AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON MAY 1, 2012

REGISTRATION NO. 333-162132

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 3 TO

FORM S-1

REGISTRATION STATEMENT

UNDER THE

SECURITIES ACT OF 1933

SUPERFUND GREEN, L.P.

(Exact name of registrant as specified in its charter)

| Delaware | 6221 | 98-0375395 | ||

| (State of Organization) | (Primary Standard Industrial Classification Code Number) |

(I.R.S. Employer Identification Number) |

Superfund Office Building

P.O. Box 1479

Grand Anse St. George’s, Grenada

West Indies

(473) 439- 2418

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Martin Schneider

Superfund Office Building

P.O. Box 1479

Grand Anse St. George’s,

Grenada West Indies

(473) 439-2418

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

James B. Biery

Daniel F. Spies

Sidley Austin LLP

One South Dearborn Street

Chicago, Illinois 60603

(312) 853-4167

Approximate Date Of Commencement Of Proposed Sale To The Public: As soon as practicable after the effective date of this Post-Effective Amendment No. 3.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 (the “Securities Act”) check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if a smaller reporting company) | Smaller reporting company | x | |||

PROSPECTUS AND DISCLOSURE DOCUMENT

SUPERFUND GREEN, L.P.

$204,536,123 SERIES A

$307,741,250 SERIES B

UNITS OF LIMITED PARTNERSHIP INTEREST

The Offering

Superfund Green, L.P., a Delaware limited partnership (the “Fund”), is offering two separate series of limited partnership units (“Units”), designated Series A and Series B (the “Series”), in an aggregate offering amount of up to $512,227,373 for both Series A and Series B together. The two Series are traded and managed the same way except for the degree of leverage. The assets of each Series are segregated from the other Series and each Series is offered separately.

Superfund USA, Inc. and additional selling agents, which serve as underwriters, are offering the Series’ Units on the last day of each month at a price of month-end net asset value per Unit. As of February 29, 2012, the net asset value of a Series A Unit was $1,316.24 and the net asset value of a Series B Unit was $1,408.73. No up-front underwriting discount or commissions apply. The selling agents will use their best efforts to sell the Units offered. The offering will be conducted on a continuous basis until all Units have been sold. This offering is scheduled to terminate on November 24, 2012, provided, however, that it may terminate earlier if all of the Units registered pursuant to the registration statement of which this Prospectus is part have been sold and it may be extended for up to six months beyond November 24, 2012 pursuant to the rules of the Securities Act of 1933. Subscription proceeds are held in escrow at HSBC Bank USA until released to the Series. There is no minimum number of Units that must be sold for Units to be issued at the end of each month. Regardless of the net asset value at which Units are issued, the initial aggregate net asset value of an investor’s Units will equal the dollar amount of the investor’s subscription, and no up-front underwriting discount or commission will be taken, although, as described herein, certain Units will pay an installment selling commission of up to 10% of the gross offering proceeds of the Units in monthly installments of 1/12 of 4.0% of the month-end net asset value of such Units.

The Risks

These are speculative securities. BEFORE YOU DECIDE WHETHER TO INVEST, READ THIS ENTIRE PROSPECTUS CAREFULLY AND CONSIDER “THE RISKS YOU FACE” ON PAGE 12.

| • | The Fund is speculative and highly leveraged. The Series will acquire positions with face amounts substantially greater than their total equity. Leverage magnifies the impact of both gains and losses. |

| • | Performance can be volatile and the net asset value per Unit may fluctuate significantly in a single month. |

| • | You could lose all or substantially all of your investment in each Series. |

| • | Superfund Capital Management, Inc. has total trading authority over each Series. The use of a single advisor could mean lack of diversification and, consequently, higher risk. |

| • | There is no secondary market for the Units, and none is expected to develop. While the Units have redemption rights, there are restrictions. For example, redemptions can occur only at the end of a month. See “Distributions and Redemptions.” |

| • | Transfers of interest in the Units are subject to limitations, such as 30 days’ advance written notice of any intent to transfer. Also, Superfund Capital Management, Inc. may deny a request to transfer if it determines that the transfer may result in adverse legal or tax consequences for a Series. See “Superfund Green, L.P. Sixth Amended and Restated Limited Partnership Agreement.” |

| • | Substantial expenses must be offset by trading profits and interest income for each Series to be profitable. |

| • | No U.S. regulatory authority or exchange has the power to compel the enforcement of the rules of a foreign board of trade or any applicable foreign laws. |

To invest, you will be required to represent and warrant, among other things, that you have received a copy of this Prospectus and that you satisfy the minimum net worth and income requirements for residents of your state to invest in a Series. You are encouraged to discuss your investment decision with your individual financial, tax and legal advisors.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

This Prospectus is in two parts: a disclosure document and a statement of additional information. These parts are bound together, and both contain important information.

THE COMMODITY FUTURES TRADING COMMISSION HAS NOT PASSED UPON THE MERITS OF PARTICIPATING IN THIS POOL NOR HAS THE COMMISSION PASSED ON THE ADEQUACY OR ACCURACY OF THIS DISCLOSURE DOCUMENT.

SUPERFUND CAPITAL MANAGEMENT, INC.

General Partner

Prospectus dated [ ], 2012

COMMODITY FUTURES TRADING COMMISSION

RISK DISCLOSURE STATEMENT

YOU SHOULD CAREFULLY CONSIDER WHETHER YOUR FINANCIAL CONDITION PERMITS YOU TO PARTICIPATE IN A COMMODITY POOL. IN SO DOING, YOU SHOULD BE AWARE THAT COMMODITY INTEREST TRADING CAN QUICKLY LEAD TO LARGE LOSSES AS WELL AS GAINS. SUCH TRADING LOSSES CAN SHARPLY REDUCE THE NET ASSET VALUE OF THE POOL AND CONSEQUENTLY THE VALUE OF YOUR INTEREST IN THE POOL. IN ADDITION, RESTRICTIONS ON REDEMPTIONS MAY AFFECT YOUR ABILITY TO WITHDRAW YOUR PARTICIPATION IN THE POOL.

FURTHER, COMMODITY POOLS MAY BE SUBJECT TO SUBSTANTIAL CHARGES FOR MANAGEMENT, AND ADVISORY AND BROKERAGE FEES. IT MAY BE NECESSARY FOR THOSE POOLS THAT ARE SUBJECT TO THESE CHARGES TO MAKE SUBSTANTIAL TRADING PROFITS TO AVOID DEPLETION OR EXHAUSTION OF THEIR ASSETS. THIS DISCLOSURE DOCUMENT CONTAINS A COMPLETE DESCRIPTION OF EACH EXPENSE TO BE CHARGED THIS POOL AT PAGES 4 THROUGH 8 AND 43 THROUGH 46 AND A STATEMENT OF THE PERCENTAGE RETURN NECESSARY TO BREAK EVEN, THAT IS, TO RECOVER THE AMOUNT OF YOUR INITIAL INVESTMENT, AT PAGES 6, 7 AND 8.

THIS BRIEF STATEMENT CANNOT DISCLOSE ALL THE RISKS AND OTHER FACTORS NECESSARY TO EVALUATE YOUR PARTICIPATION IN THIS COMMODITY POOL. THEREFORE, BEFORE YOU DECIDE TO PARTICIPATE IN THIS COMMODITY POOL, YOU SHOULD CAREFULLY STUDY THIS DISCLOSURE DOCUMENT, INCLUDING A DESCRIPTION OF THE PRINCIPAL RISK FACTORS OF THIS INVESTMENT, AT PAGE 12.

YOU SHOULD ALSO BE AWARE THAT THIS COMMODITY POOL MAY TRADE FOREIGN FUTURES OR OPTIONS CONTRACTS. TRANSACTIONS ON MARKETS LOCATED OUTSIDE THE UNITED STATES, INCLUDING MARKETS FORMALLY LINKED TO A UNITED STATES MARKET, MAY BE SUBJECT TO REGULATIONS WHICH OFFER DIFFERENT OR DIMINISHED PROTECTION TO THE POOL AND ITS PARTICIPANTS. FURTHER, UNITED STATES REGULATORY AUTHORITIES MAY BE UNABLE TO COMPEL THE ENFORCEMENT OF THE RULES OF REGULATORY AUTHORITIES OR MARKETS IN NON-UNITED STATES JURISDICTIONS WHERE TRANSACTIONS FOR THE POOL MAY BE EFFECTED.

SWAPS TRANSACTIONS, LIKE OTHER FINANCIAL TRANSACTIONS, INVOLVE A VARIETY OF SIGNIFICANT RISKS. THE SPECIFIC RISKS PRESENTED BY A PARTICULAR SWAP TRANSACTION NECESSARILY DEPEND UPON THE TERMS OF THE TRANSACTION AND YOUR CIRCUMSTANCES. IN GENERAL, HOWEVER, ALL SWAPS TRANSACTIONS INVOLVE SOME COMBINATION OF MARKET RISK, CREDIT RISK, COUNTERPARTY CREDIT RISK, FUNDING RISK, LIQUIDITY RISK, AND OPERATIONAL RISK.

HIGHLY CUSTOMIZED SWAPS TRANSACTIONS IN PARTICULAR MAY INCREASE LIQUIDITY RISK, WHICH MAY RESULT IN A SUSPENSION OF REDEMPTIONS. HIGHLY LEVERAGED TRANSACTIONS MAY EXPERIENCE SUBSTANTIAL GAINS OR LOSSES IN VALUE AS A RESULT OF RELATIVELY SMALL CHANGES IN THE VALUE OR LEVEL OF AN UNDERLYING OR RELATED MARKET FACTOR.

IN EVALUATING THE RISKS AND CONTRACTUAL OBLIGATIONS ASSOCIATED WITH A PARTICULAR SWAP TRANSACTION, IT IS IMPORTANT TO CONSIDER THAT A SWAP TRANSACTION MAY BE MODIFIED OR TERMINATED ONLY BY MUTUAL CONSENT OF THE ORIGINAL PARTIES AND SUBJECT TO AGREEMENT ON INDIVIDUALLY NEGOTIATED TERMS. THEREFORE, IT MAY NOT BE POSSIBLE FOR THE COMMODITY POOL OPERATOR TO MODIFY, TERMINATE, OR OFFSET THE POOL’S OBLIGATIONS OR THE POOL’S EXPOSURE TO THE RISKS ASSOCIATED WITH A TRANSACTION PRIOR TO ITS SCHEDULED TERMINATION DATE.

THIS PROSPECTUS DOES NOT INCLUDE ALL OF THE INFORMATION OR EXHIBITS IN SUPERFUND GREEN, L.P.’S REGISTRATION STATEMENT. YOU CAN READ AND COPY THE ENTIRE REGISTRATION STATEMENT AT THE PUBLIC REFERENCE FACILITIES MAINTAINED BY THE SECURITIES AND EXCHANGE COMMISSION (“SEC”) IN WASHINGTON, D.C. SUPERFUND GREEN, L.P. FILES QUARTERLY AND ANNUAL REPORTS WITH THE SEC. YOU CAN READ AND COPY THESE REPORTS AT THE SEC PUBLIC REFERENCE FACILITY AT 100 F STREET, N.E., WASHINGTON, D.C. 20549. PLEASE CALL THE SEC AT 1-800-SEC-0300 FOR FURTHER INFORMATION. SUPERFUND GREEN, L.P.’S FILINGS WILL BE POSTED AT THE SEC WEBSITE AT HTTP://WWW.SEC.GOV.

SUPERFUND CAPITAL MANAGEMENT, INC.

General Partner

SUPERFUND OFFICE BUILDING

PO BOX 1479

GRAND ANSE

ST. GEORGE’S, GRENADA

WEST INDIES

(473) 439-2418

TABLE OF CONTENTS

i

ii

| 40 | ||||

| 41 | ||||

| 41 | ||||

| 42 | ||||

| 42 | ||||

| 42 | ||||

| 43 | ||||

| 43 | ||||

| 44 | ||||

| 44 | ||||

| 45 | ||||

| 45 | ||||

| 45 | ||||

| 46 | ||||

| 46 | ||||

| 46 | ||||

| 47 | ||||

| 50 | ||||

| 50 | ||||

| 50 | ||||

| 51 | ||||

| 51 | ||||

| SUPERFUND GREEN, L.P. SIXTH AMENDED AND RESTATED LIMITED PARTNERSHIP AGREEMENT |

51 | |||

| 51 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 52 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| 53 | ||||

| 54 | ||||

| Taxation of Limited Partners on Profits and Losses of Each Series |

54 | |||

| 54 | ||||

iii

| “Passive-Activity Loss Rules” and Their Effect on the Treatment of Income and Loss |

54 | |||

| 54 | ||||

| Potential Series-Level Consequences of Redemptions and Transfers of Units |

55 | |||

| Gain or Loss on Section 1256 Contracts and Non-Section 1256 Contracts |

55 | |||

| 55 | ||||

| 55 | ||||

| 55 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 56 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 57 | ||||

| 58 | ||||

| 58 | ||||

| 59 | ||||

| 59 | ||||

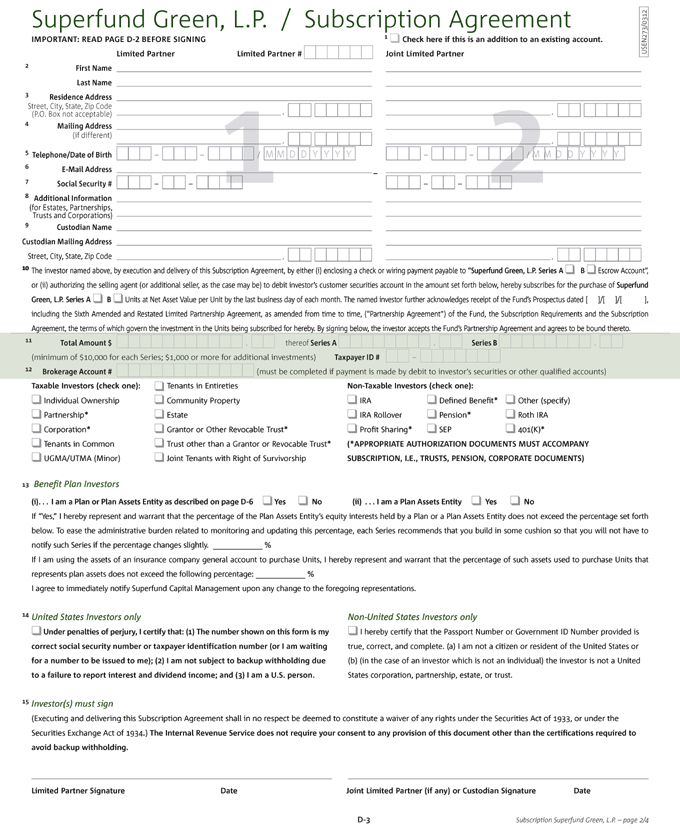

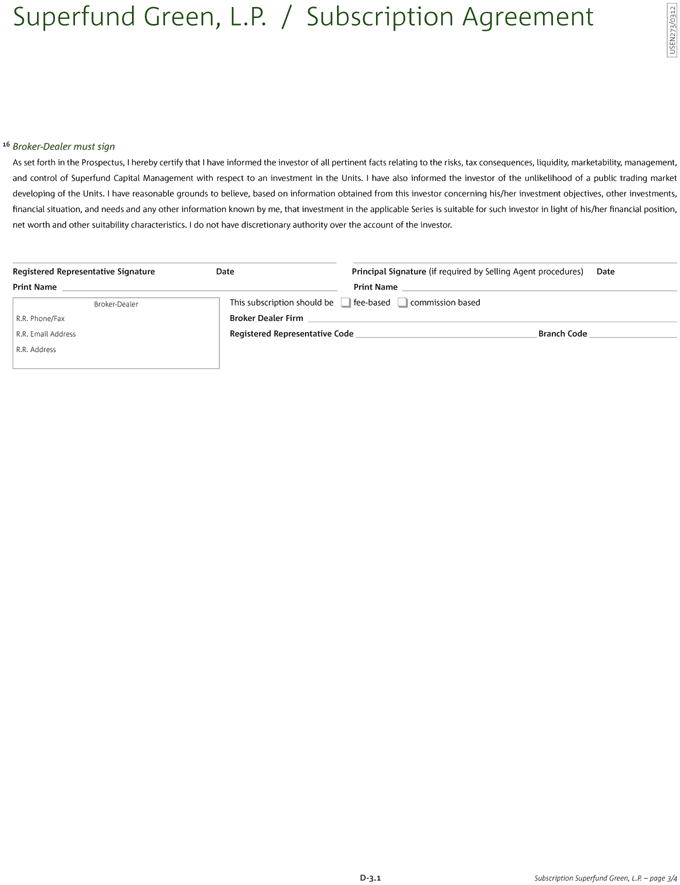

| Representations and Warranties of Investors in the Subscription Agreement |

60 | |||

| 60 | ||||

| 60 | ||||

| 60 | ||||

| 61 | ||||

| 62 | ||||

| 62 | ||||

| 63 | ||||

| 64 | ||||

| 114 | ||||

| 116 | ||||

| 125 | ||||

| 125 | ||||

| 127 | ||||

| 127 | ||||

| 128 | ||||

iv

EXHIBITS

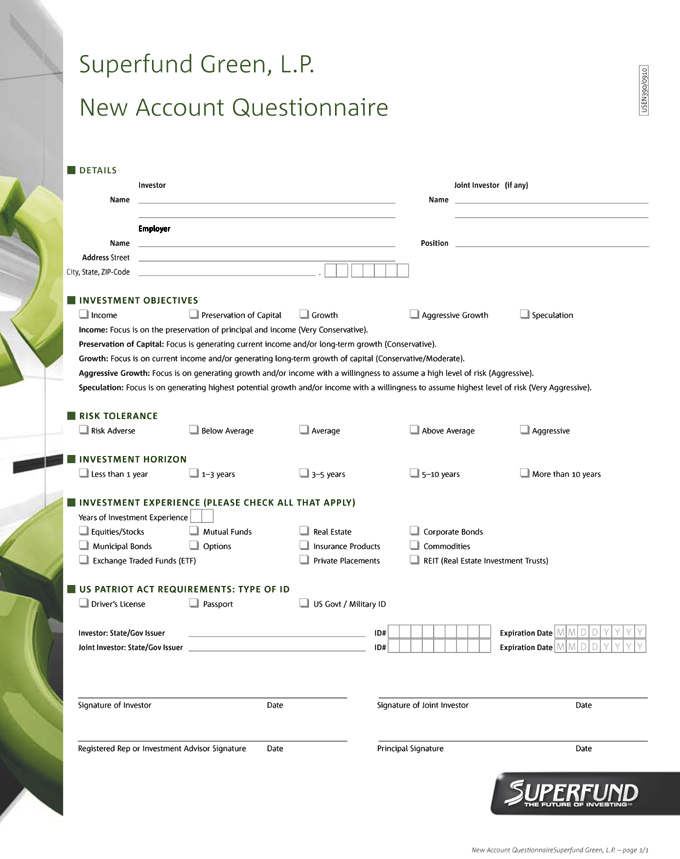

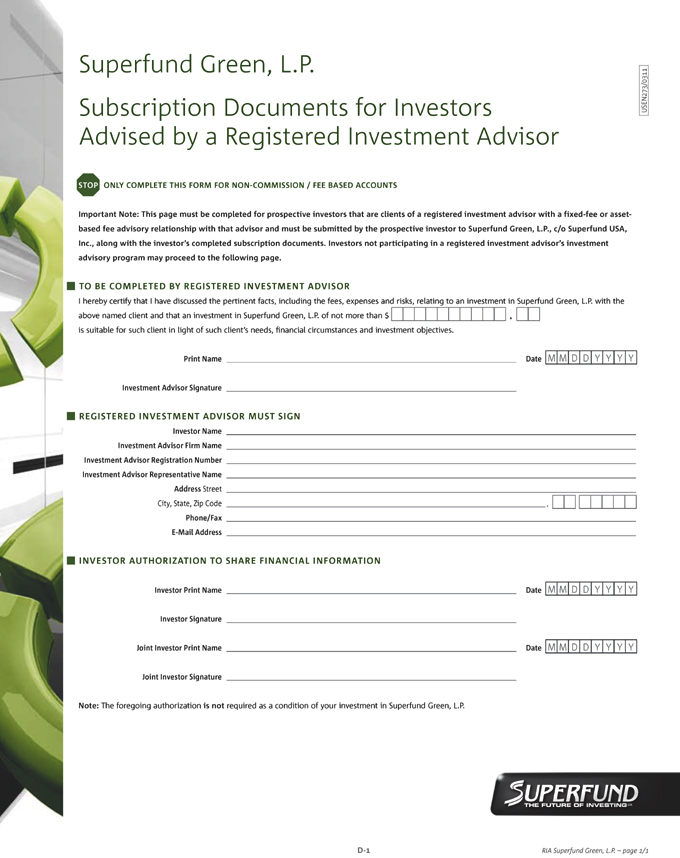

| EXHIBIT A: |

Superfund Green, L.P. Form of Sixth Amended and Restated Limited Partnership Agreement |

A-1 | ||||

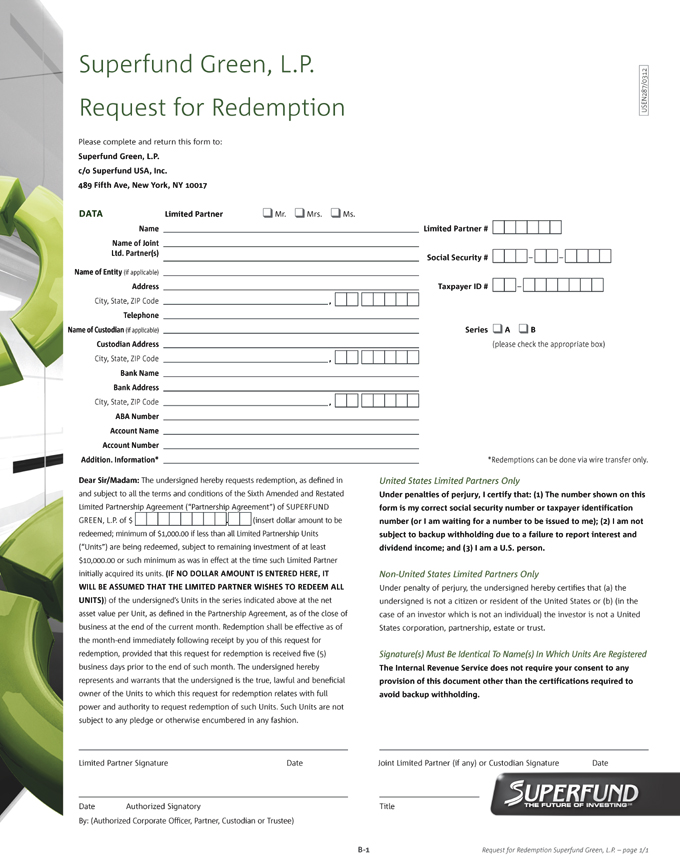

| EXHIBIT B: |

Superfund Green, L.P. Request for Redemption |

B-1 | ||||

| EXHIBIT C: |

Superfund Green, L.P. Subscription Representations |

C-1 | ||||

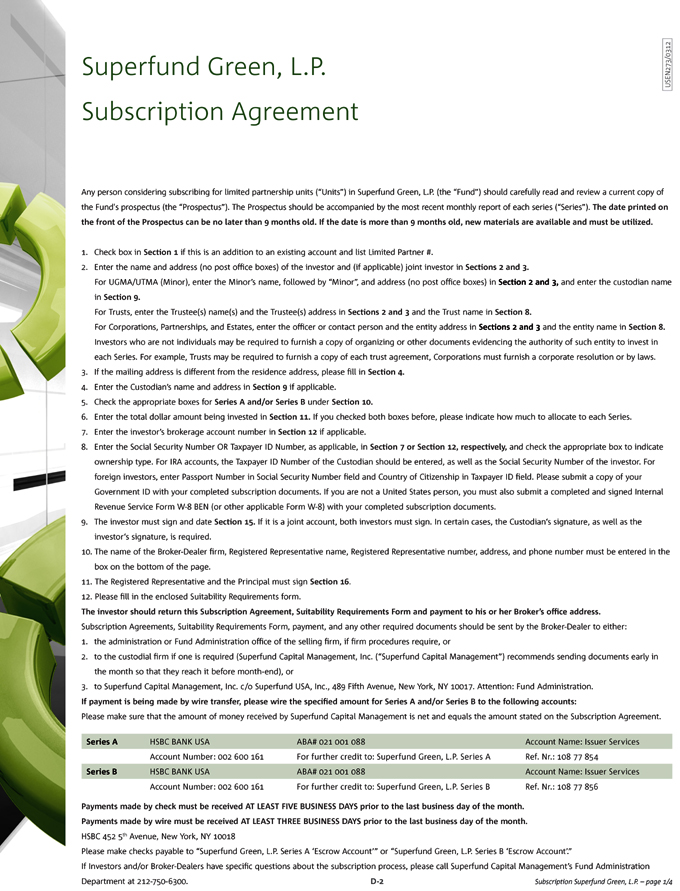

| EXHIBIT D: |

Superfund Green, L.P. Subscription Agreement |

D-1 | ||||

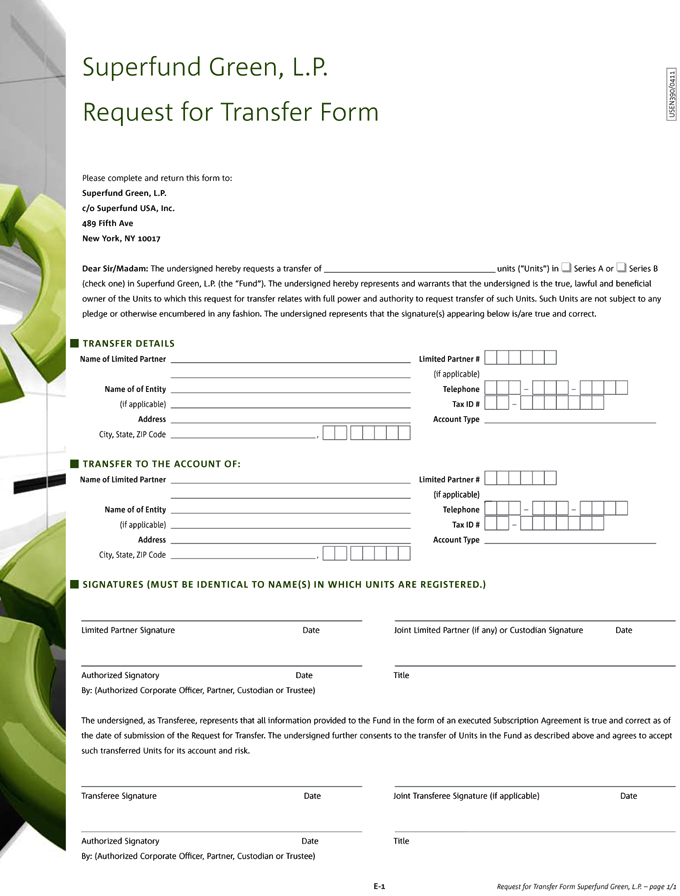

| EXHIBIT E: |

Superfund Green, L.P. Request for Transfer Form |

E-1 | ||||

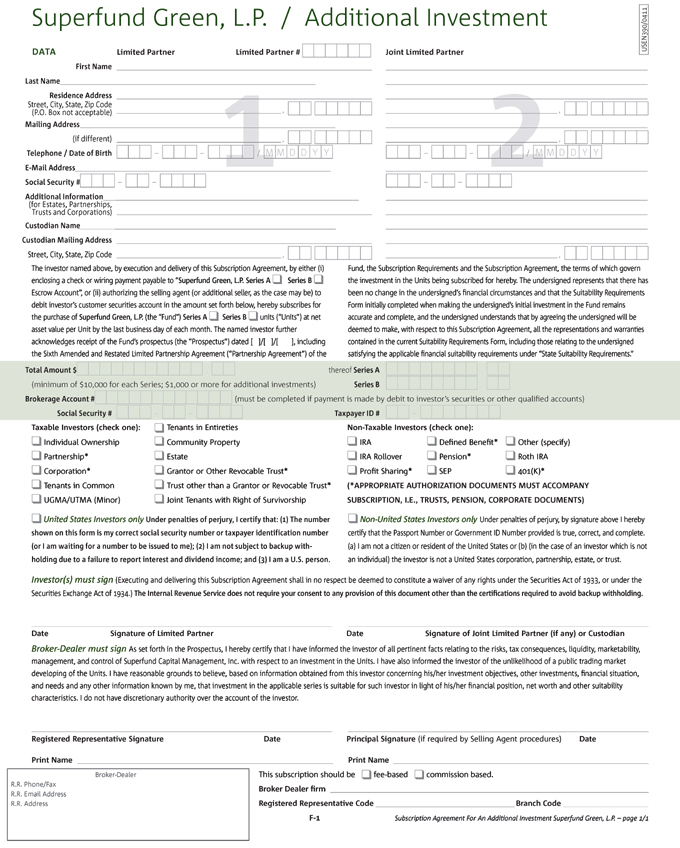

| EXHIBIT F: |

Superfund Green, L.P. Subscription Agreement for an Additional Investment |

F-1 | ||||

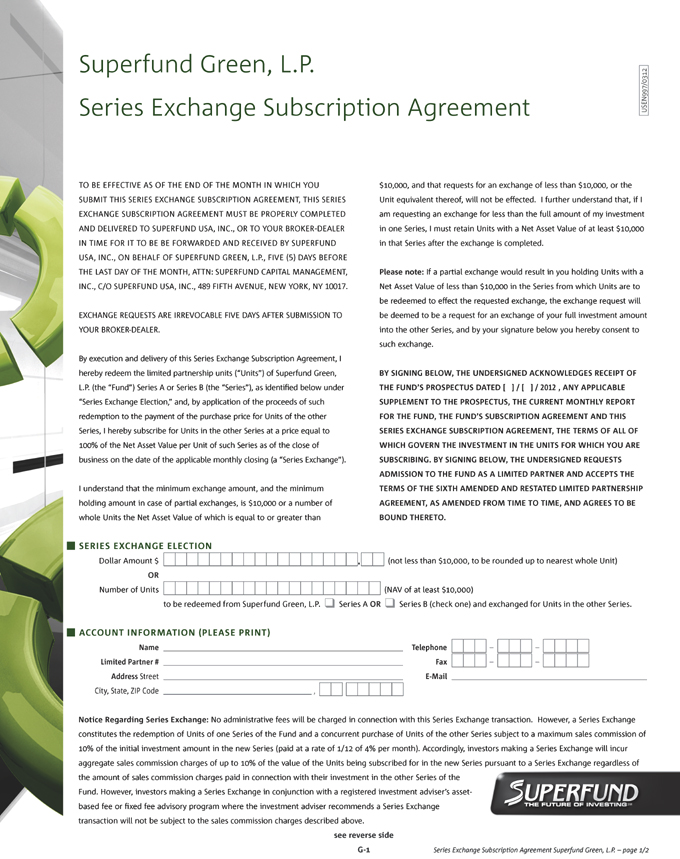

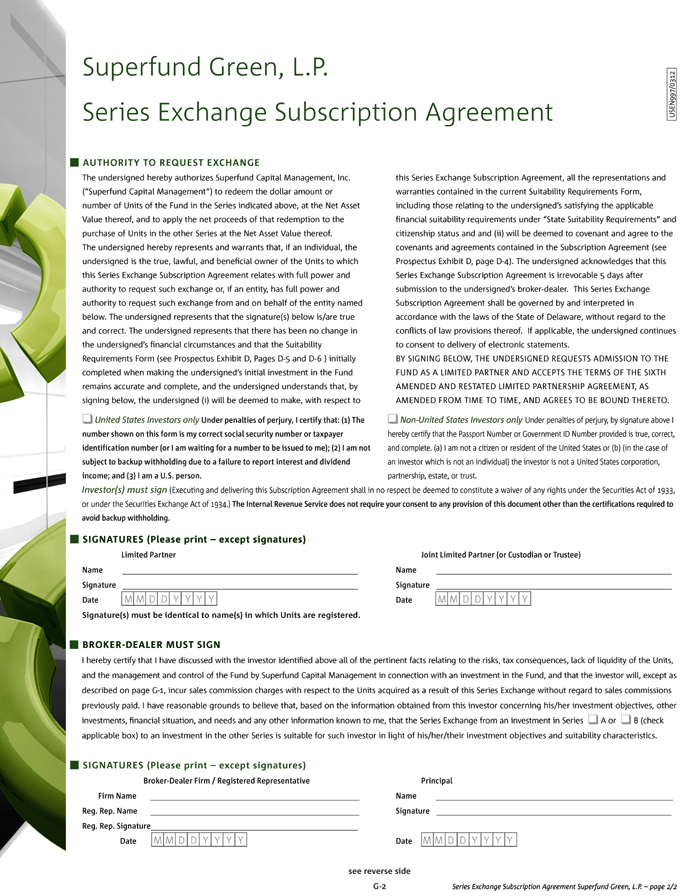

| EXHIBIT G: |

Superfund Green, L.P. Series Exchange Subscription Agreement |

G-1 |

An electronic version of this Prospectus is available on a dedicated web site (http://www.superfund.net) being maintained by Superfund USA, Inc.

v

Superfund Green, L.P. (the “Fund”), is offering two separate series of limited partnership units (“Units”): Superfund Green, L.P. Series A and Superfund Green, L.P. Series B (each, a “Series”). Each Series trades speculatively in the U.S. and international futures and cash foreign currency markets. Specifically, each Series trades in a portfolio of more than 120 futures and forward markets using fully automated, proprietary, computerized trading systems. The Superfund trading systems are licensed to Superfund Capital Management, Inc., the Fund’s general partner and a Grenada corporation (“Superfund Capital Management”) on a non-exclusive basis. These systems automatically initiate buy and sell trading signals and monitor relevant technical indicators on over 120 markets traded in the United States, Canada, Europe and Asia. Each Series’ strategy is based on the implementation of a four-point philosophy consisting of (i) market diversification, (ii) technical analysis, (iii) systematic, primarily trend-following, trading models, and (iv) money management. Superfund Capital Management may also formulate new approaches to carry out the overall investment objective of each Series. Superfund Capital Management reserves the right to trade other pools and/or funds.

The leverage and trading methodology employed with respect to Series A is the same as that for Superfund Q-AG, a private non-U.S. fund managed by Superfund Trading Management, Inc., an affiliate of Superfund Capital Management. The leverage and trading methodology employed with respect to Series B is the same as that for Superfund GCT, a private non-U.S. fund managed by Superfund Fund Management Inc., an affiliate of Superfund Capital Management. Series B is leveraged approximately 1.5 times Series A. Performance information for each Series is shown beginning on page 23 and for these private, non-U.S. funds beginning on page 118 of the Prospectus.

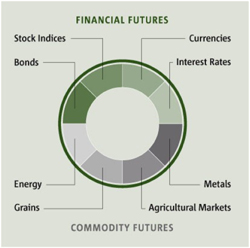

Each Series trades in more than 120 futures and forward markets globally, including both commodity and financial futures. The primary sectors that each Series may trade are: currencies, interest rates, bonds, stock indices, metals, energy, grains and agricultural markets. Each Series will emphasize instruments with low correlation to each other and high liquidity for order execution. Notwithstanding each Series’ philosophy of diversification among markets traded, a majority of each Series’ market exposure may be concentrated in only one or two market sectors from time to time.

The proprietary software technology embodied in Superfund’s trading systems examines a broad array of investments around the world to identify possible opportunities that fit within a narrow selection criteria. This methodology primarily uses trend-following technical trading strategies. The holding period for positions can vary from less than one day to months. The technology is designed to isolate market patterns that offer high reward to risk potential based on historical data. Once potential trades are identified, the systems apply additional filters such as overall risk capital and portfolio volatility prior to generating definite buy or sell signals. All transactions are then executed using a fully automated computerized system.

Effective July 1, 2010, Superfund Capital Management integrated a systematic, technical short-term trading strategy into the Fund’s primary trend-following methodology. This short-term strategy seeks trading opportunities arising out of short term changes in futures and forward market prices, with trades lasting from less than a day to more than a week, and has exhibited low correlation to the trend-following methodology historically utilized by the Fund.

The following summary provides a review in outline form of certain important aspects of an investment in each Series.

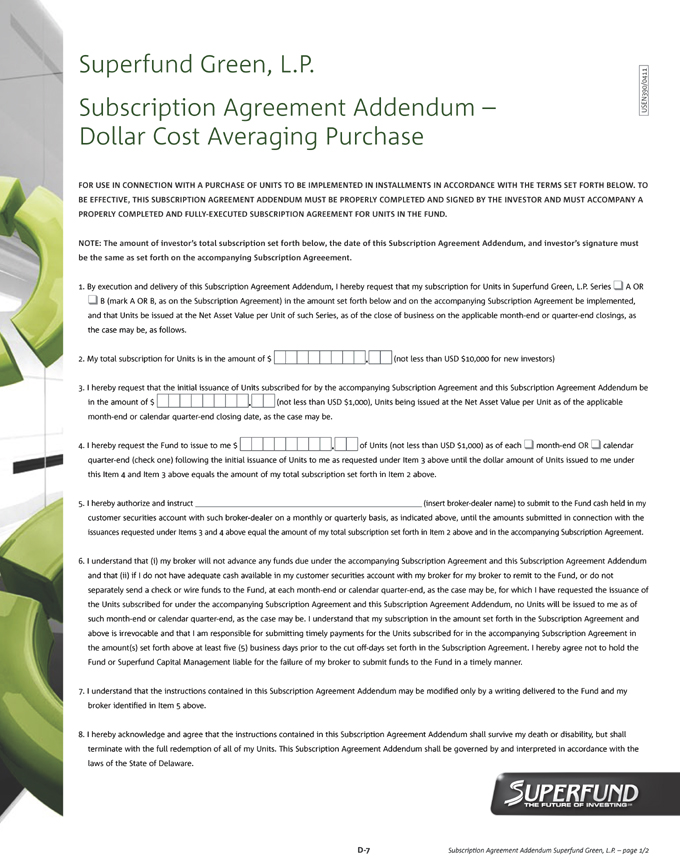

| • | Investors must submit subscriptions at least five business days prior to the applicable month-end closing date. Approved subscriptions will be accepted once payments are received and cleared at the applicable month-end net asset value for the respective Series. Pursuant to an addendum to the Subscription Agreement, investors may subscribe for Units and receive them, and pay for them in equal installments, over a period of time to achieve an average price for the Units acquired; provided, however, that no Units will be issued until such Units have been fully paid for by the investor. |

1

| • | Each Series will accept subscriptions throughout the continuing offering period, which can be terminated by Superfund Capital Management at any time. The offering is scheduled to terminate on November 24, 2012, provided, however, that it may terminate earlier if all of the Units registered pursuant to the registration statement of which this Prospectus is part have been sold and it may be extended for up to six months beyond November 24, 2012 pursuant to the rules of the Securities Act of 1933. Additional registration statements may also be filed in the future offering additional Units for sale to the public. |

| • | The selling agents serve as underwriters and will use their best efforts to sell the Units offered, without any firm underwriting commitment. Superfund Capital Management is also offering Units, through Superfund USA, Inc. (“Superfund USA”), which also serves as an underwriter, to potential investors by distributing this Prospectus and making it available on a dedicated internet website (http://www.superfund.net). Superfund Capital Management intends to engage in marketing efforts through media including but not limited to third-party websites, newspapers, magazines, other periodicals, television, radio, seminars, conferences, workshops, and sporting and charity events. Investors are required to make representations and warranties regarding their suitability to purchase the Units in the Subscription Agreement. Read the Subscription Agreement as well as this Prospectus carefully before you decide whether to invest. |

Minimum Investment in Each Series

The minimum initial investment is $10,000 per Series. Persons that become limited partners by holding Units in a particular Series may make additional investments in that same Series of at least $1,000.

Is Superfund Green, L.P. a Suitable Investment for You?

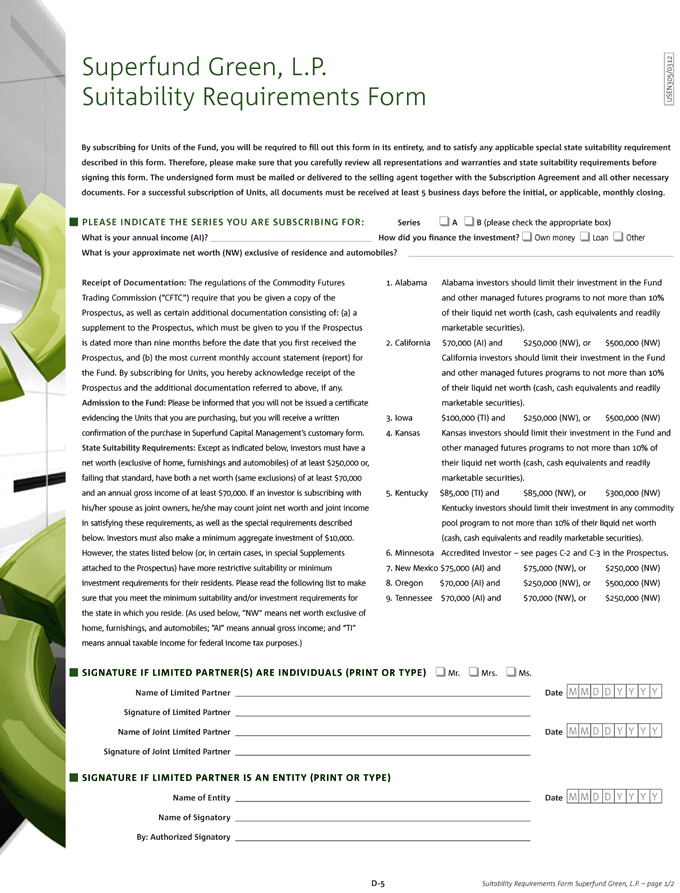

The primary objective of the Units is to achieve substantial capital appreciation over time. An investment in the Units may fit within your portfolio allocation strategy if you are interested in the Units’ potential to produce returns that are generally unrelated to traditional securities investments. An investment in each Series is speculative and involves a high degree of risk. Each Series is not a complete investment program. Superfund Capital Management offers each Series as a diversification opportunity for an investor’s entire investment portfolio, and therefore an investment in each Series should only be a limited portion of the investor’s portfolio. You must, at a minimum, have:

(1) a net worth of at least $250,000, exclusive of home, furnishings and automobiles; or

(2) a net worth, similarly calculated, of at least $70,000 and an annual gross income of at least $70,000.

A number of jurisdictions in which the Units are offered impose higher minimum suitability standards on prospective investors. See Exhibit C to this Prospectus. These suitability standards are, in each case, regulatory minimums only, and merely because you meet such standards does not mean that an investment in the Units is suitable for you. YOU MAY NOT INVEST MORE THAN 10% OF YOUR NET WORTH, EXCLUSIVE OF HOME, FURNISHINGS AND AUTOMOBILES, IN THE FUND.

Risk Factors You Should Consider Before Investing in Either Series

| • | Each Series is a highly volatile and speculative investment. There can be no assurance that each Series will achieve its objectives or avoid substantial losses. You must be prepared to lose all or substantially all of your investment. |

2

| • | For every gain made in a futures, forward or swap transaction, the opposing side of that transaction will have an equal and offsetting loss. Each Series has from time to time in the past experienced drawdowns. Investments managed by Superfund Capital Management, including the Series, will likely experience drawdowns in the future. |

| • | Each Series trades in futures and forward contracts and may trade swap contracts. Therefore, each Series is a party to financial instruments with elements of off-balance sheet market risk, including market volatility and possible illiquidity. There is also a credit risk that a counterparty will not be able to meet its obligations to each Series. |

| • | There is no secondary market for Units of each Series and it is not anticipated that any such market will develop. |

| • | Each Series is subject to numerous conflicts of interest including the following: |

(1) Superfund Capital Management is both the general partner and trading advisor of each Series and its fees and services have not been negotiated at arm’s length. Superfund Capital Management has a disincentive to replace itself as trading advisor, even if doing so may be in the best interests of each Series;

(2) Superfund Capital Management, each Series’ clearing brokers and their respective principals and affiliates, may trade in the futures, forward and swaps markets for their own accounts and may take positions opposite or ahead of those taken for each Series; and

(3) Superfund Capital Management’s principals are not obligated to devote any minimum amount of time to the Fund.

| • | Owners of Units (“Limited Partners”) take no part in the management of each Series, and the past performance of Superfund Capital Management or each Series is not necessarily indicative of future results of a Series. |

| • | Superfund Capital Management will be paid a monthly management fee of 1/12 of 1.85% of the monthly net asset value (1.85% annually) for each Series, regardless of profitability. Superfund Capital Management will also be paid monthly performance fees equal to 25% of aggregate cumulative net appreciation (if any) of each Series above its previous highest value, excluding interest income. |

| • | Each Series is a single-advisor fund which may be inherently more volatile than multi-advisor managed futures products. |

| • | Although each Series is liquid compared to other “alternative” investments such as real estate or venture capital, liquidity is restricted, as the Units may only be redeemed on a monthly basis, upon five business days’ written notice. You may transfer or assign your Units after 30 days’ advance notice, and only with the consent of Superfund Capital Management which may not be given if such transfer may result in adverse legal or tax consequences for a Series. |

| • | Even though Superfund Capital Management does not presently intend to make distributions from either Series, you will be liable for taxes on your share of trading profits and other income of the Series in which you invest. |

| • | Each Series must experience certain levels of trading profits in order for you to break even on your investment. Based on an initial investment of $10,000 (and assuming no changes in net asset value and interest income of 0.05%), the break even points for each Series are as follows: Series A — 8.95% ($895.00); Series A not subject to selling commissions — 4.95% ($495.00); Series B — 9.95% ($995.00); Series B not subject to selling commissions — 5.95% ($595.00). A more detailed break even analysis begins at page 6. |

3

Investment Factors You Should Consider Before Investing in Either Series

| • | Each Series is a leveraged investment fund managed by an experienced, professional trading advisor and it trades in a wide range of futures and forward markets. |

| • | Superfund Capital Management utilizes proprietary, systematic trading systems for each Series. |

| • | Each Series has the potential to help diversify traditional securities portfolios. A diverse portfolio consisting of assets that perform in an unrelated manner, or non-correlated assets, may increase overall return and/or reduce the volatility (a primary measure of risk) of a portfolio. However, non-correlation will not provide any diversification advantages unless the non-correlated assets are outperforming other portfolio assets, and there is no guarantee that either Series will outperform other sectors of an investor’s portfolio or not produce losses. Each Series’ profitability also depends on the success of Superfund Capital Management’s trading techniques. If a Series is unprofitable, then the Series will not increase the return on an investor’s portfolio or achieve its diversification objectives. |

| • | Investors in each Series get the advantage of limited liability in highly leveraged trading. |

Superfund Capital Management, the general partner and trading advisor for each Series, is responsible for the administration and trading of each Series. Superfund Capital Management serves as the general partner and trading adviser for other investment funds with a similar strategy to that of each Series. Moreover, affiliates of Superfund Capital Management manage various offshore investment funds with strategies substantially similar to that of each Series.

Each Series’ charges are substantial and must be offset by trading gains and interest income in order to avoid depletion of each Series’ assets.

| • | 1.85% annual management fee (1/12 of 1.85% payable monthly) for each Series. |

| • | 25% of new appreciation (if any) in each Series’ net assets computed on a monthly basis and excluding interest income and as adjusted for subscriptions and redemptions. |

| • | Up to 1% of net assets in each Series per year (up to 1/12 of 1% payable monthly) for ongoing offering expenses (including the costs of updating this Prospectus and registering additional Units for sale to the public), such as legal, auditing, administration, printing and postage costs, not to exceed the amount of actual expenses incurred. Ongoing offering expenses will not exceed 0.3542% of the gross offering proceeds of the Units registered pursuant to the registration statement of which this Prospectus is part. Superfund Capital Management will assume liability for ongoing offering expenses in excess of 1% of average month-end net assets per year of each Series. |

| • | Up to 0.15% of net assets in each Series per year (1/12 of 0.15% payable monthly) for operating expenses such as legal, auditing, administration, printing and postage, not to exceed the amount of actual expense incurred. |

4

| • | An annual selling commission will be paid to Superfund USA, an affiliate of Superfund Capital Management. The Units pay a commission of 4% of the month-end net asset value per Unit (1/12 of 4% per month) in the initial year after purchase. The Units pay additional selling commissions of 4% per annum of the month-end net asset value per Unit thereafter. Each Series and Superfund USA may retain additional selling agents to assist with the placement of the Units. Superfund USA will pay all or a portion of the selling commission described above which it receives in respect of the Units sold by the additional selling agents to the additional selling agents effecting the sales. If the selling commission paid in the initial year after purchase is less than 4% of proceeds due to a decrease in the net asset value per Unit, the maximum additional selling commissions paid will exceed 6% of the proceeds. If the selling commission paid in the initial year after purchase is more than 4% of the proceeds due to an increase in the net asset value per Unit, the maximum additional selling commissions paid will be less than 6% of the proceeds. In either case, the maximum cumulative selling commission per Unit sold pursuant to this Prospectus is 10% of the gross offering proceeds price for such Unit (which is equal to $51,227,737 out of the $512,227,373 in Units offered pursuant to this Prospectus). |

| • | If you participate in a registered investment adviser’s asset-based fee or fixed fee advisory program and your investment adviser recommends a portfolio allocation to the Fund or if the Units are purchased by commodity pools operated by commodity pool operators registered as such with the National Futures Association (“NFA”), your Units purchased through Superfund USA will not be subject to the selling commissions described above. |

| • | $9.00 brokerage commission per round-turn transaction plus applicable regulatory and exchange fees, where brokerage commissions are charged in U.S. dollars, a portion of which will be paid to the clearing brokers for execution and clearing costs and the balance of which will be paid to Superfund Asset Management, Inc. (“Superfund Asset Management”) which serves as introducing broker for each Series and is an affiliate of Superfund Capital Management. Brokerage commissions for certain foreign futures contracts to be traded by the Fund are charged in currencies other than the U.S. dollar. Commission rates for brokerage commissions charged in foreign currencies will be reset on the first day of each calendar month to the foreign currency equivalent of $9.00 based on the then current U.S. dollar exchange rate for the applicable foreign currencies. Daily fluctuations in foreign currency exchange rates will, however, cause the actual commissions charged to the Fund for certain foreign futures contracts to be more or less than $9.00. |

| • | There are no penalties or charges applied upon the redemption of Units. |

5

The following tables show the fees and expenses that an investor would incur on an initial investment of $10,000 in each Series and the amount that such investment must earn to break even after one year.

Series A

| Routine Expenses |

Percentage Return Required Initial Twelve Months of Investment |

Dollar Return Required ($10,000 Initial Investment) Initial Twelve Months of Investment |

||||||

| Management Fees |

1.85 | % | $ | 185.00 | ||||

| General Partner Performance Fees(1) |

0.00 | % | $ | 0.00 | ||||

| Selling Commissions(2) |

4.00 | % | $ | 400.00 | ||||

| Ongoing Offering Expenses(3) |

1.00 | % | $ | 100.00 | ||||

| Operating Expenses(3) |

0.15 | % | $ | 15.00 | ||||

| Brokerage Fees(4) |

2.00 | % | $ | 200.00 | ||||

| Less Interest Income(5) |

0.05 | % | $ | 5.00 | ||||

| TWELVE-MONTH BREAKEVEN |

8.95 | % | $ | 895.00 | ||||

Series A for Investors Not Subject to Selling Commissions(6)

| Routine Expenses |

Percentage Return Required Initial Twelve Months of Investment |

Dollar Return Required ($10,000 Initial Investment) Initial Twelve Months of Investment |

||||||

| Management Fees |

1.85 | % | $ | 185.00 | ||||

| General Partner Performance Fees(1) |

0.00 | % | $ | 0.00 | ||||

| Selling Commissions(2) |

0.00 | % | $ | 0.00 | ||||

| Ongoing Offering Expenses(3) |

1.00 | % | $ | 100.00 | ||||

| Operating Expenses(3) |

0.15 | % | $ | 15.00 | ||||

| Brokerage Fees(4) |

2.00 | % | $ | 200.00 | ||||

| Less Interest Income(5) |

0.05 | % | $ | 5.00 | ||||

| TWELVE-MONTH BREAKEVEN |

4.95 | % | $ | 495.00 | ||||

6

Series B

| Routine Expenses |

Percentage Return Required Initial Twelve Months of Investment |

Dollar Return Required ($10,000 Initial Investment) Initial Twelve Months of Investment |

||||||

| Management Fees |

1.85 | % | $ | 185.00 | ||||

| General Partner Performance Fees(1) |

0.00 | % | $ | 0.00 | ||||

| Selling Commissions(2) |

4.00 | % | $ | 400.00 | ||||

| Ongoing Offering Expenses(3) |

1.00 | % | $ | 100.00 | ||||

| Operating Expenses(3) |

0.15 | % | $ | 15.00 | ||||

| Brokerage Fees(4) |

3.00 | % | $ | 300.00 | ||||

| Less Interest Income(5) |

0.05 | % | $ | 5.00 | ||||

| TWELVE-MONTH BREAKEVEN |

9.95 | % | $ | 995.00 | ||||

Series B for Investors Not Subject to Selling Commissions(6)

| Routine Expenses |

Percentage Return Required Initial Twelve Months of Investment |

Dollar Return Required ($10,000 Initial Investment) Initial Twelve Months of Investment |

||||||

| Management Fees |

1.85 | % | $ | 185.00 | ||||

| General Partner Performance Fees(1) |

0.00 | % | $ | 0.00 | ||||

| Selling Commissions(2) |

0.00 | % | $ | 0.00 | ||||

| Ongoing Offering Expenses(3) |

1.00 | % | $ | 100.00 | ||||

| Operating Expenses(3) |

0.15 | % | $ | 15.00 | ||||

| Brokerage Fees(4) |

3.00 | % | $ | 300.00 | ||||

| Less Interest Income(5) |

0.05 | % | $ | 5.00 | ||||

| TWELVE-MONTH BREAKEVEN |

5.95 | % | $ | 595.00 | ||||

| (1) | No performance fees will be charged until breakeven costs are met. However, because Superfund Capital Management’s performance fee is payable monthly, it is possible for Superfund Capital Management to earn a performance fee during a break-even or losing year if, after payment of a performance fee, a Series incurs losses resulting in a break-even or losing year. It is impossible to predict what performance fee, if any, could be paid during a break-even or losing year, thus none is shown. |

| (2) | The maximum cumulative selling commission per Unit sold pursuant to this Prospectus is 10% of the gross offering proceeds for such Unit. |

| (3) | Not to exceed the amount of actual expenses incurred. |

7

| (4) | Assumes 1,720 round-turn transactions for Series A and 2,585 round turns transactions for Series B per million dollars per year at a rate of $9 per round-turn transaction.* These assumptions are based on the average number of round-turn transactions per million dollars per year over the last three years traded on behalf of the Series and the average risk capital of each Series allocated to the Fund’s short-term systematic, technical trading strategy since July 1, 2010. The Superfund Green, L.P. Sixth Amended and Restated Limited Partnership Agreement (the “Partnership Agreement”) provides that brokerage commission costs borne by the Fund shall not exceed 5% (Series A) and 7% (Series B) annually of average annual net assets of the Series. |

| (5) | Estimated. Interest income includes the assumed interest rate of 0.10% per annum based on current cash market information and the fact that less than half of the Fund’s assets are currently held in interest bearing accounts. |

The twelve-month break-even points shown are dependent on interest income of 0.05% per annum. If interest income earned is less, the Series will have to earn trading profits greater than the amounts shown to cover their costs. Actual interest to be earned by the Fund will be at the prevailing rates for the period being measured which may be less than or greater than 0.05% over any twelve month period.

| (6) | Certain Units are not subject to selling commissions: (i) Units purchased through Superfund USA by investors that participate in a registered investment adviser’s asset-based fee or fixed fee advisory program; (ii) Units purchased through Superfund USA by investors who are commodity pools operated by commodity pool operators registered as such with the NFA; and (iii) Units for which the investor has paid the maximum cumulative selling commissions of 10% of the original purchase price. |

| * | In no instance will the total of all fees computed on a net asset basis exceed 20% per annum for either Series A or Series B. |

Each Series is intended to be a medium-to long-term, i.e., 3- to 5-year, investment. Units are transferable, but no market exists for their sale and none is expected to develop. Monthly redemptions are permitted upon five business days’ written notice to Superfund Capital Management; provided, however, that the payment of redemption proceeds may be delayed in special circumstances, including, but not limited to, inability to liquidate dealers’ positions as of a redemption date or default or delay in payments due to each Series from clearing brokers, banks, or other persons or entities. If the net asset value per Unit within a Series as of the end of any business day declines by 50% or more from either the prior year-end or the prior month-end Unit value of such Series, Superfund Capital Management will suspend trading activities, notify all Limited Partners within such Series of the relevant facts within seven business days and declare a special redemption period. Superfund Capital Management may deny a request to transfer if it determines that the transfer may result in adverse legal or tax consequences for either Series but not a redemption request submitted in good form and in a timely manner. Superfund Capital Management does not intend to make any distributions from either Series. Upon written request, an investment in either Series may be exchanged for an investment in the other Series by a simultaneous redemption and subscription at the then applicable respective net asset values of each Series.

Each Series will be classified as a partnership for federal income tax purposes. As such, you will be taxed each year on the income attributable to the Series in which you invest whether or not you redeem Units or receive distributions from the Series.

To the extent the Fund invests in futures and other commodity contracts, gain or loss on such investments will, depending on the contracts traded, consist of a mixture of: (1) ordinary income or loss; and/or (2) capital gain or loss. Forty percent (40%) of trading profits, if any, on U.S. exchange-traded futures contracts and certain foreign currency forward contracts are taxed as short-term capital gains at ordinary income rates and the remaining sixty percent (60%) are taxed as long-term capital gains at a lower maximum rate for non-corporate investors. Trading gains or losses from other contracts will be primarily short-term capital gains or losses, and interest income is taxed at ordinary income rates.

8

Capital losses on the Units may be deducted against capital gains but may only be deducted by non-corporate investors against ordinary income to the extent of $3,000 per year. Therefore, you could pay tax on a Series’ interest income even though your overall investment in the Fund has been unprofitable.

Within 30 calendar days after the end of each month, Superfund Capital Management will distribute to investors a monthly report of the Fund. Superfund Capital Management will also distribute an annual report of the Fund within 90 calendar days after the end of the Fund’s fiscal year and will provide investors with federal income tax information for the Fund before April 15 of each year.

Commodity Futures Trading Commission (“CFTC”) rules require that this Prospectus be accompanied by summary financial information, which may be a recent monthly report of the Fund, current within 60 calendar days.

9

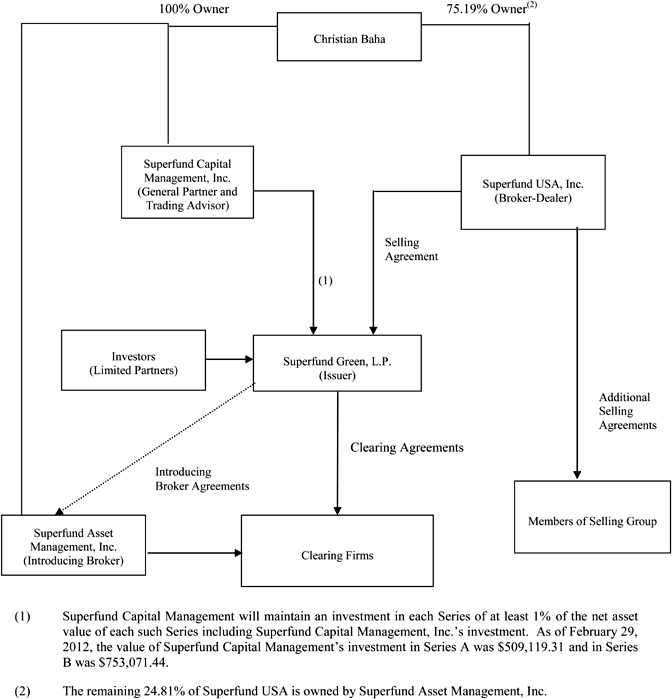

The organizational chart below illustrates the relationships among the various service providers of this offering. Superfund Capital Management is both the general partner and trading advisor for each Series. The selling agents (other than Superfund USA) and clearing brokers are not affiliated with Superfund Capital Management or each Series.

10

Descriptions of the dealings between Superfund Capital Management and its affiliates and the Fund are set forth below under “Conflicts of Interest” and “Charges to Each Series.”

11

Possible Total Loss of an Investment in Each Series

Futures and forward contracts have a high degree of price variability and are subject to occasional rapid and substantial changes. Consequently, you could lose all or substantially all of your investment in each Series.

Each Series Will Be Highly Leveraged

Because the amount of margin funds necessary to be deposited with a clearing broker in order to enter into a futures or forward contract position is typically about 2% to 10% of the total value of the contract, each Series will be able to hold positions with face values equal to several times each Series’ net assets. Over the long term, for periods of several years, the average ratio of margin to equity for Series A is targeted to be approximately 20% and approximately 30% for Series B, but over shorter time periods the average ratio of margin to equity for each Series can range from 0% to more than 50% due to factors such as market volatility and changes in margin requirements, and there can be no assurance that targeted margin to equity ratios will be met. As a result of this leveraging, even a small movement in the price of a contract can cause major losses. Superfund Capital Management will monitor the leverage of each Series regularly but is not limited by the amount of leverage it may employ, except that Series A will be leveraged less than Series B.

The Performance of the Fund Is Expected To Be Volatile; Volatile Performances Can Result in Sudden Large Losses

Superfund Capital Management expects the performance of each Series to be volatile. Futures and forward contract prices have a high degree of variability and are subject to occasional rapid and substantial changes, and the value of the Units may suffer substantial loss from time to time. The net asset value per Unit may change substantially between the date on which you subscribe for Units and the date on which your Units are issued or the date on which you request a redemption and the month-end redemption date. Since its inception in October 2002 through February 2012, monthly returns have ranged from up 19.45% to down 20.12% for Series A Units and from up 27.33% to down 29.11% for Series B Units.

Various factors may influence the price movements of commodity interests, such as: changing supply and demand relationships; weather; agricultural, trade, fiscal, monetary and exchange control programs and policies of governments; United States and foreign political and economic events and policies; changes in national and international interest rates and rates of inflation; currency devaluations and revaluations; and emotions of the marketplace. None of these factors can be controlled by Superfund Capital Management and no assurance can be given that Superfund Capital Management’s advice will result in profitable trades for a participating customer or that a customer will not incur substantial losses.

Illiquidity of Your Investment

There is no secondary market for the Units. While the Units have redemption rights, there are restrictions. For example, redemptions can occur only at the end of a month. If a large number of redemption requests were to be received at one time, each Series might have to liquidate positions to satisfy the requests. Such a forced liquidation could adversely affect each Series and consequently your investment. Transfers of the Units are subject to limitations, such as 30 days’ advance written notice of any intent to transfer. Also, Superfund Capital Management may deny a request to transfer if it determines that the transfer may result in adverse legal or tax consequences for each Series. Because Units cannot be readily liquidated, it will not be possible for you to limit losses or realize accrued profits, if any, except at a month-end in accordance with the Fund’s redemption provisions. See “Superfund Green, L.P. Sixth Amended and Restated Limited Partnership Agreement — Dispositions.”

12

In illiquid markets, the Fund could be unable to close out positions to limit losses or to take positions in order to execute the trading strategies employed by the Fund. There are too many different factors that can contribute to market illiquidity to predict when or where illiquid markets may occur.

Unexpected market illiquidity has caused major losses for some traders in recent years in such market sectors as emerging market currencies. There can be no assurance that the same will not happen in the markets traded by the Fund. In addition, the large size of the positions the Fund may take increases the risk of illiquidity by both making its positions more difficult to liquidate and increasing the losses incurred while trying to do so.

United States commodity exchanges impose limits on the amount the price of some, but not all, futures contracts may change on a single day. Once a futures contract has reached its daily limit, it may be impossible for the Fund to liquidate a position in that contract, if the market has moved adversely to the Fund, until the limit is either raised by the exchange or the contract begins to trade away from the limit price.

The Fund Will Trade Extensively in Foreign Markets Which May Not Be Subject to the Same Level of Regulatory Oversight as Trading in Domestic Markets

A substantial portion of the Fund’s trades take place on markets or exchanges outside the United States. The risk of loss in trading foreign futures contracts and foreign options can be substantial. Non-U.S. markets may not be subject to the same degree of regulation as their U.S. counterparts. None of the CFTC, NFA or any domestic exchange regulates activities of any foreign boards of trade or has the power to compel enforcement of the rules of a foreign board of trade or any applicable foreign laws. In addition, some foreign exchanges are “principals’ markets” in which performance is the responsibility only of the individual exchange member counterparty, not of the exchange or a clearing facility. In such cases, the Fund will be subject to the risk that the member with whom the Fund has traded is unable or unwilling to perform its obligations under the transaction.

Trading on foreign exchanges also presents the risk of loss due to the possible imposition of exchange controls (making it difficult or impossible for the Fund to repatriate some or all of the Series’ assets held by foreign counterparties), government expropriation of assets, taxation, government intervention in markets, limited rights in the event of bankruptcy of a foreign counterparty or exchange and variances in foreign exchange rates between the time a position is entered and the time it is exited.

The Fund’s Forward Transactions are Not Currently Regulated and are Subject to Credit Risk

Each Series, as an eligible contract participant, trades forward contracts in foreign currencies. Forward contracts are typically traded through the over-the-counter dealer market which is dominated by major money center banks and is not currently regulated by the CFTC. Thus, you do not currently receive the protection of CFTC regulation or the statutory scheme of the Commodity Exchange Act in connection with this trading activity by each Series. Also, each Series faces the risk of non-performance by the counterparties to the forward contracts and such non-performance may cause some or all of your gain to be unrealized.

The interbank currency markets may in the near future become subject to regulation under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Reform Act”), a development which may entail increased costs and result in burdensome reporting requirements. The imposition of credit controls by governmental authorities or the implementation of regulations pursuant to the Reform Act might limit such forward trading to less than that which Superfund Capital Management would otherwise recommend, to the possible detriment of the Fund. In its forward trading, the Fund will be subject to the risk of the failure of, or the inability or refusal to perform with respect to its forward contracts by, the principals with which the Fund trades. Assets on deposit with such principals will also generally not be protected by the same segregation requirements imposed on CFTC-regulated commodity brokers in respect of customer funds on deposit with them. Accordingly, the insolvency or bankruptcy of such parties could also subject the Fund to the risk of loss.

13

Currency forward markets are substantially unregulated and price movements in such markets are caused by many unpredictable factors including general economic and financial conditions, governmental policies, national and international political and economic events, and changes in interest rates. Such factors combined with the lack of regulation could expose each Series to significant losses which they might otherwise have avoided.

Currency forward positions can be established using less margin than is typical for futures contracts. Thus, a small movement in the price of the underlying currency can result in a substantial price movement relative to the margin deposit. In addition, cash foreign currencies are traded through a dealer market and not on an exchange. This presents the risks of both counterparty creditworthiness and possible default or bankruptcy by the counterparty.

When the Reform Act goes into effect and the CFTC promulgates rules pursuant to the Reform Act, each Series may be limited to engaging in foreign currency futures transactions and, for off-exchange transactions, “retail forex transactions” which could limit each Series’ potential currency forward counterparties. Limiting each Series’ potential currency forward counterparties could lead to the Fund bearing higher upfront and mark-to-market margin, less favorable trade pricing, and the possible imposition of new or increased fees. The “retail forex” markets could also be significantly less liquid than the interbank market. Moreover, the creditworthiness of counterparties with whom each Series may be required to trade could be weaker than the creditworthiness of the financial institutions with whom each Series currently engages for its currency forward transactions.

Non-Correlated, Not Negatively Correlated, Performance Objective

Historically, managed futures have been generally non-correlated to the performance of other asset classes such as stocks and bonds. Non-correlation means that there is no statistically valid relationship between the past performance of futures and forward contracts on the one hand and stocks or bonds on the other hand. Non-correlation should not be confused with negative correlation, where the performance of two asset classes would be exactly opposite. Because of this non-correlation, each Series cannot be expected to be automatically profitable during unfavorable periods for the stock market, or vice versa. The futures, forward and swap markets are fundamentally different from the securities markets in that for every gain made in a futures, forward or swap transaction, the opposing side of that transaction will have an equal and off-setting loss. If a Series does not perform in a manner non-correlated with the general financial markets or does not perform successfully, you will obtain no diversification benefits by investing in the Units of such Series and such Series may have no gains to offset your losses from other investments.

Superfund Capital Management Analyzes Only Technical Market Data, Not Any Economic Factors External to Market Prices

The trading systems used by Superfund Capital Management for each Series are primarily technical, trend-following methods involving instruments that are not historically correlated with each other. The profitability of trading under these systems generally depends on, among other things, the occurrence of significant price trends which are sustained movements, up or down, in futures and forward prices. Such trends may not develop; there have been periods in the past without price trends in certain markets. The likelihood of the Units being profitable could be materially diminished during periods when events external to the markets themselves have an important impact on prices. During such periods, Superfund Capital Management’s historic price analysis could establish positions on the wrong side of the price movements caused by such events.

Superfund Capital Management’s Trading Methodology is Subject to Change Over Time

Superfund Capital Management may periodically modify its trading methodology without approval by or notice to Limited Partners, provided, however, that Limited Partners will be notified of any material changes in Superfund Capital Management’s trading methodology in accordance with applicable regulations. Modifications may include changes in or substitution of technical trading systems, risk control overlays, money management

14

principles and markets traded as well as the incorporation of non-trend-following systems within Superfund Capital Management’s primary trend-following methodology and the inclusion of non-technical methods of analysis. For example, Superfund Capital Management has recently integrated a systematic, technical short-term trading strategy into the Fund’s primary trend-following methodology. Although Superfund Capital Management believes this modification of the Fund’s trading strategy will be beneficial to the Fund, there can be no assurance that this particular trading strategy will not increase the volatility of the Fund’s returns or not result in losses.

Speculative Position Limits May Alter Trading Decisions for Each Series

The CFTC has established limits on the maximum net long or net short positions which any person may hold or control in certain futures contracts. Exchanges also have established such limits. In November 2011, the CFTC adopted a new position limits regime for 28 so-called “exempt” (i.e. metals and energy) and agricultural futures and options contracts and their economically equivalent swap contracts. These position limits are not yet effective and there is considerable uncertainty surrounding their application. All accounts controlled by Superfund Capital Management, including the account of each Series, are combined for speculative position limit purposes. If positions in those accounts were to approach the level of the particular speculative position limit, such limits could cause a modification of Superfund Capital Management’s trading decisions for each Series or force liquidation of certain futures positions, possibly resulting in losses.

Increase in Assets Under Management May Affect Trading Decisions

The more assets Superfund Capital Management manages, the more difficult it may be for Superfund Capital Management to trade profitably because of the difficulty of trading larger positions without adversely affecting prices and performance. Accordingly, such increases in equity under management may require Superfund Capital Management to modify its trading decisions for each Series which could have a detrimental effect on your investment.

Each Series’ Trading is Not Transparent

Superfund Capital Management makes each Series’ trading decisions. While Superfund Capital Management receives daily trade confirmations from the clearing brokers, only a Series’ net trading results are reported to Limited Partners and only on a monthly basis. Accordingly, an investment in each Series does not offer Limited Partners the same transparency, i.e., an ability to review all investment positions daily, that a personal trading account offers.

Investors are Taxed Based on Their Share of Profits in Each Series

Investors are taxed each year on their share of each Series’ profits, if any, irrespective of whether they redeem any Units or receive any cash distributions from each Series. All performance information included in this Prospectus is presented on a pre-tax basis; investors who experience such performance may have to redeem Units or pay the related taxes from other sources.

Tax Could Be Due From Investors on Their Share of Each Series’ Ordinary Income Despite Overall Losses

Investors may be required to pay tax on their allocable share of each Series’ ordinary income, which in the case of each Series is each Series’ interest income and gain on some foreign futures contracts, even though each Series incurs overall losses. Capital losses can be used only to offset capital gains and up to $3,000 of ordinary income each year for non-corporate investors. Consequently, if a non-corporate investor were allocated $5,000 of ordinary income and $10,000 of capital losses, the investor would owe tax on $2,000 of ordinary income even though the investor would have a $5,000 loss for the year. The $7,000 capital loss carry forward could be used in subsequent years to offset capital gain and ordinary income, but subject to the same annual limitation on its deductibility against ordinary income.

15

Deductibility of Management and Performance Fees

Although each Series treats the management fees and performance fees paid and other expenses of such Series as ordinary and necessary business expenses, upon audit each Series may be required to treat such fees as “investment advisory fees” if each Series’ trading activities were determined to not constitute a trade or business for tax purposes. If the expenses were determined to be investment advisory fees, a Limited Partner’s tax liability would likely increase. In addition, upon audit, a portion of the management and performance fees might be treated as a non-deductible syndication cost or might be treated as a reduction in each Series’ capital gain or as an increase in each Series’ capital loss. If the management and performance fees were so treated, a Limited Partner’s tax liability would likely increase.

Accounting for Uncertainty in Income Taxes May Have Effects on the Periodic Calculations of Net Asset Value

Accounting Standards Codification Topic No. 740, “Income Taxes” (in part formerly known as “FIN 48”) (“ASC 740”), provides guidance on the recognition of uncertain tax positions. ASC 740 prescribes the minimum recognition threshold that a tax position is required to meet before being recognized in an entity’s financial statements. It also provides guidance on recognition, measurement, classification and interest and penalties with respect to tax positions. A prospective investor should be aware that, among other things, ASC 740 could have a material adverse effect on the periodic calculations of the Net Asset Value of the Fund, including reducing the Net Asset Value of the Fund to reflect reserves for income taxes, such as foreign withholding taxes, that may be payable by the Fund. This could cause benefits or detriments to certain investors, depending upon the timing of their entry and exit from the Fund.

Fees and Commissions are Charged Regardless of Profitability

Each Series is subject to substantial charges payable irrespective of profitability in addition to performance fees which are payable based on each Series’ profitability. Included in these charges are management, Ongoing offering, and brokerage fees and operating expenses. On each Series’ forward and swap trading, “bid-ask” spreads are incorporated into the pricing of each Series’ forward and swap contracts by the counterparties in addition to the brokerage fees paid by each Series. It is not possible to quantify the “bid-ask” spreads paid by each Series because each Series cannot determine the profit its counterparty is making on its forward and swap transactions. Such spreads can at times represent significant profits to the counterparty.

Failure of Brokerage Firms; Disciplinary History of Clearing Brokers

The Commodity Exchange Act requires a clearing broker to segregate all funds received from customers from such broker’s proprietary assets. If any of the clearing brokers fails to do so, the assets of each Series might not be fully protected in the event of the bankruptcy of the clearing broker. Furthermore, in the event of a clearing broker’s bankruptcy, each Series could be limited to recovering only a pro rata share, which may be zero, of all available funds segregated on behalf of any such clearing broker’s combined customer accounts, even though certain property specifically traceable to each Series (for example, Treasury Bills deposited by each Series with the clearing broker as margin) was held by the clearing broker. The clearing brokers have been the subject of certain regulatory and private causes of action in the past and may be again in the future. Such actions could affect the ability of a clearing firm to conduct its business. See “The Clearing Brokers.” Furthermore, dealers in forward and swap contracts are not currently regulated by the Commodity Exchange Act and are not currently obligated to segregate customer assets. As a result, you do not have such basic protections in forward and swap contracts.

16

Investors Must Not Rely on Past Performance of the Series or Superfund Capital Management in Deciding Whether to Buy Units

The future performance of each Series is not predictable, and no assurance can be given that each Series will perform successfully in the future. Past performance of a trading program is not necessarily indicative of future results.

MF Global Exposure; Could Result in Additional Losses

On October 31, 2011, MF Global Inc. (“MF Global”) one of the Fund’s clearing brokers at the time, reported to the Securities and Exchange Commission (“SEC”) and CFTC possible deficiencies in customer segregated accounts held at the firm. As a result, the SEC and CFTC determined that a liquidation led by SIPC would be the safest and most prudent course of action to protect customer accounts and assets, and SIPC initiated the liquidation of MF Global under the Securities Investor Protection Act.

The Fund held assets on deposit in accounts at MF Global as of October 31, 2011, the date that the liquidation proceedings commenced with respect to MF Global. As a result of such liquidation proceedings, customer accounts at MF Global were, and continue to be as of the date hereof, frozen, at least in part, including accounts belonging to the Fund. On November 2, 2011, the CFTC reported an estimated 11.6% shortfall in the customer segregated funds account of MF Global. On November 21, 2011, the SIPC liquidation Trustee announced that the shortfall in the customer segregated funds account could be as much as 22% or more. After consideration of the Fund’s exposure, Superfund Capital Management caused the Fund to take a reserve to account for the Fund’s estimated exposure to such 22% shortfall as of October 31, 2011. The foregoing reserve was based upon information available at the time such reserve was taken and is in accordance with generally accepted accounting principles, although there can be no assurance that any actual shortfall will not be greater than Superfund Capital Management’s estimate (or that customer funds will not be located reducing the estimated shortfall). As additional information becomes available, additional reserves may be taken or prior reserves reversed, which will be accounted for in accordance with generally accepted accounting principles as of the time that such information is then available (and not as of the date that the liquidation proceedings commenced with respect to MF Global). As a result, all Limited Partners will participate in any future reserves taken (resulting in decreases in each Series’ net asset value) or any reversal of prior reserves (resulting in increases in each Series’ net asset value) to the extent that such Limited Partner holds Units at the time that such reserve is taken or reversed. Were the entirety of the Fund’s assets held at MF Global unrecoverable, the Series A Units would incur a further loss, based on Net Asset Value at February 29, 2012 of 3.09% and the Series B Units would experience a loss of 3.26%.

The Fund is subject to numerous actual and potential conflicts of interest, including: (1) Superfund Capital Management will not select any other trading advisor for the Fund even if doing so would be beneficial to the Fund; (2) the affiliation between Superfund Capital Management and Superfund Asset Management creates an incentive for Superfund Capital Management to trade more frequently than it otherwise might absent the affiliation; (3) the proprietary trading of Superfund Capital Management or its principals or of the Fund’s clearing brokers and their affiliates and personnel may increase competition for positions sought to be entered by the Fund making it more difficult for the Fund to enter positions at favorable prices; and (4) the compensation that the selling agents, including Superfund USA, receive gives them an incentive to promote the sale of Units as well as to discourage redemptions. See “Conflicts of Interest.”

Because Superfund Capital Management has not established any formal procedures for resolving conflicts of interest and because there is no independent control over how conflicts of interest are resolved, you will be dependent on the good faith of the parties with conflicts to resolve the conflicts equitably. Superfund Capital Management cannot assure that conflicts of interest will not result in losses for the Fund.

Lack of Independent Experts Representing Investors

Superfund Capital Management has consulted with counsel, accountants and other experts regarding the formation and operation of each Series. No counsel has been appointed to represent the Limited Partners in connection with the offering of the Units. Accordingly, each prospective investor should consult his own legal, tax and financial advisers regarding the desirability of an investment in each Series.

17

Reliance on Superfund Capital Management

Each Series is structured as a single-advisor managed futures fund. Many managed futures funds are structured as multi-advisor funds to attempt to control risk and reduce volatility through combining advisors whose historical performance records have exhibited a significant degree of non-correlation with each other. As a single-advisor managed futures fund, the Series may have greater volatility and a higher risk of loss than investment vehicles employing multiple advisors, but may also have increased performance volatility and a higher risk of loss. Superfund Capital Management may retain additional trading advisors on behalf of each Series in the future.

The incapacity of one or more of Superfund Capital Management’s principals could have a material and adverse effect on its ability to discharge its obligations under the Partnership Agreement. Additionally, Superfund Capital Management may withdraw as general partner with respect to a Series, or the Fund as a whole, upon 120 days’ notice, which would cause such Series, or the Fund, to terminate unless a substitute general partner was obtained. Neither Superfund Capital Management nor its principals are under any obligation to devote a minimum amount of time to the operation of the Fund.

Possibility of Termination of Each Series Before Expiration of its Stated Term

As general partner, Superfund Capital Management may withdraw from each Series upon 120 days’ notice, which would cause each Series to terminate unless a substitute general partner were obtained. Other events, such as a long-term substantial loss suffered by each Series, could also cause each Series to terminate before the expiration of its stated term. This could cause you to liquidate your investments and upset the overall maturity and timing of your investment portfolio. If the registrations with the CFTC or memberships in the NFA of Superfund Capital Management or the clearing brokers were revoked or suspended, such entity would no longer be able to provide services to each Series.

Each Series is Not a Regulated Investment Company

Although Superfund Capital Management is subject to regulation by the CFTC, each Series is not an investment company subject to the Investment Company Act of 1940. Accordingly, you do not have the protections afforded by that statute which, for example, require investment companies to have a majority of disinterested directors and regulate the relationship between the adviser and the investment company.

A Bankruptcy Court Could Find the Assets of One Series to be Available to Offset the Liabilities of the Other Series

The Fund is organized as a series limited partnership pursuant to Section 17-218 (“Section 17-218”) of the Delaware Revised Uniform Limited Partnership Act (the “Act”), with separate series of limited partnership interests and assets. Section 17-218 provides that, if certain conditions (as set forth in Section 17-218) are met, the debts, liabilities, obligations and expenses incurred, contracted for or otherwise existing with respect to a particular series will be enforceable only against the assets of such series and not against the assets of the limited partnership generally or any other series. Accordingly, the assets of one Series of the Fund include only those funds and other assets that are paid to, held by or distributed to the Fund on account of and for the benefit of that Series, including, without limitation, funds delivered to the Fund for the purchase of Units in that Series. However, the limitations on inter-series liability provided by Section 17-218 have never been tested in court. Thus there is a risk that a court, and in particular, a Bankruptcy Court, could determine that the assets of one Series should be applied to meet the liabilities of the other Series or the liabilities of the Fund generally where the assets of such other Series or of the Fund generally are insufficient to meet its liabilities.

18

Proposed Regulatory Change is Impossible to Predict

The futures markets are subject to comprehensive statutes, regulations and margin requirements. In addition, the CFTC and the exchanges are authorized to take extraordinary actions in the event of a market emergency, including, for example, the retroactive implementation of speculative position limits or higher margin requirements, the establishment of daily price limits and the suspension of trading. The regulation of futures and forward transactions in the United States is a rapidly changing area of law and is subject to modification by government and judicial action. In addition, various national governments have expressed concern regarding the disruptive effects of speculative trading in the currency markets and the need to regulate the “derivatives” markets in general. The effect of any future regulatory change on each Series is impossible to predict, but could be substantial and adverse.

Forwards, Swaps, Hybrids and Other Derivatives are Subject to Varying CFTC Regulation

Each Series may trade foreign exchange contracts in the interbank market. In addition to swaps, each Series may also trade hybrid instruments and other off-exchange contracts. Swap agreements involve trading income streams such as fixed rate for floating rate interest. Hybrids are instruments which combine features of a security with those of a futures contract. Currently, there is no exchange and there is a limited usage of clearinghouses for these contracts and traders must rely on the creditworthiness of the counterparty to fulfill the obligations of the transaction.

The Reform Act includes provisions that comprehensively regulate the over-the-counter derivatives markets for the first time. The Reform Act mandates a substantial portion of over-the-counter derivatives to be executed in regulated markets and submitted for clearing to regulated clearinghouses. The mandates imposed by the Reform Act may result in the Fund bearing higher upfront and mark-to-market margin, less favorable trade pricing, and the possible imposition of new or increased fees.

Options on Futures are Speculative and Highly Leveraged

In the future, options on futures contracts may be used by each Series to generate premium income or capital gains. Futures options involve risks similar to futures in that options are speculative and highly leveraged. The buyer of an option risks losing the entire purchase price (the premium) of the option. The writer (seller) of an option risks losing the difference between the premium received for the option and the price of the commodity or futures contract underlying the option which the writer must purchase or deliver upon exercise of the option (which losses can be unlimited). Specific market movements of the commodities or futures contracts underlying an option cannot accurately be predicted.

Each Series may commit up to 60% of its assets as margin for positions held by the clearing brokers. Because such commitment typically represents only a small percentage of the total value of such positions, adverse price movements can cause losses in excess of such commitment and potentially in excess of the total assets of a Series.

A Computer System’s Failure Could Result in Losses or Delays in Reporting

Superfund Capital Management’s strategies are dependent to a significant degree on the proper functioning of its internal computer systems. Accordingly, systems failures, whether due to third-party failures upon which such systems are dependent or the failure of Superfund Capital Management’s hardware or software, could disrupt trading or make trading impossible until such failure is remedied. Such failures may result from events including “acts of God” and domestic or international terrorism. Any such failure, and consequential inability to trade (even for a short time), could, in certain market conditions, cause the Fund to experience significant trading losses or to miss opportunities for profitable trading. Lastly, any such failures could cause a temporary delay in reports to investors.

19

Superfund Capital Management is the general partner and commodity trading advisor of each Series. It is a Grenada corporation with offices located at Superfund Office Building, P.O. Box 1479, Grand Anse, St. George’s, Grenada West Indies, and its telephone number is (473) 439-2418. The firm’s books and records are maintained at this location and are available there for inspection. Its sole business is the trading and management of discretionary futures accounts, including commodity pools. It has been registered with the CFTC as a commodity pool operator since May 9, 2001, and has been a member of the NFA in that capacity since January 7, 2003. As of February 29, 2012, Superfund Capital Management and its affiliates had approximately $800 million in assets under management in the futures and forward markets. Christian Baha owns 100% of Superfund Capital Management and its affiliate, Superfund Fund Management, Inc.

The principals of Superfund Capital Management are Nigel James, Martin Schneider, Gizela Benedek, and Christian Baha. As discussed below, Mr. James is responsible for the firm’s trading decisions through the implementation of proprietary, computerized trading systems. The principals of Superfund Capital Management have not purchased and do not intend to purchase Units. Superfund Capital Management has agreed that its capital account as general partner of each Series at all times will equal at least 1% of the net aggregate capital contributions of all Limited Partners in each such Series. There have never been any material administrative, civil or criminal proceedings brought against Superfund Capital Management or its principals, whether pending, on appeal or concluded. The firm maintains any required past performance information for itself and its trading principals at the address shown above in this section.