false--02-28Q120210001170010126692000012985360000.50.5350000000350000000163081376162755339163081376162755339P0Y1577960004372130000P1YP3YP3YP3YP1Y

0001170010

2020-03-01

2020-05-31

0001170010

2020-06-29

0001170010

us-gaap:NonoperatingIncomeExpenseMember

2019-03-01

2019-05-31

0001170010

us-gaap:NonoperatingIncomeExpenseMember

2020-03-01

2020-05-31

0001170010

kmx:NetSalesAndOperatingRevenuesMember

2019-03-01

2019-05-31

0001170010

kmx:IncomeTaxProvisionMember

2019-03-01

2019-05-31

0001170010

kmx:OtherMember

us-gaap:CostOfSalesMember

2020-03-01

2020-05-31

0001170010

kmx:WholesaleVehiclesMember

2019-03-01

2019-05-31

0001170010

2019-03-01

2019-05-31

0001170010

kmx:OtherMember

kmx:NetSalesAndOperatingRevenuesMember

2020-03-01

2020-05-31

0001170010

kmx:OtherMember

2019-03-01

2019-05-31

0001170010

kmx:NetIncomeLossFromFinancingMember

2020-03-01

2020-05-31

0001170010

kmx:UsedVehiclesMember

us-gaap:CostOfSalesMember

2020-03-01

2020-05-31

0001170010

us-gaap:InterestExpenseMember

2019-03-01

2019-05-31

0001170010

kmx:OtherMember

kmx:NetSalesAndOperatingRevenuesMember

2019-03-01

2019-05-31

0001170010

us-gaap:InterestExpenseMember

2020-03-01

2020-05-31

0001170010

kmx:UsedVehiclesMember

us-gaap:CostOfSalesMember

2019-03-01

2019-05-31

0001170010

kmx:NetEarningsMember

2019-03-01

2019-05-31

0001170010

kmx:WholesaleVehiclesMember

kmx:NetSalesAndOperatingRevenuesMember

2019-03-01

2019-05-31

0001170010

kmx:NetSalesAndOperatingRevenuesMember

2020-03-01

2020-05-31

0001170010

kmx:OtherMember

2020-03-01

2020-05-31

0001170010

kmx:WholesaleVehiclesMember

2020-03-01

2020-05-31

0001170010

kmx:OtherMember

us-gaap:CostOfSalesMember

2019-03-01

2019-05-31

0001170010

us-gaap:CostOfSalesMember

2020-03-01

2020-05-31

0001170010

kmx:UsedVehiclesMember

2020-03-01

2020-05-31

0001170010

kmx:WholesaleVehiclesMember

us-gaap:CostOfSalesMember

2020-03-01

2020-05-31

0001170010

kmx:GrossProfitMember

2020-03-01

2020-05-31

0001170010

kmx:UsedVehiclesMember

kmx:NetSalesAndOperatingRevenuesMember

2020-03-01

2020-05-31

0001170010

kmx:UsedVehiclesMember

2019-03-01

2019-05-31

0001170010

kmx:EarningsBeforeIncomeTaxesMember

2019-03-01

2019-05-31

0001170010

kmx:NetIncomeLossFromFinancingMember

2019-03-01

2019-05-31

0001170010

kmx:WholesaleVehiclesMember

kmx:NetSalesAndOperatingRevenuesMember

2020-03-01

2020-05-31

0001170010

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-03-01

2019-05-31

0001170010

us-gaap:CostOfSalesMember

2019-03-01

2019-05-31

0001170010

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2020-03-01

2020-05-31

0001170010

kmx:WholesaleVehiclesMember

us-gaap:CostOfSalesMember

2019-03-01

2019-05-31

0001170010

kmx:IncomeTaxProvisionMember

2020-03-01

2020-05-31

0001170010

kmx:NetEarningsMember

2020-03-01

2020-05-31

0001170010

kmx:EarningsBeforeIncomeTaxesMember

2020-03-01

2020-05-31

0001170010

kmx:UsedVehiclesMember

kmx:NetSalesAndOperatingRevenuesMember

2019-03-01

2019-05-31

0001170010

kmx:GrossProfitMember

2019-03-01

2019-05-31

0001170010

2020-05-31

0001170010

2020-02-29

0001170010

2019-05-31

0001170010

2019-02-28

0001170010

us-gaap:AdditionalPaidInCapitalMember

2020-03-01

2020-05-31

0001170010

us-gaap:CommonStockMember

2020-03-01

2020-05-31

0001170010

us-gaap:CommonStockMember

2020-02-29

0001170010

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-05-31

0001170010

us-gaap:CommonStockMember

2020-05-31

0001170010

us-gaap:AccountingStandardsUpdate201613Member

us-gaap:RetainedEarningsMember

2020-03-01

2020-05-31

0001170010

us-gaap:AdditionalPaidInCapitalMember

2020-05-31

0001170010

us-gaap:AccountingStandardsUpdate201613Member

2020-03-01

2020-05-31

0001170010

us-gaap:RetainedEarningsMember

2020-05-31

0001170010

us-gaap:AdditionalPaidInCapitalMember

2020-02-29

0001170010

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-02-29

0001170010

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2020-03-01

2020-05-31

0001170010

us-gaap:RetainedEarningsMember

2020-03-01

2020-05-31

0001170010

us-gaap:RetainedEarningsMember

2020-02-29

0001170010

us-gaap:AdditionalPaidInCapitalMember

2019-03-01

2019-05-31

0001170010

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-05-31

0001170010

us-gaap:CommonStockMember

2019-02-28

0001170010

us-gaap:CommonStockMember

2019-03-01

2019-05-31

0001170010

us-gaap:AdditionalPaidInCapitalMember

2019-05-31

0001170010

us-gaap:RetainedEarningsMember

2019-02-28

0001170010

us-gaap:RetainedEarningsMember

2019-05-31

0001170010

us-gaap:CommonStockMember

2019-05-31

0001170010

us-gaap:RetainedEarningsMember

2019-03-01

2019-05-31

0001170010

us-gaap:AdditionalPaidInCapitalMember

2019-02-28

0001170010

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-02-28

0001170010

us-gaap:AccumulatedOtherComprehensiveIncomeMember

2019-03-01

2019-05-31

0001170010

us-gaap:AccountingStandardsUpdate201613Member

2020-03-01

0001170010

kmx:OtherMember

2020-03-01

2020-05-31

0001170010

kmx:OtherDomain

2020-03-01

2020-05-31

0001170010

kmx:ThirdpartyfinancefeesDomain

2019-03-01

2019-05-31

0001170010

kmx:ThirdpartyfinancefeesDomain

2020-03-01

2020-05-31

0001170010

kmx:UsedVehiclesMember

2019-03-01

2019-05-31

0001170010

kmx:ExtendedprotectionplanDomain

2020-03-01

2020-05-31

0001170010

kmx:ServiceDomain

2020-03-01

2020-05-31

0001170010

kmx:ServiceDomain

2019-03-01

2019-05-31

0001170010

kmx:WholesaleVehiclesMember

2019-03-01

2019-05-31

0001170010

kmx:OtherMember

2019-03-01

2019-05-31

0001170010

kmx:WholesaleVehiclesMember

2020-03-01

2020-05-31

0001170010

kmx:UsedVehiclesMember

2020-03-01

2020-05-31

0001170010

kmx:ExtendedprotectionplanDomain

2019-03-01

2019-05-31

0001170010

kmx:OtherDomain

2019-03-01

2019-05-31

0001170010

kmx:TotalDirectExpensesMember

2020-03-01

2020-05-31

0001170010

kmx:OtherDirectExpensesMember

2019-03-01

2019-05-31

0001170010

kmx:TotalOtherNonoperatingExpenseIncomePercentMember

2019-03-01

2019-05-31

0001170010

kmx:TotalOtherNonoperatingExpenseIncomePercentMember

2020-03-01

2020-05-31

0001170010

kmx:PayrollAndFringeBenefitExpenseMember

2019-03-01

2019-05-31

0001170010

kmx:OtherDirectExpensesMember

2020-03-01

2020-05-31

0001170010

kmx:ProvisionForLoanLossesMember

2020-03-01

2020-05-31

0001170010

kmx:TotalDirectExpensesMember

2019-03-01

2019-05-31

0001170010

kmx:InterestIncomeExpenseNetMember

2020-03-01

2020-05-31

0001170010

kmx:TotalInterestMarginAfterProvisionForLoanLossesMember

2019-03-01

2019-05-31

0001170010

kmx:TotalInterestMarginAfterProvisionForLoanLossesMember

2020-03-01

2020-05-31

0001170010

kmx:InterestAndFeeIncomeMember

2020-03-01

2020-05-31

0001170010

kmx:ProvisionForLoanLossesMember

2019-03-01

2019-05-31

0001170010

kmx:CarmaxAutoFinanceIncomeMember

2019-03-01

2019-05-31

0001170010

kmx:InterestAndFeeIncomeMember

2019-03-01

2019-05-31

0001170010

kmx:InterestIncomeExpenseNetMember

2019-03-01

2019-05-31

0001170010

kmx:CarmaxAutoFinanceIncomeMember

2020-03-01

2020-05-31

0001170010

kmx:PayrollAndFringeBenefitExpenseMember

2020-03-01

2020-05-31

0001170010

us-gaap:AllowanceForLoanAndLeaseLossesMember

2019-02-28

0001170010

2020-03-01

0001170010

us-gaap:AllowanceForLoanAndLeaseLossesMember

2020-05-31

0001170010

us-gaap:AllowanceForLoanAndLeaseLossesMember

2020-03-01

0001170010

us-gaap:AllowanceForLoanAndLeaseLossesMember

2020-02-29

0001170010

us-gaap:AllowanceForLoanAndLeaseLossesMember

2019-05-31

0001170010

kmx:CreditGradeBMember

2020-02-29

0001170010

kmx:CreditGradeCAndOtherMember

2020-02-29

0001170010

kmx:CreditGradeAMember

2020-02-29

0001170010

kmx:COVID19impactsMember

2020-03-01

2020-05-31

0001170010

kmx:CurrentPeriodOriginationsMember

2020-03-01

2020-05-31

0001170010

kmx:ThirtyOneToSixtyDaysPastDueMember

kmx:CreditGradeAMember

2020-05-31

0001170010

kmx:CreditGradeAMember

2020-05-31

0001170010

kmx:ThirtyOneToSixtyDaysPastDueMember

kmx:CreditGradeCAndOtherMember

2020-05-31

0001170010

kmx:GreaterThanNinetyDaysPastDueMember

kmx:CreditGradeCAndOtherMember

2020-05-31

0001170010

kmx:GreaterThanNinetyDaysPastDueMember

kmx:CreditGradeAMember

2020-05-31

0001170010

us-gaap:FinancingReceivables1To29DaysPastDueMember

2020-05-31

0001170010

kmx:ManagedReceivablesMember

2020-05-31

0001170010

kmx:SixtyOneToNinetyDaysPastDueMember

kmx:CreditGradeBMember

2020-05-31

0001170010

kmx:SixtyOneToNinetyDaysPastDueMember

2020-05-31

0001170010

kmx:CreditGradeCAndOtherMember

2020-05-31

0001170010

kmx:SixtyOneToNinetyDaysPastDueMember

kmx:CreditGradeCAndOtherMember

2020-05-31

0001170010

kmx:GreaterThanNinetyDaysPastDueMember

2020-05-31

0001170010

kmx:ThirtyOneToSixtyDaysPastDueMember

2020-05-31

0001170010

kmx:CreditGradeBMember

2020-05-31

0001170010

kmx:ThirtyOneToSixtyDaysPastDueMember

kmx:CreditGradeBMember

2020-05-31

0001170010

kmx:SixtyOneToNinetyDaysPastDueMember

kmx:CreditGradeAMember

2020-05-31

0001170010

kmx:GreaterThanNinetyDaysPastDueMember

kmx:CreditGradeBMember

2020-05-31

0001170010

kmx:SixtyOneToNinetyDaysPastDueMember

2020-02-29

0001170010

kmx:ManagedReceivablesMember

2020-02-29

0001170010

kmx:GreaterThanNinetyDaysPastDueMember

2020-02-29

0001170010

kmx:ThirtyOneToSixtyDaysPastDueMember

2020-02-29

0001170010

kmx:OtherReceivablesMember

2020-02-29

0001170010

kmx:TermSecuritizationsMember

2020-05-31

0001170010

kmx:TermSecuritizationsMember

2020-02-29

0001170010

kmx:WarehouseFacilitiesReceivablesMember

2020-05-31

0001170010

kmx:OtherReceivablesMember

2020-05-31

0001170010

kmx:WarehouseFacilitiesReceivablesMember

2020-02-29

0001170010

kmx:ExcessCollateralMember

2020-02-29

0001170010

kmx:ExcessCollateralMember

2020-05-31

0001170010

us-gaap:CashFlowHedgingMember

us-gaap:InterestRateSwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2020-03-01

2020-05-31

0001170010

us-gaap:CashFlowHedgingMember

us-gaap:InterestRateSwapMember

us-gaap:NondesignatedMember

2020-05-31

0001170010

us-gaap:CashFlowHedgingMember

us-gaap:InterestRateSwapMember

us-gaap:NondesignatedMember

2020-03-01

2020-05-31

0001170010

us-gaap:CashFlowHedgingMember

us-gaap:InterestRateSwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2020-02-29

0001170010

us-gaap:CashFlowHedgingMember

us-gaap:InterestRateSwapMember

us-gaap:DesignatedAsHedgingInstrumentMember

2020-05-31

0001170010

us-gaap:FairValueInputsLevel1Member

2020-05-31

0001170010

us-gaap:FairValueInputsLevel2Member

2020-05-31

0001170010

us-gaap:DesignatedAsHedgingInstrumentMember

2020-05-31

0001170010

us-gaap:NondesignatedMember

2020-05-31

0001170010

us-gaap:FairValueInputsLevel1Member

us-gaap:NondesignatedMember

2020-05-31

0001170010

us-gaap:FairValueInputsLevel2Member

us-gaap:DesignatedAsHedgingInstrumentMember

2020-05-31

0001170010

us-gaap:FairValueInputsLevel1Member

us-gaap:DesignatedAsHedgingInstrumentMember

2020-05-31

0001170010

us-gaap:FairValueInputsLevel2Member

us-gaap:NondesignatedMember

2020-05-31

0001170010

us-gaap:FairValueInputsLevel2Member

2020-02-29

0001170010

us-gaap:FairValueInputsLevel1Member

2020-02-29

0001170010

us-gaap:FairValueInputsLevel1Member

us-gaap:DesignatedAsHedgingInstrumentMember

2020-02-29

0001170010

us-gaap:DesignatedAsHedgingInstrumentMember

2020-02-29

0001170010

us-gaap:FairValueInputsLevel2Member

us-gaap:DesignatedAsHedgingInstrumentMember

2020-02-29

0001170010

kmx:WarehouseFacilitiesMember

2020-05-31

0001170010

kmx:WarehouseFacilityOneMember

2020-05-31

0001170010

kmx:WarehouseFacilityThreeMember

2020-05-31

0001170010

kmx:TermSecuritizationsDebtMember

2020-05-31

0001170010

kmx:WarehouseFacilityTwoMember

2020-05-31

0001170010

kmx:A4.27seniornotesdue2028Member

2020-05-31

0001170010

kmx:A4.17seniornotesdue2026Member

2020-02-29

0001170010

kmx:A4.27seniornotesdue2028Member

2020-02-29

0001170010

kmx:A4.17seniornotesdue2026Member

2020-05-31

0001170010

kmx:TermLoanMember

2020-02-29

0001170010

us-gaap:RevolvingCreditFacilityMember

2020-05-31

0001170010

kmx:A3.86seniornotesdues2023Member

2020-02-29

0001170010

kmx:TermLoanMember

2020-05-31

0001170010

us-gaap:RevolvingCreditFacilityMember

2020-02-29

0001170010

kmx:A3.86seniornotesdues2023Member

2020-05-31

0001170010

us-gaap:LineOfCreditMember

2020-05-31

0001170010

kmx:TermLoanMember

2020-05-31

0001170010

srt:MaximumMember

kmx:FinancingObligationMember

2020-03-01

2020-05-31

0001170010

srt:MinimumMember

kmx:FinancingObligationMember

2020-03-01

2020-05-31

0001170010

us-gaap:SeniorNotesMember

2020-05-31

0001170010

kmx:ShareRepurchaseProgramMember

2020-03-01

2020-05-31

0001170010

kmx:ShareRepurchaseProgramMember

2019-05-31

0001170010

kmx:ShareRepurchaseProgramMember

2019-03-01

2019-05-31

0001170010

kmx:ShareRepurchaseProgramMember

2020-05-31

0001170010

kmx:CashSettledRestrictedStockUnitsMember

2020-03-01

2020-05-31

0001170010

kmx:CashSettledRestrictedStockUnitsMember

2019-03-01

2019-05-31

0001170010

kmx:DeferredStockUnitsMember

2020-03-01

2020-05-31

0001170010

us-gaap:RestrictedStockMember

2019-03-01

2019-05-31

0001170010

us-gaap:EmployeeStockOptionMember

2020-03-01

2020-05-31

0001170010

kmx:OthersharebasedincentivesMember

2020-03-01

2020-05-31

0001170010

kmx:DeferredStockUnitsMember

2019-03-01

2019-05-31

0001170010

kmx:StockSettledRestrictedStockUnitsMember

2019-03-01

2019-05-31

0001170010

us-gaap:EmployeeStockMember

2019-03-01

2019-05-31

0001170010

kmx:OthersharebasedincentivesMember

2019-03-01

2019-05-31

0001170010

us-gaap:PerformanceSharesMember

2020-03-01

2020-05-31

0001170010

us-gaap:EmployeeStockMember

2020-03-01

2020-05-31

0001170010

us-gaap:RestrictedStockMember

2020-03-01

2020-05-31

0001170010

kmx:StockSettledRestrictedStockUnitsMember

2020-03-01

2020-05-31

0001170010

us-gaap:PerformanceSharesMember

2019-03-01

2019-05-31

0001170010

us-gaap:EmployeeStockOptionMember

2019-03-01

2019-05-31

0001170010

srt:MaximumMember

2020-05-31

0001170010

srt:MinimumMember

2020-05-31

0001170010

kmx:StockSettledRestrictedStockUnitsMember

2020-05-31

0001170010

kmx:StockSettledRestrictedStockUnitsMember

2020-02-29

0001170010

us-gaap:RestrictedStockMember

2020-05-31

0001170010

us-gaap:StockOptionMember

2020-03-01

2020-05-31

0001170010

srt:MaximumMember

us-gaap:PerformanceSharesMember

2020-03-01

2020-05-31

0001170010

srt:MaximumMember

kmx:StockSettledRestrictedStockUnitsMember

2020-03-01

2020-05-31

0001170010

us-gaap:PerformanceSharesMember

kmx:Fiscal2020GrantsYear1Member

2020-03-01

2020-05-31

0001170010

kmx:DeferredStockUnitsMember

2020-05-31

0001170010

srt:MinimumMember

kmx:StockSettledRestrictedStockUnitsMember

2020-03-01

2020-05-31

0001170010

srt:MinimumMember

us-gaap:PerformanceSharesMember

2020-03-01

2020-05-31

0001170010

us-gaap:PerformanceSharesMember

2020-05-31

0001170010

us-gaap:PerformanceSharesMember

kmx:Fiscal2018grantsMember

2020-03-01

2020-05-31

0001170010

srt:MinimumMember

kmx:CashSettledRestrictedStockUnitsMember

2020-03-01

2020-05-31

0001170010

srt:MaximumMember

kmx:CashSettledRestrictedStockUnitsMember

2020-03-01

2020-05-31

0001170010

us-gaap:PerformanceSharesMember

kmx:Fiscal2020GrantsPerformanceTargetNotSetMember

2020-05-31

0001170010

us-gaap:StockOptionMember

2019-03-01

2019-05-31

0001170010

us-gaap:StockOptionMember

2020-05-31

0001170010

kmx:OthersharebasedincentivesMember

2020-05-31

0001170010

us-gaap:StockOptionMember

2020-02-29

0001170010

us-gaap:CostOfSalesMember

2020-03-01

2020-05-31

0001170010

kmx:CarmaxAutoFinanceIncomeMember

2020-03-01

2020-05-31

0001170010

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2020-03-01

2020-05-31

0001170010

us-gaap:SellingGeneralAndAdministrativeExpensesMember

2019-03-01

2019-05-31

0001170010

kmx:CarmaxAutoFinanceIncomeMember

2019-03-01

2019-05-31

0001170010

us-gaap:CostOfSalesMember

2019-03-01

2019-05-31

0001170010

kmx:CashSettledRestrictedStockUnitsMember

2020-02-29

0001170010

kmx:CashSettledRestrictedStockUnitsMember

2020-05-31

0001170010

srt:MinimumMember

us-gaap:RestrictedStockMember

2020-03-01

2020-05-31

0001170010

srt:MaximumMember

us-gaap:RestrictedStockMember

2020-03-01

2020-05-31

0001170010

us-gaap:EmployeeStockOptionMember

2019-03-01

2019-05-31

0001170010

kmx:StockSettledStockUnitsAndAwardsMember

2020-03-01

2020-05-31

0001170010

us-gaap:EmployeeStockOptionMember

2020-03-01

2020-05-31

0001170010

kmx:StockSettledStockUnitsAndAwardsMember

2019-03-01

2019-05-31

0001170010

kmx:CarmaxAutoFinanceMember

2020-03-01

2020-05-31

0001170010

kmx:CarmaxAutoFinanceMember

2019-03-01

2019-05-31

0001170010

kmx:UnrecognizedActuarialLossesMember

2020-02-29

0001170010

kmx:UnrecognizedHedgeLossesMember

2020-02-29

0001170010

kmx:UnrecognizedHedgeLossesMember

2020-03-01

2020-05-31

0001170010

kmx:UnrecognizedActuarialLossesMember

2020-03-01

2020-05-31

0001170010

kmx:UnrecognizedActuarialLossesMember

2020-05-31

0001170010

kmx:UnrecognizedHedgeLossesMember

2020-05-31

0001170010

srt:MinimumMember

us-gaap:RealEstateMember

2020-03-01

2020-05-31

0001170010

srt:MinimumMember

us-gaap:EquipmentMember

2020-03-01

2020-05-31

0001170010

srt:MaximumMember

2020-03-01

2020-05-31

0001170010

srt:MinimumMember

2020-03-01

2020-05-31

0001170010

srt:MaximumMember

us-gaap:RealEstateMember

2020-03-01

2020-05-31

0001170010

srt:MaximumMember

us-gaap:EquipmentMember

2020-03-01

2020-05-31

iso4217:USD

xbrli:shares

iso4217:USD

kmx:segment

xbrli:pure

xbrli:shares

utreg:Rate

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

|

| |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Quarterly Period Ended May 31, 2020

OR

|

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission File Number: 1-31420

CARMAX, INC.

(Exact name of registrant as specified in its charter)

|

| | | |

Virginia | | 54-1821055 |

(State or other jurisdiction of incorporation) | | (I.R.S. Employer Identification No.) |

| |

12800 Tuckahoe Creek Parkway | | 23238 |

Richmond, | Virginia | | |

(Address of Principal Executive Offices) | | (Zip Code) |

(804) 747-0422

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock | KMX | New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

| | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date.

|

| | |

Class | | Outstanding as of June 29, 2020 |

Common Stock, par value $0.50 | | 163,077,762 |

CARMAX, INC. AND SUBSIDIARIES

TABLE OF CONTENTS

|

| | | |

| Page No. |

PART I. | FINANCIAL INFORMATION | |

| | | |

| Item 1. | Financial Statements: | |

| | | |

| | Consolidated Statements of Earnings (Unaudited) – | |

| | Three Months Ended May 31, 2020 and 2019 | |

| | | |

| | Consolidated Statements of Comprehensive Income (Unaudited) – | |

| | Three Months Ended May 31, 2020 and 2019 | |

| | | |

| | Consolidated Balance Sheets (Unaudited) – | |

| | May 31, 2020 and February 29, 2020 | |

| | | |

| | Consolidated Statements of Cash Flows (Unaudited) – | |

| | Three Months Ended May 31, 2020 and 2019 | |

| | | |

| | Consolidated Statements of Shareholders’ Equity (Unaudited) – | |

| | Three Months Ended May 31, 2020 and 2019 | |

| | | |

| | Notes to Consolidated Financial Statements (Unaudited) | |

| | | |

| Item 2. | Management’s Discussion and Analysis of Financial Condition and | |

| | Results of Operations | |

| | | |

| Item 3. | Quantitative and Qualitative Disclosures About Market Risk | |

| | | |

| Item 4. | Controls and Procedures | |

| | | |

PART II. | OTHER INFORMATION | |

| | | |

| Item 1. | Legal Proceedings | |

| | | |

| Item 1A. | Risk Factors | |

| | | |

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds | |

| | | |

| Item 6. | Exhibits | |

| | | |

SIGNATURES | |

| |

PART I. FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Earnings

(Unaudited)

|

| | | | | | | | | | | |

| Three Months Ended May 31 |

(In thousands except per share data) | 2020 | %(1) | | 2019 | %(1) |

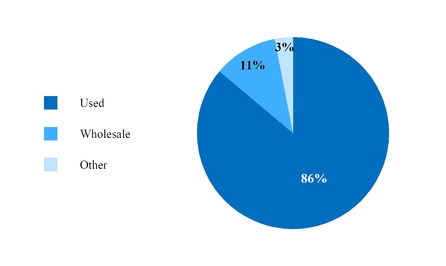

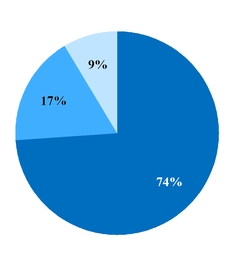

SALES AND OPERATING REVENUES: | | | | | |

Used vehicle sales | $ | 2,786,202 |

| 86.3 |

| | $ | 4,540,657 |

| 84.6 |

|

Wholesale vehicle sales | 342,852 |

| 10.6 |

| | 662,449 |

| 12.3 |

|

Other sales and revenues | 99,728 |

| 3.1 |

| | 163,212 |

| 3.0 |

|

NET SALES AND OPERATING REVENUES | 3,228,782 |

| 100.0 |

| | 5,366,318 |

| 100.0 |

|

COST OF SALES: | | | | | |

Used vehicle cost of sales | 2,524,676 |

| 78.2 |

| | 4,043,824 |

| 75.4 |

|

Wholesale vehicle cost of sales | 280,922 |

| 8.7 |

| | 536,490 |

| 10.0 |

|

Other cost of sales | 69,001 |

| 2.1 |

| | 43,621 |

| 0.8 |

|

TOTAL COST OF SALES | 2,874,599 |

| 89.0 |

| | 4,623,935 |

| 86.2 |

|

GROSS PROFIT | 354,183 |

| 11.0 |

| | 742,383 |

| 13.8 |

|

CARMAX AUTO FINANCE INCOME | 50,950 |

| 1.6 |

| | 115,959 |

| 2.2 |

|

Selling, general and administrative expenses | 373,716 |

| 11.6 |

| | 489,660 |

| 9.1 |

|

Interest expense | 23,958 |

| 0.7 |

| | 17,784 |

| 0.3 |

|

Other expense (income) | 3,295 |

| 0.1 |

| | (359 | ) | — |

|

Earnings before income taxes | 4,164 |

| 0.1 |

| | 351,257 |

| 6.5 |

|

Income tax provision | (814 | ) | — |

| | 84,513 |

| 1.6 |

|

NET EARNINGS | $ | 4,978 |

| 0.2 |

| | $ | 266,744 |

| 5.0 |

|

WEIGHTED AVERAGE COMMON SHARES: | | | | | |

Basic | 162,673 |

| | | 166,324 |

|

|

|

Diluted | 163,537 |

| | | 167,643 |

|

|

|

NET EARNINGS PER SHARE: | | | | | |

Basic | $ | 0.03 |

| | | $ | 1.60 |

|

|

|

Diluted | $ | 0.03 |

| | | $ | 1.59 |

|

|

|

(1) Percents are calculated as a percentage of net sales and operating revenues and may not total due to rounding.

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Comprehensive Income

(Unaudited)

|

| | | | | | | |

| Three Months Ended May 31 |

(In thousands) | 2020 | | 2019 |

NET EARNINGS | $ | 4,978 |

| | $ | 266,744 |

|

Other comprehensive loss, net of taxes: | | | |

Net change in retirement benefit plan unrecognized actuarial losses | 728 |

| | 355 |

|

Net change in cash flow hedge unrecognized losses | (16,062 | ) | | (13,551 | ) |

Other comprehensive loss, net of taxes | (15,334 | ) | | (13,196 | ) |

TOTAL COMPREHENSIVE (LOSS) INCOME | $ | (10,356 | ) | | $ | 253,548 |

|

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited)

|

| | | | | | | |

| As of May 31 | | As of February 29 |

(In thousands except share data) | 2020 | | 2020 |

ASSETS | |

| | |

|

CURRENT ASSETS: | |

| | |

|

Cash and cash equivalents | $ | 658,022 |

| | $ | 58,211 |

|

Restricted cash from collections on auto loans receivable | 480,565 |

| | 481,043 |

|

Accounts receivable, net | 145,018 |

| | 191,090 |

|

Inventory | 1,899,430 |

| | 2,846,416 |

|

Other current assets | 100,696 |

| | 86,927 |

|

TOTAL CURRENT ASSETS | 3,283,731 |

| | 3,663,687 |

|

Auto loans receivable, net of allowance for loan losses of $437,213 and $157,796 as of May 31, 2020 and February 29, 2020, respectively | 12,794,622 |

| | 13,551,711 |

|

Property and equipment, net of accumulated depreciation of $1,298,536 and $1,266,920 as of May 31, 2020 and February 29, 2020, respectively | 3,064,738 |

| | 3,069,102 |

|

Deferred income taxes | 119,066 |

| | 89,842 |

|

Operating lease assets | 443,678 |

| | 449,094 |

|

Other assets | 266,697 |

| | 258,746 |

|

TOTAL ASSETS | $ | 19,972,532 |

| | $ | 21,082,182 |

|

| | | |

LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | |

CURRENT LIABILITIES: | |

| | |

Accounts payable | $ | 390,160 |

| | $ | 737,144 |

|

Accrued expenses and other current liabilities | 290,080 |

| | 331,738 |

|

Accrued income taxes | — |

| | 1,389 |

|

Current portion of operating lease liabilities | 30,881 |

| | 30,980 |

|

Short-term debt | 86 |

| | 40 |

|

Current portion of long-term debt | 9,744 |

| | 9,251 |

|

Current portion of non-recourse notes payable | 430,055 |

| | 424,165 |

|

TOTAL CURRENT LIABILITIES | 1,151,006 |

| | 1,534,707 |

|

Long-term debt, excluding current portion | 1,693,888 |

| | 1,778,672 |

|

Non-recourse notes payable, excluding current portion | 12,722,292 |

| | 13,165,384 |

|

Operating lease liabilities, excluding current portion | 435,325 |

| | 440,671 |

|

Other liabilities | 391,711 |

| | 393,873 |

|

TOTAL LIABILITIES | 16,394,222 |

| | 17,313,307 |

|

| | | |

Commitments and contingent liabilities |

|

| |

|

|

SHAREHOLDERS’ EQUITY: | | | |

Common stock, $0.50 par value; 350,000,000 shares authorized; 162,755,339 and 163,081,376 shares issued and outstanding as of May 31, 2020 and February 29, 2020, respectively | 81,378 |

| | 81,541 |

|

Capital in excess of par value | 1,358,428 |

| | 1,348,988 |

|

Accumulated other comprehensive loss | (165,405 | ) | | (150,071 | ) |

Retained earnings | 2,303,909 |

| | 2,488,417 |

|

TOTAL SHAREHOLDERS’ EQUITY | 3,578,310 |

| | 3,768,875 |

|

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 19,972,532 |

| | $ | 21,082,182 |

|

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(Unaudited)

|

| | | | | | | |

| Three Months Ended May 31 |

(In thousands) | 2020 | | 2019 |

OPERATING ACTIVITIES: | | | |

Net earnings | $ | 4,978 |

| | $ | 266,744 |

|

Adjustments to reconcile net earnings to net cash provided by operating activities: | | | |

Depreciation and amortization | 58,340 |

| | 51,506 |

|

Share-based compensation expense | 25,057 |

| | 45,025 |

|

Provision for loan losses | 122,018 |

| | 38,152 |

|

Provision for cancellation reserves | 13,552 |

| | 25,465 |

|

Deferred income tax provision | 25,041 |

| | 9,392 |

|

Other | 5,386 |

| | 1,736 |

|

Net decrease (increase) in: | | | |

Accounts receivable, net | 46,072 |

| | 5,971 |

|

Inventory | 946,986 |

| | (31,688 | ) |

Other current assets | (13,769 | ) | | (10,387 | ) |

Auto loans receivable, net | 433,044 |

| | (386,922 | ) |

Other assets | (3,247 | ) | | (6,349 | ) |

Net (decrease) increase in: | | | |

Accounts Payable, accrued expenses and other | | | |

current liabilities and accrued income taxes | (382,102 | ) | | 81,886 |

|

Other liabilities | (31,797 | ) | | (47,330 | ) |

NET CASH PROVIDED BY OPERATING ACTIVITIES | 1,249,559 |

| | 43,201 |

|

INVESTING ACTIVITIES: | | | |

Capital expenditures | (62,871 | ) | | (78,970 | ) |

Proceeds from disposal of property and equipment | — |

| | 2 |

|

Purchases of investments | (2,369 | ) | | (7,224 | ) |

Sales of investments | 168 |

| | 81 |

|

NET CASH USED IN INVESTING ACTIVITIES | (65,072 | ) | | (86,111 | ) |

FINANCING ACTIVITIES: | | | |

Increase (decrease) in short-term debt, net | 46 |

| | (458 | ) |

Proceeds from issuances of long-term debt | 977,500 |

| | 1,715,200 |

|

Payments on long-term debt | (1,062,578 | ) | | (1,809,179 | ) |

Cash paid for debt issuance costs | (2,610 | ) | | (3,416 | ) |

Payments on finance lease obligations | (1,370 | ) | | (745 | ) |

Issuances of non-recourse notes payable | 1,982,000 |

| | 2,851,000 |

|

Payments on non-recourse notes payable | (2,420,291 | ) | | (2,492,809 | ) |

Repurchase and retirement of common stock | (54,140 | ) | | (211,961 | ) |

Equity issuances | 1,706 |

| | 33,251 |

|

NET CASH (USED IN) PROVIDED BY FINANCING ACTIVITIES | (579,737 | ) | | 80,883 |

|

Increase in cash, cash equivalents, and restricted cash | 604,750 |

| | 37,973 |

|

Cash, cash equivalents, and restricted cash at beginning of year | 656,390 |

| | 595,377 |

|

CASH, CASH EQUIVALENTS, AND RESTRICTED CASH AT END OF PERIOD | $ | 1,261,140 |

| | $ | 633,350 |

|

| | | |

RECONCILIATION OF CASH, CASH EQUIVALENTS AND RESTRICTED CASH TO THE CONSOLIDATED BALANCE SHEETS: |

Cash and cash equivalents | $ | 658,022 |

| | $ | 42,197 |

|

Restricted cash from collections on auto loans receivable | 480,565 |

| | 479,436 |

|

Restricted cash included in other assets | 122,553 |

| | 111,717 |

|

CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | $ | 1,261,140 |

| | $ | 633,350 |

|

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2020 |

| | | | | | | | | Accumulated | | |

| Common | | | | Capital in | | | | Other | | |

| Shares | | Common | | Excess of | | Retained | | Comprehensive | | |

(In thousands) | Outstanding | | Stock | | Par Value | | Earnings | | Loss | | Total |

Balance as of February 29, 2020 | 163,081 |

| | $ | 81,541 |

| | $ | 1,348,988 |

| | $ | 2,488,417 |

| | $ | (150,071 | ) | | $ | 3,768,875 |

|

Net earnings | — |

| | — |

| | — |

| | 4,978 |

| | — |

| | 4,978 |

|

Other comprehensive loss | — |

| | — |

| | — |

| | — |

| | (15,334 | ) | | (15,334 | ) |

Share-based compensation expense | — |

| | — |

| | 17,652 |

| | — |

| | — |

| | 17,652 |

|

Repurchases of common stock | (515 | ) | | (258 | ) | | (4,271 | ) | | (36,180 | ) | | — |

| | (40,709 | ) |

Exercise of common stock options | 35 |

| | 18 |

| | 1,688 |

| | — |

| | — |

| | 1,706 |

|

Stock incentive plans, net shares issued | 154 |

| | 77 |

| | (5,629 | ) | | — |

| | — |

| | (5,552 | ) |

Adoption of CECL | — |

| | — |

| | — |

| | (153,306 | ) | | — |

| | (153,306 | ) |

Balance as of May 31, 2020 | 162,755 |

| | $ | 81,378 |

| | $ | 1,358,428 |

| | $ | 2,303,909 |

| | $ | (165,405 | ) | | $ | 3,578,310 |

|

CARMAX, INC. AND SUBSIDIARIES

Consolidated Statements of Shareholders’ Equity

(Unaudited)

|

| | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended May 31, 2019 |

| | | | | | | | | Accumulated | | |

| Common | | | | Capital in | | | | Other | | |

| Shares | | Common | | Excess of | | Retained | | Comprehensive | | |

(In thousands) | Outstanding | | Stock | | Par Value | | Earnings | | Loss | | Total |

Balance as of February 28, 2019 | 167,479 |

| | $ | 83,739 |

| | $ | 1,237,153 |

| | $ | 2,104,146 |

| | $ | (68,010 | ) | | $ | 3,357,028 |

|

Net earnings | — |

| | — |

| | — |

| | 266,744 |

| | — |

| | 266,744 |

|

Other comprehensive loss | — |

| | — |

| | — |

| | — |

| | (13,196 | ) | | (13,196 | ) |

Share-based compensation expense | — |

| | — |

| | 18,912 |

| | — |

| | — |

| | 18,912 |

|

Repurchases of common stock | (2,953 | ) | | (1,476 | ) | | (21,991 | ) | | (181,368 | ) | | — |

| | (204,835 | ) |

Exercise of common stock options | 727 |

| | 363 |

| | 32,888 |

| | — |

| | — |

| | 33,251 |

|

Stock incentive plans, net shares issued | 142 |

| | 71 |

| | (5,220 | ) | | — |

| | — |

| | (5,149 | ) |

Balance as of May 31, 2019 | 165,395 |

| | $ | 82,697 |

| | $ | 1,261,742 |

| | $ | 2,189,522 |

| | $ | (81,206 | ) | | $ | 3,452,755 |

|

See accompanying notes to consolidated financial statements.

CARMAX, INC. AND SUBSIDIARIES

Notes to Consolidated Financial Statements

(Unaudited)

1. Background

Business. CarMax, Inc. (“we,” “our,” “us,” “CarMax” and “the company”), including its wholly owned subsidiaries, is the nation’s largest retailer of used vehicles. We operate in two reportable segments: CarMax Sales Operations and CarMax Auto Finance (“CAF”). Our CarMax Sales Operations segment consists of all aspects of our auto merchandising and service operations, excluding financing provided by CAF. Our CAF segment consists solely of our own finance operation that provides financing to customers buying retail vehicles from CarMax.

We deliver an unrivaled customer experience by offering a broad selection of quality used vehicles and related products and services at competitive, no-haggle prices using a customer-friendly sales process. Our omni-channel experience provides the majority of our customers with multiple options to interact with us throughout their car-buying journeys, including our mobile apps; carmax.com; over the phone or online with a centralized customer experience consultant; or, in-person at one of our attractive, modern sales facilities. We offer customers a range of related products and services, including the appraisal and purchase of vehicles directly from consumers; the financing of retail vehicle purchases through CAF and third-party finance providers; the sale of extended protection plan (“EPP”) products, which include extended service plans (“ESPs”) and guaranteed asset protection (“GAP”); and vehicle repair service. Vehicles purchased through the appraisal process that do not meet our retail standards are sold to licensed dealers through on-site or virtual wholesale auctions.

Basis of Presentation and Use of Estimates. The accompanying interim unaudited consolidated financial statements include the accounts of CarMax and our wholly owned subsidiaries. All significant intercompany balances and transactions have been eliminated in consolidation. These consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“GAAP”) for interim financial information. Accordingly, they do not include all of the information and footnotes required by U.S. GAAP for complete financial statements. In the opinion of management, such interim consolidated financial statements reflect all normal recurring adjustments considered necessary to present fairly the financial position and the results of operations and cash flows for the interim periods presented. The results of operations for the interim periods are not necessarily indicative of the results to be expected for the full fiscal year.

The accounting policies followed in the presentation of our interim financial results are consistent with those included in the company’s Annual Report on Form 10-K for the fiscal year ended February 29, 2020 (the “2020 Annual Report”), with the exception of those related to recent accounting pronouncements adopted in the current fiscal year. These consolidated financial statements should be read in conjunction with the audited consolidated financial statements and footnotes included in our 2020 Annual Report.

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenues and expenses and the disclosure of contingent assets and liabilities. Actual results could differ from those estimates. In particular, the novel coronavirus (“COVID-19”) pandemic and the resulting adverse impacts to global economic conditions, as well as our operations, may impact future estimates including, but not limited to, our allowance for loan losses, inventory valuations, fair value measurements, downward adjustments to investments in equity securities, asset impairment charges, the effectiveness of the company’s hedging instruments, deferred tax valuation allowances, cancellation reserves, actuarial losses on our retirement benefit plans and discount rate assumptions. Certain prior year amounts have been reclassified to conform to the current year’s presentation. Amounts and percentages may not total due to rounding.

Recent Accounting Pronouncements.

Adopted in the Current Period.

In June 2016, the Financial Accounting Standards Board (“FASB”) issued an accounting pronouncement (ASU 2016-13 or “CECL”) related to the measurement of credit losses on financial instruments. This pronouncement, along with subsequent ASUs issued to clarify certain provisions of ASU 2016-13, changes the impairment model for most financial assets and requires the use of an “expected loss” model for instruments measured at amortized cost. Under this model, entities are required to estimate the lifetime expected credit loss on such instruments and record an allowance to offset the amortized cost basis of the financial asset, resulting in a net presentation of the amount expected to be collected on the financial asset. In developing the estimate for lifetime expected credit loss, entities must incorporate historical experience, current conditions, and reasonable and supportable forecasts. This pronouncement is effective for fiscal years, and for interim periods within those fiscal years, beginning after December 15, 2019.

We have designed an allowance for loan loss methodology to comply with these new requirements, which has been adopted for our fiscal year beginning March 1, 2020 using the modified retrospective approach. The adoption of this pronouncement resulted in the recognition of a $202.0 million increase in the allowance for loan losses on our opening consolidated balance sheet as of March 1, 2020, with a corresponding net-of-tax $153.3 million reduction in retained earnings. The increase in the allowance for loan losses on the opening balance sheet is primarily the result of extending the loan loss forecast period from 12 months to the entire lifetime of the loan portfolio. We expect this new methodology could increase volatility in our quarterly provision for loan losses. This volatility is driven by estimating loan losses over a longer forecast period and the incorporation of economic adjustment factors, including changes in U.S. unemployment rates and the National Automobile Dealers Association ("NADA") used vehicle price index, and such volatility could be significant. We have implemented testing of the effectiveness of our new allowance for loan loss methodology, as well as relevant controls and governance structure.

In August 2018, the FASB issued an accounting pronouncement (FASB ASU 2018-14) related to disclosure requirements for defined benefit plans. The pronouncement eliminates, modifies and adds disclosure requirements for defined benefit plans. We adopted this pronouncement for our fiscal year beginning March 1, 2020, and it did not have a material effect on our consolidated financial statements.

In October 2018, the FASB issued an accounting pronouncement (FASB ASU 2018-17) related to related party guidance for variable interest entities. We adopted this pronouncement for our fiscal year beginning March 1, 2020, and it did not have a material effect on our consolidated financial statements.

In March 2020, the FASB issued an accounting pronouncement (FASB ASU 2020-04) related to reference rate reform. The pronouncement provides optional guidance for a limited period of time to ease the potential burden of accounting for reference rate reform. This guidance is effective for all entities as of March 12, 2020 through December 31, 2022. We expect to utilize this optional guidance but do not expect it to have a material effect on our consolidated financial statements.

2. Revenue

We recognize revenue when control of the good or service has been transferred to the customer, generally either at the time of sale or upon delivery to a customer. Our contracts have a fixed contract price and revenue is measured as the amount of consideration we expect to receive in exchange for transferring goods or providing services. We collect sales taxes and other taxes from customers on behalf of governmental authorities at the time of sale. These taxes are accounted for on a net basis and are not included in net sales and operating revenues or cost of sales. We generally expense sales commissions when incurred because the amortization period would have been less than one year. These costs are recorded within selling, general and administrative expenses. We do not have any significant payment terms as payment is received at or shortly after the point of sale.

Disaggregation of Revenue

|

| | | | | | | |

| Three Months Ended May 31 |

(In millions) | 2020 | | 2019 |

Used vehicle sales | $ | 2,786.2 |

| | $ | 4,540.7 |

|

Wholesale vehicle sales | 342.9 |

| | 662.4 |

|

Other sales and revenues: | | | |

Extended protection plan revenues | 73.4 |

| | 111.3 |

|

Third-party finance fees, net | (10.7 | ) | | (15.5 | ) |

Service revenues | 19.5 |

| | 34.0 |

|

Other | 17.5 |

| | 33.4 |

|

Total other sales and revenues | 99.7 |

| | 163.2 |

|

Total net sales and operating revenues | $ | 3,228.8 |

| | $ | 5,366.3 |

|

Used Vehicle Sales. Revenue from the sale of used vehicles is recognized upon transfer of control of the vehicle to the customer. As part of our customer service strategy, we guarantee the retail vehicles we sell with a 7-day, money-back guarantee. We record a reserve for estimated returns based on historical experience and trends. The reserve for estimated returns is presented gross on the consolidated balance sheets, with a return asset recorded in other current assets and a refund liability recorded in accrued expenses and other current liabilities. We also guarantee the used vehicles we sell with a 90-day/4,000 mile limited warranty.

These warranties are deemed assurance-type warranties and accounted for as warranty obligations. See Note 15 for additional information on this warranty and its related obligation.

Wholesale Vehicle Sales. Wholesale vehicles are sold at our auctions, and revenue from the sale of these vehicles is recognized upon transfer of control of the vehicle to the customer. Dealers also pay a fee to us based on the sale price of the vehicles they purchase. This fee is recognized as revenue at the time of sale. While we provide condition disclosures on each wholesale vehicle sold, the vehicles are subject to a limited right of return. We record a reserve for estimated returns based on historical experience and trends. The reserve for estimated returns is presented gross on the consolidated balance sheets, with a return asset recorded in other current assets and a refund liability recorded in accrued expenses and other current liabilities.

EPP Revenues. We also sell ESP and GAP products on behalf of unrelated third parties, who are primarily responsible for fulfilling the contract, to customers who purchase a retail vehicle. The ESPs we currently offer on all used vehicles provide coverage up to 60 months (subject to mileage limitations), while GAP covers the customer for the term of their finance contract. We recognize revenue, on a net basis, at the time of sale. We also record a reserve, or refund liability, for estimated contract cancellations. The reserve for cancellations is evaluated for each product and is based on forecasted forward cancellation curves utilizing historical experience, recent trends and credit mix of the customer base. Our risk related to contract cancellations is limited to the revenue that we receive. Cancellations fluctuate depending on the volume of EPP sales, customer financing default or prepayment rates, and shifts in customer behavior, including those related to changes in the coverage or term of the product. The current portion of estimated cancellation reserves is recognized as a component of accrued expenses and other current liabilities with the remaining amount recognized in other liabilities. See Note 7 for additional information on cancellation reserves.

We are contractually entitled to receive profit-sharing revenues based on the performance of the ESPs administered by third parties. These revenues are a form of variable consideration included in EPP revenues to the extent that it is probable that it will not result in a significant revenue reversal. An estimate of the amount to which we expect to be entitled, subject to various constraints, is recognized upon satisfying the performance obligation of selling the ESP. These constraints include factors that are outside of the company’s influence or control and the length of time until settlement. We apply the expected value method, utilizing historical claims and cancellation data from CarMax customers, as well as external data and other qualitative assumptions. This estimate is reassessed each reporting period with changes reflected in other sales and revenues on our consolidated statements of earnings and other assets on our consolidated balance sheets. As of May 31, 2020 and February 29, 2020, no long-term contract asset was recognized related to cumulative profit-sharing payments to which we expect to be entitled.

Third-Party Finance Fees. Customers applying for financing who are not approved or are conditionally approved by CAF are generally evaluated by other third-party finance providers. These providers generally either pay us or are paid a fixed, pre-negotiated fee per contract. We recognize these fees at the time of sale.

Service Revenues. Service revenue consists of labor and parts income related to vehicle repair service, including repairs of vehicles covered under an ESP we sell or warranty program. Service revenue is recognized at the time the work is completed.

Other Revenues. Other revenues consist primarily of new vehicle sales at our two new car franchise locations and sales of accessories. Revenue in this category is recognized upon transfer of control to the customer.

3. CarMax Auto Finance

CAF provides financing to qualified retail customers purchasing vehicles from CarMax. CAF provides us the opportunity to capture additional profits, cash flows and sales while managing our reliance on third-party finance sources. Management regularly analyzes CAF’s operating results by assessing profitability, the performance of the auto loans receivable, including trends in credit losses and delinquencies, and CAF direct expenses. This information is used to assess CAF’s performance and make operating decisions, including resource allocation.

We typically use securitizations or other funding arrangements to fund loans originated by CAF. CAF income primarily reflects the interest and fee income generated by the auto loans receivable less the interest expense associated with the debt issued to fund these receivables, a provision for estimated loan losses and direct CAF expenses.

CAF income does not include any allocation of indirect costs. Although CAF benefits from certain indirect overhead expenditures, we have not allocated indirect costs to CAF to avoid making subjective allocation decisions. Examples of indirect costs not allocated to CAF include retail store expenses and corporate expenses. In addition, except for auto loans receivable, which are disclosed in Note 4, CAF assets are not separately reported nor do we allocate assets to CAF because such allocation would not be useful to management in making operating decisions.

Components of CAF Income

|

| | | | | | | | | | | | | |

| Three Months Ended May 31 |

(In millions) | 2020 | | % (1) | | 2019 | | % (1) |

Interest margin: | | | | | | | |

Interest and fee income | $ | 282.5 |

| | 8.4 |

| | $ | 266.2 |

| | 8.4 |

|

Interest expense | (84.6 | ) | | (2.5 | ) | | (87.4 | ) | | (2.8 | ) |

Total interest margin | 197.9 |

| | 5.9 |

| | 178.8 |

| | 5.6 |

|

Provision for loan losses | (122.0 | ) | | (3.6 | ) | | (38.2 | ) | | (1.2 | ) |

Total interest margin after provision for loan losses | 75.9 |

| | 2.3 |

| | 140.6 |

| | 4.4 |

|

| | | | | | | |

Total other expense | (1.9 | ) | | (0.1 | ) | | — |

| | — |

|

| | | | | | | |

Direct expenses: | | | | | | | |

Payroll and fringe benefit expense | (11.2 | ) | | (0.3 | ) | | (10.1 | ) | | (0.3 | ) |

Other direct expenses | (11.8 | ) | | (0.4 | ) | | (14.5 | ) | | (0.5 | ) |

Total direct expenses | (23.0 | ) | | (0.7 | ) | | (24.6 | ) | | (0.8 | ) |

CarMax Auto Finance income | $ | 51.0 |

| | 1.5 |

| | $ | 116.0 |

| | 3.7 |

|

| | | | | | | |

Total average managed receivables | $ | 13,408.5 |

| |

|

| | $ | 12,707.3 |

| |

|

|

| |

(1) | Annualized percentage of total average managed receivables. |

4. Auto Loans Receivable

Auto loans receivable include amounts due from customers related to retail vehicle sales financed through CAF and are presented net of an allowance for estimated loan losses. We generally use warehouse facilities to fund auto loans receivable originated by CAF until we elect to fund them through an asset-backed term funding transaction, such as a term securitization or alternative funding arrangement. We recognize transfers of auto loans receivable into the warehouse facilities and asset-backed term funding transactions (together, “non-recourse funding vehicles”) as secured borrowings, which result in recording the auto loans receivable and the related non-recourse notes payable on our consolidated balance sheets. The majority of the auto loans receivable serve as collateral for the related non-recourse notes payable of $13.17 billion as of May 31, 2020 and $13.61 billion as of February 29, 2020. See Note 9 for additional information on non-recourse notes payable.

Interest income and expenses related to auto loans are included in CAF income. Interest income on auto loans receivable is recognized when earned based on contractual loan terms. All loans continue to accrue interest until repayment or charge-off. When a charge-off occurs, accrued interest is written off by reversing interest income. Direct costs associated with loan originations are not considered material, and thus, are expensed as incurred. See Note 3 for additional information on CAF income.

Auto Loans Receivable, Net

|

| | | | | | | |

| As of May 31 | | As of February 29 |

(In millions) | 2020 | | 2020 |

Asset-backed term funding | $ | 10,795.3 |

| | $ | 11,007.1 |

|

Warehouse facilities | 1,949.7 |

| | 2,181.7 |

|

Overcollateralization (1) | 291.0 |

| | 289.0 |

|

Other managed receivables (2) | 135.9 |

| | 140.0 |

|

Total ending managed receivables | 13,171.9 |

| | 13,617.8 |

|

Accrued interest and fees | 64.8 |

| | 56.2 |

|

Other | (4.9 | ) | | 35.5 |

|

Less: allowance for loan losses | (437.2 | ) | | (157.8 | ) |

Auto loans receivable, net | $ | 12,794.6 |

| | $ | 13,551.7 |

|

| |

(1) | Represents receivables restricted as excess collateral for the non-recourse funding vehicles. |

| |

(2) | Other managed receivables includes receivables not funded through the non-recourse funding vehicles. |

Credit Quality. When customers apply for financing, CAF’s proprietary scoring models rely on the customers’ credit history and certain application information to evaluate and rank their risk. We obtain credit histories and other credit data that includes information such as number, age, type of and payment history for prior or existing credit accounts. The application information that is used includes income, collateral value and down payment. The scoring models yield credit grades that represent the relative likelihood of repayment. Customers with the highest probability of repayment are A-grade customers. Customers assigned a lower grade are determined to have a lower probability of repayment. For loans that are approved, the credit grade influences the terms of the agreement, such as the required loan-to-value ratio and interest rate. After origination, credit grades are generally not updated.

CAF uses a combination of the initial credit grades and historical performance to monitor the credit quality of the auto loans receivable on an ongoing basis. We validate the accuracy of the scoring models periodically. Loan performance is reviewed on a recurring basis to identify whether the assigned grades adequately reflect the customers’ likelihood of repayment.

Ending Managed Receivables by Major Credit Grade

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of May 31, 2020 |

| Fiscal Year of Origination (1) | | | | |

(In millions) | 2021 | | 2020 | | 2019 | | 2018 | | 2017 | | Prior to 2017 | | Total | | % (2) |

A | $ | 493.7 |

| | $ | 2,928.5 |

| | $ | 1,689.5 |

| | $ | 957.6 |

| | $ | 450.1 |

| | $ | 139.7 |

| | $ | 6,659.1 |

| | 50.6 |

B | 334.0 |

| | 1,891.8 |

| | 1,214.7 |

| | 731.3 |

| | 367.2 |

| | 160.9 |

| | 4,699.9 |

| | 35.7 |

C and other | 129.7 |

| | 706.8 |

| | 438.6 |

| | 271.8 |

| | 174.0 |

| | 92.0 |

| | 1,812.9 |

| | 13.7 |

Total ending managed receivables | $ | 957.4 |

| | $ | 5,527.1 |

| | $ | 3,342.8 |

| | $ | 1,960.7 |

| | $ | 991.3 |

| | $ | 392.6 |

| | $ | 13,171.9 |

| | 100.0 |

|

| | | | | |

| As of February 29 |

(In millions) | 2020 (1) | | % (2) |

A | $ | 6,915.9 |

| | 50.8 |

B | 4,841.2 |

| | 35.6 |

C and other | 1,860.7 |

| | 13.6 |

Total ending managed receivables | $ | 13,617.8 |

| | 100.0 |

| |

(1) | Classified based on credit grade assigned when customers were initially approved for financing. |

| |

(2) | Percent of total ending managed receivables. |

Allowance for Loan Losses. The allowance for loan losses at May 31, 2020 represents the net credit losses expected over the remaining contractual life of our managed receivables. The allowance for loan losses is determined using a net loss timing curve, primarily based on the composition of the portfolio of managed receivables and historical gross loss and recovery trends. For receivables that have less than 18 months of performance history, the net loss estimate takes into account the credit grades of the receivables and historical losses by credit grade to supplement actual loss data in estimating future performance. Once the receivables have 18 months of performance history, the net loss estimate reflects actual loss experience of those receivables to date, along with forward loss curves, to predict future performance. The forward loss curves are constructed using historical performance data and show the average timing of losses over the course of a receivable’s life.

The output of the net loss timing curve is adjusted to take into account reasonable and supportable forecasts about the future. Specifically, the change in U.S. unemployment rates and the NADA used vehicle price index are used to predict changes in gross loss and recovery rate, respectively. An economic adjustment factor is developed to capture the relationship between changes in these forecasts and changes in gross loss and recovery rates. This factor is applied to the output of the net loss timing curve for the reasonable and supportable forecast period of two years. After the end of this two year period, the impact of the economic factor is phased out of the allowance for loan loss calculation on a straight-line basis over a period of 12 months. We periodically consider whether the use of alternative metrics would result in improved model performance and revise the models when appropriate. The provision for loan losses is the periodic expense of maintaining an adequate allowance.

Allowance for Loan Losses

|

| | | | | | | | | | | |

| Three Months Ended May 31 |

(In millions) | 2020 | | % (1) | | 2019 (2) | | % (1) |

Balance as of beginning of period | $ | 157.8 |

| | 1.16 | | $ | 138.2 |

| | 1.10 |

Adoption of CECL | 202.0 |

| | | | — |

| | |

Adjusted balance as of beginning of period | 359.8 |

| | 2.64 | | 138.2 |

| | 1.10 |

Charge-offs | (70.7 | ) | | | | (65.9 | ) | |

|

Recoveries (3) | 26.1 |

| | | | 36.5 |

| |

|

Provision for loan losses | 122.0 |

| | | | 38.2 |

| |

|

Balance as of end of period | $ | 437.2 |

| | 3.32 | | $ | 147.0 |

| | 1.14 |

| |

(1) | Percent of total ending managed receivables. |

| |

(2) | The comparative information has not been restated and continues to be reported under the accounting guidance in effect during fiscal 2020. |

| |

(3) | Net of costs incurred to recover vehicle. |

As discussed in Note 1, we adopted CECL during the first quarter of fiscal 2021. The adoption of this pronouncement resulted in the recognition of a $202.0 million increase in the allowance for loan losses as of March 1, 2020, with a corresponding net-of-tax decrease of $153.3 million in retained earnings. During the first quarter of fiscal 2021, we recorded a provision for loan losses of $122.0 million. The provision included an $84.0 million increase in our estimate of lifetime losses on existing loans, largely resulting from worsening economic factors in response to COVID-19. In particular, the U.S. unemployment rate rose significantly during the quarter. This rate is used in loss prediction to incorporate how current and forecasted economic conditions impact customer hardship, or ability to pay. Changes in the NADA used vehicle price index were not significant. The remaining $38.0 million of provision recorded in the first quarter of fiscal 2021 largely reflected our estimate of lifetime losses on originations made during the current quarter.

Past Due Receivables. An account is considered delinquent when the related customer fails to make a substantial portion of a scheduled payment on or before the due date. In general, accounts are charged-off on the last business day of the month during which the earliest of the following occurs: the receivable is 120 days or more delinquent as of the last business day of the month, the related vehicle is repossessed and liquidated, or the receivable is otherwise deemed uncollectible. For purposes of determining impairment, auto loans are evaluated collectively, as they represent a large group of smaller-balance homogeneous loans, and therefore, are not individually evaluated for impairment.

Past Due Receivables

|

| | | | | | | | | | | | | | | | | |

| As of May 31, 2020 |

| Major Credit Grade | | | | |

(In millions) | A | | B | | C & Other | | Total | | % (1) |

Current | $ | 6,632.0 |

| | $ | 4,554.5 |

| | $ | 1,658.7 |

| | $ | 12,845.2 |

| | 97.52 |

Delinquent loans: | | | | | | | | | |

31-60 days past due | 16.4 |

| | 89.3 |

| | 92.8 |

| | 198.5 |

| | 1.51 |

61-90 days past due | 7.0 |

| | 38.9 |

| | 44.3 |

| | 90.2 |

| | 0.68 |

Greater than 90 days past due | 3.7 |

| | 17.2 |

| | 17.1 |

| | 38.0 |

| | 0.29 |

Total past due | 27.1 |

| | 145.4 |

| | 154.2 |

| | 326.7 |

| | 2.48 |

Total ending managed receivables | $ | 6,659.1 |

| | $ | 4,699.9 |

| | $ | 1,812.9 |

| | $ | 13,171.9 |

| | 100.00 |

|

| | | | | |

| As of February 29 |

(In millions) | 2020 | | % (1) |

Total ending managed receivables | $ | 13,617.8 |

| | 100.00 |

Delinquent loans: | | | |

31-60 days past due | $ | 296.4 |

| | 2.18 |

61-90 days past due | 138.3 |

| | 1.01 |

Greater than 90 days past due | 34.2 |

| | 0.25 |

Total past due | $ | 468.9 |

| | 3.44 |

| |

(1) | Percent of total ending managed receivables. |

5. Derivative Instruments and Hedging Activities

We use derivatives to manage certain risks arising from both our business operations and economic conditions, particularly with regard to issuances of debt. Primary exposures include LIBOR and other rates used as benchmarks in our securitizations and other debt financing. We enter into derivative instruments to manage exposures related to the future known receipt or payment of uncertain cash amounts, the values of which are impacted by interest rates, and generally designate these derivative instruments as cash flow hedges for accounting purposes. In certain cases, we may choose not to designate a derivative instrument as a cash flow hedge for accounting purposes due to uncertainty around the probability that future hedged transactions will occur. Our derivative instruments are used to manage (i) differences in the amount of our known or expected cash receipts and our known or expected cash payments principally related to the funding of our auto loans receivable, and (ii) exposure to variable interest rates associated with our term loan.

For the derivatives associated with our non-recourse funding vehicles that are designated as cash flow hedges, the changes in fair value are initially recorded in accumulated other comprehensive loss (“AOCL”). For the majority of these derivatives, the amounts are subsequently reclassified into CAF income in the period that the hedged forecasted transaction affects earnings, which occurs as interest expense is recognized on those future issuances of debt. During the next 12 months, we estimate that an additional $22.8 million will be reclassified in AOCL as a decrease to CAF income. Changes in fair value related to derivatives that have not been designated as cash flow hedges for accounting purposes are recognized in the income statement in the period in which the change occurs. For the three months ended May 31, 2020, we recognized a loss of $1.9 million in CAF income representing these changes in fair value.

As of May 31, 2020 and February 29, 2020, we had interest rate swaps outstanding with a combined notional amount of $1.96 billion and $2.62 billion, respectively, that were designated as cash flow hedges of interest rate risk. As of May 31, 2020, we had an interest rate swap outstanding with a notional amount of $0.40 billion that was not designated as a cash flow hedge.

See Note 6 for discussion of fair values of financial instruments and Note 12 for the effect on comprehensive income.

6. Fair Value Measurements

Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants in the principal market or, if none exists, the most advantageous market, for the specific asset or liability at the measurement date (referred to as the “exit price”). The fair value should be based on assumptions that market participants would use, including a consideration of nonperformance risk.

We assess the inputs used to measure fair value using the three-tier hierarchy. The hierarchy indicates the extent to which inputs used in measuring fair value are observable in the market.

| |

Level 1 | Inputs include unadjusted quoted prices in active markets for identical assets or liabilities that we can access at the measurement date. |

| |

Level 2 | Inputs other than quoted prices included within Level 1 that are observable for the asset or liability, either directly or indirectly, including quoted prices for similar assets in active markets, quoted prices from identical or similar assets in inactive markets and observable inputs such as interest rates and yield curves. |

| |

Level 3 | Inputs that are significant to the measurement that are not observable in the market and include management’s judgments about the assumptions market participants would use in pricing the asset or liability (including assumptions about risk). |

Our fair value processes include controls that are designed to ensure that fair values are appropriate. Such controls include model validation, review of key model inputs, analysis of period-over-period fluctuations and reviews by senior management.

Valuation Methodologies

Money Market Securities. Money market securities are cash equivalents, which are included in cash and cash equivalents, restricted cash from collections on auto loans receivable and other assets. They consist of highly liquid investments with original maturities of three months or less and are classified as Level 1.

Mutual Fund Investments. Mutual fund investments consist of publicly traded mutual funds that primarily include diversified equity investments in large-, mid- and small-cap domestic and international companies or investment grade debt securities. The investments, which are included in other assets, are held in a rabbi trust established to fund informally our executive deferred compensation plan and are classified as Level 1.

Derivative Instruments. The fair values of our derivative instruments are included in either other current assets, other assets, accounts payable or other liabilities. Our derivatives are not exchange-traded and are over-the-counter customized derivative instruments. All of our derivative exposures are with highly rated bank counterparties.

We measure derivative fair values assuming that the unit of account is an individual derivative instrument and that derivatives are sold or transferred on a stand-alone basis. We estimate the fair value of our derivatives using quotes determined by the derivative counterparties and third-party valuation services. Quotes from third-party valuation services and quotes received from bank counterparties project future cash flows and discount the future amounts to a present value using market-based expectations for interest rates and the contractual terms of the derivative instruments. The models do not require significant judgment and model inputs can typically be observed in a liquid market; however, because the models include inputs other than quoted prices in active markets, all derivatives are classified as Level 2.

Our derivative fair value measurements consider assumptions about counterparty and our own nonperformance risk. We monitor counterparty and our own nonperformance risk and, in the event that we determine that a party is unlikely to perform under terms of the contract, we would adjust the derivative fair value to reflect the nonperformance risk.

Items Measured at Fair Value on a Recurring Basis |

| | | | | | | | | | | |

| As of May 31, 2020 |

(In thousands) | Level 1 | | Level 2 | | Total |

Assets: | | | | | |

Money market securities | $ | 697,363 |

| | $ | — |

| | $ | 697,363 |

|

Mutual fund investments | 22,330 |

| | — |

| | 22,330 |

|

Total assets at fair value | $ | 719,693 |

| | $ | — |

| | $ | 719,693 |

|

| | | | | |

Percent of total assets at fair value | 100.0 | % | | — | % | | 100.0 | % |

Percent of total assets | 3.6 | % | | — | % | | 3.6 | % |

| | | | | |

Liabilities: | | | | | |

Derivative instruments designated as hedges | $ | — |

| | $ | (25,719 | ) | | $ | (25,719 | ) |

Derivative instruments not designated as hedges | — |

| | (1,892 | ) | | (1,892 | ) |

Total liabilities at fair value | $ | — |

| | $ | (27,611 | ) | | $ | (27,611 | ) |

| | | | | |

Percent of total liabilities | — | % | | 0.2 | % | | 0.2 | % |

|

| | | | | | | | | | | |

| As of February 29, 2020 |

(In thousands) | Level 1 | | Level 2 | | Total |

Assets: | | | | | |

Money market securities | $ | 273,203 |

| | $ | — |

| | $ | 273,203 |

|

Mutual fund investments | 22,668 |

| | — |

| | 22,668 |

|

Total assets at fair value | $ | 295,871 |

| | $ | — |

| | $ | 295,871 |

|

| | | | | |

Percent of total assets at fair value | 100.0 | % | | — | % | | 100.0 | % |

Percent of total assets | 1.4 | % | | — | % | | 1.4 | % |

| | | | | |

Liabilities: | | | | | |

Derivative instruments designated as hedges | $ | — |

| | $ | (23,992 | ) | | $ | (23,992 | ) |

Total liabilities at fair value | $ | — |

| | $ | (23,992 | ) | | $ | (23,992 | ) |

| | | | | |

Percent of total liabilities | — | % | | 0.1 | % | | 0.1 | % |

Fair Value of Financial Instruments

The carrying value of our cash and cash equivalents, accounts receivable, other restricted cash deposits and accounts payable approximates fair value due to the short-term nature and/or variable rates associated with these financial instruments. Auto loans receivable are presented net of an allowance for estimated loan losses. We believe that the carrying value of our revolving credit facility and term loan approximates fair value due to the variable rates associated with these obligations. The fair value of our senior unsecured notes, which are not carried at fair value on our consolidated balance sheets, was determined using Level 2 inputs based on quoted market prices. The carrying value and fair value of the senior unsecured notes as of May 31, 2020 and February 29, 2020, respectively, are as follows:

|

| | | | | | | |