2017

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the Fiscal Year Ended December 31, 2017

Commission file number 1-16811

(Exact name of registrant as specified in its charter)

Delaware | 25-1897152 | |

(State of Incorporation) | (I.R.S. Employer Identification No.) | |

600 Grant Street, Pittsburgh, PA 15219-2800

(Address of principal executive offices)

Tel. No. (412) 433-1121

Securities registered pursuant to Section 12 (b) of the Act:

Title of Each Class | Name of Exchange on which Registered | |

United States Steel Corporation Common Stock, par value $1.00 | New York Stock Exchange, Chicago Stock Exchange | |

Indicate by check mark whether the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes þ No

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15 (d) of the Securities Exchange Act of 1934 during the preceding 12 months and (2) has been subject to such filing requirements for at least the past 90 days. Yes þ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Website, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K (§229.405 of this chapter) is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definition of “large accelerated filer,” “accelerated filer," “smaller reporting company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.(Check one):

Large accelerated filer P | Accelerated filer | Non-accelerated filer | Smaller reporting company | Emerging growth company(a) __ | ||||

(Do not check if a smaller reporting company) | ||||||||

(a) If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ___ | ||||||||

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes No þ

Aggregate market value of Common Stock held by non-affiliates as of June 30, 2017 (the last business day of the registrant’s most recently completed second fiscal quarter): $3.9 billion. The amount shown is based on the closing price of the registrant’s Common Stock on the New York Stock Exchange composite tape on that date. Shares of Common Stock held by executive officers and directors of the registrant are not included in the computation. However, the registrant has made no determination that such individuals are “affiliates” within the meaning of Rule 405 under the Securities Act of 1933.

There were 175,883,206 shares of United States Steel Corporation Common Stock outstanding as of February 15, 2018.

Documents Incorporated By Reference:

Portions of the Proxy Statement for the 2018 Annual Meeting of Stockholders are incorporated into Part III.

INDEX

Item 1. | |||

Item 1A | |||

Item 1B | |||

Item 2. | |||

Item 3. | |||

Item 4. | |||

Item 5. | |||

Item 6. | |||

Item 7. | |||

Item 7A | |||

Item 8. | |||

Item 9. | |||

Item 9A | |||

Item 9B | |||

Item 10. | |||

Item 11. | |||

Item 12. | |||

Item 13. | |||

Item 14. | |||

Item 15. | |||

Item 16. | |||

TOTAL NUMBER OF PAGES | 110 | ||

FORWARD-LOOKING STATEMENTS

This report contains information that may constitute “forward-looking statements” within the meaning of Section 27 of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. We intend the forward-looking statements to be covered by the safe harbor provisions for forward-looking statements in those sections. Generally, we have identified such forward-looking statements by using the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “project,” “target,” “forecast,” “aim,” "should," “will” and similar expressions or by using future dates in connection with any discussion of, among other things, operating performance, trends, events or developments that we expect or anticipate will occur in the future, statements relating to volume growth, share of sales and earnings per share growth, and statements expressing general views about future operating results. However, the absence of these words or similar expressions does not mean that a statement is not forward-looking. Forward-looking statements are not historical facts, but instead represent only the Company’s beliefs regarding future events, many of which, by their nature, are inherently uncertain and outside of the Company’s control. It is possible that the Company’s actual results and financial condition may differ, possibly materially, from the anticipated results and financial condition indicated in these forward-looking statements. Management believes that these forward-looking statements are reasonable as of the time made. However, caution should be taken not to place undue reliance on any such forward-looking statements because such statements speak only as of the date when made. Our Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law. In addition, forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from our Company's historical experience and our present expectations or projections. These risks and uncertainties include, but are not limited to the risks and uncertainties described in this report in “Item 1A. Risk Factors” and those described from time to time in our future reports filed with the Securities and Exchange Commission.

References in this Annual Report on Form 10-K to "U. S. Steel," "the Company," "we," "us," and "our" refer to United States Steel Corporation and its consolidated subsidiaries unless otherwise indicated by the context.

Non-Generally Accepted Accounting Principles (non-GAAP) Financial Measures

This report contains certain non-GAAP financial measures such as earnings (loss) before interest, income taxes, depreciation, depletion and amortization (EBITDA), adjusted EBITDA, adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and cash conversion cycle.

We believe that EBITDA, considered along with the net earnings (loss), is a relevant indicator of trends relating to cash generating activity and provides management and investors with additional information for comparison of our operating results to the operating results of other companies.

Adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share are non-GAAP measures that exclude the effects of gains (losses) associated with our retained interest in U. S. Steel Canada Inc., gains (losses) on the sale of ownership interests in equity investees, restructuring charges, impairment charges, significant temporary idling charges, debt extinguishment and other related costs and effects of tax reform that are not part of the Company's core operations. Adjusted EBITDA is also a non-GAAP measure that excludes the effects of gains (losses) associated with our retained interest in U. S. Steel Canada Inc., gains (losses) on the sale of ownership interests in equity investees, restructuring charges, impairment charges and significant temporary idling charges. We present adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA to enhance the understanding of our ongoing operating performance and established trends affecting our core operations, by excluding the effects of gains (losses) associated with our retained interest in U. S. Steel Canada Inc., gains (losses) on the sale of ownership interests in equity investees, restructuring charges, impairment charges, significant temporary idling charges, debt extinguishment and other related costs and effects of tax reform that can obscure underlying trends. U. S. Steel's management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA as alternative measures of operating performance and not alternative measures of the Company's liquidity. U. S. Steel’s management considers adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA useful to investors by facilitating a comparison of our operating performance to the operating performance of our competitors. Additionally, the presentation of adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA provides insight into management’s view and assessment of the Company’s ongoing operating performance, because management does not consider the adjusting items when evaluating the Company’s financial performance or in preparing the Company’s annual financial Outlook. Adjusted net earnings (loss), adjusted net earnings (loss) per diluted share and adjusted EBITDA should not be considered a substitute for net earnings

3

(loss), earnings (loss) per diluted share or other financial measures as computed in accordance with U.S. GAAP and is not necessarily comparable to similarly titled measures used by other companies.

We believe the cash conversion cycle is a useful measure in providing investors with information regarding our cash management performance and is a widely accepted measure of working capital management efficiency. The cash conversion cycle should not be considered in isolation or as an alternative to other GAAP metrics as an indicator of performance.

4

10-K SUMMARY

Our vision is to transform our company in meaningful ways that strategically position us for the future. This vision is about more than U. S. Steel; it is about reinforcing the economic and societal benefits associated with strong domestic manufacturing capabilities, of which steel is a foundational industry.

Underlying our efforts is our belief that we must operate as a principled company committed to a code of conduct that is rooted in our Gary Principles and our core values, the most important of which is safety - of our employees, our environment, and our facilities and equipment. These core beliefs have served us well for much of our history, and our commitment to them remains as strong as the products we make every day.

During 2017, we continued to transform U. S. Steel through a disciplined approach committed to finding ways to innovate, grow, and overcome obstacles in order to create value and benefit the long-term interests of all U. S. Steel stakeholders, including employees, customers, stockholders, and the communities where we do business.

We are focused on execution of a two-phased stockholder value creation strategy: (1) earn the right to grow, and (2) drive and sustain profitable growth. Earning the right to grow means delivering consistent, reliable EBITDA across the business cycle by achieving operational excellence through a focused effort by our talented workforce to deliver superior results in four business-critical areas: safety, quality, delivery, and cost. Driving and sustaining profitable growth, economic profit across the business cycle and above-average returns for long-term stockholders, is enabled through stable, reliable facilities that produce innovative product and service solutions for discerning steel customers. Underlying both phases is our unwavering commitment to strengthen our balance sheet, with an emphasis on cash flow, liquidity, and financial flexibility.

We are on a mission to become an industry leader by striving to create a sustainable competitive advantage with a customer-centric focus on: delivering high-quality, on time value-added products; collaborating with customers to develop innovative solutions that address their most challenging needs, including new advanced high-strength steels to meet fuel efficiency and safety requirements for automotive customers and new premium connections that provide strong, durable connections between pipes used by energy customers in oil and gas drilling; generating economic profit through active participation in relevant markets; and creating and maintaining a competitive cost structure centered around operational flexibility.

We have launched a series of initiatives that we believe will enable us to achieve true operational excellence by improving our performance across our core business processes, including commercial, supply chain, manufacturing, procurement, innovation, and operational and functional support. Our highly talented, capable and collaborative employees are the driving force behind many of these continuous improvement projects, and their efforts are creating a culture where accountability and high performance are valued and celebrated.

5

KEY PERFORMANCE INDICATORS

This section provides an overview of select key performance indicators for U. S. Steel which management and investors use to assess the Company's financial performance. It does not contain all of the information you should consider. Fluctuations for year to year changes are explained in Item 7. "Management's Discussion and Analysis of Financial Condition and Results of Operations." Please read the entire Annual Report on Form 10-K.

• | While we continue to face challenges driven primarily by uncertain geopolitical factors, our successful navigation through the industry downturn positioned us to benefit from improved industry conditions in 2017. |

• | Our investments in our assets helped to provide a more stable operating performance in 2017. |

• | Our 2017 results include a favorable impact of $344 million related to our previously disclosed change in accounting method for property, plant and equipment. |

• | Our 2017 net earnings includes an $81 million income tax benefit from tax reform. |

6

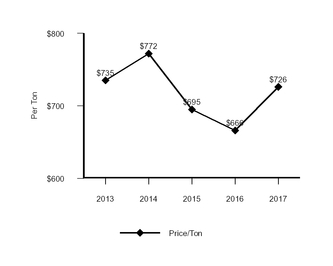

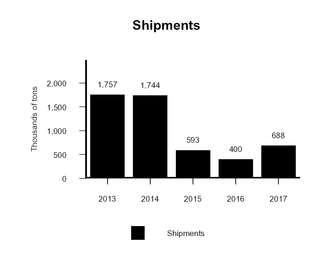

• | The increase in net sales in 2017 as compared to 2016 is primarily due to higher average realized prices in all of our reportable segments. Improved market conditions for our Flat-Rolled segment, notably for hot-rolled, resulted in spot price increases in 2017 as well as price increases for both market-based and firm priced contracts from 2016 to 2017. Lower imports resulted in higher average realized prices for our USSE segment. Improved market conditions for our Tubular segment resulted in higher average realized prices and higher shipments. |

7

• | These amounts are derived starting from net earnings (loss) as shown on page 6. For a full reconciliation of adjusted EBITDA see page 15. |

• | EBITDA increased for all three reportable segments in 2017 as compared to 2016 with higher average realized prices in all three segments. Our long-term strategic goals of improving our balance sheet, enhancing operational efficiency and reliability and seeking robust enforcement of our trade laws led to a successful year. |

• | Our 2017 adjusted EBITDA includes a favorable impact of $381 million related to our previously disclosed change in accounting method for property, plant and equipment. |

8

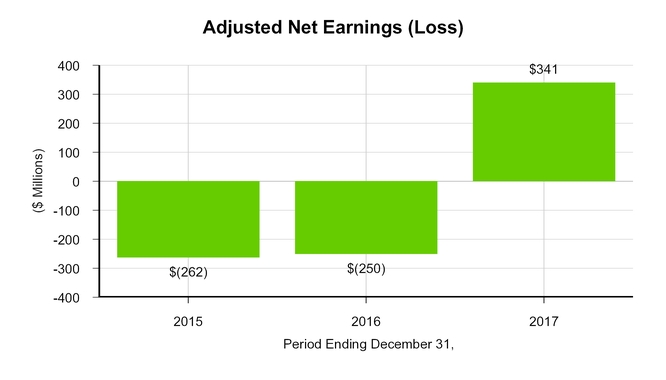

• | These amounts are derived starting from net earnings (loss) as shown on page 6. For a full reconciliation of adjusted net earnings (loss) see page 15. |

• | Our efforts towards achieving economic profit across the business cycle continue, and are reflected in our improved results in 2017 as compared to 2016. |

• | Our 2017 results include a favorable impact of $344 million related to our previously disclosed change in accounting method for property, plant and equipment. |

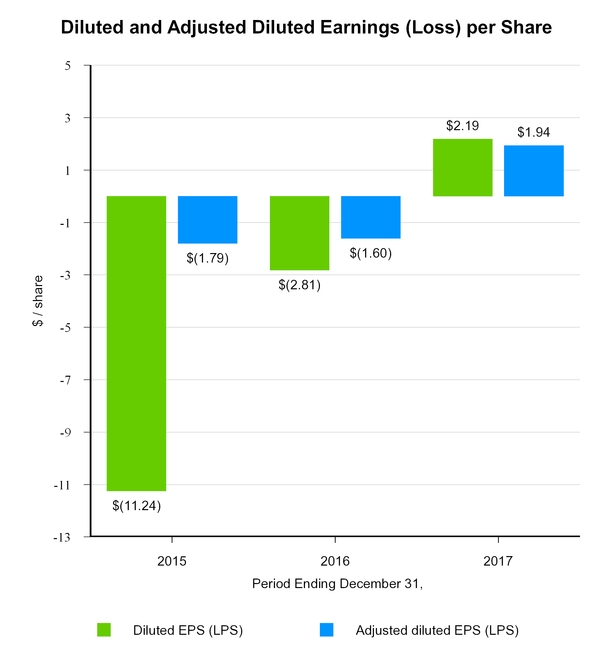

• | See reconciliation from diluted net earnings (loss) per share to adjusted diluted net earnings (loss) per share on page 16. |

• | Our 2017 results include a favorable impact of $1.95 per diluted share related to our previously disclosed change in accounting method for property, plant and equipment. |

9

• | The increase in our cash from operations in 2016 as compared to 2015 was due to efficient working capital management. |

• | In 2017, improved financial performance more than offset the changes in working capital. |

• | Our cash conversion cycle was 63, 43 and 30 days for 2015, 2016 and 2017, respectively. See “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Financial Condition, Cash Flows and Liquidity – Cash Flows” for the calculation of our cash conversion cycle. |

10

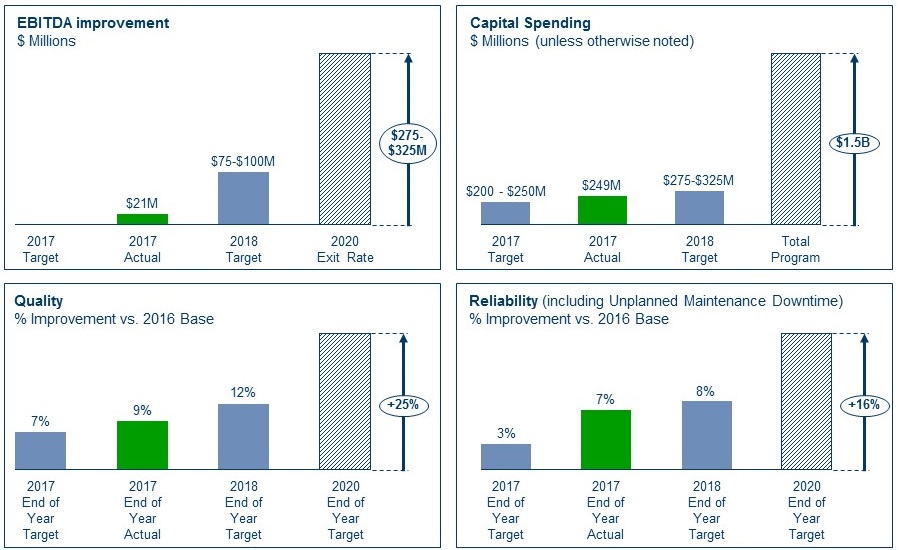

Flat-Rolled Segment Asset Revitalization Program Performance Scorecard

• | We have developed a performance scorecard that includes two financial and two non-financial metrics for |

tracking our progress on implementing our Flat-Rolled Segment asset revitalization program. We believe these metrics will effectively measure how successfully we are implementing the program.

• | We made good progress in 2017, exceeding the EBITDA, quality, and reliability improvements we had |

committed to for 2017 for this asset revitalization program. We established the additional improvement goals we expect to achieve in 2018.

11

• | Maintaining strong cash and liquidity continues to be a strategic priority. |

• | Total liquidity improved significantly from 2015 to 2016 due to improved cash levels. |

• | Total liquidity further improved from 2016 to 2017 primarily due to higher Asset Based Loan (ABL) availability and improved cash levels, which was driven by higher values of inventory and trade receivable that serve as collateral for the ABL, as well as improved profitability levels. |

12

• | The decrease in pension and OPEB expense from 2015 to 2016 was primarily due to the freezing of benefit accruals for non-represented participants effective December 31, 2015. |

• | The increase in 2017 pension and OPEB expense from 2016 is primarily due to a lower return on assets assumption for OPEB benefits as a result of actions taken in 2016 to de-risk the OPEB benefit plan. |

• | 2018 pension and OPEB expense is expected to be approximately $195 million. |

• | For further details, see Note 17 to the Consolidated Financial Statements. |

13

• | As we continue to focus on strengthening the balance sheet, the funded status of our benefit plans is improving. This is partially attributable to the decision to freeze benefit accruals for non-represented participants in the defined benefit pension plan effective December 31, 2015 and the closure of OPEB plans to represented employees hired or rehired under certain conditions on or after January 1, 2016. |

• | Our funded status continued to improve in 2017 due to strong asset returns. Additionally, U. S. Steel made a voluntary contribution of $75 million in 2017 to the Company's main defined benefit pension plan. |

• | On a U.S. GAAP basis the funded status of our pension and OPEB obligations improved to 93% and 86% respectively, at December 31, 2017 from 88% and 82% respectively, at December 31, 2016. |

• | For further details, see Note 17 to the Consolidated Financial Statements. |

14

NON-GAAP FINANCIAL MEASURES

As disclosed on page 3 of this report, we present EBITDA, adjusted EBITDA, adjusted net earnings (loss) and adjusted net earnings (loss) per diluted share, which are non-GAAP measures, as an additional measurement to enhance the understanding of our operating performance and facilitate a comparison with that of our competitors.

RECONCILIATION TO ADJUSTED NET EARNINGS (LOSS) (a) | ||||||||||||

Year Ended December 31, | ||||||||||||

(Dollars in millions) | 2017 | 2016 | 2015 | |||||||||

Reconciliation to adjusted net earnings (loss) attributable to United States Steel Corporation | ||||||||||||

Net earnings (loss) attributable to United States Steel Corporation, as reported | $ | 387 | $ | (440 | ) | $ | (1,642 | ) | ||||

Loss on shutdown of certain tubular pipe mill assets (b) | 35 | 126 | — | |||||||||

(Gain) loss associated with U. S. Steel Canada Inc. | (72 | ) | — | 266 | ||||||||

Loss on shutdown of Fairfield Flat-Rolled Operations (b) (c) | — | — | 53 | |||||||||

Loss on shutdown of coke production facilities (b) | — | — | 65 | |||||||||

Restructuring and other charges (b) (d) | — | (2 | ) | 64 | ||||||||

Granite City Works temporary idling charges | 17 | 18 | 99 | |||||||||

Post-employment benefit actuarial adjustment | — | — | 26 | |||||||||

(Gain) loss on equity investee transactions | (2 | ) | 12 | 18 | ||||||||

Deferred tax asset valuation allowance | — | — | 753 | |||||||||

Impairment of intangible assets | — | 14 | — | |||||||||

Loss on extinguishment of debt and other related costs | 57 | 22 | 36 | |||||||||

Effect of tax reform | (81 | ) | — | — | ||||||||

Total Adjustments | (46 | ) | 190 | 1,380 | ||||||||

Adjusted net earnings (loss) attributable to United States Steel Corporation | $ | 341 | $ | (250 | ) | $ | (262 | ) | ||||

(b) Included in restructuring and other charges on the Consolidated Statement of Operations.

(c) Fairfield Flat-Rolled Operations includes the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at the former Fairfield Works. The #5 coating line continues to operate.

(d) The 2015 amount consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits.

15

RECONCILIATION TO ADJUSTED NET EARNINGS (LOSS) PER SHARE (a) | ||||||||||||

Year Ended December 31, | ||||||||||||

2017 | 2016 | 2015 | ||||||||||

Reconciliation to adjusted diluted net earnings (loss) per share | ||||||||||||

Diluted net earnings (loss) per share, as reported | $ | 2.19 | $ | (2.81 | ) | $ | (11.24 | ) | ||||

Loss on shutdown of certain tubular pipe mill assets (b) | 0.20 | 0.80 | — | |||||||||

(Gain) loss associated with U. S. Steel Canada Inc. | (0.41 | ) | — | 1.82 | ||||||||

Loss on shutdown of Fairfield Flat-Rolled Operations (b) (c) | — | — | 0.37 | |||||||||

Loss on shutdown of coke production facilities (b) | — | — | 0.44 | |||||||||

Restructuring and other charges (b) (d) | — | (0.01 | ) | 0.44 | ||||||||

Granite City Works temporary idling charges | 0.10 | 0.11 | 0.68 | |||||||||

Post-employment benefit actuarial adjustment | — | — | 0.18 | |||||||||

(Gain) loss on equity investee transactions | (0.01 | ) | 0.08 | 0.12 | ||||||||

Deferred tax asset valuation allowance | — | — | 5.15 | |||||||||

Impairment of intangible assets | — | 0.09 | — | |||||||||

Loss on extinguishment of debt and other related costs | 0.33 | 0.14 | 0.25 | |||||||||

Effect of tax reform | (0.46 | ) | — | — | ||||||||

Total adjustments | (0.25 | ) | 1.21 | 9.45 | ||||||||

Adjusted diluted net earnings (loss) per share | $ | 1.94 | $ | (1.60 | ) | $ | (1.79 | ) | ||||

(a) The adjustments included in this table have been tax affected at the quarterly effective tax rate through the third quarter of 2015. Subsequent to the third quarter of 2015, the adjustments have been tax affected at a 0% tax rate due to the recognition of a full valuation allowance which was established in the fourth quarter of 2015.

(b)Included in restructuring and other charges and cost of sales in the Consolidated Statement of Operations.

(c) Fairfield Flat-Rolled Operations includes the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at the former Fairfield Works. The #5 coating line continues to operate.

(d) The 2015 amount consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits.

16

RECONCILIATION TO EBITDA AND ADJUSTED EBITDA | ||||||||||||

Year Ended December 31, | ||||||||||||

(Dollars in millions) | 2017 | 2016 | 2015 | |||||||||

Reconciliation to EBITDA and Adjusted EBITDA | ||||||||||||

Net earnings (loss) attributable to U. S. Steel Corporation | $ | 387 | $ | (440 | ) | $ | (1,642 | ) | ||||

Income tax (benefit) provision | (86 | ) | 24 | 183 | ||||||||

Net interest and other financial costs | 307 | 251 | 257 | |||||||||

Depreciation, depletion and amortization expense | 501 | 507 | 547 | |||||||||

EBITDA | 1,109 | 342 | (655 | ) | ||||||||

Loss on shutdown of certain tubular pipe mill assets (a) | 35 | 126 | — | |||||||||

(Gain) loss associated with U. S. Steel Canada Inc. | (72 | ) | — | 392 | ||||||||

Loss on shutdown of Fairfield Flat-Rolled Operations (a) (b) | — | — | 91 | |||||||||

Loss on shutdown of coke production facilities (a) | — | — | 153 | |||||||||

Restructuring and other charges (a) (c) | — | (2 | ) | 78 | ||||||||

Granite City Works temporary idling charges | 17 | 18 | 99 | |||||||||

Post-employment benefit actuarial adjustment | — | — | 26 | |||||||||

(Gain) loss on equity investee transactions | (2 | ) | 12 | 18 | ||||||||

Impairment of intangible assets | — | 14 | — | |||||||||

Adjusted EBITDA | $ | 1,087 | $ | 510 | $ | 202 | ||||||

(a) Included in restructuring and other charges in the Consolidated Statement of Operations.

(b) Fairfield Flat-Rolled Operations includes the blast furnace and associated steelmaking operations, along with most of the flat-rolled finishing operations at Fairfield Works. The #5 coating line continues to operate.

(c) The 2015 amount consists primarily of employee related costs, including costs for severance, supplemental unemployment benefits and continuation of health care benefits.

17

PART I

Item 1. BUSINESS

United States Steel Corporation (U. S. Steel) is an integrated steel producer of flat-rolled and tubular products with major production operations in the United States and Europe. An integrated steel producer uses iron ore and coke as primary raw materials for steel production. U. S. Steel has annual raw steel production capability of 22.0 million net tons (17.0 million tons in the United States and 5.0 million tons in Europe). U. S. Steel supplies customers throughout the world primarily in the automotive, consumer, industrial and oil country tubular goods (OCTG) markets. According to World Steel Association’s latest published statistics, in 2016 U. S. Steel was the third largest steel producer in the United States and the twenty-fourth largest steel producer in the world. U. S. Steel is also engaged in other business activities consisting primarily of railroad services and real estate operations.

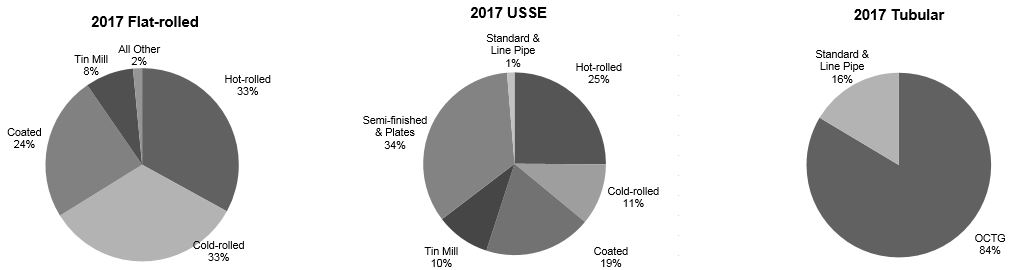

Segments

U. S. Steel has three reportable operating segments: Flat-Rolled Products (Flat-Rolled), U. S. Steel Europe (USSE) and Tubular Products (Tubular). The results of our railroad and real estate businesses that do not constitute reportable segments are combined and disclosed in the Other Businesses category.

Flat-Rolled

The Flat-Rolled segment includes the operating results of U. S. Steel’s integrated steel plants and equity investees in North America involved in the production of slabs, strip mill plates, sheets and tin mill products, as well as all iron ore and coke production facilities in the United States. These operations primarily serve North American customers in the service center, conversion, transportation (including automotive), construction, container, and appliance and electrical markets.

The Flat-Rolled segment is structured to specifically address customer needs through three "commercial entities." Our Flat-Rolled segment commercial entities are focused on customers in the: (1) automotive, (2) consumer and (3) industrial, service center and mining industries.

Automotive Solutions collaborates with customers to develop solutions such as the next generation of advanced high strength steel (AHSS) to address challenges facing the automotive industry, including increased fuel economy standards and enhanced safety requirements.

Consumer Solutions partners with customers in the appliance, packaging, container and construction markets. Consumer Solutions has a robust presence with our tin customers, who represent roughly one quarter of this market category. Additional product lines within the market category include the Company's COR-TEN AZP®, ACRYLUME®, GALVALUME® and Weathered Metals Series®.

Industrial, Service Center and Mining Solutions focuses on the Company's customers in the service center business, pipe and tube manufacturing markets, and agricultural and industrial equipment markets.

Flat-Rolled has aggregate annual raw steel production capability of 17.0 million tons produced at our Gary Works, Mon Valley Works, Great Lakes Works and Granite City Works facilities. Prior to the permanent shut down of the Fairfield Flat-Rolled operations beginning in August 2015, annual raw steel production capability for Flat-Rolled was 19.4 million tons. Raw steel production was 10.8 million tons in 2017, 10.7 million tons in 2016 and 11.3 million tons in 2015. Raw steel production averaged 64 percent of capability in 2017, 63 percent of capability in 2016 and 60 percent of capability in 2015. In December 2015 Granite City Works was temporarily idled and if its production capability is excluded, Flat-Rolled production would have been 76 percent and 75 percent of capability in 2017 and 2016 respectively.

European Operations

The USSE segment includes the operating results of U. S. Steel Košice (USSK), U. S. Steel’s integrated steel plant and coke production facilities in Slovakia, and its subsidiaries. USSE primarily serves customers in the Eastern European construction, service center, conversion, container, transportation (including automotive), appliance and electrical, and oil, gas and petrochemical markets. USSE produces and sells slabs, sheet, strip mill plate, tin mill products and spiral welded pipe, as well as heating radiators and refractory ceramic materials.

18

USSE has annual raw steel production capability of 5.0 million tons. USSE’s raw steel production was 5.1 million tons in 2017, 5.0 million tons in 2016, and 4.7 million tons in 2015. USSE’s raw steel production averaged 102 percent of capability in 2017, 99 percent of capability in 2016 and 93 percent of capability in 2015.

Tubular

The Tubular segment includes the operating results of U. S. Steel’s tubular production facilities, in the United States, and equity investees in the United States and Brazil. Our ownership interest in the equity investment in Brazil was sold in December of 2017. These operations produce and sell seamless and electric resistance welded (ERW) steel casing and tubing (commonly known as OCTG), and standard and line pipe and mechanical tubing and primarily serve customers in the oil, gas and petrochemical markets. Tubular's annual production capability is 1.5 million tons.

U. S. Steel Tubular Products, Inc. (USSTP), a wholly owned subsidiary of U. S. Steel, is designing and developing a range of premium and semi-premium connections to address the growing needs for technical solutions for our end users' well site production challenges. Through its wholly owned subsidiary, U. S. Steel Oilwell Services, LLC, USSTP also offers rig site services, which provides the technical expertise for proper installation of our tubular products and proprietary connections at the well site.

For further information, see "Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations" and Note 4 to the Consolidated Financial Statements.

19

Financial and Operational Highlights

Steel Shipments by Product and Segment

The following table shows steel shipments to end customers, joint ventures and equity investees of U. S. Steel.

(Thousands of Tons) | Flat-Rolled | USSE | Tubular | Total | ||||||||

Product—2017 | ||||||||||||

Hot-rolled Sheets | 3,262 | 1,151 | — | 4,413 | ||||||||

Cold-rolled Sheets | 3,281 | 499 | — | 3,780 | ||||||||

Coated Sheets | 2,394 | 872 | — | 3,266 | ||||||||

Tin Mill Products | 800 | 441 | — | 1,241 | ||||||||

Oil country tubular goods (OCTG) | — | — | 575 | 575 | ||||||||

Standard and line pipe | — | 61 | 113 | 174 | ||||||||

Semi-finished and Plates | 148 | 1,561 | — | 1,709 | ||||||||

Other | 2 | — | — | 2 | ||||||||

TOTAL | 9,887 | 4,585 | 688 | 15,160 | ||||||||

Memo: Intersegment shipments from Flat-Rolled to Tubular, hot-rolled sheets | 158 | |||||||||||

Memo: Intersegment shipments from USSK to Flat-Rolled, slabs | 47 | |||||||||||

Product—2016 | ||||||||||||

Hot-rolled Sheets | 2,784 | 1,337 | — | 4,121 | ||||||||

Cold-rolled Sheets | 3,775 | 459 | — | 4,234 | ||||||||

Coated Sheets | 2,655 | 849 | — | 3,504 | ||||||||

Tin Mill Products | 831 | 439 | — | 1,270 | ||||||||

Oil country tubular goods (OCTG) | — | — | 351 | 351 | ||||||||

Standard and line pipe | — | 60 | 49 | 109 | ||||||||

Semi-finished and Plates | 23 | 1,352 | — | 1,375 | ||||||||

Other | 26 | — | — | 26 | ||||||||

TOTAL | 10,094 | 4,496 | 400 | 14,990 | ||||||||

Memo: Intersegment shipments from Flat-Rolled to Tubular | ||||||||||||

Hot-rolled sheets | 42 | |||||||||||

Product—2015 | ||||||||||||

Hot-rolled Sheets | 3,283 | 1,165 | — | 4,448 | ||||||||

Cold-rolled Sheets | 3,507 | 470 | — | 3,977 | ||||||||

Coated Sheets | 2,511 | 865 | — | 3,376 | ||||||||

Tin Mill Products | 927 | 428 | — | 1,355 | ||||||||

Oil country tubular goods (OCTG) | — | — | 345 | 345 | ||||||||

Standard and line pipe | — | 55 | 248 | 303 | ||||||||

Semi-finished and Plates | 47 | 1,374 | — | 1,421 | ||||||||

Other | 320 | — | — | 320 | ||||||||

TOTAL | 10,595 | 4,357 | 593 | 15,545 | ||||||||

Memo: Intersegment shipments from Flat-Rolled to Tubular | ||||||||||||

Hot-rolled sheets | 219 | |||||||||||

Rounds | 197 | |||||||||||

20

Steel Shipments by Market and Segment

The following table does not include shipments to end customers by joint ventures and other equity investees of U. S. Steel. Shipments of materials to these entities are included in the “Further Conversion – Joint Ventures” market classification. No single customer accounted for more than 10 percent of gross annual revenues.

(Thousands of Tons) | Flat-Rolled | USSE | Tubular | Total | ||||||||

Major Market – 2017 | ||||||||||||

Steel Service Centers | 1,587 | 761 | — | 2,348 | ||||||||

Further Conversion – Trade Customers | 2,951 | 284 | — | 3,235 | ||||||||

– Joint Ventures | 1,513 | — | — | 1,513 | ||||||||

Transportation (Including Automotive) | 1,453 | 708 | — | 2,161 | ||||||||

Construction and Construction Products | 665 | 1,831 | 41 | 2,537 | ||||||||

Containers | 597 | 438 | — | 1,035 | ||||||||

Appliances and Electrical Equipment | 406 | 247 | — | 653 | ||||||||

Oil, Gas and Petrochemicals | — | 10 | 631 | 641 | ||||||||

Exports from the United States | 452 | — | 16 | 468 | ||||||||

All Other | 263 | 306 | — | 569 | ||||||||

TOTAL | 9,887 | 4,585 | 688 | 15,160 | ||||||||

Major Market – 2016 | ||||||||||||

Steel Service Centers | 1,765 | 801 | — | 2,566 | ||||||||

Further Conversion – Trade Customers | 2,650 | 274 | — | 2,924 | ||||||||

– Joint Ventures | 1,423 | — | — | 1,423 | ||||||||

Transportation (Including Automotive) | 1,725 | 660 | — | 2,385 | ||||||||

Construction and Construction Products | 725 | 1,811 | 40 | 2,576 | ||||||||

Containers | 600 | 436 | — | 1,036 | ||||||||

Appliances and Electrical Equipment | 420 | 236 | — | 656 | ||||||||

Oil, Gas and Petrochemicals | — | 4 | 340 | 344 | ||||||||

Exports from the United States | 436 | — | 20 | 456 | ||||||||

All Other | 350 | 274 | — | 624 | ||||||||

TOTAL | 10,094 | 4,496 | 400 | 14,990 | ||||||||

Major Market – 2015 | ||||||||||||

Steel Service Centers | 1,702 | 718 | — | 2,420 | ||||||||

Further Conversion – Trade Customers | 3,039 | 304 | — | 3,343 | ||||||||

– Joint Ventures | 1,254 | — | — | 1,254 | ||||||||

Transportation (Including Automotive) | 2,011 | 705 | — | 2,716 | ||||||||

Construction and Construction Products | 649 | 1,703 | 55 | 2,407 | ||||||||

Containers | 692 | 424 | — | 1,116 | ||||||||

Appliances and Electrical Equipment | 429 | 236 | — | 665 | ||||||||

Oil, Gas and Petrochemicals | — | — | 513 | 513 | ||||||||

Exports from the United States | 234 | — | 25 | 259 | ||||||||

All Other | 585 | 267 | — | 852 | ||||||||

TOTAL | 10,595 | 4,357 | 593 | 15,545 | ||||||||

21

Business Strategy

We are committed to improving our operations, revitalizing our assets, and developing our talent. Foundational to all our efforts is our belief that we must operate as a principled company committed to a code of conduct that is rooted in our Gary Principles and our core values, the most important of which is safety - of our employees, our environment, and our facilities and equipment. This core belief has served us well for much of our history, and our commitment to it remains as strong as the products we make every day.

We are focused on execution of our two-phased stockholder value creation strategy: (1) earn the right to grow, and (2) drive and sustain profitable growth. Earning the right to grow means delivering consistent, reliable EBITDA across the business cycle by achieving operational excellence through a focused effort by our talented workforce to deliver superior results in four business-critical areas: safety, quality, delivery, and cost. Driving and sustaining profitable growth, economic profit across the business cycle and above-average returns for long-term stockholders, is enabled through stable, reliable facilities that produce innovative product and service solutions for discerning steel customers. Underlying both phases is our unwavering commitment to strengthen our balance sheet, with an emphasis on cash flow, liquidity, and financial flexibility.

We are on a mission to become an industry leader by striving to create a sustainable competitive advantage with a customer-centric focus on: delivering high-quality, value-added products on time every time; collaborating with customers to develop innovative solutions that address their most challenging needs, including new advanced high-strength steels to meet fuel efficiency and safety requirements for automotive customers and new premium connections that provide strong, durable connections between pipes used by energy customers in oil and gas drilling; generating economic profit through active participation in relevant markets; and creating and maintaining a competitive cost structure centered around operational flexibility. The strategic positioning of operations within the commercial entities enhances our ability to better hear the voice of the customer, ensuring that we deliver superior value and drive results in the markets we choose to serve.

U. S. Steel will continue to evaluate potential strategic and organizational opportunities, which may include the acquisition, divestiture or consolidation of assets. Given recent market conditions, the cyclicality of our industry, and the continued challenges faced by the Company, we are focused on strategically maintaining and spending cash (including capital investments under our asset revitalization program), in order to invest in areas consistent with our long-term strategy, and are considering various possibilities, including exiting lines of business and the sale of certain assets, that we believe would ultimately result in a stronger balance sheet and greater stockholder value. The Company will pursue opportunities based on its long-term strategy, and what the Board of Directors determines to be in the best interests of the Company's stockholders at the time.

Changes to Operational Footprint

On December 22, 2017, a subsidiary of U. S. Steel completed the sale of its 50% ownership interest in Apolo Tubulars, S.A. joint venture for $11 million. As a result of the transaction, U. S. Steel recognized a non-cash loss of approximately $18 million.

On September 29, 2017, a subsidiary of U. S. Steel completed the sale of its 15% ownership interest in Tilden Mining Company L.C. for $105 million. As a result of the transaction, U. S. Steel recognized a gain of approximately $26 million.

On June 30, 2017, U. S. Steel completed the restructuring and disposition of USSC through a sale and transfer of all of the issued and outstanding shares in USSC to an affiliate of Bedrock Industries Group LLC (Bedrock). In accordance with the Second Amended and Restated Plan of Compromise, Arrangement and Reorganization, approved by the Ontario Superior Court of Justice on June 9, 2017, U. S. Steel received approximately $127 million in satisfaction of its secured claims, including interest, which resulted in a gain of $72 million on the Company's retained interest in USSC. U. S. Steel also agreed to the discharge and cancellation of its unsecured claims for nominal consideration. The terms of the settlement also included mutual releases among key stakeholders, including a release of all claims against the Company regarding environmental, pension and other liabilities.

In March 2017, U. S. Steel made a strategic decision to permanently shutdown the Lorain No. 6 Quench & Temper Mill and relocate the equipment.

22

In February 2017, the Company restarted production on the hot strip mill at Granite City Works to provide better alignment with customer needs and improve service while increasing the pace of our asset revitalization program. The hot strip mill had been temporarily idle since January 2016.

In December 2016, the Company reached agreements to supply iron ore pellets to third party customers over the next several years. The Keetac Iron Ore Operations restarted production in the first quarter of 2017 to take full advantage of these business opportunities. It had previously been idle since May 2015 due to significantly lower steel production.

In December 2016, the Company made the strategic decision to permanently close the Lorain #4 and Lone Star #1 pipe mills and the Bellville Tubular Operations after considering a number of factors, including challenging market conditions for tubular products, reduced rig counts, and high levels of unfairly traded imports.

In April 2016, U. S. Steel temporarily idled its Lone Star tubular operations. These operations were restarted in April 2017.

During 2015, the Company adjusted operating levels at several of its tubular operations as declining oil prices and rig counts have significantly reduced demand for OCTG products.

In August 2015, U. S. Steel permanently shut down most of the Fairfield Flat-Rolled operations.

In 2015, the Company permanently closed the coke making operations at Granite City Works and Gary Works. Also, in 2015, U. S. Steel temporarily idled steelmaking operations at Granite City Works.

Steel Innovation

In addition to the increased focus on our operations, we are continuing to develop the next generation of steel products for our customers. Our Generation 3 (GEN3) steels will provide superior formability and high-strength properties while using a low-alloyed approach for robust weldability. To expand our capabilities in GEN3 steels, a new continuous galvanizing line will be constructed at our PRO-TEC Coating Company joint venture (PRO-TEC), which will allow PRO-TEC to produce these GEN3 steels with a hot-dipped zinc coating. This line will be the first of its kind and will utilize proprietary technology capable of producing the high-quality, cutting-edge advanced high-strength steels that will meet our automotive customers’ needs and solve some of their most pressing challenges. Our GEN3 steels reinforce why steel will remain the lowest cost, strongest, safest, and most environmentally efficient material of choice.

Asset Revitalization

Our Flat-Rolled segment asset revitalization program is a comprehensive $2 billion investment plan with a focus on continually improving safety, quality, delivery and cost. We currently expect capital spending for this program to be approximately $1.5 billion from 2017 through 2020. As we revitalize our assets, we expect to increase profitability, productivity and operational stability, and reduce volatility. This program is designed to prioritize investment in the areas with the highest returns. Importantly, while this is a large program, the majority of projects are not complex projects. This means that projects are easier to execute. Due to the smaller nature of many of the projects, we do not have to complete the entire program in order to start seeing benefits. Also, by breaking the program down into a series of smaller projects, we have greater flexibility to adjust the scope and pace of project implementation based on changes in business conditions. Our asset revitalization program covers investments in our existing assets and involves investments beyond routine capital and maintenance spending. These projects are expected to deliver both operational and commercial benefits, with most of the benefits coming from operational improvements. The commercial benefits we expect to realize will be driven primarily by things we can control, such as better product quality, improved delivery performance, and increased throughput on constrained assets. Being regarded as a top quartile performer in the eyes of our customers will support sustainable commercial benefits from these investments. After we complete our full asset revitalization program, we expect to have well maintained facilities with a strong core infrastructure, and strong reliability centered maintenance organizations. We will deliver products to our customers with improved reliability and quality. While this program only covers our existing assets, it will create a stable foundation for our future as we continue to evaluate strategic growth projects to strengthen our position as the markets we serve continue to grow and evolve. Refer to our Flat-Rolled segment Asset Revitalization Program Performance Scorecard on page 11 in the 10-K summary section of this document for how we measure success in this program.

23

Safety

U. S. Steel has a long-standing commitment to the safety and health of the men and women who work in our facilities. For our Company, safety is our primary core value. Every employee has the right to return home safely at the end of every day, and we are working to eliminate all injuries and incidents at all of our facilities. Ensuring a safe workplace also improves productivity, quality, reliability and financial performance. By making safety and health a personal responsibility, our employees are making a daily commitment to follow safe work practices, look out for the safety of co-workers and ensure safe working conditions for everyone. A “Safety First” mindset is as essential to our success as the tools and technologies we rely on to do business.

Our objective is to attain a sustainable zero harm culture supported by leadership and owned by an engaged and highly skilled workforce, empowered with the capabilities and resources needed to assess, reduce, and eliminate workplace risks and hazards. In support of these objectives, we have developed an enhanced Safety Management System, initiated new safety communication methods and enhanced contractor safety processes.

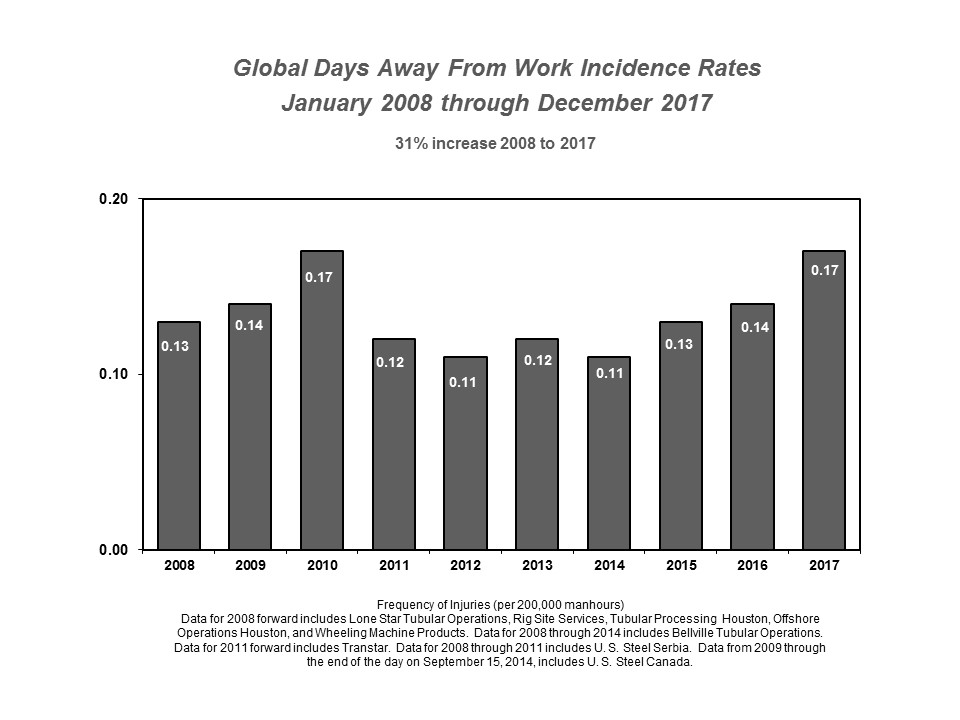

U. S. Steel finished 2017 with a Global Total OSHA Recordable Rate of 1.04, which is 60% better than the Bureau of Labor Statistics for Iron & Steel rate of 2.60 and 32% better than American Iron and Steel Institute rate of 1.54. U. S. Steel finished 2017 with a Days Away From Work Rate of 0.17, which is 76% better than the Bureau of Labor Statistics for Iron & Steel rate of 0.70 and 43% better than American Iron and Steel Institute rate of 0.30. Additionally, when comparing our most severe injuries - cases involving 31 or more days away from work - U. S. Steel performs at a level almost 7 times better than the Bureau of Labor Statistics for Iron and Steel.

In 2017 we experienced one domestic employee fatality and three contractor fatalities (one in the United States and two in Europe). These tragic events serve as a reminder that we must remain vigilant in our safety efforts to ensure every employee and contractor returns home safely every day.

Through 2017, the 13 year performance for our key safety measures: Total Recordable Incidence and Days Away From Work rates show improvement of 34% and 51% respectively, as shown on the following graphs.

24

25

26

Environmental Stewardship

U. S. Steel is committed to effective environmental stewardship. We have implemented and continue to develop business practices that are environmentally effective. We believe part of being a good corporate citizen requires a dedicated focus on how our industry affects the environment. U. S. Steel's environmental expenditures totaled $255 million in 2017, $232 million in 2016 and $354 million in 2015. For further information, see “Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations – Environmental Matters.” We have taken the actions described below in furtherance of that goal.

U. S. Steel, largely through the American Iron and Steel Institute (AISI), World Steel Association and the European Confederation of Iron and Steel Industries (Eurofer), is involved in the promotion of cost effective environmental strategies through the development of appropriate air, water, waste and climate change laws and regulations at the local, state, national and international levels.

We are committed to reducing emissions as well as our carbon footprint. We have investigated, created and implemented innovative, best practice solutions throughout U. S. Steel to manage and reduce energy consumption. We are also committed to investing in technologies to further improve the environmental performance of our steelmaking process. In addition, we continue to focus on implementing energy reduction strategies, use of efficient energy sources, waste reduction management and the utilization of by-product fuels.

According to the AISI, relative to competing materials, steel has approximately one-fifth the carbon footprint of aluminum, one-twelfth the footprint of magnesium, and one-ninth the footprint of carbon fiber composites. Our advanced high strength steel (AHSS) used in today’s vehicles afford significant light-weighting opportunities that assist the automobile industry in meeting ever-increasing fuel economy standards while enhancing a vehicle's safety and engine performance. When comparing steel to aluminum, in terms of sustainability, steel has a smaller carbon footprint and costs less.

In 2017 alone, U. S. Steel recycled 2.9 million tons of purchased and produced steel scrap. Because of steel’s physical properties, our products can be recycled at the end of their useful life without loss of quality, contributing to steel’s high recycling rate and affordability. Comparatively, due to limitations in aluminum processing, very little recycled aluminum is included in aluminum sheet goods used for automotive or aircraft applications. This means that any increased use of aluminum sheet for high-end applications must come from Greenhouse Gas (GHG) intensive primary aluminum, which generates significantly more GHG emissions than steel.

U. S. Steel also completed a project to utilize biomass from Clairton Works biological wastewater treatment facility to “seed” other biological wastewater treatment facilities in Pennsylvania, Indiana, and Illinois in 2017. This helps these facilities recover from treatment facility upsets, thereby reducing the amount of pollutants released during the upsets.

In December 2017, U. S. Steel enhanced our website disclosures of GHG emission and energy efficiency projects.

Many of our major production facilities have Environmental Management Systems that are certified to the ISO 14001 Standard. This standard, published by the International Organization for Standardization (ISO), provides the framework for the measurement and improvement of environmental impacts of the certified facility.

Commercial Strategy

Our commercial strategy is focused on providing customer focused solutions with value-added steel products, including maintaining AHSS leadership with GEN3 steels and coated sheets for the automotive and appliance industries, electrical steel sheets for the manufacture of motors and electrical equipment, galvanized and Galvalume® sheets for construction, hot rolled skelp used in the production of energy transmitting line pipe, tin mill products for the packaging industry and pipe, connections, accessories and rig site services for use in drilling for oil and gas.

We are responsive to our customers' changing needs by developing new steel products and uses for steel that meet the evolving market and regulatory demands imposed on them. In connection with this commitment, we have research centers in Pittsburgh, Pennsylvania, and Košice, Slovakia, an automotive center in Troy, Michigan and a Research and Development Laboratory and Test Facility for Tubular products in Houston, Texas. The focus of these centers is to develop new products and to collaborate with our customers to better provide innovative solutions to serve their needs. Examples of our customer focused product innovation include the development of the first commercially available coated AHSS and GEN3 steels and embedding application engineers at original equipment manufacturers to demonstrate how to best utilize the material in body design to meet automobile passenger safety requirements while significantly reducing weight to meet future vehicle fuel efficiency standards; and a line of premium and semi-premium

27

tubular connections designed for our customers operating in challenging drilling environments. These connections optimize performance and provide outstanding sealing capabilities for onshore and offshore oil and gas drilling. Engineered, designed, tested and commercialized in 2015, the USS-LIBERTY TC™ premium connection is used by our customers focused on horizontal drilling. Since its introduction, more than 1.5 million feet has been shipped to customers operating in every major shale play in North America. Another successful premium connection, USS-EAGLE SFH™ was introduced in 2017 for customers drilling deep, high-pressure horizontal onshore natural gas and oil wells in North America. Please refer to Item I. Business Strategy for further details of our commercial entities and related strategies.

Workforce

At U. S. Steel, we are committed to attracting, developing, and retaining a workforce of talented and diverse people — all working together to deliver superior results for our Company, stockholders, customers and communities. We regularly review our human capital needs and focus on the selection, development and retention of employees in order to sustain and enhance our competitive position in the markets we serve.

Capital Structure and Liquidity

Our primary financial goal is to enhance stockholder value by focusing on our capital structure, liquidity, and financial flexibility by deploying cash strategically as we earn the right to grow. Our cash deployment strategy is aligned to our strategic priorities, and includes; revitalizing our capital, both human and equipment; strengthening our balance sheet; maintaining a healthy pension plan; and delivering sustainable growth with a focus on safety, quality, delivery and cost.

Our liquidity supports our ability to satisfy short-term obligations, fund working capital requirements, and provides a foundation to execute key strategic initiatives such as our asset revitalization program.

We are focused on strengthening our balance sheet and credit ratings, and may proactively manage our company's debt maturity profile from time to time to protect our capital structure from unforeseen external events and re-financing risks.

In 2017, we undertook several steps to support these goals. The Company issued $750 million of 6.875% Senior Notes due August 15, 2025 and received net proceeds of approximately $737 million, which was used together with cash on hand to repay certain of the Company's outstanding debt obligations. U. S. Steel completed a redemption of all the aggregate principal amount of its $70 million Lorain County Port Authority Recovery Zone Facility Revenue Bonds, and an optional redemption of $161 million of its 7.00% Senior Notes due 2018, $200 million of its 6.875% Senior Notes due 2021, and $400 million of its 7.50% Senior Notes due 2022. Additionally, the Company completed an optional partial redemption of $200 million in aggregate principle amount of its 8.375% Senior Secured Notes due 2021.

In November 2017 we made a voluntary contribution of $75 million to U. S. Steel's main defined benefit pension plan as part of our long term pension liability management strategy.

During 2017, U. S. Steel reduced debt by $328 million and extended the maturities of long-term debt as a result of actions noted above. We ended 2017 with $1.533 billion of cash and cash equivalents on hand and total liquidity of approximately $3.350 billion.

Steel Industry Background and Competition

The global steel industry is cyclical, highly competitive and has historically been characterized by overcapacity.

U. S. Steel's competitive position may be affected by, among other things, differences among U. S. Steel's and its competitors' cost structure, labor costs, environmental remediation and compliance costs, global capacity and the existence and magnitude of government subsidies.

U. S. Steel competes with many North American and international steel producers. Competitors include integrated producers, which, like U. S. Steel, use iron ore and coke as the primary raw materials for steel production, as well as electric arc furnace (EAF) producers, which primarily use steel scrap and other iron-bearing feedstocks as raw materials. Global steel capacity has continued to increase, with some published sources estimating that steel capacity in China alone is over one billion metric tons per year. In addition, other materials, such as aluminum, plastics and composites, compete with steel in several applications.

28

EAF producers typically require lower capital expenditures for construction of facilities and may have lower total employment costs; however, these competitive advantages may be minimized or eliminated by the cost of scrap when scrap prices are high. During 2017, certain public scrap prices in certain publications averaged more than 50% higher than 2016. Some mini-mills utilize thin slab casting technology to produce flat-rolled products and are increasingly able to compete directly with integrated producers in many flat-rolled product applications previously produced only by integrated steelmakers.

U. S. Steel provides defined benefit pension and/or other post-employment benefits to approximately 95,000 current employees, retirees and their beneficiaries. Many of our competitors do not have comparable retiree obligations. Participation in U. S. Steel's main defined benefit pension plan was closed to new entrants on July 1, 2003 and benefit accruals for all non-represented participants were frozen effective December 31, 2015. With amendments effective June 30, 2014, retiree medical and life insurance benefits for non-represented employees were eliminated for those who retire after December 31,2017. The United Steelworkers (USW) ratified successor three year Collective Bargaining Agreements with U. S. Steel and its U. S. Steel Tubular Products, Inc. subsidiary (the 2015 Labor Agreements) on February 1, 2016, which were effective as of September 1, 2015 and expire on September 1, 2018. These 2015 Labor Agreements provided for the closure of other post-employment benefits (OPEB) plans to represented employees hired or rehired under certain conditions on or after January 1, 2016.

We believe that our major North American and many European integrated steel competitors are confronted with substantially similar environmental regulatory conditions and therefore do not believe that our relative position with regard to such competitors will be materially affected by the impact of environmental laws and regulations. However, if future regulations do not recognize the fact that the integrated steel process involves a series of chemical reactions involving carbon that create carbon dioxide (CO2) emissions without linking these emissions to steel scrap as well, our competitive position relative to mini-mills will be adversely impacted. Our competitive position compared to producers in developing nations such as China, Russia, Ukraine, Turkey, Brazil and India, will be harmed unless such nations require commensurate reductions in CO2 emissions. Competing materials such as plastics may not be similarly impacted. The specific impact on each competitor will vary depending on a number of factors, including the age and location of its operating facilities and its production methods. U. S. Steel is also responsible for remediation costs related to former and present operating locations and disposal of environmentally sensitive materials. Many of our competitors, including North American producers, or their successors, that have been the subject of bankruptcy relief have no or substantially lower liabilities for such environmental remediation matters.

International Trade

U. S. Steel continues to face competition from foreign steel producers, many of which are heavily subsidized by their governments and dump steel into the United States (U.S.) market. Trade-distorting policies and practices, coupled with global steel overcapacity, impact pricing in the U.S. market and influence the Company's ability to compete on a level playing field. U. S. Steel continues to lead the industry in efforts to address dumped and subsidized steel imports that injure the Company, our workers, and our country’s national and economic security.

U. S. Steel continues to be actively engaged in relevant administrative reviews and five-year reviews (Sunset Review) of antidumping (AD) and countervailing duty (CVD) orders before the U.S. International Trade Commission (USITC) and the U.S. Department of Commerce (DOC), including the following:

• | On January 30, 2018, the USITC voted to continue the AD order on seamless carbon and alloy steel standard, line, and pressure pipe (SSLPP) from Germany for another five years in the fourth Sunset Review of the 1995 AD order. U. S. Steel actively participated in that Sunset Review. As a result of the USITC’s determination, Mannesmannrohren-Werke AG will continue to be subject to 20.08% AD duties and all other companies will continue to be subject to 57.72% AD duties on SSLPP imports from Germany. |

• | On October 2, 2017, the DOC issued preliminary results in the second administrative review of the AD order on oil country tubular goods (OCTG) from Korea for the period September 2015 through August 2016. In its preliminary results, the DOC calculated the dumping margins of 46.37% for Nexteel Co., Ltd., 6.66% for SeAH Steel Corporation and 19.58% for non-examined companies. U. S. Steel is participating in the administrative review, which is currently in the briefing stage. The final results are due on April 11, 2018. |

• | On May 1, 2017, the DOC automatically initiated a Sunset Review of the AD order on tin mill products from Japan. The DOC concluded that revocation of the order would lead to margins of up to 95.29%. The USITC concurrently published its notice of institution of the Sunset Review which covers the same order and decided |

29

to conduct a full Sunset Review and vote on continuation of the order in April 2018. U. S. Steel is participating in the Sunset Review and, if successful, the order will remain in effect for another five years.

On December 5, 2017, in response to circumvention petitions filed by U.S. Steel and other domestic steel producers in September 2016, the DOC preliminarily found that imports of cold-rolled and galvanized steel made from Chinese substrate are covered by the AD/CVD orders on such imports from China. As a result of the preliminary determination, U.S. imports of cold-rolled steel from Vietnam made from Chinese hot-rolled steel are subject to 522.23% cash deposit requirements and U.S. imports of galvanized steel from Vietnam made from Chinese hot- or cold-rolled steel are subject to 238.48% cash deposit requirements, both retroactive to November 4, 2016. The DOC's final circumvention determinations are expected in the second quarter of 2018.

U. S. Steel is also actively involved in several appeals before the U.S. Court of International Trade and U.S. Court of Appeals for the Federal Circuit concerning the AD/CVD orders imposed in 2016 on flat-rolled steel cases as well as several OCTG cases.

In April 2016, U. S. Steel launched a case under Section 337 of the Tariff Act of 1930 against several Chinese producers and their distributors. All but seven of the producers did not respond and are considered to be in default. The complaint alleged three causes of action: 1) illegal conspiracy to fix prices and control output and export volumes; 2) the theft of trade secrets through industrial espionage; and 3) circumvention of duties by false labeling of the steel’s origin and transshipment (FDO). On May 26, 2016, the USITC instituted an investigation on all three causes of action. On February 15, 2017, U. S. Steel voluntarily withdrew the trade secrets claim preserving its right to resurrect the claim when additional information becomes available. On October 2, 2017, the Administrative Law Judge (ALJ) assigned to the case terminated the FDO claim. The Company has elected not to pursue an appeal leaving the price fixing claim as the remaining claim. That claim is pending before the USITC. The remedy sought by U. S. Steel in that claim is the barring of all Chinese carbon and alloy steel from the U.S. market.

On December 12, 2016, China filed a complaint at the World Trade Organization (WTO) against the U.S. and the European Union (EU) alleging that the U.S. and EU are violating their treaty obligations by continuing to use the non-market economy (NME) methodology for price comparisons in antidumping duty investigations and reviews. On April 3, 2017, the DOC issued a notice requesting comments and information on whether China should continue to be treated as a NME country under U.S. antidumping laws. U. S. Steel and other domestic producers submitted comments to the DOC on May 10, 2017. On October 26, 2017, the DOC issued a memorandum concluding that it will continue to use the NME methodology for antidumping proceedings involving imports from China because the state continues to fundamentally distort China’s economy. China then requested additional consultations with the U.S. regarding its WTO complaint. The outcome of these WTO disputes may impact U.S. dumping orders on Chinese goods, including many steel products.

On April 19, 2017, the DOC initiated an investigation under Section 232 of the Trade Expansion Act of 1962 to determine the effects of steel imports on U.S. national security. On May 24, 2017, U. S. Steel testified at the DOC public hearing and remains active in the investigation. On January 11, 2018, the DOC submitted its investigation report to the President, who under the statute has until April 11, 2018 to announce any action based on the DOC findings.

U. S. Steel continually assesses the impact of imports and global excess capacity on our business, and continues to execute a broad, global strategy to enhance the means and manner in which it competes in the U.S. market and internationally.

Facilities and Locations as of December 31, 2017

30

Flat-Rolled

During 2017, U. S. Steel continued to review and adjust its operating levels at several of its Flat-Rolled operations. Customer order rates will determine the size and duration of any adjustments that we make at our Flat-Rolled operations during 2018.

The operating results of all facilities within U. S. Steel’s integrated steel plants in the U.S. are included in Flat-Rolled. These facilities include Gary Works, Great Lakes Works, Mon Valley Works and Granite City Works. The operating results of U. S. Steel’s coke and iron ore pellet operations and many equity investees in North America are also included in Flat-Rolled.

Gary Works, located in Gary, Indiana, has annual raw steel production capability of 7.5 million tons. Gary Works has four blast furnaces, six steelmaking vessels, a vacuum degassing unit and four slab casters. Finishing facilities include a hot strip mill, two pickling lines, two cold reduction mills, three temper mills, a double cold reduction line, four annealing facilities and two tin coating lines. Principal products include hot-rolled, cold-rolled and coated sheets and tin mill products. Gary Works also produces strip mill plate in coil.

The Midwest Plant, located in Portage, Indiana, processes hot-rolled and cold-rolled bands and produces tin mill products, hot dip galvanized, cold-rolled and electrical lamination sheets. Midwest facilities include a currently idle pickling line, two cold reduction mills, two temper mills, a double cold reduction mill, two annealing facilities, two hot dip galvanizing lines, a tin coating line and a tin-free steel line.

East Chicago Tin is located in East Chicago, Indiana and produces tin mill products. Facilities include a pickling line, a cold reduction mill, two annealing facilities, a temper mill, a tin coating line and a tin-free steel line.

Great Lakes Works, located in Ecorse and River Rouge, Michigan, has annual raw steel production capability of 3.8 million tons. Great Lakes facilities include three blast furnaces, two steelmaking vessels, a vacuum degassing unit, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, three annealing facilities, a temper mill, a recoil and inspection line, two electrolytic galvanizing lines (one being the former Double Eagle Steel Coating Company's (DESCO) line) and a hot dip galvanizing line. Principal products include hot-rolled, cold-rolled and coated sheets.

Mon Valley Works consists of the Edgar Thomson Plant, located in Braddock, Pennsylvania; the Irvin Plant, located in West Mifflin, Pennsylvania; the Fairless Plant, located in Fairless Hills, Pennsylvania; and the Clairton Plant, located in Clairton, Pennsylvania. Mon Valley Works has annual raw steel production capability of 2.9 million tons. Facilities at the Edgar Thomson Plant include two blast furnaces, two steelmaking vessels, a vacuum degassing unit and a slab caster. Irvin Plant facilities include a hot strip mill, two pickling lines, a cold reduction mill, three annealing facilities, a temper mill and two hot dip galvanizing lines. The Fairless Plant operates a hot dip galvanizing line. Principal products from Mon Valley Works include hot-rolled, cold-rolled and coated sheets, as well as coke and coke by-products produced at the Clairton Plant.

The Clairton Plant is comprised of ten coke batteries with an annual coke production capacity of 4.3 million tons. Almost all of the coke we produce is consumed by U. S. Steel facilities, or swapped with other domestic steel producers. Coke by-products are sold to the chemicals and raw materials industries.

Granite City Works, located in Granite City, Illinois, has annual raw steel production capability of 2.8 million tons. Granite City’s facilities includes two blast furnaces, two steelmaking vessels, two slab casters, a hot strip mill, a pickling line, a tandem cold reduction mill, a hot dip galvanizing line and a hot dip galvanizing/Galvalume® line. Principal products include hot-rolled and coated sheets. Gateway Energy and Coke Company LLC (Gateway) constructed a coke plant, which began operating in October 2009 to supply Granite City Works under a 15-year agreement with Suncoke.

U. S. Steel owns and operates a cogeneration facility that utilizes by-products from the Gateway coke plant to generate heat and power. During December 2015, the Granite City Works steelmaking operations and hot strip mill were temporarily idled. In the first quarter 2017, the hot strip mill restarted operations.

Subsequent to the permanent shutdown of the steelmaking operations in August 2015, Fairfield Works, located in Fairfield, Alabama, consists of the #5 coating line.

U. S. Steel owns a Research and Technology Center located in Munhall, Pennsylvania (near Pittsburgh) where we carry out a wide range of applied research, development and technical support functions.

31

U. S. Steel also owns an automotive technical center in Troy, Michigan. This facility brings automotive sales, service, distribution and logistics services, product technology and applications research into one location. Much of U. S. Steel’s work in developing new grades of steel to meet the demands of automakers for high-strength, light-weight and formable materials is carried out at this location.

U. S. Steel has iron ore pellet operations located at Mt. Iron (Minntac) and Keewatin (Keetac), Minnesota with annual iron ore pellet production capability of 22.4 million tons. During 2017, 2016 and 2015, these operations produced 21.1 million, 15.0 million and 15.5 million tons of iron ore pellets, respectively.

Joint Ventures Within Flat-Rolled

U. S. Steel participates in a number of joint ventures that are included in Flat-Rolled, most of which are conducted through subsidiaries. All of these joint ventures are accounted for under the equity method. The significant joint ventures and other investments are described below. For information regarding joint ventures and other investments, see Note 11 to the Consolidated Financial Statements.

U. S. Steel has a 14.7 percent ownership interest in Hibbing Taconite Company (Hibbing), which is based in Hibbing, Minnesota. Hibbing’s rated annual production capability is 9.1 million tons of iron ore pellets, of which our share is about 1.3 million tons.

U. S. Steel and POSCO of South Korea participate in a 50-50 joint venture, USS-POSCO Industries (UPI), located in Pittsburg, California. The joint venture markets sheet and tin mill products, principally in the western United States. UPI produces cold-rolled sheets, galvanized sheets, tin plate and tin-free steel from hot bands principally provided by POSCO and U. S. Steel. UPI’s annual production capability is approximately 1.5 million tons.

U. S. Steel and Kobe Steel, Ltd. of Japan participate in a 50-50 joint venture, PRO-TEC Coating Company

(PRO-TEC). PRO-TEC owns and operates two hot dip galvanizing lines and a continuous annealing line (CAL) in Leipsic, Ohio, which primarily serve the automotive industry. PRO-TEC’s annual production capability is approximately 1.5 million tons. U. S. Steel's domestic production facilities supply PRO-TEC with cold-rolled sheets and U. S. Steel markets all of PRO-TEC's products. The CAL produces high strength, lightweight steels that are an integral component in automotive manufacturing as vehicle emission and safety requirements become increasingly stringent. On September 25, 2017, U. S. Steel and Kobe Steel, Ltd. announced their agreement to begin construction of a new continuous galvanizing line (CGL) at PRO-TEC, in response to increased demand for advanced high-strength steels (AHSS). The new CGL, an investment of approximately $400 million financed by the joint venture, will have a yearly capacity of 500,000 tons. This line, which will utilize a proprietary process, will be capable of coating steel that will help automakers manufacture economically lightweight vehicles to meet increasing fuel efficiency requirements while maintaining exceptionally high safety standards. Construction began in the fourth quarter of 2017 and the line is expected to commence startup in 2019.

U. S. Steel and ArcelorMittal participate in the Double G Coatings Company, L.P. a 50-50 joint venture (Double G), which operates a hot dip galvanizing and Galvalume® facility located near Jackson, Mississippi and primarily serves the construction industry. Double G processes steel supplied by each partner and each partner markets the steel it has processed by Double G. Double G’s annual production capability is approximately 315,000 tons.

U. S. Steel and Worthington Industries, Inc. participate in Worthington Specialty Processing (Worthington), a joint venture with locations in Jackson, Canton, and Taylor, Michigan, in which U. S. Steel has a 49 percent interest. Worthington slits, cuts to length, and presses blanks from steel coils to desired specifications. Worthington’s annual production capability is approximately 890,000 tons.

Chrome Deposit Corporation (CDC), a 50-50 joint venture between U. S. Steel and Court Holdings, reconditions finishing work rolls, which require grinding, chrome plating and/or texturing. The rolls are used on rolling mills to provide superior finishes on steel sheets. CDC has seven locations across the United States, with all locations near major steel plants.