|

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

|

|

|

|

|

(State or other jurisdiction of incorporation or organization)

|

(I.R.S. Employer Identification No.)

|

|

|

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

||

|

|

|

The

|

|

Large accelerated filer ☐

|

|

|

Non-accelerated filer ☐

|

Smaller reporting company

|

|

Emerging growth company

|

|

Page No.

|

||

|

PART I

|

||

|

Item 1.

|

5

|

|

|

Item 1A.

|

23

|

|

|

Item 1B.

|

37

|

|

|

Item 1C.

|

37

|

|

|

Item 2.

|

38

|

|

|

Item 3.

|

39

|

|

|

Item 4.

|

39

|

|

|

PART II

|

||

|

Item 5.

|

39

|

|

|

Item 6.

|

41

|

|

|

Item 7.

|

41

|

|

|

Item 7A.

|

63

|

|

|

Item 8.

|

64 | |

|

Item 9.

|

105

|

|

|

Item 9A.

|

105

|

|

|

Item 9B.

|

105

|

|

|

Item 9C.

|

106

|

|

|

PART III

|

||

|

Item 10.

|

107

|

|

|

Item 11.

|

107

|

|

|

Item 12.

|

107 |

|

|

Item 13.

|

107

|

|

|

Item 14.

|

107

|

|

|

PART IV

|

||

|

Item 15.

|

108

|

|

|

Item 16.

|

110

|

|

|

111

|

||

| ● |

potential recession in the United States and our market areas;

|

| ● |

the impacts related to or resulting from recent bank failures and any continuation of the recent uncertainty in the banking industry, including the associated impact to the Company and other financial

institutions of any regulatory changes or other mitigation efforts taken by government agencies in response thereto;

|

| ● |

increased competition for deposits and related changes in deposit customer behavior;

|

| ● |

the persistence of the current inflationary environment in the United States and our market areas, and its impact on market interest rates, the economy and credit quality;

|

| ● |

our ability to effectively execute our expansion strategy and manage our growth, including identifying and consummating suitable acquisitions;

|

| ● |

business and economic conditions, particularly those affecting our market areas, as well as the concentration of our business in such market areas;

|

| ● |

the impact of pandemics, epidemics, or any other health-related crisis;

|

| ● |

high concentrations of loans secured by real estate located in our market areas;

|

| ● |

increases in unemployment rates in the United States and our market areas;

|

| ● |

risks associated with our commercial loan portfolio, including the risk for deterioration in value of the general business assets that secure such loans;

|

| ● |

potential changes in the prices, values and sales volumes of commercial and residential real estate securing our real estate loans;

|

| ● |

risks associated with our agricultural loan portfolio, including the heightened sensitivity to weather conditions, commodity prices, and other factors generally outside the borrowers and our control;

|

| ● |

risks associated with the sale of crop insurance products, including termination of or substantial changes to the federal crop insurance program;

|

| ● |

risks related to the significant amount of credit that we have extended to a limited number of borrowers and in a limited geographic area;

|

| ● |

public funds deposits comprising a relatively high percentage of our deposits;

|

| ● |

potential impairment on the goodwill we have recorded or may record in connection with business acquisitions;

|

| ● |

our ability to maintain our reputation;

|

| ● |

our ability to successfully manage our credit risk and the sufficiency of our allowance for credit losses;

|

| ● |

our ability to attract, hire and retain qualified management personnel;

|

| ● |

our dependence on our management team, including our ability to retain executive officers and key employees and their customer and community relationships;

|

| ● |

interest rate fluctuations, which could have an adverse effect on our profitability;

|

| ● |

competition from banks, credit unions and other financial services providers;

|

| ● |

our ability to keep pace with technological change or difficulties we may experience when implementing new technologies;

|

| ● |

cybersecurity risk, including cyber incidents or other failures, disruptions or breaches of our operational or security systems or infrastructure, or those of our third-party vendors or other service providers,

including as a result of a cyber attack, could impact the Company’s reputation, increase regulatory oversight, and impact the financial results of the Company;

|

| ● |

our ability to maintain effective internal control over financial reporting;

|

| ● |

employee error, fraudulent activity by employees or customers and inaccurate or incomplete information about our customers and counterparties;

|

| ● |

increased capital requirements imposed by banking regulators, which may require us to raise capital at a time when capital is not available on favorable terms or at all;

|

| ● |

our ability to maintain adequate liquidity and to raise necessary capital to fund our acquisition strategy and operations or to meet increased minimum regulatory capital levels;

|

| ● |

costs and effects of litigation, investigations or similar matters to which we may be subject, including any effect on our reputation;

|

| ● |

natural disasters, severe weather, acts of god, acts of war or terrorism, geopolitical instability, public health outbreaks (such as coronavirus), other international or domestic calamities, and other matters

beyond our control;

|

| ● |

uncertainty regarding United States fiscal debt and budget matters;

|

| ● |

changes in tariffs and trade barriers;

|

| ● |

compliance with governmental and regulatory requirements, including the Dodd-Frank Act Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”), Economic Growth, Regulatory Relief, and Consumer

Protection Act of 2018 (“EGRRCPA”), and others relating to banking, consumer protection, securities and tax matters;

|

| ● |

changes in the laws, rules, regulations, interpretations or policies that apply to the Company’s business and operations, and any additional regulations, or repeals that may be forthcoming as a result thereof,

which could cause the Company to incur additional costs and adversely affect the Company’s business environment, operations and financial results; and

|

| ● |

our ability to navigate the uncertain impacts of current and future governmental monetary and fiscal policies, including the current and future policies of the Board of Governors of the Federal Reserve System

(“Federal Reserve”) and as a result of initiatives of the Biden administration.

|

| Item 1. |

Business

|

|

Basel III

Minimum

for Capital

Adequacy

Purposes

|

Basel III

Additional

Capital

Conservation

Buffer

|

Basel III

Ratio with

Capital

Conservation

Buffer

|

||||||||||

|

Total risk based capital (total capital to risk-weighted assets)

|

8.00

|

%

|

2.50

|

%

|

10.50

|

%

|

||||||

|

Tier 1 risk based capital (Tier 1 to risk-weighted assets)

|

6.00

|

%

|

2.50

|

%

|

8.50

|

%

|

||||||

|

Common equity Tier 1 risk based capital (CET1 to risk-weighted assets)

|

4.50

|

%

|

2.50

|

%

|

7.00

|

%

|

||||||

|

Tier 1 leverage ratio (Tier 1 to average assets)

|

4.00

|

%

|

—

|

4.00

|

%

|

|||||||

| ● |

assigning exposures secured by single-family residential properties to either a 50% risk weight for first-lien mortgages that meet prudent underwriting standards or a 100% risk weight category for all other

mortgages;

|

| ● |

providing for a 20% credit conversion factor for the unused portion of a commitment with an original maturity of one year or less that is not unconditionally cancellable (increased from 0% under the previous

risk-based capital rules);

|

| ● |

assigning a 150% risk weight to all exposures that are nonaccrual or 90 days or more past due (increased from 100% under the previous risk-based capital rules), except for those secured by single-family

residential properties, which will be assigned a 100% risk weight, consistent with the previous risk-based capital rules;

|

| ● |

applying a 150% risk weight instead of a 100% risk weight for certain high-volatility commercial real estate, or HVCRE, loans, or acquisition, development, and construction, or ADC, loans; and

|

| ● |

applying a 250% risk weight to the portion of mortgage servicing rights and deferred tax assets arising from temporary differences that could not be realized through net operating loss carrybacks that are not

deducted from CET1 capital (increased from 100% under the previous risk-based capital rules).

|

| ● |

internal policies, procedures and controls designed to implement and maintain the bank’s compliance with all of the requirements of the BSA, the USA PATRIOT Act, the National Defense Authorization Act and

related laws and regulations;

|

| ● |

systems and procedures for monitoring and reporting suspicious transactions and activities;

|

| ● |

a designated compliance officer;

|

| ● |

employee training;

|

| ● |

an independent audit function to test the AML program;

|

| ● |

procedures to verify the identity of each customer upon the opening of accounts; and

|

| ● |

heightened due diligence policies, procedures and controls applicable to certain foreign accounts and relationships.

|

| • |

continued focus on fair lending, including promoting racial and economic equity for underserved, vulnerable and marginalized communities;

|

| • |

focused efforts on enforcing certain compliance obligations the CFPB deems a priority, such as automobile loan servicing, debt collection, deposit, overdraft, non-sufficient funds, representment fees and other

services fees, mortgage origination and servicing, and remittances, among others; and

|

| • |

rulemaking plans concerning, among others, consumers’ access to their financial information and requirements for financial institutions to collect, report and make public certain information concerning credit

applications made by women-owned, minority-owned and small businesses.

|

| Item 1A. |

Risk Factors

|

| Item 1B. |

Unresolved Staff Comments

|

| Item 1C. |

Cybersecurity

|

| ● |

a comprehensive risk management process, integrated with the Enterprise Risk Management system, that continuously assesses, identifies, and manages current and emerging cybersecurity threats and risks, evaluates

the effectiveness of information security controls, and reports the overall risk posture to Executive Management and the Board of Directors.

|

| ● |

assessment of daily cyber threat intelligence from multiple sources;

|

| ● |

the use of third party information security services for continuous monitoring and alerting of information systems, network. and user activity;

|

| ● |

a Vulnerability Management Program that scans networks, devices, and information systems for known cyber vulnerabilities, and initiates processes to mitigate them;

|

| ● |

a third party risk management program that evaluates and ensures our key partners adhere to the same level of information security posture as we do internally;

|

| ● |

Business Continuity and Incident Response plans that are designed and tested for anticipated operational failures, natural disasters, cyberattacks, and other disruptive events; and

|

| ● |

an Information Security Awareness program to ensure employees and customers maintain an awareness of information security threats and best practices to prevent them.

|

| Item 2. |

Properties

|

|

Lubbock/South Plains

|

Dallas/Ft. Worth

|

|||||

|

Location

|

Branch or LPO

|

Location

|

Branch or LPO

|

|||

|

Lubbock

|

Main Branch

|

Plano

|

Branch

|

|||

|

Lubbock

|

4th Street Branch

|

Dallas

|

Uptown Branch

|

|||

|

Lubbock

|

50th and Indiana Branch

|

Forney

|

Branch

|

|||

|

Lubbock

|

Kingsgate Branch

|

Arlington

|

LPO

|

|||

|

Lubbock

|

Milwaukee Branch

|

Dallas

|

Hillcrest LPO

|

|||

|

Lubbock

|

Overton Branch

|

Ft. Worth

|

LPO

|

|||

|

Lubbock

|

University Branch

|

Grand Prairie

|

LPO

|

|||

|

Morton

|

Branch

|

Southlake

|

LPO

|

|||

|

Idalou

|

Branch

|

|||||

|

Levelland

|

Branch

|

|||||

|

El Paso

|

Houston

|

|||||

|

Location

|

Branch or LPO

|

Location

|

Branch or LPO

|

|||

|

El Paso

|

East Branch

|

Houston

|

Branch

|

|||

|

El Paso

|

West Branch

|

|||||

|

El Paso

|

Mesa Hills LPO

|

|||||

|

Bryan/College Station

|

Ruidoso, New Mexico

|

|||||

|

Location

|

Branch or LPO

|

Location

|

Branch or LPO

|

|||

|

College Station

|

Branch

|

Ruidoso

|

Gateway Branch

|

|||

|

College Station

|

LPO

|

Ruidoso

|

River Crossing Branch

|

|||

|

The Permian Basin

|

Other Markets

|

|||||

|

Location

|

Branch or LPO

|

Location

|

Branch or LPO

|

|||

|

Odessa

|

University Branch

|

Abilene, Texas

|

LPO

|

|||

|

Odessa

|

Grandview Branch

|

|||||

|

Midland

|

Branch

|

|||||

|

Kermit

|

Branch

|

|||||

|

Fort Stockton

|

Branch

|

|||||

|

Monahans

|

Branch

|

|||||

| Item 3. |

Legal Proceedings

|

| Item 4. |

Mine Safety Disclosures

|

| Item 5. |

Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities.

|

|

Plan Category

|

Number of Shares to be

Issued Upon Exercise of

Outstanding Awards

|

Weighted-Average

Exercise Price of

Outstanding Awards

|

Number of Shares

Available for

Future Grants

|

|||||||||

|

Equity compensation plans approved by shareholders(1)

|

1,406,775

|

$

|

15.40

|

2,036,512

|

||||||||

|

Equity compensation plans not approved by shareholders

|

—

|

—

|

—

|

|||||||||

|

Total

|

1,406,775

|

$

|

15.40

|

2,036,512

|

||||||||

| (1) |

The number of shares available for future issuance includes 2,036,512 shares available under the Company’s 2019 Equity Incentive Plan (which allows for the issuance of options, as well as various other

stock-based awards).

|

|

Total Shares

Repurchased (1)

|

Average Price

Paid Per Share

|

Total Dollar Amount

Purchased Pursuant to

Publicly-Announced Plans

|

Maximum Dollar Amount

Remaining Available for

Repurchase Pursuant to

Publicly-Announced Plans

|

|||||||||||||

|

October 2023

|

107,803

|

$

|

26.47

|

$

|

2,853,822

|

$

|

277,330

|

|||||||||

|

November 2023

|

10,360

|

26.77

|

277,330

|

—

|

||||||||||||

|

December 2023

|

—

|

—

|

—

|

—

|

||||||||||||

|

Total

|

130,189

|

|||||||||||||||

|

(1)

|

Includes 100,000 shares that the Company repurchased from Curtis C. Griffith, the Chairman and Chief Executive Officer of the Company, on November 7, 2023, at a price of $26.30 per share, in a privately negotiated transaction outside

of the Program

|

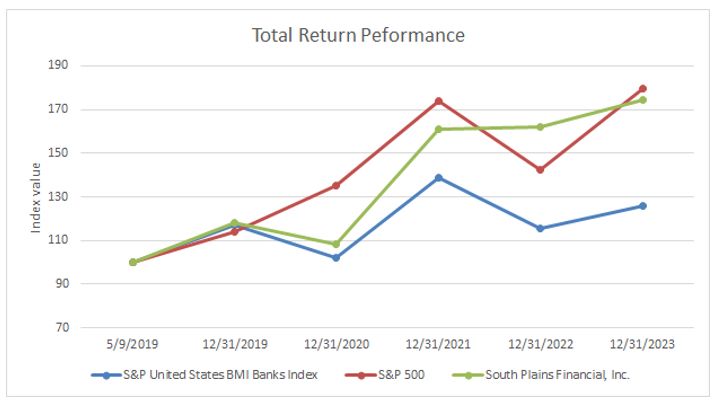

|

Dollars

|

5/9/19

|

12/31/19

|

12/31/20

|

12/31/21

|

12/31/22

|

12/31/23

|

||||||||||||||||||

|

South Plains Financial, Inc.

|

$

|

100.0

|

$

|

118.25

|

$

|

108.42

|

$

|

161.21

|

$

|

162.27

|

$

|

174.28

|

||||||||||||

|

S&P United States BMI Banks Index

|

100.0

|

117.22

|

102.26

|

139.04

|

115.32

|

179.71

|

||||||||||||||||||

|

S&P 500

|

100.0

|

114.03

|

135.01

|

173.77

|

142.30

|

125.80

|

||||||||||||||||||

| Item 6. |

[Reserved]

|

| Item 7. |

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

As of or for the Year Ended December 31,

|

||||||||||||

|

2023

|

2022

|

2021

|

||||||||||

|

Selected Income Statement Data:

|

||||||||||||

|

Net interest income

|

$

|

139,747

|

$

|

138,476

|

$

|

121,764

|

||||||

|

Provision for credit losses

|

4,610

|

(2,619

|

)

|

(1,918

|

)

|

|||||||

|

Noninterest income

|

79,226

|

76,145

|

97,469

|

|||||||||

|

Noninterest expense

|

134,946

|

144,089

|

148,030

|

|||||||||

|

Income tax expense

|

16,672

|

14,911

|

14,507

|

|||||||||

|

Net income

|

62,745

|

58,240

|

58,614

|

|||||||||

|

Share and Per Share Data:

|

||||||||||||

|

Earnings per share (basic)

|

$

|

3.73

|

$

|

3.35

|

$

|

3.26

|

||||||

|

Earnings per share (diluted)

|

3.62

|

3.23

|

3.17

|

|||||||||

|

Dividends per share

|

0.52

|

0.46

|

0.30

|

|||||||||

|

Tangible book value per share(1)

|

23.47

|

19.57

|

21.51

|

|||||||||

|

Selected Period End Balance Sheet Data:

|

||||||||||||

|

Cash and cash equivalents

|

$

|

330,158

|

$

|

234,883

|

$

|

486,821

|

||||||

|

Investment securities

|

622,762

|

701,711

|

724,504

|

|||||||||

|

Gross loans held for investment

|

3,014,153

|

2,748,081

|

2,437,577

|

|||||||||

|

Allowance for credit losses on loans

|

42,356

|

39,288

|

42,098

|

|||||||||

|

Total assets

|

4,204,793

|

3,944,063

|

3,901,855

|

|||||||||

|

Total deposits

|

3,626,153

|

3,406,430

|

3,341,222

|

|||||||||

|

Borrowings

|

110,168

|

122,354

|

122,168

|

|||||||||

|

Total stockholders’ equity

|

407,114

|

357,014

|

407,427

|

|||||||||

|

Performance Ratios:

|

||||||||||||

|

Return on average assets

|

1.54

|

%

|

1.47

|

%

|

1.56

|

%

|

||||||

|

Return on average stockholders’ equity

|

16.58

|

%

|

15.79

|

%

|

15.08

|

%

|

||||||

|

Net interest margin(2)

|

3.61

|

%

|

3.73

|

%

|

3.51

|

%

|

||||||

|

Efficiency ratio(3)

|

61.33

|

%

|

66.76

|

%

|

67.14

|

%

|

||||||

|

Credit Quality Ratios:

|

||||||||||||

|

Nonperforming assets to total assets(4)

|

0.14

|

%

|

0.20

|

%

|

0.30

|

%

|

||||||

|

Nonperforming loans to total loans held for investment(5)

|

0.17

|

%

|

0.28

|

%

|

0.43

|

%

|

||||||

|

Allowance for credit losses on loans to nonperforming loans(5)

|

818.00

|

%

|

504.34

|

%

|

397.23

|

%

|

||||||

|

Allowance for credit losses on loans to total loans held for investment

|

1.41

|

%

|

1.43

|

%

|

1.73

|

%

|

||||||

|

Net loan charge-offs to average loans

|

0.07

|

%

|

0.01

|

%

|

0.06

|

%

|

||||||

|

Capital Ratios:

|

||||||||||||

|

Total stockholders’ equity to total assets

|

9.68

|

%

|

9.05

|

%

|

10.44

|

%

|

||||||

|

Tangible common equity to tangible assets(1)

|

9.21

|

%

|

8.50

|

%

|

9.85

|

%

|

||||||

|

Common equity tier 1 capital ratio

|

12.41

|

%

|

11.81

|

%

|

12.91

|

%

|

||||||

|

Tier 1 leverage ratio

|

11.33

|

%

|

11.03

|

%

|

10.77

|

%

|

||||||

|

Tier 1 risk-based capital ratio

|

13.69

|

%

|

13.15

|

%

|

14.49

|

%

|

||||||

|

Total risk-based capital ratio

|

16.74

|

%

|

16.58

|

%

|

18.40

|

%

|

||||||

| (1) |

Represents a non-GAAP financial measure. See our reconciliation of non-GAAP financial measures to their most directly comparable GAAP financial measures under the caption “Management’s Discussion and

Analysis of Financial Condition and Results of Operations — Non-GAAP Financial Measures.”

|

| (2) |

Net interest margin is calculated as the annual net interest income, on a fully tax-equivalent basis, divided by average interest-earning assets.

|

| (3) |

The efficiency ratio is calculated by dividing noninterest expense by the sum of net interest income on a tax-equivalent basis and noninterest income.

|

| (4) |

Nonperforming assets consist of nonperforming loans plus foreclosed assets.

|

| (5) |

Nonperforming loans include nonaccrual loans and loans past due 90 days or more.

|

|

Year Ended December 31,

|

||||||||||||||||||||||||||||||||||||

|

2023

|

2022

|

2021

|

||||||||||||||||||||||||||||||||||

|

Average Balance

|

Interest

|

Yield/Rate

|

Average Balance

|

Interest

|

Yield/Rate

|

Average Balance

|

Interest

|

Yield/Rate

|

||||||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||||||

|

Assets:

|

||||||||||||||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||||||||||||||

|

Loans(1)

|

$

|

2,924,473

|

$

|

176,627

|

6.04

|

%

|

$

|

2,612,161

|

$

|

137,957

|

5.28

|

%

|

$

|

2,420,201

|

$

|

120,545

|

4.98

|

%

|

||||||||||||||||||

|

Investment securities – taxable

|

570,655

|

21,590

|

3.78

|

%

|

594,405

|

15,010

|

2.53

|

%

|

532,272

|

9,292

|

1.75

|

%

|

||||||||||||||||||||||||

|

Investment securities – non-taxable

|

185,205

|

4,901

|

2.65

|

%

|

216,216

|

5,733

|

2.65

|

%

|

219,385

|

5,872

|

2.68

|

%

|

||||||||||||||||||||||||

|

Other interest-earning assets (2)

|

223,152

|

9,973

|

4.47

|

%

|

318,862

|

3,675

|

1.15

|

%

|

336,081

|

565

|

0.17

|

%

|

||||||||||||||||||||||||

|

Total interest-earning assets

|

3,903,485

|

213,091

|

5.46

|

%

|

3,741,644

|

162,375

|

4.34

|

%

|

3,507,939

|

136,274

|

3.88

|

%

|

||||||||||||||||||||||||

|

Noninterest-earning assets

|

176,495

|

222,544

|

261,140

|

|||||||||||||||||||||||||||||||||

|

Total assets

|

$

|

4,079,980

|

$

|

3,964,188

|

$

|

3,769,079

|

||||||||||||||||||||||||||||||

|

Liabilities and Stockholders’ Equity:

|

||||||||||||||||||||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||||||||||||||

|

NOW, savings and money market deposits

|

2,117,985

|

55,423

|

2.62

|

%

|

1,889,888

|

13,013

|

0.69

|

%

|

1,841,678

|

4,163

|

0.23

|

%

|

||||||||||||||||||||||||

|

Time deposits

|

321,205

|

9,564

|

2.98

|

%

|

327,289

|

3,989

|

1.22

|

%

|

329,509

|

4,130

|

1.25

|

%

|

||||||||||||||||||||||||

|

Short-term borrowings

|

84

|

5

|

5.95

|

%

|

4

|

—

|

0.00

|

%

|

8,045

|

5

|

0.06

|

%

|

||||||||||||||||||||||||

|

Notes payable & other longer-term borrowings

|

—

|

—

|

0.00

|

%

|

—

|

—

|

0.00

|

%

|

19,641

|

38

|

0.19

|

%

|

||||||||||||||||||||||||

|

Subordinated debt

|

75,458

|

4,018

|

5.32

|

%

|

75,874

|

4,050

|

5.34

|

%

|

75,699

|

4,056

|

5.36

|

%

|

||||||||||||||||||||||||

|

Junior subordinated deferrable interest debentures

|

46,393

|

3,276

|

7.06

|

%

|

46,393

|

1,640

|

3.54

|

%

|

46,393

|

880

|

1.90

|

%

|

||||||||||||||||||||||||

|

Total interest-bearing liabilities

|

2,561,125

|

72,286

|

2.82

|

%

|

2,339,448

|

22,692

|

0.97

|

%

|

2,320,965

|

13,272

|

0.57

|

%

|

||||||||||||||||||||||||

|

Noninterest-bearing liabilities:

|

||||||||||||||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

1,069,280

|

1,189,730

|

1,016,835

|

|||||||||||||||||||||||||||||||||

|

Other liabilities

|

71,102

|

66,182

|

42,654

|

|||||||||||||||||||||||||||||||||

|

Total noninterest-bearing liabilities

|

1,140,382

|

1,255,912

|

1,059,489

|

|||||||||||||||||||||||||||||||||

|

Stockholders’ equity

|

378,473

|

368,828

|

388,625

|

|||||||||||||||||||||||||||||||||

|

Total liabilities and stockholders’ equity

|

$

|

4,079,980

|

$

|

3,964,188

|

$

|

3,769,079

|

||||||||||||||||||||||||||||||

|

Net interest income

|

$

|

140,805

|

$

|

139,683

|

$

|

123,002

|

||||||||||||||||||||||||||||||

|

Net interest spread

|

2.64

|

%

|

3.37

|

%

|

3.31

|

%

|

||||||||||||||||||||||||||||||

|

Net interest margin(3)

|

3.61

|

%

|

3.73

|

%

|

3.51

|

%

|

||||||||||||||||||||||||||||||

| (1) |

Average loan balances include nonaccrual loans and loans held for sale.

|

| (2) |

Includes income and average balances for interest-earning deposits at other banks, nonmarketable securities, federal funds sold and other miscellaneous interest-earning assets.

|

| (3) |

Net interest margin is calculated as the annualized net interest income, on a fully tax-equivalent basis, divided by average interest-earning assets.

|

|

Year Ended December 31, 2023 over 2022

|

Year Ended December 31, 2022 over 2021

|

|||||||||||||||||||||||

|

Change due to:

|

Change due to:

|

|||||||||||||||||||||||

|

Volume

|

Rate

|

Total Variance

|

Volume

|

Rate

|

Total Variance

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Interest-earning assets:

|

||||||||||||||||||||||||

|

Loans

|

$

|

16,494

|

$

|

22,176

|

$

|

38,670

|

$

|

7,134

|

$

|

10,278

|

$

|

17,412

|

||||||||||||

|

Investment securities – taxable

|

(600

|

)

|

7,180

|

6,580

|

1,085

|

4,633

|

5,718

|

|||||||||||||||||

|

Investment securities – non-taxable

|

(822

|

)

|

(10

|

)

|

(832

|

)

|

(85

|

)

|

(54

|

)

|

(139

|

)

|

||||||||||||

|

Other interest-earning assets

|

(1,103

|

)

|

7,401

|

6,298

|

(29

|

)

|

3,139

|

3,110

|

||||||||||||||||

|

Total increase (decrease) in interest income

|

13,969

|

36,747

|

50,716

|

8,105

|

17,996

|

26,101

|

||||||||||||||||||

|

Interest-bearing liabilities:

|

||||||||||||||||||||||||

|

NOW, Savings, MMDAs

|

1,571

|

40,839

|

42,410

|

109

|

8,741

|

8,850

|

||||||||||||||||||

|

Time deposits

|

(74

|

)

|

5,649

|

5,575

|

(28

|

)

|

(113

|

)

|

(141

|

)

|

||||||||||||||

|

Short-term borrowings

|

—

|

5

|

5

|

(5

|

)

|

—

|

(5

|

)

|

||||||||||||||||

|

Notes payable & other borrowings

|

—

|

—

|

—

|

(38

|

)

|

—

|

(38

|

)

|

||||||||||||||||

|

Subordinated debt

|

(22

|

)

|

(10

|

)

|

(32

|

)

|

9

|

(15

|

)

|

(6

|

)

|

|||||||||||||

|

Junior subordinated deferrable interest debentures

|

—

|

1,636

|

1,636

|

—

|

760

|

760

|

||||||||||||||||||

|

Total increase (decrease) interest expense:

|

1,475

|

48,119

|

49,594

|

47

|

9,373

|

9,420

|

||||||||||||||||||

|

Increase (decrease) in net interest income

|

$

|

12,494

|

$

|

(11,372

|

)

|

$

|

1,122

|

$

|

8,058

|

$

|

8,623

|

$

|

16,681

|

|||||||||||

|

Year Ended

December 31, 2023 over 2022

|

Year Ended

December 31, 2022 over 2021

|

|||||||||||||||||||||||

|

2023

|

2022

|

Increase (decrease)

|

2022

|

2021

|

Increase (decrease)

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Noninterest income:

|

||||||||||||||||||||||||

|

Service charges on deposit accounts

|

$

|

7,130

|

$

|

6,829

|

$

|

301

|

$

|

6,829

|

$

|

6,963

|

$

|

(134

|

)

|

|||||||||||

|

Income from insurance activities

|

1,515

|

10,826

|

(9,311

|

)

|

10,826

|

8,314

|

2,512

|

|||||||||||||||||

|

Bank card services and interchange fees

|

13,323

|

12,946

|

377

|

12,946

|

12,239

|

707

|

||||||||||||||||||

|

Mortgage banking activities

|

13,817

|

31,370

|

(17,553

|

)

|

31,370

|

59,726

|

(28,356

|

)

|

||||||||||||||||

|

Investment commissions

|

1,698

|

1,825

|

(127

|

)

|

1,825

|

1,934

|

(109

|

)

|

||||||||||||||||

|

Fiduciary income

|

2,433

|

2,390

|

43

|

2,390

|

2,917

|

(527

|

)

|

|||||||||||||||||

|

Gain on sale of subsidiary

|

33,778

|

—

|

33,778

|

—

|

—

|

—

|

||||||||||||||||||

|

Other income and fees(1)

|

5,532

|

9,959

|

(4,427

|

)

|

9,959

|

5,376

|

4,583

|

|||||||||||||||||

|

Total noninterest income

|

$

|

79,226

|

$

|

76,145

|

$

|

3,081

|

$

|

76,145

|

$

|

97,469

|

$

|

(21,324

|

)

|

|||||||||||

| (1) |

Other income and fees includes income and fees associated with the increase in the cash surrender value of life insurance, safe deposit box rental, check printing, collections, legal settlements, wire

transfer, Small Business Investment Company (“SBIC”) investments, and other miscellaneous services.

|

|

Year Ended

December 31, 2023 over 2022

|

Year Ended

December 31, 2022 over 2021

|

|||||||||||||||||||||||

|

2023

|

2022

|

Increase (decrease)

|

2022

|

2021

|

Increase (decrease)

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Noninterest expense:

|

||||||||||||||||||||||||

|

Salaries and employee benefits

|

$

|

79,377

|

$

|

86,323

|

$

|

(6,946

|

)

|

$

|

86,323

|

$

|

93,360

|

$

|

(7,037

|

)

|

||||||||||

|

Occupancy expense, net

|

16,102

|

15,987

|

115

|

15,987

|

14,560

|

1,427

|

||||||||||||||||||

|

Professional services

|

6,433

|

9,740

|

(3,307

|

)

|

9,740

|

6,752

|

2,988

|

|||||||||||||||||

|

Marketing and development

|

3,453

|

3,614

|

(161

|

)

|

3,614

|

3,225

|

389

|

|||||||||||||||||

|

IT and data services

|

3,410

|

3,780

|

(370

|

)

|

3,780

|

4,007

|

(227

|

)

|

||||||||||||||||

|

Bankcard expenses

|

5,557

|

5,376

|

181

|

5,376

|

4,995

|

381

|

||||||||||||||||||

|

Appraisal expenses

|

1,087

|

1,747

|

(660

|

)

|

1,747

|

3,248

|

(1,501

|

)

|

||||||||||||||||

|

Realized loss on sale of securities

|

3,409

|

—

|

3,409

|

—

|

—

|

—

|

||||||||||||||||||

|

Other expenses(1)

|

16,118

|

17,522

|

(1,404

|

)

|

17,522

|

17,883

|

(361

|

)

|

||||||||||||||||

|

Total noninterest expense

|

$

|

134,946

|

$

|

144,089

|

$

|

(9,143

|

)

|

$

|

144,089

|

$

|

148,030

|

$

|

(3,941

|

)

|

||||||||||

| (1) |

Other expenses include items such as banking regulatory assessments, telephone expenses, postage, courier fees, directors’ fees, and insurance.

|

|

Due in

One Year or

Less

|

Due after One

Year

Through Five

Years

|

Due after Five

Years

Through

Fifteen Years

|

Due after

Fifteen Years

|

Total

|

||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||

|

Commercial real estate

|

$

|

110,563

|

$

|

597,520

|

$

|

288,569

|

$

|

84,404

|

$

|

1,081,056

|

||||||||||

|

Commercial - specialized

|

130,836

|

115,520

|

74,148

|

51,872

|

372,376

|

|||||||||||||||

|

Commercial - general

|

77,012

|

166,654

|

149,795

|

123,900

|

517,361

|

|||||||||||||||

|

Consumer:

|

||||||||||||||||||||

|

1-4 family residential

|

32,425

|

92,820

|

80,478

|

329,008

|

534,731

|

|||||||||||||||

|

Auto loans

|

3,074

|

192,825

|

109,372

|

—

|

305,271

|

|||||||||||||||

|

Other consumer

|

8,487

|

46,961

|

18,720

|

—

|

74,168

|

|||||||||||||||

|

Construction

|

108,663

|

15,072

|

1,324

|

4,131

|

129,190

|

|||||||||||||||

|

Total loans

|

$

|

471,060

|

$

|

1,227,372

|

$

|

722,406

|

$

|

593,315

|

$

|

3,014,153

|

||||||||||

|

Fixed

Rate

|

Adjustable

Rate

|

|||||||

|

(Dollars in thousands)

|

||||||||

|

Commercial real estate

|

$

|

438,873

|

$

|

531,620

|

||||

|

Commercial - specialized

|

90,848

|

150,692

|

||||||

|

Commercial - general

|

160,529

|

279,820

|

||||||

|

Consumer:

|

||||||||

|

1-4 family residential

|

307,699

|

194,607

|

||||||

|

Auto loans

|

302,197

|

—

|

||||||

|

Other consumer

|

65,681

|

—

|

||||||

|

Construction

|

11,112

|

9,415

|

||||||

|

Total loans

|

$

|

1,376,939

|

$

|

1,166,154

|

||||

|

December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

(Dollars in thousands)

|

||||||||

|

Commitments to grant loans and unfunded commitments under lines of credit

|

$

|

598,800

|

$

|

682,296

|

||||

|

Standby letters of credit

|

11,503

|

13,864

|

||||||

|

Total

|

$

|

610,303

|

$

|

696,160

|

||||

|

As of or for the Year Ended December 31,

|

||||||||||||

|

2023

|

2022

|

2021

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Average loans outstanding during period(1)

|

||||||||||||

|

Commercial real estate

|

$

|

988,121

|

$

|

817,365

|

$

|

705,516

|

||||||

|

Commercial – specialized

|

350,940

|

351,598

|

336,754

|

|||||||||

|

Commercial – general

|

517,242

|

476,553

|

490,945

|

|||||||||

|

Consumer:

|

||||||||||||

|

1-4 family residential

|

512,149

|

409,023

|

374,609

|

|||||||||

|

Auto loans

|

317,465

|

285,493

|

227,301

|

|||||||||

|

Other consumer

|

78,842

|

85,881

|

68,106

|

|||||||||

|

Construction

|

140,460

|

150,072

|

124,840

|

|||||||||

|

Loans held for sale

|

19,254

|

36,176

|

92,130

|

|||||||||

|

Total average loans outstanding during period

|

$

|

2,924,473

|

$

|

2,612,161

|

$

|

2,420,201

|

||||||

|

Net charge-offs (recoveries) during the period

|

||||||||||||

|

Commercial real estate

|

$

|

—

|

$

|

(418

|

)

|

$

|

(109

|

)

|

||||

|

Commercial – specialized

|

(164

|

)

|

(807

|

)

|

11

|

|||||||

|

Commercial – general

|

292

|

(122

|

)

|

459

|

||||||||

|

Consumer:

|

||||||||||||

|

1-4 family residential

|

(5

|

)

|

100

|

44

|

||||||||

|

Auto loans

|

691

|

364

|

483

|

|||||||||

|

Other consumer

|

861

|

913

|

653

|

|||||||||

|

Construction

|

319

|

161

|

(4

|

)

|

||||||||

|

Total net charge-offs (recoveries) during the period

|

$

|

1,994

|

$

|

191

|

$

|

1,537

|

||||||

|

Total loans held for investment outstanding

|

$

|

3,014,153

|

$

|

2,748,081

|

$

|

2,437,577

|

||||||

|

Nonaccrual loans

|

$

|

3,242

|

$

|

5,802

|

$

|

9,518

|

||||||

|

Allowance for credit losses

|

$

|

42,356

|

$

|

39,288

|

$

|

42,098

|

||||||

|

Ratio of allowance to total loans held for investment

|

1.41

|

%

|

1.43

|

%

|

1.73

|

%

|

||||||

|

Ratio of allowance to nonaccrual loans

|

1,306.48

|

%

|

677.15

|

%

|

442.30

|

%

|

||||||

|

Ratio of nonaccrual loans to total loans held for investment

|

0.11

|

%

|

0.21

|

%

|

0.39

|

%

|

||||||

|

Ratio of net charge-offs (recoveries) to average loans during the period

|

||||||||||||

|

Commercial real estate

|

—

|

(0.05

|

)%

|

(0.02

|

)%

|

|||||||

|

Commercial – specialized

|

(0.05

|

)%

|

(0.23

|

)%

|

—

|

|||||||

|

Commercial – general

|

0.06

|

%

|

(0.03

|

)%

|

0.09

|

%

|

||||||

|

Consumer:

|

||||||||||||

|

1-4 family residential

|

—

|

0.02

|

%

|

0.01

|

%

|

|||||||

|

Auto loans

|

0.22

|

%

|

0.13

|

%

|

0.21

|

%

|

||||||

|

Other consumer

|

1.09

|

%

|

1.06

|

%

|

0.96

|

%

|

||||||

|

Construction

|

0.23

|

%

|

0.11

|

%

|

—

|

|||||||

|

Total ratio of net charge-offs (recoveries) to average loans during the period

|

0.07

|

%

|

0.01

|

%

|

0.06

|

%

|

||||||

| (1) |

Average outstanding balances include loans held for sale.

|

|

As of December, 31

|

||||||||||||||||||||||||

|

2023

|

2022

|

2021

|

||||||||||||||||||||||

|

Amount

|

% of

Total

|

Amount

|

% of

Total

|

Amount

|

% of

Total

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Commercial real estate

|

$

|

15,808

|

37.3

|

%

|

$

|

13,029

|

33.1

|

%

|

$

|

17,245

|

41.0

|

%

|

||||||||||||

|

Commercial – specialized

|

4,020

|

9.5

|

%

|

3,425

|

8.7

|

%

|

4,363

|

10.4

|

%

|

|||||||||||||||

|

Commercial – general

|

6,391

|

15.1

|

%

|

9,215

|

23.5

|

%

|

8,466

|

20.1

|

%

|

|||||||||||||||

|

Consumer:

|

||||||||||||||||||||||||

|

1-4 family residential

|

9,177

|

21.7

|

%

|

6,194

|

15.8

|

%

|

5,268

|

12.5

|

%

|

|||||||||||||||

|

Auto loans

|

3,601

|

8.5

|

%

|

3,926

|

10.0

|

%

|

3,653

|

8.7

|

%

|

|||||||||||||||

|

Other consumer

|

968

|

2.3

|

%

|

1,376

|

3.5

|

%

|

1,357

|

3.2

|

%

|

|||||||||||||||

|

Construction

|

2,391

|

5.6

|

%

|

2,123

|

5.4

|

%

|

1,746

|

4.1

|

%

|

|||||||||||||||

|

Total allowance for credit losses

|

$

|

42,356

|

100.0

|

%

|

$

|

39,288

|

100.0

|

%

|

$

|

42,098

|

100.0

|

%

|

||||||||||||

|

As of December 31, 2023

|

||||||||||||||||||||||||||||||||

|

Due in

One Year or Less

|

Due after One Year

Through Five Years

|

Due after Five Years

Through Ten Years

|

Due after

Ten Years

|

|||||||||||||||||||||||||||||

|

Amortized

Cost

|

Weighted

Average Yield

|

Amortized

Cost

|

Weighted

Average Yield

|

Amortized

Cost

|

Weighted

Average Yield

|

Amortized

Cost

|

Weighted

Average Yield

|

|||||||||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||||||||||

|

Available-for-sale

|

||||||||||||||||||||||||||||||||

|

State and municipal

|

$

|

735

|

3.65

|

%

|

$

|

6,112

|

1.73

|

%

|

$

|

4,897

|

2.15

|

%

|

$

|

191,070

|

2.28

|

%

|

||||||||||||||||

|

Residential mortgage-

backed securities

|

—

|

—

|

3,038

|

2.02

|

%

|

920

|

2.91

|

%

|

347,293

|

2.20

|

%

|

|||||||||||||||||||||

|

Commercial mortgage-backed securities

|

—

|

—

|

—

|

—

|

47,898

|

2.22

|

%

|

—

|

—

|

|||||||||||||||||||||||

|

Collateralized mortgage obligations

|

—

|

—

|

—

|

—

|

72,391

|

6.01

|

%

|

—

|

—

|

|||||||||||||||||||||||

|

Asset-backed and other amortizing securities

|

—

|

—

|

—

|

—

|

2,359

|

3.07

|

%

|

16,117

|

2.79

|

%

|

||||||||||||||||||||||

|

Other securities

|

—

|

—

|

—

|

—

|

12,000

|

4.47

|

%

|

—

|

—

|

|||||||||||||||||||||||

|

Total available-for-sale

|

$

|

735

|

3.65

|

%

|

$

|

9,150

|

1.83

|

%

|

$

|

140,465

|

4.38

|

%

|

$

|

554,480

|

2.24

|

%

|

||||||||||||||||

|

December 31, 2023

|

December 31, 2022

|

|||||||||||||||

|

Amount

|

% of Total

|

Amount

|

% of Total

|

|||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||

|

Noninterest-bearing deposits

|

$

|

974,201

|

26.9

|

%

|

$

|

1,150,488

|

33.8

|

%

|

||||||||

|

NOW and other transaction accounts

|

562,066

|

15.5

|

%

|

350,910

|

10.3

|

%

|

||||||||||

|

Money market and other savings

|

1,722,170

|

47.5

|

%

|

1,618,833

|

47.5

|

%

|

||||||||||

|

Time deposits

|

367,716

|

10.1

|

%

|

286,199

|

8.4

|

%

|

||||||||||

|

Total deposits

|

$

|

3,626,153

|

100.0

|

%

|

$

|

3,406,430

|

100.0

|

%

|

||||||||

|

2023

|

2022

|

2021

|

||||||||||||||||||||||

|

Average

Balance

|

Weighted

Average Rate

|

Average

Balance

|

Weighted

Average

Rate

|

Average

Balance

|

Weighted

Average

Rate

|

|||||||||||||||||||

|

(Dollars in thousands)

|

||||||||||||||||||||||||

|

Noninterest-bearing deposits

|

$

|

1,069,280

|

—

|

%

|

$

|

1,189,730

|

—

|

%

|

$

|

1,016,835

|

—

|

%

|

||||||||||||

|

Interest-bearing deposits:

|

||||||||||||||||||||||||

|

NOW and interest-bearing demand accounts

|

401,075

|

2.93

|

%

|

352,791

|

0.59

|

%

|

355,274

|

0.03

|

%

|

|||||||||||||||

|

Savings accounts

|

145,758

|

0.87

|

%

|

151,128

|

0.32

|

%

|

132,426

|

0.09

|

%

|

|||||||||||||||

|

Money market accounts

|

1,571,152

|

2.70

|

%

|

1,385,969

|

0.75

|

%

|

1,353,978

|

0.29

|

%

|

|||||||||||||||

|

Time deposits

|

321,205

|

2.98

|

%

|

327,289

|

1.22

|

%

|

329,509

|

1.25

|

%

|

|||||||||||||||

|

Total interest-bearing deposits

|

2,439,190

|

2.66

|

%

|

2,217,177

|

0.77

|

%

|

2,171,187

|

0.38

|

%

|

|||||||||||||||

|

Total deposits

|

$

|

3,508,470

|

1.85

|

%

|

$

|

3,406,907

|

0.50

|

%

|

$

|

3,188,022

|

0.26

|

%

|

||||||||||||

|

(Dollars in thousands)

|

Three

Months

|

Three to

Six Months

|

Six to

12 Months

|

After

12 Months

|

Total

|

|||||||||||||||

|

$

|

78,777

|

$

|

14,934

|

$

|

53,727

|

$

|

11,694

|

$

|

159,132

|

|||||||||||

|

Name of Trust

|

Issue

Date

|

Amount

of Trust

Preferred

Securities

|

Amount of

Debentures

|

Stated

Maturity Date

of Trust Preferred

Securities and

Debentures(1)

|

Interest Rate of

Trust Preferred

Securities and

Debentures(2)(3)

|

||||||||||

|

(Dollars in thousands)

|

|||||||||||||||

|

South Plains Financial Capital Trust III

|

2004

|

$

|

10,000

|

$

|

10,310

|

2034

|

3-mo. CME Term

SOFR + 291 bps; 8.32%

|

||||||||

|

South Plains Financial Capital Trust IV

|

2005

|

20,000

|

20,619

|

2035

|

3-mo. CME Term

SOFR + 165 bps; 7.04%

|

||||||||||

|

South Plains Financial Capital Trust V

|

2007

|

15,000

|

15,464

|

2037

|

3-mo. CME Term

SOFR + 176 bps; 7.15%

|

||||||||||

|

Total

|

$

|

45,000

|

$

|

46,393

|

|||||||||||

| (1) |

May be redeemed at the Company’s option.

|

| (2) |

Interest payable quarterly with principal due at maturity.

|

| (3) |

Rate as of last reset date, prior to December 31, 2023.

|

|

Actual

|

Minimum Capital

Requirement with

Capital Buffer

|

Minimum

To be Considered

Well Capitalized

|

||||||||||||||||||||||

|

Amount

|

Ratio

|

Amount

|

Ratio

|

Amount

|

Ratio

|

|||||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||||||

|

As of December 31, 2023:

|

||||||||||||||||||||||||

|

Total capital (to risk-weighted assets)

|

||||||||||||||||||||||||

|

Consolidated

|

$

|

589,565

|

16.74

|

%

|

$

|

369,753

|

10.50

|

%

|

N/A

|

N/A

|

||||||||||||||

|

Bank

|

494,353

|

14.04

|

%

|

369,635

|

10.50

|

%

|

$

|

352,033

|

10.00

|

%

|

||||||||||||||

|

Tier 1 capital (to risk-weighted assets)

|

||||||||||||||||||||||||

|

Consolidated

|

482,044

|

13.69

|

%

|

299,324

|

8.50

|

%

|

N/A

|

N/A

|

||||||||||||||||

|

Bank

|

450,607

|

12.80

|

%

|

299,228

|

8.50

|

%

|

281,627

|

8.00

|

%

|

|||||||||||||||

|

CET 1 capital (to risk-weighted assets)

|

||||||||||||||||||||||||

|

Consolidated

|

437,044

|

12.41

|

%

|

246,502

|

7.00

|

%

|

N/A

|

N/A

|

||||||||||||||||

|

Bank

|

450,607

|

12.80

|

%

|

246,423

|

7.00

|

%

|

228,822

|

6.50

|

%

|

|||||||||||||||

|

Tier 1 capital (to average assets)

|

||||||||||||||||||||||||

|

Consolidated

|

482,044

|

11.33

|

%

|

171,037

|

4.00

|

%

|

N/A

|

N/A

|

||||||||||||||||

|

Bank

|

450,607

|

10.60

|

%

|

170,945

|

4.00

|

%

|

212,594

|

5.00

|

%

|

|||||||||||||||

|

Actual

|

Minimum Capital

Requirement with

Capital Buffer

|

Minimum

To be Considered

Well Capitalized

|

||||||||||||||||||||||

|

Amount

|

Ratio

|

Amount

|

Ratio

|

Amount

|

Ratio

|

|||||||||||||||||||

|

(Dollars in Thousands)

|

||||||||||||||||||||||||

|

As of December 31, 2022:

|

||||||||||||||||||||||||

|

Total capital (to risk-weighted assets)

|

||||||||||||||||||||||||

|

Consolidated

|

$

|

559,094

|

16.58

|

%

|

$

|

354,045

|

10.50

|

%

|

N/A

|

N/A

|

||||||||||||||

|

Bank

|

454,427

|

13.48

|

%

|

353,967

|

10.50

|

%

|

$

|

337,112

|

10.00

|

%

|

||||||||||||||

|

Tier 1 capital (to risk-weighted assets)

|

||||||||||||||||||||||||

|

Consolidated

|

443,265

|

13.15

|

%

|

286,608

|

8.50

|

%

|

N/A

|

N/A

|

||||||||||||||||

|

Bank

|

414,559

|

12.30

|

%

|

286,545

|

8.50

|

%

|

269,689

|

8.00

|

%

|

|||||||||||||||

|

CET 1 capital (to risk-weighted assets)

|

||||||||||||||||||||||||

|

Consolidated

|

398,265

|

11.81

|

%

|

236,030

|

7.00

|

%

|

N/A

|

N/A

|

||||||||||||||||

|

Bank

|

414,559

|

12.30

|

%

|

235,978

|

7.00

|

%

|

219,122

|

6.50

|

%

|

|||||||||||||||

|

Tier 1 capital (to average assets)

|

||||||||||||||||||||||||

|

Consolidated

|

443,265

|

11.03

|

%

|

161,662

|

4.00

|

%

|

N/A

|

N/A

|

||||||||||||||||

|

Bank

|

414,559

|

10.32

|

%

|

161,574

|

4.00

|

%

|

200,774

|

5.00

|

%

|

|||||||||||||||

|

As of December 31,

|

|||||||||

|

2023

|

2022

|

||||||||

|

Change in Interest Rates (Basis Points)

|

Percent Change in

Net Interest Income

|

Percent Change in

Net Interest Income

|

|||||||

|

+300

|

(10.02

|

)

|

(1.50

|

)

|

|||||

|

+200

|

(6.59

|

)

|

(0.96

|

)

|

|||||

|

+100

|

(3.21

|

)

|

(0.61

|

)

|

|||||

|

-100

|

3.35

|

(1.50

|

)

|

||||||

|

-200

|

6.86

|

(2.81

|

)

|

||||||

|

As of December 31,

|

||||||||||||

|

2023

|

2022

|

2021

|

||||||||||

|

(Dollars in thousands)

|

||||||||||||

|

Total stockholders’ equity

|

$

|

407,114

|

$

|

357,014

|

$

|

407,427

|

||||||

|

Less: Goodwill and other intangibles

|

(21,744

|

)

|

(23,857

|

)

|

(25,403

|

)

|

||||||

|

Tangible common equity

|

$

|

$ 385,370

|

$

|

333,157

|

$

|

382,024

|

||||||

|

Total assets

|

$

|

4,204,793

|

$

|

3,944,063

|

$

|

3,901,855

|

||||||

|

Less: Goodwill and other intangibles

|

(21,744

|

)

|

(23,857

|

)

|

(25,403

|

)

|

||||||

|

Tangible assets

|

$

|

4,183,049

|

$

|

3,920,206

|

$

|

3,876,452

|

||||||

|

Shares outstanding

|

16,417,099

|

17,027,197

|

17,760,243

|

|||||||||

|

Total stockholders’ equity to total assets

|

9.68

|

%

|

9.05

|

%

|

10.44

|

%

|

||||||

|

Tangible common equity to tangible assets

|

9.21

|

%

|

8.50

|

%

|

9.85

|

%

|

||||||

|

Book value per share

|

$

|

24.80

|

$

|

20.97

|

$

|

22.94

|

||||||

|

Tangible book value per share

|

$

|

23.47

|

$

|

19.57

|

$

|

21.51

|

||||||

| Item 7A. |

Quantitative and Qualitative Disclosures About Market Risk

|

| Item 8. |

Financial Statements and Supplementary Data

|

|

Page

|

||

| Report of Independent Registered Public Accounting Firm (PCAOB ID #) | 1 |

|

|

Report of Independent Registered Public Accounting Firm (PCAOB ID #)

|

2 |

|

|

Consolidated Financial Statements:

|

||

|

Consolidated Balance Sheets

|

4 | |

|

Consolidated Statements of Comprehensive Income (Loss)

|

5 | |

|

Consolidated Statements of Changes in Stockholders’ Equity

|

7 | |

|

Consolidated Statements of Cash Flows

|

8 | |

|

Notes to Consolidated Financial Statements

|

10 | |

|

December 31,

|

||||||||

|

2023

|

2022

|

|||||||

|

ASSETS

|

|

|||||||

|

Cash and due from banks

|

$

|

|

$

|

|

||||

|

Interest-bearing deposits in banks

|

|

|

||||||

|

Cash and cash equivalents

|

|

|

||||||

|

Securities available for sale

|

|

|

||||||

|

Loans held for sale ($

|

|

|

||||||

|

Loans held for investment

|

|

|

||||||

|

Allowance for credit losses on loans

|

(

|

)

|

(

|

)

|

||||

| Loans held for investment, net |

||||||||

|

Accrued interest receivable

|

|

|

||||||

|

Premises and equipment, net

|

|

|

||||||

|

Bank-owned life insurance

|

|

|

||||||

|

Goodwill

|

|

|

||||||

|

Intangible assets, net

|

|

|

||||||

|

Mortgage servicing rights

|

|

|

||||||

|

Deferred tax asset, net

|

|

|

||||||

|

Other assets

|

|

|

||||||

|

Total assets

|

$

|

|

$

|

|

||||

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

||||||||

|

Deposits:

|

||||||||

|

Noninterest-bearing

|

$

|

|

$

|

|

||||

|

Interest-bearing

|

|

|

||||||

|

Total deposits

|

|

|

||||||

|

Accrued expenses and other liabilities

|

|

|

||||||

|

Subordinated debt

|

|

|

||||||

|

Junior subordinated deferrable interest debentures

|

|

|

||||||

|

Total liabilities

|

|

|

||||||

|

Stockholders’ equity:

|

||||||||

|

Common stock, $

|

|

|

||||||

|

Additional paid-in capital

|

|

|

||||||

|

Retained earnings

|

|

|

||||||

|

Accumulated other comprehensive loss

|

(

|

)

|

(

|

)

|

||||

|

Total stockholders’ equity

|

|

|

||||||

|

Total liabilities and stockholders’ equity

|

$

|

|

$

|

|

||||

|

Year Ended December 31,

|

||||||||||||

|

2023

|

2022

|

2021 | ||||||||||

|

Interest income:

|

||||||||||||

|

Loans, including fees

|

$

|

|

$

|

|

$ | |||||||

|

Securities:

|

||||||||||||

|