Use these links to rapidly review the document

Table of Contents

ITEM 8. Financial Statements and Supplementary Data

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ý |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended December 31, 2012 |

||

or |

||

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

for the transition period from to |

||

Commission File Number 001-31239

MARKWEST ENERGY PARTNERS, L.P.

(Exact name of registrant as specified in its charter)

Delaware |

27-0005456 (I.R.S. Employer Identification No.) |

1515 Arapahoe Street, Tower 1, Suite 1600, Denver, CO 80202-2137

(Address of principal executive offices)

Registrant's telephone number, including area code: 303-925-9200

Securities registered pursuant to Section 12(b) of the Act: Common units representing limited partner interests, New York Stock Exchange

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ý No o

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes o No ý

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ý No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ý No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ý | Accelerated filer o | Non-accelerated filer o (Do not check if a smaller reporting company) |

Smaller reporting company o |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes o No ý

The aggregate market value of common units held by non-affiliates of the registrant on June 30, 2012 was approximately $5.5 billion. As of February 19, 2013, the number of the registrant's common units and Class B units outstanding were 129,134,880 and 19,954,389, respectively.

DOCUMENTS INCORPORATED BY REFERENCE:

The information required by Part III of this Report, to the extent not set forth herein, is incorporated herein by reference from the registrant's definitive proxy statement relating to the Annual Meeting of Unitholders to be held in 2013, which definitive proxy statement shall be filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year to which this Report relates.

MarkWest Energy Partners, L.P.

Form 10-K

Throughout this document we make statements that are classified as "forward-looking." Please refer to the "Forward-Looking Statements" included later in this section for an explanation of these types of assertions. Also, in this document, unless the context requires otherwise, references to "we," "us," "our," "MarkWest Energy" or the "Partnership" are intended to mean MarkWest Energy Partners, L.P., and its consolidated subsidiaries. References to "MarkWest Hydrocarbon" or the "Corporation" are intended to mean MarkWest Hydrocarbon, Inc., a wholly-owned taxable subsidiary of the Partnership. References to "General Partner" are intended to mean MarkWest Energy GP, L.L.C., the general partner of the Partnership.

2

The abbreviations, acronyms and industry technology used in this report are defined as follows.

Bbl |

Barrel | |

Bbl/d |

Barrels per day | |

Bcf/d |

Billion cubic feet per day | |

Btu |

One British thermal unit, an energy measurement | |

Credit Facility |

Amended and restated revolving credit agreement | |

DER |

Distribution equivalent right | |

Dth/d |

Dekatherms per day | |

EBITDA (a non-GAAP financial measure) |

Earnings Before Interest, Taxes, Depreciation and Amortization | |

EPA |

Environmental Protection Agency | |

ERCOT |

Electric Reliability Council of Texas | |

FASB |

Financial Accounting Standards Board | |

FERC |

Federal Energy Regulatory Commission | |

GAAP |

Accounting principles generally accepted in the United States of America | |

Gal |

Gallon | |

Gal/d |

Gallons per day | |

IFRS |

International Financial Reporting Standards | |

LIBOR |

London Interbank Offered Rate | |

Mcf |

One thousand cubic feet of natural gas | |

Mcf/d |

One thousand cubic feet of natural gas per day | |

MMBtu |

One million British thermal units, an energy measurement | |

MMBtu/d |

One million British thermal units per day | |

MMcf/d |

One million cubic feet of natural gas per day | |

Net operating margin (a non-GAAP financial measure) |

Segment revenue, excluding any derivative gain (loss), less purchased product costs, excluding any derivative gain (loss) | |

NGL |

Natural gas liquids, such as ethane, propane, butanes and natural gasoline | |

N/A |

Not applicable | |

OTC |

Over-the-Counter | |

SEC |

Securities and Exchange Commission | |

SMR |

Steam methane reformer, operated by a third party and located at the Javelina gas processing and fractionation facility in Corpus Christi, Texas | |

TSR Performance Units |

Phantom units containing performance vesting criteria related to the Partnership's total shareholder return | |

VIE |

Variable interest entity | |

WTI |

West Texas Intermediate |

3

Certain statements and information included in this Annual Report on Form 10-K may constitute "forward-looking statements." The words "could," "may," "predict," "should," "expect," "hope," "continue," "potential," "plan," "intend," "anticipate," "project," "believe," "estimate" and similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on current expectations, estimates, assumptions and beliefs concerning future events impacting us and therefore involve a number of risks and uncertainties. While management believes that these forward-looking statements are reasonable as and when made, there can be no assurance that future developments affecting us will be those that we anticipate. All comments concerning our expectations for future revenues and operating results are based on our forecasts for our existing operations and do not include the potential impact of any future acquisitions. Our forward-looking statements involve significant risks and uncertainties (some of which are beyond our control) and assumptions that could cause actual results to differ materially from our historical experience and our present expectations or projections. Important factors that could cause actual results to differ materially from those in the forward-looking statements include those described in (i) Item 1A. Risk Factors of this Form 10-K and elsewhere in this report, (ii) our reports and registration statements filed from time to time with the SEC and (iii) other announcements we make from time to time. Investors are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise. Undue reliance should not be placed on forward-looking statements as many of these factors are beyond our ability to control or predict.

4

General

MarkWest Energy Partners, L.P. is a publicly traded Delaware limited partnership formed in January 2002. We are a master limited partnership engaged in the gathering, processing and transportation of natural gas; the gathering, transportation, fractionation, storage and marketing of NGLs; and the gathering and transportation of crude oil. We have a leading presence in many unconventional gas plays including the Marcellus Shale, Utica Shale, Huron/Berea Shale, Haynesville Shale, Woodford Shale and Granite Wash formation. We conduct our operations in the following operating segments: Southwest, Northeast, Liberty and Utica. The Southwest segment includes the operations of our processing facilities in Corpus Christi, TX that were reported separately in the Gulf Coast segment in prior years. The Utica segment includes our operations in the Utica Shale region in eastern Ohio and has previously been included in the Liberty segment. Maps detailing the individual assets can be found on our Internet website, www.markwest.com. For more information on these segments, see Our Operating Segments discussion below.

The following table summarizes the operating performance for each segment for the year ended December 31, 2012 (amounts in thousands). For further discussion of our segments and a reconciliation to our consolidated statement of operations, see Note 23 of the accompanying Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K.

| |

Southwest | Northeast | Liberty | Utica | Total | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Revenue |

$ | 856,416 | $ | 225,818 | $ | 319,867 | $ | 571 | $ | 1,402,672 | ||||||

Purchased product costs |

387,902 | 68,402 | 74,024 | — | 530,328 | |||||||||||

Net operating margin(1) |

468,514 | 157,416 | 245,843 | 571 | 872,344 | |||||||||||

Facility expenses |

124,921 | 24,106 | 65,825 | 3,968 | 218,820 | |||||||||||

Portion of operating income attributable to non-controlling interests |

5,790 | — | — | (1,359 | ) | 4,431 | ||||||||||

Operating income before items not allocated to segments |

$ | 337,803 | $ | 133,310 | $ | 180,018 | $ | (2,038 | ) | $ | 649,093 | |||||

- (1)

- Net operating margin is a non-GAAP financial measure. For a reconciliation of net operating margin to income from operations, the most comparable GAAP financial measure, see Non-GAAP Measures discussion below.

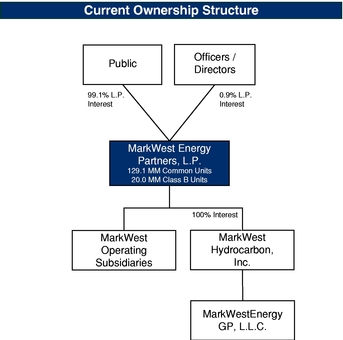

Organizational Structure

We are a master limited partnership with outstanding common units, Class A units and Class B units.

- •

- Our common units are publicly traded on the New York Stock Exchange under the symbol "MWE."

- •

- All of our Class A units are owned by MarkWest Hydrocarbon and our General Partner, which are our wholly-owned subsidiaries, as a result of the ownership structure adopted after the February 2008 merger of the Partnership and MarkWest Hydrocarbon (the "Merger"). The Class A units generally share in our income or losses on a pro-rata basis with our common units and our Class B units, however the Class A units do not share in any income or losses that are attributable to our ownership interest (or disposition of such interest) in MarkWest Hydrocarbon. The only impact of the Class A units on our consolidated results of operations

5

- •

- All of our Class B units were issued to and are held by M&R MWE Liberty, LLC ("M&R"), an affiliate of The Energy and Minerals Group ("EMG"), as part of our December 31, 2011 acquisition of the non-controlling interest in MarkWest Liberty Midstream & Resources, L.L.C. ("MarkWest Liberty Midstream"). The Class B units will convert to common units on a one-for-one basis (the "Converted Units") in five equal installments beginning on July 1, 2013 and each of the first four anniversaries of such date. Class B units (i) share in our income and losses, (ii) are not entitled to participate in any distributions of available cash prior to their conversion and (iii) do not have the right to vote on, approve or disapprove, or otherwise consent to or not consent to any matter (including mergers, unit exchanges and similar statutory authorizations) other than those matters that disproportionately and adversely affect the rights and preferences of the Class B units. Upon conversion of the Class B units, the right of M&R and certain of its affiliates to vote as a common unitholder of the Partnership will be limited to a maximum of 5% of the Partnership's outstanding common units. Once converted, M&R and certain of its affiliates will have the right to participate in the Partnership's underwritten offerings of our common units in an amount up to 20% of the total number of common units offered and will have comparable 20% participation and sale rights with respect to any continuous equity or similar program that is implemented or effective during any period after the conversion of Class B units. In addition, M&R and certain of its affiliates will have the right to demand that we conduct up to three underwritten offerings beginning in 2017, but restricted to no more than one offering in any twelve-month period. M&R also has limited rights to distribute an aggregate of 2,500,000 common units to its members and their limited partners beginning in 2016. Except as described above, M&R is not permitted to transfer its Class B units or Converted Units without the prior written consent of the General Partner's board of directors (the "Board").

and financial position is that MarkWest Hydrocarbon pays income tax on its pro-rata share of our income or losses. The Class A units do not have voting rights, except as required by law.

The following table provides the aggregate number of units and relative ownership interests of the Class A and B units and common units as of February 19, 2013 (units in millions):

| |

Units | % | |||||

|---|---|---|---|---|---|---|---|

Common units |

129.1 | 75.2 | % | ||||

Class A units |

22.6 | 13.2 | % | ||||

Class B units |

20.0 | 11.6 | % | ||||

Total units |

171.7 | 100 | % | ||||

The Class A units are not treated as outstanding common units in the accompanying Consolidated Balance Sheets as they are all held by our wholly owned subsidiaries and therefore eliminated in consolidation. The ownership percentages as of February 19, 2013 in the graphic depicted below reflect the Partnership structure from the basis of the consolidated financial statements with the Class A units

6

eliminated in consolidation. All Class B units are owned by M&R and included in the public ownership percentage.

The primary benefit of our organizational structure is the absence of incentive distribution rights, which represents a general partner's right to receive an increasing percentage of quarterly distributions of available cash after a minimum quarterly distribution and certain target distribution levels had been achieved. The absence of incentive distribution rights substantially lowers our cost of equity capital and increases the cash available to be distributed to our common unitholders. This enhances our ability to compete for organic growth projects and new acquisitions and improves the returns to our unitholders on all future expansion projects.

Key Developments

Expansion of Marcellus Shale Operations

In May 2012, we acquired natural gas gathering and processing assets from Keystone Midstream Services, LLC ("Keystone") for a final purchase price of approximately $507.3 million. The acquisition expanded our presence in the liquids-rich Marcellus Shale into northwest Pennsylvania. Keystone's existing assets are located in Butler County, Pennsylvania and include two cryogenic gas processing plants totaling approximately 90 MMcf/d of processing capacity, a gas gathering system and associated field compression ("Keystone Complex"). This acquisition is referred to as the "Keystone Acquisition."

As a result of the Keystone Acquisition, we became a party to a long-term fee-based agreement to gather and process certain natural gas owned or controlled by R.E. Gas Development, L.L.C. ("Rex Energy"), a subsidiary of Rex Energy Corporation, and Summit Discovery Resources II, L.L.C. ("Summit"), a subsidiary of Sumitomo Corporation, at the acquired facilities and in 2013 to exchange the resulting NGLs for fractionated products at facilities already owned and operated by us. Rex Energy and Summit have dedicated an area of approximately 900 square miles to us as part of this long-term gathering and processing agreement.

During the third quarter of 2012, we began operations of 200 MMcf/d of processing capacity at our facilities in Sherwood, West Virginia ("Sherwood Complex"). An additional 400 MMcf/d of processing capacity is expected to commence operation at our Sherwood Complex during 2013. The

7

processing expansion under construction at the Sherwood Complex is supported by a long-term fee-based agreement with Antero Resources Appalachian Corporation ("Antero").

During the fourth quarter of 2012, we began operations of 200 MMcf/d of processing capacity in Mobley, West Virginia ("Mobley Complex"). An additional 320 MMcf/d of processing capacity is expected to commence operation at our Mobley Complex during 2013. The expansion facilities are supported by long-term fee-based agreements with EQT and Magnum Hunter Resources Corporation.

In 2012, we announced an 800 MMcf/d expansion of our processing facilities in Majorsville, West Virginia (the "Majorsville Complex") that is supported by long-term processing agreements with CONSOL Energy Inc., Noble Energy Inc., Range Resources Corporation, Statoil ASA, and an affiliate of Chesapeake Energy Corporation. This expansion consists of four, 200 MMcf/d processing plants that are expected to begin operations in 2013 and 2014 and will bring the total cryogenic processing capacity at the Majorsville Complex to approximately 1.1 Bcf/d.

In July 2012, we announced a long-term fee-based agreement with XTO Energy Inc., a subsidiary of Exxon Mobil Corporation ("XTO") to extend our NGL gathering pipeline in northwest Pennsylvania to XTO's processing plant in Butler County, Pennsylvania. The NGLs will be transported by truck until the pipeline is completed in early 2014.

In September 2012, we signed a 10-year agreement to become a firm shipper on the Mariner East ("Mariner East") pipeline subject to final regulatory approvals. Mariner East is currently designed to transport ethane and propane sourced at our Houston, Pennsylvania processing and fractionation complex ("Houston Complex") to Sunoco Inc. and its affiliates' ("Sunoco") Marcus Hook facility near Philadelphia, Pennsylvania. Once delivered, the ethane-propane mix will be re-fractionated into purity products for sale into domestic and international markets.

Utica Shale Operations

In June 2012, MarkWest Utica EMG, L.L.C. and its subsidiaries ("MarkWest Utica EMG") executed long-term fee-based agreements with Gulfport Energy Corporation ("Gulfport") to provide gathering, processing, fractionation, and marketing services in the liquids-rich corridor of the Utica Shale. Under the terms of the agreements, MarkWest Utica EMG is developing natural gas gathering infrastructure, which provides service to Gulfport, primarily in Harrison, Guernsey, and Belmont counties. Initial operations began in the third quarter of 2012. MarkWest Utica EMG is processing the gas at its processing facilities in Cadiz Township in Ohio ("Cadiz Complex"), and is expected to provide NGL fractionation and marketing services at its fractionation facility in Harrison County, Ohio ("Harrison Fractionation Facility") when it is completed in the first quarter of 2014.

In November 2012, MarkWest Utica EMG executed long-term fee-based agreements with two producers, Antero and Rex Energy, to provide gas processing, fractionation, and marketing services in Noble County, Ohio. MarkWest Utica EMG will process gas produced by Antero and Rex Energy within certain dedicated acreage of the Utica Shale at its processing facilities in Seneca Township, in Ohio ("Seneca Complex") and will provide NGL fractionation and marketing services at the planned Harrison Fractionation Facility.

Northeast Expansion

In the fourth quarter 2012, we completed an additional cryogenic natural gas processing plant at the Langley processing complex with a capacity of 150 MMcf/d. The capacity at the Langley processing complex is supported by a long-term processing agreement with an affiliate of EQT Corporation ("EQT").

8

East Texas Expansion

During the fourth quarter 2012, we completed a 120 MMcf/d expansion of our processing facilities in East Texas, bringing the total processing capacity at this facility to 400 MMcf/d. The processing expansion is supported by long-term fee-based agreements with a number of producers including Anadarko Petroleum Corporation.

See Our Operating Segments below for additional discussion of our existing operations and planned expansions.

Common Unit Offerings

We issued a total of 32.2 million common units and received net proceeds of approximately $1.6 billion from registered public offerings of our common units in 2012. See Note 16 of the accompanying Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K for further discussion of the accounting treatment of the common unit offerings.

In November 2012, we entered into an Equity Distribution Agreement (the "EDA") with a financial institution ("Manager"). Pursuant to the terms of the EDA, we may from time to time, through the Manager as our sales agent, offer and sell common units having an aggregate offering price of up to $600 million. As of December 31, 2012, we have issued 0.1 million common units and received net proceeds of approximately $6 million under the Agreement. The Manager received $0.2 million for acting as our sales agent in connection with these issuances. For more information see Note 16 of the accompanying Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K.

Senior Notes Offerings and Tender Offers

On August 10, 2012, we completed a public offering of $750 million in aggregate principal amount of 5.5% senior unsecured notes due February 2023 (the "2023A Senior Notes"), which were issued at 99.015% of par. Interest on the 2023A Senior Notes is payable semi-annually in arrears on February 15 and August 15, commencing February 15, 2013. We received net proceeds of approximately $730 million from the 2023A Senior Notes offering after deducting the underwriting fees and other third-party expenses. We used the net proceeds from the offering to repay borrowings under our revolving credit facility and for general partnership purposes, including, but not limited to, funding capital expenditures and general working capital.

In January 2013, we completed a public offering for $1 billion in aggregate principal amount of 4.5% senior unsecured notes due July 2023 (the "2023B Senior Notes"), which were issued at par. Interest on the 2023B Senior Notes is payable semi-annually in arrears on January 15 and July 15. We received net proceeds of approximately $986.9 million from the 2023B Senior Notes offering after deducting underwriting fees and other third-party expenses. A portion of the proceeds, together with cash on hand, was used to repurchase $81.1 million aggregate principal amount of our 8.75% senior notes due April 2018, $175 million of the outstanding principal amount of our 6.5% senior notes due August 2021 and $245 million of the outstanding principal amount of our 6.25% senior notes due June 2022, with the remainder used to fund our capital expenditure program and for general partnership purposes.

Credit Facility

On December 20, 2012 we amended our Credit Facility to increase the maximum permissible total leverage ratio from 5.25 to 1 to 5.5 to 1 for any quarter ending on or before December 31, 2013 as well as to permanently increase the EBITDA adjustment for material projects from 15% to 20%. On June 29, 2012, we amended our revolving Credit Facility to increase the borrowing capacity to $1.2 billion and retained the existing accordion option, providing for potential future increases of up to

9

an aggregate of $250 million upon the satisfaction of certain requirements. The term of our Credit Facility was extended one year to September 2017. The actual borrowing capacity of our Credit Facility may be limited at times by financial covenant requirements. See Note 15 of the accompanying Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K for further details of our Credit Facility.

Increase in MarkWest Utica EMG Funding Commitment

In February 2013, we and EMG Utica, LLC ("EMG Utica") executed an Amended and Restated Limited Liability Company Agreement of MarkWest Utica EMG (the "Amended Utica LLC Agreement"). Pursuant to the Amended Utica LLC Agreement, EMG Utica's aggregate funding commitment has increased from $500 million to $950 million. Thereafter, EMG has the right to make additional contributions at varying rates and ultimately has the right to continue to make contributions to maintain EMG Utica's percentage ownership in MarkWest Utica EMG. See Item 7. Management Discussion and Analysis of Financial Condition and Results of Operation—Liquidity and Capital Resources included in this Form 10-K for further discussion of the Amended Utica LLC Agreement.

Business Strategy

Our primary business strategy is to provide top-tier midstream services by developing and operating high-quality, strategically located assets in the liquids-rich areas of six core natural gas producing resource plays in the United States. We plan to accomplish this through the following:

- •

- Developing long-term integrated relationships with our producer

customers. As a top-rated midstream service provider, we develop long-term, integrated relationships with key

producer customers as evidenced by our relationships with the primary producers in the Marcellus Shale, Utica Shale, Huron/Berea Shale, Haynesville Shale, Woodford Shale and Granite Wash formations.

We continue to build relationships characterized by joint planning for the development of emerging resource plays and our commitment to grow to meet the specific needs of our customers.

- •

- Expanding operations through organic growth projects. By

expanding our existing infrastructure and customer relationships, we intend to continue growing in our primary areas of operation to meet the anticipated demand for additional midstream services.

During 2012, we spent approximately $1.7 billion on capital expenditures to develop midstream infrastructure in the Marcellus and Utica Shale regions. We increased our processing capacity in

the Marcellus region by 78% in 2012. In addition we completed the construction of an additional 150 MMcf/d of cryogenic processing capacity at our Langley, Kentucky facilities in our Northeast segment

and an additional 120 MMcf/d of cryogenic processing capacity at our East Texas facilities in our Southwest Segment. We also executed long-term agreements with producers that will support

the construction of 14 new processing plants primarily in the Marcellus and Utica Shale regions by the end of 2014, which will increase our total company-wide processing capacity by

approximately 98%.

- •

- Expanding operations through strategic acquisitions. We intend to continue pursuing strategic acquisitions of assets and businesses in our existing areas of operation that leverage our current asset base, personnel and customer relationships. We may also seek to acquire assets in certain regions outside of our current areas of operation. We believe that our capital structure positions us to compete more effectively for future acquisitions. For example, in 2012 we completed the Keystone Acquisition, in which we acquired natural gas processing and gas gathering assets located in the northwest Pennsylvania section of the Marcellus Shale. Commencing in 2013, the NGLs attributable to that gas will be fractionated in our Houston fractionation facility. The Keystone Acquisition supports our further expansion into the liquids-rich corridor of the

10

- •

- Maintaining our financial flexibility. Our goal is to

maintain a capital structure with approximately equal amounts of debt and equity financing on a long-term basis. During 2012, we raised approximately $2.4 billion of capital by

strategically accessing the debt and equity markets to fund our acquisition and planned expansion projects. See Note 15, Note 16 and Note 28 of the accompanying Notes to

Consolidated Financial Statements included in Item 8 of this Form 10-K for further discussion of the recent transactions related to our senior notes and common unit

offerings. We also entered into amendments to our Credit Facility to expand the total borrowing capacity from $900 million to $1.2 billion, retain the existing accordion option, extend

the term to September 2017, and to increase the leverage ratio from 5.25 to 1 to 5.5 to 1 for any quarter ending on or before December 31, 2013. As of December 31, 2012, we and our

wholly-owned subsidiaries had approximately $313.0 million of cash and cash equivalents and we had approximately $1,188.4 million of unused capacity under our Credit Facility, of which

approximately $680 million was available for borrowing based on financial covenant requirements. Additionally, the full amount of unused capacity is available for borrowing on a

short-term basis to provide financial flexibility within a given fiscal quarter. We believe that our Credit Facility, our ability to issue additional partnership units and

long-term debt, our strong relationships with our existing joint venture partners and the sale of non-strategic assets will provide us with the financial flexibility to

facilitate the execution of our business strategy.

- •

- Reducing the sensitivity of our cash flows to commodity price

fluctuations. We intend to continue to secure long-term, fee-based contracts in order to further reduce our

exposure to short-term changes in commodity prices. We estimate that fee-based contracts will account for approximately 60% of our net operating margin by the end of 2013. We

also engage in risk management activities in order to reduce the effect of commodity price volatility related to future natural gas, NGL and crude oil transactions. We may utilize a combination of

fixed-price forward contracts, fixed-for-floating price swaps and options available in the OTC market. We monitor these activities to ensure compliance with our commodity risk

management policy. See Note 6 of the accompanying Notes to the Consolidated Financial Statements included in Item 8 of this Form 10-K for further discussion of our

commodity risk management policy.

- •

- Increasing utilization of our facilities. We seek to increase the utilization of our existing facilities by providing additional services to our existing customers and by establishing relationships with new customers. We also continue to develop additional capacity at many of our facilities, which enables us to increase throughput with minimal incremental costs.

Marcellus Shale. In February 2011, we acquired natural gas processing and NGL pipeline assets located in Kentucky and West Virginia (the "Langley Acquisition") for processing gas produced in the Huron/Berea Shale and transporting NGLs to our Siloam fractionation facility.

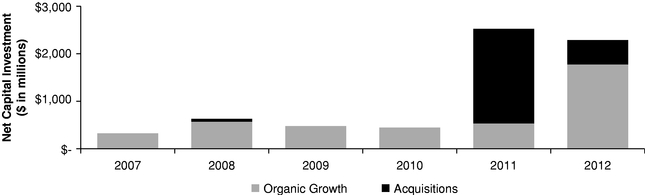

Execution of our business strategy has allowed us to grow substantially since our inception. The majority of our growth since 2007 has focused on the development of midstream services to support the increase in NGL production and natural gas supply in liquids-rich resource plays. As a result, we now have a strong presence in the Marcellus Shale, Utica Shale, Huron/Berea Shale, Haynesville Shale, Woodford Shale and Granite Wash formation; six emerging resource plays that are expected to be a significant source of domestic natural gas and NGL production. The following table summarizes the magnitude of our expenditures over time on acquisitions of businesses and non-controlling interests and

11

organic growth capital, including equity investments. The amounts include the portion of our growth projects funded by contributions from our current and former joint venture partners.

We believe that the following competitive strengths position us to continue to successfully execute our primary business strategy:

- •

- Leading position in the liquids-rich areas of the northeast United

States. Since our inception, we have been the largest processor and fractionator in the northeast United States and we continue to

strengthen our position in these critical growth areas that is driven by the development of the Marcellus, Huron/Berea, and Utica shale formations. We are the largest processor and fractionator in the

Marcellus Shale and we have announced plans that we believe allows us to be the largest processor and fractionator in the Utica Shale by 2014. At December 31, 2012 our Northeast, Liberty and

Utica segments have combined processing capacity in excess of 1.8 Bcf/d and combined fractionation capacity of nearly 85,000 barrels per day, as well as an integrated NGL pipeline, storage and

marketing infrastructure. Our processing and fractionation capacity is supported by strategic long-term agreements that include significant acreage dedications from key producers. We

believe our significant presence and asset base provide us with a competitive advantage in capturing and contracting for new supplies of natural gas as the production from these shale formations

continues to be developed.

- •

- Strategic and growing position with high-quality assets in the

Southwest. Our internal growth projects have allowed us to expand our presence in several long-lived natural gas supply

basins in the Southwest, particularly in Texas and Oklahoma. All of our major operating assets and growth projects in this region have been characterized by several common critical success factors

that include:

- •

- an existing strong competitive position;

- •

- access to a significant reserve or customer base with a stable or growing production profile;

- •

- ample opportunities for long-term continued organic growth;

- •

- ready access to markets; and

- •

- close proximity to other expansion opportunities.

Specifically, our East Texas and Appleby gathering systems are located in the East Texas Basin, producing from or with direct access to the Cotton Valley, Pettit and Travis Peak reservoirs as well as the Haynesville and Bossier Shales. Our Foss Lake gathering system and the associated expanded Arapaho gas processing plants are located in the Anadarko Basin in Oklahoma and are connected to the Granite Wash area in the Texas panhandle. Additionally, we have a significant gathering system located in the Woodford Shale reservoir. Our gathering systems are relatively new and provide producers with low-pressure and fuel-efficient service, a significant

12

- •

- Long-term Contracts. We believe our

long-term contracts, which we define as contracts with remaining terms of four years or more, lend greater stability to our cash flow profile. All of the long-term

fee-based contracts supporting the expansion of our Liberty and Utica segments have remaining terms between 8 to 15 years. In our Southwest segment, approximately 38% of our current

gathering volumes in East Texas are under contract for longer than four years as of December 31, 2012; approximately 53% of our current daily throughput in the Western Oklahoma gathering system

and Arapaho processing plants are subject to contracts with remaining terms of more than four years; and approximately 91% of our throughput in the Woodford gathering system is subject to contracts

with remaining terms of more than four years. Also in our Southwest segment, our processing and fractionation contracts with refinery customers that account for 74% of the volumes processed at our

processing facilities in Corpus Christi, TX have remaining terms of at least six years and we have two lateral natural gas transmission pipelines that operate under fixed-fee contracts

with remaining terms of approximately eight and 16 years. In Appalachia, our natural gas processing and NGL fractionation and exchange contracts with 61% of NGL volumes are subject to contracts

with remaining terms of at least nine years.

- •

- Experienced management with operational, technical and acquisition expertise. Each member of our executive management team has substantial experience in the energy industry and has interests aligned with those of our common unitholders through our long-term incentive compensation plans. Our facility managers have extensive experience operating our facilities. Our management team's operational and technical expertise has enabled us to upgrade our existing facilities, as well as to design and build new midstream infrastructure facilities. Since our initial public offering in May 2002, our management team has utilized a disciplined approach to analyze and evaluate numerous acquisition opportunities, and has completed 14 acquisitions as of December 31, 2012, including the acquisitions of the gas gathering and processing assets from Keystone effective May 29, 2012 and the non-controlling interest in MarkWest Liberty Midstream effective December 31, 2011.

competitive advantage for us over many competing gathering systems in those areas. We also provide high quality processing and fractionation service to six strategically located gulf coast refineries that we believe will continue to play a key role in supporting the long-term U.S. demand for refined petroleum products.

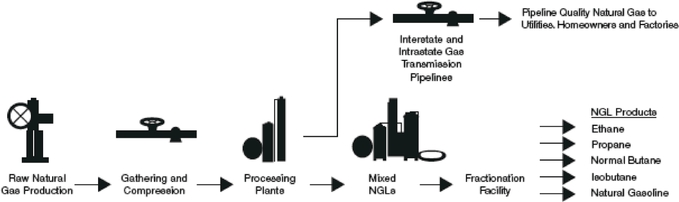

Industry Overview

We provide services in the midstream sector of the natural gas industry which includes natural gas gathering, transportation, processing and fractionation. The following diagram illustrates the typical natural gas gathering, natural gas processing and NGL fractionation processes:

13

The natural gas production process begins with the drilling of wells into gas-bearing rock formations. The gathering process begins when a producing well is connected to a gathering system. Gathering systems typically consist of a network of small diameter pipelines and, if necessary, compression systems that collect natural gas from points near producing wells and transport it to larger pipelines for further transmission.

Historically, the majority of the domestic on-shore natural gas supply has been produced from conventional reservoirs that are characterized by large pockets of natural gas that are accessed successfully using vertical drilling techniques. In the past decade, the supply of natural gas production from the conventional sources has declined as these reservoirs are being depleted. Due to advances in well completion technology and horizontal drilling techniques, unconventional sources such as shale, tight sand and coal bed methane formations have become the most significant source of current and expected future natural gas production.

Natural gas has a widely varying composition, depending on the field, formation reservoir or facility from which it is produced. The principal constituents of natural gas are methane and ethane. Some natural gas also contains varying amounts of heavier components, such as propane, butane, natural gasoline and inert substances that may be removed by any number of processing methods.

Most natural gas produced at the wellhead is not suitable for long-haul pipeline transportation or commercial use. It must be gathered, compressed and transported via pipeline to a central facility, and potentially processed and treated. Natural gas processing and treating involves the separation of raw natural gas into pipeline-quality natural gas, principally methane, and a mixed NGL stream, as well as the removal of contaminants that may interfere with pipeline transportation or the end-use of the gas. Our business includes providing these services either for a fee or a percentage of the NGLs removed or gas units processed. The industry as a whole is characterized by regional competition, based on the proximity of gathering systems and processing plants to producing natural gas wells, or to facilities that produce natural gas as a byproduct of refining crude oil. Due to the shift in the source of natural gas production, midstream providers with a significant presence in the emerging resource plays will likely have a competitive advantage.

The removal and separation of individual hydrocarbons and other constituents by processing is possible because of differences in physical properties. Each component has a distinctive weight, boiling point, vapor pressure and other physical characteristics. Natural gas may also be diluted or contaminated by water, sulfur compounds, carbon dioxide, nitrogen, helium or other components.

After being separated from natural gas at the processing plant, the mixed NGL stream is typically transported to a centralized facility for fractionation. Fractionation is the process by which NGLs are further separated into individual, more marketable components, primarily ethane, propane, normal butane, isobutane and natural gasoline. Fractionation systems typically exist either as an integral part of a gas processing plant or as a central fractionator, often located many miles from the primary production and processing facility. A central fractionator may receive mixed streams of NGLs from many processing plants.

Basic NGL products and their typical uses are discussed below. The basic products are sold in all of our segments except as noted.

- •

- Ethane is used primarily as feedstock in the production of ethylene, one of the basic building blocks for a wide range of plastics and other chemical products.

Ethane is not currently recovered from the natural gas stream in our Northeast and Liberty segments. However, we are developing projects that would allow us to recover ethane and provide our producer customers with access to markets for the ethane produced in the Liberty segment, which are expected to begin operations in mid-2013. See Our Operating Segments—Liberty Segment below in this Item 1 for further discussion of our ethane solution.

14

- •

- Propane is used for heating, engine and industrial fuels, agricultural

burning and drying and as a petrochemical feedstock for the production of ethylene and propylene. Propane is principally used as a fuel in our operating areas.

- •

- Normal butane is mainly used for gasoline blending, as a fuel gas, either

alone or in a mixture with propane, and as a feedstock for the manufacture of ethylene and butadiene, a key ingredient of synthetic rubber.

- •

- Isobutane is primarily used by refiners to enhance the octane content of

motor gasoline.

- •

- Natural gasoline is principally used as a motor gasoline blend stock or petrochemical feedstock.

The other primary products produced and sold from our Javelina facility are discussed below.

- •

- Ethylene is primarily used in the production of a wide range of plastics

and other chemical products.

- •

- Propylene is primarily used in manufacturing plastics, synthetic fibers and foams. It is also used in the manufacture of polypropylene, which has a variety of end-uses including packaging film, carpet and upholstery fibers and plastic parts for appliances, automobiles, houseware and medical products.

Our Operating Segments

We conduct our operations in the following operating segments: Southwest, Northeast, Liberty and Utica. Our assets and operations in each of these segments are described below.

- •

- East Texas. We own a system that consists of natural gas gathering pipelines, centralized compressor stations, a natural gas processing complex and an NGL pipeline. The East Texas system is located in Panola, Harrison and Rusk Counties and services the Carthage Field. Producing formations in Panola County consist of the Cotton Valley, Pettit, Travis Peak, Haynesville and Bossier formations. For natural gas that is processed in this area, we purchase NGLs from the producers under percent-of-proceeds arrangements, or we transport and process volumes for a fee. We completed an additional 120 MMcf/d cryogenic processing plant during the fourth quarter of 2012, increasing total processing capacity in East Texas to 400 MMcf/d. We also expanded gathering capacity in East Texas by 140 MMcf/d in the third quarter of 2012 and residue gas outlet capacities by 60 MMcf/d in the fourth quarter of 2012. Additional NGL outlet capacity that will allow us to market the additional NGLs produced as a result of the expansion is expected to be completed in the fourth quarter of 2013 and will allow us to fully utilize the expanded processing capacity.

Southwest Segment

- •

- Oklahoma. We own an extensive natural gas gathering system in the Woodford Shale play in the Arkoma Basin of southeast Oklahoma. We own a 40% non-operating membership interest in Centrahoma Processing L.L.C. ("Centrahoma"), a joint venture with Atlas Pipeline Partners, L.P. ("Atlas") that is accounted for using the equity method. The liquids-rich natural gas gathered in the Woodford system is processed through Centrahoma or other third-party processors. We have agreed to fund our share of a 120 MMcf/d processing plant expansion at Centrahoma in order to support the liquids-rich drilling programs in the Woodford Shale. The expansion is expected

Approximately 83% of our natural gas volumes in the East Texas System in 2012 resulted from contracts with six producers. We sell substantially all of the purchased and retained NGLs produced at our East Texas processing facility to Targa Resources Partners, L.P. ("Targa") under a long-term contract. Such sales represented approximately 11.8% of our consolidated revenue in 2012. The initial term of the Targa agreement expires in December 2015.

15

- •

- Javelina. We own and operate the Javelina processing and

fractionation facility in Corpus Christi, Texas that treats, processes and fractionates off-gas from six local refineries operated by three different refinery customers. We have a product

supply agreement creating a long-term contractual obligation for the payment of processing fees in exchange for all of the product processed by the SMR, see Note 5 of the

accompanying Notes to Consolidated Financial Statements for further discussion of this agreement and the related sale of the steam methane reformer (the "SMR Transaction"). The product received under

this agreement is sold to a refinery customer pursuant to a corresponding long-term agreement.

- •

- Other Southwest. We own a number of natural gas gathering systems and lateral pipelines located in Texas, Louisiana and New Mexico, including the Appleby gathering system in Nacogdoches County, Texas. We gather a significant portion of the natural gas produced from fields adjacent to our gathering systems, including from wells targeting the Haynesville Shale. In many areas we are the primary gatherer, and in some of the areas served by our smaller systems we are the sole gatherer. Our Hobbs, New Mexico natural gas lateral pipeline is subject to regulation by FERC.

to be operational in the first quarter of 2014. In addition, we own gas gathering systems in Western Oklahoma and the Texas panhandle, which are both connected to a natural gas processing complex in Western Oklahoma. The gathering portion consists of a pipeline system that is connected to natural gas wells and associated compression facilities. The majority of the gathered gas is ultimately compressed and delivered to the processing complex.

Approximately 74% of our Oklahoma volumes in 2012 resulted from contracts with four producers. We sell substantially all of the NGLs produced in the Western Oklahoma processing complex to ONEOK Hydrocarbon L.P. ("ONEOK") under a long-term contract. Such sales represented approximately 12.6% of our consolidated revenue in 2012. The initial term of the ONEOK agreement expires in October 2021.

Through our joint venture, MarkWest Pioneer L.L.C. ("MarkWest Pioneer"), we operate the Arkoma Connector Pipeline, a 50-mile FERC-regulated pipeline that interconnects with the Midcontinent Express Pipeline and Gulf Crossing Pipeline at Bennington, Oklahoma and is designed to provide approximately 638,000 Dth/d of Woodford Shale takeaway capacity. We completed an additional interconnect with the Natural Gas Pipeline of America L.L.C ("NGPL Pipeline") in Bennington, Oklahoma in April 2012. For a complete discussion of the formation of, and accounting treatment for, MarkWest Pioneer, see Note 4 of the accompanying Notes to Consolidated Financial Statements included in Item 8 of this Form 10-K.

- •

- Kentucky and southern West Virginia. Our Northeast segment assets include the Kenova, Boldman, Cobb, Kermit and the Langley natural gas processing complexes, an NGL pipeline, and the Siloam NGL fractionation facility. During the fourth quarter of 2012, we completed an additional cryogenic natural gas processing plant at the Langley processing complex with a capacity of 150 MMcf/d. In addition, we have two caverns for storing propane at our Siloam facility and additional propane storage capacity under a long-term firm-capacity agreement with a third-party. Including our presence in the Marcellus Shale (see Liberty Segment below), we are the largest processor and fractionator of natural gas in the Northeast, with fully integrated processing, fractionation, storage and marketing operations.

The Other Southwest area does not have any customers that we consider to be significant to the Southwest segment revenue or our consolidated revenue.

Northeast Segment

16

- •

- Michigan. We own and operate a FERC-regulated crude oil pipeline in Michigan ("Michigan Crude Pipeline") providing interstate transportation service.

- •

- Marcellus Shale. We provide extensive natural gas midstream services in southwest Pennsylvania and northern West Virginia through MarkWest Liberty Midstream. With gathering capacity of 525 MMcf/d and current processing capacity of over 1.1 Bcf/d, we are the largest processor of natural gas in the Marcellus Shale, with fully integrated gathering, processing, fractionation, storage and marketing operations that are critical to the liquids-rich gas development in the northeast United States.

The Northeast Segment has one customer that accounts for a significant portion of its segment revenue, but this customer does not account for a significant portion of our consolidated revenue.

Liberty Segment

- •

- Existing gathering system delivering to our Houston Complex.

- •

- Existing gathering lines acquired in the Keystone Acquisition.

- •

- Existing gathering system completed in the fourth quarter of 2012, delivering to our Sherwood Complex.

- •

- 355 MMcf/d of current cryogenic processing capacity at our Houston Complex.

- •

- 270 MMcf/d of current cryogenic processing capacity at our Majorsville Complex.

- •

- 200 MMcf/d of current cryogenic processing capacity at our Mobley Complex.

- •

- 90 MMcf/d of cryogenic processing capacity at our Keystone Complex, which we acquired in the Keystone Acquisition.

- •

- 200 MMcf/d of current cryogenic processing capacity at our Sherwood Complex completed in the fourth quarter of 2012.

- •

- 800 MMcf/d expansion of our Majorsville Complex under construction that is supported by long-term agreements

with Chesapeake Energy Corporation, CONSOL Energy Inc., Noble Energy Inc. and Range Resources Corporation. The Majorsville expansion includes four 200 MMcf/d processing plants

that are expected to commence operation in 2013 and 2014 and will bring our total cryogenic processing capacity at Majorsville to approximately 1.1 Bcf/d.

- •

- 320 MMcf/d cryogenic processing capacity under construction at our Mobley Complex. A 120 MMcf/d facility is expected to be

completed during the first quarter of 2013 and an additional 200 MMcf/d facility is expected to be operational during the fourth quarter of 2013. The expansion facilities are supported by

long-term fee-based agreements with EQT and Magnum Hunter Resources Corporation.

- •

- 400 MMcf/d cryogenic processing capacity under construction at our Sherwood Complex, 200 MMcf/d of which is expected to be completed in the second quarter of 2013 and 200 MMcf/d of which is expected to be completed in the third quarter of 2013. The

The gathering, processing and fractionation facilities currently operating and under construction in our Liberty segment consist of the following:

Natural Gas Gathering

Natural Gas Processing

17

- •

- 120 MMcf/d cryogenic processing capacity under construction in Butler County, Pennsylvania, which is expected to commence operation in the first quarter of 2014. Based on producers' production, we may expand our Keystone Complex by an additional 200 MMcf/d as soon as 2014.

- •

- NGLs produced at the Majorsville Complex are delivered through an NGL pipeline ("Majorsville Pipeline") to the Houston

Complex for exchange for fractionated products. The NGL pipeline from our Mobley Complex to the Majorsville Complex was completed in the fourth quarter of 2012. The NGL pipeline connecting the

Sherwood Complex to the Mobley Complex is under construction and is expected to be completed in the first quarter of 2013. Additionally, we are expanding our NGL gathering system into Northwest

Pennsylvania to allow us to gather, fractionate and market NGLs produced at our Keystone Complex and at a processing facility owned by XTO that is expected to begin operations in early 2013. We will

gather NGLs for XTO and exchange them for fractionated NGL products pursuant to a long-term fee-based agreement. The NGLs will be transported by truck to the Houston Complex

for fractionation until the NGL pipeline is complete in late 2013.

- •

- Existing propane-plus fractionation facility at our Houston Complex with a design capacity of 60,000 Bbl/d.

- •

- Existing interconnect with a key interstate pipeline providing a market outlet and storage for the propane produced from

this region.

- •

- Existing agreements to access international markets. Propane is currently being transported by truck to a third-party

terminal near Philadelphia, Pennsylvania where it is loaded onto marine vessels and delivered to international markets. We plan to add rail deliveries to the terminal in the next several months as

rail unloading capabilities are expanded. As discussed below, we will also have the ability to deliver propane to Sunoco's terminal in Philadelphia via pipeline once the Mariner East pipeline is

placed into service.

- •

- Existing extensions of our NGL gathering system to receive NGLs produced at a third-party's Fort Beeler processing plant

and our Mobley Complex. This project allows our producer customers at the Mobley Complex as well as certain producers at the third party's plant to benefit from our integrated NGL fractionation and

marketing operations.

- •

- Existing twelve bay truck loading and unloading facility at our Houston Complex. The unloading facility allows for

regional marketing of purity NGLs and the unloading facility allows for the receipt of raw NGLs for fractionation and marketing.

- •

- Existing 200 railcar loading facility at our Houston Complex that expands our market access and allows for long-haul, cost-effective transportation of purity NGLs.

expansion plans are based, in part, on Antero's decision to support the additional capacity under a long-term fee-based processing agreement.

By the end of 2014, MarkWest Liberty Midstream is expected to have approximately 3.0 Bcf/d of cryogenic processing capacity that is supported primarily by long-term fee-based agreements with our producer customers.

NGL Gathering, Fractionation and Market Outlets

We continue to evaluate additional projects to expand our gathering, processing, fractionation, and marketing operations in the Marcellus Shale.

18

- •

- Two de-ethanization facilities totaling 76,000 Bbl/d are under construction at our Houston and Majorsville

Complexes that are expected to be completed by mid-2013.

- •

- A third de-ethanization facility at our Majorsville Complex that would increase production capacity of purity

ethane to approximately 115,000 Bbl/d in first quarter 2014.

- •

- A joint pipeline project with Sunoco that is currently under construction to deliver Marcellus ethane to the Sarnia,

Ontario, Canadian markets ("Mariner West"). Mariner West will utilize new and existing pipelines and is anticipated to have an initial capacity to transport up to 50,000 Bbl/d of ethane in the third

quarter of 2013 with the ability to expand to support higher volumes as needed.

- •

- Mariner East, a Sunoco pipeline and marine project that is expected to begin at our Houston Complex, is intended to

deliver Marcellus purity ethane and purity propane to the Gulf Coast and international markets. Mariner East, for which we have made a 5,000 bbl/d commitment, is expected to begin delivering propane

in the second half of 2014 and ethane in the first half of 2015.

- •

- Connection to Enterprise Products Partners L.P.'s NGL pipeline from Appalachia to Texas ("ATEX Pipeline"). We expect to begin delivering ethane to the ATEX Pipeline in the first quarter 2014.

Ethane Recovery and Associated Market Outlets

Due to increased natural gas production from the liquids-rich area of the Marcellus Shale, natural gas processors must begin to recover a significant amount of ethane from the gas stream to meet the pipeline gas quality specifications for residue gas and to allow for the ability to benefit from price uplift received from the sale of ethane. We are developing solutions that will have the capability to recover and fractionate ethane, and provide access to ethane markets in North America and internationally. The primary components of our ethane recovery, fractionation and marketing solutions consist of the following:

There is one individual customer that accounted for approximately 56% of our Liberty segment revenue during the year ended December 31, 2012. We consider this customer to be significant to the Liberty segment revenue but not to our consolidated revenue.

Utica Segment

Effective January 1, 2012, we formed MarkWest Utica EMG, a joint venture with EMG focused on the development of fully integrated midstream services in the Utica Shale in eastern Ohio. The current Utica development plan includes:

- •

- 325 MMcf/d processing in our Cadiz Complex planned and expected to be complete in 2014. It began the first phase of

operations in the fourth quarter of 2012 with interim mechanical refrigeration processing capacity of 60 MMcf/d.

- •

- 400 MMcf/d processing in our Seneca Complex is expected to begin the first phase of operations in the third quarter of 2013 with processing capacity of 200 MMcf/d.

- •

- 100,000 Bbl/d of NGL fractionation, storage, and marketing capabilities in Harrison County for propane and heavier components (the "Hopedale Fractionation Facility"). The Hopedale Fractionation Facility will be jointly owned by MarkWest Utica EMG and MarkWest Liberty Midstream and is expected to begin operations in the first quarter of 2014.

Natural Gas Processing

NGL Gathering, Fractionation and Market Outlets

19

- •

- Both processing complexes are expected to be connected via an NGL gathering pipeline system to the Hopedale Fractionation

Facility that is expected to be operational by the first quarter of 2014.

- •

- From the Hopedale Fractionation Facility we plan to market NGLs by truck, rail and pipeline. A rail car loading facility that can accommodate 200 rail cars and an eight bay truck loading and unloading facility are under construction at the Hopedale Fractionation Facility and are expected to be complete by mid-2013. Additionally, the Hopedale Fractionation Facility is expected to be connected to our extensive processing and NGL pipeline network in our Liberty segment and provide for the integrated operation of the two largest fractionation complexes in the northeast United States by the first quarter of 2014.

- •

- At our Cadiz Complex we are also constructing de-ethanization capacity and a connection to the ATEX Pipeline. We expect to begin delivering ethane to the ATEX Pipeline in the first quarter of 2014.

Ethane Recovery and Associated Market Outlets

The following summarizes the percentage of our revenue and net operating margin (a non-GAAP financial measure, see Non-GAAP Measures discussion below) generated by our assets, by segment, for the year ended December 31, 2012:

| |

Southwest | Northeast | Liberty | Utica | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Segment revenue |

61 | % | 16 | % | 23 | % | <1 | % | |||||

Net operating margin |

54 | % | 18 | % | 28 | % | <1 | % | |||||

For further financial information regarding our segments, see Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations and Item 8. Financial Statements and Supplementary Data included in this Form 10-K.

Equity Investment in Unconsolidated Affiliate

We own a 40% non-operating membership interest in Centrahoma, a joint venture with Atlas that is accounted for using the equity method. Centrahoma owns certain processing plants in the Arkoma Basin and Atlas operates an additional processing plant that is not owned by Centrahoma but is located adjacent to and operates in conjunction with the Centrahoma plants. We have signed long-term agreements to dedicate the processing rights for our natural gas gathering system in the Woodford Shale to Centrahoma and to Atlas' independently owned processing facility. This processing facility is being expanded by an additional 120 MMcf/d and is expected to be complete by the first quarter of 2014. The financial results for Centrahoma are included in Earnings from unconsolidated affiliates and are not included in our segment results.

Our Contracts

We generate the majority of our revenues and net operating margin (a non-GAAP financial measure, see Non-GAAP Measures below for discussion and reconciliation of net operating margin) from natural gas gathering, transportation and processing; NGL gathering, transportation, fractionation, exchange, marketing and storage; and crude oil gathering and transportation. We enter into a variety of contract types. In many cases, we provide services under contracts that contain a combination of more than one of the arrangements described below. We provide services under the following types of arrangements:

- •

- Fee-based arrangements: Under fee-based arrangements, we receive a fee or fees for one or more of the following services: gathering, processing and transportation of natural gas; transportation,

20

- •

- Percent-of-proceeds

arrangements: Under percent-of-proceeds arrangements, we gather and process natural gas on behalf of producers,

sell the resulting residue gas, condensate and NGLs at market prices and remit to producers an agreed-upon percentage of the proceeds. In other cases, instead of remitting cash payments to

the producer, we deliver an agreed-upon percentage of the residue gas and NGLs to the producer and sell the volumes we keep to third parties at market prices. The percentage of volumes

that we retain can be either fixed or variable. Generally, under these types of arrangements, our revenues and net operating margins increase as natural gas, condensate and NGL prices increase and our

revenues and net operating margins decrease as natural gas, condensate and NGL prices decrease.

- •

- Percent-of-index

arrangements: Under percent-of-index arrangements, we purchase natural gas at either (i) a percentage

discount to a specified index price, (ii) a specified index price less a fixed amount or (iii) a percentage discount to a specified index price less an additional fixed amount. We then

gather and deliver the natural gas to pipelines where we resell the natural gas at the index price, or at a different percentage discount to the index price. With respect to (i) and

(iii) above, the net operating margins we realize under the arrangements decrease in periods of low natural gas prices because these net operating margins are based on a percentage of the index

price. Conversely, our net operating margins increase during periods of high natural gas prices.

- •

- Keep-whole arrangements: Under keep-whole arrangements, we gather natural gas for the producer, process the natural gas and sell the resulting condensate and NGLs to third parties at market prices. Because the extraction of NGLs from the natural gas during processing reduces the Btu content of the natural gas, we must either purchase natural gas at market prices for return to producers or make cash payment to the producers equal to the energy content of this natural gas. Certain keep-whole arrangements also have provisions that require us to share a percentage of the keep-whole profits with the producers based on the oil to gas ratio or the relative price of NGLs to natural gas. Accordingly, under these arrangements our revenues and net operating margins increase as the price of condensate and NGLs increases relative to the price of natural gas and decrease as the price of natural gas increases relative to the price of condensate and NGLs.

gathering, fractionation, exchange, marketing and storage of NGLs; and gathering and transportation of crude oil. The revenue we earn from these arrangements is generally directly related to the volume of natural gas, NGLs or crude oil that flows through our systems and facilities and is not directly dependent on commodity prices. If a sustained decline in commodity prices were to result in a decline in volumes, however, our revenues from these arrangements would be reduced. In certain cases, our arrangements provide for minimum annual payments, fixed demand charges or fixed returns on gathering system expenditures.

Under certain contracts, we are allowed to retain a fixed percentage of the volume gathered to cover the compression fuel charges and deemed-line losses. To the extent that we operate our gathering systems more or less efficiently than specified per contract allowance, we retain the benefit or loss for our own account.

The terms of our contracts vary based on gas quality conditions, the competitive environment when the contracts are signed and customer requirements. Our contract mix and, accordingly, our exposure to natural gas and NGL prices, may change as a result of changes in producer preferences, our expansion in regions where some types of contracts are more common and other market factors, including current market and financial conditions which have increased the risk of volatility in oil, natural gas and NGL prices. Any change in mix may influence our long-term financial results.

21

Non-GAAP Measures

In evaluating the Partnership's financial performance, management utilizes the segment performance measures, segment revenues and operating income before items not allocated to segments. These financial measures are presented in Note 23 to the accompanying consolidated financial statements and are considered non-GAAP financial measures when presented outside of the notes to the consolidated financial statements. The use of these measures allows investors to understand how management evaluates financial performance to make operating decisions and allocate resources. See Note 23 to the accompanying consolidated financial statements for the reconciliations of segment revenue and operating income before items not allocated to segments to the respective most comparable GAAP measure.

Management evaluates contract performance on the basis of net operating margin (a non-GAAP financial measure), which is defined as revenue, excluding any derivative gain (loss), less purchased product costs, excluding any derivative gain (loss). These charges have been excluded for the purpose of enhancing the understanding by both management and investors of the underlying baseline operating performance of our contractual arrangements, which management uses to evaluate our financial performance for purposes of planning and forecasting. Net operating margin does not have any standardized definition and, therefore, is unlikely to be comparable to similar measures presented by other reporting companies. Net operating margin results should not be evaluated in isolation of, or as a substitute for, our financial results prepared in accordance with GAAP. Our use of net operating margin and the underlying methodology in excluding certain charges is not necessarily an indication of the results of operations expected in the future, or that we will not, in fact, incur such charges in future periods.

The following is a reconciliation of net operating margin to income from operations, the most comparable GAAP financial measure of this non-GAAP financial measure (in thousands):

| |

Year ended December 31, | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| |

2012 | 2011 | 2010 | |||||||

Segment revenue |

$ | 1,402,672 | $ | 1,549,819 | $ | 1,241,563 | ||||

Purchased product costs |

(530,328 | ) | (682,370 | ) | (578,627 | ) | ||||

Net operating margin |

872,344 | 867,449 | 662,936 | |||||||

Facility expenses |

(208,385 | ) | (173,598 | ) | (151,449 | ) | ||||

Derivative gain (loss) |

69,126 | (75,515 | ) | (80,350 | ) | |||||

Revenue deferral adjustment |

(7,441 | ) | (15,385 | ) | — | |||||

Selling, general and administrative expenses |

(94,116 | ) | (81,229 | ) | (75,258 | ) | ||||

Depreciation |

(189,549 | ) | (149,954 | ) | (123,198 | ) | ||||

Amortization of intangible assets |

(53,320 | ) | (43,617 | ) | (40,833 | ) | ||||

Loss on disposal of property, plant and equipment |

(6,254 | ) | (8,797 | ) | (3,149 | ) | ||||

Accretion of asset retirement obligations |

(677 | ) | (1,190 | ) | (237 | ) | ||||

Income from operations |

$ | 381,728 | $ | 318,164 | $ | 188,462 | ||||

The following table does not give effect to our active commodity risk management program. For further discussion of how we manage commodity price volatility for the portion of our net operating margin that is not fee-based, see Note 6 of the accompanying Notes to the Consolidated Financial Statements included in Item 8 of this Form 10-K. We manage our business by taking into account the partial offset of short natural gas positions primarily in our Southwest segment. The calculated percentages for net operating margin for percent-of-proceeds, percent-of-index and keep-whole contracts reflect the partial offset of our natural gas positions. The calculated percentages are less than one percent for percent-of-index due to the offset of our natural gas positions and, therefore, not

22

meaningful to the table below. For the year ended December 31, 2012, we calculated the following approximate percentages of our segment net operating margin from the following types of contracts:

| |

Fee- Based |

Percent-of- Proceeds(1) |

Keep- Whole(2) |

|||||||

|---|---|---|---|---|---|---|---|---|---|---|

Southwest |

44 | % | 33 | % | 23 | % | ||||

Northeast |

17 | % | 13 | % | 70 | % | ||||

Liberty |

75 | % | 25 | % | 0 | % | ||||

Utica |

100 | % | 0 | % | 0 | % | ||||

- (1)

- Includes

condensate sales and other types of arrangements tied to NGL prices.

- (2)

- Includes condensate sales and other types of arrangements tied to both NGL and natural gas prices.

Competition

In each of our operating segments, we face competition for natural gas gathering, crude oil transportation and in obtaining natural gas supplies for our processing and related services; in obtaining unprocessed NGLs for gathering and fractionation; and in marketing our products and services. Competition for natural gas supplies is based primarily on the location of gas gathering facilities and gas processing plants, operating efficiency and reliability and the ability to obtain a satisfactory price for products recovered. Competitive factors affecting our fractionation services include availability of capacity, proximity to supply and industry marketing centers and cost efficiency and reliability of service. Competition for customers to purchase our natural gas and NGLs is based primarily on price, delivery capabilities, flexibility and maintenance of high-quality customer relationships.

Our competitors include:

- •

- natural gas midstream providers, of varying financial resources and experience, that gather, transport, process,

fractionate, store and market natural gas and NGLs;

- •

- major integrated oil companies;

- •

- medium and large sized independent exploration and production companies; and

- •

- major interstate and intrastate pipelines.

Some of our competitors operate as master limited partnerships and may enjoy a cost of capital comparable to and, in some cases, lower than ours. Other competitors, such as major oil and gas and pipeline companies, have capital resources and contracted supplies of natural gas substantially greater than ours. Smaller local distributors may enjoy a marketing advantage in their immediate service areas.

We believe that our customer focus in all segments, demonstrated by our ability to offer an integrated package of services and our flexibility in considering various types of contractual arrangements, allows us to compete more effectively. Additionally, we have critical connections to the key market outlets for NGLs and natural gas in each of our segments. In the Southwest segment, our major gathering systems are relatively new, located primarily in the heart of shale plays with significant long-term growth opportunities and provide producers with low-pressure and fuel-efficient service, which differentiates us from many competing gathering systems in those areas. The strategic location of our assets and the long-term nature of our contracts also provide a significant competitive advantage. In the Northeast segment, our operational experience of more than 20 years as the largest processor and fractionator and our existing presence in the Appalachian Basin provide a significant competitive advantage. In the Liberty segment, our early entrance in the liquids-rich corridors of the Marcellus and Utica Shales through our strategic gathering and processing agreements with key producers enhances our competitive position to participate in the further development of these resource plays.

23

Seasonality

Our business can be affected by seasonal fluctuations in the demand for natural gas and NGLs and the related fluctuations in commodity prices caused by various factors such as changes in transportation and travel patterns and variations in weather patterns from year to year. Our Northeast segment could be particularly impacted by seasonality as the majority of its revenues are generated by NGL sales. However, we manage the seasonality impact through the execution of our marketing strategy. We have access to approximately 50 million gallons of propane storage capacity in the northeast region provided by our own storage facilities and a firm capacity arrangement with a third-party which provides us with flexibility to manage the seasonality impact. Overall, our exposure to the seasonal fluctuations in the commodity markets is declining due to our growth in fee-based business.

Regulatory Matters

Our operations are subject to extensive regulations. The failure to comply with applicable laws and regulations or to obtain, maintain and comply with requisite permits and authorizations can result in substantial penalties and other costs to the Partnership. The regulatory burden on our operations increases our cost of doing business and, consequently, affects our profitability. However, we do not believe that we are affected in a significantly different manner by these laws and regulations than are our competitors. Due to the myriad of complex federal, state, provincial and local regulations that may affect us, directly or indirectly, reliance on the following discussion of certain laws and regulations should not be considered an exhaustive review of all regulatory considerations affecting our operations.