Exhibit 99.1

August 1, 2018

Presentation Script and Slides

The following script should be read in conjunction with the accompanying slide presentation, which contains, among other information, source data for certain information set forth in the script.

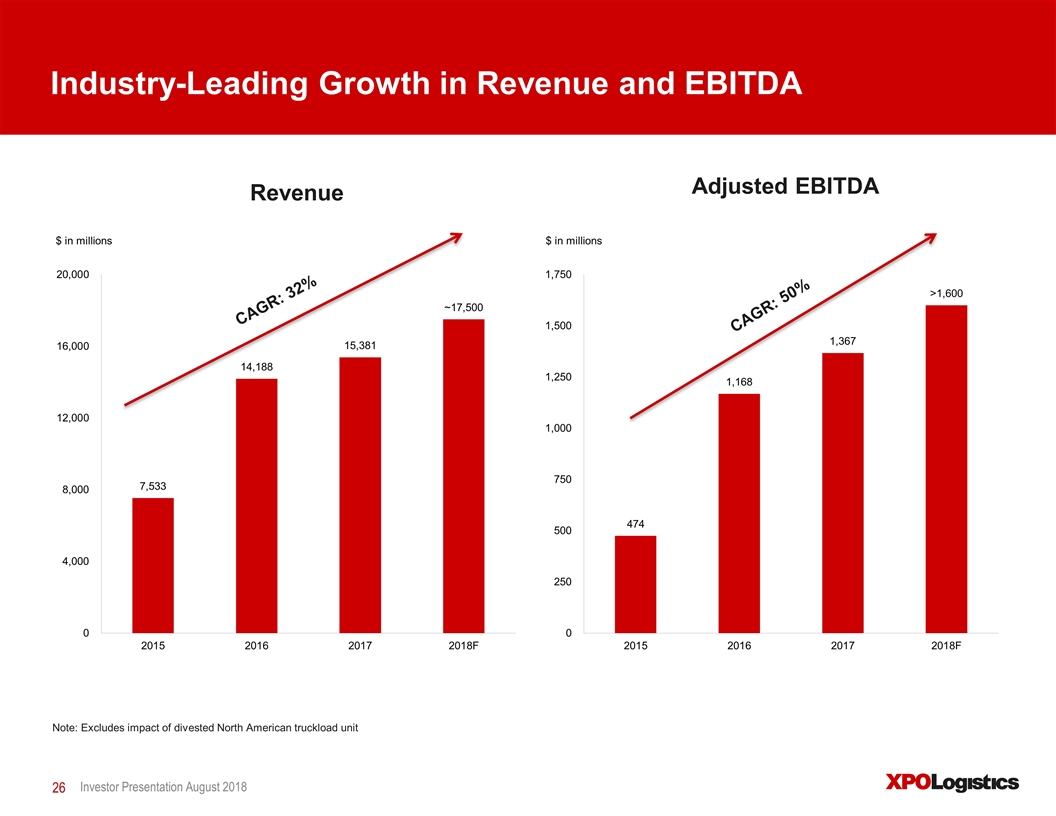

Thank you for joining us. We’ll start with an overview of XPO Logistics today — our company, our technology and our value propositions for customers and investors. We’ll discuss our operations in depth, including some of the significant investments we’re making in 2018 to drive long-term growth. And we’ll talk about our strong second quarter performance, including record quarterly results for revenue, net income, adjusted EBITDA, cash flow from operations and free cash flow, as well as robust organic revenue growth of 10.9%.

XPO is a top ten global logistics company with over $15 billion of revenue, operating as a highly integrated network of people, technology and physical assets. We use our network to help customers manage their goods more efficiently throughout their supply chains. We run our business under the single brand of XPO Logistics.

As context, we have two reporting segments: transportation and logistics. Approximately 63% of our revenue comes from transportation. The other 37% is logistics, which we sometimes refer to as “supply chain” or “contract logistics.”

Our markets are highly diversified. The more than 50,000 customers we serve are in every major industry and touch every part of the economy. Our revenue derives from a mix of key verticals, such as retail and e-commerce, food and beverage, consumer packaged goods and industrial. About 60% of our revenue is generated in the United States, 13% comes from France and 12% from the United Kingdom. Of the balance, Spain is the next largest at 4% of revenue. In total, we operate in 32 countries with 1,505 locations and over 97,000 employees.

These are the key factors driving our high growth and returns:

| • | Significant investments in secular drivers of organic growth |

| • | Leadership positions in fast-growing areas of transportation and logistics |

| • | Strong presence in the e-commerce sector |

| • | $1 trillion addressable opportunity, of which we hold less than 2% market share |

| • | Cutting-edge technology that differentiates XPO in every line of business |

| • | Numerous company-specific margin improvement initiatives |

| • | Low maintenance capex requirements |

| • | Longstanding track record of creating value through M&A integrations |

| • | World-class operators who are laser-focused on driving results |

1

We have an additional opportunity to increase our profitability through the cross-fertilization of best practices. This is already paying dividends, given the caliber of our operations on both sides of the Atlantic. We’re sharing knowledge across all of our service offerings and geographies, with an emphasis on high-impact areas such as customer service, sales, safety, warehouse management, cross-dock operations, equipment maintenance, training and HR. The veteran operators who lead our business units are adept at integrating these practices into daily operations.

Our sales strategy is two-fold: earn a greater share of wallet with our existing customer base and penetrate high-growth verticals where companies have a need for multiple XPO services. We’re continuing to make sizable investments in our sales organization to get in front of high-potential customers that can benefit from our capabilities. These customers are typically national and multinational companies that can use multiple lines of our business. The one exception, in terms of customer size, is in less-than-truckload, where the largest opportunity is with smaller, local customers. We have over 20,000 customers in our LTL base.

In North American LTL, we’ve hired over 200 LTL sales associates and sales support personnel since October, including 150 in the first six months of this year. These new hires have been trained in our LTL business and understand our optimal freight profile. We expect to see positive impacts on our revenue and margin in the back half of 2018.

In addition, we’ve deepened our bench of senior-level sales talent in Europe, beefed up sales support, raised incentive compensation and invested in new training and analytics to drive cross-selling companywide. We won a record $2.1 billion of new business through June, including $1.1 billion of new business closed in the second quarter — this is the most new business closed in any quarter in our history. Our sales pipeline stands at a remarkable $3.4 billion globally.

We’re on track to deliver on our target of at least $1.6 billion of adjusted EBITDA this year, which reflects a 17% increase over 2017. Some of this momentum is coming from a strong macro environment but, importantly, we’re also making significant investments to drive organic growth. In 2018, we’re investing in building out our XPO Direct distribution network, enhancing our contract logistics infrastructure, growing our LTL salesforce, expanding our last mile footprint and funding proprietary technology, with an emphasis on the e-commerce supply chain. The vast majority of the benefit from these investments will come after 2018.

Company Overview

We’ve meticulously built XPO to provide exceptional value for customers while generating high returns for our shareholders. At the top of our value proposition is an intense customer service culture and a highly engaged employee base, led by best-in-class operators.

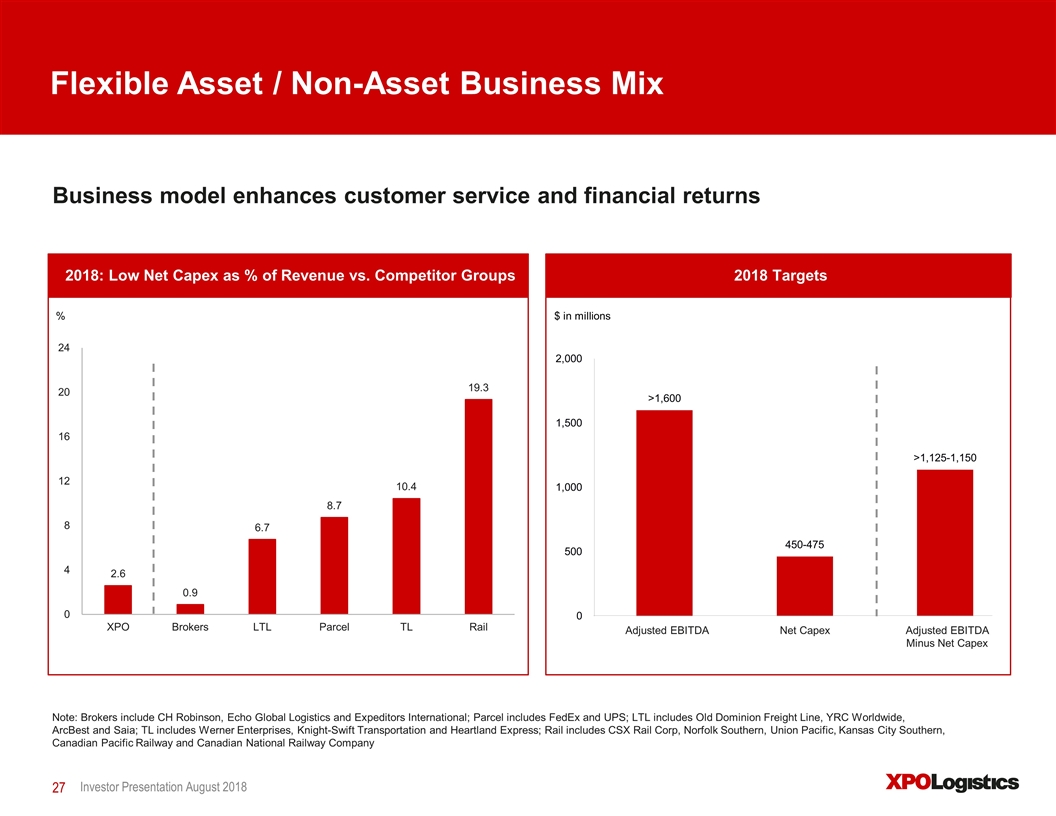

We offer an unmatched range of solutions for the efficient management of goods throughout the supply chain. Our business model is asset-light overall, with assets accounting for just under a third of revenue. Our estimated net capex for 2018 is 2.6% of revenue.

The assets we do own are critical components of the customer services we provide:

| • | 810 contract logistics facilities |

| • | 457 cross-docks |

2

| • | Truck transportation assets of 16,000 tractors and 39,000 trailers |

| • | Intermodal transportation assets of 9,500 53-ft. boxes and 5,000 chassis |

Our industry is large, growing and fragmented, with underpenetrated market sectors and trends toward outsourcing. Many companies are seeking to consolidate their supply chain relationships. This is particularly true of large companies with multiple end-markets or multinational footprints.

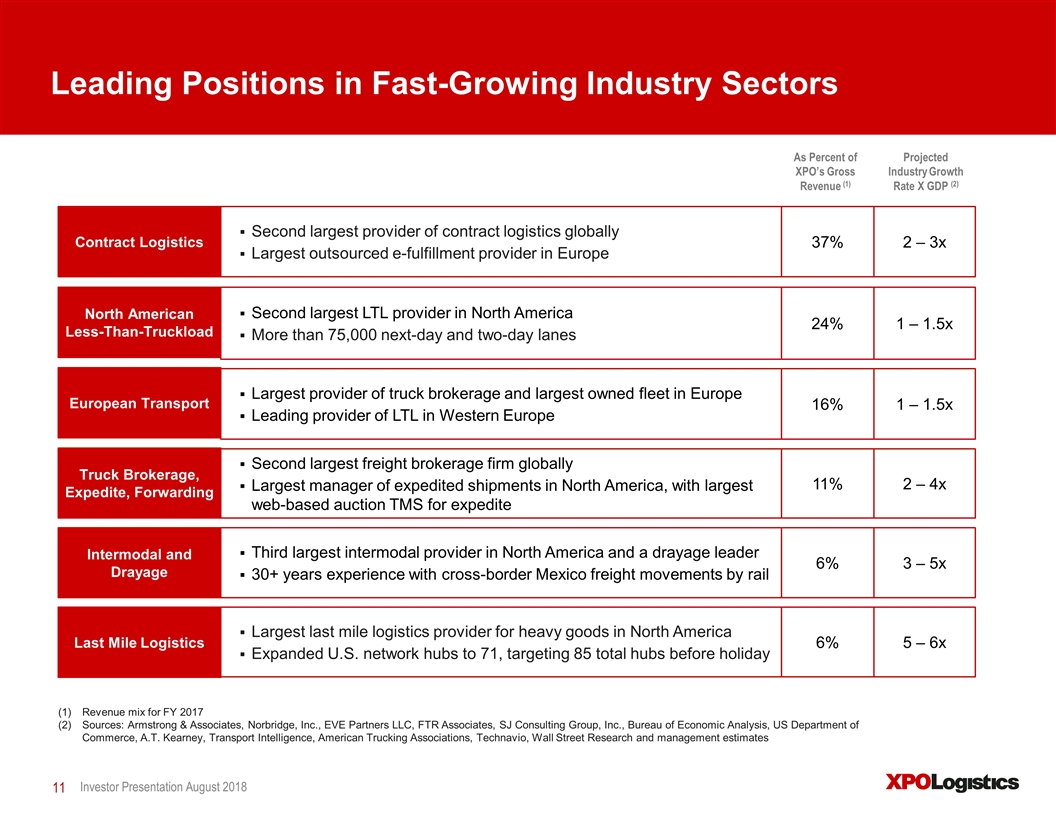

All of these industry attributes play directly to our strengths of scale, density, service range and technology. We offer not only the convenience of a single source, but also the strength and stability of a global leader. XPO is the:

| • | Largest last mile logistics provider for heavy goods in North America, a more than $13 billion sector that’s estimated to be growing at five to six times GDP |

| • | Largest manager of expedited shipments in North America by ground, air and TMS technology |

| • | Second largest contract logistics provider worldwide, with the largest 3PL e-fulfillment platform in Europe |

| • | Second largest provider of less-than-truckload transportation in North America, and a leading LTL provider in Western Europe |

| • | Second largest freight broker worldwide, with the largest owned road fleet in Europe |

| • | Third largest provider of intermodal in North America and a drayage leader |

In addition, we’re a top five global provider of managed transportation based on the value of freight under management, and a global freight forwarder with an integrated network of ocean, air, ground and cross-border services.

Looking solely at the spaces where we already operate, we have a total addressable opportunity of $1 trillion or more. Now let’s take a deeper look into XPO, starting with our technology.

Transformative Technology

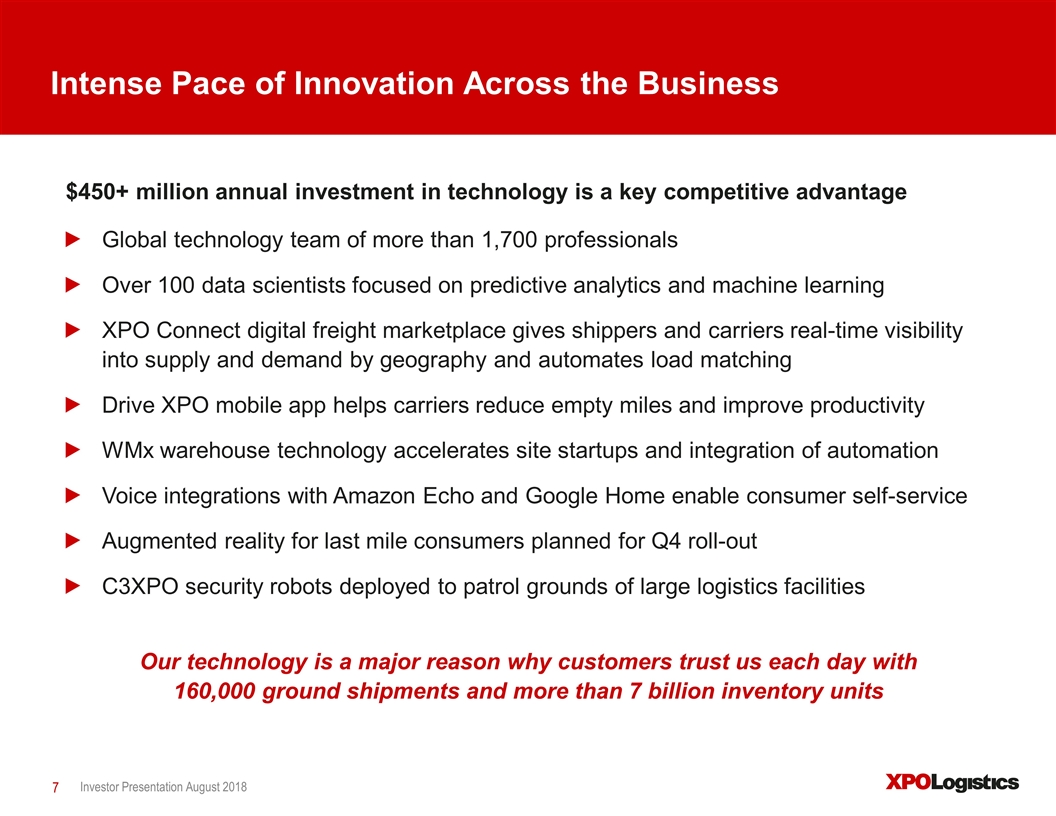

XPO empowers its employees to deliver world-class service through technology. We place massive importance on innovation because we believe that great technology in the hands of well-trained employees, propelled by scale, is the ultimate competitive moat in our industry. Our technology is purpose-built to continuously improve customer service, control costs and leverage our scale. This is a major reason why customers trust us with 160,000 ground shipments and more than 7 billion inventory units each day.

We spend more than $450 million a year on technology. We’ve built a highly scalable, cloud-based platform to speed innovation companywide, with a global team of over 1,700 technology professionals, including more than 100 data scientists. Our efforts are concentrated in four areas: automation and intelligent machines, dynamic data science, the digital freight marketplace, and visibility and customer service, specifically in the e-commerce supply chain.

The significant investments we’re making in technology are funding exciting developments. In June, we announced a groundbreaking partnership with Nestlé, the world’s largest food and drink company, to co-create a 638,000-square-foot distribution center in the UK for Nestlé’s

3

consumer packaged goods. We’re investing $77 million in this site, which is scheduled to open in 2020 and will feature advanced sorting systems and robotics alongside state-of-the-art automation, with a digital ecosystem that integrates predictive data and intelligent machines. It will house an XPO technology laboratory and operate as both a think tank and a launch pad for our innovations.

More broadly, in logistics, our warehouses are becoming high-tech hubs with collaborative robots, drones for inventory management and sophisticated analytics for demand forecasting. Our algorithms can predict the flow of goods and future returns, helping our e-commerce customers plan for peak inventory, capacity and labor levels. We recently started using dynamic analytics in our warehouses to optimize workforce productivity day by day, and shift by shift. Our proprietary technology facilitates omnichannel distribution, lean manufacturing support, aftermarket support, supply chain optimization and transportation management.

In February, we announced WMx, our new cloud-based, mobile warehouse management platform. WMx integrates robotics and advanced automation into customer solutions more rapidly than before, which dramatically reduces ramp-up time on new projects. WMx also turbocharges our logistics operations and brings greater efficiency to multi-site and multi-channel environments.

In last mile, our web-based technology delivers a superior consumer experience with industry-leading satisfaction levels. This protects the brands of our e-tail and retail customers. Recently, we launched Google Home and Amazon Echo voice self-service capabilities integrated with our last mile network — an industry-first capability that gives consumers a way to manage their home delivery experience from the point of sale through fulfillment by using Google Assistant and Amazon’s Alexa.

We’ve also introduced Ship XPO web-based tools for consumers. If you buy something from one of our last mile customers online, you can track your order in real time, set personalized alerts, and reschedule delivery times electronically using our software. We’re able to offer a tight delivery window, which is especially important with heavy goods, and our technology is geared to facilitate the most complex home installations. Our system also gathers actionable, real-time feedback post-delivery to help our customers build loyalty. Later this year, we expect to roll out our new augmented reality technology. It gives consumers the ability to create a virtual image of how an item will look in a given room prior to delivery. This makes the last mile process more efficient and decreases the likelihood of returns.

In transportation, in April, we announced the introduction of XPO Connect, a cloud-based, digital freight marketplace that’s fully automated, self-learning and dynamic. XPO Connect gives customers direct access to our transportation network and the predictive data that powers it. The platform is designed to provide shippers with a single point of entry for visibility across multiple transportation modes in real time. Shippers can see fluctuations in capacity, look at the spot rates by geography and post loads. Then they can assign loads and track freight movements through one, secure login.

Carrier signups for XPO Connect went from zero to 6,000 in the first three months after the April launch. The carriers use our Drive XPO mobile app to interact with our Freight Optimizer brokerage system and XPO Connect. They can bid on loads and reduce empty miles, which increases the capacity available to our customers. Drive XPO also serves as a geo-locator and supports voice-to-text communications. We’re rolling it out to our European brokerage network to deliver the same benefits to our customers there.

4

In LTL, we launched a next-generation web integration for customers that gives them access to more shipping tools without custom programming — delivery and pickup management, pricing and planning tools, and electronic document handling. This follows the deployment of 14,000 handhelds and inspection tablets for drivers and dockworkers to enhance productivity and revenue collection from accessorials and ancillary services. We also developed new RFP and pricing systems for LTL, with robust algorithms and profitability monitoring. Overall, we’ve improved the business intelligence we use internally for LTL pricing, workforce planning and network optimization.

Our most recent introduction is XPO Direct, a shared-space distribution network of warehouses and last mile hubs that gives our customers flexible capacity and helps them accelerate order fulfillment and reduce shipment time in transit. With XPO Direct, our facilities serve as stockholding sites and cross-docks that can be utilized by multiple customers at the same time. Transportation needs are supported by our brokered, contracted and owned capacity.

XPO Direct gives customers a way to manage B2C and B2B fulfillment using our scale and capacity without the capital investment of adding distribution centers. We can use our North American footprint to position goods within one and two-day ground transportation range of 90% of the U.S. population and in close proximity to retail stores for inventory replenishment. Currently, we have 75 facilities in our network and we expect that number to be approximately 100 by year-end. Our technology links these sites and can predict where stock should be positioned for the greatest efficiency.

The supply chain industry is wide open for disruptive thinking like this. Our position as a leading champion of technology has led to important new advantages for our customers. We’re constantly unearthing new efficiencies through advanced automation, consumerization and a whole raft of other innovations, some of which are purpose-built for individual customers.

Logistics Operations

Contract Logistics

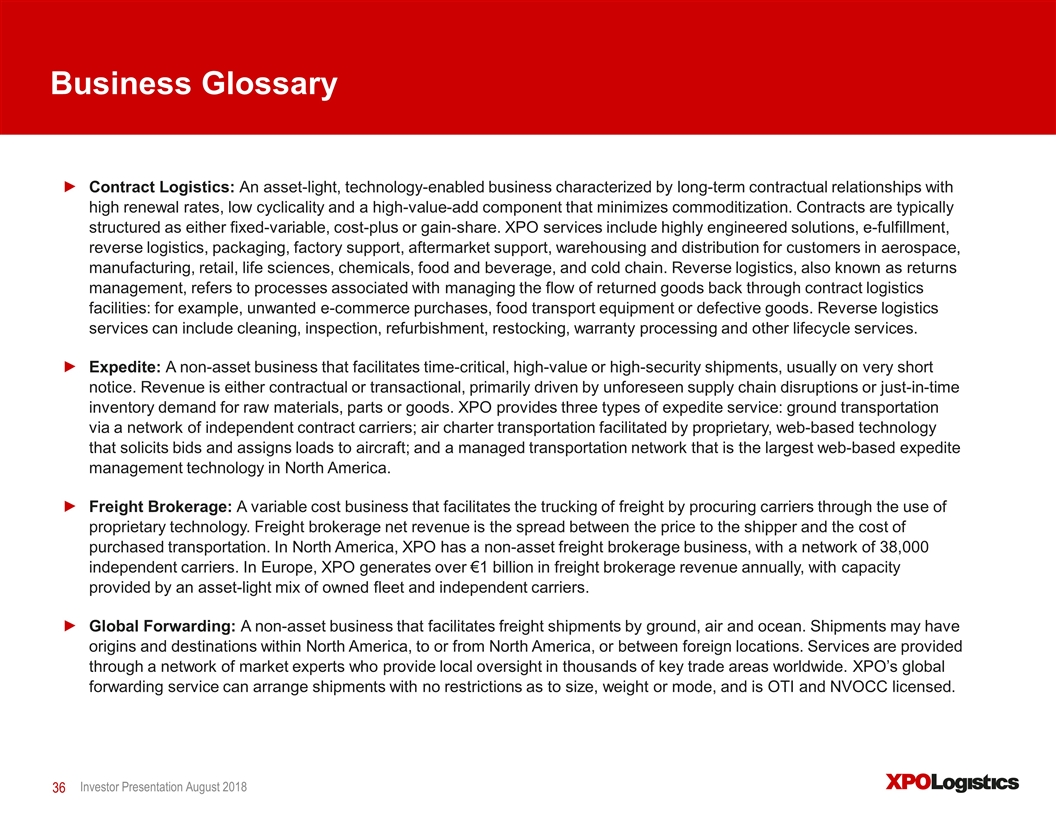

Contract logistics is an asset-light business characterized by long-term contractual relationships, low cyclicality and a high-value-add component that minimizes commoditization. It has low capex requirements as a percentage of revenue, which leads to strong free cash flow conversion and ROIC.

As the second largest logistics provider worldwide, we’re at the forefront of a $120 billion sector that’s estimated to grow at two to three times GDP. In 2017, our facility space increased by 8% globally from the prior year. In 2018, we’re continuing to expand, with a record 183 million square feet of logistics space through June. Our scale and reach make us particularly attractive to multinational customers, as do our vertical expertise, technology and engineering capabilities. When we secure a new logistics contract, the initial tenure is approximately five years on average, with a historical renewal rate of over 95%. These relationships can lead to cross-selling and a wider use of our services, such as inbound and outbound logistics.

Our logistics teams provide a range of services to customers, including e-fulfillment and other types of contract logistics, highly engineered solutions and high-value-add services, such as order personalization and refurbishment. We also perform reverse logistics management, packaging and labeling, recycling, warranty management, distribution and managed transportation, and we collaborate with our larger customers to forecast demand and optimize production flows.

5

Our competitive positioning in logistics is as a technology leader. We’re innovative, fast-moving, and we can handle very complex, large contract logistics implementations. Most of our competitors are specialists in one or two specific verticals, but there are very few companies that have the breadth of capabilities or technology resources that we have. With robotics, for instance, we work with 29 of the top robotics suppliers in the world, that we culled down from the hundreds we looked at.

Reverse logistics is a fast-growing area of logistics, and one where we have a high profile as a quality provider: we manage over 170 million returned units annually. It’s a complex service, requiring inspections, repackaging, refurbishment, resale or disposal, refunds and warranty management. Our technology is a major differentiator in this space. We’ve developed predictive analytics that use machine learning to forecast the future rate of return by SKU number. That’s a high-value service for e-tailers, as consumers increasingly test drive products they buy online.

Our biggest contract logistics win to date is an omnichannel reverse logistics facility we began ramping up in the second quarter. We’ve partnered with a large footwear and apparel customer to implement a 1.1 million square foot returns processing center in the U.S. The site has been custom-designed to drastically improve the processing time it takes to get products back into the supply chain once they’re returned through retail, wholesale and e-commerce channels. What used to take three to six months to turn around now takes five days, or just 24 hours for digital products. We’ve created the capacity to process 63 million returned units annually.

Many of our logistics customers are the preeminent names in retail and e-commerce, food and beverage, technology, aerospace, wireless, industrial and manufacturing, chemical, agribusiness, life sciences and healthcare. We also have strong positions in fast-growing sub-verticals: for example, XPO is the number one provider of fashion logistics in Italy.

We also have complementary strengths in different verticals in Europe and North America. For example, in Europe we’re a specialist in cold chain logistics, which includes some sectors that are less sensitive to economic cycles, such as food and beverage. Our European cold chain experts are helping us build this business in North America. In the U.S., we’re strong in aerospace and other high tech, which is opening new doors in Europe.

We’ve built a global logistics pipeline of approximately $1.8 billion of active bids. A number of the wins we had in late 2017 are ramping up now. We had been averaging two customer implementations a week in contract logistics — an incredible pace — and now we’re up to three a week on average. The vast majority of these are front-loaded investments in long-term contracts.

A large lever for cost savings in our warehouse operations is workforce productivity. Our operations performance team collaborates between North America and Europe to optimize our warehouses. The team is helping management at every site understand the gaps between average performance and great performance, and devise action plans for improvements. Our recent deployment of dynamic planning tools in our logistics sites is a good example of how we’re applying technology in this regard.

Transportation Operations

Our other segment — transportation — includes our lines for truck brokerage and transportation, LTL, last mile, intermodal and drayage, expedite and global forwarding.

6

Truck Brokerage and Transportation

XPO utilizes a blended transportation model of brokered, owned and contracted capacity for truck transportation. The non-asset portion of our model is variable cost and gives us extensive flexibility. It includes our brokerage operations, as well as contracted capacity with independent owner-operators.

Brokerage is compelling to us for a number of reasons. In addition to low fixed costs, it has high free cash flow conversion and minimal capex requirements, with tailwinds from outsourcing and supplier consolidation. Brokerage is also valuable to most of our customers who use XPO for other lines of business. Examples of brokered freight include industrial flows of raw materials and finished goods, consumer goods, sensitive or high-value freight, and freight that requires high security.

We’ve built a powerful truckload management system called Freight Optimizer that drives our brokerage operations in both North America and Europe. Our launch of the Drive XPO mobile app gives truck drivers a way to interact with Freight Optimizer from the road, locating loads and bidding to fill empty miles. The app also interacts with XPO Connect, our digital freight marketplace.

In North America, our brokerage network includes approximately 38,000 independent carriers representing over a million trucks. That’s critically important to shippers — they value our ability to find them capacity under all kinds of market conditions. When the truckload market is tight, as it has been for a while now, shippers are looking to guarantee capacity.

In Europe, the largest components of our transportation operations are LTL, dedicated transport and brokerage. These three service lines generate about 80% of our European transport EBITDA. We also have a non-dedicated truckload business that provides on-demand capacity for our customers.

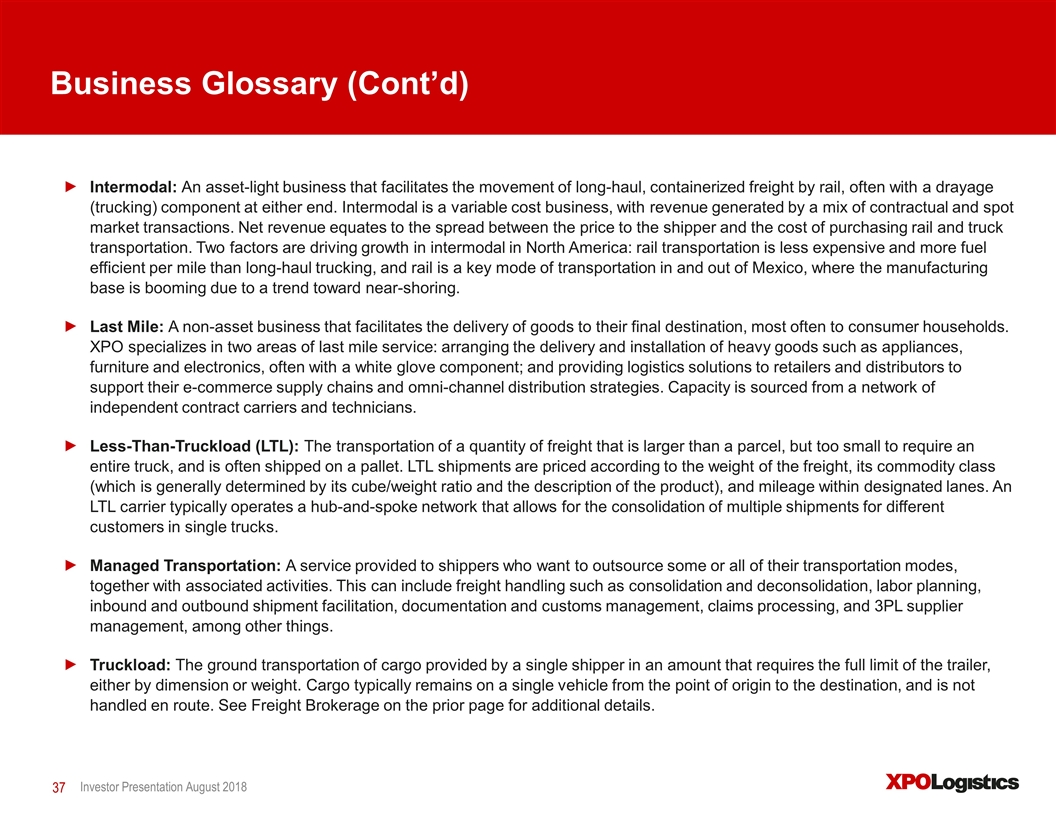

Less-Than-Truckload (LTL)

LTL is a major success story for us in both North America and Europe. Our LTL business in North America is asset-based; it utilizes employee drivers, a fleet of tractors and trailers for line-haul, pick-up and delivery of pallets, and a network of terminals. In Western Europe, where we’re a leading LTL provider, we typically contract with independent carriers for some or most of the transportation, depending on the country. These relationships are supported by our terminals and staff.

Our LTL team is laser-focused on on-time, damage-free performance. We have the second largest LTL network in the U.S., covering 99% of all zip codes, and one of the industry’s most modern fleets, delivering approximately 20 billion pounds of freight a year. We’ve significantly increased the number of salespeople dedicated to serving our LTL customer base and plan to add more this year.

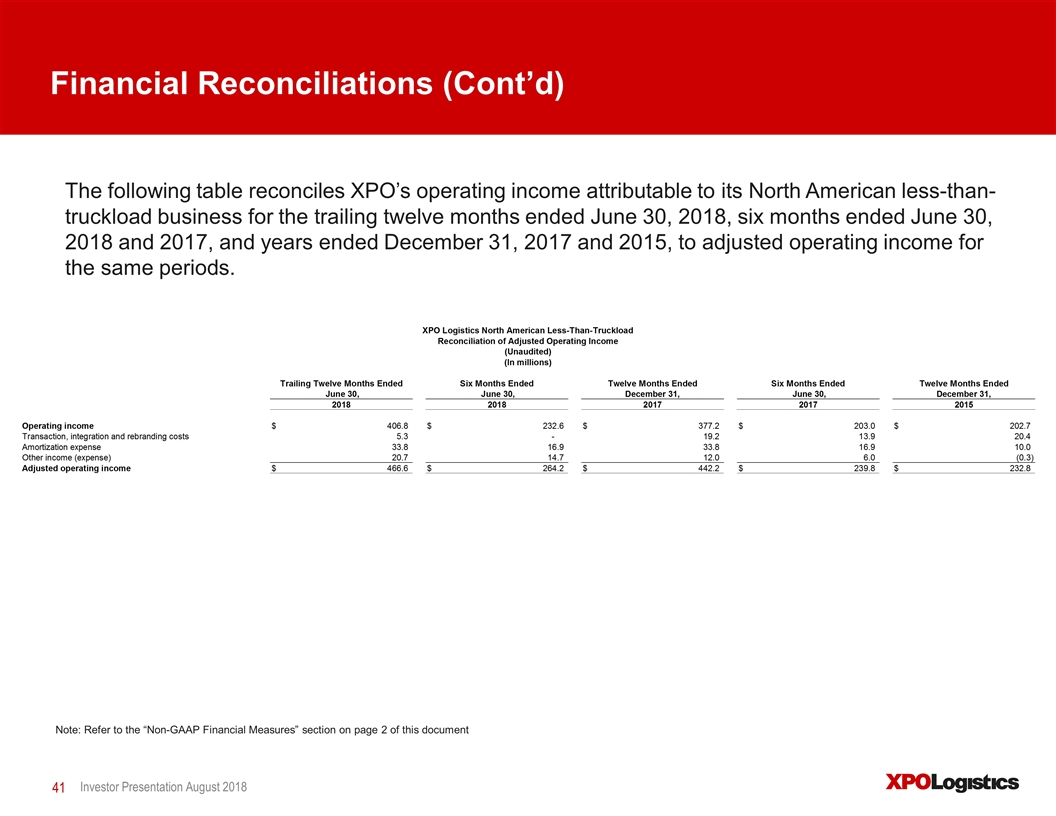

In North American LTL, we now expect to achieve 150 to 200 basis points of improvement this year versus 2017. We’re well on the way: in the second quarter, our adjusted operating ratio was the best in 30 years at 84.3%. We’ve brought our LTL operation a long way forward since we acquired the business in late October 2015. When you compare the 12 months of 2015, with the trailing 12 months through June 30, 2018, we’ve doubled the LTL adjusted operating income in 32 months of ownership. The business is on track to generate over $1 billion of EBITDA within three years.

7

The $15 million we’ve invested in our LTL sales organization in North America is geared to generate incremental growth and optimize our freight mix. We’re focused on profitable freight that matches our network for the long-term. As a result, we expect to see meaningful acceleration in operating income growth in the second half of this year. We also have initiatives underway to improve trailer utilization and enhance customer service to become even more cost efficient.

The next big efficiency for us in LTL is workforce utilization aligned with engineered standards. Our transformation and big data teams are using labor analytics to model an optimal solution for any given day based on the amount of work forecasted. They look at things like pick-up and delivery hours, dock hours, overtime, part-time labor and full-time labor. This is being executed in our European transport operations as well.

Last Mile Logistics

Last mile is an asset-light operation, and an outsized performer in our service range. We manage the final delivery of goods to homes using a network of contract carriers and white glove technicians for assembly and installation.

XPO is by far the largest facilitator for the home delivery of heavy goods in North America. Our last mile customers include most of the big-box retailers who sell heavy goods — items such as appliances, furniture, exercise equipment and large electronics. We expect to facilitate about 14 million last mile deliveries this year, and yet we hold just 7% share in the U.S. last mile space.

Our last mile business is an exciting combination of expertise, technology and scale that generates industry-leading consumer satisfaction ratings. We use our proprietary, state-of-the-art technology to enable real-time performance monitoring: consumers are surveyed within minutes of delivery to capture feedback and escalate any issues for prompt resolution.

While goods are in transit, our technology gives consumers a choice of self-service options, including web-based tools and voice-activated connection to Google and Amazon intelligent assistants. Consumers can self-monitor their orders and receive automated appointment verifications by phone, email or text. The result is a consistently best-in-class home delivery experience at a national level.

E-commerce is an immense tailwind for last mile, and one that’s predicted to grow globally at double-digit rates through at least 2025. Within e-commerce, there’s an ongoing shift toward customers buying large, heavy items online. Given our specialization in heavy goods, this represents tremendous growth potential for us now and over the long term.

In North America, we’ve deployed new technology tools for route planning to increase efficiency as our network grows in scale. We currently have 71 last mile hubs in operation, with a target of 85 hubs total. We expect to have the remaining 14 locations open before the holiday season this year. This will position our last mile footprint within 125 miles of approximately 90% of the U.S. population. We estimate that going from 55 in 2017 to 85 hubs could lower the cost per delivery by as much as 30% by reducing the length of transit.

In Europe, which is another fragmented last mile landscape, there’s a large opportunity for us to further apply our last mile technology and best practices. We’ve established last mile operations for heavy goods in the UK, Ireland, the Netherlands, Spain and France, and have won several sizable contracts. It’s a small but growing presence in a sector where our expertise is in strong demand.

8

Intermodal and Drayage

Intermodal and drayage are additional growth opportunities for us. Both are asset-light operations in North America involved in the long-haul portion of containerized freight movements. Services include rail brokerage, local drayage by independent trucking contractors, and on-site operational services. XPO has one of the largest drayage networks in the U.S., with more than 2,300 independent owner-operators and access to another 25,000 drayage trucks.

The nature of intermodal is that demand is influenced by external factors, such as the availability of truck capacity. Right now, truck capacity is tight and fuel prices are creeping up, both of which are good for intermodal. In general, intermodal can be a much less expensive mode for freight that is not time-sensitive. The main drivers of customer satisfaction are cost effectiveness, ready capacity and service performance.

Our proprietary Rail Optimizer technology is a growth engine and a competitive advantage for us in intermodal — it enables constant communication with the railroads and provides a high level of visibility into the door-to-door movements of long-haul freight. This helps us reduce empty miles and otherwise add value for customers. Rail Optimizer helped us win the largest contract in XPO’s history last year.

Expedite

We offer expedited transportation, a non-asset business, as part of our freight brokerage operations in North America. Expedited shipments are time-critical goods or raw materials that have to get somewhere very quickly, typically on little notice.

We use a network of contracted owner-operators to handle expedited ground transportation, and an electronic bid platform to assign air charter loads. A large and separate component of our expedite operations is our proprietary transportation management platform, which awards loads electronically based on carriers’ online bids. These transactions primarily happen on a machine-to-machine basis. Our technology initiates a new auction on the internet every few seconds, and we take a fee for facilitating the entire process.

One key driver of expedite demand is the trend toward just-in-time (JIT) urgent shipments. JIT is a supply chain strategy that requires 3PL support for both manufacturing production and inventory management. As the largest manager of expedited shipments in North America, we can pivot very quickly, often saving our customers from disastrous monetary loss.

Our expedite group serves our other service lines as well. For example, if a track repair stalls a rail container, we can off-load those goods to an expedite ground carrier in our network or put them on a chartered aircraft. This ability to find solutions to almost any challenge is a major advantage of our integrated organization.

9

Managed Transportation

XPO is a top five global provider of managed transportation, with approximately $2.7 billion of freight under management. Managed transportation is a non-asset service provided to shippers who want to outsource some or all of their transportation modes, together with associated activities. These activities can include freight handling such as consolidation and deconsolidation, labor planning, inbound and outbound shipment facilitation, documentation and customs management, claims processing and 3PL supplier management, among other services.

Global Forwarding

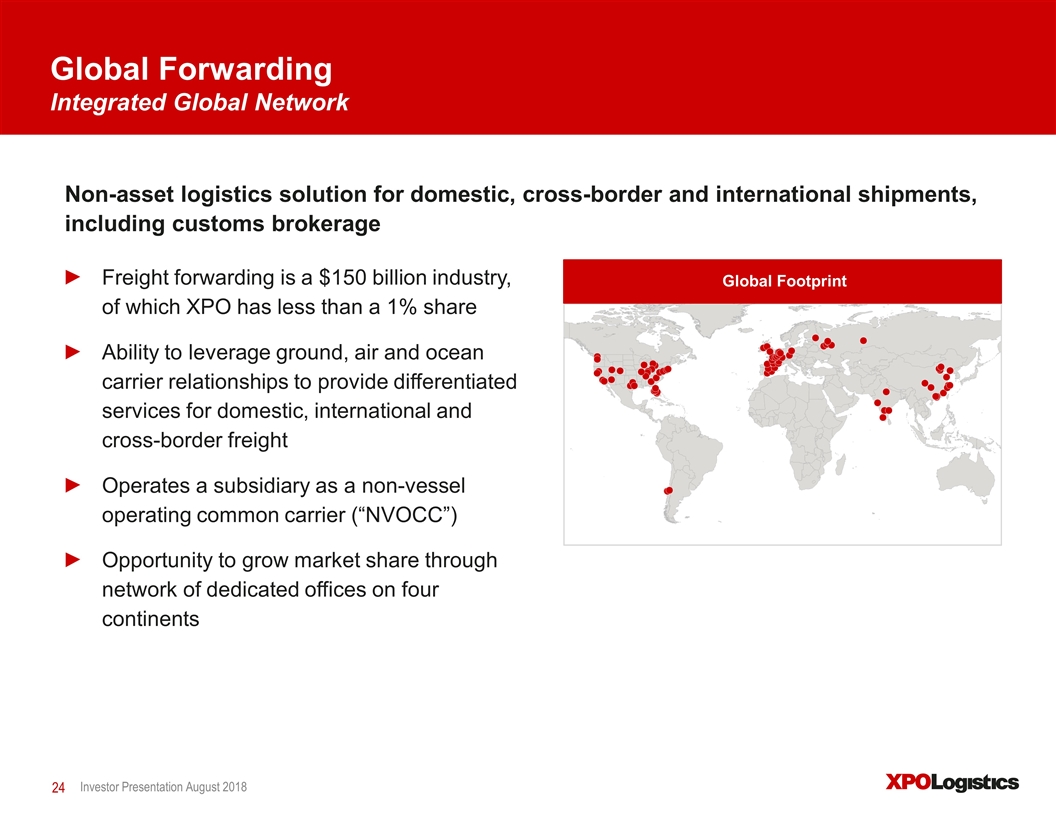

We provide non-asset global forwarding services in a $150 billion sector where customers depend on our domestic, cross-border and international expertise. The shipments we forward may have origins and destinations within the same country or move between countries or continents. They may travel by ground, air, ocean or some combination of these modes.

XPO has a network of independent market experts and licensed customs brokers that provide local oversight in thousands of key trade areas worldwide, and we operate a subsidiary as a non-vessel operating common carrier (NVOCC). We have an opportunity to grow market share in forwarding through our network of dedicated offices on four continents.

Service-Driven, Results-Oriented Culture

The common denominator across all areas of transportation and logistics is that customers want results. A zero-fail mindset is part of our DNA, dating back a quarter century to our roots in expedite. Anything less than stellar service is not an option for us.

Transportation customers want on-time pickup and delivery. Contract logistics customers want their goods to flow smoothly through the supply chain. All customers want visibility into flows, accurate documentation and damage-free handling. If a disruption does occur, customers expect to know about it right away and hear a solution. And increasingly, customers want real-time insights into supply chain activities, which is why we invest heavily in developing mobile applications, end-to-end visibility, predictive analytics and the digital freight marketplace.

We see an opportunity to continue to differentiate XPO on the basis of phenomenal customer service in each of our service offerings. The litmus test is always our customer. Is the customer thrilled to have chosen XPO? Are we constantly improving the value we deliver? When we receive awards for operational excellence and performance from world-class companies such as Boeing, Diebold, Navistar, Nissan, Nordstrom, The Home Depot and Whirlpool, we know we’re doing our job.

Sustainability is another big focus for us. It’s an area where XPO has already set an example in the industry, giving us an opportunity to build on that position. Our company has been named a Top 75 Green Supply Chain Partner by Inbound Logistics for three consecutive years, and in 2016 was awarded the label “Objectif CO2” for outstanding environmental performance of transport operations in Europe by the French Ministry of the Environment and the French Environment and Energy Agency.

The UK warehouse of the future that we’re creating with Nestlé will be sited on man-made plateaus, with landscaping to minimize the visual impact to nearby settlements. Additional

10

sustainability measures include environmentally friendly ammonia refrigeration systems, energy-saving LED lighting, air-source heat pumps for administration areas and rainwater harvesting.

Many of our logistics facilities are ISO14001-certified, which ensures environmental and other regulatory compliances. We monitor fuel emissions from forklifts in our warehouses, and we have protocols in place to take immediate corrective action if needed. Our packaging engineers ensure that the optimal carton size is used for each product slated for distribution, and when feasible, we purchase recycled packaging. As a byproduct of our reverse logistics operations, we recycle millions of electronic components and batteries each year.

In transportation, in 2017, we made a substantial capex investment in EPA 2013-compliant and GHG14-compliant Freightliner Cascadia tractors in North America, and Euro 6-compliant tractors in Europe. We’ll be investing another $90 million in North American LTL fleet this year. In Europe, we own a large fleet of natural gas trucks, and we launched government-approved mega-trucks in Spain. These trucks can significantly reduce CO2 emissions through increased carrying capacity. Our LTL locations have energy-saving policies in place and are implementing a phased upgrade to LED lighting.

That sums up our many opportunities for value creation. Now it’s about operational excellence and further accelerating returns.

Financial Highlights1

We’re off to a strong start in 2018. Highlights of our second quarter results include:

| • | $4.36 billion of revenue |

| • | 10.9% organic revenue growth |

| • | $137.5 million of net income attributable to common shareholders; $1.03 per diluted share |

| • | $131.8 million of adjusted net income attributable to common shareholders; $0.98 per diluted share |

| • | $436.7 million of adjusted EBITDA |

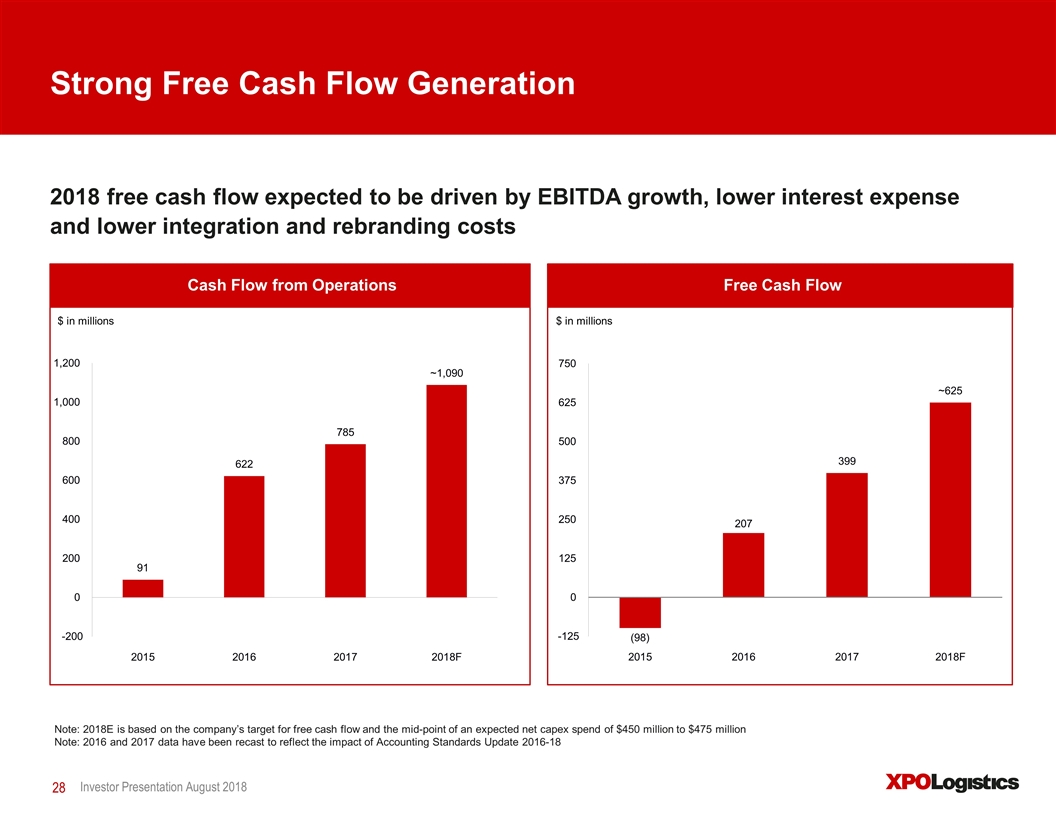

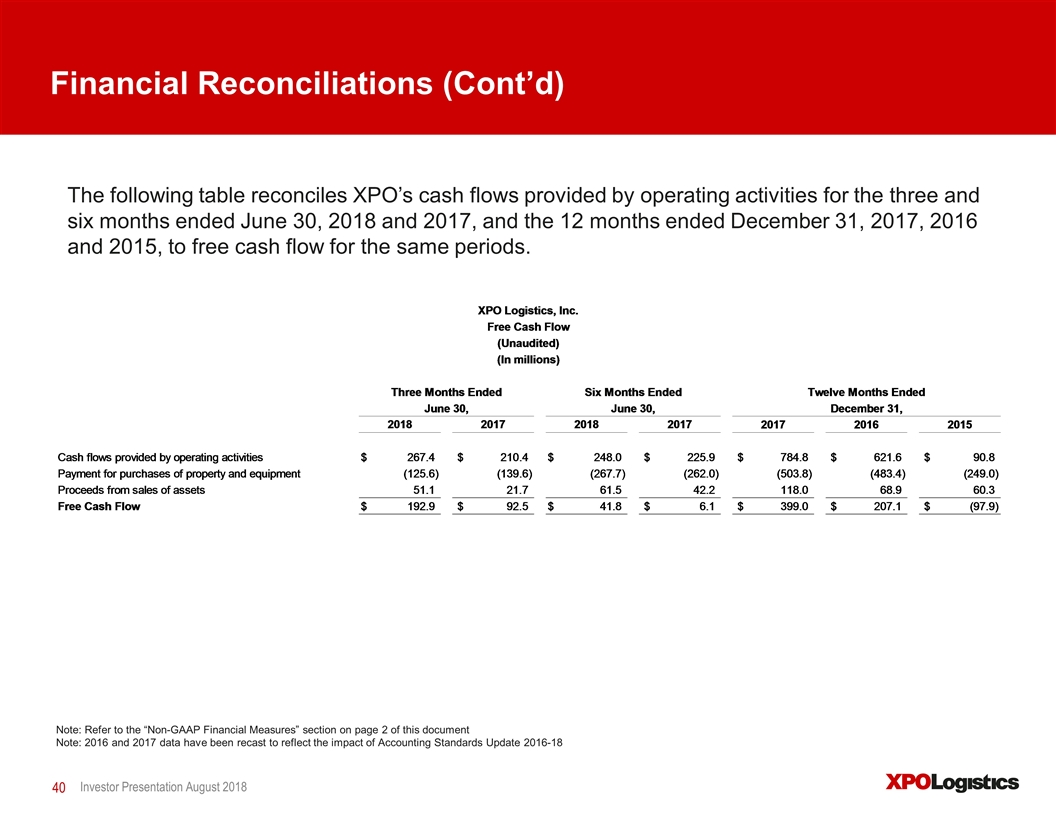

Cash flow from operations was $267.4 million, and free cash flow was $192.9 million. This is in line with our expectation of generating approximately $625 million of free cash flow this year.

We’ve reaffirmed both targets in our outlook: adjusted EBITDA of at least $1.6 billion for full year 2018, and 2017–2018 cumulative free cash flow of approximately $1 billion.

High Growth and High Returns

In summary, our strategy is working. We’re continuing to execute for high growth and high returns from a position of considerable operational and financial strength.

XPO is on the radar in every industry that requires transportation or logistics. Our ability to drive efficiencies through technology in so many parts of the supply chain clearly resonates with customers. While this is particularly true in the e-commerce sector, we work closely with all types of companies to look at the entire supply chain, from sourcing to the end-customer. Our collaborative approach and our proprietary technology are major reasons why 67% of Fortune 100 companies use XPO.

| 1 | Reconciliations of non-GAAP financial measures used in this document are provided in the accompanying slide presentation. |

11

The disciplined investments we’re making in the business this year — in technology, sales, workforce productivity, logistics infrastructure, XPO Direct and other areas — are designed to propel long-term growth and returns in any economy. Our goal is always to help our customers operate more efficiently and reduce their costs: that’s the path to shareholder value. We make these investments with confidence because we have a deep bench of seasoned operators who know how to achieve results.

Looking forward, we expect our 2018 performance to once again outpace the industry and deliver at least 17% adjusted EBITDA growth. Our sales organization is much larger and more integrated than it was a year ago, with more market data available. We just closed a record $2.1 billion of new business in the first six months, and our sales pipeline stands at a robust $3.4 billion. We also have initiatives underway around the globe to continuously improve our cost structure. For example, our centralized procurement team has already achieved an annual run rate of $160 million in savings.

In 2016, we made the Fortune 500 list for the first time. One year later, we were ranked as the fastest-growing transportation company on the list. This year, Fortune named XPO one of the world’s most admired companies. Forbes has ranked us as the top-performing U.S. company on the Global 2000 and one of America’s best employers. In Italy, we were awarded Logistics Company of the Year for innovation and safety. These are all important achievements — but we’re most proud of two achievements that speak directly to our promise to stakeholders: our efforts, together with a favorable stock market, made XPO the best-performing stock of 2017 in the transportation universe. And for the sixth straight year, we delivered results that met or exceeded our financial targets.

As we move through 2018, we have a thirst to create even more value for our customers and our shareholders. We grew XPO into a global leader in four years, primarily through acquisitions, then took the time to ensure that we have the best operators in place, with a motivated workforce, a culture of accountability and meticulous growth plans for each line of business.

We’re growing organically faster than the market, and we’re growing profitability faster than revenue. Now we’re looking at M&A as a way to augment our momentum. With all the positive news we have to report, we still see the vast majority of our opportunity ahead.

Thank you for your interest!

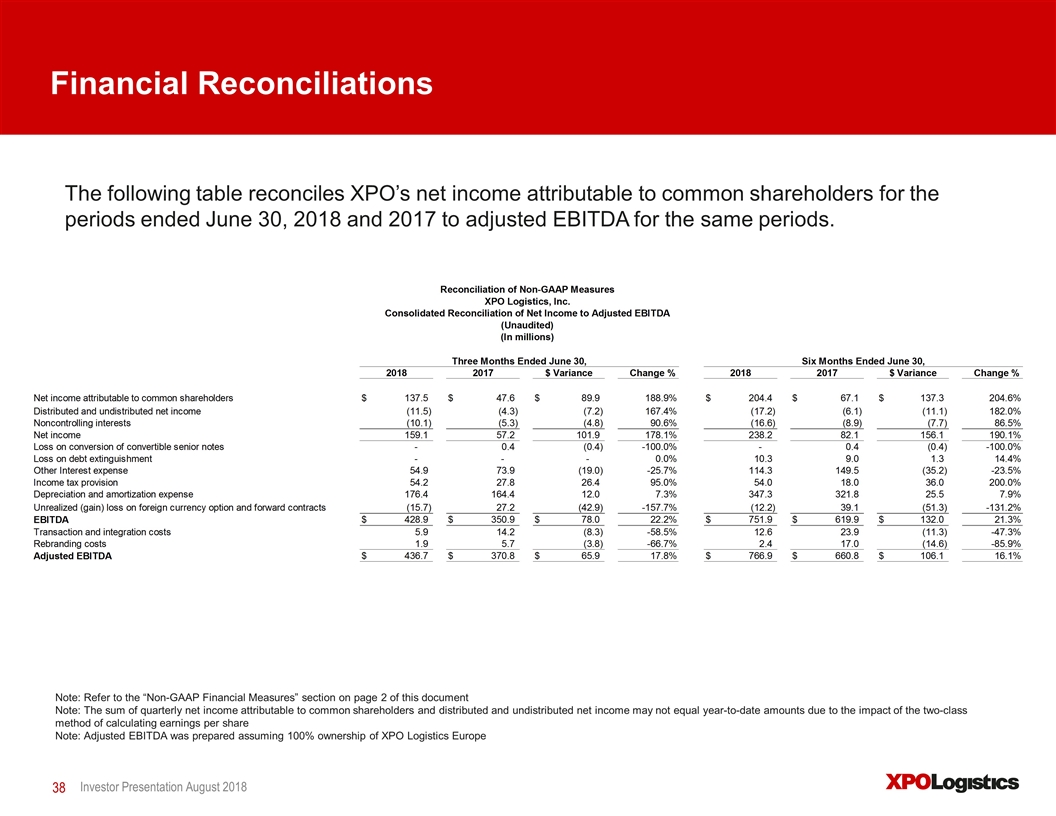

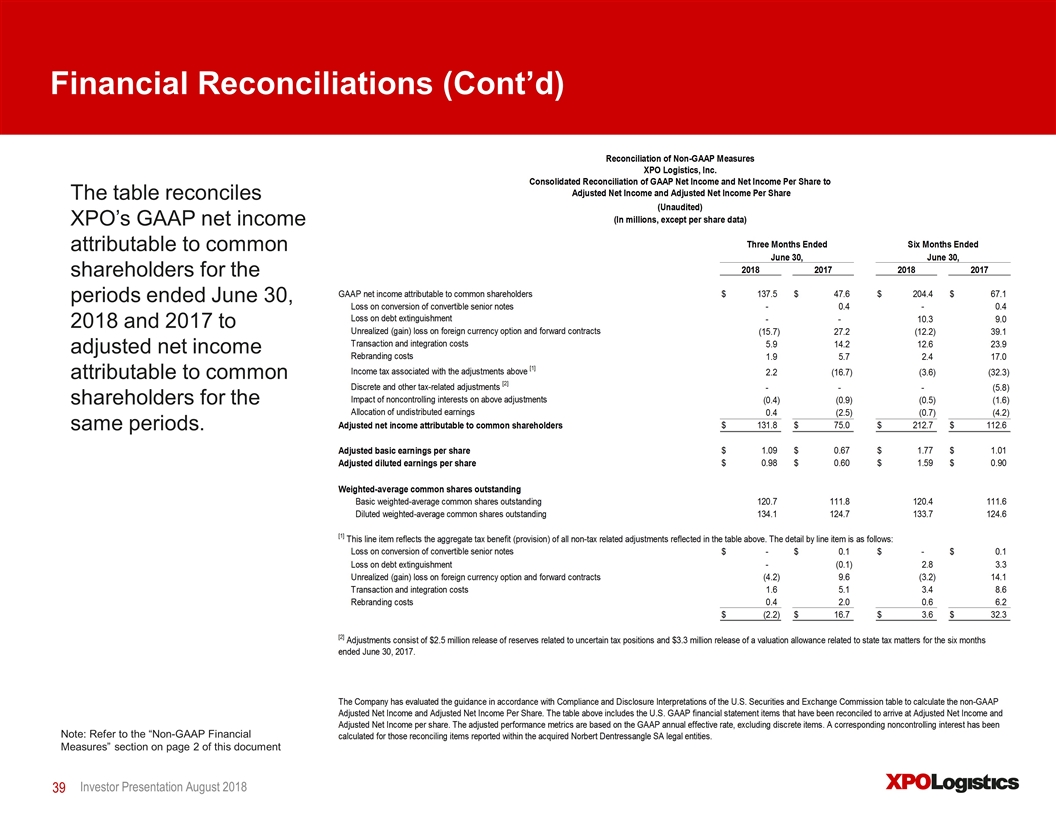

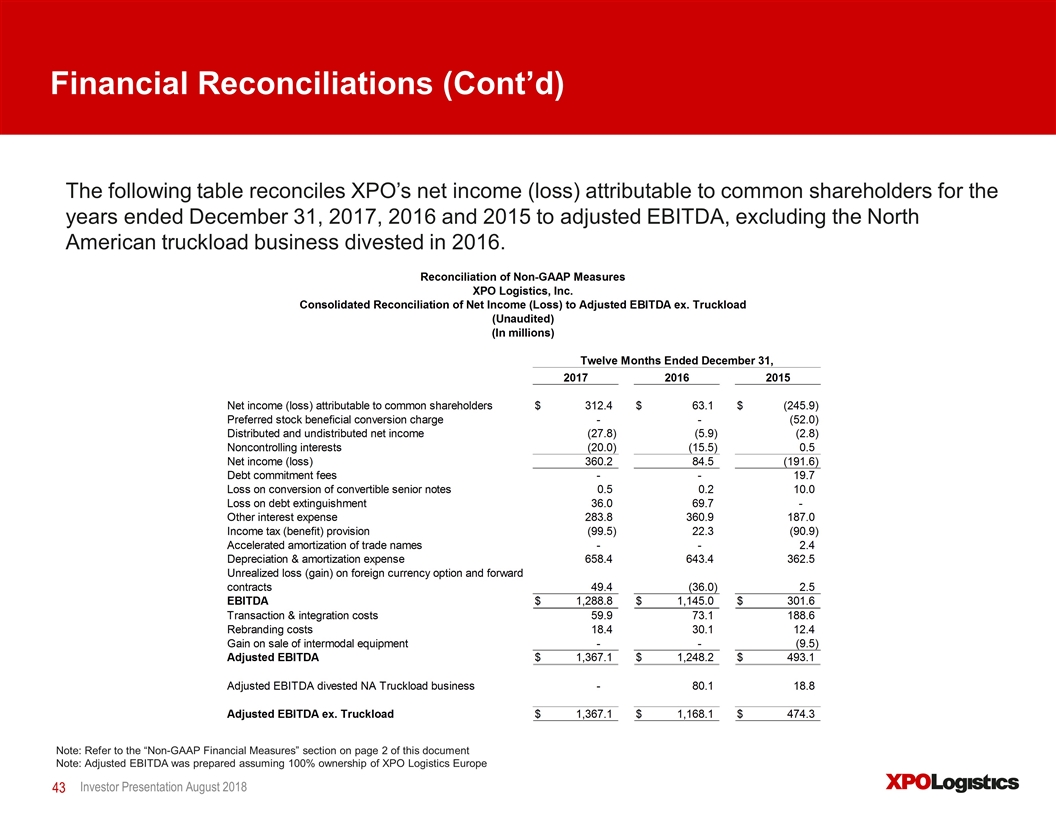

Non-GAAP Financial Measures

As required by the rules of the Securities and Exchange Commission (“SEC”), we provide reconciliations of the non-GAAP financial measures contained in this document to the most directly comparable measure under GAAP, which are set forth in the financial tables attached to the accompanying slide presentation. This document contains the following non-GAAP financial measures: earnings before interest, taxes, depreciation and amortization (“EBITDA”) and adjusted EBITDA; free cash flow; adjusted net income attributable to common shareholders and adjusted earnings per share (basic and diluted) (“adjusted EPS”); net revenue; adjusted operating income for our North American less-than-truckload business; and organic revenue.

12

We believe that the above adjusted financial measures facilitate analysis of our ongoing business operations because they exclude items that may not be reflective of, or are unrelated to, XPO and its business segments’ core operating performance, and may assist investors with comparisons to prior periods and assessing trends in our underlying businesses. Other companies may calculate these non-GAAP financial measures differently, and therefore our measures may not be comparable to similarly titled measures of other companies. Items excluded from such non-GAAP financial measures are significant and necessary components of the operations of our business, and, therefore, such measures should only be used as supplemental measures of our operating performance.

Adjusted EBITDA, adjusted net income attributable to common shareholders and adjusted EPS include adjustments for acquisition costs and related integration, transformation and rebranding initiatives. Transaction and integration adjustments are generally incremental costs that result from an actual or planned acquisition and include transaction costs, restructuring costs, acquisition and integration consulting fees, internal salaries and wages (to the extent the individuals are assigned full-time to integration and transformation activities) and certain costs related to integrating and converging IT systems. Rebranding adjustments primarily relate to the rebranding of the XPO Logistics name on our truck fleet and buildings. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and evaluating XPO’s and each business segment’s ongoing performance.

We believe that free cash flow is an important measure of our ability to repay maturing debt or fund other uses of capital that we believe will enhance stockholder value. We believe that EBITDA and adjusted EBITDA improve comparability from period to period by removing the impact of our capital structure (interest and financing expenses), asset base (depreciation and amortization), tax impacts and other adjustments as set out in the attached tables that management has determined are not reflective of normalized operating activities.

We believe that adjusted net income attributable to common shareholders and adjusted EPS improve the comparability of our operating results from period to period by removing the impact of certain costs and gains that management has determined are not reflective of our core operating activities. We believe that net revenue improves the comparability of our operating results from period to period by removing the cost of transportation and services, in particular the cost of fuel, incurred in the reporting period as set out in the attached tables. We believe that adjusted operating income for our North American less-than-truckload business improves the comparability of our operating results from period to period by removing the impact of certain transaction, integration and rebranding costs and amortization and depreciation expenses incurred in the reporting period as set out in the attached tables. We believe that organic revenue is an important measure because it excludes the impact of the following items: foreign currency exchange rate fluctuations and fuel surcharges.

With respect to our 2018 financial target of adjusted EBITDA and our 2017-2018 cumulative target for free cash flow, each of which is a non-GAAP measure, a reconciliation of the non-GAAP measure to the corresponding GAAP measure is not available without unreasonable effort due to the variability and complexity of the reconciling items described below that we exclude from the non-GAAP target measure. The variability of these items may have a significant impact on our future GAAP financial results and, as a result, we are unable to prepare the forward-looking balance sheet, statement of income and statement of cash flow, prepared in accordance with GAAP that would be required to produce such a reconciliation.

13

Forward-looking Statements

This document includes forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including our financial targets. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. In some cases, forward-looking statements can be identified by the use of forward-looking terms such as “anticipate,” “estimate,” “believe,” “continue,” “could,” “intend,” “may,” “plan,” “potential,” “predict,” “should,” “will,” “expect,” “objective,” “projection,” “forecast,” “goal,” “guidance,” “outlook,” “effort,” “target,” “trajectory” or the negative of these terms or other comparable terms. However, the absence of these words does not mean that the statements are not forward-looking. These forward-looking statements are based on certain assumptions and analyses made by us in light of our experience and our perception of historical trends, current conditions and expected future developments, as well as other factors we believe are appropriate in the circumstances.

These forward-looking statements are subject to known and unknown risks, uncertainties and assumptions that may cause actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by such forward-looking statements. Factors that might cause or contribute to a material difference include the risks discussed in our filings with the SEC and the following: economic conditions generally; competition and pricing pressures; our ability to align our investments in capital assets, including equipment, service centers and warehouses, to our customers’ demands; our ability to successfully integrate and realize anticipated synergies, cost savings and profit improvement opportunities with respect to acquired companies; our ability to develop and implement suitable information technology systems and prevent failures in or breaches of such systems; our substantial indebtedness; our ability to raise debt and equity capital; our ability to maintain positive relationships with our network of third-party transportation providers; our ability to attract and retain qualified drivers; litigation, including litigation related to alleged misclassification of independent contractors; labor matters, including our ability to manage our subcontractors, and risks associated with labor disputes at our customers and efforts by labor organizations to organize our employees; risks associated with our self-insured claims; risks associated with defined benefit plans for our current and former employees; fluctuations in currency exchange rates; fluctuations in fixed and floating interest rates; our ability to execute our growth strategy through acquisitions; fuel price and fuel surcharge changes; issues related to our intellectual property rights; governmental regulation, including trade compliance laws; and governmental or political actions, including the United Kingdom’s likely exit from the European Union. All forward-looking statements set forth in this document are qualified by these cautionary statements and there can be no assurance that the actual results or developments anticipated by us will be realized or, even if substantially realized, that they will have the expected consequences to or effects on us or our business or operations. Forward-looking statements set forth in this document speak only as of the date hereof, and we do not undertake any obligation to update forward-looking statements to reflect subsequent events or circumstances, changes in expectations or the occurrence of unanticipated events, except to the extent required by law.

14