UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or 12(g) of the Securities Exchange Act of 1934

AMERICAN DOCTORS ONLINE, INC.

(Exact name of registrant as specified in its charter)

Delaware

(State of other jurisdiction of incorporation)

06-1558586

(I.R.S. Employer Identification No.)

200 Mill Road, Suite 350A

Fairhaven, MA 02719

(Address of principal executive office) (Zip code)

866-539-7379

(Registrant’s telephone number)

Copies to:

Laura Anthony, Esq.

Legal and Compliance, LLC

330 Clematis Street, Suite 217

West Palm Beach, FL 33401

561-514-0936

LAnthony@LegalandCompliance.com

Securities to be registered under Section 12(b) of the Act:

Title of each class to be so registered |

Name of each exchange on which each class is to be registered | |

| None | None |

Securities to be registered under Section 12(g) of the Act:

| Common stock, par value $0.01 per share | None | |

| (Title of class) |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |

| Non-accelerated filer | ☐ | Smaller Reporting Company | ☑ |

TABLE OF CONTENTS

| Item 1. | Business | 3 |

| Item 1A. | Risk Factors | 9 |

| Item 2. | Financial Information | 15 |

| Item 3. | Properties | 23 |

| Item 4. | Security Ownership of Certain Beneficial Owners and Management | 24 |

| Item 5. | Directors and Executive Officers | 24 |

| Item 6. | Executive Compensation | 26 |

| Item 7. | Certain Relationships and Related Transactions, and Director Independence | 28 |

| Item 8. | Legal Proceedings | 29 |

| Item 9. | Market price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters | 29 |

| Item 10. | Recent Sales of Unregistered Securities | 29 |

| Item 11. | Description of Registrant’s Securities to be Registered | 33 |

| Item 12. | Indemnification of Directors and Officers | 34 |

| Item 13. | Financial Statements and Supplementary Data | 35 |

| Item 14. | Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 36 |

| Item 15. | Financial Statements and Exhibits | 37 |

| 2 |

Forward Looking Statements

There are statements in this Registration Statement that are not historical facts. These "forward-looking statements" can be identified by use of terminology such as "believe," "hope," "may," "anticipate," "should," "intend," "plan," "will," "expect," "estimate," "project," "positioned," "strategy" and similar expressions. You should be aware that these forward-looking statements are subject to risks and uncertainties that are beyond our control. Although we believe that the expectations reflected in such forward-looking statements, including those regarding future operations, are reasonable, we can give no assurance that such expectations will prove to be correct. Forward-looking statements are not guarantees of future performance and they involve various risks and uncertainties. Forward-looking statements contained in this document include statements regarding our proposed products, market opportunities and acceptance, expectations for revenues, cash flows and financial performance, and intentions for the future. Such forward-looking statements are included under Item 1. “Business” and Item 2. “Financial Information - Management’s Discussion and Analysis of Financial Condition and Results of Operation.” All forward-looking statements included in this document are made as of the date hereof, based on information available to us as of such date, and we assume no obligation to update any forward-looking statement. It is important to note that such statements may not prove to be accurate and that our actual results and future events could differ materially from those anticipated in such statements. Among the factors that could cause actual results to differ materially from our expectations are those described under Item 1. “Business” and Item 2. “Financial Information - Management’s Discussion and Analysis of Financial Condition and Results of Operations.” All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by this section and other factors included elsewhere in this document. You should assume that the information contained in this document is accurate as of the date of this Form 10 only.

Emerging Growth Company

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act (“JOBS Act”).

Item 1. Business

Overview

American Doctors Online, Inc. (“ADOL”) a Delaware corporation, formed in 1999, owns four U.S. patents and has three pending patent applications. These patents are the foundation of ADOL’s current business and future licensing offerings and are expected to generate the majority of the Company’s revenues in licensing fees and royalties. Management believes that the depth of the Company’s intellectual property includes the fundamental methodologies inherent to providing video conferencing for the delivery of telehealth/telemedicine services. For example, the initial patent covers a method for delivering medical examination, diagnosis, and treatment services to a patient over a network using a medical call center and audio-visual technologies with any plurality of healthcare practitioners' terminals and patient terminals as a way to bring patients face-to-face with physicians to provide medical consultation.

ADOL has executed a Management Services and License Agreement with PhoneDOCTORx, LLC, (“PDRx”). PDRx, a Massachusetts limited liability company, founded in 1999, is owned by five physicians, who collectively own over 70% of ADOL. Based on the common control and ownership between ADOL and PDRx, the financial results and disclosures contained herein consolidate PDRx and ADOL. ADOL exerts no influence on, or has any involvement in the practice of medicine completed by PDRx’s clinical staff.

The original PDRx concept utilized the initial patented videoconferencing claims in Retail Pharmacies to provide timely and appropriate medical care to patients who had simple, day-to-day medical needs (e.g., poison ivy). During this phase, PDRx safely helped many patients avoid a trip to the Emergency Department. In 2005, the focus of PDRx changed to address the challenges faced by Extended Care Facilities (“ECF’s”) and overburdened community physicians to provide timely care to their patients. Management concluded that helping ECF’s solve these issues would better employ the clinical resources of PDRx. As this new concept was being refined, the management team realized that the solution would yield a multiple win for ECF’s, their patients, their nursing staffs, their primary care and covering physicians, already overcrowded Emergency Departments, and the Healthcare System which would save significant costs from preventing unnecessary transfers and hospital admissions. Today PDRx, through the sub-licensing of the ADOL patents, is an innovative telemedicine company that provides remote covering physician consultations via audio and/or video conferencing technologies. It provides ECFs nurses, patients and their families’ confidential, real-time access to Board Certified physicians in non-urgent, urgent and emergent care settings through a state-of-the-art medical call center. PDRx through sub-licenses of ADOL’s patented telehealth / telemedicine technology provides medical services including face-to-face, real-time access to covering physicians, resulting in reduction of unnecessary and avoidable transfers and readmissions to the Emergency Department.

Between 2006 and 2012, PDRx had over 38,000 clinical telemedicine encounters utilizing ADOL’s patented processes. For the years ended December 31, 2013 and 2012 PDRx generated $385,470 and $263,349, respectively, in revenue utilizing the telemedicine technology generated from ADOL’s patented process.

Pursuant to a management services contract, ADOL provides PDRx with support for PDRx’s administration, management, finance, human relations, information technology, and sales and marketing functions. The license and management services contracts have been in place since 2001. The current agreement was effective September 17, 2011 and has a thirty year term.

ADOL believes PDRx is a blueprint for other physician based companies and groups throughout the U.S who could also exploit the ADOL patents through licensure. PDRx has proven the value of utilizing telemedicine for non-urgent, urgent and emergent care. Additionally, there is as a myriad of other types of business models that can provide telemedicine videoconferencing services that would benefit from the licensing of one or more of ADOL’s patents.

ADOL’s business model is to license to telehealth/telemedicine providers one or more of the patents in our patent portfolio, pursuant to non-exclusive agreements, with terms and conditions similar to other licensing agreements involving medical IP. Management believes that the depth of the Company’s intellectual property includes the fundamental methodologies inherent to providing video conferencing for the delivery of telehealth/telemedicine services. Accordingly, ADOL believes it is well positioned to license the patent portfolio to various type entities operating within the healthcare system. ADOL has not yet licensed its patents to customers other than PDRx.

| 3 |

Telehealth / Telemedicine Industry

As formally defined by the American Telemedicine Association (“ATA”), telemedicine is the use of medical information exchanged from one site to another via electronic communications to improve a patient’s clinical health status. Telemedicine includes a growing variety of applications and services using two-way video, email, smart phones, wireless tools and other forms of telecommunications technology. Starting out over forty years ago with demonstrations of hospitals extending care to patients in remote areas, the use of telemedicine has spread rapidly and is now becoming integrated into the ongoing operations of hospitals, specialty departments, home health agencies, private physician offices as well as consumer’s homes and workplaces.

Telemedicine is not a separate medical specialty. Products and services related to telemedicine are often part of a larger investment by health care institutions in either information technology or in the delivery of virtual clinical care. ATA has historically considered telemedicine and telehealth to be interchangeable terms, encompassing a wide definition of remote healthcare. Patient consultations via video conferencing, transmission of still images, e-health including patient portals, remote monitoring of vital signs, continuing medical education, consumer-focused wireless applications and nursing call centers, among other applications, are all considered part of telemedicine and telehealth.

Telemedicine uses audio and video conferencing technologies and the combination of all other forms of electronic communication tools so that a doctor at one site can treat patients at a different site. The combined use of audio and video conferencing allows the patient and doctor to see and talk to each other as in live television broadcast. Tools used by clinicians to observe and collect vital information, such as otoscope and stethoscopes, have been adapted so the clinician can deploy them on the patient as if they were in the same room.

While the term telehealth is sometimes used to refer to a broader definition of remote healthcare that does not always involve clinical services, ATA uses the terms in the same way one would refer to medicine or health in the common vernacular. Telemedicine is closely allied with the term health information technology (“”HIT”). However, HIT more commonly refers to electronic medical records and related information systems while telemedicine refers to the actual delivery of remote clinical services using technology.

Telehealth is the delivery of healthcare services and information via telecommunication technologies. Telehealth can deliver preventative, educational, and curative services. Telemedicine focuses on the curative aspects of telehealth and uses telecommunication and information technologies to provide and support clinical services at a distance. Because telehealth is immediately available, immensely flexible, and free of geographic barriers it has become an efficient and effective methodology/process to deliver health services that overcome the existing problems of provider supply and patient access.

Telehealth, including home monitoring devices and thousands of health care applications for personal computers, smartphones, and other platforms, has claimed a significant place in the healthcare industry. Telehealth applications can address specific conditions; they can be proactive or preventative, informative or supportive.

There has been a global focus on the use of telemedicine as a tool to cut down healthcare costs. Implementation of the new U.S. healthcare law will, if anything, intensify this focus, by increasing the number of people with health insurance and those seeking medical services. In the near to mid-term, telemedicine technologies offer one of the few ways of enabling healthcare personnel to meet the increased demand without unacceptable delays.

Telehealth/Telemedicine Market

BCC Research, LLC (“BCC”), is a leading information resource producing high-quality market research reports, newsletters, and conferences. BCC’s information products explore major market, economic, scientific,and technological developments for business leaders in industrial, pharmaceutical, and high technology organizations. Industry analysis and market forecasts for advanced materials, high-tech systems and components, nanotechnology and novel processing methods are at the forefront of the company’s expertise. For more than 35 years, BCC’s market analysis has provided businesses with the insight needed to make intelligent and strategic business decisions. BCC Research is a unit of Eli Research, which is based in Durham, N.C. As a leading market research company covering changes driven by science and technology, they define telemedicine as the use of telecommunications technology to deliver medical information or services to patients or other users at a distance from the provider.

Telemedicine offers a network and framework for e-healthcare wherein patients and healthcare service providers are on a common delivery platform for healthcare services. In simple words, telemedicine covers all healthcare services being delivered remotely with the help of telecom technologies.

According to BCC’s research, the most important factor contributing to the adoption of telemedicine among patients is improved clinical outcome. Patients also prefer the convenience of telemedicine as opposed to spending time on doctor’s appointments or hospital admissions, if avoidable. Although cost reduction is an important factor, it was not ranked as the most important reason contributing to the adoption of telemedicine among patients. Telemedicine also acts as an important interface between urban and rural healthcare.

Telehome and Telehospital/Clinic Segments

In their October 2013 update to their March 2012 report, BCC has divided the total U.S. telemedicine market of $6.66 billion into two major segments: telehome and telehospitals/clinics.

The BCC reports also found that in 2012, the U.S. telehospital/clinics segment accounted for $4.2 billion and is expected to approach $9.2 billion by 2018, with a compound annual growth rate (“CAGR”) of 13.7%. The U.S. telehome segment accounted for over $2.4 billion in 2012 and is expected to grow at a CAGR of 23.4% to exceed $8.6 billion by 2018.

BCC further divides the telemedicine market into technology and service segments. The telemedicine service market is comprised of store-and-forward and videoconferencing. Videoconferencing allows face-to-face encounters between people in different locations in real time. Tandberg (now part of Cisco) and Polycom, Inc. are the main U.S. players offering videoconferencing. Store-and-forward telemedicine is used to transmit clinical signals and images for pathological and radiological purposes to other locations for diagnosis. The fields of dermatology, pathology, radiology, neurology and ophthalmology are mainly dependent upon static reports or images, and they may not require live interaction with patients. Psychology, psychiatry, surgery, cardiology, emergency and triage applications, however, require real-time, two-way, audio-video communication.

Management believes the strength of the Company’s patent claims pertain to videoconferencing, therefore, the following discussion relates only to the videoconferencing segment within the U.S. telemedicine services market. BCC reports that videoconferencing within the U.S. telehospital/clinics segment accounted for approximately $1.4 billion of the total telemedicine market in 2012, and it is expected to grow from 2012 to 2018 at a CAGR of 15% to reach $3.3 billion by 2018. BCC estimates that the videoconferencing within the U.S. telehome segment accounted for $436 million in 2012, and is expected to grow to 2018 at a CAGR of 25.4% to reach approximately $1.7 billion by 2018. Accordingly, the total U.S. videoconferencing telemedicine market in 2012 was approximately $1.8 billion and is expected to be $5.0 billion in 2018.

Technology

Unlike today, the telecom infrastructure in the past was not robust enough to support telemedicine. Recently, networking technology has improved considerably, delivering high-quality audio, video, images with improved bandwidth, reduced latency, higher reliability, redundancy and vast reach to the masses. Wireless technology has grown with wearable, wireless, mobile and satellite devices. Internet protocol (IP)-based technology, along with the availability of high-speed networks, is making the technology fully interoperable and computer-based. Network companies are actively working to make information storage and transmission safe and secure. Telemedicine has received a significant boost with the improved technology.

| 4 |

Our Intellectual Property

Intellectual Property

The Company has a significant market opportunity because we believe that the depth of the Company’s intellectual property portfolio includes the fundamental methodologies inherent to providing video conferencing for the delivery of telehealth/telemedicine services. These patents could apply to virtually every participant in this market. ADOL’s IP assets consist of four patents issued and three patents pending.

The table below is a summary of the issued patents, followed by a brief description of each:

| ISSUED PATENTS | ||||||||||||||||||||||||||||

| Initial | Amended | |||||||||||||||||||||||||||

| Date | Application | Assign | Date | Issued | Patent | Assigned | ||||||||||||||||||||||

| Filed | Number | Date | Issued | to | Number | Date | Assignee | |||||||||||||||||||||

| 9 | /14/2001 | 09 | /855,738 | 10 | /18/2001 | 10 | /28/2003 | Dr. Paul Bulat | 6638218 | 10 | /23/2013 | ADOL | ||||||||||||||||

| 10 | /27/2003 | 10 | /694,519 | 2 | /12/2004 | 3 | /14/2006 | Dr. Paul Bulat | 7011629 | 10 | /23/2013 | ADOL | ||||||||||||||||

| 12 | /29/2005 | 11 | /321,332 | 3 | /18/2009 | 4 | /26/2010 | Dr. Paul Bulat | 7691059 | 10 | /23/2013 | ADOL | ||||||||||||||||

| 11 | /18/2008 | 12 | /273,065 | 11 | /18/2008 | 6 | /28/2011 | Dr. Paul Bulat | 7970633 | 10 | /23/2013 | ADOL | ||||||||||||||||

| Amended Assign dates reflect an amendment to the assignees name only. | ||||||||||||||||||||||||||||

US 6,638,218

A system and method for delivering medical examination, diagnosis, and treatment services from a physician to a patient over network is provided. A physician call center enables any of a first plurality of physician terminals to be in audiovisual communication over the network with any of a second plurality of patient terminals. A call is received at the call center from a patient at one of the patient terminals and the call is routed to an available physician at one of the physician terminals. The available physician may carry on a two-way conversation with the patient, visually observe the patient, and make an assessment whether the patient may be suffering from an acute non-urgent condition. The available physician may conduct an examination of the patient over the network, including by visual study of the patient, only if the assessment is that the patient may be suffering from an acute non-urgent condition.

US 7,011,629

A

method for providing a covering physician service via a network to a patient who has consented to use the service and who has

access to one of a first plurality of patient terminals, the method comprising: receiving at a call center, the call center enabling

any of a second plurality of health care practitioner terminals to be in audio-visual communication over the network with any

of the first plurality of patient terminals, a call from the patient at one of the patient terminals and routing the call to an

available health care practitioner at one of the health care practitioner terminals so that the available health care practitioner

may carry on a two-way conversation with the patient and visually observe the patient; and permitting the available health care

practitioner to make an assessment of the patient and to treat the patient.

US 7,691,059

A method for delivering medical examination, diagnosis, and treatment services to a patient over a network, the method comprising: providing a call center enabling any of a first plurality of health care practitioner terminals to be in audiovisual communication over the network with any of a second plurality of patient terminals; receiving a call at the call center from a patient at one of the patient terminals and routing the call to an available health care practitioner at one of the health care practitioner terminals, so that the available health care practitioner may carry on a two-way conversation with the patient and visually observe the patient; and permitting the available health care practitioner to make an assessment of the patient and to conduct an examination of the patient over the network, including by a visual study of the patient

US 7,970,633

A system for delivering medical examination, diagnosis, and treatment services from a health care practitioner to a patient over a network, the system comprising:

| • | a plurality of health care practitioner terminals, each of the plurality of health care practitioner terminals including a display device; |

| • | a plurality of patient terminals in audiovisual communication over the network with any of the plurality of health care practitioner terminals; and |

| • | a call center in communication with the patient terminals and the health care practitioner terminals, the call center routing a call from a patient at one of the patient terminals to an available health care practitioner at one of the health care practitioner terminals, so that the available health care practitioner may carry on a two-way conversation with the patient and visually observe the patient. |

Three additional patents are pending and another group is currently in development. The existing awarded patents can be viewed via the ADOL website at: http://www.adoltelemed.com/patents.php

Notwithstanding anything to the contrary set forth in any of the Company’s filings under the Securities Act of 1933 or the Securities Exchange Act of 1934 that might incorporate future filings, the information set forth on the United States Patent and Trademark Office, or the USPTO Website, shall not be deemed to be a part of or incorporated by reference into any such filings. The Company does not warrant the accuracy or completeness, or adequacy of the USPTO Website, and expressly disclaims liability for errors or omissions on such website.

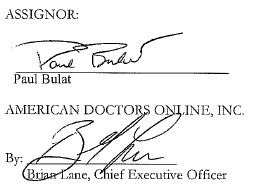

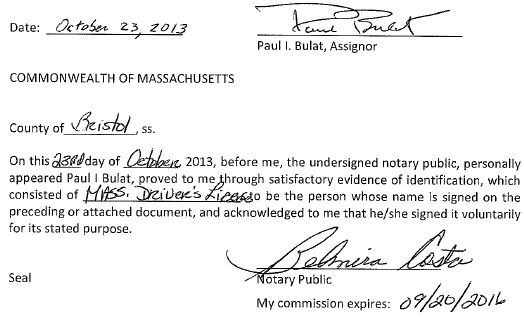

Purchase of Patents

All of the issued patents were assigned from Dr. Paul Bulat the inventor and our Founder and Chairman of the board of the directors pursuant to various Patent Assignments with the United States Patent and Trademark Office. Additionally on October 23, 2013, the Company entered into a Patent Purchase Agreement with Mr. Bulat. Pursuant to the Patent Purchase Agreement, the Company agreed to issue 3,500,000 shares of Series A Convertible Preferred Stock to Dr. Bulat. Based on the conversion feature of the Series A Preferred Stock, the holder, in his sole discretion is entitled to convert the 3,500,000 shares of Series A Preferred Stock to 7,000,000 shares of Company common stock. The Company valued the 3,500,000 shares of Series A Preferred Stock, as if it had been converted to the 7,000,000 shares of common stock, at $3,500,000, or $0.50 per share of common stock, the same value at that time, as the most recent sales of common stock; capitalized Mr. Bulat’s historical cost of $16,675 (patent attorney fees) and recorded compensation expense of $3,483,325.

Marketing and Sales

Our Strategy

Our strategy is to become a market leader in delivery of telehealth/telemedicine via video conferencing. The key elements of our growth strategy include:

| • | Implement a patent and technology licensing program to commercialize our intellectual property. |

| • | Establish American Doctors Online, Inc. as a dominant US source of providing telemedicine services via video teleconferencing pursuant to our patents, through licensing to other telemedicine companies, hardware and software companies and telecom companies. |

| • | Leverage our patent portfolio, technology and software to develop additional patents that can be licensed directly to our then current customers and to attract new customers. |

The Company plans to employ a leveraged, partner-oriented, marketing strategy for our patent and technology licensing program. The marketing strategy for our patent and technology licensing program will initially be focused on Original Equipment manufacturers (“OEMs”) and service providers. In furtherance of our strategy, in June 2013, we engaged ipCapital Group (“ipCG”) to help us support and grow our licensing business. Led by John Cronin, ipCG is a leading advisor on licensing technology and intellectual property. Prior to founding ipCG, Mr. Cronin was a distinguished inventor at IBM for 17 years where he patented 100 inventions, published over 150 technical papers, received IBM’s “Most Distinguished Inventor Award,” and was recognized as IBM’s “Top Inventor.”

IpCG has delivered over 700 IP engagements to companies in a wide range of industries including over 10% of the Fortune 500. Their professional services maximize financial results for clients that seek to develop and execute intellectual property (IP) strategies, strengthen and monetize IP portfolios, and establish and implement Intellectual Asset Management (IAM) practices. They have an interdisciplinary team trained in business, IP rules/regulations, marketing, and product development that provides a systematic and comprehensive view of the full lifecycle of IP, from creation to monetization to retirement. Since its founding in 1998, ipCG has supported the licensing efforts of clients across a variety of technologies and markets.

Additionally, ipCG was engaged to provide strategic intellectual property (“IP”) support to the Company. Utilizing a three phase approach, ipCG assisted the Company in the following matters:

| • | Phase 1: Systematically Invent-Around Selected Filings – ipNavigationSM process |

| • | Phase 2: Define and Analyze ADOL’s IP Landscape (ipLandscape® and ipAnalytics® Process) |

| • | Phase 3: Estimate the value range of ADOL’s portfolio (ipValue ModelSM) |

In Phase 1, ipCG using its proprietary ipNavigationSM methodology on ADOL patent filings identified specific ways in which the IP could be strengthened to enhance its value, mitigate risk of competitive invent-around, and provide a technology path in which the Company can further protect its inventions. Management believes this phase will ultimately result in increasing the strength and value of the Company’s IP by building a more robust and strategic portfolio and mitigating risks from competitor filings.

The Phase 2 analysis provided a framework to map our existing IP portfolio, search and analyze relevant competitive IP, and provide data-driven strategic observations. This resulted in establishing the critical input needed for developing the Company’s IP strategy for the future and communicating such with investors.

The Phase 3 analysis included a detailed IP valuation, wherein ipCG utilizing the BCC market study and the average of an Industry Income Approach and Royalty Approach based model, resulting in an average five year and ten year valuation of $14.9 million and $72.4, respectively.

On April 15, 2014, the Company entered into a three month Consulting Agreement with a consultant (the “Consultant”) to assist the Company regarding the formation of strategic relationships with existing and new identified technology companies. Additionally, the Consultant will work with the executive management team in developing market strategies and comprehensive video conferencing technology solution offerings including the bundling of these technologies, working with ADOL’s partner on developing licensing packages, creating new sales proposal formats for consultation services and technologies/products, and assisting with the development and placement of products and services. The Company will compensate the Consultant $100 per hour, for a minimum of 40 hours per week, for these services, which may be paid, at the option of the Company, in the form of cash or equity consideration.

| 5 |

Additionally, management plans to leverage the Company’s relationship with Premier Purchasing Partners, L.P. (“PPP”). Effective June 1, 2013, for a period of thirty five (35) months, ADOL entered into a Group Purchasing Agreement - Software License/Application Service Providers contract with PPP to deliver telehealth and telemedicine services. PPP is an affiliate of Premier, Inc. (“Premier”) an alliance of hospitals and alternative sites of care that is focused on using technology to facilitate the delivery of high-quality, cost-effective care. Under this contract PPP will offer ADOL’s telehealth / telemedicine bundles for delivery nationally to Premier’s member facilities and shall be compensated based on a percentage of our products or services purchased or licensed by Premier’s member facilities..

Once the Company begins generating additional licensing revenue, management intends to build a sales force that will be responsible for managing existing accounts and pursuing licensing and sales opportunities with new customers.

Management’s objective is to be one of the leaders in the services segment of telehealth/telemedicine market

| • | Invest in research and development efforts to extend our technology leadership. We plan to build upon our current IP portfolio to enhance our product and licensing capabilities. |

| • | Expand our licensing/sales organization to acquire new customers. We intend to continue to invest in our licensing/sales organization as we pursue larger enterprise and government opportunities. |

| • | Exploit our channel relationships with Group Purchasing Organizations. Under this contract PPP will offer ADOL’s telehealth / telemedicine bundles for delivery nationally to Premier’s member facilities. |

| • | Drive greater penetration into our customer base. Initially, we believe licensees/customers will deploy our platform to provide audio visual telemedicine services between a patient and licensed physician. We see a significant opportunity to upsell and cross sell additional licenses, subscriptions and services as our customers realize the increasing value of our platform. |

Massachusetts (MA) Sexual Assault Nurse Examiner (SANE) Program

In 2013, the Company was invited to be part of a national sexual assault telemedicine examination project demonstration program developed by the Massachusetts Department of Public Health (“MDPH”). Telemedicine can improve the health status of patients and sexual assault survivors by exchanging medical information from one site to another via electronic communications using voice (audio) and face-to-face (video) communication. The MDPH is an agency of the Commonwealth of Massachusetts which serves the people of the Commonwealth, particularly the underserved and promotes healthy people, healthy families and healthy communities and operates the MA SANE Program. The MA SANE Program is a state funded program to provide expert care to patients of sexual assault in 27 designated hospitals and Child Advocacy Centers. SANEs are specially trained and certified professional nurses skilled in performing quality forensic medical-legal exams. For the past 15 years, the Massachusetts SANE Program has provided expert forensic nursing care to over 14,000 survivors of sexual assault. When applied to the SANE practice, telemedicine has the potential to create a national community of support and increase their confidence, role satisfaction and provider retention. Other participants in the national sexual assault examination telemedicine program include:

| • | The

Office for Victims of Crime (“OVC”). The mission of the OVC, a component

of the U.S. Department of Justice, is to enhance the Nation's capacity to assist crime

victims and to provide leadership in changing attitudes, policies, and practices in ways

that will promote justice and healing for all victims. OVC is charged by Congress with

administering the Crime Victims Fund, a major source of funding for victim services throughout

the Nation. |

| • | The National Institute of Justice (“NIJ”). The NIJ is the research, development and evaluation agency of the U.S. Department of Justice and is dedicated to improving knowledge and understanding of crime and justice issues through science. NIJ provides objective and independent knowledge and tools to reduce crime and promote justice, particularly at the state and local levels. |

| • | The

Office on Violence Against Women (“OVW”). The mission of the OFW, a component

of the U.S. Department of Justice, is to provide federal leadership in developing the

nation’s capacity to reduce violence against women and administer justice for and

strengthen services to victims of domestic violence, dating violence, sexual assault,

and stalking. |

Adult and adolescent sexual assault (SA) patients/survivors have unique medical, emotional and forensic needs which require a trauma-informed approach to care. Such an approach assures survivors will be supported while making informed decisions regarding their post-assault medical care and involvement in the criminal justice system. SANE Programs have been shown to improve the quality of healthcare for patients/survivors, increase the quality of forensic evidence collection, support police investigations, and increase the successful prosecution of such cases (Campbell, Bybee, Kelley, Dworkin, & Patterson, 2012; Campbell, Patterson, & Bybee, 2009; Crandall & Helitzer, 2003; Campbell, Patterson, & Lichty, 2005).

To address the lack of access to expert care and forensic evidence collection involving sexual assault incidences for adults and adolescents, the MDPH has recently been awarded a grant by the OVC, in collaboration with NIJ and the OVW. The purpose of the grant is to establish a National Sexual Assault TeleNursing Center that will use telemedicine technology to provide 24/7, 365 day remote expert consultation by MA SANEs to clinicians caring for adult and adolescent sexual assault patients in remote and/or underserved regions of the United States.

Pursuant to the grant, the above organizations entertained proposals from various organizations to provide the required telemedicine technology and consultation expertise on establishing a telemedicine service. Based on our proposal, including the use of our intellectual property, the Company was chosen as the telemedicine advisor/consultant, technology provider and has subsequently entered into contracts with MDPH.

The Company’s telemedicine equipment has been installed at the TeleNursing Center hub and telemedicine carts have been provided to each pilot site. MA SANEs will use this equipment to provide 24/7, 365 day voice and face-to-face guidance and support whenever pilot site clinicians encounter sexual assault patients and initiate calls to the TeleNursing Center. It is anticipated that the use of telemedicine as a vehicle to access SANE expertise will provide a trauma-informed patient experience, promote healing and enhance the adjudication of cases.

A total of four to five national sites will partner with the TeleNursing Center for this demonstration project. The National TeleNursing Center HUB is located at Newton Wellesley Hospital Newton, Massachusetts. Newton-Wellesley Hospital is a comprehensive medical center that provides the services and expertise of a major medical facility with the convenience and personal attention of a community hospital. The Hospital is committed to delivering high-quality, safe and efficient medical care to each and every patient.

The first tribal partner for the TeleNursing demonstration project is the Hopi Health Care Center (HHCC) in Polacca, Arizona. Where the Company has performed the network assessment and started working on technology placement/selection. Additional pilot sites representing either the military, rural hospitals or correctional facilities will be solicited for participation in 2014.

| 6 |

Customers

In addition to current revenue pursuant to PDRx’s sub-licensing of the Company’s patents to ECF’s and SNF’s, management plans on commercializing the Company’s patented technology as discussed above under Marketing and Sales. The Company intends to license the patents and technology within the telemedicine markets to original equipment manufacturers (“OEM’s”), technology and software companies, to telecom network providers, telemedicine providers, healthcare companies and health insurance companies.

Competition

ADOL’s market competition falls into 3 main categories: patents/licensure, clinical services, and consulting/technology – “Integrators.” Management believes the largest patent holders/filers in the US for telehealth and telemedicine as of 2013 include:

| • | Robert Bosch 62 patent filings |

| • | Medtronic 61 patent filings |

| • | Philips 43 patent filings |

| • | Boston Scientific 36 patent filings |

American Well, Teladoc, and MDLIVE are three of the largest national telemedicine service providers. The following information was reported on their respective websites:

| • | American Well provides a turnkey telehealth product for its clients, by building its own doctors’ network including 50 doctors on staff, and another 1300 nationwide who are available on a per-call basis. They offer a telemedicine application and service model for its clientele at $49 a call/video encounter. |

| • | Teladoc provides patients with 24/7 access to quality health care via phone, online video and mobile app for treatment of non-emergency medical issues, such as allergies, bronchitis, pink eye and sinus problems. Teladoc’s physicians are board-certified and state-licensed with an average of 15 years’ experience, and complete more than 250,000 consults annually with a 95 percent patient satisfaction rate. |

| • | MDLIVE a leading telehealth provider of online and on-demand healthcare delivery services and software that benefit patients, hospitals, employers, payers, physician practice groups and accountable-care organizations. MDLIVE has physicians that are licensed in all 50 states and authorized to write prescriptions. |

The Company believes that three of the largest equipment and telemedicine system integration companies are AVI-SPL, AMD Global Telemedicine, Inc. (“AMD”) and Global Med.

Each of these system integration works with other technology companies and healthcare information technology companies such as Cisco, Polycom, Rubbermaid, ProConnections, AT&T, Verizon, and others by bundling these companies’ solutions into specific offerings. Once a bundle is created they put their logo/brand on it and sell it into the healthcare marketplace to hospitals, providers, and payors.

| • | AVI-SPL designs, develops and implements advanced Telehealth, Telemedicine solutions and integrated operating rooms that improve the patient experience, and facilitate anytime collaboration between doctors and hospitals. Using AVI-SPL integrated medical solutions, caregivers communicate with their patients and peers virtually anywhere at any time, leading to improved department meetings, knowledge sharing, medical training courses, project management, patient care and oversight. |

| • | AMD is a leading provider of Telemedicine Encounter Management Solutions (TEMS) TM to over 8,100 patient end-points in more than 94 countries. |

| • | GlobalMed a privately held telemedicine company, is a leader in Telehealth hardware and software research&development, design, engineering, manufacture and support. |

Government Regulation

A substantial portion of the Company’s revenue comes from healthcare customers. The Company handles or has access to personal health information subject in the United States to the Health Insurance Portability and Accountability Act (“HIPAA”) and related regulations. These statutes and related regulations impose numerous requirements regarding the use and disclosure of personal health information with which we must comply.

Information Systems: The Company’s information systems, to the extent such systems hold or transmit patient medical information, operate in compliance with state and federal laws and regulations relating to the privacy and security of patient medical information, including HIPAA. While the Company has endeavored to establish its information systems to be compliant with such laws, including HIPAA, such laws are complex and subject to interpretation.

Privacy and Security of Health Information and Personal Information; Standard Transactions: The Company may be engaged by a healthcare practice or facility that is considered a Covered Entity under the terms of HIPAA. In providing and performing administration and support services for such Covered Entities (i.e. physician practices), medical chart review, healthcare facility call and message management, healthcare emergency dispatch and physician practice administration, the company may come in contact with a Covered Entity’s confidential patient medical information. Under such an engagement, the Covered Entity may make available and/or transfer to the Company certain Protected Health Information, as that term is defined and certain Electronic Protected Health Information ("EPHI") as that term is defined, in connection with goods or services that are being provided by the Company to the Covered Entity, that is confidential and subject to protection under HIPAA, HIPAA regulations and the HITECH Act. As such, the Company would be considered a Business Associate of the Covered Entity and further be subject to state and federal laws and implementing regulations relating to the privacy and security of the medical information of the patients the Company’s client physician practices and facilities treat. The Company, as a “Business Associate”, is subject to state and federal laws and implementing regulations relating to the privacy and security of the medical information of the patients its client physicians treat. The principal federal legislation is part of HIPAA, pursuant to which, the Secretary of the Department of Health and Human Services, or “HHS”, has issued final regulations designed to improve the efficiency and effectiveness of the healthcare system by facilitating the electronic exchange of information in certain financial and administrative transactions, while protecting the privacy and security of the patient information exchanged. These regulations also confer certain rights on patients regarding their access to and control of their medical records in the hands of healthcare providers.

Four principal regulations have been issued in final form: privacy regulations, security regulations, standards for electronic transactions, and the National Provider Identifier regulations. The HIPAA privacy regulations, which fully came into effect in April 2003, establish comprehensive federal standards with respect to the uses and disclosures of an individual’s personal health information, referred to in the privacy regulations as “protected health information,” by health plans, healthcare providers, and healthcare clearinghouses. The Company is a Business Associate within the meaning of HIPAA. HIPAA requires health care providers to enter into Business Associate contracts with certain businesses to which they disclose patient health information. These Business Associate contracts generally require the recipients of such information to use appropriate safeguards to protect the patient health information they receive. The regulations establish a complex regulatory framework on a variety of subjects, including:

| • | Provide that the company obtain and use confidential patient health information obtained from its clients only as necessary to perform customer service and support functions; |

| • | Limit access to such information to those employees and agents who perform identified service and support functions; |

| • | Prohibit disclosure of patient health information received from clients to persons who are not employees or agents of the company in the absence of express approval from legal counsel and, if appropriate, the client and/or patient; |

| • | Require all employees and agents of the company to report uses and disclosures of patient information that are not permitted by the company’s Privacy and Security Policy; |

| • | Provide that the company investigate all reports that patient health information was used in a manner not permitted by its Privacy and Security Policy and will impose appropriate sanctions for conduct prohibited by the policy as required and/or permitted by law; |

| • | Establish and ensure that the company’s employees and agents who may come in contact with patient health information receive training regarding the company’s Privacy and Security Policy and the importance of protecting the privacy and security of patient health information; |

| • | Provide for the storage and transmission of patient health information received from clients in a secure manner that protects the integrity, confidentiality and availability of the information; and |

| • | Establish that the company’s employees, contractors and agents who may come in contact with patient health information maintain any and all protected health information obtained through operating their respective businesses confidential, and agree and acknowledge that such information is subject to protection under HIPAA, the HIPAA regulations and the HITECH Act and will conduct their businesses according to such. |

| 7 |

The federal privacy regulations, among other things, restricts the Company’s ability to use or disclose protected health information in the form of patient-identifiable data, without written patient authorization, for purposes other than payment, physician treatment, or healthcare operations (as defined by HIPAA) except for disclosures for various public policy purposes and other permitted purposes outlined in the privacy regulations. The privacy regulations provide for significant fines and other penalties for wrongful use or disclosure of protected health information, including potential civil and criminal fines and penalties. Although the HIPAA statute and regulations do not expressly provide for a private right of damages, the Company could incur damages under state laws to private parties for the wrongful use or disclosure of confidential health information or other private personal information.

The Company has implemented policies and practices that it believes brings it into compliance with the privacy regulations. However, the documentation and process requirements of the privacy regulations are complex and subject to interpretation. Failure to comply with the privacy regulations could subject the Company to sanctions or penalties, loss of business, and negative publicity.

The HIPAA privacy regulations establish a “floor” of minimum protection for patients as to their medical information and do not supersede state laws that are more stringent. Therefore, the Company is required to comply with both HIPAA privacy regulations and various state privacy laws. The failure to do so could subject the Company to regulatory actions, including significant fines or penalties, and to private actions by patients, as well as to adverse publicity and possible loss of business. In addition, federal and state laws and judicial decisions provide individuals with various rights for violation of the privacy of their medical information by healthcare providers.

The final HIPAA security regulations, which establish detailed requirements for physical, administrative, and technical measures for safeguarding protected health information in electronic form, became effective on April 21, 2005. The Company has employed what it considers to be a reasonable and appropriate level of physical, administrative and technical safeguards for patient information. Failure to comply with the security regulations could subject the Company to sanctions or penalties and negative publicity.

The final HIPAA regulations for electronic transactions, referred to as the transaction standards, establish uniform standards for certain specific electronic transactions and code sets and mandatory requirements as to data form and data content to be used in connection with common electronic transactions, such as billing claims, remittance advices, enrollment, and eligibility.

The HIPAA regulations on adoption of national provider identifiers, or NPI, required healthcare providers to adopt new, unique identifiers for reporting on claims transactions submitted after May 23, 2007. The Company may obtain NPIs for our client physicians so that we may report NPIs to Medicare, Medicaid, and other health plans on their behalf.

The healthcare information of the Company’s client physician’s patients includes social security numbers and other personal information that are not of an exclusively medical nature. The consumer protection laws of a majority of states now require organizations that maintain such personal information to notify each individual if their personal information is accessed by unauthorized persons or organizations, so that the individuals can, among other things, take steps to protect themselves from identity theft. The costs of notification and the adverse publicity can both be significant. Failure to comply with these state consumer protection laws can subject a company to penalties that vary from state to state, but may include significant civil monetary penalties, as well as to private litigation and adverse publicity. California recently enacted legislation that expanded its version of a notification law to cover improper access to medical information generally, and other states may follow suit.

Federal and State Fraud and Abuse Laws: The federal healthcare Anti-Kickback Statute prohibits, among other things, knowingly and willfully offering, paying, soliciting, or receiving remuneration to induce referrals or in return for purchasing, leasing, ordering, or arranging for the purchase, lease, or order of any healthcare item or service reimbursable under a governmental payor program. The definition of “remuneration” has been broadly interpreted to include anything of value, including gifts, discounts, the furnishing of supplies or equipment, credit arrangements, payments of cash, waivers of payments, ownership interests, opportunity to earn income, and providing anything at less than its fair market value. The Anti-Kickback Statute is broad, and it prohibits many arrangements and practices that are lawful in businesses outside of the healthcare industry. Recognizing that the Anti-Kickback Statute is broad and may technically prohibit many innocuous or beneficial arrangements within the healthcare industry, HHS has issued a series of regulatory “safe harbors.” These safe harbor regulations set forth certain provisions that, if met, will provide healthcare providers and other parties with an affirmative defense against prosecution under the federal Anti-Kickback Statute. Although full compliance with these provisions ensures against prosecution under the federal Anti-Kickback Statute, the failure of a transaction or arrangement to fit within a specific safe harbor does not necessarily mean that the transaction or arrangement is illegal or that prosecution under the federal Anti-Kickback Statute will be pursued.

Physician Referral Prohibitions: Under a federal law directed at “self-referral,” commonly known as the Stark Law, prohibitions exist, with certain exceptions, on Medicare and Medicaid payments for procedures/tests referred by physicians who personally, or through a family member, have an investment interest in, or a compensation arrangement with, the facility performing the procedures/tests. A person who engages in a scheme to circumvent the Stark Law’s referral prohibition may be fined up to $100,000 for each such arrangement or scheme. In addition, any person who presents or causes to be presented a claim to the Medicare or Medicaid programs in violation of the Stark Law is subject to civil monetary penalties of up to $15,000 per bill submission, an assessment of up to three times the amount claimed, and possible exclusion from participation in federal governmental payor programs. Bills submitted in violation of the Stark Law may not be paid by Medicare or Medicaid, and any person collecting any amounts with respect to any such prohibited bill is obligated to refund such amounts.

Any arrangement between a facility and a physician’s or physicians’ practice that involves remuneration will prohibit the facility from obtaining payment for services resulting from the physicians’ referrals, unless the arrangement is protected by an exception to the self-referral prohibition or a provision stating that the particular arrangement would not result in remuneration. Among other things, a facility’s provision of any item, device, or supply to a physician would result in a Stark Law violation unless it was used only to collect, transport, process, or store specimens for the facility, or was used only to order tests or procedures or communicate related results. This may preclude a facility’s provision of fax machines and computers that may be used for unrelated purposes. Most arrangements involving physicians that would violate the Anti-Kickback Statute would also violate the Stark Law. Many states also have “self-referral” and other laws that are not limited to Medicare and Medicaid referrals. These laws may prohibit arrangements which are not prohibited by the Stark Law, such as a laboratory’s placement of a phlebotomist in a physician’s office to collect specimens for the laboratory. Finally, recent amendments to these laws require self-disclosure of violations by providers.

| 8 |

Corporate Practice of Medicine: The Company’s contractual relationships with licensed healthcare practices and providers are subject to regulatory oversight, mainly by state licensing authorities. In certain states, for example, limitations may apply to the relationship with the provider that the Company intends to engage, particularly in terms of the degree of control that the Company exercises or has the power to exercise over the practice of medicine by those providers. A number of states, including Florida, New York, Texas, and California, have enacted laws prohibiting business corporations, such as the Company, from practicing medicine and employing or engaging physicians to practice medicine. These requirements are generally imposed by state law in the states in which we operate, vary from state to state, and are not always consistent among states. In addition, these requirements are subject to broad powers of interpretation and enforcement by state regulators. Some of these requirements may apply to the Company even if it does not have a physical presence in the state, based solely on the engagement of a healthcare provider licensed in the state or the provision of services to a resident of the state. The Company believes that it operates in material compliance with these requirements. However, failure to comply can lead to action against the Company and the licensed healthcare professionals that the Company engages, fines or penalties, receipt of cease and desist orders from state regulators, loss of healthcare professionals’ licenses or permits, the need to make changes to the terms of engagement of those professionals that interfere with the Company’s business, and other material adverse consequences.

Referrals of a Public Company: A public company is not able to accept referrals from physicians who own, directly or indirectly, shares of its stock unless it complies with the Stark Law exception for publicly traded securities. This requires, among other things, $75 million in stockholders’ equity (total assets minus total liabilities). The parallel safe harbor requires, among other things, $50 million in undepreciated net tangible assets, in order for any distributions to such stockholders to be protected under the Anti-Kickback Statute. We intend to become publicly traded in the future.

Compliance Programs: Compliance with government rules and regulations is a significant concern throughout the industry, in part due to evolving interpretations of these rules and regulations. The Company seeks to conduct its business in compliance with all statutes and regulations applicable to its operations. To this end, the Company has established and continues to establish compliance programs that review for regulatory compliance procedures, policies, and facilities throughout its business.

Company and Other Information

We were incorporated under the laws of the State of Delaware in April 1999. Our principal executive office is located at 200 Mill Road, Suite 350A, Fairhaven, MA 02719, and our telephone number is (866) 539-7379. Our website address is www.adoltelemed.com. We do not incorporate the information on or accessible through our website into this registration statement, and you should not consider any information on, or that can be accessed through, our website a part of this registration statement.

Employees

We currently have 5 employees (full time/part time), other than our three officers and directors. We intend to hire additional employees as described in our plan of operations if we are able to raise the required funds.

Item 1A. Risk Factors.

Investing in our common stock involves a high degree of risk. You should carefully consider the risks and uncertainties described below, together with all of the other information in this Registration Statement, including our financial statements and related notes, before investing in our common stock. If any of the following risks are realized, in whole or in part, our business, financial condition, results of operations and prospects could be materially and adversely affected.

Risks Related to Our Corporation

We have incurred losses from operations since inception and continued losses threaten the company’s ability to remain in business and pursue our business plan.

Since inception in 1999 through March 31, 2014, ADOL has incurred cumulative losses of $14,664,053. We anticipate incurring additional losses from operating activities in the near future. Even if ADOL is able to obtain additional equity financing, investors have no assurance we will be able achieve profitability in our operations. Until we achieve break even between revenues and expenses, we will remain dependent on obtaining additional debt and equity funding. In the event ADOL does not become profitable within a reasonable period of time, we may cease operations.

If ADOL does not obtain additional financing, ADOL’s business will fail.

ADOL anticipates that additional funding will be needed for general administrative expenses and marketing costs. At this time it is our intention to raise the required funds through an equity placement by filing a registration statement, whereby we will register additional shares of our common stock for sale. However, there is no guarantee that we will be able to raise the required cash and because of this ADOL’s business may fail. We do not currently generate sufficient revenue from operations to pay all of our monthly expenses.

We do not currently have any arrangements for financing. Obtaining additional funding will be subject to a number of factors, including general market conditions, investor acceptance of our business plan and initial results from our business operations. These factors may impact the timing, amount, terms or conditions of additional financing available to us. The most likely source of future funds available to us is through the sale of additional shares of common stock, debt financing or advances made from stockholders

Our financial condition could be adversely affected if our available liquidity is insufficient.

If our business is significantly adversely affected by deterioration in the economic environment or otherwise, it could lead us to seek new or additional sources of liquidity to fund the company’s needs. Currently, for a non-investment-grade company such as ours, the capital markets are challenging, with limited available financing and at higher costs than in recent years. There can be no guarantee that ADOL would be able to access any new sources of liquidity on commercially reasonable terms or at all.

We have no experience as a public company.

We have never operated as a public company. At the time this registration statement becomes effective we will become subject to the reporting requirements of the Securities Exchange Act of 1934. ADOL has no experience in complying with the various rules and regulations, which are required of a publicly reporting company. As a result, we may not be able to operate successfully as a publicly reporting company, even if ADOL’s operations are successful.

| 9 |

We currently have only a small management team and staff, which could limit ADOL’s ability to effectively seize market opportunities and grow our business.

ADOL’s operations are subject to all of the risks inherent in a growing business enterprise, including the likelihood of operating losses. As a smaller company with a limited operating history, ADOL’s success will depend, among other factors, upon how ADOL will manage the problems, expenses, difficulties, complications and delays frequently encountered in connection with the growth of a business, including but not limited to channels of distribution, and current and future development. In addition, ADOL has only a small management team and staff to grow ADOL’s business and manage the risks inherent in a growing business enterprise. These factors could limit ADOL’s ability to effectively seize market opportunities and grow ADOL’s business.

We will incur increased costs as a result of being a public company. These costs will adversely impact ADOL’s results of operations.

At the time this registration statement becomes effective we will become subject to the reporting requirements of the Securities Exchange Act of 1934. As a result of being subject to these reporting requirements, ADOL will incur significant legal, accounting and other expenses that a private company does not incur. We estimate these costs to be approximately $150,000 annually and include the costs associated with having our financial statements prepared, audited and filed with the Securities and Exchange Commission (“SEC”) via EDGAR (the Electronic Data Gathering, Analysis, and Retrieval system) and XBRL (eXtensible Business Reporting Language) costs.

In addition, when and if we become publicly traded, we have costs associated with our transfer agent. The Sarbanes-Oxley Act of 2002 (SOX) and related rules resulted in an increase in costs of maintaining compliance with the public reporting requirements, as well as making it more difficult and more expensive for us to obtain directors' and officers' liability insurance. These added costs will delay the time in which we may expect to achieve profitability, if at all.

Our results of operations may vary significantly from period to period, which could cause the trading price of our common stock to decline if and when our common stock trades.

Our results of operations may vary significantly as a result of a number of factors, many of which are outside of our control and may be difficult to predict, including:

| • | our ability to attract and retain new customers; |

| • | the budgeting cycles and purchasing practices of customers; |

| • | the timing and length of our sales cycles; |

| • | changes in customer or reseller requirements or market needs; |

| • | the timing and success of new product and service introductions by us or our competitors or any other change in the competitive landscape of the market, including consolidation among our customers or competitors; |

| • | insolvency or credit difficulties confronting our customers, affecting their ability to purchase or pay for our licenses, subscriptions and services; |

| • | the cost and potential outcomes of future litigation; |

| • | general economic conditions; |

| • | future accounting pronouncements or changes in our accounting policies or practices; and |

| • | the amount and timing of operating costs and capital expenditures related to the expansion of our business. |

Any of the above factors, individually or in the aggregate, may result in significant fluctuations in our financial and other operating results from period to period. As a result of this variability, our historical results of operations should not be relied upon as an indication of future performance. Moreover, this variability and unpredictability could result in our failure to meet our operating plan or the expectations of investors or analysts for any period. There is currently no trading market for our common stock and there is no guarantee that one will be established. However, if we do establish a trading market for our common stock and if we fail to meet such expectations for these or other reasons, the market price of our common stock could fall substantially, and we could face costly lawsuits, including securities class action suits.

We are highly dependent on our Chairman and our Chief Executive Officer and the loss of either of them could have a material adverse effect on ADOL’s business and results of operations. Further, we may not be able to attract qualified directors or officers to replace them or other key management personnel necessary to grow our business.

We are highly reliant on the services of our Chairman and Chief Innovations Officer; Paul Bulat, MD and our Chief Executive Officer, Brian G. Lane. If either left, it could have a material adverse effect on our business and results of operations. The Company has employment agreements with Mr. Lane and Dr. Bulat that expire in October, 2015, at which time we may seek to renew such agreements. Furthermore, we must continue to hire experienced managers to continue to grow our business. As a company with limited operating history, we may have difficulty attracting and retaining new individuals. If we are not successful in attracting management, it could have a material adverse effect on our ability to grow our business, which would adversely affect our results of operations and financial condition.

Supporting a growing customer base could strain our personnel and corporate infrastructure, and if we are unable to scale our operations and increase productivity, we may not be able to successfully implement our business plan.

Our current management and human resources infrastructure is comprised of our Chairman, our CEO and several outsourced consultants. Our success will depend, in part, upon the ability of our Management to manage our proposed business effectively. To do so, we will need to hire, train and manage new employees as needed. To manage the expected domestic growth of ADOL’s operations and personnel, we will need to continue to improve our operational, financial and management controls and our reporting systems and procedures. If we fail to successfully scale our operations and increase productivity, we will be unable to execute our business plan.

| 10 |

If we do not effectively manage changes in our business, these changes could place a significant strain on our management and operations.

To manage our growth successfully, we must continue to improve and expand our systems and infrastructure in a timely and efficient manner. Our controls, systems, procedures and resources may not be adequate to support a changing and growing company. If our management fails to respond effectively to changes and growth in our business, including acquisitions, this could have a material adverse effect on the Company’s business, financial condition, results of operations and future prospects.

Our business model is subject to change

We may elect to make hiring, marketing, pricing, and service decisions that could increase our expenses, affect our revenues and impact our overall financial results. Moreover, because our expense levels in any given quarter are based, in part, on management’s expectations regarding future revenues, if revenues are below expectations, the effect on our operating results may be magnified by our inability to adjust spending in a timely manner to compensate for a shortfall in revenues. The extent to which expenses are not subsequently followed by increased revenues would harm our operating results and could seriously impair our business.

ADOL’s Directors and Officers possess the majority of our voting power, and through this ownership, control our Company and our corporate actions.

Our current Officers and Directors as a group hold approximately 71% of the voting power of the outstanding shares of stock. These Officers and Directors have a controlling influence in determining the outcome of any corporate transaction or other matters submitted to our stockholders for approval, including mergers, consolidations and the sale of all or substantially all of our assets, election of directors, and other significant corporate actions. Such officer and director may also have the power to prevent or cause a change in control. In addition, without the consent of these stockholders, ADOL could be prevented from entering into transactions that could be beneficial to us. The interests of these stockholders may give rise to a conflict of interest with the Company and the Company’s other shareholders. For additional details concerning voting power please refer to the section below entitled “Description of Securities.”

Legal proceedings to assert our intellectual property rights could require us to spend money and could impair our operations.

In the event that a competitor infringes upon our intellectual property rights, enforcing these rights may be costly, difficult, and time consuming. Even if successful, litigation to enforce our intellectual property rights or to defend our intellectual property rights against challenge could be expensive and time-consuming and could divert our management’s attention from our primary business. We may not have sufficient resources to enforce our intellectual property rights or to defend our patents or other intellectual property rights against a challenge. If we are unsuccessful in enforcing and protecting our intellectual property rights and protecting our products, it could harm our business, results of operations and financial condition.

We may encounter issues with privacy and security of personal information.

A substantial portion of our revenue comes from healthcare customers. Our software solutions may handle or have access to personal health information subject in the United States to HIPAA and related regulations. These statutes and related regulations impose numerous requirements regarding the use and disclosure of personal health information with which we must comply. Our failure to accurately anticipate or interpret these complex and technical laws and regulations could subject us to civil and/or criminal liability. We make every effort to comply with these and all relevant statutes and regulations. Such failure could adversely impact our ability to market and sell our software solutions to healthcare customers, and have a material adverse impact on our software operations, financial condition and statement of income.

We have limited licensing and marketing experience, sales force or distribution capabilities. We currently do not have any sales staff and even if we are unable to recruit key personnel to perform these functions, we may not be able to successfully commercialize our patents.

Our ability to produce revenues ultimately depends on our ability to sell our products and services. We currently have limited experience in marketing or selling our products and services. Developing a marketing and sales force is time-consuming and will involve the investment of significant amounts of financial and management resources, and could delay the launch of new products/services or expansion of existing product/service sales. In addition, we will compete with many companies that currently have extensive and well-funded marketing and sales operations. If we fail to establish successful marketing and sales capabilities or fail to enter into successful marketing arrangements with third parties, our ability to generate revenues will suffer.

Furthermore, even if we enter into marketing and distributing arrangements with third parties, these third parties may not be successful or effective in licensing and marketing our patents. If we fail to create successful and effective licensing, marketing and distribution channels, our ability to generate revenue and achieve our anticipated growth could be adversely affected. If these distributors experience financial or other difficulties, licensing of our patents could be reduced, and our business, financial condition and results of operations could be harmed.

| 11 |

Claims by others that we infringe their proprietary technology or other rights could harm our business.

Technology companies frequently enter into litigation based on allegations of patent infringement or other violations of intellectual property rights. In addition, patent holding companies seek to monetize patents they have purchased or otherwise obtained. As we attempt to gain an increasingly higher profile, the possibility of intellectual property rights claims against us grows. Third parties may assert claims of infringement of intellectual property rights against us. As of the date of this Form 10 registration statement, no claims have been made against us. Third parties may in the future also assert claims against our customers or channel partners, with whom we may have license and other agreements that could obligate us to indemnify against claims that our products infringe the intellectual property rights of third parties. While we intend to increase the size of our patent portfolio, others may now and in the future have significantly larger and more mature patent portfolios than we have. In addition, future litigation may involve patent holding companies or other patent owners who have no relevant product offerings or revenue and against whom our own patents may therefore provide little or no deterrence or protection. Any claim of intellectual property infringement by a third party, even a claim without merit, could cause us to incur substantial costs defending against such claim, could distract our management from our business and could require us to cease use of such intellectual property. Furthermore, because of the substantial amount of discovery required in connection with intellectual property litigation, there is a risk that some of our confidential information could be compromised by the discovery process.

Although third parties may offer a license to their technology or other intellectual property, the terms of any offered license may not be acceptable, and the failure to obtain a license or the costs associated with any license could cause our business, financial condition and results of operations to be materially and adversely affected. In addition, some licenses may be non-exclusive, and therefore our competitors may have access to the same technology licensed to us. If a third party does not offer us a license to its technology or other intellectual property on reasonable terms, or at all, we could be enjoined from continued use of such intellectual property. As a result, we may be required to develop alternative, non-infringing technology, which could require significant time (during which we could be unable to continue to offer our affected products, subscriptions or services), effort, and expense and may ultimately not be successful. Furthermore, a successful claimant could secure a judgment or we may agree to a settlement that prevents us from distributing certain products, providing certain subscriptions or performing certain services or that requires us to pay substantial damages, royalties or other fees. Any of these events could harm our business, financial condition and results of operations.

If

we are not able to adequately protect our patented rights, our operations would be negatively impacted.