Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended February 29, 2012

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 1-31420

CARMAX, INC.

(Exact name of registrant as specified in its charter)

| VIRGINIA | 54-1821055 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) | |

| 12800 TUCKAHOE CREEK PARKWAY, RICHMOND, VIRGINIA | 23238 | |

| (Address of principal executive offices) | (Zip Code) | |

Registrant’s telephone number, including area code: (804) 747-0422

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Name of each exchange on which registered | |

| Common Stock, par value $0.50 | New York Stock Exchange | |

| Rights to Purchase Series A Preferred Stock, par value $20.00 |

New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer or a non-accelerated filer or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | x | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (do not check if a smaller reporting company) | Smaller reporting company | ¨ | |||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No x

The aggregate market value of the registrant’s common stock held by non-affiliates as of August 31, 2011, computed by reference to the closing price of the registrant’s common stock on the New York Stock Exchange on that date, was $6.36 billion.

On March 31, 2012, there were 227,160,637 outstanding shares of CarMax, Inc. common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the CarMax, Inc. Notice of 2012 Annual Meeting of Shareholders and Proxy Statement are incorporated by reference in Part III of this Form 10-K.

Table of Contents

FORM 10-K

FOR FISCAL YEAR ENDED FEBRUARY 29, 2012

TABLE OF CONTENTS

| Page No. |

||||||

| PART I | ||||||

| Item 1. |

3 | |||||

| Item 1A. |

10 | |||||

| Item 1B. |

14 | |||||

| Item 2. |

14 | |||||

| Item 3. |

15 | |||||

| Item 4. |

15 | |||||

| PART II | ||||||

| Item 5. |

16 | |||||

| Item 6. |

18 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

19 | ||||

| Item 7A. |

36 | |||||

| Item 8. |

37 | |||||

| Item 9. |

Changes in and Disagreements with Accountants on Accounting and Financial Disclosure |

74 | ||||

| Item 9A. |

74 | |||||

| Item 9B. |

74 | |||||

| PART III | ||||||

| Item 10. |

75 | |||||

| Item 11. |

76 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

76 | ||||

| Item 13. |

Certain Relationships and Related Transactions and Director Independence |

76 | ||||

| Item 14. |

76 | |||||

| PART IV | ||||||

| Item 15. |

77 | |||||

| 78 | ||||||

2

Table of Contents

In this document, “we,” “our,” “us,” “CarMax” and “the company” refer to CarMax, Inc. and its wholly owned subsidiaries, unless the context requires otherwise.

FORWARD-LOOKING AND CAUTIONARY STATEMENTS

This Annual Report on Form 10-K and, in particular, the description of our business set forth in Item 1 and our Management’s Discussion and Analysis of Financial Condition and Results of Operations set forth in Item 7 contain a number of forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding:

| • | Our projected future sales growth, comparable store unit sales growth, margins, earnings, CarMax Auto Finance income and earnings per share. |

| • | Our expectations of factors that could affect CarMax Auto Finance income. |

| • | Our expected future expenditures, cash needs and financing sources. |

| • | The projected number, timing and cost of new store openings. |

| • | Our sales and marketing plans. |

| • | Our assessment of the potential outcome and financial impact of litigation and the potential impact of unasserted claims. |

| • | Our assessment of competitors and potential competitors. |

| • | Our assessment of the effect of recent legislation and accounting pronouncements. |

In addition, any statements contained in or incorporated by reference into this report that are not statements of historical fact should be considered forward-looking statements. You can identify these forward-looking statements by use of words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “predict,” “should,” “will” and other similar expressions, whether in the negative or affirmative. We cannot guarantee that we will achieve the plans, intentions or expectations disclosed in the forward-looking statements. There are a number of important risks and uncertainties that could cause actual results to differ materially from those indicated by our forward-looking statements. These risks and uncertainties include, without limitation, those set forth in Item 1A under the heading “Risk Factors.” We caution investors not to place undue reliance on any forward-looking statements as these statements speak only as of the date when made. We undertake no obligation to update any forward-looking statements made in this report.

| Item 1. | Business. |

BUSINESS OVERVIEW

CarMax Background. CarMax, Inc. was incorporated under the laws of the Commonwealth of Virginia in 1996. CarMax, Inc. is a holding company and our operations are conducted through our subsidiaries. Our home office is located at 12800 Tuckahoe Creek Parkway, Richmond, Virginia.

Under the ownership of Circuit City Stores, Inc. (“Circuit City”), we began operations in 1993 with the opening of our first CarMax superstore in Richmond, Virginia. In 1997, Circuit City completed the initial public offering of a tracking stock that was intended to track separately the performance of the CarMax operations. On October 1, 2002, the CarMax business was separated from Circuit City through a tax-free transaction, becoming an independent, publicly traded company.

CarMax Business. We are the nation’s largest retailer of used cars, based on the 408,080 used vehicles we retailed during the fiscal year ended February 29, 2012. As of the end of fiscal 2012, we operated 108 used car superstores in 53 metropolitan markets. In addition, we are one of the nation’s largest wholesale vehicle auction operators, based on the 316,649 wholesale vehicles we sold through our on-site auctions in fiscal 2012.

We were the first used vehicle retailer to offer a large selection of high quality used vehicles at competitively low, “no-haggle” prices using a customer-friendly sales process in an attractive, modern sales facility. The CarMax consumer offer provides customers the opportunity to shop for vehicles the same way they shop for items at other

3

Table of Contents

“big-box” retailers, and it is structured around four customer benefits: low, no-haggle prices; a broad selection; high quality vehicles; and a customer-friendly sales process. Our strategy is to revolutionize the auto retailing market by addressing the major sources of customer dissatisfaction with traditional auto retailers and to maximize operating efficiencies through the use of standardized operating procedures and store formats enhanced by sophisticated, proprietary management information systems.

The CarMax consumer offer enables customers to evaluate separately each component of the sales process and to make informed decisions based on comprehensive information about the options, terms and associated prices of each component. The customer can accept or decline any individual element of the offer without affecting the price or terms of any other component of the offer. Our no-haggle pricing and our commission structure, which is generally based on a fixed dollars-per-unit standard, allow sales consultants to focus solely on meeting customer needs.

All of the used vehicles we retail are thoroughly reconditioned to meet our high standards, and each vehicle must pass a comprehensive inspection before being offered for sale. In fiscal 2012, 90% of the used vehicles we retailed were 0 to 6 years old.

We also wholesale used vehicles. Vehicles purchased through our in-store appraisal process that do not meet our retail standards are sold to licensed dealers through our on-site wholesale auctions. Unlike many other auto auctions, we own all the vehicles that we sell in our auctions, which allows us to maintain a high auction sales rate. This high sales rate, combined with dealer-friendly practices, makes our auctions an attractive source of vehicles for independent used car dealers. As of February 29, 2012, we conducted weekly or bi-weekly auctions at 52 of our 108 used car superstores.

In addition, we sell new vehicles at four locations under franchise agreements with three new car manufacturers. In fiscal 2012, new vehicles comprised only 2% of our total retail vehicle unit sales.

Our finance program provides customers financing alternatives through CarMax Auto Finance (“CAF”), our own finance operation, and third-party financing providers. This program provides access to credit for customers throughout the credit spectrum. We believe that our processes and systems, the transparency of our pricing and our vehicle quality provide a unique and ideal environment in which to originate and procure high quality auto loans. CAF focuses solely on originating loans through CarMax stores, customizing its offers to meet the customer’s risk profile and ensuring credit availability to support CarMax retail vehicle unit sales.

We provide customers with a full range of other related products and services, including the appraisal and purchase of vehicles directly from consumers; the sale of extended service plans (“ESP”), guaranteed asset protection (“GAP”) and accessories; and vehicle repair service.

We have separated the practice of trading in a used vehicle in conjunction with the purchase of another vehicle into two distinct and independent transactions. We will appraise a consumer’s vehicle and make an offer to buy that vehicle regardless of whether the owner is purchasing a vehicle from us. We acquire a significant percentage of our retail used vehicle inventory through this unique in-store appraisal process. We also acquire a large portion of our used vehicle inventory through wholesale auctions and, to a lesser extent, directly from other sources, including wholesalers, dealers and fleet owners.

Our proprietary inventory management and pricing system tracks each vehicle throughout the sales process. Using the information provided by this system and applying statistical modeling techniques, we are able to optimize our inventory mix, anticipate future inventory needs at each store, evaluate sales consultant and buyer performance and refine our vehicle pricing strategy. Because of the pricing discipline afforded by the inventory management and pricing system, generally more than 99% of the entire used car inventory offered at retail is sold at retail.

Industry and Competition. The U.S. used car marketplace is highly fragmented and competitive. According to industry sources, as of December 31, 2011, there were approximately 17,900 franchised automotive dealerships, which sell both new and used vehicles. In addition, used vehicles were sold by approximately 37,500 independent used vehicle dealers, as well as millions of private individuals. Our primary retail competitors are the franchised auto dealers, who sell the majority of late-model used vehicles. Independent used car dealers predominantly sell older, higher mileage cars than we do. The number of franchised and independent auto dealers has gradually declined over the last decade due to a variety of factors, including franchise terminations resulting from the bankruptcy reorganizations of General Motors and Chrysler and the discontinuation of several brands by the major auto manufacturers. Despite the recent acceleration in dealership closures, the automotive retail environment remains highly fragmented.

4

Table of Contents

Based on industry data, there were approximately 39 million used cars sold in the U.S. in calendar year 2011, of which between 15 million and 16 million were estimated to be late-model, 0- to 6-year old vehicles. While we are the largest retailer of used vehicles in the U.S., selling more than two times as many used vehicles as the next largest retailer in calendar 2011, we still represented less than 3% of the total late-model used units sold. Over the last several years, competition has been affected by the increasing use of Internet-based marketing for both used vehicles and vehicle financing. In both the used and new vehicle markets, we seek to distinguish ourselves from traditional dealerships through our consumer offer, sales approach and other innovative operating strategies.

We believe that our principal competitive advantages in used vehicle retailing include our ability to provide a high degree of customer satisfaction with the car-buying experience by virtue of our competitively low, no-haggle prices and our customer-friendly sales process; our breadth of selection of the most popular makes and models available both on site and via our website, carmax.com; the quality of our vehicles; our proprietary information systems; CAF; and the locations of our retail stores. In addition, we believe our willingness to appraise and purchase a customer’s vehicle, whether or not the customer is buying a car from us, provides us a competitive sourcing advantage for retail vehicles. Our large volume of appraisal purchases supplies not only a large portion of our retail inventory, but also provides the scale that enables us to conduct our own wholesale auctions to dispose of vehicles that don’t meet our retail standards. Upon request by a customer, we will transfer virtually any used vehicle in our nationwide inventory to a local superstore. Transfer fees may apply, depending on the distance the vehicle needs to travel. In fiscal 2012, approximately 30% of our vehicles sold were transferred at customer request. Our Certified Quality Inspection assures that every vehicle we offer for sale meets our stringent standards. We back every vehicle with a 5-day, money-back guarantee and at least a 30-day limited warranty. We maintain an ability to offer or arrange customer financing with competitive terms. All of the finance offers by CAF and our third-party providers are backed by a 3-day payoff offer whereby a customer can refinance their loan within three business days at no charge. Additionally, we offer comprehensive and competitively priced ESP and GAP products. We believe that we are competitive in all of these areas and that we enjoy advantages over competitors that employ traditional high-pressure, negotiation-oriented sales techniques.

Our sales consultants play a significant role in ensuring a customer-friendly sales process. A sales consultant is paid a commission, generally based on a fixed dollars-per-unit standard, thereby earning the same dollar sales commission regardless of the gross profit on the vehicle being sold. In addition, sales consultants do not receive commissions based on the number of credit approvals or the amount a customer finances. This pay structure aligns our sales associates’ interests with those of our customers, in contrast to other dealerships where sales and finance personnel may receive higher commissions for negotiating higher prices and interest rates or steering customers to vehicles with higher gross profits.

In our wholesale auctions, we compete with other automotive auction houses. In contrast with the highly fragmented used vehicle market, the automotive auction market has two primary competitors representing an estimated two-thirds of the U.S. whole car auction market. These competitors auction vehicles of all ages, while CarMax predominately sells older, higher mileage vehicles. We believe our principal competitive advantages include our high vehicle sales rate, our vehicle condition disclosures and arbitration policies, our broad geographic distribution and our dealer-friendly practices. Because we own the cars that we auction, we generally sell more than 95% of the vehicles offered, which is substantially higher than the sales rate at most other auto auctions. Our policy of making vehicle condition disclosures, noting mechanical and other issues found during our appraisal process, is also not a typical practice used at other auctions of older, higher mileage vehicles. Together, these factors make our auctions attractive to dealers, resulting in a high dealer-to-car attendance ratio.

Marketing and Advertising. Our marketing strategies are focused on developing awareness of the advantages of shopping at our stores and on attracting customers who are already considering buying or selling a vehicle. Our marketing strategies are implemented primarily through television and radio broadcasts, carmax.com, Internet search engines and online classified listings. We also reach out to customers and potential customers to build awareness and loyalty through Facebook, Twitter and other social media. Television and radio advertisements are designed to build consumer awareness of the CarMax name, carmax.com and key components of the CarMax offer. Broadcast and Internet advertisements are designed to drive customers to our stores and to carmax.com.

We continually adjust our marketing programs in response to the evolving media landscape. We have customized our marketing program based on awareness levels in each market. Beginning in fiscal 2012, we began to transition a portion of our television and radio advertising to national cable network and national radio programming. In

5

Table of Contents

addition to providing cost savings, this transition allows us to build awareness of CarMax prior to our entrance into new markets. We are also building awareness and driving traffic to our stores and carmax.com by listing retail vehicles on online classified sites, such as AutoTrader.com and cars.com. We believe using these online classified services allows our vehicles to appear on sites that are visited by a majority of buyers of late-model used vehicles who use the Internet in their shopping process. Our advertising on the Internet also includes advertisements on search engines, such as Google and Yahoo!

Our website, carmax.com, is a marketing tool for communicating the CarMax consumer offer in detail, a sophisticated search engine for finding the right vehicle and a sales channel for customers who prefer to complete a part of the shopping and sales process online. The website offers complete inventory and pricing search capabilities. Information on each of the thousands of cars available in our nationwide inventory is updated several times per day. Carmax.com includes detailed information, such as vehicle photos, prices, features, specifications and store locations, as well as advanced feature-based search capabilities, and sorting and comparison tools that allow consumers to easily compare vehicles. The site also includes features such as detailed vehicle reviews, payment calculators and email alerts when new inventory arrives. Virtually any used vehicle in our nationwide inventory can be transferred at customer request to their local superstore. Customers can contact sales consultants online via carmax.com, by telephone or by fax. Customers can work with these sales consultants from the comfort of home, including applying for financing, and they need to visit the store only to complete the final steps of the transaction, such as signing the paperwork and picking up their vehicle. We also have a mobile website application that allows customers to search for and view cars on their smartphones. Our survey data indicates that during fiscal 2012, more than 70% of customers who purchased a vehicle from us had first visited our website.

We also maintain a website, carmaxauctions.com, that supports our wholesale auctions. This website, which is accessible only by authorized dealers, provides listings of all vehicles that will be available in upcoming auctions. It also has many features similar to our retail website, including vehicle photos, free vehicle history reports and vehicle search and alert capabilities.

Suppliers for Used Vehicles. We acquire used vehicle inventory directly from consumers through our in-store appraisal process and our car-buying centers, as well as, through other sources, including local, regional and online auctions, wholesalers, franchised and independent dealers and fleet owners, such as leasing companies and rental companies. The supply of used vehicles is influenced by a variety of factors, including the total number of vehicles in operation; the rate of new vehicle sales, which in turn generate used-car trade-ins; and the number of used vehicles sold or remarketed through retail channels, wholesale transactions and at automotive auctions. According to industry data, there are approximately 240 million light vehicles in operation in the U.S., including approximately 80 million vehicles that are 0 to 6 years old. In recent years, generally between 10 million and 17 million new vehicles and between 35 million and 45 million used vehicles have been retailed annually and between 8 million and 10 million vehicles have been remarketed at wholesale auctions each year.

Our used vehicle inventory acquired directly from consumers through our appraisal process at our stores and car-buying centers helps provide an inventory of makes and models that reflects the consumer preferences of each market. We have replaced the traditional “trade-in” transaction with a process in which a CarMax-trained buyer appraises a customer’s vehicle and provides the owner with a written, guaranteed offer that is good for seven days. An appraisal is available to every customer free of charge, whether or not the customer purchases a vehicle from us. Based on their age, mileage or condition, fewer than half of the vehicles acquired through this in-store appraisal process meet our high-quality retail standards. Those vehicles that do not meet our retail standards are sold to licensed dealers through our on-site wholesale auctions.

The inventory purchasing function is primarily performed at the store level and is the responsibility of the buyers, who handle both on-site appraisals and off-site auction purchases. Our buyers evaluate all used vehicles based on internal and external auction data and market sales, as well as estimated reconditioning costs and, for off-site purchases, transportation costs. Our buyers, in collaboration with our home office staff, utilize the extensive inventory and sales trend data available through the CarMax information system to decide which inventory to purchase at off-site auctions. Our inventory and pricing models help the buyers tailor inventories to the buying preferences at each superstore, recommend pricing adjustments and optimize inventory turnover to help maintain gross profit per unit.

Based on consumer acceptance of the in-store appraisal process, our experience and success to date in acquiring vehicles from auctions and other sources, and the large size of the U.S. auction market relative to our needs, we believe that sources of used vehicles will continue to be sufficient to meet our current and future needs.

6

Table of Contents

Suppliers for New Vehicles. Our new car operations are governed by the terms of the sales, service and dealer agreements. Among other things, these agreements generally impose operating requirements and restrictions, including inventory levels, working capital, monthly financial reporting, signage and cooperation with marketing strategies. A manufacturer may terminate a dealer agreement under certain circumstances. In addition to selling new vehicles using our low, no-haggle price strategy, the franchise and dealer agreements generally allow us to perform warranty work on these vehicles and sell related parts and services within a specified market area. Designation of specified market areas generally does not guarantee exclusivity within a specified territory.

Seasonality. Historically, our business has been seasonal. Typically, our superstores experience their strongest traffic and sales in the spring and summer quarters. Sales are typically slowest in the fall quarter, when used vehicles generally experience proportionately more of their annual depreciation. We believe this is partly the result of a decline in customer traffic, as well as discounts on model year closeouts that can pressure pricing for late-model used vehicles. Customer traffic generally tends to slow in the fall as the weather changes and as customers shift their spending priorities. We typically experience an increase in subprime traffic and sales in February and March, coincident with tax refund season.

Products and Services

Merchandising. We offer customers a broad selection of makes and models of used vehicles, including both domestic and imported vehicles, at competitive prices. Our used car selection covers popular brands from manufacturers such as Chrysler, Ford, General Motors, Honda, Hyundai, Kia, Mazda, Nissan, Subaru, Toyota and Volkswagen and luxury brands such as Acura, BMW, Infiniti, Lexus and Mercedes-Benz. Our primary focus is vehicles that are 0 to 6 years old and generally range in price from $12,000 to $32,000. For the more cost-conscious consumer, we also offer used cars that are more than 6 years old. The mix of our used vehicle inventory by make, model and age will vary from time to time, depending on consumer preferences.

We have implemented an everyday low-price strategy under which we set no-haggle prices on both our used and new vehicles. We believe that our pricing is competitive with the best-negotiated prices in the market. Prices on all vehicles are clearly displayed on each vehicle’s information sticker, on carmax.com and on applicable online classified sites on which they are listed. We extend our no-haggle philosophy to every component of the vehicle transaction, including vehicle appraisal offers, financing rates, accessories, and ESP and GAP pricing.

Reconditioning and Service. An integral part of our used car consumer offer is the reconditioning process. This process includes a comprehensive Certified Quality Inspection of the engine and all major systems, including cooling, fuel, drivetrain, transmission, electronics, suspension, brakes, steering, air conditioning and other equipment, as well as the interior and exterior of the vehicle. Based on this quality inspection, we determine the reconditioning necessary to bring the vehicle up to our quality standards. Our technicians complete vehicle inspections. We perform most routine mechanical and minor body repairs in-house; however, for some reconditioning services, we engage third parties specializing in those services. Many superstores depend upon nearby, typically larger, superstores for reconditioning, which increases efficiency and reduces overhead.

All CarMax used car superstores provide vehicle repair service, including repairs of vehicles covered by our ESPs. We also provide factory-authorized service at all new car franchises. We have developed systems and procedures that are intended to ensure that our retail repair service is conducted in the same customer-friendly and efficient manner as our other operations.

We believe that the efficiency of our reconditioning and service operations is enhanced by our modern facilities, our information systems and our technician training and development process. The training and development process and our compensation programs are designed to increase the productivity of technicians, identify opportunities for waste reduction and achieve high-quality repairs. Our information systems provide the ability to track repair history and enable trend analysis, which serves as guidance for our continuous improvement efforts.

Wholesale Auctions. Vehicles purchased through our in-store appraisal process that do not meet our retail standards are sold through on-site wholesale auctions. As of February 29, 2012, wholesale auctions were conducted at 52 of our 108 superstores and were generally held on a weekly or bi-weekly basis. Auction frequency at a given superstore is determined by the number of vehicles to be auctioned, which depends on the number of stores in that market and the consumer awareness of CarMax and our in-store appraisal offer. The typical wholesale vehicle is approximately 10 years old and has more than 100,000 miles. Participation in our wholesale auctions is restricted to licensed automobile dealers, the majority of whom are independent dealers. To participate in a CarMax auction, dealers must register with our centralized auction support group, at which time we determine the purchase limit available to each dealer. We provide condition disclosures on each vehicle, including those for vehicles with major

7

Table of Contents

mechanical issues, possible frame or flood damage, branded titles, salvage history and unknown true mileage. Professional, licensed auctioneers conduct our auctions. The average auction sales rate was 96% in fiscal 2012. Dealers pay a fee to us based on the sales price of the vehicles they purchase.

Customer Credit. We offer financing alternatives to customers throughout the credit spectrum through CAF and our arrangements with several industry-leading financial institutions. We believe our program enables us to capture additional sales and enhances the CarMax consumer offer. Credit applications are initially reviewed by CAF. Customers who are not approved by CAF may be evaluated by the other financial institutions. Having an array of finance sources increases discrete approvals, expands finance opportunities for our customers and mitigates risk to CarMax. In fiscal 2012, 87% of our applicants received an approval from one or more of our sources. We periodically test additional third-party providers.

Customers applying for financing provide credit information that is electronically submitted by sales consultants through our proprietary information system. A majority of applicants receive a response within five minutes. Vehicles are financed using retail installment contracts secured by the vehicles. Customers are permitted to refinance or pay off their contract within three business days of a purchase without incurring any finance or related charges. Third-party providers purchasing subprime finance contracts generally purchase these contracts at a discount, while providers purchasing prime and non-prime finance contracts generally pay us a fixed, pre-negotiated fee per vehicle. We have no recourse liability on retail installment contracts arranged with third-party providers.

CarMax Auto Finance. We offer financing through CAF to qualified customers purchasing vehicles at CarMax. CAF utilizes proprietary scoring models based upon the credit history of the customer along with CAF’s historical experience to predict the likelihood of customer repayment. We offer customers an array of competitive rates and terms, allowing them to choose the one that best fits their needs. We randomly test different credit offers and closely monitor acceptance rates and 3-day payoffs to assess market competitiveness. After the effect of 3-day payoffs and vehicle returns, CAF financed 37% of our retail vehicle unit sales in fiscal 2012. As of February 29, 2012, CAF serviced approximately 414,000 customers in its $4.98 billion portfolio of managed receivables. We maintain a dedicated website for CAF (www.carmaxautofinance.com) through which customers can set up online payment plans and view and update account information.

Extended Service Plans and Guaranteed Asset Protection. At the time of the sale, we offer the customer an ESP. We sell these plans on behalf of unrelated third parties that are the primary obligors. Under the third-party service plan programs, we have no contractual liability to the customer. The ESPs we offer on all used vehicles provide coverage up to 72 months (subject to mileage limitations) and include multiple mileage and deductible options, depending on the vehicle odometer reading, make and model. We offer ESPs at competitive, fixed prices, which are based primarily on the historical repair record of the vehicle make and model, the mileage option selected and the deductible chosen. All ESPs that we sell (other than manufacturer programs) have been designed to our specifications and are administered by the third parties through private-label arrangements. We receive a commission from the administrator at the time of sale. In fiscal 2012, approximately 60% of the customers who purchased a used vehicle also purchased an ESP.

Our ESP customers have access to vehicle repair service at each CarMax store and at thousands of independent and franchised service providers. We believe that the quality of the services provided by this network, as well as the broad scope of our ESPs, helps promote customer satisfaction and loyalty, and thus increases the likelihood of repeat and referral business.

We also offer GAP at the time of the sale. GAP is a product that will pay the difference between the customer’s insurance settlement and the finance contract payoff amount on their vehicle in the case of a total loss or unrecovered theft. We sell this product on behalf of an unrelated third party that is the primary obligor and we have no contractual liability to the customer. GAP has been designed to our specifications and is administered by the third party through a private-label arrangement. We receive a commission from the administrator at the time of sale.

Systems

Our stores are supported by an advanced, proprietary information system that improves the customer experience, while providing tightly integrated automation of all operating functions. Using a computer or smartphone, customers can search our entire vehicle inventory through our website, carmax.com. They can also print a detailed listing for any vehicle from a computer, which includes the vehicle’s features and specifications and its location on the display lot. Our integrated inventory management system tracks every vehicle through its life from purchase through reconditioning and test-drives to ultimate sale. Using radio frequency identification (“RFID”) tags, all vehicles are scanned and tracked daily as a loss prevention measure. Test-drive information is also captured on

8

Table of Contents

every vehicle using RFID tags, linking the specific vehicle and the sales consultant. We also capture data on vehicles we wholesale, which helps us track market pricing. A computerized finance application process and computer-assisted document preparation ensure rapid completion of the sales transaction. Behind the scenes, our proprietary store technology provides our management with real-time information about many aspects of store operations, such as inventory management, pricing, vehicle transfers, wholesale auctions and sales consultant productivity. In addition, our store system provides a direct link to our proprietary credit processing information system to facilitate the credit review and approval process of our in-house financing and third party providers.

Our proprietary inventory management and pricing system is centralized and allows us to buy the mix of makes, models, age, mileage and price points tailored to customer buying preferences at each superstore. This system also generates recommended initial retail price points, as well as retail price markdowns for specific vehicles based on complex algorithms that take into account factors including sales history, consumer interest and seasonal patterns. We believe this systematic approach to vehicle pricing allows us to optimize inventory turns, which minimizes the depreciation risk inherent in used cars and helps us to achieve our targeted gross profit dollars per unit.

In addition to inventory management, our Electronic Repair Order system (“ERO”) is used to sequence reconditioning procedures. ERO provides information that helps increase quality and reduce costs, which further enhances our customer service and profitability.

Through our centralized systems, we are able to quickly integrate new stores into our store network. We continue to enhance and refine our information systems, which we believe to be a core competitive advantage. The design of our information systems incorporates off-site backups, redundant processing and other measures to reduce the risk of significant data loss in the event of an emergency or disaster.

Associates

On February 29, 2012, we had a total of 16,460 full- and part-time associates, including 12,394 hourly and salaried associates and 4,066 sales associates, who worked on a commission basis. We employ additional associates during peak selling seasons. As of February 29, 2012, our location general managers averaged more than nine years of CarMax experience, in addition to prior retail management experience. We staff each newly opened store with associates who have extensive CarMax training.

We believe we have created a unique corporate culture and maintain good employee relations. No associate is subject to a collective bargaining agreement. We focus on providing our associates with the information and resources they need to offer exceptional customer service. We reward associates whose behavior exemplifies our culture, and we believe that our favorable working conditions and compensation programs allow us to attract and retain highly qualified individuals. We have been recognized for the success of our efforts by a number of external organizations.

Training. To further support our emphasis on attracting, developing and retaining qualified associates, we have made a commitment to providing exceptional training programs. Store associates receive many hours of structured, self-paced training that introduces them to company policies and their specific job responsibilities through KMX University (“KMXU”) – our intranet-based, on-premises learning management system. KMXU is comprised of customized applications hosted within a learning management system that allow us to author, deliver and track training events and to measure associate competency after training. KMXU also provides a variety of learning activities and collaborative discussions delivered through an integrated virtual classroom system. Most new store associates are also assigned mentors who provide on-the-job guidance and support.

We also provide comprehensive, facilitator-led classroom training courses at the associate and manager levels. All sales consultants go through a four-phase on-boarding process in which they are partnered with a mentor, combining self-paced online training with shadowing and role-playing. Our professional selling skills training provides sales associates the opportunity to learn and practice customer-oriented selling techniques. This online training program contains modules on a variety of skill sets, including building confidence, connecting with the customer, and listening and persuasion techniques. We also have a call recording and review program to provide constructive feedback to associates on how to improve their interactions with customers. Buyers-in-training undergo a 6- to 18-month apprenticeship under the supervision of experienced buyers, and they generally will assist with the appraisal of more than 1,000 cars before making their first independent purchase. Business office associates undergo a 3- to 6-month, four-phase on-the-job certification process in order to be fully cross-trained in all functional areas of the business office. All business office associates and managers also receive regular training through facilitated competency-based training courses. We utilize a mix of internal and external technical training programs in an effort to provide a stable future supply of qualified technicians. The technicians attend in-house and

9

Table of Contents

vendor-sponsored training programs designed to develop their skills in performing repairs on the diverse makes and models of vehicles we sell. Technicians at our new car franchises also attend manufacturer-sponsored training programs to stay abreast of current diagnostic, repair and maintenance techniques for those manufacturers’ vehicles. Most new managers attend an intensive week-long workshop at the home office where they meet with senior leaders and learn fundamental CarMax management skills.

Laws and Regulations

Vehicle Dealer and Other Laws and Regulations. We operate in a highly regulated industry. In every state in which we operate, we must obtain various licenses and permits in order to conduct business, including dealer, service, sales and finance licenses issued by state and local regulatory authorities. A wide range of federal, state and local laws and regulations govern the manner in which we conduct business, including advertising, sales, financing and employment practices. These laws include consumer protection laws, privacy laws and state franchise laws, as well as other laws and regulations applicable to new and used motor vehicle dealers. These laws also include federal and state wage-hour, anti-discrimination and other employment practices laws. Our financing activities with customers are subject to federal truth-in-lending, consumer leasing, equal credit opportunity and fair credit reporting laws and regulations, as well as state and local motor vehicle finance, collection, repossession and installment finance laws.

Claims arising out of actual or alleged violations of law could be asserted against us by individuals or governmental authorities and could expose us to significant damages or other penalties, including revocation or suspension of the licenses necessary to conduct business and fines.

Environmental Laws and Regulations. We are subject to a variety of federal, state and local laws and regulations that pertain to the environment. Our business involves the use, handling and disposal of hazardous materials and wastes, including motor oil, gasoline, solvents, lubricants, paints and other substances. We are subject to compliance with regulations concerning the operation of underground and aboveground gasoline storage tanks, gasoline dispensing equipment, above-ground oil tanks and automotive paint booths.

AVAILABILITY OF REPORTS AND OTHER INFORMATION

The following items are available free of charge through the “Corporate Governance” link on our investor information home page at investor.carmax.com, as soon as reasonably practicable after filing or furnishing the material to the Securities and Exchange Commission (the “SEC”): annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements on Schedule 14A, and any amendments to those reports. In addition, the following documents are also available free of charge on our website: Corporate Governance Guidelines, Code of Business Conduct, and the charters of the Audit Committee, Nominating and Governance Committee, and Compensation and Personnel Committee. We publish any changes to these documents on our website. We also promptly disclose reportable waivers of the Code of Business Conduct on our website. The contents of our website are not, however, part of this report.

Printed copies of these documents are also available to any shareholder, without charge, upon written request to our corporate secretary at the address set forth on the cover page of this report.

| Item 1A. | Risk Factors. |

We are subject to a variety of risks, the most significant of which are described below. Our business, sales, results of operations and financial condition could be materially adversely affected by any of these risks or additional risks.

Economic Conditions. We are subject to changes in general or regional U.S. economic conditions, including, but not limited to, consumer credit availability, consumer credit delinquency and loss rates, interest rates, gasoline prices, inflation, personal discretionary spending levels, unemployment levels, the state of the housing market, and consumer sentiment about the economy in general. The difficult U.S. economic environment over the past several years has adversely affected the automotive retail industry in general, including CarMax. Any significant change or further deterioration in economic conditions could adversely affect consumer demand or increase costs and have a material adverse effect on our business, sales, results of operations and financial condition.

Capital. Changes in the availability or cost of capital and working capital financing, including the long-term financing to support the origination of auto loan receivables through CAF and our geographic expansion, could adversely affect sales, operating strategies and store growth. Further, our current credit facility and certain securitization and sale-leaseback agreements contain covenants and/or performance triggers. Any failure to comply with these covenants or performance triggers could have a material adverse effect on our business, results of operations and financial condition.

10

Table of Contents

We use a securitization program to fund substantially all of the auto loan receivables originated by CAF. Initially, we sell these receivables into our warehouse facilities. We periodically refinance the receivables through term securitizations. Changes in the condition of the asset-backed securitization market could lead us to incur higher costs to access funds in this market or require us to seek alternative means to finance our loan originations. In the event that this market ceased to exist and there were no immediate alternative funding sources available, we might be forced to curtail our lending practices for some period of time. The impact of reducing or curtailing CAF’s loan originations could have a material adverse effect on our business, sales and results of operations.

Disruptions in the capital and credit markets could adversely affect our ability to draw on our revolving credit facility. If our ability to secure funds from the facility were significantly impaired, our access to working capital would be impacted, our ability to maintain appropriate inventory levels could be affected and these conditions could have a material adverse effect on our business, sales, results of operations and financial condition.

Third-Party Financing Providers. CarMax provides financing to qualified customers through CAF and a number of third-party financing providers. In the event that one or more of these third-party providers could no longer, or choose not to, provide financing to our customers, could only provide financing to a reduced segment of our customers or could no longer provide financing at competitive rates of interest, it could have a material adverse effect on our business, sales and results of operations. Additionally, if we were unable to replace the current third-party providers upon the occurrence of one or more of the foregoing events, it could also have a material adverse effect on our business, sales and results of operations.

Competition. Automotive retailing and wholesaling is a highly competitive business. Our competition includes publicly and privately owned new and used car dealers, as well as millions of private individuals. Competitors buy and sell the same or similar makes of vehicles that we offer in the same or similar markets at competitive prices. Further, new entrants to the market could result in increased acquisition costs for used vehicles and lower-than-expected retail and wholesale sales and margins. Competition is affected by the increasing use of the Internet to market, buy and sell used vehicles and provide vehicle financing. The increasing use of the Internet in the automotive retail and wholesale industry could have a material adverse effect on our sales and results of operations. In addition, CAF and our third-party financing providers are subject to competition from various financial institutions.

Retail Prices. Any significant changes in retail prices for used and new vehicles could have a material adverse effect on our sales and results of operations. If any of our competitors seek to gain or retain market share by reducing prices for used or new vehicles, we would likely reduce our prices in order to remain competitive, which could result in a decrease in our sales and results of operations and require a change in our operating strategies.

Inventory. A reduction in the availability of or access to sources of inventory could have a material adverse effect on our business. A failure to adjust appraisal offers to stay in line with broader market trade-in offer trends, or a failure to recognize those trends, could adversely affect our ability to acquire inventory. Should we develop excess inventory, the inability to liquidate the excess inventory at prices that allow us to meet margin targets or to recover our costs could have a material adverse effect on our results of operations.

Regulatory and Legislative Environment. We are subject to a wide range of federal, state and local laws and regulations, such as licensing requirements and laws regarding advertising, vehicle sales, financing and employment practices. Our facilities and business operations are also subject to laws and regulations relating to environmental protection and health and safety. The violation of these laws or regulations could result in administrative, civil or criminal penalties or in a cease-and-desist order against business operations. As a result, we have incurred and will continue to incur capital and operating expenses and other costs to comply with these laws and regulations. Further, private plaintiffs and federal, state and local regulatory and law enforcement authorities have increased their scrutiny of advertising, sales, financing and insurance activities in the sale and leasing of motor vehicles. If, as a result, other automotive retailers adopt more transparent, consumer-oriented business practices, our differentiation versus those retailers could be reduced.

Recent federal legislative and regulatory initiatives and reforms may result in an increase in expenses or a decrease in revenues. For example, the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 regulates, among other things, the provision of consumer financing and established a new consumer financial protection agency with broad regulatory powers. This legislation and related regulation could have a material adverse effect on

11

Table of Contents

our results of operations. The Patient Protection and Affordable Care Act of 2010, as it is phased in over time, significantly affects the provision of health care services and may impact the cost of providing our associates with health coverage. Current federal labor policy could lead to increased unionization efforts, which could increase labor costs, disrupt store operations, and have a material adverse effect on our results of operations.

Confidential Customer Information. In the normal course of business, we collect, process and retain sensitive and confidential customer information and may share that information with our third-party service providers. Despite the security measures we have in place and the assurances we have from our third-party providers, our facilities and systems, and those of third-party service providers, could be vulnerable to external or internal security breaches, acts of vandalism, computer viruses, misplaced or lost data, programming or human errors or other similar events. Any security breach involving the misappropriation, loss or other unauthorized disclosure of confidential information, whether experienced by us or by our third-party service providers, and whether due to an external cyber-security incident, a programming error, or other cause, could damage our reputation, expose us to mitigation costs and the risks of private litigation and government enforcement, disrupt our business, or otherwise have a material adverse effect on our sales and results of operations.

Reputation. Our reputation as a company that is founded on the fundamental principle of integrity is critical to our success. Our reputation as a retailer offering high-quality vehicles at competitive, no-haggle prices with a customer-friendly sales process in attractive, modern facilities is also critical to our success. If we fail to maintain the high standards on which this reputation is built, or if an event occurs that damages this reputation, it could adversely affect consumer demand and have a material adverse effect on our business, sales and results of operations. Even the perception of a decrease in the quality of our brand could impact results. Accordingly, if we fail to correct or mitigate misinformation or negative information, including information spread through social media or normal media channels, about the vehicles we offer, our customer experience, or any aspect of our brand, it could have a material adverse effect on our business, sales and results of operations.

Growth. Our inability to acquire or lease suitable real estate at favorable terms could limit our expansion and could have a material adverse effect on our business and results of operations. The expansion of our store base places significant demands on our management team, our associates and our systems. If we fail to effectively or efficiently manage our growth, it could have a material adverse effect on our business, sales and results of operations.

Management and Workforce. Our success depends upon the continued contributions of our store, region and corporate management teams. Consequently, the loss of the services of key employees could have a material adverse effect on our business. In addition, an inability to build our management bench strength to support store growth could have a material adverse effect on our business. Our ability to meet our staffing needs while controlling related costs is subject to numerous external and internal factors, including unemployment levels, prevailing wage rates, changes in employment legislation, competition for qualified employees in the industry and regions in which we operate, and associate relations. An inability to retain qualified associates or a significant increase in labor costs could have a material adverse effect on our business, sales and results of operations.

Information Systems. Our business is dependent upon the integrity and efficient operation of our information systems. In particular, we rely on our information systems to effectively manage sales, inventory, carmax.com, consumer financing and customer information. The failure of these systems to perform as designed could disrupt our business operations and have a material adverse effect on our sales and results of operations. In addition, despite our ongoing efforts to maintain and enhance the integrity and security of these systems, we could be subjected to attacks by hackers, including denial-of-service attacks directed at our websites or other system breaches or malfunctions due to associate error or misconduct or other disruptions. Such incidents could disrupt our business and have a material adverse effect on sales and results of operations.

Accounting Policies and Matters. We have identified several accounting policies as being “critical” to the fair presentation of our financial condition and results of operations because they involve major aspects of our business and require management to make judgments about matters that are inherently uncertain. These policies are described in Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, and the notes to consolidated financial statements included in Item 8. Materially different amounts could be recorded under different conditions or using different assumptions.

Additionally, the Financial Accounting Standards Board has proposed various rule changes including, but not limited to, accounting for leases. The SEC is also currently considering adopting rules that would require U.S. issuers to prepare their financial statements contained in SEC filings in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board. The implementation of these or other new accounting requirements or other changes to U.S. generally accepted accounting principles could have a material adverse effect on our reported results of operations and financial condition.

12

Table of Contents

Litigation. We are subject to various litigation matters, which could have a material adverse effect on our business and results of operations. Claims arising out of actual or alleged violations of law could be asserted against us by individuals, either individually or through class actions, or by governmental entities in civil or criminal investigations and proceedings. These actions could expose us to adverse publicity and to substantial monetary damages and legal defense costs, injunctive relief and criminal and civil fines and penalties, including suspension or revocation of licenses to conduct business.

Automotive Manufacturers. Adverse conditions affecting one or more automotive manufacturers could have a material adverse effect on our results of operations. Manufacturer recalls could also adversely affect used vehicle sales or valuations and could expose us to litigation and adverse publicity related to the sale of a recalled vehicle, which could have a material adverse effect on our business, sales and results of operations.

Weather. The occurrence of severe weather events, such as rain, snow, wind, storms, hurricanes or other natural disasters, could cause store closures, adversely affecting consumer traffic, and could have a material adverse effect on our sales and results of operations in a given period.

Seasonal Fluctuations. Our business is subject to seasonal fluctuations. We generally realize a higher proportion of revenue and operating profit during the first and second fiscal quarters. If conditions arise that impair vehicle sales during the first or second fiscal quarters, these conditions could have a disproportionately large adverse effect on our annual results of operations.

Geographic Concentration. Our performance is subject to local economic, competitive and other conditions prevailing in geographic areas where we operate. Since a large portion of our sales is generated in the Southeastern U.S., including Florida, and in Texas, Southern California and Washington, D.C./Baltimore, our results of operations depend substantially on general economic conditions and consumer spending habits in these markets. In the event that any of these geographic areas experienced a downturn in economic conditions, it could have a material adverse effect on our business, sales and results of operations.

Other Material Events. The occurrence of certain material events including acts of terrorism, the outbreak of war or other significant national or international events could have a material adverse effect on our business, sales, results of operations or financial condition.

13

Table of Contents

| Item 1B. | Unresolved Staff Comments. |

None.

| Item 2. | Properties. |

We conduct our used vehicle operations in two basic retail formats – production and non-production superstores. Production superstores are those locations at which vehicle reconditioning is performed. In determining whether to construct a production or a non-production superstore on a given site, we take several factors into account, including the anticipated long-term regional reconditioning needs and the available acreage of the sites in that market. As a result, some superstores that are constructed to accommodate reconditioning activities may initially be operated as non-production superstores until we expand our presence in that market. As of February 29, 2012, we operated 63 production superstores and 45 non-production superstores. At that date, we also operated one new car store, which was located adjacent to our used car superstore in Laurel, Maryland. Our remaining three new car franchises are operated as part of our used car superstores.

Production superstores are generally 40,000 to 60,000 square feet on 10 to 25 acres, but a few range from 70,000 to 95,000 square feet on 20 to 35 acres. Non-production superstores are generally 10,000 to 25,000 square feet on 4 to 12 acres.

USED CAR SUPERSTORES AS OF FEBRUARY 29, 2012

| Total | ||||

| Alabama |

2 | |||

| Arizona |

3 | |||

| California |

14 | |||

| Colorado |

1 | |||

| Connecticut |

2 | |||

| Florida |

10 | |||

| Georgia |

6 | |||

| Illinois |

6 | |||

| Indiana |

2 | |||

| Kansas |

2 | |||

| Kentucky |

2 | |||

| Louisiana |

1 | |||

| Maryland |

4 | |||

| Massachusetts |

1 | |||

| Mississippi |

1 | |||

| Missouri |

1 | |||

| Nebraska |

1 | |||

| Nevada |

2 | |||

| New Mexico |

1 | |||

| North Carolina |

8 | |||

| Ohio |

4 | |||

| Oklahoma |

2 | |||

| South Carolina |

3 | |||

| Tennessee |

5 | |||

| Texas |

12 | |||

| Utah |

1 | |||

| Virginia |

8 | |||

| Wisconsin |

3 | |||

|

|

|

|||

| Total |

108 | |||

|

|

|

|||

As of February 29, 2012, we leased 58 of our 108 used car superstores, our new car store and our CAF office building in Atlanta, Georgia. We owned the remaining 50 stores currently in operation. We also owned our home office building in Richmond, Virginia, and land associated with planned future store openings.

14

Table of Contents

Expansion

Since opening our first used car superstore in 1993, we have grown organically, through the construction and opening of company-operated stores. We do not franchise our operations. As of February 29, 2012, we operated 108 used car superstores in 53 U.S. markets, which represented approximately 50% of the U.S. population. We believe that further geographic expansion and additional fill-in opportunities in existing markets will provide a foundation for future sales and earnings growth.

In December 2008, we temporarily suspended store growth due to the weak economic and sales environment. We resumed store growth in fiscal 2011, opening three superstores that year and five superstores in fiscal 2012. We plan to open 10 superstores in fiscal 2013 and between 10 and 15 superstores in each of the following 3 fiscal years.

For additional details on our future expansion plans, see “Fiscal 2013 Planned Superstore Openings,” included in Part II, Item 7, of this Form 10-K.

| Item 3. | Legal Proceedings. |

On April 2, 2008, Mr. John Fowler filed a putative class action lawsuit against CarMax Auto Superstores California, LLC and CarMax Auto Superstores West Coast, Inc. in the Superior Court of California, County of Los Angeles. Subsequently, two other lawsuits, Leena Areso et al. v. CarMax Auto Superstores California, LLC and Justin Weaver v. CarMax Auto Superstores California, LLC, were consolidated as part of the Fowler case. The allegations in the consolidated case involved: (1) failure to provide meal and rest breaks or compensation in lieu thereof; (2) failure to pay wages of terminated or resigned employees related to meal and rest breaks and overtime; (3) failure to pay overtime; (4) failure to comply with itemized employee wage statement provisions; (5) unfair competition; and (6) California’s Labor Code Private Attorney General Act. The putative class consisted of sales consultants, sales managers, and other hourly employees who worked for the company in California from April 2, 2004, to the present. On May 12, 2009, the court dismissed all of the class claims with respect to the sales manager putative class. On June 16, 2009, the court dismissed all claims related to the failure to comply with the itemized employee wage statement provisions. The court also granted CarMax’s motion for summary adjudication with regard to CarMax’s alleged failure to pay overtime to the sales consultant putative class. The plaintiffs appealed the court’s ruling regarding the sales consultant overtime claim. On May 20, 2011, the California Court of Appeal affirmed the ruling in favor of CarMax. The plaintiffs filed a Petition of Review with the California Supreme Court, which was denied. As a result, the plaintiffs’ overtime claims are no longer a part of the lawsuit.

The claims currently remaining in the lawsuit regarding the sales consultant putative class are: (1) failure to provide meal and rest breaks or compensation in lieu thereof; (2) failure to pay wages of terminated or resigned employees related to meal and rest breaks; (3) unfair competition; and (4) California’s Labor Code Private Attorney General Act. On June 16, 2009, the court entered a stay of these claims pending the outcome of a California Supreme Court case involving unrelated third parties but related legal issues. Subsequently, CarMax moved to lift the stay and compel the plaintiffs’ remaining claims into arbitration on an individual basis, which the court granted on November 21, 2011. The plaintiffs appealed the court’s ruling to the California Court of Appeal. The appeal is pending. The Fowler lawsuit seeks compensatory and special damages, wages, interest, civil and statutory penalties, restitution, injunctive relief and the recovery of attorneys’ fees. We are unable to make a reasonable estimate of the amount or range of loss that could result from an unfavorable outcome in these matters.

We are involved in various other legal proceedings in the normal course of business. Based upon our evaluation of information currently available, we believe that the ultimate resolution of any such proceedings will not have a material adverse effect, either individually or in the aggregate, on our financial condition, results of operations or cash flows.

| Item 4. | Mine Safety Disclosures. |

None.

15

Table of Contents

Item 5. Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Our common stock is listed and traded on the New York Stock Exchange under the ticker symbol KMX. We are authorized to issue up to 350,000,000 shares of common stock and up to 20,000,000 shares of preferred stock. As of February 29, 2012, there were 227,118,666 shares of CarMax common stock outstanding and there were approximately 4,400 shareholders of record. As of that date, there were no preferred shares outstanding.

The following table presents the quarterly high and low sales prices per share for our common stock for each quarter during the last two fiscal years, as reported on the New York Stock Exchange composite tape.

| 1st Quarter |

2nd Quarter |

3rd Quarter |

4th Quarter |

|||||||||||||

| Fiscal 2012 |

||||||||||||||||

| High |

$ | 35.98 | $ | 34.81 | $ | 31.73 | $ | 33.48 | ||||||||

| Low |

$ | 28.39 | $ | 25.18 | $ | 22.77 | $ | 28.44 | ||||||||

| Fiscal 2011 |

||||||||||||||||

| High |

$ | 26.50 | $ | 22.55 | $ | 34.37 | $ | 37.02 | ||||||||

| Low |

$ | 20.30 | $ | 18.62 | $ | 20.24 | $ | 31.10 | ||||||||

To date, we have not paid a cash dividend on CarMax common stock. We believe it is prudent to retain our net earnings for use in operations and for geographic expansion, as well as to maintain maximum financial flexibility and liquidity for our business. Therefore, we do not anticipate paying any cash dividends in the foreseeable future.

During the fourth quarter of fiscal 2012, we sold no CarMax equity securities that were not registered under the Securities Act of 1933, as amended. In addition, we did not repurchase any CarMax equity securities during this period.

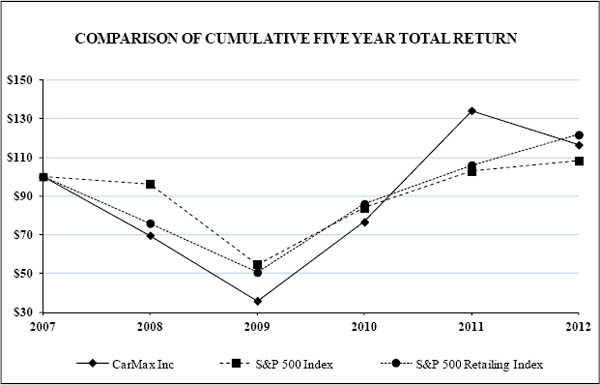

Performance Graph

The following graph compares the cumulative total shareholder return (stock price appreciation plus dividends, as applicable) on our common stock for the last five fiscal years with the cumulative total return of the S&P 500 Index and the S&P 500 Retailing Index. The graph assumes an original investment of $100 in CarMax common stock and in each index on February 28, 2007, and the reinvestment of all dividends, as applicable.

16

Table of Contents

| As of February 29 or 28 | ||||||||||||||||||||||||

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |||||||||||||||||||

| CarMax |

$ | 100.00 | $ | 69.68 | $ | 35.79 | $ | 76.63 | $ | 134.24 | $ | 116.49 | ||||||||||||

| S&P 500 Index |

$ | 100.00 | $ | 96.41 | $ | 54.63 | $ | 83.92 | $ | 102.86 | $ | 108.12 | ||||||||||||

| S&P 500 Retailing Index |

$ | 100.00 | $ | 75.93 | $ | 50.54 | $ | 86.01 | $ | 106.02 | $ | 121.71 | ||||||||||||

17

Table of Contents

| Item 6. | Selected Financial Data. |

| (Dollars and shares in millions, except per share) |

FY12 | FY11 (1)(2) | FY10 (1) | FY09 (1) | FY08 (1) | FY07 (1) | ||||||||||||||||||

| Income statement information |

||||||||||||||||||||||||

| Used vehicle sales |

$ | 7,826.9 | $ | 7,210.0 | $ | 6,192.3 | $ | 5,690.7 | $ | 6,589.3 | $ | 5,872.8 | ||||||||||||

| New vehicle sales |

200.6 | 198.5 | 186.5 | 261.9 | 370.6 | 445.1 | ||||||||||||||||||

| Wholesale vehicle sales |

1,721.6 | 1,301.7 | 844.9 | 779.8 | 985.0 | 918.4 | ||||||||||||||||||

| Other sales and revenues |

254.5 | 265.3 | 246.6 | 241.6 | 254.6 | 229.3 | ||||||||||||||||||

| Net sales and operating revenues |

10,003.6 | 8,975.6 | 7,470.2 | 6,974.0 | 8,199.6 | 7,465.7 | ||||||||||||||||||

| Gross profit |

1,378.8 | 1,301.2 | 1,098.9 | 968.2 | 1,072.4 | 971.1 | ||||||||||||||||||

| CarMax Auto Finance income |

262.2 | 220.0 | 175.2 | 15.3 | 85.9 | 132.6 | ||||||||||||||||||

| SG&A |

940.8 | 878.8 | 792.2 | 856.1 | 832.4 | 750.4 | ||||||||||||||||||

| Interest expense |

33.7 | 34.7 | 36.0 | 38.6 | 38.0 | 39.0 | ||||||||||||||||||

| Earnings before income taxes |

666.9 | 608.2 | 446.5 | 90.5 | 289.9 | 315.4 | ||||||||||||||||||

| Income tax provision |

253.1 | 230.7 | 168.6 | 35.2 | 112.5 | 122.0 | ||||||||||||||||||

| Net earnings |

413.8 | 377.5 | 277.8 | 55.2 | 177.5 | 193.4 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Share and per share information |

||||||||||||||||||||||||

| Weighted average basic shares outstanding |

226.3 | 223.4 | 219.5 | 217.5 | 216.0 | 212.5 | ||||||||||||||||||

| Weighted average diluted shares outstanding |

230.7 | 227.6 | 222.2 | 219.4 | 220.0 | 216.6 | ||||||||||||||||||

| Basic net earnings per share |

$ | 1.83 | $ | 1.68 | $ | 1.25 | $ | 0.25 | $ | 0.82 | $ | 0.91 | ||||||||||||

| Diluted net earnings per share |

$ | 1.79 | $ | 1.65 | $ | 1.24 | $ | 0.25 | $ | 0.80 | $ | 0.89 | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Balance sheet information |

||||||||||||||||||||||||

| Total current assets |

$ | 1,853.4 | $ | 1,410.1 | $ | 1,556.4 | $ | 1,287.8 | $ | 1,356.9 | $ | 1,150.5 | ||||||||||||

| Auto loan receivables, net |

4,959.8 | 4,320.6 | — | — | — | — | ||||||||||||||||||

| Total assets |

8,331.5 | 7,125.5 | 2,856.4 | 2,693.6 | 2,646.0 | 2,211.5 | ||||||||||||||||||

| Total current liabilities |

646.3 | 522.7 | 490.5 | 502.7 | 500.7 | 521.4 | ||||||||||||||||||

| Short-term debt and current portion: |

||||||||||||||||||||||||

| Non-recourse notes payable |

174.3 | 132.5 | — | — | — | — | ||||||||||||||||||

| Other |

15.1 | 13.6 | 133.6 | 168.2 | 108.6 | 158.3 | ||||||||||||||||||

| Non-current debt: |

||||||||||||||||||||||||

| Non-recourse notes payable |

4,509.8 | 3,881.1 | — | — | — | — | ||||||||||||||||||

| Other |

353.6 | 367.6 | 378.5 | 539.6 | 581.3 | 395.8 | ||||||||||||||||||

| Total shareholders’ equity |

2,673.1 | 2,239.2 | 1,884.6 | 1,547.9 | 1,447.7 | 1,210.7 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Unit sales information |

||||||||||||||||||||||||

| Used vehicle units sold |

408,080 | 396,181 | 357,129 | 345,465 | 377,244 | 337,021 | ||||||||||||||||||

| Wholesale vehicle units sold |

316,649 | 263,061 | 197,382 | 194,081 | 222,406 | 208,959 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Percent changes in |

||||||||||||||||||||||||

| Comparable store used vehicle unit sales |

1 | 10 | 1 | (16 | ) | 3 | 9 | |||||||||||||||||

| Total used vehicle unit sales |

3 | 11 | 3 | (8 | ) | 12 | 16 | |||||||||||||||||

| Wholesale vehicle unit sales |

20 | 33 | 2 | (13 | ) | 6 | 16 | |||||||||||||||||

| Net sales and operating revenues |

11 | 20 | 7 | (15 | ) | 10 | 19 | |||||||||||||||||

| Net earnings |

10 | 36 | 403 | (69 | ) | (8 | ) | 50 | ||||||||||||||||

| Diluted net earnings per share |

8 | 33 | 396 | (69 | ) | (10 | ) | 46 | ||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| Other year-end information |

||||||||||||||||||||||||

| Used car superstores |

108 | 103 | 100 | 100 | 89 | 77 | ||||||||||||||||||

| Associates |

16,460 | 15,565 | 13,439 | 13,035 | 15,637 | 13,736 | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|||||||||||||

| (1) | As discussed in Note 2(K), amounts reflect the revisions to correct our accounting for sale-leaseback transactions. |

| (2) | As discussed in Note 2(E), fiscal 2011 reflects the adoption of ASU Nos. 2009-16 and 2009-17 effective March 1, 2010. |

18

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) is provided as a supplement to, and should be read in conjunction with, our audited consolidated financial statements and the accompanying notes presented in Item 8, Consolidated Financial Statements and Supplementary Data. Note references are to the notes to consolidated financial statements included in Item 8. Certain prior year amounts have been reclassified to conform to the current year’s presentation. All references to net earnings per share are to diluted net earnings per share. Amounts and percentages may not total due to rounding.

In fiscal 2012, we revised our consolidated financial statements for fiscal 2011 and fiscal 2010 to correct our accounting for sale-leaseback transactions. See Note 2(K) for additional information. As of March 1, 2010, we adopted new accounting rules related to securitizations that affected the timing of the recognition of CarMax Auto Finance (“CAF”) income and resulted in the consolidation of the auto loan receivables and related non-recourse notes payable that previously were reflected as off-balance sheet items. The new rules were adopted on a prospective basis and prior year balances have not been restated. See Notes 2(E), 3, 4 and 5 for additional information.

BUSINESS OVERVIEW

General