Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 10-K

(Mark One)

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended January 29, 2011

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-15274

J. C. PENNEY COMPANY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 26-0037077 | |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

6501 Legacy Drive, Plano, Texas 75024-3698

(Address of principal executive offices)

(Zip Code)

(972) 431-1000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Name of each exchange on which registered | |

| Common Stock of 50 cents par value | New York Stock Exchange | |

| Preferred Stock Purchase Rights | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes x No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Act. Yes ¨ No x

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§ 229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. x

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer x |

Accelerated filer ¨ | |

| Non-accelerated filer ¨ (Do not check if a smaller reporting company) |

Smaller reporting company ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ¨ No x

State the aggregate market value of the voting and non-voting common equity held by non-affiliates computed by reference to the price at which the common equity was last sold, or the average bid and asked price of such common equity, as of the last business day of the registrant’s most recently completed second fiscal quarter (July 31, 2010). $5,616,298,853

Indicate the number of shares outstanding of each of the registrant’s classes of common stock, as of the latest practicable date.

229,873,694 shares of Common Stock of 50 cents par value, as of March 21, 2011.

DOCUMENTS INCORPORATED BY REFERENCE

| Documents from which portions are incorporated by reference |

Parts of the Form 10-K into which incorporated | |

| J. C. Penney Company, Inc. 2011 Proxy Statement |

Part III |

Table of Contents

| Page | ||||||

| Part I |

||||||

| Item 1. |

Business | 1 | ||||

| Item 1A. |

Risk Factors | 4 | ||||

| Item 1B. |

Unresolved Staff Comments | 8 | ||||

| Item 2. |

Properties | 8 | ||||

| Item 3. |

Legal Proceedings | 10 | ||||

| Item 4. |

Reserved | 10 | ||||

| Part II |

||||||

| Item 5. |

11 | |||||

| Item 6. |

13 | |||||

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations |

16 | ||||

| Item 7A. |

40 | |||||

| Item 8. |

41 | |||||

| Item 9. |

Changes in and Disagreements With Accountants on Accounting and Financial Disclosure |

41 | ||||

| Item 9A. |

41 | |||||

| Item 9B. |

44 | |||||

| Part III |

||||||

| Item 10. |

44 | |||||

| Item 11. |

44 | |||||

| Item 12. |

Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters |

45 | ||||

| Item 13. |

Certain Relationships and Related Transactions, and Director Independence |

45 | ||||

| Item 14. |

46 | |||||

| Part IV |

||||||

| Item 15. |

47 | |||||

| 48 | ||||||

| F-1 | ||||||

| E-1 | ||||||

i

Table of Contents

PART I

Business Overview

J. C. Penney Company, Inc. is a holding company whose principal operating subsidiary is J. C. Penney Corporation, Inc. (JCP). JCP was incorporated in Delaware in 1924, and J. C. Penney Company, Inc. was incorporated in Delaware in 2002, when the holding company structure was implemented. The new holding company assumed the name J. C. Penney Company, Inc. (Company). The holding company has no independent assets or operations, and no direct subsidiaries other than JCP. Common stock of the Company is publicly traded under the symbol “JCP” on the New York Stock Exchange. The Company is a co-obligor (or guarantor, as appropriate) regarding the payment of principal and interest on JCP’s outstanding debt securities. The guarantee by the Company of certain of JCP’s outstanding debt securities is full and unconditional. The holding company and its consolidated subsidiaries, including JCP, are collectively referred to in this Annual Report on Form 10-K as “we,” “us,” “our,” “ourselves,” “Company” or “jcpenney.”

Since our founding by James Cash Penney in 1902, we have grown to be a major retailer, operating 1,106 department stores in 49 states and Puerto Rico as of January 29, 2011. Our business consists of selling merchandise and services to consumers through our department stores and through the Internet website at jcp.com. Department stores and Internet generally serve the same type of customers and provide virtually the same mix of merchandise, and department stores accept returns from sales made in stores and via the Internet. We sell family apparel and footwear, accessories, fine and fashion jewelry, beauty products through Sephora inside jcpenney and home furnishings. In addition, our department stores provide our customers with services such as styling salon, optical, portrait photography and custom decorating. See Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations, for sales by category.

A five-year summary of certain financial and operational information regarding our continuing operations can be found in Part II, Item 6, Selected Financial Data, of this Annual Report on Form 10-K. For a discussion of our ongoing merchandise initiatives, see Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Competition and Seasonality

The business of marketing merchandise and services is highly competitive. We are one of the largest department store and e-commerce retailers in the United States, and we have numerous competitors, as further described in Item 1A, Risk Factors. Many factors enter into the competition for the consumer’s patronage, including price, quality, style, service, product mix, convenience and credit availability. Our annual earnings depend to a great extent on the results of operations for the last quarter of the fiscal year, which includes the holiday season, when a significant portion of our sales and profits are recorded.

Trademarks

The jcpenney, Every Day Matters, Okie Dokie, Worthington, east5th, a.n.a, St. John’s Bay, she said, The Original Arizona Jean Company, Ambrielle, Decree, Linden Street, Article 365, Stafford,

1

Table of Contents

J. Ferrar, jcpenney Home Collection and Studio by jcpenney Home Collection trademarks, as well as certain other trademarks, have been registered, or are the subject of pending trademark applications with the United States Patent and Trademark Office and with the registries of many foreign countries and/or are protected by common law. We consider our marks and the accompanying name recognition to be valuable to our business. For further discussion of our private brands, see Part II, Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations.

Website Availability

We maintain an Internet website at www.jcpenney.net and make available free of charge through this website our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and all related amendments to those reports, as soon as reasonably practicable after the materials are electronically filed with or furnished to the Securities and Exchange Commission. In addition, the website also provides press releases, an investor update package, access to webcasts of management presentations and other materials useful in evaluating our Company.

Suppliers

We have a diversified supplier base, both domestic and foreign, and are not dependent to any significant degree on any single supplier. We purchase our merchandise from over 3,500 domestic and foreign suppliers, many of which have done business with us for many years. In addition to our Plano, Texas home office, we, through our international purchasing subsidiary, maintained buying and quality assurance inspection offices in 19 foreign countries as of January 29, 2011.

Employment

The Company and its consolidated subsidiaries employed approximately 156,000 full-time and part-time associates as of January 29, 2011.

Environmental Matters

Environmental protection requirements did not have a material effect upon our operations during 2010. It is possible that compliance with such requirements (including any new requirements) would lengthen lead time in expansion or renovation plans and increase construction costs, and therefore operating costs, due in part to the expense and time required to conduct environmental and ecological studies and any required remediation.

As of January 29, 2011, we estimated our total potential environmental liabilities to range from $36 million to $42 million and recorded our best estimate of $37 million in other liabilities in the Consolidated Balance Sheet as of that date. This estimate covered potential liabilities primarily related to underground storage tanks, remediation of environmental conditions involving our former drugstore locations and asbestos removal in connection with approved plans to renovate or dispose of our facilities. We continue to assess required remediation and the adequacy of environmental reserves as new information becomes available and known conditions are further delineated. If we were to incur losses at the upper end of the estimated range, we do not believe that such losses would have a material effect on our financial condition, results of operations or liquidity.

2

Table of Contents

Executive Officers of the Registrant

The following is a list, as of March 1, 2011, of the names and ages of the executive officers of J. C. Penney Company, Inc. and of the offices and other positions held by each such person with the Company. These officers hold identical positions with JCP. References to Company positions held during fiscal years 2001 and earlier (prior to the creation of the holding company) are for JCP. There is no family relationship between any of the named persons.

| Name |

Offices and Other Positions Held With the Company |

Age | ||||

| Myron E. Ullman, III |

Chairman of the Board and Chief Executive Officer | 64 | ||||

| Michael P. Dastugue |

Executive Vice President and Chief Financial Officer | 46 | ||||

| Janet L. Dhillon |

Executive Vice President, General Counsel and Secretary | 48 | ||||

| Dennis P. Miller |

Senior Vice President and Controller | 58 | ||||

| Thomas M. Nealon |

Group Executive Vice President | 50 | ||||

| Michael T. Theilmann |

Group Executive Vice President | 46 | ||||

Mr. Ullman has served as Chairman of the Board of Directors and Chief Executive Officer of the Company since 2004. He was Directeur General, Group Managing Director, LVMH Moët Hennessy Louis Vuitton (luxury goods manufacturer/retailer) from 1999 to 2002. He was President of LVMH Selective Retail Group from 1998 to 1999. From 1995 to 1998, he was Chairman of the Board and Chief Executive Officer of DFS Group Ltd. From 1992 to 1995, he was Chairman of the Board and Chief Executive Officer of R. H. Macy & Company, Inc. He has served as a director of the Company and as a director of JCP since 2004.

Mr. Dastugue has served as Executive Vice President and Chief Financial Officer of the Company since January 2011 and served as Senior Vice President, Finance, from February 2010 until he assumed his current position. Since 1991, he has held a series of positions of increasing responsibility with the Company, including Vice President and Treasurer from 2000 to 2004, Senior Vice President, Director of Corporate Finance in 2005 and Senior Vice President, Director of Property Development from 2005 to 2010. He has served as a director of JCP since January 2011.

Ms. Dhillon has served as Executive Vice President, General Counsel and Secretary of the Company since 2009. Prior to joining the Company, she served as Senior Vice President and General Counsel and Chief Compliance Officer of US Airways Group, Inc. and US Airways, Inc. from 2006 to 2009. Ms. Dhillon joined US Airways, Inc. in 2004 as Managing Director and Associate General Counsel and served as Vice President and Deputy General Counsel of US Airways Group, Inc. and US Airways, Inc. from 2005 to 2006. Ms. Dhillon was with the law firm of Skadden, Arps, Slate, Meagher & Flom LLP from 1991 to 2004. She has served as a director of JCP since July 2009.

Mr. Miller has served as Senior Vice President and Controller of the Company since 2008. He served as Vice President, Director of Procurement and Strategic Sourcing of JCP from 2004 to 2008. From 2001 to 2004, he served as Senior Vice President and Chief Financial Officer of Eckerd Corporation, a former subsidiary of the Company.

Mr. Nealon has served as Group Executive Vice President since August 2010. He served as Executive Vice President and Chief Information Officer of the Company from 2006 to August 2010. From 2002

3

Table of Contents

to 2006, he was employed by EDS, where he served on assignment as the Senior Vice President and Chief Information Officer of Southwest Airlines Co. From 2000 to 2002, he was a partner with the Feld Group.

Mr. Theilmann has served as Group Executive Vice President since August 2010. He served as Executive Vice President, Chief Human Resources and Administration Officer of the Company from 2005 to August 2010. From 2002 to 2005, he served as Senior Vice President, Human Resources and Chief People Officer of the International business of Yum! Brands Inc. From 2000 to 2002, he served as Vice President of Human Resources for European operations at Yum! Brands Inc.

The following risk factors should be read carefully in connection with evaluating our business and the forward-looking information contained in this Annual Report on Form 10-K. Any of the following risks could materially adversely affect our business, operating results, financial condition and the actual outcome of matters as to which forward-looking statements are made in this Annual Report on Form 10-K.

Our Company’s growth and profitability depend on the level of consumer confidence and spending.

Our results of operations are sensitive to changes in overall economic and political conditions that impact consumer spending, including discretionary spending. Many economic factors outside of our control, including the housing market, interest rates, recession, inflation and deflation, energy costs and availability, consumer credit availability and terms, consumer debt levels, tax rates and policy, and unemployment trends influence consumer confidence and spending. The domestic and international political situation and actions also affect consumer confidence and spending. Additional events that could impact our performance include pandemics, terrorist threats and activities, worldwide military and domestic disturbances and conflicts, political instability and civil unrest. Further declines in the level of consumer spending could adversely affect our growth and profitability.

The retail industry is highly competitive, which could adversely impact our sales and profitability.

The retail industry is highly competitive, with few barriers to entry. We compete with many other local, regional and national retailers for customers, associates, locations, merchandise, services and other important aspects of our business. Those competitors include other department stores, discounters, home furnishing stores, specialty retailers, wholesale clubs, direct-to-consumer businesses and other forms of retail commerce. Some competitors are larger than jcpenney, have greater financial resources available to them, and, as a result, may be able to devote greater resources to sourcing, promoting and selling their products. Competition is characterized by many factors, including merchandise assortment, advertising, price, quality, service, location, reputation and credit availability. The performance of competitors as well as changes in their pricing and promotional policies, marketing activities, new store openings, launches of Internet websites, brand launches and other merchandise and operational strategies could cause us to have lower sales, lower gross margin and/or higher operating expenses such as marketing costs and other selling, general and administrative expenses, which in turn could have an adverse impact on our profitability.

4

Table of Contents

Our sales and operating results depend on customer preferences and fashion trends.

Our sales and operating results depend in part on our ability to predict and respond to changes in fashion trends and customer preferences in a timely manner by consistently offering stylish quality merchandise assortments at competitive prices. We continuously assess emerging styles and trends and focus on developing a merchandise assortment to meet customer preferences. Even with these efforts, we cannot be certain that we will be able to successfully meet constantly changing customer demands. To the extent our predictions differ from our customers’ preferences, we may be faced with excess inventories for some products and/or missed opportunities for others. Excess inventories can result in lower gross margins due to greater than anticipated discounts and markdowns that might be necessary to reduce inventory levels. Low inventory levels can adversely affect the fulfillment of customer demand and diminish sales and brand loyalty. Consequently, any sustained failure to identify and respond to emerging trends in lifestyle and customer preferences and buying trends could have an adverse impact on our business and any significant misjudgments regarding inventory levels could adversely impact our results of operations.

Our profitability depends on our ability to source merchandise and deliver it to our customers in a timely and cost-effective manner.

Our merchandise is sourced from a wide variety of suppliers, and our business depends on being able to find qualified suppliers and access products in a timely and efficient manner. A substantial portion of our merchandise is sourced outside of the United States. All of our suppliers must comply with our supplier legal compliance program and applicable laws, including consumer and product safety laws. Although we diversify our sourcing and production by country, the failure of a supplier to produce and deliver our goods on time, to meet our quality standards and adhere to our product safety requirements or to meet the requirements of our supplier compliance program or applicable laws, or our inability to flow merchandise to our stores or through the Internet channel in the right quantities at the right time could adversely affect our profitability and could result in damage to our reputation. Inflationary pressures on commodity prices and other input costs could increase our cost of goods, and an inability to pass such cost increases on to our customers or a change in our merchandise mix as a result of such cost increases could have an adverse impact on our profitability. Additionally, the impact of current and future economic conditions on our suppliers cannot be predicted and may cause our suppliers to be unable to access financing or become insolvent and thus become unable to supply us with products. Similarly, political or financial instability, changes in U.S. and foreign laws and regulations affecting the importation and taxation of goods, including duties, tariffs and quotas, or changes in the enforcement of those laws and regulations, as well as currency exchange rates, transport capacity and costs and other factors relating to foreign trade and the inability to access suitable merchandise on acceptable terms could adversely impact our results of operations.

Our business is seasonal.

Our annual earnings and cash flows depend to a great extent on the results of operations for the last quarter of our fiscal year, which includes the holiday season. Our fiscal fourth-quarter results may fluctuate significantly, based on many factors, including holiday spending patterns and weather conditions. This seasonality causes our operating results to vary considerably from quarter to quarter.

5

Table of Contents

The moderation of our new store growth strategy as a result of current economic conditions could adversely impact our future growth and profitability.

Our future growth and profitability depend in part on our ability to add new stores. Current and projected future economic conditions have caused us to moderate the number of new stores that we plan to open in the near term and have made it difficult for third-party developers to obtain financing for new sites. These factors could negatively impact our future anticipated store openings. Furthermore, although we have conducted strategic market research, including reviewing demographic and regional economic trends, prior to making a decision to enter into a particular market, we cannot be certain that our entry into a particular market will prove successful. The failure to expand by successfully opening new stores, or the failure of a significant number of these stores to perform as planned, could have an adverse impact on our future growth, profitability and cash flows.

The failure to retain, attract and motivate our associates, including associates in key positions, could have an adverse impact on our results of operations.

Our results depend on the contributions of our associates, including our senior management team and other key associates. Our performance depends to a great extent on our ability to retain, attract and motivate talented associates throughout the organization, many of whom, particularly in the department stores, are in entry level or part-time positions with historically high rates of turnover. Our ability to meet our labor needs while controlling our costs is subject to external factors such as unemployment levels, prevailing wage rates, minimum wage legislation and changing demographics. If we are unable to retain, attract and motivate talented associates at all levels, our results of operations could be adversely impacted.

Changes in federal, state or local laws and regulations could expose us to legal risks and adversely affect our results of operations.

Our business is subject to a wide array of laws and regulations. While our management believes that our associate relations are good, significant legislative changes that impact our relationship with our associates could increase our expenses and adversely affect our results of operations. Examples of possible legislative changes impacting our relationship with our associates include changes to an employer’s obligation to recognize collective bargaining units, the process by which collective bargaining agreements are negotiated or imposed, minimum wage requirements, and health care mandates. In addition, if we fail to comply with applicable laws and regulations we could be subject to legal risk, including government enforcement action and class action civil litigation. Changes in the regulatory environment regarding other topics such as privacy and information security, product safety or environmental protection, including regulations in response to concerns regarding climate change, among others, could also cause our expenses to increase and adversely affect our results of operations.

Our operations are dependent on information technology systems; disruptions in those systems could have an adverse impact on our results of operations.

Our operations are dependent upon the integrity, security and consistent operation of various systems and data centers, including the point-of-sale systems in the stores, our Internet website, data centers that process transactions, communication systems and various software applications used throughout our Company to track inventory flow, process transactions and generate performance and financial reports. We could encounter difficulties in developing new systems or maintaining and upgrading

6

Table of Contents

existing systems. Such difficulties could lead to significant expenses or to losses due to disruption in business operations. In addition, despite our considerable efforts and technology to secure our computer network, security could be compromised, confidential information could be misappropriated or system disruptions could occur. This could lead to loss of sales or profits, cause our customers to lose confidence in our ability to protect their personal information which could lead to lost future sales or cause us to incur significant costs to reimburse third parties for damages, any of which could have an adverse impact on our results of operations. In addition, the continued realization of the benefits of our centralized buying and allocation processes and systems is a key element of our ability to meet our long-term customer and financial goals. The effectiveness of these processes and systems is an important component of our ability to have the right inventory at the right place, time and price.

Significant changes in discount rates, actual investment return on pension assets, and other factors could affect our earnings, equity, and pension contributions in future periods.

Our earnings may be positively or negatively impacted by the amount of income or expense recorded for our qualified pension plan. Generally accepted accounting principles in the United States of America (GAAP) require that income or expense for the plan be calculated at the annual measurement date using actuarial assumptions and calculations. The most significant assumptions relate to the capital markets, interest rates and other economic conditions. Changes in key economic indicators can change the assumptions. Two critical assumptions used to estimate pension income or expense for the year are the expected long-term rate of return on plan assets and the discount rate. In addition, at the measurement date, we must also reflect the funded status of the plan (assets and liabilities) on the balance sheet, which may result in a significant change to equity through a reduction or increase to other comprehensive income. Although GAAP expense and pension contributions are not directly related, the key economic factors that affect GAAP expense would also likely affect the amount of cash we could be required to contribute to the pension plan. Potential pension contributions include both mandatory amounts required under federal law and discretionary contributions to improve a plan’s funded status.

As a result of their ownership stakes in the Company, our largest stockholders have the ability to materially influence actions to be taken or approved by our stockholders. These stockholders are represented on our Board of Directors and, therefore, also have the ability to materially influence actions to be taken or approved by our Board.

As of March 1, 2011, Pershing Square Capital Management L.P., PS Management GP, LLC and Pershing Square GP, LLC (together “Pershing Square”) beneficially owned approximately 16.5% of the outstanding shares of our common stock. William A. Ackman, Chief Executive Officer of Pershing Square Capital Management, is one of our directors.

As of March 1, 2011, Vornado Realty Trust, Vornado Realty L.P., VNO Fashion LLC and VSPS I L.L.C. (together “Vornado”) beneficially owned approximately 9.9% of the outstanding shares of our common stock. Steven Roth, Chairman of the Board of Trustees of Vornado Realty Trust, is one of our directors.

Together, Pershing Square and Vornado owned approximately 26.4% of our outstanding shares as of March 1, 2011. Pershing Square and Vornado have each stated that they intend to consult with each other in connection with their respective investments in our common stock. As a result, Pershing Square and Vornado have the ability to materially influence actions to be taken or approved by our

7

Table of Contents

stockholders, including the election of directors and any transactions involving a change of control. Pershing Square and Vornado also have the ability to materially influence actions to be taken or approved by our Board.

In the future, Pershing Square or Vornado may acquire or sell shares of our common stock and thereby increase or decrease their ownership stake in us. On October 18, 2010, we adopted a Stockholder Rights Plan, which restricts any person or group from acquiring (i) beneficial ownership of 10% or more of our common stock and (ii) in the case of any person or group that owns 10% or more of our outstanding common stock as of October 18, 2010, any additional shares of common stock.

Future share repurchases by us may increase Pershing Square’s and Vornado’s percentage ownership in the Company, and as a result, it is possible that Pershing Square’s and/or Vornado’s ability to influence the Company’s actions could become even greater in the future. However, on February 25, 2011, we entered into separate stockholder agreements with each of Pershing Square and Vornado, which generally provide that Pershing Square and Vornado will vote the number of shares of our common stock that it owns in excess of 16.5%, in Pershing Square’s case, and 9.9% in Vornado’s case, as a result of not participating in our current share repurchase program, to be present and voted at stockholder meetings either as recommended by our Board of Directors or in direct proportion to how all other stockholders vote.

Item 1B. Unresolved Staff Comments.

None.

At January 29, 2011, we operated 1,106 department stores throughout the continental United States, Alaska and Puerto Rico, of which 426 were owned, including 120 stores located on ground leases. The following table lists the number of stores operating by state as of January 29, 2011:

| Alabama |

22 | Maine | 6 | Oklahoma | 19 | |||||||||

| Alaska |

1 | Maryland | 17 | Oregon | 14 | |||||||||

| Arizona |

23 | Massachusetts | 13 | Pennsylvania | 41 | |||||||||

| Arkansas |

16 | Michigan | 43 | Rhode Island | 3 | |||||||||

| California |

80 | Minnesota | 26 | South Carolina | 18 | |||||||||

| Colorado |

22 | Mississippi | 18 | South Dakota | 8 | |||||||||

| Connecticut |

10 | Missouri | 26 | Tennessee | 26 | |||||||||

| Delaware |

3 | Montana | 9 | Texas | 93 | |||||||||

| Florida |

60 | Nebraska | 12 | Utah | 9 | |||||||||

| Georgia |

31 | Nevada | 7 | Vermont | 6 | |||||||||

| Idaho |

9 | New Hampshire | 9 | Virginia | 28 | |||||||||

| Illinois |

42 | New Jersey | 17 | Washington | 23 | |||||||||

| Indiana |

30 | New Mexico | 10 | West Virginia | 9 | |||||||||

| Iowa |

20 | New York | 43 | Wisconsin | 24 | |||||||||

| Kansas |

19 | North Carolina | 36 | Wyoming | 5 | |||||||||

| Kentucky |

22 | North Dakota | 8 | Puerto Rico | 7 | |||||||||

| Louisiana |

16 | Ohio | 47 | |||||||||||

| Total square feet |

111.6 | million | ||||||||||||

8

Table of Contents

At January 29, 2011, our supply chain network operated 26 facilities at 18 locations, of which nine were owned, with multiple types of distribution activities housed in certain owned locations. Our network includes 13 store merchandise distribution centers, five regional warehouses, four jcp.com fulfillment centers and four furniture distribution centers as indicated in the following table:

| Facility / Location |

Leased/Owned | Square Footage (in thousands) |

||||||

| Store Merchandise Distribution Centers |

||||||||

| Breinigsville, Pennsylvania |

Leased | 504 | ||||||

| Forest Park, Georgia |

Owned | 530 | ||||||

| Buena Park, California |

Owned | 543 | ||||||

| Cedar Hill, Texas |

Leased | 433 | ||||||

| Columbus, Ohio |

Owned | 386 | ||||||

| Plainfield, Indiana |

Leased | 436 | ||||||

| Lakeland, Florida |

Leased | 360 | ||||||

| Lenexa, Kansas |

Owned | 322 | ||||||

| Manchester, Connecticut |

Owned | 390 | ||||||

| Wauwatosa, Wisconsin |

Owned | 507 | ||||||

| Spanish Fork, Utah |

Leased | 400 | ||||||

| Statesville, North Carolina |

Owned | 313 | ||||||

| Sumner, Washington |

Leased | 350 | ||||||

| Total store merchandise distribution centers |

5,474 | |||||||

| Regional Warehouses |

||||||||

| Haslet, Texas |

Owned | 1,063 | ||||||

| Forest Park, Georgia |

Owned | 427 | ||||||

| Buena Park, California |

Owned | 146 | ||||||

| Lathrop, California |

Leased | 436 | ||||||

| Statesville, North Carolina |

Owned | 131 | ||||||

| Total regional warehouses |

2,203 | |||||||

| jcp.com Fulfillment Centers |

|

|||||||

| Columbus, Ohio |

Owned | 1,516 | ||||||

| Lenexa, Kansas |

Owned | 1,622 | ||||||

| Manchester, Connecticut |

Owned | 1,666 | ||||||

| Reno, Nevada |

Owned | 1,660 | ||||||

| Total jcp.com fulfillment centers |

6,464 | |||||||

| Furniture Distribution Centers |

||||||||

| Forest Park, Georgia |

Owned | 343 | ||||||

| Chino, California |

Leased | 325 | ||||||

| Langhorne, Pennsylvania |

Leased | 228 | ||||||

| Wauwatosa, Wisconsin |

Owned | 592 | ||||||

| Total furniture distribution centers |

1,488 | |||||||

| Total supply chain network |

15,629 | |||||||

We also own our home office facility in Plano, Texas, and approximately 240 acres of property adjacent to the facility. Furthermore, as of the end of the year we operated 19 outlet stores totaling approximately 2.0 million square feet, of which we own four. In the fourth quarter of 2010, the Company announced that it would be exiting these outlet stores as part of our restructuring plan to discontinue the catalog print business.

9

Table of Contents

The Company has no material proceedings pending against it.

10

Table of Contents

PART II

Item 5. Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities.

Market for Registrant’s Common Equity

Our common stock is traded principally on the New York Stock Exchange (NYSE) under the symbol “JCP.” The number of stockholders of record at March 21, 2011, was 31,882. In addition to common stock, we have authorized 25 million shares of preferred stock, of which no shares were issued and outstanding at January 29, 2011.

The table below sets forth the quoted high and low market prices of our common stock on the NYSE for each quarterly period indicated, the quarter-end closing market price of our common stock, as well as the quarterly cash dividends declared per share of common stock:

| First Quarter | Second Quarter | Third Quarter | Fourth Quarter | |||||||||||||||||||||||||||||

| 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | 2010 | 2009 | |||||||||||||||||||||||||

| Dividend per share |

$ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | $ | 0.20 | ||||||||||||||||

| Market price: |

||||||||||||||||||||||||||||||||

| High |

$ | 33.75 | $ | 31.17 | $ | 30.15 | $ | 32.89 | $ | 34.50 | $ | 37.21 | $ | 35.12 | $ | 33.81 | ||||||||||||||||

| Low |

$ | 23.92 | $ | 13.71 | $ | 20.32 | $ | 24.56 | $ | 19.42 | $ | 28.65 | $ | 28.71 | $ | 24.18 | ||||||||||||||||

| Close |

$ | 29.17 | $ | 31.00 | $ | 24.63 | $ | 30.15 | $ | 31.18 | $ | 33.13 | $ | 32.29 | $ | 24.83 | ||||||||||||||||

Our Board of Directors (Board) reviews the dividend policy and rate, taking into consideration the overall financial and strategic outlook for our earnings, liquidity and cash flow projections, as well as competitive factors. On March 24, 2011, the Board declared a quarterly dividend of $0.20 per share to be paid on May 2, 2011.

Additional information relating to the common stock and preferred stock is included in this Annual Report on Form 10-K on the Consolidated Statements of Stockholders’ Equity and in Note 11 to the consolidated financial statements.

Issuer Purchases of Securities

No repurchases of common stock were made during the fourth quarter of 2010, and no amounts were authorized for share repurchase as of January 29, 2011. In February 2011, the Board authorized a program to repurchase up to $900 million of common stock on the open market. This program was launched on March 4, 2011 and is expected to be completed in 2011.

11

Table of Contents

Five-Year Total Stockholder Return Comparison

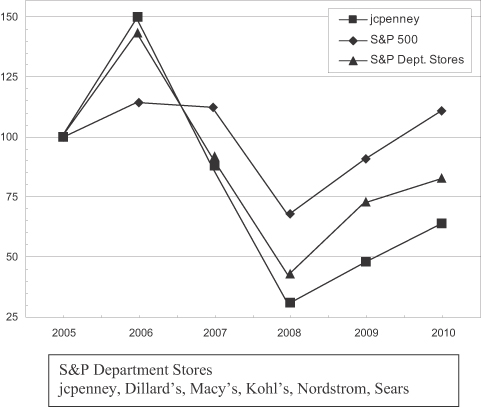

The following presentation compares our cumulative stockholder returns for the past five fiscal years with the returns of the S&P 500 Stock Index and the S&P 500 Retail Index for Department Stores over the same period. A list of these companies follows the graph below. The graph assumes $100 invested at the closing price of our common stock on the NYSE and each index as of the last trading day of our fiscal year 2005 and assumes that all dividends were reinvested on the date paid. The points on the graph represent fiscal year-end amounts based on the last trading day of each fiscal year. The following graph and related information shall not be deemed “soliciting material” or to be “filed” with the Securities and Exchange Commission, nor shall such information be incorporated by reference into any filing under the Securities Act of 1933 or Securities Exchange Act of 1934, each as amended, except to the extent that we specifically incorporate it by reference into such filing.

| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |||||||||||||||||||

|

jcpenney |

$ | 100 | $ | 150 | $ | 88 | $ | 31 | $ | 48 | $ | 64 | ||||||||||||

| S&P 500 |

100 | 115 | 113 | 68 | 91 | 111 | ||||||||||||||||||

| S&P Department Stores |

100 | 144 | 92 | 43 | 73 | 83 | ||||||||||||||||||

The stockholder returns shown are neither determinative nor indicative of future performance.

12

Table of Contents

Item 6. Selected Financial Data.

FIVE-YEAR FINANCIAL SUMMARY (UNAUDITED)

| (in millions, except per share data) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

| Results for the year |

||||||||||||||||||||

| Total net sales |

$ | 17,759 | $ | 17,556 | $ | 18,486 | $ | 19,860 | $ | 19,903 | ||||||||||

| Sales percent increase/(decrease): |

||||||||||||||||||||

| Total net sales |

1.2 | % | (5.0 | )% | (6.9 | )% | (0.2 | )%(1) | 6.0 | %(1) | ||||||||||

| Comparable store sales(2) |

2.5 | % | (6.3 | )% | (8.5 | )% | 0.0 | % | 4.9 | % | ||||||||||

| Operating income |

832 | 663 | 1,135 | 1,888 | 1,922 | |||||||||||||||

| As a percent of sales |

4.7 | % | 3.8 | % | 6.1 | % | 9.5 | % | 9.7 | % | ||||||||||

| Adjusted operating income (non-GAAP)(3) |

1,053 | 961 | 1,002 | 1,791 | 1,931 | |||||||||||||||

| As a percent of sales (non-GAAP)(3) |

5.9 | % | 5.5 | % | 5.4 | % | 9.0 | % | 9.7 | % | ||||||||||

| Income from continuing operations |

378 | 249 | 567 | 1,105 | 1,134 | |||||||||||||||

| Adjusted income from continuing operations (non-GAAP)(3) |

513 | 433 | 484 | 1,043 | 1,140 | |||||||||||||||

| Per common share |

||||||||||||||||||||

| Income from continuing operations, diluted |

$ | 1.59 | $ | 1.07 | $ | 2.54 | $ | 4.90 | $ | 4.88 | ||||||||||

| Adjusted income from continuing operations, diluted (non-GAAP)(3) |

2.16 | 1.86 | 2.17 | 4.63 | 4.91 | |||||||||||||||

| Dividends declared |

0.80 | 0.80 | 0.80 | 0.80 | 0.72 | |||||||||||||||

| Financial position and cash flow |

||||||||||||||||||||

| Total assets |

$ | 13,042 | $ | 12,581 | $ | 12,011 | $ | 14,309 | $ | 12,673 | ||||||||||

| Cash and cash equivalents |

2,622 | 3,011 | 2,352 | 2,532 | 2,803 | |||||||||||||||

| Long-term debt, including current maturities |

3,099 | 3,392 | 3,505 | 3,708 | 3,444 | |||||||||||||||

| Free cash flow (non-GAAP)(3) |

158 | 677 | 22 | (269 | ) | 632 | ||||||||||||||

(1) Includes the effect of the 53rd week in 2006. Excluding sales of $254 million for the 53rd week in 2006, total net sales increased 1.1% in 2007 and 4.6% in 2006.

(2) Comparable store sales are presented on a 52-week basis and include sales from new and relocated stores that have been opened for 12 consecutive full fiscal months and online sales through jcp.com. Stores closed for an extended period are not included in comparable store sales calculations, while stores remodeled and minor expansions not requiring store closures remain in the calculations. Our definition and calculation of comparable store sales may differ from other companies in the retail industry.

(3) See Non-GAAP Financial Measures beginning on the following page for additional information and reconciliation to the most directly comparable GAAP financial measure.

FIVE-YEAR OPERATIONS SUMMARY (UNAUDITED)

| 2010 | 2009 | 2008 | 2007 | 2006 | ||||||||||||||||

| Number of department stores: |

||||||||||||||||||||

| Beginning of year |

1,108 | 1,093 | 1,067 | 1,033 | 1,019 | |||||||||||||||

| Openings |

2 | 17 | 35 | 50 | 28 | |||||||||||||||

| Closings(1) |

(4 | ) | (2 | ) | (9 | ) | (16 | ) | (14 | ) | ||||||||||

| End of year |

1,106 | 1,108 | 1,093 | 1,067 | 1,033 | |||||||||||||||

| Gross selling space (square feet in millions) |

111.6 | 111.7 | 109.9 | 106.6 | 103.1 | |||||||||||||||

| Sales per gross square foot(2) |

$ | 153 | $ | 149 | $ | 160 | $ | 177 | $ | 176 | ||||||||||

| Sales per net selling square foot(2) |

$ | 210 | $ | 206 | $ | 223 | $ | 248 | $ | 248 | ||||||||||

(1) Includes relocations of -, 1, 7, 15, and 10, respectively.

(2) Calculation includes the sales and square footage of department stores that were open for the full fiscal year and sales for jcp.com. The 2006 calculations exclude sales of the 53rd week.

13

Table of Contents

NON-GAAP FINANCIAL MEASURES

We report our financial information in accordance with generally accepted accounting principles in the United States (GAAP). However, we present certain financial measures and ratios identified as non-GAAP under the rules of the Securities and Exchange Commission (SEC) to assess our results. We believe the presentation of these non-GAAP financial measures and ratios is useful in order to better understand our financial performance, as well as facilitate the comparison of our results to the results of our peer companies. It is important to view non-GAAP financial measures in addition to, rather than as a substitute for, those measures and ratios prepared in accordance with GAAP. We have provided reconciliations of the most directly comparable GAAP measures to our non-GAAP financial measures presented.

Non-GAAP Measures Excluding Non-Cash Primary Pension Plan Expense/(Income)

Our operating non-GAAP financial measures are presented to exclude, or adjust for, the impact of our primary pension plan expense/(income). Unlike other operating expenses, primary pension plan expense/(income) is determined using numerous complex assumptions about changes in pension assets and liabilities that are subject to factors beyond our control, such as market volatility. We believe it is useful for investors to understand the impact of the non-cash primary pension plan on our financial results and therefore are presenting the following non-GAAP financial measures: (1) adjusted operating income; (2) adjusted income from continuing operations; and (3) adjusted diluted EPS from continuing operations.

Adjusted Operating Income. The following table reconciles operating income, the most directly comparable GAAP financial measure, to adjusted operating income, a non-GAAP financial measure:

| ($ in millions) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

| Operating income (GAAP) |

$ | 832 | $ | 663 | $ | 1,135 | $ | 1,888 | $ | 1,922 | ||||||||||

| As a percent of sales |

4.7 | % | 3.8 | % | 6.1 | % | 9.5 | % | 9.7 | % | ||||||||||

| Add/(deduct): primary pension plan expense/(income) |

221 | 298 | (133 | ) | (97 | ) | 9 | |||||||||||||

| Adjusted operating income (non-GAAP) |

$ | 1,053 | $ | 961 | $ | 1,002 | $ | 1,791 | $ | 1,931 | ||||||||||

| As a percent of sales |

5.9 | % | 5.5 | % | 5.4 | % | 9.0 | % | 9.7 | % | ||||||||||

Adjusted Income and Diluted Earnings per Share (EPS) from Continuing Operations. The following table reconciles income and diluted EPS from continuing operations, the most directly comparable GAAP financial measures, to adjusted income and diluted EPS from continuing operations, non-GAAP financial measures:

| ($ in millions, except per share data) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

| Income from continuing operations (GAAP) |

$ | 378 | $ | 249 | $ | 567 | $ | 1,105 | $ | 1,134 | ||||||||||

| Diluted EPS from continuing operations (GAAP) |

$ | 1.59 | $ | 1.07 | $ | 2.54 | $ | 4.90 | $ | 4.88 | ||||||||||

| Add/(deduct): primary pension plan expense/(income), net of income tax |

135 | 184 | (83 | ) | (62 | ) | 6 | |||||||||||||

| Adjusted income from continuing operations (non-GAAP) |

$ | 513 | $ | 433 | $ | 484 | $ | 1,043 | $ | 1,140 | ||||||||||

| Adjusted diluted EPS from continuing operations (non-GAAP) |

$ | 2.16 | $ | 1.86 | $ | 2.17 | $ | 4.63 | $ | 4.91 | ||||||||||

14

Table of Contents

Free Cash Flow

Free cash flow is a key financial measure of our ability to generate additional cash from operating our business and in evaluating our financial performance. We define free cash flow as net cash provided by operating activities excluding discretionary cash contributions to our primary pension plan and any associated cash tax impacts, less capital expenditures and dividends paid, plus proceeds from the sale of assets. Adjustments to exclude discretionary pension plan contributions are more indicative of our ability to generate cash flows from operating activities. We believe discretionary contributions to our pension plan are more reflective of financing transactions to reduce off-balance sheet debt relating to the pension liability. We believe that free cash flow is a relevant indicator of our ability to repay maturing debt, revise our dividend policy or fund other uses of capital that we believe will enhance stockholder value. Free cash flow is limited and does not represent remaining cash flows available for discretionary expenditures due to the fact that the measure does not deduct the payments required for debt maturities, pay-down of off-balance sheet pension debt and other obligations or payments made for business acquisitions. Therefore, we believe it is important to view free cash flow in addition to, rather than as a substitute for, our entire statement of cash flows and those measures prepared in accordance with GAAP.

The following table reconciles net cash provided by operating activities, the most directly comparable GAAP measure, to free cash flow, a non-GAAP financial measure.

| ($ in millions) | 2010 | 2009 | 2008 | 2007 | 2006 | |||||||||||||||

| Net cash provided by operating activities (GAAP) |

$ | 592 | $ | 1,573 | $ | 1,156 | $ | 1,232 | $ | 1,237 | ||||||||||

| Less: |

||||||||||||||||||||

| Capital expenditures |

(499 | ) | (600 | ) | (969 | ) | (1,243 | ) | (772 | ) | ||||||||||

| Dividends paid, common stock |

(189 | ) | (183 | ) | (178 | ) | (174 | ) | (153 | ) | ||||||||||

| Tax benefit from pension contribution |

(152 | ) | (126 | )(1) | - | (110 | )(2) | - | ||||||||||||

| Plus: |

||||||||||||||||||||

| Discretionary cash pension contribution |

392 | - | - | - | 300 | |||||||||||||||

| Proceeds from sale of assets |

14 | 13 | 13 | 26 | 20 | |||||||||||||||

| Free cash flow (non-GAAP) |

$ | 158 | $ | 677 | $ | 22 | $ | (269 | ) | $ | 632 | |||||||||

(1) Related to the discretionary contribution of $340 million of Company common stock in 2009.

(2) Related to the $300 million discretionary cash contribution in 2006.

15

Table of Contents

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

The following discussion, which presents our results, should be read in conjunction with the accompanying consolidated financial statements and notes thereto, along with the unaudited Five-Year Financial and Operations Summaries, the risk factors and the cautionary statement regarding forward-looking information. Unless otherwise indicated, this Management’s Discussion and Analysis (MD&A) relates only to results from continuing operations, all references to earnings per share (EPS) are on a diluted basis and all references to years relate to fiscal years rather than to calendar years.

Financial Reporting

We remain committed to continuously improving the transparency of our financial reporting by providing stockholders with informative financial disclosures and presenting a clear and balanced view of our financial position and operating results. We continue to employ a reporting matrix that requires written certifications on a quarterly basis from a cross-disciplined team of approximately 20 senior members of our management team who have responsibility for preparing, verifying and reporting corporate results.

For this Annual Report on Form 10-K, we enhanced our financial reporting as follows:

| • | Supplemental cash flow information and significant non-cash transactions have been moved from a footnote presentation to be more prominently included directly on the face of the Consolidated Statements of Cash Flows. |

| • | We combined several related footnotes that contained information about common stock and stockholders’ equity into a single footnote titled, “Stockholders’ Equity.” |

| • | We addressed the new disclosure requirements to provide information on recurring or nonrecurring fair value measurements, including significant transfers into and out of level one and level two categories. |

| • | We simplified the content and presentation of Item 6, Selected Financial Data. |

| • | We revised our definition and calculation of free cash flow (a non-GAAP financial measure) to exclude discretionary pension contributions and any related cash tax effects, which more appropriately reflects our ability to generate cash flows from operating activities. |

| • | In view of the growth of our JCP Rewards® customer loyalty program in 2010, we added a significant accounting policy to describe the accounting for the program. |

Consistent with the requirements of Section 404 of the Sarbanes-Oxley Act of 2002, we are required to report on the effectiveness of our internal control over financial reporting each fiscal year. In relation to these requirements, our external auditors expressed an unqualified opinion regarding the effective operation of our internal control over financial reporting.

16

Table of Contents

Executive Overview

Despite the continued economic weakness during the year, we began to see some improvement in the retail sector. Our comparable store sales were positive for each quarter of 2010 and grew 2.5% for the year, while total net sales grew 1.2%. Total sales were 130 basis points lower than comparable store sales due to the reduction in sales resulting from discontinuing catalog print media. The gross margin rate as a percent of sales decreased slightly to 39.2%, compared to last year’s historic peak of 39.4%; however, we leveraged operating expenses to grow operating income by $169 million. EPS from continuing operations of $1.59 was 48.6% higher than last year. Other key highlights for 2010 were as follows:

| • | We opened 76 Sephora inside jcpenney beauty boutiques to bring our total to 231 locations. |

| • | We successfully launched the Liz Claiborne® brand. |

| • | We completed several financing transactions during the year that further strengthened our financial position and created additional financial flexibility to support our growth plans: |

| • | We closed a public offering of $400 million aggregate principal amount of 5.65% Senior Notes due 2020 and used the net proceeds of approximately $392 million to make a voluntary cash contribution to our qualified pension plan. |

| • | We accepted for purchase $300 million principal amount of outstanding 6.375% Senior Notes due 2036, which were validly tendered pursuant to a cash tender offer, and incurred approximately $20 million, or about $0.05 per share, in related expenses, consisting primarily of bond premiums paid. |

| • | We recorded $32 million of restructuring charges, amounting to approximately $0.08 on a per share basis, primarily to reflect the write down of the catalog outlet stores, which are being exited, and related severance. |

Current Developments

| • | In February, our Board authorized a program to repurchase up to $900 million of our common stock. |

| • | In March, our Board declared a quarterly dividend of $0.20 per share to be paid to stockholders on May 2, 2011. The dividend rate remains unchanged from our previous quarterly dividend payment. |

| • | To further enhance our liquidity, we plan to renew our revolving credit facility early in 2011, ahead of its maturity in 2012. |

17

Table of Contents

Results of Operations

Three-Year Comparison of Operating Performance

| (in millions, except EPS) | 2010 | 2009 | 2008 | |||||||||

| Total net sales |

$ | 17,759 | $ | 17,556 | $ | 18,486 | ||||||

| Percent increase/(decrease) from prior year |

1.2 | % | (5.0 | )% | (6.9 | )% | ||||||

| Comparable store sales increase/(decrease)(1) |

2.5 | % | (6.3 | )% | (8.5 | )% | ||||||

| Gross margin |

6,960 | 6,910 | 6,915 | |||||||||

| Operating expenses: |

||||||||||||

| Selling, general and administrative (SG&A) |

5,350 | 5,382 | 5,395 | |||||||||

| Pension expense/(income) |

255 | 337 | (90 | ) | ||||||||

| Depreciation and amortization |

511 | 495 | 469 | |||||||||

| Pre-opening |

8 | 28 | 31 | |||||||||

| Real estate and other, net |

4 | 5 | (25 | ) | ||||||||

| Total operating expenses |

6,128 | 6,247 | 5,780 | |||||||||

| Operating income |

832 | 663 | 1,135 | |||||||||

| As a percent of sales |

4.7 | % | 3.8 | % | 6.1 | % | ||||||

| Adjusted operating income (non-GAAP)(2) |

1,053 | 961 | 1,002 | |||||||||

| As a percent of sales |

5.9 | % | 5.5 | % | 5.4 | % | ||||||

| Net interest expense |

231 | 260 | 225 | |||||||||

| Bond premiums and unamortized costs |

20 | - | - | |||||||||

| Income from continuing operations before income taxes |

581 | 403 | 910 | |||||||||

| Income tax expense |

203 | 154 | 343 | |||||||||

| Income from continuing operations |

$ | 378 | $ | 249 | $ | 567 | ||||||

| Adjusted income from continuing operations (non-GAAP)(2) |

$ | 513 | $ | 433 | $ | 484 | ||||||

| Diluted EPS from continuing operations |

$ | 1.59 | $ | 1.07 | $ | 2.54 | ||||||

| Adjusted diluted EPS from continuing operations (non-GAAP)(2) |

$ | 2.16 | $ | 1.86 | $ | 2.17 | ||||||

| Average shares used for diluted EPS |

238 | 233 | 223 | |||||||||

(1) Comparable store sales are presented on a 52-week basis and include sales from new and relocated stores that have been opened for 12 consecutive full fiscal months and online sales through jcp.com. Stores closed for an extended period are not included in comparable store sales calculations, while stores remodeled and minor expansions not requiring store closures remain in the calculations. Our definition and calculation of comparable store sales may differ from other companies in the retail industry.

(2) See Item 6, Selected Financial Data, for a discussion of this non-GAAP financial measure and reconciliation to its most directly comparable GAAP financial measure.

Income from continuing operations was $378 million, or $1.59 per share, in 2010 compared to $249 million, or $1.07 per share, in 2009 and $567 million, or $2.54 per share, in 2008. Results for 2010 reflected improved profitability achieved by delivering top line sales growth and leveraging operating expenses. Included in results were charges of $32 million, or $0.08 per share, for initial restructuring charges related primarily to the wind down of our catalog and outlet operations and the streamlining of our call center operations and custom decorating business. Operating expenses benefited from lower primary pension plan expense by $77 million, or approximately $0.22 per share. Earnings for 2010 were favorably impacted by the decrease of our effective income tax rate due to favorable resolution of certain state income tax audits and an increase in our federal wage tax credit.

18

Table of Contents

Earnings for 2009 reflected the economic downturn as well as the significant increase in the non-cash primary pension plan charge. Notwithstanding these impacts, results benefited significantly from gross margin improvement that reflected the success of our strategy to sell a greater portion of merchandise at regular promotional prices and less at clearance prices. Results for 2008 were impacted by pressure on gross margins in a highly promotional selling environment, particularly during the holiday season. Gross margin declined both in dollars and as a percentage of sales from the pressure of declining sales levels that resulted from the slowdown in consumer spending. The impact on operating income from lower gross margin was somewhat mitigated by effective control over operating expenses, despite incremental expenses related to new store openings.

Excluding the non-cash impact of our primary pension plan, adjusted income from continuing operations (non-GAAP) was $513 million, or $2.16 per share, in 2010 compared with $433 million, or $1.86 per share, in 2009 and $484 million, or $2.17 per share, in 2008.

2010 Compared to 2009

Total Net Sales

Our year-to-year change in total net sales is comprised of (a) sales from new stores net of closings and relocations including catalog print media and outlet store sales, referred to as non-comparable store sales and (b) sales of stores opened in both years as well as online sales from jcp.com, referred to as comparable store sales. We consider comparable store sales to be a key indicator of our current performance measuring the growth in sales and sales productivity of existing stores. Positive comparable store sales contribute to greater leveraging of operating costs, particularly payroll and occupancy costs, while negative comparable store sales contribute to de-leveraging of costs. Comparable store sales also have a direct impact on our total net sales and the level of cash flow.

| 2010 | 2009 | |||||||

| Total net sales (in millions) |

$ | 17,759 | $ | 17,556 | ||||

| Sales percent increase/(decrease) |

||||||||

| Total net sales |

1.2 | % | (5.0 | )% | ||||

| Comparable store sales |

2.5 | % | (6.3 | )% | ||||

| Sales per gross square foot(1) |

$ | 153 | $ | 149 | ||||

(1) Calculation includes the sales of stores that were open for the full fiscal year, as well as online sales through jcp.com.

Total net sales increased $203 million in 2010 compared to 2009. The following table provides the components of the net sales increase:

| ($ in millions) | 2010 | |||

| Comparable store sales, including Internet |

$ | 406 | ||

| Sales of new (non-comparable) stores, net |

77 | |||

| Sales decline through catalog print media and outlet stores |

(280 | ) | ||

| 2010 total net sales increase |

$ | 203 | ||

In 2010, comparable store sales increased 2.5% mainly as customers responded to our new merchandise initiatives and the value offered through our private brands. Sales of non-comparable stores opened in 2010 and 2009, net of closings, added $77 million. In 2010, we opened two new stores and closed four, while in 2009 we opened 17 new stores and closed or relocated two stores. As expected with the wind down of the catalog business, catalog print media and outlet store sales

19

Table of Contents

declined in 2010. Internet sales, which are included in comparable store sales, increased 4.4% to slightly more than $1.5 billion for the year. All components combined, total net sales increased $203 million or 1.2% in the year.

During 2010, the percent increase in our off-mall store traffic exceeded the increase in our mall traffic, which was also above last year’s level. In addition, our conversion rates for both mall and off-mall stores were above 2009 levels. Our average unit retail was down in 2010 compared to last year, primarily as a result of a greater portion of promotional sales in our mix this year and a higher proportion of sales in the “good” and “better” merchandise categories at lower price points than sales of merchandise in the “best” category at higher price points. For 2010, our unit sales, number of transactions and units per transaction were higher than last year. Sales in all geographic regions increased in 2010, with the best performance in the southeast and southwest regions with the weakest in the northwest and northeast regions. Our best performing categories were men’s apparel and women’s accessories, including Sephora. Home and women’s apparel experienced the weakest performance for the year. Private and exclusive brands found only at jcpenney continue to grow and as a percent of total merchandise sales were 55% in 2010 versus 54% in 2009.

Total Net Sales Mix

The following percentages represent the mix of total net sales:

| 2010 | 2009 | |||||||

| Women’s apparel |

24 | % | 24 | % | ||||

| Men’s apparel and accessories |

20 | % | 19 | % | ||||

| Home |

18 | % | 19 | % | ||||

| Women’s accessories, including Sephora |

12 | % | 11 | % | ||||

| Children’s apparel |

11 | % | 11 | % | ||||

| Family footwear |

7 | % | 7 | % | ||||

| Fine jewelry |

4 | % | 4 | % | ||||

| Services and other |

4 | % | 5 | % | ||||

| 100 | % | 100 | % | |||||

During the year, we opened 76 Sephora inside jcpenney locations, bringing us to 231 locations compared to 155 at the end of 2009. We plan to open an additional 76 Sephora inside jcpenney locations in 2011.

Merchandise Initiatives

In 2010, we focused on improving our merchandise assortments through the following initiatives:

| • | In April, we introduced One KissTM, a new brand of fine jewelry by Cindy Crawford. |

| • | In July, in time for the back-to-school shopping season, we launched UproarTM and Supergirl® by Nastia. Uproar is a new private label brand in stores and jcp.com for girls and boys ages 9 to 13. Supergirl by Nastia, an exclusive jcpenney brand for girls 8 to 12 years old, was created through a partnership with Warner Bros. Consumer Products and five-time Olympic medalist Nastia Liukin. |

| • | In August, we launched Liz Claiborne, making jcpenney the exclusive department store for Liz® branded merchandise in the United States and Puerto Rico. Liz Claiborne is available in all stores and jcp.com and consists of merchandise in approximately 30 categories, including women’s and men’s apparel, home and accessories. |

| • | Also in August, we launched MNG by Mango®, fast fashion merchandise consisting of career and casual women’s sportswear, as well as handbags, accessories and footwear. MNG |

20

Table of Contents

| by Mango is available exclusively at jcpenney and is available on jcp.com. At the end of the year, MNG by Mango was available in 77 stores, and is expected to reach a total of about 500 stores by the end of 2011. |

| • | In September, we launched a new unique collaboration with People StyleWatch®. People StyleWatch editors select “Must Have” items from jcpenney’s fashion assortment, focusing on women’s and juniors’ apparel, accessories and footwear. The items branded as “Must Have” items are displayed and clearly highlighted in jcpenney stores, online at jcp.com and through print and digital media. Displays are refreshed up to 10 times a year to showcase “People StyleWatch Must Haves.” |

| • | In the fall, we became the exclusive department store retailer for the Call it Spring® brand by The ALDO® Group. Call it Spring was launched as a shop-within-a-shop concept similar to Sephora and provides a collection of more than 300 styles of on-trend footwear and accessories targeting younger, modern customers. Call it Spring is expected to be available in approximately 500 stores by the end of 2011. |

| • | In October, we announced an alliance with Condé Nast to launch Modern Bride™, a concept devoted to providing style and exceptional customer service. In February 2011, we introduced the Modern Bride concept in our fine jewelry department, in time for Valentine’s Day, offering an expanded assortment of bridal jewelry including engagement rings and wedding bands. |

| • | In November, we announced our newly created Growth Brands Division and our plans to pursue high potential opportunities in the retail sector, including both digital and store opportunities. The Growth Brands Division will be separate from our core jcpenney brand and will leverage our merchandising, marketing, product development, sourcing, IT, planning and allocation and consumer research capabilities. We announced three retail businesses that will debut under this division. In summer 2011, in partnership with Hearst Magazines, we will launch two online retail businesses: Gifting Grace™, a comprehensive online gifting resource for women, and CLAD™, aimed at men and offering an assortment of designer brands. We also plan to launch The Foundry Big & Tall Supply Co.™ with a website catering to the men’s big & tall customer, followed by the opening of 10 stand-alone specialty retail stores. |

Gross Margin

Gross margin is a measure of profitability of a retail company at the most fundamental level of buying and selling merchandise and measures a company’s ability to effectively manage the total costs of sourcing and allocating merchandise against the corresponding retail pricing designed to offer quality merchandise at compelling prices. Gross margins not only cover marketing, selling and other operating expenses, but also must include a profit element to reinvest back into the business. Gross margin is the difference between total net sales and cost of the merchandise sold and is typically expressed as a percentage of total net sales. The cost of merchandise sold includes all direct costs of bringing merchandise to its final selling destination. These costs include:

| • cost of the merchandise (net of discounts or allowances earned) • freight • warehousing • sourcing and procurement • buying and brand development costs including buyers’ salaries and related expenses |

• merchandise examination • inspection and testing • merchandise distribution center expenses • shipping and handling costs incurred related to sales to customers |

21

Table of Contents

| ($ in millions) | 2010 | 2009 | ||||||

| Gross margin |

$ | 6,960 | $ | 6,910 | ||||

| As a percent of sales |

39.2 | % | 39.4 | % | ||||

Gross margin decreased slightly to 39.2% of sales, or 20 basis points, in 2010 compared to 2009’s historical high annual gross margin rate of 39.4%. On a dollar basis, gross margin increased $50 million, or 0.7%, to $6,960 million compared to $6,910 million last year. The gross margin rate decreased due to higher markdowns from increased promotional activity that were somewhat offset by increased vendor support and lower year-over-year shrinkage, as a result of our shrinkage reduction initiatives. The gross margin level was also negatively impacted by the elimination of catalog print media.

Selling, General and Administrative (SG&A) Expenses

The following costs are included in SG&A expenses, except if related to merchandise buying, sourcing, warehousing or distribution activities:

| • salaries • marketing • occupancy and rent • utilities and maintenance • information technology |

• administrative costs related to our home office, district and regional operations • credit/debit card fees • real, personal property and other taxes (excluding income taxes) |

| ($ in millions) | 2010 | 2009 | ||||||

| SG&A |

$ | 5,350 | $ | 5,382 | ||||

| As a percent of sales |

30.1 | % | 30.7 | % | ||||

SG&A expenses declined $32 million to $5,350 million in 2010 compared to $5,382 million in 2009. As a percent of sales, SG&A expenses were leveraged and decreased 60 basis points to 30.1% compared to 30.7% in 2009. A lower incentive compensation accrual for 2010 offset higher store salary costs that were impacted by the minimum wage increase and the resumption of merit increases, as well as the higher salaries associated with the additional Sephora inside jcpenney locations, which are more labor intensive than other departments in the store. The lower incentive compensation accrual was primarily the result of not achieving our sales plan as the discontinuation of the catalog business had a greater impact on sales than expected. In addition, last year’s accrual included a special one-time recognition bonus program for mostly store-based hourly associates. Risk insurance expense, as well as health and welfare plan costs were also lower in the year. Risk insurance expense declined as a result of our workers’ compensation initiatives and favorable industry trends and health and welfare costs were lower as a result of a decline in participation levels. While our year-over-year marketing expense was relatively flat with last year, spending was reallocated from catalog and print media to local and national advertising and online media.

Pension Expense

| ($ in millions) | 2010 | 2009 | ||||||

| Primary pension plan expense |

$ | 221 | $ | 298 | ||||

| Supplemental pension plans expense |

34 | 39 | ||||||

| Total pension expense |

$ | 255 | $ | 337 | ||||

22

Table of Contents

Total pension expense was $255 million in 2010 compared to $337 million in 2009 and consisted mainly of the primary pension plan expense of $221 million in 2010 versus $298 million for 2009. The 2010 primary pension plan expense declined mainly as a result of higher returns on our pension plan assets as of the 2009 year-end measurement date due to positive market returns in 2009 combined with our May 2009 discretionary contribution of common stock to the plan.

Based on our 2010 year-end measurement of primary pension plan assets and benefit obligations, we expect our 2011 non-cash primary pension plan expense to decline to $87 million compared to $221 million in 2010. The lower expense will benefit EPS about $0.35 based on the 2010 level of shares used for the EPS calculation. The reduction is primarily the result of positive returns on plan assets due to favorable capital market experience in 2010 and our discretionary cash contribution of $392 million in May 2010, partially offset by a 90 basis point decline in our expected return on plan assets. The decline of the expected rate of return is due to our new target allocation strategy to mitigate volatility risk by decreasing the plan’s asset allocation to equities and shifting to less volatile fixed income investments. For more information, see Note 14 to our consolidated financial statements.

Depreciation and Amortization Expenses

Depreciation and amortization expenses in 2010 increased $16 million to $511 million, or approximately 3.2%, compared to $495 million in 2009 primarily as a result of our store renewals and updates over the past two years.

Pre-Opening Expense

Pre-opening expense, which includes advertising, hiring and training costs for new associates, processing and stocking initial merchandise inventory and rental costs prior to store opening and similar costs prior to a new Sephora inside jcpenney location opening, was $8 million for 2010 compared to $28 million in 2009. In 2010, we opened two new stores and 76 Sephora inside jcpenney locations compared to 17 new stores and 64 Sephora inside jcpenney locations in 2009.

Real Estate and Other, Net

| ($ in millions) | 2010 | 2009 | ||||||

| Real estate activities |

$ | (34 | ) | $ | (34 | ) | ||

| Net gains from sale of real estate |

(8 | ) | (2 | ) | ||||

| Impairments |

3 | 42 | ||||||

| Restructuring charges |

32 | - | ||||||

| Other |

11 | (1 | ) | |||||

| Total expense |

$ | 4 | $ | 5 | ||||

Real estate and other consists of ongoing operating income from our real estate subsidiaries, net gains from the sale of facilities and equipment that are no longer used in our operations, other non-operating corporate charges and credits, as well as asset impairments and restructuring related charges.

Real estate and other expenses totaled $4 million in 2010 compared to $5 million in 2009. While operating income from our real estate activities was consistent year-over-year at $34 million, net gains from sale of real estate were $6 million higher in 2010 from the sale of two properties. In 2010, impairments totaled $3 million and related primarily to one underperforming store that continues to operate. In 2009, impairments totaled $42 million and related to seven underperforming department

23

Table of Contents

stores and other corporate assets. Real estate and other in 2010 also included $32 million of initial restructuring charges related primarily to the wind down of our catalog and outlet operations and streamlining the related call center operations and facility consolidation within our custom decorating business. Other expenses of $11 million in 2010 included legal and other advisory costs related to the Company’s evaluation of capital restructuring alternatives.

Operating Income

Operating income increased 90 basis points to 4.7% of sales in 2010 compared to 3.8% last year. Excluding the non-cash impact of the primary pension plan, adjusted operating income (non-GAAP) increased 40 basis points to 5.9% of sales compared to 5.5% in 2009.

Net Interest Expense

Net interest expense consists principally of interest expense on long-term debt, net of interest income earned on cash and cash equivalents. Net interest expense was $231 million, a decrease of $29 million, or 11.2%, from $260 million in 2009. The decrease was primarily due to lower debt levels combined with lower interest rate levels resulting from long-term debt transactions completed during the year.

Bond Premiums and Unamortized Costs

In 2010, we incurred $20 million of additional financing costs, consisting primarily of bond premiums paid in connection with the debt tender offer completed in May 2010. There were no comparable costs in 2009.

Income Taxes

The effective income tax rate for continuing operations for 2010 was 34.9% compared with 38.2% for 2009. The tax rate decreased due to favorable resolution of certain state income tax audits combined with changes in state tax laws and an increase in our federal wage tax credit.

Income from Continuing Operations

Income from continuing operations for 2010 increased 51.8% to $378 million, or $1.59 per share, compared with $249 million, or $1.07 per share, last year. Excluding the non-cash impact of the primary pension plan, adjusted income from continuing operations (non-GAAP) increased 18.5% to $513 million, or $2.16 per share, compared to $433 million, or $1.86 per share, for 2009.

Discontinued Operations