Exhibit 99.1

MPLX & MarkWest provide supplemental information regarding the strategic combination announced July 13

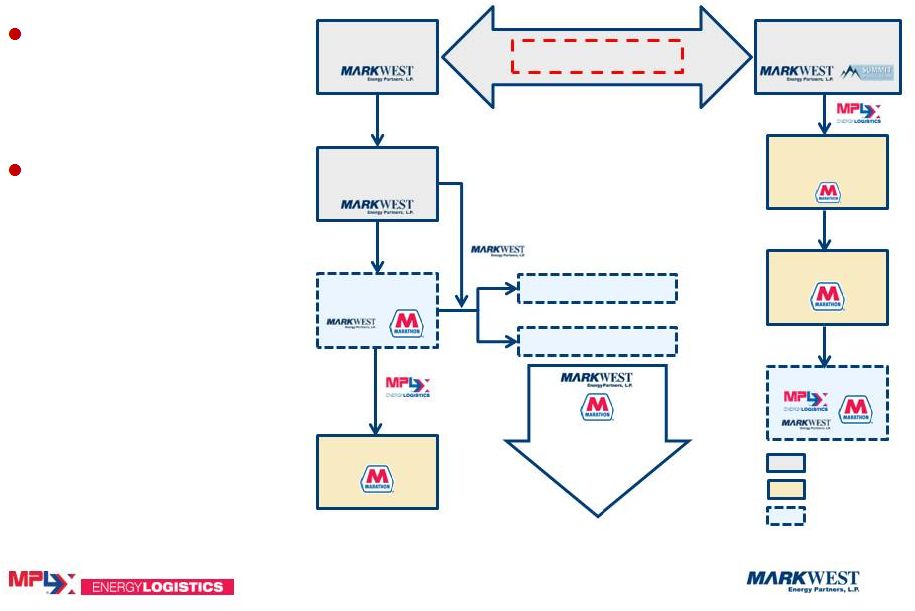

FINDLAY, Ohio, and DENVER, July 20, 2015 – Last week MPLX LP (NYSE: MPLX) and MarkWest Energy Partners, L.P. (NYSE:MWE) (MarkWest) announced they had signed a definitive merger agreement whereby MarkWest would become a wholly owned subsidiary of MPLX. In connection with the announcement, MPLX affirmed its anticipated distribution growth guidance of 29 percent in 2015 and shared that it expects a 25 percent compound annual distribution growth rate for the combined entity through 2017, with a “peer-leading” distribution growth profile thereafter. MPLX and MarkWest are clarifying “peer-leading” implies an annual distribution growth profile of approximately 20 percent in years 2018 and 2019.

The combined partnership also anticipates the opportunity for incremental growth capital investments afforded by the stronger financial position of the combined entity and support from its investment grade sponsor Marathon Petroleum Corporation (NYSE:MPC).

MPLX and MarkWest are providing additional information on the incremental organic growth opportunities available to the combined partnership, and have added information to the announcement materials to supplement that discussion.

All materials will be available under the Investor Relations tabs for MPLX at http://www.mplx.com and MarkWest at http://www.markwest.com and will be a part of a Form 8-K filed with the Securities Exchange Commission this morning.

###

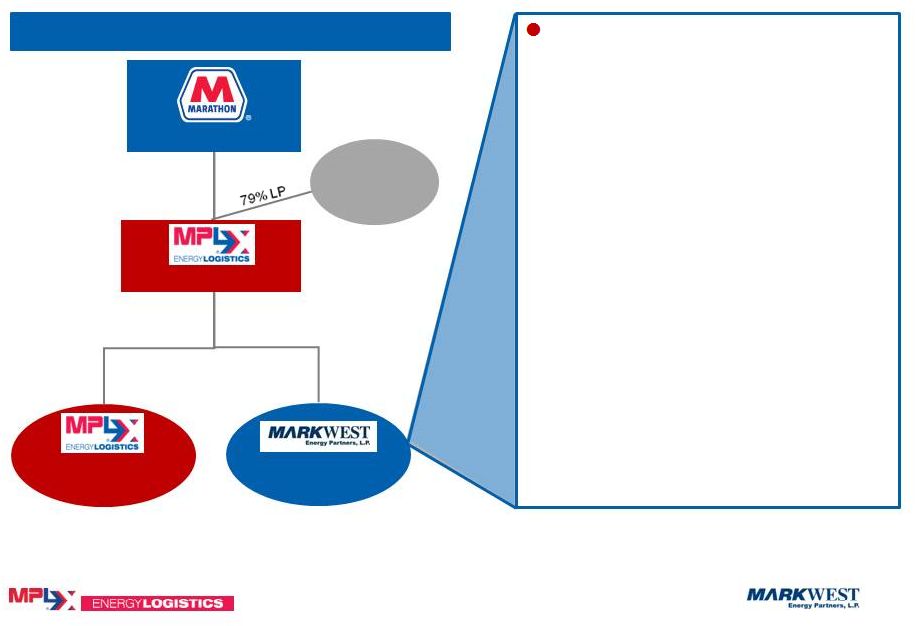

About MPLX LP

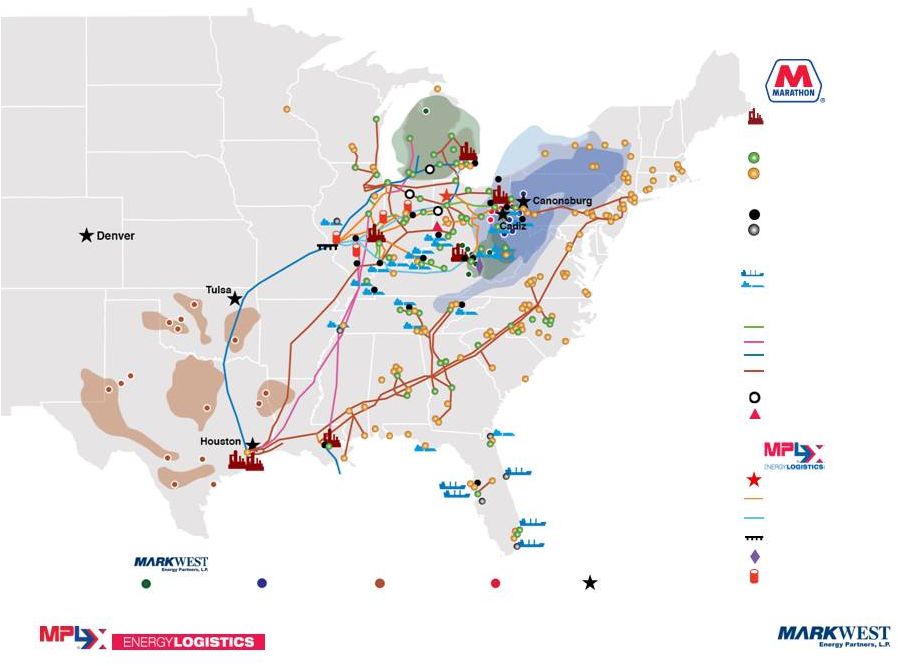

MPLX is a fee-based, growth-oriented master limited partnership formed in 2012 by Marathon Petroleum Corporation to own, operate, develop and acquire pipelines and other midstream assets related to the transportation and storage of crude oil, refined products and other hydrocarbon-based products. Headquartered in Findlay, Ohio, MPLX’s assets consist of a 99.5 percent equity interest in a network of common carrier crude oil and products pipeline assets located in the Midwest and Gulf Coast regions of the United States and a 100 percent interest in a butane storage cavern located in West Virginia with approximately 1 million barrels of natural gas liquids storage capacity.

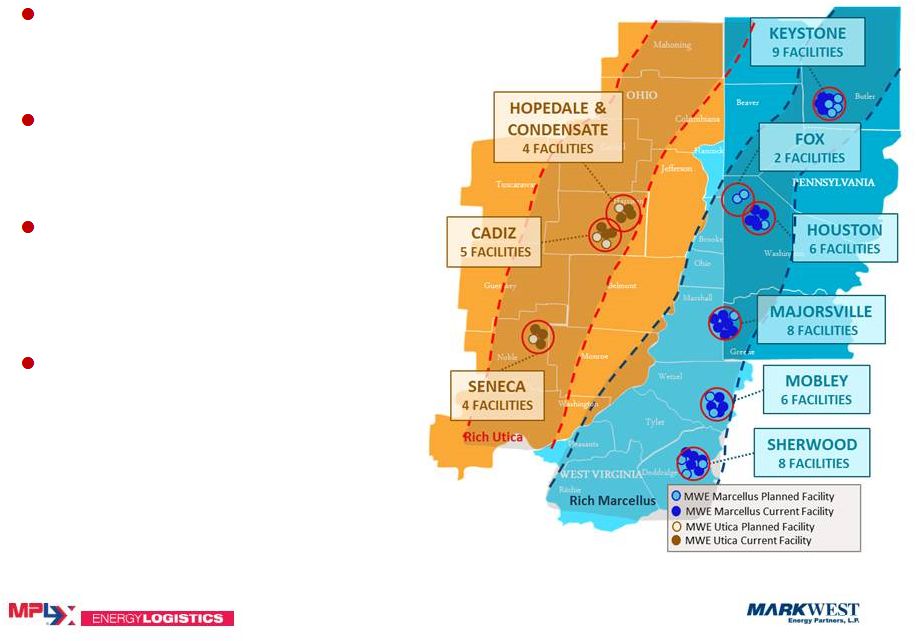

About MarkWest Energy Partners

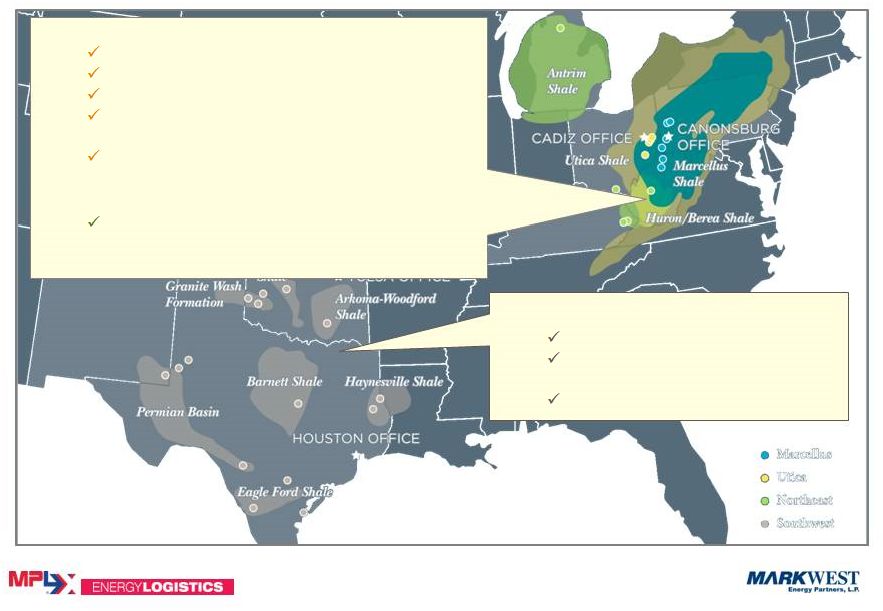

MarkWest Energy Partners, L.P. is a master limited partnership that owns and operates midstream service businesses. MarkWest has a leading presence in many natural gas resource plays including the Marcellus Shale, Utica Shale, Huron/Berea Shale, Haynesville Shale, Woodford Shale and Granite Wash formation.

MPLX Investor Relations Contacts:

Geri Ewing (419) 421-2071

Teresa Homan (419) 421-2965

MPLX Media Contacts:

Chuck Rice (419) 421-2521

Jamal Kheiry (419) 421-3312

MarkWest Investor Relations and Media Contact:

Joshua Hallenbeck (866) 858-0482

This press release contains forward-looking statements within the meaning of federal securities laws regarding MPLX LP (“MPLX”), Marathon Petroleum Corporation (“MPC”), and MarkWest Energy Partners, L.P. (“MWE”). These forward-looking statements relate to, among other things, expectations, estimates and projections concerning the business and operations of MPC, MPLX and MWE. You can identify forward-looking statements by words such as “anticipate,” “believe,” “imply,” “estimate,” “objective,” “expect,” “forecast,” “plan,” “project,” “potential,” “could,” “may,” “should,” “would,” “will” or other similar expressions that convey the uncertainty of future events or outcomes. Such forward-looking statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond the companies’ control and are difficult to predict. Factors that could cause MPLX’s or MWE’s actual results to differ materially from those in the forward-looking statements include: their ability to complete the proposed merger of MPLX and MWE on anticipated terms and timetable; the ability to obtain approval of the transaction by the unitholders of MWE and satisfy other conditions to the closing of the transaction contemplated by the merger agreement; the ability to obtain governmental approvals of the MPLX/MWE transaction based on the proposed terms and schedule, and any conditions imposed on the combined company in connection with consummation of the MPLX/MWE transaction; the risk that the costs savings and any other synergies from the MPLX/MWE transaction may not be fully realized or may take longer to realize than expected; disruption from the MPLX/MWE transaction making it more difficult to maintain relationships with customers, employees or suppliers; risks relating to any unforeseen liabilities of MWE or MPLX, as applicable; the adequacy of their respective capital resources and liquidity, including, but not limited to, availability of sufficient cash flow to pay distributions and execute their respective business plans; the timing and extent of changes in commodity prices and demand for crude oil, refined products, feedstocks or other hydrocarbon-based products; volatility in and/or degradation of market and industry conditions; completion of pipeline capacity by competitors; disruptions due to equipment interruption or failure, including electrical shortages and power grid failures; the suspension, reduction or termination of MPC’s obligations under MPLX’s commercial agreements; each company’s ability to successfully implement its growth plan, whether through organic growth or acquisitions; modifications to earnings and distribution growth objectives; federal and state environmental, economic, health and safety, energy and other policies and regulations; changes to MPLX’s capital budget; other risk factors inherent to their industry; and the factors set forth under the heading “Risk Factors” in MPLX’s Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with the Securities and Exchange Commission (SEC); and the factors set forth under the heading “Risk Factors” in MWE’s Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with the SEC.

2

Factors that could cause MPC’s actual results to differ materially from those in the forward-looking statements include: risks described above relating to the MPLX/MWE proposed merger; changes to the expected construction costs and timing of pipeline projects; volatility in and/or degradation of market and industry conditions; the availability and pricing of crude oil and other feedstocks; slower growth in domestic and Canadian crude supply; an easing or lifting of the U.S. crude oil export ban; completion of pipeline capacity to areas outside the U.S. Midwest; consumer demand for refined products; transportation logistics; the reliability of processing units and other equipment; MPC’s ability to successfully implement growth opportunities; modifications to MPLX earnings and distribution growth objectives; federal and state environmental, economic, health and safety, energy and other policies and regulations; MPC’s ability to successfully integrate the acquired Hess retail operations and achieve the strategic and other expected objectives relating to the acquisition; changes to MPC’s capital budget; other risk factors inherent to MPC’s industry; and the factors set forth under the heading “Risk Factors” in MPC’s Annual Report on Form 10-K for the year ended Dec. 31, 2014, filed with SEC. In addition, the forward-looking statements included herein could be affected by general domestic and international economic and political conditions. Unpredictable or unknown factors not discussed here, in MPLX’s Form 10-K, in MPC’s Form 10-K, or in MWE’s Form 10-K could also have material adverse effects on forward-looking statements. Copies of MPLX’s Form 10-K are available on the SEC website, MPLX’s website at http://ir.mplx.com or by contacting MPLX’s Investor Relations office. Copies of MPC’s Form 10-K are available on the SEC website, MPC’s website at http://ir.marathonpetroleum.com or by contacting MPC’s Investor Relations office. Copies of MWE’s Form 10-K are available on the SEC website, MWE’s website at http://investor.markwest.com or by contacting MWE’s Investor Relations office.

None of MPLX, MPC, or MWE undertake any duty to update any forward-looking statement except as required by law.

Additional Information

This communication may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed transaction, a registration statement on Form S-4 will be filed with the SEC and will include a proxy statement of MWE. INVESTORS AND SECURITY HOLDERS ARE ENCOURAGED TO READ THE REGISTRATION STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT/PROSPECTUS THAT WILL BE PART OF THE REGISTRATION STATEMENT, WHEN THEY BECOME AVAILABLE, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. The final proxy statement/prospectus will be mailed to unitholders of MWE. Investors and security holders will be able to obtain the documents free of charge at the SEC’s website, www.sec.gov, from MPLX LP at its website, http://ir.mplx.com, or 200 E. Hardin Street, Findlay, Ohio 45840, Attention: Corporate Secretary, or from MWE at its website, http://investor.markwest.com, or 1515 Arapahoe Street, Tower 1, Suite 1600, Denver, CO 80202, Attention: Corporate Secretary.

Participants in Solicitation

MPLX and MWE and their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed merger. Information concerning MPLX participants is set forth in MPLX’s Form 10-K for the year ended December 31, 2014, as filed with the SEC on February 27, 2015, and MPLX’s current report on Form 8-K, as filed with the SEC on March 9, 2015.

3

Information concerning MWE’s participants is set forth in the proxy statement, dated April 23, 2015, for MWE’s 2015 Annual Meeting of Common Unitholders as filed with the SEC on Schedule 14A and MWE’s current reports on Form 8-K, as filed with the SEC on May 5, 2015, May 19, 2015 and June 8, 2015. Additional information regarding the interests of participants of MPLX and MWE in the solicitation of proxies in respect of the proposed merger will be included in the registration statement and proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. These documents, when available, may be obtained free of charge from MPLX or MWE using the contact information above.

Non-Solicitation

This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

4