UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section

14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

| ☑ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| CHECK THE APPROPRIATE BOX: | ||

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☑ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Under Rule 14a-12 | |

ConocoPhillips

(Name of Registrant as Specified In Its

Charter)

(Name of Person(s) Filing Proxy

Statement, if Other Than the Registrant)

| PAYMENT OF FILING FEE (CHECK THE APPROPRIATE BOX): | |||

| ☑ | No fee required. | ||

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | ||

| 1) Title of each class of securities to which transaction applies: | |||

| 2) Aggregate number of securities to which transaction applies: | |||

| 3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||

| 4) Proposed maximum aggregate value of transaction: | |||

| 5) Total fee paid: | |||

| ☐ | Fee paid previously with preliminary materials: | ||

| ☐ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. | ||

| 1) Amount previously paid: | |||

| 2) Form, Schedule or Registration Statement No.: | |||

| 3) Filing Party: | |||

| 4) Date Filed: | |||

A Message from Our Chairman and Chief Executive Officer and Lead Director

MARCH 29, 2021

Dear Fellow Stockholders,

On behalf of the Board of Directors (the “Board”) and the Executive Leadership Team, we are pleased to invite you to participate in the 2021 Annual Meeting of Stockholders (the “Annual Meeting”). We planned to return to an in-person meeting this year; however, the health and well-being of our employees, stockholders and partners remain of the utmost importance to us, and due to the ongoing coronavirus (COVID-19) pandemic and to be consistent with our SPIRIT Values and public health guidelines, this year’s Annual Meeting will be virtual only. This does not represent a change in our stockholder engagement philosophy and we remain committed to an in-person meeting in 2022.

The Annual Meeting will be held on Tuesday, May 11, 2021, at 9:00 a.m. Central Daylight Time. It will be conducted via live webcast. You will be able to participate online at www.virtualshareholdermeeting.com/ COP2021. You may submit questions electronically both before and during the meeting or by using a live phone line during the meeting, and you will also be able to vote your shares electronically (other than shares held through our employee benefit plans, which must be voted prior to the meeting). The attached Notice of the 2021 Annual Meeting of Stockholders and Proxy Statement provide information on how to join the meeting online and about the business we plan to conduct.

AN UNPRECEDENTED YEAR

We entered 2020 with strong momentum, having successfully implemented a multi-year plan with a value proposition to deliver superior returns through price cycles; however, 2020 brought unprecedented challenges, including simultaneous supply and demand shocks that drove the industry into a severe downturn. The supply shock was triggered by disagreements between OPEC and Russia, beginning in early March, which resulted in significant supply coming onto the market and an oil price war. The demand shock was triggered by the COVID-19 pandemic, which caused social and economic consequences not felt just in our industry, but globally. The significant industry downturn tested our value proposition, but we remained disciplined – we established priorities around workforce health, exercised available flexibility across our operations, preserved financial strength and safely delivered the underlying business.

While the pandemic was unexpected and demanded intense focus, the Board and management remained actively engaged to ensure that our business response during this historic year preserved our competitiveness and our ability to deliver our compelling value proposition to stockholders. Throughout 2020, management exercised available flexibility to conserve cash and preserve value for stockholders. In the second and third quarters, we curtailed a significant portion of our production globally based on clear economic criteria that created future value. We completed critical dispositions to high-grade the portfolio, achieved two significant discoveries in Norway, acquired high-value adjacent acreage in the Montney and progressed major projects across our global operations. Our balance sheet stayed strong and we satisfied our commitment to return cash from operations to stockholders.

We are proud of the fact that our model for the business succeeded, even in the face of historic challenges. This success is what put us in a strong position to acquire Concho Resources Inc. (“Concho”). The combination of two premier companies leaves us uniquely positioned to lead a structural change for our vital industry that is critical to investors. Although the pandemic and its effects may be far from over, our value proposition remains intact and we continue to believe that its core principles – focusing on free cash flow generation, maintaining a strong balance sheet, delivering compelling returns on and of capital, and demonstrating ESG leadership – are the right ones for the upstream business and offer a compelling investment for this cyclical industry.

RISING TO THE COVID-19 CHALLENGE

As the COVID-19 pandemic emerged, we took swift actions to respond across our global operations. We began by establishing and communicating three priorities to guide our actions: protect the health and

| S | SAFETY | |||

| No task is so important that we can’t take the time to do it safely. A safe company is a successful company. | ||||

| P | PEOPLE | |||

| We respect one another. We recognize that our success depends upon the capabilities and inclusion of our employees. We value different voices and opinions. | ||||

| I | INTEGRITY | |||

| We are ethical and trustworthy in our relationships with internal and external stakeholders. We keep our promises. | ||||

| R | RESPONSIBILITY | |||

| We are accountable for our actions. We care about our neighbors in the communities where we operate. We strive to make a positive impact across our operations. | ||||

| I | INNOVATION | |||

| We anticipate change and respond with creative solutions. We are responsive to the changing needs of the industry. We embrace learning. We are not afraid to try new things. | ||||

| T | TEAMWORK | |||

| We have a “can do” attitude that inspires top performance from everyone. We encourage collaboration. We celebrate success. We win together. | ||||

| 2 | ConocoPhillips |

A Message from Our Chairman and Chief Executive Officer and Lead Director

well-being of our workforce, help mitigate the spread of COVID-19, and safely execute the business. In conjunction with these priorities, we developed a governance structure and various protocols that have served us well in responding to the pandemic, including:

| • | Standing up a Crisis Management Support Team; |

| • | Communicating regularly with employees and providing them with sufficient flexibility to support any challenges; and |

| • | Equipping our employees with the necessary technology and training to adjust to a remote work environment. |

It is with tremendous pride and gratitude that we reflect on the extraordinary efforts of our workforce, especially those in the field, whose resilience and dedication during an incredibly challenging year allowed us to deliver our business plans despite the ongoing pandemic. And we are especially proud about the fact that this was achieved while staying true to our SPIRIT Values.

COMBINING TWO PREMIER COMPANIES

On January 15, 2021, the acquisition of Concho was completed. The transaction marks another transformational moment in our history and results in ConocoPhillips being the world’s largest independent oil and gas company with production of approximately 1.5 million barrels of oil equivalent per day. The combination of Concho’s best-in-class position in the Permian Basin and ConocoPhillips’ best-in-class global diverse portfolio creates a company of unmatched scale and quality among independent peers. We have established an integration structure with clear roles and responsibilities within the combined organization to ensure the two companies are successfully merged and that we capture the expected transaction value and synergies. In the brief time since completing the transaction, we already have line of sight to how we will exceed our initial estimates of expected value capture from the combined company and will provide updates as integration activities progress.

LOOKING TO THE FUTURE

We believe we play a critical role in a vital industry, but we also recognize that there is an imperative to progress the industry, especially by delivering stronger financial and climate-related performance. ConocoPhillips has always included corporate responsibilities in its business model, and consistent with that philosophy we recently streamlined our commitment into three essential mandates. As a company, we must:

| • | Provide affordable energy to the world by investing in the lowest-cost resources that will be developed in any lower-carbon scenario; |

| • | Generate superior returns on and of capital; and |

| • | Demonstrate ESG leadership and excellence. |

Aligned with these mandates we have (i) eliminated an explicit production growth target from our capital allocation criteria, and instead established cost of supply as the primary basis for capital allocation, (ii) used and will continue to use a scenario-based strategic planning process to ensure our plans are sufficiently flexible to navigate through price cycles and the energy transition, and (iii) been a leader in ESG, including being the first U.S. exploration and production company to set greenhouse gas (GHG) emissions intensity reduction targets in 2017. Further, in October 2020 we became the first U.S.-based oil and gas company to adopt a Paris-aligned climate-risk strategy with specific targets, including:

| • | Setting an ambition to become a net-zero company for operational (scope 1 and scope 2) emissions by 2050; |

| • | Revising our previous operational greenhouse gas emissions intensity reduction target to 35-45% by 2030, from the earlier 5-15% goal; |

| • | Endorsing the World Bank Zero Routine Flaring by 2030 initiative, with an ambition to meet the goal by 2025; |

| • | Adding continuous methane monitoring devices to our operations, with an initial focus on our Lower 48 facilities; |

| • | Advocating for a U.S. carbon price to address end-use (scope 3) emissions through our membership in the Climate Leadership Council; and |

| • | Including ESG performance in executive and employee compensation programs. |

We are proud of our leadership in ESG and we are committed to continued ESG excellence.

YOUR INPUT IS VALUED AND YOUR VOTE IS VERY IMPORTANT

We strongly believe that regular engagement with all of our stakeholders – stockholders, employees, customers, suppliers, advocacy groups, governments and communities – is critical to our long-term success. The Annual Meeting is another opportunity for stockholders to express views on matters relating to ConocoPhillips’ business, and we hope you will participate.

Whether or not you plan to participate in the Annual Meeting, and no matter how many shares you own, we encourage you to vote promptly. Prior to the meeting, you may sign and return your proxy card, use telephone or Internet voting, or visit the Annual Meeting website at www.conocophillips.com/annualmeeting to register your vote. Instructions on how to vote begin on page 125.

We look forward to sharing more about our company and your company during the Annual Meeting on May 11.

Thank you for your continued support.

|

|

|

| Ryan M. Lance | Robert A. Niblock | |

| Chairman and Chief Executive Officer | Lead Director |

| 2021 Proxy Statement | 3 |

Notice of 2021 Annual Meeting of Stockholders

|

DATE & TIME Tuesday, May 11, 2021 |

|

LOCATION Online at |

|

RECORD DATE March 15, 2021 |

Proposals Requiring Your Vote

| Purpose | Board Recommendation | Page | ||

| 1. Election of 15 Directors | FOR each nominee | 36 | ||

| 2. Ratification of Independent Registered Public Accounting Firm | FOR | 50 | ||

| 3. Advisory Approval of the Compensation of our Named Executive Officers | FOR | 52 | ||

| 4. Stockholder Proposal – Simple Majority Vote Standard | FOR | 118 | ||

| 5. Stockholder Proposal – Emission Reduction Targets | AGAINST | 120 |

Only stockholders of record at the close of business on March 15, 2021 will be entitled to receive notice of, and to vote at, the Annual Meeting. A list of stockholders entitled to vote at the Annual Meeting will be available for inspection by any stockholder at our offices in Houston, Texas during ordinary business hours for a period of 10 days prior to the meeting. This list will also be available for stockholders to view online at the time of the meeting.

Visit our Annual Meeting website at www.conocophillips.com/annualmeeting to learn more about our Annual Meeting, review and download this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 2020 (the “Annual Report”), submit questions in advance of the Annual Meeting, and sign up for electronic delivery of materials for future annual meetings.

March 29, 2021

By Order of the Board of Directors

Shannon B. Kinney

Corporate Secretary

| PARTICIPATE IN THE FUTURE OF CONOCOPHILLIPS—VOTE NOW | Your vote is very important to us and to our business. Even if you plan to participate in the Annual Meeting, please vote right away. For more information on voting, please see “Available Information and Questions and Answers About the Annual Meeting and Voting” beginning on page 124. | ||||||||

|

ONLINE Use your smartphone or computer. www.proxyvote.com |

|

PHONE CALL Dial (800) 690-6903 toll-free 24/7. |

||||||

|

MAIL Cast your ballot, sign your proxy card, and send by mail in the enclosed postage- paid envelope. |

|

ANNUAL MEETING You may participate in the Annual Meeting and vote electronically. |

Important Notice Regarding the Availability of Proxy Materials for the 2021 Annual Meeting of Stockholders to be Held on May 11, 2021: This Proxy Statement and our 2020 Annual Report are available at www.conocophillips.com/ annualmeeting. | |||||

| 4 | ConocoPhillips |

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. For more complete information regarding ConocoPhillips’ 2020 performance, please review our Annual Report.

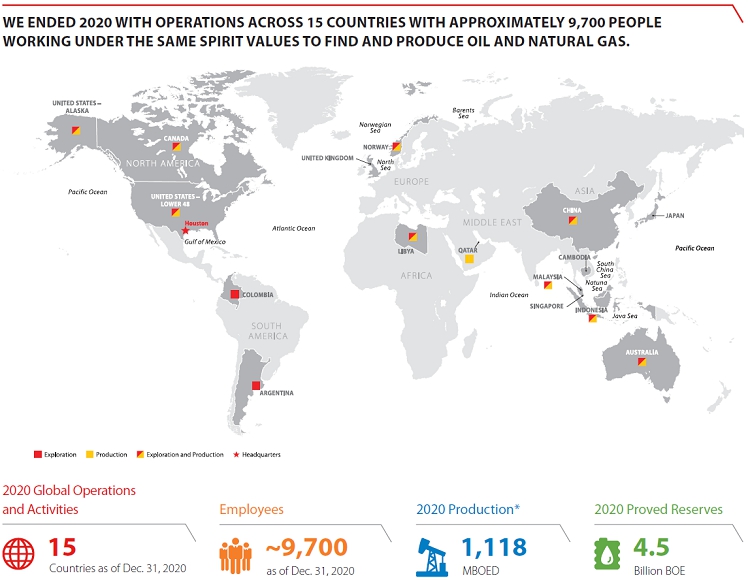

Company Overview

Headquartered in Houston, Texas, as of December 31, 2020, ConocoPhillips had operations and activities in 15 countries, $63 billion of total assets, and approximately 9,700 employees. Production excluding Libya averaged 1,118 thousand barrels of oil equivalent per day (“MBOED”) in 2020, and proved reserves were 4.5 billion barrels of oil equivalent (“BBOE”) as of December 31, 2020. Our key focus areas include safely operating producing assets, executing major developments, and exploring for new resources in promising areas. On January 15, 2021, we completed our acquisition of Concho Resources Inc. (“Concho”), an independent oil and gas exploration and production company with operations in New Mexico and West Texas, significantly increasing our Permian position by adding complementary acreage across the Delaware and Midland basins. Our diverse, low cost of supply portfolio includes resource-rich unconventional plays in North America; conventional assets in North America, Europe, Asia; LNG developments; oil sands assets in Canada; and an inventory of global conventional and unconventional exploration prospects.

| * | Production excludes Libya. |

| 2021 Proxy Statement | 5 |

Proxy Summary

A Challenging Year Affirms Our Value Proposition

We entered 2020 committed to the core principles of our value proposition to provide superior returns to stockholders through price cycles – focusing on free cash flow generation, maintaining a strong balance sheet, delivering compelling returns on and of capital, and demonstrating ESG leadership. Supporting these core principles were our strategic cash flow allocation priorities: (1) invest enough capital to sustain production and pay the existing dividend; (2) grow the dividend annually; (3) maintain ‘A’ credit rating; (4) return greater than 30 percent of cash from operations to stockholders; and (5) disciplined investment to expand cash from operations. Before the end of the first quarter of 2020, the energy landscape changed dramatically with simultaneous supply and demand shocks that drove the industry into a severe downturn. The supply shock was triggered by disagreements between OPEC and Russia, beginning in early March, which resulted in significant supply coming onto the market and an oil price war. The demand shock was triggered by the COVID-19 pandemic, which caused unprecedented social and economic consequences.

COVID-19 Response

Throughout the pandemic, our priorities have been consistent: protecting the health and well-being of our workforce; mitigating the spread of COVID-19; and safely running the business. As a global company, we had to respond swiftly to the local realities, and do so in a way that was consistent with our SPIRIT Values, which include:

Safety – Implementing rigorous cleaning and disinfecting processes and mitigation protocols to keep our workplace safe, including temperature scans, social distancing, face covering requirements and increased sanitation

People – Communicating regularly with employees and providing sufficient flexibility to support any challenges

Integrity – Transitioning to a remote work environment, as needed, to ensure the safety of our employees, partners, and the community

Responsibility – Standing up a Crisis Management Support Team in March 2020

Innovation – Equipping our employees with the necessary technology and training to seamlessly transition to and from a remote work environment

Teamwork – Continuing to run the business, despite unprecedented challenges, including successfully executing our curtailment program, and preserving long-term value for our stockholders

Our workforce and operations have adjusted to mitigate the impacts of the COVID-19 pandemic. In remote locations, such as offshore platforms, the North Slope of Alaska, Curtis Island in Australia, and western Canada and Indonesia, where operations require working in confined spaces where viruses could rapidly spread, personnel are asked to perform a self-assessment for symptoms of illness each day and, when appropriate, are subject to more restrictive measures traveling to and working on location. We took a thoughtful approach to staffing levels in certain operations to minimize health risk exposure and increase social distancing. These mitigation measures have thus far been effective at reducing business operations disruptions, and we continue to evolve and modify our business continuity plans.

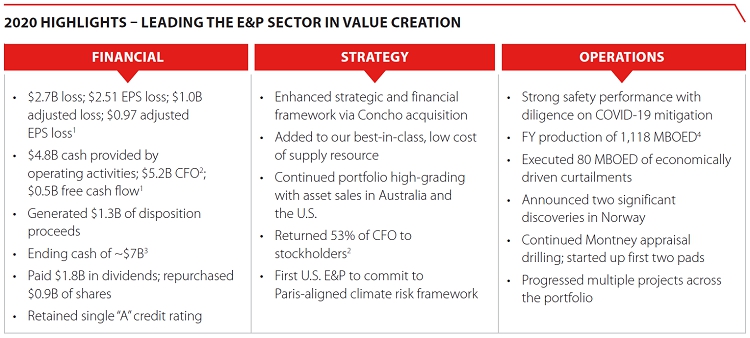

Company Performance

Our decisive actions over the last several years, including focusing on free cash flow generation, high-grading our asset base, lowering the cost of supply of our investment resource portfolio, and strengthening our balance sheet positioned us well relative to our independent exploration and production peers for the volatile cycles of our industry. When the recent downturn started in early 2020, we closely monitored the market and took prudent actions in response to an unprecedented challenge, including reducing our 2020 operating plan capital by $2.3 billion, reducing our 2020 operating costs by $600 million and suspending our share repurchase program, thereby decreasing uses of cash by approximately $5 billion in 2020. Furthermore, when oil prices weakened during the second quarter of 2020, our strong balance sheet enabled us to forgo some production and cash flow in anticipation of receiving higher cash flows for those volumes in the future. To that end, we established an economic framework for evaluating our assets on a month-to-month basis to determine where to implement production curtailments to preserve stockholder value. It was a historic year, and even with mitigation efforts, the disruption to our industry caused by the COVID-19 pandemic had a corresponding impact on our financial performance. See our Annual Report on Form 10-K for information on how the COVID-19 pandemic impacted us and a more detailed discussion of our performance.

| 6 | ConocoPhillips |

Proxy Summary

Notwithstanding the challenges we faced in 2020, the year served to strengthen our confidence that we are offering the right value proposition for this cyclical business. The chart below highlights how we ended 2020 ready to lead the sector in value creation:

| 1 | Adjusted loss, adjusted EPS loss and free cash flow are non-GAAP measures. Further information related to these measures as well as reconciliations to the nearest GAAP measure are included on Appendix A. |

| 2 | Cash provided by operating activities was $4.8B. Excluding operating working capital of ($0.4B), cash from operations was $5.2B. Cash from operations (CFO) is a non-GAAP measure. Further information related to this measure is included on Appendix A. |

| 3 | Ending cash includes cash, cash equivalents, and restricted cash totaling $3.3B and short-term investments of $3.6B. Restricted cash was $0.3B. |

| 4 | Production excludes Libya. |

Importantly, we delivered these milestones while operating safely and with a commitment to ESG excellence. We maintained our ongoing practice of engaging with stockholders throughout 2020 and received consistent feedback that our disciplined, returns-focused strategy is the right one for our business and that our disclosures were addressing the things that our stockholders care about most.

ConocoPhillips understands the importance of maintaining a robust stockholder engagement program. During 2020, ConocoPhillips continued this long-standing practice. Executives and management from our human resources, legal, investor relations, government affairs, and sustainable development groups routinely engaged with stockholders. When appropriate, directors also met with stockholders on a variety of topics, including our response to the COVID-19 pandemic, strategy and value proposition, corporate governance, executive compensation, human capital management, culture, climate change, and sustainability. We spoke with representatives from our top institutional investors, mutual funds, public pension funds, labor unions, and socially responsible funds to hear their views on these important topics. Overall, investors expressed strong support for ConocoPhillips. We believe our regular stockholder engagement was productive and provided an open exchange of ideas and perspectives for both ConocoPhillips and our stockholders. For more information, see “Stockholder Engagement and Board Responsiveness” beginning on page 16 and “2020 Say on Pay Vote Result, Stockholder Engagement, and Board Responsiveness” beginning on page 57.

| 2021 Proxy Statement | 7 |

Proxy Summary

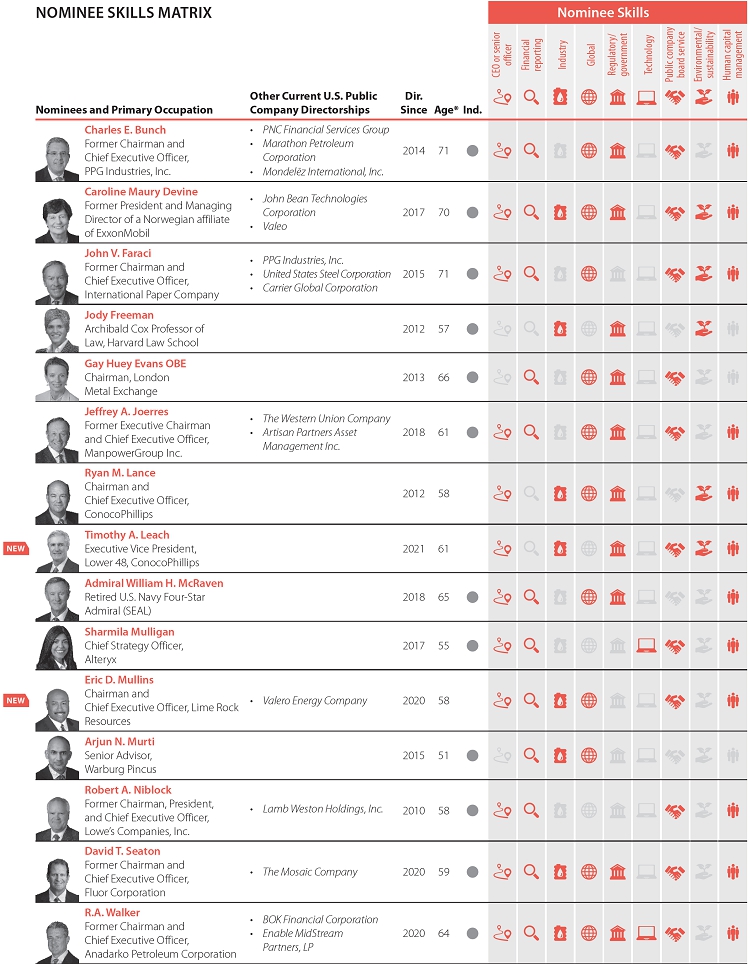

The Board recommends a vote FOR each of the 15 nominees listed below. All of the nominees are currently serving as directors.

| 8 | ConocoPhillips |

Proxy Summary

| 2021 Proxy Statement | 9 |

Proxy Summary

Board Refreshment and Diversity

The Committee on Directors’ Affairs regularly evaluates the size and composition of the Board and continually assesses whether the composition appropriately relates to ConocoPhillips’ strategic needs, which change as our business environment evolves. When conducting its review of the appropriate skills and qualifications desired of directors, the Committee on Directors’ Affairs considers any planned retirements from the Board, as well as background and diversity (including gender, ethnicity, race, national origin, and geographic background). As shown below, the Board balances its commitment to maintaining institutional knowledge with the need for fresh perspectives that board refreshment and director succession planning provide.

Our Board oversees the development and execution of our strategy. We have robust governance practices and procedures that support our strategy. To maintain and enhance independent oversight, our Board is focused on its composition and effectiveness and has implemented a number of measures for continuous improvement.

The measures outlined below align our corporate governance structure with our strategic objectives and enable the Board to effectively communicate and execute our culture of compliance and rigorous risk management.

| COMPREHENSIVE, INTEGRATED GOVERNANCE PRACTICES | |||

|

|||

| • | Our Board is committed to regular renewal and refreshment. We are continuously focused on the director recruitment and selection process. As a result, we have an experienced and diverse group of nominees. See “How Are Nominees Selected?” beginning on page 36. | ||

| • | Our Board’s thorough onboarding and director education processes complement this recruitment process. See “Director Onboarding and Education” beginning on page 23. | ||

| • | Our independent Lead Director’s robust duties are set forth in our Corporate Governance Guidelines. See “Our Lead Director” beginning on page 20. | ||

| • | Our non-employee directors meet privately in executive session at each regularly scheduled Board meeting. | ||

| • | Our Board reviews CEO and senior management succession and development plans at least annually and assesses candidates during Board and committee meetings and in less formal settings. | ||

| • | Our Board and committees conduct intensive and thoughtful annual evaluations of the Board, its committees, and its directors, including self-evaluations and peer assessments. See “Board and Committee Evaluations” on page 22. | ||

| • | Our directors provide feedback on Board and committee effectiveness, including areas such as Board composition and the Board/management succession-planning process. | ||

| • | Our Board regularly assesses its leadership structure. | ||

| • | Our Board’s decision-making is informed by input from stockholders. | ||

|

The governance best practices we have adopted support these general principles: |

|

• Annual election of all directors • Long-standing commitment to sustainability • Stock ownership guidelines for directors and executives • Independent Audit and Finance, Human Resources and Compensation and Directors’ Affairs committees • Transparent public policy engagement • Prohibition on pledging and hedging for all employees |

• Proxy access • Active stockholder engagement • Majority independent Board • Executive sessions of non-employee directors held at each regularly scheduled Board meeting • Empowered independent Lead Director • Majority vote standard in uncontested elections • Clawback Policy |

| 10 | ConocoPhillips |

Proxy Summary

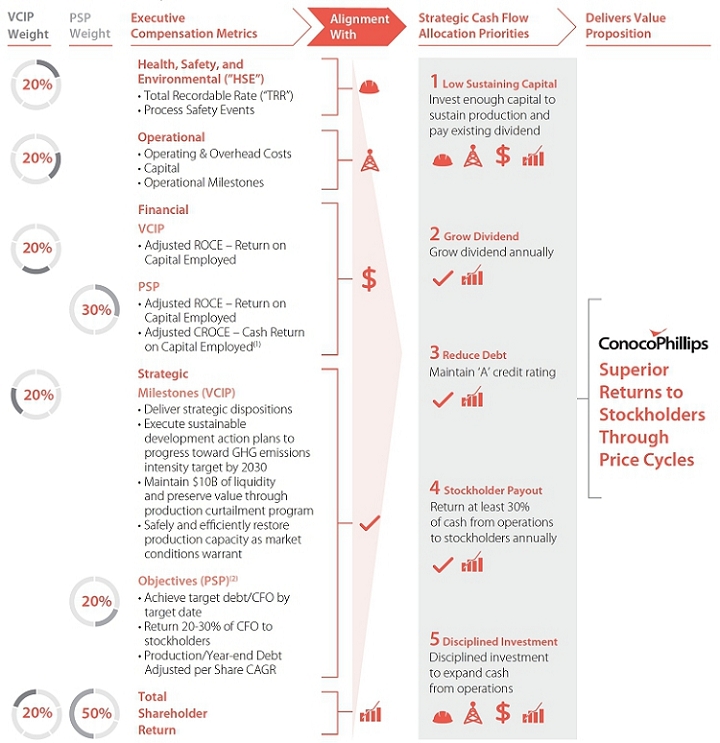

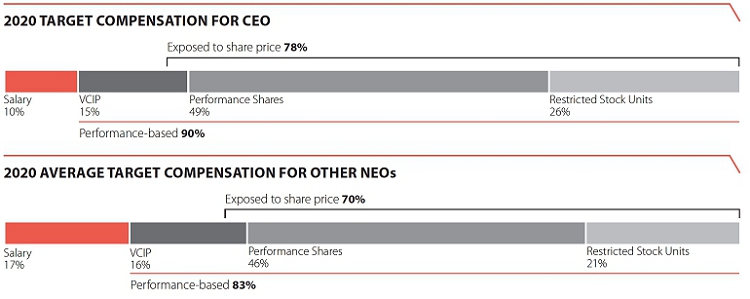

2020 Compensation Program Structure

Each year the Human Resources and Compensation Committee (the “HRCC”), advised by its independent compensation consultant and informed by feedback from stockholders, undertakes a rigorous process to set and review executive compensation. The HRCC believes a substantial portion of our executive compensation should be equity-based and focused on rewarding long-term performance and furthermore, that this approach most closely aligns the interests of our top executives with those of our stockholders.

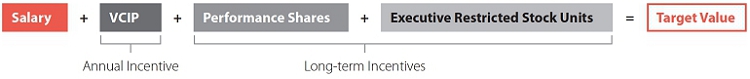

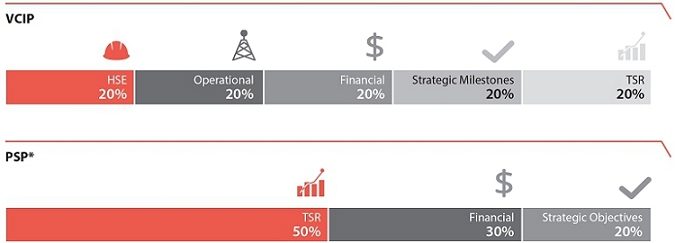

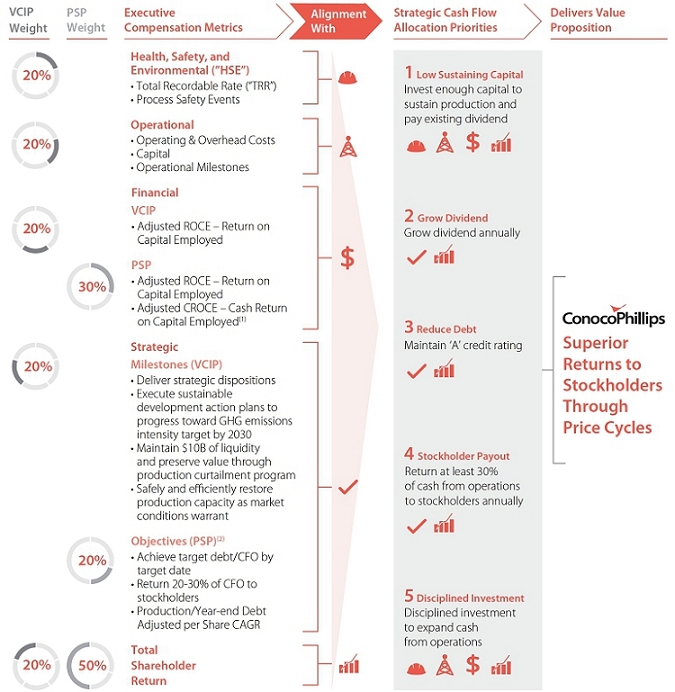

The four primary elements of our executive compensation program are designed to provide a target total value for compensation that is competitive with our peers and attracts and retains the talented executives necessary to manage a large and complex company like ConocoPhillips. The following chart summarizes the principal components of our executive compensation program and the performance drivers of each element.

| 2020 Element of Pay | Overview | Key Benchmarks/Performance Measures | ||

|

Annual Salary

|

Fixed cash compensation to attract and retain executives and balance at-risk compensation

Range: Salary grade minimum/maximum

|

• Benchmarked to compensation reference group median; adjusted for experience, responsibility, performance, and potential

| ||

|

Variable Cash Incentive Program (“VCIP”)

|

Variable annual cash compensation to motivate and reward executives for achieving annual goals and strategic milestones that are critical to our strategic priorities

Range: 0% - 200% of target for corporate performance, inclusive of individual adjustments |

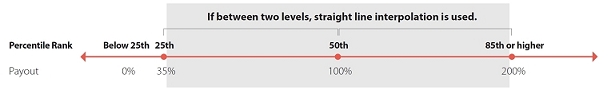

• Health, Safety, and Environmental (20%) • Operational (20%) • Financial – Absolute and Relative Adjusted ROCE (20%) • Strategic Milestones (20%) • Relative TSR (20%) • Measured over a one-year performance period and aligned with our strategic priorities |

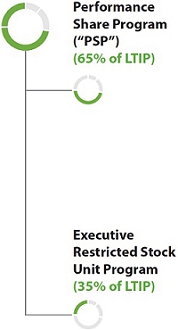

| Long-Term Incentive Program (“LTIP”) | ||||

|

Variable long-term equity-based compensation to motivate and reward executives for achieving multi-year strategic priorities

Granted at beginning of three-year performance period with final cash payout following the conclusion of the performance period based on HRCC assessment of progress toward pre-established corporate performance metrics and stock price on the settlement date

Range: 0% - 200% of total target award, inclusive of corporate performance adjustments |

• Relative TSR (50%)(1) • Financial – Relative Adjusted ROCE and/or Adjusted CROCE (30%)(1)(2) • Strategic Objectives (20%)(1) • Measured over a three-year performance period and aligned with our strategic priorities • Stock price | ||

|

Long-term equity-based compensation designed to encourage executive retention while incentivizing absolute performance that is aligned with stockholder interests

Annual award settles in cash on third anniversary of grant date based on the stock price on the settlement date(3)

Range: 0% - 100% of target |

• Stock price • Vest in three years | |||

| (1) | Performance share programs commencing prior to 2019, including PSP 18, include Strategic Objectives as a PSP measure; however, effective with performance share programs commencing in 2019, Strategic Objectives has been eliminated as a performance measure from the PSP and the weighting of relative TSR has increased from 50% to 60% and relative Financial has increased from 30% to 40%. This change allows the HRCC to calculate payouts under the LTIP on a formulaic basis. |

| (2) | Beginning with performance share programs commencing in 2020, the financial performance measure was further simplified by removing Adjusted CROCE, thereby strengthening the correlation between the payout and the remaining Adjusted ROCE metric. |

| (3) | Beginning with 2020 grants, Executive Restricted Stock Unit grants will be settled in shares rather than cash to provide additional common stock ownership through ConocoPhillips’ executive compensation programs, and better align with market practice. |

| 2021 Proxy Statement | 11 |

Proxy Summary

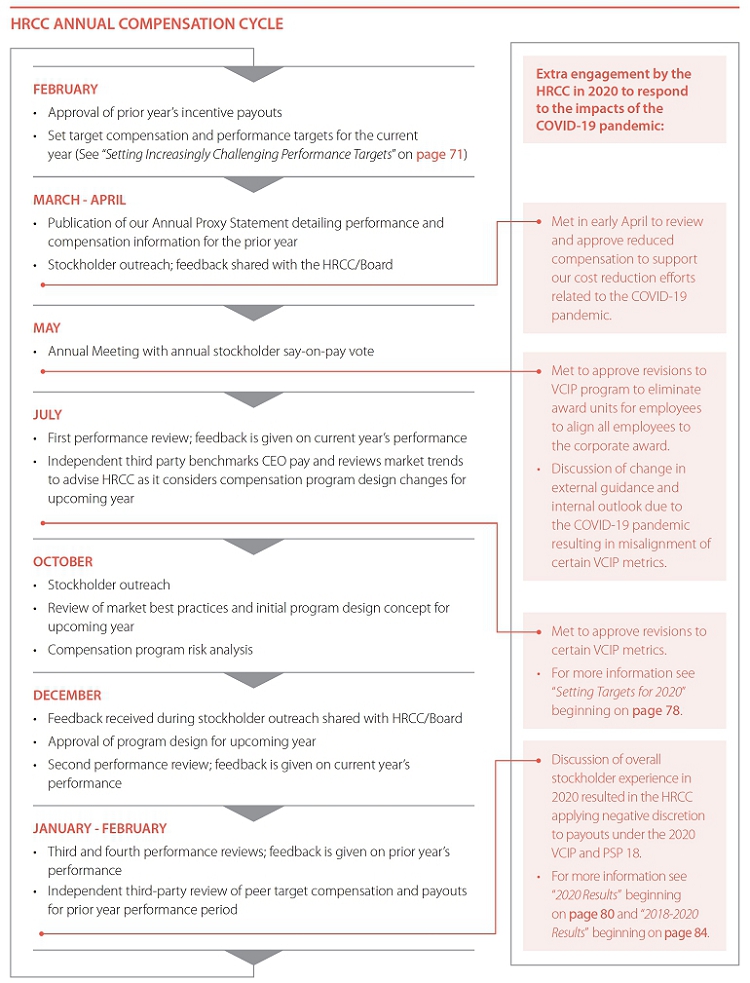

Compensation and Governance Practices

Management and the HRCC believe pay and performance are best aligned through a rigorous review process of our executive compensation programs. This process, which is described under the heading “HRCC Annual Compensation Cycle” on page 67, consists of benchmarking against our peers, completing four distinct performance reviews, incorporating stockholder feedback, and seeking the assistance of an independent third-party compensation consultant.

In connection with this ongoing review and based on feedback received through our stockholder outreach program, the HRCC maintains what it believes are best practices for executive compensation. Below is a summary of those practices.

| WHAT WE DO | |

|

Pay for Performance: We align executive compensation with corporate and individual performance on both a short-term and long-term basis. The majority of our target total direct compensation for employees who are a senior vice president or higher, executives who report directly to the CEO, or any other employee considered an officer under Section 16(b) of the Securities Exchange Act of 1934 (“Senior Officers”) is variable incentive compensation. Actual total direct compensation varies based on the extent of achievement of, among other things, safety, operational, and financial performance, and strategic goals, as well as stock performance and individual performance. |

|

Stock Ownership Guidelines: Our Stock Ownership Guidelines require executives to own stock or have an interest in restricted stock units valued at a multiple of base salary, ranging from 1.8 times base salary for lower-level executives to six times base salary for the CEO. Each director is expected to own stock in the amount of the aggregate annual equity grants he or she received during his or her first five years on the Board. All of our Named Executive Officers and current directors meet or exceed these requirements. |

|

Mitigation of Risk: Our compensation plans have provisions designed to mitigate undue risk, including caps on the maximum level of payouts, clawback provisions, varied performance measurement periods, and multiple performance metrics. In addition, the Board, the HRCC, and management perform an annual risk assessment to identify potential undue risk created by our incentive plans. |

|

Clawback Policy: Executives’ incentive compensation is subject to a clawback that applies in the event of certain financial restatements. This is in addition to provisions contained in our award documents that, if an executive engages in any activity we determine is detrimental to ConocoPhillips, permit us to suspend the right to exercise, refuse to honor the exercise of awards already requested, or cancel awards granted. |

|

Independent Compensation Consultant: The HRCC retained Frederic W. Cook & Co., Inc. (“FW Cook”) to serve as its independent executive compensation consultant. During 2020, FW Cook provided no other services to ConocoPhillips. |

|

Double Trigger: Beginning with awards granted pursuant to long-term incentive programs in 2014, equity awards do not vest in the event of a change in control unless there is also a qualifying termination of employment. |

|

Limited Payouts: The HRCC has implemented caps on all executive incentive programs. Payouts for the Executive Leadership Team, which includes the Named Executive Officers, under the annual incentive program and Performance Share Program, are limited to 200 percent of the total target award. |

| WHAT WE DON’T DO | |

|

No Excise Tax Gross-Ups for Future Change in Control Plan Participants: In 2012, we eliminated excise tax gross-ups for future participants in our Change in Control Severance Plan. |

|

No Current Payment of Dividend Equivalents on Unvested Long-Term Incentives: Dividend equivalents on unvested restricted stock units awarded under the long-term incentive programs are only paid out to the extent that the underlying award is ultimately earned. |

|

No Repricing of Underwater Stock Options: Our plans do not permit us to reprice, exchange, or buy out underwater options without stockholder approval. |

|

No Pledging, Hedging, Short Sales, or Derivative Transactions: Company policies prohibit all of our employees from pledging, hedging, or trading in derivatives of ConocoPhillips stock. |

|

No Employment Agreements for Our Named Executive Officers: All compensation for our Named Executive Officers is established by the HRCC. |

| 12 | ConocoPhillips |

| 2021 Proxy Statement | 13 |

ConocoPhillips recognizes the importance of delivering energy to the world and we are committed to demonstrating leadership in the production of natural gas and oil by being competitive both financially and with our environmental and social performance. As we manage through the uncertainty of the energy transition, natural gas and oil will still be in demand in a 2-degree world and flexibility and resilience will be required to ensure that supply. Our governance structure is designed to ensure that management of sustainability-related risks and opportunities throughout the organization is incorporated into our strategic and operating decisions. Our governance model extends from the Board’s Public Policy Committee, through the executive team, to leaders and internal subject matter experts.

| Operated assets and major projects are examined through our sustainable development (“SD”) risk management process against the physical, social, and political settings of our operations to ascertain potential risks. Sustainability-related risks are identified for climate change, water, biodiversity and stakeholder engagement, and action plans for each priority risk include line-of-sight goals for business units and key functions. |  |

Managing Climate-Related Risks

Our comprehensive governance framework provides Board and management oversight of our climate-related risk processes and mitigation plans as outlined in our Managing Climate-Related Risks report. Our integrated management system approach to identify, assess, and manage climate-related risks links directly to the enterprise risk management process, which includes an annual review by executive leadership and the Board.

We use scenarios in our strategic planning process to:

| • | Gain a better understanding of external factors that impact our business; |

| • | Test the robustness of our strategy across different business environments; |

| • | Communicate risks appropriately; and |

| • | Adjust prudently to changes in the business environment. |

| 14 | ConocoPhillips |

ESG Excellence

| In 2020 we announced a Paris-aligned climate risk framework – a first for a U.S.-based oil and gas company. The framework includes specific emissions intensity reduction goals, a commitment to end routine flaring, permanent methane monitoring in Lower 48 and advocating for a well-designed carbon price in the U.S. In adopting this framework, we decided that a strategy of being a low cost of supply, Paris-aligned E&P puts us in a position to contribute to meeting global energy demand with resources that are the most likely to be developed in any scenario that meets the Paris agreement’s aim of a less-than-2 degrees Celsius temperature increase. Looking to the future, we have created a Low Carbon Team to further evaluate low-carbon opportunities and technologies such as carbon capture and utilization, the hydrogen economy, and alternative energy technologies which can further reduce our GHG emissions intensity. This framework supports our ambition to reach a net-zero operational emissions target by 2050 and demonstrates our commitment to greenhouse gas emissions reductions and managing climate-related risks and issues throughout the business. It also ensures that appropriate risk management discussions occur throughout the lifecycles of our assets. |

Managing Water Risks

Access to water is essential to the communities and ecosystems near our operations and to our ability to produce natural gas and oil. Fresh water is a limited resource in regions experiencing water scarcity, and local availability may be affected in the future by physical effects of climate change, such as droughts. Although access to water and water scarcity are issues of global importance, we manage water risks and mitigate potential impacts to water resources locally, taking into account the unique social, economic, and environmental conditions of each basin or offshore marine area.

Managing Biodiversity Risks

The World Economic Forum estimates that diversity within and between species and the diversity of ecosystems is declining faster than at any other time in human history. We assess potential biodiversity impacts associated with the direct and indirect operational footprint of our onshore and offshore assets through our integrated management system approach. We address potential impacts to areas with biological or cultural significance using the Mitigation Hierarchy and proactive conservation.

Engaging Stakeholders

We are committed to respectfully engaging with local stakeholders to understand their values and interests, reduce the impact of our operations and contribute to economic opportunities. We build long-term benefits for both ConocoPhillips and local communities by first listening to understand concerns, finding mutually agreeable solutions to mitigate these concerns through our actions and then integrating them into planning and decision-making. Our approach with communities is to build strong relationships with transparency, courtesy and trust. This creates the best solutions to potential issues for the community and the business and builds a base for shared value from development.

Recognition

Notable ESG achievements in 2020 include:

| • | Named to the North American Dow Jones Sustainability Index as the top U.S. performer in the Oil & Gas Upstream & Integrated sector and included in the Sustainability Yearbook 2021; |

| • | Rated “A” by MSCI; |

| • | Rated in the 6th percentile of oil and gas producers by Sustainalytics; |

| • | Received a score of “1” on both environmental and social metrics from ISS QualityScore; and |

| • | Achieved a B rating for CDP, which is above the industry and North American average. |

To learn more about sustainable development at ConocoPhillips, please view our Sustainability Report on our website under “Company Reports and Resources.”

| 2021 Proxy Statement | 15 |

The Committee on Directors’ Affairs and our Board annually review our governance structure, taking into account any changes in Securities and Exchange Commission (the “SEC”) and New York Stock Exchange (the “NYSE”) rules, as well as current best practices. Our Corporate Governance Guidelines address the matters shown below, among others.

|

• Director qualifications; • Director responsibilities; • Board committees; |

• Director access to officers, employees, and independent advisors; • Director compensation and stock ownership requirements; |

• Director orientation and continuing education; • Chief Executive Officer evaluation and management succession planning; and • Board performance evaluations. |

The Corporate Governance Guidelines are posted on our website under “Investors > Corporate Governance” and are available in print upon request (see “Available Information and Questions and Answers about the Annual Meeting and Voting” beginning on page 124).

Stockholder Engagement and Board Responsiveness

ConocoPhillips is committed to engaging in constructive and meaningful conversations with stockholders and to building and managing long-term relationships based on mutual trust and respect. The Board values the input and insights of our stockholders and believes that consistent and effective Board-stockholder communication strengthens the Board’s role as an active, informed, and engaged fiduciary.

Board Oversight of Engagement

In an effort to continuously improve ConocoPhillips’ governance processes and communications, the Committee on Directors’ Affairs has adopted Board and Shareholder Communication and Engagement Guidelines. Recognizing that director attendance at the annual meeting provides stockholders with a valuable opportunity to communicate with Board members, we expect directors to attend. In 2020, all of the directors standing for re-election participated in the annual meeting. We anticipate that all of the director nominees will participate in the Annual Meeting in May. We also support an open and transparent process for stockholders and other interested parties to contact the Board in between annual meetings as noted under “Communications with the Board of Directors” on page 19.

| 16 | ConocoPhillips |

Corporate Governance Matters

Ongoing Engagement and Board Reporting

Executives and management from ConocoPhillips’ human resources, legal, investor relations, government affairs, and sustainable development groups and, when appropriate, directors meet with stockholders regularly on a variety of topics. Management provides reports to the Board and its committees regarding the key themes and results of these conversations, including typical investor concerns and questions, emerging issues, and pertinent corporate governance matters.

In 2020, we actively reached out to investors owning more than 50 percent of our stock to invite them to participate in in-depth discussions with our engagement team. We gained valuable feedback during these discussions, which was shared with the Board and its relevant committees.

Board Responsiveness

Our Board is committed to constructive engagement with investors. We regularly evaluate and respond to the views expressed by our stockholders. This dialogue has led to enhancements in our corporate governance, environmental, social, and executive compensation activities that the Board believes are in the best interest of ConocoPhillips and our stockholders.

To better communicate with our stockholders, ConocoPhillips has formed a Governance Leadership Team, which is an engagement team comprised of management and internal subject matter experts on strategy, governance, compensation, compliance, human capital management, and environmental and social issues, to lead a comprehensive, year-round stockholder engagement program.

The Governance Leadership Team that spearheaded our 2020 outreach efforts consisted of the following members of ConocoPhillips management: Ellen R. DeSanctis, Senior Vice President, Corporate Relations; Heather G. Sirdashney, Vice President, Human Resources and Real Estate and Facilities Services; Brian E. Pittman, General Manager, Compensation and Benefits; Shannon B. Kinney, Deputy General Counsel, Chief Compliance Officer, and Corporate Secretary; and Lloyd L. Visser, Vice President, Sustainable Development. In some instances, our Lead Director, Robert A. Niblock, and our Chair of the HRCC, Charles E. Bunch, also participated in stockholder meetings.

In these meetings, we discussed how the COVID-19 pandemic was impacting our business, our strategy and value proposition, corporate governance, executive compensation, human capital management, culture, climate change, and sustainability. In 2020, the feedback received from our stockholders on these and other topics was overwhelmingly positive.

| 2021 Proxy Statement | 17 |

Corporate Governance Matters

| WHAT WE LEARNED FROM OUR MEETINGS WITH STOCKHOLDERS |

|

• Stockholders were interested in how we responded to the global pandemic, including impacts to our strategy, workforce and compensation decisions • Stockholders were interested in learning more about the directors added to the Board and appreciated the refreshment process undertaken to ensure optimal Board composition • Stockholders were pleased to learn of our commitment to disclose U.S. EEO-1 data and other progress we have made on diversity and inclusion efforts • Stockholders were supportive of our ongoing review of our performance peer group and compensation reference group • Stockholders were supportive of our inclusion of the S&P 500 Total Return Index* in our performance peer group • Stockholders commended our announcement to adopt a Paris-aligned climate risk framework to meet net-zero operational emissions by 2050, and wanted to learn more about how we would accomplish our ambitions |

|

| CHANGES INFORMED BY STOCKHOLDER INPUT |

|

As part of our continued commitment to constructive engagement with our stockholders, we devote a meaningful amount of time to discussing the views voiced by our stockholders and share such input with our Board and its committees, where applicable, for their consideration. Our dialogue has led to the following changes: • Provided additional disclosure around the impact the global pandemic had on the business, our strategy and compensation (see page 6 and page 54) • Continued transparency around targets and results for our annual and long-term incentive programs (see pages 78-86) • Adopted a Paris-aligned climate risk framework with an ambition to meet net-zero operational emissions by 2050 (see page 15) • Effective with the annual incentive and performance share programs commencing in 2020, added the S&P 500 Total Return Index* to the performance peer group and amended the performance peer group of PSP 19 to include the S&P 500 Total Return Index*, broadening the performance benchmark beyond industry peers to further align executive pay with long-term stockholder interests • Beginning with 2020 grants, Executive Restricted Stock Unit grants will be settled in shares rather than cash to provide additional common stock ownership through ConocoPhillips’ executive compensation programs, and better align with market practice • Elected two new directors to our Board with extensive industry experience since our last Annual Meeting |

| * | Relative TSR metrics only |

| 18 | ConocoPhillips |

Corporate Governance Matters

Communications with the Board of Directors

Stockholders and interested parties may write or call our Board by contacting our Corporate Secretary as provided below:

|

Write to: |  |

Call: |  |

Email: |  |

Annual Meeting Website: | |||

| ConocoPhillips Board of Directors c/o Corporate Secretary ConocoPhillips P.O. Box 4783 Houston, TX 77210-4783 |

(281) 293-3030 | boardcommunication@ conocophillips.com | www.conocophillips.com/ annualmeeting | |||||||

Relevant communications will be distributed to the full Board or to individual directors, as appropriate. The Corporate Secretary will not forward business solicitations, or advertisements, junk mail and mass mailings, new product suggestions, product complaints, product inquiries, resumes and other forms of job inquiries, surveys, or communications that are unduly hostile, threatening, illegal, or similarly unsuitable. Any communication that is filtered out is available to any director upon request.

| Board Overview | ||

| • | Chairman and Chief Executive Officer: Ryan M. Lance | |

| • | Lead Director: Robert A. Niblock | |

| • | Active engagement by all directors | |

| • | 12 of our 15 director nominees are independent | |

| • | All members of the Audit and Finance Committee, Human Resources and Compensation Committee, and Committee on Directors’ Affairs are independent and the Public Policy Committee is comprised of only non-employee directors | |

Chairman and CEO Roles

ConocoPhillips believes that independent board oversight is an essential component of strong corporate performance and enhances stockholder value. A combined position of Chairman and CEO is only one element of our leadership structure. Under our Corporate Governance Guidelines, if the offices of Chairman and CEO are held by the same person, a lead director must be selected from among the non-employee directors. Robert A. Niblock currently serves as Lead Director. Furthermore, each of the Audit and Finance, Human Resources and Compensation, and Directors’ Affairs committees is made up entirely of independent directors. While the Board retains the authority to separate the positions of Chairman and CEO if it deems appropriate in the future, the Board believes the combined role of Chairman and CEO is currently effective. Combining these roles places one person in a position to guide the Board in setting priorities for ConocoPhillips and in addressing the risks and challenges we face. The Board believes that, while each of its directors brings a diversity of skills and perspectives to the Board, Mr. Lance, by virtue of his day-to-day involvement in managing ConocoPhillips, is best suited to perform this unified role.

The Board believes there is no single organizational model that is the best and most effective in all circumstances. As a result, the Board periodically considers whether the offices of Chairman and CEO should be combined and who should serve in such capacities. The Board will continue to reexamine its corporate governance policies and leadership structures on an ongoing basis to ensure that they continue to meet our needs.

| 2021 Proxy Statement | 19 |

Corporate Governance Matters

Our Lead Director

|

Robert A. Niblock Lead Director | |

• Lead Director since 2019 • Chair of Committee on Directors’ Affairs • Member of the Executive and Public Policy Committees

Consideration in Selecting the Current Lead Director Several factors are considered when the non-employee directors select a Lead Director, including experience serving on public company boards, tenure on the ConocoPhillips Board, leadership at the committee level, either at ConocoPhillips or on another board, areas of expertise (with a focus on leadership and corporate governance), interest, integrity, and ability to meet the time requirements of the position.

After considering all of the above factors the non-employee directors selected Mr. Niblock as Lead Director in May 2019. Prior to becoming Lead Director, Mr. Niblock served as an active director including service on the Committee of Directors’ Affairs (2014-present), the Public Policy Committee (2019-present), the Executive Committee (2014-present), the Audit and Finance Committee (2010-2014) and the Human Resources and Compensation Committee (2014-2019). In addition, he served as Chair of the Human Resources and Compensation Committee (2014-2019) and Chair of the Committee on Directors’ Affairs (2019-present). Mr. Niblock has developed a significant amount of institutional knowledge about ConocoPhillips, and the non-employee directors believe he is exceptionally qualified to serve as ConocoPhillips’ Lead Director. | ||

Independent Directors

The Board believes its current structure and processes encourage the directors to be actively involved in guiding the work of the Board. The Chairs of the Board’s committees establish their agendas and review their committee materials in advance of meetings, conferring with other directors and members of management as each deems appropriate. Moreover, each director is authorized to suggest agenda items and to raise matters that are not on the agenda at Board and committee meetings.

Our Corporate Governance Guidelines require our Lead Director to preside over an executive session of the non-employee directors at every meeting. Each executive session may include a discussion of the performance of the Chairman and CEO, matters concerning the relationship of the Board with the Chairman and CEO and other members of senior management, and such other matters as the non-employee directors deem appropriate. In addition, our Lead Director presides over a meeting of our independent directors at least once a year as required by the NYSE rules. No formal action of the Board is taken at these meetings, although the non-employee directors may subsequently recommend matters for consideration by the full Board. The Board may invite guest attendees for the purpose of making presentations, responding to questions by the directors, or providing counsel on specific matters within their areas of expertise.

LEAD DIRECTOR’S RESPONSIBILITIES:

| • | Presides at all meetings of the Board at which the Chairman is not present, including executive sessions of the Board, and manages the discussion with the Chairman following such executive sessions; |

| • | Serves as liaison between the Chairman and the non-employee directors; |

| • | Advises the Chairman of the Board’s informational needs and ensures appropriate information is provided to the Board; |

| • | In consultation with the Chairman, approves meeting agendas for the Board; |

| • | Approves meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

| • | Has authority to call meetings of the non-employee directors; |

| • | Approves the retention of consultants that report directly to the Board; |

| • | Ensures that the Board’s self-assessments are conducted annually to promote efficient and effective Board performance and functioning; |

| • | Evaluates the performance of the CEO in consultation with the Chair of the Human Resources and Compensation Committee; and |

| • | If requested by stockholders, after consulting with the Chairman and CEO, ensures that he or she will be available for appropriate engagements with those stockholders. |

| 20 | ConocoPhillips |

Corporate Governance Matters

The Corporate Governance Guidelines contain director independence standards that are consistent with the standards set forth in the NYSE Listed Company Manual to assist the Board in determining the independence of ConocoPhillips’ non-employee directors. Under such standards, a director is per se not independent if the director is a current employee of a company that has made payments to, or received payments from, ConocoPhillips for property or services in an amount which, in any of the last three fiscal years, exceeds the greater of $1 million, or 2 percent of such other company’s consolidated gross revenues. Mr. Mullins is chairman and chief executive officer of Lime Rock Resources. As a result of a transaction between ConocoPhillips and Lime Rock Resources in August 2018, Mr. Mullins is considered per se not independent until the expiry of the three-year lookback prescribed by the NYSE standards. In deciding to nominate Mr. Mullins to the Board, the Board determined that his extensive industry experience and valuable expertise in financing and strategic matters outweighed the fact that he cannot currently be considered independent. Furthermore, the Board currently consists of enough independent directors with the requisite skills and experience to serve on committees that require independent directors such that the addition of a non-independent director does not place too great a burden on the other independent directors.

Other than Mr. Mullins, the Board has determined that all non-employee directors meet the standards regarding independence set forth in the Corporate Governance Guidelines and are free of any material relationship with ConocoPhillips (either directly or indirectly as a partner, stockholder, or officer of an organization that has a relationship with ConocoPhillips). In making such determination, the Board specifically considered the fact that many of our directors may be directors, retired officers, and stockholders of companies with which we conduct business. In addition, some of our directors may serve as employees of, or consultants or advisors to, companies that do business with ConocoPhillips and its affiliates. In all cases, the Board determined that the nature of the business conducted and the interest of the director by virtue of such position were immaterial both to ConocoPhillips and to the director.

In recommending that each non-employee director other than Mr. Mullins is independent, our Board, with input from the Committee on Directors’ Affairs, considered relationships that, while not constituting related-party transactions in which a director had a direct or indirect material interest, nonetheless involved transactions between ConocoPhillips and a company with which a director is affiliated, whether through employment status or by virtue of serving as a director. Included in the Committee’s review were the following transactions, which occurred in the ordinary course of business. In all instances, it was determined that the nature of the business conducted and the dollar amounts involved were immaterial, both to ConocoPhillips and the relevant counterparty, and fell within independence standards set forth in the ConocoPhillips Corporate Governance Guidelines and the NYSE Listed Company Manual.

| Director | Matters Considered |

| Charles E. Bunch | Ordinary course business transactions with Marathon Petroleum Corporation |

| John V. Faraci | Ordinary course business transactions with Royal Bank of Canada and the National Fish and Wildlife Foundation |

| Gay Huey Evans OBE | Ordinary course business transactions with Standard Chartered PLC and IHS Markit Inc. |

| Jeffrey A. Joerres | Ordinary course business transactions with Johnson Controls International plc |

| Arjun N. Murti | Ordinary course business transactions with RS Energy Group Inc. |

| David T. Seaton | Ordinary course business transactions with The Mosaic Company, the American Petroleum Institute, the National Association of Manufacturers, and the Business Roundtable |

| R.A. Walker | Ordinary course business transactions with Anadarko Petroleum Corporation, Health Care Services Corp., CenterPoint Energy Corporation, the Business Roundtable, the American Petroleum Institute, the Permian Strategic Partnership, and the United Way of Greater Houston |

In accordance with SEC rules, we maintain a policy on related party transactions (“Related Party Transaction Policy”), which requires the Audit and Finance Committee to review all known Reportable Related Party Transactions. A Reportable Related Party Transaction is a transaction, arrangement, or relationship (or series of similar transactions, arrangements or relationships) in which:

| • | We (or one of our subsidiaries) was, is or will be a participant; |

| • | The aggregate amount involved exceeds $120,000 in any fiscal year; and |

| 2021 Proxy Statement | 21 |

Corporate Governance Matters

| • | Any person who is, or at any time since the beginning of ConocoPhillips’ last fiscal year was, an executive officer, director, director nominee or holder of at least 5 percent of our equity securities (each a “Covered Person”), or any of such Covered Person’s immediate family members, had, has or will have a direct or indirect material interest. |

In accordance with the Related Party Transaction Policy, Covered Persons are required to identify affiliations or relationships that they or their immediate family members have that could reasonably be expected to give rise to a Reportable Related Party Transaction. Based on this information, our legal staff, in consultation with the finance team, performs the necessary diligence to determine whether a Reportable Related Party Transaction exists. Upon determining that a transaction was, is, or will be a Reportable Related Party Transaction, the General Counsel presents all relevant facts and circumstances to the Audit and Finance Committee, which reviews transactions for materiality and determines whether the transaction is in the best interest of ConocoPhillips, before either approving, ratifying, or disapproving it. In making its decision, the Audit and Finance Committee considers whether the transaction is on terms comparable to those that could be obtained in arm’s length dealings with an unrelated third party and the extent of the Covered Person’s interest in the transaction, taking into account the conflicts of interest provisions of ConocoPhillips’ Code of Business Ethics and Conduct and such other factors as it believes are relevant.

The Audit and Finance Committee approved or ratified the following Reportable Related Party Transaction:

Cameron Smith, son-in-law of William L. Bullock, Jr., our EVP and Chief Financial Officer, was employed in a non-executive position. The aggregate value of the compensation paid to Mr. Smith during fiscal year 2020 was approximately $221,821, consisting of salary, annual incentive (earned in fiscal 2020 and paid in fiscal 2021), and restricted stock units. In addition, Mr. Smith received the standard benefits provided to other non-executive ConocoPhillips employees for his services during fiscal year 2020.

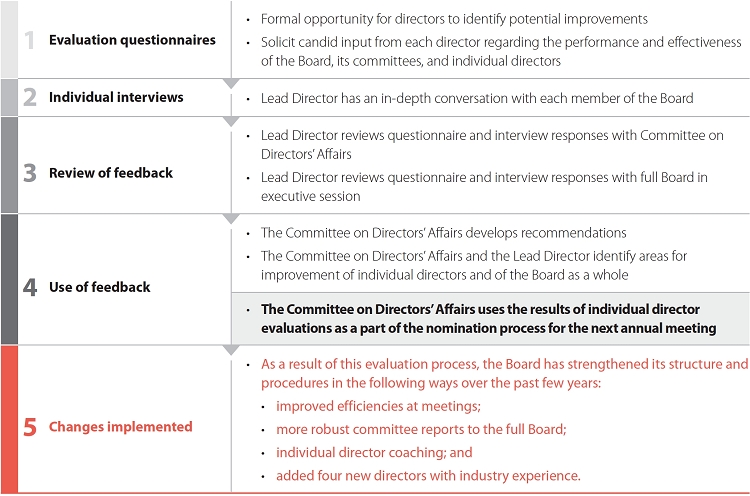

Board and Committee Evaluations

Each year, the Board performs a rigorous full Board evaluation, and each director performs a self-evaluation and an evaluation of each of his or her peers. Generally, the evaluation process described below is managed by the Corporate Secretary’s office with oversight by the Committee on Directors’ Affairs. However, the Committee on Directors’ Affairs periodically retains an independent third party to manage the evaluation process to ensure it remains as thorough and transparent as possible.

| 22 | ConocoPhillips |

Corporate Governance Matters

In addition to participating in the full Board evaluation, members of each committee also complete a detailed questionnaire annually to evaluate how well the committee is operating and to suggest improvements. Each committee’s Chair summarizes the responses and reviews them with the members of his or her respective committee.

The Committee on Directors’ Affairs reviews these evaluation processes annually and develops any changes it deems necessary to maintain best practices.

Director Onboarding and Education

The Board has an orientation and onboarding program for new directors and provides continuing education for all directors that is overseen by the Committee on Directors’ Affairs.

| New Director Orientation | The orientation program is tailored to the needs of each new director depending on his or her level of experience serving on other boards and knowledge of ConocoPhillips and the oil and gas industry. Materials provided to new directors include information on ConocoPhillips’ strategic plans, financial matters, corporate governance practices, Code of Business Ethics and Conduct, and other key policies and practices. The onboarding process includes a series of meetings with members of senior management and their staff for deep-dive briefings on ConocoPhillips’ operations and financial strategies and SPIRIT Values. In addition, the orientation program includes a visit to ConocoPhillips’ headquarters, and to the extent practicable, certain of our significant facilities. | |

| Continuing Director Education | Continuing director education is provided during portions of Board and committee meetings and is focused on topics necessary to assist them in discharging their duties, including regular reviews of compliance and corporate governance developments; business-specific learning opportunities through site visits and Board meetings; and briefing sessions on topics that present special risks and opportunities to ConocoPhillips. Education often takes the form of “white papers” covering timely subjects or topics. As part of the Board’s annual evaluation process, directors are asked to identify areas where they feel continuing education would be helpful. | |

| Director Education Seminars | Directors may attend educational seminars and programs sponsored by external organizations. ConocoPhillips covers the reasonable expenses for a director’s participation in outside continuing education approved by the Committee on Directors’ Affairs. |

| 2021 Proxy Statement | 23 |

Corporate Governance Matters

While our management team is responsible for the day-to-day management of risk, the Board has broad oversight responsibility for our risk-management programs. In this role, the Board is responsible for ensuring that the risk-management processes designed and implemented by management are functioning as intended and that necessary steps are taken to foster a culture of prudent decision-making throughout the organization.

In order to maintain effective Board oversight across the entire enterprise, the Board delegates to individual committees certain elements of its oversight function, as shown below. In addition, the Board delegates authority to the Audit and Finance Committee to manage the risk oversight efforts of the various committees. As part of this authority, the Audit and Finance Committee regularly discusses ConocoPhillips’ enterprise risk-management policies and facilitates appropriate coordination among committees to ensure that our risk-management programs are functioning properly. The Board receives regular updates from its committees on individual categories of risk, including strategy, reputation, operations, climate change, people, technology, investment, political, legislative, regulatory, and market, and receives a report periodically from the Chair of the Audit and Finance Committee about oversight efforts and coordination.

The Board exercises its oversight function with respect to all material risks to ConocoPhillips, which are identified and discussed in our public filings with the SEC.

|

Board Oversight During the COVID-19 Pandemic

Since early 2020, ConocoPhillips, like the rest of the world, has been navigating how to respond to the risks and challenges presented by the COVID-19 pandemic. During this time, management has increased the level of Board communications and interactions, and the Board has overseen a swift, but agile response, that is consistent with our SPIRIT Values, which include:

Safety – Implementing rigorous cleaning and disinfecting processes and mitigation protocols to keep our workplace safe, including temperature scans, social distancing, face covering requirements and increased sanitation

People – Communicating regularly with employees and providing sufficient flexibility to support any challenges

Integrity – Transitioning to a remote work environment, as needed, to ensure the safety of our employees, partners, and the community

Responsibility – Standing up a Crisis Management Support Team in March 2020

Innovation – Equipping our employees with the necessary technology and training to seamlessly transition to and from a remote work environment

Teamwork – Continuing to run the business, despite unprecedented challenges, including successfully executing our curtailment program, and preserving long-term value for our stockholders

Management and the Board are continuing to oversee our response to the risks and challenges presented by the COVID-19 pandemic.

|

| 24 | ConocoPhillips |

Corporate Governance Matters

Code of Business Ethics and Conduct

ConocoPhillips has adopted a worldwide Code of Business Ethics and Conduct, which applies to all directors, officers, and employees. The Code of Business Ethics and Conduct is designed to help resolve ethical issues in an increasingly complex global business environment and covers topics such as conflicts of interest, insider trading, competition and fair dealing, discrimination and harassment, confidentiality, payments to government personnel, anti-boycott laws, U.S. embargos and sanctions, compliance procedures, employee complaint procedures, expectations for supervisors, internal investigations, use of social media, and money laundering. In accordance with good corporate governance practices, we periodically review and revise the Code of Business Ethics and Conduct as necessary.

The Code of Business Ethics and Conduct is posted on our website under “Investors > Corporate Governance.” Any amendments to the Code of Business Ethics and Conduct or waivers of it for our directors and executive officers will be posted on our website promptly to the extent required by law. Stockholders may request printed copies of our Code of Business Ethics and Conduct by following the instructions located under “Available Information and Questions and Answers About the Annual Meeting and Voting” beginning on page 124.

We believe our performance is not merely about what we do, but how we do it. The way we do our work is what sets us apart and drives our performance. We run our business under a set of guiding principles we call our SPIRIT Values – Safety, People, Integrity, Responsibility, Innovation, and Teamwork. These set the tone for how we behave with all our stakeholders, internally and externally. They are shared by everyone in our organization, distinguish us from competitors, and are a source of pride.

We know that our people are one of our greatest assets. Our reputation and integrity require that each employee, officer, director, and those working on our behalf maintain personal responsibility for ethical business conduct. We respect one another and have created an inclusive environment that reflects the different backgrounds, experiences, ideas, and perspectives of our employees. We recognize that a strong corporate culture is critical to our long-term success. Senior management is influential in defining and shaping our corporate culture and sets the expectations and tone for an ethical work environment. Our Board also provides valuable oversight in assessing and monitoring our corporate culture. ConocoPhillips has a longstanding commitment to ensuring respectful, fair, and nondiscriminatory treatment for all employees and maintaining a workforce that is free from all forms of unlawful conduct.

| Policies & Training | Board Oversight | Internal Resources | Investigative Processes | ||||||

|

|

|

| ||||||

• Code of Business Ethics and Conduct; mandatory annual attestations completed by all employees

• Equal Employment Opportunity and Affirmative Action Policies/Programs

• Workplace Harassment Prevention Training required for all employees

|

• Audit and Finance Committee provides oversight to Global Compliance & Ethics (“GC&E”) organization

• Five in-person* Committee/ Board meetings throughout the year

• Compliance program activity, key metrics and aggregate investigative updates shared with the Audit and Finance Committee

|

• Multiple avenues to seek guidance or report workplace ethical concerns

• Ethics Helpline, accessible by phone or online

• Employees can also report concerns to Supervisors, Human Resources representatives, or directly to GC&E

|

• Fair and confidential investigative processes conducted by an independent investigator

• Anonymous reporting always available; zero tolerance for retaliation

• GC&E reviews all investigation summaries and recommendations to ensure global consistency

|

| * | In 2020, Board and committee meetings were held virtually due to the ongoing COVID-19 pandemic. |

| 2021 Proxy Statement | 25 |

Corporate Governance Matters

Values, Principles and Governance

At ConocoPhillips, our human capital management strategy is built upon the strong foundation of our SPIRIT Values and is responsive to feedback from key stakeholders. Our SPIRIT Values – Safety, People, Integrity, Responsibility, Innovation, and Teamwork – set the tone for how we interact with all our stakeholders, internally and externally and are a source of pride. Our day-to-day work is guided by the principles of accountability and performance, which means the way we do our work is as important as the results we deliver. We believe our SPIRIT Values and principles set us apart, align our workforce and provide a foundation for our culture.

Our Executive Leadership Team (“ELT”) and our Board play a key role in setting our human capital management strategy and holding us accountable for our progress. The ELT and Board engage often on workforce-related topics. Our human capital management programs are supported by business leaders across ConocoPhillips and overseen and administered by our human resources function.

We depend on our workforce to successfully execute our company’s strategy and we recognize the importance of creating a culture in which our people feel valued. We take a broad view of human capital management that begins with creating an innovative and inclusive culture supported by programs and processes that engage our workforce and make sure they have the skills to meet our evolving business needs. The key elements of our human capital management strategy are described below.

Culture of Feedback and Engagement

Our human capital management strategy recognizes that a compelling culture and an engaged workforce are powerful determinants of business success. Beginning in 2019, we launched a coordinated, multi-year, global employee feedback program called Perspectives. With the COVID-19 pandemic, a significant industry downturn and heightened focus on racial injustice, we elected to focus our 2020 Perspectives on the specific topic of Diversity and Inclusion (“D&I”). The survey received a high response rate with over 10,000 comments. The ELT and our global internal D&I Council analyzed the survey data to identify D&I strengths and gaps to establish 2021 D&I priorities and action plans. The company’s D&I commitment, activities and programs are described below.

Diversity and Inclusion

Our commitment to D&I is foundational to our SPIRIT Values and our company-wide D&I vision is to have “a diverse culture of belonging where everyone feels valued.” We believe a diverse workforce and an inclusive environment that reflects different backgrounds, experiences, ideas, and perspectives drives innovation, employee satisfaction and overall company performance. We hold our entire workforce accountable for creating and sustaining an inclusive work environment. Our leaders are accountable for having personal D&I goals each year and we believe senior leadership involvement is critical for achieving meaningful progress on D&I.