UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________

FORM N-CSR

________

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act File Number 811-21061

Aetos Multi-Strategy Arbitrage Fund, LLC

(Exact name of registrant as specified in charter)

________

c/o Aetos Alternatives Management, LP

875 Third Avenue, 6th Floor

New York, NY 10022

(Address of principal executive offices) (Zip code)

Harold Schaaff

Aetos Alternatives Management, LP

875 Third Avenue, 6th Floor

New York, NY 10022

(Name and address of agent for service)

Registrant’s telephone number, including area code: 1-212-201-2500

Date of fiscal year end: January 31

Date of reporting period: July 31, 2021

Item 1. Reports to Stockholders.

AETOS MULTI-STRATEGY ARBITRAGE FUND, LLC

AETOS DISTRESSED INVESTMENT STRATEGIES FUND, LLC

AETOS LONG/SHORT STRATEGIES FUND, LLC

(Delaware Limited Liability Companies)

Financial Statements (Unaudited)

July 31, 2021

Table of Contents

The Funds file their complete schedule of portfolio holdings with the Securities and Exchange Commission for the first and third quarters of each fiscal year on Form N-PORT within sixty days after the end of each period. The Funds’ Forms N-PORT are available on the Commission's web site at http://www.sec.gov, and may be reviewed and copied at the Commission's Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that the Funds use to determine how to vote proxies relating to portfolio securities, as well as information relating to how the Funds voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-212-201-2500; and (ii) on the Commission's website at http://www.sec.gov, and may be reviewed and copied at the commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

Aetos Multi-Strategy Arbitrage Fund, LLC

Schedule of Investments (Unaudited)

July 31, 2021

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Investments in Portfolio Funds (2) | ||||||||||||||||

| Commodity Trading Advisor (4) | ||||||||||||||||

| GSA Trend Fund LP | 08/01/18 - 10/01/20 | $ | 16,487,602 | $ | 17,373,461 | 3.34 | % | Daily | ||||||||

| Total Commodity Trading Advisor | 16,487,602 | 17,373,461 | 3.34 | |||||||||||||

| Convertible Arbitrage (5) | ||||||||||||||||

| CNH CA II, Ltd. | 04/01/21 - 07/01/21 | 15,000,000 | 15,122,423 | 2.91 | Quarterly (10) | |||||||||||

| Total Convertible Arbitrage | 15,000,000 | 15,122,423 | 2.91 | |||||||||||||

| The accompanying notes are an integral part of the financial statements | 1 |

Aetos Multi-Strategy Arbitrage Fund, LLC

Schedule of Investments (Unaudited)

July 31, 2021

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

Credit - Convertible Arbitrage (6) | ||||||||||||||||

| Aequim Arbitrage Fund LP | 03/01/19 - 01/01/21 | 30,031,906 | 42,326,192 | 8.13 | Quarterly (9) | |||||||||||

| Total Credit - Convertible Arbitrage | 30,031,906 | 42,326,192 | 8.13 | |||||||||||||

| Event Driven Arbitrage (7) | ||||||||||||||||

| Davidson Kempner Partners | 07/01/06 - 07/01/12 | 49,041,413 | 95,395,296 | 18.33 | Semi-Annual | |||||||||||

| Farallon Capital Offshore Investors, Inc. | 02/01/07 - 04/01/12 | 45,554,327 | 93,897,534 | 18.04 | Semi-Annual (9) | |||||||||||

| Governors Lane Onshore Fund LP | 08/01/15 - 08/01/16 | 35,000,000 | 47,427,634 | 9.11 | Quarterly (9) | |||||||||||

| Luxor Capital Partners Liquidating SPV, LLC | 07/01/16 | 279,527 | 187,577 | 0.04 | In Liquidation (11) | |||||||||||

| Oceanwood European Financials Capital Structure Opportunities Segregated Portfolio | 08/01/19 | 9,306,245 | 10,919,640 | 2.10 | Quarterly (9) | |||||||||||

| Oceanwood Opportunities Fund L.P. | 02/01/12 - 07/01/16 | 33,386,852 | 51,548,957 | 9.91 | Quarterly | |||||||||||

| Total Event Driven Arbitrage | 172,568,364 | 299,376,638 | 57.53 | |||||||||||||

| Fixed Income Arbitrage (8) | ||||||||||||||||

| FFIP, L.P. | 04/01/07 - 04/01/12 | 37,984,278 | 84,146,024 | 16.17 | Annual (9) | |||||||||||

| Parsec Onshore Partners, L.P. | 04/01/08 - 04/01/12 | 30,757,405 | 53,168,834 | 10.21 | Monthly | |||||||||||

| Total Fixed Income Arbitrage | 68,741,683 | 137,314,858 | 26.38 | |||||||||||||

| Total investments in Portfolio Funds | 302,829,555 | 511,513,572 | 98.29 | |||||||||||||

| Money Market Investment | ||||||||||||||||

| JPMorgan U.S. Government Money Market Fund, | ||||||||||||||||

| Agency Shares, 0.006%(3) (Shares 10,524,688) | 10,524,688 | 10,524,688 | 2.02 | |||||||||||||

| Total investments | $ | 313,354,243 | $ | 522,038,260 | 100.31 | % | ||||||||||

| The accompanying notes are an integral part of the financial statements | 2 |

Aetos Multi-Strategy Arbitrage Fund, LLC

Schedule of Investments (Unaudited)

July 31, 2021

| (1) | Percentages are based on Members’ Capital of $520,402,518. |

| (2) | Non-income producing investments. |

| (3) | Rate disclosed is the 7-day effective yield as of 07/31/21. |

| (4) | Portfolio Funds in this strategy invest in futures contracts and foreign exchange forwards contracts using a variety of systematic trading strategies to meet investment objectives, which are typically the capturing of directional moves, both long and short, across diversified portfolios of markets and asset classes. |

| (5) | Portfolio Funds in this strategy generally look to exploit relative mispricings between securities in a company’s capital structure where the manager can go long the undervalued security and hedge out resulting equity and/or credit betas. In convertible bonds, opportunities can be found where sellers do not properly assess the value of the embedded credit and equity option components, resulting in convertibles that trade either cheap or expensive to their fundamental value. This strategy is implemented with the use of leverage. |

| (6) | Portfolio Funds in this strategy generally look to exploit relative mispricings between securities in a company’s capital structure where the manager can go long the undervalued security and hedge out resulting equity and/or credit betas. In convertible bonds, opportunities can be found where sellers do not properly assess the value of the embedded credit and equity option components, resulting in convertibles that trade either cheap or expensive to their fundamental value. In other corporate credit situations, opportunities arise when different components of a company’s capital structure imply very different fundamental outcomes (i.e. equity near zero and debt near par), creating the opportunity to structure long and short positions that have favorable payoff profiles. Both of these strategies are implemented with the use of leverage. |

| (7) | Portfolio Funds in this strategy invest in securities of companies involved in certain special situations, including mergers, acquisitions, asset sales, spin-offs, balance sheet restructuring, bankruptcy and other situations. These special situations constitute an “event” which the Portfolio Managers believe will trigger a change in the price of securities relative to their current price or close the gap between securities that are being arbitraged. |

| (8) | Portfolio Funds in this strategy look to exploit mispricings between related fixed income instruments, including sovereign debt, corporate debt and derivative instruments such as futures, options and swaps. Exploitable opportunities may be found in closely related securities trading at different prices, in the value between fixed income instruments and related derivative instruments, in the shape of yield curves and in credit spreads. These strategies typically require leverage in order to exploit relatively small mispricings. |

| (9) | Portfolio Fund subject to investor-level percentage limitations on redemptions. |

| (10) | Portfolio Fund subject to lock-up provision up to one year. |

| (11) | Portfolio Fund in liquidation. Mandatory distributions are expected to be received when underlying investments of the Portfolio Fund are realized. |

The aggregate cost of investments for tax purposes was $495,062,910. Net unrealized appreciation on investments for tax purposes was $26,975,350 consisting of $28,041,195 of gross unrealized appreciation and $1,065,845 of gross unrealized depreciation.

The investments in Portfolio Funds shown above, representing 98.29% of Members’ Capital, have been fair valued using NAV as a practical expedient.

| The accompanying notes are an integral part of the financial statements | 3 |

Aetos Distressed Investment Strategies Fund, LLC

Schedule of Investments (Unaudited)

July 31, 2021

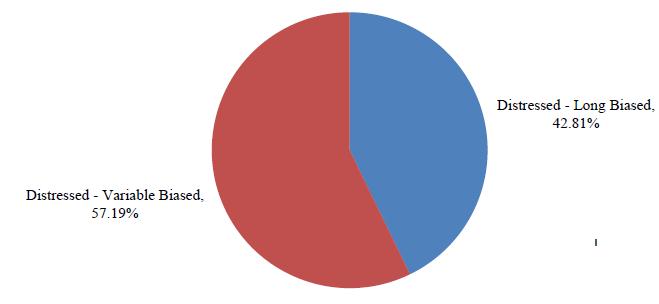

Investment Strategy as a Percentage of Investments in Portfolio Funds

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Investments in Portfolio Funds (2) | ||||||||||||||||

| Distressed - Long Biased (4) | ||||||||||||||||

| AG Mortgage Value Partners, L.P. | 05/01/13 | $ | 1,098,305 | $ | 2,156,229 | 0.78 | % | Side Pockets Only (10) | ||||||||

| Centerbridge Credit Partners, L.P. | 06/01/10 - 11/01/20 | 31,869,580 | 52,991,820 | 19.16 | Bi-Annual (9) | |||||||||||

| Davidson Kempner Distressed Opportunities Fund LP | 11/01/09 - 11/01/20 | 28,384,765 | 58,683,439 | 21.22 | Annual (7) | |||||||||||

| Marble Ridge LP | 02/01/17 - 06/01/20 | 4,428,978 | 4,084,218 | 1.48 | In Liquidation (11) | |||||||||||

| Total Distressed - Long Biased | 65,781,628 | 117,915,706 | 42.64 | |||||||||||||

| The accompanying notes are an integral part of the financial statements | 4 |

Aetos Distressed Investment Strategies Fund, LLC

Schedule of Investments (Unaudited)

July 31, 2021

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Distressed - Variable Biased (5) | ||||||||||||||||

| Anchorage Capital Partners, L.P. | 09/01/08 - 11/01/20 | 30,315,043 | 58,774,275 | 21.25 | Annual (7) | |||||||||||

| Aurelius Capital Partners, LP | 07/01/08 - 01/01/13 | 20,731,356 | 40,664,915 | 14.70 | Semi-Annual | |||||||||||

| Carronade Capital Partners, LP | 02/01/21 - 07/01/21 | 10,000,000 | 10,375,590 | 3.75 | Quarterly (6) (8) | |||||||||||

| King Street Capital, L.P. | 07/01/08 | 22,387,488 | 47,740,063 | 17.26 | Quarterly (6) | |||||||||||

| Total Distressed - Variable Biased | 83,433,887 | 157,554,843 | 56.96 | |||||||||||||

| Total investments in Portfolio Funds | 149,215,515 | 275,470,549 | 99.60 | |||||||||||||

| Money Market Investment | ||||||||||||||||

| JPMorgan U.S. Government Money Market Fund, | ||||||||||||||||

| Agency Shares, 0.006%(3) (Shares 5,192,821) | 5,192,821 | 5,192,821 | 1.88 | |||||||||||||

| Total investments | $ | 154,408,336 | $ | 280,663,370 | 101.48 | % | ||||||||||

| (1) | Percentages are based on Members’ Capital of $276,567,394. |

| (2) | Non-income producing investments. |

| (3) | Rate disclosed is the 7-day effective yield as of 07/31/21. |

| (4) | Portfolio Funds in this strategy invest in securities of companies in various levels of financial distress, including bankruptcy, exchange offers, workouts, financial reorganizations and other credit-related situations. Corporate bankruptcy or distress often causes a company’s securities to trade at a discounted value. The Portfolio Funds will tend to run their investment portfolios with a long bias net exposure. |

| (5) | Portfolio Funds in this strategy invest in securities of companies in various levels of financial distress, including bankruptcy, exchange offers, workouts, financial reorganizations and other credit-related situations. Corporate bankruptcy or distress often causes a company’s securities to trade at a discounted value. The Portfolio Funds will tend to run their investment portfolios with a variable net exposure. |

| (6) | Portfolio Fund subject to investor-level percentage limitations on redemptions. |

| (7) | Portfolio Fund subject to lock-up provision up to one year. |

| (8) | Portfolio Fund subject to lock-up provision up to eighteen months. |

| (9) | Portfolio Fund subject to lock-up provision up to three years. |

| (10) | See Note 5. |

| (11) | Portfolio Fund in liquidation. Mandatory distributions are expected to be received when underlying investments of the Portfolio Fund are realized. |

| The accompanying notes are an integral part of the financial statements | 5 |

Aetos Distressed Investment Strategies Fund, LLC

Schedule of Investments (Unaudited)

July 31, 2021

The aggregate cost of investments for tax purposes was $238,136,614. Net unrealized appreciation on investments for tax purposes was $42,526,756 consisting of $45,496,211 of gross unrealized appreciation and $2,969,455 of gross unrealized depreciation.

The investments in Portfolio Funds shown above, representing 99.6% of Members’ Capital, have been fair valued using NAV as a practical expedient.

| The accompanying notes are an integral part of the financial statements | 6 |

Aetos Long/Short Strategies Fund, LLC

Schedule of Investments (Unaudited)

July 31, 2021

Investment Strategy as a Percentage of Investments in Portfolio Funds

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Investments in Portfolio Funds (2) | ||||||||||||||||

| Directional Equity (4) | ||||||||||||||||

| Egerton Capital Partners, L.P. | 07/01/11 - 05/01/15 | $ | 26,654,459 | $ | 62,939,983 | 10.54 | % | Monthly | ||||||||

| Sachem Head LP | 08/01/16 - 09/01/17 | 13,388,555 | 28,036,761 | 4.70 | Quarterly (8) | |||||||||||

| The Children's Investment Fund LP | 05/01/20 | 5,000,000 | 7,766,000 | 1.30 | Monthly | |||||||||||

| Total Directional Equity | 45,043,014 | 98,742,744 | 16.54 | |||||||||||||

| The accompanying notes are an integral part of the financial statements | 7 |

Aetos Long/Short Strategies Fund, LLC

Schedule of Investments (Unaudited)

July 31, 2021

| Investments | Date(s) of Acquisition | Cost | Fair Value | Percentage of Members' Capital (1) | Liquidity | |||||||||||

| Equity Hedged - Generalist (5) | ||||||||||||||||

| Eton Park Fund, L.P. | 05/01/15 | 39,293 | 40,181 | 0.01 | In Liquidation (11) | |||||||||||

| Highfields Capital II LP | 07/01/15 | 1,725,661 | 394,712 | 0.06 | In Liquidation (11) | |||||||||||

| Junto Capital Partners LP | 01/01/19 - 10/01/19 | 45,000,000 | 56,499,943 | 9.46 | Quarterly (8) | |||||||||||

| Lakewood Capital Partners, LP | 05/01/17 - 05/01/19 | 45,231,456 | 57,019,878 | 9.55 | Quarterly | |||||||||||

| MW Market Neutral TOPS Fund | 10/01/20 | 10,492,447 | 18,750,057 | 3.14 | Monthly | |||||||||||

| MW TOPS Fund | 05/01/15 - 05/01/19 | 26,143,993 | 35,185,803 | 5.89 | Monthly | |||||||||||

| Naya Fund LP | 02/01/19 - 07/01/19 | 27,360,072 | 36,039,657 | 6.04 | Quarterly | |||||||||||

| Nitorum Fund, L.P. | 12/01/17 - 06/01/19 | 37,718,046 | 43,918,478 | 7.36 | Annual (10) | |||||||||||

| Viking Global Equities LP | 08/01/06 - 03/01/11 | 14,706,334 | 66,258,116 | 11.10 | Annual | |||||||||||

| Total Equity Hedged - Generalist | 208,417,302 | 314,106,825 | 52.61 | |||||||||||||

| Equity Hedged - Sector Specialist (6) | ||||||||||||||||

| Cadian Fund LP | 05/01/10 - 11/01/13 | 12,657,376 | 34,968,672 | 5.86 | Quarterly (8) | |||||||||||

| Encompass Capital Fund L.P. | 06/01/15 - 07/01/16 | 18,900,169 | 35,974,450 | 6.03 | Quarterly (8) | |||||||||||

| Long Pond Capital QP Fund, LP | 02/01/14 | 17,528,593 | 30,199,880 | 5.06 | Quarterly (8) | |||||||||||

| North River Partners, L.P. | 11/01/13 | 16,000,533 | 30,239,645 | 5.06 | Quarterly | |||||||||||

| Woodline Fund LP | 08/01/20 - 04/01/21 | 25,000,000 | 27,394,711 | 4.59 | Quarterly (9) | |||||||||||

| Total Equity Hedged - Sector Specialist | 90,086,671 | 158,777,358 | 26.60 | |||||||||||||

| Short-Biased Equity (7) | ||||||||||||||||

| Kriticos International Limited | 05/01/13 - 11/01/18 | 40,950,929 | 14,324,309 | 2.40 | Quarterly | |||||||||||

| Total Short-Biased Equity | 40,950,929 | 14,324,309 | 2.40 | |||||||||||||

| Total investments in Portfolio Funds | 384,497,916 | 585,951,236 | 98.15 | |||||||||||||

| Money Market Investment | ||||||||||||||||

| JPMorgan U.S. Government Money Market Fund, | ||||||||||||||||

| Agency Shares, 0.006%(3) (Shares 13,016,878) | 13,016,878 | 13,016,878 | 2.18 | |||||||||||||

| Total investments | $ | 397,514,794 | $ | 598,968,114 | 100.33 | % | ||||||||||

| The accompanying notes are an integral part of the financial statements | 8 |

Aetos Long/Short Strategies Fund, LLC

Schedule of Investments (Unaudited)

July 31, 2021

| (1) | Percentages are based on Members’ Capital of $597,022,532. |

| (2) | Non-income producing investments. |

| (3) | Rate disclosed is the 7-day effective yield as of 07/31/21. |

| (4) | Portfolio Funds in this strategy make investments that combine long positions in undervalued common stocks or corporate bonds and short positions in overvalued common stocks or corporate bonds in order to focus on generating positive returns through the Portfolio Managers’ ability to select securities through fundamental analysis, while hedging out some portion of market risk. The Portfolio Funds will tend to run their investment portfolios with a relatively high or variable net exposure. |

| (5) | Portfolio Funds in this strategy make investments that combine long positions in undervalued common stocks or corporate bonds and short positions in overvalued common stocks or corporate bonds in order to focus on generating positive returns through the Portfolio Managers’ ability to select securities through fundamental analysis, while hedging out some portion of market risk. The Portfolio Funds will tend to run their investment portfolios with a relatively low net exposure and will invest broadly across all market sectors. |

| (6) | Portfolio Funds in this strategy make investments that combine long positions in undervalued common stocks or corporate bonds and short positions in overvalued common stocks or corporate bonds in order to focus on generating positive returns through the Portfolio Managers’ ability to select securities through fundamental analysis, while hedging out some portion of market risk. The Portfolio Funds will tend to run their investment portfolios with a relatively low net exposure and will focus on investing in specific market sectors. |

| (7) | Portfolio Funds in this strategy make investments in short positions in overvalued common stocks or corporate bonds in order to focus on generating positive returns through the Portfolio Managers’ ability to select securities through fundamental analysis, while hedging out some portion of market risk. The Portfolio Funds will tend to run their investment portfolios with a permanent net short or short-only exposure. |

| (8) | Portfolio Fund subject to investor-level percentage limitations on redemptions. |

| (9) | Portfolio Fund subject to lock-up provision up to one year. |

| (10) | Portfolio Fund subject to lock-up provision up to three years. |

| (11) | Portfolio Fund in liquidation. Mandatory distributions are expected to be received when underlying investments of the Portfolio Fund are realized. |

| The aggregate cost of investments for tax purposes was $557,343,555. Net unrealized appreciation on investments for tax purposes was $41,624,559 consisting of $126,785,811 of gross unrealized appreciation and $85,161,252 of gross unrealized depreciation. | ||

| The investments in Portfolio Funds shown above, representing 98.15% of Members’ Capital, have been fair valued using NAV as a practical expedient. |

| The accompanying notes are an integral part of the financial statements | 9 |

Statements of Assets and Liabilities

July 31, 2021

(Unaudited)

| Aetos | ||||||||||||

| Aetos | Distressed | Aetos | ||||||||||

| Multi-Strategy | Investment | Long/Short | ||||||||||

| Arbitrage | Strategies | Strategies | ||||||||||

| Fund, LLC | Fund, LLC | Fund, LLC | ||||||||||

| Assets | ||||||||||||

| Investments in Portfolio Funds and Money Market Investment, at cost | $ | 313,354,243 | $ | 154,408,336 | $ | 397,514,794 | ||||||

| Investments in Portfolio Funds and Money Market Investment, at value | $ | 522,038,260 | $ | 280,663,370 | $ | 598,968,114 | ||||||

| Accrued income | 164 | 150 | 159 | |||||||||

| Total assets | 522,038,424 | 280,663,520 | 598,968,273 | |||||||||

| Liabilities | ||||||||||||

| Redemptions of Interests payable | 878,496 | 3,476,021 | 1,210,048 | |||||||||

| Investment management fees payable | 238,627 | 126,818 | 273,761 | |||||||||

| Professional fees payable | 431,697 | 442,552 | 219,667 | |||||||||

| Board of Managers’ fees payable | 21,392 | 21,392 | 21,392 | |||||||||

| Withholding Tax payable | 46,101 | 24,167 | 199,222 | |||||||||

| Other accrued expenses | 19,593 | 5,176 | 21,651 | |||||||||

| Total liabilities | 1,635,906 | 4,096,126 | 1,945,741 | |||||||||

| Commitments and contingencies (see Note 7) | ||||||||||||

| Net Members’ Capital | $ | 520,402,518 | $ | 276,567,394 | $ | 597,022,532 | ||||||

| The accompanying notes are an integral part of the financial statements | 10 |

For the six-month period ended July 31, 2021

(Unaudited)

| Aetos | ||||||||||||

| Aetos | Distressed | Aetos | ||||||||||

| Multi-Strategy | Investment | Long/Short | ||||||||||

| Arbitrage | Strategies | Strategies | ||||||||||

| Fund, LLC | Fund, LLC | Fund, LLC | ||||||||||

| Investment income: | ||||||||||||

| Dividends from money market funds | $ | 456 | $ | 825 | $ | 753 | ||||||

| Total investment income | 456 | 825 | 753 | |||||||||

| Expenses: | ||||||||||||

| Investment management fees | 1,448,566 | 835,309 | 1,696,957 | |||||||||

| Administration fees | 199,508 | 114,478 | 231,315 | |||||||||

| Board of Managers’ fees | 42,783 | 42,783 | 42,783 | |||||||||

| Professional fees | 233,373 | 231,213 | 165,343 | |||||||||

| Custodian fees | 54,306 | 34,779 | 66,704 | |||||||||

| Registration fees | 5,974 | 7,202 | 7,238 | |||||||||

| Printing fees | 4,000 | 4,000 | 4,000 | |||||||||

| Other expenses | 12,278 | 12,099 | 12,618 | |||||||||

| Total expenses | 2,000,788 | 1,281,863 | 2,226,958 | |||||||||

| Net investment loss | (2,000,332 | ) | (1,281,038 | ) | (2,226,205 | ) | ||||||

| Net realized gain on Portfolio Funds sold | 5,598,761 | 17,592,980 | 38,498,515 | |||||||||

| Net change in unrealized appreciation on investments in Portfolio Funds | 10,355,894 | 13,403,481 | 25,412,914 | |||||||||

| Net increase in Members’ Capital derived from investment activities | $ | 13,954,323 | $ | 29,715,423 | $ | 61,685,224 | ||||||

| The accompanying notes are an integral part of the financial statements | 11 |

Statements of Changes in Members’ Capital

For the six-month period ended July 31, 2021 and the year ended January 31, 2021

(Unaudited)

| Aetos Multi-Strategy Arbitrage Fund, LLC | Aetos Distressed Investment Strategies Fund, LLC | |||||||||||||||

| 2/1/20– | 2/1/20– | 2/1/20– | 2/1/20– | |||||||||||||

| 7/31/21 | 1/31/21 | 7/31/21 | 1/31/21 | |||||||||||||

| From investment activities: | ||||||||||||||||

| Net investment loss | $ | (2,000,332 | ) | $ | (3,702,033 | ) | $ | (1,281,038 | ) | $ | (2,453,729 | ) | ||||

| Net realized gain/(loss) on Portfolio Funds sold | 5,598,761 | 10,943,124 | 17,592,980 | (18,442 | ) | |||||||||||

| Net change in unrealized appreciation on investments in Portfolio Funds | 10,355,894 | 26,368,243 | 13,403,481 | 13,122,441 | ||||||||||||

| Net increase in Members’ Capital derived from investment activities | 13,954,323 | 33,609,334 | 29,715,423 | 10,650,270 | ||||||||||||

| Distributions: | ||||||||||||||||

| Tax withholding on behalf of foreign investors | (52,520 | ) | (128,902 | ) | (233,412 | ) | (534,456 | ) | ||||||||

| Refund of tax withholding on behalf of foreign investors | 2,602 | 77,221 | 110,620 | 158,167 | ||||||||||||

| Total distributions | (49,918 | ) | (51,681 | ) | (122,792 | ) | (376,289 | ) | ||||||||

| Members’ Capital transactions: | ||||||||||||||||

| Proceeds from sales of Interests | 29,596,200 | 5,030,965 | 18,560,400 | 3,515,942 | ||||||||||||

| Repurchase of Interests | (41,948,452 | ) | (18,587,821 | ) | (82,917,197 | ) | (8,817,142 | ) | ||||||||

| Net decrease in Members’ Capital derived from capital transactions | (12,352,252 | ) | (13,556,856 | ) | (64,356,797 | ) | (5,301,200 | ) | ||||||||

| Net increase/(decrease) in Members’ Capital | 1,552,153 | 20,000,797 | (34,764,166 | ) | 4,972,781 | |||||||||||

| Members’ Capital at beginning of period | 518,850,365 | 498,849,568 | 311,331,560 | 306,358,779 | ||||||||||||

| Members’ Capital at end of period | $ | 520,402,518 | $ | 518,850,365 | $ | 276,567,394 | $ | 311,331,560 | ||||||||

| The accompanying notes are an integral part of the financial statements | 12 |

Statements of Changes in Members’ Capital (Concluded)

For the six-month period ended July 31, 2021 and year ended January 31, 2021

(Unaudited)

| Aetos Long/Short Strategies Fund, LLC | ||||||||

| 2/1/20– | 2/1/20– | |||||||

| 7/31/21 | 1/31/21 | |||||||

| From investment activities: | ||||||||

| Net investment loss | $ | (2,226,205 | ) | $ | (5,053,793 | ) | ||

| Net realized gain on Portfolio Funds sold | 38,498,515 | 103,136,129 | ||||||

| Net change in unrealized appreciation/(depreciation) on investments in Portfolio Funds | 25,412,914 | (91,791,178 | ) | |||||

| Net increase in Members’ Capital derived from investment activities | 61,685,224 | 6,291,158 | ||||||

| Distributions: | ||||||||

| Tax withholding on behalf of foreign investors | (378,110 | ) | (910,557 | ) | ||||

| Total distributions | (378,110 | ) | (910,557 | ) | ||||

| Members’ Capital transactions: | ||||||||

| Proceeds from sales of Interests | 27,089,400 | 8,328,866 | ||||||

| Repurchase of Interests | (70,932,557 | ) | (347,576,302 | ) | ||||

| Net decrease in Members’ Capital derived from capital transactions | (43,843,157 | ) | (339,247,436 | ) | ||||

| Net increase/(decrease) in Members’ Capital | 17,463,957 | (333,866,835 | ) | |||||

| Members’ Capital at beginning of period | 579,558,575 | 913,425,410 | ||||||

| Members’ Capital at end of period | $ | 597,022,532 | $ | 579,558,575 | ||||

| The accompanying notes are an integral part of the financial statements | 13 |

For the six-month period ended July 31, 2021

| Aetos | ||||||||||||

| Aetos | Distressed | Aetos | ||||||||||

| Multi-Strategy | Investment | Long/Short | ||||||||||

| Arbitrage | Strategies | Strategies | ||||||||||

| Fund, LLC | Fund, LLC | Fund, LLC | ||||||||||

| Cash flows from operating activities | ||||||||||||

| Net increase in Members’ Capital derived from investment activities | $ | 13,954,323 | $ | 29,715,423 | $ | 61,685,224 | ||||||

| Adjustments to reconcile net increase in Members’ Capital derived from investment activities to net cash provided by operating activities Purchases of Portfolio Funds | (15,000,000 | ) | (5,000,000 | ) | (10,000,000 | ) | ||||||

| Net Sales of Money Market Investments | 5,714,889 | 32,076,998 | 11,422,416 | |||||||||

| Sales of Portfolio Funds | 24,172,280 | 35,826,696 | 78,024,899 | |||||||||

| Net realized gain on Portfolio Funds sold | (5,598,761 | ) | (17,592,980 | ) | (38,498,515 | ) | ||||||

| Net change in unrealized appreciation on investments in Portfolio Funds | (10,355,894 | ) | (13,403,481 | ) | (25,412,914 | ) | ||||||

| (Increase)/decrease in accrued income | (92 | ) | 31 | (38 | ) | |||||||

| Increase/(decrease) in investment management fees payable | 712 | (15,941 | ) | 8,008 | ||||||||

| Increase/(decrease) in professional fees payable and other accrued expenses | 94,615 | 96,701 | (22,078 | ) | ||||||||

| Net cash provided by operating activities | 12,982,072 | 61,703,447 | 77,207,002 | |||||||||

| Cash flows from financing activities | ||||||||||||

| Tax withholding on behalf of foreign investors | (13,345 | ) | (225,938 | ) | (282,981 | ) | ||||||

| Refund of tax withholding on behalf of foreign investors | 2,602 | 110,620 | — | |||||||||

| Proceeds from sales of Interests | 29,596,200 | 18,560,400 | 27,089,400 | |||||||||

| Repurchases of Interests | (42,567,529 | ) | (80,148,529 | ) | (104,013,421 | ) | ||||||

| Net cash used in financing activities | (12,982,072 | ) | (61,703,447 | ) | (77,207,002 | ) | ||||||

| Net change in cash | — | — | — | |||||||||

| Cash, beginning of period | — | — | — | |||||||||

| Cash, end of period | $ | — | $ | — | $ | — | ||||||

| The accompanying notes are an integral part of the financial statements | 14 |

Aetos Multi-Strategy Arbitrage Fund, LLC

| 2/1/21 - 7/31/21 | 2/1/20 - 1/31/21 | 2/1/19 - 1/31/20 | 2/1/18 - 1/31/19 | 2/1/17 - 1/31/18 | 2/1/16 - 1/31/17 | |||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Total return(1) | 2.69 | % | 6.86 | % | 7.45 | % | 0.40 | % | 7.35 | % | 7.08 | % | ||||||||||||

| Net assets, end of period (000's) | $ | 520,403 | $ | 518,850 | $ | 498,850 | $ | 469,087 | $ | 511,439 | $ | 534,213 | ||||||||||||

| Ratios to average net assets: | ||||||||||||||||||||||||

| Expenses(2)(3) | 0.77 | %(4) | 0.76 | % | 0.77 | % | 0.77 | % | 0.94 | % | 0.95 | % | ||||||||||||

| Net investment loss | (0.77 | )%(4) | (0.75 | )% | (0.70 | )% | (0.66 | )% | (0.90 | )% | (0.94 | )% | ||||||||||||

| Portfolio turnover rate(5) | 2.92 | % | 0.22 | % | 10.48 | % | 3.70 | % | 0.00 | % | 14.96 | % | ||||||||||||

Aetos Distressed Investment Strategies Fund, LLC

| 2/1/21 - 7/31/21 | 2/1/20 - 1/31/21 | 2/1/19 - 1/31/20 | 2/1/18 - 1/31/19 | 2/1/17 - 1/31/18 | 2/1/16 - 1/31/17 | |||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Total return(1) | 10.23 | % | 3.58 | % | 1.88 | % | (0.19 | )% | 3.66 | % | 10.98 | % | ||||||||||||

| Net assets, end of period (000's) | $ | 276,567 | $ | 311,332 | $ | 306,359 | $ | 299,724 | $ | 321,895 | $ | 409,326 | ||||||||||||

| Ratios to average net assets: | ||||||||||||||||||||||||

| Expenses(2)(3) | 0.85 | %(4) | 0.84 | % | 0.84 | % | 0.84 | % | 0.98 | % | 0.97 | % | ||||||||||||

| Net investment loss | (0.85 | )%(4) | (0.83 | )% | (0.71 | )% | (0.71 | )% | (0.93 | )% | (0.37 | )% | ||||||||||||

| Portfolio turnover rate(5) | 3.54 | % | 10.39 | % | 1.72 | % | 0.66 | % | 5.88 | % | 7.30 | % | ||||||||||||

Aetos Long/Short Strategies Fund, LLC

| 2/1/21 - 7/31/21 | 2/1/20 - 1/31/21 | 2/1/19 - 1/31/20 | 2/1/18 - 1/31/19 | 2/1/17 - 1/31/18 | 2/1/16 - 1/31/17 | |||||||||||||||||||

| (Unaudited) | ||||||||||||||||||||||||

| Total return(1) | 10.78 | % | 3.35 | % | 10.66 | % | (2.08 | )% | 9.17 | % | 3.77 | % | ||||||||||||

| Net assets, end of period (000's) | $ | 597,023 | $ | 579,559 | $ | 913,425 | $ | 917,411 | $ | 969,108 | $ | 917,167 | ||||||||||||

| Ratios to average net assets: | ||||||||||||||||||||||||

| Expenses(2)(3) | 0.73 | %(4) | 0.70 | % | 0.70 | % | 0.69 | % | 0.87 | % | 0.88 | % | ||||||||||||

| Net investment loss | (0.73 | )%(4) | (0.70 | )% | (0.64 | )% | (0.62 | )% | (0.84 | )% | (0.87 | )% | ||||||||||||

| Portfolio turnover rate(5) | 1.66 | % | 2.82 | % | 9.95 | % | 2.97 | % | 14.10 | % | 4.83 | % | ||||||||||||

| (1) | Total return for periods less than one year have not been annualized. Tax withholding on behalf of certain investors is treated as a reinvested distribution. |

| (2) | Expense ratios do not reflect the Fund’s proportionate share of expenses of the Portfolio Funds. |

| (3) | The expense ratios do not include the Program Fees charged separately to investors as described in Note 3 in the Notes to Financial Statements. |

| (4) | Annualized. |

| (5) | Portfolio turnover rate for periods less than one year have not been annualized. |

| The accompanying notes are an integral part of the financial statements | 15 |

July 31, 2021

(Unaudited)

1. Organization

The Aetos Multi-Strategy Arbitrage Fund, LLC, the Aetos Distressed Investment Strategies Fund, LLC, and the Aetos Long/Short Strategies Fund, LLC (collectively the “Funds” or “Master Funds” and individually a “Fund” or “Master Fund”) were formed in the state of Delaware as limited liability companies. The Funds are registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as closed-end, non-diversified, management investment companies. The Funds are investment companies and, accordingly, follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 - Financial Services - Investment Companies, which is part of U.S. generally accepted accounting principles (“GAAP”). Each Fund is a fund-of-funds. The Funds seek capital appreciation by allocating their assets among a select group of private investment funds (commonly known as hedge funds) (“Portfolio Funds”) that utilize a variety of alternative investment strategies that seek to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes. Aetos Alternatives Management, LP serves as the Investment Manager to the Funds.

The Funds operate under a master fund/feeder fund structure. The Feeder Funds (as defined below) invest substantially all of their investable assets in the Master Funds. As of July 31, 2021 the Feeder Funds’ beneficial ownership of their corresponding Master Funds’ members’ capital are 86%, 86%, 85%, 1%, 1% and 1%, for the Aetos Capital Multi-Strategy Arbitrage Cayman Fund, Aetos Capital Distressed Investment Strategies Cayman Fund, Aetos Capital Long/Short Strategies Cayman Fund, Aetos Capital Multi-Strategy Arbitrage Cayman Fund II, Aetos Capital Distressed Investment Strategies Cayman Fund II and Aetos Capital Long/Short Strategies Cayman Fund II (collectively the “Feeder Funds” and individually a “Feeder Fund”) respectively. The Investment Manager may receive an additional management fee and/or an incentive fee at the feeder fund level.

The principal investment objective of each Fund is as follows:

Aetos Multi-Strategy Arbitrage Fund, LLC seeks to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes, by allocating its assets among a select group of portfolio managers that utilize a variety of arbitrage strategies.

Aetos Distressed Investment Strategies Fund, LLC seeks to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes, by allocating its assets among a select group of portfolio managers across a variety of distressed investment strategies.

Aetos Long/Short Strategies Fund, LLC seeks to produce an attractive absolute return on invested capital, largely independent of the various benchmarks associated with traditional asset classes, by allocating its assets among a select group of portfolio managers across a variety of long/short strategies.

16

Notes to Financial Statements (Unaudited) (continued)

1. Organization (continued)

The Funds may offer, from time to time, to repurchase outstanding members’ interests (“Interests”) pursuant to written tenders by members. The Funds may offer to repurchase Interests four times each year, as of the last business day of March, June, September and December. However, repurchase offers will only be made at such times and on such terms as may be determined by the Funds’ Board of Managers (the “Board”) in its sole discretion.

Interests may be purchased on the first business day of each calendar month or at such other times as may be determined by the Board.

The following table presents the repurchase offers that occurred during the period ended July 31, 2021:

Aetos Multi-Strategy Arbitrage Fund, LLC

| Repurchase Offer #1 | Repurchase Offer #2 | |||||||

| Commencement Date | February 26, 2021 | May 31, 2021 | ||||||

| Repurchase Request Deadline | March 31, 2021 | June 30, 2021 | ||||||

| Repurchase Pricing Date | March 31, 2021 | June 30, 2021 | ||||||

| Amount Repurchased | $ | 8,765,828 | $ | 33,182,624 | ||||

Aetos Distressed Investment Strategies Fund, LLC

| Repurchase Offer #1 | Repurchase Offer #2 | |||||||

| Commencement Date | February 26, 2021 | May 31, 2021 | ||||||

| Repurchase Request Deadline | March 31, 2021 | June 30, 2021 | ||||||

| Repurchase Pricing Date | March 31, 2021 | June 30, 2021 | ||||||

| Amount Repurchased | $ | 33,463,410 | $ | 49,453,787 | ||||

Aetos Long/Short Strategies Fund, LLC

| Repurchase Offer #1 | Repurchase Offer #2 | |||||||

| Commencement Date | February 26, 2021 | May 31, 2021 | ||||||

| Repurchase Request Deadline | March 31, 2021 | June 30, 2021 | ||||||

| Repurchase Pricing Date | March 31, 2021 | June 30, 2021 | ||||||

| Amount Repurchased | $ | 11,893,777 | $ | 59,038,780 | ||||

2. Significant Accounting Policies

The Funds’ financial statements are prepared in conformity with accounting principles generally accepted in the United States of America. The following is a summary of the significant accounting policies followed by the Funds:

17

Notes to Financial Statements (Unaudited) (continued)

2. Significant Accounting Policies (continued)

A. Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires the Investment Manager to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes. Actual results could differ from these estimates, and such differences could be material.

B. Portfolio Valuation and Security Transactions

The net asset values of the Funds are determined as of the close of business at the end of each month in accordance with the valuation principles set forth below or as may be determined from time to time pursuant to policies established by the Board.

The Investment Manager has established a Valuation Committee that has oversight responsibility for the valuation of each of the Funds’ investments in Portfolio Funds. Members of the Valuation Committee include key members of the Investment Manager’s Senior Management, Compliance, Due Diligence and Risk Management teams.

Investments in Portfolio Funds are presented in the accompanying financial statements at fair value, as determined by the Funds’ Investment Manager under the general supervision of the Board. Such fair value generally represents a Fund’s pro-rata interest in the net assets of a Portfolio Fund as provided by the Portfolio Funds. As a general matter, the fair value of the Funds’ interests in Portfolio Funds will represent the amount that the Funds could reasonably expect to receive from the Portfolio Funds if the Funds’ interests were redeemed at the time of the valuation, based on information reasonably available at the time the valuation is determined and that the Funds believe to be reliable.

The Investment Manager considers information provided by the Portfolio Funds regarding the methods they use to value underlying investments in the Portfolio Funds and any restrictions on or illiquidity of the interests in the Portfolio Funds, in determining fair value.

Considerable judgment is required to interpret the factors used to develop estimates of fair value. Accordingly, the estimates may not be indicative of the amounts a Fund could realize in a current market exchange and the differences could be material to the financial statements. The use of different factors or estimation methodologies could have a significant effect on the estimated fair value.

Investments in open-end registered investment companies are valued at net asset value (“NAV”).

18

Notes to Financial Statements (Unaudited) (continued)

2. Significant Accounting Policies (continued)

B. Portfolio Valuation and Security Transactions (continued)

The FASB issued ASC Topic 820, Fair Value Measurements and Disclosures which establishes a fair value hierarchy and specifies that a valuation technique used to measure fair value shall maximize the use of observable inputs and minimize the use of unobservable inputs. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (an exit price). Accordingly the fair value hierarchy gives the highest priority to valuations based upon unadjusted quoted prices in active markets for identical assets or liabilities and the lowest priority to valuations based upon unobservable inputs that are significant to the valuation. The levels of the fair value hierarchy under FASB ASC Topic 820-10-35-39 to 55 are as follows:

| · | Level 1 – Inputs that reflect unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date; |

| · | Level 2 – Inputs other than quoted prices that are observable for the asset or liability either directly or indirectly, including inputs in markets that are not considered to be active. |

| · | Level 3 – Inputs that are unobservable. |

Inputs broadly refer to assumptions that market participants use to make valuation decisions, including assumptions about risk. ASC Topic 820-10-35-59 permits the Investment Manager to estimate the fair value of the investments in the Portfolio Funds at the net asset value reported by the Portfolio Funds if the net asset value is calculated in a manner consistent with the measurement principles of ASC Topic 946. The Investment Manager evaluates each Portfolio Fund individually to determine that its net asset value is calculated in a manner consistent with ASC Topic 946.

The Investment Manager also considers whether an adjustment to the net asset value reported by the Portfolio Fund is necessary based upon various factors, including, but not limited to, the attributes of the interest in the Portfolio Fund held, including the rights and obligations, and any restrictions on or illiquidity of such interests, and the fair value of such Portfolio Fund’s investment portfolio or other assets and liabilities. The net asset value reported by the Portfolio Funds may be based upon unobservable inputs and a significant change in those unobservable inputs could result in a significantly lower or higher reported net asset value reported for such Portfolio Funds.

Valuations reflected in this report are as of the report date. As a result, changes in the valuation due to market events and/or issuer related events after the report date and prior to the issuance of the report are not reflected herein.

19

Notes to Financial Statements (Unaudited) (continued)

2. Significant Accounting Policies (continued)

B. Portfolio Valuation and Security Transactions (continued)

The following table presents information about the level within the fair value hierarchy at which the Funds’ investments are measured as of July 31, 2021:

| Aetos Multi-Strategy Arbitrage Fund, LLC | ||||||||||||||||

| Strategy | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments in Portfolio Funds (1) | $ | — | $ | — | $ | — | $ | 511,513,572 | ||||||||

| Money Market Investment | 10,524,688 | — | — | 10,524,688 | ||||||||||||

| Total Investments | $ | 10,524,688 | $ | — | $ | — | $ | 522,038,260 | ||||||||

| Aetos Distressed Investment Strategies Fund, LLC | ||||||||||||||||

| Strategy | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments in Portfolio Funds (1) | $ | — | $ | — | $ | — | $ | 275,470,549 | ||||||||

| Money Market Investment | 5,192,821 | — | — | 5,192,821 | ||||||||||||

| Total Investments | $ | 5,192,821 | $ | — | $ | — | $ | 280,663,370 | ||||||||

| Aetos Long/Short Strategies Fund, LLC | ||||||||||||||||

| Strategy | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

| Investments in Portfolio Funds (1) | $ | — | $ | — | $ | — | $ | 585,951,236 | ||||||||

| Money Market Investment | 13,016,878 | — | — | 13,016,878 | ||||||||||||

| Total Investments | $ | 13,016,878 | $ | — | $ | — | $ | 598,968,114 |

(1) In accordance with ASC 820-10-35-54B investments in Portfolio Funds that are measured at fair value using the net asset value per share (or its equivalent) as a practical expedient have not been classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statements of Assets and Liabilities.

Realized gains and losses from Portfolio Fund transactions are calculated on the identified cost basis. Investments are recorded on the effective date of the subscription in the Portfolio Fund.

C. Fund Income and Expenses

Expenses are recorded on an accrual basis. Each Fund bears its own expenses including, but not limited to, any taxes and investment-related expenses incurred by the Funds (e.g., fees and expenses charged by the Portfolio Managers and Portfolio Funds, professional fees, custody and administrative fees). Most expenses of the Funds can be directly attributed to a particular Fund. Expenses which cannot be directly attributed are apportioned among the Funds based upon relative net assets or on another reasonable basis.

Dividend income is recorded on the ex-dividend date.

20

Notes to Financial Statements (Unaudited) (continued)

2. Significant Accounting Policies (continued)

D. Income Taxes

Each Fund intends to continue to be treated as a partnership for Federal income tax purposes. Each Member is responsible for the tax liability or benefit relating to the Member’s distributive share of taxable income or loss. Accordingly, no provision for Federal income taxes is reflected in the accompanying financial statements. The Funds withhold and pay taxes on foreign Members’ share of U.S. source income and U.S. effectively connected income, if any, allocated from Portfolio Funds to the extent such income is not exempted from withholding under the Internal Revenue Code and Regulations thereunder. The actual amount of such taxes is not known until all Form K-1s from Portfolio Funds are received, usually in the following tax year. Prior to the final determination, the amount of tax is estimated based on information available. The final tax could be different from the estimated tax and the difference could be significant. Such withholdings are recorded as distributions in the Statements of Changes in Members’ Capital, and are allocated to the individual Members’ Capital accounts to which they apply and are not an expense of the Funds.

The Investment Manager applies the authoritative guidance on accounting for and disclosure of uncertainty in tax positions, which requires the Investment Manager to determine whether a tax position of the Funds is more likely than not to be sustained upon examination, including resolution of any related appeals or litigation processes, based on the technical merits of the position. However, the Investment Manager's conclusions regarding Accounting for Uncertainty in Income Taxes may be subject to review and adjustment at a later date based on on-going analyses of tax laws, regulations and interpretations thereof and other factors. Each of the Fund's federal, state and local tax returns for all open tax years remains subject to examination by the Internal Revenue Service and local tax authorities.

E. Distribution Policy

The Funds have no present intention of making periodic distributions of their net investment income or capital gains, if any, to Members. The amount and frequency of distributions, if any, will be determined in the sole discretion of the Board.

F. Distributions from Portfolio Funds

Distributions from Portfolio Funds will be classified as investment income or realized gains in the Statements of Operations, or alternatively, as a decrease to the cost of the investments based on the U.S. income tax characteristics of the distribution if such information is available. In cases where the tax characteristics are not available, such distributions are generally classified as investment income.

G. Cash

Cash is defined as cash on deposit at financial institutions.

21

Notes to Financial Statements (Unaudited) (continued)

3. Investment Manager Fee, Related Party Transactions and Other

The Funds paid the Investment Manager a monthly management fee (the “Management Fee”) at the annual rate of 0.55% of the net asset value of each Fund as of the last day of the month (before any repurchases of Interests). The Investment Manager is responsible for providing day-to-day investment management services to the Funds, and for providing various administrative services to the Funds.

The Investment Manager may also be paid a Program Fee outside of the Funds for services rendered to investors. The Program Fee is paid directly by the investors at an annual rate of up to 0.60% of an investor’s assets in the Funds. The Program Fee may also include an annual performance-based incentive fee outside of the Funds based on the return of an investor’s account with the Investment Manager.

HedgeServ (Cayman) Ltd., a limited company incorporated in the Cayman Islands, (the “Administrator”) provides administration, accounting and investor services to the Funds. In consideration for such services, the Funds pay the Administrator a monthly fee based on their combined prior month-end net assets at an annual rate of 0.12% on the first $250 million of net assets, 0.10% on net assets between $250 million and $500 million, 0.07% on net assets between $500 million and $750 million and 0.06% on net assets over $750 million, and will reimburse the Administrator for certain out-of-pocket expenses. Each Fund is allocated its pro-rata share of the monthly fee based upon its prior month-end members’ capital adjusted for capital activity.

JPMorgan Chase Bank, N.A. acts as the custodian (the “Custodian”) for the Funds’ assets. In consideration for such services, the Funds pay the Custodian a monthly fee, based on their combined month-end portfolio market values, at an annual rate of 0.025% on the first $500 million of portfolio market value, 0.02% on portfolio market value between $500 million and $1 billion and 0.015% on portfolio market value over $1 billion. Each Fund is allocated its pro-rata share of the monthly fee based upon its month-end portfolio market value.

Each Member of the Board who is not an “interested person” of the Funds as defined by the 1940 Act receives an annual retainer of $60,000 and regular quarterly meeting fees of $6,000 per meeting (additional meeting fees are $500 per meeting). The chairman of the audit committee receives an additional annual retainer of $4,700. Any Member of the Board of Managers who is an “interested person” does not receive any annual or other fee from the Funds. All Members of the Board of Managers are reimbursed by the Funds for reasonable out-of-pocket expenses.

Net profits or net losses of the Funds for each fiscal period are allocated among and credited to or debited against the capital accounts of Members as of the last day of each fiscal period in accordance with each Member’s respective investment percentage for each Fund. Net profits or net losses are measured as the net change in the value of the net assets of a Fund during a fiscal period, before giving effect to any repurchases of Interests in the Fund, and excluding the amount of any items to be allocated among the capital accounts of the Members of the Fund, other than in accordance with the Members’ respective investment percentages.

22

Notes to Financial Statements (Unaudited) (continued)

4. Financial Instruments with Off-Balance Sheet Risk

In the normal course of business, the Portfolio Funds in which the Funds invest trade various financial instruments and enter into various investment activities with off-balance sheet risk. These include, but are not limited to, short selling activities, writing option contracts, use of leverage and swap contracts. The Funds’ risk of loss in these Portfolio Funds is limited to the value of their investments in the Portfolio Funds.

5. Risk Factors

Limitations on the Funds’ ability to withdraw their assets from Portfolio Funds may limit the Funds’ ability to repurchase their Interests. For example, many Portfolio Funds impose lock-up periods prior to allowing withdrawals, which can be two years or longer. After expiration of the lock-up period, withdrawals typically are permitted only on a limited basis, such as daily, monthly, quarterly, semi-annually, annually or biannually. Many Portfolio Funds may also indefinitely suspend redemptions or establish restrictions on the ability to fully receive proceeds from redemptions through the application of a redemption restriction or “gate.” In instances where the primary source of funds to repurchase Interests will be withdrawals from Portfolio Funds, the application of these lock-ups and withdrawal limitations may significantly limit the Funds’ ability to repurchase their Interests.

The Funds invest primarily in Portfolio Funds that are not registered under the 1940 Act and invest in and actively trade securities and other financial instruments using different strategies and investment techniques that may involve significant risks. Such risks include those related to the volatility of the equity, credit, and currency markets, the use of leverage associated with certain fixed income strategies, derivative contracts and in connection with short positions, the potential illiquidity of certain instruments and counterparty and broker arrangements.

Some of the Portfolio Funds in which the Funds invest may invest all or a portion of their assets in securities which are illiquid or are subject to an anticipated event. These Portfolio Funds may create “side pockets” in which to hold these securities. Side pockets are series or classes of shares which are not redeemable by the investors but which are automatically redeemed or converted back into the Portfolio Fund’s regular series or classes of shares upon the realization of those securities or the happening of some other liquidity event with respect to those securities.

These “side pockets” can often be held for long periods before they are realized, and may therefore be much less liquid than the general liquidity offered on the Portfolio Fund’s regular series or classes of shares. Should the Funds seek to liquidate their investment in a Portfolio Fund that maintains investments in a side pocket arrangement or that holds a substantial portion of its assets in illiquid securities, the Funds might not be able to fully liquidate their investments without delay, which could be considerable. In such cases, during the period until the Funds are permitted to fully liquidate the investment in the Portfolio Fund, the value of the investment could fluctuate.

23

Notes to Financial Statements (Unaudited) (continued)

5. Risk Factors (continued)

The Portfolio Funds may utilize leverage in pursuit of achieving a potentially greater investment return. The use of leverage exposes a Portfolio Fund to additional risk including (i) greater losses from investments than would otherwise have been the case had the Portfolio Fund not used leverage to make the investments; (ii) margin calls or interim margin requirements may force premature liquidations of investment positions; and (iii) losses on investments where the investment fails to earn a return that equals or exceeds the Portfolio Fund’s cost of leverage related to such investment. In the event of a sudden, precipitous drop in the value of a Portfolio Fund’s assets, the Portfolio Fund might not be able to liquidate assets quickly enough to repay its borrowings, further magnifying the losses incurred by the Portfolio Fund.

The Portfolio Funds may invest a higher percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Portfolio Funds may be more susceptible to economic, political and regulatory developments in a particular sector of the market, positive or negative, and may experience increased volatility of the Portfolio Fund's net asset value.

The Portfolio Funds may invest in securities of foreign companies that involve special risks and considerations not typically associated with investments in the United States of America, due to concentrated investments in a limited number of countries or regions, which may vary throughout the year depending on the Portfolio Fund. Such concentrations may subject the Portfolio Funds to additional risks resulting from political or economic conditions in such countries or regions and the possible imposition of adverse governmental laws or currency exchange restrictions could cause the securities and their markets to be less liquid and their prices to be more volatile than those of comparable U.S. securities.

The Funds invest in a limited number of Portfolio Funds and such concentrations may result in additional risk. Various risks are also associated with an investment in the Funds, including risks relating to the multi-manager structure of the Funds, risks relating to compensation arrangements and risks related to limited liquidity of the Interests.

The Funds and Portfolio Funds are also subject to the risk of losses arising in connection with cybersecurity incidents.

The outbreak of the novel coronavirus disease 2019 (“COVID-19”) globally continues to adversely impact global commercial activity and has contributed to significant volatility in financial markets. While, due to the evolving and highly uncertain nature of this event, it currently is not possible to estimate its impact precisely, the COVID-19 pandemic may continue to impact the performance and liquidity of the Funds’ underlying managers and their investments and therefore the financial performance and liquidity of the Funds themselves. Moreover, changes in interest rates, reduced liquidity or a continued slowdown in the United States or further deterioration of global economic conditions may also adversely affect the financial performance of the Funds and their underlying managers. Further, extreme market volatility may leave the Funds and/or the underlying managers unable to react to market events in a prudent manner consistent with historical practices in dealing with more orderly markets.

24

Notes to Financial Statements (Unaudited) (continued)

5. Risk Factors (continued)

In the normal course of business, the Funds enter into contracts that contain a variety of representations which provide general indemnifications. Each Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against each Fund that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote.

6. Investment Transactions

For the period ended July 31, 2021, purchases and sales of Portfolio Funds were as follows:

| Fund | Purchases | Sales | ||||||

| Aetos Multi-Strategy Arbitrage Fund, LLC | $ | 15,000,000 | $ | 24,172,281 | ||||

| Aetos Distressed Investment Strategies Fund, LLC | 10,000,000 | 35,826,204 | ||||||

| Aetos Long/Short Strategies Fund, LLC | 10,000,000 | 74,547,952 | ||||||

7. Investments in Portfolio Funds

As of July 31, 2021, collectively the Funds had investments in thirty-seven Portfolio Funds, none of which were related parties. The agreements related to investments in Portfolio Funds provide for compensation to the general partners/managers in the form of management fees of 0% to 2.0% (per annum) of the net assets and incentive fees or allocations of 0% to 25% of net profits earned. The Portfolio Funds generally provide for periodic redemptions, with lock-up provisions ranging up to 3 years from initial investment.

The liquidity provisions shown in the following tables apply after any applicable lock-up provisions. Further liquidity detail is also provided in the Schedule of Investments.

25

Notes to Financial Statements (Unaudited) (continued)

7. Investments in Portfolio Funds (continued)

| Number of Portfolio Funds | % of Total Portfolio Funds | |||||||

| Aetos Multi-Strategy Arbitrage Fund, LLC | ||||||||

| Funds allowing daily withdrawals (notice period of 1 day) | 1 | 3.40 | % | |||||

| Funds allowing monthly withdrawals (notice period of 30 days) | 1 | 10.39 | % | |||||

| Funds allowing quarterly withdrawals (notice periods ranging from 45 to 90 days) | 5 | 32.72 | % | |||||

| Funds allowing semi-annual withdrawals (notice periods ranging from 60 to 65 days) | 2 | 37.00 | % | |||||

| Funds allowing annual withdrawals (notice period of 60 days) | 1 | 16.45 | % | |||||

| Funds in liquidation | 1 | 0.04 | % | |||||

| Number of Portfolio Funds | % of Total Portfolio Funds | |||||||

| Aetos Distressed Investment Strategies Fund, LLC | ||||||||

| Funds allowing quarterly withdrawals (notice period of 65 days) | 2 | 21.10 | % | |||||

| Funds allowing semi-annual withdrawals (notice period of 65 days) | 1 | 14.76 | % | |||||

| Funds allowing annual withdrawals (notice periods ranging from 65 to 90 days) | 2 | 42.64 | % | |||||

| Funds allowing bi-annual withdrawals (notice period of 90 days) | 1 | 19.24 | % | |||||

| Funds fully comprised of side-pocket investments | 1 | 0.78 | % | |||||

| Funds in liquidation | 1 | 1.48 | % | |||||

| Number of Portfolio Funds | % of Total Portfolio Funds | |||||||

| Aetos Long/Short Strategies Fund, LLC | ||||||||

| Funds allowing monthly withdrawals (notice periods ranging from 30 to 90 days) | 4 | 21.27 | % | |||||

| Funds allowing quarterly withdrawals (notice periods ranging from 30 to 65 days) | 10 | 59.85 | % | |||||

| Funds allowing annual withdrawals (notice periods ranging from 45 to 60 days) | 2 | 18.80 | % | |||||

| Funds in liquidation | 2 | 0.08 | % | |||||

26

Notes to Financial Statements (Unaudited) (continued)

7. Investments in Portfolio Funds (continued)

At July 31 2021, the Funds had made no commitment to purchase Portfolio Funds and made the following redemption requests from Portfolio Funds, which are effective August 1, 2021 through December 31, 2021:

| Fund Redemptions | Amount | ||||

| Aetos Distressed Investment Strategies Fund, LLC | |||||

| Anchorage Capital Partners, L.P. | $ | 5,500,000 | |||

| Centerbridge Credit Partners, L.P. | 5,000,000 | ||||

| King Street Capital, L.P | 20,000,000 | ||||

| Marble Ridge LP | 978,947 | ||||

| Aetos Long/Short Strategies Fund, LLC | |||||

| Encompass Capital Fund L.P. | $ | 8,993,613 | |||

| Egerton Capital Partners, L.P. | 5,000,000 | ||||

| Kriticos International Limited | 3,000,000 | ||||

| Lakewood Capital Partners, LP | 10,000,000 | ||||

| Long Pond Capital QP Fund, LP | 5,000,000 | ||||

| Nitorum Fund, L.P. | 5,000,000 | ||||

| Aetos Multi-Strategy Arbitrage Fund, LLC | |||||

| Oceanwood European Financials Capital Structure Opportunities Segregated Portfolio | $ | 5,000,000 | |||

| FFIP, L.P. | 7,875,863 | ||||

8. Subsequent Events

Through October 1, 2021, the Funds received the following commitments from investors:

| Fund | Amount | |||

| Aetos Multi-Strategy Arbitrage Fund, LLC | $ | 32,600,000 | ||

| Aetos Distressed Investment Strategies Fund, LLC | 8,150,000 | |||

| Aetos Long/Short Strategies Fund, LLC | 40,750,000 | |||

27

Notes to Financial Statements (Unaudited) (continued)

8. Subsequent Events (continued)

The following table summarizes the repurchase requests received by the Funds subsequent to July 31, 2021, all of which are effective from September 30, 2021 to December 31, 2021:

| Fund | Number of Investors | Estimated Redemption Amount Subsequent to 07/31/21 | % of Members’ Capital | |||||||||

| Aetos Multi-Strategy Arbitrage Fund, LLC | 20 | $ | 64,360,866 | 12.37 | % | |||||||

| Aetos Distressed Investment Strategies Fund, LLC | 20 | 47,010,064 | 17.00 | % | ||||||||

| Aetos Long/Short Strategies Fund, LLC | 25 | 110,007,408 | 18.43 | % | ||||||||

The Funds have evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. Based on this evaluation, no additional disclosures or adjustments were required to the financial statements as of July 31, 2021.

28

Approval of Continuation of Investment Advisory Agreements

July 31, 2021

(Unaudited)

At a virtual meeting held on July 22, 2021 (the "July Meeting"), the Board of Managers of each Fund (the “Boards”), including the board members who are not "interested persons" of the Funds, as such term is defined in Section 2(a)(19) of the 1940 Act (the "Independent Board Members"), discussed the materials previously provided to them and reviewed the nature, quality and scope of the services provided to the Funds by the Investment Manager. Although the 1940 Act requires that continuances of the Investment Advisory Agreements be approved by the in-person vote of a majority of the Independent Board Members, the July Meeting was held virtually through the internet in view of the health risks associated with holding an in-person meeting during the COVID-19 pandemic and governmental restrictions on gatherings. The July Meeting was held in reliance on an order issued by the Securities and Exchange Commission on March 13,2020, as extended on March 25, 2020, which provided registered investment companies temporary relief from the in-person voting requirements of the 1940 Act with respect to the approval of a fund’s advisory agreement in response to the challenges arising in connection with the COVID-19 pandemic. The Boards also considered the proposed fees to be charged under the Investment Advisory Agreements, as well as each Fund’s performance, and reviewed the comparative fee and performance data previously provided by the Investment Manager. They also considered the information provided by the Investment Manager regarding the Investment Manager’s financial performance and profitability. In considering the approval of the continuation of the Investment Advisory Agreement for each Fund for an additional one-year term, the Board members gave particular consideration to the following factors:

Nature, Extent and Quality of Services

The Board of each Fund reviewed and considered the nature and extent of the investment advisory services provided by the Investment Manager to the Funds under the relevant Investment Advisory Agreement, including the selection of underlying hedge funds (“Portfolio Funds”), allocation of each Fund’s assets among, and monitoring performance of, Portfolio Funds, evaluation of risk exposure of Portfolio Funds and reputation, experience and training of Portfolio Funds’ investment managers (“Portfolio Managers”), management of short-term cash and operations of each Portfolio Fund, and day-to-day portfolio management and general due diligence examination of Portfolio Funds before and after committing assets of each Fund for investment. The Boards also reviewed and considered the nature and extent of the non-advisory, administrative services provided by the Investment Manager under the Investment Advisory Agreements, including, among other things, providing to each Fund office facilities, equipment and personnel. The Boards also reviewed and considered the qualifications of the portfolio managers, the senior administrative managers and other key personnel of the Investment Manager who provide the investment advisory and administrative services to each Fund. The Boards determined that the Investment Manager’s portfolio managers and key personnel are well qualified by education and/or training and experience to perform the services to each Fund in an efficient and professional manner. The Boards concluded that the overall quality of the advisory and administrative services was satisfactory.

29

Approval of Continuation

of Investment Advisory Agreements

(Unaudited)(continued)

Performance Relative to Comparable Funds Managed by Other Advisers

The Boards reviewed the performance of each Fund based on information provided by the Investment Manager that showed each Fund’s return for its most recent fiscal year and its average return for its most recent three- and five-year periods as compared to the return of other comparable registered funds-of-hedge-funds, an index of fund of hedge funds and relevant market indices, for their most recent fiscal years and their average returns for their most recent three- and five-year periods. The Boards considered each Fund’s performance since inception and the relative lack of correlation of such performance to fixed income or equity indices generally. The Boards concluded that each Fund’s performance was satisfactory.

Fees and Expense Ratios Relative to Comparable Funds Managed by Other Advisers

The Boards reviewed the management fee rate of 0.55% annually of the net asset value of each Fund (the “Management Fee”) and total expense ratio of each Fund. The Boards also reviewed the annual separate program fee (the "Program Fee") of up to 0.60% annually of an investor's assets in the investment program managed by the Investment Manager (the "Program") and the performance fee of up to 10% annually of aggregate Program net profits above the return of the 90 day Treasury Bill (the “Incentive Fee”) payable to the Investment Manager by Program investors in the Funds. The Boards also reviewed a report prepared by the Investment Manager comparing the fees payable by each Fund to those payable by other comparable registered funds-of-hedge-funds. The Boards noted that the fees payable to the Investment Manager, including the Program fee and the Incentive Fee, were generally lower (and sometimes significantly lower) than or comparable to the fees payable to the advisers of most comparable registered funds-of-hedge-funds. The Boards concluded that each Fund’s Management Fee, the Program fee, the Incentive Fee and the Fund's total expense ratio were reasonable and satisfactory in light of the services provided.

Breakpoints and Economies of Scale

The Boards reviewed the structure of each Fund’s Management Fee schedule under the Investment Advisory Agreements and noted that it does not include any breakpoints. The Boards considered that each Fund’s Management Fee was 0.55% annually and concluded that the fee was sufficiently low that the Boards did not need to consider adding breakpoints at this time. Although the Boards also determined that, given the relative size of each Fund, economies of scale were not a factor that needed to be considered at this time, the Boards also recognized the Investment Manager's continued reinvestment in its business through, among other things, investments in its business infrastructure and information technology and other systems and platforms that will, among other things, support growth, simplify and enhance information sharing, and enhance the investment process to the benefit of all of the Funds.

30

Approval of Continuation

of Investment Advisory Agreements

(Unaudited)(continued)

Profitability of the Investment Manager

The Boards considered and reviewed information concerning the costs incurred and profits realized by the Investment Manager during the previous year from the Investment Manager’s relationship with each Fund. The Boards also considered and reviewed information concerning the costs incurred and profits realized by the Investment Manager during the previous year. The Boards noted that the Funds’ investor base consists of sophisticated, mostly institutional investors that are capable of evaluating whether the fees charged and the services provided by the Investment Manager are appropriate. The Boards noted that the Investment Manager had first become profitable in 2005, and that its profit margins had not substantially increased since that time and, in fact, had experienced a decline over the last several years. Based on their review of the information they received, the Boards concluded that the profits earned by the Investment Manager were not excessive in light of the advisory, administrative and other services provided to each Fund.

Other Benefits to the Investment Manager

The Boards considered other benefits received by the Investment Manager as a result of their relationships with the Funds and did not regard such benefits as excessive.

General Conclusion

After considering and weighing all of the above factors, the Board of each Fund, including the Independent Board Members, unanimously concluded that it would be in the best interest of such Fund and its Members to continue the Investment Advisory Agreements for an additional one-year term. No single factor reviewed by the Boards was identified by the Boards as the principal factor in determining whether to approve the continuation of each Investment Advisory Agreement, and each Board member attributed different weights to the various factors. Prior to voting, the Independent Board Members also discussed the proposed continuation of each Investment Advisory Agreement in private sessions with legal counsel for the Funds at which no representatives of the Investment Manager were present.

31

Item 2. Code of Ethics.

Not applicable for semi-annual report.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual report.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual report.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual report.

Item 6. Schedule of Investments.

Included as part of the report to shareholders filed under Item 1 of this Form.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable for semi-annual report.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable for semi-annual report.

Item 9. Purchases of Equity Securities by Closed-End Management Company and Affiliated Purchasers.

Not applicable as Interests of the Fund are not registered pursuant to Section 12 of the Exchange Act.

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the Registrant's board of directors since the Registrant's last proxy solicitation.

Item 11. Controls and Procedures.

(a) The certifying officers, whose certifications are included herewith, have evaluated the registrant’s disclosure controls and procedures within 90 days of the filing date of this report. In their opinion, based on their evaluation, the registrant’s disclosure controls and procedures are adequately designed, and are operating effectively to ensure, that information required to be disclosed by the registrant in the reports it files or submits under the Securities Exchange Act of 1934 is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission’s rules and forms.

(b) There were no significant changes in the registrant’s internal control over financial reporting that occurred during the registrant’s last fiscal half-year that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Items 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

Not applicable as the Fund does not engage in securities lending activities.

Items 13. Exhibits.

(a)(1) Not applicable for semi-annual report.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| (Registrant) | Aetos Multi-Strategy Arbitrage Fund, LLC |

| By (Signature and Title)* | /s/ Michael F. Klein |

| Michael F. Klein, President | |

| Date: 09/27/21 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| By (Signature and Title)* | /s/ Michael F. Klein |

| Michael F. Klein, President | |

| Date: 09/27/21 | |