UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D C 20549

Form 10-K

|

(Mark One) |

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2014 |

|

|

OR |

|

|

☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-31446

CIMAREX ENERGY CO.

(Exact name of registrant as specified in its charter)

|

Delaware |

45-0466694 |

1700 Lincoln Street, Suite 3700, Denver, Colorado 80203

(Address of principal executive offices including ZIP code)

(303) 295-3995

(Registrant’s telephone number)

Securities Registered Pursuant to Section 12(b) of the Act:

|

Title of Each Class |

Name of each exchange on which registered |

|

Common Stock ($0.01 par value) |

New York Stock Exchange |

Securities Registered Pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. YES ☒ NO ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. YES ☐ NO ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. YES ☒ NO ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). YES ☒ NO ☐

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of the registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. ☒

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer ☒ |

Accelerated filer ☐ |

Non-accelerated filer ☐ |

Smaller reporting company ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). YES ☐ NO ☒

Aggregate market value of the voting stock held by non-affiliates of Cimarex Energy Co. as of June 30, 2014 was approximately $12.3 billion.

Number of shares of Cimarex Energy Co. common stock outstanding as of February 13, 2015 was 87,597,134. Documents Incorporated by Reference: Portions of the Registrant’s Proxy Statement for its 2015 Annual Meeting of Stockholders are incorporated by reference into Part III of this Form 10-K.

DESCRIPTION

2

Bbl/d—Barrels (of oil or natural gas liquids) per day

Bbls—Barrels (of oil or natural gas liquids)

Bcf—Billion cubic feet

Bcfe—Billion cubic feet equivalent

Btu—British thermal unit

GAAP—Generally accepted accounting principles in the U.S.

MBbls—Thousand barrels

Mcf—Thousand cubic feet (of natural gas)

Mcfe—Thousand cubic feet equivalent

MMBbl/MMBbls—Million barrels

MMBtu—Million British Thermal units

MMcf—Million cubic feet

MMcf/d—Million cubic feet per day

MMcfe—Million cubic feet equivalent

MMcfe/d—Million cubic feet equivalent per day

Net Acres—Gross acreage multiplied by working interest percentage

Net Production—Gross production multiplied by net revenue interest

NGL or NGLs—Natural gas liquids

PUD—Proved undeveloped

Tcf—Trillion cubic feet

Tcfe—Trillion cubic feet equivalent

Energy equivalent is determined using the ratio of one barrel of crude oil, condensate or NGL to six Mcf of natural gas

3

Forward-Looking Statements

Throughout this Form 10-K, we make statements that may be deemed “forward-looking” statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. In particular, in our Management’s Discussion and Analysis of Financial Condition, we are providing “2015 Outlook,” which contains projections for certain 2015 operational activities. All statements, other than statements of historical facts, that address activities, events, outcomes and other matters that Cimarex plans, expects, intends, assumes, believes, budgets, predicts, forecasts, projects, estimates or anticipates (and other similar expressions) will, should or may occur in the future are forward-looking statements. These forward-looking statements are based on management’s current belief, based on currently available information, as to the outcome and timing of future events. When considering forward-looking statements, you should keep in mind the risk factors and other cautionary statements in this Form 10- K. Forward-looking statements include statements with respect to, among other things:

|

· |

Fluctuations in the price we receive for our oil and gas production; |

|

· |

Timing and amount of future production of oil and natural gas; |

|

· |

Reductions in the quantity of oil and gas sold due to decreased industrywide demand and/or curtailments in production from specific properties or areas due to mechanical, transportation, marketing, weather or other problems; |

|

· |

Reserve estimates; |

|

· |

Cash flow and anticipated liquidity; |

|

· |

Amount, nature and timing of capital expenditures; |

|

· |

Access to capital markets; |

|

· |

Legislation and regulatory changes; |

|

· |

Operating costs and other expenses; |

|

· |

Operating and capital expenditures that are either significantly higher or lower than anticipated because the actual cost of identified projects varied from original estimates and/or from the number of exploration and development opportunities being greater or fewer than currently anticipated; |

|

· |

Exploration and development opportunities that we pursue may not result in economic, productive oil and gas properties; |

|

· |

Drilling of wells; |

|

· |

Estimates of proved reserves, exploitation potential or exploration prospect size; |

|

· |

Increased financing costs due to a significant increase in interest rates; |

|

· |

De-risking of acreage. |

We caution you that these forward-looking statements are subject to all of the risks and uncertainties, many of which are beyond our control, incident to the exploration for and development, production and sale of oil and gas. These risks include, but are not limited to, commodity price volatility, inflation, lack of availability of goods and services,

4

environmental risks, drilling and other operating risks, regulatory changes, the uncertainty inherent in estimating proved oil and natural gas reserves and in projecting future rates of production and timing of development expenditures and other risks described herein.

Reserve engineering is a subjective process of estimating underground accumulations of oil and natural gas that cannot be measured in an exact way. The accuracy of any reserve estimate depends on the quality of available data and the interpretation of such data by our engineers. As a result, estimates made by different engineers often vary from one another. In addition, the results of drilling, testing and production activities may justify revisions of estimates that were made previously. If significant, such revisions could change the timing of future production and development drilling. Accordingly, reserve estimates are generally different from the quantities of oil and natural gas that are ultimately recovered.

Should one or more of the risks or uncertainties described above or elsewhere in this Form 10-K cause our underlying assumptions to be incorrect, our actual results and plans could differ materially from those expressed in any forward-looking statements.

All forward-looking statements, express or implied, included in this Form 10-K and attributable to Cimarex are qualified in their entirety by this cautionary statement. This cautionary statement should also be considered in connection with any subsequent written or oral forward-looking statements that Cimarex or persons acting on its behalf may issue. Cimarex does not undertake any obligation to update any forward-looking statements to reflect events or circumstances after the date of filing this Form 10-K with the Securities and Exchange Commission, except as required by law.

5

ITEMS 1 AND 2. BUSINESS AND PROPERTIES

General

Cimarex Energy Co., a Delaware corporation formed in 2002, is an independent oil and gas exploration and production company. Our operations are located mainly in Oklahoma, Texas and New Mexico. On our website -- www.cimarex.com -- you will find our annual reports, proxy statements and all of our Securities and Exchange Commission (SEC) filings.

Our principal business objective is to profitably grow proved reserves and production for the long-term benefit of our shareholders. Our strategy centers on maximizing cash flow from producing properties to reinvest in exploration and development opportunities. We consider merger and acquisition opportunities that enhance our competitive position and we occasionally divest of non-core assets. Key elements to our approach include:

|

· |

Maintaining a strong financial position |

|

· |

Investment in a diversified portfolio of drilling opportunities with varying geologic characteristics, in different geographic areas and with assorted exposure to oil, natural gas and NGLs |

|

· |

Detailed evaluation and ranking of investment decisions based on rate of return |

|

· |

Tracking predicted versus actual results in a centralized exploration management system, providing feedback to improve results |

|

· |

Attracting quality employees and maintaining integrated teams of geoscientists, landmen and engineers |

|

· |

Maximizing profitability by efficiently operating our properties |

Conservative use of leverage has long been the key to our financial strategy. We believe that low leverage mitigates financial risk, which enables us to withstand volatility in commodity prices and provide competitive returns to shareholders. Cimarex looks to enhance shareholder returns through quarterly dividends which have increased 100% over the last five years. In June 2014, Cimarex was added to the S&P 500. See Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer purchases of Equity Securities – Stock Performance Graph and Item. 6 Selected Financial Data for additional financial and operating information for fiscal years 2010-2014.

Proved Oil and Gas Reserves

In 2014, our total proved reserves grew 25% to 3.1 Tcfe. Proved undeveloped reserves as a percentage of total proved reserves increased to 23% from 20% a year ago. We added 814 Bcfe of new reserves through extensions and discoveries and had upward revisions of 105 Bcfe. Organic growth, as represented by our reserve replacement ratio (excluding reserve purchases and sales) was 2.9 times. The change in our proved reserves is as follows (in Bcfe):

|

Proved Reserves at December 31, 2013 |

2,497.0 | |

|

Revisions of previous estimates |

104.8 | |

|

Extensions and discoveries |

813.9 | |

|

Purchases of reserves |

133.6 | |

|

Production |

(317.0) | |

|

Sales of reserves |

(100.0) | |

|

Proved Reserves at December 31, 2014 |

3,132.3 |

6

A breakdown by commodity of our proved oil and gas reserves follows:

|

Years Ended December 31, |

|||||||||

|

2014 |

2013 |

2012 |

|||||||

|

Total Proved Reserves: |

|||||||||

|

Gas (Bcf) |

1,666.7 | 1,293.5 | 1,251.9 | ||||||

|

Oil (MMBbls) |

119.0 | 108.5 | 77.9 | ||||||

|

NGL (MMBbls) |

125.3 | 92.0 | 89.9 | ||||||

|

Equivalent (Bcfe) |

3,132.3 | 2,497.0 | 2,258.8 | ||||||

|

% Developed |

77 | 80 | 80 | ||||||

See “Supplemental Oil and Gas Information” in Item 8 of this report for further information.

Production volumes totaled 869 MMcfe of natural gas equivalent per day, a 25% increase over 2013. Production volumes are comprised of 49% natural gas, 30% oil and 21% NGLs. The following tables show our production volumes by region, the average commodity prices received and production cost per unit of production (Mcfe). Separate data also is included for our Cana-Woodford project, which is part of our Mid-Continent region and is part of our largest producing field.

|

Production Volumes |

Net Average Daily Volumes |

|||||||||||||||

|

Gas |

Oil |

NGL |

Equivalent |

Gas |

Oil |

NGL |

Equivalent |

|||||||||

|

Years Ended December 31, |

(MMcf) |

(MBbls) |

(MBbls) |

(MMcfe) |

(MMcf) |

(MBbls) |

(MBbls) |

(MMcfe) |

||||||||

|

2014 |

||||||||||||||||

|

Permian Basin |

45,200 | 12,552 | 4,187 | 145,636 | 123.8 | 34.4 | 11.5 | 399.0 | ||||||||

|

Mid-Continent |

106,711 | 2,682 | 6,980 | 164,682 | 292.4 | 7.3 | 19.1 | 451.2 | ||||||||

|

Other |

3,217 | 405 | 176 | 6,704 | 8.8 | 1.1 | 0.5 | 18.4 | ||||||||

|

Total Company |

155,128 | 15,639 | 11,343 | 317,022 | 425.0 | 42.8 | 31.1 | 868.6 | ||||||||

|

Cana-Woodford |

76,915 | 1,903 | 5,937 | 123,952 | 210.7 | 5.2 | 16.3 | 339.6 | ||||||||

|

2013 |

||||||||||||||||

|

Permian Basin |

35,414 | 10,739 | 2,823 | 116,783 | 97.0 | 29.4 | 7.7 | 320.0 | ||||||||

|

Mid-Continent |

84,779 | 2,171 | 4,757 | 126,345 | 232.3 | 5.9 | 13.0 | 346.1 | ||||||||

|

Other |

5,055 | 470 | 296 | 9,659 | 13.8 | 1.4 | 0.9 | 26.5 | ||||||||

|

Total Company |

125,248 | 13,380 | 7,876 | 252,787 | 343.1 | 36.7 | 21.6 | 692.6 | ||||||||

|

Cana-Woodford |

50,919 | 1,150 | 3,863 | 81,000 | 139.5 | 3.2 | 10.6 | 221.9 | ||||||||

|

2012 |

||||||||||||||||

|

Permian Basin |

29,135 | 8,750 | 2,480 | 96,517 | 79.6 | 23.9 | 6.8 | 263.7 | ||||||||

|

Mid-Continent |

80,998 | 2,210 | 3,962 | 118,029 | 221.3 | 6.1 | 10.8 | 322.5 | ||||||||

|

Other |

8,362 | 556 | 510 | 14,754 | 22.9 | 1.5 | 1.4 | 40.3 | ||||||||

|

Total Company |

118,495 | 11,516 | 6,952 | 229,300 | 323.8 | 31.5 | 19.0 | 626.5 | ||||||||

|

Cana-Woodford |

43,222 | 898 | 2,830 | 65,593 | 118.1 | 2.5 | 7.7 | 179.2 | ||||||||

7

|

Average Realized Price |

Production |

|||||||||||

|

Gas |

Oil |

NGL |

Cost |

|||||||||

|

Years Ended December 31, |

(per Mcf) |

(per Bbl) |

(per Bbl) |

(per Mcfe) |

||||||||

|

2014 |

||||||||||||

|

Permian Basin |

$ |

4.48 |

$ |

82.44 |

$ |

30.04 |

$ |

1.58 | ||||

|

Mid-Continent |

$ |

4.42 |

$ |

88.23 |

$ |

35.03 |

$ |

0.58 | ||||

|

Other |

$ |

4.40 |

$ |

92.82 |

$ |

32.09 |

$ |

2.31 | ||||

|

Total Company |

$ |

4.43 |

$ |

83.70 |

$ |

33.14 |

$ |

1.08 | ||||

|

Cana-Woodford |

$ |

4.32 |

$ |

88.21 |

$ |

34.89 |

$ |

0.24 | ||||

|

2013 |

||||||||||||

|

Permian Basin |

$ |

3.91 |

$ |

93.02 |

$ |

26.13 |

$ |

1.48 | ||||

|

Mid-Continent |

$ |

3.70 |

$ |

93.48 |

$ |

31.25 |

$ |

0.76 | ||||

|

Other |

$ |

3.74 |

$ |

102.67 |

$ |

29.81 |

$ |

1.85 | ||||

|

Total Company |

$ |

3.76 |

$ |

93.44 |

$ |

29.36 |

$ |

1.13 | ||||

|

Cana-Woodford |

$ |

3.57 |

$ |

94.33 |

$ |

30.64 |

$ |

0.27 | ||||

|

2012 |

||||||||||||

|

Permian Basin |

$ |

2.93 |

$ |

87.93 |

$ |

30.78 |

$ |

1.50 | ||||

|

Mid-Continent |

$ |

2.86 |

$ |

90.41 |

$ |

29.91 |

$ |

0.77 | ||||

|

Other |

$ |

2.88 |

$ |

105.37 |

$ |

35.95 |

$ |

1.55 | ||||

|

Total Company |

$ |

2.88 |

$ |

89.25 |

$ |

30.66 |

$ |

1.13 | ||||

|

Cana-Woodford |

$ |

2.69 |

$ |

90.64 |

$ |

29.67 |

$ |

0.25 | ||||

Acquisitions and Divestitures

In 2014 we made property acquisitions totaling $250 million, including a $238 million acquisition of properties in our Cana-Woodford shale play where enhanced completion techniques along with new workover designs were used to increase returns. In addition, we sold interests in various non-core oil and gas properties for $446 million, including non-strategic, high-value acreage in Reagan County, Texas, for $242 million, and other producing properties in southwestern Kansas.

Exploration and Production Overview

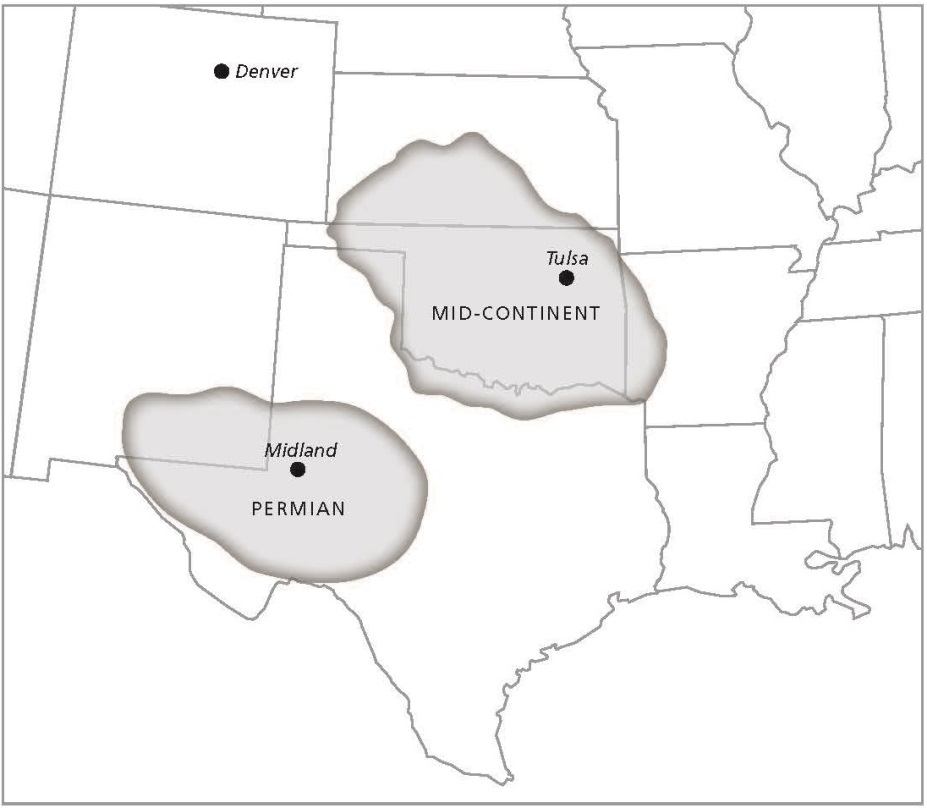

Cimarex has one reportable segment, exploration and production (E&P). Our E&P activities take place primarily in two areas: the Permian Basin and the Mid-Continent region. Almost all of our exploration and development (E&D)

8

capital is allocated between these two areas. In 2014, E&D investment totaled $1.88 billion. Of that, 73% was invested in the Permian Basin and 25% in the Mid-Continent region.

In 2014, Cimarex drilled or participated in 312 gross (174.6 net) wells, of which we operated 185 gross (144.5 net) wells. At year-end, we were in the process of drilling or participating in 8 gross (4.0 net) wells and there were 54 gross (31.9 net) wells waiting on completion. A summary of our 2014 exploration and development activity by region is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Gross |

|

Net |

|

% |

|

|

|

|

E&D |

|

Wells |

|

Wells |

|

Completed |

|

|

|

|

Capital |

|

Drilled |

|

Drilled |

|

As Producers |

|

|

|

|

(in millions) |

|

|

|

|

|

|

|

|

Permian Basin |

|

$ |

1,377 |

|

171 |

|

117 |

|

99 |

|

Mid-Continent |

|

|

463 |

|

139 |

|

57 |

|

100 |

|

Other |

|

|

41 |

|

2 |

|

1 |

|

50 |

|

|

|

$ |

1,881 |

|

312 |

|

175 |

|

99 |

The Permian region encompasses west Texas and southeast New Mexico. Cimarex’s Permian Basin efforts are located in the western half of the Permian Basin known as the Delaware Basin. In 2014, we focused on drilling horizontal wells that yielded oil and liquids-rich gas from the Wolfcamp shale, the Bone Spring formation, and the Avalon shale. Cimarex saw improved results in its Wolfcamp shale wells, as measured by production and reserves, with the implementation of long laterals and in the Bone Spring wells via upsized well completions.

The Permian region produced 399 MMcfe per day in 2014, which was 46% of our total company production. Because of strong oil prices in the first nine months, the Permian was our most active drilling region in 2014. Oil production in the Permian Basin in 2014 averaged a record 34,390 barrels per day, a 17% increase over 2013.

Our Mid-Continent region consists of Oklahoma and the Texas Panhandle. Our activity in 2014 in the Mid-Continent was focused in the Cana-Woodford shale in Oklahoma. Returns increased significantly in this play during 2014 as we implemented well completion techniques in this area that were highly successful in our Delaware Basin Wolfcamp

9

Shale wells in 2013. These improved results, combined with a favorable average product price mix, led to the Mid-Continent region posting the company’s strongest returns in 2014. Cimarex also had success in a new zone, the Meramec, which sits above the Woodford Shale. Cimarex is working to delineate the size and potential of the Meramec play.

The Mid-Continent region is our largest producing area. During 2014, production averaged 451.2 MMcfe per day, or 52% of total company production. Production from the region increased 30% in 2014 versus 2013. New completion designs and improved workover technology both contributed to higher production from the region.

Wells Drilled

We drilled the following exploratory and developmental wells in 2014:

|

Wells Drilled |

||||||||||||

|

2014 |

2013 |

2012 |

||||||||||

|

Gross |

Net |

Gross |

Net |

Gross |

Net |

|||||||

|

Exploratory |

||||||||||||

|

Productive |

1 | 0.4 | 1 | 1.0 | 8 | 6.3 | ||||||

|

Dry |

1 | 0.5 | 3 | 2.4 | 5 | 2.6 | ||||||

|

Total |

2 | 0.9 | 4 | 3.4 | 13 | 8.9 | ||||||

|

Developmental |

||||||||||||

|

Productive |

309 | 173.6 | 359 | 181.0 | 328 | 177.0 | ||||||

|

Dry |

1 | 0.1 | 2 | 1.0 | 11 | 6.1 | ||||||

|

Total |

310 | 173.7 | 361 | 182.0 | 339 | 183.1 | ||||||

We have working interests in the following productive wells by region as of December 31, 2014:

|

Gas |

Oil |

|||||||

|

Gross |

Net |

Gross |

Net |

|||||

|

Mid-Continent |

3,757 | 1,447 | 490 | 166 | ||||

|

Permian Basin |

1,002 | 511 | 4,968 | 991 | ||||

|

Other |

295 | 86 | 108 | 39 | ||||

| 5,054 | 2,044 | 5,566 | 1,196 | |||||

Significant Properties

All of our oil and gas assets (proved reserves and undeveloped acreage) are located in the United States. We have varying levels of ownership interests in our properties consisting of working, royalty and overriding royalty interests. We operate the wells that comprise 74% of our proved reserves. In 2014, proved reserves in the Watonga-Chickasha field were approximately 54% of the company’s total proved reserves. The Cana-Woodford shale makes up the majority of this field. No other field had reserves in excess of 15% of our total proved reserves.

10

At December 31, 2014, 63% of our total proved reserves were located in the Mid-Continent region and 36% were in the Permian Basin. We owned an interest in 10,620 gross (3,240 net) productive oil and gas wells. The following table summarizes our estimated proved oil and gas reserves by region as of December 31, 2014.

|

% of |

||||||||||

|

Gas |

Oil |

NGL |

Equivalent |

Total Proved |

||||||

|

(Bcf) |

(MMBbl) |

(MMBbl) |

(Bcfe) |

Reserves |

||||||

|

Mid-Continent |

1,280.2 | 27.8 | 89.6 | 1,984.7 | 63 | |||||

|

Permian Basin |

370.7 | 90.1 | 35.3 | 1,122.7 | 36 | |||||

|

Other |

15.8 | 1.1 | 0.4 | 24.9 | 1 | |||||

| 1,666.7 | 119.0 | 125.3 | 3,132.3 | 100 |

At December 31, 2014, our ten largest producing fields held 80% of total proved reserves. We are the principal operator of our production in each of these fields.

|

% of |

||||||||||

|

Total |

Average |

Approximate |

||||||||

|

Proved |

Working |

Average Depth |

||||||||

|

Field |

Region |

Reserves |

Interest % |

(feet) |

Primary Formation |

|||||

|

Watonga-Chickasha |

Mid-Continent |

54.0 |

46.4 |

13,000' |

Woodford |

|||||

|

Ford, West |

Permian Basin |

5.3 |

59.9 |

9,500' |

Wolfcamp |

|||||

|

Lusk |

Permian Basin |

5.0 |

55.4 |

9,500' |

Bone Spring |

|||||

|

Dixieland |

Permian Basin |

3.1 |

98.3 |

11,000' |

Wolfcamp |

|||||

|

Two Georges |

Permian Basin |

2.5 |

92.7 |

11,500' |

Bone Spring |

|||||

|

Cottonwood Draw |

Permian Basin |

2.4 |

72.5 |

3,000'-10,000' |

Delaware/Wolfcamp |

|||||

|

Red Hills |

Permian Basin |

2.4 |

64.3 |

8,800' |

Bone Spring/Wolfcamp |

|||||

|

Phantom |

Permian Basin |

2.3 |

58.9 |

11,500' |

Bone Spring |

|||||

|

Sandbar |

Permian Basin |

1.9 |

58.1 |

7,500' |

Bone Spring |

|||||

|

Benson |

Permian Basin |

1.1 |

83.8 |

9,500' |

Bone Spring |

|||||

|

79.9 |

11

Acreage

The following table sets forth the gross and net acres of both developed and undeveloped leases held by Cimarex as of December 31, 2014. Gross acres are the total number of acres in which we own a working interest. Net acres are the gross acres multiplied by our working interest.

|

Acreage |

||||||||||||

|

Undeveloped |

Developed |

Total |

||||||||||

|

Gross |

Net |

Gross |

Net |

Gross |

Net |

|||||||

|

Mid-Continent |

||||||||||||

|

Kansas |

18,231 | 18,191 |

— |

— |

18,231 | 18,191 | ||||||

|

Oklahoma |

103,907 | 80,314 | 700,703 | 290,550 | 804,610 | 370,864 | ||||||

|

Texas |

28,577 | 18,314 | 134,207 | 58,148 | 162,784 | 76,462 | ||||||

| 150,715 | 116,819 | 834,910 | 348,698 | 985,625 | 465,517 | |||||||

|

Permian Basin |

||||||||||||

|

New Mexico |

83,091 | 58,017 | 198,185 | 138,291 | 281,276 | 196,308 | ||||||

|

Texas |

149,724 | 125,275 | 186,686 | 138,684 | 336,410 | 263,959 | ||||||

| 232,815 | 183,292 | 384,871 | 276,975 | 617,686 | 460,267 | |||||||

|

Other |

||||||||||||

|

Arizona |

2,098,481 | 2,098,481 | 17,207 |

— |

2,115,688 | 2,098,481 | ||||||

|

California |

380,782 | 380,782 |

— |

— |

380,782 | 380,782 | ||||||

|

Colorado |

67,892 | 44,408 | 36,414 | 2,127 | 104,306 | 46,535 | ||||||

|

Gulf of Mexico |

25,000 | 13,000 | 58,388 | 13,443 | 83,388 | 26,443 | ||||||

|

Louisiana |

5,362 | 1,601 | 11,842 | 3,040 | 17,204 | 4,641 | ||||||

|

Michigan |

31,794 | 31,716 | 1,183 | 1,183 | 32,977 | 32,899 | ||||||

|

Montana |

35,258 | 10,379 | 8,248 | 1,875 | 43,506 | 12,254 | ||||||

|

Nevada |

1,196,299 | 1,196,299 | 440 | 1 | 1,196,739 | 1,196,300 | ||||||

|

New Mexico |

1,635,750 | 1,629,343 | 18,412 | 2,578 | 1,654,162 | 1,631,921 | ||||||

|

Texas |

36,464 | 11,976 | 96,729 | 36,137 | 133,193 | 48,113 | ||||||

|

Utah |

86,068 | 59,433 | 26,211 | 1,575 | 112,279 | 61,008 | ||||||

|

Wyoming |

98,801 | 13,865 | 43,118 | 4,796 | 141,919 | 18,661 | ||||||

|

Other |

161,978 | 146,193 | 9,512 | 3,486 | 171,490 | 149,679 | ||||||

| 5,859,929 | 5,637,476 | 327,704 | 70,241 | 6,187,633 | 5,707,717 | |||||||

|

Total |

6,243,459 | 5,937,587 | 1,547,485 | 695,914 | 7,790,944 | 6,633,501 | ||||||

The table below summarizes by year and region our undeveloped acreage expirations in the next five years. In most cases, the drilling of a commercial well will hold the acreage beyond the expiration.

|

Acreage |

|||||||||||||||||||

|

2015 |

2016 |

2017 |

2018 |

2019 |

|||||||||||||||

|

Gross |

Net |

Gross |

Net |

Gross |

Net |

Gross |

Net |

Gross |

Net |

||||||||||

|

Mid-Continent |

10,174 | 9,865 | 22,293 | 20,600 | 15,859 | 15,859 | 325 | 325 |

— |

— |

|||||||||

|

Permian Basin |

27,976 | 25,659 | 43,196 | 42,711 | 11,066 | 11,051 | 19,297 | 18,309 | 3,983 | 3,983 | |||||||||

|

Other |

20,754 | 20,754 | 200,352 | 200,175 | 52,641 | 52,641 | 31,412 | 31,412 | 67,448 | 67,448 | |||||||||

| 58,904 | 56,278 | 265,841 | 263,486 | 79,566 | 79,551 | 51,034 | 50,046 | 71,431 | 71,431 | ||||||||||

|

% of undeveloped |

0.9 | 0.9 | 4.3 | 4.4 | 1.3 | 1.3 | 0.8 | 0.8 | 1.1 | 1.2 | |||||||||

12

Marketing

Our oil and gas production is sold under short-term arrangements at market-responsive prices. We sell our oil at prices tied directly or indirectly to field postings. Our gas is sold under price mechanisms related to either monthly or daily index prices on pipelines where we deliver our gas.

We sell our oil and gas to a broad portfolio of customers. Our major customers during 2014 were Enterprise Products Partners L.P. (Enterprise), Sunoco Logistics Partners L.P. (Sunoco) and Oneok Partners, L.P. (Oneok). Enterprise and Sunoco each accounted for 19% of our consolidated revenues in 2014. Oneok accounted for 10% of our 2014 consolidated revenues.

Enterprise is a significant oil purchaser in Oklahoma and West Texas. Sunoco is a significant purchaser of our oil in Southeast New Mexico and Canadian County, Oklahoma. If either of these entities were to stop purchasing our production, we believe there are a number of other purchasers to whom we could sell our production with some delay. If both parties were to discontinue purchasing our product, there would be challenges initially, but ample markets to handle the disruption.

Oneok primarily purchases our NGLs and provides gathering, compression and processing services for the majority of our Mid-Continent region gas production. In the event Oneok ceased buying our NGLs, a minimal impact would occur as these products are piped to various processing and storage market areas where we could sell to a different purchaser. In the event Oneok ceased gathering, compressing, and processing our gas, there would be challenges initially, but several other entities exist to fill in the gap.

We regularly monitor the credit worthiness of all our customers and may require parent company guarantees, letters of credit or prepayments when deemed necessary.

Corporate Headquarters and Employees

Our corporate headquarters is located at 1700 Lincoln St., Suite 3700, Denver, Colorado 80203. On December 31, 2014, and 2013, Cimarex had 991 and 908 employees, respectively. None of our employees are subject to collective bargaining agreements.

Competition

The oil and gas industry is highly competitive, particularly for prospective undeveloped leases and purchases of proved reserves. There is also competition for rigs and related equipment used to drill for and produce oil and gas. Our competitive position is also highly dependent on our ability to recruit and retain geological, geophysical and engineering expertise. We compete for prospects, proved reserves, oil-field services and qualified oil and gas professionals with major and diversified energy companies and other independent operators that have larger financial, human and technological resources than we do.

We compete with integrated, independent and other energy companies for the sale and transportation of our oil and gas to marketing companies and end users. The oil and gas industry competes with other energy industries that supply fuel and power to industrial, commercial and residential consumers. Many of these competitors have greater financial and human resources. The effect of these competitive factors cannot be predicted.

Proved Reserves Estimation Procedures

Proved oil and gas reserve quantities are based on estimates prepared by Cimarex in accordance with the SEC’s rules for reporting oil and gas reserves. Our reserve definitions conform with definitions of Rules 4-10(a) (1)-(32) of Regulation S-X of the SEC. All of our reserve estimates are maintained by our internal Corporate Reservoir Engineering group, which is comprised of reservoir engineers and engineering technicians. The objectives and management of this group are separate from and independent of the exploration and production functions of the company. The primary objective of our Corporate Reservoir Engineering group is to maintain accurate forecasts on all properties of the company

13

through ongoing monitoring and timely updates of operating and economic parameters (production forecasts, prices and regional differentials, operating expenses, ownership, etc.) in accordance with guidelines established by the SEC. This separation of function and responsibility is a key internal control.

Cimarex engineers are responsible for estimates of proved reserves. Corporate engineers interact with the exploration and production departments to ensure all available engineering and geologic data is taken into account prior to establishing or revising an estimate. After preparing the reserves update, the corporate engineers review their recommendations with the Vice President of Corporate Engineering. After approval from the Vice President of Corporate Engineering, the revisions are entered into our reserves database by the engineering technician.

During the course of the year, the Vice President of Corporate Engineering presents summary reserves information to senior management and to our Board of Directors for their review. From time to time, the Vice President of Corporate Engineering also will confer with the Vice President of Exploration, Chief Operating Officer and the Chief Executive Officer regarding specific reserves-related issues. In addition, Corporate Reservoir Engineering maintains a set of basic guidelines and procedures to ensure that critical checks and reviews of the reserves database are performed on a regular basis.

Together, these internal controls are designed to promote a comprehensive, objective and accurate reserves estimation process. As an additional confirmation of the reasonableness of our internal estimates, DeGolyer and MacNaughton, an independent petroleum engineering consulting firm, reviewed greater than 80% of the total future net revenue discounted at 10% attributable to the total interests owned by Cimarex as of December 31, 2014. The individual primarily responsible for overseeing the review is a Senior Vice President with DeGolyer and MacNaughton and a Registered Professional Engineer in the State of Texas with over 40 years of experience in oil and gas reservoir studies and evaluations.

The technical employee primarily responsible for overseeing the oil and gas reserves estimation process is Cimarex’s Vice President of Corporate Engineering. This individual graduated from the Colorado School of Mines with a Bachelor of Science degree in Engineering and has more than 20 years of practical experience in oil and gas reservoir evaluation. He has been directly involved in the annual reserves reporting process of Cimarex since 2002 and has served in his current role for the past ten years.

Title to Oil and Gas Properties

We undertake title examination and perform curative work at the time we lease undeveloped acreage, prepare for the drilling of a prospect or acquire proved properties. We believe title to our properties is good and defensible, and is in accordance with industry standards. Nevertheless, we are involved in title disputes from time to time that result in litigation. Our oil and gas properties are subject to customary royalty interests, liens incidental to operating agreements, tax liens and other burdens and minor encumbrances, easements and restrictions.

Government Regulation

Oil and gas production and transportation is subject to extensive federal, state and local laws and regulations. Compliance with existing laws often is difficult and costly, but has not had a significant adverse effect on our operations or financial condition. In recent years, we have been most directly impacted by federal and state environmental regulations and energy conservation rules. We are also impacted by federal and state regulation of pipelines and other oil and gas transportation systems.

The states in which we conduct operations establish requirements for drilling permits, the method of developing fields, the size of well spacing units, drilling density within productive formations and the unitization or pooling of properties. In addition, state conservation laws include requirements for waste prevention, establish limits on the maximum rate of production from wells, generally prohibit the venting or flaring of natural gas and impose certain requirements regarding the ratability of production.

14

Environmental Regulation. Various federal, state and local laws regulating the discharge of materials into the environment, or otherwise relating to the protection of the environment, directly impact oil and gas exploration, development and production operations, which consequently impact our operations and costs. These laws and regulations govern, among other things, emissions to the atmosphere, discharges of pollutants into waters, underground injection of waste water, the generation, storage, transportation and disposal of waste materials, and protection of public health, natural resources and wildlife. These laws and regulations may impose substantial liabilities for noncompliance and for any contamination resulting from our operations and may require the suspension or cessation of operations in affected areas.

Cimarex is committed to environmental protection and believes we are in material compliance with applicable environmental laws and regulations. We obtain permits for our facilities and operations in accordance with the applicable laws and regulations. There are no known issues that have a significant adverse effect on the permitting process or permit compliance status of any of our facilities or operations. Expenditures are required to comply with environmental regulations. These costs are a normal, recurring expense of operations and not an extraordinary cost of compliance with government regulations.

We do not anticipate that we will be required under current environmental laws and regulations to expend amounts that will have a material adverse effect on our financial position or operations. However, due to continuing changes in these laws and regulations, we are unable to predict with any reasonable degree of certainty any potential delays in development plans that could arise, or our future costs of complying with these governmental requirements. We maintain levels of insurance customary in the industry to limit our financial exposure in the event of a substantial environmental claim resulting from sudden, unanticipated and accidental discharges of oil, produced water or other substances as well as additional coverage for certain other pollution events.

Gas Gathering and Transportation. The Federal Energy Regulatory Commission (FERC) requires interstate gas pipelines to provide open access transportation. FERC also enforces the prohibition of market manipulation by any entity, and the facilitation of the sale or transportation of natural gas in interstate commerce. Interstate pipelines have implemented these requirements, providing us with additional market access and more fairly applied transportation services and rates. FERC continues to review and modify its open access and other regulations applicable to interstate pipelines.

Under the Natural Gas Policy Act (NGPA), natural gas gathering facilities are expressly exempt from FERC jurisdiction. What constitutes “gathering” under the NGPA has evolved through FERC decisions and judicial review of such decisions. We believe that our gathering systems meet the test for non-jurisdictional “gathering” systems under the NGPA and that our facilities are not subject to federal regulations. Although exempt from FERC oversight, our natural gas gathering systems and services may receive regulatory scrutiny by state and federal agencies regarding the safety and operating aspects of the transportation and storage activities of these facilities.

In addition to using our own gathering facilities, we may use third-party gathering services or interstate transmission facilities (owned and operated by interstate pipelines) to ship our gas to markets.

Additional proposals and proceedings that might affect the oil and gas industry are pending before the U.S. Congress, FERC, Bureau of Land Management (BLM), state legislatures, state agencies, local governments and the courts. We cannot predict when or whether any such proposals may become effective and what effect they will have on our operations. We do not anticipate that compliance with existing federal, state and local laws, rules or regulations will have a material adverse effect upon our capital expenditures, earnings or competitive position.

Federal and State Income and Other Local Taxation

Cimarex and the petroleum industry in general are affected by both federal and state income tax laws, as well as other local tax regulations involving ad valorem, personal property, franchise, severance and other excise taxes. We have considered the effects of these provisions on our operations and do not anticipate that there will be any undisclosed impact on our capital expenditures, earnings or competitive position.

15

The following risks and uncertainties, together with other information set forth in this Form 10-K, should be carefully considered by current and future investors in our securities. These risks and uncertainties are not the only ones we face. Additional risks and uncertainties presently unknown to us or currently deemed immaterial also may impair our business operations. The occurrence of one or more of these risks or uncertainties could materially and adversely affect our business, our financial condition, and the results of our operations, which in turn could negatively impact the value of our securities.

Oil, gas, and NGL prices fluctuate due to a number of uncontrollable factors, creating a component of uncertainty in our development plans and overall operations. Declines in prices adversely affect our financial results and rate of growth in proved reserves and production.

Oil and gas markets are volatile. We cannot predict future prices. The prices we receive for our production heavily influence our revenue, profitability, access to capital, and future rate of growth. The prices we receive depend on numerous factors beyond our control. These factors include, but are not limited to, changes in domestic and global supply and demand for oil and gas, the level of domestic and global oil and gas exploration and production activity, geopolitical instability, the actions of the Organization of Petroleum Exporting Countries, weather conditions, technological advances affecting energy consumption, governmental regulations and taxes, and the price and technological advancement of alternative fuels.

Our proved oil and gas reserves and production volumes will decrease unless those reserves are replaced with new discoveries or acquisitions. Accordingly, for the foreseeable future, we expect to make substantial capital investments for the exploration and development of new oil and gas reserves. Historically, we have paid for these types of capital expenditures with cash flow provided by our production operations, our revolving credit facility, and proceeds from the sale of senior notes. Low prices reduce our cash flow and the amount of oil and gas that we can economically produce and may cause us to curtail, delay, or defer certain exploration and development projects. Moreover, low prices also may impact our abilities to borrow under our revolving credit facility and to raise additional debt or equity capital to fund acquisitions.

If prices stay at recent lower levels or decrease, we will be required to take write-downs of the carrying values of our oil and gas properties and/or our goodwill.

Accounting rules require that we periodically review the carrying value of our oil and gas properties and goodwill for possible impairment.

As of December 31, 2014, the calculated value of the ceiling limitation exceeded the carrying value of our oil and gas properties subject to a ceiling test and no impairment was necessary. However, a decline of 8% or more in the value of the ceiling limitation would have resulted in an impairment. If commodity prices stay at the current early 2015 levels or decline further, we will incur full cost ceiling impairments in future quarters. Because the ceiling calculation uses rolling 12-month average commodity prices, the effect of lower quarter-over-quarter prices in 2015 compared to 2014 is a lower ceiling value each quarter. This will result in ongoing impairments each quarter until prices stabilize or improve. Impairment charges would not affect cash flow from operating activities, but would adversely affect our net income and stockholders’ equity.

U.S. or global financial markets may impact our business and financial condition.

A credit crisis or other turmoil in the U.S. or global financial system may have a negative impact on our business and our financial condition. Our ability to access the capital markets may be restricted at a time when we would like, or need, to raise financing. This could have an impact on our flexibility to react to changing economic and business conditions. Deteriorating economic conditions could have a negative impact on our lenders, the purchasers of our oil and gas production and the working interest owners in properties we operate, causing them to fail to meet their obligations to us.

16

Failure to economically replace oil and gas reserves could negatively affect our financial results and future rate of growth.

In order to replace the reserves depleted by production and to maintain or increase our total proved reserves and overall production levels, we must either locate and develop new oil and gas reserves or acquire producing properties from others. This requires significant capital expenditures and can impose reinvestment risk for us, as we may not be able to continue to replace our reserves economically. While we occasionally may seek to acquire proved reserves, our main business strategy is to grow through exploration and drilling. Without successful exploration and development, our reserves, production and revenues could decline rapidly, which would negatively impact the results of our operations.

Exploration and development involves numerous risks, including new governmental regulations and the risk that we will not discover any commercially productive oil or gas reservoirs. Additionally, it can be unprofitable, not only from drilling dry holes, but also from drilling productive wells that do not return a profit because of insufficient reserves or declines in commodity prices.

Our drilling operations may be curtailed, delayed, or canceled for many reasons. Factors such as unforeseen poor drilling conditions, title problems, unexpected pressure irregularities, equipment failures, accidents, adverse weather conditions, compliance with environmental and other governmental requirements, bans, moratoria or other restrictions implemented by local governments and the cost of, or shortages or delays in the availability of, drilling and completion services could negatively impact our drilling operations.

Our proved reserve estimates may be inaccurate and future net cash flows are uncertain.

Estimates of total proved oil and gas reserves (consisting of proved developed and proved undeveloped reserves) and associated future net cash flow depend on a number of variables and assumptions. See “Forward-Looking Statement” in this report. Among others, changes in any of the following factors may cause actual results to vary considerably from our estimates:

|

· |

timing of development expenditures; |

|

· |

amount of required capital expenditures and associated economics; |

|

· |

recovery efficiencies, decline rates, drainage areas, and reservoir limits; |

|

· |

anticipated reservoir and production characteristics and interpretations of geologic and geophysical data; |

|

· |

production rates, reservoir pressure, unexpected water encroachment, and other subsurface conditions; |

|

· |

oil, gas, and NGL prices; |

|

· |

governmental regulation; |

|

· |

access to assets restricted by local government action; |

|

· |

operating costs; |

|

· |

property, severance, excise and other taxes incidental to oil and gas operations; |

|

· |

workover and remediation costs; and |

|

· |

federal and state income taxes. |

At December 31, 2014, 23% of our total proved reserves are categorized as proved undeveloped.

17

Our proved oil and gas reserve estimates are prepared by Cimarex engineers in accordance with guidelines established by the SEC. DeGolyer and MacNaughton, independent petroleum engineers, reviewed our reserve estimates for properties that comprised at least 80% of the discounted future net cash flows before income taxes, using a 10% discount rate, as of December 31, 2014.

The cash flow amounts referred to in this filing should not be construed as the current market value of our proved reserves. In accordance with SEC guidelines, the estimated discounted net cash flow from proved reserves is based on the average of the previous 12 months' first-day-of-the-month prices and costs as of the date of the estimate, whereas actual future prices and costs may be materially different.

Hedging transactions may limit our potential gains and involve other risks.

To limit our exposure to price risk, we enter into hedging agreements from time to time, and use commodity derivatives. During 2014, we had hedges covering 28% of our oil production and 32% of our gas production. We currently do not have any hedges in place for 2015 or later periods. Hedges limit volatility and increase the predictability of a portion of our cash flow. These transactions also limit our potential gains when oil and gas prices exceed the prices established by the hedges.

In certain circumstances, hedging transactions may expose us to the risk of financial loss, including instances in which:

|

· |

the counterparties to our hedging agreements fail to perform; |

|

· |

there is a sudden unexpected event that materially increases oil and natural gas prices; or |

|

· |

there is a widening of price basis differentials between delivery points for our production and the delivery point assumed in the hedge arrangement. |

Because we account for derivative contracts under mark-to-market accounting, during periods we have hedging transactions in place we expect continued volatility in derivative gains or losses on our income statement as changes occur in the relevant price indexes.

The adoption of derivatives legislation could have an adverse effect on our ability to use derivative instruments as hedges against fluctuating commodity prices.

In July 2010, the Dodd-Frank Act was enacted, representing an extensive overhaul of the framework for regulation of U.S. financial markets. The Dodd-Frank Act called for various regulatory agencies, including the SEC and the Commodities Futures Trading Commission (CFTC), to establish regulations for implementation of many of its provisions. The Dodd-Frank Act contains significant derivatives regulations, including requirements that certain transactions be cleared on exchanges and that cash collateral (margin) be posted for such transactions. The Dodd-Frank Act provides for an exemption from the clearing and cash collateral requirements for commercial end-users, such as Cimarex, and it includes a number of defined terms used in determining how this exemption applies to particular derivative transactions and the parties to those transactions.

We have satisfied the requirements for the end-user exception to the clearing requirement and intend to continue to engage in derivative transactions. However, the CFTC is still finalizing rules that will have an impact on our hedging counterparties and possibly end-users as well. The ultimate effect of these new rules and any additional regulations is currently uncertain. New rules and regulations in this area may result in significant increased costs and disclosure obligations as well as decreased liquidity as entities that previously served as hedge counterparties exit the market.

18

We have been an early entrant into new or emerging resource plays. As a result, our drilling results in these areas are uncertain. The value of our undeveloped acreage may decline and we may incur impairment charges if drilling results are unsuccessful.

New or emerging oil and gas resource plays have limited or no production history. Consequently, in those areas it is difficult to predict our future drilling costs and results. Therefore, our cost of drilling, completing and operating wells in these areas may be higher than initially expected. Similarly, our production may be lower than initially expected, and the value of our undeveloped acreage may decline if our results are unsuccessful. As a result, we may be required to write down the carrying value of our undeveloped acreage in new or emerging plays.

Furthermore, unless production is established during the primary term of certain of our undeveloped oil and gas leases, the leases will expire, and we will lose our right to develop those properties.

Our business depends on oil and gas pipeline and transportation facilities, some of which are owned by others.

In addition to the existence of adequate markets, our oil and natural gas production depends in large part on the proximity and capacity of pipeline systems, as well as storage, transportation, processing and fractionation facilities, most of which are owned by third parties. The lack of availability or the lack of capacity on these systems and facilities could result in the curtailment of production or the delay or discontinuance of drilling plans. This is more likely in remote areas without established infrastructure, such as our Culberson County, Texas area where we have significant development activities. The lack of availability or capacity in these facilities or the loss of the these facilities due to weather, fire or other reasons, for an extended period of time could negatively affect our revenues.

A limited number of companies purchase a majority of our oil, NGLs and natural gas. The loss of a significant purchaser could have a material adverse effect on our ability to sell production.

Federal and state regulation of oil and natural gas, local government activity, adverse court rulings, tax and energy policies, changes in supply and demand, pipeline pressures, damage to or destruction of pipelines and general economic conditions could adversely affect our ability to produce and market oil and natural gas.

Competition in our industry is intense and many of our competitors have greater financial and technological resources.

We operate in the competitive area of oil and gas exploration and production. Many of our competitors are large, well-established companies that have larger operating staffs and greater capital resources. These competitors may be willing to pay more for exploratory prospects and productive oil and gas properties. They may also be able to define, evaluate, bid for and purchase a greater number of properties and prospects than our financial or human resources permit.

Because our activity is also concentrated in areas of heavy industry competition, there is heightened demand for personnel, equipment, power, services, facilities and resources, resulting in higher costs than in other areas. Such intense competition also could result in delays in securing, or the inability to secure, the personnel, equipment, power, services, resources or facilities necessary for our development activities, which could negatively impact our production volumes. We also face higher costs in remote areas where vendors can charge higher rates due to that remoteness along with the inability to attract employees to those areas and the ability to deploy their resources in easier to access areas.

We may be subject to information technology system failures, network disruptions and breaches in data security.

Information system failures, network disruptions and breaches in data security could have a material adverse effect on our ability to conduct our business. We could experience system failures due to power or telecommunications failures, human error, natural disasters, fire, sabotage, hardware or software malfunction or defects, computer viruses, intentional acts of vandalism or terrorism and similar acts. Such system failures could result in the unanticipated disruption of our operations, the processing of transactions, the failure to meet regulatory standards and the reporting of our financial results. While management has taken steps to address these concerns by implementing network security and internal control measures, there can be no assurance that a system failure or data security breach will not have a material adverse effect on our financial condition and results of operations.

19

We are subject to complex laws and regulations that can adversely affect the cost, manner, and feasibility of doing business.

Exploration, production, and the sale of oil and gas are subject to extensive laws and regulations, including those implemented to protect the environment, human health and safety and wildlife. Federal, state, and local regulatory agencies frequently require permitting and impose conditions on our activities. During the permitting process, these regulatory agencies often exercise considerable discretion in both the timing and scope of the permits, and the public, including special interest groups, often has an opportunity to influence the timing and outcome of the process. The requirements or conditions imposed by these agencies can be costly and can delay the commencement of our operations.

Failing to comply with any of the applicable laws and regulations could result in the suspension or termination of our operations and subject us to administrative, civil and criminal liabilities and penalties. Such costs could have a material adverse effect on both our financial condition and operations.

Environmental matters and costs can be significant.

As an owner, lessee, or operator of oil and gas properties, we are subject to various complex, stringent and constantly evolving environmental laws and regulations. Our operations inherently create the risk of environmental liability to the government and private parties stemming from our use, generation, handling and disposal of water and waste materials, as well as the release of hydrocarbons or other substances into the air, soil, or water. The environmental laws and regulations to which we are subject impose numerous obligations applicable to our operations, including: the acquisition of a permit before conducting regulated activities associated with drilling for and producing oil and gas; the restriction of types, quantities, and concentration of materials that can be released into the environment; the limitation or prohibition of drilling activities on certain lands lying within wilderness, wetlands, and other protected areas; the application of specific health and safety criteria addressing worker protection; and the imposition of substantial liabilities for pollution resulting from our operations. Numerous governmental authorities, such as the U.S. Environmental Protection Agency (EPA) and analogous state agencies have the power to enforce compliance with these laws and regulations and the permits issued under them. Such enforcement actions often involve taking difficult and costly compliance measures or corrective actions. Failure to comply with these laws and regulations may result in the assessment of sanctions, including administrative, civil or criminal penalties, the imposition of investigatory or remedial obligations, and the issuance of orders limiting or prohibiting some or all of our operations. In addition, we may experience delays in obtaining or be unable to obtain required permits, which may delay or interrupt our operations and limit our growth and revenue.

Liabilities under certain environmental laws can be joint and several and may in some cases be imposed regardless of fault on our part such as where we own a working interest in a property operated by another party. We also could be held liable for damages or remediating lands or facilities previously owned or operated by others regardless of whether such contamination resulted from our own actions and regardless if we were in compliance with all applicable law at the time. Further, claims for damages to persons or property, including natural resources, may result from the environmental, health and safety impacts of our operations. Since these environmental risks generally are not fully insurable and can result in substantial costs, such liabilities could have a material adverse effect on both our financial condition and operations.

Our financial condition and results of operations may be materially adversely affected if we incur costs and liabilities due to a failure to comply with environmental regulations or a release of hazardous substances into the environment.

Our operations are subject to environmental laws and regulations relating to the management and release of hazardous substances, pollutants, solid and hazardous wastes and petroleum hydrocarbons. These laws generally regulate the generation, storage, treatment, discharge, transportation and disposal of pollutants and solid and hazardous waste and may impose strict and, in some cases, joint and several liability for the investigation and remediation of affected areas

20

where hazardous substances may have been released or disposed. The most significant of these environmental laws is as follows:

|

· |

The Comprehensive Environmental Response, Compensation, and Liability Act, as amended, referred to as CERCLA or the Superfund law, and comparable state laws, which imposes liability on generators, transporters and arrangers of hazardous substances at sites where hazardous substance releases have occurred or are threatening to occur; |

|

· |

The Oil Pollution Act of 1990 (OPA), under which owners and operators of onshore facilities and pipelines, lessees or permittees of an area in which an offshore facility is located, and owners and operators of vessels are liable for removal costs and damages that result from a discharge of oil into navigable waters of the United States; |

|

· |

The Resource Conservation and Recovery Act (RCRA), as amended, and comparable state statutes, which governs the treatment, storage and disposal of solid waste; |

|

· |

The Federal Water Pollution Control Act, as amended, also known as the Clean Water Act (CWA), which governs the discharge of pollutants, including natural gas wastes into federal and state waters; |

|

· |

The Safe Drinking Water Act (SDWA), which governs the disposal of wastewater in underground injection wells; and |

|

· |

The Clean Air Act (CAA) which governs the emission of pollutants into the air, |

We believe we are in substantial compliance with the requirements of CERCLA, RCRA, OPA, CWA, SDWA, CAA and related state and local laws and regulations. We also believe we hold all necessary and up-to-date permits, registrations and other authorizations required under such laws and regulations. Although the current costs of managing our wastes as they are presently classified are reflected in our budget, any legislative or regulatory reclassification of oil and natural gas exploration and production wastes could increase our costs to manage and dispose of such wastes and have a material adverse effect on our financial condition and operations.

Federal regulatory initiatives relating to the protection of threatened or endangered species could result in increased costs and additional operating restrictions or delays.

The Federal Endangered Species Act (ESA) was established to protect endangered and threatened species. Pursuant to the ESA, if a species is listed as threatened or endangered, restrictions may be imposed on activities adversely affecting that species' habitat. The U.S. Fish and Wildlife Service (FWS) may designate critical habitat and suitable habitat areas it believes are necessary for survival of a threatened or endangered species. A critical habitat or suitable habitat designation could result in further material restrictions to federal land use and may materially delay or prohibit land access for oil and natural gas development. Similar protections are offered to migratory birds under the Migratory Bird Treaty Act. We conduct operations on federal oil and natural gas leases in areas where certain species are currently listed as threatened or endangered, or could be listed as such, under the ESA. Operations in areas where threatened or endangered species or their habitat are known to exist may require us to incur increased costs to implement mitigation or protective measures and also may restrict or preclude our drilling activities in those areas or during certain seasons, such as breeding and nesting seasons. On March 27, 2014, the FWS announced the listing of the lesser prairie chicken, whose habitat is over a five-state region, including Texas, New Mexico and Oklahoma, where we conduct operations, as a threatened species under the ESA. Listing of the lesser prairie chicken as a threatened species imposes restrictions on disturbances to critical habitat by landowners and drilling companies that would harass, harm or otherwise result in a "taking" of this species. However, the FWS also announced a final rule that will limit regulatory impacts on landowners and businesses from the listing if those landowners and businesses have entered into certain range-wide conservation planning agreements, such as those developed by the Western Association of Fish and Wildlife Agencies (WAFWA), pursuant to which such parties agreed to take steps to protect the lesser prairie chicken's habitat and to pay a mitigation fee if its actions harm the lesser prairie chicken's habitat. We entered into a voluntary Candidate Conservation Agreement (CCA) with the WAFWA, whereby we agreed to take certain actions and limit certain activities, such as limiting drilling on certain portions of our

21

acreage during nesting seasons, in an effort to protect the lesser prairie chicken. Such CCA could result in increased costs to us from species protection measures, time delays or limitations on drilling activities, which costs, delays or limitations may be significant. We could encounter similar issues if the greater sage grouse is listed as a threatened or endangered species because its habitat includes our areas of operation. A listing decision is anticipated in 2015.

We use some of the latest available horizontal drilling and completion techniques, which involve risk and uncertainty in their application.

Our horizontal drilling operations utilize some of the latest drilling and completion techniques. The risks or such techniques include, but are not limited to, the following:

|

· |

landing the wellbore in the desired drilling zone; |

|

· |

staying in the desired drilling zone while drilling horizontally through the formation; |

|

· |

running casing the entire length of the wellbore; |

|

· |

being able to run tools and other equipment consistently through the horizontal wellbore. |

|

· |

the ability to fracture stimulate the planned number of stages; |

|

· |

the ability to run tools the entire length of the wellbore during completion operations; and |

|

· |

the ability to successfully clean out the wellbore after completion of the final fracture stimulation stage. |

Any of the above factors could have a material adverse effect on our financial position, results of operations or cash flows.

Our hydraulic fracturing activities are subject to risks that could negatively impact our operations and profitability.

We use hydraulic fracturing for the completion of almost all of our wells. Hydraulic fracturing is a process that involves pumping fluid and proppant at high pressure into a hydrocarbon bearing formation to create and hold open fractures. Those fractures enable gas or oil to move through the formation's pores to the well bore. Typically, the fluid used in this process is primarily water. In plays where hydraulic fracturing is necessary for successful development, the demand for water may exceed the supply. A lack of readily available water or a significant increase in the cost of water could cause delays or increased completion costs.

While hydraulic fracturing historically has been regulated by state oil and natural gas commissions, the practice has become increasingly controversial in certain parts of the country, resulting in increased scrutiny and regulation from federal agencies. For example, in October 2011, the EPA announced its plan to propose federal pre-treatment standards for wastewater generated during the hydraulic fracturing process. Hydraulic fracturing requires the use of a significant volume of water with some resulting "flowback water," as well as "produced water." If adopted, the new pretreatment rules will require shale gas operations to pretreat wastewater before transferring it to treatment facilities. Moreover, the EPA has indicated that it may develop and issue regulations under the Toxic Substances Control Act to require companies to disclose information regarding the chemicals used in hydraulic fracturing; however, to date, it has taken no action to do so. In addition to the use of water, hydraulic fracturing fluid contains chemicals or additives designed to optimize production. Many states already require companies to disclose the components of this fluid, and additional states and municipalities, as well as the federal government, may follow with additional regulations regarding disclosure and other issues concerning hydraulic fracturing. Indeed, in May 2013, the BLM published a supplemental notice of proposed rulemaking governing hydraulic fracturing on federal and Indian lands that replaces a prior draft of proposed rulemaking issued by the agency in May 2012. The revised proposed rule would continue to require public disclosure of chemicals used in hydraulic fracturing on federal and Indian lands, confirmation that wells used in fracturing operations meet appropriate construction standards, and development of appropriate plans for managing flowback water that returns to the

22

surface. A final rule is expected to be published in 2015. In May 2013, the Texas Railroad Commission adopted new rules governing well casing, cementing and other standards for ensuring that hydraulic fracturing operations do not contaminate nearby water resources. Many additional regulations also are being considered by federal, state and municipal governments and agencies, including limiting water withdrawals and usage, water disposal, restricting which additives may be used, implementing local or state-wide hydraulic fracturing moratoriums and temporary or permanent bans in certain environmentally sensitive and other areas. Public sentiment against hydraulic fracturing and shale gas production has become more vocal, which could lead to permitting and compliance requirements becoming more stringent. Consequences of these actions could increase our capital, compliance, and operating costs significantly, as well as delay or halt our ability to develop our oil and gas reserves.

Any of the above factors could have a material adverse effect on our financial position, results of operations or cash flows.

The adoption of climate change legislation or regulations restricting emission of greenhouse gases could result in increased operating costs and reduced demand for the oil and natural gas we produce.

Studies have suggested that emission of certain gases, commonly referred to as greenhouse gases (GHGs) may be impacting the earth's climate. Methane, a primary component of natural gas, and carbon dioxide, also present in natural gas as a secondary product, sometimes considered an impurity or a by-product of the burning of oil and natural gas, are examples of GHGs. The U.S. Congress and various states have been evaluating, and in some cases implementing, climate-related legislation and other regulatory initiatives that restrict emissions of GHGs. In December 2009, the EPA published its findings that emissions of GHGs present an endangerment to public health and the environment because emissions of such gases are contributing to the warming of the earth's atmosphere and other climatic changes. Based on these findings, the EPA adopted regulations under existing provisions of the Federal Clean Air Act that establish Prevention of Significant Deterioration (PSD) and Title V permit reviews for GHG emissions from certain large stationary sources. Facilities required to obtain PSD and/or Title V permits under EPA’s GHG Tailoring Rule for their GHG emissions also may be required to meet "Best Available Control Technology" standards that will be established by the states or, in some cases, by the EPA on a case-by-case basis. The EPA has also adopted rules requiring the monitoring and reporting of GHG emissions from specified sources in the United States, including, among others, certain oil and natural gas production facilities on an annual basis, which includes certain of our operations. In recent proposed rulemaking EPA is widening the scope of annual GHG reporting to include not only activities associated with completion and workover of gas wells with hydraulic fracturing and activities associated with oil and natural gas production operations, but also completions and workovers of oil wells with hydraulic fracturing, gathering and boosting systems, and transmission pipelines.

While Congress has from time to time considered legislation to reduce emissions of GHGs, there has not been significant activity in the form of adopted legislation to reduce GHG emissions at the federal level in recent years. In the absence of such federal climate legislation, a number of state and regional efforts have emerged that are aimed at tracking and/or reducing GHG emissions by means of cap and trade programs that typically require major sources of GHG emissions, such as electric power plants, to acquire and surrender emission allowances in return for emitting those GHGs. In January 2015, President Obama announced a series of administration actions to reduce methane emissions, including rulemaking by the EPA and the BLM as well as updating of standards by the Department of Transportation’s Pipeline and Hazardous Materials Administration. The current administration intends to promulgate proposed climate change rulemaking this summer aimed at reducing GHG emissions by 45% by 2025 compared to 2012 levels. The current administration intends to finalize proposed climate change rulemaking by 2016. It is not possible at this time to predict how legislation or new regulations that may be adopted to address GHG emissions would impact our business. Any such future laws and regulations that require reporting of GHGs or otherwise limit emissions of GHGs from our equipment and operations could require us to incur costs to develop and implement best management practices aimed at reducing GHG emissions, install and maintain emissions control technologies, as well as monitor and report on GHG emissions associated with our operations, and such requirements also could adversely affect demand for the oil and natural gas that we produce.

23

Our limited ability to influence operations and associated costs on non-operated properties could result in economic losses that are partially beyond our control.