UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

|

o |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

|

|

|

OR | |

|

|

|

|

o |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report . . . . . . . . . . . . . . . . . . .

For the transition period from to

Commission file number 0-51504

|

GENETIC TECHNOLOGIES LIMITED |

|

(Exact name of Registrant as specified in its charter) |

|

|

|

N/A |

|

(Translation of Registrant’s name into English) |

|

|

|

AUSTRALIA |

|

(Jurisdiction of incorporation or organization) |

|

|

|

60-66 Hanover Street, Fitzroy, Victoria, 3065, Australia Telephone: 011 61 3 8412 7000; Facsimile: 011 61 3 8412 7040 |

|

(Address of principal executive offices) |

|

|

|

Kevin Fischer Telephone: 011 61 3 8412 7000; Facsimile: 011 61 3 8412 7040 Email: kevin.fischer@gtglabs.com 60-66 Hanover Street, Fitzroy, Victoria, 3065, Australia |

|

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person) |

Securities registered or to be registered pursuant to Section 12(b) of the Act. None

Securities registered or to be registered pursuant to Section 12(g) of the Act.

|

American Depositary Shares each representing 150 Ordinary Shares and evidenced by American Depositary Receipts |

|

Title of each Class |

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

|

|

2,435,282,724 Ordinary Shares |

|

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

o Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

o Yes x No

Note — Checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

x Yes o No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). x Yes o No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

Large accelerated filer o |

|

Accelerated filer o |

|

Non-accelerated filer x |

|

Emerging growth company o |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. o Yes o No

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

U.S. GAAP o |

|

International Financial Reporting Standards as issued |

|

Other o |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow.

o Item 17 o Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

o Yes x No

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court.

o Yes o No

|

1 | ||

|

|

|

|

|

1 | ||

|

|

|

|

|

1 | ||

|

|

|

|

|

1 | ||

|

|

|

|

|

3 | ||

|

|

|

|

|

3 | ||

|

|

|

|

|

4 | ||

|

|

|

|

|

19 | ||

|

|

|

|

|

19 | ||

|

|

|

|

|

20 | ||

|

|

|

|

|

29 | ||

|

|

|

|

|

29 | ||

|

|

|

|

|

30 | ||

|

|

|

|

|

30 | ||

|

|

|

|

|

34 | ||

|

|

|

|

|

35 | ||

|

|

|

|

|

36 | ||

|

|

|

|

|

36 | ||

|

|

|

|

|

36 | ||

|

|

|

|

|

36 | ||

|

|

|

|

|

36 | ||

|

|

|

|

|

38 |

|

44 | ||

|

|

|

|

|

46 | ||

|

|

|

|

|

46 | ||

|

|

|

|

|

46 | ||

|

|

|

|

|

46 | ||

|

|

|

|

|

46 | ||

|

|

|

|

|

47 | ||

|

|

|

|

|

47 | ||

|

|

|

|

|

47 | ||

|

|

|

|

|

48 | ||

|

|

|

|

|

49 | ||

|

|

|

|

|

49 | ||

|

|

|

|

|

51 | ||

|

|

|

|

|

51 | ||

|

|

|

|

|

51 | ||

|

|

|

|

|

51 | ||

|

|

|

|

|

51 | ||

|

|

|

|

|

51 | ||

|

|

|

|

|

51 | ||

|

|

|

|

|

55 | ||

|

|

|

|

|

56 | ||

|

|

|

|

|

Exchange Controls and Other Limitations Affecting Security Holders |

56 | |

|

|

|

|

|

57 | ||

|

|

|

|

|

63 | ||

|

|

|

|

|

63 | ||

|

|

|

|

|

63 | ||

|

|

|

|

|

63 | ||

|

|

|

|

|

64 |

|

64 | ||

|

|

|

|

|

64 | ||

|

|

|

|

|

64 | ||

|

|

|

|

|

64 | ||

|

|

|

|

|

64 | ||

|

|

|

|

|

64 | ||

|

|

|

|

|

Material Modifications to The Rights Of Security Holders and Use Of Proceeds |

64 | |

|

|

|

|

|

65 | ||

|

|

|

|

|

65 | ||

|

|

|

|

|

Management’s annual report on internal control over financial reporting |

65 | |

|

|

|

|

|

66 | ||

|

|

|

|

|

66 | ||

|

|

|

|

|

66 | ||

|

|

|

|

|

66 | ||

|

|

|

|

|

67 | ||

|

|

|

|

|

68 | ||

|

|

|

|

|

Purchases Of Equity Securities By The Issuer And Affiliated Purchasers |

68 | |

|

|

|

|

|

68 | ||

|

|

|

|

|

68 | ||

|

|

|

|

|

68 | ||

|

|

|

|

|

68 | ||

|

|

|

|

|

69 | ||

|

|

|

|

|

69 |

INTRODUCTION

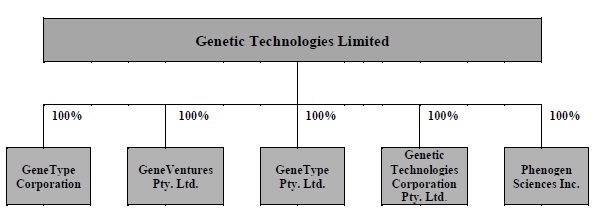

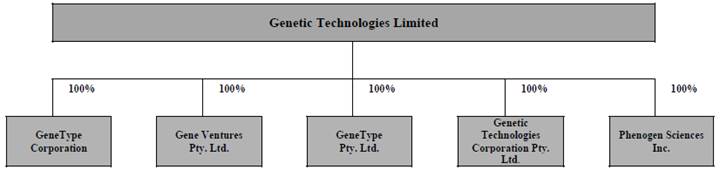

In this Annual Report, the “Company,” “Genetic Technologies”, “we,” “us” and “our” refer to Genetic Technologies Limited and its consolidated subsidiaries.

Our consolidated financial statements are set out on pages F1 to F39 of this Annual Report (refer to Item 18 “Financial Statements”).

References to the “ADSs” are to our ADSs described in Item 12.D “American Depositary Shares” and references to the “Ordinary Shares” are to our Ordinary Shares described in Item 10.A “Share Capital”.

Our fiscal year ends on June 30 and references in this Annual Report to any specific fiscal year are to the twelve month period ended on June 30 of such year.

FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that involve risks and uncertainties. We use words such as “anticipates”, “believes”, “plans”, “expects”, “future”, “intends” and similar expressions to identify such forward-looking statements. This Annual Report also contains forward-looking statements attributed to certain third parties relating to their estimates regarding the growth of Genetic Technologies and related service markets and spending. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Annual Report. Our actual results could differ materially from those anticipated in these forward-looking statements for many reasons, including the risks faced by us described below under the caption “Risk Factors” and elsewhere in this Annual Report.

Although we believe that the expectations reflected in such forward-looking statements are reasonable at this time, we can give no assurance that such expectations will prove to be correct. Given these uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Important factors that could cause actual results to differ materially from our expectations are contained in cautionary statements in this Annual Report including, without limitation, in conjunction with the forward-looking statements included in this Annual Report and specifically under Item 3.D “Risk Factors”.

All subsequent written and oral forward-looking statements attributable to us are expressly qualified in their entirety by reference to these cautionary statements.

ENFORCEMENT OF LIABILITIES AND SERVICE OF PROCESS

We are incorporated under the laws of Western Australia in the Commonwealth of Australia. The majority of our directors and executive officers, and any experts named in this Annual Report, reside outside the U.S. Substantially all of our assets, our directors’ and executive officers’ assets and such experts’ assets are located outside the U.S. As a result, it may not be possible for investors to affect service of process within the U.S. upon us or our directors, executive officers or such experts, or to enforce against them or us in U.S. courts, judgments obtained in U.S. courts based upon the civil liability provisions of the federal securities laws of the U.S. In addition, we have been advised by our Australian solicitors that there is doubt that the courts of Australia will enforce against us, our directors, executive officers and experts named herein, judgments obtained in the U.S. based upon the civil liability provisions of the federal securities laws of the U.S. or will enter judgments in original actions brought in Australian courts based upon the federal securities laws of the U.S.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3.A Selected Financial Data

The following selected financial data for the five years ended June 30, 2018 is derived from the audited consolidated financial statements of Genetic Technologies Limited, prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board, which became effective for our Company as of our fiscal year ended June 30, 2006.

The balance sheet data as of June 30, 2018 and 2017 and the statement of comprehensive income/(loss) data for the 2018, 2017 and 2016 fiscal years are derived from our audited consolidated financial statements which are included in this Annual Report. Balance sheet data as of June 30, 2016, 2015 and 2014 and statement of comprehensive income/ (loss) data for the 2015 and 2014 financial years are derived from our audited consolidated financial statements which are not included in this Annual Report. The data should be read in conjunction with the consolidated financial statements, related notes and other financial information included herein.

All amounts are stated in Australian dollars as of June 30, as noted.

GENETIC TECHNOLOGIES LIMITED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME/ (LOSS)

FOR 2018, 2017, 2016, 2015 AND 2014

|

|

|

Year ended |

|

Year ended |

|

Year ended |

|

Year ended |

|

Year ended |

|

|

|

|

AUD |

|

AUD |

|

AUD |

|

AUD |

|

AUD |

|

|

Revenue from operations |

|

|

|

|

|

|

|

|

|

|

|

|

Genetic testing services |

|

189,254 |

|

518,506 |

|

824,586 |

|

2,011,918 |

|

4,564,280 |

|

|

Less: cost of sales |

|

(300,088 |

) |

(492,417 |

) |

(743,060 |

) |

(891,243 |

) |

(1,837,729 |

) |

|

Gross profit from operations |

|

(110,834 |

) |

26,089 |

|

81,526 |

|

1,120,675 |

|

2,726,551 |

|

|

Other revenue |

|

— |

|

— |

|

300,548 |

|

1,027,151 |

|

863,832 |

|

|

Gain on deconsolidation of subsidiary |

|

— |

|

— |

|

— |

|

— |

|

761,361 |

|

|

Selling and marketing expenses |

|

(1,066,404 |

) |

(2,721,474 |

) |

(3,186,497 |

) |

(4,504,299 |

) |

(6,251,595 |

) |

|

General and administrative expenses |

|

(3,015,818 |

) |

(3,109,530 |

) |

(3,429,357 |

) |

(4,222,988 |

) |

(3,173,109 |

) |

|

Licensing, patent and legal costs |

|

— |

|

— |

|

(103,581 |

) |

(435,418 |

) |

(1,079,199 |

) |

|

Laboratory, research and development costs |

|

(2,210,498 |

) |

(2,366,334 |

) |

(2,584,752 |

) |

(2,851,665 |

) |

(3,298,127 |

) |

|

Finance costs |

|

(28,843 |

) |

(31,995 |

) |

(28,889 |

) |

(264,694 |

) |

(744,199 |

) |

|

Foreign exchange gains reclassified on liquidation of subsidiary |

|

527,049 |

|

|

|

|

|

|

|

|

|

|

Gain on disposal of business |

|

— |

|

— |

|

— |

|

1,396,798 |

|

— |

|

|

Impairment of intangible asset expense |

|

— |

|

(544,694 |

) |

— |

|

— |

|

— |

|

|

Fair value loss on ImmunAid option fee |

|

— |

|

— |

|

— |

|

(795,533 |

) |

— |

|

|

Share of net loss of associates accounted for using the equity method |

|

— |

|

— |

|

— |

|

— |

|

(362,682 |

) |

|

Fair value gain/ (loss) on financial liabilities at fair value through profit or loss |

|

— |

|

— |

|

— |

|

349,246 |

|

(648,374 |

) |

|

Non-operating income and expenses |

|

441,476 |

|

344,112 |

|

492,037 |

|

370,557 |

|

1,071,072 |

|

|

Profit/(loss) from continuing operations before income tax |

|

(5,463,872 |

) |

(8,403,826 |

) |

(8,458,965 |

) |

(8,810,170 |

) |

(10,134,469 |

) |

|

Net profit from discontinued operation |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

Profit/(loss) before income tax |

|

(5,463,872 |

) |

(8,403,826 |

) |

(8,458,965 |

) |

(8,810,170 |

) |

(10,134,469 |

) |

|

Income tax expense |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

Profit/(loss) for the year |

|

(5,463,872 |

) |

(8,403,826 |

) |

(8,458,965 |

) |

(8,810,170 |

) |

(10,134,469 |

) |

|

Other comprehensive income/(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

Exchange gains/(losses) on translation of controlled foreign operations |

|

(522,966 |

) |

(130,655 |

) |

1,307,219 |

|

414,005 |

|

(149,162 |

) |

|

Exchange gains/(losses) on translation of non-controlled foreign operations |

|

— |

|

— |

|

— |

|

— |

|

86 |

|

|

Other comprehensive income/(loss) for the year, net of tax |

|

(522,966 |

) |

(130,655 |

) |

1,307,219 |

|

414,005 |

|

(149,076 |

) |

|

Total comprehensive profit/(loss) for the year |

|

(5,986,481 |

) |

(8,534,481 |

) |

(7,151,746 |

) |

(8,396,165 |

) |

(10,283,545 |

) |

|

Profit/(loss) for the year is attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

Owners of Genetic Technologies Limited |

|

(5,463,872 |

) |

(8,403,826 |

) |

(8,458,965 |

) |

(8,810,170 |

) |

(10,125,197 |

) |

|

Non-controlling interests |

|

— |

|

— |

|

— |

|

— |

|

(9,272 |

) |

|

Total profit/(loss) for the year |

|

(5,463,872 |

) |

(8,403,826 |

) |

(8,458,965 |

) |

(8,810,170 |

) |

(10,134,469 |

) |

|

Total comprehensive profit/(loss) for the year is attributable to: |

|

|

|

|

|

|

|

|

|

|

|

|

Owners of Genetic Technologies Limited |

|

(5,986,838 |

) |

(8,534,481 |

) |

(7,151,746 |

) |

(8,396,165 |

) |

(10,274,359 |

) |

|

Non-controlling interests |

|

— |

|

— |

|

— |

|

— |

|

(9,186 |

) |

|

Total comprehensive profit/(loss) for the year |

|

(5,986,838 |

) |

(8,534,481 |

) |

(7,151,746 |

) |

(8,396,165 |

) |

(10,283,545 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings/(loss) per share (cents per share) |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted net profit/(loss) per ordinary share |

|

(0.22 |

) |

(0.40 |

) |

(0.49 |

) |

(0.82 |

) |

(1.76 |

) |

|

Weighted-average shares outstanding |

|

2,435,282,724 |

|

2,121,638,888 |

|

1,715,214,158 |

|

1,072,803,358 |

|

574,557,747 |

|

GENETIC TECHNOLOGIES LIMITED

CONSOLIDATED BALANCE SHEET DATA

FOR 2018, 2017, 2016, 2015 AND 2014

|

|

|

As of |

|

As of |

|

As of |

|

As of |

|

As of |

|

|

|

|

AUD |

|

AUD |

|

AUD |

|

AUD |

|

AUD |

|

|

Assets |

|

|

|

|

|

|

|

|

|

|

|

|

Current assets |

|

5,990,697 |

|

11,631,649 |

|

12,131,070 |

|

19,566,096 |

|

4,360,509 |

|

|

Non-current assets |

|

175,284 |

|

476,648 |

|

1,158,616 |

|

1,153,636 |

|

2,368,690 |

|

|

Total assets |

|

6,165,981 |

|

12,108,297 |

|

13,289,686 |

|

20,719,732 |

|

6,729,199 |

|

|

Liabilities |

|

|

|

|

|

|

|

|

|

|

|

|

Current liabilities |

|

(1,450,713 |

) |

(1,465,293 |

) |

(1,332,189 |

) |

(1,735,163 |

) |

(2,318,016 |

) |

|

Non-current liabilities |

|

(3,390 |

) |

(63,960 |

) |

(74,308 |

) |

(25,321 |

) |

(2,583,664 |

) |

|

Total liabilities |

|

(1,454,103 |

) |

(1,529,253 |

) |

(1,406,497 |

) |

(1,760,484 |

) |

(4,901,680 |

) |

|

Net assets |

|

4,711,878 |

|

10,579,044 |

|

11,883,189 |

|

18,959,248 |

|

1,827,519 |

|

|

Equity |

|

|

|

|

|

|

|

|

|

|

|

|

Contributed equity |

|

122,372,662 |

|

122,382,625 |

|

115,272,576 |

|

115,247,128 |

|

90,080,492 |

|

|

Reserves |

|

5,651,162 |

|

6,044,493 |

|

6,054,861 |

|

4,697,403 |

|

3,922,140 |

|

|

Accumulated losses |

|

(123,311,946 |

) |

(117,848,074 |

) |

(109,444,248 |

) |

(100,985,283 |

) |

(92,175,113 |

) |

|

Non-controlling interests |

|

— |

|

— |

|

— |

|

— |

|

— |

|

|

Total equity |

|

4,711,878 |

|

10,579,044 |

|

11,883,189 |

|

18,959,248 |

|

1,827,519 |

|

Exchange rates

The following table sets forth, for the periods and dates indicated, certain information concerning the noon buying rate in New York City for Australian dollars expressed in U.S. dollars per $1.00 as certified for customs purposes by the Federal Reserve Bank of New York.

|

Period ended |

|

At period end |

|

Average rate |

|

High |

|

Low |

|

|

|

|

|

|

|

|

|

|

|

|

|

Yearly data |

|

|

|

|

|

|

|

|

|

|

June 2014 |

|

0.9427 |

|

0.9186 |

|

0.9705 |

|

0.8715 |

|

|

June 2015 |

|

0.7704 |

|

0.8365 |

|

0.9488 |

|

0.7566 |

|

|

June 2016 |

|

0.7432 |

|

0.7289 |

|

0.7817 |

|

0.6855 |

|

|

June 2017 |

|

0.7676 |

|

0.7562 |

|

0.7680 |

|

0.7387 |

|

|

June 2018 |

|

0.7399 |

|

0.7753 |

|

0.8105 |

|

0.7355 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Monthly data |

|

|

|

|

|

|

|

|

|

|

April 2018 |

|

0.7543 |

|

0.7684 |

|

0.7784 |

|

0.7543 |

|

|

May 2018 |

|

0.7570 |

|

0.7525 |

|

0.7595 |

|

0.7445 |

|

|

June 2018 |

|

0.7399 |

|

0.7498 |

|

0.7677 |

|

0.7355 |

|

|

July 2018 |

|

0.7438 |

|

0.7403 |

|

0.7466 |

|

0.7322 |

|

|

August 2018 |

|

0.7192 |

|

0.7325 |

|

0.7428 |

|

0.7192 |

|

|

September 2018 |

|

0.7238 |

|

0.7206 |

|

0.7278 |

|

0.7107 |

|

|

October 19, 2018 |

|

0.7132 |

|

|

|

|

|

|

|

Item 3.B Capitalization and Indebtedness

Not applicable.

Item 3.C Reasons for the Offer and Use of Proceeds

Not applicable.

Before you purchase our ADSs, you should be aware that there are risks, including those described below. You should consider carefully these risk factors together with all of the other information contained elsewhere in this Annual Report before you decide to purchase our ADSs.

Risks Related to our Business and Business Strategy

A material uncertainty exists that may cast significant doubt about our Company’s ability to continue as a Going concern.

For the year ending June 30, 2018, the Group incurred a total comprehensive loss of $5,986,838 (2017: $8,534,481) and net cash outflow from operations of $5,621,315 (2017: $6,813,639). As at June 30, 2018 the Group held total cash and cash equivalents of $5,487,035.

During the 2019 financial year, the Directors expect increased cash outflows from operations as the Company continues to invest resources in expanding the research & development, sales & marketing, and blockchain activities in support of the distribution of BREVAGenplus® and its pipeline of risk assessment products. As a result of these expected cash outflows, the Directors intend to raise new equity funding within the next twelve months in order to ensure the Company continues to hold adequate levels of available cash resources to meet creditors and other commitments. The Company has subsequent to June 30, 2018 executed an equity placement facility with Kentgrove Capital Pty Ltd whereby it has an opportunity to raise equity funding of up to $20 million in a series of individual placements of up to $1 million (or a higher amount by mutual agreement) over a period of 20 months, expiring April 7, 2020. The Company has in place an open Placement Prospectus, which provides the Company with greater flexibility should the opportunity arise to offer and issue any of the Placement Shares while this Prospectus remains open. Since June 30, 2018, the Company has issued 100,000,000 shares under this facility, resulting in cash inflows from financing of $1,350,000. In addition to this facility the Directors will also consider other sources of equity funding through traditional offerings in either Australia or the United States.

The continuing viability of the Company and its ability to continue as a going concern and meet its debts and commitments as they fall due is dependent on the satisfactory completion of planned equity raisings, which are not guaranteed.

Due to the uncertainty surrounding the timing, quantum or the ability to raise additional equity, there is a material uncertainty that may cast significant doubt on the Group’s ability to continue as a going concern and therefore, that it may be unable to realise its assets and discharge its liabilities in the normal course of business. However, the Directors believe that the Group will be successful in the above matters and accordingly, have prepared the financial report on a going concern basis. As such no adjustments have been made to the financial statements relating to the recoverability and classification of the asset carrying amounts or classification of liabilities that might be necessary should the Group not be able to continue as a going concern.

Our stock price is volatile and can fluctuate significantly based on events not in our control and general industry conditions. As a result, the value of your investment may decline significantly.

The biotechnology sector can be particularly vulnerable to abrupt changes in investor sentiment. Stock prices of companies in the biotechnology industry, including ours, can swing dramatically, with little relationship to operating performance. Our stock price may be affected by a number of factors including, but not limited to:

· product development events;

· the outcome of litigation;

· decisions relating to intellectual property rights;

· the entrance of competitive products or technologies into our markets;

· new medical discoveries;

· the establishment of strategic partnerships and alliances;

· changes in reimbursement policies or other practices related to the pharmaceutical industry; or

· other industry and market changes or trends.

Since our listing on the Australian Securities Exchange in August 2000, the price of our Ordinary Shares has ranged from a low of $0.006 to a high of $0.97 per share. Further fluctuations are likely to occur due to events which are not within our control and general market conditions affecting the biotechnology sector or the stock market generally.

In addition, low trading volume may increase the volatility of the price of our ADSs. A thin trading market could cause the price of our ADSs to fluctuate significantly more than the stock market as a whole. For example, trades involving a relatively small number of our ADSs may have a greater impact on the trading price for our ADSs than would be the case if the trading volume were higher.

The following chart illustrates the fluctuation in the price of our shares (in Australian dollars) over the last five years:

(Refer Item 9.A for more information on key data points on this chart)

(Source: Yahoo Finance: https//au.finance.yahoo.com/)

The fact that we do not expect to pay cash dividends may lead to decreased prices for our stock.

We have never declared or paid a cash dividend on our Ordinary Shares and we do not anticipate to do so in the foreseeable future. We intend to retain future cash earnings, if any, for reinvestment in the development and expansion of our business. Whether we pay cash dividends in the future will be at the discretion of our Board of Directors and may be dependent on our financial condition, results of operations, capital requirements and any other factors our Board of Directors decides is relevant. As a result, an investor may only recognize an economic gain on an investment in our stock from an appreciation in the price of our stock, which is uncertain and unpredictable. There is no guarantee that our ordinary shares will appreciate in value or even maintain the price at which an investor purchased the ordinary shares.

You may have difficulty in effecting service of legal process and enforcing judgments against us and our Management.

We are a public company limited by shares, registered and operating under the Australian Corporations Act 2001. The majority of our directors and officers named in this Annual Report reside outside the U.S. Substantially all, or a substantial portion of, the assets of those persons are also located outside the U.S. As a result, it may not be possible to affect service on such persons in the U.S. or to enforce, in foreign courts, judgments against such persons obtained in U.S. courts and predicated on the civil liability provisions of the federal securities laws of the U.S. Furthermore, substantially all of our directly-owned assets are located outside the U.S., and, as such, any judgment obtained in the U.S. against us may not be collectible within the U.S. There is doubt as to the enforceability in the Commonwealth of Australia, in original actions or in actions for enforcement of judgments of U.S. courts, of civil liabilities predicated solely upon federal or state securities laws of the U.S., especially in the case of enforcement of judgments of U.S. courts where the defendant has not been properly served in Australia.

Because we are not necessarily required to provide you with the same information as an issuer of securities based in the United States, you may not be afforded the same protection or information you would have if you had invested in a public corporation based in the United States.

We are exempt from certain provisions of the Securities Exchange Act of 1934, as amended, commonly referred to as the Exchange Act, that are applicable to U.S. public companies, including (i) the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q or current reports on Form 8-K; (ii) the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act; and (iii) the sections of the Exchange Act requiring insiders to file public reports of their stock ownership and trading activities and liability for insiders who profit from trades made in a short period of time. The exempt provisions would be available to you if you had invested in a U.S. corporation.

However, in line with the Australian Securities Exchange regulations, we disclose our financial results on a semi-annual basis (which is performed under International Standard on Review Engagements) and to be fully audited annually (which is performed under International Standards on Auditing) which are required to have a limited review semi-annually and to be fully audited annually. The information, which may have an effect on our stock price on the Australian Securities Exchange, will be disclosed to the Australian Securities Exchange and also the Securities Exchange Commission. Other relevant information pertaining to our Company will also be disclosed in line with the Australian Securities Exchange regulations and information dissemination requirements for listed companies. We will provide our semi-annual results and other material information that we make public in Australia in the U.S. under the cover of an SEC Form 6-K. Nevertheless, you may not be afforded the same protection or information, which would be made available to you, were you investing in a United States public corporation because the requirements of a Form 10-Q and Form 8-K are not applicable to us.

If significant liquidity does not eventuate for our ADSs on NASDAQ, your ability to resell your ADSs could be negatively affected because there would be limited buyers for your interests.

Historically, there was virtually no trading in our ADSs through the pink sheets after the establishment of our Level I ADR Program. However, subsequent to the Level II listing of our ADSs on the NASDAQ Global Market on September 2, 2005, the trading volumes of our ADSs have increased. The Company subsequently transferred the listing of its ADSs to the NASDAQ Capital Market effective as from June 30, 2010. An active trading market for the ADSs, however, may not be maintained in the future. If an active trading market is not maintained, the liquidity and trading prices of the ADSs could be negatively affected.

In certain circumstances, holders of ADSs may have limited rights relative to holders of Ordinary Shares.

The rights of holders of ADSs with respect to the voting of Ordinary Shares and the right to receive certain distributions may be limited in certain respects by the deposit agreement entered into by us and The Bank of New York Mellon. For example, although ADS holders are entitled under the deposit agreement, subject to any applicable provisions of Australian law and of our Constitution, to instruct the depositary as to the exercise of the voting rights pertaining to the Ordinary Shares represented by the American Depositary Shares, and the depositary has agreed that it will try, as far as practical, to vote the Ordinary Shares so represented in accordance with such instructions, ADS holders may not receive notices sent by the depositary in time to ensure that the depositary will vote the Ordinary Shares. This means that, from a practical point of view, the holders of ADSs may not be able to exercise their right to vote. In addition, under the deposit agreement, the depositary has the right to restrict distributions to holders of the ADSs in the event that it is unlawful or impractical to make such distributions. We have no obligation to take any action to permit distributions to holders of our American Depositary Receipts, or ADSs. As a result, holders of ADSs may not receive distributions made by us.

Our Company has a history of incurring losses.

The business now called Genetic Technologies Limited was founded in 1989. With the exception of the year ended June 30, 2011, the Company has incurred operating losses in every year of its existence. As at June 30, 2018, the Company had accumulated losses of $123,311,946 and the extent of any future losses and whether or not the Company can generate profits in future years remains uncertain. The Company currently does not generate sufficient revenue to cover its operating expenses. We expect our capital outlays and operating expenditures to continue to increase for the foreseeable future as we continue to commercialise existing R&D capabilities, IP and introduce an enhanced BREVAGenplus breast cancer risk assessment test and a colon cancer risk assessment test progress development of a suite of genetic screening tests targeting both cancer and non-oncological diseases utilising the latest technology and platforms, and explore and capitalise on blockchain opportunities in the medical and biotech industries.

There is no certainty that the Company will be able to raise additional funds by issuing further shares and/or the raising of debt and, if such funds are available, on what terms the Company would be able to secure them. If we fail to generate sufficient revenue and eventually become profitable, or if we are unable to fund our continuing losses, our shareholders could lose all or part of their investments.

There is a substantial risk that we are, or will become, a passive foreign investment company, or PFIC, which will subject our U.S. investors to adverse tax rules.

Holders of our ADSs who are U.S. residents face income tax risks. There is a substantial risk that we are, or will become, a passive foreign investment company, commonly referred to as a PFIC. Our treatment as a PFIC could result in a reduction in the after-tax return to the holders of our ADSs and would likely cause a reduction in the value of such ADSs. For U.S. federal income tax purposes, we will be classified as a PFIC for any taxable year in which either (i) 75% or more of our gross income is passive income, or (ii) at least 50% of the average value of all of our assets for the taxable year produce or are held for the production of passive income. For this purpose, cash is considered to be an asset that produces passive income. We believe that we were a PFIC for the taxable year ended June 30, 2018 and there is a substantial risk we will be classified as a PFIC for the current taxable year. If we are classified as a PFIC for U.S. federal income tax purposes, highly complex rules will apply to U.S. holders owning ADSs. Accordingly, you are urged to consult your tax advisors regarding the application of such rules. United States residents should carefully read “Item 10.E. Additional Information—Taxation, United States Federal Income Tax Consequences” in this Annual Report, for a more complete discussion of the U.S. federal income tax risks related to owning and disposing of our ADSs.

The failure to establish sales, marketing and distribution capacity will materially impact our ability to successfully market and sell our genetic risk assessment tests

We currently have no experience in marketing, sales or distribution of genetic risk assessment tests. We announced in August 2018 that we were transitioning the BREVAGenplus commercial program from a direct salesforce in the US to an ecommerce based sales solution. To successfully establish a web based Consumer Initiated Testing (CIT) platform for the BREVAGenplus and future genetic risk assessment tests, we will have to enter into marketing arrangements with other parties who have established appropriate marketing and sales capabilities in the design and development of a suitable ecommerce platform. We may not be able to enter into marketing arrangements with any marketing party, or if such arrangements are established, our marketing partners may not be able to develop and design an ecommerce sales solution that achieves commercial success for BREVAGenplus or other future genetic risk assessment test. Failure to establish sufficient marketing capabilities through engagement with third party marketing service providers will materially impact our ability to successfully market and sell our tests.

If We Fail To Maintain An Effective System Of Internal Control Over Financial Reporting, We May Not Be Able To Accurately Report Our Financial Results Or Prevent Fraud.

Effective internal controls over financial reporting are necessary for us to provide reliable financial reports and, together with adequate disclosure controls and procedures, are designed to prevent fraud. Any failure to design and implement an effective system of internal control may reveal deficiencies in our internal controls over financial reporting that are deemed to be material weaknesses. Ineffective internal controls could also cause investors to lose confidence in our reported financial information, which could have a negative effect on the trading price of the ADSs and our ordinary shares.

As of June 30, 2018 Chief Executive Officer and Chief Financial Officer assessed the effectiveness of our internal control over financial reporting. In making this assessment, management used the criteria set forth by the Committee of Sponsoring Organizations of the Treadway Commission in Internal Control — Integrated Framework (2013). A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis. In connection with this assessment, we identified the following material weaknesses in internal control over financial reporting as of June 30, 2018.

The Company did not maintain an adequate segregation of duties with respect to internal control over financial reporting, given we have limited accounting personnel to enable and sufficiently evidence an independent review of complex financial reporting matters.

In an effort to remediate the identified material weaknesses and to enhance our overall control environment, we have implemented key steps to ensure continuity in the finance team and ongoing training, which through the introduction of a more controlled month end closing process has provided opportunity for the finance team to take on tasks including the preparation of the month end Finance Board reports and the FY2018 Annual Report which can now be reviewed by the CFO. Refer to Item 15 of this annual report on Form 20-F for further information on our remediation activities. We cannot assure you that the measures we have taken to date, and actions we may take in the future, will be sufficient to remediate the control deficiencies that led to our material weaknesses in our internal control over financial reporting or that they will prevent potential future material weaknesses.

Risks related to the Company’s Blockchain Projects

There is an Uncertain Regulatory Framework for Blockchain Technology. Changes to the framework could negatively affect us.

The regulatory status of blockchain technology is unclear or unsettled in many jurisdictions. It is difficult to predict how or whether governmental authorities will regulate such technologies. It is likewise difficult to predict how or whether any governmental authority may make changes to existing laws, regulations and/or rules that will affect blockchain technology and its applications. Such changes could negatively affect us in various ways, including ceasing the development of our blockchain projects or ceasing operations in a jurisdiction in the event that governmental or other actions make such operations unlawful or commercially undesirable to continue.

Blockchain technology will operate in a new and developing legal and regulatory environment. There is no established body of law or court decisions concerning blockchain and smart contracts. The Company may need to change its business model to comply with these licensing and/or registration requirements (or any other legal or regulatory requirements) in order to avoid violating applicable laws or regulations or because of the cost of such compliance. Uncertainty in how the legal and regulatory environment will develop could negatively impact the Company.

There is a risk that the Company’s Blockchain Technology could be Superseded or not function as intended.

There can be no assurance that the technology being proposed to underpin the Company’s blockchain applications will not be supplanted by competing protocols that improve upon, or fully replace, the Company’s technology. In addition, the Company’s use of blockchain may include coding errors or otherwise not function as intended, which may negatively affect its functionality.

Blockchain technology may be subject to risks of hacking and security weakness, which could have an adverse effect on the Company’s projects or implementation.

Hackers or other malicious groups or organizations may attempt to interfere with the Company’s blockchain in a variety of ways, including but not limited to malware attacks, denial of service attacks, consensus-based attacks, Sybil attacks, smurfing and spoofing. Furthermore, hackers or other individuals may uncover and exploit intentional or unintentional bugs or weaknesses in the network. Any of these risks if they occur could have a materially adverse effect on the Company’s projects or the implementation of its blockchain applications.

Risks Related to our Industry

Our sales cycle is typically lengthy.

The sales cycle for our testing products is typically lengthy. As a result, we may expend substantial funds and management effort with no assurance of successfully selling our products or services. Our ability to obtain customers for our molecular risk assessment and predictive genetic testing services depends significantly on the perception that our services can help accelerate efforts in genomics. Our sales effort requires the effective demonstration of the benefits of our services to, and significant training of, many different departments within a potential customer. In addition, we sometimes are required to negotiate agreements containing terms unique to each customer. Our business could also be adversely affected if we expend money without any return.

If our competitors develop superior products, our operations and financial condition could be affected.

We are currently subject to increased competition from biotechnology and diagnostic companies, academic and research institutions and government or other publicly-funded agencies that are pursuing products and services which are substantially similar to our molecular risk assessment testing services, or which otherwise address the needs of our customers and potential customers. Our competitors in the predictive genetic testing and assessment market include private and public sector enterprises located in Australia, the U.S. and elsewhere. Many of the organizations competing with us are much larger and have more ready access to needed resources. In particular, they would have greater experience in the areas of finance, research and development, manufacturing, marketing, sales, distribution, technical and regulatory matters than we do. In addition, many of the larger current and potential competitors have already established name / brand recognition and more extensive collaborative relationships.

Our competitive position in the molecular risk assessment and predictive testing area is based upon, amongst other things, our ability to:

· maintain first to market advantage;

· continue to strengthen and maintain scientific credibility through the process of obtaining scientific validation and undertaken further clinical trials supported by Peer-reviewed publication in medical journals;

· create and maintain scientifically-advanced technology and offer proprietary products and services;

· attract and retain qualified personnel;

· obtain patent or other protection for our products and services;

· obtain required government approvals and other accreditations on a timely basis; and

· successfully market our products and services.

If we are not successful in meeting these goals, our business could be adversely affected. Similarly, our competitors may succeed in developing technologies, products or services that are more effective than any that we are developing or that would render our technology and services obsolete, noncompetitive or uneconomical.

We have important relationships with external parties over whom we have limited control.

We have relationships with academic consultants and other advisers who are not employed by us. Accordingly, we have limited control over their activities and can expect only limited amounts of their time to be dedicated to our activities. These persons may have consulting, employment or advisory arrangements with other entities that may conflict with or compete with their obligations to us. Our consultants typically sign agreements that provide for confidentiality of our proprietary information and results of studies. However, in connection with every relationship, we may not be able to maintain the confidentiality of our technology, the dissemination of which could hurt our competitive position and results from operations. To the extent that our scientific consultants develop inventions or processes independently that may be applicable to our proposed products, disputes may arise as to the ownership of the proprietary rights to such information, and we may not be successful with any dispute outcomes.

We may be subject to professional liability suits and our insurance may not be sufficient to cover damages. If this occurs, our business and financial condition may be adversely affected.

Our business exposes us to potential liability risks that are inherent in the testing, manufacturing, marketing and sale of molecular risk assessment and predictive tests. The use of our products and product candidates, whether for clinical trials or commercial sale, may expose us to professional liability claims and possible adverse publicity. We may be subject to claims resulting from incorrect results of analysis of genetic variations or other screening tests performed using our services. Litigation of such claims could be costly. We could expend significant funds during any litigation proceeding brought against us. Further, if a court were to require us to pay damages to a plaintiff, the amount of such damages could be significant and severely damage our financial condition. Although we have public and product liability insurance coverage under broadform liability and professional indemnity policies, for an aggregate amount of A$60,000,000, the level or breadth of our coverage may not be adequate to fully cover any potential liability claims. To date we have not been subject to any claims, or ultimately liability, in excess of the amount of our coverage. In addition, we may not be able to obtain additional professional liability coverage in the future at an acceptable cost. A successful claim or series of claims brought against us in excess of our insurance coverage and the effect of professional liability litigation upon the reputation and marketability of our technology and products, together with the diversion of the attention of key personnel, could negatively affect our business.

We use potentially hazardous materials, chemicals and patient samples in our business and any disputes relating to improper handling, storage or disposal of these materials could be time consuming and costly.

Our research and development, production and service activities involve the controlled use of hazardous laboratory materials and chemicals, including small quantities of acid and alcohol, and patient tissue samples. We do not knowingly deal with infectious samples. We, our collaborators and service providers are subject to stringent Australian federal, state and local laws and regulations governing occupational health and safety standards, including those governing the use, storage, handling and disposal of these materials and certain waste products. However, we could be liable for accidental contamination or discharge or any resultant injury from hazardous materials, and conveyance, processing, and storage of and data on patient samples. If we, our collaborators or service providers fail to comply with applicable laws or regulations, we could be required to pay penalties or be held liable for any damages that result and this liability could exceed our financial resources. Further, future changes to environmental health and safety laws could cause us to incur additional expense or restrict our operations. To date, we have not had a reportable event or serious injury.

In addition, our collaborators and service providers may be working with these same types of hazardous materials, including hazardous chemicals, in connection with our collaborations. In the event of a lawsuit or investigation, we could be held responsible for any injury caused to persons or property by exposure to, or release of, these hazardous materials or patient samples that may contain infectious materials. The cost of this liability could exceed our resources. While we maintain broadform liability insurance coverage for these risks, in the amount of up to A$40,000,000, the level or breadth of our coverage may not be adequate to fully cover potential liability claims. To date, we have not been subject to claims, or ultimately liability, in excess of the amount of our coverage. Our broadform insurance coverage also covers us against losses arising from an interruption of our business activities as a result of the mishandling of such materials. We also maintain workers’ compensation insurance, which is mandatory in Australia, covering all of our workers in the event of injury.

We depend on the collaborative efforts of our academic and corporate partners for research, development and commercialization of some of our products. A breach by our partners of their obligations, or the termination of the relationship, could deprive us of valuable resources and require additional investment of time and money.

Our strategy for research, development and commercialization of some of our products has historically involved entering into various arrangements with academic, corporate partners and others. As a result, the success of our strategy depends, in part, upon the strength of those relationships and these outside parties undertaking their responsibilities and performing their tasks to the best of their ability and responding in a timely manner. Our collaborators may also be our competitors. We cannot necessarily control the amount and timing of resources that our collaborators devote to performing their contractual obligations and we have no certainty that these parties will perform their obligations as expected or that any revenue will be derived from these arrangements.

If our collaborators breach or terminate their agreement with us or otherwise fail to conduct their collaborative activities in a timely manner, the development or commercialization of the product candidate or research program under such collaborative arrangement may be delayed. If that is the case, we may be required to undertake unforeseen additional responsibilities or to devote unforeseen additional funds or other resources to such development or commercialization, or such development or commercialization could be terminated. The termination or cancellation of collaborative arrangements could adversely affect our financial condition, intellectual property position and general operations. In addition, disagreements between collaborators and us could lead to delays in the collaborative research, development, or commercialization of certain products or could require or result in formal legal process or arbitration for resolution. These consequences could be time-consuming and expensive and could have material adverse effects on the Company.

Other than our contractual rights under our license agreements, we may be limited in our ability to convince our licensees to fulfill their obligations. If our licensees fail to act promptly and effectively, or if a dispute arises, it could have a material adverse effect on our results of operations and the price of our ordinary shares and ADSs.

We rely upon scientific, technical and clinical data supplied by academic and corporate collaborators, licensors, licensees, independent contractors and others in the evaluation and development of potential therapeutic methods. There may be errors or omissions in this data that would materially adversely affect the development of these methods.

We may seek additional collaborative arrangements to develop and commercialize our products in the future. We may not be able to negotiate acceptable arrangements in the future and, if negotiated, we have no certainty that they will be on favorable terms or if they will be successful. In addition, our partners may pursue alternative technologies independently or in collaboration with others as a means of developing treatments for the diseases targeted by their collaborative programs with us. If any of these events occur, the progress of the Company could be adversely affected and our results of operations and financial condition could suffer.

Currently our financial results depend largely on the sales of our breast cancer risk assessment test, BREVAGenplus.

For the near future, we expect to continue to derive a substantial majority of our revenues from sales of one product, our breast cancer risk test BREVAGen. We do not expect to recognize significant revenues from BREVAGenplus, a second generation BREVAGen product, until increased levels of adoption and reimbursement for this test have been established. If we are unable to increase sales of BREVAGenplus or successfully develop and commercialize other tests or enhancements, our ability to achieve sustained revenues and profitability would be impacted.

If our sole laboratory facility becomes inoperable, we will be unable to perform our tests and our business will be harmed.

We do not have redundant clinical reference laboratory facilities outside of Melbourne, Australia. Our current lease of laboratory premises expires August 31, 2018. The facility and the equipment we use to perform our tests would be costly to replace and could require substantial lead time to repair or replace. The facility may be harmed or rendered inoperable by natural or man-made disasters, including flooding and power outages, which may render it difficult or impossible for us to perform our tests for some period of time. The inability to perform our tests or the backlog of tests that could develop if our facility is inoperable for even a short period of time may result in the loss of customers or harm our reputation, and we may be unable to regain those customers in the future.

If we no longer had our own facility and needed to rely on a third party to perform our tests, we could only use another facility with established state licensure and Clinical Laboratory Improvements Amendments (CLIA) accreditation under the scope of which BREVAgenplus tests could be performed following validation and other required procedures. We cannot assure you that we would be able to find another CLIA-certified facility willing to comply with the required procedures, that this laboratory would be willing to perform the tests on commercially reasonable terms, or that it would be able to meet our quality standards. In order to establish a redundant clinical reference laboratory facility, we would have to spend considerable time and money securing adequate space, constructing the facility, recruiting and training employees, and establishing the additional operational and administrative infrastructure necessary to support a second facility. We may not be able, or it may take considerable time, to replicate our testing processes or results in a new facility. Additionally, any new clinical reference laboratory facility would be subject to certification under CLIA and licensing by several states, including California and New York, which could take a significant amount of time and result in delays in our ability to begin operations.

The loss of key members of our senior management team or our inability to attract and retain highly skilled scientists, clinicians and salespeople could adversely affect our business.

Our success depends largely on the skills, experience and performance of key members of our executive management team and others in key management positions. The efforts of each of these persons together will be critical as we continue to develop our technologies and testing processes, continue our international expansion and transition to a company with multiple commercialized products on offer. If we were to lose one or more of these key employees, we may experience difficulties in competing effectively, developing our technologies and implementing our business strategies.

Our research and development programs and commercial laboratory operations depend on our ability to attract and retain highly skilled scientists and technicians, including licensed laboratory technicians, chemists, biostatisticians and engineers. We may not be able to attract or retain qualified scientists and technicians in the future due to the competition for qualified personnel among life science businesses. In addition, if there were to be a shortage of clinical laboratory scientists in coming years, this would make it more difficult to hire sufficient numbers of qualified personnel. We also face competition from universities and public and private research institutions in recruiting and retaining highly qualified scientific personnel. In addition, our success depends on our ability to attract and retain salespeople with extensive experience in oncology and close relationships with medical oncologists, pathologists and other hospital personnel. We may have difficulties sourcing, recruiting or retaining qualified salespeople, which could cause delays or a decline in the rate of adoption of our tests. If we are not able to attract and retain the necessary personnel to accomplish our business objectives, we may experience constraints that could adversely affect our ability to support our research and development and sales programs.

FDA regulation of LDTs may result in significant changes, and our business could be adversely impacted if we fail to adapt.

Clinical laboratory tests like ours are regulated under the CLIA, as well as by applicable state laws. Diagnostic kits that are sold and distributed through interstate commerce are regulated as medical devices by the federal Food and Drug Administration (FDA). The FDA has exercised its discretion and has not subjected most Laboratory Developed Tests, or LDTs to FDA regulation, although reagents or software provided by third parties and used to perform LDTs may be subject to regulation.

The FDA claims to have regulatory authority over LDTs under the Medical Device Amendments of 1976 and has stated in the past that it would issue guidance to the industry regarding its regulatory approach. In such discussions, the FDA has indicated that it would use a risk-based approach to regulation and would direct more resources to tests with wider distribution and with the highest risk of injury, but that it will be sensitive to the need to not adversely impact patient care or innovation. In October 2014, the FDA announced its framework and timetable for implementing this guidance. We cannot predict the ultimate timing or form of any such guidance or regulation and the potential impact on our existing tests. If adopted, such a regulatory approach by the FDA may lead to an increased regulatory burden, including additional costs and delays in introducing new tests or even continuing with our current tests. While the ultimate impact of the FDA’s approach is unknown, it may be extensive and may result in significant changes. Our failure to adapt to these changes could have a material adverse effect on our business.

If the FDA decides to regulate our tests, it may require additional pre-market clinical testing prior to submitting a regulatory notification or application for commercial sales. If we are required to conduct pre-market clinical trials, whether using prospectively acquired samples or archival samples, delays in the commencement or completion of clinical testing could significantly increase our test development costs and delay commercialization of any future tests, and interrupt sales of our current tests. Many of the factors that may cause or lead to a delay in the commencement or completion of clinical trials may also ultimately lead to delay or denial of regulatory clearance or approval. The commencement of clinical trials may be delayed due to insufficient patient enrollment, which is a function of many factors, including the size of the patient population, the nature of the protocol, the proximity of patients to clinical sites and the eligibility criteria for the clinical trial.

We may find it necessary to engage contract research organizations to perform data collection and analysis and other aspects of our clinical trials, which might increase the cost and complexity of our trials. We may also depend on clinical investigators, medical institutions and contract research organizations to perform the trials. If these parties do not successfully carry out their contractual duties or obligations or meet expected deadlines, or if the quality, completeness or accuracy of the clinical data they obtain is compromised due to the failure to adhere to our clinical protocols or for other reasons, our clinical trials may have to be extended, delayed or terminated. Many of these factors would be beyond our control. We may not be able to enter into replacement arrangements without undue delays or considerable expenditures. If there are delays in testing or approvals as a result of the failure to perform by third parties, our research and development costs would increase, and we may not be able to obtain regulatory clearance or approval for our tests. In addition, we may not be able to establish or maintain relationships with these parties on favorable terms, if at all. Each of these outcomes would harm our ability to market our tests, or to achieve sustained profitability.

Even if the clinical trials are timely completed, there is no assurance that the results of those trials will be sufficient to support regulatory clearance or approval for the intended indications. Failure of the clinical data to support an intended use of given LDT would likely have an adverse impact on the Company.

Our business could be harmed from the loss or suspension of a license or imposition of a fine or penalties under, or future changes in, or changing interpretations of, CLIA or state laboratory licensing laws to which we are subject.

The clinical laboratory testing industry is subject to extensive federal and state regulation, and many of these statutes and regulations have not been interpreted by the courts. The regulations implementing CLIA set out federal regulatory standards that apply to virtually all clinical laboratories (regardless of the location, size or type of laboratory), including those operated by physicians in their offices, by requiring that they be certified by the federal government or by a federally approved accreditation agency. CLIA does not preempt state law, which in some cases may be more stringent than federal law and require additional personnel qualifications, quality control, record maintenance and proficiency testing. The sanction for failure to comply with CLIA and state requirements may be suspension, revocation or limitation of a laboratory’s CLIA certificate, which is necessary to conduct business, as well as significant fines and/or criminal penalties. Several states have similar laws and we may be subject to similar penalties. If the certification of one laboratory owned by the Company is suspended or revoked that may preclude the Company from owning or operating any other laboratory in the Country for two years.

We cannot assure you that applicable statutes and regulations and more specifically, the Food, Drug, and Cosmetic Act, will not be interpreted or applied by a prosecutorial, regulatory or judicial authority in a manner that would adversely affect our business. Potential sanctions for violation of these statutes and regulations include significant fines and the suspension or loss of various licenses, certificates and authorizations, which could have a material adverse effect on our business. In addition, compliance with future legislation could impose additional requirements on us, which may be costly.

Failure to establish, and perform to, appropriate quality standards to assure that the highest level of quality is observed in the performance of our testing services and in the design, manufacture and marketing of our products could adversely affect the results of our operations and adversely impact our reputation.

The provision of clinical testing services, and the design, manufacture and marketing of diagnostic products involve certain inherent risks. The services that we provide and the products that we design, manufacture and market are intended to provide information for healthcare providers in providing patient care. Therefore, users of our services and products may have a greater sensitivity to errors than the users of services or products that are intended for other purposes.

Similarly, negligence in performing our services can lead to injury or other adverse events. We may be sued under common law, physician liability or other liability law for acts or omissions by our laboratory personnel. We are subject to the attendant risk of substantial damages awards and risk to our reputation.

Failure to comply with complex federal and state laws and regulations related to submission of claims for clinical laboratory services could result in significant monetary damages and penalties and exclusion from the Medicare and Medicaid programs.

We are subject to extensive federal and state laws and regulations relating to the submission of claims for payment for clinical laboratory services, including those that relate to coverage of our services under Medicare, Medicaid and other governmental health care programs, the amounts that may be billed for our services and to whom claims for services may be submitted. In addition, we are subject to various laws regulating our interactions with other healthcare providers and with patients, such as the Anti-Kickback Statute, the Anti-Inducement Statute, and the Ethics in Patient Referrals Act of 1989, commonly referred to as the Stark law. These laws are complicated.

Our failure to comply with applicable laws and regulations could result in our inability to receive payment for our services or result in attempts by third-party payers, such as Medicare and Medicaid, to recover payments from us that have already been made. Submission of claims in violation of certain statutory or regulatory requirements can result in penalties, including substantial civil penalties for each item or service billed to Medicare in violation of the legal requirement, and exclusion from participation in Medicare, Medicaid and other federal health care programs. Government authorities or whistleblowers may also assert that violations of laws and regulations related to submission or causing the submission of claims violate the federal False Claims Act, or FCA, or other laws related to fraud and abuse, including submission of claims for services that were not medically necessary. Violations of the FCA could result in significant economic liability. The FCA provides that all damages are trebled, and each false claim submitted is subject to a penalty of up to $21,563 for violations occurring after November 2, 2015 and $11,000 for violations occurring before November 2, 2015. For example, we could be subject to FCA liability if it were determined that the services we provided were not medically necessary and not reimbursable or if it were determined that we improperly paid physicians who referred patients to our laboratory. It is also possible that the government could attempt to hold us liable under fraud and abuse laws for improper claims submitted by an entity for services that we performed if we were found to have knowingly participated in the arrangement that resulted in submission of the improper claims.

Failure to comply with HIPAA, including regarding the use of new “standard transactions,” may negatively impact our profitability and cash flows.

Pursuant to the Health Insurance Portability and Accountability Act of 1996, as amended, or HIPAA, we must comply with comprehensive privacy and security standards with respect to the use and disclosure of protected health information, as well as standards for electronic transactions, including specified transaction and code set rules. Under the 2009 HITECH amendments to HIPAA, the law was expanded, including requirements to provide notification of certain identified data breaches, direct patient access to laboratory records, the extension of certain HIPAA privacy and security standards directly to business associates, and heightened penalties for noncompliance, and enforcement efforts.

In addition, HIPAA not only seeks to ensure patient privacy, but also requires providers that bill electronically to do so using standard code sets. These HIPAA transaction standards are complex, and subject to differences in interpretation by payers. For instance, some payers may interpret the standards to require us to provide certain types of information, including demographic information not usually provided to us by physicians. As a result of inconsistent application of transaction standards by payers or our inability to obtain certain billing information not usually provided to us by physicians, we could face increased costs and complexity, a temporary disruption in receipts and ongoing reductions in the timeliness of reimbursement. In addition, new requirements for additional standard transactions, such as claims attachments, Version 5010 of the HIPAA Transaction Standards and the ICD-10-CM Code Set, could prove technically difficult, time-consuming or expensive to implement.

Complying with numerous regulations pertaining to our business is an expensive and time-consuming process, and any failure to comply could result in substantial penalties.

The clinical laboratory testing industry is highly regulated and there can be no assurance that the regulatory environment in which we operate will not change significantly and adversely in the future. Areas of the regulatory environment that may affect our ability to conduct business include, without limitation:

· federal and state laws applicable to billing and claims payment;

· federal and state laboratory anti-mark-up laws;

· federal and state anti-kickback laws;

· federal and state false claims laws;