Exhibit 99.1

| NEWS RELEASE |

Nabors Announces Third Quarter 2019 Results

HAMILTON, Bermuda, October 29, 2019 /PRNewswire/ -- Nabors Industries Ltd. (“Nabors” or the “Company”) (NYSE: NBR) today reported third quarter 2019 operating revenues of $758 million, compared to operating revenues of $771 million in the second quarter. Net income from continuing operations attributable to Nabors common shareholders for the quarter was a loss of $123 million, or $0.37 per share, compared to a loss of $208 million, or $0.61 per share, in the prior quarter. The third quarter’s results included after-tax charges of $23.3 million, or $0.06 per share, related to a foreign tax settlement and foreign exchange losses.

Anthony Petrello, Nabors Chairman, CEO and President, commented, “I believe the strength of our third-quarter results, in a weak U.S. market, is beginning to illustrate the effectiveness and ultimate value creation potential of the strategy we have implemented over the last several years. We have, and continue to be, focused on providing our customers the highest quality global rig fleet, crews and drilling technologies.

“For the third quarter, our adjusted EBITDA grew by more than 4%, to $207 million, overcoming the impact of the weak market environment in the U.S. Lower 48. The $8.6 million sequential increase principally arose from 10% growth in our International results. Moderate improvements in our Drilling Solutions and Canrig operations also contributed. These favorable performances, more than offset a relatively modest 3% decline in U.S. Drilling. This was attributable to fewer rigs operating in our Lower 48 operations at slightly higher average daily revenue and margin.

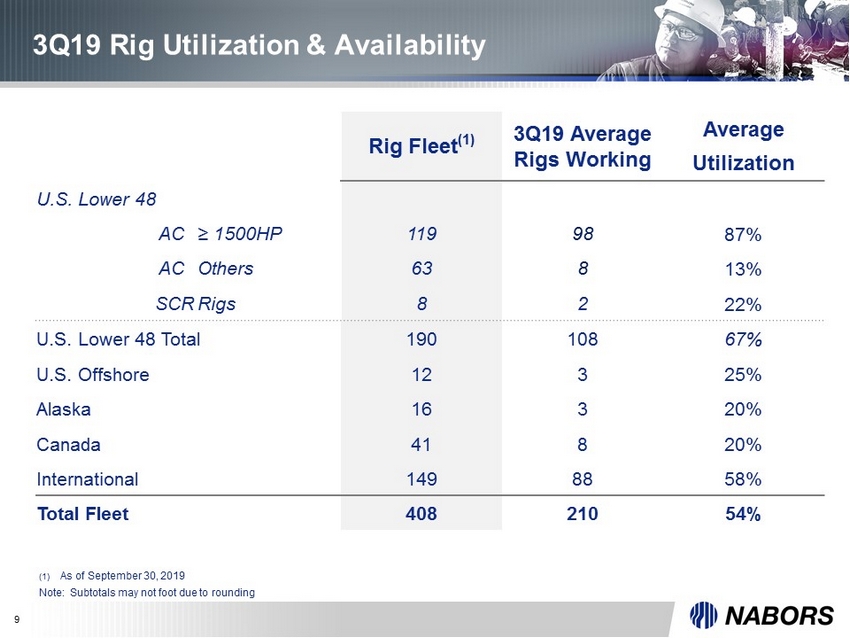

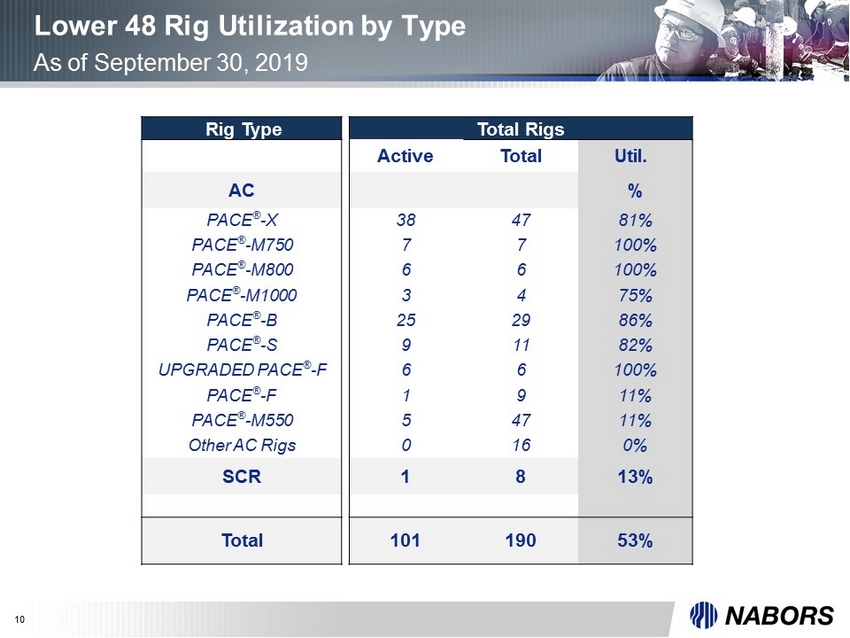

“In the U.S. Lower 48 the capability and quality of our highest-spec rigs has resulted in better utilization and high re-contracting rates with limited rate adjustments relative to competitors. The year-to-date change in our rig count is less than one-half that of the 24% that characterizes the full industry. Notably, our highest-specification rigs have been averaging approximately 90% utilization and represent 95% of our current rig count.

“Our Rig Technologies and Drilling Solutions segments also delivered some significant achievements during the third quarter. In Rig Technologies, our Canrig subsidiary deployed the first new generation CanrigâSigma top drive. This revolutionary new and simplified design, delivers 50% more capability with higher reliability, and lower cost of ownership. We believe these features make it the most cost-effective solution worldwide for the increasing number of difficult and complex wells.

“Our Drilling Solutions segment continued to increase the penetration of its advanced services. The most significant elements are the new and existing software products that enhance drilling performance, automate directional drilling and integrate tubular running operations into the rig systems. The number of installs for our NavigatorTM and ROCKit® Pilot directional drilling automation software increased by 30% sequentially. The majority of these installations are with third-party directional drilling firms, which confirms the value of these products.”

| NEWS RELEASE |

Consolidated and Segment Results

The U.S. Drilling segment reported a $4 million reduction in adjusted EBITDA at $121 million. This consisted of a $5 million decline in the Lower 48 operation, partially offset by a small improvement in the U.S. Offshore. During the quarter, the Lower 48 rig count decreased by seven rigs while average margins per rig day improved slightly to $10,231. The Company expects competitive pressures to compress daily margins by a couple hundred dollars for the next quarter. This segment’s rig count currently stands at 107, with 99 rigs working in the Lower 48. Based on the Company’s current outlook, the fourth quarter Lower 48 rig count should be around 100, and begin to increase in the first quarter.

International Drilling adjusted EBITDA increased sequentially by 10%, to $95 million. The quarterly average rig count declined by one to 88, while the average margin per day improved by $1,130 to $13,740. This improvement was a result of progress from initiatives to improve operating costs and favorable operating performance. The Company expects fourth quarter results similar to the third quarter, with improved cash flow generation. The anticipated incremental contribution from recent and prospective rig startups will be offset by a sequential decrease in non-cash deferred revenue, with the expiration of contracts that included upfront customer funding. These contracts have been renewed and are expected to yield higher cash flow in aggregate.

Canada Drilling adjusted EBITDA improved nominally to $1.5 million reflecting the beginning of the customary seasonal upturn. The average daily gross margin was essentially flat at $3,800, as was the number of rigs working during the quarter. The company expects a moderate improvement in rig count and daily margin in the fourth quarter.

In Drilling Solutions, adjusted EBITDA of $23 million was $1 million higher than the second quarter, despite the large decrease in the industry rig count in the Lower 48. The 4.5% sequential increase in adjusted EBITDA occurred in the face of a 3.6% decline in revenues. This was even more significant considering the magnitude of lost revenue associated with the idling of a high number of Lower 48 rigs on which NDS had been providing services. An increase in higher margin international activity, as well as integrated tubular running services (TRS) jobs in the U.S. constituted the majority of the improvement. The integrated approach reduces costs by incorporating TRS into the rig operating systems. During the third quarter, integrated TRS jobs were 41% of all jobs completed, up from less than 3% in the first quarter this year.

In the Rig Technologies segment, third quarter adjusted EBITDA was $2.2 million. Sequentially, this reflects a decrease of less than $1 million on a $10 million decrease in revenue, a result of lower capital equipment and spare parts shipments during the quarter. Significant cost reductions, the expansion of aftermarket repairs and recertifications, and a favorable external/internal sales mix substantially offset these revenue reductions.

| NEWS RELEASE |

Capital Expenditures and Liquidity

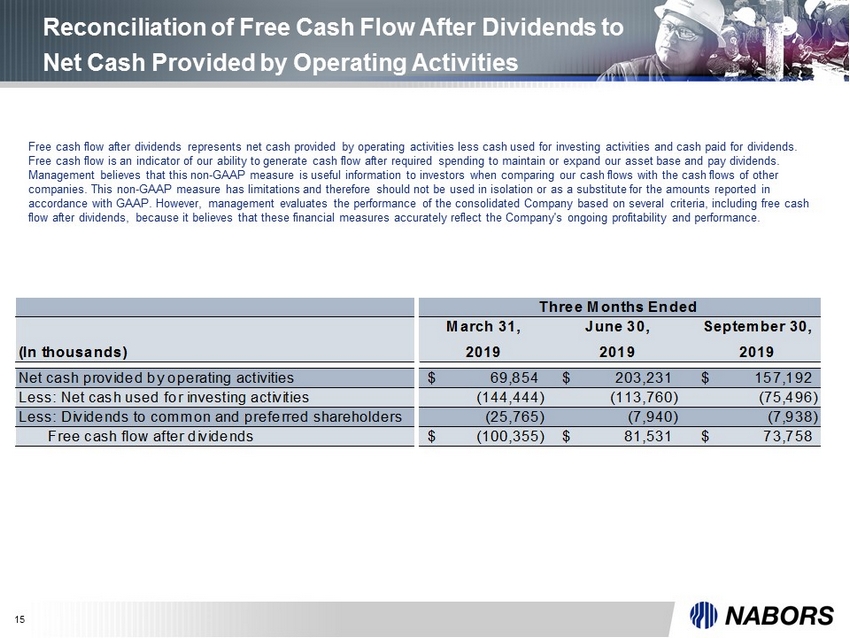

William Restrepo, Nabors Chief Financial Officer, stated, “Quarterly free cash flow after dividends reached $74 million, as compared to $82 million in the prior quarter. The third quarter results included approximately $70 million in semiannual cash interest payments as well as significant reductions in working capital and capital expenditures.

“Capital expenditures were $87 million in the third quarter, $43 million less than the preceding quarter. We currently expect full year 2019 capital expenditures in the range of $400 to $410 million. This implies another $35 to $45 million reduction in capital expenditures in the fourth quarter. These results reinforce our confidence in achieving our targeted reduction in net debt of more than $200 million for the full year.”

Mr. Petrello concluded, “Our short-term expectations remain positive view for our international operations, with a more cautious view in North America. We remain more universally confident for all of our segments over the longer-term. International demand for higher specification rigs supports moderate growth in activity leading to improving pricing as the availability of rigs tightens. In North America, we expect to continue relative outperformance in both utilization and margins, regardless of how the market develops. We also expect our other segments to increase penetration with their technology and service initiatives. Notwithstanding the potential for near-term variances, over time we expect stable to improving consolidated results.

“We maintain our intense focus on improving free cash flow after dividends, returns on capital and debt reduction. Our third quarter performance bolsters our confidence we can achieve these objectives.”

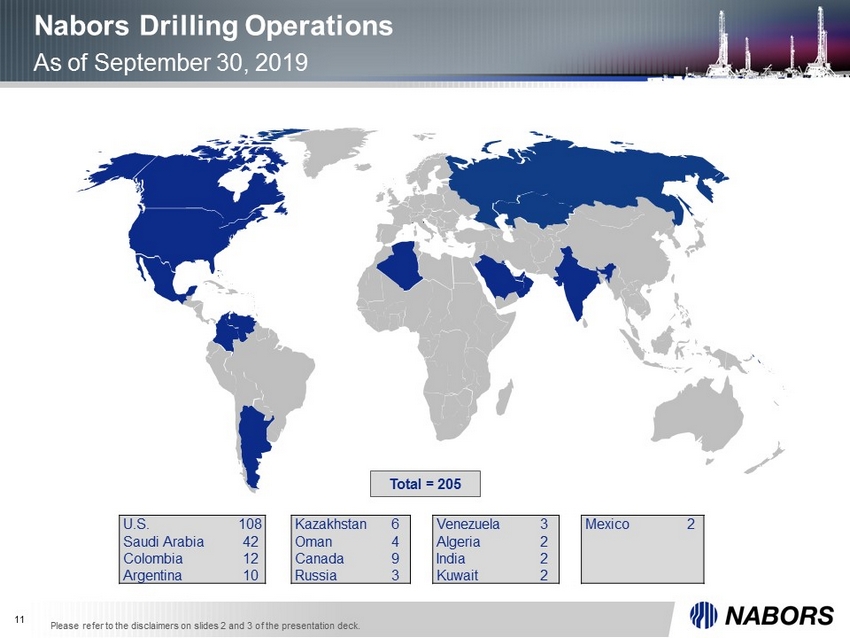

About Nabors

Nabors, (NYSE: NBR) owns and operates one of the world's largest land-based drilling rig fleets and provides offshore platform rigs in the United States and numerous international markets. Nabors also provides directional drilling services, performance tools, and innovative technologies for its own rig fleet and those of third parties. Leveraging our advanced drilling automation capabilities, Nabors highly skilled workforce continues to set new standards for operational excellence and transform our industry.

Forward-looking Statements

The information included in this press release includes forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. Such forward-looking statements are subject to a number of risks and uncertainties, as disclosed by Nabors from time to time in its filings with the Securities and Exchange Commission. As a result of these factors, Nabors' actual results may differ materially from those indicated or implied by such forward-looking statements. The forward-looking statements contained in this press release reflect management's estimates and beliefs as of the date of this press release. Nabors does not undertake to update these forward-looking statements.

| NEWS RELEASE |

Non-GAAP Disclaimer

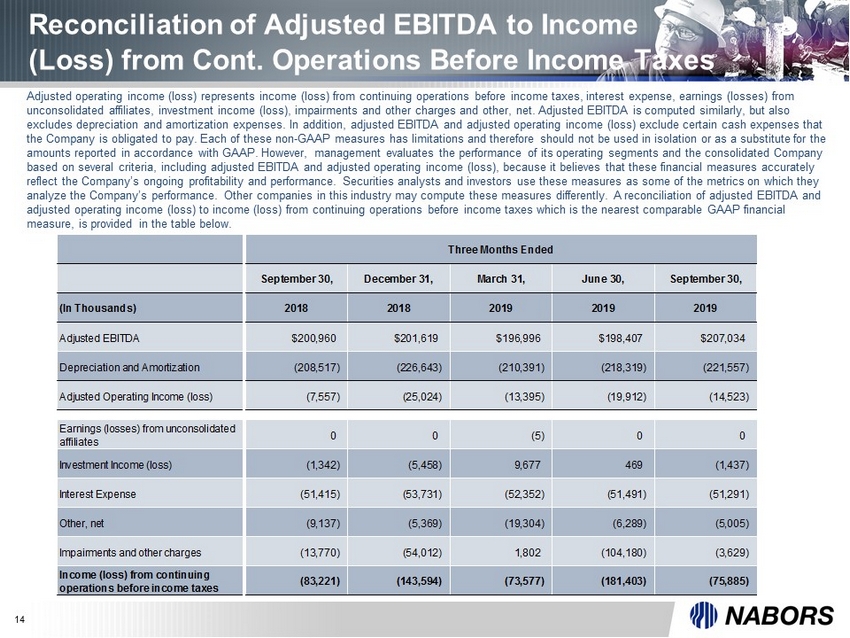

This press release presents certain “non-GAAP” financial measures. The components of these non-GAAP measures are computed by using amounts that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”). Adjusted operating income (loss) represents income (loss) from continuing operations before income taxes, interest expense, earnings (losses) from unconsolidated affiliates, investment income (loss), impairments and other charges and other, net. Adjusted EBITDA is computed similarly, but also excludes depreciation and amortization expenses. In addition, adjusted EBITDA and adjusted operating income (loss) exclude certain cash expenses that the Company is obligated to make. Net debt is calculated as total debt minus the sum of cash and cash equivalents. Free cash flow after dividends represents net cash provided by operating activities less cash used for investing activities and cash paid for dividends. Free cash flow is an indicator of our ability to generate cash flow after required spending to maintain or expand our asset base and pay dividends. Management believes that this non-GAAP measure is useful information to investors when comparing our cash flows with the cash flows of other companies. Each of these non-GAAP measures has limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. However, management evaluates the performance of its operating segments and the consolidated Company based on several criteria, including adjusted EBITDA, adjusted operating income (loss), net debt, and free cash flow after dividends, because it believes that these financial measures accurately reflect the Company’s ongoing profitability and performance. Securities analysts and investors also use these measures as some of the metrics on which they analyze the Company’s performance. Other companies in this industry may compute these measures differently. Reconciliations of consolidated adjusted EBITDA and adjusted operating income (loss) to income (loss) from continuing operations before income taxes, net debt to total debt, and free cash flow after dividends to cash flow provided by operations, which are their nearest comparable GAAP financial measures, are included in the tables at the end of this press release.

Media Contact: Dennis A. Smith, Senior Vice President of Corporate Development & Investor Relations, +1 281-775-8038 or William C. Conroy, Senior Director of Corporate Development & Investor Relations, +1 281-775-2423. To request investor materials, contact Nabors' corporate headquarters in Hamilton, Bermuda at +441-292-1510 or via e-mail mark.andrews@nabors.com

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (LOSS)

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, | June 30, | September 30, | ||||||||||||||||||

| (In thousands, except per share amounts) | 2019 | 2018 | 2019 | 2019 | 2018 | |||||||||||||||

| Revenues and other income: | ||||||||||||||||||||

| Operating revenues | $ | 758,076 | $ | 779,425 | $ | 771,406 | $ | 2,329,122 | $ | 2,275,539 | ||||||||||

| Earnings (losses) from unconsolidated affiliates | - | - | - | (5 | ) | 1 | ||||||||||||||

| Investment income (loss) | (1,437 | ) | (1,342 | ) | 469 | 8,709 | (4,041 | ) | ||||||||||||

| Total revenues and other income | 756,639 | 778,083 | 771,875 | 2,337,826 | 2,271,499 | |||||||||||||||

| Costs and other deductions: | ||||||||||||||||||||

| Direct costs | 475,461 | 497,194 | 496,664 | 1,493,082 | 1,466,572 | |||||||||||||||

| General and administrative expenses | 63,577 | 66,813 | 64,415 | 196,159 | 209,207 | |||||||||||||||

| Research and engineering | 12,004 | 14,458 | 11,920 | 37,444 | 42,703 | |||||||||||||||

| Depreciation and amortization | 221,557 | 208,517 | 218,319 | 650,267 | 640,227 | |||||||||||||||

| Interest expense | 51,291 | 51,415 | 51,491 | 155,134 | 173,393 | |||||||||||||||

| Impairments and other charges | 3,629 | 13,770 | 104,180 | 106,007 | 90,434 | |||||||||||||||

| Other, net | 5,005 | 9,137 | 6,289 | 30,598 | 24,163 | |||||||||||||||

| Total costs and other deductions | 832,524 | 861,304 | 953,278 | 2,668,691 | 2,646,699 | |||||||||||||||

| Income (loss) from continuing operations before income taxes | (75,885 | ) | (83,221 | ) | (181,403 | ) | (330,865 | ) | (375,200 | ) | ||||||||||

| Income tax expense (benefit) | 23,903 | 10,489 | 11,398 | 65,100 | 57,312 | |||||||||||||||

| Income (loss) from continuing operations, net of tax | (99,788 | ) | (93,710 | ) | (192,801 | ) | (395,965 | ) | (432,512 | ) | ||||||||||

| Income (loss) from discontinued operations, net of tax | 157 | (13,933 | ) | (34 | ) | (34 | ) | (14,592 | ) | |||||||||||

| Net income (loss) | (99,631 | ) | (107,643 | ) | (192,835 | ) | (395,999 | ) | (447,104 | ) | ||||||||||

| Less: Net (income) loss attributable to noncontrolling interest | (19,297 | ) | (6,934 | ) | (10,729 | ) | (44,202 | ) | (10,426 | ) | ||||||||||

| Net income (loss) attributable to Nabors | $ | (118,928 | ) | $ | (114,577 | ) | $ | (203,564 | ) | $ | (440,201 | ) | $ | (457,530 | ) | |||||

| Less: Preferred stock dividend | $ | (4,310 | ) | $ | (4,313 | ) | $ | (4,312 | ) | $ | (12,935 | ) | $ | (7,993 | ) | |||||

| Net income (loss) attributable to Nabors common shareholders | $ | (123,238 | ) | $ | (118,890 | ) | $ | (207,876 | ) | $ | (453,136 | ) | $ | (465,523 | ) | |||||

| Amounts attributable to Nabors common shareholders: | ||||||||||||||||||||

| Net income (loss) from continuing operations | $ | (123,395 | ) | $ | (104,957 | ) | $ | (207,842 | ) | $ | (453,102 | ) | $ | (450,931 | ) | |||||

| Net income (loss) from discontinued operations | 157 | (13,933 | ) | (34 | ) | (34 | ) | (14,592 | ) | |||||||||||

| Net income (loss) attributable to Nabors common shareholders | $ | (123,238 | ) | $ | (118,890 | ) | $ | (207,876 | ) | $ | (453,136 | ) | $ | (465,523 | ) | |||||

| Earnings (losses) per share: | ||||||||||||||||||||

| Basic from continuing operations | $ | (0.37 | ) | $ | (0.31 | ) | $ | (0.61 | ) | $ | (1.33 | ) | $ | (1.39 | ) | |||||

| Basic from discontinued operations | - | (0.04 | ) | - | - | (0.05 | ) | |||||||||||||

| Total Basic | $ | (0.37 | ) | $ | (0.35 | ) | $ | (0.61 | ) | $ | (1.33 | ) | $ | (1.44 | ) | |||||

| Diluted from continuing operations | $ | (0.37 | ) | $ | (0.31 | ) | $ | (0.61 | ) | $ | (1.33 | ) | $ | (1.39 | ) | |||||

| Diluted from discontinued operations | - | (0.04 | ) | - | - | (0.05 | ) | |||||||||||||

| Total Diluted | $ | (0.37 | ) | $ | (0.35 | ) | $ | (0.61 | ) | $ | (1.33 | ) | $ | (1.44 | ) | |||||

| Weighted-average number of common shares outstanding: | ||||||||||||||||||||

| Basic | 352,026 | 350,194 | 351,543 | 351,444 | 329,118 | |||||||||||||||

| Diluted | 352,026 | 350,194 | 351,543 | 351,444 | 329,118 | |||||||||||||||

| Adjusted EBITDA | $ | 207,034 | $ | 200,960 | $ | 198,407 | $ | 602,437 | $ | 557,057 | ||||||||||

| Adjusted operating income (loss) | $ | (14,523 | ) | $ | (7,557 | ) | $ | (19,912 | ) | $ | (47,830 | ) | $ | (83,170 | ) | |||||

1-1

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

| September 30, | June 30, | December 31, | ||||||||||

| (In thousands) | 2019 | 2019 | 2018 | |||||||||

| (Unaudited) | ||||||||||||

| ASSETS | ||||||||||||

| Current assets: | ||||||||||||

| Cash and short-term investments | $ | 418,937 | $ | 395,716 | $ | 481,802 | ||||||

| Accounts receivable, net | 613,527 | 737,353 | 756,320 | |||||||||

| Assets held for sale | 8,037 | 8,004 | 12,250 | |||||||||

| Other current assets | 339,847 | 325,606 | 343,191 | |||||||||

| Total current assets | 1,380,348 | 1,466,679 | 1,593,563 | |||||||||

| Property, plant and equipment, net | 5,152,236 | 5,301,252 | 5,467,870 | |||||||||

| Goodwill | 90,543 | 90,645 | 183,914 | |||||||||

| Other long-term assets | 650,370 | 655,927 | 608,597 | |||||||||

| Total assets | $ | 7,273,497 | $ | 7,514,503 | $ | 7,853,944 | ||||||

| LIABILITIES AND EQUITY | ||||||||||||

| Current liabilities: | ||||||||||||

| Current portion of debt | $ | 1,058 | $ | 790 | $ | 561 | ||||||

| Other current liabilities | 681,246 | 771,377 | 831,516 | |||||||||

| Total current liabilities | 682,304 | 772,167 | 832,077 | |||||||||

| Long-term debt | 3,516,592 | 3,550,577 | 3,585,884 | |||||||||

| Other long-term liabilities | 313,497 | 321,576 | 280,796 | |||||||||

| Total liabilities | 4,512,393 | 4,644,320 | 4,698,757 | |||||||||

| Redeemable noncontrolling interest in subsidiary | 420,217 | 415,042 | 404,861 | |||||||||

| Equity: | ||||||||||||

| Shareholders' equity | 2,251,705 | 2,381,514 | 2,700,850 | |||||||||

| Noncontrolling interest | 89,182 | 73,627 | 49,476 | |||||||||

| Total equity | 2,340,887 | 2,455,141 | 2,750,326 | |||||||||

| Total liabilities and equity | $ | 7,273,497 | $ | 7,514,503 | $ | 7,853,944 | ||||||

1-2

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

SEGMENT REPORTING

(Unaudited)

The following tables set forth certain information with respect to our reportable segments and rig activity:

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, | June 30, | September 30, | ||||||||||||||||||

| (In thousands, except rig activity) | 2019 | 2018 | 2019 | 2019 | 2018 | |||||||||||||||

| Operating revenues: | ||||||||||||||||||||

| U.S. Drilling | $ | 307,808 | $ | 273,996 | $ | 323,402 | $ | 951,419 | $ | 779,393 | ||||||||||

| Canada Drilling | 12,191 | 26,645 | 11,389 | 48,895 | 75,974 | |||||||||||||||

| International Drilling | 328,278 | 377,125 | 326,905 | 992,439 | 1,123,956 | |||||||||||||||

| Drilling Solutions | 62,286 | 60,923 | 64,583 | 192,291 | 183,430 | |||||||||||||||

| Rig Technologies (1) | 63,106 | 63,641 | 72,751 | 207,610 | 209,631 | |||||||||||||||

| Other reconciling items (2) | (15,593 | ) | (22,905 | ) | (27,624 | ) | (63,532 | ) | (96,845 | ) | ||||||||||

| Total operating revenues | $ | 758,076 | $ | 779,425 | $ | 771,406 | $ | 2,329,122 | $ | 2,275,539 | ||||||||||

| Adjusted EBITDA: (3) | ||||||||||||||||||||

| U.S. Drilling | $ | 120,936 | $ | 99,353 | $ | 124,924 | $ | 370,865 | $ | 259,343 | ||||||||||

| Canada Drilling | 1,466 | 7,294 | 1,069 | 9,981 | 21,556 | |||||||||||||||

| International Drilling | 95,214 | 116,797 | 86,767 | 267,825 | 363,418 | |||||||||||||||

| Drilling Solutions | 23,471 | 16,145 | 22,461 | 66,978 | 45,638 | |||||||||||||||

| Rig Technologies (1) | 2,173 | 137 | 3,160 | 3,037 | (8,101 | ) | ||||||||||||||

| Other reconciling items (4) | (36,226 | ) | (38,766 | ) | (39,974 | ) | (116,249 | ) | (124,797 | ) | ||||||||||

| Total adjusted EBITDA | $ | 207,034 | $ | 200,960 | $ | 198,407 | $ | 602,437 | $ | 557,057 | ||||||||||

| Adjusted operating income (loss): (5) | ||||||||||||||||||||

| U.S. Drilling | $ | 12,427 | $ | 2,578 | $ | 20,392 | $ | 57,502 | $ | (30,275 | ) | |||||||||

| Canada Drilling | (5,701 | ) | (1,895 | ) | (5,537 | ) | (11,297 | ) | (7,095 | ) | ||||||||||

| International Drilling | 2,466 | 25,680 | (6,884 | ) | (10,055 | ) | 74,702 | |||||||||||||

| Drilling Solutions | 16,145 | 9,506 | 13,793 | 42,793 | 25,773 | |||||||||||||||

| Rig Technologies (1) | (641 | ) | (4,141 | ) | 496 | (5,293 | ) | (20,550 | ) | |||||||||||

| Other reconciling items (4) | (39,219 | ) | (39,285 | ) | (42,172 | ) | (121,480 | ) | (125,725 | ) | ||||||||||

| Total adjusted operating income (loss) | $ | (14,523 | ) | $ | (7,557 | ) | $ | (19,912 | ) | $ | (47,830 | ) | $ | (83,170 | ) | |||||

| Rig activity: | ||||||||||||||||||||

| Average Rigs Working: (6) | ||||||||||||||||||||

| U.S. Drilling | 114.1 | 111.6 | 122.2 | 119.0 | 111.8 | |||||||||||||||

| Canada Drilling | 7.7 | 17.9 | 7.4 | 10.4 | 16.4 | |||||||||||||||

| International Drilling | 87.7 | 96.0 | 88.6 | 88.7 | 94.6 | |||||||||||||||

| Total average rigs working | 209.5 | 225.5 | 218.2 | 218.1 | 222.8 | |||||||||||||||

1-3

| (1) | Includes our oilfield equipment manufacturing, automated systems, and downhole tools. |

| (2) | Represents the elimination of inter-segment transactions. |

| (3) | Adjusted EBITDA represents income (loss) from continuing operations before income taxes, interest expense, depreciation and amortization, earnings (losses) from unconsolidated affiliates, investment income (loss), impairments and other charges and other, net. Adjusted EBITDA is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. In addition, adjusted EBITDA excludes certain cash expenses that the Company is obligated to make. However, management evaluates the performance of its operating segments and the consolidated Company based on several criteria, including adjusted EBITDA and adjusted operating income (loss), because it believes that these financial measures accurately reflect the Company’s ongoing profitability and performance. Securities analysts and investors use this measure as one of the metrics on which they analyze the Company’s performance. Other companies in this industry may compute these measures differently. A reconciliation of this non-GAAP measure to income (loss) from continuing operations before income taxes, which is the most closely comparable GAAP measure, is provided in the table set forth immediately following the heading "Reconciliation of Non-GAAP Financial Measures to Income (loss) from Continuing Operations before Income Taxes". |

| (4) | Represents the elimination of inter-segment transactions and unallocated corporate expenses. |

| (5) | Adjusted operating income (loss) represents income (loss) from continuing operations before income taxes, interest expense, earnings (losses) from unconsolidated affiliates, investment income (loss), impairments and other charges and other, net. Adjusted operating income (loss) is a non-GAAP financial measure and should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. In addition, adjusted operating income (loss) excludes certain cash expenses that the Company is obligated to make. However, management evaluates the performance of its operating segments and the consolidated Company based on several criteria, including adjusted EBITDA and adjusted operating income (loss), because it believes that these financial measures accurately reflect the Company’s ongoing profitability and performance. Securities analysts and investors use this measure as one of the metrics on which they analyze the Company’s performance. Other companies in this industry may compute these measures differently. A reconciliation of this non-GAAP measure to income (loss) from continuing operations before income taxes, which is the most closely comparable GAAP measure, is provided in the table set forth immediately following the heading "Reconciliation of Non-GAAP Financial Measures to Income (loss) from Continuing Operations before Income Taxes". |

| (6) | Represents a measure of the average number of rigs operating during a given period. For example, one rig operating 45 days during a quarter represents approximately 0.5 average rigs working for the quarter. On an annual period, one rig operating 182.5 days represents approximately 0.5 average rigs working for the year. |

1-4

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO

INCOME (LOSS) FROM CONTINUING OPERATIONS BEFORE INCOME TAXES

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||||||||||

| September 30, | June 30, | September 30, | ||||||||||||||||||

| (In thousands) | 2019 | 2018 | 2019 | 2019 | 2018 | |||||||||||||||

| Adjusted EBITDA | $ | 207,034 | $ | 200,960 | $ | 198,407 | $ | 602,437 | $ | 557,057 | ||||||||||

| Depreciation and amortization | (221,557 | ) | (208,517 | ) | (218,319 | ) | (650,267 | ) | (640,227 | ) | ||||||||||

| Adjusted operating income (loss) | (14,523 | ) | (7,557 | ) | (19,912 | ) | (47,830 | ) | (83,170 | ) | ||||||||||

| Earnings (losses) from unconsolidated affiliates | - | - | - | (5 | ) | 1 | ||||||||||||||

| Investment income (loss) | (1,437 | ) | (1,342 | ) | 469 | 8,709 | (4,041 | ) | ||||||||||||

| Interest expense | (51,291 | ) | (51,415 | ) | (51,491 | ) | (155,134 | ) | (173,393 | ) | ||||||||||

| Impairments and other charges | (3,629 | ) | (13,770 | ) | (104,180 | ) | (106,007 | ) | (90,434 | ) | ||||||||||

| Other, net | (5,005 | ) | (9,137 | ) | (6,289 | ) | (30,598 | ) | (24,163 | ) | ||||||||||

| Income (loss) from continuing operations before income taxes | $ | (75,885 | ) | $ | (83,221 | ) | $ | (181,403 | ) | $ | (330,865 | ) | $ | (375,200 | ) | |||||

1-5

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

RECONCILIATION OF NET DEBT TO TOTAL DEBT

| September 30, | June 30, | December 31, | ||||||||||

| (In thousands) | 2019 | 2019 | 2018 | |||||||||

| (Unaudited) | ||||||||||||

| Current portion of debt | $ | 1,058 | $ | 790 | $ | 561 | ||||||

| Long-term debt | 3,516,592 | 3,550,577 | 3,585,884 | |||||||||

| Total Debt | 3,517,650 | 3,551,367 | 3,586,445 | |||||||||

| Less: Cash and short-term investments | 418,937 | 395,716 | 481,802 | |||||||||

| Net Debt | $ | 3,098,713 | $ | 3,155,651 | $ | 3,104,643 | ||||||

1-6

NABORS INDUSTRIES LTD. AND SUBSIDIARIES

RECONCILIATION OF FREE CASH FLOW AFTER DIVIDENDS TO

NET CASH PROVIDED BY OPERATING ACTIVITIES

(Unaudited)

| Three Months Ended | Nine Months Ended | |||||||||||

| September 30, | June 30, | September 30, | ||||||||||

| (In thousands) | 2019 | 2019 | 2019 | |||||||||

| Net cash provided by operating activities | $ | 157,192 | $ | 203,231 | $ | 430,277 | ||||||

| Less: Net cash used for investing activities | (75,496 | ) | (113,760 | ) | (333,700 | ) | ||||||

| Less: Dividends to common and preferred shareholders | (7,938 | ) | (7,940 | ) | (41,643 | ) | ||||||

| Free cash flow after dividends | $ | 73,758 | $ | 81,531 | $ | 54,934 | ||||||

Free cash flow after dividends represents net cash provided by operating activities less cash used for investing activities and cash paid for dividends. Free cash flow is an indicator of our ability to generate cash flow after required spending to maintain or expand our asset base and pay dividends. Management believes that this non-GAAP measure is useful information to investors when comparing our cash flows with the cash flows of other companies. This non-GAAP measure has limitations and therefore should not be used in isolation or as a substitute for the amounts reported in accordance with GAAP. However, management evaluates the performance of the consolidated Company based on several criteria, including free cash flow after dividends, because it believes that these financial measures accurately reflect the Company's ongoing profitability and performance.

1-7