0001162461DEFA14AFALSE00011624612023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | |

| ☐ | Preliminary Proxy Statement |

| | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| | |

| ☐ | Definitive Proxy Statement |

| | |

| ☒ | Definitive Additional Materials |

| | |

| ☐ | Soliciting Material Pursuant to §240.14a-12 |

CUTERA, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | | | | |

| ☒ | | No fee required. |

| | | | |

| ☐ | | Fee paid previously with preliminary materials. |

| | | | |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Explanatory Note

This supplement (this “Supplement”) to Cutera, Inc.’s (the “Company”) definitive proxy statement (the “Proxy Statement”) filed with the U.S. Securities and Exchange Commission on June 17, 2024 for use at the 2024 Annual Meeting of Stockholders (the “Annual Meeting”) is being filed to correct certain inadvertent errors and clarify Proposal Four in the Proxy Statement. This Supplement should be read in conjunction with the Proxy Statement. Except as specifically supplemented by the information contained in this Supplement, all information set forth in the Proxy Statement continues to apply and should be considered in voting your shares of Company common stock. Capitalized terms used in this Supplement without definition have the same meanings as set forth in the Proxy Statement.

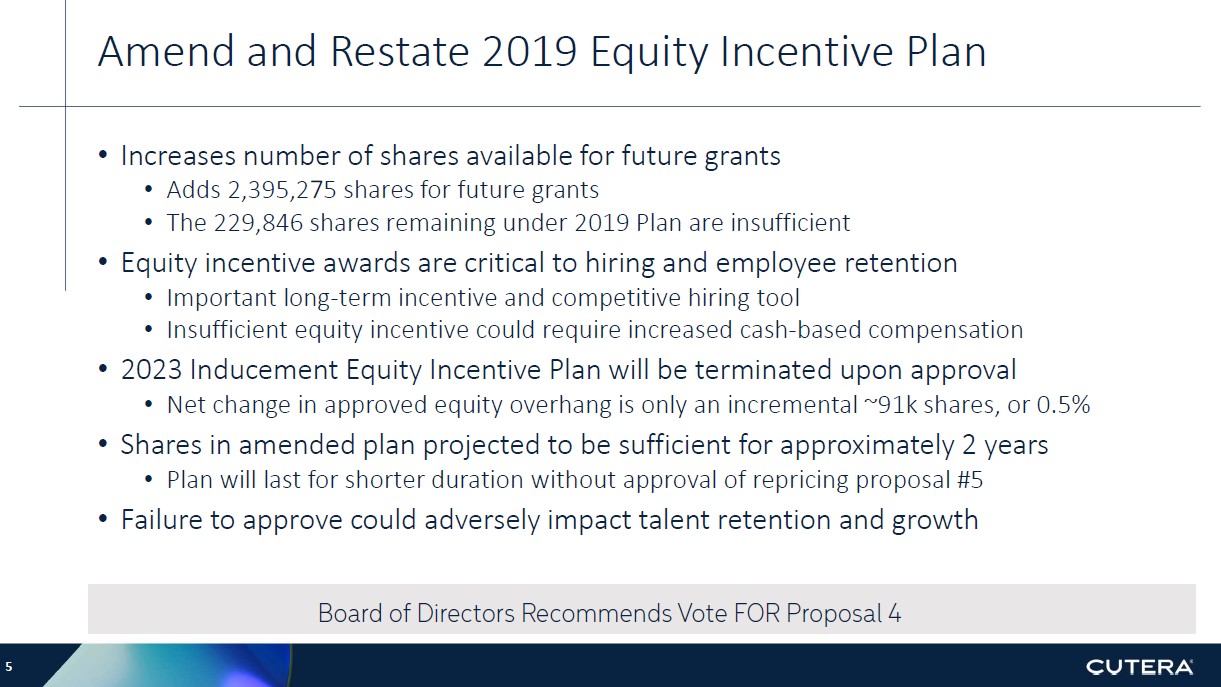

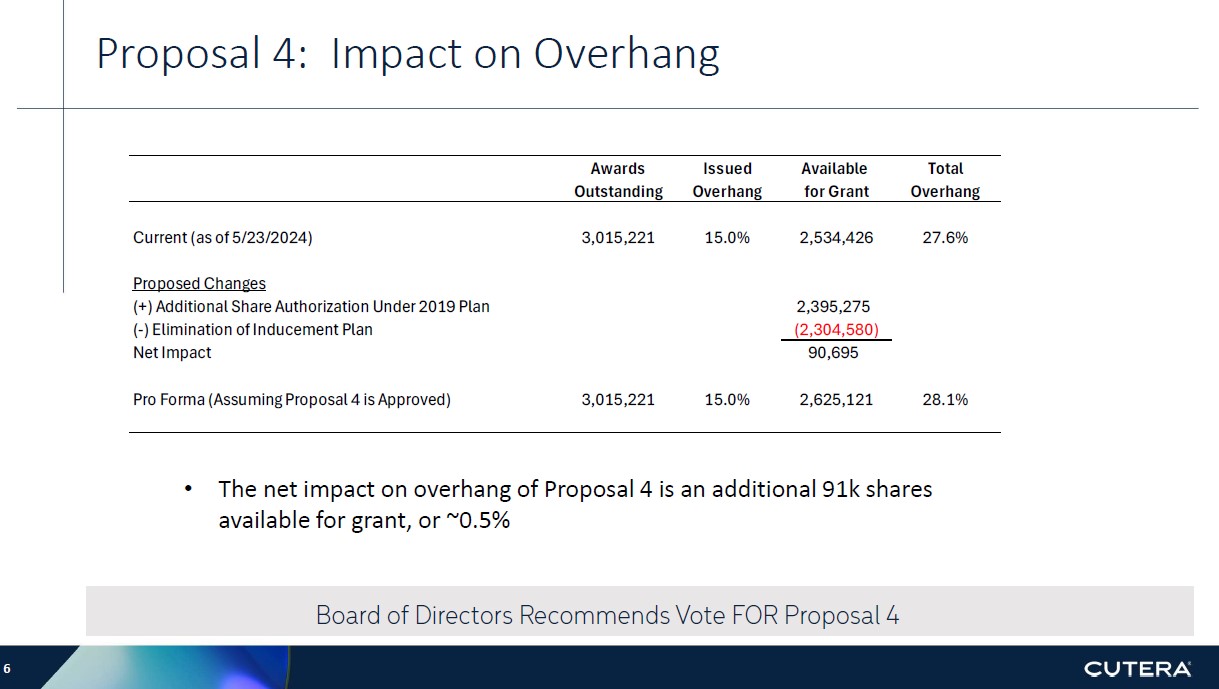

When determining to recommend Proposal Four for stockholder approval, the Board specifically noted a net dilutive effect of only an additional 90,695 shares (or less than 0.5% of the Company's outstanding shares) when accounting for the 2,395,275 share increase to the Amended and Restated Plan and the corresponding contingent termination of the Inducement Plan and the 2,304,580 shares available for grant thereunder, and therefore is filing this Supplement to clarify the net dilutive effect of the approval of Proposal Four.

On page 26 of the Proxy Statement, the Company correctly indicated that the Inducement Plan would be terminated if Proposal Four receives the requisite stockholder approval, stating in relevant part: “In addition, if our stockholders approve the Amended and Restated Plan, our non-stockholder-approved 2023 Inducement Equity Incentive Plan (the “Inducement Plan”) will be terminated upon such approval (which means no further grants can be made under the Inducement Plan but outstanding awards granted under the Inducement Plan will continue to be governed by such plan’s terms)”; however, in subsequent sections of the Proxy Statement, the disclosure inadvertently misstated the number of shares that would be available under the Company’s equity plans following approval of Proposal Four at the Annual Meeting due to the 2,304,580 shares available under the Inducement Plan being included in such share counts instead of being terminated along with the Inducement Plan. Specifically:

•On page 27 of the Proxy Statement, it incorrectly states “There were 4,929,701 shares available for grant in the Amended and Restated Plan as of May 23, 2024 (including the 2,395,275 shares that we are requesting stockholders to approve at the 2024 Annual Meeting).” The 4,929,701 figure should not include shares available under the Inducement Plan and should therefore state that only 2,626,662 shares were available, including the 2,395,275 shares that the Company is requesting stockholders approve pursuant to Proposal Four;

•The chart on page 28 of the Proxy Statement indicated that the total equity overhang would be 39.5% in the event that the 2,395,275 additional shares were approved pursuant to Proposal Four. This figure should read 28.1%; and

•On page 29 of the Proxy Statement, it incorrectly states “As of May 23, 2024, a total of 20,501,192 shares were authorized for issuance under our 2019 Equity Incentive Plan, of which 2,534,426 shares remained available for future awards. Upon stockholder approval of the Amended and Restated Plan at the 2024 Annual Meeting on July 15, 2024, the total number of shares authorized for issuance under the Amended and Restated Plan will be 22,896,467, of which 4,929,701 shares will be available for future awards described below.” This sentence should read “As of May 23, 2024, a total of 13,351,192 shares were authorized for issuance under our 2019 Equity Incentive Plan, of which 231,387 shares remained available for future awards. Upon stockholder approval of the Amended and Restated Plan at the 2024 Annual Meeting on July 15, 2024, the total number of shares authorized for issuance under the Amended and Restated Plan will be 15,746,467, of which 2,626,662 shares will be available for future awards as described below.”

Additional Information

If you have already voted by Internet, telephone, or by mail, you do not need to take any action unless you wish to change your vote. Proxy voting instructions already returned by Company stockholders (via Internet, telephone, or by mail) will remain valid and will be voted at the Annual Meeting unless revoked. Important information regarding how to vote your shares and revoke proxies already cast is available in the Proxy Statement under the caption Can I change my vote? in the section Questions & Answers Regarding this Solicitation and Voting at the Annual Meeting.