurred losses and LAE included losses associated with changes in premium estimates and the patterns of their earnings. The effect on net income from the increase or decrease in losses attributable to changes in premium estimates, after considering corresponding changes in premium estimates and acquisition expenses, was not significant.

The following table sets forth the net favorable loss development by operating segment for the years ended December 31, 2014, 2013 and 2012 ($ in thousands):

| |

|

|

|

|

|

|

|

|

|

| |

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

Property and Marine

|

|

$

|

(27,382

|

)

|

|

$

|

(71,269

|

)

|

|

$

|

(45,664

|

)

|

|

Casualty

|

|

|

(97,795

|

)

|

|

|

(103,165

|

)

|

|

|

(182,014

|

)

|

|

Finite Risk

|

|

|

(2,456

|

)

|

|

|

(8,859

|

)

|

|

|

(7,865

|

)

|

|

Net favorable loss development

|

|

$

|

(127,633

|

)

|

|

$

|

(183,293

|

)

|

|

$

|

(235,543

|

)

|

The Property and Marine segment net favorable loss development included net favorable loss development related to major catastrophe events of $14.1 million, $41.1 million and $12.7 million for the years ended December 31, 2014, 2013 and 2012, respectively. For the years ended December 31, 2014, 2013 and 2012, the net favorable loss development related to major catastrophe events resulted primarily from events that occurred during 2010 through 2013. Property and marine net favorable loss development, excluding major catastrophes, for the years ended December 31, 2014, 2013 and 2012 was primarily attributable to the property per risk and catastrophe excess-of-loss (non-major events) classes.

The Casualty segment net favorable loss development included $82.8 million, $98.2 million and $165.8 million attributable to the long-tailed casualty classes for years ended December 31, 2014, 2013 and 2012, respectively. The majority of the long-tailed casualty net favorable loss development for the years ended December 31, 2014 and 2013 was attributable to the 2011 and prior underwriting years of the claims made, umbrella and international casualty classes. The majority of the long-tailed casualty net favorable loss development for the year ended December 31, 2012 was attributable to the 2009 and prior underwriting years of the claims made, umbrella, casualty occurrence and international casualty classes.

The Finite Risk segment net favorable loss development was offset by additional profit commissions of $1.9 million, $7.1 million and $8.1 million for the years ended December 31, 2014, 2013 and 2012, respectively.

The net favorable loss development for the years ended December 31, 2014, 2013 and 2012 was primarily attributable to a level of cumulative losses reported by our ceding companies that was lower than expected and that, in our judgment, resulted in sufficient credibility in the loss experience to change our previously selected loss ratios and reduce estimated ultimate losses.

Loss Reserve Development

The table below shows the loss reserve development from December 31, 2004 through December 31, 2014.

The top line of the table shows the liability for unpaid losses and LAE, net of unpaid retrocessional reinsurance recoverable, at the balance sheet date for each of the indicated years. This represents our estimate of our gross and net liability for losses and LAE arising in the current year and all prior years that are unpaid at the balance sheet date, including our estimate of IBNR.

We re-estimate the liability to reflect additional information regarding claims incurred prior to the end of each succeeding year. Changes in our estimate of our liability for unpaid losses and LAE recorded at the end of the prior year are reflected in the consolidated statement of operations of the year during which the liabilities are re-estimated and result in a redundancy or deficiency of our unpaid losses and LAE. A cumulative redundancy or deficiency reflects the cumulative difference between the original estimate of our liability for unpaid losses and LAE and the current re-estimated liability.

The table also shows the cumulative amounts paid as of successive years with respect to that liability. Unpaid losses and LAE denominated in foreign currencies are restated at the foreign exchange rates in effect as of December 31, 2014 and the resulting cumulative foreign exchange effect is shown as an adjustment to the cumulative redundancy. At the bottom of the table is a reconciliation of the gross reserve for claims and claim expenses to the net reserve for claims and claim expenses, the gross re-estimated liability to the net re-estimated liability for claims and claim expenses, and the cumulative redundancy on gross reserves.

The table does not present accident year or underwriting year development data nor does it include any corresponding adjustments that may accompany loss redundancies or deficiencies such as premium or commission adjustments. Conditions and trends that have affected the development of liabilities in the past may not necessarily exist in the future. Therefore, it would not be appropriate to extrapolate future deficiencies or redundancies based on the following table.

Development of Loss and LAE Reserves

($ in thousands)

| |

|

2004

|

|

|

2005

|

|

|

2006

|

|

|

2007

|

|

|

2008

|

|

|

2009

|

|

|

2010

|

|

|

2011

|

|

|

2012

|

|

|

2013

|

|

|

2014

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net unpaid losses and LAE as of December 31,

|

|

$

|

1,379,227

|

|

|

$

|

2,268,655

|

|

|

$

|

2,326,227

|

|

|

$

|

2,342,185

|

|

|

$

|

2,452,045

|

|

|

$

|

2,335,008

|

|

|

$

|

2,208,466

|

|

|

$

|

2,385,659

|

|

|

$

|

1,957,685

|

|

|

$

|

1,670,171

|

|

|

$

|

1,432,888

|

|

|

Net unpaid losses and LAE re-estimated as of:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One year later

|

|

|

1,306,708

|

|

|

|

2,215,635

|

|

|

|

2,235,849

|

|

|

|

2,182,249

|

|

|

|

2,351,083

|

|

|

|

2,177,178

|

|

|

|

2,108,308

|

|

|

|

2,173,658

|

|

|

|

1,796,995

|

|

|

|

1,542,084

|

|

|

|

|

|

|

Two years later

|

|

|

1,277,627

|

|

|

|

2,149,153

|

|

|

|

2,129,932

|

|

|

|

2,076,330

|

|

|

|

2,217,451

|

|

|

|

2,075,876

|

|

|

|

1,915,000

|

|

|

|

2,045,402

|

|

|

|

1,683,583

|

|

|

|

|

|

|

|

|

|

|

Three years later

|

|

|

1,254,213

|

|

|

|

2,072,604

|

|

|

|

2,032,074

|

|

|

|

1,931,064

|

|

|

|

2,124,700

|

|

|

|

1,895,039

|

|

|

|

1,831,634

|

|

|

|

1,942,546

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Four years later

|

|

|

1,210,091

|

|

|

|

1,999,484

|

|

|

|

1,924,117

|

|

|

|

1,848,172

|

|

|

|

1,972,937

|

|

|

|

1,836,005

|

|

|

|

1,759,422

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Five years later

|

|

|

1,170,602

|

|

|

|

1,934,784

|

|

|

|

1,868,036

|

|

|

|

1,739,881

|

|

|

|

1,934,738

|

|

|

|

1,775,309

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six years later

|

|

|

1,131,404

|

|

|

|

1,900,762

|

|

|

|

1,803,652

|

|

|

|

1,706,956

|

|

|

|

1,894,474

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Seven years later

|

|

|

1,112,460

|

|

|

|

1,858,502

|

|

|

|

1,784,579

|

|

|

|

1,676,558

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eight years later

|

|

|

1,090,007

|

|

|

|

1,850,103

|

|

|

|

1,763,779

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine years later

|

|

|

1,092,033

|

|

|

|

1,838,310

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ten years later

|

|

|

1,088,833

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net cumulative redundancy

|

|

|

290,394

|

|

|

|

430,345

|

|

|

|

562,448

|

|

|

|

665,627

|

|

|

|

557,572

|

|

|

|

559,699

|

|

|

|

449,044

|

|

|

|

443,113

|

|

|

|

274,102

|

|

|

|

128,090

|

|

|

|

|

|

|

Adjustment for foreign currency exchange

|

|

|

(3,571

|

)

|

|

|

14,932

|

|

|

|

(3,783

|

)

|

|

|

(15,163

|

)

|

|

|

4,835

|

|

|

|

(6,856

|

)

|

|

|

(1,180

|

)

|

|

|

(14,100

|

)

|

|

|

(23,791

|

)

|

|

|

(15,852

|

)

|

|

|

|

|

|

Cumulative redundancy excluding foreign currency exchange

|

|

|

286,823

|

|

|

|

445,277

|

|

|

|

558,665

|

|

|

|

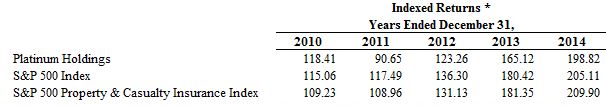

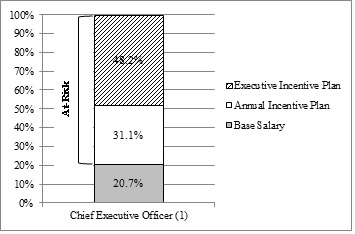

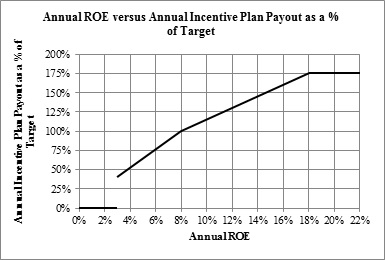

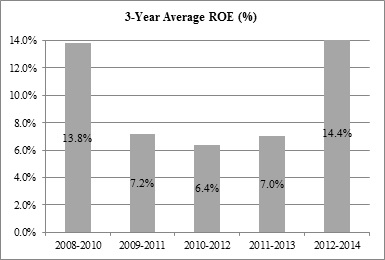

650,464