ecom-20210930false2021Q30001169652--12-31us-gaap:AccountingStandardsUpdate201613Member00011696522021-01-012021-09-30xbrli:shares00011696522021-10-29iso4217:USD00011696522021-09-3000011696522020-12-31iso4217:USDxbrli:shares00011696522021-07-012021-09-3000011696522020-07-012020-09-3000011696522020-01-012020-09-3000011696522019-12-3100011696522020-09-300001169652us-gaap:CommonStockMember2020-12-310001169652us-gaap:AdditionalPaidInCapitalMember2020-12-310001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001169652us-gaap:RetainedEarningsMember2020-12-310001169652us-gaap:CommonStockMember2021-01-012021-03-310001169652us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-3100011696522021-01-012021-03-310001169652us-gaap:RetainedEarningsMember2021-01-012021-03-310001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310001169652us-gaap:CommonStockMember2021-03-310001169652us-gaap:AdditionalPaidInCapitalMember2021-03-310001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310001169652us-gaap:RetainedEarningsMember2021-03-3100011696522021-03-310001169652us-gaap:CommonStockMember2021-04-012021-06-300001169652us-gaap:AdditionalPaidInCapitalMember2021-04-012021-06-3000011696522021-04-012021-06-300001169652us-gaap:RetainedEarningsMember2021-04-012021-06-300001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012021-06-300001169652us-gaap:CommonStockMember2021-06-300001169652us-gaap:AdditionalPaidInCapitalMember2021-06-300001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-300001169652us-gaap:RetainedEarningsMember2021-06-3000011696522021-06-300001169652us-gaap:CommonStockMember2021-07-012021-09-300001169652us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001169652us-gaap:RetainedEarningsMember2021-07-012021-09-300001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012021-09-300001169652us-gaap:CommonStockMember2021-09-300001169652us-gaap:AdditionalPaidInCapitalMember2021-09-300001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-300001169652us-gaap:RetainedEarningsMember2021-09-300001169652us-gaap:CommonStockMember2019-12-310001169652us-gaap:AdditionalPaidInCapitalMember2019-12-310001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001169652us-gaap:RetainedEarningsMember2019-12-3100011696522020-01-012020-03-310001169652srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001169652us-gaap:CommonStockMember2020-01-012020-03-310001169652us-gaap:AdditionalPaidInCapitalMember2020-01-012020-03-310001169652us-gaap:RetainedEarningsMember2020-01-012020-03-310001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-03-310001169652us-gaap:CommonStockMember2020-03-310001169652us-gaap:AdditionalPaidInCapitalMember2020-03-310001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-03-310001169652us-gaap:RetainedEarningsMember2020-03-3100011696522020-03-310001169652us-gaap:CommonStockMember2020-04-012020-06-300001169652us-gaap:AdditionalPaidInCapitalMember2020-04-012020-06-3000011696522020-04-012020-06-300001169652us-gaap:RetainedEarningsMember2020-04-012020-06-300001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-04-012020-06-300001169652us-gaap:CommonStockMember2020-06-300001169652us-gaap:AdditionalPaidInCapitalMember2020-06-300001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-06-300001169652us-gaap:RetainedEarningsMember2020-06-3000011696522020-06-300001169652us-gaap:CommonStockMember2020-07-012020-09-300001169652us-gaap:AdditionalPaidInCapitalMember2020-07-012020-09-300001169652us-gaap:RetainedEarningsMember2020-07-012020-09-300001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-07-012020-09-300001169652us-gaap:CommonStockMember2020-09-300001169652us-gaap:AdditionalPaidInCapitalMember2020-09-300001169652us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-09-300001169652us-gaap:RetainedEarningsMember2020-09-3000011696522021-09-160001169652us-gaap:CustomerRelationshipsMember2021-01-012021-09-300001169652us-gaap:TechnologyBasedIntangibleAssetsMember2021-01-012021-09-300001169652ecom:BlueBoardMember2021-09-300001169652us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberecom:TwoThousandTwentyRevolvingCreditFacilityMember2020-08-050001169652us-gaap:LetterOfCreditMemberus-gaap:LineOfCreditMemberecom:TwoThousandTwentyRevolvingCreditFacilityMember2020-08-05xbrli:pure0001169652us-gaap:LineOfCreditMemberus-gaap:BaseRateMemberus-gaap:RevolvingCreditFacilityMemberecom:TwoThousandTwentyRevolvingCreditFacilityMember2020-08-052020-08-050001169652us-gaap:LineOfCreditMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMemberecom:TwoThousandTwentyRevolvingCreditFacilityMember2020-08-052020-08-050001169652us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMemberecom:TwoThousandTwentyRevolvingCreditFacilityMember2020-08-052020-08-050001169652ecom:MarketplacesandDigitalMarketingMember2021-01-012021-09-300001169652ecom:RetailersMember2021-07-012021-09-300001169652ecom:RetailersMember2020-07-012020-09-300001169652ecom:RetailersMember2021-01-012021-09-300001169652ecom:RetailersMember2020-01-012020-09-300001169652ecom:BrandsMember2021-07-012021-09-300001169652ecom:BrandsMember2020-07-012020-09-300001169652ecom:BrandsMember2021-01-012021-09-300001169652ecom:BrandsMember2020-01-012020-09-300001169652ecom:OtherMember2021-07-012021-09-300001169652ecom:OtherMember2020-07-012020-09-300001169652ecom:OtherMember2021-01-012021-09-300001169652ecom:OtherMember2020-01-012020-09-3000011696522021-10-012021-09-3000011696522021-01-010001169652us-gaap:PerformanceSharesMember2021-01-012021-09-300001169652us-gaap:PerformanceSharesMembersrt:MinimumMember2021-01-012021-09-300001169652ecom:PerformanceSharesTwoThousandTwentyFiscalYearGrantsMembersrt:MaximumMember2021-01-012021-09-300001169652ecom:PerformanceSharesTwoThousandTwentyOneFiscalYearGrantsMembersrt:MaximumMember2021-01-012021-09-300001169652us-gaap:PerformanceSharesMemberus-gaap:ShareBasedCompensationAwardTrancheOneMember2021-01-012021-09-300001169652us-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:PerformanceSharesMember2021-01-012021-09-300001169652us-gaap:CostOfSalesMember2021-07-012021-09-300001169652us-gaap:CostOfSalesMember2020-07-012020-09-300001169652us-gaap:CostOfSalesMember2021-01-012021-09-300001169652us-gaap:CostOfSalesMember2020-01-012020-09-300001169652us-gaap:SellingAndMarketingExpenseMember2021-07-012021-09-300001169652us-gaap:SellingAndMarketingExpenseMember2020-07-012020-09-300001169652us-gaap:SellingAndMarketingExpenseMember2021-01-012021-09-300001169652us-gaap:SellingAndMarketingExpenseMember2020-01-012020-09-300001169652us-gaap:ResearchAndDevelopmentExpenseMember2021-07-012021-09-300001169652us-gaap:ResearchAndDevelopmentExpenseMember2020-07-012020-09-300001169652us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-09-300001169652us-gaap:ResearchAndDevelopmentExpenseMember2020-01-012020-09-300001169652us-gaap:GeneralAndAdministrativeExpenseMember2021-07-012021-09-300001169652us-gaap:GeneralAndAdministrativeExpenseMember2020-07-012020-09-300001169652us-gaap:GeneralAndAdministrativeExpenseMember2021-01-012021-09-300001169652us-gaap:GeneralAndAdministrativeExpenseMember2020-01-012020-09-300001169652us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-09-300001169652us-gaap:EmployeeStockOptionMember2021-07-012021-09-300001169652us-gaap:EmployeeStockOptionMember2020-07-012020-09-300001169652us-gaap:EmployeeStockOptionMember2021-01-012021-09-300001169652us-gaap:EmployeeStockOptionMember2020-01-012020-09-300001169652us-gaap:RestrictedStockUnitsRSUMember2021-07-012021-09-300001169652us-gaap:RestrictedStockUnitsRSUMember2020-07-012020-09-300001169652us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-09-300001169652us-gaap:StockOptionMember2021-07-012021-09-300001169652us-gaap:StockOptionMember2020-07-012020-09-300001169652us-gaap:StockOptionMember2021-01-012021-09-300001169652us-gaap:StockOptionMember2020-01-012020-09-300001169652us-gaap:RestrictedStockUnitsRSUMember2021-07-012021-09-300001169652us-gaap:RestrictedStockUnitsRSUMember2020-07-012020-09-300001169652us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-09-300001169652us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-09-300001169652us-gaap:InternalRevenueServiceIRSMember2021-01-012021-09-300001169652us-gaap:InternalRevenueServiceIRSMember2020-07-012020-09-300001169652us-gaap:InternalRevenueServiceIRSMember2020-01-012020-09-300001169652us-gaap:InternalRevenueServiceIRSMember2021-07-012021-09-300001169652us-gaap:HerMajestysRevenueAndCustomsHMRCMember2020-01-012020-06-300001169652us-gaap:HerMajestysRevenueAndCustomsHMRCMember2020-07-012020-09-300001169652us-gaap:HerMajestysRevenueAndCustomsHMRCMember2021-01-012021-03-310001169652us-gaap:HerMajestysRevenueAndCustomsHMRCMember2021-04-012021-06-30ecom:segment0001169652country:US2021-07-012021-09-300001169652country:US2020-07-012020-09-300001169652country:US2021-01-012021-09-300001169652country:US2020-01-012020-09-300001169652us-gaap:NonUsMember2021-07-012021-09-300001169652us-gaap:NonUsMember2020-07-012020-09-300001169652us-gaap:NonUsMember2021-01-012021-09-300001169652us-gaap:NonUsMember2020-01-012020-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________________________________

FORM 10-Q

(Mark one)

| | | | | |

☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2021

OR

| | | | | |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number 001-35940

____________________________________________________

CHANNELADVISOR CORPORATION

(Exact name of registrant as specified in its charter)

____________________________________________________

| | | | | | | | |

| Delaware | | 56-2257867 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (I.R.S. Employer

Identification No.) |

| |

3025 Carrington Mill Boulevard, Morrisville, NC | | 27560 |

| (Address of principal executive offices) | | (Zip Code) |

(919) 228-4700

(Registrant's telephone number, including area code)

N/A

(Former name, former address and former

fiscal year, if changed since last report)

____________________________________________________

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.001 par value | ECOM | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Securities Exchange Act of 1934.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☒ |

| Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Securities Exchange Act of 1934). Yes ☐ No ☒

The number of outstanding shares of the registrant's common stock, par value $0.001 per share, as of the close of business on October 29, 2021 was 30,048,948.

TABLE OF CONTENTS

PART I - FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| | | | | | | | | | | |

| September 30, 2021 | | December 31, 2020 |

| | (unaudited) | | |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 97,019 | | | $ | 71,545 | |

Accounts receivable, net of allowance of $250 and $417 as of September 30, 2021 and December 31, 2020, respectively | 25,240 | | | 24,705 | |

| Prepaid expenses and other current assets | 15,226 | | | 13,874 | |

| Total current assets | 137,485 | | | 110,124 | |

| Operating lease right of use assets | 5,284 | | | 8,141 | |

| Property and equipment, net | 8,188 | | | 8,707 | |

| Goodwill | 30,186 | | | 30,990 | |

| Intangible assets, net | 3,331 | | | 4,155 | |

| Deferred contract costs, net of current portion | 17,274 | | | 14,040 | |

| Long-term deferred tax assets, net | 4,304 | | | 3,551 | |

| Other assets | 826 | | | 953 | |

| Total assets | $ | 206,878 | | | $ | 180,661 | |

| Liabilities and stockholders' equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 613 | | | $ | 158 | |

| Accrued expenses | 17,612 | | | 14,008 | |

| Deferred revenue | 28,425 | | | 22,819 | |

| Other current liabilities | 5,682 | | | 6,029 | |

| Total current liabilities | 52,332 | | | 43,014 | |

| Long-term operating leases, net of current portion | 1,689 | | | 5,394 | |

| Other long-term liabilities | 2,029 | | | 2,162 | |

| Total liabilities | 56,050 | | | 50,570 | |

| Commitments and contingencies | | | |

| Stockholders' equity: | | | |

Preferred stock, $0.001 par value, 5,000,000 shares authorized, no shares issued and outstanding as of September 30, 2021 and December 31, 2020 | — | | | — | |

Common stock, $0.001 par value, 100,000,000 shares authorized, 30,048,948 and 29,020,424 shares issued and outstanding as of September 30, 2021 and December 31, 2020, respectively | 30 | | | 29 | |

| Additional paid-in capital | 297,251 | | | 288,842 | |

| Accumulated other comprehensive loss | (2,314) | | | (1,095) | |

| Accumulated deficit | (144,139) | | | (157,685) | |

| Total stockholders' equity | 150,828 | | | 130,091 | |

| Total liabilities and stockholders' equity | $ | 206,878 | | | $ | 180,661 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Revenue | $ | 41,575 | | | $ | 35,285 | | | $ | 122,284 | | | $ | 104,760 | |

| Cost of revenue | 10,100 | | | 7,691 | | | 28,041 | | | 21,807 | |

| Gross profit | 31,475 | | | 27,594 | | | 94,243 | | | 82,953 | |

| Operating expenses: | | | | | | | |

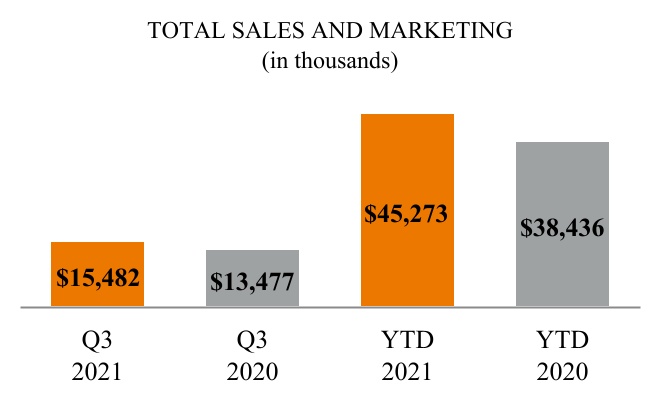

| Sales and marketing | 15,482 | | | 13,477 | | | 45,273 | | | 38,436 | |

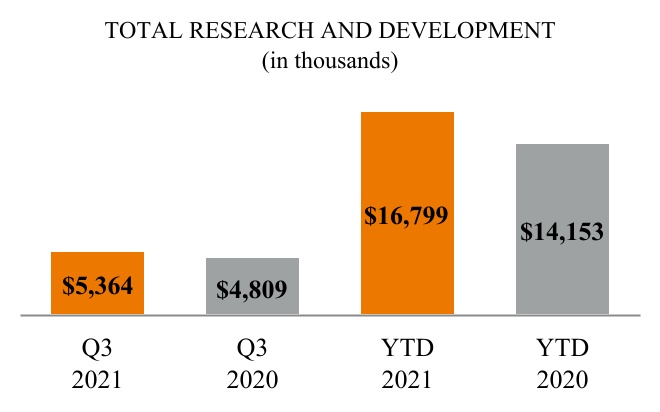

| Research and development | 5,364 | | | 4,809 | | | 16,799 | | | 14,153 | |

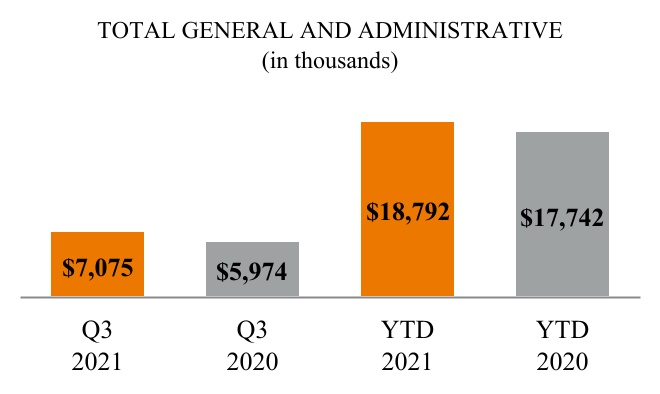

| General and administrative | 7,075 | | | 5,974 | | | 18,792 | | | 17,742 | |

| Total operating expenses | 27,921 | | | 24,260 | | | 80,864 | | | 70,331 | |

| Income from operations | 3,554 | | | 3,334 | | | 13,379 | | | 12,622 | |

| Other (expense) income: | | | | | | | |

| Interest (expense) income, net | (30) | | | (1) | | | (96) | | | 210 | |

| Other (expense) income, net | (29) | | | 5 | | | (164) | | | 44 | |

| Total other (expense) income | (59) | | | 4 | | | (260) | | | 254 | |

| Income before income taxes | 3,495 | | | 3,338 | | | 13,119 | | | 12,876 | |

| Income tax (benefit) expense | (34) | | | (374) | | | (427) | | | 171 | |

| Net income | $ | 3,529 | | | $ | 3,712 | | | $ | 13,546 | | | $ | 12,705 | |

| Net income per share: | | | | | | | |

| Basic | $ | 0.12 | | | $ | 0.13 | | | $ | 0.46 | | | $ | 0.45 | |

| Diluted | $ | 0.11 | | | $ | 0.12 | | | $ | 0.43 | | | $ | 0.43 | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 29,931,173 | | | 28,802,310 | | | 29,665,439 | | | 28,485,547 | |

| Diluted | 31,474,314 | | | 30,436,601 | | | 31,295,737 | | | 29,815,829 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Net income | $ | 3,529 | | | $ | 3,712 | | | $ | 13,546 | | | $ | 12,705 | |

| Other comprehensive (loss) income: | | | | | | | |

| Foreign currency translation adjustments | (1,157) | | | 438 | | | (1,219) | | | (63) | |

| Total comprehensive income | $ | 2,372 | | | $ | 4,150 | | | $ | 12,327 | | | $ | 12,642 | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands)

| | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2021 | | 2020 |

| Cash flows from operating activities | | | |

| Net income | $ | 13,546 | | | $ | 12,705 | |

| Adjustments to reconcile net income to cash and cash equivalents provided by operating activities: | | | |

| Depreciation and amortization | 5,064 | | | 4,655 | |

| Bad debt (recovery) expense | (99) | | | 479 | |

| Stock-based compensation expense | 9,739 | | | 7,732 | |

| Deferred income taxes | (875) | | | (61) | |

| Other items, net | (1,982) | | | (617) | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | (583) | | | 343 | |

| Prepaid expenses and other assets | 79 | | | (917) | |

| Deferred contract costs | (4,884) | | | (1,800) | |

| Accounts payable and accrued expenses | 86 | | | 3,404 | |

| Deferred revenue | 6,388 | | | 62 | |

| Cash and cash equivalents provided by operating activities | 26,479 | | | 25,985 | |

| Cash flows from investing activities | | | |

| Acquisition, net of cash acquired | — | | | (8,787) | |

| Purchases of property and equipment | (1,125) | | | (1,021) | |

| Payment of software development costs | (2,577) | | | (2,283) | |

| Cash and cash equivalents used in investing activities | (3,702) | | | (12,091) | |

| Cash flows from financing activities | | | |

| Repayment of finance leases | (12) | | | (1,418) | |

| Proceeds from exercise of stock options | 4,237 | | | 3,553 | |

| Payment of statutory tax withholding related to net-share settlement of restricted stock units | (1,363) | | | (1,299) | |

| Payment of line of credit financing costs | — | | | (179) | |

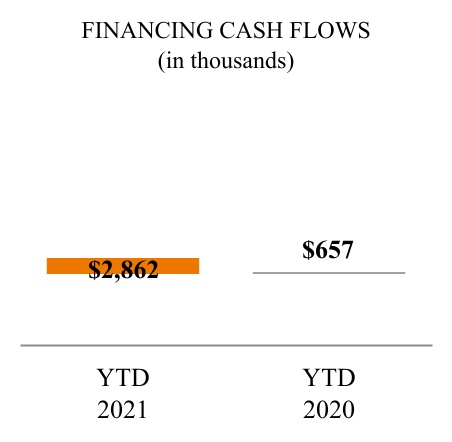

| Cash and cash equivalents provided by financing activities | 2,862 | | | 657 | |

| Effect of currency exchange rate changes on cash and cash equivalents | (165) | | | 21 | |

| Net increase in cash and cash equivalents | 25,474 | | | 14,572 | |

| Cash and cash equivalents, beginning of period | 71,545 | | | 51,785 | |

| Cash and cash equivalents, end of period | $ | 97,019 | | | $ | 66,357 | |

| Supplemental disclosure of cash flow information | | | |

| Cash paid for interest | $ | 69 | | | $ | 109 | |

| Cash paid for income taxes, net | $ | 456 | | | $ | 386 | |

| Supplemental disclosure of noncash investing and financing activities | | | |

| Accrued statutory tax withholding related to net-share settlement of restricted stock units | $ | 4,204 | | | $ | 1,889 | |

| Accrued capital expenditures | $ | 45 | | | $ | 379 | |

| | | |

The accompanying notes are an integral part of the unaudited condensed consolidated financial statements.

CHANNELADVISOR CORPORATION AND SUBSIDIARIES

NOTES TO UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. DESCRIPTION OF THE BUSINESS

ChannelAdvisor Corporation ("ChannelAdvisor" or the "Company") was incorporated in the state of Delaware and capitalized in June 2001. The Company began operations in July 2001. ChannelAdvisor is a leading multichannel commerce platform whose mission is to connect and optimize the world's commerce. For over two decades, ChannelAdvisor has helped brands and retailers worldwide improve their online performance by expanding sales channels, connecting with consumers across the entire buying cycle, optimizing their operations for peak performance and providing actionable analytics to improve competitiveness. Thousands of customers depend on ChannelAdvisor to securely power their e-commerce operations on hundreds of channels, including Amazon, eBay, Facebook, Google and Walmart. The Company is headquartered in Morrisville, North Carolina and maintains sales, service, support and research and development offices in various domestic and international locations.

2. SIGNIFICANT ACCOUNTING POLICIES

Principles of Consolidation

The accompanying condensed consolidated financial statements include the accounts of the Company and its wholly owned subsidiaries. All intercompany accounts and transactions have been eliminated in consolidation.

Interim Condensed Consolidated Financial Information

The accompanying condensed consolidated financial statements and footnotes have been prepared in accordance with generally accepted accounting principles in the United States of America, or U.S. GAAP, as contained in the Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, for interim financial information. In the opinion of management, the interim financial information includes all adjustments of a normal recurring nature necessary for a fair presentation of financial position, the results of operations, comprehensive income and cash flows. The results of operations for the three and nine months ended September 30, 2021 are not necessarily indicative of the results for the full year or the results for any future periods, especially in light of the ongoing impacts, and potential future effects of, the COVID-19 pandemic on the Company’s business, operations and financial performance. These unaudited interim financial statements should be read in conjunction with the audited financial statements and related footnotes for the year ended December 31, 2020, or fiscal 2020, which are included in the Company's Annual Report on Form 10-K for fiscal 2020. There have been no material changes to the Company's significant accounting policies from those described in the footnotes to the audited financial statements contained in the Company's Annual Report on Form 10-K for fiscal 2020.

Recent Accounting Pronouncements

The Company has reviewed new accounting pronouncements that were issued during the nine months ended September 30, 2021 and does not believe that these pronouncements are applicable to the Company, or that they will have a material impact on its financial position or results of operations.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the condensed consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

On an ongoing basis, the Company evaluates its estimates, including those related to the accounts receivable allowance, the useful lives of long-lived assets and other intangible assets, income taxes, assumptions used for purposes of determining stock-based compensation, leases, including estimating lease terms and extensions, and revenue recognition, including standalone selling prices for contracts with multiple performance obligations and the expected period of benefit for deferred contract costs, among others. Estimates and assumptions are also required to value assets acquired and liabilities assumed as well as contingent consideration, where applicable, in conjunction with business combinations. The Company bases its estimates on historical experience and on various other assumptions that it believes to be reasonable, the results of which form the basis for making judgments about the carrying value of assets and liabilities.

3. STOCKHOLDERS' EQUITY

The following tables summarize quarterly stockholders' equity activity for the nine-month periods ended September 30, 2021 and 2020 (in thousands, except number of shares):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarterly Activity For The Nine Months Ended September 30, 2021 |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

Loss | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| Shares | | Amount | | |

| Balance, December 31, 2020 | 29,020,424 | | | $ | 29 | | | $ | 288,842 | | | $ | (1,095) | | | $ | (157,685) | | | $ | 130,091 | |

| Exercise of stock options and vesting of restricted stock units | 802,270 | | | 1 | | | 3,586 | | | — | | | — | | | 3,587 | |

| Stock-based compensation expense | — | | | — | | | 3,048 | | | — | | | — | | | 3,048 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (89,842) | | | — | | | (2,061) | | | — | | | — | | | (2,061) | |

| Net income | — | | | — | | | — | | | — | | | 5,457 | | | 5,457 | |

| Foreign currency translation adjustments | — | | | — | | | — | | | (150) | | | — | | | (150) | |

| Balance, March 31, 2021 | 29,732,852 | | | 30 | | | 293,415 | | | (1,245) | | | (152,228) | | | 139,972 | |

| Exercise of stock options and vesting of restricted stock units | 146,164 | | | — | | | 136 | | | — | | | — | | | 136 | |

| Stock-based compensation expense | — | | | — | | | 3,576 | | | — | | | — | | | 3,576 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (48,409) | | | — | | | (1,177) | | | — | | | — | | | (1,177) | |

| Net income | — | | | — | | | — | | | — | | | 4,560 | | | 4,560 | |

| Foreign currency translation adjustments | — | | | — | | | — | | | 88 | | | — | | | 88 | |

| Balance, June 30, 2021 | 29,830,607 | | | 30 | | | 295,950 | | | (1,157) | | | (147,668) | | | 147,155 | |

| Exercise of stock options and vesting of restricted stock units | 314,529 | | | — | | | 515 | | | — | | | — | | | 515 | |

| Stock-based compensation expense | — | | | — | | | 3,115 | | | — | | | — | | | 3,115 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (96,188) | | | — | | | (2,329) | | | — | | | — | | | (2,329) | |

| Net income | — | | | — | | | — | | | — | | | 3,529 | | | 3,529 | |

| Foreign currency translation adjustments | — | | | — | | | — | | | (1,157) | | | — | | | (1,157) | |

| Balance, September 30, 2021 | 30,048,948 | | | $ | 30 | | | $ | 297,251 | | | $ | (2,314) | | | $ | (144,139) | | | $ | 150,828 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarterly Activity For The Nine Months Ended September 30, 2020 |

| Common Stock | | Additional

Paid-In

Capital | | Accumulated

Other

Comprehensive

Loss | | Accumulated

Deficit | | Total

Stockholders'

Equity |

| Shares | | Amount | | |

| Balance, December 31, 2019 | 28,077,469 | | | $ | 28 | | | $ | 278,111 | | | $ | (1,740) | | | $ | (176,750) | | | $ | 99,649 | |

Cumulative effect of accounting change (1) | — | | | — | | | — | | | — | | | 240 | | | 240 | |

| Exercise of stock options and vesting of restricted stock units | 394,998 | | | — | | | 87 | | | — | | | — | | | 87 | |

| Stock-based compensation expense | — | | | — | | | 2,914 | | | — | | | — | | | 2,914 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (107,398) | | | — | | | (980) | | | — | | | — | | | (980) | |

| Net income | — | | | — | | | — | | | — | | | 2,007 | | | 2,007 | |

| Foreign currency translation adjustments | — | | | — | | | — | | | (800) | | | — | | | (800) | |

| Balance, March 31, 2020 | 28,365,069 | | | 28 | | | 280,132 | | | (2,540) | | | (174,503) | | | 103,117 | |

| Exercise of stock options and vesting of restricted stock units | 330,692 | | | 1 | | | 2,046 | | | — | | | — | | | 2,047 | |

| Stock-based compensation expense | — | | | — | | | 2,556 | | | — | | | — | | | 2,556 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (48,675) | | | — | | | (659) | | | — | | | — | | | (659) | |

| Net income | — | | | — | | | — | | | — | | | 6,986 | | | 6,986 | |

| Foreign currency translation adjustments | — | | | — | | | — | | | 299 | | | — | | | 299 | |

| Balance, June 30, 2020 | 28,647,086 | | | 29 | | | 284,075 | | | (2,241) | | | (167,517) | | | 114,346 | |

| Exercise of stock options and vesting of restricted stock units | 411,651 | | | — | | | 1,420 | | | — | | | — | | | 1,420 | |

| Stock-based compensation expense | — | | | — | | | 2,262 | | | — | | | — | | | 2,262 | |

| Statutory tax withholding related to net-share settlement of restricted stock units | (77,533) | | | — | | | (1,549) | | | — | | | — | | | (1,549) | |

| Net income | — | | | — | | | — | | | — | | | 3,712 | | | 3,712 | |

| Foreign currency translation adjustments | — | | | — | | | — | | | 438 | | | — | | | 438 | |

| Balance, September 30, 2020 | 28,981,204 | | | $ | 29 | | | $ | 286,208 | | | $ | (1,803) | | | $ | (163,805) | | | $ | 120,629 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1) The Company recorded a reduction to accumulated deficit at January 1, 2020 as a result of its adoption of ASU 2016-13, Financial Instruments - Credit Losses

Share Repurchase Program

On September 16, 2021, the Company announced that its Board of Directors approved a share repurchase program authorizing the repurchase of up to $25 million of the Company’s common stock through August 10, 2022. Repurchases may be made from time to time on the open market at prevailing prices or in negotiated transactions off the market. The share repurchase program does not obligate the Company to repurchase any particular amount of its shares. As of September 30, 2021, the Company had not repurchased any shares under this program.

4. GOODWILL AND INTANGIBLE ASSETS

The Company has acquired intangible assets in connection with its business acquisitions. These assets were recorded at their estimated fair values at the acquisition date and are being amortized over their respective estimated useful lives using the straight-line method. The estimated useful lives and amortization methodology used in computing amortization are as follows:

| | | | | | | | |

| Estimated Useful Life | Amortization Methodology |

| Customer relationships | 7 years | Straight-line |

| Acquired technology | 7 years | Straight-line |

Amortization expense associated with the Company's intangible assets was $0.3 million for both the three months ended September 30, 2021 and 2020, and $0.8 million and $0.6 million for the nine months ended September 30, 2021 and 2020, respectively.

There were no changes to the Company's goodwill during the nine months ended September 30, 2021, other than foreign currency translation adjustments.

5. FAIR VALUE OF MEASUREMENTS

The Company uses a three-tier fair value hierarchy to classify and disclose all assets and liabilities measured at fair value on a recurring basis, as well as assets and liabilities measured at fair value on a non-recurring basis, in periods subsequent to their initial measurement. The hierarchy requires the Company to use observable inputs when available, and to minimize the use of unobservable inputs when determining fair value. The three tiers are defined as follows:

•Level 1. Observable inputs based on unadjusted quoted prices in active markets for identical assets or liabilities;

•Level 2. Inputs, other than quoted prices in active markets, that are observable either directly or indirectly; and

•Level 3. Unobservable inputs for which there is little or no market data, which require the Company to develop its own assumptions.

The carrying amounts of certain of the Company's financial instruments, including cash and cash equivalents, accounts receivable, accounts payable and accrued expenses approximate their respective fair values due to their short-term nature.

The acquisition of Blueboard, a private limited company organized under the laws of France ("BlueBoard"), on July 23, 2020 included a contingent consideration arrangement that allows for payments of up to $3.0 million based upon the achievement of specified annual revenue targets through July 2023. Contingent consideration was measured at fair value at the acquisition date and is remeasured at fair value at each reporting date until the contingency is resolved.

The fair value of the contingent consideration related to the BlueBoard acquisition was estimated utilizing Black-Scholes option pricing models in which various scenarios for achievement of the financial targets and resulting payouts are then discounted to determine the present value of the resulting liability. Key assumptions used in the measurement of fair value of contingent consideration include the forecasted revenue growth, revenue volatility and discount rates among other assumptions. Changes in any valuation inputs in isolation may result in a significantly lower or higher fair value measurement in the future. The fair value of the contingent consideration is recorded in "Other long-term liabilities" on the Company's consolidated balance sheet. Changes in the fair value of contingent consideration are recognized within general and administrative expenses in the Company’s consolidated statements of operations.

The following table presents the changes to the Company's liability for acquisition-related contingent consideration for the nine months ended September 30, 2021 (in thousands):

| | | | | |

| Balance as of December 31, 2020 | $ | 1,330 | |

| Change in fair value | (1,325) | |

| Balance as of September 30, 2021 | $ | 5 | |

6. CAPITALIZED SOFTWARE DEVELOPMENT COSTS

Capitalized software development costs related to creating internally developed software and implementing software purchased for internal use are included in property and equipment in the accompanying condensed consolidated balance sheets. The Company capitalized software development costs of $0.9 million during both the three months ended September 30, 2021 and 2020, and $2.6 million and $2.3 million during the nine months ended September 30, 2021 and 2020, respectively. Amortization expense related to capitalized internally developed software was $0.7 million and $0.5 million for the three months ended September 30, 2021 and 2020, respectively, and $2.0 million and $1.3 million for the nine months ended September 30, 2021 and 2020, respectively, and is included in cost of revenue or general and administrative expense in the accompanying condensed consolidated statements of operations, depending upon the nature of the software development project. The net book value of capitalized internally developed software was $4.8 million and $4.2 million at September 30, 2021 and December 31, 2020, respectively.

7. LINE OF CREDIT

On August 5, 2020, the Company established a $25.0 million revolving credit facility with a commercial lender that is available for use until August 5, 2023. Proceeds from borrowings under the credit facility may be used for working capital and general corporate purposes, including acquisitions. Up to $10.0 million of the facility is available for letters of credit. Additionally, the Company may request increases to the facility, subject to the consent of the lender, provided that the aggregate amount of such increases during the term do not exceed $10.0 million. Amounts borrowed under the facility will bear interest equal to either a base rate plus 2.25% per annum or LIBOR plus 3.25% per annum. The Company will pay a fee on all outstanding letters of credit at a rate of 3.25% per annum. In addition, the Company will pay a quarterly fee at a rate of 0.50% per annum on the undrawn portion of the facility. As collateral for extension of credit under the facility, the Company granted security interests in substantially all of its assets and those of one of its subsidiaries. The agreement for the credit facility contains customary representations and warranties and subjects the Company to affirmative and negative covenants. As of September 30, 2021, the Company had not drawn on, or issued any letters of credit under, the credit facility.

8. REVENUE FROM CONTRACTS WITH CUSTOMERS

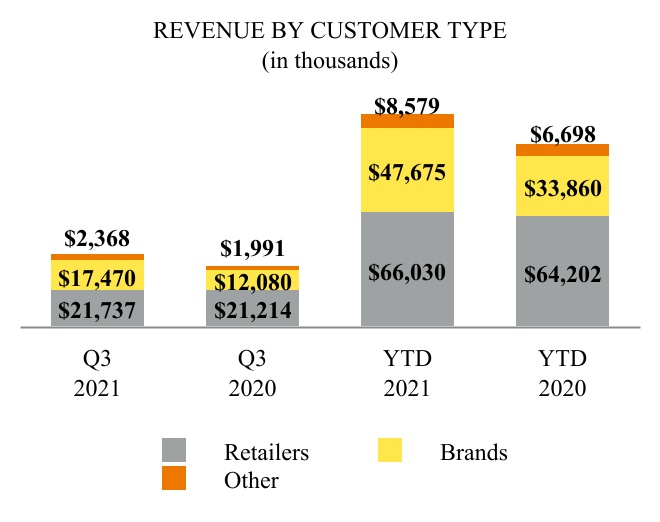

Revenue Recognition and Disaggregation of Revenue

The Company derives the majority of its revenue from subscription fees paid for access to and usage of its SaaS solutions for a specified contract term. A customer typically pays a recurring subscription fee based on a specified minimum amount of gross merchandise value, or GMV, or advertising spend that the customer expects to process through the Company's platform. Subscription fees may also include implementation fees such as launch assistance and training fees. The remaining portion of a customer's fee is variable and is based on a specified percentage of GMV or advertising spend processed through the Company's platform in excess of the customer's specified minimum GMV or advertising spend amount. In most cases, the specified percentage of excess GMV or advertising spend on which the variable fee is based is fixed and does not vary depending on the amount of the excess. Subscription fees are billed in advance of the subscription term and are due in accordance with contract terms, which generally provide for payment within 30 days. Variable fees are subject to the same payment terms, although they are generally billed at the end of the period in which they are incurred. The Company also generates revenue from its solutions that allow brands to direct potential consumers from their websites and digital marketing campaigns to authorized resellers. The majority of the Company's contracts have a one year term. The Company's contractual arrangements include performance, termination and cancellation provisions, but do not provide for refunds. Customers do not have the contractual right to take possession of the Company's software at any time. Sales taxes collected from customers and remitted to government authorities are excluded from revenue.

The Company's customers are categorized as follows:

Retailers. The Company generally categorizes a customer as a retailer if it primarily focuses on selling third-party products.

Brands. The Company generally categorizes a customer as a brand if it primarily focuses on selling its own proprietary products.

Other. Other is primarily comprised of strategic partnerships.

The following table summarizes revenue disaggregation by customer type for the three and nine months ended September 30, 2021 and 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Retailers | $ | 21,737 | | | $ | 21,214 | | | $ | 66,030 | | | $ | 64,202 | |

| Brands | 17,470 | | | 12,080 | | | 47,675 | | | 33,860 | |

| Other | 2,368 | | | 1,991 | | | 8,579 | | | 6,698 | |

| $ | 41,575 | | | $ | 35,285 | | | $ | 122,284 | | | $ | 104,760 | |

Contracts with Multiple Performance Obligations

Customers may elect to purchase a subscription to multiple modules, multiple modules with multiple service levels, or, for certain of the Company's solutions, multiple brands or geographies. The Company evaluates such contracts to determine whether the services to be provided are distinct and accordingly should be accounted for as separate performance obligations. If the Company determines that a contract has multiple performance obligations, the transaction price, which is the total price of the contract, is allocated to each performance obligation based on a relative standalone selling price method. The Company estimates standalone selling price based on observable prices in past transactions for which the product offering subject to the

performance obligation has been sold separately. As the performance obligations are satisfied, revenue is recognized as discussed above.

Transaction Price Allocated to Future Performance Obligations

As the Company typically enters into contracts with customers for a twelve-month subscription term, a substantial majority of its performance obligations that have not yet been satisfied as of September 30, 2021 are part of a contract that has an original expected duration of one year or less. For contracts with an original expected duration of greater than one year, the aggregate transaction price allocated to the unsatisfied performance obligations was $40.0 million as of September 30, 2021, of which $23.3 million is expected to be recognized as revenue over the next twelve months.

Deferred Revenue

Deferred revenue generally represents the unearned portion of subscription fees. Deferred revenue is recorded when fees are invoiced in advance of performance. Deferred amounts are generally recognized within one year. Deferred revenue is included in the accompanying condensed consolidated balance sheets under "Total current liabilities," net of any long-term portion that is included in "Other long-term liabilities." The following table summarizes deferred revenue activity for the nine months ended September 30, 2021 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Balance, beginning of period | | Net additions | | Revenue recognized from deferred revenue | | Balance, end of period |

| Deferred revenue | $ | 23,301 | | | 102,770 | | | (96,523) | | | $ | 29,548 | |

Of the $122.3 million of revenue recognized in the nine months ended September 30, 2021, $20.1 million was included in deferred revenue at January 1, 2021.

Costs to Obtain Contracts

The Company capitalizes sales commissions and a portion of other incentive compensation costs that are directly related to obtaining customer contracts and that would not have been incurred if the contract had not been obtained. These costs are included in the accompanying condensed consolidated balance sheets and are classified as "Prepaid expenses and other current assets," net of any long-term portion that is included in "Deferred contract costs, net of current portion." As of September 30, 2021, $8.7 million was included in "Prepaid expenses and other current assets." Deferred contract costs are amortized to sales and marketing expense over the expected period of benefit, which the Company has determined to be five years based on the estimated customer relationship period. The following table summarizes deferred contract cost activity for the nine months ended September 30, 2021 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| Balance, beginning of period | | Additions | | Amortized costs (1) | | Balance, end of period |

| Deferred contract costs | $ | 21,333 | | | 11,366 | | | (6,719) | | | $ | 25,980 | |

(1) Includes contract costs amortized to sales and marketing expense during the period and the impact from foreign currency exchange rate fluctuations.

9. STOCK-BASED COMPENSATION

In February 2020, the Company’s Compensation Committee implemented changes to the equity compensation program for the Company’s executive officers. Beginning in 2020, 50% of each executive's equity awards were granted in the form of performance-based vesting restricted stock units, or PSUs, that are eligible for vesting only if the Company achieves pre-defined targets set by the Compensation Committee for the Company’s combined year-over-year revenue growth and adjusted earnings before interest, tax, depreciation and amortization, or EBITDA, margin over a two-year measurement period, subject to the executive’s continued service with the Company. For any PSUs granted in 2020 to vest, revenue growth must be positive over the performance period. Vesting of the PSU awards is based on a sliding scale of actual performance against the pre-defined goals. The sliding scale ranges from zero vesting and forfeiture of the awards if the Company does not achieve the performance threshold, to an award of up to 150% and 200% of the target number of awards for fiscal 2020 and 2021 grants, respectively, if the pre-defined maximum performance is achieved. As soon as reasonably practicable after the completion of the performance period, the Compensation Committee will determine the level of attainment of the performance goal and if the performance threshold is achieved, on the second anniversary of the grant date, subject to the executive’s continued service as of that date, 50% of the earned PSU awards will vest and, on the third anniversary of the grant date, the remaining 50% of earned PSU awards will vest, subject to the executive’s continued service as of that date. The Committee may make adjustments to the manner in which the achievement is determined as it deems equitable and appropriate to exclude the effect of

unusual, non-recurring or infrequent matters, transactions or events affecting the Company or its consolidated financial statements; changes in accounting principles, practices or policies or in tax laws or other laws or requirements; or other similar events, matters or changed circumstances. Each adjustment, if any, shall be made solely for the purpose of maintaining the intended economics of the award in light of changed circumstances to prevent the dilution or enlargement of the executive’s rights with respect to the PSUs. The fair value of the PSU awards is determined using the Company’s stock price on the grant date. These awards are equity classified and will be expensed over the requisite service period based on the extent to which achievement of the performance metrics is probable.

The Company recognizes stock-based compensation expense using the accelerated attribution method, net of estimated forfeitures, in which compensation cost for each vesting tranche in an award is recognized ratably from the service inception date to the vesting date for that tranche.

Stock-based compensation expense is included in the following line items in the accompanying condensed consolidated statements of operations for the three and nine months ended September 30, 2021 and 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Cost of revenue | $ | 169 | | | $ | 203 | | | $ | 665 | | | $ | 760 | |

| Sales and marketing | 928 | | | 544 | | | 2,744 | | | 2,061 | |

| Research and development | 567 | | | 485 | | | 1,869 | | | 1,708 | |

| General and administrative | 1,451 | | | 1,030 | | | 4,461 | | | 3,203 | |

| Total stock-based compensation expense | $ | 3,115 | | | $ | 2,262 | | | $ | 9,739 | | | $ | 7,732 | |

During the nine months ended September 30, 2021, the Company granted the following share-based awards:

| | | | | | | | | | | |

| Number of Shares Underlying Grant | | Weighted Average Grant Date Fair Value |

| Restricted stock units | 449,506 | | | $ | 23.39 | |

| Performance stock units | 71,932 | | | $ | 23.88 | |

| Total share-based awards | 521,438 | | | |

10. NET INCOME PER SHARE

Basic net income per share is calculated by dividing net income by the weighted-average number of shares of common stock outstanding for the period. Diluted net income per share is calculated giving effect to all potentially dilutive shares of common stock, including stock options and restricted stock units. The dilutive effect of outstanding awards is reflected in diluted earnings per share by application of the treasury stock method.

The following table summarizes the calculation of basic and diluted net income per share (in thousands, except share and per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Basic: | | | | | | | |

| Net income | $ | 3,529 | | | $ | 3,712 | | | $ | 13,546 | | | $ | 12,705 | |

| Weighted average common shares outstanding, basic | 29,931,173 | | | 28,802,310 | | | 29,665,439 | | | 28,485,547 | |

| Basic net income per share | $ | 0.12 | | | $ | 0.13 | | | $ | 0.46 | | | $ | 0.45 | |

| Diluted: | | | | | | | |

| Net income | $ | 3,529 | | | $ | 3,712 | | | $ | 13,546 | | | $ | 12,705 | |

| Weighted average common shares outstanding, basic | 29,931,173 | | | 28,802,310 | | | 29,665,439 | | | 28,485,547 | |

| Dilutive effect of: | | | | | | | |

| Stock options | 575,293 | | | 571,884 | | | 595,938 | | | 334,565 | |

| Unvested restricted stock units | 967,848 | | | 1,062,407 | | | 1,034,360 | | | 995,717 | |

| Weighted average common shares outstanding, diluted | 31,474,314 | | | 30,436,601 | | | 31,295,737 | | | 29,815,829 | |

| Diluted net income per share | $ | 0.11 | | | $ | 0.12 | | | $ | 0.43 | | | $ | 0.43 | |

The following equity instruments have been excluded from the calculation of diluted net income per share because the effect is anti-dilutive:

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Stock options | 21,632 | | | 145,279 | | | 22,235 | | | 528,777 | |

| Restricted stock units | 5,291 | | | 19,322 | | | 231,680 | | | 26,397 | |

11. INCOME TAXES

At the end of each interim reporting period, the Company estimates its effective income tax rate expected to be applicable for the full year. This estimate is used to determine the income tax provision or benefit on a year-to-date basis and may change in subsequent interim periods.

The Company's effective tax rate was (1.0)% and (11.2)% for the three months ended September 30, 2021 and 2020, respectively, and (3.3)% and 1.3% for the nine months ended September 30, 2021 and 2020, respectively. The tax benefit and expense for each of the periods was based on U.S. federal, state, local and foreign income taxes. The Company’s effective tax rate for these periods is lower than the U.S. federal statutory rate of 21% primarily due to the utilization of operating loss carryforwards which are subject to a valuation allowance. As a result of uncertainties relating to the timing and sufficiency of future taxable income in certain tax jurisdictions in which the Company operates, the Company cannot recognize the tax benefit of operating loss carryforwards generated in those jurisdictions until the operating loss carryforwards are utilized. The increase in the effective tax rate for the three months ended September 30, 2021 compared with the same period in the prior year was primarily due to the revaluation of the Company’s UK deferred tax assets resulting from an increase in the UK statutory tax rate from 17% to 19% enacted during the third quarter of 2020. The decrease in the effective tax rate for the nine months ended September 30, 2021 compared with the same period in the prior year was primarily due to the revaluation of the Company's UK deferred tax assets resulting from the enactment of an additional increase in the UK statutory tax rate from 19% to 25% during the second quarter of 2021, as well as an increase in U.S. state income tax benefits resulting from tax deductions for stock-based compensation.

The American Rescue Plan Act, or ARP Act, was enacted on March 11, 2021. The ARP Act includes provisions on taxes, health care, unemployment benefits, direct payments, state and local funding and other issues. Included in the tax provisions was an expansion of the limitations on the deduction of excessive executive compensation. The Coronavirus, Aid, Relief and Economic Security Act, or CARES Act, was enacted on March 27, 2020. The CARES Act includes both income tax and non-income tax measures to assist companies. Some of the key income tax-related provisions of the CARES Act include the elimination of the 80% limitation on certain net operating loss carryforwards and allowing net operating loss carrybacks, an increase to the interest expense deduction limit, passage of technical corrections to the Tax Cuts and Jobs Act of 2017, and

acceleration of the Alternative Minimum Tax Credit refund. In addition to the income tax provisions, the ARP Act and CARES Act include non-income tax provisions, such as loan programs, penalty and interest-free deferral of certain tax payments, and payroll tax credits. The Company has decided not to apply for any of the loan programs in either Act. The Company is currently benefiting from penalty and interest-free tax payment deferral of the 2020 U.S. Social Security tax payments as provided in the CARES Act. The Company is also monitoring COVID-19 tax relief developments in U.S. states and foreign jurisdictions where the Company has operations.

The corporate tax changes in the ARP Act and CARES Act had an insignificant impact on the income tax provision for the three and nine months ended September 30, 2021.

The Company recorded a valuation allowance against all of its U.S. deferred tax assets as of September 30, 2021. The Company intends to continue maintaining a full valuation allowance on its U.S. deferred tax assets until there is sufficient evidence to support the reversal of all or some portion of the allowance. However, given its current earnings and anticipated future earnings, there is a reasonable possibility that within the next 12 months, sufficient positive evidence may become available to allow it to reach a conclusion that a portion of the valuation allowance will no longer be needed. Release of the valuation allowance would result in the recognition of certain deferred tax assets and a decrease to income tax expense for the period the release is recorded. However, the Company is currently unable to determine the exact timing and amount of the valuation allowance release.

12. SEGMENT AND GEOGRAPHIC INFORMATION

Operating segments are defined as components of an enterprise for which discrete financial information is available that is evaluated regularly by the chief operating decision maker, or CODM, for purposes of allocating resources and evaluating financial performance. The Company's CODM reviews financial information presented on a consolidated basis for purposes of allocating resources and evaluating financial performance. As such, the Company's operations constitute a single operating segment and one reportable segment.

Substantially all assets were held in the United States during the nine months ended September 30, 2021 and the year ended December 31, 2020. The Company categorizes domestic and international revenue from customers based on their billing address. The following table summarizes revenue by geography for the three and nine months ended September 30, 2021 and 2020 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |

| Domestic | $ | 29,199 | | | $ | 26,135 | | | $ | 87,181 | | | $ | 78,571 | |

| International | 12,376 | | | 9,150 | | | 35,103 | | | 26,189 | |

| Total revenue | $ | 41,575 | | | $ | 35,285 | | | $ | 122,284 | | | $ | 104,760 | |

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

Certain statements contained in this Quarterly Report on Form 10-Q may constitute forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. The words or phrases "would be," "will allow," "intends to," "will likely result," "are expected to," "will continue," "is anticipated," "estimate," "project," or similar expressions, or the negative of such words or phrases, are intended to identify "forward-looking statements." We have based these forward-looking statements on our current expectations and projections about future events. Because such statements include risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. These forward-looking statements are based upon information available to us as of the date of this Quarterly Report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements. Factors that could cause or contribute to these differences include those below and elsewhere in this Quarterly Report on Form 10-Q, particularly in Part II – Item 1A, "Risk Factors," and our other filings with the Securities and Exchange Commission. Statements made herein are as of the date of the filing of this Form 10-Q with the Securities and Exchange Commission and should not be relied upon as of any subsequent date. Unless otherwise required by applicable law, we do not undertake, and we specifically disclaim, any obligation to update any forward-looking statements to reflect occurrences, developments, unanticipated events or circumstances after the date of such statement.

The following discussion and analysis of our financial condition and results of operations should be read in conjunction with our unaudited condensed consolidated financial statements and related notes that appear in Item 1 of this Quarterly Report on Form 10-Q and with our audited consolidated financial statements and related notes for the year ended December 31, 2020, which are included in our Annual Report on Form 10-K for fiscal 2020.

We are a leading multichannel commerce platform whose mission is to connect and optimize the world's commerce. For over two decades, we have helped brands and retailers worldwide improve their online performance by expanding sales channels, connecting with consumers across the entire buying cycle, optimizing their operations for peak performance and providing actionable analytics to improve competitiveness. More specifically, our platform allows our customers to manage their product listings, inventory availability, pricing optimization, search terms, orders and fulfillment, and other critical functions across these channels. Thousands of customers depend on us to securely power their e-commerce operations on hundreds of channels, including Amazon, eBay, Facebook, Google and Walmart. Our brand analytics solution helps leading global brands gain a competitive advantage on their e-commerce channels with actionable insights into how their products are performing across thousands of retailer websites and marketplaces. Our fulfillment solution makes it easier for customers to connect to their supply chain, which could include distributors, manufacturers and third-party logistics providers. We also offer solutions that allow brands to send their web visitors or digital marketing audiences directly to authorized resellers and to gain insight into consumer behavior. Overall, our platform delivers significant breadth, scalability and flexibility and facilitates billions of dollars in e-commerce transactions annually across the globe.

We serve customers across a wide range of industries and geographies. Our customers include the online businesses of brands and retailers, as well as advertising agencies that use our solutions on behalf of their clients.

EXECUTIVE OVERVIEW

FINANCIAL HIGHLIGHTS

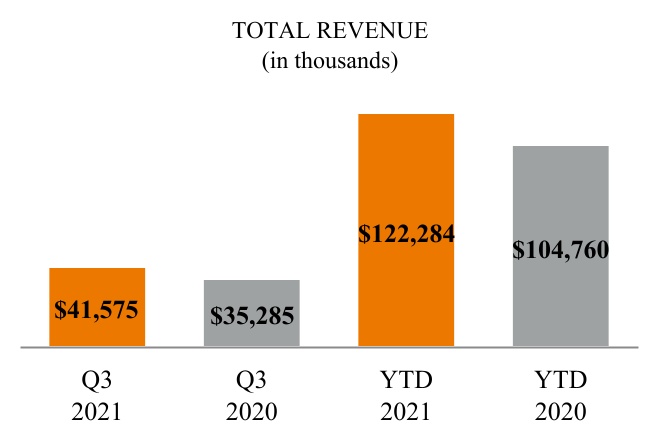

•Total revenue of $41.6 million and $122.3 million for the three and nine months ended September 30, 2021 increased 17.8% and 16.7%, respectively, from the comparable prior year periods;

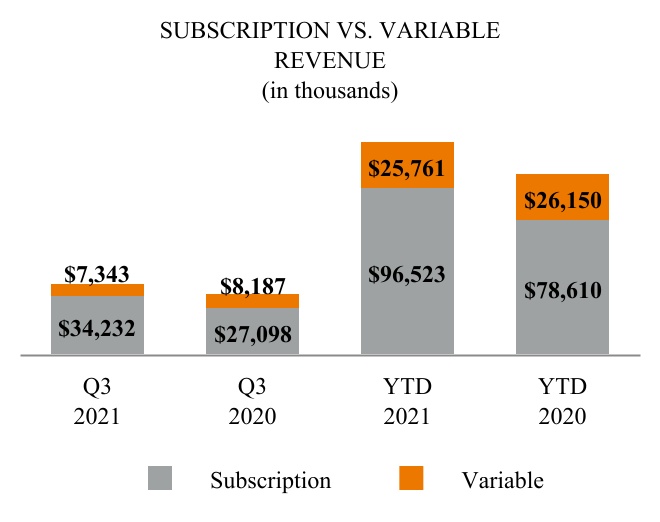

•Revenue was comprised of 82.3% subscription revenue and 17.7% variable revenue for the three months ended September 30, 2021 compared with 76.8% subscription revenue and 23.2% variable revenue for the comparable prior year period;

•Revenue was comprised of 78.9% subscription revenue and 21.1% variable revenue for the nine months ended September 30, 2021 compared with 75.0% subscription revenue and 25.0% variable revenue for the comparable prior year period;

•Revenue from our brands customers represented 42.0% and 39.0% of total revenue for the three and nine months ended September 30, 2021, respectively, up from 34.2% and 32.3% of total revenue for the comparable prior year periods;

•Revenue derived from customers located outside of the United States as a percentage of total revenue was 29.8% and 28.7% for the three and nine months ended September 30, 2021, respectively, compared with 25.9% and 25.0% for the comparable prior year periods;

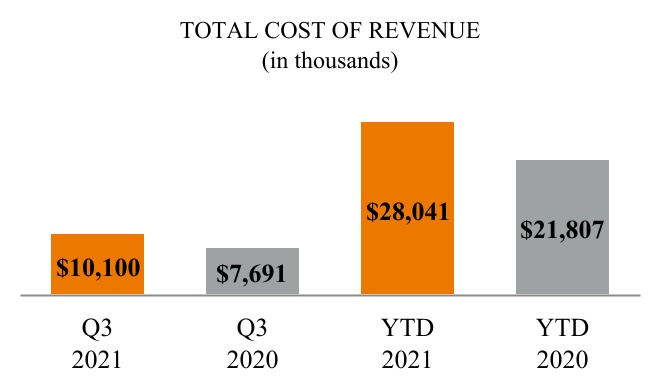

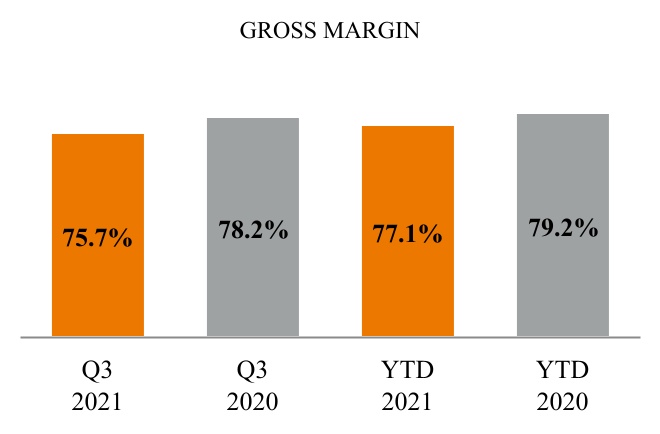

•Gross margin of 75.7% and 77.1% for the three and nine months ended September 30, 2021, respectively, declined by 250 and 210 basis points, respectively, compared with 78.2% and 79.2% for the comparable prior year periods;

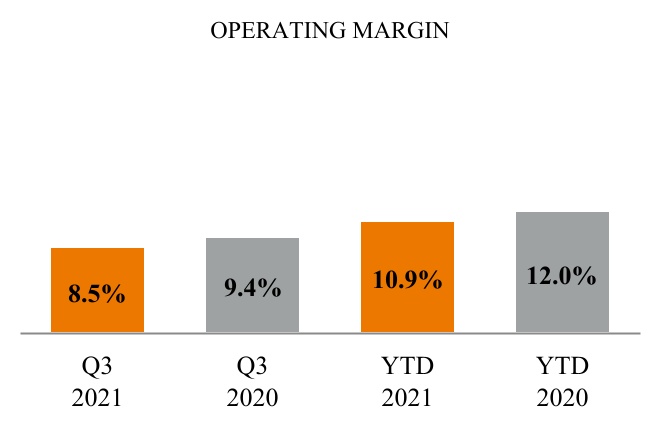

•Operating margin of 8.5% and 10.9% for the three and nine months ended September 30, 2021, respectively, declined from 9.4% and 12.0% for the comparable prior year periods;

•Net income was $3.5 million and $13.5 million for the three and nine months ended September 30, 2021, respectively, compared with net income of $3.7 million and $12.7 million for the comparable prior year periods;

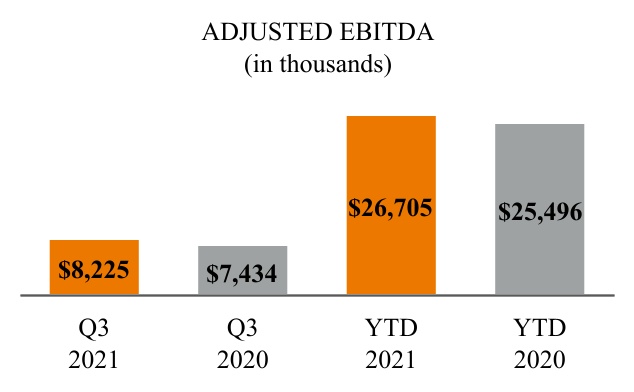

•Adjusted EBITDA, a non-GAAP measure, was $8.2 million and $26.7 million for the three and nine months ended September 30, 2021, respectively, compared with adjusted EBITDA of $7.4 million and $25.5 million for the comparable prior year periods;

•Cash and cash equivalents were $97.0 million at September 30, 2021 compared with $71.5 million at December 31, 2020;

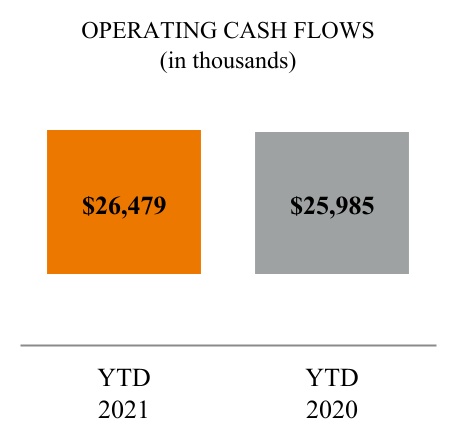

•Operating cash flow was $26.5 million for the nine months ended September 30, 2021 compared with $26.0 million for the comparable prior year period; and

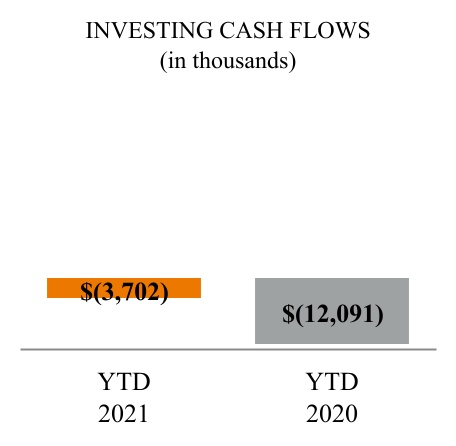

•Free cash flow, a non-GAAP measure, was $22.8 million for the nine months ended September 30, 2021 compared with $22.7 million for the comparable prior year period.

EFFECTS OF COVID-19 ON OUR BUSINESS

COVID-19 has affected e-commerce in different ways and presents our business with both opportunities and risks. In general, the closing of many physical retail stores and the stay-at-home orders issued by many jurisdictions have driven a substantial shift in commerce to online channels like Amazon and Walmart. Since the first quarter of 2020, our business has been positively affected by a substantial increase in e-commerce volumes, which drove an increase in gross merchandise value, or GMV, processed through our platform, and benefited our variable revenue. How long, and to what extent, this level of higher GMV can continue is very difficult to forecast. We believe that the heightened GMV levels we have seen are likely to dissipate somewhat over time as COVID-19 vaccinations are administered to the overall population, new COVID-19 cases sufficiently diminish, retail stores reopen and stay-at-home orders ease. We also believe that some level of increased e-commerce may become permanent as customers become more regular online shoppers, which would increase demand for solutions, like ours, that help brands and retailers continue to shift toward digital channels.

COVID-19 has had a substantial impact on employment levels and the overall global economy. Governments around the world, including the U.S. Federal government and European Union, have enacted historic fiscal and monetary stimulus programs in an effort to mitigate the economic impact of COVID-19, and we believe these programs have helped support consumer spending. Whether and when, and to what extent, future stimulus programs are enacted is difficult to predict. Therefore, the risk of continued global economic distress remains high and may impact consumer demand and, hence, e-commerce volumes. How long this economic climate lasts, and whether or not the impact on consumer demand is more than offset by the shift to online shopping that we have seen since March 2020, is not knowable at this point.

Additionally, COVID-19 has led to well-publicized supply chain disruptions globally, across virtually every industry. Brands and retailers face increased difficulty sourcing parts and inventory, have encountered substantially increased shipping and logistics costs, and often face labor shortages. For many businesses, this has led to increased costs, higher prices, and disruptions to inventory availability, which may impact consumer spending and e-commerce volumes, particularly during the holiday season. Although we have not seen a significant impact to our business or our financial results thus far, these factors incrementally increase our uncertainty about the macroeconomic environment, and we believe these challenges will persist into 2022.

For all of these reasons, it has remained difficult to forecast our revenue and profitability for future periods, especially as continued outbreaks of COVID-19 could disrupt our operations and/or those of our customers. However, we believe we currently have sufficient liquidity and that our business model, which is substantially based on subscription revenues, positions us to continue to manage through the challenges presented by COVID-19.

TRENDS IN OUR BUSINESS

The following trends have contributed to the results of our consolidated operations, and we anticipate that they will continue to affect our future results:

•Growth in Online Shopping. Consumers continue to move more of their spending from offline to online. The continuing shift to online shopping and overall growth has contributed to our historical growth and we expect that this online shift will continue to benefit our business. Global efforts to implement social distancing, including stay-at-home orders and similar mobility and gathering restrictions, due to the COVID-19 pandemic, have increased e-commerce as consumers have increasingly turned to online purchasing for many products they would have purchased at brick and mortar stores. However, it is unclear to what degree this recent shift in favor of e-commerce will continue once the public health impacts of the COVID-19 pandemic have begun to subside.

•Product Offering Expansion. As online shopping evolves, we continue to expand our product offerings to reflect the needs of companies seeking to attract consumers. We continue to enhance our product offerings by increasing online shopping channel integrations, including marketplace and first-party retail programs, and providing capabilities that allow brands and retailers to be more competitive. This includes support for advertising, advanced algorithmic repricing, machine learning-based demand forecasting, analytics capabilities, fulfillment features and user experience.

•Channel Expansion. We have experienced substantial growth in GMV on our platform from large channels like Zalando, Target Plus and Shopify, as well as numerous smaller marketplaces that we refer to collectively as our long tail of marketplaces. Many of our brands customers see a significant opportunity in expanding their reach to more consumers via global channel expansion. We implemented a plan at the beginning of 2021 to add at least 80 additional channel connections across the globe over an 18-month period to help our customers with this opportunity. We anticipate that we will achieve this by early 2022 and we have initiated planning to add at least 80 additional channel connections again in 2022.

•Growth in Mobile Usage. We believe the shift toward mobile commerce will increasingly favor aggregators such as Amazon, eBay, Google and Walmart, all of which are focal points of our platform. These systems understand the identity of the buyer, helping to reduce friction in the mobile commerce process, while offering a wide selection of merchandise in a single location. We believe that the growth in mobile commerce may result in increased revenue for us.

•Evolving Fulfillment Landscape. Consumers have been conditioned to expect fast, efficient delivery of products. We believe that determining and executing on a strategy to more expeditiously receive, process and deliver online orders, which we refer to collectively as fulfillment, is critical to success for online sellers. Therefore, it will be increasingly important for us to facilitate and optimize fulfillment services on behalf of our customers, which in turn may result in additional research and development investment.

•Focus on Employees. We strive to provide competitive compensation and benefits programs to help attract and retain employees who are focused on facilitating the success of our customers. We implemented a COVID-19 global work-from-home policy beginning in March 2020 to help protect our employees and support our communities' efforts to slow the transmission of COVID-19. This transition went smoothly, as our workforce is globally distributed and employees have the equipment they need to work from home, including global video communications systems. In May 2021, we implemented a formal global flexible work policy that provides our employees the ability to determine whether they will continue to work from home or from the office, as our offices around the world reopen. We are not dependent on our physical office locations or travel for our business operations.

•Seasonality. Our revenue fluctuates as a result of seasonal variations in our business, principally due to the peak consumer demand and related increased volume of our customers' GMV during the year-end holiday season. As a result, we have historically had higher revenue in our fourth quarter than other quarters due to increased GMV processed through our platform, resulting in higher variable fees. Since the second quarter of 2020, we have seen an increase in GMV processed through our platform, which does not follow the typical seasonal variations in our business, and resulted in higher than normal variable revenue. Refer to "Revenue" below for additional information.

OPPORTUNITIES AND RISKS

•Brands. We believe the digital transformation to e-commerce has changed the way brands interact with their customers, which is why we have identified that growing our brands business represents a significant strategic opportunity for us. We generally categorize a customer as a brand if it primarily focuses on selling its own proprietary products. Brands tend to have longer customer life cycles, stronger financial stability and overall better unit economics

than retailers, which we consider to be companies focused primarily on selling third-party products. Brands also offer increased expansion opportunities to grow their e-commerce business through our platform; however they tend to have longer sales cycles. To help drive our future growth, we have made significant investments in our sales force, modified our sales compensation plans and allocated resources focused on growing our customer base of brands. We plan to continue to invest in our sales organization and also further invest in our services and R&D organizations, which we believe will improve customer and revenue retention and contribute to expanding the relationships we already have with our current brands customers.

•Dynamic E-commerce Landscape. We need to continue to innovate in the face of a rapidly changing e-commerce landscape if we are to remain competitive.

•Strategic Partnerships. Our business development team's mission is to expand our sales and market opportunities through strategic partner relationships. We plan to continue to invest in initiatives to expand our strategic partnership base to further enhance our offerings for customers and to help support our indirect sales channel efforts. The goal of these strategic partnerships is to further improve the value of our platform for our customers and, when possible, provide us opportunities for incremental revenue streams.

•Increasing Complexity of E-commerce. Although e-commerce continues to expand as brands and retailers continue to increase their online sales, it is also becoming more complex due to the hundreds of channels available to brands and retailers and the rapid pace of change and innovation across those channels. In order to gain consumers' attention in a more crowded and competitive online marketplace, an increasing number of brands and retailers sell their merchandise through multiple online channels, each with its own rules, requirements and specifications. In particular, third-party marketplaces are an increasingly important driver of growth for a number of brands and large online retailers. As a result, we need to continue to support multiple channels in a variety of geographies in order to support our targeted revenue growth, and we intend to continue making strategic investments focused on channel expansion.

•Global Growth in E-commerce. We believe the growth in e-commerce globally presents an opportunity for brands and retailers to engage in international sales. However, country-specific marketplaces are often a market share leader in their regions, as is the case for Zalando in Europe, for example. In order to help our customers capitalize on this potential market opportunity, and to address our customers' needs with respect to cross-border trade, we intend to continue to invest in our international operations. Doing business overseas involves substantial challenges, including management attention and resources needed to adapt to multiple languages, cultures, laws and commercial infrastructure, as further described in this report under the caption "Risks Related to our International Operations."

Our senior management continuously focuses on these and other trends and challenges, and we believe that our culture of innovation and our history of growth and expansion will contribute to the success of our business.

RESULTS OF OPERATIONS

The following tables set forth our condensed consolidated statement of operations data and such data expressed as a percentage of revenues for each of the periods indicated.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, | | Period-to-Period Change | | Period-to-Period Change | | |

| | 2021 | | 2020 | | 2021 | | 2020 | | Q3 2021 to Q3 2020 | | YTD 2021 to YTD 2020 | | |

| (dollars in thousands) | | | | | | |

| Revenue | $ | 41,575 | | | $ | 35,285 | | | $ | 122,284 | | | $ | 104,760 | | | $ | 6,290 | | 17.8 | % | | $ | 17,524 | | 16.7 | % | | |

| Cost of revenue | 10,100 | | | 7,691 | | | 28,041 | | | 21,807 | | | 2,409 | | 31.3 | | | 6,234 | | 28.6 | | | |

| Gross profit | 31,475 | | | 27,594 | | | 94,243 | | | 82,953 | | | 3,881 | | 14.1 | | | 11,290 | | 13.6 | | | |

| Operating expenses: | | | | | | | | | | | | | | | |

| Sales and marketing | 15,482 | | | 13,477 | | | 45,273 | | | 38,436 | | | 2,005 | | 14.9 | | | 6,837 | | 17.8 | | | |

| Research and development | 5,364 | | | 4,809 | | | 16,799 | | | 14,153 | | | 555 | | 11.5 | | | 2,646 | | 18.7 | | | |

| General and administrative | 7,075 | | | 5,974 | | | 18,792 | | | 17,742 | | | 1,101 | | 18.4 | | | 1,050 | | 5.9 | | | |

| Total operating expenses | 27,921 | | | 24,260 | | | 80,864 | | | 70,331 | | | 3,661 | | 15.1 | | | 10,533 | | 15.0 | | | |

| Income from operations | 3,554 | | | 3,334 | | | 13,379 | | | 12,622 | | | 220 | | 6.6 | | | 757 | | 6.0 | | | |

| Other (expense) income: | | | | | | | | | | | | | | | |

| Interest (expense) income, net | (30) | | | (1) | | | (96) | | | 210 | | | (29) | | * | | (306) | | * | | |

| Other (expense) income, net | (29) | | | 5 | | | (164) | | | 44 | | | (34) | | * | | (208) | | * | | |

| Total other (expense) income | (59) | | | 4 | | | (260) | | | 254 | | | (63) | | * | | (514) | | * | | |

| Income before income taxes | 3,495 | | | 3,338 | | | 13,119 | | | 12,876 | | | 157 | | 4.7 | | | 243 | | 1.9 | | | |

| Income tax (benefit) expense | (34) | | | (374) | | | (427) | | | 171 | | | 340 | | * | | (598) | | * | | |

| Net income | $ | 3,529 | | | $ | 3,712 | | | $ | 13,546 | | | $ | 12,705 | | | $ | (183) | | (4.9) | % | | $ | 841 | | 6.6 | % | | |

* Not meaningful

| | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2021 | | 2020 | | 2021 | | 2020 |