UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM

(MARK ONE)

| Annual Report Pursuant to Section 13 or 15(d) of Securities Exchange Act of 1934 |

For

the fiscal year ended

| Transition report under Section 13 or 15(d) of the Securities Exchange Act of 1934 |

For the transition period from _______ to _______.

Commission

file number

(Exact name of registrant as specified in its charter)

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s

telephone number, including area code (

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol(s) | Name of each exchange on which registered | ||

| None | Not applicable | Not applicable |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate

by check mark if the registrant is a well-known seasoned issuer, as defined by Rule 405 of the Securities Act. Yes ☐

Indicate

by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act.

Indicate

by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange

Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2)

has been subject to such filing requirements for the past 90 days.

Indicate

by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule

405 of Regulation S-T (§232-405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant

was required to submit such files.)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated file | ☐ | ||

| ☒ | Smaller reporting company | ||||

| Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate

by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness

of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered

public accounting firm that prepared or issued its audit report. Yes ☐

Indicate

by check mark whether the registrant is a shell company (as defined by Rule 12b-2 of the Exchange Act). Yes ☐

The

aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which

the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s

most recently completed second fiscal quarter was approximately $

There were shares of common stock outstanding as of April 19, 2022.

TABLE OF CONTENTS

| 2 |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This Annual Report includes forward-looking statements that relate to future events or our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Words such as, but not limited to, “believe,” “expect,” “anticipate,” “estimate,” “intend,” “plan,” “targets,” “likely,” “aim,” “will,” “would,” “could,” and similar expressions or phrases identify forward-looking statements. We have based these forward-looking statements largely on our current expectations and future events and financial trends that we believe may affect our financial condition, results of operation, business strategy and financial needs.

You should read thoroughly this Annual Report with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements including those made in Part I. Item 1A. Risk Factors appearing elsewhere in this Report. Other sections of this Report include additional factors, which could adversely impact our business and financial performance. New risk factors emerge from time to time and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements. All forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made, except as required by applicable law.

| 3 |

PART I

| Item 1. | Business. |

Unless specifically set forth to the contrary, when used in this report references to “BWMG,” the “Company,” “we,” “our,” “us,” and similar terms refers to Brownie’s Marine Group, Inc., a Florida corporation, and our wholly owned subsidiaries, Trebor Industries, Inc., a Florida corporation (“Trebor”) doing business as Brownie’s Third Lung, Brownie’s High Pressure Compressor Services, Inc. a Florida corporation (“BHP”) doing business as LW America’s, BLU3, Inc., a Florida corporation (“BLU3”) and Submersible Systems, Inc., a Florida corporation (“SSI”), doing business as Spare Air.

General

The Company owns and operates a portfolio of companies with a concentration in the industrial, and recreational diving industry. The Company, through its subsidiaries, designs, tests, manufactures, and distributes recreational hookah diving, yacht-based scuba air compressors and nitrox generation systems, and scuba and water safety products in the United States and internationally.

The Company has four subsidiaries focused on various sub-sectors of our industry:

| ● | Brownie’s Third Lung | Surface Supplied Air (“SSA”) | |

| ● | BLU3, Inc. | Ultra-Portable Tankless Dive Systems | |

| ● | LW Americas | High Pressure Gas Systems | |

| ● | Submersible Systems, Inc. | Redundant Air Tank Systems |

Our wholly owned subsidiaries do business under their respective trade names on both a wholesale and retail basis from our headquarters and manufacturing facility in Pompano Beach, Florida, and a manufacturing facility in Huntington Beach, California.

The Company, through its wholly owned subsidiaries, designs, tests, and manufactures tankless dive systems, rescue air systems and yacht-based self-contained underwater breathing apparatus (“SCUBA”) air compressor and nitrox generation fill systems and acts as the exclusive distributor for North and South America for Lenhardt & Wagner GmbH (“L&W”) compressors in the high-pressure breathing air and industrial gas markets. The Company is also the exclusive United States and Caribbean distributor for Chrysalis Trading CC, a South African manufacturer of fitness and dive equipment, doing business as Bright Weights (“Bright Weights”), of a dive ballast system produced in South Africa. Our wholly owned subsidiaries and related product lines are as follows:

Surface Supplied Air Products

Our Brownie’s Third Lung systems have been a dominant figure in gasoline powered, high-performance, and more recently in the battery powered SSA diving systems. Taking full advantage of the proprietary compressor system, a complete series of traditional “fixed speed” electric compressors were developed for the built-in-boat market in 2005. In 2010, we introduced our variable-speed battery powered hookah system which provides divers with gasoline-free all day shallow diving experiences. These systems provide performance and runtimes for up to 3 hours by utilizing a variable speed technology that controls battery consumption based on diver demand.

In 2021 we continued to expand our dealer network and our marketing efforts with both the consumer and our network of dealers. The Company continues to pursue dealers outside of the United States in order to diversify the seasonality as well as the geography risks. Additionally, we continue to pursue more aggressively the boat builder market to offer our SSA systems as an option on newly built boats, expanding our market beyond the traditional consumer markets for our products.

Our SSA products include:

● Tankless Dive Systems: The Company produces a line of tankless dive products, commonly called hookah or recreational SSA systems. These systems allow one to four divers to enjoy the marine environment up to a depth of 45 feet without the bulk and weight of conventional SCUBA gear. We believe that the removal of barriers to entry into the sport of diving and the reduction of complicated and bulky SCUBA gear invites a broader range of the general public to participate more actively and enjoyably at their own pace and schedule. Our product is designed to reduces the effort required for its transport and use while exploring, cruising or traveling.

A line of land-based systems is available for light-duty commercial applications that demand portability and performance. In addition to the gasoline-powered units and the variable speed battery powered units, a series of AC electric powered systems is also available for light to commercial use. Powered by battery for portability or household current for unlimited dive duration, these units are used primarily by businesses that work in aquatic maintenance and marine environments.

● BIAS (Boat Integrated Air Systems): The Company developed several tankless products and complimentary accessories that it believes makes boat diving easier. The BIAS battery powered tankless kit allows boat builders, dealers and end users to seamlessly install a pre-packaged kit directly into the boat and our E-Reel, a level-winding battery powered hose reel system, provides compact storage of up to 150 feet of hose. Boaters can perform their own in-water maintenance and inspections, or just dive for enjoyment. In addition to supplying air to divers, BIAS may be used for supporting air horns, inflating boat fenders/water toys and activating pneumatically operated doors.

| 4 |

Ultra Portable Tankless Dive Systems

Through our wholly-owned subsidiary BLU3, we develop and market a next generation electric, surface supplied air shallow dive system that is completely portable to the user. The BLU3 line currently consists of two models, NEMO and NOMAD, targeting specific performance levels and price points.

NEMO dive systems are currently sold in 9 countries through Amazon, and also through 54 dealers worldwide. NEMO, designed to be the world’s smallest dive system is capable of taking a diver to 10 feet for 60 to 90 minutes on one charge of its lithium-ion battery. NEMO is portable and its batteries are FAA compliant for airline travel.

NOMAD dive system (“NOMAD”) began shipping in the third quarter, 2021 and is currently sold to consumers via our website, Amazon and through our network of dealers worldwide. The NOMAD is highly portable and expands dive capability to up to 30 feet. NOMAD has been marketed through BLU3’s internet presence and marketing campaigns as well as at industry and other trade shows across the country.

We believe the BLU3 product lines are changing the way that people get into the water and explore the next atmosphere. The units are ultra-portable and can travel with the consumer to their adventures, wherever they may be.

High Pressure Gas Systems

Through our wholly-owned subsidiary LW America’s, we design, manufacture, sell and install SCUBA tank fill systems for on-board yacht use under the brand “Yacht-Pro™”. Our systems provide complete diving solutions for yachts, including nitrox systems which allow yacht owners to fill tanks with oxygen enriched air on board. The Yacht-Pro™ compressor systems offer a completely marine-prepared, variable frequency drive(“VFD”) driven, automated alternative to other compressors on the market. We also design complete dive lockers, mixed gas production and distribution systems, and the Nitrox Maker™. Nitrox is oxygen-enriched air, which reduces the effects of nitrogen on divers and is the industry standard for dive professionals. The Nitrox Maker™ continuously generates oxygen rich breathing gas directly from low-pressure air with no stored oxygen or other gases required onboard. Our light duty compressor, the new Yacht Pro Essential is specifically designed as a turn-key kit for the boat builders and is optimized to integrate to onboard power systems and withstand the marine environment with all components and hardware impervious to spray from the elements. The Yacht Pro™ series contains models for both medium-duty applications, such as recreational divers and small groups, and heavy-duty use as found on research vessels, commercial operations and live-aboard dive boats. All Yacht Pro™ models come with the variable speed frequency drive reducing the initial start-up power demand typically associated with high pressure compressor systems.

| 5 |

In August 2017, we entered into a five-year exclusive distribution agreement with L&W, which agreement renews for successive one-year terms unless terminated as provided for in the agreement. Under the terms of the Exclusive Distribution Agreement, we were appointed the exclusive distributor of L&W’s complete product line in North America and South America, including the Caribbean. We are conducting this business direct to end-users and establishing sales, distribution and service centers for high pressure air and industrial gas systems in the dive, fire, CNG, military, scientific, recreational and aerospace industries under the brand name “L&W Americas/LWA”.

We are exclusively developing a sales, distribution and service capability to assist L&W with completing a worldwide network of L&W’s agencies and service centers.

In addition to breathing air compressors and related peripheral equipment, L&W also offers compressors, storage and purification systems to meet the high-pressure requirements for natural gas filling stations, and high-pressure inert gases such as argon, helium and nitrogen for industrial applications including welding and laser cutting, and for general laboratory use.

We believe the product lines from L&W, will allow LW Americas to offer high quality, competitive products into the first responder and industrial market that utilize compressed air. Our goal will be to build a network of jobbers, dealers, installers and high-pressure compressor distributors by leveraging our know-how, brand awareness, complimentary products and creating sustainable distribution and core product original equipment manufacturer (“OEM”) integration relationships.

Redundant Air Tank Systems

In September 2021, the Company acquired SSI to further expand its product offerings and manufacturing capabilities. SSI has been manufacturing redundant air systems for recreational divers, private companies and militaries throughout the world for more than 40 years. Their state-of-the-art manufacturing facility in Huntington Beach, California is equipped to add to the machining and product development capabilities of the Company.

The SSI acquisition gives the Company access to a world-wide base of in excess of 400 dealers and distributors, GSA contracting capability, as well as the direct source for the redundant air needs for our Brownie’s Third Lung and BLU3 diving equipment and expands warehousing capabilities, reducing freight costs for both sets of customers.

SSI continues to innovate their technologies to meet changing military and commercial needs and is in development of the next generation of their Helicopter Emergency Egress Device (“HEED”) product line, specifically designed for aircraft and military vehicle use. Additionally, SSI has found use for their products in the medical field and continues to develop customer relationships in that area to grow revenue and diversify its product and customer portfolio.

Diving and Snorkeling Industry

The Sports, Fitness Industry Association (“SFIA”) estimated there were 2.6 million participants in the U.S. scuba diving market in 2020. According to a report published by the Dive Equipment Manufacturing Association (“DEMA”) in first quarter 2021, there were approximately 87,000 new participants in U.S. diving market in 2020 as compared to approximately 151,000 in 2019. DEMA attributes the drop in new open water certifications in 2020 primarily to the pandemic.

In contrast, the SFIA study indicated that participation in snorkeling increased by nearly 1% in 2020 as compared to 2019 with estimated participation of 7.7 million in the U.S.

The Company intends to enter the tourist market via a guided tour program that is currently intended to be launched in the second quarter of 2022. The Company sees the guided tour model as an important building block in introducing its battery powered diving products to the consumer market. Additionally, this model will not only give consumers the opportunity to “try before you buy”, but also provide experiential training for the consumer to increase enjoyment and safety of our diving products.

| 6 |

Yachting Industry

The global luxury yacht market is estimated to reach $6.5 billion and is poised to grow at a compound annual growth rate (“CAGR”) of 11% from 2020 to 2024, according to Technavio, a market research firm, in their industry report dated November 2020. The Company’s BIAS systems have been designed with this industry in mind. The Company markets directly to the yachting industry, by leveraging its relationships with large yacht servicing companies, yacht builders and yacht brokerages.

The recreational sailing and boating market and yachting industries also continue to grow. Allied Market Research estimates that the recreational boating market is growing at a CAGR of 5.1% through 2027 reaching total revenues of $35.4 billion.

High Pressure Compressor Line

According to Allied Market Research report published in February 2018, the North American high pressure compressor market is $880 million growing at an estimated CAGR of 3%.

The Company expects to continue to distribute L&W compressors through its YachtPro, and BIAS systems, while continuing to focus on the expansion of its distribution into non-marine related distribution channels that the Company believe should positively impact its market reach.

Intellectual Property

Trade Names

The Company either owns or has licensed from entities in which Robert Carmichael, our Chief Executive Officer, has an ownership interest, the following registered and unregistered trade names, trademarks and service marks: Brownie’s Third Lung™, browniedive.com, Brownie’s, Brownie’s Third Lung oval symbol, browniedive, YachtPro, NitroxMaker™, BLU3, diveBLU3.com, BLU3 Nemo, BLU3-Vent, Submersible Systems, Spare Air, HEED 3, Snorkelator, easy dive, spareair.com, HELO, RES, fast float rescue harness, tankfill.com, browniestankfill, browniestankfill.com, browniespublicsafety.com, browniespublicsafety, Peleton Hose System, Twin-Trim, and Kayak Diving Hose Kit.

The Company owns the following patents:

| Patent number | Description | Issued Date | Expiration Date | Owned by | ||||

| 10,758,246 | Abdominal Aortic Tourniquet | 9/1/2020 | 3/17/2034 | Trebor Industries, Inc. | ||||

| 9,782,182 | Abdominal Aortic Tourniquet | 10/10/2021 | 10/26/2033 | Trebor Industries, Inc. | ||||

| 9,351,737 | Abdominal Aortic Tourniquet | 5/31/2016 | 3/2/2034 | Trebor Industries, Inc. | ||||

| 11,265,625 | Automated Self-Contained Hooka system with unobtrusive aquatic data recording | 3/1/2022 | 10/30/2039 | BLU3, Inc. | ||||

| 11,077,924 | System for adjusting pressure limits based on depth of diver(s) | 8/3/2021 | 3/20/2039 | Brownie’s Marine Group, Inc. |

| Application number | Description | Filed Date | Owned by | |||

| 17/683,502 | Automated Self-Contained Hooka system with unobtrusive aquatic data recording | 3/1/2022 | BLU3, Inc. | |||

| 17/389,648 | System for adjusting pressure limits based on depth of diver(s) | 7/30/2021 | Brownie’s Marine Group, Inc. |

| 7 |

License Agreements

On April 6, 2018, the Company entered into a patent license agreement (the “STS Agreement”) with Setaysha Technical Solutions, LLC (“STS”) pursuant to which the Company licensed certain intellectual property, including patent rights, non-patent rights and know how from STS for use in our ultra-portable tankless dive system products. Under the STS Agreement, the Company paid an initial license fee in April 2018 through the issuance of 759,422 shares of common stock with a fair value of $30,000 which is being amortized on a straight-line basis over its five-year term. The STS Agreement further provides for royalties to be paid based on annual net revenues achieved. On December 31, 2019, the Company entered into Addendum No. 1 to the Patent License Agreement (“Addendum No. 1”) which amended the payments due upon the first commercial sale of Nemo. Upon entering into Addendum No. 1, $8,250 was paid to STS in cash and $8,250 which was accrued and paid on January 10, 2020. On February 6, 2020, the Company issued 828,221 shares of its common stock with a fair value of $18,635 in satisfaction of $13,500 for the first commercial sale. On June 30, 2020, the Company entered into Amendment No. 2 to the STS Agreement which set forth STS’s assistance related to designing and commercializing certain diving products, and provides for a minimum yearly royalty of $60,000, or $15,000 per fiscal quarter, beginning in December 2019 and increasing by 2.15% per year. With the introduction of the NOMAD in the last quarter of 2021, the Company is obligated to pay an additional annual minimum royalty of $60,000 per year for the years 2022, 2023 and 2024, also increasing the quarterly minimum royalty by $15,000 per quarter.

Marketing

Print Literature, Public Relations, and Advertising

We have in-house graphic design capability to create and maintain product support literature, catalogs, mailings, web-based advertising, newsletters, editorials, advertorials, and press releases. We also, from time-to-time, target specific markets by selectively advertising in journals and magazines that we believe reach our potential customers. In addition, we strive to issue press releases, newsletters, and social media postings periodically to keep the public informed of our latest products and related endeavors.

Tradeshows

In 2021, the Company was represented directly or indirectly at The Palm Beach Boat Show, The Annapolis Motor and Sailing Shows, The Fort Lauderdale Boat show, Diving Equipment and Manufacturing show. In 2022, the Company currently intends to expand its marketing reach via tradeshows by attending all shows attended in 2021, The Seattle Boat Show, The Dubai Boat Show, and the HAI Heli-Expo, along with various other trade and industry shows.

Websites

We sell our products online through our and our subsidiaries websites and many of our products are marketed on some of our customers’ websites. In addition to these websites, numerous other websites have quick links to the Company’s website. Our products are available both domestically and internationally. Internet sales and inquiries are also supported by the Company.

Product Research and Development

Research and development costs for the year ended December 31,2021 and December 31, 2020, were $75,439 and $115,156, respectively, none of which cost is borne directly by customers.

Government Regulation

The SCUBA industry is self-regulating; therefore, the Company is not subject to government industry specific regulation. However, SSI, our tank manufacturing company is subject to Department of Transportation (“DOT”) regulation and testing of each of their tanks. The Company strives to be a leader in promoting safe diving practices within the industry and believes it is at the forefront of self-regulation through responsible diving practices. The Company is subject to all regulations applicable to “for profit” companies as well as all trade and general commerce governmental regulation. All required federal and state permits, licenses, and bonds to operate its facility have been obtained.

Distribution/Customers

The Company has historically been predominantly a wholesale distributor to retail dive stores, marine stores, boat dealers builders, and the US and international militaries. Currently, the Company generates a significant amount of direct to consumer sales via its websites and its relationship with Amazon via BLU3, BTL and SSI. Our retail sales customers include boat owners, recreational divers, commercial divers, and pilots. The Company sells products to three entities owned by the brother of Robert Carmichael, the Company’s Chief Executive Officer, and three companies owned by Mr. Carmichael. Combined sales to these six entities for 2021 and 2020, represented 17.9% and 18.4%, respectively, of total net revenues.

| 8 |

The majority of L&W high pressure compressors and NitroxMaker™ systems have been sold to commercial dive stores, dive operators (resorts and liveaboard dive boats), yacht builders, yacht owners and high pressure compressor distribution partners.

Sales of YachtPro™ compressor systems have been split between retail sales directly to consumers and wholesale sales to OEM boat builders/resellers/brokers.

Suppliers/Raw Materials

Principal raw materials for our business include machined parts such as rods; pistons; bearings; hoses; regulators; compressors; engines; high-pressure valves and fittings; sewn goods; and various plastic parts including pans, covers, intake staffs, and quick release connections which are typically purchased on a per order basis. Most materials are readily available from multiple vendors. Some materials require greater lead times than other materials. Accordingly, we strive to avoid out of stock situations through careful monitoring of these inventory lead times, and through avoiding single source vendors whenever possible. Principle suppliers include Lenhardt & Wagner GmbH, Xometry, Inc., Burgess Manufacturing Corp, Bix International, Inc., Carrol Stream Motor Company, Zhejiang Xiangyang Gear Electormechan, Co, Xiamen Feipeng Insdustry Co. Ltd. and Catalina Cylinders, Inc.

Competition

We consider the most significant competitive factors in our business to be innovation, lifestyle, fair prices, shopping convenience, the variety of available products, knowledgeable and prompt customer service, rapid and accurate fulfillment of orders. We currently recognize one significant competitor Airline by JSink, Inc.in gasoline powered hookah sales and a variety of competitors, including Aqua Lung America, Colti America and Bauer Compressors, Inc. in our redundant air tank systems and high-pressure compressor systems sales. Currently, we believe there is limited competition for our BLU3, Sea Lion and BIAS systems products.

Overall, we are operating in a moderately competitive environment. The price structure for all the products we distribute compares favorably with the majority of our competitors based on quality and available features. We believe that our key competitive advantage is our ability to create new products and in some cases, new markets.

Employees

We currently have four full-time employees. Our subsidiaries have 31 full-time and 1 part-time employee, in the aggregate.

Seasonality

Our product lines have historically been seasonal in nature in the United States. The peak season for Legacy Products and Redundant Air Tank Systems is the second and third quarters of the year. The peak season for High Pressure products is typically the fourth and first quarters of the year. The BLU3 product line is emerging as a less seasonally influenced enterprise due to the global appeal. The Company continues to address the seasonality of the business by expanding its reach beyond the traditional markets in the U.S. and reaching to other areas of the world that may somewhat offset the seasonality.

|

Item 1A. |

Risk Factors. |

Investing in our common stock involves risks. In addition to the other information contained in this report, you should carefully consider the following risks before deciding to purchase our common stock. The occurrence of any of the following risks might cause you to lose all or a part of your investment, and certain of these risks may be further exacerbated by the continuing impact of the COVID-19 pandemic on the Company and our industry. Some statements in this report, including statements in the following risk factors, constitute forward-looking statements. Please refer to “Cautionary Statement Regarding Forward-Looking Statements” for more information regarding forward-looking statements.

| 9 |

FINANCIAL RISKS

We have a history of losses.

We incurred net losses of $1,588,467 and $1,351,619, respectively, for the year ended December 31, 2021 and 2020. At December 31, 2021 we had an accumulated deficit of $14,544,604. While our revenues increased 36.7% for the year ended December 31, 2021 from 2020, our gross profit margin decreased from 32.1% in 2020 to 30.3% in 2021, our gross profit is not sufficient to cover our operating expenses in the year ended December 31, 2021 and 2020 of $3,742,262 and $2,797,449, respectively, which includes non-cash stock compensation expenses of $1,154,801 and $858,695 for the years ending December 31, 2021 and 2020, respectively. In the year ended December 31, 2021, our selling, general and administrative expenses, increased 33.8% from 2020. There are no assurances that we will be able to increase our revenues to a level which supports profitable operations and provides sufficient capital to pay our operating expenses and other obligations as they become due.

Our auditors have raised substantial doubts as to our ability to continue as a going concern.

Our independent registered public accounting firm has included an explanatory paragraph expressing substantial doubt relating to our ability to continue as a going concern in its report on our audited consolidated financial statements for the year ended December 31, 2021 We have sustained recurring losses from operations and have used approximately $769,500 in net cash in our operation in the year ended December 31, 2021 as compared to approximately $556,000 in 2020. These factors, among others, raise substantial doubt about our ability to continue as a going concern. Our consolidated financial statements do not include any adjustments that might result from the outcome of this uncertainty. Our principal sources of liquidity are sales of equity and debt securities. We do not have any firm commitments to raise additional working capital. As we are a small company who stock is quoted on the OTC Markets, we expect to encounter difficulty in raising working capital upon terms and conditions satisfactory to us, if at all. If we are unable to obtain sufficient funding or generate sufficient revenues, our business and results of operations will be adversely affected and we may be unable to continue as a going concern.

We rely on revenues from related parties.

We generate revenues from sales to related parties, which accounted for 17.9% of our net revenues in 2021 and 18.4% of our net revenues in 2020. The loss of revenues from these related parties would have a material adverse impact on our business, results of operations and financial condition in future periods.

We depend on licenses with Robert Carmichael, our Chief Executive Officer’s ownership interests in much of our intellectual property.

The Company either owns or has licensed from entities in which Robert Carmichael, our Chairman, has an ownership interest, the following registered and unregistered trade names, trademarks and service marks: Brownie’s Third Lung™, browniedive.com, Brownie’s, Brownie’s Third Lung oval symbol, browniedive, YachtPro.

If we fail to maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results. As a result, current and potential shareholders could lose confidence in our financial reporting, which would harm our business and the trading price of our stock.

Our management has previously determined that we did not maintain effective internal controls over financial reporting. For a detailed description of these material weaknesses and our remediation efforts and plans, see Part II, Item 9A-Controls and Procedures of this Annual Report. If the result of our remediation of the identified material weaknesses is not successful, or if additional material weaknesses are identified in our internal control over financial reporting, our management will be unable to report favorably as to the effectiveness of our internal control over financial reporting and/or our disclosure controls and procedures, and we could be required to further implement expensive and time-consuming remedial measures and potentially lose investor confidence in the accuracy and completeness of our financial reports which could have an adverse effect on our stock price and potentially subject us to litigation.

| 10 |

BUSINESS AND OPERATIONAL RISKS

We are dependent upon certain key members of management and qualified employees and consultants.

Our success depends to a significant degree on the abilities and efforts of our senior management. and on our ability to attract, retain and motivate highly qualified marketing, technical, engineering and sales personnel and consultants. These people are in high demand and often have competing employment opportunities. The labor market for skilled employees is highly competitive and we may lose key employees or be forced to increase their compensation to retain these people. Employee turnover could significantly increase our recruitment, training and other related employee costs. The loss of key personnel, or the failure to attract qualified personnel, could result in delays in development or fulfillment of any current strategic and operational plans and have a material adverse effect on our business, financial condition or results of operations.

Our failure to obtain and enforce intellectual property protection may have a material adverse effect on our business.

Our success depends in part on our ability, and the ability of our patent and trademark licensors, and entities owned and controlled by Robert Carmichael to obtain and defend our intellectual property, including patent protection for our products and processes, preserve our trade secrets, defend and enforce our rights against infringement and operate without infringing the proprietary rights of third parties, both in the United States and in other countries. Despite our efforts to protect our intellectual proprietary rights, existing copyright, trademark and trade secret laws afford only limited protection.

Our industry is characterized by frequent intellectual property litigation based on allegations of infringement of intellectual property rights. Although we are not aware of any intellectual property claims against us, we may be a party to litigation in the future.

We rely on third party vendors and manufacturers.

We deal with suppliers on an order-by order basis and have no long-term purchase contracts or other contractual assurances of continued supply or pricing. In addition, we have no long-term contracts with our manufacturing sources and compete with other companies for production facility capacity. Historically, we have purchased enough inventories of products or their substitutes to satisfy demand. However, unanticipated failure of any manufacturer or supplier to meet our requirements or our inability to build or obtain substitutes could force us to curtail or cease operations. Certain of our product components are manufactured in China. Due to Covid, and the logistics challenges existing currently, we have experienced delays and may experience continued delays in our supply chain, including component products, which are manufactured in China. Our senior management will continue to monitor our situation on a daily basis, however, we expect that these factors and others we have yet to experience may materially adversely impact our company, its business and operations for the foreseeable future.

We dependent on consumer discretionary spending.

The success of our business depends largely upon a number of factors related to consumer spending, including current and future economic conditions affecting disposable consumer income such as employment, business conditions, tax rates, and interest rates. In times of economic uncertainty, consumers tend to defer expenditures for discretionary items, which effects demand for our products. Any significant deterioration in overall economic conditions that diminishes consumer confidence or discretionary income can reduce our sales and adversely affect our financial results. The impact of weakening consumer credit markets; layoffs; corporate restructurings; higher fuel prices; declines in the value of investments and residential real estate; and increases in federal and state taxation can all negatively affect our results. There can be no assurance that in this type of environment consumer spending will not decline, thereby adversely affecting our growth, net sales and profitability or that our business will not be adversely affected by continuing or future downturns in the economy, boating industry, or dive industry. If declines in consumer spending on recreational marine accessories and dive gear are other than temporary, we could be forced to curtail or cease operations.

| 11 |

Government regulations may impact us.

The SCUBA industry is self-regulating, therefore, from an industry perspective the Company is not subject to government industry specific regulation. However, our tank manufacturing operation is required to comply with DOT, as well as being approved to sell in various countries outside of the United States. The Company strives to be a leader in promoting safe diving practices within the industry and is at the forefront of self-regulation through responsible diving practices. The Company is subject to all regulations applicable to “for profit” companies as well as all trade and general commerce governmental regulation. All required federal and state permits, licenses, and bonds to operate its facility have been obtained. There can be no assurance that our operations will not be subject to more restrictive regulations in the future, which could force us to curtail or cease operations.

Our failure to adequately protect personal information that is collected on our website and our third-party payment platforms could have a material adverse effect on our business.

A wide variety of local, state, national, and international laws, directives and regulations apply to the collection, use, retention, protection, disclosure, transfer, and other processing of personal data (including with respect to the European Union’s General Data Protection Regulation and U.S. state laws such as the California Consumer Privacy Act). These data protection and privacy-related laws and regulations continue to evolve and may result in ever-increasing regulatory and public scrutiny and escalating levels of enforcement and sanctions and increased costs of compliance. Our failure to comply with applicable laws and regulations, or to protect such data, could result in enforcement actions against us, including fines, imprisonment of company officials and public censure, claims for damages by end-customers and other affected individuals, damage to our reputation and loss of goodwill (both in relation to existing end-customers and prospective end-customers), any of which could have a material adverse effect on our operations, financial performance, and business. Changing definitions of personal data and personal information, within the European Union, the United States, and elsewhere may limit or inhibit our ability to operate or expand our business, including limiting strategic partnerships that may involve the sharing of data. The evolving data protection regulatory environment may require significant management attention and financial resources to analyze and modify our information technology infrastructure to meet these changing requirements all of which could reduce our operating margins and impact our operating results and financial condition.

Bad weather could have an adverse effect on operating results.

Our business is significantly impacted by weather patterns. Unseasonably cool weather, extraordinary amounts of rainfall, or unseasonably rough surf, may decrease boat use and diving, thereby decreasing sales. Accordingly, our results of operations for any prior period may not be indicative of results of any future period.

The manufacture and distribution of recreational diving equipment could result in product liability claims.

We, like any other retailer, distributor and manufacturer of products that are designed for recreational sporting purposes, face an inherent risk of exposure to product liability claims in the event that the use of our products results in injury. Such claims may include, among other things, that our products are designed and/or manufactured improperly or fail to include adequate instructions as to proper use and/or side effects, if any. We do not obtain indemnification from parties supplying raw materials, manufacturing our products or marketing our products. In the event that we do not have adequate insurance or contractual indemnification, product liabilities relating to defective products could have a material adverse effect on our operations and financial conditions, which could force us to curtail or cease our business operations.

The worldwide impact from the COVID-19 pandemic may negatively impact our business.

While we have been relatively successful in navigating such impact to date, we have previously been affected by temporary manufacturing closures, and employment and compensation adjustments. There are also ongoing related risks to our business depending on the progression of the pandemic, and recent trends in certain regions have indicated potential returns to limited or closed government functions, business activities and person-to-person interactions. Global trade conditions and consumer trends may further adversely impact us and our industries. For example, pandemic-related issues have exacerbated port congestion and intermittent supplier shutdowns and delays, resulting in additional expenses to expedite delivery of critical parts. Similarly, increased demand for personal electronics has created a shortfall of microchip supply, and it is yet unknown how we may be impacted. We cannot predict the duration or direction of current global trends from this pandemic, the sustained impact of which is largely unknown, is rapidly evolving and has varied across geographic regions. Ultimately, we continue to monitor macroeconomic conditions to remain flexible and to optimize and evolve our business as appropriate, and we will have to accurately project demand and infrastructure requirements globally and deploy our production, workforce and other resources accordingly.

| 12 |

SHAREHOLDER RISKS

The issuance of shares of our common stock upon exercise of our outstanding options, warrants, convertible debt and Series A Convertible Preferred Stock may cause immediate and substantial dilution to our existing shareholders.

We presently have vested and unvested options, warrants, convertible debt and Series A Convertible Preferred Stock that if exercised would result in the issuance of an additional 254,577,924 shares of our common stock. The issuance of shares upon exercise of options will result in dilution to the interests of other shareholders.

Our common stock may be affected by limited trading volume and may fluctuate significantly.

Our common stock is quoted on the OTCQB tier of the OTC Markets. There is a limited public market for our common stock and there can be no assurance that an active trading market for our common stock will develop. As a result, this could adversely affect our shareholders’ ability to sell our common stock in short time periods, or possibly at all. Thinly traded common stock can be more volatile than common stock traded in an active public market. Our common stock has experienced, and is likely to experience in the future, significant price and volume fluctuations, which could adversely affect the market price of our common stock without regard to our operating performance. In addition, we believe that factors such as quarterly fluctuations in our financial results and changes in the overall economy or the condition of the financial markets could cause the price of our common stock to fluctuate substantially.

Our company is a voluntary filer with the SEC and in the event that we cease reporting under the Exchange Act, investors would have limited information available to them about the company.

While we are voluntarily file reports with the SEC under Section 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), we do not have a class of securities registered under Section 12(g) of the Exchange Act. To the extent that our duty to file Exchange Act reports has automatically suspended under Section 15(d) of the Exchange Act, as a voluntary filer, we may elect to cease reporting under the Exchange Act at such time which would limit the information available to investors and shareholders about the company.

Our common stock is deemed to be “penny stock,” which may make it more difficult for investors to sell their shares due to suitability requirements.

Our common stock is deemed to be “penny stock” as that term is defined under the Exchange Act. Penny stocks generally are equity securities with a price of less than $5.00 (other than securities registered on certain national securities exchanges. Our common stock is covered by an SEC rule that imposes additional sales practice requirements on broker-dealers who sell such securities to persons other than established customers and accredited investors, which are generally institutions with assets in excess of $5,000,000, or individuals with net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse.

Broker/dealers dealing in penny stocks are required to provide potential investors with a document disclosing the risks of penny stocks. Moreover, broker/dealers are required to determine whether an investment in a penny stock is a suitable investment for a prospective investor. These requirements may reduce the potential market for our common stock by reducing the number of potential investors. This may make it more difficult for investors in our common stock to sell shares to third parties or to otherwise dispose of them. This could cause our stock price to decline.

Our officers and directors are able to control the Company.

Our officers and directors and their affiliates own or have the right to vote a majority of the common stock of our company. As a result, they have significant influence over the management and affairs of the Company and control over matters requiring stockholder approval, including the election of directors and significant corporate transactions, such as a merger or other sale of our company or our assets. Their interests may differ from the interests of other shareholders and thus result in corporate decisions that are disadvantageous to other shareholders. This concentration of ownership and influence in management and board decision-making could also harm the price of our capital stock by, among other things, discouraging a potential acquirer from seeking to acquire shares of our capital stock (whether by making a tender offer or otherwise) or otherwise attempting to obtain control of our company.

| 13 |

| Item 1B. | Unresolved Staff Comments |

Not applicable to smaller reporting companies.

| Item 2. | Properties. |

Pompano Beach, FL

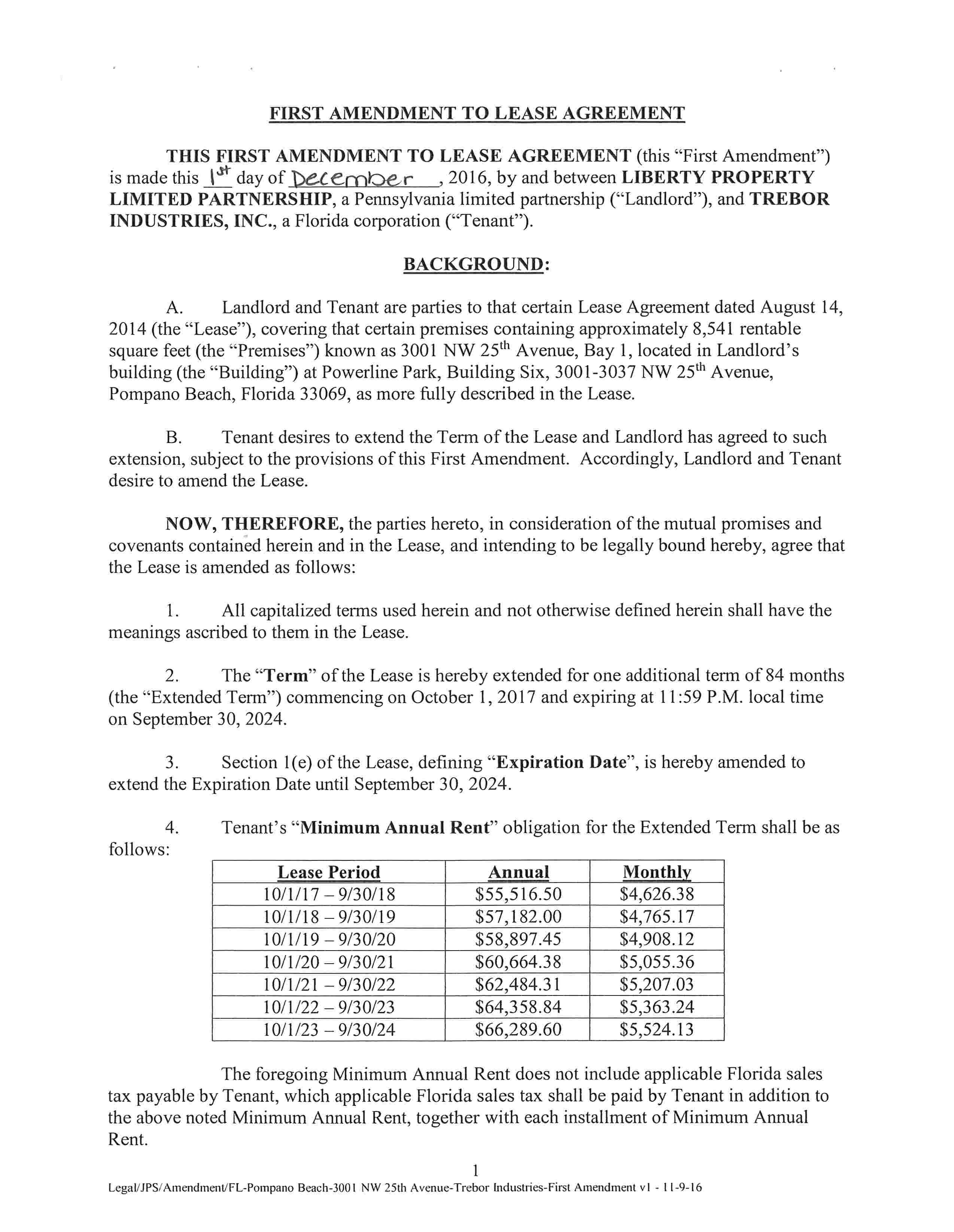

Our Pompano Beach, Florida facilities are comprised of two adjoining properties totaling approximately 16,566 square feet of leased space the bulk of which is factory and warehouse space. The initial 37-month lease covering approximately 8,541 square feet commenced on September 1, 2014. The lease provided for payment of a $5,367 security deposit, base rent of approximately $4,000 per month over the term of the lease plus sales tax, and payment of 10.76% of annual operating expenses for common areas maintenance, subject to periodic adjustment. On December 1, 2016, we entered into an amendment to the initial lease agreement, commencing on October 1, 2017, which extended the term of the lease for an additional 84 months, expiring September 30, 2024. The base rent was increased to $4,626 per month with a 3% annual escalation throughout the amended term.

On November 11, 2018, the Company entered a new 69-month lease agreement for an additional 8,025 square feet adjoining its existing facility in Pompano Beach, Florida. The new lease provided for a $6,527 security deposit, an initial base rent of approximately $4,848 per month escalating at 3% per year during the term of the lease plus Florida state sales tax and payment of 10.11% of the building’s annual operating expenses for common area maintenance, subject to adjustment as provided in the lease.

Huntington Beach, California

Our Huntington Beach, California facility is comprised of a leased 13,000 square foot free standing building of which the bulk of the square footage is warehouse and manufacturing space. The initial lease, signed in January, 2013 was for five years with a base rent of $7,410.

On January 4, 2018, the Company entered into a sixty-one month term lease renewal for its facility in Huntington Beach, California, commencing on February 1, 2018. Base rent is approximately $9,300 per month for the first 12 months with a 2.5% annual escalation throughout the term. The Company paid a security deposit of $8,450 with the initial lease that the landlord continues to hold.

We believe that the facilities are suitable for their intended purpose, are being efficiently utilized and provide adequate capacity to meet demand for the foreseeable future.

| Item 3. | Legal Proceedings. |

There are no pending legal proceedings to which we are a party or in which any director, officer or affiliate of ours, any owner of record or beneficially of more than 5% of any class of our voting securities, or security holder is a party adverse to us or has a material interest adverse to us.

| Item 4. | Mine Safety Disclosure. |

Not applicable.

PART II

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities. |

The Company’s common stock is quoted on the OTCQB tier of the OTC Markets under the symbol “BWMG”. On April 19, 2022, the closing sale price of our common stock was $0.0425 per share.

Holders of Common Stock

As of April 19, 2022, the Company had approximately 391 shareholders of record.

| 14 |

Dividends

We have not paid any dividends on our common stock and do not anticipate paying any cash dividends in the foreseeable future. We intend to retain any earnings, if any, to finance the growth of the business. We cannot assure you that we will ever pay cash dividends. Whether we pay any cash dividends in the future will depend on our financial condition, results of operations and other factors that the board of directors will consider.

Securities Authorized for Issuance under Equity Compensation Plans

The following table provides information regarding our equity compensation plans as of December 31, 2021:

Equity Compensation Plan Information

| Plan category | Number of securities to be issued upon exercise of outstanding options, warrants and rights | Weighted

average exercise price of outstanding options, warrants and rights ($) | Number of securities remaining available for future issuance under equity compensation plans | |||||||||

| Plans approved by our shareholders (1) | 2,125,000 | .0434 | 22,875,000 | |||||||||

| Plans not approved by shareholders (2) | 231,003,266 | .0361 | - | |||||||||

(1) Represents stock options granted to employees under the Equity Compensation Plan as described in Item 10 of this Annual Report. 25,000,000 shares are reserved for issuance under the Plan.

(2) Represents (i) five-year options granted to each of Robert Carmichael, Mikkel Pitzner and Blake Carmichael to purchase an aggregate of 35,295,237 shares of common stock at $0.018 per share, (ii) a three-year option to purchase 2,000,000 shares of common stock at $0.0229 per share to Jeffrey Guzy, a former director, (iii) a three-year option to purchase 2,000,000 shares of common stock at $0.0229 per share to Biz Launch Advisors, LLC, a formal financial consultant, (iv) a three-year option to purchase an aggregate of 125,000,000 shares of common stock at $0.045 per share and a to Robert Carmichael, (v) a five-year option to purchase 5,434,783 shares of common stock at $0.0184 per share, a four-year option to purchase an aggregate of 30,000,000 shares of common stock at $0.0184 per share and a five year option to purchase 2,403,846 shares of common stock at $.0401 per share to Christopher Constable (vi) a five-year option to purchase an aggregate of 21,759,400 shares of common stock at $0.0399 per share to Blake Carmichael, (vii) a five-year option to purchase 7,110,000 shares of common stock at $0.0531 per share to Christeen Buban, President of SSI.

Recent Sales of Unregistered Securities

Except as set forth below, there were no sales of equity securities during the period covered by this Report that were not registered under the Securities Act and were not previously reported in a Quarterly Report on Form 10-Q or a Current Report on Form 8-K filed by the Company.

On February 22, 2021, the Company issued 422,209 shares of common stock to an investor upon the conversion of a convertible note.

On March 1, 2021, the Company issued 3,000,000 shares of common stock to a consultant for investor relation services.

On March 25, 2021, the Company issued 27,500,000 shares of common stock to Charles Hyatt, in a private offering for proceeds of $275,000.

On February 25, 2021, the Company issued 116,279 shares of common stock to a consultant for professional business services.

On June 10, 2021, the Company issued 6,055,358 shares of common stock to an investor upon the conversion of a convertible note.

| 15 |

On August 18, 2021, the Company issued 6,114,516 shares of common stock to an investor upon the conversion of a convertible note.

On September 1, 2021, the Company issued 10,000,000 units (each unit (“Unit”) consisting of one share of common stock and a two-year warrant to purchase one share of common stock at an exercise price of $0.025 per share) to Charles Hyatt in a private offering for proceeds of $250,000.

On September 1, 2021, the Company issued 600,000 Units to Grace Hyatt in a private offering for proceeds of $15,000.

On September 20, 2021, the Company issued 4,000,000 Units to three accredited investors for aggregate proceeds of $100,000.

On September 22, 2021, the Company issued a law firm 1,190,476 shares of common stock to a law firm for legal services related to the acquisition of SSI.

On November 30, 2021 and December 31, 2021 the Company issued 484,330 shares of common stock and 112,676 shares of common stock, respectively, to a consultant for dive retail advisory services provided to the Company.

On December 31, 2021, the Company issued 763,983 shares of common stock to a vendor as compensation under an exclusivity agreement.

The above issuances did not involve any underwriters, underwriting discounts or commissions, or any public offering and we believe are exempt from the registration requirements of the Securities Act of 1933 by virtue of Section 4(2) thereof.

| Item 6. | Reserved |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations. |

You should read the following discussion and analysis of our financial condition and results of operations together with our financial statements and related notes appearing in this Annual Report. Some of the information contained in this discussion and analysis or set forth elsewhere in this Annual Report, including information with respect to our plans and strategy for our business, includes forward-looking statements that involve risks and uncertainties. As a result of many factors, our actual results could differ materially from the results described in or implied by the forward-looking statements contained in the following discussion and analysis. Forward-looking statements represent our management’s beliefs and assumptions only as of the date of this Annual Report. Actual future results may be materially different from what we expect. We undertake no obligation to update such statements to reflect events that occur or circumstances that exist after the date on which they are made, except as required by federal securities and any other applicable law.

The management’s discussion and analysis of our financial condition and results of operations are based upon our audited financial statements, which have been prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”).

Recent Developments

On September 3, 2021, the Company, entered into an Agreement and Plan of Merger and Reorganization (the “Merger Agreement”) with Submersible Acquisition, Inc., a Florida corporation and wholly owned subsidiary of the Company (“Acquisition Sub”), SSI, and Summit Holdings V, LLC, a Florida limited liability company (“Summit”) and Tierra Vista Group, LLC, a Florida limited liability company (“Tierra Vista” and, together with Summit, the “Sellers”), the owners of all of the capital stock of SSI (the “Submersible Shares”), pursuant to which Acquisition Sub merged with and into Submersible (the “Merger”), and Submersible, the surviving corporation, became a wholly owned subsidiary of the Company. The Merger became effective upon the filing of Articles of Merger with the Secretary of State of the State of Florida.

| 16 |

Pursuant to the terms and conditions of the Merger Agreement, the Company acquired all of the Submersible Shares from the Sellers for an aggregate purchase price of $1,799,919 (the “Merger Consideration”), which was paid to the Sellers at closing by issuance to the Sellers of three-year 8% convertible promissory notes in the aggregate principal amount of $350,000 and an aggregate of 27,305,442 shares (the “ Merger Shares”) of the Company’s common stock.

The Merger Shares are subject to a leak-out restriction commencing on the date of issuance, as follows: (i) up to 12.5% may be sold after 6 months; (ii) up to 25% may be sold after 9 months; (iii) up to 75% may be sold after 24 months; and (iv) up to 100% may be sold after 36 months. Notwithstanding the foregoing, the leak-out restriction may be waived by the Company under certain conditions.

The Sellers were granted “piggyback” registration rights with respect to the Merger Shares and the shares of common stock that may be received upon their conversion of the 8% convertible notes.

Interest under the notes is payable at the end of each 3-month period commencing on September 30, 2021, in shares of common stock of the Company. The Company may prepay the notes in whole or in part at any time without penalty or premium. Within 30 days after the end of each quarter, commencing on the first full quarter after the closing, the Company is obligated to pay, as a reduction of the principal amount of the notes, in cash, payments equal to 50% of SSI’s operating net income before interest, taxes, depreciation and amortization (but expressly excluding any overhead cost allocation applied to SSI by the Company). The final payment will be a balloon payment of the balance due upon the end of the term of the notes. The holders of notes may convert the notes, in whole or in part, at any time, into shares of common stock.

In connection with the Merger, Rick Kearney, Submersible’s founder, entered into a five-year confidentiality, non-competition and non-solicitation agreement with the Company.

On September 17, 2021 the Company completed a private placement of an aggregate of 14,600,000 Units to five purchasers at a purchase price of $0.025 per Unit for gross proceeds of $365,000, with each Unit consisting of one restricted share of the Company’s common stock and one two year common stock purchase warrant to purchase one restricted share of common stock at an exercise price of $0.025 per share. The Units were offered and sold pursuant to the terms of a subscription agreement (the “Subscription Agreement”) to accredited or otherwise qualified investors and included Charles Hyatt, a director and an affiliate of Mr. Hyatt, who purchased an aggregate of 10,600,000 Units. The Company did not pay any commissions or finder’s fees and is using the proceeds for working capital.

Impact of COVID-19 Pandemic

The Company has previously been affected by temporary manufacturing closures, and employment and compensation adjustments. The market continues to suffer from the impacts of the pandemic via supply chain shortages and freight delays. The continued freight delays have and will likely continue to result in additional expenses to expedite delivery of critical parts. Additionally, increased demand for personal electronics has created a shortfall of microchip supply which are used in our battery powered products, and it is yet unknown how we may be impacted.

We continue to monitor macroeconomic conditions to remain flexible and to optimize and evolve our business as appropriate, and we will have to accurately project demand and infrastructure requirements globally and deploy our production, workforce and other resources accordingly.

Results of Operations

Years Ended December 31, 2021 and 2020

Overall, our net revenues increased 36.7% in 2021 from 2020, which included an increase of 37.5% in net revenue from sales to third parties and an increase of 33.2% in sales to related parties. Our cost of revenues in 2021 was 69.7% of our total net revenues as compared to 67.9% in 2020. Included in our cost of revenues are royalty expenses we pay to Robert Carmichael which increased 10.8% in 2021 from 2020. We reported a gross profit margin of 31.2% in 2021 as compared to 32.1% in 2020.

| 17 |

Net Revenues

The following tables provides net revenues, costs of revenues, and gross profit margins for our segments for 2021 and 2020.

| Year Ended December 31, | % | |||||||||||

| 2021 | 2020 | change | ||||||||||

| Legacy SSA Products | $ | 2,897,210 | $ | 2,721,753 | 6.4 | % | ||||||

| High Pressure Gas Systems | 616,039 | 489,590 | 25.8 | % | ||||||||

| Ultra-Portable Tankless Dive Systems | 2,241,359 | 1,344,630 | 66.7 | % | ||||||||

| Redundant Air Tank Systems | 472,771 | - | N/A | |||||||||

| Total revenue | $ | 6,227,379 | $ | 4,555,973 | 36.7 | % | ||||||

Cost of revenues as a percentage of net revenues

| Year Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Legacy SSA Products | 74.6 | % | 65.1 | % | ||||

| High Pressure Gas Systems | 62.7 | % | 63.4 | % | ||||

| Ultra-Portable Tankless Dive Systems | 64.1 | % | 74.2 | % | ||||

| Redundant Air Tank Systems | 74.6 | % | - | |||||

Gross profit margins

| Year Ended December 31, | ||||||||

| 2021 | 2020 | |||||||

| Legacy SSA Products | 25.4 | % | 34.5 | % | ||||

| High Pressure Gas Systems | 37.3 | % | 36.6 | % | ||||

| Ultra-Portable Tankless Dive Systems | 35.9 | % | 25.8 | % | ||||

| Redundant Air Tank Systems | 25.4 | % | - | |||||

SSA Products segment

The increase in net revenues of 6.4% from this segment for the year ended December 31, 2021 as compared to the year ended December 31, 2020 can be attributed to increased demand at the dealer level with a 20.2% increase. This increase was offset by decreases in direct to consumer revenues of 11.4%, and revenues to affiliates of 1.1%. The decrease in consumer demand is attributed to a shift to purchases at retail from our dealer base, as the economy has allowed the retail shops to re-open after the pandemic, and consumers switched their buying habits away from our website. Management believes that total sales were stifled by supply chain issues with the critical parts delays not allowing shipment for nearly the entire month of August 2021. Additionally, the Company has been unable to supply its popular Pioneer model of the Third Lung line since the middle of 2021 due to the lack of availability in North America of the engine that is the core selling feature of that unit.

Our costs of revenues as a percentage of net revenues in this segment increased from 65.5% in the year ended December 31, 2020 to 74.6% in the year ended December 31, 2021. The increase in cost of sales, and in turn decrease product margin, can be attributed primarily to an increase in suppliers cost of products during the latter half of 2021, and the cost of having to air freight a larger amount of products in order to keep the production lines occupied, and customer demand met. Additionally, The Company reserved an additional $58,829 for slow moving inventory. Lastly, the Company made a decision to not increase prices to dealers and consumers in the second half of 2021 and accept a smaller margin to ensure the continued movement by supporting our dealer base during the second quarter of 2021 in an effort to ensure continued product movement during the fourth quarter of 2021.

| 18 |

Revenue channels for this segment are set forth below. Direct to Consumer represents items sold via our website, trade shows and walk-ins to our factory store. Dealer revenue represents sales to customers that have dealer agreements that typically operate with the lowers margin. Affiliates are resellers of our products that do not have formal dealer agreements. Other represents all other sales that do not fit in any of the categories.

| Revenue | % | Cost of Sales | Margin | |||||||||||||||||||||||||

| 2021 | 2020 | Change | 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||

| Direct to Consumer (website included) | $ | 895,348 | $ | 1,010,527 | (11.4 | )% | 62.5 | % | 51.9 | % | 37.5 | % | 48.1 | % | ||||||||||||||

| Dealers | 1,888,233 | 1,570,683 | 20.2 | % | 79.9 | % | 74.2 | % | 20.1 | % | 25.8 | % | ||||||||||||||||

| Affiliates | 97,222 | 98,324 | (1.1 | )% | 61.6 | % | 68.6 | % | 38.4 | % | 31.4 | % | ||||||||||||||||

| Other | 16,407 | 42,219 | (61.1 | )% | 201.4 | % | 61.9 | % | (101.4 | )% | 38.1 | % | ||||||||||||||||

| Total | $ | 2,897,210 | $ | 2,721,753 | 6.4 | % | 74.6 | % | 65.1 | % | 25.4 | % | 34.5 | % | ||||||||||||||

High Pressure Gas Systems segment

Sales of high-pressure breathing air compressors had a 25.8% increase for the year ended December 31, 2021 as compared to the year ended December 31, 2020 as the marketplace showed an economic recovery during 2021. All segments have opened up, and demand is continuing to increase, with travel returning, and diving operations throughout the US and Caribbean re-opened and receiving tourists. The majority of our dive resort and dive operator customers’ businesses were back-up and running during the year ended December 31, 2021, and the recovery of this customer segment is reflected in the increases in revenue of 59.8% in the reseller segment. The Original Equipment Manufacturer segment showed the largest growth with an increase of 151.1% for the year ended December 31, 2021 as compared to 2020. The direct to consumer segment, which includes yacht owners and direct to dive stores declined for the year ended December 31, 2021 as compared to the same period in the prior year as product was allocated from this customer base to increase the reseller and OEM categories.

Our costs of revenues as a percentage of net revenues in this segment remained consistent at 63.4% in the years ended December 31, 2021 and 2020.

| Revenue | % | Cost of Sales | Margin | |||||||||||||||||||||||||

| 2021 | 2020 | Change | 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||

| Resellers | $ | 347,034 | $ | 217,150 | 59.8 | % | 63.6 | % | 73.6 | % | 36.4 | % | 26.4 | % | ||||||||||||||

| Direct to Consumers | 96,380 | 203,702 | (52.7 | )% | 68.9 | % | 54.4 | % | 31.1 | % | 45.6 | % | ||||||||||||||||

| Original Equipment Manufacturers | 172,625 | 68,738 | 151.1 | % | 57.3 | % | 57.9 | % | 42.7 | % | 42.1 | % | ||||||||||||||||

| Total | $ | 616,039 | $ | 489,590 | 25.8 | % | 62.7 | % | 63.4 | % | 37.3 | % | 36.6 | % | ||||||||||||||

Ultra Portable Tankless Dive Systems

Net revenues in this segment increased 66.7% for the year ended December 31, 2021 as compared to the year ended December 31, 2020 inclusive of the one-time revenue from the BLU-Vent project booked in the year ended December 31, 2020. During the second quarter of 2020, BLU3 received a purchase order from a third-party to adapt the design of the NEMO into a functional ventilator prototype, to potentially help with the ventilator shortage that the country was facing due to the COVID–19 pandemic. BLU3 Vent emerged as the first in the Hack-a-Vent challenge to pass through preliminary testing at Uniformed Services University to confirm feasibility to treat an ARDS inflicted patient. BLU3 Vent has submitted initial documents for a review with the FDA at the direction and with the support of the Wright Brothers Institute. This project is currently suspended as urgent demand for emergency use ventilators has declined. Revenue from this agreement totaled $570,060 for the year ended December 31, 2020. Net of the one-time BLU-Vent project, revenue increased 189.4% during the year ended December 31, 2021. The increase in revenue for 2021 can be attributed to a 73.5% increase in NEMO sales over the prior year, and the introduction of the NOMAD to the market in the late third quarter of 2021 at a price point is nearly double that of NEMO. The largest contributors to the revenue increases for year ended December 31, 2021 as compared to the prior year, are the growth in dealer sales and sales via the Amazon channel. Through December 31, 2021, BLU3 is selling to Amazon in nine countries as well as a significant presence in the US Amazon Channel. BLU3 continues to expand its dealer base which can be seen by the 225.6% revenue growth for the year ended December 31, 2021 as compared to the same period in 2020. The Company’s continued focus on direct to consumer via its website accounted for an 84.1% increase for the year ended December 31, 2021 as compared to the prior year.

| 19 |

Our aggregate cost of revenue from this segment as a percentage of net revenues for the year ended December 31, 2021 decreased to 64.1% as compared to 74.2% for the year ended December 31 2020. The decrease can be attributed to efficiencies found in both the product cost and labor cost in building the NOMAD.

| Revenue | % | Cost of Sales | Margin | |||||||||||||||||||||||||

| 2021 | 2020 | Change | 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||

| Direct to Consumer | $ | 944,493 | $ | 512,892 | 84.1 | % | 54.3 | % | 43.5 | % | 45.7 | % | 56.5 | % | ||||||||||||||

| Dealers | 780,388 | 239,682 | 225.6 | % | 64.5 | % | 49.8 | % | 35.5 | % | 50.2 | % | ||||||||||||||||

| Amazon | 516,478 | 21,996 | 2,248.1 | % | 81.4 | % | 46.2 | % | 18.6 | % | 53.8 | % | ||||||||||||||||

| Ventilator | - | 570,060 | (100.0 | )% | - | 127.7 | % | - | (27.7 | )% | ||||||||||||||||||

| Total | $ | 2,241,359 | $ | 1,344,630 | 66.7 | % | 64.1 | % | 74.2 | % | 35.9 | % | 25.8 | % | ||||||||||||||

Redundant Air Tank Systems

Revenue for the year ended December 31, 2021 in the Redundant Air Tank Systems System segment represents revenue from September 3, 2021, the closing date of the acquisition of SSI. These margins were affected by direct labor costs, as supply issues during September caused delays in shipments to SSI’s worldwide customer base, which includes (1) commercial accounts, that have aircraft that require redundant air systems for their pilots and passengers, such as the oil business with helicopters flying to oil rigs located in the middle of large bodies of water. (2) government accounts that are typically domestic and international military customers who use their egress systems for various uses. (3) dealers accounts that are resellers including international distributors to the military, commercial account or dive shops, and domestic and international dive shops that carry their Spare Air product. (4) Direct to consumer sales represent not only online sales, but sales via trade shows that go direct to consumer

| Revenue | Cost of Sales | Margin | ||||||||||||||||||||||||||

| 2021 | 2020 | % change | 2021 | 2020 | 2021 | 2020 | ||||||||||||||||||||||

| Commercial | $ | 88,876 | - | 100 | % | 55.5 | % | - | 44.5 | % | - | |||||||||||||||||

| Dealers | 287,877 | - | 100 | % | 89.0 | % | - | 11.0 | % | - | ||||||||||||||||||

| Government | 42,875 | - | 100 | % | 25.6 | % | - | 74.4 | % | - | ||||||||||||||||||

| Direct to Consumers (Website) | 53,143 | - | 100 | % | 68.2 | % | - | 31.8 | % | - | ||||||||||||||||||

| Total | $ | 472,771 | - | 100 | % | 74.6 | % | - | 25.4 | % | - | |||||||||||||||||

Operating Expenses

Operating expenses, consisting of selling, general and administrative (“SG&A”) expenses and research and development costs, are reported on a consolidated basis for our operating segments. Aggregate operating expenses increased 33.8% for the year ended December 31, 2021 as compared to the year ended December 31, 2020.

Selling, General & Administrative Expenses (SG&A Expenses)

SG&A increased by 36.7% for the years ended December 31, 2021 as compared to the year ended December 31, 2020. SG&A during those years are as follows:

| Expense Item | 2021 | 2020 | % Change | |||||||||

| Payroll | $ | 1,144,020 | $ | 630,149 | 81.5 | % | ||||||

| Non-Cash Stock based compensation - options | 1,150,801 | 858,695 | 34.0 | % | ||||||||

| Professional Fees | 469,206 | 467,271 | 0.4 | % | ||||||||

| Advertising | 343,232 | 154,642 | 121.9 | % | ||||||||

| All Others | 559,569 | 571,536 | (2.8 | )% | ||||||||

| Total SG&A | $ | 3,666,823 | $ | 2,682,293 | 36.7 | % | ||||||

Payroll increases for the year ended December 31, 2021 are primarily due to the addition of SSI payroll which accounted for 34.3% of the increase. The balance of the increase can be attributed to the hiring of a chief executive officer, a social media/marketing manager, and several other operating and administrative personnel to support the growth in each of our divisions.

| 20 |

Non-Cash Stock compensation expenses increased 34.0% for the year ended December 31, 2021 as compared to the year ended December 31, 2020. The increase can be attributed to stock options issued to employees as part of the Company’s 2021 Equity Plan, stock options issued to Blake Carmichael and Christeen Buban, President of SSI, pursuant to their employment agreements during the year ended December 31, 2021. Additionally, the increase can be attributed to compensation and bonus stock options issued to our Chief Executive Officer, pursuant to his employment agreement and expenses related to options issued to our Chairman.

Professional fees, representing legal and other professional fees, which we paid in a combination of cash, common stock, or stock options, had an increase of .4% for the year ended December 31, 2021 as compared to the year ended December 31, 2020. This despite an increase in professional fees related to the acquisition of SSI.

Advertising expense increased 121.9% for the year ended December 31, 2021 as compared to the year ended December 31, 2020. 108.0% of the increase can be directly attributed to an increase of direct, internet and Amazon marketing by BLU3. The addition of SSI attributed 15.4% of the increase in advertising expenses for the year ended December 31, 2021. These increases are offset by decreases in Trebor advertising expenses associated with the agreement with the Company’s provider of marketing and advertising, which was entered into in the third quarter of 2020, and was not renewed as of July 31, 2021.

Research & Development Expenses (R&D Expenses)

R&D expenses for the year ended December 31, 2021 decreased 34.5% as compared to the year ended December 31, 2020. The decrease can be primarily attributed to the lack of R&D expenses related to the BLU-Vent project in 2021 as well as the completion of the R&D for BLU3’s NOMAD in 2021.

Other Income

For the year ended December 31, 2021 other income and expenses, totaled approximately $264,000 in income as compared to approximately $18,600 in expenses for the year ended December 31, 2020. Interest expense for the year ended December 31, 2021 was approximately $21,500 as compared to approximately $18,600 for the year ended December 31, 2020. This increase can be attributed to the increase in convertible debt related to the SSI acquisition. Other income for the year ended December 31, 2021 included a gain on the forgiveness of Trebor and SSI PPP loans totaling approximately $275,800 and the forgiveness of a loan payable of $10,000.

Liquidity and Capital Resources