cvlt-20220930COMMVAULT SYSTEMS INC0001169561--03-312023Q2FALSEP1Y600011695612022-04-012022-09-3000011695612022-10-28xbrli:shares00011695612022-09-30iso4217:USD00011695612022-03-31iso4217:USDxbrli:shares0001169561us-gaap:ProductMember2022-07-012022-09-300001169561us-gaap:ProductMember2021-07-012021-09-300001169561us-gaap:ProductMember2022-04-012022-09-300001169561us-gaap:ProductMember2021-04-012021-09-300001169561us-gaap:ServiceMember2022-07-012022-09-300001169561us-gaap:ServiceMember2021-07-012021-09-300001169561us-gaap:ServiceMember2022-04-012022-09-300001169561us-gaap:ServiceMember2021-04-012021-09-3000011695612022-07-012022-09-3000011695612021-07-012021-09-3000011695612021-04-012021-09-300001169561us-gaap:CommonStockMember2022-06-300001169561us-gaap:AdditionalPaidInCapitalMember2022-06-300001169561us-gaap:RetainedEarningsMember2022-06-300001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-06-3000011695612022-06-300001169561us-gaap:AdditionalPaidInCapitalMember2022-07-012022-09-300001169561us-gaap:CommonStockMember2022-07-012022-09-300001169561us-gaap:RetainedEarningsMember2022-07-012022-09-300001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-012022-09-300001169561us-gaap:CommonStockMember2022-09-300001169561us-gaap:AdditionalPaidInCapitalMember2022-09-300001169561us-gaap:RetainedEarningsMember2022-09-300001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-09-300001169561us-gaap:CommonStockMember2022-03-310001169561us-gaap:AdditionalPaidInCapitalMember2022-03-310001169561us-gaap:RetainedEarningsMember2022-03-310001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310001169561us-gaap:AdditionalPaidInCapitalMember2022-04-012022-09-300001169561us-gaap:CommonStockMember2022-04-012022-09-300001169561us-gaap:RetainedEarningsMember2022-04-012022-09-300001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-04-012022-09-300001169561us-gaap:CommonStockMember2021-06-300001169561us-gaap:AdditionalPaidInCapitalMember2021-06-300001169561us-gaap:RetainedEarningsMember2021-06-300001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-06-3000011695612021-06-300001169561us-gaap:AdditionalPaidInCapitalMember2021-07-012021-09-300001169561us-gaap:CommonStockMember2021-07-012021-09-300001169561us-gaap:RetainedEarningsMember2021-07-012021-09-300001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-07-012021-09-300001169561us-gaap:CommonStockMember2021-09-300001169561us-gaap:AdditionalPaidInCapitalMember2021-09-300001169561us-gaap:RetainedEarningsMember2021-09-300001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-09-3000011695612021-09-300001169561us-gaap:CommonStockMember2021-03-310001169561us-gaap:AdditionalPaidInCapitalMember2021-03-310001169561us-gaap:RetainedEarningsMember2021-03-310001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-3100011695612021-03-310001169561us-gaap:AdditionalPaidInCapitalMember2021-04-012021-09-300001169561us-gaap:CommonStockMember2021-04-012021-09-300001169561us-gaap:RetainedEarningsMember2021-04-012021-09-300001169561us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-04-012021-09-300001169561us-gaap:CustomerConcentrationRiskMembercvlt:ArrowMemberus-gaap:SalesRevenueNetMember2022-07-012022-09-30xbrli:pure0001169561us-gaap:CustomerConcentrationRiskMembercvlt:ArrowMemberus-gaap:SalesRevenueNetMember2021-07-012021-09-300001169561us-gaap:CustomerConcentrationRiskMembercvlt:ArrowMemberus-gaap:SalesRevenueNetMember2022-04-012022-09-300001169561us-gaap:CustomerConcentrationRiskMembercvlt:ArrowMemberus-gaap:SalesRevenueNetMember2021-04-012021-09-300001169561us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembercvlt:ArrowMember2022-04-012022-09-300001169561us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembercvlt:ArrowMember2021-04-012022-03-310001169561us-gaap:PrivateEquityFundsMember2022-09-30cvlt:source0001169561srt:MinimumMember2022-04-012022-09-300001169561srt:MaximumMember2022-04-012022-09-300001169561cvlt:SoftwareLicensesMember2022-04-012022-09-300001169561cvlt:ProfessionalServicesOtherMember2022-04-012022-09-300001169561cvlt:ProfessionalServicesEducationServicesMember2022-04-012022-09-300001169561us-gaap:ProductMembersrt:AmericasMember2022-07-012022-09-300001169561cvlt:InternationalMemberus-gaap:ProductMember2022-07-012022-09-300001169561us-gaap:ProductMembersrt:AmericasMember2022-04-012022-09-300001169561cvlt:InternationalMemberus-gaap:ProductMember2022-04-012022-09-300001169561cvlt:CustomerSupportServiceMembersrt:AmericasMember2022-07-012022-09-300001169561cvlt:InternationalMembercvlt:CustomerSupportServiceMember2022-07-012022-09-300001169561cvlt:CustomerSupportServiceMember2022-07-012022-09-300001169561cvlt:CustomerSupportServiceMembersrt:AmericasMember2022-04-012022-09-300001169561cvlt:InternationalMembercvlt:CustomerSupportServiceMember2022-04-012022-09-300001169561cvlt:CustomerSupportServiceMember2022-04-012022-09-300001169561us-gaap:ServiceOtherMembersrt:AmericasMember2022-07-012022-09-300001169561cvlt:InternationalMemberus-gaap:ServiceOtherMember2022-07-012022-09-300001169561us-gaap:ServiceOtherMember2022-07-012022-09-300001169561us-gaap:ServiceOtherMembersrt:AmericasMember2022-04-012022-09-300001169561cvlt:InternationalMemberus-gaap:ServiceOtherMember2022-04-012022-09-300001169561us-gaap:ServiceOtherMember2022-04-012022-09-300001169561srt:AmericasMember2022-07-012022-09-300001169561cvlt:InternationalMember2022-07-012022-09-300001169561srt:AmericasMember2022-04-012022-09-300001169561cvlt:InternationalMember2022-04-012022-09-300001169561us-gaap:ProductMembersrt:AmericasMember2021-07-012021-09-300001169561cvlt:InternationalMemberus-gaap:ProductMember2021-07-012021-09-300001169561us-gaap:ProductMembersrt:AmericasMember2021-04-012021-09-300001169561cvlt:InternationalMemberus-gaap:ProductMember2021-04-012021-09-300001169561cvlt:CustomerSupportServiceMembersrt:AmericasMember2021-07-012021-09-300001169561cvlt:InternationalMembercvlt:CustomerSupportServiceMember2021-07-012021-09-300001169561cvlt:CustomerSupportServiceMember2021-07-012021-09-300001169561cvlt:CustomerSupportServiceMembersrt:AmericasMember2021-04-012021-09-300001169561cvlt:InternationalMembercvlt:CustomerSupportServiceMember2021-04-012021-09-300001169561cvlt:CustomerSupportServiceMember2021-04-012021-09-300001169561us-gaap:ServiceOtherMembersrt:AmericasMember2021-07-012021-09-300001169561cvlt:InternationalMemberus-gaap:ServiceOtherMember2021-07-012021-09-300001169561us-gaap:ServiceOtherMember2021-07-012021-09-300001169561us-gaap:ServiceOtherMembersrt:AmericasMember2021-04-012021-09-300001169561cvlt:InternationalMemberus-gaap:ServiceOtherMember2021-04-012021-09-300001169561us-gaap:ServiceOtherMember2021-04-012021-09-300001169561srt:AmericasMember2021-07-012021-09-300001169561cvlt:InternationalMember2021-07-012021-09-300001169561srt:AmericasMember2021-04-012021-09-300001169561cvlt:InternationalMember2021-04-012021-09-300001169561us-gaap:TradeAccountsReceivableMember2022-03-310001169561us-gaap:OtherAssetsMember2022-03-310001169561cvlt:DeferredRevenueCurrentMember2022-03-310001169561cvlt:DeferredRevenueNoncurrentMember2022-03-310001169561us-gaap:TradeAccountsReceivableMember2022-04-012022-09-300001169561us-gaap:OtherAssetsMember2022-04-012022-09-300001169561cvlt:DeferredRevenueCurrentMember2022-04-012022-09-300001169561cvlt:DeferredRevenueNoncurrentMember2022-04-012022-09-300001169561us-gaap:TradeAccountsReceivableMember2022-09-300001169561us-gaap:OtherAssetsMember2022-09-300001169561cvlt:DeferredRevenueCurrentMember2022-09-300001169561cvlt:DeferredRevenueNoncurrentMember2022-09-300001169561us-gaap:ProductMember2022-09-300001169561cvlt:ProfessionalServicesOtherMember2022-10-012022-09-300001169561us-gaap:ProductMember2022-10-012022-09-3000011695612022-04-210001169561cvlt:CostOfServicesRevenueMember2022-07-012022-09-300001169561cvlt:CostOfServicesRevenueMember2021-07-012021-09-300001169561cvlt:CostOfServicesRevenueMember2022-04-012022-09-300001169561cvlt:CostOfServicesRevenueMember2021-04-012021-09-300001169561us-gaap:SellingAndMarketingExpenseMember2022-07-012022-09-300001169561us-gaap:SellingAndMarketingExpenseMember2021-07-012021-09-300001169561us-gaap:SellingAndMarketingExpenseMember2022-04-012022-09-300001169561us-gaap:SellingAndMarketingExpenseMember2021-04-012021-09-300001169561us-gaap:ResearchAndDevelopmentExpenseMember2022-07-012022-09-300001169561us-gaap:ResearchAndDevelopmentExpenseMember2021-07-012021-09-300001169561us-gaap:ResearchAndDevelopmentExpenseMember2022-04-012022-09-300001169561us-gaap:ResearchAndDevelopmentExpenseMember2021-04-012021-09-300001169561us-gaap:GeneralAndAdministrativeExpenseMember2022-07-012022-09-300001169561us-gaap:GeneralAndAdministrativeExpenseMember2021-07-012021-09-300001169561us-gaap:GeneralAndAdministrativeExpenseMember2022-04-012022-09-300001169561us-gaap:GeneralAndAdministrativeExpenseMember2021-04-012021-09-300001169561us-gaap:RestructuringChargesMember2022-07-012022-09-300001169561us-gaap:RestructuringChargesMember2021-07-012021-09-300001169561us-gaap:RestructuringChargesMember2022-04-012022-09-300001169561us-gaap:RestructuringChargesMember2021-04-012021-09-300001169561us-gaap:RestrictedStockUnitsRSUMember2022-03-310001169561us-gaap:RestrictedStockUnitsRSUMember2022-04-012022-09-300001169561us-gaap:RestrictedStockUnitsRSUMember2022-09-300001169561us-gaap:RestrictedStockUnitsRSUMember2022-07-012022-09-300001169561us-gaap:RestrictedStockUnitsRSUMember2021-07-012021-09-300001169561us-gaap:RestrictedStockUnitsRSUMember2021-04-012021-09-300001169561cvlt:PerformanceRestrictedStockUnitsMember2022-04-012022-09-300001169561us-gaap:PerformanceSharesMember2022-04-012022-09-30cvlt:tranche0001169561srt:MaximumMemberus-gaap:PerformanceSharesMember2022-04-012022-09-300001169561us-gaap:EmployeeStockMember2022-04-012022-09-300001169561us-gaap:EmployeeStockMember2022-09-300001169561us-gaap:EmployeeStockMember2021-04-012021-09-300001169561cvlt:SeniorSecuredRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-12-132021-12-130001169561cvlt:SeniorSecuredRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2021-12-130001169561cvlt:SeniorSecuredRevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMemberus-gaap:RevolvingCreditFacilityMember2021-12-132021-12-130001169561cvlt:SeniorSecuredRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-09-300001169561cvlt:SeniorSecuredRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-07-012022-09-300001169561cvlt:SeniorSecuredRevolvingCreditFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-04-012022-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ Quarterly Report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

For the quarterly period ended: September 30, 2022

☐ Transition report pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Commission File Number: 1-33026

Commvault Systems, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | | 22-3447504 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

1 Commvault Way

Tinton Falls, New Jersey 07724

(Address of principal executive offices, including zip code)

(732) 870-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock | CVLT | The Nasdaq Stock Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer”, "accelerated filer", "smaller reporting company" and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | |

| Large accelerated filer | x | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | | | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. | ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

As of October 28, 2022, there were 44,532,038 shares of the registrant’s common stock, $0.01 par value, outstanding.

COMMVAULT SYSTEMS, INC.

FORM 10-Q

INDEX

| | | | | | | | |

| | | Page |

| Part I – FINANCIAL INFORMATION |

| Item 1. | Financial Statements | |

| | |

| | |

| | |

| | |

| | |

| | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| |

| Item 1. | | |

| Item 1A. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| Item 5. | | |

| Item 6. | | |

| | |

| |

Commvault Systems, Inc.

Consolidated Balance Sheets

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | September 30,

2022 | | March 31,

2022 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 262,485 | | | $ | 267,507 | |

| | | | |

| | | | |

| Trade accounts receivable, net | | 170,166 | | | 194,238 | |

| Other current assets | | 23,225 | | | 22,336 | |

| Total current assets | | 455,876 | | | 484,081 | |

| | | | |

| Property and equipment, net | | 102,562 | | | 106,513 | |

| Operating lease assets | | 11,853 | | | 14,921 | |

| Deferred commissions cost | | 52,300 | | | 52,974 | |

| Intangible asset, net | | 2,917 | | | 3,542 | |

| Goodwill | | 127,780 | | | 127,780 | |

| Other assets | | 26,500 | | | 26,269 | |

| Total assets | | $ | 779,788 | | | $ | 816,080 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 200 | | | $ | 432 | |

| Accrued liabilities | | 86,251 | | | 121,837 | |

| Current portion of operating lease liabilities | | 3,932 | | | 4,778 | |

| Deferred revenue | | 259,013 | | | 267,017 | |

| Total current liabilities | | 349,396 | | | 394,064 | |

| Deferred revenue, less current portion | | 151,968 | | | 150,180 | |

| Deferred tax liabilities, net | | 731 | | | 808 | |

| Long-term operating lease liabilities | | 8,738 | | | 11,270 | |

| Other liabilities | | 3,692 | | | 3,929 | |

| Commitments and contingencies (Note 5) | | | | |

| Stockholders’ equity: | | | | |

Preferred stock, $0.01 par value: 50,000 shares authorized, no shares issued and outstanding | | — | | | — | |

Common stock, $0.01 par value: 250,000 shares authorized, 44,597 shares and 44,511 shares issued and outstanding at September 30, 2022 and March 31, 2022, respectively | | 444 | | | 443 | |

| Additional paid-in capital | | 1,220,667 | | | 1,165,948 | |

| Accumulated deficit | | (940,396) | | | (898,699) | |

| Accumulated other comprehensive loss | | (15,452) | | | (11,863) | |

| Total stockholders’ equity | | 265,263 | | | 255,829 | |

| Total liabilities and stockholders’ equity | | $ | 779,788 | | | $ | 816,080 | |

See accompanying unaudited notes to consolidated financial statements

Commvault Systems, Inc.

Consolidated Statements of Operations

(In thousands, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Six Months Ended September 30, |

| | | 2022 | | 2021 | | 2022 | | 2021 |

| Revenues: | | | | | | | | |

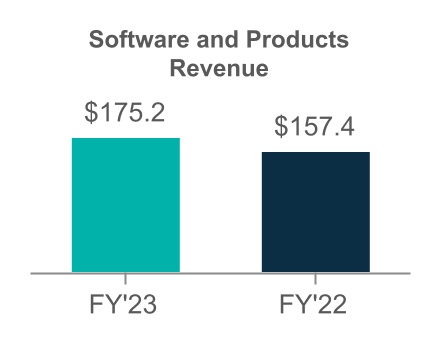

| Software and products | | $ | 82,825 | | | $ | 75,261 | | | $ | 175,261 | | | $ | 157,423 | |

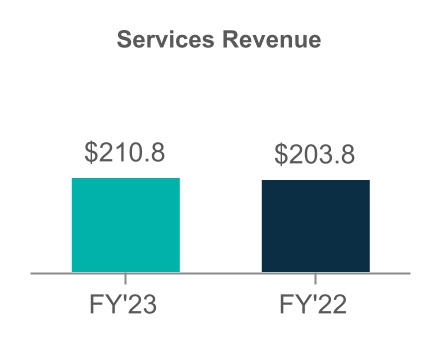

| Services | | 105,232 | | | 102,579 | | | 210,777 | | | 203,838 | |

| Total revenues | | 188,057 | | | 177,840 | | | 386,038 | | | 361,261 | |

| Cost of revenues: | | | | | | | | |

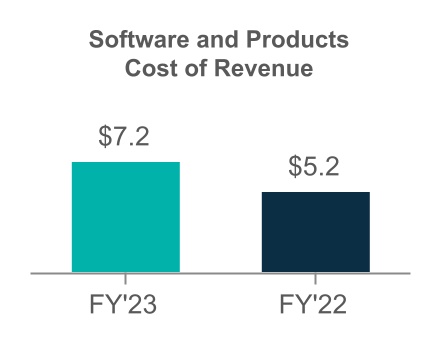

| Software and products | | 2,286 | | | 2,894 | | | 7,186 | | | 5,200 | |

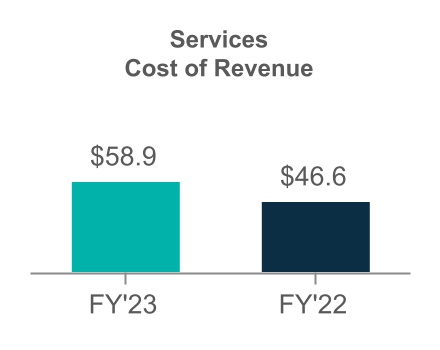

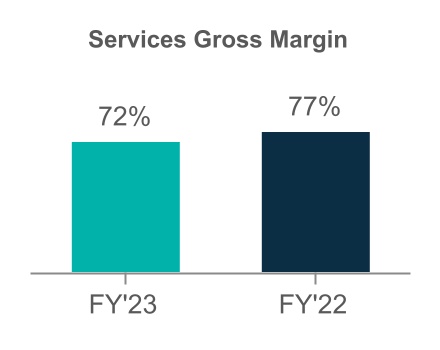

| Services | | 30,016 | | | 23,680 | | | 58,873 | | | 46,649 | |

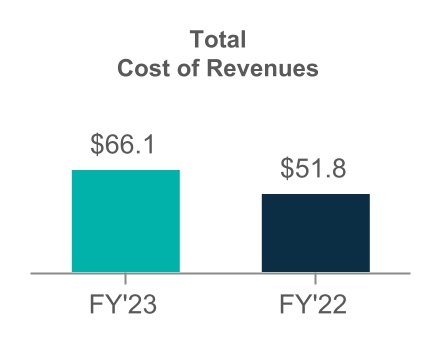

| Total cost of revenues | | 32,302 | | | 26,574 | | | 66,059 | | | 51,849 | |

| Gross margin | | 155,755 | | | 151,266 | | | 319,979 | | | 309,412 | |

| Operating expenses: | | | | | | | | |

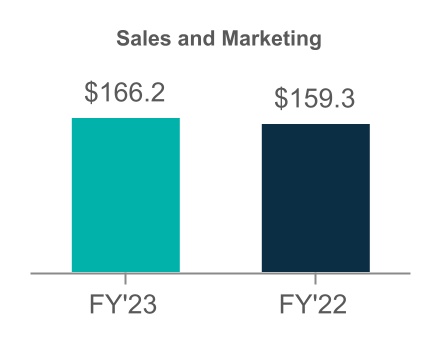

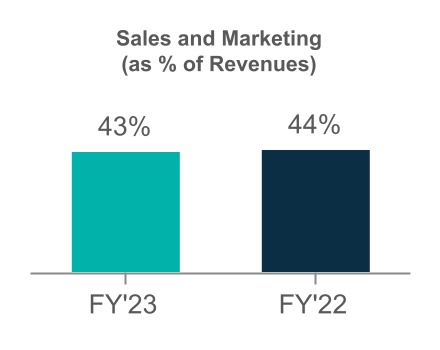

| Sales and marketing | | 81,299 | | | 82,928 | | | 166,218 | | | 159,289 | |

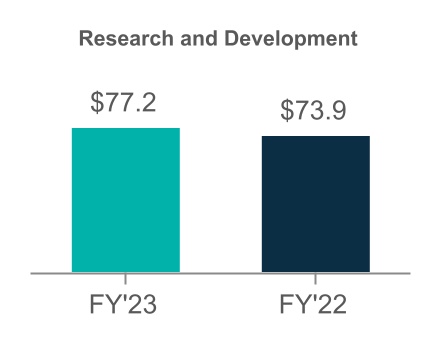

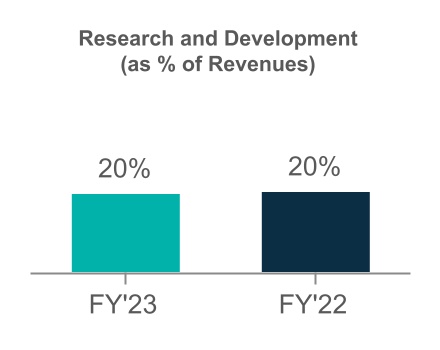

| Research and development | | 37,053 | | | 37,726 | | | 77,166 | | | 73,861 | |

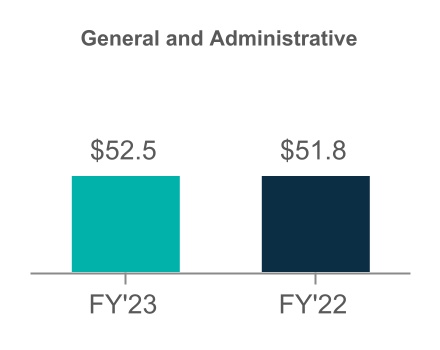

| General and administrative | | 25,553 | | | 25,358 | | | 52,529 | | | 51,787 | |

| Restructuring | | — | | | 636 | | | 2,132 | | | 2,082 | |

| | | | | | | | |

| Depreciation and amortization | | 2,537 | | | 2,352 | | | 5,172 | | | 4,633 | |

| Total operating expenses | | 146,442 | | | 149,000 | | | 303,217 | | | 291,652 | |

| Income from operations | | 9,313 | | | 2,266 | | | 16,762 | | | 17,760 | |

| Interest income | | 291 | | | 289 | | | 552 | | | 423 | |

| Interest expense | | (105) | | | — | | | (210) | | | — | |

| Other income (expense), net | | 154 | | | — | | | (235) | | | — | |

| Income before income taxes | | 9,653 | | | 2,555 | | | 16,869 | | | 18,183 | |

| Income tax expense | | 5,135 | | | 824 | | | 8,840 | | | 2,555 | |

| Net income | | $ | 4,518 | | | $ | 1,731 | | | $ | 8,029 | | | $ | 15,628 | |

| Net income per common share: | | | | | | | | |

| Basic | | $ | 0.10 | | | $ | 0.04 | | | $ | 0.18 | | | $ | 0.34 | |

| Diluted | | $ | 0.10 | | | $ | 0.04 | | | $ | 0.18 | | | $ | 0.33 | |

| Weighted average common shares outstanding: | | | | | | | | |

| Basic | | 44,759 | | | 45,743 | | | 44,751 | | | 45,960 | |

| Diluted | | 45,540 | | | 47,599 | | | 45,745 | | | 47,936 | |

See accompanying unaudited notes to consolidated financial statements

Commvault Systems, Inc.

Consolidated Statements of Comprehensive Income

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Six Months Ended September 30, |

| | | 2022 | | 2021 | | 2022 | | 2021 |

| Net income | | $ | 4,518 | | | $ | 1,731 | | | $ | 8,029 | | | $ | 15,628 | |

| Other comprehensive loss: | | | | | | | | |

| Foreign currency translation adjustment | | (1,874) | | | (722) | | | (3,589) | | | (1,313) | |

| Comprehensive income | | $ | 2,644 | | | $ | 1,009 | | | $ | 4,440 | | | $ | 14,315 | |

See accompanying unaudited notes to consolidated financial statements

Commvault Systems, Inc.

Consolidated Statements of Stockholders’ Equity

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

Common Stock | | Additional

Paid – In

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | Total |

| | | Shares | | Amount | | | | |

| Balance as of June 30, 2022 | | 44,835 | | | $ | 446 | | | $ | 1,194,931 | | | $ | (911,315) | | | $ | (13,578) | | | $ | 270,484 | |

| Stock-based compensation | | | | | | 25,327 | | | | | | | 25,327 | |

| Share issuances related to stock-based compensation | | 465 | | | 5 | | | 6,667 | | | | | | | 6,672 | |

| Repurchase of common stock | | (703) | | | (7) | | | (6,258) | | | (33,599) | | | | | (39,864) | |

| Net income | | | | | | | | 4,518 | | | | | 4,518 | |

| Other comprehensive loss | | | | | | | | | | (1,874) | | | (1,874) | |

| Balance as of September 30, 2022 | | 44,597 | | | $ | 444 | | | $ | 1,220,667 | | | $ | (940,396) | | | $ | (15,452) | | | $ | 265,263 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| |

Common Stock | | Additional

Paid – In

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | Total |

| | Shares | | Amount | | | | |

| Balance as of March 31, 2022 | | 44,511 | | | $ | 443 | | | $ | 1,165,948 | | | $ | (898,699) | | | $ | (11,863) | | | $ | 255,829 | |

| Stock-based compensation | | | | | | 56,422 | | | | | | | 56,422 | |

| Share issuances related to stock-based compensation | | 1,099 | | | 11 | | | 7,348 | | | | | | | 7,359 | |

| Repurchase of common stock | | (1,013) | | | (10) | | | (9,051) | | | (49,726) | | | | | (58,787) | |

| Net income | | | | | | | | 8,029 | | | | | 8,029 | |

| Other comprehensive loss | | | | | | | | | | (3,589) | | | (3,589) | |

| Balance as of September 30, 2022 | | 44,597 | | | $ | 444 | | | $ | 1,220,667 | | | $ | (940,396) | | | $ | (15,452) | | | $ | 265,263 | |

Commvault Systems, Inc.

Consolidated Statements of Stockholders’ Equity

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | |

Common Stock | | Additional

Paid – In

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | Total |

| | | Shares | | Amount | | | | |

| Balance as of June 30, 2021 | | 46,066 | | | $ | 459 | | | $ | 1,095,903 | | | $ | (730,883) | | | $ | (10,941) | | | $ | 354,538 | |

| Stock-based compensation | | | | | | 26,449 | | | | | | | 26,449 | |

| | | | | | | | | | | | |

| Share issuances related to stock-based compensation | | 467 | | | 5 | | | 7,821 | | | | | | | 7,826 | |

| Repurchase of common stock | | (1,159) | | | (12) | | | (10,435) | | | (79,597) | | | | | (90,044) | |

| Net income | | | | | | | | 1,731 | | | | | 1,731 | |

| Other comprehensive loss | | | | | | | | | | (722) | | | (722) | |

| Balance as of September 30, 2021 | | 45,374 | | | $ | 452 | | | $ | 1,119,738 | | | $ | (808,749) | | | $ | (11,663) | | | $ | 299,778 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

| |

Common Stock | | Additional

Paid – In

Capital | | Accumulated

Deficit | | Accumulated

Other

Comprehensive

Loss | | Total |

| | Shares | | Amount | | | | |

| Balance as of March 31, 2021 | | 46,482 | | | $ | 463 | | | $ | 1,069,695 | | | $ | (665,774) | | | $ | (10,350) | | | $ | 394,034 | |

| Stock-based compensation | | | | | | 48,260 | | | | | | | 48,260 | |

| | | | | | | | | | | | |

| Share issuances related to stock-based compensation | | 1,300 | | | 13 | | | 23,248 | | | | | | | 23,261 | |

| Repurchase of common stock | | (2,408) | | | (24) | | | (21,465) | | | (158,603) | | | | | (180,092) | |

| Net income | | | | | | | | 15,628 | | | | | 15,628 | |

| Other comprehensive income | | | | | | | | | | (1,313) | | | (1,313) | |

| Balance as of September 30, 2021 | | 45,374 | | | $ | 452 | | | $ | 1,119,738 | | | $ | (808,749) | | | $ | (11,663) | | | $ | 299,778 | |

See accompanying unaudited notes to consolidated financial statements

Commvault Systems, Inc.

Consolidated Statements of Cash Flows

(In thousands)

(Unaudited)

| | | | | | | | | | | | | | |

| | Six Months Ended September 30, |

| | | 2022 | | 2021 |

| Cash flows from operating activities | | | | |

| Net income | | $ | 8,029 | | | $ | 15,628 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation and amortization | | 5,855 | | | 5,258 | |

| Noncash stock-based compensation | | 56,422 | | | 48,260 | |

| Noncash change in fair value of equity securities | | 234 | | | — | |

| | | | |

| | | | |

| Amortization of deferred commissions cost | | 10,756 | | | 8,650 | |

| | | | |

| | | | |

| Changes in operating assets and liabilities: | | | | |

| Trade accounts receivable | | 15,863 | | | 27,519 | |

| Operating lease assets and liabilities, net | | (181) | | | (544) | |

| Other current assets and Other assets | | (461) | | | (4,346) | |

| Deferred commissions cost | | (13,017) | | | (12,897) | |

| Accounts payable | | (213) | | | (193) | |

| Accrued liabilities | | (28,604) | | | (25,952) | |

| Deferred revenue | | 16,464 | | | 1,831 | |

| Other liabilities | | 1,130 | | | 56 | |

| Net cash provided by operating activities | | 72,277 | | | 63,270 | |

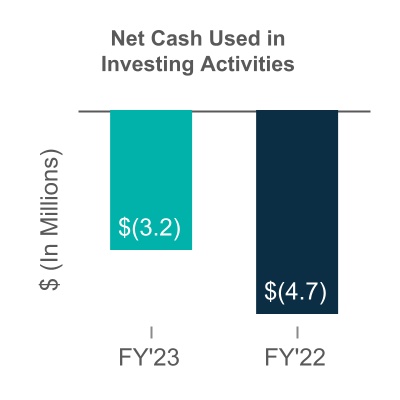

| Cash flows from investing activities | | | | |

| | | | |

| | | | |

| Purchase of property and equipment | | (1,381) | | | (1,993) | |

| Purchase of equity securities | | (1,793) | | | (2,706) | |

| | | | |

| Net cash used in investing activities | | (3,174) | | | (4,699) | |

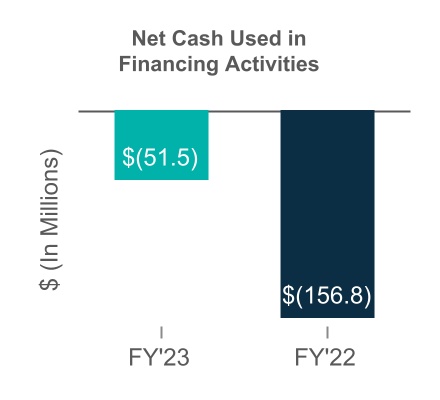

| Cash flows from financing activities | | | | |

| Repurchase of common stock | | (58,787) | | | (180,092) | |

| Proceeds from stock-based compensation plans | | 7,359 | | | 23,261 | |

| Payment of debt issuance costs | | (63) | | | — | |

| | | | |

| Net cash used in financing activities | | (51,491) | | | (156,831) | |

| Effects of exchange rate — changes in cash | | (22,634) | | | (3,170) | |

| Net decrease in cash and cash equivalents | | (5,022) | | | (101,430) | |

| Cash and cash equivalents at beginning of period | | 267,507 | | | 397,237 | |

| Cash and cash equivalents at end of period | | $ | 262,485 | | | $ | 295,807 | |

| | | | |

| | | | |

| | | | |

See accompanying unaudited notes to consolidated financial statements

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited

(In thousands, except per share data)

1. Basis of Presentation

Commvault Systems, Inc. and its subsidiaries ("Commvault," "we," "us," or "our") is a provider of data protection and information management software applications and products. We develop, market and sell a suite of software applications and services, globally, that provides our customers with data protection solutions. We also provide our customers with a broad range of professional and customer support services, including data protection-as-a-service, branded as Metallic.

The consolidated financial statements of Commvault as of September 30, 2022 and for the three and six months ended September 30, 2022 and 2021 are unaudited, and in the opinion of management, include all adjustments (consisting only of normal recurring adjustments) necessary for a fair presentation of the results for the interim periods. Accordingly, they do not include all of the information and footnotes required by U.S. generally accepted accounting principles (“U.S. GAAP”) for complete financial statements and should be read in conjunction with the financial statements and notes in our Annual Report on Form 10-K for fiscal 2022. The results reported in these financial statements should not necessarily be taken as indicative of results that may be expected for the entire fiscal year.

The preparation of financial statements and related disclosures in conformity with U.S. GAAP requires management to make judgments and estimates that affect the amounts reported in our consolidated financial statements and the accompanying notes. We base our estimates and judgments on historical experience and on various other assumptions that we believe are reasonable under the circumstances. The amounts of assets and liabilities reported in our balance sheets and the amounts of revenues and expenses reported for each of our periods presented are affected by estimates and assumptions, which are used for, but not limited to, the accounting for revenue recognition, income taxes and related reserves, deferred commissions, purchased intangible assets and goodwill. Actual results could differ from those estimates.

2. Summary of Significant Accounting Policies

Recently Adopted and Recently Issued Accounting Standards

There were no recently adopted accounting standards that had a material effect on our condensed consolidated financial statements and accompanying disclosures, and no recently issued accounting standards that are expected to have a material impact on our condensed consolidated financial statements and accompanying disclosures.

Concentration of Credit Risk

We grant credit to customers in a wide variety of industries worldwide and generally do not require collateral. Credit losses relating to these customers have been minimal.

Sales through our distribution agreement with Arrow Enterprise Computing Solutions, Inc. (“Arrow”) totaled 36% and 34% of total revenues for the three months ended September 30, 2022 and 2021, respectively, and 36% and 35% for the six months ended September 30, 2022 and 2021. Arrow accounted for approximately 27% and 30% of total accounts receivable as of September 30, 2022 and March 31, 2022, respectively.

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Equity Securities Accounted for at Net Asset Value

We held equity interests in private equity funds of $5,374 as of September 30, 2022, which are accounted for under the net asset value practical expedient as permitted under ASC 820, Fair Value Measurement. These investments are included in Other assets in the accompanying consolidated balance sheets. The net asset values of these investments are determined using quarterly capital statements from the funds, which are based on our contributions to the funds, allocation of profit and loss and changes in fair value of the underlying fund investments. Changes in fair value as reported on the capital statements are recorded through the consolidated statements of operations as non-operating income or expense. These private equity funds focus on making investments in key technology sectors, principally by investing in companies at expansion capital and growth equity stages. We had total unfunded commitments in private equity funds of $4,819 as of September 30, 2022.

Deferred Commissions Cost

Sales commissions, bonuses, and related payroll taxes earned by our employees are considered incremental and recoverable costs of obtaining a contract with a customer. Our typical contracts include performance obligations related to software licenses, software updates, customer support and other services, including data protection-as-a-service offerings. In these contracts, incremental costs of obtaining a contract are allocated to the performance obligations based on the relative estimated standalone selling prices and then recognized on a systematic basis that is consistent with the transfer of the goods or services to which the asset relates. We do not pay commissions on annual renewals of contracts for software updates and customer support for perpetual licenses. The costs allocated to software and products are expensed at the time of sale, when revenue for the functional software license or appliance is recognized. The costs allocated to software updates and customer support for perpetual licenses are amortized ratably over a period of approximately five years, the expected period of benefit of the asset capitalized. We currently estimate a period of five years is appropriate based on consideration of historical average customer life and the estimated useful life of the underlying software sold as part of the transaction. The commission paid on the renewal of a term-based or subscription software license is not commensurate with the commission paid on the initial purchase. As a result, the cost of commissions allocated to software updates and customer support on the initial term-based software license transactions are amortized over a period of approximately five years, consistent with the accounting for these costs associated with perpetual licenses. The costs of commissions allocated to software updates and support for the renewal of term-based software licenses is limited to the contractual period of the arrangement, as we pay a commensurate renewal commission upon the next renewal of the subscription license and related updates and support.

The costs related to professional services are amortized over the period the related professional services are provided and revenue is recognized. Amortization expense related to these costs is included in sales and marketing expenses in the accompanying consolidated statements of operations.

3. Revenue

We derive revenues from two primary sources: software and products, and services. Software and products revenue includes our software and integrated appliances that combine our software with hardware. Services include customer support (software updates and technical support), consulting, assessment and design services, installation services, customer education and data protection-as-a-service, which is branded as Metallic.

We sell both perpetual and term-based licenses of our software. We refer to our term-based software licenses as subscription arrangements. We do not customize our software, and installation services are not required. The software is delivered before related services are provided and is functional without professional services, updates and technical support. We have concluded that our software licenses (both perpetual and subscription) are functional intellectual property that is distinct as the user can benefit from the software on its own. Software revenue for both perpetual and subscription licenses is typically recognized when the software is delivered and/or made available for download as this is the point the user of the software can direct the use of, and obtain substantially all of the remaining benefits from, the functional intellectual property. We do not recognize software revenue related to the renewal of subscription software licenses earlier than the beginning of the new subscription period.

We also sell appliances that integrate our software with hardware and address a wide-range of business needs and use cases, ranging from support for remote or branch offices with limited IT staff up to large corporate

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

data centers. Revenue related to appliances is recognized when control of the appliances passes to the customer; typically upon delivery. In the second half of fiscal 2021 we began transitioning to a software only model in which we typically sell software to a third party, which assembles an integrated appliance that is sold to end user customers. As a result, the revenue and costs associated with hardware have declined from recent fiscal years.

Services revenue includes revenue from customer support and other professional services. Customer support includes software updates on a when-and-if-available basis, telephone support, integrated web-based support and bug fixes or patches. We sell our customer support contracts as a percentage of net software purchases the support is related to. Customer support revenue is recognized ratably over the term of the customer support agreement, which is typically one year on our perpetual licenses. The term of our subscription arrangements is typically three years but can range between one and five years.

Our other professional services include consulting, assessment and design services, installation services and customer education. Customer education services include courses taught by our instructors or third-party contractors. Revenue related to other professional services and customer education services is typically recognized as the services are performed.

Commvault data protection-as-a-service, which is branded as Metallic, allows customers to use hosted software over the contract period without taking possession of the software. Revenue related to Metallic is generally recognized ratably over the contract term as services revenue.

Most of our contracts with customers contain multiple performance obligations. For these contracts, we account for individual performance obligations separately if they are distinct. The transaction price is allocated to the separate performance obligations on a relative standalone selling price basis. Standalone selling prices of software are typically estimated using the residual approach. Standalone selling prices of services are typically estimated based on observable transactions when these services are sold on a standalone basis.

Our typical performance obligations include the following:

| | | | | | | | | | | |

| Performance Obligation | When Performance Obligation

is Typically Satisfied | When Payment is

Typically Due | How Standalone Selling Price is

Typically Estimated |

| Software and Products Revenue |

| Software Licenses | Upon shipment or made available for download (point in time) | Within 90 days of shipment except for certain subscription licenses which are paid for over time | Residual approach |

| Customer Support Revenue |

| Software Updates | Ratably over the course of the support contract (over time) | At the beginning of the contract period | Observable in renewal transactions |

| Customer Support | Ratably over the course of the support contract (over time) | At the beginning of the contract period | Observable in renewal transactions |

| Other Services Revenue |

| Other Professional Services (except for education services) | As work is performed (over time) | Within 90 days of services being performed | Observable in transactions without multiple performance obligations |

| Education Services | When the class is taught (point in time) | Within 90 days of services being performed | Observable in transactions without multiple performance obligations |

| Data protection-as-a-service (Metallic) | Ratably over the course of the contract (over time) | Annual or monthly payments | Observable in transactions without multiple performance obligations |

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

Disaggregation of Revenue

We disaggregate revenue from contracts with customers into the nature of the products and services and geographical regions. During the fourth quarter of fiscal 2022, we combined the management of our EMEA and APJ field organizations into our International region (Europe, Middle East, Africa, Australia, India, Japan, Southeast Asia, China). Our Americas region includes the United States, Canada, and Latin America.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 | | Six Months Ended September 30, 2022 |

| Americas | International | Total | | Americas | International | Total |

| Software and Products Revenue | $ | 53,163 | | $ | 29,662 | | $ | 82,825 | | | $ | 112,843 | | $ | 62,418 | | $ | 175,261 | |

| Customer Support Revenue | 45,973 | | 32,023 | | 77,996 | | | 94,004 | | 65,309 | | 159,313 | |

| Other Services Revenue | 17,055 | | 10,181 | | 27,236 | | | 31,953 | | 19,511 | | 51,464 | |

| Total Revenue | $ | 116,191 | | $ | 71,866 | | $ | 188,057 | | | $ | 238,800 | | $ | 147,238 | | $ | 386,038 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2021 | | Six Months Ended September 30, 2021 |

| Americas | International | Total | | Americas | International | Total |

| Software and Products Revenue | $ | 44,185 | | $ | 31,076 | | $ | 75,261 | | | $ | 95,972 | | $ | 61,451 | | $ | 157,423 | |

| Customer Support Revenue | 51,207 | | 36,246 | | 87,453 | | | 103,081 | | 73,341 | | 176,422 | |

| Other Services Revenue | 9,393 | | 5,733 | | 15,126 | | | 16,703 | | 10,713 | | 27,416 | |

| Total Revenue | $ | 104,785 | | $ | 73,055 | | $ | 177,840 | | | $ | 215,756 | | $ | 145,505 | | $ | 361,261 | |

Information about Contract Balances

Amounts collected in advance of services being provided are accounted for as deferred revenue. Nearly all of our deferred revenue balance is related to services revenue, primarily customer support and data protection-as-a-service contracts.

In some arrangements we allow customers to pay for term-based software licenses and products over the term of the software license. Amounts recognized as revenue in excess of amounts billed are recorded as unbilled receivables. Unbilled receivables, which are anticipated to be invoiced in the next twelve months, are included in accounts receivable on the consolidated balance sheets. Long-term unbilled receivables are included in other assets. The opening and closing balances of our accounts receivable, unbilled receivables, and deferred revenues are as follows:

| | | | | | | | | | | | | | | | | |

| Accounts Receivable | Unbilled Receivable

(current) | Unbilled Receivable

(long-term) | Deferred Revenue (current) | Deferred Revenue (long-term) |

Opening Balance as of March 31, 2022 | $ | 177,182 | | $ | 17,056 | | $ | 14,296 | | $ | 267,017 | | $ | 150,180 | |

| Increase (decrease), net | (27,769) | | 3,697 | | (260) | | (8,004) | | 1,788 | |

Ending Balance as of September 30, 2022 | $ | 149,413 | | $ | 20,753 | | $ | 14,036 | | $ | 259,013 | | $ | 151,968 | |

The net decrease in accounts receivable (inclusive of unbilled receivables) is a result of a decrease in software and products revenue relative to the fourth quarter of the prior fiscal year. The decrease in deferred revenue is primarily the result of the strengthening of the U.S. dollar and a decrease in deferred revenue associated with customer support contracts partially offset by an increase in deferred revenue associated with Metallic contracts that are billed upfront and recognized ratably over the contract period.

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

The amount of revenue recognized in the period that was included in the March 31, 2022 balance of deferred revenue was $73,314 and $165,463 for the three and six months ended September 30, 2022, respectively. The vast majority of this revenue consists of customer support arrangements and Metallic. The amount of software and products revenue recognized in the three and six months ended September 30, 2022 related to performance obligations from prior periods was not significant.

Remaining Performance Obligations

In addition to the amounts included in deferred revenue as of September 30, 2022, $71,596 of revenue may be recognized from remaining performance obligations, of which $2,771 was related to software and products. We expect the majority of this software and products revenue to be recognized during fiscal 2023. Most of this software and products revenue is associated with renewals of term licenses which have not yet expired. The majority of the services revenue is related to other professional services which may be recognized over the next twelve months but is contingent upon a number of factors, including customers’ needs and Metallic.

4. Net Income per Common Share

Basic net income per common share is computed by dividing net income by the weighted average number of common shares during the period. Diluted net income per share is computed using the weighted average number of common shares and, if dilutive, potential common shares outstanding during the period. Potential common shares consist of the incremental common shares issuable upon the vesting of restricted stock units, shares to be purchased under the Employee Stock Purchase Plan ("ESPP"), and the exercise of stock options. The dilutive effect of such potential common shares is reflected in diluted earnings per share by application of the treasury stock method.

The following table sets forth the reconciliation of basic and diluted net income per common share:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Six Months Ended September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Net income | | $ | 4,518 | | | $ | 1,731 | | | $ | 8,029 | | | $ | 15,628 | |

| Basic net income per common share: | | | | | | | | |

| Basic weighted average shares outstanding | | 44,759 | | | 45,743 | | | 44,751 | | | 45,960 | |

| Basic net income per common share | | $ | 0.10 | | | $ | 0.04 | | | $ | 0.18 | | | $ | 0.34 | |

| Diluted net income per common share: | | | | | | | | |

| Basic weighted average shares outstanding | | 44,759 | | | 45,743 | | | 44,751 | | | 45,960 | |

| Dilutive effect of stock options and restricted stock units | | 781 | | | 1,856 | | | 994 | | | 1,976 | |

| Diluted weighted average shares outstanding | | 45,540 | | | 47,599 | | | 45,745 | | | 47,936 | |

| Diluted net income per common share | | $ | 0.10 | | | $ | 0.04 | | | $ | 0.18 | | | $ | 0.33 | |

| | | | | | | | |

The diluted weighted-average shares outstanding exclude restricted stock units, performance restricted stock units, shares to be purchased under the ESPP and outstanding stock options totaling 882 and 472 for the three months ended September 30, 2022 and 2021, respectively, and 523 and 597 for the six months ended September 30, 2022 and 2021, because the effect would have been anti-dilutive.

5. Commitments and Contingencies

We do not believe that we are currently party to any pending legal action that could reasonably be expected to have a material adverse effect on our business or operating results.

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

During the second quarter of fiscal 2022, we entered into a settlement agreement resulting in a $2,500 gain which resolved certain legal matters. The settlement amount is recorded in general and administrative expenses net against related legal expenses.

6. Capitalization

Our stock repurchase program has been funded by our existing cash and cash equivalent balances, as well as cash flows provided by our operations.

On April 21, 2022, the Board of Directors (the "Board") approved a new share repurchase program of $250,000. The Board's authorization has no expiration date. For the six months ended September 30, 2022, we repurchased $58,787 of our common stock, or approximately 1,013 shares. As a result, $191,213 remains available under the current authorization.

7. Stock Plans

The following table presents the stock-based compensation expense included in cost of services revenue, sales and marketing, research and development, general and administrative and restructuring expenses for the three and six months ended September 30, 2022 and 2021. Stock-based compensation is attributable to restricted stock units, performance-based awards and the ESPP.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Six Months Ended September 30, |

| | | 2022 | | 2021 | | 2022 | | 2021 |

| Cost of services revenue | | $ | 1,226 | | | $ | 1,042 | | | $ | 2,469 | | | $ | 2,227 | |

| Sales and marketing | | 10,165 | | | 9,974 | | | 21,558 | | | 17,282 | |

| Research and development | | 7,793 | | | 8,410 | | | 17,034 | | | 15,595 | |

| General and administrative | | 6,143 | | | 6,773 | | | 14,074 | | | 12,784 | |

| Restructuring | | — | | | 250 | | | 1,287 | | | 372 | |

| Stock-based compensation expense | | $ | 25,327 | | | $ | 26,449 | | | $ | 56,422 | | | $ | 48,260 | |

As of September 30, 2022, there was $131,387 of unrecognized stock-based compensation expense that is expected to be recognized over a weighted-average period of 1.83 years. We account for forfeitures as they occur. To the extent that awards are forfeited, stock-based compensation will be different from our current estimate.

Stock option activity was not significant in the six months ended September 30, 2022. In the six months ended September 30, 2021, there were 391 options exercised with an intrinsic value of $12,460.

Restricted Stock Units

Restricted stock unit activity for the six months ended September 30, 2022 is as follows:

| | | | | | | | | | | |

| Non-vested Restricted Stock Units | Number of

Awards | | Weighted-

Average Grant

Date Fair Value |

| Non-vested as of March 31, 2022 | 3,310 | | | $ | 58.16 | |

| Awarded | 971 | | | 61.69 | |

| Vested | (955) | | | 54.56 | |

| Forfeited | (277) | | | 60.20 | |

| Non-vested as of September 30, 2022 | 3,049 | | | $ | 60.23 | |

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

The weighted-average fair value of restricted stock units awarded was $57.00 and $61.69 per unit during the three and six months ended September 30, 2022, and $76.79 and $74.28 per unit during the three and six months ended September 30, 2021. The weighted-average fair value of awards includes the awards with a market condition described below.

Performance Based Awards

In the six months ended September 30, 2022, we granted 126 performance restricted stock units ("PSUs") to certain executives. Vesting of these awards is contingent upon i) us meeting certain non-GAAP performance goals (performance-based) in fiscal 2023 and ii) our customary service periods. The awards vest over three years. The vesting quantity of these awards may vary based on actual fiscal 2023 performance. The related stock-based compensation expense is determined based on the value of the underlying shares on the date of grant and is recognized over the vesting term using the accelerated method. During the interim financial periods, management estimates the probable number of PSUs that would vest until the ultimate achievement of the performance goals is known. The awards are included in the restricted stock unit table.

Awards with a Market Condition

In the six months ended September 30, 2022, we granted 126 market performance stock units to certain executives. The vesting of these awards is contingent upon us meeting certain total shareholder return ("TSR") levels as compared to the Russell 3000 market index over the next three years. The awards vest in three annual tranches and have a maximum potential to vest at 200% (252 shares) based on TSR performance. The related stock-based compensation expense is determined based on the estimated fair value of the underlying shares on the date of grant and is recognized using the accelerated method over the vesting term. The estimated fair value was calculated using a Monte Carlo simulation model. The fair value of the awards granted during the six months ended September 30, 2022 was $76.48 per unit. The awards are included in the restricted stock unit table.

Employee Stock Purchase Plan

The Employee Stock Purchase Plan (the “Purchase Plan”) is a shareholder approved plan under which substantially all employees may purchase our common stock through payroll deductions at a price equal to 85% of the lower of the fair market values of the stock as of the beginning or the end of six-month offering periods. An employee’s payroll deductions under the Purchase Plan are limited to 10% of the employee’s salary and employees may not purchase more than $25 of stock during any calendar year. Employees purchased 107 shares in exchange for $5,418 of proceeds in the six months ended September 30, 2022 and 85 shares in exchange for $5,160 of proceeds in the six months ended September 30, 2021. The Purchase Plan is considered compensatory and the fair value of the discount and look back provision are estimated using the Black-Scholes formula and recognized over the six-month withholding period prior to purchase. The total expense associated with the Purchase Plan for the six months ended September 30, 2022 and 2021 was $1,927 and $1,567, respectively. As of September 30, 2022, there was approximately $1,448 of unrecognized cost related to the current purchase period of our Purchase Plan.

8. Income Taxes

Income tax expense was $5,135 and $8,840 in the three and six months ended September 30, 2022, respectively, compared to expense of $824 and $2,555 in the three and six months ended September 30, 2021, respectively. The increase in current income tax expense relative to the prior year relates primarily to current federal and state taxes driven by the effects of capitalization and amortization of research and development expenses starting in fiscal year 2023 as required by the 2017 Tax Cuts and Jobs Act. We believe that it is more likely than not that we will not realize the benefits of our gross deferred tax assets and therefore continue to record a valuation allowance to reduce the carrying value of these gross deferred tax assets, net of the impact of the reversal of taxable temporary differences, to zero as of September 30, 2022.

Commvault Systems, Inc

Notes to Consolidated Financial Statements - Unaudited (continued)

(In thousands, except per share data)

9. Restructuring

Our restructuring plans were aimed to increase efficiency in our sales, marketing and distribution functions, as well as reduce costs across all functional areas. In the fourth quarter of fiscal 2022, we initiated a restructuring plan to combine the management of our EMEA and APJ field organizations that has since been completed. These restructuring charges relate primarily to severance and related costs associated with headcount reductions and stock-based compensation related to modifications of existing unvested awards granted to certain employees impacted by the restructuring plan.

For the three and six months ended September 30, 2022 and 2021, restructuring charges were comprised of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Six Months Ended September 30, |

| | 2022 | | 2021 | | 2022 | | 2021 |

| Employee severance and related costs | | $ | — | | | $ | 386 | | | $ | 845 | | | $ | 1,710 | |

| | | | | | | | |

| Stock-based compensation | | — | | | 250 | | | 1,287 | | | 372 | |

| Total restructuring charges | | $ | — | | | $ | 636 | | | $ | 2,132 | | | $ | 2,082 | |

Restructuring accruals

The activity in our restructuring accruals for the six months ended September 30, 2022 is as follows:

| | | | | | | | |

| | Total |

Balance as of March 31, 2022 | | $ | 2,261 | |

| Employee severance and related costs | | 845 | |

| Payments | | (2,850) | |

Balance as of September 30, 2022 | | $ | 256 | |

10. Revolving Credit Facility

On December 13, 2021, we entered into a five-year $100,000 senior secured revolving credit facility (the “Credit Facility”) with JPMorgan Chase Bank, N.A. ("J.P. Morgan"). The Credit Facility is available for share repurchases, general corporate purposes, and letters of credit. The Credit Facility contains financial maintenance covenants including a leverage ratio and interest coverage ratio. The Credit Facility also contains certain customary events of default which would permit the lender to, among other things, declare all loans then outstanding to be immediately due and payable if such default is not cured within applicable grace periods. The Credit Facility also limits our ability to incur certain additional indebtedness, create or permit liens on assets, make acquisitions, make investments, loans or advances, sell or transfer assets, pay dividends or distributions, and engage in certain transactions with foreign affiliates. Outstanding borrowings under the Credit Facility accrue interest at an annual rate equal to Secured Overnight Financing Rate plus 1.25% subject to increases based on our actual leverage. The unused balance on the Credit Facility is also subject to a 0.25% annual interest charge subject to increases based on our actual leverage. As of September 30, 2022, there were no borrowings under the Credit Facility and we were in compliance with all covenants.

We have deferred the expense related to debt issuance costs, which are classified as other assets, and will amortize the costs into interest expense over the term of the Credit Facility. Unamortized amounts at September 30, 2022 were $486. The amortization of debt issuance costs and interest expense incurred for the three and six months ended September 30, 2022 was $93 and $185, respectively.

Item 2 - Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion and analysis along with our consolidated financial statements and the related notes included elsewhere in this quarterly report on Form 10-Q. The statements in this discussion regarding our expectations of our future performance, liquidity and capital resources, and other non-historical statements are forward-looking statements. These forward-looking statements are subject to numerous risks and uncertainties, including, but not limited to, the risks and uncertainties described under “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2022. Our actual results may differ materially from those contained in or implied by any forward-looking statements.

Overview

Incorporated in Delaware in 1996, Commvault Systems, Inc. is a global data management company offering customers enterprise level, intelligent data services via a single platform and unified code base.

We believe in solving hard problems for our customers by enabling our customers to accelerate their digital transformation in today's ever-evolving workforce. Our product portfolio includes intuitive tools and powerful machine learning technology that drives automation, reduces complexity, reigns in data fragmentation, and accelerates a customer’s cloud journey. Our product functionality share the same back-end technologies to deliver the benefits of a holistic approach to protecting, managing, and securing data. Our products address many aspects of data management, from data protection and security, to data governance, transformation and insights, while providing scalability. We believe our technology and professional services provide the broadest set of capabilities in the industry, which enables customers to efficiently and cost-effectively scale their data on premises or in the cloud.

Sources of Revenues

We derive a significant portion of our total revenues from sales of licenses of our software applications. We do not customize our software for a specific end-user customer. We sell our software applications to end-user customers both directly through our sales force and indirectly through our global network of value-added reseller partners, systems integrators, corporate resellers and original equipment manufacturers. Our software and products revenue was 45% and 44% of our total revenues for the six months ended September 30, 2022 and 2021, respectively.

We continue to focus on subscription and other recurring revenue arrangements and continue to generate revenue from the renewals of subscription licenses sold in prior years. Any of our licensing models (capacity, instance based, etc.) can be sold via a subscription arrangement. In these arrangements the customer has the right to use the software over a designated period of time. The capacity of the license is fixed and the customer has made an unconditional commitment to pay. Software revenue in these arrangements is generally recognized when the software is delivered. During the six months ended September 30, 2022 and 2021, approximately 79% and 62% of software license revenue was sold under a subscription model, respectively. We also sell to some customers, primarily managed service providers, via utility, or pay-as-you-go models. In these arrangements, there is no minimum commitment and actual usage is regularly measured and billed. Revenue in these utility arrangements is recognized as the software is used.

Our total software and products revenue in any particular period is, to a certain extent, dependent upon our ability to generate revenues from large customer software and products deals, which we refer to as larger deal transactions. Larger deal transactions (transactions greater than $0.1 million of software and products revenue) represented 74% and 68% of our total software and products revenue in the six months ended September 30, 2022 and 2021, respectively.

Software and products revenue generated through indirect distribution channels accounted for approximately 90% of total software and products revenue in both the six months ended September 30, 2022 and 2021. Software and products revenue generated through direct distribution channels accounted for approximately 10% of total software and products revenue in both the six months ended September 30, 2022 and 2021. Deals initiated by our direct sales force are sometimes transacted through indirect channels based on end-user customer requirements, which are not always in our control and can cause this overall percentage split to vary from period-to-period. As such, there may be fluctuations in the dollars and percentage of software and products revenue generated through our direct distribution channels from time-to-time. We believe that the growth of our software and products revenue, derived from both our indirect channel partners and direct sales force, are key attributes to our long-term growth strategy. We intend to continue to invest in both our channel relationships and direct sales force in the future, but we continue to expect more revenue to be generated through indirect distribution channels over the long term. The

failure of our indirect distribution channels or our direct sales force to effectively sell our software applications could have a material adverse effect on our revenues and results of operations.

We have a non-exclusive distribution agreement with Arrow Enterprise Computing Solutions, Inc. ("Arrow"), a subsidiary of Arrow Electronics, Inc. Pursuant to this distribution agreement, Arrow's primary role is to enable a more efficient and effective distribution channel for our products and services by managing our reseller partners and leveraging their own industry experience. We generated 36% and 35% of our total revenues through Arrow for the six months ended September 30, 2022 and 2021, respectively. If Arrow were to discontinue or reduce the sales of our products or if our agreement with Arrow were terminated, and if we were unable to take back the management of our reseller channel or find another distributor to replace Arrow, there could be a material adverse effect on our future business.

Our services revenue was 55% and 56% of our total revenues for the six months ended September 30, 2022 and 2021, respectively. Our services revenue is made up of fees from the delivery of customer support and other professional services, which are typically sold in connection with the sale of our software applications. Customer support agreements provide technical support and unspecified software updates on a when-and-if-available basis for an annual fee based on licenses purchased and the level of service subscribed. Metallic, our data protection-as-a-service solution, allows customers to use hosted software over the contract period without taking possession of the software. Revenue related to Metallic is also included in services revenue and is generally recognized ratably over the contract term. Other professional services include consulting, assessment and design services, implementation and post-deployment services and training, all of which to date have predominantly been sold in connection with the sale of software applications.

Foreign Currency Exchange Rates’ Impact on Results of Operations

Sales outside the United States were 45% of our total revenue for the six months ended September 30, 2022 and 47% of our total revenue for the six months ended September 30, 2021. The income statements of our non-U.S. operations are translated into U.S. dollars at the average exchange rates for each applicable month in a period. To the extent the U.S. dollar weakens against foreign currencies, the translation of these foreign currency denominated transactions generally results in increased revenue, operating expenses and income from operations for our non-U.S. operations. Similarly, our revenue, operating expenses and net income will generally decrease for our non-U.S. operations if the U.S. dollar strengthens against foreign currencies.

Using the average foreign currency exchange rates from the three months ended September 30, 2021, our software and products revenue would have been higher by $4.4 million, our services revenue would have been higher by $6.1 million, our cost of sales would have been higher by $1.4 million and our operating expenses would have been higher by $5.2 million from non-U.S. operations for the three months ended September 30, 2022. Using the average foreign currency exchange rates from the six months ended September 30, 2021, our software and products revenue would have been higher by $8.3 million, our services revenue would have been higher by $11.0 million, our cost of sales would have been higher by $2.4 million and our operating expenses would have been higher by $9.5 million from non-U.S. operations for the six months ended September 30, 2022.

In addition, we are exposed to risks of foreign currency fluctuation primarily from cash balances, accounts receivables and intercompany accounts denominated in foreign currencies and are subject to the resulting transaction gains and losses, which are recorded as a component of general and administrative expenses. We recognized net foreign currency transaction losses of approximately $0.3 million and gains of $0.2 million for the three and six months ended September 30, 2022, respectively. We recognized net foreign currency transaction losses of approximately $0.1 million and $0.2 million for the three and six months ended September 30, 2021, respectively.

Critical Accounting Policies

In presenting our consolidated financial statements in conformity with U.S. generally accepted accounting principles, we are required to make estimates and judgments that affect the amounts reported therein. Some of the estimates and assumptions we are required to make relate to matters that are inherently uncertain as they pertain to future events. We base these estimates on historical experience and on various other assumptions that we believe to be reasonable and appropriate. Actual results may differ significantly from these estimates. To the extent that there are material differences between these estimates and actual results, our future financial statement presentation, financial condition, results of operations and cash flows will be affected.

In many cases, the accounting treatment of a particular transaction is specifically dictated by GAAP and does not require management’s judgment in its application, while in other cases, significant judgment is required in selecting among available alternative accounting standards that allow different accounting treatment for similar transactions. We consider these policies requiring significant management judgment to be critical accounting policies. These critical accounting policies are:

•Revenue Recognition

•Accounting for Income Taxes

•Goodwill

There have been no significant changes in our critical accounting policies during the six months ended September 30, 2022 as compared to the critical accounting policies and estimates disclosed in “Management’s Discussion and Analysis of Financial Condition and Results of Operations - Critical Accounting Policies” included in our Annual Report on Form 10-K for the year ended March 31, 2022.

Results of Operations

Three months ended September 30, 2022 compared to three months ended September 30, 2021

Revenues (in millions)

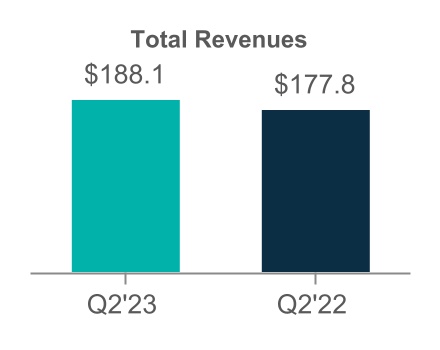

–Total revenues increased $10.3 million, or 6% as a result of the following:

•An increase in software and products and Metallic revenues.

•Software and products revenue represented 44% of our total revenue in the three months ended September 30, 2022 and 42% of our total revenue in the three months ended September 30, 2021.

•Services revenue represented 56% of our total revenue in the three months ended September 30, 2022 and 58% of our total revenue in the three months ended September 30, 2021.

•Using the average foreign currency exchange rates from the three months ended September 30, 2021, our total revenues would have increased 12% compared to the three months ended September 30, 2021.

–Software and products revenue increased $7.5 million, or 10%, as a result of the following:

•An increase of $9.1 million, or 18%, in larger deal revenue (deals greater than $0.1 million). Larger deal revenue represented 72% of our software and products revenue in the three months ended September 30, 2022 and 67% of our software and products revenue in the three months ended September 30, 2021.

•The average dollar amount of larger deal revenue transactions was approximately $346 thousand and $311 thousand for the three months ended September 30, 2022 and 2021, respectively, representing an 11% increase.

•This increase was partially offset by a decrease of $1.6 million in transactions less than $0.1 million.

•Using the average foreign currency exchange rates from the three months ended September 30, 2021, our software and products revenue would have increased 16% compared to the three months ended September 30, 2021.

–Services revenue increased $2.7 million, or 3%, primarily due to the following:

•An increase in other services revenue, driven primarily by the year over year increase in revenue from Metallic, partially offset by a decrease in revenue from customer support agreements.

•Using the average foreign currency exchange rates from the three months ended September 30, 2021, our services revenue would have increased 9% compared to the three months ended September 30, 2021.

We track software and products revenue on a geographic basis. During the fourth quarter of fiscal 2022, we combined the management of our EMEA and APJ field organizations into our International region (Europe, Middle East, Africa, Australia, India, Japan, Southeast Asia, China). Our Americas region includes the United States, Canada, and Latin America. Americas and International represented 64% and 36% of total software and products revenue, respectively, for the three months ended September 30, 2022. Software and products revenue increased year over year by 20% in the Americas and decreased by 5% in International.

▪The increase in Americas software and products revenue was primarily due to a 31% increase in larger deal transactions revenue, driven by an increase in the average dollar amount of larger deal transactions.

▪The decrease in International software and products revenue was primarily the result of foreign currency fluctuations. Using the average foreign currency exchange rates from the three months ended September 30, 2021, our International software and products revenue would have increased 9% compared to the three months ended September 30, 2021.

Our software and products revenue in International is subject to changes in foreign exchange rates as further discussed above in the “Foreign Currency Exchange Rates’ Impact on Results of Operations” section.

Cost of Revenues and Gross Margin ($ in millions)

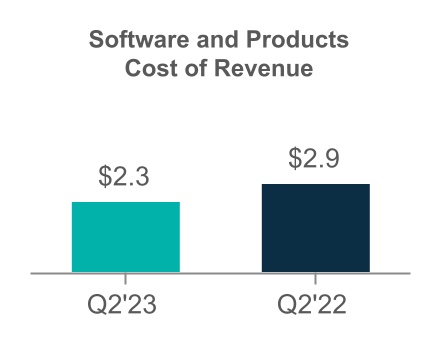

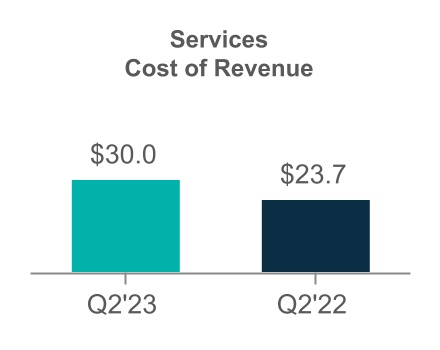

–Total cost of revenues increased $5.7 million, and represented 17% and 15% of our total revenues for the three months ended September 30, 2022 and 2021, respectively.

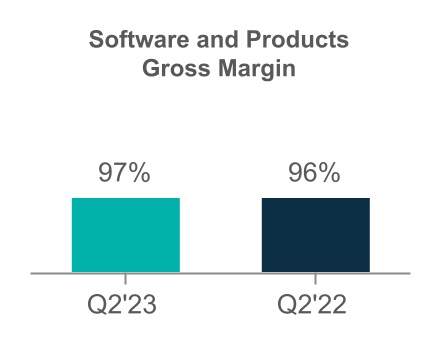

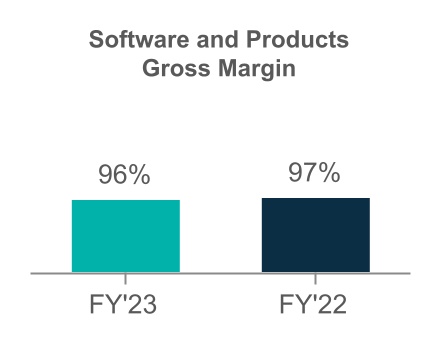

–Cost of software and products revenue decreased $0.6 million and represented 3% of our total software and products revenue for the three months ended September 30, 2022 compared to 4% for the three months ended September 30, 2021.

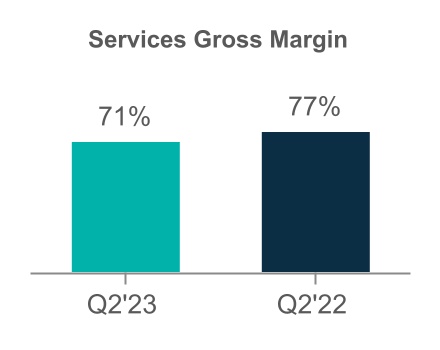

–Cost of services revenue increased $6.3 million, representing 29% of our total services revenue for the three months ended September 30, 2022 compared to 23% for the three months ended September 30, 2021. The increase in cost of services revenue primarily related to an increase in the cost of infrastructure related to Metallic as it continues to scale.

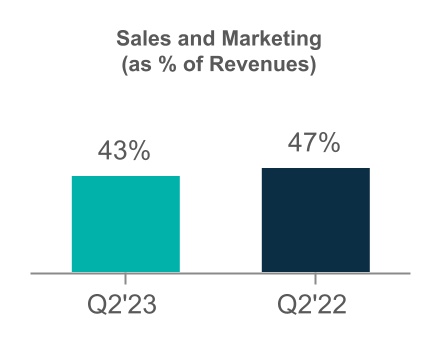

Operating Expenses ($ in millions)

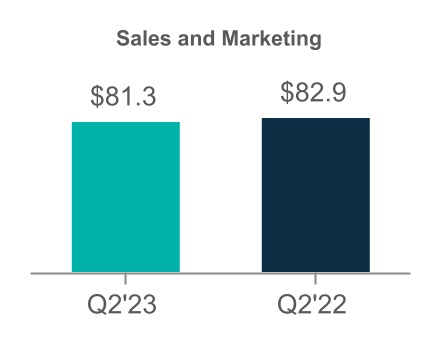

–Sales and marketing expenses decreased $1.6 million, or 2%, primarily due to decreases in employee compensation and related expenses, partially attributable to the completion of our restructuring programs. These decreases were partially offset by a $1.5 million increase in travel expenses.

–Research and development expenses decreased $0.6 million, or 2%, as a result of the completion of payments related to key employees of Hedvig, Inc., which ended in the fourth quarter of fiscal 2022. Investing in research and development has been a priority for Commvault, and we anticipate continued spending related to the development of our data and information management software applications.

–General and administrative expenses increased $0.1 million, or 1%, primarily due to the following:

•Increase in employee compensation and related expenses;

•Partially offset by a $0.6 million decrease in stock compensation expense; and

•A decrease in legal costs relative to the same period of the prior year.

–Depreciation and amortization expense increased $0.2 million, from $2.4 million in the three months ended September 30, 2021 to $2.5 million in the three months ended September 30, 2022, as a result of the acquisition of an intangible asset in the fourth quarter of fiscal year 2022.

Income Tax Expense

Income tax expense was $5.1 million in the three months ended September 30, 2022 compared to expense of $0.8 million in the three months ended September 30, 2021. The increase in current income tax expense relative to the prior year relates primarily to an increase in pre-tax income and current federal and state taxes driven by the effects of capitalization and amortization of research and development expenses starting in fiscal year 2023 as required by the 2017 Tax Cuts and Jobs Act. We believe that it is more likely than not that we will not realize the benefits of our gross deferred tax assets and therefore continue to record a valuation allowance to reduce the carrying value of these gross deferred tax assets, net of the impact of the reversal of taxable temporary differences, to zero as of September 30, 2022.

Six months ended September 30, 2022 compared to six months ended September 30, 2021

Revenues (in millions)

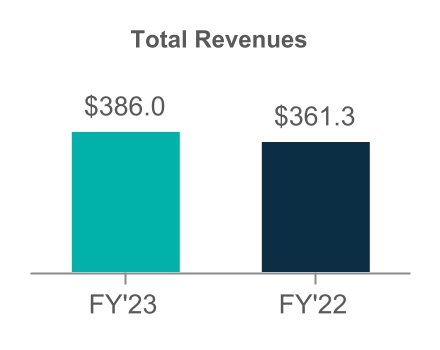

–Total revenues increased $24.7 million, or 7% as a result of the following:

•An increase in software and products and Metallic revenues.

•Software and products revenue represented 45% of our total revenue in the six months ended September 30, 2022 and 44% of our total revenue in the six months ended September 30, 2021.

•Services revenue represented 55% of our total revenue in the six months ended September 30, 2022 and 56% of our total revenue in the six months ended September 30, 2021.

•Using the average foreign currency exchange rates from the six months ended September 30, 2021, our total revenues would have increased 12% compared to the six months ended September 30, 2021.

–Software and products revenue increased $17.8 million, or 11%, as a result of the following:

•An increase of $22.5 million, or 21%, in larger deal revenue (deals greater than $0.1 million). Larger deal revenue represented 74% of our software and products revenue in the six months ended September 30, 2022 and 68% of our software and products revenue in the six months ended September 30, 2021.

•The average dollar amount of larger deal revenue transactions was approximately $363 thousand and $308 thousand for the six months ended September 30, 2022 and 2021, respectively, representing an 18% increase.

•This increase was partially offset by a decrease of $4.6 million in transactions less than $0.1 million.

•Using the average foreign currency exchange rates from the six months ended September 30, 2021, our software and products revenue would have increased 17% compared to the six months ended September 30, 2021.

–Services revenue increased $7.0 million, or 3%, primarily due to the following:

•An increase in other services revenue, driven primarily by the year over year increase in revenue from Metallic, partially offset by a decrease in revenue from customer support agreements.

•Using the average foreign currency exchange rates from the six months ended September 30, 2021, our services revenue would have increased 9% compared to the six months ended September 30, 2021.

Americas and International represented 64% and 36% of total software and products revenue, respectively, for the six months ended September 30, 2022. Software and products revenue increased year over year by 18% in the Americas and by 2% in International.

▪The increase in Americas software and products revenue was primarily the result of a 29% increase in larger deal transactions revenue driven primarily by an increase in the average dollar amount of larger deal transactions.

▪The increase in International software and products revenue was primarily the result of a 4% increase in larger deal revenue driven by an increase in the volume of larger deal transactions. Using the average foreign currency exchange rates from the six months ended September 30, 2021, our International software and products revenue would have increased 15% compared to the six months ended September 30, 2021.