ANNUAL

INFORMATION FORM

FOR THE

YEAR ENDED DECEMBER 31, 2018

This annual information form

(“AIF”) is as of March 29, 2019

| Item 1. |

|

Table of Contents |

| |

|

|

Page |

| Item

1. |

|

Table

Of Contents |

2 |

| |

|

|

|

| Item

2. |

|

Preliminary

Notes |

3 |

| |

|

|

|

| Item

3. |

|

Corporate

Structure |

11 |

| |

|

|

|

| Item

4. |

|

General

Development Of The Business |

11 |

| |

|

|

|

| Item

5. |

|

Description

Of Business |

14 |

| |

|

|

|

| Item

6. |

|

Dividends |

38 |

| |

|

|

|

| Item

7. |

|

Description

Of Capital Structure |

38 |

| |

|

|

|

| Item

8. |

|

Market

For Securities |

38 |

| |

|

|

|

| Item

9. |

|

Escrowed

Securities |

39 |

| |

|

|

|

| Item

10 |

|

Directors

And Officers |

40 |

| |

|

|

|

| Item

11. |

|

Promoters |

47 |

| |

|

|

|

| Item

12. |

|

Legal

Proceedings |

47 |

| |

|

|

|

| Item

13. |

|

Interest

Of Management And Others In Material Transactions |

48 |

| |

|

|

|

| Item

14. |

|

Transfer

Agent And Registrar |

49 |

| |

|

|

|

| Item

15. |

|

Material

Contracts |

49 |

| |

|

|

|

| Item

16. |

|

Interests

Of Experts |

49 |

| |

|

|

|

| Item

17. |

|

Additional

Information |

49 |

| |

|

|

|

| Item

18. |

|

Disclosure

For Companies Not Sending Information Circulars |

50 |

| |

|

|

|

| Item

19. |

|

Audit

And Risk Committee, Auditor Fees, Exemptions, Code Of Ethics |

50 |

| |

|

|

|

| Appendix

A - Audit And Risk Committee Charter |

53 |

| Item

2. |

|

Preliminary Notes |

This AIF

contains “forward-looking information” within the meaning of applicable Canadian securities legislation. Wherever

possible, words such as “plans”, “expects”, or “does not expect”, “budget”, “scheduled”,

“estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”,

“intend” and similar expressions or statements that certain actions, events or results “may”, “could”,

“would”, “might” or “will” be taken, occur or be achieved, have been used to identify forward-looking

information.

Forward-looking

information in this AIF include, without limitation, statements regarding:

| • |

our

ability to obtain the federal and state permits that we will be required to obtain for the Pebble Project under the Clean

Water Act (“CWA”) and the National Environmental Policy Act (“NEPA”); |

| |

|

| • |

our

expectations regarding the potential for securing the necessary permitting of a mine at the Pebble Project and our ability

to establish that such a permitted mine can be economically developed; |

| |

|

| • |

our

plan of operations, including our plans to carry out and finance exploration and development activities; |

| |

|

| • |

our ability to raise

capital, including our plans to carry out and finance exploration and development activities and working capital; |

| |

|

| • |

our

expected financial performance in future periods; |

| |

|

| • |

our

expectations regarding the exploration and development potential of the Pebble Project; |

| |

|

| • |

the

outcome of any legal proceedings in which we are engaged; and |

| |

|

| • |

factors

relating to our investment decisions. |

Forward-looking

information is based on the reasonable assumptions, estimates, analysis and opinions of management made in light of its experience

and its perception of trends, current conditions and expected developments, as well as other factors that management believes

to be relevant and reasonable in the circumstances at the date that such statements are made, but which may prove to be incorrect.

We believe that the assumptions and expectations reflected in such forward-looking information are reasonable.

Key assumptions

upon which the Company’s forward-looking information are based include:

| • |

that

we will be able to secure sufficient capital necessary for continued environmental assessment and permitting activities and

engineering work which must be completed prior to any potential development of the Pebble Project which would then require

engineering and financing in order to advance to ultimate construction; |

| |

|

| • |

that

we will ultimately be able to demonstrate that a mine at the Pebble Project can be economically developed and operated in

an environmentally sound and socially responsible manner, meeting all relevant federal, state and local regulatory requirements

so that we will be ultimately able to obtain permits authorizing construction of a mine at the Pebble Project; |

| |

|

| • |

that

the market prices of copper, gold, molybdenum and silver will not decline significantly or stay depressed for a lengthy period

of time; |

| |

|

| • |

that

key personnel will continue their employment with us; and |

| |

|

| • |

that

we will continue to be able to secure minimum adequate financing on acceptable terms. |

Readers

are cautioned that the foregoing list is not exhaustive of all factors and assumptions, which may have been used. Forward looking

statements are also subject to risks and uncertainties facing our business, any of which could have a material impact on our outlook.

| 2018

Annual Information Form | Page |

1 | |

Some of

the risks and uncertainties that could cause actual results to differ materially from those expressed in the forward-looking statements

include:

| • |

an

inability to ultimately obtain permitting for a mine at the Pebble Project; |

| |

|

| • |

an

inability to establish that the Pebble Project may be economically developed and mined or contain commercially viable deposits

of ore based on a mine plan for which government authorities are prepared to grant permits; |

| |

|

| • |

an

inability to complete a partnering transaction on terms satisfactory to the Company; |

| |

|

| • |

an

inability to continue to fund exploration and development activities and other operating costs; |

| |

|

| • |

the

highly cyclical and speculative nature of the mineral resource exploration business; |

| |

|

| • |

the

pre-development stage economic viability and technical uncertainties of the Pebble Project and the lack of known reserves

on the Pebble Project; |

| |

|

| • |

an

inability to recover even the financial statement carrying values of the Pebble Project if we cease to continue on a going

concern basis; |

| |

|

| • |

the

potential for loss of the services of key executive officers; |

| |

|

| • |

a

history of, and expectation of further, financial losses from operations impacting our ability to continue on a going concern

basis; |

| |

|

| • |

inability

to establish that the Pebble Project contains commercially viable deposits of ore; |

| |

|

| • |

the

volatility of gold, copper, molybdenum and silver prices and the share prices of mining companies; |

| |

|

| • |

the

inherent risk involved in the exploration, development and production of minerals, and the presence of unknown geological

and other physical and environmental hazards at the Pebble Project; |

| |

|

| • |

the

potential for changes in, or the introduction of new, government regulations relating to mining, including laws and regulations

relating to the protection of the environment and project legal titles; |

| |

|

| • |

potential

claims by third parties to titles or rights involving the Pebble Project; |

| |

|

| • |

the

uncertainty of the outcome of current or future litigation; |

| |

|

| • |

the

possible inability to insure our operations against all risks; |

| |

|

| • |

the

highly competitive nature of the mining business; |

| |

|

| • |

our

ability to obtain funding for working capital and other purposes; |

| |

|

| • |

the

potential equity dilution to current shareholders due to any future equity financings or from the exercise of share purchase

options and warrants to purchase the Company’s shares; |

| |

|

| • |

the

potential dilution to current shareholders from the exercise of share purchase options to purchase the Company’s shares;

and |

| |

|

| • |

that

we have never paid dividends and will not do so in the foreseeable future. |

This list

is not exhaustive of the factors that may affect any of the Company’s forward-looking statements or information. Forward-looking

statements or information are statements about the future and are inherently uncertain, and actual achievements of the Company

or other future events or conditions may differ materially from those reflected in the forward-looking statements or information

due to a variety of risks, uncertainties and other factors, including, without limitation, the risks and uncertainties described

above. See “Risk Factors” on page 31.

Our forward-looking

statements are based on the reasonable beliefs, expectations and opinions of management on the date of this AIF. Although we have

attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking

information, there may be other factors that cause results not to be as anticipated, estimated or intended. There is no assurance

that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated

in such information. Accordingly, readers should appreciate the inherent uncertainty of, and not place undue reliance on, forward-looking

information. We do not undertake to update any forward-looking information, except as, and to the extent required by, applicable

securities laws.

| 2018

Annual Information Form | Page |

2 | |

Incorporation of Continuous

Disclosure Documents by Reference

In this

AIF, the “Company” or “Northern Dynasty” refers to Northern Dynasty Minerals Ltd. and all its subsidiaries

and affiliated partnerships together unless the context states otherwise.

The AIF

incorporates by reference a technical report prepared pursuant to National Instrument 43-101, Standards of Disclosure for Mineral

Projects (“NI 43-101”) effective date December 2017, copies of which are available on request from the offices of

Northern Dynasty or by downloading from the SEDAR website under the Company’s profile at www.sedar.com.

Currency and Metric Equivalents

All dollar

amounts are expressed in Canadian dollars unless otherwise indicated. The Company’s accounts are maintained in Canadian

dollars. The daily rate of exchange on December 31, 2018, as reported by the Bank of Canada for the conversion of one Canadian

dollar into one United States dollar (“U.S. dollar”), was $1.3642.

Currency

and Exchange Rates

On March 29, 2019, the

rate of exchange of the Canadian Dollar, based on the daily rate in Canada as published by the Bank of Canada, was US$1.00 = $1.3363.

Exchange rates published by the Bank of Canada, available on its website www.bankofcanada.ca, are

nominal quotations - not buying or selling rates - and intended for statistical or analytical purposes.

The following

tables set out the exchange rates, based on the daily rates in Canada as published by the Bank of Canada for the conversion of

Canadian Dollars into U.S. dollars.

| |

Year

Ended December 31

(Canadian

Dollars per U.S. Dollar) |

| |

2018 |

2017 |

2016

1 |

2015

1 |

| Rate at end of

year |

$1.3642 |

$1.2545 |

$1.3427 |

$1.3840 |

| Average rate for

year |

$1.2957 |

$1.2986 |

$1.3248 |

$1.2787 |

| High for year |

$1.3642 |

$1.3743 |

$1.4589 |

$1.3990 |

| Low

for year |

$1.2288 |

$1.2128 |

$1.2544 |

$1.1728 |

| 1. | Based

on the daily noon rate which is no longer published by the Bank of Canada. |

| Monthly

High and Low Daily Exchange Rate (Canadian Dollar per U.S. Dollar) |

| Month

or Period |

High |

Low |

| March 2019 (to March 29, 2019) |

$1.3438 |

$1.3260 |

| February 2019 |

$1.3298 |

$1.3095 |

| January 2019 |

$1.3600 |

$1.3144 |

| December 2018 |

$1.3642 |

$1.3191 |

| November

2018 |

$1.3302 |

$1.3088 |

| 2018

Annual Information Form | Page |

3 | |

For ease

of reference, the following factors for converting metric measurements into Imperial equivalents are as follows:

| Metric

Units |

Multiply

by |

Imperial

Units |

| hectares |

2.471 |

=

acres |

| metres |

3.281 |

=

feet |

| kilometres |

0.621 |

=

miles (5,280 feet) |

| grams |

0.032 |

=

ounces (troy) |

| tonnes |

1.102 |

=

tons (short) (2,000 pounds) |

| grams/tonne |

0.029 |

=

ounces (troy)/ton |

Glossary

In this AIF

the following terms have the meanings set forth herein:

| Term |

Meaning |

| Alkalic |

Igneous

rock containing a relatively high percentage of sodium and potassium feldspar; alteration can also introduce alkali minerals. |

| Argillic |

Hydrothermal

alteration of wall rock that forms clay minerals including kaolinite, smectite, illite and other species. |

| CuEQ |

Copper

Equivalent |

| Comminution |

Reduction

of solid materials from one average particle size to a smaller average particle size by crushing, grinding, cutting, vibrating,

or other means. |

| Deportment |

Assessment

of how minerals contribute to grade, as each mineral is likely to behave differently to comminution, flotation or leaching. |

| Diorite |

Grey

to dark-grey igneous intrusive rock of intermediate composition, composed principally of plagioclase feldspar along with biotite,

hornblende and/or pyroxene. |

| Element

Abbreviations |

Au

- Gold; Ag - Silver; Al - Aluminum; Cu - Copper; Fe - Iron; Mo - Molybdenum; Na - Sodium; O - Oxygen; Pb - Lead; S - Sulphur;

Zn - Zinc. |

| Geometallurgy |

Practice

of combining geology and/or geostatistics with metallurgy. |

| Graben |

Down-dropped

block of land bordered by faults. |

| Granodiorite |

Medium-

to coarse-grained acid igneous rock with quartz (>20%), plagioclase and alkali feldspar, commonly with minor hornblende

and/or biotite. |

| Hypogene |

Processes

below the earth’s surface which, in mineral deposits, result in precipitation of primary minerals like sulphides. |

| Hydrothermal

mineral deposit |

Any

concentration of metallic minerals formed by the precipitation of solids from hot waters (hydrothermal solution). The solutions

may be sourced from a magma or from deeply circulating water heated by magma. |

| Illite

Pyrite |

Alteration

zone with significant amounts of illite – a clay mineral and pyrite – an iron sulphide mineral. |

Intrusion

(batholith, dyke, pluton) |

Medium

to coarse grained igneous bodies that crystallized at depth within the Earth’s crust. Large intrusive bodies are called

batholiths; smaller bodies are plutons and linear bodies are dykes. |

| Leached

Cap |

Rock

that originally contained mineralization that was subsequently removed due to weathering processes. |

| 2018

Annual Information Form | Page |

4 | |

| Term |

Meaning |

| Locked

Cycle Test |

A

repetitive batch flotation test used in mineral processing laboratories while developing a metallurgical flowsheet. |

| Monzonite |

Igneous

intrusive rock with approximately equal amounts of plagioclase and alkali feldspar, and less than 5% quartz by volume. |

| National

Instrument 43-101 (“NI 43-101”) |

The

Canadian securities instrument which establishes disclosure standards for mineral projects of Canadian publicly-traded resource

companies. |

| K

Silicate |

Alteration

zone with significant potassium (K) bearing silicate minerals. |

| Kriging |

A

method of estimation of a variable value (such as metal grade) at an unmeasured location from measured values, weighted by

distance and orientation, at nearby locations. |

| Porphyry

deposit |

A

type of mineral deposit genetically related to igneous intrusions in which ore minerals are widely distributed, generally

of low grade but commonly of large tonnage. |

| Potassic |

Hydrothermal

alteration that results in the production of potassium-bearing minerals such as biotite, muscovite or sericite, and/or orthoclase. |

| Preliminary

Economic Assessment |

A

study that includes an economic analysis of the potential viability of mineral resources but that does not meet the definition

of either a “pre-feasibility study” or a “feasibility study”, as such terms are defined under CIM

Definitions below. It is a term defined under NI 43-101. |

| Pyrophyllite |

Aluminosilicate

hydroxide mineral that forms as a result of hydrothermal alteration or low grade metamorphism. |

| QSP |

Quartz

Sericite Pyrite; an alteration zone. |

| Sericite |

Alteration

zone with significant sericite, a fine-grained version of the mica mineral muscovite. |

| Sodic

Potassic |

Alteration

zone with significant sodium (Na) and potassium (K) bearing minerals |

| Sodic |

In

this report, refers to a type of hydrothermal alteration that contains sodium-bearing minerals, most commonly albite feldspar.

|

| Subduction |

Process

by which one tectonic plate moves under another tectonic plate. |

| Supergene |

Refers

to processes that occur relatively near the surface of the earth which modify or destroy original (hypogene) minerals by oxidation

and chemical weathering. |

| Superterrane |

A

group of physically connected and related geological terranes (group of related rock units). |

Canadian Mineral Property

Disclosure Standards and Resource Estimates

The discussion

of mineral deposit classifications in this AIF uses the certain technical terms presented below as they are defined in accordance

with the CIM Definition Standards on mineral resources and reserves (the “CIM Definition Standards”) adopted

by the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM Council”), as required by NI 43-101.

The following definitions are reproduced from the latest version of the CIM Standards, which were adopted by the CIM Council on

May 10, 2014 (the “CIM Definitions”). Estimated mineral resources fall into two broad categories dependent

on whether the economic viability of them has been established and these are namely “resources” (potential for economic

viability) and “reserves” (viable economic production is feasible). Resources are sub-divided into categories depending

on the confidence level of the estimate based on level of detail of sampling and geological understanding of the deposit. The

categories, from lowest confidence to highest confidence, are inferred resource, indicated resource and measured resource. The

Company does not claim to have any reserves at this time. The CIM definitions are as follows:

| 2018

Annual Information Form | Page |

5 | |

| Term |

Definition |

| Mineral

Resource |

A

concentration or occurrence of solid material of economic interest in or on the Earth’s crust in such form, grade or

quality and quantity that there are reasonable prospects for eventual economic extraction. The location, quantity, grade or

quality, continuity and other geological characteristics of a mineral resource are known, estimated or interpreted from specific

geological evidence and knowledge, including sampling. |

| Measured

Mineral Resource |

That

part of a mineral resource for which quantity, grade or quality, densities, shape, and physical characteristics are estimated

with confidence sufficient to allow the application of modifying factors to support detailed mine planning and final evaluation

of the economic viability of the deposit. Geological evidence is derived from detailed and reliable exploration, sampling

and testing and is sufficient to confirm geological and grade or quality continuity between points of observation. A measured

mineral resource has a higher level of confidence than that applying to either an Indicated mineral resource or an inferred

mineral resource. It may be converted to a proven mineral reserve or to a probable mineral reserve. |

| Indicated

Mineral Resource |

That

part of a mineral resource for which quantity, grade or quality, densities, shape and physical characteristics are estimated

with sufficient confidence to allow the application of modifying factors in sufficient detail to support mine planning and

evaluation of the economic viability of the deposit. Geological evidence is derived from adequately detailed and reliable

exploration, sampling and testing and is sufficient to assume geological and grade or quality continuity between points of

observation. An indicated mineral resource has a lower level of confidence than that applying to a measured mineral resource

and may only be converted to a probable mineral reserve. |

| Inferred

Mineral Resource |

That

part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence

and sampling. Geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred

mineral resource has a lower level of confidence than that applying to an indicated mineral resource and may not be converted

to a mineral reserve. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated

mineral resources with continued exploration. |

| Mineral

Reserve |

The

economically mineable part of a measured and/or indicated mineral resource. It includes diluting materials and allowances

for losses, which may occur when the material is mined or extracted and is defined by studies at pre-feasibility or feasibility

level as appropriate that include application of modifying factors. Such studies demonstrate that, at the time of reporting,

extraction could reasonably be justified. The reference point at which mineral reserves are defined, usually the point where

the ore is delivered to the processing plant, must be stated. It is important that, in all situations where the reference

point is different, such as for a saleable product, a clarifying statement is included to ensure that the reader is fully

informed as to what is being reported. The public disclosure of a mineral reserve must be demonstrated by a pre-feasibility

study or feasibility study. |

| 2018

Annual Information Form | Page |

6 | |

| Term |

Meaning |

| Proven

Mineral Reserve |

The

economically mineable part of a measured mineral resource. A proven mineral reserve implies a high degree of confidence in

the modifying factors. |

| Probable

Mineral Reserve |

The

economically mineable part of an indicated, and in some circumstances, a measured mineral resource. The confidence in the

modifying factors applying to a probable mineral reserve is lower than that applying to a proven mineral reserve. |

| Modifying

Factors |

Considerations

used to convert mineral resources to mineral reserves. These include, but are not restricted to, mining, processing, metallurgical,

infrastructure, economic, marketing, legal, environmental, social and governmental factors. |

| Feasibility

Study |

A

comprehensive technical and economic study of the selected development option for a mineral project that includes appropriately

detailed assessments of applicable modifying factors together with any other relevant operational factors and detailed financial

analysis that are necessary to demonstrate, at the time of reporting, that extraction is reasonably justified (economically

mineable). The results of the study may reasonably serve as the basis for a final decision by a proponent or financial institution

to proceed with, or finance, the development of the project. The confidence level of the study will be higher than that of

a pre-feasibility study. |

| Pre-feasibility

Study |

A

comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced

to a stage where a preferred mining method, in the case of underground mining, or the pit configuration, in the case of an

open pit, is established and an effective method of mineral processing is determined. It includes a financial analysis based

on reasonable assumptions on the modifying factors and the evaluation of any other relevant factors which are sufficient for

a qualified person, acting reasonably, to determine if all or part of the mineral resource may be converted to a mineral reserve

at the time of reporting. A pre-feasibility study is at a lower confidence level than a feasibility study. |

Cautionary Notes to United

States Investors Concerning Canadian Mineral Property Disclosure Standards

As a Canadian issuer, we are

required to comply with reporting standards in Canada that require that we make disclosure regarding our mineral properties, including

any estimates of mineral reserves and resources, in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities

Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning

mineral projects. In accordance with NI 43-101, the Company uses the terms mineral reserves and resources as they are defined

in accordance with the CIM Definition Standards on mineral reserves and resources adopted by the Canadian Institute of Mining,

Metallurgy and Petroleum.

The United States Securities

and Exchange Commission (the “SEC”) has adopted amendments to its disclosure rules to modernize the mineral property

disclosure requirements for issuers whose securities are registered with the SEC under the US Exchange Act, effective February

25, 2019 (the “SEC Modernization Rules”). The SEC Modernization Rules have replaced the historical property

disclosure requirements for mining registrants that were included in SEC Industry Guide 7 (“Guide 7”), which will

be rescinded upon expiry of a transition period.

The SEC

Modernization Rules include the adoption of definitions of the following terms, which are substantially similar to the corresponding

terms under the CIM Definition Standards that are presented above under “Canadian Mineral Property Disclosure Standards

and Resource Estimates”:

| • |

mineral

resource; |

| |

|

| • |

indicated

mineral resource; |

| |

|

| • |

inferred

mineral resource; |

| |

|

| • |

mineral

reserve; |

| |

|

| • |

proven

mineral reserve; |

| 2018

Annual Information Form | Page |

7 | |

| • |

probable

mineral reserve; |

| |

|

| • |

modifying

factors; |

| |

|

| • |

feasibility

study; and |

| |

|

| • |

preliminary

feasibility study (or “pre-feasibility study”). |

As a result

of the adoption of the SEC Modernization Rules, the SEC will now recognize estimates of “measured mineral resources”,

“indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions

of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to the corresponding

CIM Definitions.

We are

not required to provide disclosure on our mineral properties, including the Pebble Project, under the SEC Modernization Rules

as we are presently a “foreign issuer” under the US Exchange Act and entitled to file continuous disclosure reports

with the SEC under the MJDS between Canada and the United States. Accordingly, we anticipate that we will be entitled to continue

to provide disclosure on our mineral properties, including the Pebble Project, in accordance with NI 43-101 disclosure standards

and CIM Definition Standards. However, if we either cease to be a “foreign issuer” or cease to be entitled to file

reports under the MJDS, then we will be required to provide disclosure on our mineral properties under the SEC Modernization Rules.

Accordingly, United States investors are cautioned that the disclosure that we provide on our mineral properties, including the

Pebble Project, in the AIF and under our continuous disclosure obligations under the US Exchange Act may be different from the

disclosure that we would otherwise be required to provide as a US domestic issuer or a non-MJDS foreign issuer under the SEC Modernization

Rules.

United

States investors are cautioned that while the above terms are substantially similar to CIM Definitions, there are differences

in the definitions under the SEC Modernization Rules and the CIM Definition Standards. Accordingly, there is no assurance any

mineral resources that we may report as “measured mineral resources”, “indicated mineral resources” and

“inferred mineral resources” under NI 43-101 would be the same had we prepared the resource estimates under the standards

adopted under the SEC Modernization Rules.

United

States investors are also cautioned that while the SEC will now recognize “measured mineral resources”, “indicated

mineral resources” and “inferred mineral resources”, investors should not assume that any part or all of the

mineral deposits in these categories will ever be converted into a higher category of mineral resources or into mineral reserves.

Mineralization described by these terms has a great amount of uncertainty as to their existence, and great uncertainty as to their

economic and legal feasibility. Accordingly, investors are cautioned not to assume that any “measured mineral resources”,

“indicated mineral resources”, or “inferred mineral resources” that we report in this AIF are or will

be economically or legally mineable.

Further,

“inferred resources” have a great amount of uncertainty as to their existence and as to whether they can be mined

legally or economically. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred

resources exist. In accordance with Canadian securities laws, estimates of “inferred mineral resources” cannot form

the basis of feasibility or other economic studies, except in limited circumstances where permitted under NI 43-101.

For the

above reasons, information contained in this AIF and the documents incorporated by reference herein containing descriptions of

our mineral deposits may not be comparable to similar information made public by United States companies subject to the reporting

and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

| 2018

Annual Information Form | Page |

8 | |

| Item

3. |

|

Corporate Structure |

Northern

Dynasty is a mineral exploration company incorporated on May 11, 1983 pursuant to the Company Act of the Province of British Columbia

(predecessor statute to the British Columbia Corporations Act in force since 2004), under the name “Dynasty Resources Inc.”

On November 30, 1983, the Company changed its name to “Northern Dynasty Explorations Ltd.” and subsequently, on October

11, 1997, changed its name to Northern Dynasty Minerals Ltd. Northern Dynasty became a reporting company in the Province of British

Columbia on April 10, 1984 and was listed on the Vancouver Stock Exchange (now absorbed by the TSX Venture Exchange and herein

generally “TSX-V”) from 1984-1987, listed on the Toronto Stock Exchange (“TSX”) from 1987-1993, and delisted

from trading but continued to comply with its continuous disclosure obligations from 1993 to 1994, and thereafter listed on TSX-V

from 1994 to October 30, 2007 when it again began trading on the TSX. In November 2004, the common shares of Northern Dynasty

were also listed on the American Stock Exchange (“AMEX”). AMEX was purchased by the New York Stock Exchange (“NYSE”)

and the Company now trades on the NYSE American Exchange (“NYSE American”).

The head

office of Northern Dynasty is located at 1040 West Georgia Street, 15th floor, Vancouver, British Columbia, Canada V6E 4H1, telephone

(604) 684-6365, facsimile (604) 684-8092. The Company’s legal registered office is in care of its Canadian attorneys, McMillan

LLP, Barristers & Solicitors, at Suite 1500, 1055 West Georgia Street, Vancouver, British Columbia, Canada V6E 4N7, telephone

(604) 689-9111, facsimile (604) 685-7084.

The Company’s

Alaska mineral resource exploration business is operated through a wholly-owned Alaskan registered limited partnership, the Pebble

Limited Partnership (the “Pebble Partnership” or “PLP”), in which the Company owns a 100% interest in

the Pebble Partnership through an Alaskan general partnership, the Northern Dynasty Partnership, which is a partnership formed

by two of its subsidiaries. An indirectly wholly-owned subsidiary of the Company, Pebble Mines Corp. is the general partner of

the Pebble Partnership and responsible for its day-to-day operations. The business address of the Northern Dynasty Partnership

is Suite 505, 3201 C Street, Anchorage, Alaska, USA, 99503.

In this

AIF, a reference to the “Company” or “Northern Dynasty” includes a reference to PLP and the Company’s

wholly-owned subsidiaries and other consolidated interests and entities, unless the context clearly indicates otherwise. Certain

terms used herein are defined in the text and others are included in the glossary of this AIF.

| Item 4. | | General

Development of the Business |

Company Development

Northern

Dynasty is a mineral exploration company focused on the exploration and advancement towards feasibility, permitting and ultimately

development of the Pebble Project, a copper-gold-molybdenum mineral project located in southwest Alaska (the “Pebble

Project” or the “Project”). The Pebble Project is comprised of mineral claims that are held by subsidiaries

of the Pebble Partnership, a 100% wholly-owned subsidiary of Northern Dynasty.

Northern

Dynasty acquired a 100% interest the Pebble Project from an Alaskan subsidiary of Teck Resources Limited (“Teck”)

in a series of transactions from October 2001 through to June 2006. Teck has retained certain royalties in the Pebble Project,

as described in detail below under Item 5 – Description of Business.

The Pebble

Partnership was converted into a limited partnership in July 2007 in connection with a joint venture for the Pebble Project entered

into between the Company and an affiliate of Anglo American plc (“Anglo American”). From July 2007 to December 2013,

approximately US$573 million was provided to the Pebble Partnership by the affiliate of Anglo American, largely spent on exploration

programs, resource estimates, environmental data collection and technical studies, with a significant portion spent on engineering

of various possible mine development models and related infrastructure, power and transportation systems. The technical and engineering

studies that were completed relating to mine-site and infrastructure development are not considered to be current or necessarily

representative of management’s current understanding of the most likely development scenario for the Project. Accordingly,

the Company is uncertain whether it can realize significant value from this prior work. Environmental baseline studies and data,

as well as geological information from exploration, remain important information available to the Company from this period in

continuing its advancement of the Project.

| 2018

Annual Information Form | Page |

9 | |

Anglo American

withdrew from the Pebble Partnership effective December 10, 2013, and Northern Dynasty has since that time held a 100% interest

in the Pebble Partnership.

To December

31, 2018, approximately $887 million (US$814 million) in expenditures have been incurred on the Pebble Project. In addition, Northern

Dynasty has spent approximately $106 million in acquisition costs on the Pebble Project.

Northern

Dynasty does not have any operating revenue, although currently and historically it has had non-material annual interest revenue

as a consequence of investing its surplus funds.

Three Year History

The United

States Environmental Protection Agency (the “EPA”) announced the initiation of a regulatory action under CWA in February

2014 to consider restriction or a prohibition on mining activities associated with the Pebble deposit. From that time until May

2017, much of the Company’s efforts focused on providing information and responses to ward off this action, in particular,

advancing a Multi-dimensional Strategy to position the Pebble Project to initiate federal and state permitting under NEPA unencumbered

by any extraordinary development restrictions imposed by the federal agency. This strategy included three discrete pieces of litigation

against the EPA:

| • |

challenging

the EPA’s statutory authority to pre-emptively impose development restrictions at the Pebble Project under Section 404(c)

of the CWA prior to the Pebble Partnership submitting a proposed development plan for the project or the development of an

EIS under NEPA; |

| |

|

| • |

alleging

that the EPA violated Federal Advisory Committee Act in the course of undertaking the Bristol Bay Watershed Assessment

and subsequent Section 404(c) of the CWA regulatory action; and |

| |

|

| • |

alleging

that the EPA is unlawfully withholding relevant documentation and other information sought by the Pebble Partnership under

Freedom of Information Act. |

Other activities

by the Company during this period included maintaining an active corporate presence in Alaska to advance relationships with political

and regulatory offices of government (both in Alaska and Washington, D.C.), Alaska Native partners and broader stakeholder relationships;

maintaining the Pebble Project and Pebble claims in good standing; and seeking potential partner(s) to further advance the Pebble

Project.

The Multi-dimensional

Strategy was successful. On May 12, 2017, Northern Dynasty announced that the Pebble Partnership and the EPA (the “parties”)

had reached a settlement agreement (the “joint settlement agreement”) with respect to the parties’ longstanding

legal dispute over the pre-emptive regulatory action under the CWA. Under the terms of the joint settlement agreement:

| • |

the

EPA agreed the Pebble Project can proceed into normal course permitting under the CWA and NEPA and that it cannot seek to

utilize its authority under CWA 404(c) until such time as a final EIS has been completed by the US Army Corps of Engineers

(“USACE”) so long as that occurs within a period of four years following the settlement agreement, and the Pebble

Partnership files permit applications within 30 months of the date of the settlement agreement. EPA further agreed to initiate

a process to consider withdrawing the Proposed Determination it issued under CWA 404(c) in July 2014. In January 2018, EPA

announced that it had suspended the process to withdraw the preemptive regulatory action but will continue to support Pebble’s

due process rights and right to proceed with permitting as agreed to in the 2017 joint settlement agreement; and |

| |

|

| • |

the

Pebble Partnership agreed to terminate each of the legal actions it brought against EPA since 2014, including the action under

the Federal Advisory Committee Act; an action challenging EPA’s statutory authority under the CWA; and an action

under the Freedom of Information Act. |

| 2018

Annual Information Form | Page |

10 | |

A copy

of the joint settlement agreement is posted under the Company’s profile on SEDAR at www.sedar.com

and EDGAR at www.sec.gov.

The Pebble

Project has advanced significantly since the Pebble Partnership secured the legal settlement with the US EPA, enabling Pebble

to enter normal course permitting under NEPA:

| • |

On

December 22, 2017, the Pebble Partnership filed its 404 wetlands permit application under the CWA with the USACE, which was

“receipted” as complete by USACE on January 5, 2018; |

| |

|

| • |

On

February 5, 2018, USACE announced the appointment of AECOM – a leading global engineering firm – as third-party

contractor for the Environmental Impact Statement (“EIS”) process; |

| |

|

| • |

On

March 19, 2018, USACE published guidelines and timelines for completing NEPA permitting, and the associated EIS process; and |

| |

|

| • |

Between

April and August 2018, the Pebble Project was advanced through the Scoping Phase of the EIS process administered by the USACE;

|

| |

|

| • |

the

Scoping Document was released on August 31, 2018; and |

| |

|

| • |

On

February 20, 2019, USACE released the Draft EIS. USACE initiated a 90-day public comment period on the Draft EIS on March

1, 2019. |

In December

2017, Northern Dynasty and First Quantum Minerals Ltd. (the “parties”) entered into a framework agreement, which contemplated

that the parties would execute an option agreement whereby First Quantum could earn a 50% interest in the Pebble Partnership.

First Quantum also made a non-refundable early option payment of US$37.5 million to be applied solely for the purpose of progressing

permitting of the Pebble Project. On May 25, 2018, the Company announced that the parties had been unable to reach agreement on

the option and partnership transaction contemplated in the December 2017 framework agreement, and it was terminated in accordance

with its terms. Northern Dynasty continues its efforts to secure a partner for the project.

Northern

Dynasty has completed the following financings and/or raised funds within the past three years in order to fund its business operations:

| • |

in

June and July 2016, the Company completed a prospectus offering of 38,000,000 units and a private placement of 4,444,376 units

respectively, in the capital of the Company. The units were priced at $0.45 per unit and the Company raised aggregate gross

proceeds of approximately $19.1 million. Each Unit comprised of one common share and one common share purchase warrant (“Warrant”),

each Warrant exercisable into one common share of the Company at an exercise price of $0.65 per share until June 10, 2021.

The Warrants were listed and trade on the TSX under the symbol NDM.WT.B; |

| |

|

| • |

in

January 2017, the Company completed a bought deal offering of 20,240,000 common shares which includes the exercise in full

of the Underwriter’s over-allotment option, at price of US$1.85 per share for gross proceeds of approximately US$37.4

million; |

| |

|

| • |

in

December 2017, the Company received a non-refundable early option payment of US$37.5 million as a result of a framework

agreement with First Quantum, which was terminated in May 2018; |

| |

|

| • |

in

December 2018, the Company completed a private placement of 10,150,322 special warrants (the “Special Warrants”)

at a price of $0.83 (US$0.62) per Special Warrant for aggregate gross proceeds of approximately $8.4 million (US$6.3 million).

The Special Warrants converted into common shares on a one-for-one

basis without payment of any additional consideration on February 19, 2019; |

| |

|

| • |

in

March 2019, the Company completed two financings: |

| |

○ |

a

bought deal offering of 17,968,750 common shares at US$0.64 per common share for gross proceeds of US$11.5 million, which

included the exercise of an over-allotment option of 2,343,750 common shares for additional gross proceeds of US$1.5 million.

The offering was by way of a prospectus supplement to the Company’s existing Canadian base shelf prospectus and related

US registration statement on Form F-10 (SEC File No. 333-229262); and |

| |

|

|

| |

○ |

a

private placement of 3,769,476 common shares at $0.86 (US$0.64) per common share for gross proceeds of approximately $3.2

million (US$2.4 million). |

| 2018

Annual Information Form | Page |

11 | |

| Item

5. |

|

Description of

Business |

The Company’s

business is the exploration and advancement towards feasibility, permitting and ultimately development of the Pebble Project.

The

Pebble Project Is Subject To State and Federal Laws

The Pebble

Partnership and its subsidiaries are required to comply with all Alaska statutes in connection with the Pebble Project. These

statutes govern titles, operations, environmental, development, operating and generally all aspects of exploration and development

of a mine in Alaska.

Alaska

Statute 38.05.185 among others establishes the rights to mining claims and mineral leases on lands owned by the State of Alaska

and open to mineral entry. This group of statutes also covers annual labor and rental requirements, and royalties.

Operations

on claims or leases on state owned land must be permitted under a plan of operations as set out in Title 11 of the Alaska Administrative

Code, Chapter 86, Section 800. This regulation generally provides that the State Division of Mining can be the lead agency in

coordinating the comments of all agencies, which must consent to the issuance of a plan of operations, and sets the requirements

for the approval of a plan of operations.

Environmental

conditions are controlled by Alaska Statute 46.08 (which prohibits release of oil and hazardous substances), Alaska Statute 46.03.060

(which sets water quality standards), and Alaska Statute 46.14 (which sets air quality standards).

Once a

decision is made to enter permitting, the Pebble Project will be required to satisfy permitting requirements at three levels:

federal, state and local (borough). The process takes approximately 3-4 years to complete and involves 11 regulatory agencies,

60+ categories of permits and significant ongoing opportunities for public involvement. The Alaska Department of Natural Resources

Large Mine Permitting Team is responsible for coordinating permitting activities for large mine projects.

To satisfy

permitting requirements under NEPA and other regulatory statutes, a project must provide a comprehensive project design and operating

plan for mine-site and infrastructure facilities; documentation of development alternatives investigated; mitigation and compensation

strategies, and identification of residual effects; and environmental monitoring, reclamation and closure plans. The first step

is to provide the required information (including a Project Description and Environmental Baseline Document) for an EIS under

NEPA, prepared by a third-party contractor under the direction of a lead federal agency. The EIS will determine whether sufficient

evaluation of the project’s environmental effects and development alternatives has been undertaken. It will also provide

the basis for federal, state and local government agencies to make individual permitting decisions.

Under the CWA, Section 404(c),

the Administrator of the EPA is given the right to disallow the specification (including the withdrawal of specification) of any

defined area as a disposal site if he or she determines that the release of such material will have an unacceptable adverse effect

on municipal water supplies, local wildlife, spawning and breeding areas of fisheries, shellfish beds, and/or recreational areas.

Such decisions made by the Administrator require notice and opportunity for public hearings, and consultation with the Secretary

of the Army. The Administrator shall set forth in writing and make public his or her findings and reasons for making any

determination under this subsection.

| 2018

Annual Information Form | Page |

12 | |

The following

disclosure is mainly summarized from the “2018 Technical Report on the Pebble Project, Southwest Alaska, USA” by J.

David Gaunt, P.Geo., James Lang, P.Geo., Eric Titley, P.Geo., and Ting Lu, P.Eng., and Stephen Hodgson, PEng., effective date

December 22, 2017 (“2018 Technical Report”), and updated by Company staff. J. David Gaunt, P.Geo., James Lang, P.Geo.,

Eric Titley, P.Geo., Ting Lu, P.Eng., and Stephen Hodgson, PEng., are the qualified persons for the 2018 Technical Report and

have reviewed and approved the content derived from that report.

Introduction

The Pebble

deposit was originally discovered in 1989 and was acquired by Northern Dynasty in 2001. Since that time, Northern Dynasty and

subsequently the Pebble Limited Partnership (the “Pebble Partnership”, in which Northern Dynasty currently owns a

100% interest) have conducted significant mineral exploration, environmental baseline data collection, and engineering work on

the Pebble Project to advance it towards development.

Since the

acquisition by Northern Dynasty, work at Pebble has led to an overall expansion of the Pebble deposit, as well as the discovery

of several other mineralized occurrences along an extensive northeast-trending mineralized system underlying the property. Over

1 million feet of drilling has been completed on the property, a large proportion of which has been focused on the Pebble deposit.

Several estimates of the mineral resources have been made over that time; the previous estimate of the mineral resources in the

Pebble deposit was in 2014.

Comprehensive

deposit delineation, environmental, socioeconomic and engineering studies of the Pebble deposit began in 2004 and continued through

2013.

In February

2014, the EPA announced a pre-emptive regulatory action under the CWA to consider restriction or a prohibition of mining activities

associated with the Pebble deposit. From 2014-2017, Northern Dynasty and the Pebble Partnership focused on a multi-dimensional

strategy, including legal and other initiatives to ward off this action. On May 12, 2017, Northern Dynasty announced a settlement

agreement with EPA, clearing the way for Pebble to apply for a CWA 404 permit with the USACE. Section 404 of the CWA governs the

discharge of dredged or fill materials into waters of the US, including wetlands. The USACE issues Section 404 permits with oversight

by the EPA. Also, in light of stakeholder and regulatory feedback, Northern Dynasty had initiated a broad review of the Pebble

Project that took place in 2016 and 2017 to consider, among other things, a smaller project footprint and improved environmental

and safety enhancements, and has incorporated these and other improvements into a new proposed development project for Pebble.

This proposal is outlined in a Project Description prepared by the Pebble Partnership and included as part of the Pebble Partnership’s

CWA 404 permit application filed with the USACE on December 22, 2017. On January 8, 2018, USACE accepted the permitting documentation

and confirmed that an EIS level of analysis is required to comply with its NEPA review of the Pebble Project. In light of the

foregoing, Northern Dynasty commissioned a technical report to update information on the mineral resources and project status.

The 2018 Technical Report incorporates a summary of the Project Description submitted with the CWA 404 permit application and

an analysis of the revisions to the resource estimate based on process modifications reflected in the proposed project included

in the Project Description.

Northern

Dynasty completed a Preliminary Assessment (now known as a Preliminary Economic Assessment or “PEA”) on the Pebble

Project in February 2011 and, as noted above, since that time after considering stakeholder feedback, the Pebble Partnership submitted

an application for a CWA 404 permit for the Pebble Project on the basis of a substantially smaller mine facility footprint and

with other material revisions. These are summarized in the 2018 Technical Report and described briefly below. As a result, the

economic analysis included in the 2011 PEA is considered by Northern Dynasty to be out of date such that it can no longer be relied

upon. In light of the foregoing, the Pebble Project is no longer an advanced property for the purposes of NI 43-101, as the potential

economic viability of the Pebble Project is not currently supported by a preliminary economic assessment, pre-feasibility study

or feasibility study. The EIS process currently underway by the USACE will consider alternative scenarios with respect to a number

of aspects of the proposed project. Accordingly, the Company has not completed a current comprehensive economic analysis of the

Pebble Project. As part of the EIS preparation process, USACE is undertaking a comprehensive alternatives assessment to consider

a broad range of development alternatives. No preferred alternative was identified in the Draft EIS released by USACE on February

20, 2019, which allows USACE to incorporate public input on various alternatives presented in the Draft EIS during the public

review process. Northern Dynasty, through Pebble Partnership, also continues to advance engineering studies. Northern Dynasty

cautions that the current Project Description may not be the ultimate development plan for the project and that a final project

design has not been selected.

| 2018

Annual Information Form | Page |

13 | |

Property

Description and Location

The Pebble

Project is located in southwest Alaska, approximately 200 miles southwest of Anchorage, 17 miles northwest of the village of Iliamna,

160 miles northeast of Bristol Bay, and approximately 60 miles west of Cook Inlet.

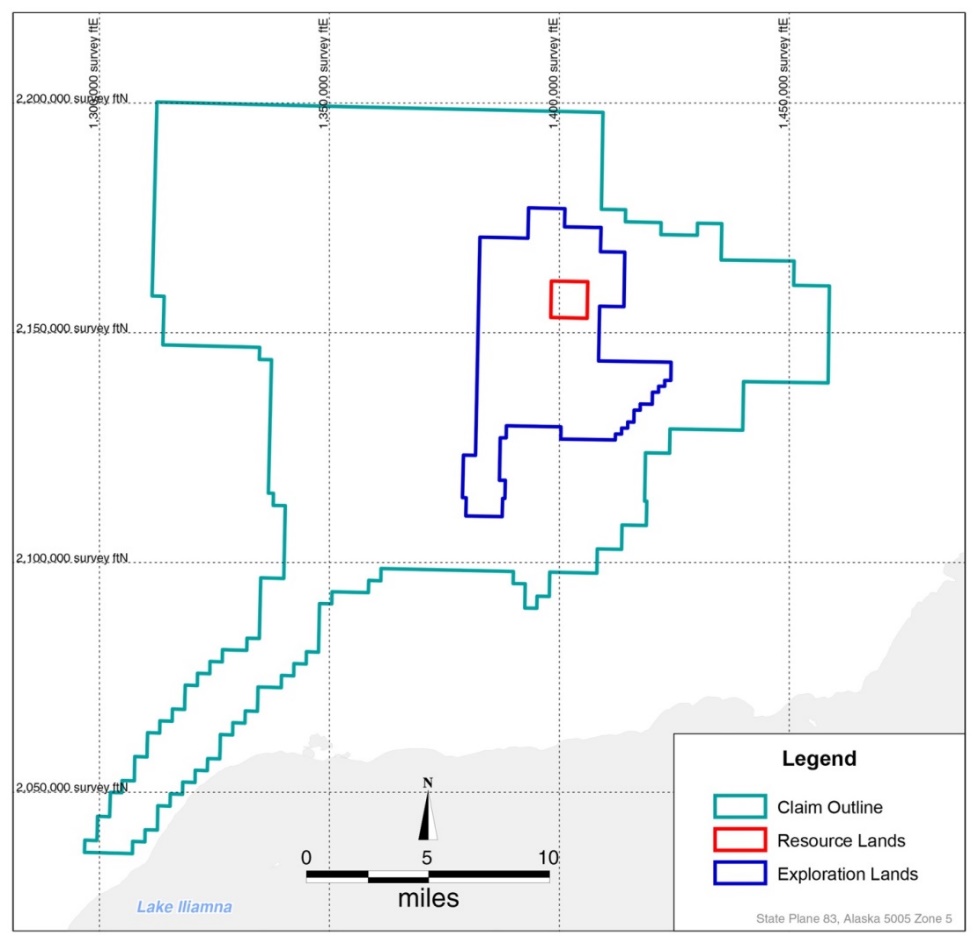

Figure 1 Property

Location – Pebble Project

Source: 2018

Technical Report

Northern

Dynasty holds, indirectly through wholly-owned subsidiaries of the wholly-owned Pebble Partnership, Pebble East Claims Corporation

and Pebble West Claims Corporation, a 100% interest in a contiguous block of 2,402 mineral claims covering approximately 417 square

miles (which includes the Pebble Deposit) (Figure 2).

State

mineral claims in Alaska are kept in good standing by performing annual assessment work or in lieu of assessment work by paying

$100 per year per 40 acre (0.06 square mile) mineral claim, and by paying annual

escalating state rentals. All of the assessment work payment obligations

come due annually on August 31. Credit for excess work can be banked for a maximum of four years, and can be applied as necessary

to continue to hold the claims in good standing. The Project claims have a variable amount of work credit available that can be

applied in this way1. State rentals for 2019 are approximately US$1,082,120 and are payable no later than 90 days after

the assessment work is due.

1

Annual assessment work obligations for the property of some US$667,700 are due in 2019.

| 2018

Annual Information Form | Page |

14 | |

The Pebble

Partnership currently does not own surface rights associated with the mineral claims that comprise the Pebble Property. All lands

are held by the State of Alaska, and surface rights may be acquired from the state government once areas required for mine development

have been determined and permits awarded. Permits necessary for exploration drilling and other field programs associated with

pre-development assessment of the Pebble Project are applied for each year. Environmental liabilities associated with the Pebble

Project include removal of structures, closing monitoring wells, and removal of piezometers. The State of Alaska holds a $2 million

bond associated with removal and reclamation of these liabilities.

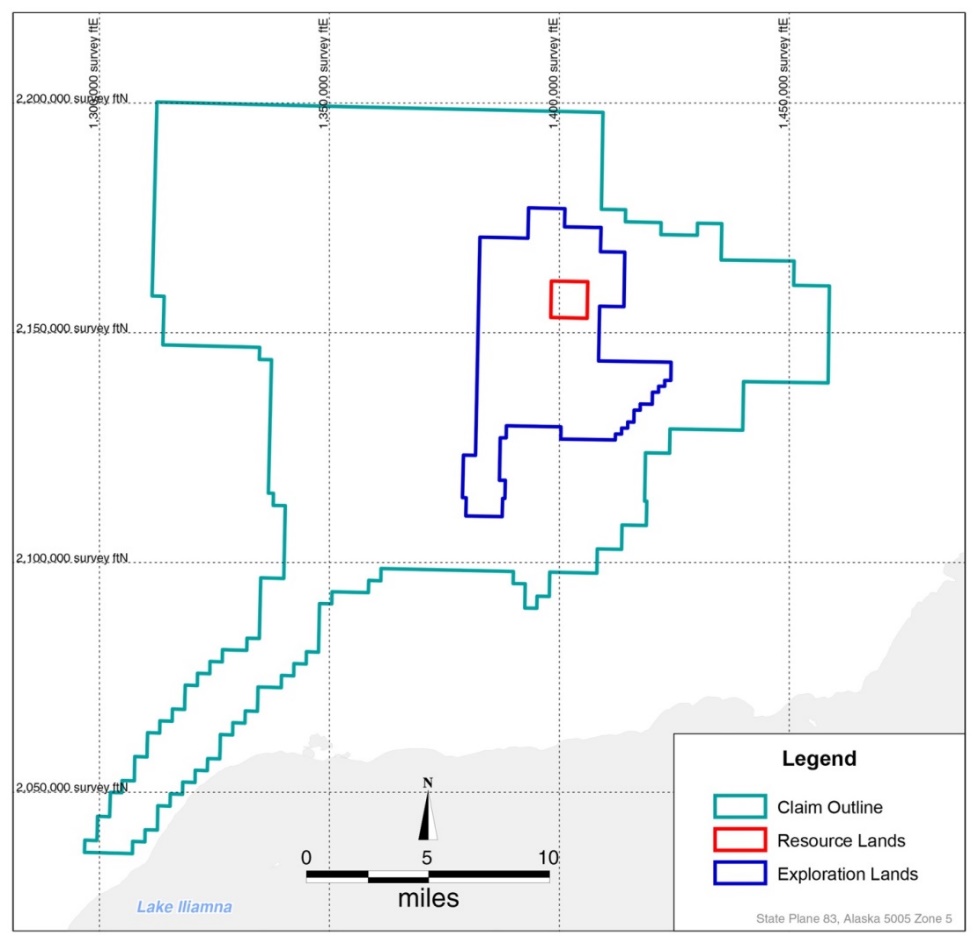

Figure 2 Mineral

Claims – Pebble Project

Source: 2018

Technical Report

Northern

Dynasty acquired the Pebble Property by way of a two-part (Resource Lands and Exploration Lands) purchase option from an Alaskan

subsidiary of Teck Cominco Limited (now Teck Resources Limited), which still retains a 4% pre-payback advance net profits royalty

interest (after debt service) and 5% after-payback net profits interest royalty in any mine production from the Exploration Lands

portion of the Pebble property shown on the figure below.

| 2018

Annual Information Form | Page |

15 | |

Source: 2018

Technical Report

Accessibility,

climate, local resources, infrastructure and physiography

Current

access to the property is by helicopter from Iliamna. There is a modern airfield at Iliamna, with two paved 4,920 ft airstrips,

that services the communities of Iliamna and Newhalen. The runways are suitable for DC-6 and Hercules cargo aircraft and commercial

jet aircraft.

There are

paved roads that connect the villages of Iliamna and Newhalen to the airport and to each other, and a partly paved, partly gravel

road that extends to a proposed Newhalen River crossing near Nondalton. The property is currently not connected to any of these

local communities by road; a road would be planned as part of the project design.

There is

no access road connecting the communities nearest to the Pebble Project with the coast on Cook Inlet. From the coast, at Williamsport

on Iniskin Bay, there is an 18.6-mile state-maintained road that terminates at the east end of Iliamna Lake, where watercraft

and transport barges may be used to access Iliamna. The route from Williamsport, over land to Pile Bay on Iliamna Lake, is currently

used to transport bulk fuel, equipment and supplies to communities around the lake during the summer months. Also during summer,

supplies are barged up the Kvichak River, approximately 43.4 miles southwest of Iliamna, from Kvichak Bay on the North Pacific

Ocean.

A small

run-of-river hydroelectric installation on the nearby Tazimina River provides power for the three communities in the summer months.

Supplemental power generation using diesel generators is required during winter months.

Iliamna

and surrounding communities have a combined population of just over 400 people. As such, there is limited local commercial infrastructure

except that which services seasonal sports fishing and hunting.

The property

is situated at approximately 1,000 ft above mean sea level in an area described as subarctic tundra. It is characterized by gently

rolling hills and an absence of permafrost. The climate is sufficiently moderate to allow a well-planned mineral exploration program

to be conducted year-round at Pebble.

| 2018

Annual Information Form | Page |

16 | |

Geological

Setting and Mineralization

Pebble

is a porphyry-style copper-gold-molybdenum-silver deposit that comprises two adjacent, contiguous, coeval hydrothermal centers

called the Pebble East and Pebble West zones. Mineralization in the Pebble West zone extends from surface to depths of at least

3,000 ft whereas higher grade mineralization in the Pebble East zone extends to a depth of at least 5,810 ft but is concealed

beneath an east-thickening wedge of unmineralized rock types. An important exploration target is represented by high-grade, but

as yet undelineated, mineralization on the far eastern side of the deposit which was dropped 1,970 to 2,950 ft by normal faults

into the northeast-trending East Graben.

The Pebble

deposit formed about 90 million years ago in response to intrusion of granodiorite magmas generated by subduction of the Pacific

Plate beneath the Wrangellia Superterrane. The Pebble deposit is hosted by these granodiorite intrusions and by the sedimentary

and volcanic rocks of Jurassic to Cretaceous age, granodiorite and diorite sills and alkalic monzonite intrusions and associated

breccias which host them.

Mineralization

at Pebble is predominantly hypogene, although the Pebble West zone contains a thin zone of variably developed leached cap and

underlying supergene mineralization. Disseminated and vein-hosted copper-gold-molybdenum-silver mineralization, dominated by chalcopyrite

and locally accompanied by bornite, is associated with early potassic alteration in the shallow part of the Pebble East zone and

with early sodic-potassic alteration in the Pebble West zone and deeper parts of the Pebble East zone. High-grade copper-gold

mineralization is associated with younger pyrophyllite- and sericite-bearing subtypes of advanced argillic alteration in the Pebble

East zone. The deposit is surrounded by weakly mineralized quartz-sericite-pyrite alteration; in the upper center of the deposit

quartz-illite-pyrite alteration is an illite-altered relict of a mostly eroded quartz-sericite-pyrite cap to the deposit.

Exploration

Historical

Cominco

Alaska, a division of Cominco Ltd. now Teck (“Cominco (Teck)”), began reconnaissance exploration in the Pebble region

in the mid-1980s and in 1984 discovered the Sharp Mountain gold prospect near the southern margin of the current property. Gold

was discovered in quartz veins of probable Tertiary age near the peak of Sharp Mountain. Grab samples of veins in talus ranged

from 0.045 oz/ton Au to 9.32 oz/ton Au and 3.0 oz/ton Ag. In 1987, examination and sampling of several prominent limonitic and

hematitic alteration zones yielded anomalous gold concentrations from the Sill prospect and the Pebble discovery outcrop.

Geophysical

surveys were conducted on the property between 1988 and 1997. An induced polarization (“IP”) survey in 1989 at Pebble

displayed response characteristics of a large porphyry-copper system. The surveys were dipole-dipole IP surveys, which defined

a chargeability anomaly about 31.1 square miles in extent within Cretaceous age rocks that surround the eastern to southern margins

of the Kaskanak batholith. All known zones of mineralization of Cretaceous age on the Pebble property occur within the broad IP

anomaly.

In 1991,

baseline environmental and engineering studies were initiated and weather stations were established. A preliminary evaluation

was undertaken by Cominco (Teck) in 1991, and updated in 1992. Historical estimates of the mineral resources for the Pebble deposit

were completed by Cominco (Teck), most recently in 2000.

Northern Dynasty

and Pebble Partnership

Between

2001 and 2006, the entire Pebble property was mapped for rock type, structure and alteration at a scale of 1:10,000, providing

an important geological framework for interpretation of other exploration data. A geological map of the Pebble deposit was also

constructed but, due to a paucity of outcrop, was based solely on drill hole information. The content and interpretation of district

and deposit scale geological maps have not changed materially from those presented in 2009 and 2010.

A number

of geophysical surveys, including IP, magnetic and other survey types were completed by Northern Dynasty and the Pebble Partnership

between 2001 and 2010 to test the Pebble deposit and other occurrences on the Pebble property. Between 2001 and 2003, Northern

Dynasty collected 1,026 soil samples, outlining high-contrast, coincident anomalies in gold, copper, molybdenum and other metals

in an area that measures at least 5.6 miles north-south by up to 2.5 miles east-west, with strong but smaller anomalies in several

outlying zones. All soil geochemical anomalies lie within the 31.1 square mile IP chargeability anomaly. Limited surficial geochemical

surveys were completed in 2010 and 2011.

| 2018

Annual Information Form | Page |

17 | |

Drilling

Extensive

drilling totalling 1,046,592 ft has been completed in 1,383 holes on the Pebble Project. These drill programs took place during

20 of the 31 years from 1988 to 2018.

Northern

Dynasty with its partners completed drilling for exploration, deposit delineation, engineering and environmental purposes between

2002 and 2018. Highlights from exploration and deposit delineation drilling since 2002 include:

| • |

in

2002, drill testing of IP chargeability and multi-element geochemical anomalies outside of the Pebble deposit but within the

larger and broader IP chargeability anomaly discovered the 38 Zone porphyry copper-gold-molybdenum deposit, the 52 Zone porphyry

copper occurrence, the 37 Zone gold-copper skarn deposit, the 25 Zone gold deposit, and several small occurrences in which

gold values exceeded 3.0 g/t. |

| |

|

| • |

in

2003, drilling took place within and adjacent to the Pebble West zone and outside the Pebble deposit to test for extensions

and new mineralization at four other zones, including the 38 Zone porphyry copper-gold-molybdenum deposit and the 37 Zone

gold-copper skarn deposit. |

| |

|

| • |

in

2004, 147 exploration holes were drilled in the Pebble deposit; the Pebble East zone is identified; the 308 Zone porphyry

copper-gold-molybdenum deposit is discovered. |

| |

|

| • |

in

2005 and 2006, drilling at Pebble East confirms its large size and higher grades of copper, gold and molybdenum. |

| |

|

| • |

in

2007, 34 holes extend Pebble East to the northeast, northwest, south and southeast. |

| |

|

| • |

in

2008, 31 delineation and infill holes were drilled at Pebble East. FMMUSA drilled seven exploration holes on land that is

now controlled by the Pebble Partnership. |

| |

|

| • |

in

2009 and 2010, delineation holes were drilled at the margins of Pebble West and exploration holes were drilled elsewhere on

the property. |

| |

|

| • |

in

2011 and 2012, holes drilled at the Pebble West zone indicate potential for resource expansion laterally and to depth; exploration

targets were tested on the Kaskanak claims to the northwest and south of Pebble, and on the KAS claims further south. |

| |

|

| • |

in

2013 and 2018, geotechnical holes were drilled to test tailings and water storage facilities in areas remote from the Pebble

deposit. |

Drilling

for engineering (metallurgical and geotechnical) and environmental (hydrological) purposes began in 2004 and continued through

2018. No drilling took place in 2014, 2015, 2016 or 2017.

| 2018

Annual Information Form | Page |

18 | |

The spatial

distribution and type of holes drilled are illustrated below.

Figure

3 Location of Drill Holes – Pebble Project

Source: 2018

Technical Report

Most of

the footage on the Pebble Project was drilled using diamond core drills and the Pebble resource estimate was calculated exclusively

from these holes. Many of the cored holes were advanced through overburden using a tricone bit with no core recovery. These overburden

lengths are included in the core drilling total.

Since early

2004, all Pebble drill core has been geotechnically logged. Nearly 70,000 measurements were made for a variety of geotechnical

parameters on 736,000 ft of core drilling. Recovery is generally very good and averages 98.6% overall; two-thirds of all measured

intervals have 100% core recovery. Additionally, all Pebble drill core from the 2002 through 2018 drill programs was photographed

in a digital format.

All drill

hole collars have been surveyed using a differential global positioning system. A digital terrain model for the site was generated

by photogrammetric methods in 2004. All post-Cominco (Teck) drill holes have been surveyed downhole, typically using a downhole

survey (single shot magnetic gravimetric) tool. A total of 1,029 holes were drilled vertically (-90°) and 190 were inclined

from -42° to -85° at various azimuths.

A summary

of drilling by various categories (operator, type, year and area) to the end of the 2018 program are compiled in the table below.

As shown in Figure 3 and Table 1 (East, West, Main), a large proportion of the drilling has been directed toward the Pebble deposit.

| 2018

Annual Information Form | Page |

19 | |

Table

1 Summary of Drill Holes – Pebble Project

| |

No.

of Holes |

Feet |

Metres |

| By

Operator |

| Cominco

(Teck) 1 |

164 |

75,741.0 |

23,086 |

| Northern

Dynasty |

578 |

495,069.5 |

150,897 |

| Pebble

Partnership 2 |

634 |

470,331.9 |

143,357 |

| FMMUSA |

7 |

5,450.0 |

1,661 |

| Total |

1,383 |

1,046,592.4 |

319,001 |

| By

Type |

| Core

1,5 |

1,160 |

1,027,671.9 |

313,234 |

| Percussion

6 |

223 |

18,920.6 |

5,767 |

| Total |

1,383 |

1,046,592.4 |

319,001 |

| By

Year |

| 1988

1 |

26 |

7,601.5 |

2,317 |

| 1989

1 |

27 |

7,422.0 |

2,262 |

| 1990 |

25 |

10,021.0 |

3,054 |

| 1991 |

48 |

28,129.0 |

8,574 |

| 1992 |

14 |

6,609.0 |

2,014 |

| 1993 |

4 |

1,263.0 |

385 |

| 1997 |

20 |

14,695.5 |

4,479 |

| 2002 |

68 |

37,236.8 |

11,350 |

| 2003 |

67 |

71,226.6 |

21,710 |

| 2004 |

267 |

165,567.7 |

50,465 |

| 2005 |

114 |

81,978.5 |

24,987 |

| 2006

3 |

48 |

72,826.9 |

22,198 |

| 2007

4 |

92 |

167,666.9 |

51,105 |

| 2008

5 |

241 |

184,726.4 |

56,305 |

| 2009 |

33 |

34,947.5 |

10,652 |

| 2010 |

66 |

57,582.0 |

17,551 |

| 2011 |

85 |

50,767.7 |

15,474 |

| 2012 |

81 |

35,760.2 |

10,900 |

| 2013 |

29 |

6,190.0 |

1,887 |

| 2018 |

28 |

4,374.2 |

1,333 |

| Total |

1,383 |

1,046,592.4 |

319,001 |

| 2018

Annual Information Form | Page |

20 | |

| |

No.

of Holes |

Feet |

Metres |

| By

Area |

| East |

149 |

450,047.3 |

137,174 |

| West |

447 |

349,128.7 |

106,414 |

| Main

7 |

77 |

7,712.4 |

2,351 |

| NW |

215 |

49,951.1 |

15,225 |

| North |

84 |

30,927.0 |

9,427 |

| NE |

15 |

1,495.0 |

456 |

| South |

117 |

48,387.8 |

14,749 |

| 25

Zone |

8 |

4,047.0 |

1,234 |

| 37

Zone |

7 |

4,252.0 |

1,296 |

| 38

Zone |

20 |

14,221.5 |

4,335 |

| 52

Zone |

5 |

2,534.0 |

772 |

| 308

Zone |

1 |

879.0 |

268 |

| Eastern |

5 |

621.5 |

189 |

| Southern |

147 |

64,374.4 |

19,621 |

| SW |

39 |

6,658.8 |

2,030 |

| Sill |

39 |

10,445.5 |

3,184 |

| Cook

Inlet |

8 |

909.5 |

277 |

| Total |

1,383 |

1,046,592.4 |

319,001 |

Notes

to table:

1.

Includes holes drilled on the Sill prospect.

2.

Holes started by Northern Dynasty and finished by the Pebble Partnership are included as the Pebble Partnership.

3.

Drill holes counted in the year in which they were completed.

4.

Wedged holes are counted as a single hole including full length of all wedges drilled.

5.

Includes FMMUSA drill holes; data acquired in 2010.

6.

Percussion holes were drilled for engineering and environmental purposes. Shallow (<15 ft) auger holes not included.

7.

Comprises holes drilled entirely in Tertiary cover rocks within the Pebble West and Pebble East areas.

Some

numbers may not sum exactly due to rounding.

Sampling,

Analysis and Security of Samples

The Pebble

deposit has been explored by extensive core drilling, with 80,859 samples having been taken from drill core for assay analysis.

Nearly all potentially mineralized Cretaceous core drilled and recovered has been sampled by halving in 10 ft lengths. Similarly,

all core recovered from the Late Cretaceous to Early Tertiary cover sequence has also been sampled, typically on 20 ft sample

lengths, with some shorter sample intervals in areas of geologic interest. Unconsolidated overburden material, where it exists,

is generally not recovered by core drilling and therefore not usually sampled.

Rock chips

from the 223 rotary percussion holes were generally not sampled for assay analysis, as the holes were drilled for monitoring wells

and environmental purposes. Only 35 samples were taken from the drill chips of 26 rotary percussion holes outside the Pebble deposit

area, which were drilled for condemnation purposes.

Analytical

work in 2002 and from 2004 to 2018 was completed by ALS Minerals Laboratories of North Vancouver, an ISO/IEC 17025:2005 certified