UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

For the fiscal year ended March 31 , 2021

OR

Commission File Number: 1-33026

Commvault Systems, Inc.

(Exact name of registrant as specified in its charter)

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) | |||||||

(Address of principal executive offices, including zip code)

(732 ) 870-4000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by the Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that registrant was required to submit such files.) Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” "smaller reporting company" and “emerging growth company” in rule 12b-2 of the Exchange Act.

þ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | Smaller reporting company | ||||||||||||||||||

| Emerging growth company | |||||||||||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act o

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

As of September 30, 2020, the last business day of the Registrant’s most recently completed second fiscal quarter; the aggregate market value of voting and non-voting common stock held by non-affiliates of the registrant (based upon the closing price of the common stock as reported by The NASDAQ Stock Market) was approximately $1.9 billion.

As of May 10, 2021, there were 46,026,243 shares of the registrant’s common stock ($0.01 par value) outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

COMMVAULT SYSTEMS, INC.

FORM 10-K

FISCAL YEAR ENDED MARCH 31, 2021

TABLE OF CONTENTS

| Page | ||||||||

| PART I | ||||||||

| Item 1. | ||||||||

| Item 1A. | ||||||||

| Item 1B. | ||||||||

| Item 2. | ||||||||

| Item 3. | ||||||||

| Item 4. | ||||||||

| PART II | ||||||||

| Item 5. | ||||||||

| Item 6. | ||||||||

| Item 7. | ||||||||

| Item 7A. | ||||||||

| Item 8. | ||||||||

| Item 9. | ||||||||

| Item 9A. | ||||||||

| Item 9B. | ||||||||

| PART III | ||||||||

| Item 10. | ||||||||

| Item 11. | ||||||||

| Item 12. | ||||||||

| Item 13. | ||||||||

| Item 14. | ||||||||

| PART IV | ||||||||

| Item 15. | ||||||||

| Item 16. | ||||||||

2

FORWARD-LOOKING STATEMENTS

The discussion throughout this Annual Report on Form 10-K contains forward-looking statements. In some cases, you can identify these statements by our use of forward-looking words such as “may,” “will,” “should,” “anticipate,” “estimate,” “expect,” “plan,” “believe,” “predict,” “potential,” “project,” “intend,” “could,” "feel" or similar expressions. In particular, statements regarding our plans, strategies, prospects and expectations regarding our business are forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). You should be aware that these statements and any other forward-looking statements in this document reflect only our expectations and are not guarantees of performance. These statements involve risks, uncertainties and assumptions. Many of these risks, uncertainties and assumptions are beyond our control and may cause actual results and performance to differ materially from our expectations. Important factors that could cause our actual results to be materially different from our expectations include the risks and uncertainties set forth under the heading “Risk Factors.” Accordingly, you should not place undue reliance on the forward-looking statements contained in this Annual Report on Form 10-K. These forward-looking statements speak only as of the date on which the statements were made. We undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

References in this Annual Report on Form 10-K to "Commvault," the "Company, "we," "our" or "us" refer to Commvault Systems, Inc., including as the context requires, its direct and indirect subsidiaries.

3

PART I

| Item 1. | Business | ||||

Company Overview

Commvault Systems, Inc. is a global data protection and information management software company offering customers enterprise level, intelligent data management solutions built from the ground up on a single platform and unified code base. Commvault was incorporated in Delaware in 1996.

At Commvault, we believe in solving hard problems for our customers. To do this, we provide capabilities which enable our customers to accelerate their digital transformation in today's ever evolving workforce using tools that are light touch and utilize artificial intelligence and machine learning to drive automation. Our product portfolio empowers our customers to reduce complexity, reign in data fragmentation, and accelerate their cloud journey. All software functionality shares the same back-end technologies to deliver the benefits of a holistic approach to protecting, managing, and accessing data. Our software addresses many aspects of storage and data management in the enterprise, while providing scalability and control of data and information. We believe our technology provides the broadest set of capabilities in the industry, which allows customers to reduce storage costs and administrative overhead. We also provide our customers with a broad range of professional services.

Products

Commvault provides a portfolio of intelligent data management solutions that help organizations securely manage their data without increasing costs or complexity. These offerings are organized into three categories - (1) Data Protection, (2) Data Insights and (3) Storage.

All of Commvault's products are managed seamlessly through a single view. The Commvault Command Center is our user interface for managing data protection and disaster recovery initiatives. It provides default configuration values and streamlined procedures for routine data protection and recovery tasks. Customers can use the Command Center to set up their data protection environment, identify content that they want to protect, and initiate and monitor backups and restores. The main navigation pane allows customers to easily access various components including downloads, forms, analytics, monitoring and more. This provides a controlled foundation for self-service, helping to reduce the load on administrators and IT support staff.

Data Protection

Commvault Backup and Recovery is designed to meet the needs of any size business and covers workloads across all locations: hybrid environments include on-premises and multiple cloud providers; physical servers; virtual machines; applications and databases; endpoint devices; cloud applications and more. Commvault Backup and Recovery provides backup, verifiable recovery and cost-optimized cloud workload mobility, helping to ensure data availability, even across multiple clouds. Our simplified backup and recovery solution allows customers to manage all workloads – cloud, virtual machines ("VMs"), containers, applications, databases and endpoints – from a single platform, while flexible copy data management allows users to multi-purpose backed-up data for DevOps, replication and more, across your entire infra-structure.

Commvault Disaster Recovery provides an easy-to-use replication and disaster recovery solution from a single extensible platform, all managed through an intuitive user interface. Commvault’s standalone disaster recovery solution is both easy to implement and cost-effective. It provides orchestration and automated compliance reporting, flexible replication, cost-optimized cloud data mobility, and verifiable recoverability via copy data management.

Commvault Complete Data Protection is a comprehensive, yet easy-to-use data protection solution that combines Commvault Backup and Recovery with Commvault Disaster Recovery. It delivers backup, replication, and disaster recovery for all workloads, on-premises, in the cloud, across multiple clouds, and in hybrid environments. It provides trusted recovery of data and applications, virtual machines, and containers, along with verifiable recoverability of replicas, cost-optimized cloud data mobility, security and resilient ransomware protection, and flexible copy data management to leverage protected data for DevOps, testing, and analytics.

4

Data Insights

Commvault Activate is an integrated family of solutions for actionable insights, combining Commvault Data Governance, Commvault File Storage Optimization, and Commvault eDiscovery and Compliance. Activate can operate independent of Commvault Complete Data Protection or as part of a combined solution to maximize data management capabilities for any business. This means that with Activate customers can gain insights to data that isn’t managed by Commvault to drive analytics, and other tasks against those data sources.

Storage

Hyperscale

Commvault HyperScale X is an intuitive and easy-to-deploy, scale-out solution that is fully integrated with Commvault’s intelligent data management platform to help enterprises transition from legacy scale-up infrastructures. It provides scalability, security and resiliency to accelerate an organization’s digital transformation journey as they move to hybrid cloud, container and virtualized environments. Its flexible architecture allows customers to get up and running quickly and grow as needs change. HyperScale X technology accelerates hybrid cloud adoption with an integrated solution that delivers comprehensive data management for all workloads, including containers, virtual and databases, from a single, extensible platform. With HyperScale X, customers can leverage the entire Commvault software portfolio giving them access to all the features, functions, and industry leading integration with applications, databases, public cloud environments, hypervisors, operating systems, NAS systems and primary storage arrays, wherever the data resides. It is available in two form factors giving customers the flexibility to choose an implementation based on specific needs and preferences:

•Commvault HyperScale X Appliance: A fully integrated appliance that streamlines operations and infrastructure and is ideally suited for smaller deployments with capacity requirements less than 150 terabytes that want the simplicity of an all-in-one integrated appliance from a single vendor

•Commvault HyperScale X Software: Pre-validated hardware platform and configuration, provides greater flexibility and allows customer to leverage existing vendor relationships, and is ideally suited for larger environments that require greater scale

Hedvig

The Hedvig Distributed Storage Platform provides software-defined storage built on a truly hyperscale architecture that uses modern distributed system techniques to meet our customers primary, secondary and cloud data needs. With the capability to connect to any operating system, hypervisor, container or cloud, this unique platform also has the versatility to deploy in hyperscale or hyperconverged mode. Hedvig’s patented Universal Data Plane architecture stores, protects and replicates data across any number of private and/or public cloud data centers. The advanced software stack of the Hedvig Distributed Storage Platform simplifies all aspects of storage with a full set of enterprise data capabilities that can be provisioned at the application level and automated. The Hedvig Distributed Storage Platform is also integrated in our HyperScale X technology.

Metallic Cloud Storage (MCSS)

MCSS is the “easy button” to adopt secure and scalable cloud storage in minutes, right from the Commvault Command Center — delivering against an organizations hybrid cloud strategy, without the need for additional cloud expertise. It is an integrated cloud storage target that makes it simple for IT organizations to adopt cloud storage for Commvault Backup & Recovery or HyperScale X – to ease digital transformation, save costs, reduce risk and scale limitlessly.

Metallic Backup-as-a-Service

Launched in October 2019, Metallic delivers data protection technology with the ease and agility of software as a service ("SaaS"), getting companies up and running in protecting critical business data within minutes. Powered by the same core Commvault technology, Metallic delivers enterprise-grade data protection, with the simplicity of SaaS. Metallic runs on a pre-built platform, with core code deployed in the cloud. An active SaaS layer and application program interfaces manage functions including billing, metrics, and identity management. Current Metallic offerings include data protection for virtual machines and Kubernetes, databases, files, Office 365, Salesforce and endpoints.

5

Services

Commvault offers a wide range of professional services to complement its product portfolio. The cornerstone of our service offerings is our customer support. We offer multiple levels of customer success that can be tailored to the customer’s response needs and business sensitivities.

Our customer support services consist of:

•Real-Time Support. Our support staff is available 24/7 by telephone to provide first response and manage the resolution of customer issues. In addition to phone support, our customers have access to an online product support database for help with troubleshooting and operational questions. Innovative use of web-based diagnostic tools provides problem analysis and resolution. Our software design is also an important element in our comprehensive customer support, including “root cause” problem analysis, intelligent alerting and troubleshooting assistance. Our software is directly linked to our online support database allowing customers to analyze problems without engaging our technical support personnel.

•Significant Network and Hardware Expertise. Our support engineers have extensive knowledge of complex applications, servers and networks. We proactively take ownership of the customer’s problem, regardless of whether the issue is directly related to our products or to those of another vendor. We have also developed and maintain a knowledge library of storage systems and software products to further enable our support organization to quickly and effectively resolve customer problems.

•Global Operations. Our global customer support headquarters is located at our state-of-the-art technical support center in Tinton Falls, New Jersey. We also have established support operations in Reading, United Kingdom; Sydney, Australia; Bangalore, India; and Shanghai, China, which are complemented by regional support centers. Our cloud-based support system creates a virtual global support center combining these locations to allow for the fastest possible resolution times for customer incidents. We have designed our support infrastructure to be able to scale with the increasing globalization of our customers.

•Enhanced Support Options. We offer several enhanced customer support services such as Enterprise Support. Our Enterprise Support service is for customers with critical support needs and builds on our 24/7 real-time support deliverables and includes various levels of enhanced services to ensure dedicated support and customized reporting. Enterprise Support adds a specialized team of technical support engineers, an assigned support account manager and innovative tools to achieve our customers’ mission.

Our technology consultants ensure that our customers' software environment is designed for optimal results and will continue to deliver over the long term. This same team of experts can install, configure, personalize and validate that environment so customers can achieve a better return on investment, faster and with more confidence.

•Technology Consulting Services. Our technology consulting ensures that a customer’s software environment is designed for optimal results and will continue to deliver over the long term. We offer services such as architecture design; implementation; personalization; data migration; and health assessment. In addition, our residency services offer customers staff-augmentation options to assist with the rapid expert deployment of the Commvault software suite.

•Business Consulting Services. Our business consultants provide transformational insights that align to how specific businesses gather, retain and employ data. We offer services such as disaster recovery readiness and policy implementation; private cloud services design; data classification and archive policy implementation; and operational efficiency assessment.

•Education Services. We provide global onsite training, offsite training and self-paced online alternatives for our products.

•Remote Managed Services. Commvault Remote Managed Services provides remote monitoring and management of the Commvault data management platform deployed on a customer's environment. Our engineers configure, maintain and optimize a customer's Commvault software environment remotely via a secure connection.

6

Customers

Our current customer base spans thousands of organizations across a wide variety of sizes, including large global enterprise companies, and small or mid-sized businesses and government agencies. We support customers in a broad range of industries, including banking, insurance and financial services, government, healthcare, pharmaceuticals and medical services, technology, legal, manufacturing, utilities and energy.

Strategic Relationships

An important element of Commvault’s strategy is to establish relationships with third parties that assist us in developing, marketing, selling and implementing our software and services. We believe that strategic and technology-based relationships with industry leaders are fundamental to our success. We have forged numerous relationships with software application, hardware and cloud vendors to enhance our combined capabilities and to create the optimal combination of data and information management applications. We believe this approach enhances our ability to expand our product offerings and customer base and to enter new markets. We have established the following types of strategic relationships:

Alliance and Technology Partners. We maintain strategic product and technology relationships with major industry leaders to ensure that our software applications are integrated with, supported by and add value to our partners’ hardware and software products. Collaboration with these market leaders allows us to provide applications that enable our customers to improve data and information management efficiency. Our significant strategic relationships include Microsoft (including Azure), Cisco, Dell EMC, Amazon Web Services (AWS), NetApp, Nutanix, Fujitsu, Google Cloud, Hitachi, Hewlett Packard Enterprise, IBM, Lenovo, OpenStack, Oracle, Pure Storage, Red Hat, Salesforce, SAP, ServiceNow, Splunk, Supermicro and VMware. In addition to these relationships, we maintain relationships with a broad range of industry operating system, application and infrastructure vendors to verify and demonstrate the interoperability of our software applications with their equipment and technologies.

Distributors, Value-Added Reseller, Systems Integrator, Corporate Reseller and Original Equipment Manufacturer Relationships. Our corporate resellers bundle or sell our software applications together with their own products, and our value-added resellers resell our software applications independently. As of March 31, 2021, we had more than 500 reseller partners and systems integrators that have distributed our software worldwide.

In order to broaden our market coverage, we work closely with our global original equipment manufacturer ("OEM") partners, investing significant time and resources to deliver unique, joint solutions incorporating Commvault software. These partners team with our technical, engineering, marketing and sales force on helping to enhance integration, tuning, operational management, implementation and vision for solutions that are designed to meet current and future data and information management needs. Our alliance managers work directly with global OEM partners to design, deliver and support field activities that make it easier for customers to locate, learn about, and purchase these differentiated solutions. Our most significant OEM partner is Hitachi Vantara ("Hitachi"). Hitachi has no obligation to recommend or offer our software applications exclusively or at all, and they have no minimum sales requirements and can terminate our relationship at any time.

Additionally, we have a non-exclusive distribution agreement covering our North American commercial markets and our U.S. Federal Government markets with Arrow Enterprise Computing Solutions, Inc. ("Arrow"), a subsidiary of Arrow Electronics, Inc. Pursuant to this distribution agreement, Arrow's primary role is to enable a more efficient and effective distribution channel for our products and services by managing our reseller partners and leveraging their own industry experience. Sales generated through our distribution agreement with Arrow accounted for 36% of our total revenue in fiscal 2021 and 37% of our total revenue in fiscal 2020.

Service Provider Partners. Our software is the data protection platform for over 200 service providers, which provide cloud-based solutions to client systems worldwide. As companies of all sizes and markets rapidly adopt cloud infrastructures for improved costs, speed and agility, we remain committed to these strategic relationships to address this growing trend. Customers looking to move IT operations into the cloud depend on service providers to help them migrate, manage and protect their cloud infrastructures. We have partnered with a broad ecosystem of managed service provider and cloud partners so they can effectively deliver data management-as-a-service solutions based on Commvault software across geographies, vertical markets and offerings. Leading providers who have integrated Commvault software into their solution portfolios include Microsoft Azure, Amazon AWS, Google Cloud, Rackspace, Meridian, Sirius and Flexential.

7

Competition

The data storage management market is intensely competitive, highly fragmented and characterized by rapidly changing technology and evolving standards. The principal competitive factors in our industry include product functionality, product performance, product integration, platform coverage, ability to scale, price, worldwide sales infrastructure, global technical support, name recognition and reputation. The ability of major system vendors to bundle hardware and software solutions is also a significant competitive factor in our industry.

We currently compete with other providers of data and information management software as well as large and emerging storage hardware manufacturers that have developed or acquired their own data and information management software products. These manufacturers have the resources and capabilities to develop their own data and information management software applications, and many have been making acquisitions and broadening their efforts to include broader data and information management and storage products. These manufacturers and our other current and potential competitors may establish cooperative relationships among themselves or with third parties, creating new competitors or alliances. Large operating system and application vendors have introduced products or functionality that includes some of the same functions offered by our software applications. In the future, further development by these vendors could cause some features of our software applications to become redundant.

Our primary competitors in the data and information management software applications market, each of which has one or more products that compete with a part of or our entire software suite, are Dell-EMC, IBM, Veritas, Veeam, Rubrik and Cohesity.

Some of our competitors have greater financial resources and may have the ability to offer their products at lower prices than ours. In addition, some of our competitors have greater name recognition than us, which could provide them a competitive advantage with some customers. Some of our competitors also have longer operating histories, have substantially greater technical, sales, marketing and other global resources than we do, as well as a larger installed customer base and broader product offerings, including hardware. As a result, these competitors can devote greater resources to the development, promotion, sale and support of their products than we can. Refer to our "Risk Factors" below.

Sales and Marketing

We sell our data and information management software applications and related services to large global enterprises, small and medium sized businesses, and government agencies. We sell through our worldwide direct sales force and our global network of distributors, value-added resellers, systems integrators, corporate resellers and OEM partners.

We have a variety of marketing programs designed to create brand awareness and market recognition for our product offerings and for sales lead generation. Our marketing efforts include webinars, active participation at trade shows, technical conferences and technology seminars; advertising; content development and distribution; public relations; social media; industry analyst relations; publication of technical and educational articles in industry journals; sales training; and preparation of competitive analyses. In addition, our strategic partners augment our marketing and sales campaigns through seminars, trade shows and joint public relations and advertising campaigns. Our customers and strategic partners provide references and recommendations that we often feature in external marketing activities.

Research and Development

Our research and development organization is responsible for the design, development, testing and certification of our data and information management software applications. Our engineering efforts support product development across all major operating systems, databases, applications and network storage devices. A substantial amount of our development effort goes into certification, integration and support of our applications to ensure interoperability with our strategic partners’ hardware and software products. We have also made substantial investments in the automation of our product test and quality assurance laboratories.

Technology, Intellectual Property and Proprietary Rights

We believe our software platform serves as a major differentiator versus our competitors’ data and information management software products. Our platform’s unique indexing, cataloging, data movement, media management and policy technologies are the source of the performance, scale, management, cost of ownership

8

benefits and seamless interoperability inherent in all of our data and information management software applications. Additional options enable content search, data encryption and auditing features to support data discovery and compliance requirements. Our success and ability to compete depend on our continued development and protection of our proprietary software and other technologies, including "open source" software. We rely primarily on a combination of trade secret, patent, copyright and trademark laws, as well as contractual provisions, to establish and protect our intellectual property rights.

As of March 31, 2021, we had 883 issued patents and 399 pending patent applications in the United States, as well as 130 issued patents in foreign countries and 15 pending foreign patent applications. As disclosed, we have established proprietary trademark rights in markets across the globe, and own hundreds of U.S. and foreign trademark registrations and pending registration applications for marks comprised of or incorporating the Commvault name. Refer to our “Risk Factors” below.

People

Commvault aims to unlock potential in data, customers and our employees. To accomplish that, everyone has the green light to discover, create, nurture and sustain the energy needed to drive innovation and help our customers—by inspiring one another, by imagining what others simply don’t and by working to make what’s already great, even greater—whether that’s product, process or team. As of March 31, 2021, we had 2,671 employees worldwide, including 1,003 in sales and marketing, 724 in research and development, 621 in customer services and support and 323 in general and administration. Approximately 48% were in the United States and 52% were located internationally.

Inclusion and Diversity

At Commvault, we believe that diversity is more than a program – it is a business imperative at the heart of our human capital management strategy. In partnership with our leadership team, we not only drive the ability to be a best-in-class data management organization but uphold our value in the marketplace by leading as an employer of choice. Our commitment is driven and executed by a three-pronged approach to Inclusion and Diversity ("I&D"): Workplace Inclusion, Workforce Diversity and Personal Accountability.

To fortify our strategy, we continue to elevate our employee engagement efforts – which is the foundation of our approach. We have implemented an Employee Resource Group (“ERG”) operating model and have established four ERGs to provide opportunity for cross-cultural learning, mentoring and relationship building across employees:

1.CV WIT (Women in Technology),

2.Multi-Culture,

3.LGBTQ+ & Allies, and

4.VALOR (Veterans)

In addition to our continued employee engagement initiatives, in 2020 we launched the Courageous Conversations platform. Courageous Conversations was designed as a forum where difficult conversations can be broached in an open, safe and respectful manner. This platform has become the hub for all I&D related conversations, where employees and senior leaders share courageous life experiences related to bias and social injustice. Since its inception, we have hosted seven powerful sessions, each virtually, reaching our workforce population around the globe.

We continue to be committed to our focus to secure the very best talent, with a concerted effort to expound on and build a truly inclusive and diverse pipeline of candidates. We are committed to providing a clear line of sight to career progression while investing in the development, creativity and aspirational needs of all employees.

COVID-19 Response

Commvault values its people. In navigating this unprecedented time, we are focused on driving business globally while honoring and caring for the health and safety of our employees, customers, and partners. During 2020, and continuing into 2021, the vast majority of our employees worked remotely, delivering successful and proactive results. We continue to monitor the spread of COVID-19 and are adhering to guidelines set forth by the World Health Organization and Centers for Disease Control as we look to reopen offices. We continue to provide employees with routine updates, resources and support to ensure everyone’s health, safety and well-being.

9

Information about our Executive Officers

The following table presents information with respect to our executive officers as of May 10, 2021:

| Name | Age | Position | ||||||||||||

| Sanjay Mirchandani | 56 | President and Chief Executive Officer | ||||||||||||

| Brian Carolan | 50 | Vice President, Chief Financial Officer | ||||||||||||

| Riccardo Di Blasio | 49 | Vice President, Chief Revenue Officer | ||||||||||||

| Gary Merrill | 46 | Chief - Business Operations | ||||||||||||

Sanjay Mirchandani, has served as our President and Chief Executive Officer since February 2019. Prior to joining Commvault, Mr. Mirchandani served from September 2016 to January 2019 as the Chief Executive Officer of Puppet, Inc. (“Puppet”), an Oregon-based IT automation company. Mr. Mirchandani joined Puppet in May 2016 as President and Chief Operating Officer. Mr. Mirchandani brings a wealth of international business experience through his diverse well-rounded career in technology. Before joining Puppet, from October 2013 to April 2016, Mr. Mirchandani served as Corporate Senior Vice President and General Manager of Asia Pacific and Japan at VMware, Inc. and, from June 2006 to October 2013, Mr. Mirchandani held various senior leadership positions at EMC Corporation, including Chief Information Officer and leader of the Global Centers of Excellence. Prior to that, Mr. Mirchandani held various positions at Microsoft Corporation and Arthur Andersen LLP. Mr. Mirchandani has a Master of Business Administration degree from the University of Pittsburgh and a bachelor’s degree in mathematics from Drew University.

Brian Carolan has served as our Vice President, Finance and Chief Financial Officer since October 2012. Prior to his current role, Mr. Carolan served as our Vice President, Finance and Chief Accounting Officer from July 2006 until September 2012. He also held the position of Controller from February 2001 until June 2006. Prior to joining Commvault, Mr. Carolan was with Ernst & Young LLP in its Technology, Communications and Entertainment audit practice from 1993 until January 2001. Mr. Carolan obtained his bachelor’s degree in accounting from Villanova University, his master’s degree in business administration from New York University and is a certified public accountant in the State of New Jersey.

Riccardo Di Blasio has served as our Vice President, Chief Revenue Officer since May 2019. Prior to joining Commvault, Mr. Di Blasio led DXC Technology as Global Head of Sales for VMware Cloud Platform Services. Prior to that role, he was Chief Executive Officer at Globetouch, Inc., leading the company growth in the IoT and connected cars industry from January 2017 until April 2018. He also served as Chief Operating Officer at Cohesity from October 2015 until November 2016, where he significantly grew the sales and support organizations while expanding global operations and achieving double digit growth in sales. Previous to those positions, he served in various leadership roles for more than a decade across US and Europe, as Senior Vice President of Sales and Marketing at VMware and EMC Corporation.

Gary Merrill was appointed to Chief - Business Operations effective April 2021. Prior to his current role, Mr. Merrill served as Vice President of Operations of the Company from April 2019 through March 2021, and Vice President Finance, Chief Accounting Officer from December 2012 to March 2019. Mr. Merrill was Corporate Controller of the Company from 2007 to 2012 and Assistant Controller from 2005 to 2007. Prior to joining the Company, Mr. Merrill held accounting management positions with several publicly traded companies. Mr. Merrill began his career with Arthur Andersen LLP in its audit practice. Mr. Merrill obtained his bachelor’s degree in accounting from Elizabethtown College and is a Certified Public Accountant in the State of Pennsylvania.

Available Information

Our internet address is www.commvault.com. On the investor relations section of this website, we post the filings as soon as reasonably practicable after they are electronically filed with or furnished to the U.S. Securities and Exchange Commission ("SEC") including: our Annual Reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, our proxy statements related to our annual stockholders’ meetings and any amendment to those reports or statements filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended. All such filings are available on the Investors Relations portion of our web site free of charge. The contents of our web site are not incorporated by reference into this Form 10-K or in any other report, statement or document we file with the SEC.

10

The SEC maintains an internet site at http://www.sec.gov that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC and you can also access our SEC filings at the SEC’s Internet address.

11

| Item 1A. | Risk Factors | ||||

You should consider each of the following factors as well as the other information in this Annual Report in evaluating our business and our prospects. The risks and uncertainties described below are not the only ones we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. If any of the following risks actually occur, our business and financial results could be harmed. In that case, the trading price of our common stock could decline. You should also refer to the other information set forth in this Annual Report, including our financial statements and the related notes.

Summary of Risk Factors

Risks Related to Our Business

•The novel coronavirus (COVID-19) pandemic could adversely affect our business in a material way.

•We have engaged, and may continue to engage, in strategic acquisitions or transactions, which could have a material adverse effect on our business, results of operations, financial condition and cash flows.

•Our industry is intensely competitive, and many of our competitors have greater financial, technical and sales and marketing resources and larger installed customer bases than we do, which could enable them to compete more effectively than we do.

•We rely on indirect sales channels, such as value-added resellers, systems integrators, corporate resellers, distributors, and OEMs, for the distribution of our software applications, and the failure of these channels to effectively sell our software applications could have a material adverse effect on our revenues and results of operations.

•We may not be able to respond to rapid technological changes with new software applications and services offerings, which could have a material adverse effect on our sales and profitability.

•If the cost for annual maintenance and support agreements, or our term-based subscription licenses, with our customers is not competitive in the market or if our customers do not renew their agreements either at all, or on terms that are less favorable to us, our business and financial performance might be adversely impacted.

•In periods of volatile economic conditions, our exposure to credit risk and payment delinquencies on our accounts receivable significantly increases.

•We develop software applications that interoperate with certain software, operating systems and hardware developed by others, and if the developers of those operating systems and hardware do not cooperate with us or we are unable to devote the necessary resources so that our applications interoperate with those systems, our software development efforts may be delayed or foreclosed and our business and results of operations may be adversely affected.

•We sell a backup appliance which integrates our software with hardware. If we fail to accurately predict our manufacturing requirements and manage our supply chain we could incur additional costs or experience manufacturing delays that could harm our business.

•We encounter long sales and implementation cycles, particularly for our larger customers, which could have an adverse effect on the size, timing and predictability of our revenues.

•We depend on growth in the data and information management software market, and lack of growth or contraction in this market could have a material adverse effect on our sales and financial condition.

•Our software applications are complex and may contain undetected errors, which could adversely affect not only our software applications’ performance but also our reputation and the acceptance of our software applications in the market.

•We may not receive significant revenues from our current research and development efforts for several years, if at all.

•We implemented a restructuring program in fiscal 2019, which we cannot guarantee will achieve its intended result.

•Our ability to sell our software applications is highly dependent on the quality of our service offerings, and our failure to offer high quality support and professional services would have a material adverse effect on our sales of software applications and results of operations.

12

•A portion of our revenue is generated by sales to government entities, which are subject to a number of challenges and risks.

•Change in senior management could cause disruption in the Company and have a material effect on our business. Furthermore, the loss of key personnel or the failure to attract and retain highly qualified personnel could have an adverse effect on our business.

•Risks from investing in growth opportunities could impact our business.

Risks Related to our International Operations

•Volatility in the global economy could adversely impact our continued growth, results of operations and our ability to forecast future business.

•Our international sales and operations are subject to factors that could have an adverse effect on our results of operations.

•We may experience fluctuations in foreign currency exchange rates that could adversely impact our results of operations.

Risks Related to Information Technology and Security

•We may be subject to information technology system failures, network disruptions and breaches in data security.

•Many of our key financial systems used for internal purposes are cloud-based solutions provided by third parties.

Risks Related to Legal Matters and Intellectual Property

•We are, and may in the future become, involved in litigation that may have a material adverse effect on our business.

•Protection of our intellectual property is limited, and any misuse of our intellectual property by others could materially adversely affect our sales and results of operations.

•Claims that we misuse the intellectual property of others could subject us to significant liability and disrupt our business, which could have a material adverse effect on our results of operations and financial condition.

•Our use of “open source” software could negatively affect our business and subjects us to possible litigation.

Risks Related to Tax and Accounting

•Our effective tax rate is difficult to project, and changes in such tax rate or adverse results of tax examinations could adversely affect our operating results.

•Our reported financial results may be adversely affected by changes in accounting principles generally accepted in the United States.

Risks Related to our Common Stock

•Certain provisions of our certificate of formation and our amended and restated bylaws or Delaware law could prevent or delay a potential acquisition of control of our Company, which could decrease the trading price of our common stock.

•Although we believe we currently have adequate internal control over financial reporting, we are required to assess our internal control over financial reporting on an annual basis, and any future adverse results from such assessment could result in a loss of investor confidence in our financial reports and have an adverse effect on our stock price.

•We may experience a decline in revenues or volatility in our quarterly operating results, which may adversely affect the market price of our common stock.

•The price of our common stock may be highly volatile and may decline regardless of our operating performance.

General Risks

•Our business could be materially and adversely affected as a result of natural disasters, terrorism or other catastrophic events.

13

Risks Related to Our Business

The novel coronavirus (COVID-19) pandemic could adversely affect our business in a material way.

As a global company, with employees and customers located around the world in a variety of industries, our performance may be impacted by global economic and other conditions, including the COVID-19 pandemic which has caused global economic uncertainty. Efforts to combat this pandemic to date include a range of travel restrictions, shelter in place orders, and mandatory business and other closure, each of which may cause significant disruption to our customers and cause them to curtail or limit spending. As a software company, our ability to support our customers has not been significantly impacted by work-from-home orders or travel restrictions. However, these measures have caused disruptions to our sales efforts and decreased customer spending, which may negatively impact our performance. The extent to which COVID-19 will impact our business is difficult to predict as it depends on factors outside of our control, including the duration of the pandemic and the impact on our customers’ businesses. We have taken precautionary measures to protect the health and safety of our employees and to preserve our cash position and we continue to monitor events.

We have engaged, and may continue to engage, in strategic acquisitions or transactions, which could have a material adverse effect on our business, results of operations, financial condition and cash flows.

Acquisitions involve a number of risks, including diversion of management’s attention, ability to finance the acquisition on attractive terms, failure to retain key personnel or valuable customers, legal liabilities and the need to amortize acquired intangible assets, any of which could have a material adverse effect on our business, results of operations, financial condition and cash flows. Any additional future acquisitions may also result in the incurrence of indebtedness or the issuance of additional equity securities.

The intellectual property of an acquired business may be an important component of the value that we agree to pay for such a business. Although we conduct due diligence in connection with each of our acquisitions, such acquisitions are subject to the risks that the acquired business may not own the intellectual property that we believe we are acquiring, that the intellectual property is dependent upon licenses from third parties, that the acquired business infringes upon the intellectual property rights of others or that the technology does not have the acceptance in the marketplace that we anticipated.

We could also experience financial or other setbacks if transactions encounter unanticipated problems, including problems related to execution, integration or underperformance relative to prior expectations. Our management may not be able to successfully integrate any acquired business into our operations or maintain our standards, controls and policies, which could have a material adverse effect on our business, results of operations and financial condition. Consequently, any acquisition we complete may not result in long-term benefits to us or we may not be able to further develop the acquired business in the manner we anticipated.

Following the completion of acquisitions, we may have to rely on the seller to provide administrative and other support, including financial reporting and internal controls, and other transition services to the acquired business for a period of time. There can be no assurance that the seller will do so in a manner that is acceptable to us.

Our industry is intensely competitive, and many of our competitors have greater financial, technical and sales and marketing resources and larger installed customer bases than we do, which could enable them to compete more effectively than we do.

The data and information management software market is intensely competitive, highly fragmented and characterized by rapidly changing technology and evolving standards, changing customer requirements and frequent new product introductions. Competitors vary in size and in the scope and breadth of the products and services offered. Our primary competitors include Dell-EMC, IBM, Veritas, Veeam, Rubrik and Cohesity.

The principal competitive factors in our industry include product functionality, product integration, platform coverage, ability to scale, price, worldwide sales infrastructure, global technical support, name recognition and reputation. The ability of major system vendors to bundle hardware and software solutions is also a significant competitive factor in our industry. If we are unable to address these factors, our competitive position could weaken and we could experience a decline in revenues that could adversely affect our business.

14

Many of our current and potential competitors have longer operating histories and have substantially greater financial, technical, sales, marketing and other resources than we do, as well as larger installed customer bases, greater name recognition and broader product offerings, including hardware. Some of these competitors can devote greater resources to the development, promotion, sale and support of their products than we can and have the ability to bundle their hardware and software products in a combined offering. As a result, these competitors may be able to respond more quickly to new or emerging technologies and changes in customer requirements.

It is also costly and time-consuming to change data and information management systems. Most of our new customers have installed data and information management software, which gives an incumbent competitor an advantage in retaining a customer because it already understands the network infrastructure, user demands and information technology needs of the customer, and also because some customers are reluctant to invest the time and money necessary to change vendors.

Our current and potential competitors may establish cooperative relationships among themselves or with third parties. If so, new competitors or alliances that include our competitors may emerge that could acquire significant market share. In addition, large operating system and application vendors, as well as some hardware manufacturers, have introduced products or functionality that includes some of the same functions offered by our software applications. In the future, further development by these vendors could cause our software applications and services to become redundant, which could seriously harm our sales, results of operations and financial condition.

New competitors entering our markets can have a negative impact on our competitive positioning. In addition, we expect to encounter new competitors as we enter new markets. Furthermore, many of our existing competitors are broadening their operating systems platform coverage. We also expect increased competition from OEMs, including those we partner with, and from systems and network management companies, especially those that have historically focused on the mainframe computer market and have been making acquisitions and broadening their efforts to include data and information management and storage products. We expect that competition will increase as a result of future software industry consolidation. Increased competition could harm our business by causing, among other things, price reductions of our products, reduced profitability and loss of market share.

We rely on indirect sales channels, such as value-added resellers, systems integrators, corporate resellers, distributors, and OEMs, for the distribution of our software applications, and the failure of these channels to effectively sell our software applications could have a material adverse effect on our revenues and results of operations.

We rely significantly on our value-added resellers, systems integrators and corporate resellers, which we collectively refer to as resellers, for the marketing and distribution of our software applications and services. Resellers are our most significant distribution channel. However, our agreements with resellers are generally not exclusive, are generally renewable annually, typically do not contain minimum sales requirements and in many cases may be terminated by either party without cause. Many of our resellers carry software applications that compete with ours. These resellers may give a higher priority to other software applications, including those of our competitors, or may not continue to carry our software applications at all. If a number of resellers were to discontinue or reduce the sales of our products, or were to promote our competitors’ products in lieu of our own, it could have a material adverse effect on our future revenues. Events or occurrences of this nature could seriously harm our sales and results of operations. If we fail to manage our resellers successfully, there may be conflicts between resellers or they could fail to perform as we anticipate, including required compliance with the terms and obligations of our reseller agreement, either of which could reduce our sales or impact our reputation in the market. In addition, we expect that a portion of our sales growth will depend upon our ability to identify and attract new reseller partners. Our competitors also use reseller arrangements and may be more successful in attracting reseller partners and could enter into exclusive relationships with resellers that make it difficult to expand our reseller network. Any failure on our part to maintain and/or expand our network of resellers could impair our ability to grow revenues in the future.

Some of our resellers possess significant resources and advanced technical abilities. These resellers, particularly our corporate resellers, may, either independently or jointly with our competitors, develop and market products and related services that compete with our offerings. If this were to occur, these resellers might discontinue marketing and distributing our software applications and services. In addition, these resellers would have an advantage over us when marketing their competing products and related services because of their existing

15

customer relationships. The occurrence of any of these events could have a material adverse effect on our revenues and results of operations.

In addition, we have a distribution agreement covering our North American commercial markets and our U.S. Federal Government market with Arrow. Pursuant to this distribution agreement, Arrow’s primary role is to enable a more efficient and effective distribution channel for our products and services by managing our reseller partners and leveraging their own industry experience. Many of our North American resellers buy from Arrow. Sales through our distribution agreement with Arrow accounted for approximately 36% of our total revenues for fiscal 2021 and 37% of our total revenues for fiscal 2020. If Arrow was to discontinue or reduce the sales of our products or if our agreement with Arrow was terminated, and if we were unable to take back the management of our reseller channel or find another North American distributor to replace Arrow, then it could have a material adverse effect on our future revenues.

Our OEMs sell our software applications and in some cases incorporate our data and information management software into systems that they sell. A material portion of our revenues is generated through these arrangements. However, we have no control over the shipping dates or volumes of systems these OEMs ship and they have no obligation to ship systems incorporating our software applications. They also have no obligation to recommend or offer our software applications exclusively or at all, and they have no minimum sales requirements and can terminate our relationship at any time. These OEMs also could choose to develop their own data and information management software internally and incorporate those products into their systems instead of our software applications. The OEMs that we do business with also compete with one another. If one of our OEM partners views our arrangement with another OEM as competing with its products, it may decide to stop doing business with us. Any material decrease in the volume of sales generated by OEMs we do business with, as a result of these factors or otherwise, could have a material adverse effect on our revenues and results of operations in future periods.

We may not be able to respond to rapid technological changes with new software applications and services offerings, which could have a material adverse effect on our sales and profitability.

The markets for our software applications are characterized by rapid technological changes, changing customer needs, frequent new product introductions and evolving industry standards. The introduction of software applications embodying new technologies and the emergence of new industry standards could make our existing and future software applications obsolete and unmarketable. As a result, we may not be able to accurately predict the lifecycle of our software applications, and they may become obsolete before we receive the amount of revenues that we anticipate from them. If any of the foregoing events were to occur, our ability to retain or increase market share in the data and information management software market could be materially adversely affected.

We devote significant resources to the development of new products and the enhancement of existing products. To be successful, we need to anticipate, develop and introduce new software applications and services on a timely and cost-effective basis that keep pace with technological developments and emerging industry standards and that address the increasingly sophisticated needs of our customers. We may fail to develop and market software applications and services that respond to technological changes or evolving industry standards, experience difficulties that could delay or prevent the successful development, introduction and marketing of these applications and services or fail to develop applications and services that adequately meet the requirements of the marketplace or achieve market acceptance. Our failure to develop and market such applications and services on a timely basis, or at all, could have a material adverse effect on our sales and profitability.

16

If the cost for annual maintenance and support agreements, or our term-based subscription licenses, with our customers is not competitive in the market or if our customers do not renew their agreements either at all, or on terms that are less favorable to us, our business and financial performance might be adversely impacted.

Most of our maintenance agreements are for a one-year term. As the end of the annual period approaches, we pursue the renewal of the agreement with the customer. Historically, maintenance renewals have represented a significant portion of our total revenue. Because of this characteristic of our business, if our customers do not renew their annual maintenance and support agreements either at all, or on terms that are less favorable to us, our business and financial performance might be adversely impacted.

Additionally, beginning in fiscal 2018 we began to increase a significant amount of our sales to term-based, or subscription, license arrangements. The arrangements are typically three years in duration. If at the end of the initial term, customers elect to not renew their licenses, or they renew them on terms that are less favorable to us, our business and financial performance might be adversely impacted.

In periods of volatile economic conditions, our exposure to credit risk and payment delinquencies on our accounts receivable significantly increases.

Our outstanding accounts receivables are generally not secured. Our standard terms and conditions permit payment within a specified number of days following the receipt of our product. Volatile economic conditions, including those related to the recent COVID-19 pandemic, could result in our customers and resellers facing liquidity concerns leading to them not being able to satisfy their payment obligations to us, which would have a material adverse effect on our financial condition, operating results and cash flows.

In addition, in the future we may transition a more significant percentage of our revenue to subscription, or term based, arrangements. In these arrangements, our customers may pay for software and related services over a period of several years. Due to the potential for extended period of collection, we may be exposed to more significant credit risk.

We develop software applications that interoperate with certain software, operating systems and hardware developed by others, and if the developers of those operating systems and hardware do not cooperate with us or we are unable to devote the necessary resources so that our applications interoperate with those systems, our software development efforts may be delayed or foreclosed and our business and results of operations may be adversely affected.

Our software applications operate primarily on the Windows, UNIX, Linux and Novell Netware operating systems; used in conjunction with Microsoft SQL; and on hardware devices of numerous manufacturers. When new or updated versions of these operating systems, software applications, and hardware devices are introduced, it is often necessary for us to develop updated versions of our software applications so that they interoperate properly with these systems and devices. We may not accomplish these development efforts quickly or cost-effectively, and it is not clear what the relative growth rates of these operating systems and hardware will be. These development efforts require the cooperation of the developers of the operating systems, software applications, and hardware, substantial capital investment and the devotion of substantial employee or financial resources. For some operating systems, we must obtain some proprietary application program interfaces from the owner in order to develop software applications that interoperate with the operating system. Operating system and software owners have no obligation to assist in these development efforts. If they do not provide us with assistance, the contractual right, or the necessary proprietary application program interfaces on a timely basis, we may experience delays or be unable to expand our software applications into other areas.

We sell a backup appliance which integrates our software with hardware. If we fail to accurately predict our manufacturing requirements and manage our supply chain we could incur additional costs or experience manufacturing delays that could harm our business.

We generally provide forecasts of our requirements to our supply chain partners on a rolling basis. If our forecast exceeds our actual requirements, a supply chain partner may assess additional charges or we may incur costs for excess inventory, each of which could negatively affect our gross margins. If our forecast is less than our actual requirements, the applicable supply chain partner may have insufficient time or components to produce or fulfill our product requirements, which could delay or interrupt manufacturing of our products or fulfillment of orders for our products, and result in delays in shipments, customer dissatisfaction, and deferral or loss of revenue. Further, we may be required to purchase sufficient inventory to satisfy our future needs in situations where a

17

component or product is being discontinued. If we fail to accurately predict our requirements, we may be unable to fulfill those orders or we may be required to record charges for excess inventory. Any of the foregoing could adversely affect our business, financial condition or results of operations.

We encounter long sales and implementation cycles, particularly for our larger customers, which could have an adverse effect on the size, timing and predictability of our revenues.

Potential or existing customers, particularly larger enterprise customers, generally commit significant resources to an evaluation of available software and require us to expend substantial time, effort and money educating them as to the value of our software and services. Sales of our core software products to these larger customers often require an extensive education and marketing effort.

We could expend significant funds and resources during a sales cycle and ultimately fail to win the customer. Our sales cycle for all of our products and services is subject to significant risks and delays over which we have little or no control, including:

•our customers’ budgetary constraints;

•the timing of our customers’ budget cycles and approval processes;

•our customers’ willingness to replace their current software solutions;

•our need to educate potential customers about the uses and benefits of our products and services; and

•the timing of the expiration of our customers’ current license agreements or outsourcing agreements for similar services.

If our sales cycles lengthen unexpectedly, they could adversely affect the timing of our revenues or increase costs, which may cause fluctuations in our quarterly revenues and results of operations. Finally, if we are unsuccessful in closing sales of our products after spending significant funds and management resources, our operating margins and results of operations could be adversely impacted, and the price of our common stock could decline.

We depend on growth in the data and information management software market, and lack of growth or contraction in this market could have a material adverse effect on our sales and financial condition.

Demand for data and information management software is linked to growth in the amount of data generated and stored, demand for data retention and management (whether as a result of regulatory requirements or otherwise) and demand for and adoption of new storage devices and networking technologies. Because our software applications are concentrated within the data and information management software market, if the demand for storage devices, storage software applications, storage capacity or storage networking devices declines, our sales, profitability and financial condition would be materially adversely affected. Segments of the computer and software industry have in the past experienced significant economic downturns. The occurrence of any of these factors in the data and information management software market could materially adversely affect our sales, profitability and financial condition.

Furthermore, the data and information management software market is dynamic and evolving. Our future financial performance will depend in large part on continued growth in the number of organizations adopting data and information management software for their computing environments. The market for data and information management software may not continue to grow at historic rates, or at all. If this market fails to grow or grows more slowly than we currently anticipate, our sales and profitability could be adversely affected.

Our software applications are complex and may contain undetected errors, which could adversely affect not only our software applications’ performance but also our reputation and the acceptance of our software applications in the market.

Software applications as complex as those we offer contain undetected errors or failures, especially when products are first introduced or new versions are released. Despite extensive testing by us and by our customers, we have in the past discovered errors in our software applications and will do so in the future. As a result of past discovered errors, we experienced delays and lost revenues while we corrected those software applications. In addition, customers in the past have brought to our attention “bugs” in our software created by the customers’ unique operating environments, which are often characterized by a wide variety of both standard and non-standard configurations that make pre-release testing very difficult and time consuming. Although we have been able to fix

18

these software bugs in the past, we may not always be able to do so. Our software products may also be subject to intentional attacks by viruses that seek to take advantage of these bugs, errors or other weaknesses. Any of these events may result in the loss of, or delay in, market acceptance of our software applications and services, which would seriously harm our sales, results of operations and financial condition.

Furthermore, we believe that our reputation and name recognition are critical factors in our ability to compete and generate additional sales. Promotion and enhancement of our name will depend largely on our success in continuing to provide effective software applications and services. The occurrence of errors in our software applications or the detection of bugs by our customers may damage our reputation in the market and our relationships with our existing customers, and as a result, we may be unable to attract or retain customers.

In addition, because our software applications are used to manage data that is often critical to our customers, they may have a greater sensitivity to defects in our products than to defects in other, less critical, applications. As a result, the licensing and support of our software applications involve the risk of product liability claims. Our license agreements with our customers typically contain provisions designed to limit our exposure to potential product liability claims. However, the limitation of liability provisions contained in our license agreements vary and may not be effective as a result of existing or future national, federal, state, or local laws or ordinances or unfavorable judicial decisions. Although we have not experienced any material product liability claims to date, the sale and support of our products entail the risk of such claims, which could be substantial in light of the use of our products in enterprise-wide environments. In addition, our insurance against product liability may not be adequate to cover all potential claims.

We may not receive significant revenues from our current research and development efforts for several years, if at all.

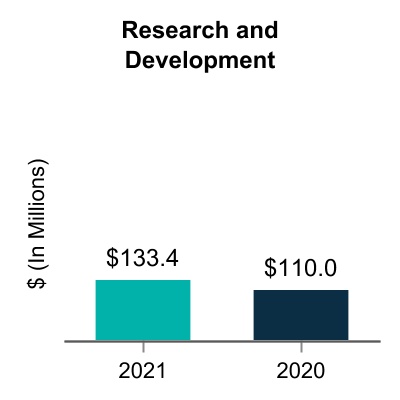

Developing software is expensive, and the investment in product development may involve a long payback cycle. Our research and development expenses were $133.4 million, or 18% of our total revenues in fiscal 2021, $110.0 million, or 16% of our total revenues in fiscal 2020 and $92.6 million, or 13% of our total revenues in fiscal 2019. Our future plans include significant investments in software research and development and related product opportunities. We believe that we must continue to dedicate a significant amount of resources to our research and development efforts to maintain our competitive position. However, we may not recognize significant revenues from these investments for several years, if at all.

We implemented a restructuring program in fiscal 2019, which we cannot guarantee will achieve its intended result.

In fiscal 2019 we initiated a restructuring plan to increase efficiency in our sales, marketing and distribution functions while reducing costs across all functional areas. We cannot guarantee the restructuring program will achieve its intended result. Risks associated with this restructuring program also include additional unexpected costs, adverse effects on employee morale and the failure to meet operational and growth targets due to the loss of key employees, any of which may impair our ability to achieve anticipated results of operations or otherwise harm our business.

Our ability to sell our software applications is highly dependent on the quality of our service offerings, and our failure to offer high quality support and professional services would have a material adverse effect on our sales of software applications and results of operations.

Our services include the assessment and design of solutions to meet our customers’ storage management requirements and the efficient installation and deployment of our software applications based on specified business objectives. Further, once our software applications are deployed, our customers depend on us to resolve issues relating to our software applications. A high level of service is critical for the successful marketing and sale of our software. If we or our partners do not effectively install or deploy our applications, or succeed in helping our customers quickly resolve post-deployment issues, it would adversely affect our ability to sell software products to existing customers and could harm our reputation with prospective customers. As a result, our failure to maintain high quality support and professional services would have a material adverse effect on our sales of software applications and results of operations.

19

A portion of our revenue is generated by sales to government entities, which are subject to a number of challenges and risks.

Sales to U.S. and foreign federal, state, and local governmental agency end-customers have accounted for a portion of our revenue, and we may in the future increase sales to government entities. However, government entities have recently announced reductions in, or experienced increased pressure to reduce spending. In particular, such measures have adversely affected European public sector transactions, and U.S. debt issues and budget concerns may adversely impact future U.S. public sector transactions. Such budgetary constraints or shifts in spending priorities of government entities may adversely affect sales of our products and services to such entities. In addition, sales to government entities are subject to a number of risks. Selling to government entities can be highly competitive, expensive and time consuming, often requiring significant upfront time and expense without any assurance that we will successfully sell our products to such governmental entity. Government entities may require contract terms that differ from our standard arrangements. Government contracts may require the maintenance of certain security clearances for facilities and employees which can entail administrative time and effort possibly resulting in additional costs and delays. In addition, government demand for our products may be more volatile as they are affected by public sector budgetary cycles, funding authorizations, and the potential for funding reductions or delays, making the time to close such transactions more difficult to predict. This risk is enhanced as the size of such sales to the government entities increases. If the use of our products expands to more sensitive, secure or mission critical uses by our government customers, we may be subject to increased scrutiny, potential reputational risk, or potential liability should our products fail to perform as expected or should we not comply with the terms of our government contracts or government contracting requirements.

Most of our sales to government entities have been made indirectly through providers that sell our products. Government entities may have contractual or other legal rights to terminate contracts with our providers for convenience or due to a default, and any such termination may adversely impact our future results of operations. Governments routinely audit and investigate government contractors, and we may be subject to such audits and investigations. If an audit or investigation uncovers improper or illegal activities, including any misuse of confidential or classified information by our employees, we may be subject to civil or criminal penalties and administrative sanctions.

Change in senior management could cause disruption in the Company and have a material effect on our business. Furthermore, the loss of key personnel or the failure to attract and retain highly qualified personnel could have an adverse effect on our business.

We have had, and could have, changes in senior management which could be disruptive to management and operations of the Company and could have a material effect on our business, operating results and financial conditions. Turnover at the senior management level may create instability within the Company, which could impede the Company’s day to day operations. Such instability could impede our ability to fully implement our business plan and growth strategy, which would harm our business and prospects.