CONSOLIDATED

FINANCIAL STATEMENTS

FOR THE YEARS ENDED

DECEMBER 31, 2016 and

2015

(Expressed in thousands of Canadian Dollars)

|

Deloitte LLP |

| 2800 - 1055 Dunsmuir Street | |

| 4 Bentall Centre | |

| P.O. Box 49279 | |

| Vancouver BC V7X 1P4 | |

| Canada | |

| Tel: 604-669-4466 | |

| Fax: 778-374-0496 | |

| www.deloitte.ca |

Report of Independent Registered Public Accounting Firm

To the Board of Directors and Shareholders of Northern Dynasty Minerals Ltd.

We have audited the accompanying consolidated financial statements of Northern Dynasty Minerals Ltd. (the “Company”), which comprise the consolidated statements of financial position as at December 31, 2016 and December 31, 2015, and the consolidated statements of comprehensive loss, consolidated statements of changes in equity, and consolidated statements of cash flows for the years then ended, and a summary of significant accounting policies and other explanatory information.

Management’s Responsibility for the Consolidated Financial

Statements

Management is responsible for the preparation and fair

presentation of these consolidated financial statements in accordance with

International Financial Reporting Standards as issued by the International

Accounting Standards Board, and for such internal control as management

determines is necessary to enable the preparation of consolidated financial

statements that are free from material misstatement, whether due to fraud or

error.

Auditor’s Responsibility

Our responsibility is to

express an opinion on these consolidated financial statements based on our

audits. We conducted our audits in accordance with Canadian generally accepted

auditing standards and the standards of the Public Company Accounting Oversight

Board (United States). Those standards require that we comply with ethical

requirements and plan and perform the audit to obtain reasonable assurance about

whether the consolidated financial statements are free from material

misstatement. We were not engaged to perform an audit of the Company’s internal

control over financial reporting. Our audits included consideration of internal

control over financial reporting as a basis for designing audit procedures that

are appropriate in the circumstances, but not for the purpose of expressing an

opinion on the effectiveness of the Company’s internal control over financial

reporting. Accordingly, we express no such opinion.

An audit involves performing procedures to obtain audit evidence about the amounts and disclosures in the consolidated financial statements. The procedures selected depend on the auditor’s judgment, including the assessment of the risks of material misstatement of the consolidated financial statements, whether due to fraud or error. An audit also includes evaluating the appropriateness of accounting policies used and the reasonableness of accounting estimates made by management, as well as evaluating the overall presentation of the consolidated financial statements.

We believe that the audit evidence we have obtained in our audits is sufficient and appropriate to provide a basis for our audit opinion.

Member of Deloitte Touche Tohmatsu Limited

Opinion

In our opinion, the consolidated financial

statements present fairly, in all material respects, the financial position of

Northern Dynasty Minerals Ltd. as at December 31, 2016 and December 31, 2015,

and its financial performance and its cash flows for the years then ended in

accordance with International Financial Reporting Standards as issued by the

International Accounting Standards Board.

Emphasis of Matter

The accompanying consolidated

financial statements have been prepared assuming that the Company will continue

as a going concern. As discussed in Note 1 of the consolidated financial

statements, the Company incurred a net loss of $26,982,000 and $33,829,000

during the years ended December 31, 2016 and 2015, respectively and had a

deficit of $406,106,000 as at December 31, 2016. This condition, along with

other matters as set forth in Note 1, indicate the existence of material

uncertainties that raise substantial doubt about the Company’s ability to

continue as a going concern. Management's plans concerning these matters are

also discussed in Note 1 to the consolidated financial statements. The

consolidated financial statements do not include any adjustments that might

result from the outcome of these uncertainties.

/s/ Deloitte LLP

Chartered Professional Accountants

March 30, 2017

Vancouver, Canada

Page | 2

Northern Dynasty Minerals

Ltd.

Consolidated Statements of

Financial Position

(Expressed in thousands of Canadian

Dollars)

| December 31 | December 31 | ||||||

| Notes | 2016 | 2015 | |||||

| ASSETS | |||||||

| Non-current assets | |||||||

| Mineral property, plant and equipment | 3 | $ | 142,472 | $ | 147,088 | ||

| Total non-current assets | 142,472 | 147,088 | |||||

| Current assets | |||||||

| Available-for-sale financial assets | 4 | – | 1,579 | ||||

| Amounts receivable and prepaid expenses | 5 | 679 | 1,075 | ||||

| Restricted cash | 6 (b) | – | 453 | ||||

| Cash and cash equivalents | 6 (a) | 7,196 | 7,509 | ||||

| Total current assets | 7,875 | 10,616 | |||||

| Total Assets | $ | 150,347 | $ | 157,704 | |||

| EQUITY | |||||||

| Capital and reserves | |||||||

| Share capital | 7 (a) | $ | 452,132 | $ | 435,069 | ||

| Reserves | 102,821 | 99,035 | |||||

| Deficit | (406,106 | ) | (379,124 | ) | |||

| Total Equity | 148,847 | 154,980 | |||||

| LIABILITIES | |||||||

| Current liabilities | |||||||

| Payables to related parties | 8 | 240 | 677 | ||||

| Trade and other payables | 9 | 1,260 | 2,047 | ||||

| Total current liabilities | 1,500 | 2,724 | |||||

| Total Liabilities | 1,500 | 2,724 | |||||

| Total Equity and Liabilities | $ | 150,347 | $ | 157,704 | |||

| Commitments (note 14) | |||||||

| Events after the reporting date (note 15) |

The accompanying notes are an integral part of these consolidated financial statements.

These consolidated financial statements are signed on the Company's behalf by:

| /s/ Ronald W. Thiessen | /s/ Christian Milau |

| Ronald W. Thiessen | Christian Milau |

| Director | Director |

Page | 3

Northern Dynasty Minerals

Ltd.

Consolidated Statements of

Comprehensive Loss

(Expressed in thousands of Canadian Dollars,

except for share information)

| Year ended December 31 | |||||||

| Notes | 2016 | 2015 | |||||

| Expenses | |||||||

| Exploration and evaluation expenses | 3, 11 | $ | 7,935 | $ | 8,718 | ||

| General and administrative expenses | 11 | 6,729 | 8,272 | ||||

| Legal, accounting and audit | 9,442 | 17,001 | |||||

| Share-based compensation | 7 (d)-(f) | 2,995 | 903 | ||||

| Loss from operating activities | 27,101 | 34,894 | |||||

| Foreign exchange (gain) loss | (43 | ) | 618 | ||||

| Interest income | (33 | ) | (99 | ) | |||

| Interest expense on loans | 7 (b) | – | 144 | ||||

| Other income | (11 | ) | (214 | ) | |||

| Amount receivable written off | 15 | – | |||||

| Gain on sale of available-for-sale financial assets | (70 | ) | – | ||||

| Loss on sale of plant and equipment | 23 | – | |||||

| Loss before tax | 26,982 | 35,343 | |||||

| Deferred income tax recovery | 12 | – | (1,514 | ) | |||

| Net loss | $ | 26,982 | $ | 33,829 | |||

| Other comprehensive loss (income) | |||||||

| Items that may be subsequently reclassified to loss | |||||||

| Foreign exchange translation difference | 3, 7 (g) | 4,246 | (23,300 | ) | |||

| Change in fair value of available-for-sale financial assets | 4 | – | 113 | ||||

| Derecognition of available-for-sale financial assets | 4 | (105 | ) | – | |||

| Other comprehensive loss (income) | $ | 4,141 | $ | (23,187 | ) | ||

| Total comprehensive loss | $ | 31,123 | $ | 10,642 | |||

| Basic and diluted loss per common share | 10 | $ | 0.11 | $ | 0.23 | ||

The accompanying notes are an integral part of these consolidated financial statements.

Page | 4

Northern Dynasty Minerals

Ltd.

Consolidated Statements of Cash

Flows

(Expressed in thousands of Canadian Dollars)

| Year ended December 31 | |||||||

| Notes | 2016 | 2015 | |||||

| Operating activities | |||||||

| Net loss | $ | (26,982 | ) | $ | (33,829 | ) | |

| Non-cash or non operating items | |||||||

| Amount receivable written off | 15 | – | |||||

| Deferred income tax recovery | – | (1,514 | ) | ||||

| Depreciation | 3 | 205 | 279 | ||||

| Interest received on cash held | (33 | ) | (99 | ) | |||

| Interest expense on loans | 7 (b) | – | 144 | ||||

| Gain on sale of surplus site inventory | (11 | ) | (173 | ) | |||

| Gain on sale of available-for-sale financial assets | (70 | ) | – | ||||

| Loss on sale of plant and equipment | 23 | 5 | |||||

| Share-based compensation | 2,995 | 903 | |||||

| Unrealized exchange loss | 68 | – | |||||

| Changes in working capital items | |||||||

| Restricted cash | 453 | 826 | |||||

| Amounts receivable and prepaid expenses | 405 | (8 | ) | ||||

| Trade and other payables | (645 | ) | (4,374 | ) | |||

| Payables to related parties | (437 | ) | 294 | ||||

| Net cash used in operating activities | (24,014 | ) | (37,546 | ) | |||

| Investing activities | |||||||

| Acquisition of plant and equipment | 3 | – | (28 | ) | |||

| Proceeds from sale of equipment | 3 | – | 70 | ||||

| Proceeds from sale of available-for-sale financial assets | 4 | 1,754 | 280 | ||||

| Proceeds from sale of surplus site inventory | 11 | 173 | |||||

| Interest received on cash and cash equivalents | 33 | 99 | |||||

| Net cash from investing activities | 1,798 | 594 | |||||

| Financing activities | |||||||

| Cash received on acquisitions net of transaction costs | 7 (b) | – | 12,347 | ||||

| Proceeds from prospectus unit financing net of transaction costs | 7 (b) | 16,030 | – | ||||

| Proceeds from private placement unit financing net of transaction costs | 7 (b) | 1,967 | – | ||||

| Proceeds from private placment of special warrants net of transaction costs | 7 (b) | – | 17,485 | ||||

| Proceeds from private placement of common shares net of transaction costs | 7 (b) | – | 5,166 | ||||

| Proceeds from the exercise of share purchase options and warrants | 7 (c) | 3,974 | 7 | ||||

| Net cash from financing activities | 21,971 | 35,005 | |||||

| Net decrease in cash and cash equivalents | (245 | ) | (1,947 | ) | |||

| Effect of exchange rate fluctuations on cash and cash equivalents | (68 | ) | 9 | ||||

| Cash and cash equivalents - beginning balance | 7,509 | 9,447 | |||||

| Cash and cash equivalents - ending balance | 6 (a) | $ | 7,196 | $ | 7,509 | ||

| Supplementary cash flow information (note 6(a)) | |||||||

The accompanying notes are an integral part of these consolidated financial statements.

Page | 5

NorthernDynasty MineralsLtd.

Consolidated Statements of Changes in Equity

(Expressed in

thousands of Canadian Dollars, except for share information)

| Notes | Share capital | Reserves | |||||||||||||||||||||||

| Foreign | |||||||||||||||||||||||||

| Number of | Equity settled | currency | Share | ||||||||||||||||||||||

| common | share-based | translation | Investment | Purchase | |||||||||||||||||||||

| shares | compensation | reserve | revaluation | Warrants | Total | ||||||||||||||||||||

| (note 7(a)) | Amount | reserve | (note 7(g)) | reserve | (note 7c)) | Deficit | equity | ||||||||||||||||||

| Balance at January 1, 2015 | 95,009,864 | $ | 389,227 | $ | 55,294 | $ | 17,179 | $ | 6 | $ | 11,552 | $ | (345,295 | ) | $ | 127,963 | |||||||||

| Special warrants issued net of transaction costs | 7 (c) | – | – | – | – | – | 17,485 | – | 17,485 | ||||||||||||||||

| Conversion of special warrants into common shares | 7 (c) | 73,562,735 | 29,037 | – | – | – | (29,037 | ) | – | – | |||||||||||||||

| Common shares issued pursuant to a private placement, net of transaction costs | 7 (b) | 12,573,292 | 5,046 | – | – | – | – | – | 5,046 | ||||||||||||||||

| Common shares issued as referral fees relating to a private placement | 7 (b) | 300,000 | 120 | – | – | – | – | – | 120 | ||||||||||||||||

| Common shares issued for the acquisition of Cannon Point, net of transaction cost | 7 (b) | 12,881,344 | 4,062 | – | – | – | – | – | 4,062 | ||||||||||||||||

| Options and warrants issued for the acquisition of Cannon Point | 7 (b) | – | – | – | – | – | 217 | – | 217 | ||||||||||||||||

| Common shares issued for the acquisition of Mission Gold | 7 (b) | 27,593,341 | 7,564 | – | – | – | – | – | 7,564 | ||||||||||||||||

| Options and warrants issued pursuant to the acquisition of Mission Gold, net of transaction cost | 7 (b) | – | – | – | – | – | 2,255 | – | 2,255 | ||||||||||||||||

| Common shares issued upon exercise of share purchase options not under option plan | 7 (c) | 18,800 | 7 | – | – | – | – | – | 7 | ||||||||||||||||

| Fair value allocated to shares issued on options exercised | 7 (c) | – | 6 | – | – | – | (6 | ) | – | – | |||||||||||||||

| Share-based compensation | 7 (d) | – | – | 903 | – | – | – | – | 903 | ||||||||||||||||

| Net loss | – | – | – | – | – | – | (33,829 | ) | (33,829 | ) | |||||||||||||||

| Other comprehensive income (loss) net of tax | – | – | – | 23,300 | (113 | ) | – | – | 23,187 | ||||||||||||||||

| Total comprehensive loss | (10,642 | ) | |||||||||||||||||||||||

| Balance at December 31, 2015 | 221,939,376 | $ | 435,069 | $ | 56,197 | $ | 40,479 | $ | (107 | ) | $ | 2,466 | $ | (379,124 | ) | $ | 154,980 |

| Balance at January 1, 2016 | 221,939,376 | $ | 435,069 | $ | 56,197 | $ | 40,479 | $ | (107 | ) | $ | 2,466 | $ | (379,124 | ) | $ | 154,980 | ||||||||

| Common shares issued on exercise of share purchase options per option plan | 7 (d) | 548,869 | 503 | – | – | – | – | – | 503 | ||||||||||||||||

| Common shares issued upon exercise of share purchase options not issued per option plan | 7 (c) | 376,000 | 132 | – | – | – | – | – | 132 | ||||||||||||||||

| Common shares issued upon exercise of warrants | 7 (c) | 5,560,940 | 3,363 | – | – | – | – | – | 3,363 | ||||||||||||||||

| Fair value allocated to shares issued on options exercised per plan | 7 (d) | – | 266 | (266 | ) | – | – | – | – | – | |||||||||||||||

| Fair value allocated to shares issued on options exercised not under option plan | 7 (c) | – | 98 | – | – | – | (98 | ) | – | – | |||||||||||||||

| Fair value and costs allocated to share capital on exercise of warrants | – | 1,090 | – | – | – | (1,090 | ) | – | – | ||||||||||||||||

| Common Shares issued pursuant to prospectus financing, net of transaction costs | 7 (b) | 38,000,000 | 10,347 | – | – | – | – | – | 10,347 | ||||||||||||||||

| Warrants issued pursuant to prospectus financing, net of transaction costs | 7 (b) | – | – | – | – | – | 5,683 | – | 5,683 | ||||||||||||||||

| Common shares issued pursuant to private placement, net of transaction costs | 7 (b) | 4,444,376 | 1,264 | – | – | – | – | – | 1,264 | ||||||||||||||||

| Warrants issued pursuant to private placement, net of transaction costs | 7 (b) | – | – | – | – | – | 703 | – | 703 | ||||||||||||||||

| Share-based compensation | 7 (d)-(f) | – | – | 2,995 | – | – | – | – | 2,995 | ||||||||||||||||

| Net loss | – | – | – | – | – | – | (26,982 | ) | (26,982 | ) | |||||||||||||||

| Other comprehensive (loss) income net of tax | – | – | – | (4,246 | ) | 105 | – | – | (4,141 | ) | |||||||||||||||

| Total comprehensive loss | (31,123 | ) | |||||||||||||||||||||||

| Balance at December 31, 2016 | 270,869,561 | $ | 452,132 | $ | 58,926 | $ | 36,233 | $ | (2 | ) | $ | 7,664 | $ | (406,106 | ) | $ | 148,847 |

The accompanying notes are an integral part of these consolidated financial statements.

Page | 6

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

| 1. |

NATURE AND CONTINUANCE OF OPERATIONS |

|

Northern Dynasty Minerals Ltd. (the "Company") is incorporated under the laws of the Province of British Columbia, Canada, and its principal business activity is the exploration of mineral properties. The Company is listed on the Toronto Stock Exchange ("TSX") under the symbol "NDM" and on the New York Stock Exchange-MKT ("NYSE-MKT") under the symbol "NAK". The Company’s corporate office is located at 1040 West Georgia Street, 15th floor, Vancouver, British Columbia. | |

|

The consolidated financial statements ("Financial Statements") of the Company as at and for the year ended December 31, 2016, include financial information for the Company and its subsidiaries (note 2(c)) (together referred to as the "Group" and individually as "Group entities"). The Company is the ultimate parent. The Group’s core mineral property interest is the Pebble Copper-Gold-Molybdenum Project (the "Pebble Project") located in Alaska, United States of America ("USA" or "US"). | |

|

The Group is in the process of exploring and developing the Pebble Project and has not yet determined whether the Pebble Project contains mineral reserves that are economically recoverable. The Group’s continuing operations and the underlying value and recoverability of the amounts shown for the Group’s mineral property interests, is entirely dependent upon the existence of economically recoverable mineral reserves; the ability of the Group to obtain financing to complete the exploration and development of the Pebble Project; the Group obtaining the necessary permits to mine; and future profitable production or proceeds from the disposition of the Pebble Project. | |

|

During the year ended December 31, 2016, the Company raised aggregate gross proceeds of $19.1 million through a prospectus financing and a private placement of units, consisting of common shares and warrants (note 7(b)), $4.0 million from the exercise of share purchase options and warrants (notes 7(c)-(d)) and $1.8 million through the sale of available-for-sale financial assets (note 4). | |

|

As at December 31, 2016, the Group has $7.2 million in cash and cash equivalents for its operating requirements. The Group incurred a net loss of $27.0 million and $33.8 million during the years ended December 31, 2016 and 2015, respectively and had a deficit $406.1 million as at December 31, 2016. Subsequent to the reporting period, the Group completed a bought deal financing and raised gross proceeds of approximately US$37.4 million (note 15). Accordingly, the Group has prioritized the allocation of available financial resources in order to meet key corporate and Pebble Project expenditure requirements for at least the next twelve months. Additional financing will be required in order to progress any material expenditures at the Pebble Project beyond 2017. Additional financing may include any of or a combination of debt equity and/or contributions from possible new Pebble Project participants. There can be no assurances that the Group will be successful in obtaining additional financing. If the Group is unable to raise the necessary capital resources and generate sufficient cash flows to meet obligations as they come due, the Group may, at some point, consider reducing or curtailing its operations. As such there is material uncertainty that raises substantial doubt about the Company’s ability to continue as a going concern. | |

|

In July 2014, the United States Environmental Protection Agency (the "EPA") announced a proposal under Section 404(c) of the Clean Water Act to restrict and impose limitations on all discharges of dredged or fill material ("EPA Action") associated with mining the Pebble deposit. The Company believes that the EPA does not have the statutory authority to impose conditions on the development at Pebble prior to the submission of a detailed development plan and its thorough review by federal and state agencies, including review under the National Environmental Protection Act ("NEPA"). The Pebble Limited Partnership (the “Pebble Partnership”), a wholly-owned subsidiary of the Company, along with the State of Alaska and the Alaska Peninsula Corporation, an Alaska Native village corporation with extensive land holdings in the Pebble Project area, filed for an injunction to stop the EPA Action with the US Federal Court in Alaska (the "Court"). However, the Court has deferred judgment thereon until the EPA has issued a final determination. The Company appealed the Court’s decision to the 9th Circuit Court of Appeals. The appeal was denied in May 2015. The Pebble Partnership still holds the option to pursue its statutory authority case in the instance that EPA finalizes a pre-emptive regulatory action under the Clean Water Act 404(c). In September 2014, the Pebble Partnership initiated a second action against the EPA in federal district court in Alaska charging that the EPA violated the Federal Advisory Committee Act ("FACA"). In November 2014, the U.S. federal court judge in Alaska granted, in relation to the FACA case, the Pebble Partnership’s request for a preliminary injunction, which, although considered by the Company as a significant procedural milestone in the litigation, does not resolve the Pebble Partnership’s claims that the EPA Actions with respect to the Bristol Bay Assessment and subsequent 404(c) regulatory process, violated FACA. In June 2015, the EPA’s motion to dismiss the FACA case was rejected and as a result the FACA case is moving forward. The Company expects its legal rights will be upheld by the Court and that the Company will ultimately be able to apply for the necessary permits under NEPA. On October 14, 2014, the Pebble Partnership filed suit in the federal district court in Alaska charging that the EPA has violated the Freedom of Information Act ("FOIA") by improperly withholding documents related to the Pebble Project, the Bristol Bay Watershed Assessment and consideration of a pre-emptive 404(c) veto under the Clean Water Act. |

Page | 7

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

The EPA has moved for summary judgment claiming that its search for and disclosure of documents was adequate. The Pebble Partnership has opposed the motion pointing out several deficiencies in the EPA’s search parameters and pointing out the agency’s overly broad assertion of the deliberative process privilege to withhold documents. On August 24, 2015, the U.S. federal court judge granted in part and deferred in part the EPA’s motion for summary judgement on the FOIA litigation. The court accepted the EPA’s position that it had made an adequate search for documents but left the matter open should the EPA not meet its obligations in the FACA litigation or if additional documents surface. Additionally, the judge ordered the EPA to produce a sample of 183 partially or fully withheld documents so that it could conduct an in camera review of the sample and test the merits of the EPA’s withholdings under the deliberative process privilege. Before producing this sample to the Court, the EPA chose to voluntarily release 115 documents (or 63% of the sample ordered by the Court), relinquishing its claim of privilege as to these documents.

In briefings before the Court, the Pebble Partnership argued that the voluntary release of 63% of the agency’s same documents conclusively demonstrated that the EPA had been over broad in its assertion of the deliberative process privilege, particularly because the content of the voluntarily released documents was not in fact deliberative. The Court agreed, finding that the EPA "improperly withheld documents in full," and that "many of the documents that the defendant released should have been released to begin with because the portions that the defendant released were not deliberative." It then ordered the EPA to review an additional 65 documents. Of these 65 documents, the EPA voluntarily released 55 documents in whole or in part (or 85% of the documents). Given the EPA’s high rate of release, the Pebble Partnership submitted a brief to the Court arguing that the EPA should be forced to review the remaining documents being withheld and arguing that judgment should not be granted to the agency at this time. A decision has not yet been issued. The Court agreed, concluding that it had "no confidence that [the EPA] has properly withheld documents, either in full or in part, pursuant to the deliberative process privilege." The Court reiterated its earlier finding that EPA had been withholding documents that "should never have been withheld to begin with." As a result, the Court ordered the Agency to re-evaluate all remaining documents the EPA is withholding in response to the Pebble Partnership’s January 2014 FOIA request and to submit these documents for in camera review. After this review, the Court issued an order resolving Pebble’s challenges to the remaining withholdings and forcing EPA, yet again, to produce additional documents that the agency had been improperly withholding for over two years.

On October 27, 2016, the Pebble Partnership and the EPA filed a joint Notice in federal court stating their intent to enter into mediation in an effort to resolve ongoing litigation under FACA.

On December 30, 2016, the Pebble Partnership and the EPA filed a joint Notice in federal court staying the ongoing FACA litigation until March 20, 2017 and, on that date, the parties filed a Joint Motion in federal court to extend a stay of proceedings in ongoing litigation under FACA to May 4, 2017 in the interest of resolving the matter.

Page | 8

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

|

The Company has made substantial progress in recent direct discussions with the EPA and intends to continue negotiating the matter directly, rather than through mediation. US Government representatives are actively engaged in these discussions and, along with the Pebble Partnership, are focused on achieving a resolution that will be agreeable to both parties. In the meantime, the Court’s Preliminary Injunction of November 25, 2014, will remain in effect for the duration of any stay. | |

| 2. |

SIGNIFICANT ACCOUNTING POLICIES |

| (a) |

Statement of Compliance |

|

These Financial Statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board ("IASB") and interpretations issued by the IFRS Interpretations Committee ("IFRIC"s) that are effective for the Group’s reporting year ended December 31, 2016. These Financial Statements were authorized for issue by the Board of Directors on March 28, 2017. | |

| (b) |

Basis of Preparation |

|

These Financial Statements have been prepared on a historical cost basis using the accrual basis of accounting, except for cash flow information and for financial instruments classified as available-for-sale, which are stated at their fair value (notes 2(e) and 4). The accounting policies set out below have been applied consistently to all periods presented in these Financial Statements. | |

| (c) |

Basis of Consolidation |

|

These Financial Statements incorporate the financial statements of the Company, the Company’s subsidiaries, and entities controlled by the Company and its subsidiaries listed below: |

| Name of Subsidiary 1 |

Place of

Incorporation |

Principal Activity |

Ownership |

| 3537137 Canada Inc. 2 | Canada | Holding Company. Wholly-owned subsidiary of the Company. | 100% |

| Pebble Services Inc. | Nevada, USA | Management and services company. Wholly-owned subsidiary of the Company. | 100% |

| Northern Dynasty Partnership | Alaska, USA | Holds 99.9% of the Pebble Limited Partnership and 100% of Pebble Mines Corp. | 100% (indirect) |

| Pebble Limited Partnership | Alaska, USA | Holding Company and Exploration of the Pebble Project. | 100% (indirect) |

| Pebble Mines Corp. | Delaware, USA | General Partner. Holds 0.1% of Pebble Limited Partnership. | 100% (indirect) |

| Pebble West Claims Corporation 3 | Alaska, USA | Holding Company. Subsidiary of the Pebble Limited Partnership. | 100% (indirect) |

| Pebble East Claims Corporation 4 | Alaska, USA | Holding Company. Subsidiary of the Pebble Limited Partnership. | 100% (indirect) |

| U5 Resources Inc. 5 | Nevada, USA | Holding Company. Wholly-owned subsidiary of the Company. | 100% |

| Cannon Point Resources Ltd. | British Columbia, Canada | Not active. Wholly-owned subsidiary of the Company. | 100% |

| MGL Subco Ltd. | British Columbia, Canada | Not active. Wholly-owned subsidiary of the Company. | 100% |

Page | 9

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

| Delta Minerals Inc. | British Columbia, Canada | Not active. Wholly-owned subsidiary of MGL Subco Ltd. | 100% (indirect) |

| Imperial Gold Corporation | British Columbia, Canada | Not active. Wholly-owned subsidiary of Delta Minerals Inc. | 100% (indirect) |

| Yuma Gold Inc. | Nevada, USA | Not active. Wholly-owned subsidiary of Imperial Gold Corporation. | 100% (indirect) |

Notes:

| 1. |

An inactive wholly-owned subsidiary, 0796412 BC Ltd., was dissolved on February 17, 2016. | |

| 2. |

Holds 20% interest in the Northern Dynasty Partnership. The Company holds the remaining 80% interest. | |

| 3. |

Holds the Pebble Project claims. | |

| 4. |

Holds certain of the Pebble Project claims and claims located south and west of the Pebble Project claims. | |

| 5. |

Holds certain mineral claims located north of the Pebble Project claims. |

|

Control is achieved when the Group is exposed, or has rights, to variable returns from its involvement with the investee and has the ability to affect those returns through its power over the investee. Specifically, the Group controls an investee if, and only if, the Company has power over the investee (i.e. existing rights that give it the current ability to direct the relevant activities of the investee); exposure, or rights, to variable returns from its involvement with the investee; and the ability to use its power over the investee to affect its returns. | |

|

Intra-Group balances and transactions, including any unrealized income and expenses arising from intra- Group transactions, are eliminated in preparing the Financial Statements. Unrealized gains arising from transactions with equity accounted investees are eliminated against the investment to the extent of the Group’s interest in the investee. Unrealized losses are eliminated in the same way as unrealized gains, but only to the extent that there is no evidence of impairment. | |

| (d) |

Foreign Currencies |

|

The functional currency is the currency of the primary economic environment in which the entity operates and has been determined for each entity within the Group. The functional currency of U5 Resources Inc., Pebble Services Inc., Pebble Mines Corp., the Pebble Partnership and its subsidiaries, and Yuma Gold Inc. is the US dollar and for all other entities within the Group, the functional currency is the Canadian dollar. The functional currency determinations were conducted through an analysis of the factors for consideration identified in IAS 21, The Effects of Changes in Foreign Exchange Rates. | |

|

Transactions in currencies other than the functional currency are recorded at the rates of exchange prevailing on dates of transactions. At the end of each reporting period, monetary assets and liabilities that are denominated in foreign currencies are translated at the rates prevailing at that date. Non-monetary assets and liabilities carried at fair value that are denominated in foreign currencies are translated at rates prevailing at the date when the fair value was determined. Non-monetary items that are measured in terms of historical cost in a foreign currency are not retranslated. | |

|

The results and financial position of entities within the Group which have a functional currency that differs from that of the Group are translated into Canadian dollars as follows: (i) assets and liabilities for each statement of financial position are translated at the closing exchange rate at that date; (ii) income and expenses for each income statement are translated at average exchange rates for the period; and (iii) the resulting exchange differences are included in the foreign currency translation reserve within equity. |

Page | 10

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

| (e) |

Financial Instruments |

|

Non-derivative financial assets: | |

|

The Group has the following non-derivative financial assets: available-for-sale financial assets (note 4) and loans and receivables. | |

|

Available-for-sale financial assets | |

|

Available-for-sale ("AFS") financial assets are non-derivatives that are either designated as AFS or are not classified as (i) loans and receivables, (ii) held-to-maturity investments or (iii) financial assets at fair value through profit or loss. The Group’s investments in marketable securities are classified as AFS financial assets. Subsequent to initial recognition, they are measured at fair value and changes therein, other than impairment losses, are recognized in other comprehensive income or loss and accumulated in the investment revaluation reserve within equity. When an investment is derecognized, the cumulative gain or loss in the investment revaluation reserve is transferred to profit or loss. | |

|

The fair value of AFS monetary assets denominated in a foreign currency is determined in that foreign currency and translated at the spot rate at the end of the reporting period. The change in fair value attributable to translation differences that result from the amortized cost of the monetary asset is recognized within other comprehensive income or loss. The change in fair value of AFS equity investments is recognized in other comprehensive income or loss. | |

|

Loans and receivables | |

|

Loans and receivables are financial assets with fixed or determinable payments that are not quoted in an active market. Such assets are initially recognized at fair value plus any directly attributable transaction costs. Subsequent to initial recognition, loans and receivables are measured at amortized cost using the effective interest method, less any impairment losses. | |

|

Loans and receivables consist of cash and cash equivalents, restricted cash (note 6), and amounts receivable (note 5). | |

|

Cash and cash equivalents and restricted cash | |

|

Cash and cash equivalents and restricted cash in the statements of financial position are comprised of cash and highly liquid investments having maturity dates of three months or less from the date of purchase, which are readily convertible into known amounts of cash. | |

|

The Group’s cash and cash equivalents and restricted cash are invested in business and savings accounts and guaranteed investment certificates at major financial institutions and are available on demand by the Group for its programs and, as such, are subject to an insignificant risk of change in value. | |

|

Non-derivative financial liabilities: | |

|

The Group’s non-derivative financial liabilities comprise trade and other payables (note 9) and a payable to a related party (note 8(b)). | |

|

All financial liabilities fall within the classification of other financial liabilities versus financial liabilities through profit or loss, and are recognized initially at fair value net of any directly attributable transaction costs. Subsequent to initial recognition these financial liabilities are measured at amortized cost using the effective interest method. |

Page | 11

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

Impairment of financial assets:

When an AFS financial asset is considered to be impaired, cumulative gains or losses previously recognized in other comprehensive income or loss are reclassified to profit or loss in the period. Financial assets are assessed for indicators of impairment at the end of each reporting period. Financial assets are impaired when there is objective evidence that, as a result of one or more events that occurred after the initial recognition of the financial assets, the estimated future cash flows of the investments have been impacted. For marketable securities classified as AFS, a significant or prolonged decline in the fair value of the securities below their cost is considered to be objective evidence of impairment.

For all other financial assets, objective evidence of impairment could include:

| • |

significant financial difficulty of the issuer or counterparty; or | |

| • |

default or delinquency in interest or principal payments; or | |

| • |

it becoming probable that the borrower will enter bankruptcy or financial re-organization. |

|

For certain categories of financial assets, such as amounts receivable, assets that are assessed not to be impaired individually are subsequently assessed for impairment on a collective basis. The carrying amount of financial assets is reduced by the impairment loss directly for all financial assets with the exception of amounts receivable, where the carrying amount is reduced through the use of an allowance account. When an amount receivable is considered uncollectible, it is written off against the allowance account. Subsequent recoveries of amounts previously written off are credited against the allowance account. Changes in the carrying amount of the allowance account are recognized in profit or loss. | |

|

With the exception of AFS equity instruments, if, in a subsequent period, the amount of the impairment loss decreases and the decrease can be related objectively to an event occurring after the impairment was recognized, the previously recognized impairment loss is reversed through profit or loss to the extent that the carrying amount of the investment at the date the impairment is reversed does not exceed what the amortized cost would have been had the impairment not been recognized. In respect of AFS equity securities, impairment losses previously recognized through profit or loss are not reversed through profit or loss. Any increase in fair value subsequent to an impairment loss is recognized directly in equity. | |

|

When an AFS financial asset is considered to be impaired, cumulative gains or losses previously recognized in other comprehensive income are reclassified to profit or loss in the reporting period. | |

|

Derivative financial assets and liabilities: | |

|

The Group has no derivative financial assets or liabilities. | |

| (f) |

Exploration and Evaluation Expenditure |

|

Exploration and evaluation expenditures include the costs of acquiring licenses, costs associated with exploration and evaluation activity, and the acquisition date fair value of exploration and evaluation assets acquired in a business combination or an asset acquisition. Exploration and evaluation expenditures are expensed as incurred except for expenditures associated with the acquisition of exploration and evaluation assets through a business combination or an asset acquisition. Costs incurred before the Group has obtained the legal rights to explore an area are expensed. | |

|

Acquisition costs, including general and administrative costs, are only capitalized to the extent that these costs can be related directly to operational activities in the relevant area of interest where it is considered likely to be recoverable by future exploitation or sale or where the activities have not reached a stage which permits a reasonable assessment of the existence of reserves. |

Page | 12

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

Exploration and evaluation ("E&E") assets are assessed for impairment only when facts and circumstances suggest that the carrying amount of an E&E asset may exceed its recoverable amount and when the Group has sufficient information to reach a conclusion about technical feasibility and commercial viability.

Industry-specific indicators for an impairment review arise typically when one of the following circumstances applies:

•

Substantive expenditure on further exploration and evaluation activities is

neither budgeted nor planned;

• title to the

asset is compromised;

• adverse changes in the

taxation and regulatory environment;

• adverse

changes in variations in commodity prices and markets; and

• variations in the exchange rate for the

currency of operation.

|

Once the technical feasibility and commercial viability of the extraction of mineral resources in an area of interest are demonstrable, exploration and evaluation assets attributable to that area of interest are first tested for impairment and then reclassified to mining property and development assets within property, plant and equipment. | |

|

Recoverability of the carrying amount of any exploration and evaluation assets is dependent on successful development and commercial exploitation, or alternatively, sale of the respective assets. | |

| (g) |

Mineral property, plant and equipment |

|

Mineral property, plant and equipment are carried at cost, less accumulated depreciation and accumulated impairment losses. | |

|

The cost of mineral property, plant and equipment consists of the acquisition costs transferred from E&E assets, any costs directly attributable to bringing the asset to the location and condition necessary for its intended use, including costs to further delineate the ore body, development and construction costs, removal of overburden to initially expose the ore body, an initial estimate of the costs of dismantling, removing the item and restoring the site on which it is located and, if applicable, borrowing costs. | |

|

Mineral property acquisition and development costs are not currently depreciated as the Pebble Project is still in the development stage and no saleable minerals are being produced. | |

|

The cost of an item of plant and equipment consists of the purchase price, any costs directly attributable to bringing the asset to the location and condition necessary for its intended use, and an initial estimate of the costs of dismantling and removing the item and restoring the site on which it is located. | |

|

Depreciation is provided at rates calculated to write off the cost of plant and equipment, less their estimated residual value, using the declining balance method at various rates ranging from 20% to 30% per annum. | |

|

An item of equipment is derecognized upon disposal or when no future economic benefits are expected to arise from the continued use of the asset. Any gain or loss arising on disposal of the asset, determined as the difference between the net disposal proceeds and the carrying amount of the asset, is recognized in profit or loss. | |

|

Where an item of equipment consists of major components with different useful lives, the components are accounted for as separate items of equipment. Expenditures incurred to replace a component of an item of equipment that is accounted for separately, including major inspection and overhaul expenditures, are capitalized. | |

|

Residual values and estimated useful lives are reviewed at least annually. |

Page | 13

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

| (h) |

Impairment of Non-Financial Assets |

|

At the end of each reporting period the carrying amounts of the Group’s non-financial assets are reviewed to determine whether there is any indication that these assets are impaired. If any such indication exists, the recoverable amount of the asset is estimated in order to determine the extent of the impairment loss, if any. Where it is not possible to estimate the recoverable amount of an individual asset, the Group estimates the recoverable amount of the cash-generating unit to which the asset belongs. The recoverable amount is the higher of fair value less costs to sell and value in use. Fair value is determined as the amount that would be obtained from the sale of the asset in an arm’s length transaction between knowledgeable and willing parties. In assessing value in use, the estimated future cash flows are discounted to their present value using a pre-tax discount rate that reflects current market assessments of the time value of money and the risks specific to the asset. If the recoverable amount of an asset is estimated to be less than its carrying amount, the carrying amount of the asset is reduced to its recoverable amount and the impairment loss is recognized in profit or loss for the period. For an asset that does not generate largely independent cash inflows, the recoverable amount is determined for the cash generating unit to which the asset belongs. | |

|

Where an impairment loss subsequently reverses, the carrying amount of the asset (or cash-generating unit) is increased to the revised estimate of its recoverable amount. This increase in the carrying amount is limited to the carrying amount that would have been determined had no impairment loss been recognized for the asset (or cash-generating unit) in prior years. A reversal of an impairment loss is recognized immediately in profit or loss. The Group has not recorded any impairment charges in the years presented. | |

| (i) |

Share Capital, Special Warrants and Warrants |

|

Common shares, special warrants and warrants (notes 7(b)-(c)) are classified as equity. Transaction costs directly attributable to the issue of common shares, share purchase options, special warrants and warrants are recognized as a deduction from equity, net of any tax effects. Where units comprising of common shares and warrants are issued (note 7(b)), the proceeds and any transaction costs are apportioned between the common shares and warrants according to their relative fair values. | |

|

Upon conversion of special warrants and warrants into common shares, the carrying amount, net of a pro rata share of the transaction costs, is transferred to common share capital. | |

| (j) |

Share-based Payment Transactions |

|

Equity-settled share-based Option Plan | |

|

The Group operates an equity-settled share-based option plan for its employees and service providers (note 7(d)). The fair value of share purchase options granted is recognized as an employee or consultant expense with a corresponding increase in the equity-settled share-based payments reserve in equity (the "Equity Reserve"). An individual is classified as an employee when the individual is an employee for legal or tax purposes ("direct employee") or provides services similar to those performed by a direct employee. | |

|

The fair value is measured at grant date for each tranche, which is expensed on a straight line basis over the vesting period, with a corresponding increase in the Equity Reserve. The fair value of share purchase options granted is measured using the Black-Scholes option pricing model, taking into account the terms and conditions upon which the share purchase options were granted and forfeiture rates as appropriate. At the end of each reporting period, the amount recognized as an expense is adjusted to reflect the actual number of share purchase options that are expected to vest. |

Page | 14

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

|

Deferred Share Unit ("DSU") Plan | |

|

The Group adopted and operates a DSU plan for its non-executive directors. The Group determines whether to account for DSUs as equity-settled or cash-settled based on the terms of the contractual arrangement. The fair value of DSUs granted is recognized as an employee expense with a corresponding increase in the Equity Reserve if deemed equity-settled or a liability is raised if cash-settled at grant date. | |

|

The fair value is estimated using the quoted market price of the Company’s common shares at grant date and expensed over the vesting period as share-based compensation in the statement of loss and comprehensive loss until they are fully vested. If the DSUs are cash-settled, the expense and liability are adjusted each reporting period for changes in the quoted market price of the Company’s common shares. | |

|

Restricted Share Unit ("RSU") Plan | |

|

The Group has also adopted a RSU plan for its employees, executive directors and eligible consultants of the Group. The Group determines whether to account for the RSUs as equity-settled or cash-settled based on the terms of the contractual arrangement. The fair value of RSUs is recognized as an employee expense with a corresponding increase in the Equity Reserve if deemed equity –settled or a liability is raised if cash settled at grant date. | |

|

The fair value is estimated using the number of RSUs and the quoted market price of the Company’s common shares at the grant date. It is then expensed over the vesting period with the credit recognized in equity in the Equity Reserve. If cash-settled, the expense and liability are adjusted each reporting period for changes in the quoted market value of the Company’s common shares. | |

| (k) |

Income Taxes |

|

Income tax on the profit or loss for the years presented comprises current and deferred tax. Income tax is recognized in profit or loss except to the extent that it relates to items recognized in other comprehensive income or loss or directly in equity, in which case it is recognized in other comprehensive income or loss or equity. | |

|

Current tax expense is the expected tax payable on the taxable income for the year, using tax rates enacted or substantively enacted at year end, adjusted for amendments to tax payable with regard to previous years. | |

|

Deferred tax is provided using the balance sheet liability method, providing for unused tax loss carry forwards and temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for taxation purposes. The following temporary differences are not provided for: goodwill not deductible for tax purposes; the initial recognition of assets or liabilities that affect neither accounting nor taxable profit; and differences relating to investments in subsidiaries, associates, and joint ventures to the extent that they will probably not reverse in the foreseeable future. The amount of deferred tax provided is based on the expected manner of realization or settlement of the carrying amount of assets and liabilities, using tax rates enacted or substantively enacted at the end of the reporting period applicable to the period of expected realization or settlement. | |

|

A deferred tax asset is recognized only to the extent that it is probable that future taxable profits will be available against which the asset can be utilized. | |

|

Additional income taxes that arise from the distribution of dividends are recognized at the same time as the liability to pay the related dividend. |

Page | 15

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

|

Deferred tax assets and liabilities are offset when there is a legally enforceable right to set off current tax assets against current tax liabilities and when they relate to income taxes levied by the same taxation authority and the Group intends to settle its current tax assets and liabilities on a net basis. | |

| (l) |

Restoration, Rehabilitation, and Environmental Obligations |

|

An obligation to incur restoration, rehabilitation and environmental costs arises when environmental disturbance is caused by the exploration or development of a mineral property interest. Such costs arising from the decommissioning of plant and other site preparation work, discounted to their net present value, are provided for and capitalized at the start of each project to the carrying amount of the asset, along with a corresponding liability as soon as the obligation to incur such costs arises. The timing of the actual rehabilitation expenditure is dependent on a number of factors such as the life and nature of the asset, the operating license conditions and, when applicable, the environment in which the mine operates. | |

|

Discount rates using a pre-tax rate that reflects the time value of money are used to calculate the net present value. These costs are charged against profit or loss over the economic life of the related asset, through amortization using either the unit-of-production or the straight line method. The corresponding liability is progressively increased as the effect of discounting unwinds, creating an expense recognized in profit or loss. | |

|

Decommissioning costs are also adjusted for changes in estimates. Those adjustments are accounted for as a change in the corresponding capitalized cost, except where a reduction in costs is greater than the unamortized capitalized cost of the related assets, in which case the capitalized cost is reduced to nil and the remaining adjustment is recognized in profit or loss. | |

|

The operations of the Group have been, and may in the future be, affected from time to time in varying degree by changes in environmental regulations, including those for site restoration costs. Both the likelihood of new regulations and their overall effect upon the Group are not predictable. | |

|

The Group has no material restoration, rehabilitation and environmental obligations as the disturbance to date is immaterial. | |

| (m) |

Loss per Share |

|

The Group presents basic and diluted loss per share data for its common shares, calculated by dividing the loss attributable to common shareholders of the Group by the weighted average number of common shares and any fully prepaid special warrants outstanding during the year. Diluted loss per share does not adjust the loss attributable to common shareholders or the weighted average number of common shares outstanding when the effect is anti-dilutive. | |

| (n) |

Segment Reporting |

|

The Group operates in a single reportable operating segment – the acquisition, exploration and development of mineral properties. The Group’s core asset, the Pebble Project, is located in Alaska, USA. | |

| (o) |

Significant Accounting Estimates and Judgments |

|

The preparation of these Financial Statements requires management to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities at the date of the Financial Statements and reported amounts of expenses during the reporting period. Actual outcomes could differ from these estimates. These Financial Statements include estimates which, by their nature, are uncertain. The impacts of such estimates are pervasive throughout the Financial Statements, and may require accounting adjustments based on future occurrences. Revisions to accounting estimates are recognized in the period in which the estimate is revised and future periods if the revision affects both current and future periods. These estimates are based on historical experience, current and future economic conditions and other factors, including expectations of future events that are believed to be reasonable under the circumstances. |

Page | 16

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

Sources of estimation uncertainty

Significant assumptions about the future and other sources of estimation uncertainty that management has made at the end of the reporting period, that could result in a material adjustment to the carrying amounts of assets and liabilities, in the event that actual results differ from assumptions made, relate to, but are not limited to, the following:

| 1. |

The Group uses the Black-Scholes option pricing model to calculate the fair value of share purchase options granted for determining share-based compensation included in the loss for the year. Inputs used in this model require subjective assumptions, including the expected price volatility from three to five years. Changes in the subjective input assumptions can affect the fair value estimate, and therefore the existing models do not necessarily provide a reliable single measure of the fair value of the Group’s share purchase options. The weighted average assumptions applied are disclosed in Note 7(d). | |

| 2. |

Significant assumptions about the future and other sources of estimation uncertainty are made in determining the provision for any deferred income tax expense included in the loss for the year and the composition of deferred income tax liabilities included in the Statement of Financial Position. |

Critical accounting judgments

These include:

| 1. |

In terms of IFRS 6, Exploration for and Evaluation of Mineral Resources, management identified indicators that required testing the Group’s mineral property interest ("MPI") for impairment. The Group used judgment in determining from an analysis of facts and circumstances that no impairment of the MPI was necessary. | |

| 2. |

Pursuant to IAS 21, The Effects of Changes in Foreign Exchange Rates ("IAS 21") in determining the functional currency of the parent and its subsidiaries, the Group used judgment in identifying the currency in which financing activities are denominated and the currency that mainly influences the cost of undertaking the business activities in each jurisdiction in which each entity operates. | |

| 3. |

The Group has employed judgement that going concern was an appropriate basis for the preparation of the Financial Statements, as the Group considered existing and future available financial resources (note 15) in determining that such financial resources are able to meet key corporate Pebble Project expenditure requirements for at least the next twelve months (refer note 1). |

| (p) |

Amendments, Interpretations, Revised and New Standards Adopted by the Group |

|

The Group adopted the following amendments and annual improvements that became effective January 1, 2016: |

•

Amendments to IAS 1, Presentation of Financial Statements

• Amendments to IAS 16, Property, Plant

and Equipment

• Amendments to IAS 28,

Investments in Associates

• Amendments

to IAS 38, Intangible Assets

•

Amendments to IFRS 10, Consolidated Financial Statements

• Amendments to IFRS 11, Joint

Arrangements

• Annual improvements to IFRS

2012 – 2014 Cycle ("AIP 2012-2014")

The amendments and annual improvements had no material effect on the Financial Statements.

Page | 17

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

| (q) |

Accounting Standards, Amendments and Revised Standards Not Yet Effective Effective for annual periods commencing on or after January 1, 2018 |

| • |

IFRS 9, Financial Instruments ("IFRS 9") | |

|

IFRS 9 replaces IAS 39, Financial Instruments: Recognition and Measurement, in its entirety. The standard incorporates a number of improvements: a) includes a logical model for classification and measurement (IFRS 9 provides for principle-based approach to classification which is driven by cash flow characteristics and the business model in which an asset is held); b) includes a single, forward-looking "expected loss" impairment model (IFRS 9 will require entities to account for expected credit losses from when financial instruments are first recognized and to recognize full lifetime expected losses on a timely basis); and c) includes a substantially-reformed model for hedge accounting with enhanced disclosures about risk management activity (IFRS 9’s new model aligns the accounting treatment with risk management activities). The standard permits early adoption. | ||

|

The Group will adopt IFRS 9 at the effective date and anticipates that the adoption will have no material impact on its financial statements given the extent of its current use of financial instruments. | ||

| • |

IFRS 15, Revenue from Contracts with Customers ("IFRS 15") | |

|

IFRS 15 supersedes IAS 11, Construction Contracts, IAS 18, Revenue, IFRIC 13, Customer Loyalty Programmes, IFRIC 15, Agreements for the Construction of Real Estate, IFRIC 18, Transfers of Assets from Customers and SIC 31, Revenue – Barter Transactions Involving Advertising Services. IFRS 15 establishes a single five-step model framework for determining the nature, amount, timing and certainty of revenue and cash flows arising from a contract with a customer. The standard permits early adoption. | ||

|

The Group will adopt IFRS 15 at the effective date and anticipates that the adoption will have no material impact on its financial statements as the Group does not generate significant revenue given the Group’s current stage of development of the Pebble Project. The Group will reassess the impact once significant revenue is generated. |

Effective for annual periods commencing on or after January 1, 2019

| • |

IFRS 16, Leases ("IFRS 16") and revised IAS 17, Leases ("IAS 17"). | |

|

The IASB issued IFRS 16 and revised IAS 17 in January 2016. IFRS 16 specifies how to recognize, measure, present and disclose leases. IFRS 16 provides a single lessee accounting model, requiring the recognition of assets and liabilities for all leases, unless the term of the lease is twelve months or less or the underlying asset has a low value. Lessor accounting however remains unchanged from IAS 17 and the distinction between operating and finance leases is retained. IAS 17, as revised, now prescribes the accounting policies and disclosures applicable to leases, both for lessees and lessors. | ||

|

The Group will adopt IFRS 16 at the effective date and anticipates that the adoption will not have a significant impact other than the accounting for office, accommodation and storage leases the Group may have entered into where the minimum lease term is more than 12 months. In October 2016, the Group entered into a 5 year long term office lease (refer note 14). |

Page | 18

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

| 3. |

MINERAL PROPERTY, PLANT AND EQUIPMENT |

|

The Group’s exploration and evaluation assets are comprised of the following: |

| Year ended December 31, 2016 | Mineral Property | Plant and | ||||||||

| interest 1 | equipment | Total | ||||||||

| Cost | ||||||||||

| Beginning balance | $ | 112,541 | $ | 1,032 | $ | 113,573 | ||||

| Additions | – | – | – | |||||||

| Dispositions | – | (151 | ) | (151 | ) | |||||

| Ending balance | $ | 112,541 | $ | 881 | $ | 113,422 | ||||

| Accumulated depreciation | ||||||||||

| Beginning balance | $ | – | $ | (481 | ) | $ | (481 | ) | ||

| Depreciation 2 | – | (205 | ) | (205 | ) | |||||

| Eliminated on disposal | – | 128 | 128 | |||||||

| Ending balance | $ | – | $ | (558 | ) | $ | (558 | ) | ||

| Foreign currency translation difference | 29,381 | 227 | 29,608 | |||||||

| Net carrying value – Ending balance | $ | 141,922 | $ | 550 | $ | 142,472 |

| Year ended December 31, 2015 | Mineral Property | Plant and | ||||||||

| interest 1 | equipment | Total | ||||||||

| Cost | ||||||||||

| Beginning balance | $ | 112,541 | $ | 1,155 | $ | 113,696 | ||||

| Additions | – | 28 | 28 | |||||||

| Dispositions | – | (151 | ) | (151 | ) | |||||

| Ending balance | $ | 112,541 | $ | 1,032 | $ | 113,573 | ||||

| Accumulated depreciation | ||||||||||

| Beginning balance | $ | – | $ | (278 | ) | $ | (278 | ) | ||

| Depreciation 2 | – | (279 | ) | (279 | ) | |||||

| Eliminated on disposal | – | 76 | 76 | |||||||

| Ending balance | $ | – | $ | (481 | ) | $ | (481 | ) | ||

| Foreign currency translation difference | 33,743 | 253 | 33,996 | |||||||

| Net carrying value – Ending balance | $ | 146,284 | $ | 804 | $ | 147,088 |

Notes to table:

| 1. |

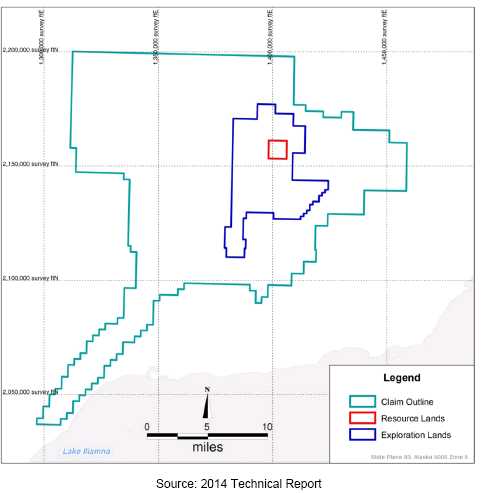

Comprises the Pebble Project, a contiguous block of 2,402 mineral claims covering approximately 417 square miles located in southwest Alaska, 17 miles (30 kilometers) from the villages of Iliamna and Newhalen, and approximately 200 miles (320 kilometers) southwest of the city of Anchorage. | |

| 2. |

Depreciation is included in exploration and evaluation expenses. |

Page | 19

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

| 4. |

AVAILABLE-FOR-SALE FINANCIAL ASSETS |

|

The Group’s available-for-sale financial assets was comprised of an investment in marketable securities of a Canadian publicly listed company acquired through the acquisition of Mission Gold Ltd. (note 7(b)). The Group disposed of the marketable securities for $1,754 during the year ended December 31, 2016. | |

| 5. |

AMOUNTS RECEIVABLE AND PREPAID EXPENSES |

| December 31 | December 31 | ||||||

| 2016 | 2015 | ||||||

| Sales tax receivable | 50 | $ | 164 | ||||

| Amounts receivable | 138 | 514 | |||||

| Prepaid expenses | 491 | 397 | |||||

| Total | 679 | $ | 1,075 |

| 6. |

CASH AND CASH EQUIVALENTS AND RESTRICTED CASH |

| (a) |

Cash and Cash Equivalents |

| December 31 | December 31 | ||||||

| 2016 | 2015 | ||||||

| Business and savings accounts | $ | 7,196 | $ | 7,509 |

Supplementary cash flow information

Non-cash investing and financing activities:

|

• |

In the year ended December 31, 2016, 41,334 options were exercised and common shares were issued but not delivered as payment was only received after the reporting date (note 15). | |

| • | In the year ended December 31, 2015, the following non-cash transactions occurred: |

| (a) |

The Group converted special warrants on a one-for-one basis into common shares of the Company at no additional cost to the holder (note 7(c)); and | |

| (b) |

The Group issued options and warrants pursuant to the acquisition of Cannon Point Resources Ltd. and Mission Gold Ltd. (note 7(b)). |

| (b) |

Restricted Cash |

|

The Group held restricted cash in the amount of $453 at December 31, 2015 for certain equipment demobilization expenses relating to the Pebble Partnership’s activities undertaken while it was subject to joint control of the Group and Anglo American plc. ("Anglo American"). This cash was not available for general use by the Group. During the year ended December 31, 2016, the Group drew down $393 from restricted cash for expenditures incurred in the last quarter of 2015 and returned the remaining balance of $60 to Anglo American in accordance with the terms of the agreement between both parties. |

Page | 20

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

| 7. |

CAPITAL AND RESERVES |

| (a) |

Authorized Share Capital |

|

At December 31, 2016, the authorized share capital comprised an unlimited (2015 – unlimited) number of common shares with no par value. As of the reporting date, the Company had 270,828,227 common shares issued and fully paid and 41,334 common shares issued to be delivered on receipt of payment (note 7(d)). | |

| (b) |

Financings and Other |

|

2016 Prospectus Financing | |

|

In June 2016, the Group completed a prospectus offering of 38,000,000 units in the capital of the Company at a price of $0.45 per unit for gross proceeds of $17,100. Each Unit consisted of one common share and one common share purchase warrant, which entitles the holder to purchase an additional common share at an exercise price of $0.65 per common share until June 10, 2021. | |

|

As of the reporting date, the Group incurred a total of $1,070 in issuance costs related to agents, advisory, regulatory and legal fees. The Group apportioned the gross proceeds and issuance costs between share capital and warrants based on their relative fair values on date of issue, with share capital using the quoted market price for shares on date of issue and warrants based on the Black Scholes option pricing model (using inputs of $0.65 exercise price; $0.42 valuation date share price; 81% expected volatility; 0.57% risk free rate; 5 years remaining life; and nil% dividend). Accordingly, net proceeds of $10,347 was allocated to share capital and $5,683 to warrants. | |

|

2016 Private Placement | |

|

In July 2016, the Group completed a private placement of 4,444,376 units in the capital of the Company, each unit comprising of one common share and one share purchase warrant, at a price of $0.45 per unit for gross proceeds of $2,000. Each share purchase warrant is exercisable into one common share at an exercise price of $0.65 per common share until June 10, 2021. The common shares and share purchase warrants were subject to applicable resale restrictions, including a four month hold under Canadian legislation. | |

|

As of the reporting date, the Group incurred a total of $33 in issuance costs related to regulatory and legal fees. The Group apportioned the gross proceeds and issuance costs between share capital and warrants based on their relative fair values on date of issue, with share capital using the quoted market price for shares on date of issue and warrants based on the Black Scholes option pricing model (using inputs of $0.65 exercise price; $0.45 valuation date share price; 81% expected volatility; 0.54% risk free rate; 5 years remaining life; and nil% dividend). Accordingly, net proceeds of $1,264 was allocated to share capital and $703 to warrants. | |

|

2015 Private Placement | |

|

In December 2015, the Group completed a private placement of 12,573,292 common shares in the Company at a price of $0.412 per share for gross proceeds of $5,180. The Group issued 300,000 common shares as referral fees to an arm’s length third party and recorded the fair value of these common shares of $120 as share issuance cost. Other legal and regulatory costs incurred in relation to the private placement was $14. | |

|

2015 Acquisition of Listed Entities |

During the year ended December 31, 2015, the Group acquired TSX Venture listed entities, Cannon Point Resources Ltd. ("Cannon Point") and Mission Gold Ltd. ("Mission Gold"), each by way of a plan of arrangement in which the Group acquired 100% of the issued and outstanding common shares by issuing 12,881,344 and 27,593,341 common shares respectively. The acquisitions enabled the Group to have access to their primary asset being cash resources of which Cannon Point had $4,397 and Mission Gold had $8,338. The Group incurred transaction costs of $104 and $284 respectively which was recorded within equity.

Page | 21

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

Pursuant to the Cannon Point arrangement, Cannon Point advanced to the Group $4,250 (the "Cash Advance") with a one year term at an interest rate of 15% per annum. The Group accrued $103 in interest on the Cash Advance up to the date of the acquisition.

Pursuant to the Mission Gold arrangement, Mission Gold provided the Group with a credit facility of $8.4 million (the "Credit Facility") with a 6-month term at an interest rate of 15% per annum. The Group only drew down $2 million of the Credit Facility before the acquisition was completed and accrued $41 in interest on the $2 million from the Credit Facility up to that date.

The following is a summary of each acquisition:

| Cannon Point | Mission Gold | ||||||

| Fair value | Fair value | ||||||

| Cash and cash equivalents | $ | 4,397 | $ | 8,338 | |||

| Common shares of a publicly listed investment (note 4) | – | 1,684 | |||||

| Amounts receivable | 126 | 81 | |||||

| Accounts payable and accrued liabilities assumed | (140 | ) | – | ||||

| Financial instruments acquired | $ | 4,383 | $ | 10,103 | |||

| Consideration 1: | |||||||

| Common shares issued (12,881,344 and 27,593,341) | $ | 4,166 | $ | 7,838 | |||

| Share purchase warrants and options (4,394,500 and 16,673,348 (note 7(c))) | 217 | 2,265 | |||||

| Total consideration | $ | 4,383 | $ | 10,103 |

Note

| 1. |

The fair value of the financial assets and liabilities was allocated to the common shares and the share purchase options/warrants issued in proportion to their relative fair values; for common shares, the quoted market price on date of issue was used and for the options and warrants, the Black Scholes options pricing model was used (using weighted average valuation inputs for i) Cannon Point: $1.63 exercise price; $0.55 valuation date share price; 87% expected volatility; 0.49% risk free rate; 0.82 years remaining life; and nil% dividend yield; and ii) Mission Gold: $0.97 exercise price; $.43 valuation date share price; 83% expected volatility; 0.59% risk free rate; 4.06 years remaining life; and nil% dividend yield). |

Page | 22

| Northern Dynasty Minerals Ltd. |

| Notes to the Consolidated Financial Statements |

| For the years ended December 31, 2016 and 2015 |

| (Expressed in thousands of Canadian Dollars, unless otherwise stated, except per share or option) |

| (c) |

Share Purchase Warrants and Options not Issued under the Group’s Incentive Plan |

|

The following reconciles warrants and non-employee options (options which are not issued under the Group’s incentive plan (note 7(d)), each exercisable to acquire one common share, at the beginning and end of the year for 2016: |

| Year ended December 31, 2016 | |||||||||||||||||

| Exercise | |||||||||||||||||

| price per | |||||||||||||||||

| common | Beginning | Ending | |||||||||||||||

| share ($) | Expiry date | balance | Issued | Exercised | Expired | balance | |||||||||||

| Options issued pursuant to the acquisition of Cannon Point | |||||||||||||||||

| 0.29 | January 29, 2016 | 150,400 | – | (150,400 | ) | – | – | ||||||||||

| 0.37 | January 29, 2016 | 220,900 | – | (61,100 | ) | (159,800 | ) | – | |||||||||

| 0.40 | January 29, 2016 | 150,400 | – | – | (150,400 | ) | – | ||||||||||

| 0.43 | January 29, 2016 | 37,600 | – | – | (37,600 | ) | – | ||||||||||